Last updated on June 6th, 2021

The ARK Invest ETFs are one of the more interesting ETFs to invest in.

However, there are quite a few ARK ETFs, such as ARKK and ARKQ.

So how exactly are they different from each other?

Contents

The difference between ARKK and ARKQ

ARKK and ARKQ are 2 ETFs managed by ARK Invest. ARKQ only invests in ARK’s Industrial Innovation theme, while ARKK invests in all 4 of ARK’s investment themes. As such, ARKK is a more diversified ETF compared to ARKQ.

Here is an in-depth comparison between these 2 ETFs:

Fund Manager

Both ETFs are offered by ARK Invest, where Catherine Wood is the portfolio manager for both of these funds.

She has always believed in disruptors and founded ARK Invest to invest in these companies.

As such, she has a pretty strong track record in identifying what she terms as ‘innovative disruptors’.

Assets under management (AUM)

Both ARKK and ARKQ started on the same date (Oct 2014). Despite that, ARKK has a much larger net assets:

| ARKK | ARKQ | |

|---|---|---|

| AUM | $17.68 Billion | $1.7 Billion |

Themes Tracked

ARKK and ARKQ do not track an actual index. Rather, they focus on certain themes that are defined by ARK Invest.

| Theme | Definition |

|---|---|

| Genomic Revolution | Advancements in DNA technologies |

| Industrial Innovation | Innovation in energy, automation and manufacturing |

| Next Generation Internet | Innovation in shared technology, infrastructure and services |

| Fintech Innovation | Technologies that make financial services more efficient |

ARK’s main aim is to invest in companies that are expected to benefit from the technological revolution.

ARKK tracks all 4 themes

ARKK tracks ‘disruptive innovation’ as a whole. This is why the ETF is called the ARK Innovation ETF.

As such, it tracks all 4 themes that are defined by ARK Invest.

ARKQ only tracks the ‘Industrial Innovation’ theme

ARKQ is a more specific ETF that only tracks the ‘Industrial Innovation‘ theme. This theme focuses on:

- Autonomous Transportation

- Robotics and Automation

- 3D Printing

- Energy Storage

- Space Exploration

The companies that ARKQ invests in are more specific to this theme. Meanwhile, ARKK invests in the broader theme of ‘disruptive innovation’. This includes the ‘Industrial Innovation’ theme as well.

