Last updated on June 6th, 2021

You’ve decided to start your investment journey. 2 of the products you’re considering are Invest Saver and StashAway.

How do they differ from each other?

Contents

- 1 The difference between POSB Invest Saver and StashAway

- 2 Type of Investment

- 3 Minimum amount to invest

- 4 Investing frequency

- 5 Choice of investment products

- 6 Ability to invest in fractional shares

- 7 Performance

- 8 Fees

- 9 Funds you can use to invest in their portfolios

- 10 Verdict

- 11 Conclusion

- 12 👉🏻 Referral Deals

The difference between POSB Invest Saver and StashAway

POSB Invest Saver is a regular savings plan that allows you to dollar cost average into an ETF or unit trust. Meanwhile, StashAway is a robo-advisor that invests your money into a globally diversified portfolio which contains different asset classes.

Here’s an in-depth breakdown on the differences between these 2 investments:

Type of Investment

Invest Saver is a regular savings plan. Meanwhile, StashAway is a robo-advisor.

Both of these investment products have some major differences. You can read my comparison between a regular savings plan and a robo-advisor to see which one is better for you.

Minimum amount to invest

Both investments have a different minimum amount to invest with them.

You require a minimum of $100 each month for Invest Saver

Invest Saver requires you to invest a minimum of $100 each month. Moreover, you can only invest in further multiples of $100.

As such, Invest Saver may be slightly more restrictive for the investment amount.

There is no minimum amount for StashAway

For StashAway, there is no minimum amount to start investing with them. This means that you can invest even with $1!

If you have a small amount you wish to invest each time, then StashAway may be more suitable for you.

However if you decide to invest in StashAway’s Income Portfolio, you will require a minimum of $10k invested before you can start receiving dividends.

Investing frequency

The frequency in which you can invest with both products is different as well.

Invest Saver invests your money via dollar cost averaging

Since Invest Saver is a regular savings plan, it will adopt a dollar cost averaging approach. As such, your money will be invested on the same day of every month.

Your funds will be deducted on the 15th of every month to be invested.

You can invest any way you want with StashAway

For StashAway, it is much more flexible. You can choose to dollar cost average into your portfolio. This can be done by setting a monthly recurring transfer to StashAway.

You can also choose to invest using 2 other strategies:

- Invest a lump sum at the start and hold for the long term

- Invest a lump sum initially and then dollar cost average a fixed sum each month

You are able to use any method you wish to invest in StashAway. This makes it much more flexible for you.

Choice of investment products

Both of these investment products allow you to invest into different types of asset classes.

Invest Saver allows you to invest in specific ETFs or unit trusts

Invest Saver allows you to invest in 4 different ETFs.

| ETF Name | Ticker | Type of ETF |

|---|---|---|

| Nikko AM Singapore STI ETF | G3B | Singapore Equity ETF |

| ABF Singapore Bond Index Fund | A35 | SGD Fixed Income ETF |

| Nikko AM SGD Investment Grade Corporate Bond ETF | MBH | SGD Fixed Income ETF |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | CFA | REIT ETF |

You may be wondering what’s the difference between A35 and MBH, since they are both bond ETFs. You can read my head-to-head comparison between these 2 ETFs to see which is better for you.

These 4 ETFs are also found in StashAway’s Income Portfolio. This portfolio may be more suitable for you if you wish to invest in all 4 ETFs together.

These ETFs offered by Invest Saver are all listed on the SGX. As such, they are pretty concentrated in Singapore and Asia.

Invest Saver also allows you to invest in an extensive list of unit trusts as well. Unit trusts can be very costly, so you should understand them first before you decide to invest in one!

You should know the ETF well before you invest in it

Since you are investing in just one ETF, you should know how these ETFs work before investing in them.

ETFs themselves are already broadly diversified. As such, they should be rather safe investments to invest in.

However, you should understand how they work so that you’ll be aware of the risks!

StashAway invests your money in a globally diversified portfolio

StashAway invests your money across different asset classes, such as:

- Stocks

- Bonds

- Real Estate (REITs)

- Commodities

StashAway has chosen to invest in ETFs listed in the US stock exchanges. As such, they will buy different ETFs for the different asset classes.

