Last updated on July 30th, 2021

If you’ve just started getting involved in the crypto space, things may be really overwhelming.

There are many different platforms available, such as BlockFi and Coinhako.

So how are they different?

Here’s what you need to know:

Contents

The difference between BlockFi and Coinhako

BlockFi is a crypto lending platform that allows you to earn interest on your crypto, and you can only purchase crypto from USD. Meanwhile, Coinhako is a platform that has SGD trading pairs with many cryptocurrencies, which makes buying crypto from SGD much more convenient.

Here is an in-depth comparison between these 2 platforms:

Founder

BlockFi was founded in 2017, and they are headquartered in New York.

BlockFi has around 225,000 users on their platform.

Meanwhile, Coinhako is a cryptocurrency exchange that is based in Singapore and founded in 2014.

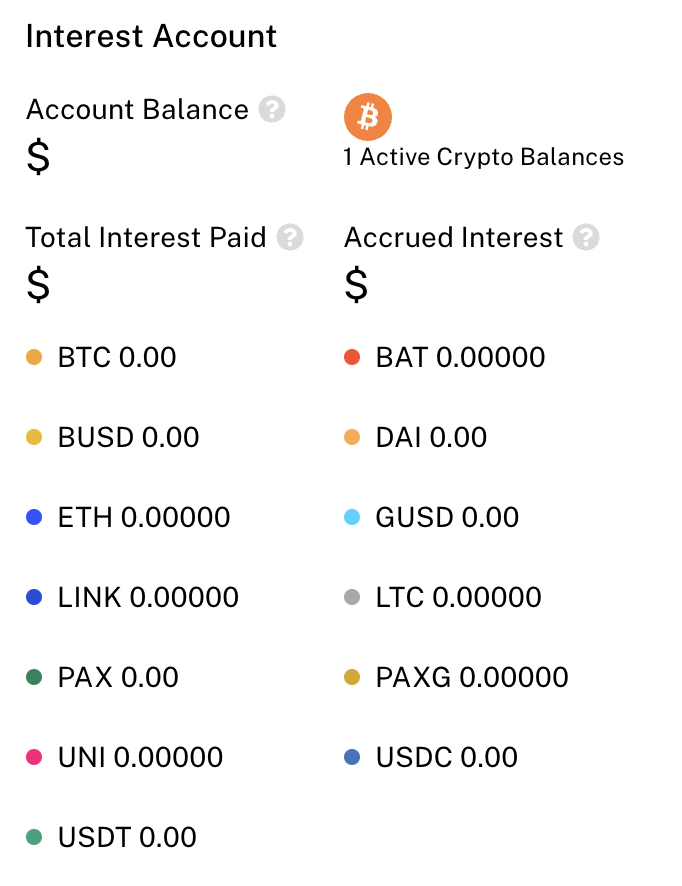

Number of currencies

BlockFi only supports 13 currencies on their platform.

This is quite little compared to other platforms. However, BlockFi still has more currencies compared to Hodlnaut.

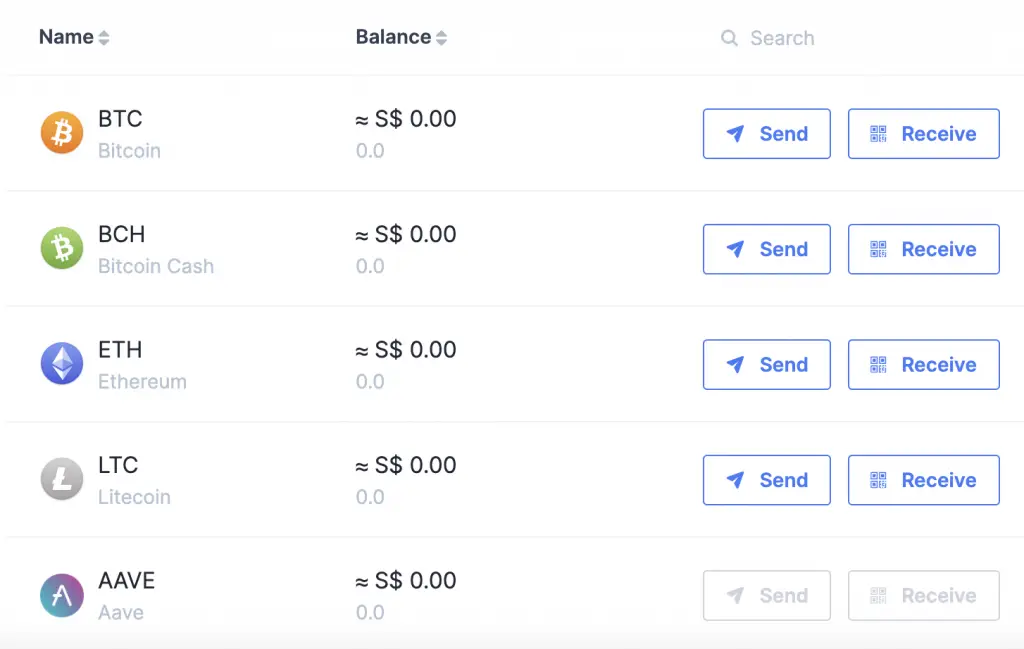

Coinhako provides full support for 21 tokens. You can buy, sell, swap, send and receive these tokens.

Some of them include:

Coinhako also has limited support for 9 other currencies. You aren’t able to send or receive these currencies to and from an external wallet.