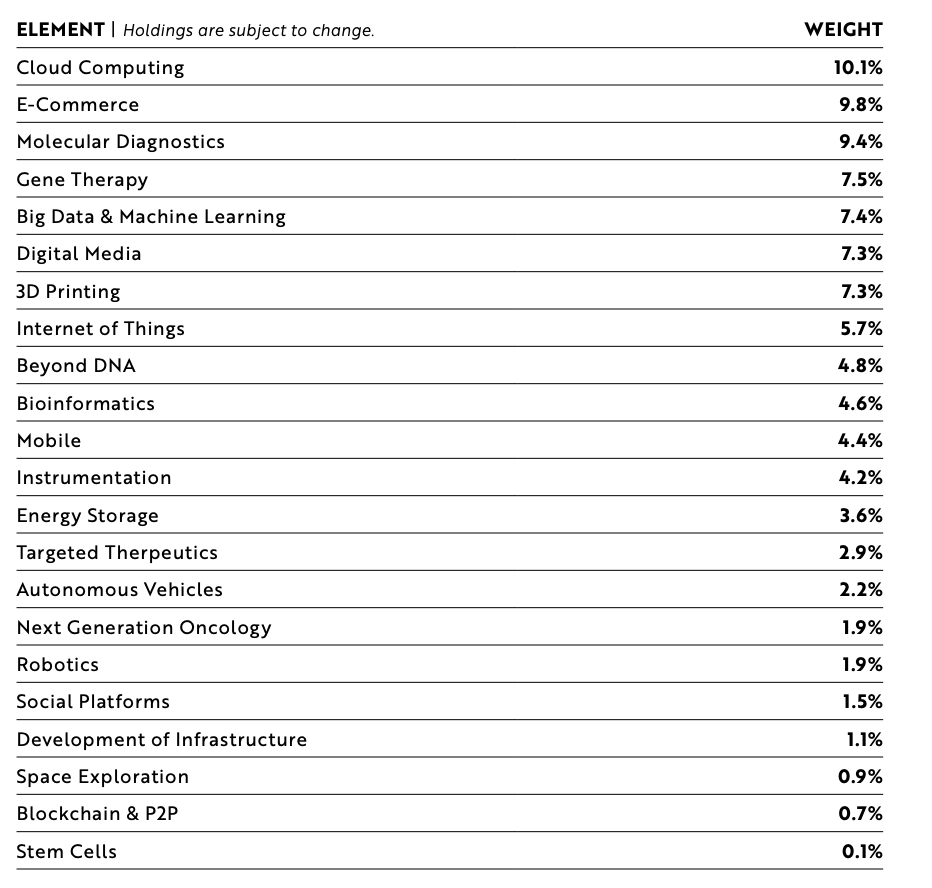

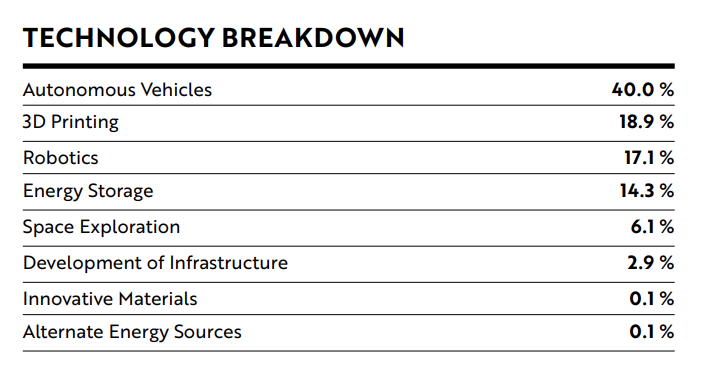

Element Weightage

Due to the different themes that both ETFs track, they will have a different weightage in the thematic elements.

Here are the thematic elements in ARKK,

and in ARKQ.

ARKK has a much broader diversification of companies in the different elements. Moreover, the weightage is much more spread out.

Meanwhile, ARKQ is heavily concentrated in autonomous vehicles.

Top 10 Holdings

Here are the top 10 holdings in ARKK,

as well as ARKQ.

Both are heavily weighted in Tesla

Both ETFs have quite a high weightage into Tesla, compared to other stocks in the themes.

Tesla performed extremely well in 2020 with a 695% increase in it’s stock price!

This could be the reason why both ARKK and ARKQ are performing really well too.

The overlap between ARKK and ARKQ

There will be an overlap in the stocks found in both ARKK and ARKQ. This is because both ETFs invest in ARK’s ‘Industrial Innovation’ theme.

This means that the stocks in this theme will be found in both ARKK and ARKQ.

You can view the overlap in stocks using ETF Research Center’s fund overlap tool. There are only 12 overlapping holdings between these 2 ETFs!

This is a much lower overlap compared to the other ARK ETFs like ARKW or ARKG.

Here are the top 5 holdings that overlap between ARKK and ARKQ:

There is still around a 28% overlap between ARKK and ARKQ.

You’ll need to decide if you prefer to invest in all 4 of ARK’s themes or just one!

ARKK has more holdings than ARKQ

ARKK has 50 holdings, while ARKQ only has 46 holdings. This may make ARKK slightly more diversified.

The ETFs’ holdings may change over time

Both ETFs are actively managed ETFs by Cathy Wood. As such, the holdings of both ETFs are very dynamic and may change when a new company shows a lot of promise.

This is in contrast to a passive ETF that tracks an index. The index only changes the allocation periodically. Meanwhile, active ETFs can change their holdings at any time.

