Last updated on November 26th, 2021

BigPay is a new mobile wallet that has entered the rather saturated sector.

With so many mobile wallet and cards in the market, what makes BigPay stand out among the crowd?

Here’s how this card works and whether it’s worth using:

Contents

BigPay Review

BigPay is another multi-currency card worth considering, especially since you are able to withdraw from your BigPay wallet. However, the rewards for using this card is not as attractive compared to other debit and credit cards out there.

Here is BigPay reviewed in-depth:

What is BigPay?

BigPay is a mobile wallet with a digital prepaid card issued by AirAsia. It aims to challenge the banking systems by giving you full control of your money.

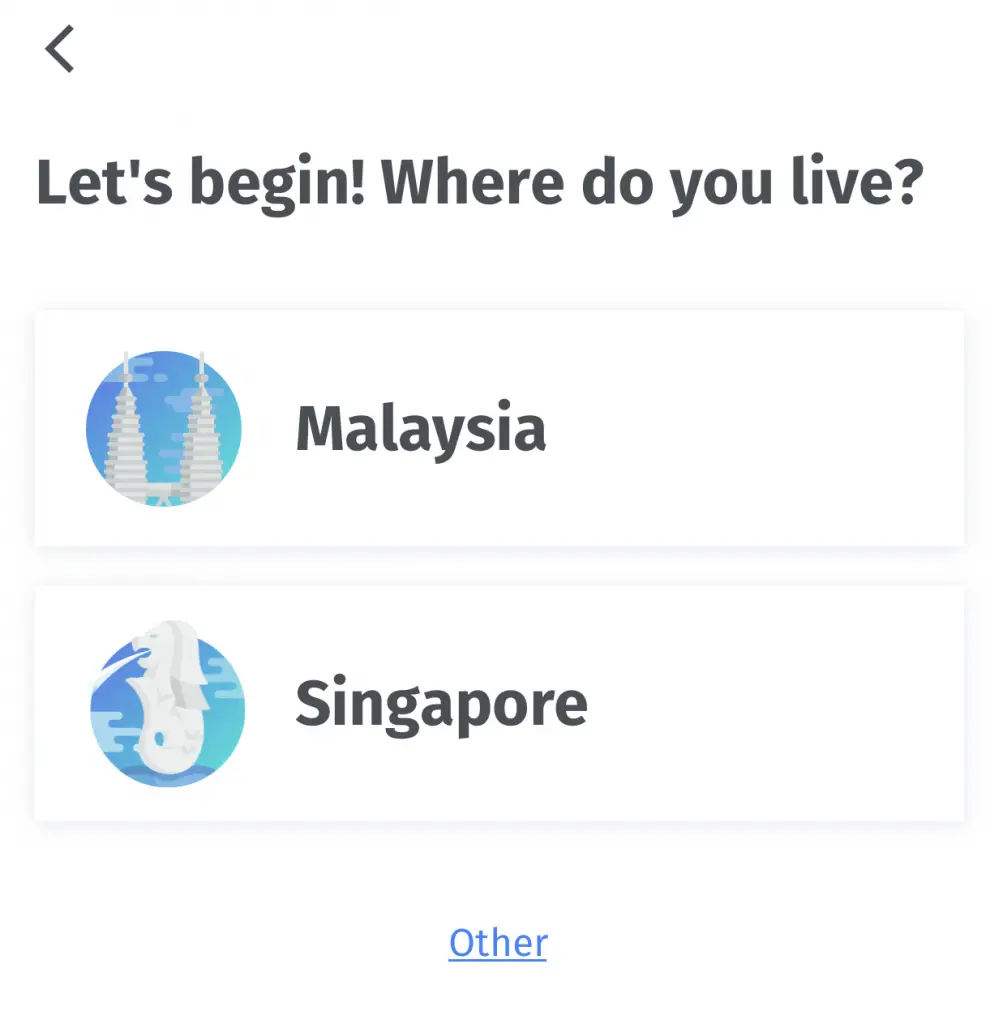

Initially, it started off in Malaysia in 2018, where AirAsia is based in. However, it has since expanded into Singapore as well.

BigPay consists of both:

- Your BigPay mobile wallet

- Your BigPay card

Is BigPay card a debit card?

Your BigPay card is a prepaid Visa card. This is similar to the Vivid Prepaid Mastercard and multi-currency cards like YouTrip and MCO.

Is BigPay a bank?

BigPay is not a bank. They are a financial service provided by AirAsia to challenge the banking system and make spending easier for you.

How do I get a BigPay card?

You can receive your BigPay card by mail after following these steps:

- Sign up for BigPay

- Top up minimum $20 to your card

- Receive your card via delivery

- Start spending with your BigPay card

#1 Sign up for BigPay

You will first need to sign up for a BigPay account.

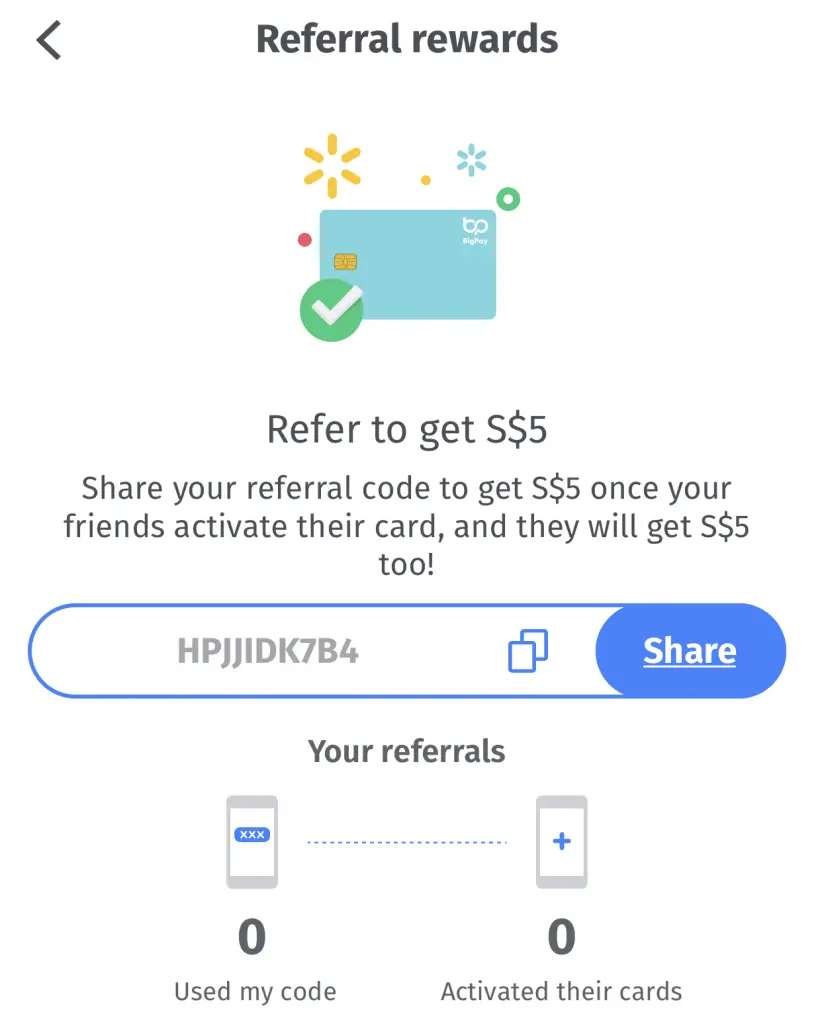

You can use my promo code ‘HPJJIDK7B4‘ when you sign up. You will receive SGD$5 credited to your wallet once you activate your card!

