Last updated on August 16th, 2021

There are so many robo-advisors that are available in Singapore. 2 of the more popular ones include Syfe and Endowus.

How are they different and which one should you be choosing?

Contents

- 1 The difference between Syfe and Endowus

- 2 Type of products they invest in

- 3 Investment strategies used

- 4 Investment portfolios offered

- 5 Cash management portfolios offered

- 6 Performance

- 7 Dividend distribution

- 8 Funds you can invest with

- 9 Minimum sum to invest

- 10 Fees

- 11 Type of account used to handle your assets

- 12 Web platform

- 13 Mobile app

- 14 Verdict

- 15 Conclusion

- 16 👉🏻 Referral Deals

The difference between Syfe and Endowus

Syfe invests in ETFs, while Endowus offers access to mutual funds. Both robo-advisors mainly differ in terms of fees, the minimum amount to invest, and the type of funds (Cash, SRS and CPF) you can use.

Here’s an in-depth comparison between these 2 robo-advisors:

Type of products they invest in

Here are the different products that these 2 robo-advisors invest in:

Syfe invests mainly in ETFs

Syfe mainly invests in ETFs. Based on the portfolio that you choose, your funds will be invested into a variety of ETFs.

Most of these ETFs are listed on US exchanges. However, Syfe’s Equity 100 also invests in CSPX, which is domiciled in Ireland.

The only exception is Syfe REIT+ which invests in Singapore REITS directly. You are not investing in an ETF, which saves some of the fees that you’ll need to pay!

Endowus invests in mutual funds

Endowus mainly invests in mutual funds. These funds are managed by many well-known firms, such as:

- Pimco

- Dimensional

- Eastspring Investments

- First Sentier Investors

- Vanguard

- Schroders

If you were to invest in these funds by yourself, they are usually very costly. Endowus provides access to these funds at a lower cost.

These funds that you can purchase are institutional share classes. This means that you’ll be charged the lowest expense ratio among the different share classes.

These share classes would normally require you to have a minimum investment of around $200k!

Moreover, all of these funds are denominated in SGD! This means that you will reduce the amount of currency risk that you’re exposed to.

Endowus’ funds are UCITS funds that help to reduce your tax

Another advantage of the funds that Endowus offers is that they are all UCITS funds.

This means that these funds are domiciled in Ireland, rather than the US. For Syfe, majority of the ETFs will be domiciled in the US.

This has significant implications on the taxes you’ll incur as a Singaporean investor. When you invest in a UCITS fund, you will reduce your taxes in 2 ways:

- Lower dividend withholding tax for US stocks (15% vs 30%)

- No estate tax for US assets

While Syfe claims that you should not incur any estate taxes, they are not 100% certain on this matter.

Investment strategies used

These 2 robo-advisors also use very different investing strategies:

Syfe has different investment strategies for different portfolios

Syfe has 2 main strategies that are used for their different portfolios:

#1 Automated Risk-managed Investments (ARI)

Syfe believes that managing risk is the most important to help you receive good returns.

Their Automated Risk-managed Investments (ARI) strategy helps you to:

- Optimise your returns when the markets are calm

- Limit your losses in volatile times

First, you’ll need to choose your risk level. Syfe’s ARI algorithm will then ensure that your portfolio remains at this risk level.

From time to time, the market conditions may change to become more stable or more volatile. The ARI algorithm will try to limit the amount of fluctuations you may experience.

This ARI algorithm is only applicable to 2 of Syfe’s portfolios:

- Global ARI

- REIT+ with risk management

#2 Smart beta strategy

Both Syfe Equity 100 and Core focus on building a smart beta portfolio for you. This is sometimes referred to as factor-based investing.

Syfe aims to provide high returns by concentrating on a few factors. These factors are chosen to ensure that your portfolio will outperform a certain index. Currently, Syfe has selected these 3 factors:

- Growth

- Large-cap

- Low-volatility

Syfe will then select the best ETFs that are weighted towards these factors.