This includes:

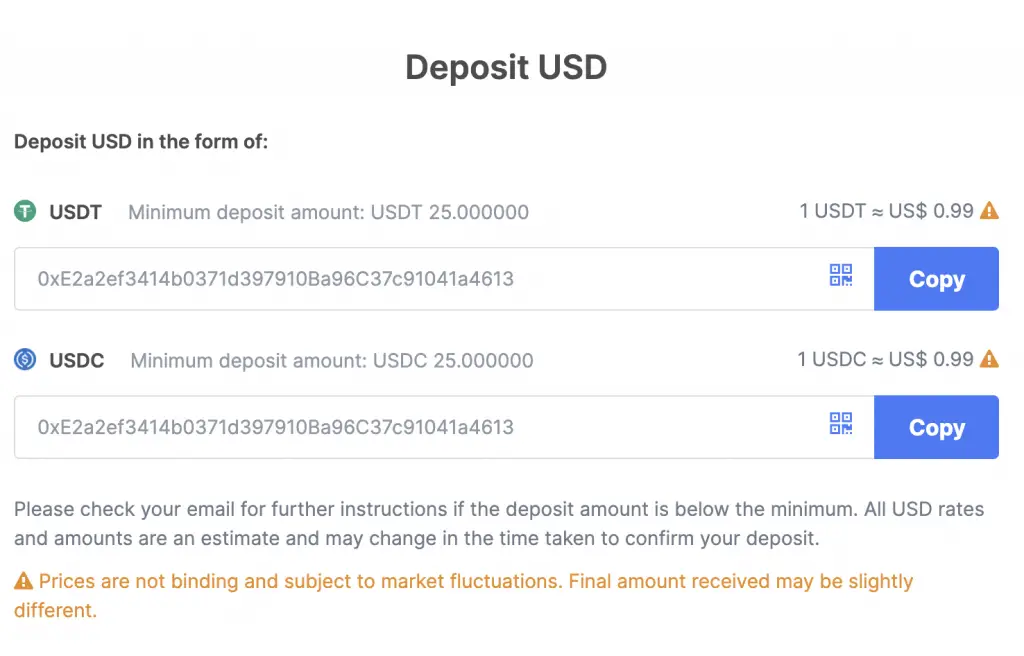

For USDT and USDC, these are rather complicated. You are able to receive both USDT and USDC from external wallets.

However, they will be converted into USD and be credited into your USD wallet on Coinhako.

In total, Coinhako supports 30 different currencies on their platform. This is much more compared to BlockFi!

Methods of funding your account

To start using either platform, you will need to fund your account. Here are some ways you can do so:

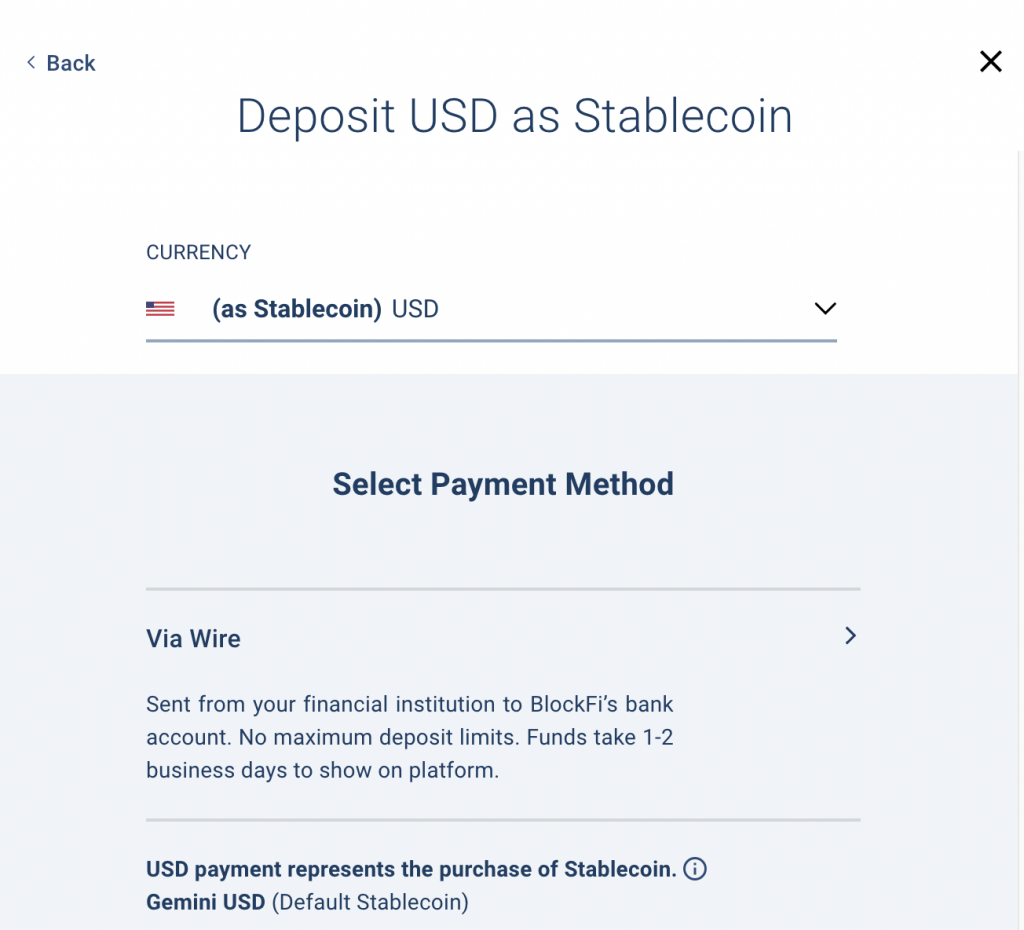

BlockFi only allows you to transfer USD into your account.

You are able to transfer your USD via a wire transfer. The minimum deposit is $10.

