Last updated on June 6th, 2021

You’ve decided to start investing in US stocks. However did you know that besides the dividend withholding tax, you will incur an estate tax as well?

This can start from 18% and goes all the way up to 40%, depending on your total assets in the US!

What exactly is this estate tax and what does it mean for Singaporeans?

Here’s what you need to know:

Contents

- 1 What is the US estate tax?

- 2 How does the estate tax work?

- 3 How do I declare my estate tax?

- 4 What are the estate tax rates?

- 5 How does this tax affect me?

- 6 What assets are included in the estate tax?

- 7 Are assets I own with robo-advisors subject to estate tax?

- 8 What assets are not included in the estate tax?

- 9 What can I do to avoid this tax?

- 10 Conclusion

- 11 👉🏻 Referral Deals

What is the US estate tax?

The US estate tax is a tax on the transfer of current assets that you own in the US. This tax is levied upon your death, even if you do not intend to transfer it to someone else.

This tax can range from 18% – 40%, depending on the value of your estate.

An estate tax is different from inheritance tax

The terms estate tax and inheritance tax are sometimes used interchangeably. However, they work in 2 different ways!

The main difference between these 2 taxes is how they are being levied. For the estate tax, it is levied regardless of whether anyone inherits your tax or not.

This is because the estate tax is a tax on your right to transfer property at your death.

The estate tax is imposed on the transfer of the decedent’s taxable estate rather than on the receipt of any part of it.

Source: IRS

In the case of an inheritance tax, it will only be levied when you inherit a part of the deceased’s assets.

How does the estate tax work?

When you pass on, your Gross Estate will have to be calculated first. Here are some things that will be included in your Gross Estate:

- Cash and securities

- Real estate

- Insurance

- Trusts

- Annuities

- Business interests

- Other assets

The value of your assets are determined at the time of your death. This may not be the price that you paid to purchase them.

After determining your Gross Estate, you may be eligible for certain deductions. Some of these include:

- Funeral and administration expenses

- Unpaid mortgages and liens

- Certain uncompensated losses

- Charitable and marital deductions (subject to limitations)

If you are able to properly document these into your tax application, they may be deducted from your Gross Estate.

How do I declare my estate tax?

Your executor is required to fill up Form 706-NA that can be found in the IRS website. This has to be done within 9 months from the time of your passing.

Some of the documents that you will need to fill up this form include:

- A certified copy of the will (if applicable)

- A copy of decedent’s death certificate

- A documentation of your estate’s valuation

Once IRS has approved the application, your executor can then apply for your assets to be transferred out.

The form looks pretty complex. As such, you might need to get a lawyer to help you with this process.

The good thing is that you do not need to file for estate tax if your total US assets are less than $60,000.

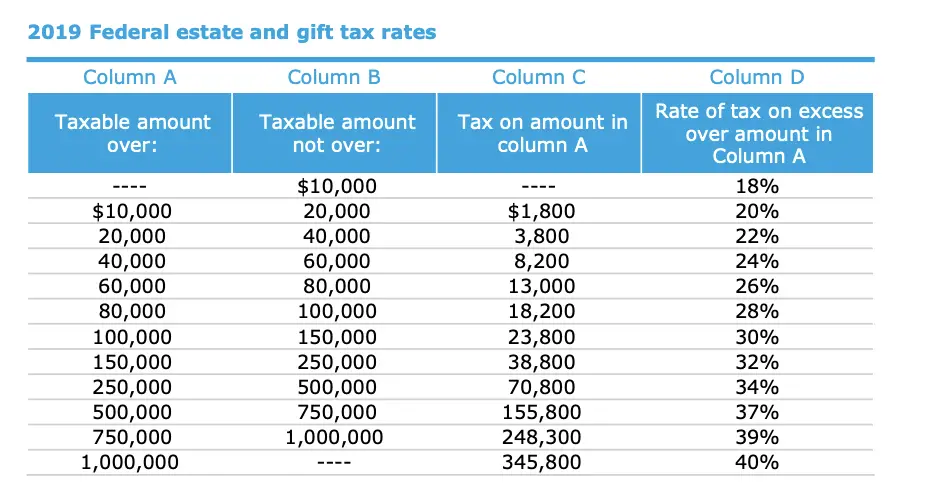

What are the estate tax rates?