For example, the current portfolio is heavily weighted in the QQQ ETF. This will help to tilt the portfolio towards the growth and large cap factors. Meanwhile, the low-volatility factor is achieved by investing in multiple sector ETFs.

This is different from the original Fama-French 3-factor model, which focused on:

- Size of firms

- Book-to-market values

- Excess return on the market

In the long run, the factors that give the best returns in the future may no longer be these 3 factors.

As such, Syfe has a dynamic factor selection to choose the best factors in the current economic climate. Your portfolio will be over or under-weighted in certain factors to produce the highest risk-adjusted returns.

This helps to ensure that your portfolio will continue to perform in any market condition!

Endowus wants to make low cost investing accessible for everyone

Endowus believes in providing evidence-based investing at the lowest cost possible.

The funds that they have chosen are backed by scientific research, rather than speculation.

Moreover, they believe that fees are something that eat into an investor’s returns. They have a 100% trailer fee rebate policy which greatly reduces your costs!

Investment portfolios offered

Here are the types of portfolios that both robo-advisors offer you:

Syfe offers 4 investment portfolios

Here are the 4 different portfolios that Syfe offers:

#1 Global ARI

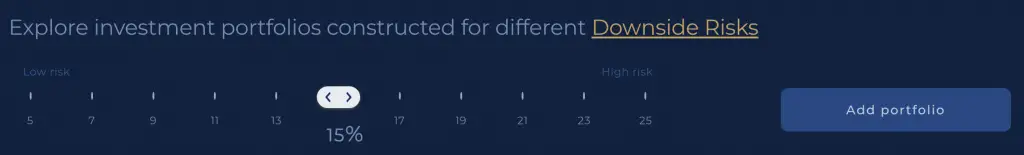

Syfe’s Global ARI portfolio uses the ARI algorithm to manage your risks. There are 11 different portfolios, based on the Downside Risk that you are able to stomach.

In 39 out of every 40 years, a Syfe portfolio in a 15% Downside Risk category (at 95% MTL) will not lose more than 15% in a given year.

Syfe

The Downside Risk ranges from 5%-25%.

Syfe will purchase assets across 3 different asset classes:

- Equity

- Bonds

- Gold

#2 REIT+

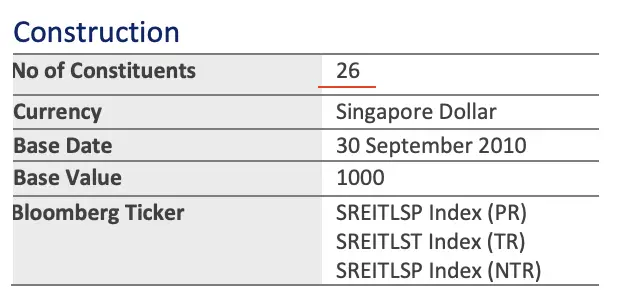

REIT+ tracks the iEdge S-REIT Leaders Index. This index measures the performance of the largest and most tradable REITs in Singapore.

This was previously called the iEdge S-REIT 20 Index. However, SGX changed it to the Leaders Index which now has 26 holdings instead.

Despite this change in the index, Syfe REIT+ still tracks the top 20 holdings out of the 26 holdings in the Leaders Index.

With the merger of CapitaLand Mall Trust and CapitaLand Commercial Trust, Syfe now only tracks 19 REITs in the index.

You can choose to invest in 100% REITs or REITS with risk management. If you choose the risk management option, you will utilise Syfe’s ARI algorithm.

This will add an allocation of ABF Singapore Bond Index Fund (A35) which is used as the bond component.

If you are wondering about the different types of bond ETFs, you can view my comparison of A35 against MBH.

If you are looking for stable returns with high dividend yields, you should be choosing the REIT+ portfolio!