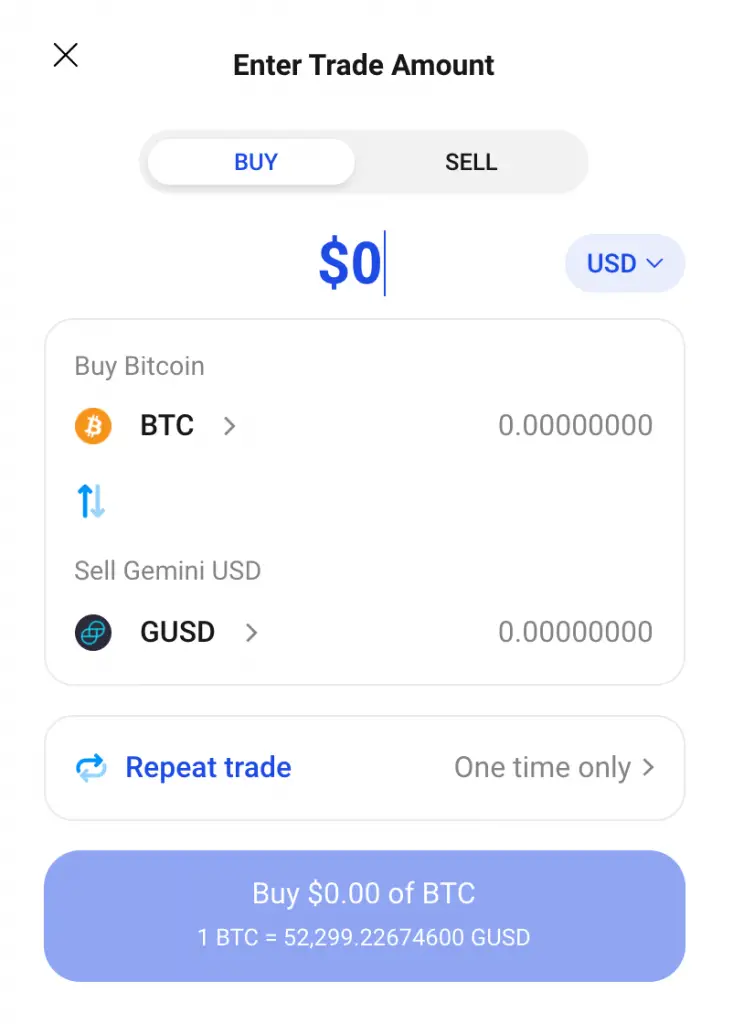

When you deposit USD into your BlockFi account, you will receive the equivalent in GUSD.

GUSD is a stablecoin that is created by Gemini.

Coinhako allows you to fund your account via 2 ways

There are 2 ways that you can fund your Coinhako account (both in SGD):

- Xfers Direct

- FAST transfer

You can view my guide on how to deposit into Coinhako to find out more.

If you are looking to buy crypto from SGD, Coinhako will be the easier option.

Methods of buying crypto

Here are some of the ways of buying crypto on either platform:

#1 Instant Buy (BlockFi and Coinhako)