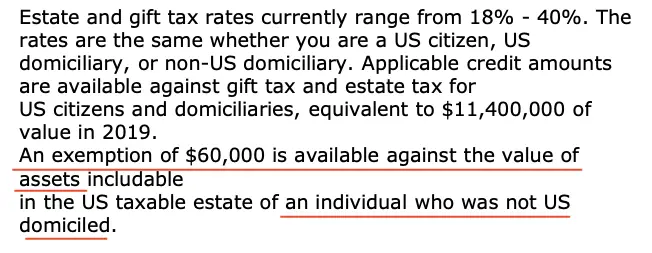

This guide by Deloitte on the US estate tax rules helps to make things a lot clearer. As long as your US assets are more than $60k, you are subject to the estate tax.

If your assets are less than $60k, you are exempted from this tax.

Your total estate after $60k will be taxable. The amount of tax that you pay depends on the amount in your estate.

It can range from 18% all the way to 40%!

How does this tax affect me?

The tax will not indirectly affect you as you’ve already passed away. However, this affects how much of your assets are able to be transferred to your loved ones.

The US Estate Tax is levied on your estate, regardless of whether you pass it on to someone else or not.

With the tax starting from 18%, it is an extremely hefty fee that you are paying by just owning US assets.

If you intend to leave a legacy behind for your loved ones, it may not be that suitable to purchase a huge amount of US assets!

What assets are included in the estate tax?

Here are some assets that you have that will be considered in the estate tax:

#1 US stocks and bonds

Any stock or bond that you own from a US company will be subject to this tax. This includes all the stocks and bonds that you own across the different brokers that you have!

Even though US stocks seem to perform better than the SGX ones, this hidden cost is something you’ll need to consider.

#2 Cash in US brokerages

The cash that you have in brokerage firms that are US companies are subject to this tax as well!

Some of these US-based brokerage firms include:

- Interactive Brokers

- Firstrade

- TD Ameritrade

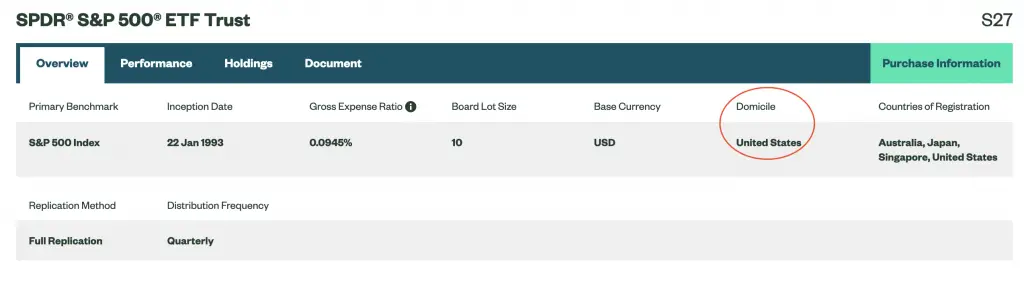

#3 US-domiciled ETFs and mutual funds

Any ETF or mutual fund that is domiciled in the US will be subject to the estate tax.

You can check where the fund is being domiciled either from:

- The fund’s fact sheet

- The fund manager’s website

The fund’s domicile and exchange listing is different

It does not matter which exchange the fund is listed on. If the fund’s domicile is in the US, it will be subject to this estate tax.

One example is the SPDR S&P 500 ETF listed on the SGX (S27). Even though it is listed on the Singapore Exchange, it is domiciled in the US.

As such, you will still incur the dividend withholding tax and estate tax even if you invest with S27!

US-domiciled funds that invest in stocks from other countries are included too

Moreover, US-domiciled funds that own stocks from other countries will be under the estate tax too!

For example, the iShares MSCI China ETF (MCHI) tracks the top China companies. However, it is also domiciled in the US.

Even though the fund owns Chinese stocks, the fund is still domiciled in the US. As such, the estate tax will also apply.

Are assets I own with robo-advisors subject to estate tax?

The assets that you own with robo-advisors may be subject to estate tax as well. Robo-advisors that invest in US-domiciled ETFs have not provided a definite answer on this issue.