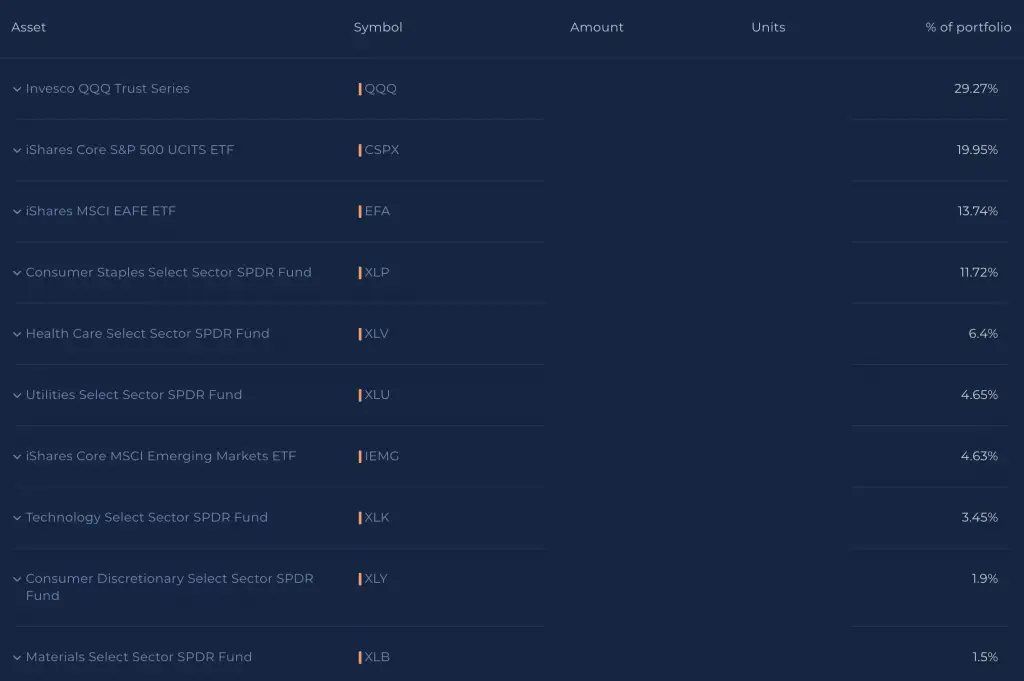

#3 Equity 100

In your Equity 100 portfolio, you will invest in a portfolio of equity ETFs. Here are some of the equity ETFs that Syfe will invest in:

Currently, Equity 100 is very heavily concentrated towards tech stocks (QQQ).

Since you are fully concentrated in stocks, you have the highest potential for returns. However, investing in stocks also come with extreme volatility!

It is only recommended that you invest in a 100% stock portfolio if you have a long time horizon. Usually, this will mean at least 40 years before your retirement.

This allows you to ride the short term volatility to have high returns in the long run!

You can view my comparison of Syfe’s Equity 100 against REIT+ and StashAway to see which portfolio is most suitable for you.

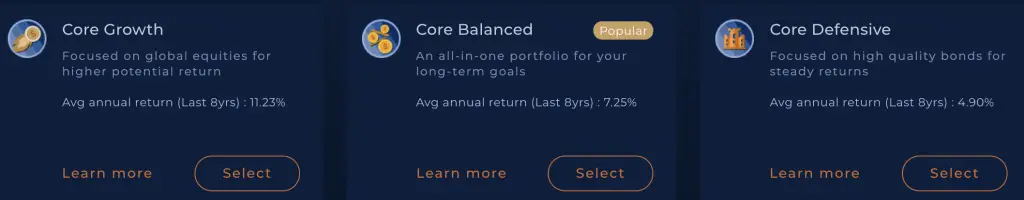

#4 Core

Syfe Core is the latest portfolio, that is somewhat similar to Global ARI, but it has greater exposure to Chinese stocks.