You are able to instantly buy crypto from either your USD (BlockFi),

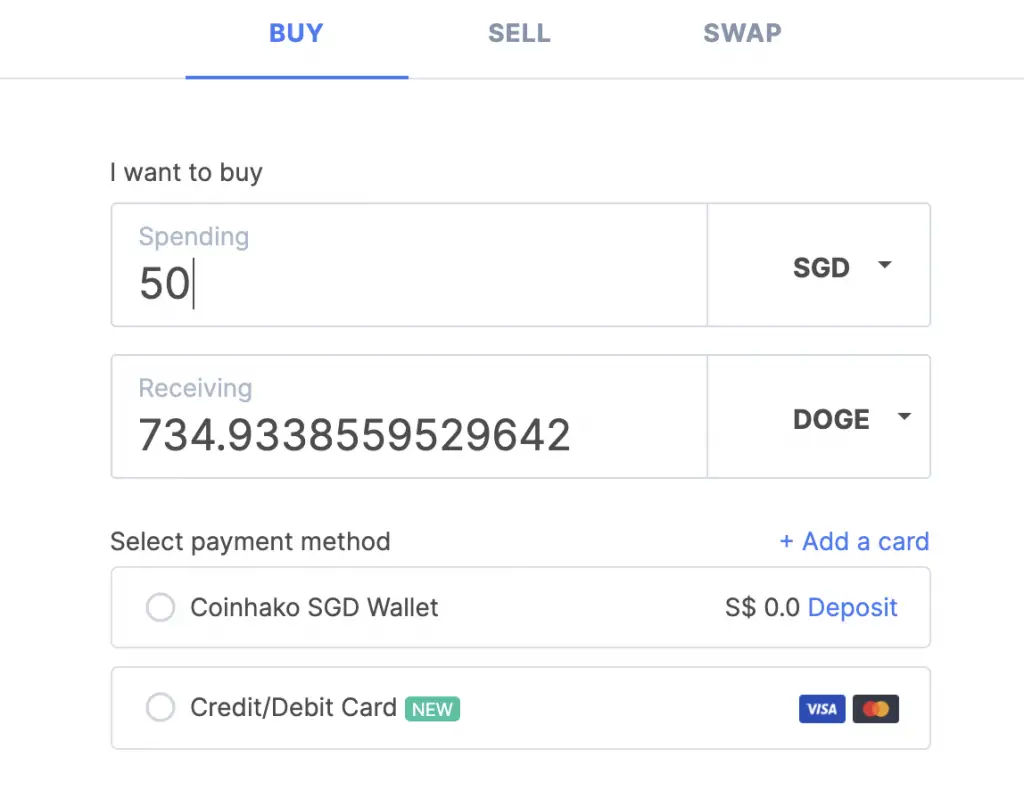

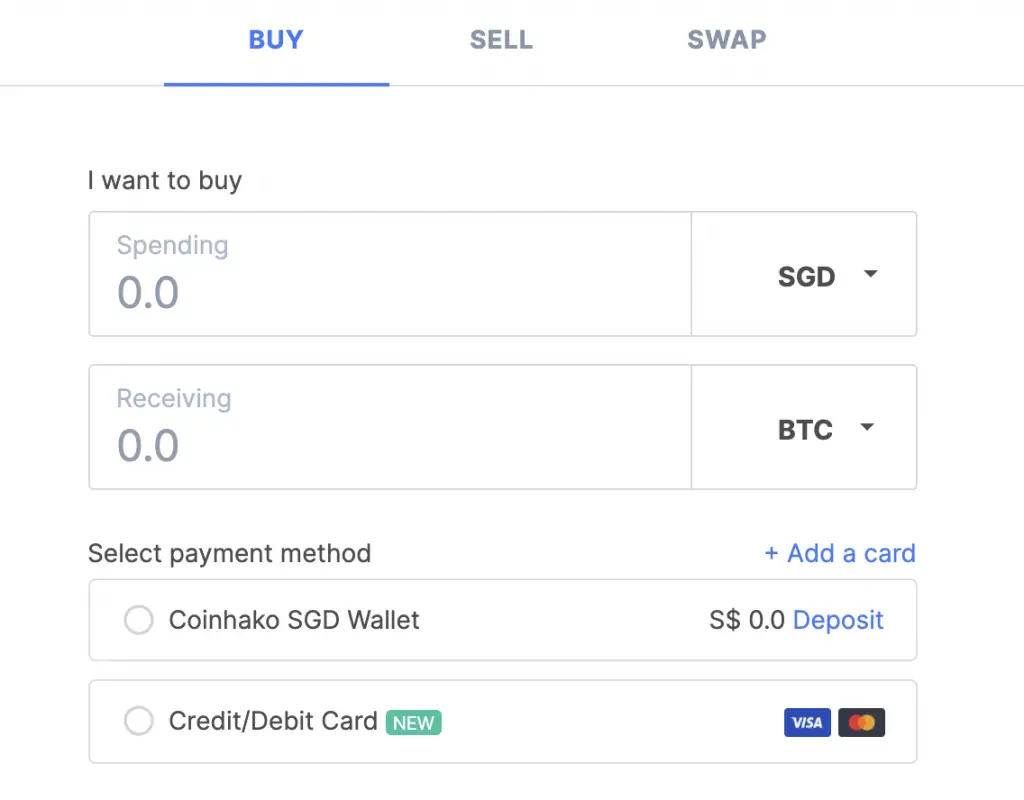

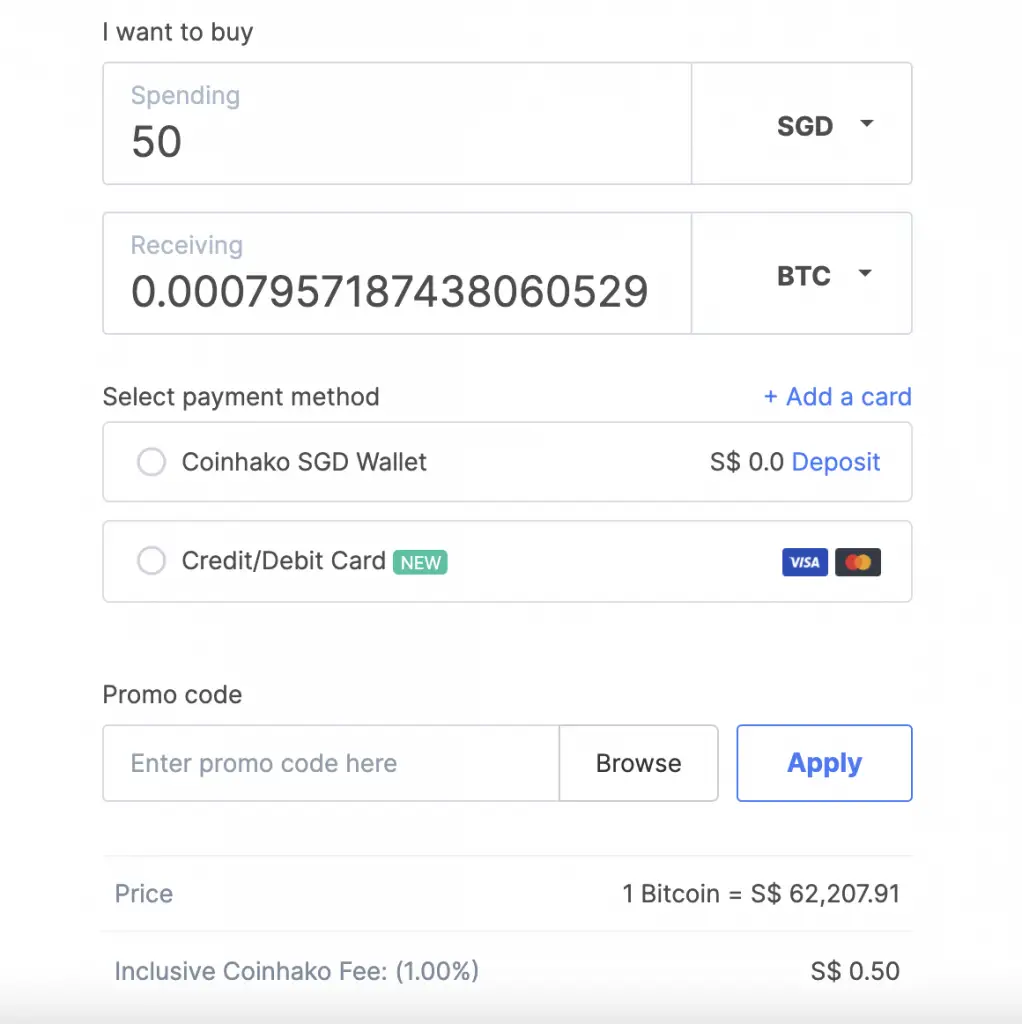

or your SGD with Coinhako.

You are buying your crypto at the platform’s prevailing rate.

This may be higher or lower compared to the current market rate.

#2 Credit card (Coinhako)

You can purchase crypto using a credit card for Coinhako too.

However, the fees are really high at 3%. Even though it is more convenient, it is definitely not worth buying crypto at such as high cost!

