Last updated on August 16th, 2021

Are you looking for a more sustainable way of investing, but the fees you incur are just too high? Or maybe you’ve already created an Endowus account, and are wondering what the ESG portfolio means.

Here’s what you need to know about the Endowus ESG portfolio:

Contents

- 1 Endowus ESG review

- 2 What is the Endowus ESG portfolio?

- 3 What funds are available for the Endowus ESG portfolio?

- 4 What are the different types of portfolios that I can invest in?

- 5 What are the returns of the ESG portfolio?

- 6 What are the fees that I’ll incur when I invest in the Endowus ESG portfolio?

- 7 Verdict

- 8 👉🏻 Referral Deals

Endowus ESG review

The Endowus ESG portfolio provides an accessible and cost-efficient method of gaining access to both equity and fixed-income ESG funds. If you are interested to invest in companies that meet these ESG indicators, you can consider using this platform.

Here is an in-depth look at the portfolios that Endowus offers:

What is the Endowus ESG portfolio?

The Endowus ESG advised portfolios offer you access to the best SGD-denominated or SGD-hedged ESG funds. These funds invest in equities or fixed income instruments that fulfil certain sustainability indicators.

ESG (Environmental, Social and Governance) is a growing trend in Singapore. If you are looking at this investing strategy, you will be focusing on companies that fulfil these 3 criteria:

| Environmental | The sustainability of the company’s practices |

| Social | How the company manages relationships with other stakeholders |

| Governance | The operations of the company |

By looking into these non-tangible factors of a company, it is thought that you can find companies that provide sustainable returns.

ESG investing has also started to become more popular in Singapore, although not many Singaporeans are invested in such instruments.

One of the main reasons is the lack of a suitable instrument. This is what Endowus is trying to solve with their ESG portfolio.

Endowus aims to provide a low-cost solution into ESG investing, while also selecting the best funds for you to invest in.

What funds are available for the Endowus ESG portfolio?

Endowus invests your money into 6 different ESG funds: 3 of them are fixed income funds, while the other 3 are equity funds. Endowus will propose the allocation into each fund, depending on your risk profile and goal of the portfolio.

Endowus allows you to invest your cash or SRS into a portfolio that contains 6 different funds:

- Mirova Global Sustainable Equity Fund

- Schroder ISF Global Sustainable Growth Equity Fund

- Schroder ISF Global Climate Change Fund

- JPM Global Bond Opportunities Sustainable Fund

- PIMCO GIS Climate Bond Fund

- UOB United Sustainable Credit Income Fund

Instead of concentrating your money into just one fund for each asset class, Endowus chooses the best 3 funds for you to invest in. This spreads your risks out across the different funds, as each fund has their own methodology of picking these ESG companies.

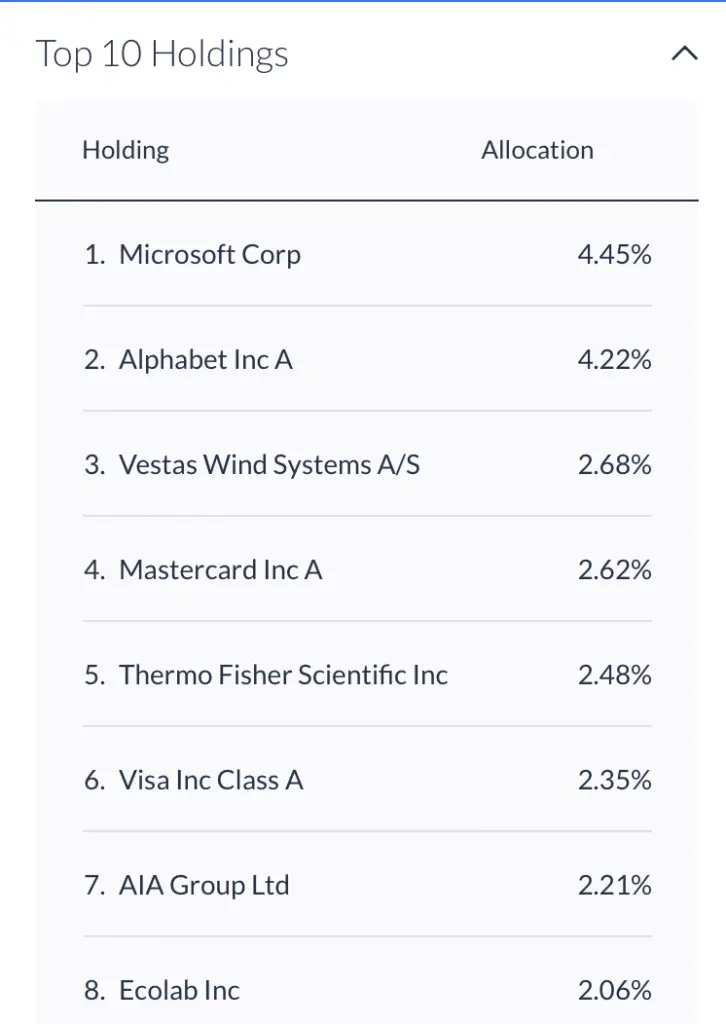

It can be interesting to see the top equity holdings that your portfolio has.