There are 3 different profiles that you can choose from, depending on your risk level:

- Growth (highest risk)

- Balanced

- Defensive (lowest risk)

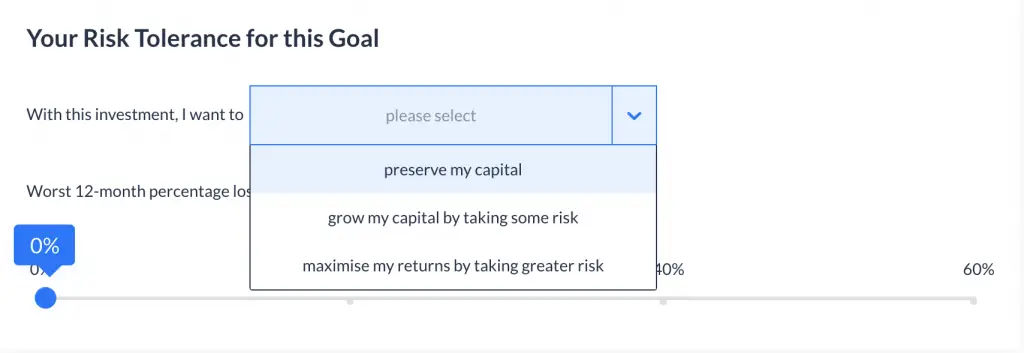

Endowus offers you different portfolios based on your risk profile

When you create a portfolio with Endowus, you’ll be asked about your risk tolerance.

Endowus will then suggest a portfolio for you based on your risk tolerance and time horizon. These portfolios will allocate your money into 2 different asset classes:

- Equities

- Fixed Income

| Portfolio | Equities | Fixed Income |

|---|---|---|

| Very Aggressive | 100% | 0% |

| Aggressive | 80% | 20% |

| Balanced | 60% | 40% |

| Measured | 40% | 60% |

| Conservative | 20% | 80% |

| Very Conservative | 0% | 100% |

The higher your risk tolerance, the greater the allocation towards equities and vice versa.

There are 2 types of advised portfolios that you can create with Endowus: Core and ESG portfolios. You can view my comparison between these portfolios to see which one is more suitable for you.

Different funds are available for you

The funds that are being used to invest both your Cash and SRS funds are the same. However, the CPFIS Scheme limits the number of funds that you can invest your CPF in.

Another difference is that the Endowus currently does not offer an ESG portfolio for your CPF funds.

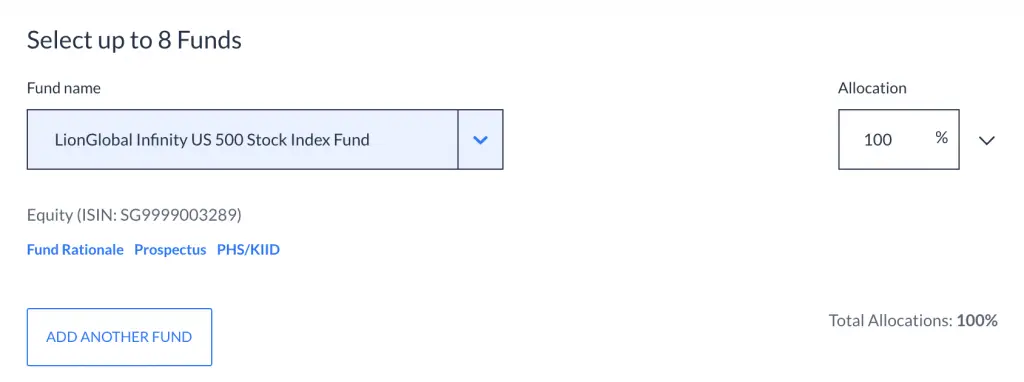

Endowus also offers a Fund Smart portfolio

Endowus also has a Fund Smart portfolio. This allows you to customise your portfolio to just the way that you like!

You get to decide:

- Which funds you want to invest in

- The allocation you wish to have in each fund

If you want to just invest in the S&P 500, you can create a portfolio that is 100% allocated into the Infinity US 500 Stock Index Fund.