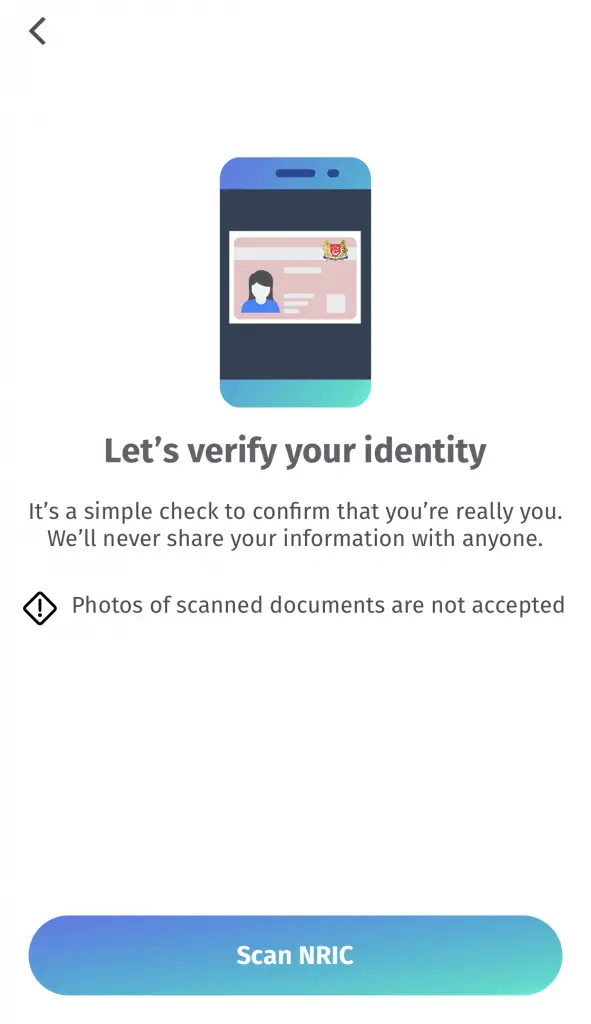

You will also need to verify your identity by uploading your NRIC.

#2 Top up your card

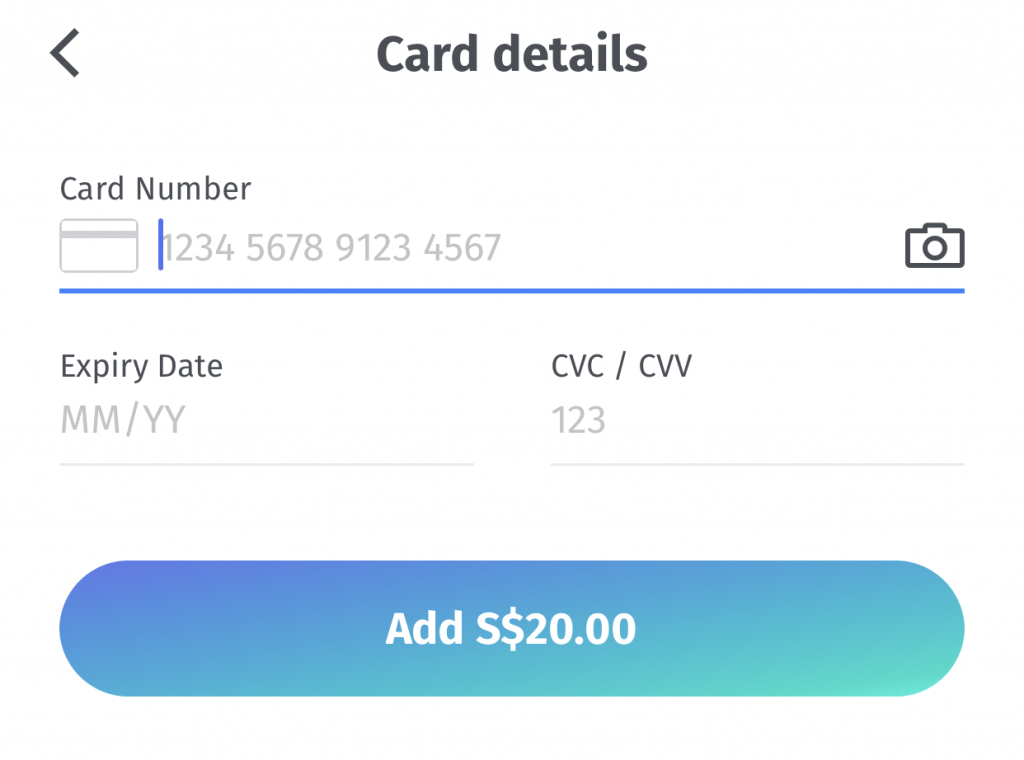

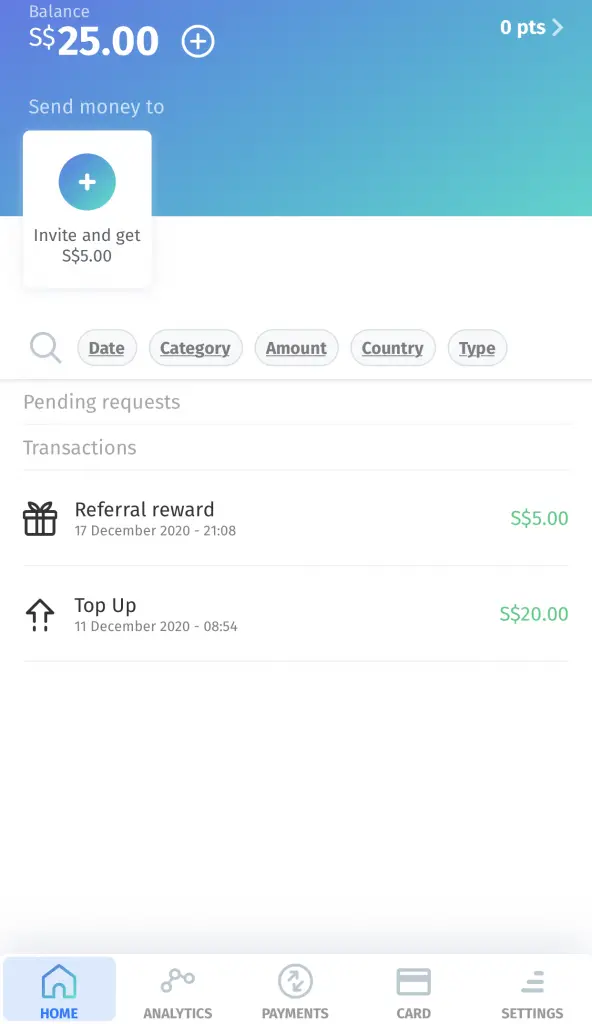

After uploading your NRIC, you will need to top up $20 to your card before it will be delivered to you.