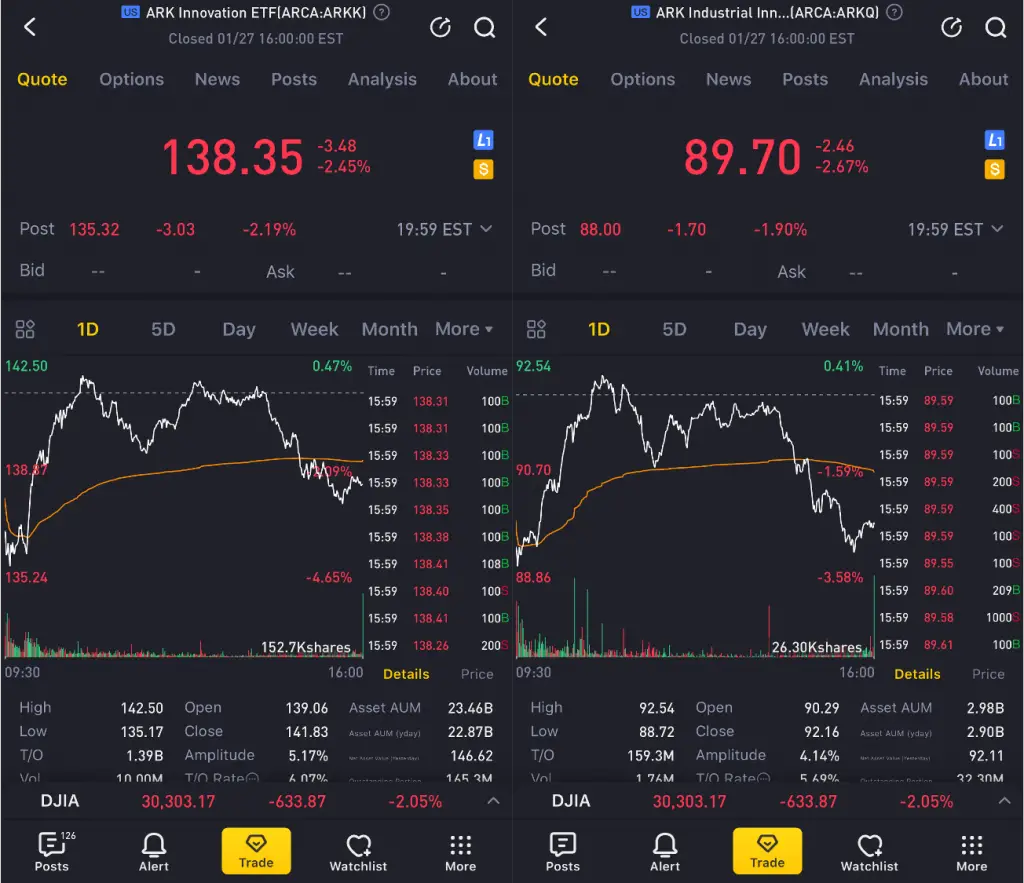

Performance

These 2 ETFs will have different performances since they contain a different basket of stocks.

Here’s how the 2 ETFs have performed between Jan 2020 – Jan 2021.

ARKK has been consistently performing better than ARKQ in the past year.

Both of these ETFs invest in tech companies of the future. As such, the performance of the 2 ETFs will be extremely volatile.

It is hard to compare the performances between these ETFs

It may be hard to compare the performances of these 2 ETFs, since they contain different stocks.

However, the technology sector still has a huge potential for growth. Both of these ETFs should be able to give solid performances, especially in the long run.

Dividends

Both of these ETFs are actively managed ETFs that invest in growth stocks. As such, you will not receive much dividends from these companies.

Growth stocks mainly reinvest most of their earnings back into the company. These funds will be used to accelerate the growth of the company further.

As such, most of these companies will not distribute a dividend to shareholders.