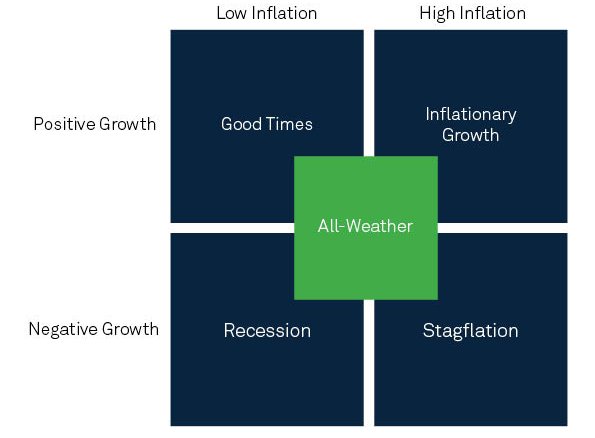

StashAway uses the ERAA framework

StashAway uses an Economic Regime-based Asset Allocation (ERAA) framework. This framework focuses on asset allocation instead of securities selection.

This means that StashAway focuses on your allocation into each asset class, rather than choosing which specific stock or bond they would invest in.

Essentially, StashAway’s ERRA framework follows the Modern Portfolio Theory.

StashAway decides on your allocation based on the current economic conditions. Here are the 4 economic regimes that are defined by StashAway:

The ERAA has a certain allocation for each regime. For example, you will be weighted more towards equities in periods of strong growth. Meanwhile during poor economic times, you may be allocated more towards bonds.

StashAway has automatic rebalancing too

The ERAA will re-optimise your for you when it detects a change in the economic regime. A recent re-optimisation was done in May to account for the effects of COVID-19.

Fractional shares allow you to own a portion of a share.

For example, a share is worth $10 but you can only invest $1.

With fractional shares, you are able to own 1/10th of the share.

This really helps you if the stock or ETF that you’re investing has a really large price. For example, a Tesla stock costs a few USD$100!

The ability to invest in fractional shares helps you to make full use of your entire investment amount.

Invest Saver does not have fractional shares

For Invest Saver, you are unable to invest in fractional shares. As such, you will only buy the maximum possible number of units with your investment amount.

For example, you invested $100 each month, and the ETF that you want to buy costs $10.

Including the fees (0.5%), you can only buy a maximum of 9 units.

9*$10 + 0.5% * 90 = $90.45

You will be refunded $9.55.

The uninvested amount will be refunded to you.

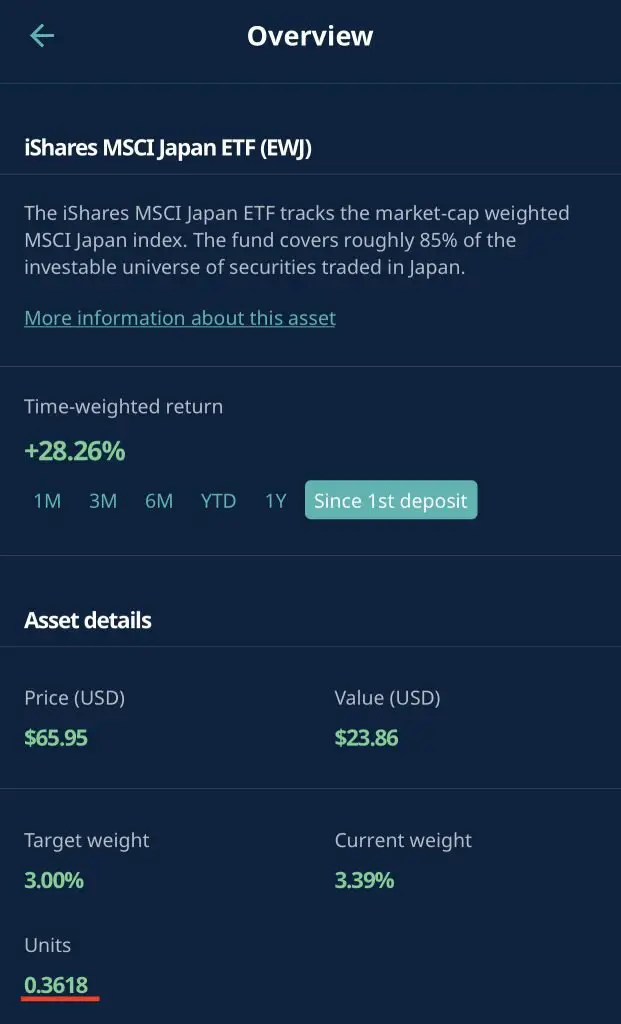

StashAway allows you to buy fractional shares

When you invest in StashAway, you are able to purchase fractional shares.

StashAway co-mingles your assets with other investors under a single custodian account. This is why they are able to allocate fractional shares to you.

If you have a small investment amount, this will really help to make investing accessible for you. However, there may always be a risk that StashAway closes down like Smartly.