Withdrawal of funds

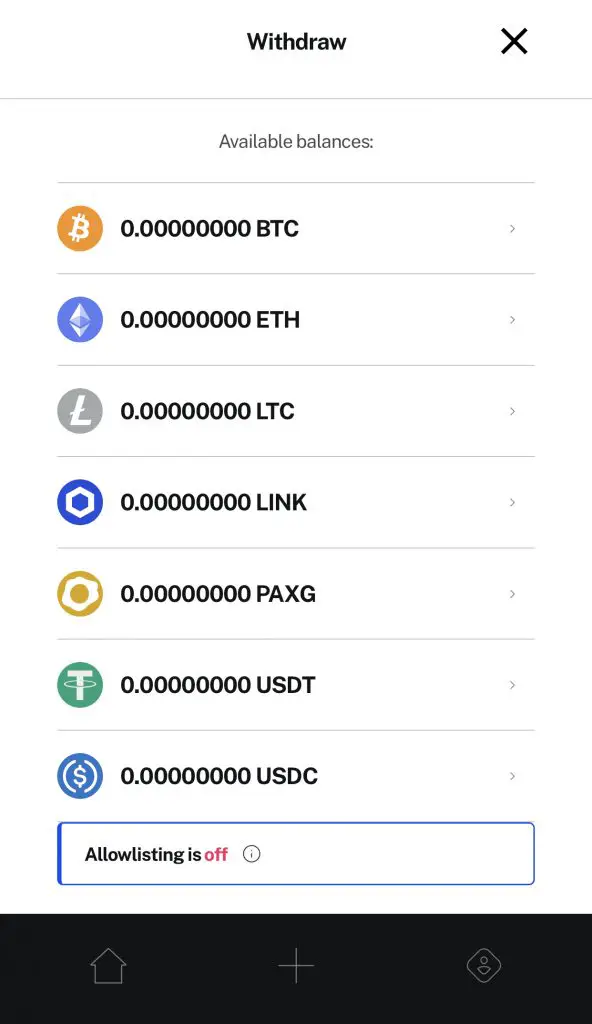

On BlockFi, you can only withdraw the supported currencies on their platform.

This means that you can only withdraw cryptocurrencies, and not fiat currencies like USD!

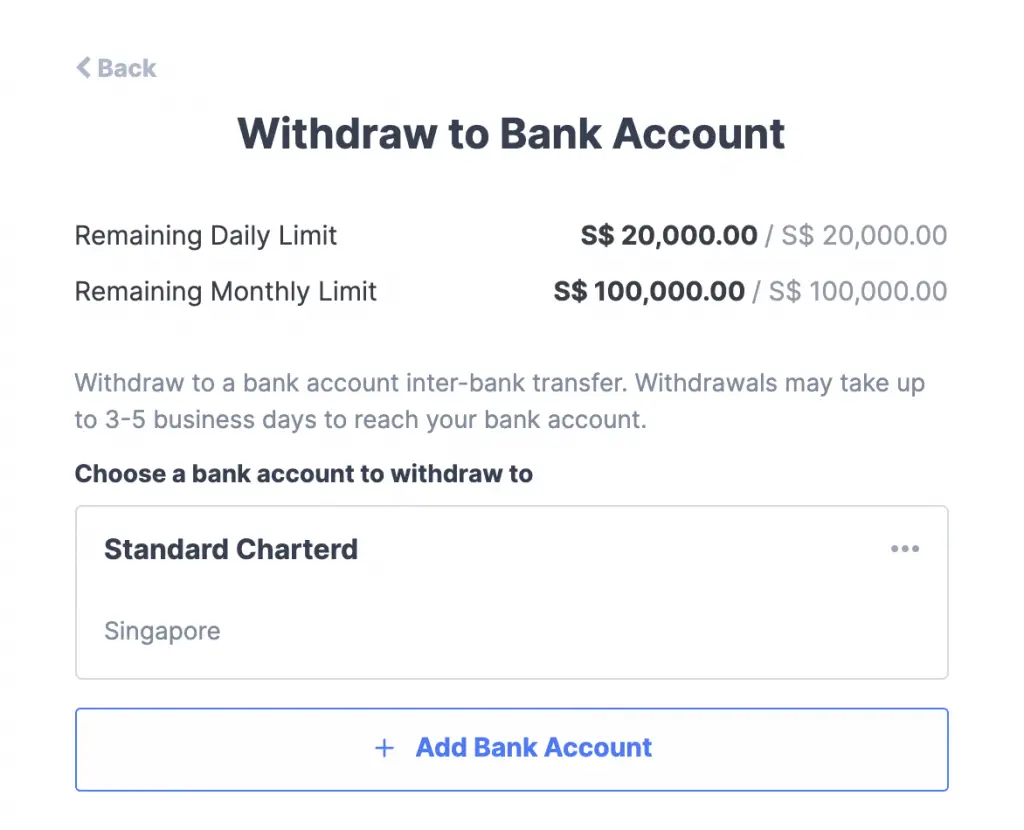

Meanwhile, Coinhako allows you to withdraw SGD to your bank account,

as well as cryptocurrencies to another platform.

This makes Coinhako slightly more versatile.

Fees

The most important thing when it comes to trading crypto are the fees. You should try to minimise your fees as much as possible!

Here are some of the fees you may incur when using either exchange:

#1 Depositing and withdrawing fees

Here are the deposit and withdrawal fees for both platforms:

| Platform | Deposits | Withdrawals |

|---|---|---|

| BlockFi | Free | 1st withdrawal is free, subsequent withdrawals depend on currency |

| Coinhako | 0.55% (Xfers) 0 (FAST) | $2 SGD per withdrawal |

You will be charged a 0.55% fee if you use Xfers direct to deposit your funds into Coinhako. You may want to use this method if you want your funds to be instantly deposited into your Coinhako account.

Both platforms also charge you a withdrawal fee.

BlockFi does not charge you a fee for your first withdrawal.

After that, you’ll be charged withdrawal fees, depending on the currency you withdraw:

| Crypto | Withdrawal Fee |

|---|---|

| BTC | 0.00075 BTC |

| ETH | 0.02 ETH |

| LTC | 0.0025 LTC |

| Stablecoins | $10.00 USD |

| PAXG | 0.015 PAXG |

Coinhako charges you a $2 withdrawal fee if you want to withdraw SGD.