The dividend yield for both ETFs have been rather unstable. Based on ARK’s prospectus, they intend to distribute dividends that they have received at least annually.

Here are the latest dividends that both ETFs distributed since December 2020:

The dividend distributions are rather inconsistent for both ETFs!

You should not worry too much about the dividend yield

You may be concerned that the dividend yields are rather low. However when you are investing in an ARK ETF, you are more concerned about capital appreciation rather than dividends.

As such, the low dividends shouldn’t worry you too much!

You may want to consider investing in the S&P 500 if you are looking for more stable dividends.

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

This expense ratio is usually deducted at the end of each year.

Here are the expense ratios for these 2 funds:

| ARKK | ARKQ | |

|---|---|---|

| Expense ratio | 0.75% | 0.75% |

Both of these ETFs have rather high expense ratios. However compared to other ETFs which are passive, these 2 ETFs are actively managed.

So long as the ARK ETFs are able to produce higher returns than passive ETFs, the expense ratio will be worth it in the end!

Ways to Invest

Both ETFs are listed on the New York Stock Exchange. This makes it rather accessible since most brokers allow trading in US stocks.

One such broker you may want to consider is Tiger Brokers.

It offers a competitive trading commission of just USD1.99 per trade!

You can read my review of Tiger Brokers, as well as how it compares to FSMOne.

Alternatively, you can use commission-free brokers to purchase US stocks, such as:

There are many brokers that you can choose from. As such, you should select one that offers the cheapest fees for your investment amount.

Investing via Kristal.AI

You can also choose to invest in both ETFs using Kristal.AI, a robo-advisor.

However, there are some tradeoffs when you invest with Kristal.AI. This is further touched on in my guide to buying the ARKK ETF.

Verdict

Here’s a comparison between these 2 ETFs.

| ARKK | ARKQ | |

|---|---|---|

| Fund Manager | Cathy Wood | Cathy Wood |

| AUM | $17.68 Billion | $7.67 Billion |

| ARK Themes Tracked | Genomic Revolution Industrial Innovation Next Generation Internet Fintech Innovation | Only Industrial Innovation |

| Number of Holdings | 50 | 46 |

| Number of Elements Tracked | 22 | 8 |

| Expense Ratio | 0.75% | 0.75% |

| Dividends | Annually | Annually |

So which ETF should you invest in?

Invest in ARKK if you want a more diversified portfolio

The ARKK ETF invests in all 4 of ARK Invest’s themes. Apart from the ‘Industrial Innovation’ theme, ARKK also invests in 3 other themes:

- Next Generation Internet

- Genomic Revolution

- Fintech Innovation

This makes ARKK slightly more diversified when it comes to investing in these disruptive innovations.

Your portfolio is spread across different companies from different sectors.

As such, even if one sector does poorly, the other sectors may perform well. Overall, your portfolio should still go up!

If you had just invested in that one sector, your portfolio will suffer huge losses!

This is the power of diversification. Ultimately, ARKK helps you to spread your risk over a greater number of assets.

Invest in ARKQ if you are very confident in industrial technologies

ARKQ is solely weighted on technologies involved in the industrial innovation.

If you are confident that these technologies will do well, then you can invest in this ETF.

ARKQ has not been performing as well as ARKK. However, the time frame for comparison is too short to determine if this will be the long term trend.

However, if you believe that these technologies will have significant growth in the future, ARKQ is one ETF you should consider.

If you are confident in only a few themes that ARK has, you may want to invest in the individual ETFs instead of ARKK. The other 3 thematic ETFs that ARK Invest has are:

- ARKG (Genomic Revolution)

- ARKW (Next Generation Internet)

- ARKF (Fintech)

In this way, you will have less of an overlap compared to investing in both ARKK and ARKQ!

Conclusion

Both ARKK and ARKQ have huge potential to generate large returns for you. However, there is some overlap between the stocks that are found in both ETFs.

As such, it may be better to decide on one of these ETFs and then invest with that ETF throughout!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?