The main advantage of using Fund Smart is that you get access to these mutual funds at the lowest cost possible!

Cash management portfolios offered

Both robo-advisors also offer a cash management portfolio as well. These portfolios are meant to provide you with a higher returns compared to leaving it in your bank account.

Moreover, these portfolios are also rather liquid for you to easily deposit and withdraw money at any time.

Here are the cash management portfolios that both robo-advisors offer:

Syfe Cash+

Syfe Cash+ invests your money into 3 different funds:

- LionGlobal SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund SGD

- LionGlobal Short Duration Bond Fund

Syfe does not charge any management fees and gives you a full rebate on any trailer fees that they receive!

| Gross Return | 1.55% |

| Fund-level Fee | -0.35% |

| Overall Rebates | 0.3% |

| Management Fee | None |

| Projected Return | 1.5% |

You can view my comparison between Syfe Cash+ and StashAway Simple to see which portfolio is better for you.

Endowus Cash Smart

Endowus Cash Smart has 3 different portfolios:

- Cash Smart Core

- Cash Smart Enhanced

- Cash Smart Ultra

Depending on the portfolio that you choose, your money will be invested into different funds:

| Portfolio | Funds |

|---|---|

| Core | Fullerton SGD Cash Fund (50%) LionGlobal SGD Enhanced Liquidity (50%) |

| Enhanced | UOB United SGD Fund (50%) LionGlobal SGD Enhanced Liquidity (50%) |

| Ultra | LionGlobal SGD Enhanced Liquidity Fund (27.5%) Fullerton Short Term Interest Rate Fund (25%) LionGlobal Short Duration Fund (25%) Nikko Shenton Income Fund (12.5%) PIMCO Low Duration Income Fund (10%) |

You can read my full review on Endowus Cash Smart to see if it’s suitable for you.

You can customise your Cash Smart portfolio using Fund Smart

Apart from the Cash Smart portfolios that are being offered by Endowus, you can choose to create your own Cash Smart portfolio as well!

Similar to the Fund Smart portfolio, you can:

- Choose the funds you wish to invest in

- Choose your allocation into each fund

This may help you to earn a higher return compared to Endowus’ recommended portfolios!

Performance

It is hard to compare the performances between these 2 robo-advisors since the portfolios are so different.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy of these robo-advisors instead!

Dividend distribution

Syfe invests in US-listed ETFs in their Equity 100, Global ARI and Core portfolios. When any dividends are issued, they will incur a 30% dividend withholding tax.

The dividends that you receive is after this 30% deduction.

If you invest in REIT+, your dividends are not subject to any withholding taxes.

However for Endowus, most of the funds that they invest in are accumulating funds. This means that any dividends you receive will be automatically reinvested for you.

Even if Endowus invests in distributing share class funds, they will still automatically reinvest the dividends for you.

These are similar to accumulating and distributing ETFs that are domiciled in Ireland.

As such, you should not expect to receive any dividends when you invest with Endowus.

Even though you do not receive the dividends, you are still subject to the 15% withholding tax on UCITS funds.

Funds you can invest with

Here are the types of funds you can use to invest in these 2 robo-advisors:

Syfe only allows you to invest in cash

One of the major limitations of Syfe is that it only allows you to invest your cash. Syfe intends to have an option for you to invest your SRS funds in the future.

Endowus allows you to invest using cash, SRS and CPF

The main selling point of Endowus is that you are able to invest your CPF funds! So far, they are the only robo-advisor that allows you to do so.

Moreover, they also offer portfolios for your Cash and SRS funds. This makes Endowus an all-in-one platform to invest all of your different funds!

Minimum sum to invest

Here are the minimum sums required to start investing with either robo-advisor:

Syfe has no minimum investment

Syfe stores your funds in a co-mingled account with Syfe’s other customers. This allows you to invest in fractional shares of the various ETFs and REITs that Syfe offers.