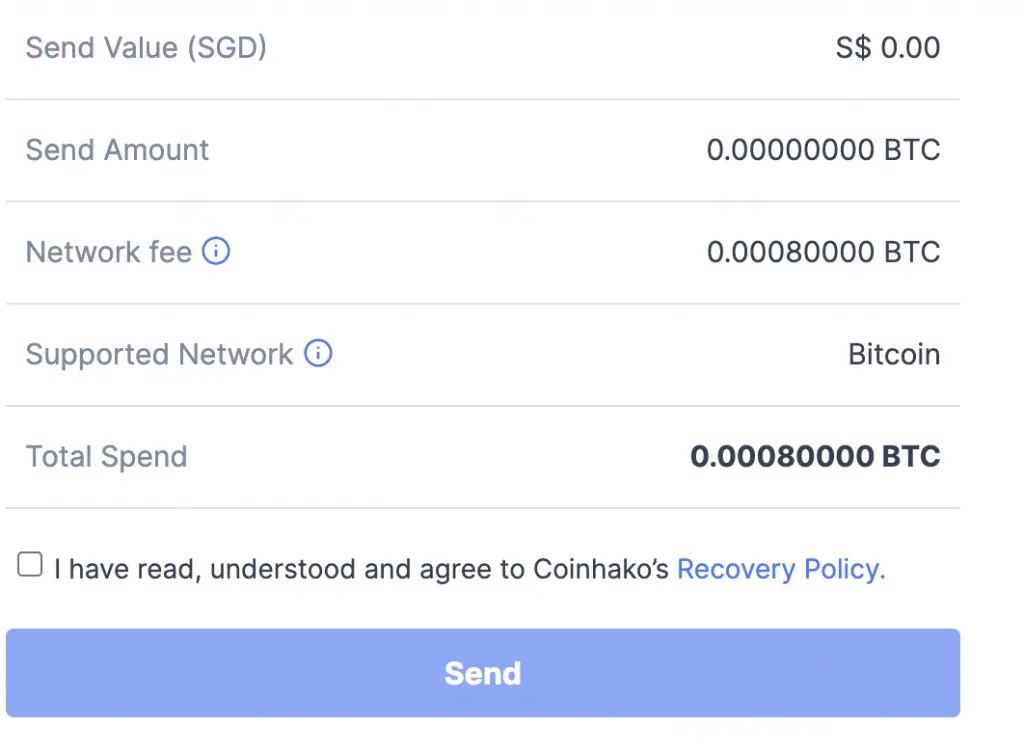

The withdrawal fee for crypto is dynamic. However, you can see the fee you’ll incur on the ‘Send‘ page.

#2 Buying and selling crypto

Here are the fees that you’ll be charged for both platforms:

BlockFi does not charge you a fee, but you may lose money from the spread

When you are exchanging between the supported currencies on BlockFi, you are not charged any fees.

However, there is a difference between the buy and sell price.

This is similar to buying and selling currency from a money exchanger.

As such, you may lose some money due to the spread.

The spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair.

Source: CMC Markets

Coinhako charges a flat 1% fee

You will need to pay a flat 1% fee for any transaction you make with Coinhako.

The best part is that you are not charged a minimum fee! Even if you buy a small amount of crypto, you will still only be charged 1%.

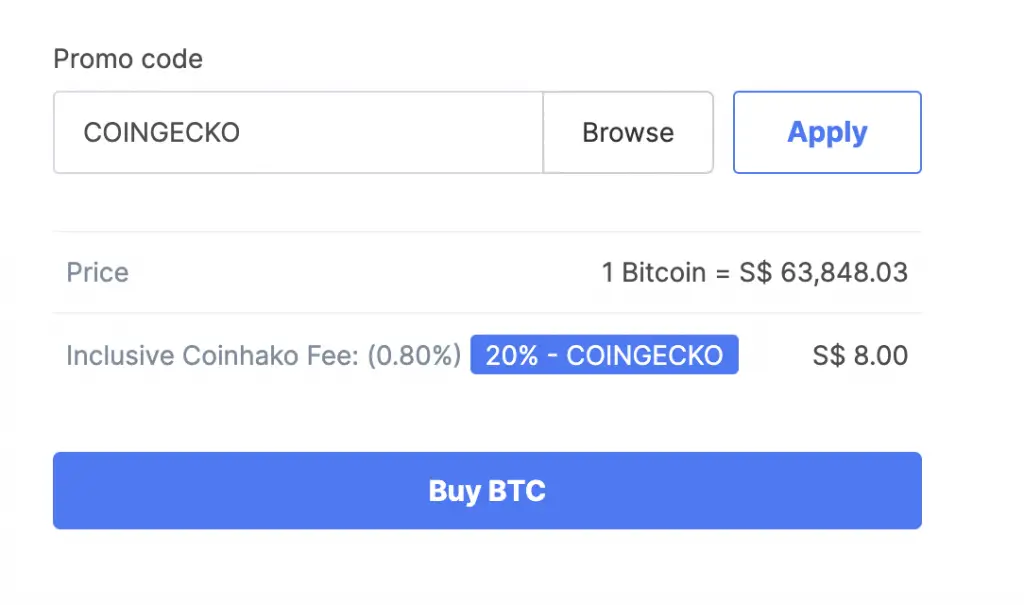

However for a limited time, you can use the promo code ‘COINGECKO‘ to trade at only 0.8%.

Moreover if you are buying crypto using a credit or debit card, you will also be charged a 3% processing fee! This fee is charged by the payment provider and not by Coinhako.

Limits and minimum amounts

For BlockFi, there is no minimum deposit. However, there is a minimum withdrawal amount of 0.003 BTC and 0.056 ETH.

While you still can withdraw amounts lower than this minimum, the transaction may take up to 30 days to process.

Meanwhile, Coinhako requires you to make a trade that is equivalent to SGD $45 each time.

This is higher than other exchanges, such as Crypto.com (USD $1), and Gemini (none).