You can top up your BigPay card using a debit or credit card. Currently, BigPay only accepts top ups from Mastercard or Visa cards.

You are unable to top up your BigPay card using an AMEX card.

You will also not be charged any fees for topping up your card.

When I topped up my BigPay card using the JumpStart debit card, I was able to receive the 1% cashback! This is an added bonus as I do not receive the cashback when topping up my YouTrip card.

#3 Get your card delivered

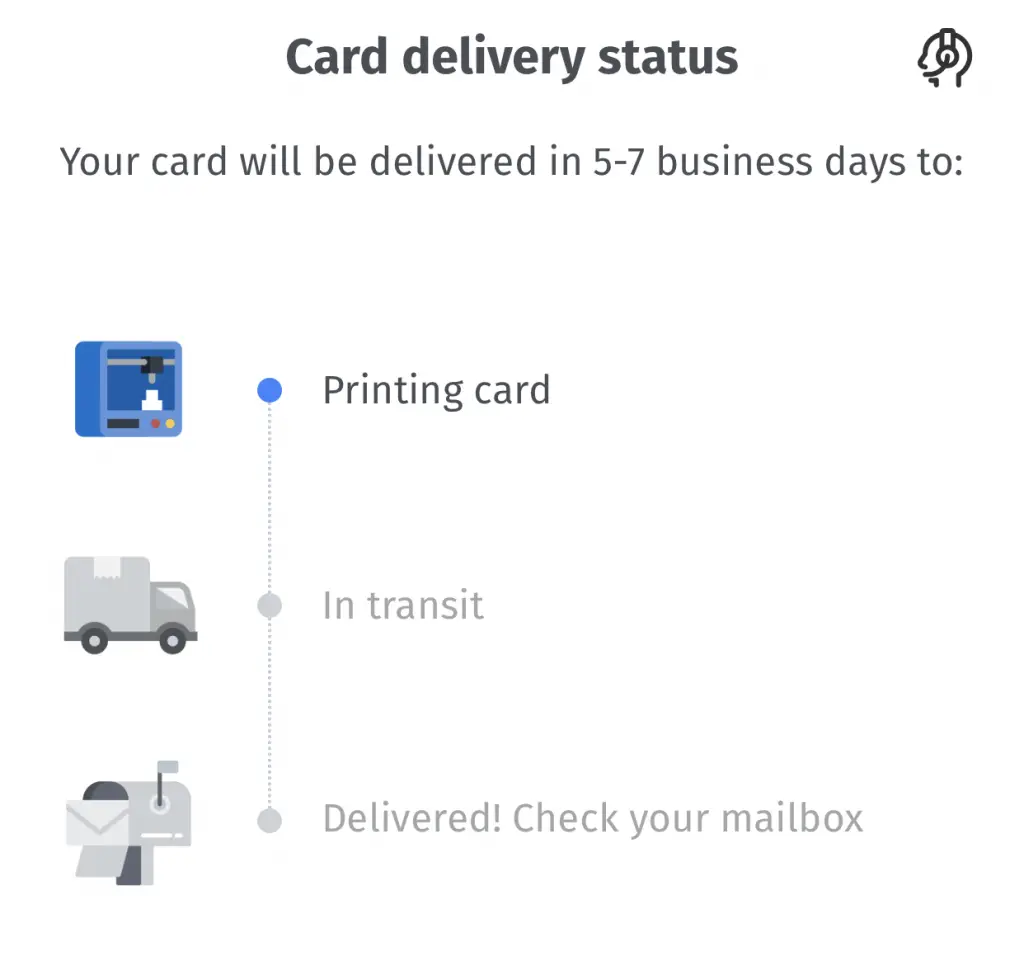

You will need to wait for your card to be delivered.

It took 6 days for my card to be delivered to me.

After receiving your card, you will need to enter the CVV to activate it.

#4 Start spending using your BigPay card

Once you’ve activated your card, you will be able to start spending!

You will need to activate Visa payWave when you make your first transaction. For this transaction, you will need to enter your PIN.

What can I use the BigPay card for?

Here are the 3 main ways that you can use your BigPay card:

#1 Local spending

You are able to use your BigPay card for any contactless transactions. Your BigPay card will work like any other Visa card that you have.

As such, you can use your BigPay card in any shops or online merchants that accept payWave as a payment method.

You are also able to use the BigPay card to top up your Crypto.com Visa card without any fees.

#2 Overseas payments

The BigPay card allows you to make overseas payments as well. This is similar to other multi-currency cards such as YouTrip and MCO.

Which countries can I use BigPay in?

You are able to use your BigPay card in most countries. So far, the only 2 countries that you can’t use BigPay include North Korea and Israel.

Here are some examples of countries you can use your BigPay card in:

- USA

- China

- Japan

- Phillipines

- Taiwan

Dynamic conversion to foreign currency

When you want to make any payments in a foreign currency, BigPay will dynamically convert your local currency into the required amount.

Moreover, BigPay does not charge you any fees for exchanging into foreign currency. As such, your transactions will be much cheaper as well!

Another card that does not have any foreign currency exchange fees is the SingLife debit card.

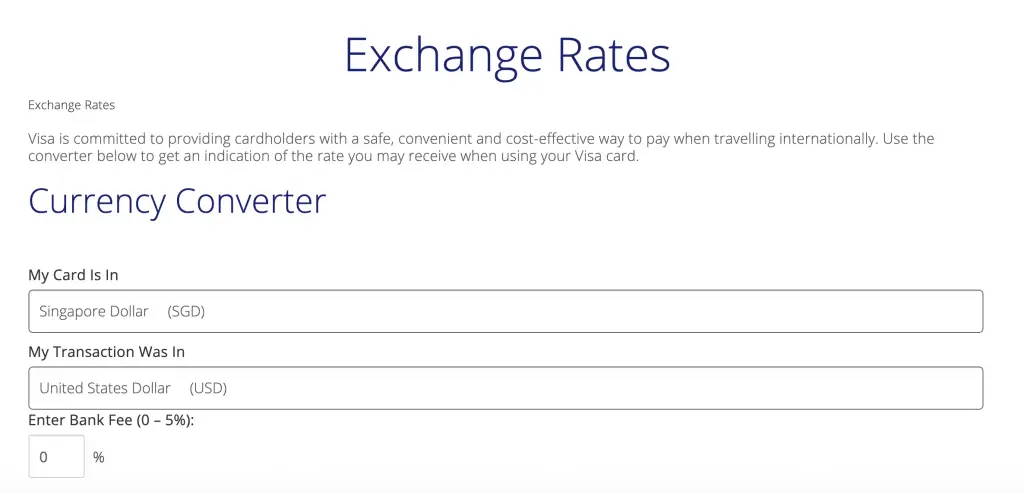

You can check the exchange rate for any currency with the Visa Currency Converter.

Since BigPay does not charge any fees, you can leave the bank fee as 0.