However, Endowus has explicitly stated that you will not be subject to estate tax when you invest with them.

Here are what some of the robo-advisors have to say regarding estate taxes:

StashAway estate tax

StashAway manages your assets under StashAway’s legal entity, Asia Wealth Platform Pte Ltd. According to StashAway, the estate tax should only apply if you are investing as an individual investor.

Your investments with StashAway should be treated as corporate investments. As such, they should not be subject to estate taxes.

This is because StashAway co-mingles your assets with other StashAway customers under a single account.

If you use StashAway’s investment portfolios, they primarily invest in US-domiciled ETFs. However, there is still some uncertainty whether your StashAway investments are subject to estate tax or not!

The only portfolio where you will not incur any estate taxes on is StashAway’s Income Portfolio.

Syfe estate tax

Syfe manages your assets in a co-mingled account that contains the assets of Syfe’s customers. In this way, your ownership of your invested funds is indirect.

According to Syfe, you should not be subject to estate taxes, which are levied on your individual US assets. However, Syfe is unable to give a definite answer as well.

There are some ways that you can avoid this tax while investing with Syfe:

If you invest in Syfe’s REIT+, you will not incur any taxes since all of these REITs are listed on the SGX.

Moreover, Syfe’s Equity 100 invests a part of your portfolio in CSPX, which is a UCITS S&P 500 ETF. A UCITS ETF is not subject to the US estate tax.

However, this is only a part of your entire Equity 100 portfolio! The remaining ETFs are still US-domiciled. As such, those ETFs may still be subject to the estate tax.

Endowus estate tax

Endowus invests in UCITS funds, which are domiciled in Ireland. You will not be subject to the US estate tax when you invest in these UCITS funds using Endowus.

One such example is the Dimensional World Equity Fund.

This is also similar to MoneyOwl, who invests your money in Dimensional Funds too.

Even though some of these UCITS funds may own US stocks, their domicile is still is in Ireland. As such, these funds are not considered in your Gross Estate!

When you invest with Endowus, your assets are held under your own name, rather than a co-mingled account. Despite this, you still do not incur any US estate tax with your assets since they are UCITS funds.

You can find out more about how robo-advisors manage their assets in my analysis on why Smartly closed down.

What assets are not included in the estate tax?

There are some assets that you can own which will not be considered in your total estate. As such, they will not be liable to this estate tax.

Some of these assets include:

- U.S. treasury and government agency securities

- Mutual funds registered outside of the U.S.

- Investment instruments which produce portfolio interest

- Equities issued by non-U.S. companies

What can I do to avoid this tax?

If you think that this tax is pretty hefty, you may want to find out how to avoid incurring this tax.

Here are 4 possible strategies you can use to avoid the US estate tax:

#1 Invest less than $60k in US assets

If you still wish to invest in US stocks but do not want to pay the estate tax, it is still possible to do so. So long as your US-based assets are less than $60k, you do not incur any estate tax!

However, this strategy can be rather limiting. This is because the value of your assets are determined by the fair market value at the point of your death.

The stocks and ETFs that you own may increase in value over time. As such, you may exceed the $60k threshold when you pass away!

One possible way would be to constantly monitor your portfolio. Once your portfolio amount exceeds $60k, you can sell some of your stocks to remain below $60k.

You may want to consider using a low cost broker like Tiger Brokers or moomoo which only charges you a minimum of USD$1.99 per trade.

#2 Choose funds that are not domiciled in the US

If you still wish to purchase ETFs and mutual funds that own a basket of US stocks, you may want to consider a UCITS funds instead.

These funds are domiciled in Ireland. Even if they own US stocks, they are not subject to the US estate tax.

Another perk with UCITS is that you can choose to invest in an accumulating ETF. The fund manager will automatically reinvest your dividends for you, which saves you on transaction fees!

Furthermore, the dividend withholding taxes will be reduced to 15% from 30% when you invest in a UCITS ETF.

This may make UCITS ETFs more tax-efficient compared to their US-domiciled counterparts.

Inheritance tax for Ireland-domiciled funds are only levied if you are an Irish citizen

You may have seen that the Irish inheritance tax is 33%, and may be quite worried that you’ll need to pay this tax.