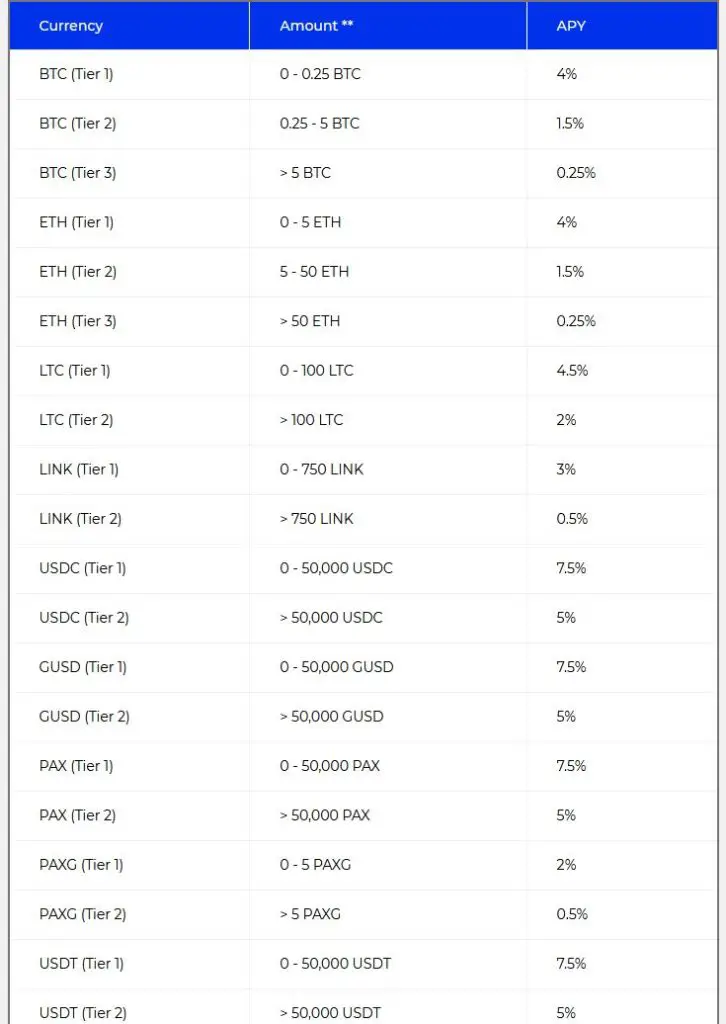

Earning interest

BlockFi’s main selling point over Coinhako is that you are able to earn interest on your crypto!

BlockFi lends your crypto to “trusted institutional and corporate borrowers“. They also lend your crypto “on overcollateralized terms“.

Over-collateralization (OC) is the provision of collateral that is worth more than enough to cover potential losses in cases of default.

Investopedia

This means that your crypto is lent to rather reputable sources who are able to pay in case of a default.

Due to these overcollateralized terms, BlockFi is generally considered to be safer compared to Gemini Earn.

Meanwhile, you aren’t able to earn interest on Coinhako!

Security

You may have heard of how crypto platforms can be hacked, and these hackers can steal your cryptocurrencies!

So how do these platforms try and combat this?

BlockFi uses Gemini as their primary custodian

To ensure that some of your assets are available to be withdrawn quickly, BlockFi leaves your assets under the custody of 3 institutions:

Gemini is BlockFi’s main custodian of your assets.

Majority of your assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft.

Gemini

It seems that Gemini’s owners are quite confident about the security of their platform!

As such, you can be reassured that your assets are rather safe with BlockFi.

Coinhako stores the majority of your currencies in a cold storage

Coinhako mentioned that they store the majority of your crypto in their ‘highly secure’ cold storage accounts.

Meanwhile, only a small percentage of your funds will be stored on their exchange. This helps to facilitate liquidity where you are able to sell or withdraw your funds.

If hackers are able to gain access to your holdings, they will only gain access to a small percentage on the exchange.

To get the rest of your funds, they will need to hack the cold storage account. This is much harder to do!

As such, most of your crypto with Coinhako will be safe and secure.

Coinhako also allows you to use 2FA apps like Authy to make your account extra secure.

Even with these measures, Coinhako was still hacked on 21st Feb 2020. Thankfully, only 20 users were affected, and any assets that were lost were reimbursed by Coinhako.

Platform

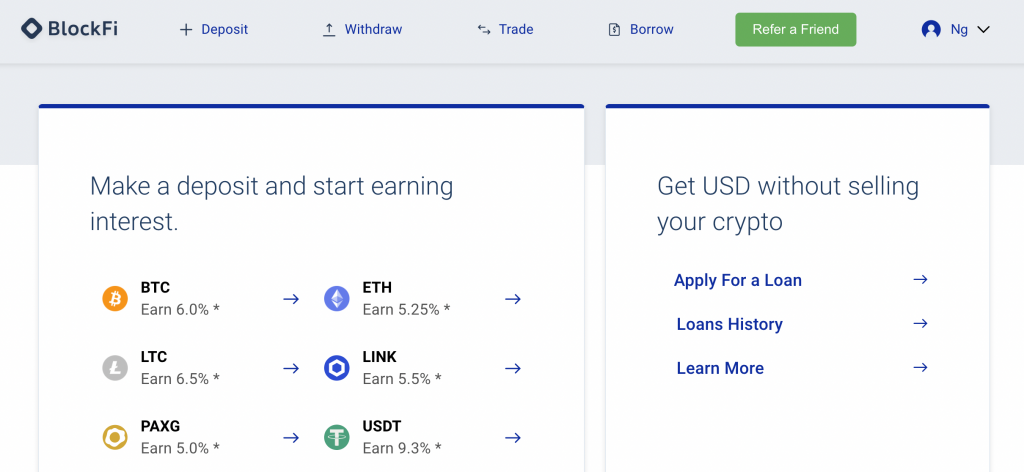

BlockFi has both a web platform,

as well as a mobile app.