If this happens, you do not have full control over the fate of your assets!

Performance

It can be quite difficult to measure the performance of both investment products, since they are so different. However, here is a brief overview of how they may perform.

Invest Saver’s performance depends on the ETF you choose

You are choosing to invest in a single ETF using Invest Saver. The performance of your regular savings plan will thus depend on its performance.

For each of the 4 ETFs, there are a specific asset class that you are investing in:

| ETF Name | Ticker | Type of ETF |

|---|---|---|

| Nikko AM Singapore STI ETF | G3B | Singapore Equity ETF |

| ABF Singapore Bond Index Fund | A35 | SGD Fixed Income ETF |

| Nikko AM SGD Investment Grade Corporate Bond ETF | MBH | SGD Fixed Income ETF |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | CFA | REIT ETF |

Generally, the riskier the asset class, the higher potential returns you may receive.

As such, the performance of these 3 asset classes will be in the following (descending) order:

- Equities

- REITs

- Fixed Income (Bonds)

G3B has the highest potential for good returns since it invests your funds into Singapore’s top 30 stocks.

If you are using Invest Saver separately from your online broker, you can track the performances together using StocksCafe.

StashAway’s performance depends on the risk profile you’ve chosen

Instead of just one asset class, StashAway invests your funds into different asset classes.

StashAway uses a Risk Index to determine your allocation into each asset class. The Risk Index ranges from 6.5-36%.

The Risk Index means that there is a 99% probability that you will not lose more than x% of your portfolio in a year.

The x% is the amount of risk you are willing to take.

The higher the Risk Index you’ve chosen, the higher the allocation of your portfolio towards stocks. If you choose a lower Risk Index portfolio, you will be allocated more towards bonds.

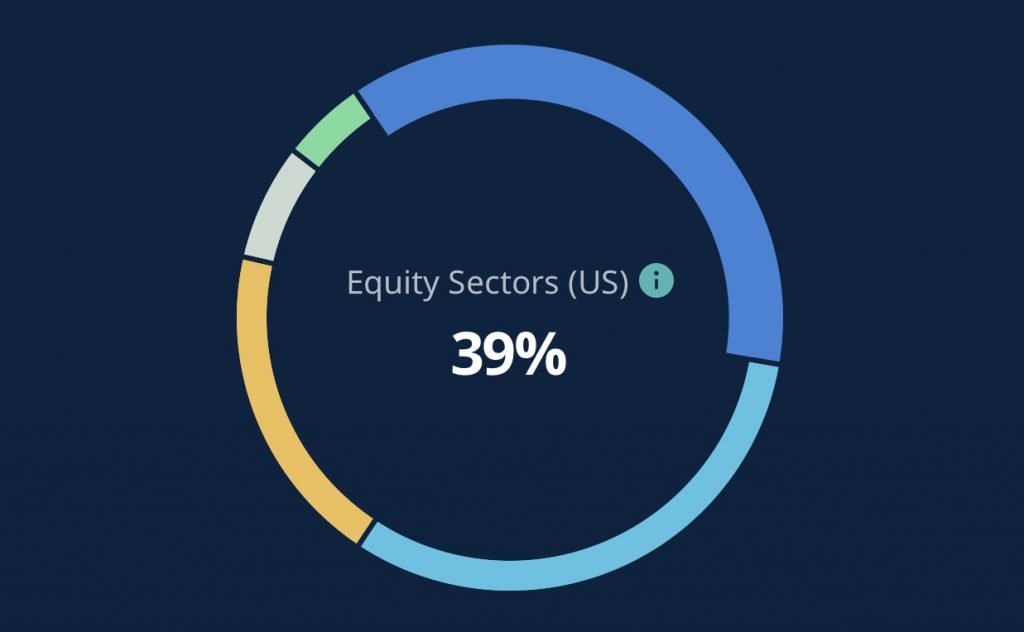

For example, here is the allocation towards each asset class in a 36% Risk Index portfolio:

Your portfolio will have a large allocation towards stocks in the US.

Stocks are one of the riskiest asset classes that you can trade on an exchange. As such, they will have the highest potential to give you the best returns.

You can view how each portfolio has performed against its index on StashAway’s website.

Fees

The fee structure of both investment plans are rather different.