However, this may not be the case!

The Irish Tax and Customs website states that inheritance is only taxable when one of the following criteria is fulfilled:

- The disponer is a resident or ordinarily resident in Ireland for tax purposes

- The beneficiary is a resident or ordinarily resident in Ireland for tax purposes

- The property is situated in Ireland

So long as you do not own any Irish property, and you and your beneficiaries are not Irish citizens, you do not need to pay this tax!

#3 Purchase more life insurance

Another strategy you can use would be to buy more life insurance. Life insurance is a ‘sum-assured‘ type of policy. So long as you meet the criteria (in this case, death), you will receive a payout.

This allows you to make multiple claims from different insurance companies.

As such, you can start purchasing a separate life policy to help to cover the costs of your estate tax!

You can purchase the premiums required to give you a sum assured that is greater than or equal to your expected estate tax.

This depends on the total value of your estate.

When your loved ones want to take over your assets, they do not need to fork out money to pay the estate tax. This is because it is already covered with your life insurance policy!

If you are willing to pay a certain amount of premiums each month for this policy, this is a strategy that you can consider.

#4 Create a joint account

There are some brokerages and robo-advisors that allow you to create a joint account. This includes:

- TD Ameritrade

- Endowus

In the event that you pass on, your joint account holder will still have access to your account.

For TD Ameritrade, they clearly state that if any joint account holder passes away, the assets will be transferred to the remaining holder.

This strategy may not be always applicable

However, this strategy may not work for all brokerages. Some of them do not allow you to create a joint account.

The rules of joint ownership are also not really covered by the IRS. Even though you are the joint account holder with someone who passed away, you may still be required to pay the estate tax!

If you are worried that this scenario may occur, you may want to clarify this with the broker before investing with them.

Conclusion

The US estate tax is something that many Singaporean investors may not be aware of. While the returns in the US markets will be better than in Singapore, these hidden costs may become really hefty!

It is important for you to take note of this tax, especially if you want to leave behind a legacy for your loved ones.

There are a few strategies to avoid this tax. However, the best way seems to be to invest in an UCITS ETF!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

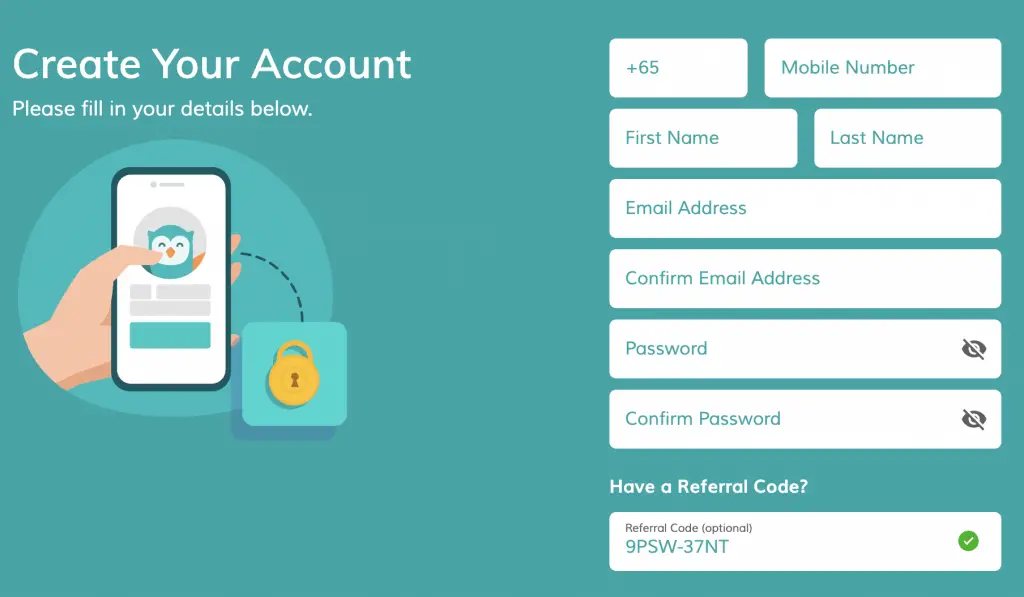

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?