The top holdings do not include Apple, Amazon or Facebook. These companies are usually the top holdings in the S&P 500.

Instead, the Endowus ESG portfolio invests your funds into more sustainable companies, such as:

Nevertheless, there will still be some overlaps with the Core portfolio. This is because some companies like Alphabet and Mastercard are included in the Core portfolios too.

Can I use my CPF funds to invest in ESG funds?

Endowus does not provide an advised ESG portfolio for your CPF funds. However, you still can choose to invest in ESG funds that are available for CPF with Fund Smart.

Out of the 7 ESG funds that are available on Endowus, you are only able to invest in 2 of them using your CPF funds:

- Schroder ISF Global Sustainable Growth Equity Fund

- Templeton Shariah Global Equity Fund

Both of them are equity funds, which means you are unable to invest in any ESG fixed income funds with your CPF.

You can choose to invest in either or both of these funds by creating a Fund Smart portfolio.

What are the different types of portfolios that I can invest in?

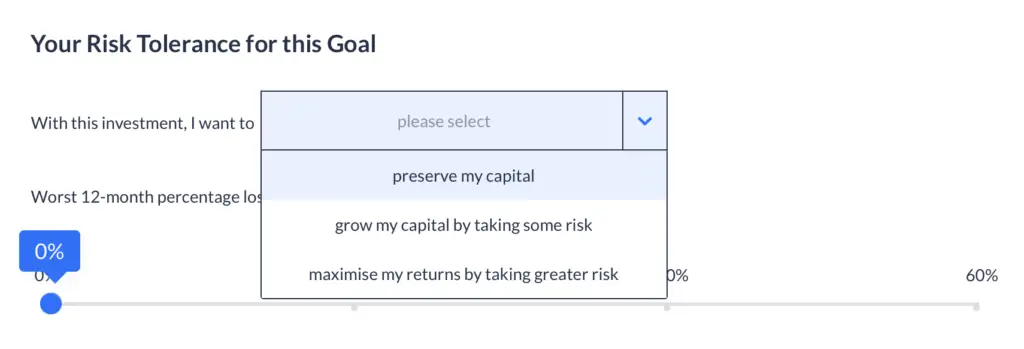

Endowus offers 6 different portfolios. Each portfolio has a different allocation towards equities (stocks) and fixed income (bonds). The more risks you are willing to take, the higher the allocation of your investments towards equities.

When you are creating a portfolio with Endowus, you will be asked to select your risk tolerance for the goal.

This is based on the time horizon that you have, as well as the risk that you’re willing to take.

Based on your risk tolerance, Endowus will suggest a suitable allocation towards stocks and bonds for you.

| Portfolio | Equities | Fixed Income |

|---|---|---|

| Very Aggressive | 100% | 0% |

| Aggressive | 80% | 20% |

| Balanced | 60% | 40% |

| Measured | 40% | 60% |

| Conservative | 20% | 80% |

| Very Conservative | 0% | 100% |

If you choose the Very Aggressive portfolio, 100% of your money will be invested into equity funds. This will give you the greatest volatility in the short term. However, you have the potential to receive greater returns in the long run.

What are the returns of the ESG portfolio?

The 100% equity ESG portfolio has outperformed the MSCI All Country World Index (17.1% vs 10.5%) in the past 3 years. However, these past returns cannot be used to predict the future returns that you can receive.

The MSCI All Country Index is slightly different from the MSCI World Index!

The ESG portfolio has performed pretty well when comparing it with the MSCI index. It has been shown to have a lower volatility compared to the index, especially during the COVID-19 crash.

While the portfolio’s performance looks really good, you can’t use these past returns to project your future returns. Ultimately, you will need to believe in this investing strategy, rather than just using these past indicators!

If you believe that ESG investing will help you to realise better returns in the future, then this portfolio is one you can consider.

What are the fees that I’ll incur when I invest in the Endowus ESG portfolio?

When you invest in either portfolio with Endowus, you will be charged 2 levels of fees:

- Fund-level fees (by the fund manager)

- Management fees (by Endowus)

Both of these fees will reduce the amount of actual returns that you will receive. As such, the best way would be to keep your costs as low as possible.

#1 Fund-level fees (by the fund manager)

When you invest in the different funds on Endowus’ platform, the fund managers will charge you a fee as well.

However, Endowus has helped to reduce the fees that you’ll incur from the fund managers in 2 ways:

- Providing you with access to institutional share classes (lowest fees amongst all share classes)

- Rebating the trailer fee to you

If you want to invest in any of these funds, Endowus is probably the most cost effective way of doing so. This is especially if you’re a retail investor!