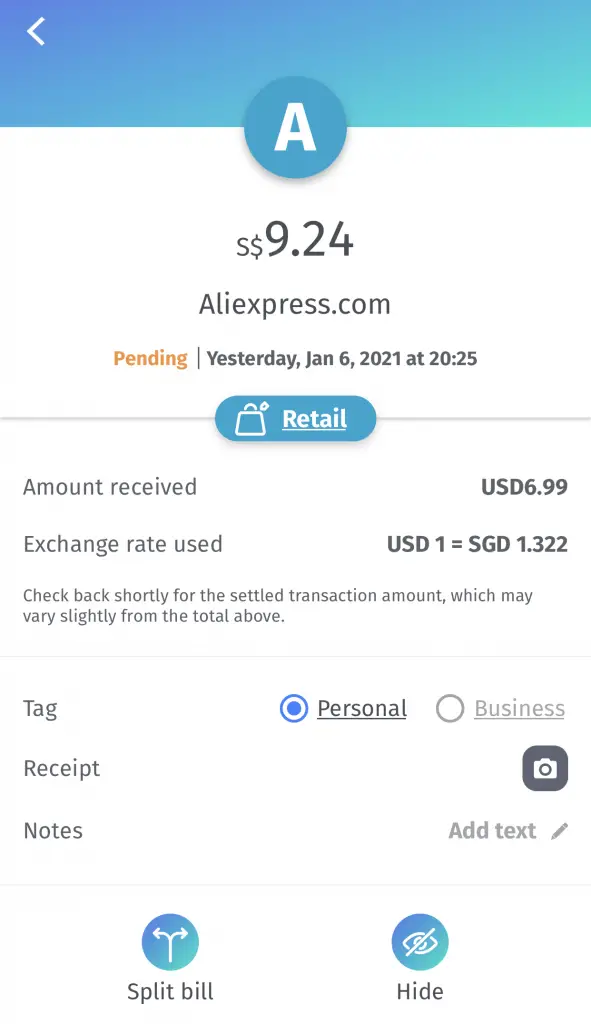

You will receive a notification whenever you make a payment with your BigPay card.

You can also view the exchange rate that BigPay used for your transaction.

Without having to spend any foreign conversion fees, your overseas transactions will be much cheaper!

Use the country’s local currency

When you are making an overseas transaction, don’t forget to ask the cashier to pay in the country’s local currency.

For example, if you are in the US, you should request to pay in USD instead of SGD. This will allow BigPay to use Visa’s exchange rate at the point in time of the transfer.

If you choose to pay in SGD, you may incur additional costs like the dynamic currency conversion fee!

Exchange of currency is only done when the merchant settles the payment

The exchange rate that you ultimately will use very much depends on the merchant. If the merchant settles the payment immediately, you will use the exchange rate at that point in time.

If the merchant decides to settle the payment later, the exchange rate will only take effect at that time.

As such, you may make a slight gain or loss, depending on the exchange rates.

You can’t store multiple currencies in the BigPay wallet

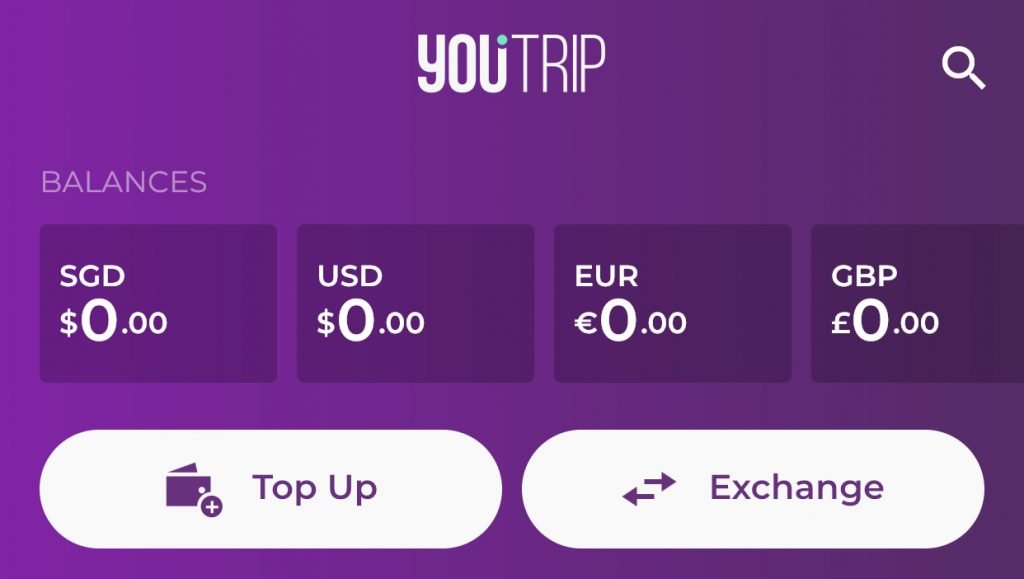

For other multi-currency cards like YouTrip, you are able to store 10 different currencies in your mobile wallet.

However, this feature is not available with BigPay. You can only convert to the foreign currency when you make the transaction.

#3 ATM withdrawals

You are able to use BigPay to make ATM withdrawals overseas. You can only withdraw up to SGD$2,500 in the foreign currency of your choice.

However, you are unable to make any withdrawals with your BigPay card at a Singapore ATM.

Fees for ATM withdrawals

The first ATM withdrawal that you make is free. However, you will incur a 2% transaction fee for every other withdrawal you make.

What features are available on the BigPay app?

Here are some features that BigPay offers you:

#1 View your transactions

You are able to view your transactions all in one place.

This will help you to keep track of your spending when you use your BigPay card.