As such, Syfe does not have a minimum investment required to start investing with them.

This makes investing extremely accessible, especially if you only have a small sum to invest!

Endowus has a minimum investment of $1,000

To use the Endowus platform for investing, you will need an initial investment of $1k. This can come from 3 different sources:

- Cash

- SRS

- CPF

You are able to combine funds from your Cash, SRS and CPF to reach the $1k total. Moreover, you can use these funds to invest in any of Endowus’ portfolios.

You do not need to just invest all of your $1k into one portfolio!

Moreover, the minimum sum for each subsequent investment is $100. You aren’t able to invest anything less than a $100!

This may be a huge initial amount if you are just starting to invest. As such, this is something you should consider first before you start to use Endowus.

Fees

Here are the fees that both robo-advisors will charge you:

Syfe charges you 0.65% for your first $20k

Here is Syfe’s pricing structure:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

Unlike other fee structures, Syfe does not have a tiered fee structure. For example if you have $30k invested with Syfe, you will incur a 0.5% fee on your entire investment amount.

Syfe has no fees for Cash+

Syfe does not charge you any fees for Cash+. As such, the amount of funds in your Cash+ portfolio will not be included in the total amount chargeable.

Endowus charges you lower fees

Endowus charges you lower fees on the amount that you have invested with them:

Flat 0.3% for single fund portfolios with Fund Smart

If you have a Fund Smart portfolio that only has a single fund inside (i.e. 100% allocation), you will only be charged 0.3%. This is irregardless of whether you’re using your Cash, SRS or CPF to invest.

This makes it one of the cheapest fees that are being provided by a robo-advisor!

You can consider investing in a broadly diversified fund, such as:

- Infinity US 500 Stock Index Fund

- Dimensional World Equity Fund

Flat 0.4% for CPF and SRS

Endowus charges a flat 0.4% fee for any amount of your CPF or SRS funds that you have invested.

This makes it one of the lowest costs being offered by a robo-advisor!

However, the reason why they are able to charge such low fees is due to the limitations that your CPF and SRS funds have.

Tiered pricing for Cash

Endowus has a tiered pricing for your cash investments:

| Amount | Fee |

|---|---|

| Up to S$200k | 0.6% |

| S$200,001 to S$1,000,000 | 0.5% |

| S$1,000,001 to S$5,000,000 | 0.35% |

| S$5,000,001 and above | 0.25% |

Endowus offers a tiered and not stacked pricing. This means that if you invest $200,001 into Endowus, you will be charged 0.5% for your entire $200,001.

Compared to other robo-advisors, Endowus’ fees are still pretty affordable.

0.05% flat fee for Cash Smart

You will still need to pay an access fee to use Cash Smart. However, this is very low at 0.05% for any amount.

It also does not matter whether you invest in Cash Smart with your Cash or SRS.

Full trailer fee rebate

Apart from the low management fees charged, Endowus also gives you a full trailer fee rebate.

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

With these trailer fee rebates, this will help to lower your cost of investing!