For example, you are investing in a Class A share if you buy the Schroder ISF Global Sustainable Growth Fund on FSMOne. You will need to pay 1.3% in fund-level fees.

Meanwhile, you are investing in Class C shares with Endowus, and will only incur a 0.86% fee! The cost difference can help to grow your money especially in the long term.

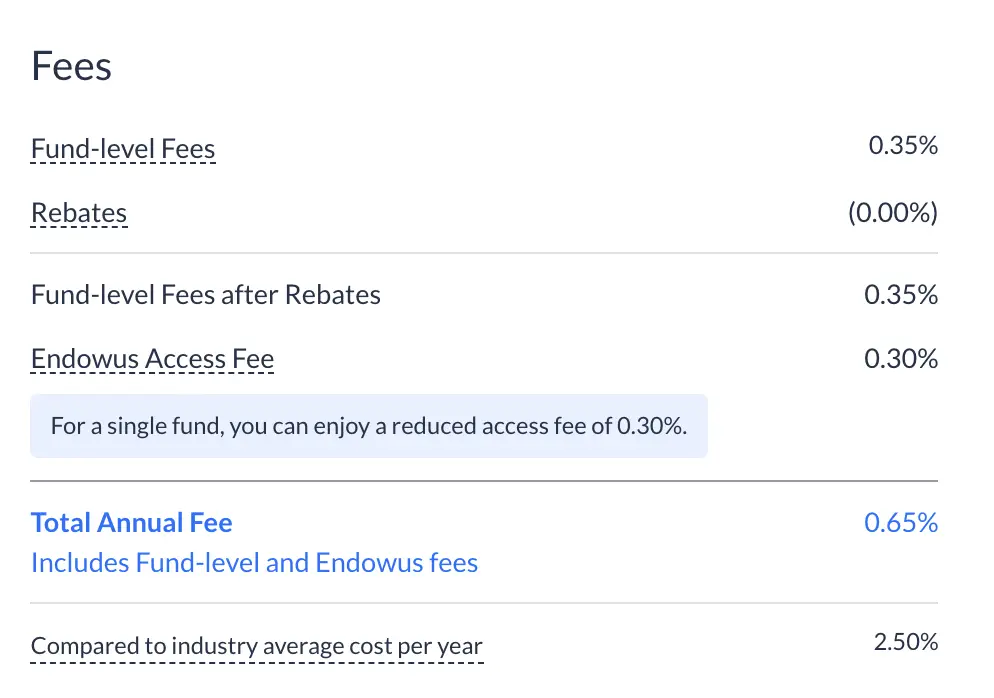

Endowus shows the breakdown of the fees you are paying when you are creating your portfolio.

Here is are the expected fund-level fees you’ll need to pay across the different risk levels:

| Risk Level | ESG |

|---|---|

| Very Aggressive | 1.01% |

| Aggressive | 0.96% |

| Balanced | 0.92% |

| Measured | 0.88% |

| Conservative | 0.84% |

| Very Conservative | 0.79% |

The fund-level fees that you’re paying for the ESG portfolios is higher compared to the Core portfolios. This is something you’ll need to consider if you intend to start ESG investing.

#2 Management fees (by Endowus)

The management fees that you are charged depends on the type of funds that you are using to invest in the ESG portfolios.

Flat 0.3% for single fund portfolios with Fund Smart

If you have a Fund Smart portfolio that only has a single fund inside (i.e. 100% allocation), you will only be charged 0.3%. This is irregardless of whether you’re using your Cash, SRS or CPF to invest.

This makes it one of the cheapest fees that are being provided by a robo-advisor!

Flat 0.4% for SRS

Endowus charges a flat 0.4% fee for any amount of your SRS funds that you have invested.

This makes it one of the lowest fees being offered by a robo-advisor!

Tiered pricing for Cash

Endowus has a tiered pricing for your cash investments:

| Amount | Fee |

|---|---|

| Up to S$200k | 0.6% |

| S$200,001 to S$1,000,000 | 0.5% |

| S$1,000,001 to S$5,000,000 | 0.35% |

| S$5,000,001 and above | 0.25% |

Endowus offers a tiered and not stacked pricing. This means that if you invest $200,001 into Endowus, you will be charged 0.5% for your entire $200,001.

Compared to other robo-advisors, Endowus’ fees are pretty affordable.

The highest amount of fees you’re expected to pay is around 1.5%

If you are investing in the most expensive option (using cash to buy the Very Aggressive portfolio), your total fees will add up to be around 1.51%. This is a rather low fee, compared to some of the fees that other fund platforms charge you!

Verdict

Endowus offers you access to these ESG funds at much lower costs compared to other platforms. Moreover, you are only required to invest $1,000 as your initial investment, and $100 for every subsequent investment.

This is much more accessible compared to if you were to invest in each individual fund on other platforms!

However, the fund-level fees are generally higher compared to the Core advised portfolios. You will need to consider if the higher fees you’ll incur will allow you to receive greater returns, especially for the long term!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?