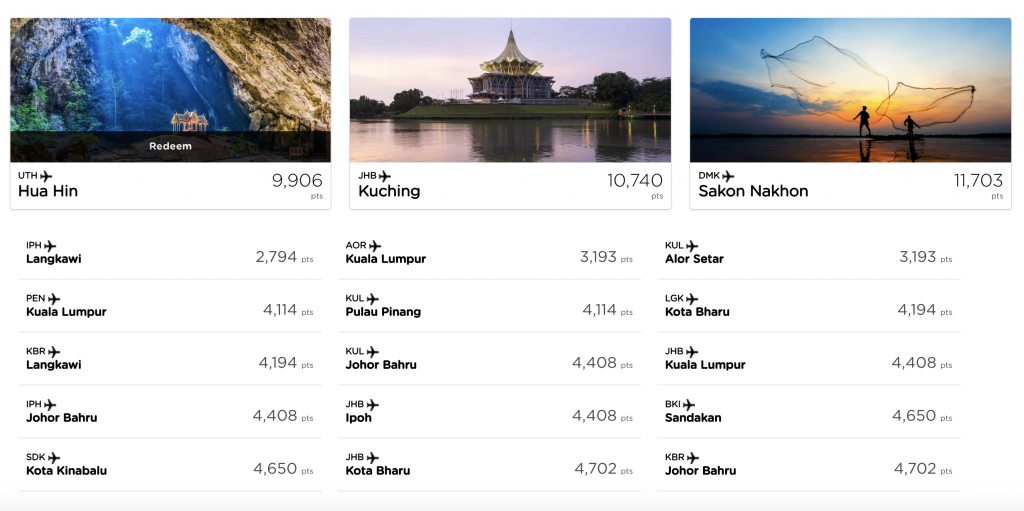

#2 Earn AirAsia BIG points when you spend

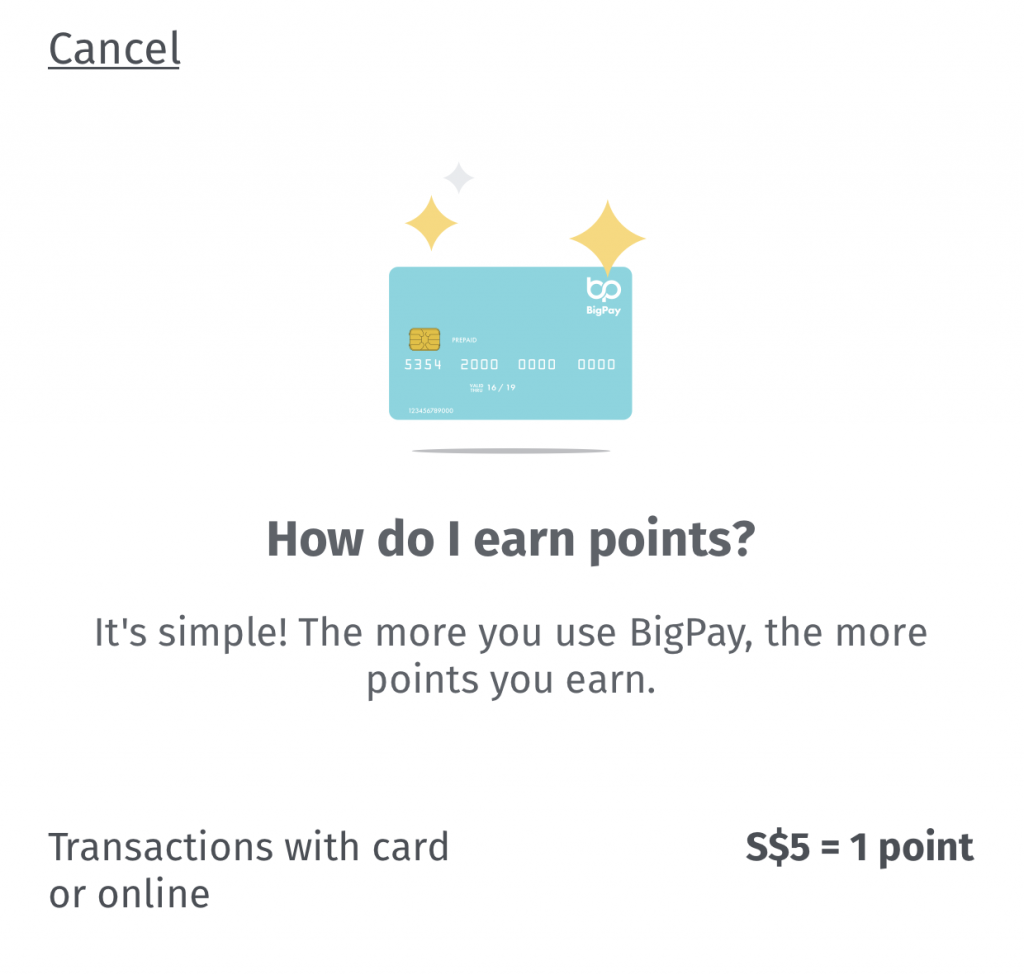

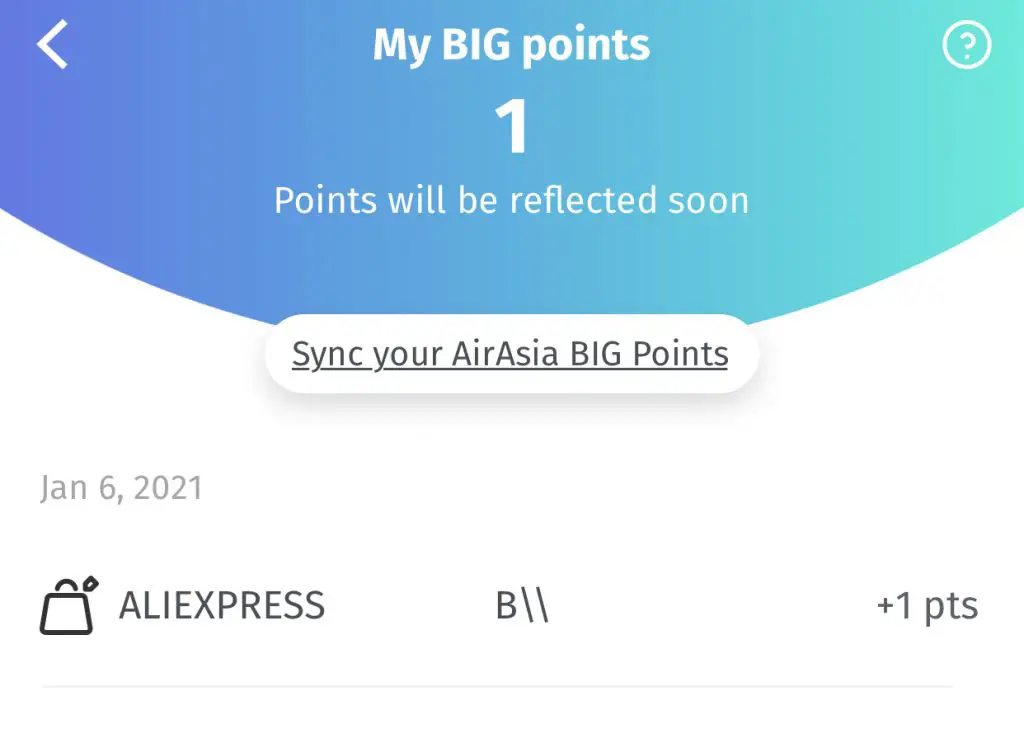

BigPay is part of AirAsia. As such, you are able to earn BIG points when you spend using your BigPay card.

For every $5 that you spend, you will receive 1 BIG point.

Your points will be credited to your account within 5-7 working days.

These BIG points can then be redeemed for flights to certain destinations.

The exchange rate for the BIG points is pretty low. Moreover, your points will expire within 24 months!

The good thing is that you can stack the BIG points with other rewards points you can earn, such as:

- Google Pay

- ShopBack

- Mall rewards e.g. Lendlease Plus

You can also link your BigPay Visa card to SNACK by Income to trigger micro-insurance policies.

If you already have a pre-existing BIG account, you can link it to your BigPay mobile wallet.