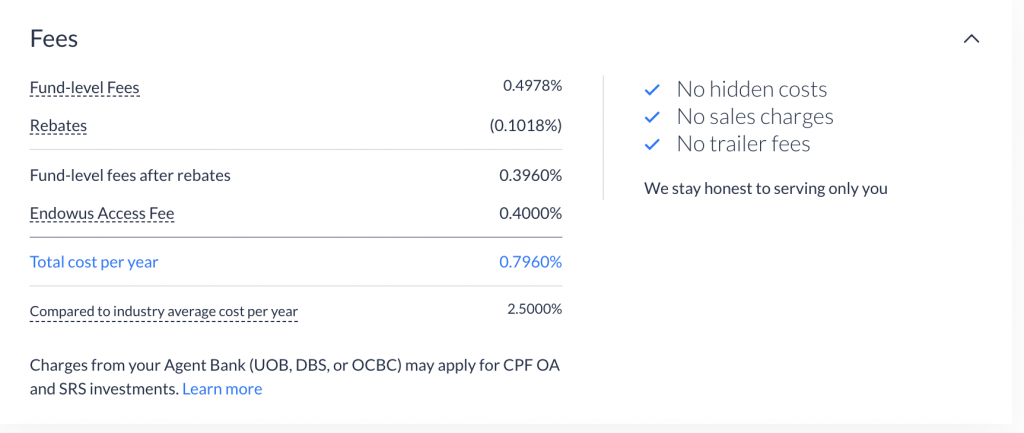

Pricing can be seen when you invest in any of their portfolios

What I really like about Endowus is the full transparency when it comes to the fees.

This is because you do not just need to pay management fees to the robo-advisor. You’ll need to pay an expense ratio to the funds managers too!

Syfe does not take this cost into account when it advertises its fees.

However, Endowus gives you the full breakdown of the fees that you’ll be charged, including fund-level fees.

This helps you to clearly see your true cost of investing with Endowus!

Type of account used to handle your assets

Both robo-advisors use different types of accounts to manage your assets:

Syfe uses a co-mingled account

Syfe co-mingles your assets with all of its other customers under one account.

This allows Syfe to purchase fractional shares for your portfolio. While this makes investing very accessible, there may be problems when Syfe closes down.

Your fractional shares may not be able to be sold off in the NYSE and SGX! This is because you can only sell off whole shares and not fractional ones on these exchanges.

As such, you do not have control over the fate of your assets, especially for your fractional shares.

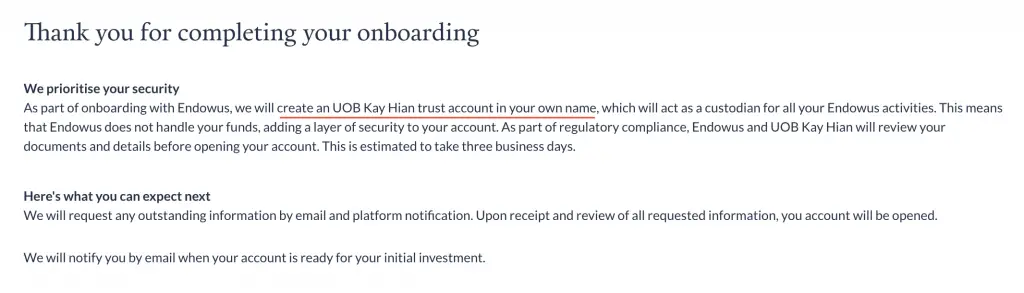

Endowus creates an account under your own name

Endowus creates an account under your own name with UOB Kay Hian.

This gives you complete control over your assets, even in the unfortunate event that Endowus closes down!

You can see how different types of custodian accounts will affect your funds in my analysis of why Smartly closed down.

Web platform

Both robo-advisors have a solid web platform. Here is how Syfe’s platform looks like,

as well as Endowus.

Mobile app

Both robo-advisors also have a mobile app too. Here’s how Syfe’s app looks like,

as well as Endowus’.

Both of them have very sleek apps that can give you quick updates on your portfolios’ performance.

However, I would suggest not installing the app on your phone! This may make you check your portfolio constantly since it is too convenient.

You may be tempted to sell your funds, especially when your portfolio is losing money!