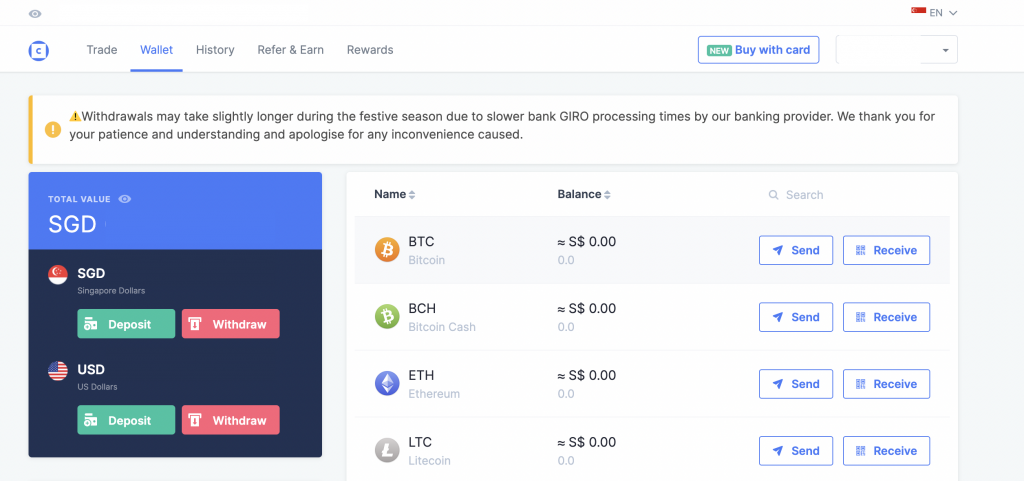

Here is how Coinhako’s web platform looks like,

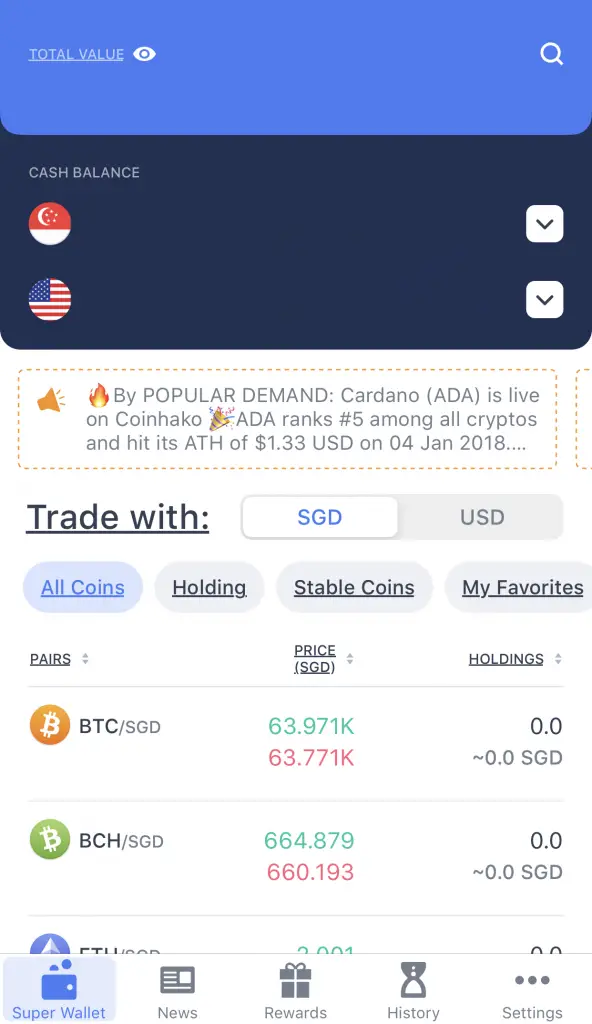

and their mobile app.

Both of these platforms seem to be very sleek and easy to use.

Verdict

Here is a comparison between BlockFi and Coinhako:

| BlockFi | Coinhako | |

|---|---|---|

| Year Founded | 2017 | 2014 |

| HQ | New York | Singapore |

| Number of Currencies | 13 | 30 |

| Funding Methods | Bank transfer (USD) | Xfers FAST |

| Methods of Buying Crypto | Exchange | SGD Wallet (Direct Buy) Credit / Debit Card |

| Withdrawal of Funds | Crypto only | SGD or crypto |

| Deposit Fees | None | 0.55% (Xfers) 0 (Inter-bank) |

| Withdrawal Fees | 1st withdrawal for both crypto and stablecoin are free | SGD$2 per withdrawal Dynamic for cryptocurrencies |

| Trading Fees | None, but may lose money due to spread | 1% |

| Earning Interest | Present | Absent |

| Minimum Amount | No minimum deposit | $45 per trade |

| Security | Gemini as primary custodian | Cold storage + hot wallet |

| Platform | Web and mobile platforms | Web and mobile platforms |

So which platform should you choose?

Choose BlockFi to earn an interest on your crypto

BlockFi’s major selling point is the ability to earn interest on your crypto.

You are able to earn interest on the crypto that you’ve chosen. It’ll be an added bonus if your crypto increases in price too!

However, BlockFi does not allow you to buy crypto directly from SGD. The only possible way to buy crypto from fiat on BlockFi include:

- Transfer USD to BlockFi to be converted to GUSD

- Convert GUSD to the crypto of your choice

This can be quite inefficient, and you may incur extra costs too!

You may want to consider buying your crypto on Gemini, and then transferring it to BlockFi.

This is because:

- You can buy BTC or ETH directly from SGD using Gemini’s Active Trader

- Gemini does not charge any fees for your first 10 withdrawals per month

Choose Coinhako to buy crypto directly from SGD

Coinhako allows you to buy 30 different cryptocurrencies directly from SGD.

However, you have to pay a premium for this convenience. This is because Coinhako charges you quite a lot of fees:

- Deposit fees (if you use Xfers Direct)

- Trading fees (Up to 1%)

- Withdrawal fees ($2 SGD for each withdrawal)

Coinhako is a suitable platform if you intend to buy and hold crypto. If you want to trade crypto, there are other options you can consider instead!

You can use both platforms together

It is possible for you to use both platforms together as well!

You can buy your crypto from SGD on Coinhako, and then send it over to BlockFi to earn interest.

However, BlockFi only supports 13 currencies!

You won’t be able to send over currencies that BlockFi does not support.

Conclusion

Both BlockFi and Coinhako serve very different purposes in your crypto investing journey.

Coinhako is suitable for buying crypto from SGD, while BlockFi is more suited towards earning an interest on your crypto.

It is possible to use both of these platforms together as well!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?