Receive benefits when using BigPay on AirAsia

You can receive some additional benefits when you use BigPay to book your AirAsia flights:

- Zero processing fees when you buy AirAsia flights

- Discounts on pre-booked check-in luggage and meals

- Exclusive access to AirAsia sales

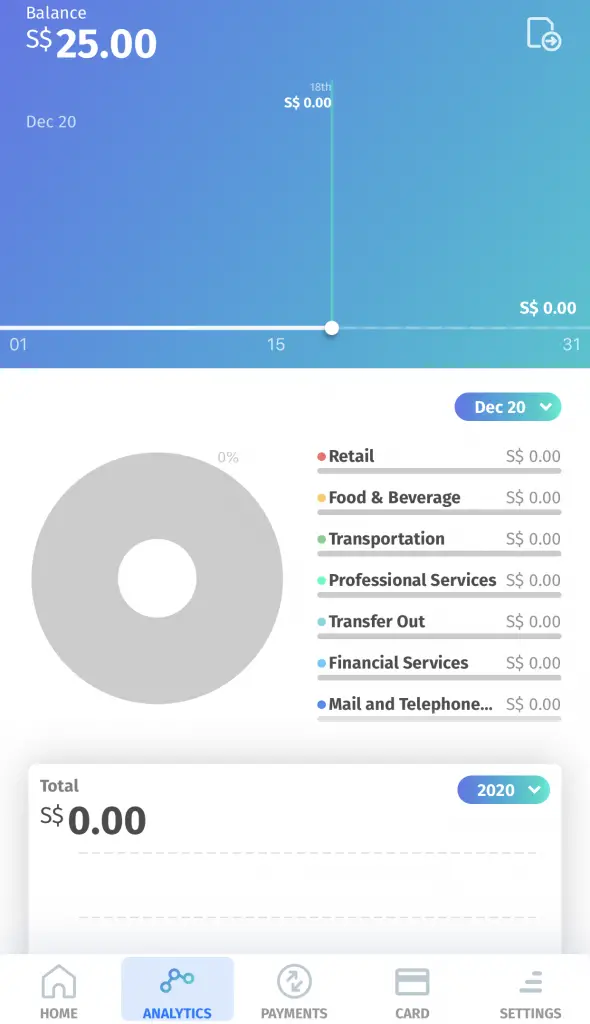

#3 Track your spending on your BigPay card

BigPay gives you a detailed breakdown on the areas that you’ve spent your money on.

This is a useful tool to track your spending.

However, this will only work if you use your BigPay card for all of your transactions.

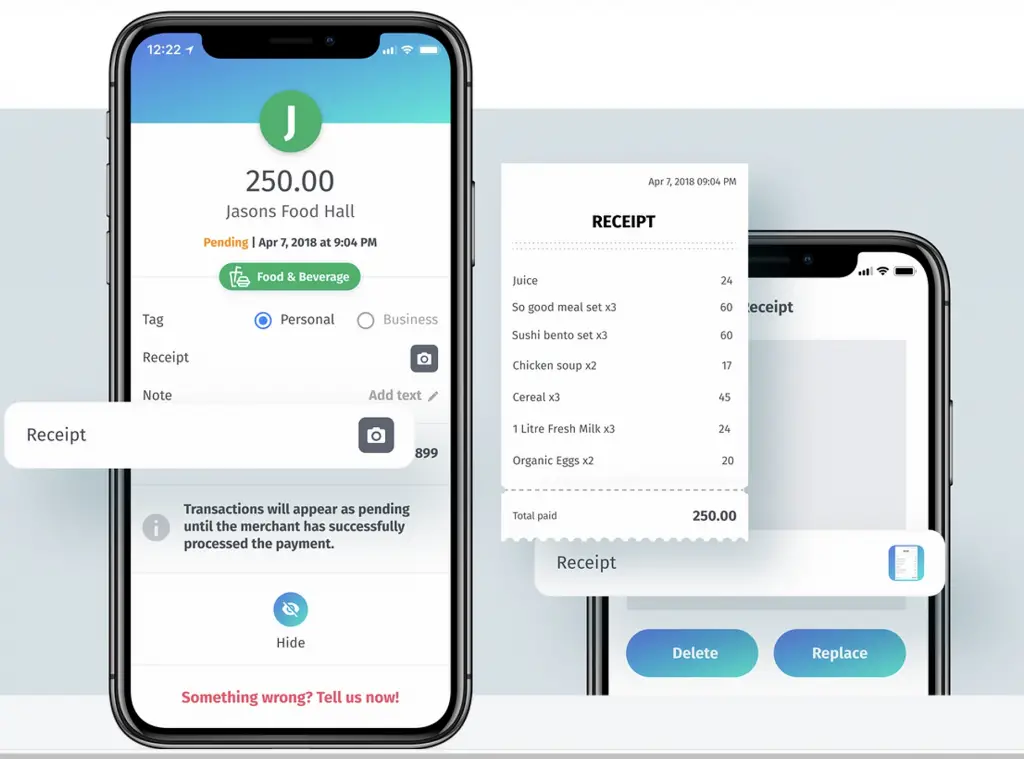

Upload your receipts

BigPay allows you to upload your receipts to the app.

This will help you to keep a copy of all of your receipts without needing to have all of them in hardcopy!

This feature is something that is lacking in other expense trackers like the Seedly app.