Invest Saver charges you a transaction fee

You will be charged for each buy or sell order that you make with Invest Saver. The transaction fee that you’ll need to pay depends on the ETF or Unit Trust that you invest in.

| Fund Name | Fee |

|---|---|

| Nikko AM Singapore STI ETF | 0.82% |

| ABF Singapore Bond Index Fund | 0.50% |

| Nikko AM SGD Investment Grade Corporate Bond ETF | 0.50% |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | 0.82% |

| All Unit Trusts | 0.82% |

If you wish to buy an ETF using a regular savings plan, Invest Saver has lower fees compared to OCBC BCIP or POEMS Share Builders Plan.

You will receive the amount that is uninvested back in your account.

StashAway charges you a management fee

Similar to the fee structure of other robo-advisors, StashAway charges you an annual management fee.

Here is the fee structure that you’ll need to pay StashAway based on your investment amount.

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

If you invest a small amount with StashAway, the amount of fees you’ll pay is rather little. However, once you start having a sizeable amount in your portfolio, the fees can be really expensive!

At a certain point in time, it may be more cost effective for you to conduct DIY investing via brokerages like Tiger Brokers instead.

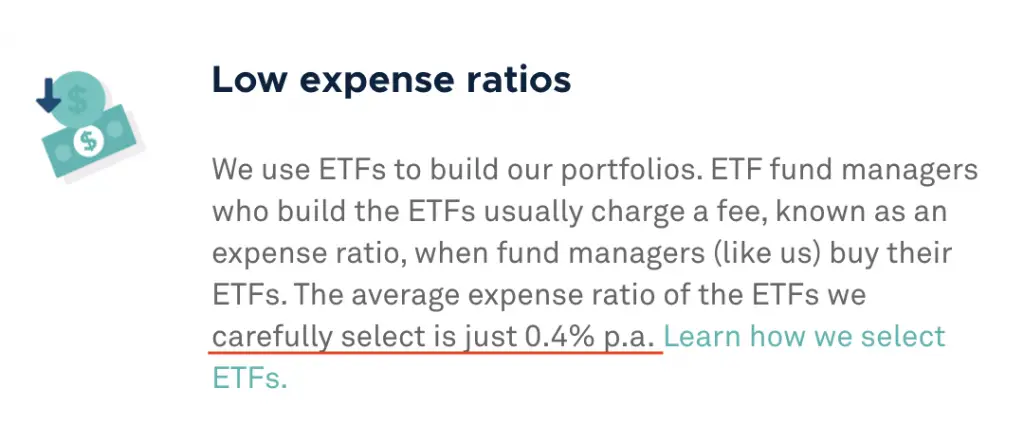

You’ll need to pay the expense ratio of the ETFs as well

Another cost that you’ll incur with either investment is the expense ratio of the ETF. This is similar to the management fee that you’re paying to StashAway.

However, you’re paying this expense ratio to the fund manager of the ETF instead.

Here are the expense ratios for Invest Saver:

| ETF Name | Expense Ratio |

|---|---|

| Nikko AM Singapore STI ETF | 0.3% |

| ABF Singapore Bond Index Fund | 0.25% |

| Nikko AM SGD Investment Grade Corporate Bond ETF | 0.27% |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | 0.6% |

Apart from the Nikko AM REIT ETF, all the expense ratios are still pretty decent at around 0.3%.

For StashAway, they claim that net expense ratio that you’ll be paying is a blended rate of around 0.4%.