Verdict

Here’s a breakdown between these 2 robo-advisors:

| Syfe | Endowus | |

|---|---|---|

| Type of Product | ETFs or REITS | Mutual Funds |

| Investment Strategy | ARI Smart Beta | Low cost investing |

| Investment Portfolios | Global ARI REIT+ Equity 100 Core | Core ESG Fund Smart |

| Cash Management Portfolios | Syfe Cash+ | Cash Smart (Core / Enhanced / Ultra) |

| Dividend Distribution | Yes 30% tax (ARI / Equity 100 / Core) No tax for REIT+ | No 15% tax |

| Funds to Invest | Cash only | Cash SRS CPF |

| Minimum Sum to Invest | None | $1,000 (Initial) $100 (Subsequent transactions) |

| Fees (Investment) | 0.4-0.65% | 0.25-0.6% (Cash) 0.4% (SRS and CPF) 0.3% (Fund Smart Single Portfolio) |

| Fees (Cash Management) | 0% | 0.05% |

| Type of Account to Handle Assets | Co-mingled | Account under your own name |

So which robo-advisor should you choose?

Choose Syfe if you have a lower investment amount

Syfe is great if you’re just starting out and do not have a large sum to invest. With its pretty affordable fees, it is a great way for you to start your investment journey.

Moreover, Syfe offers very specialised portfolios like Equity 100 and REITS+. These portfolios invest in a very specific asset class that can form a part of your entire investment portfolio!

Choose Endowus if you want a lower cost to investing

The greatest barrier to start investing with Endowus is the $1k minimum sum. However if you are able to commit this sum, Endowus is one of the cheapest platforms you could possibly use!

Moreover, it allows you to invest your SRS and CPF funds apart from your cash. It is possible for you to use Endowus for all of your investing needs !

Conclusion

Both robo-advisors offer very unique portfolios that cater to different kinds of investing needs. It is even possible to invest in both of them together!

However, the main considerations that you should have when choosing between these 2 platforms are:

- The amount of money you are able to invest

- The investment strategy you agree with

- The fees you are willing to pay

- The type of funds you wish to invest

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

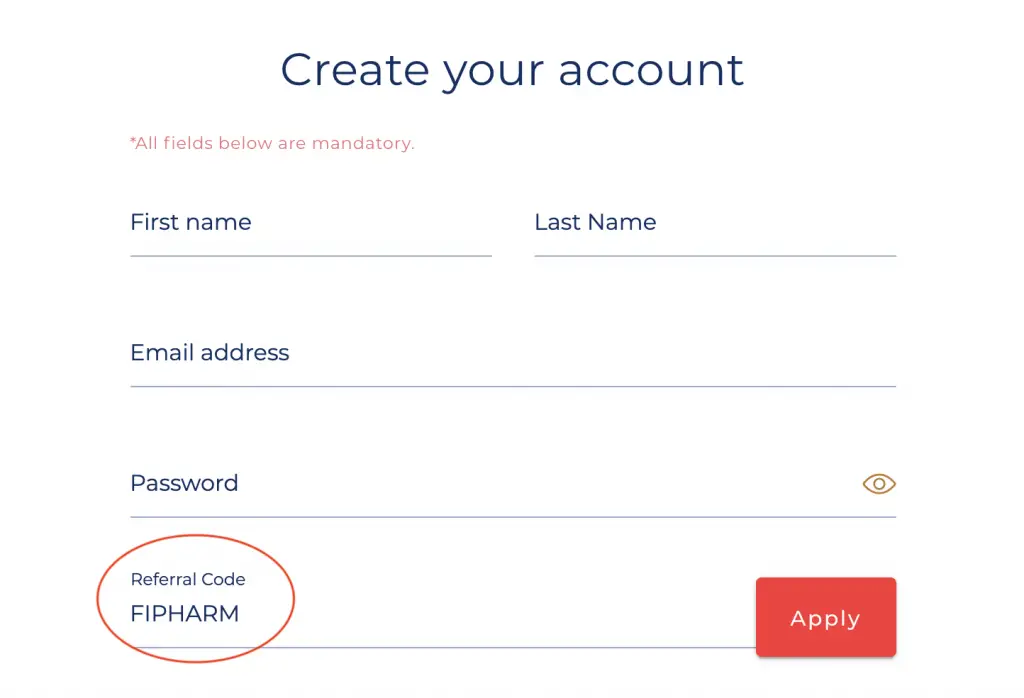

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?