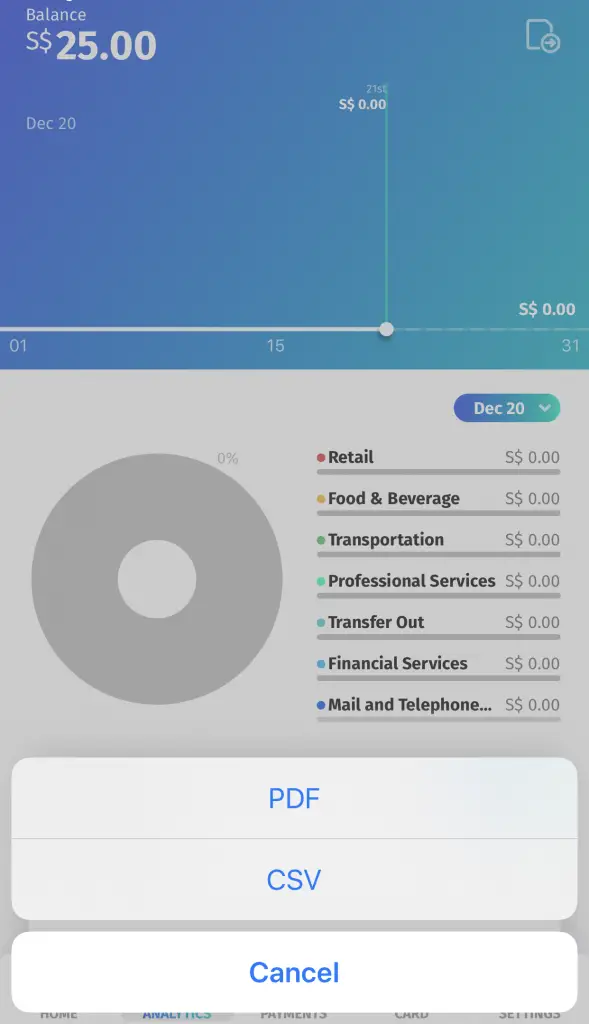

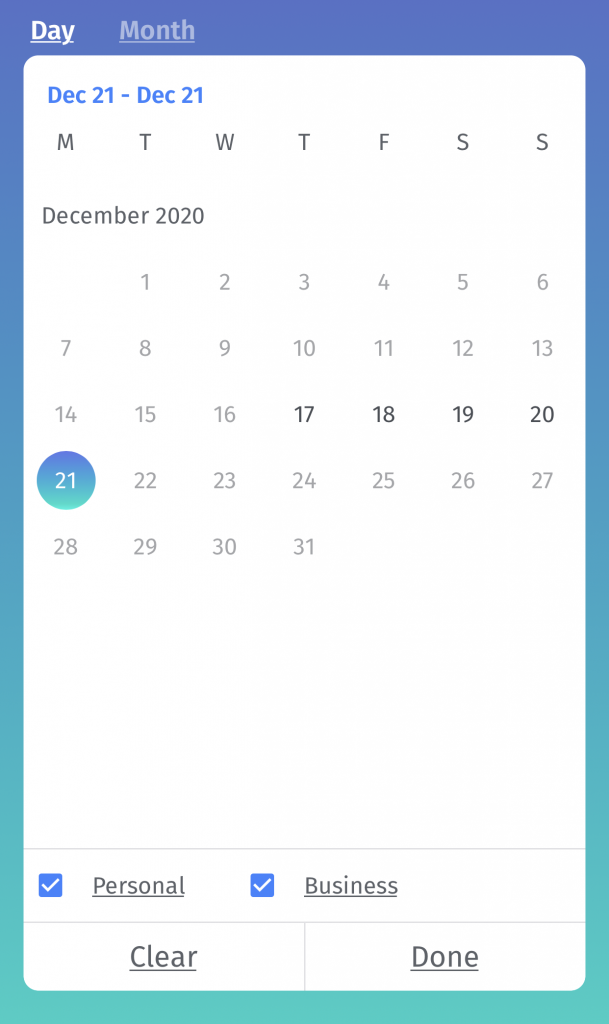

Export your expenditure information into a CSV or PDF

BigPay gives you a great option of exporting your expenditure to either a .csv or .pdf file.

You can select the time period that you wish to export your transactions as well.

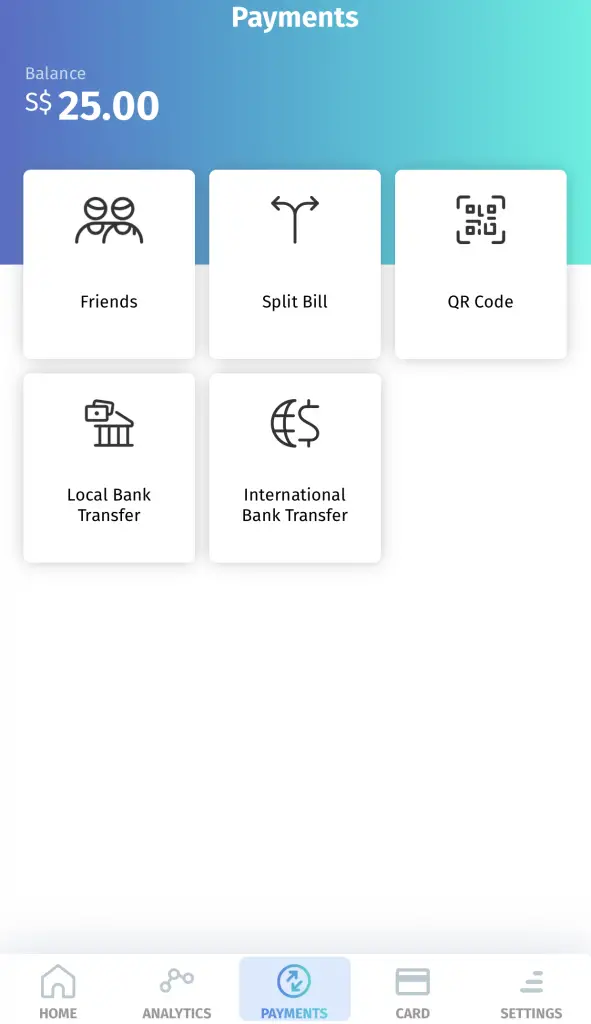

#4 Make payments

You are able to use your BigPay mobile wallet to make 3 types of payments:

1. Send to friends or split a bill

You are able to send money to your friends or split a bill with them.

However, your friends will need to have a BigPay wallet too for this function to work.

This is different from Google Pay which allows you to send money to your friends, even if they are not using Google Pay!

Google Pay will send your money to your friend’s bank account that is linked via PayNow.

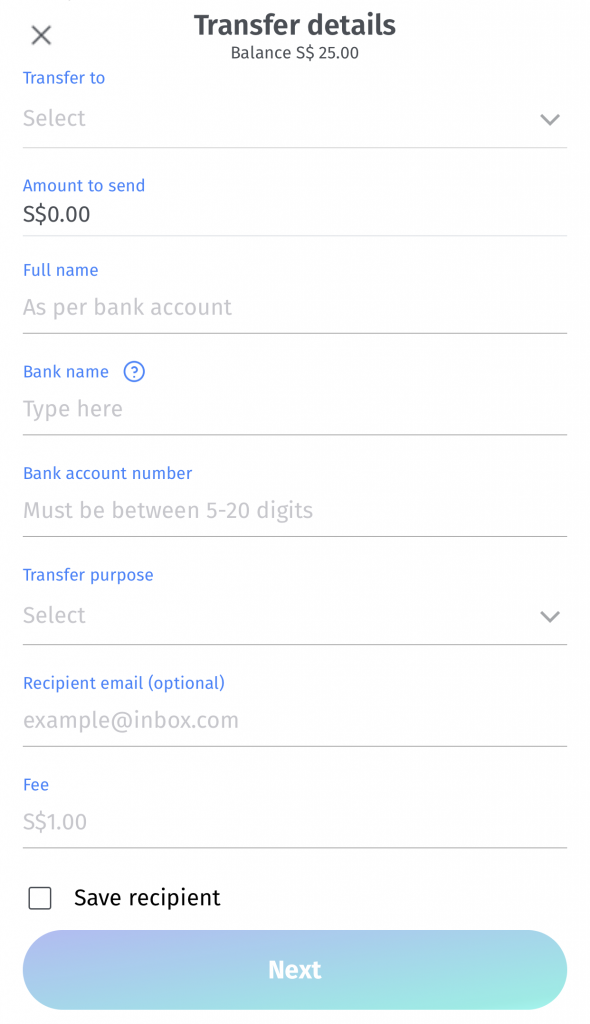

2. Local bank transfer

You can send the money in your BigPay wallet to a local bank account.

However, you will be charged a $1 fee for any transfer.

You may also want to note that you will not be awarded any BIG points when you make a transfer with your BigPay account.

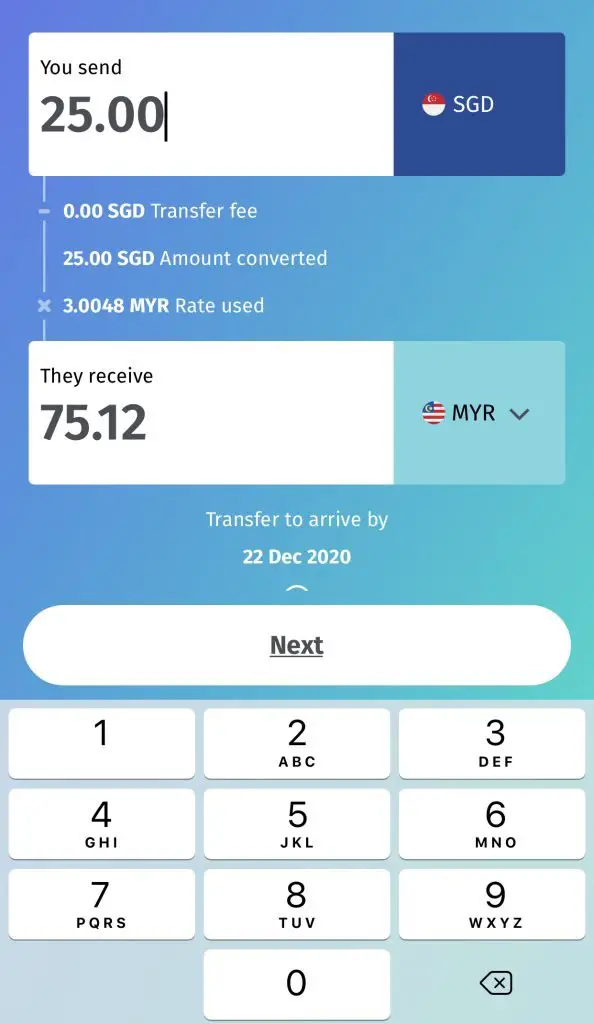

3. International bank transfer

You are also be able to make an international bank transfer with BigPay. You can see the exchange rate and fees that BigPay will charge you.