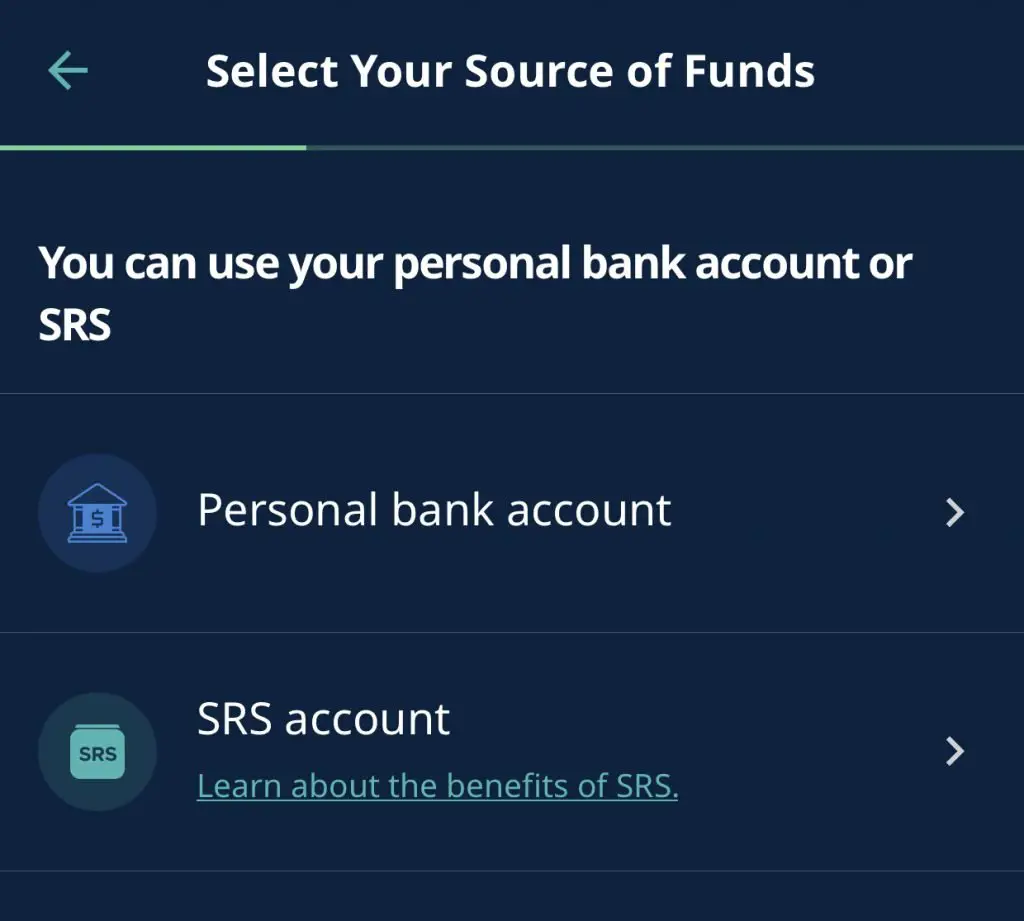

Funds you can use to invest in their portfolios

For Invest Saver, you can only invest your SRS funds into unit trusts. You cannot use your SRS funds to invest in the 4 ETFs.

You are able to invest your SRS funds into any StashAway portfolio, including StashAway Simple!

StashAway may be a better choice if you wish to invest your SRS funds.

Verdict

Here’s a breakdown between these 2 investment products:

| Invest Saver | StashAway | |

|---|---|---|

| Type of Investment | Regular Savings Plan | Robo-Advisor |

| Minimum Amount to Invest | $100 per month | No minimum |

| Investing Frequency | Every month | Anytime |

| Choice of Investment Products | 4 SGX ETFs Unit Trusts | ETFs of different asset classes |

| Diversity of Assets | Concentrated in Singapore and Asia | Globally diversified |

| Fractional Share Investment | Absent | Present |

| Performance | Depends on ETF chosen | Depends on Risk Profile chosen |

| Fees | Transaction fee + expense ratio | Management fee + expense ratio |

| Source of Funds | Cash SRS (only unit trusts) | Cash or SRS |

So which product is better for you?

Choose Invest Saver if you prefer to be concentrated in Singapore and Asia

Invest Saver offers you 4 ETFs which are heavily concentrated in Singapore and Asia. If you wish to just invest in the Asia region, these ETFs will be suitable for you.

Invest Saver can help you to cultivate an investing habit

Invest Saver deducts money from your POSB / DBS account on the same day each month. As such, this will help you to be very disciplined in your investing!

Choose StashAway if you want a globally diversified portfolio

StashAway offers you a more globally diversified portfolio. You are able to invest your funds over a wider range of assets from different countries.

You may not receive as high a return if you have fully invested in stocks. However when stocks do plummet, your portfolio will not drop as sharply.

As such, you will receive stable returns with lower volatility when investing with StashAway.

StashAway has greater flexibility

StashAway allows you to be more flexible on how you wish to invest. You are able to transfer or withdraw funds from your portfolio at any time!

However, a robo-advisor is still meant for long-term investing. You should not try to use it to beat the market since it mainly adopts a passive investing strategy.

As such, you should try not to check your performance everyday as it may tempt you to time the market!

Management fees may become very expensive in the future

The management fees that you pay StashAway may not seem much when you’ve first started investing.

You will only need to pay 80 cents for your first $1000 invested with them!

However as your investment amount increases, so does your fees. There may come a point where it may no longer be cost effective to invest with StashAway.

You may want to consider DIY investing via a low-cost broker like Tiger Brokers instead.

Conclusion

Both investment products will be able to help you to grow your money. Here are the main factors you may want to consider when choosing between Invest Saver and StashAway:

- The type of assets you wish to invest in

- The flexibility of investing you wish to have

- The type of fees you will be paying

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?