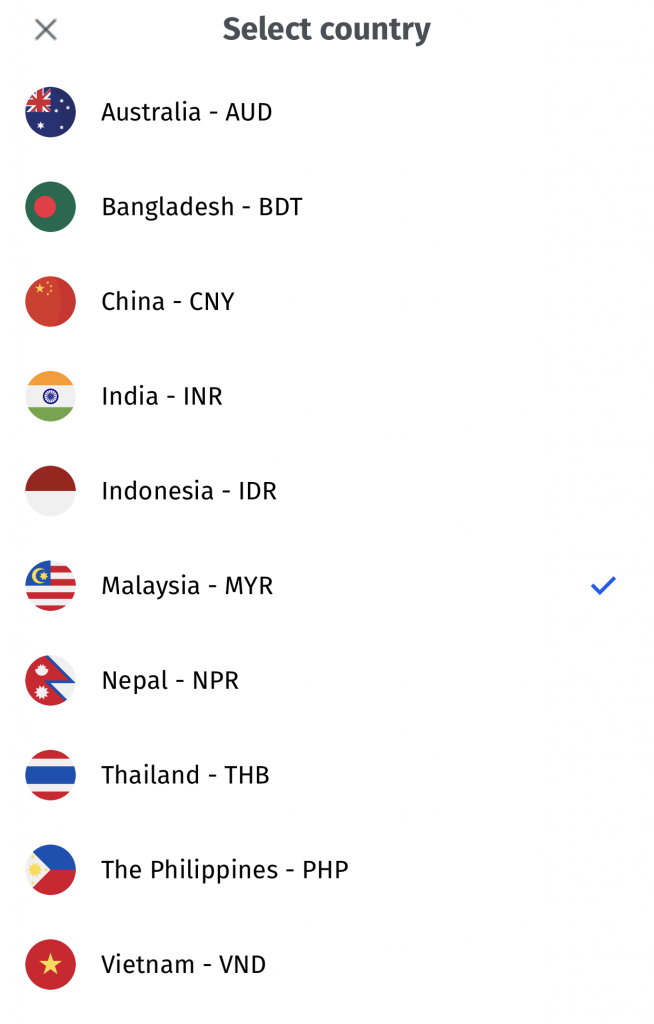

There are 10 different countries where you can make a transfer to:

- Australia (AUD)

- Bangladesh (BDT)

- China (CNY)

- India (INR)

- Indonesia (IDR)

- Malaysia (MYR)

- Nepal (NPR)

- Thailand (THB)

- The Philippines (PHP)

- Vietnam (VND)

For your very first international bank transfer, you will not be charged any fees.

For any subsequent remittances, you will be charged a fee based on the country that you remit to.

| Country | Remittance Fee |

|---|---|

| Malaysia | SGD$1 |

| Indonesia Nepal India Bangladesh | SGD$3 |

| Vietnam | SGD$4 |

| Thailand | SGD$5 |

| Australia | SGD$6 |

| China | SGD$8 |

These remittances fees are a flat fee instead of other services that charge you a percentage. As such, the higher the amount that you remit, the more worth it the remittance fee will be.

Are there any limits for the BigPay card?

Here are some limits that you may encounter with the BigPay card:

| Limit | Amount (SGD) |

|---|---|

| Spending Limit | SGD$30,000 for next 12 months from first transaction |

| ATM Withdrawal Limit | SGD$2,500 per day |

| Daily Spending Limit | SGD$300 per day |

| Maxmimum Amount In Card | SGD$5,000 |

| Transfer Limit (Singapore) | SGD$100 daily and not more than SGD$300 monthly |

| Transfer Limit (Other Countries) | SGD$5,000 daily and not more than SGD$10,000 monthly |

Is BigPay safe?

BigPay is a Major Payment Institution that is regulated under the MAS.

As such, BigPay is a regulated and approved mobile wallet that you can use in Singapore.

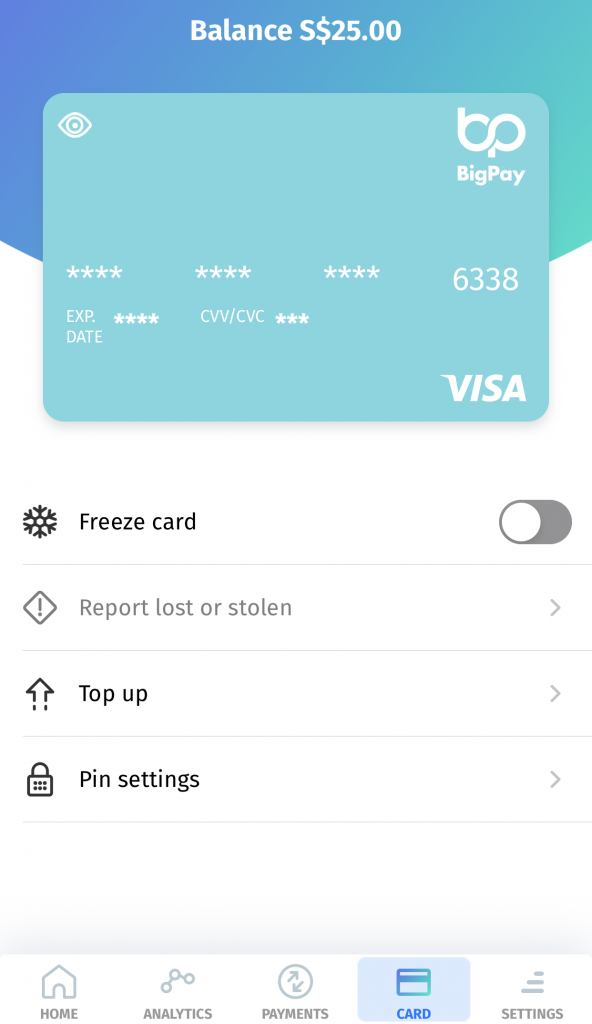

BigPay allows you to lock your BigPay card

If you have misplaced your BigPay card, you are able to use the freeze function in your BigPay app.

This will prevent anyone from spending the money you have in your BigPay wallet.

BigPay is a prepaid card

Your BigPay card is also a prepaid card that is not linked to any bank account. As such, the maximum amount that you can spend is the amount in your BigPay wallet.

Is the BigPay card worth getting?

Here are the main points about this prepaid card and mobile wallet:

#1 A multi-currency card with no foreign exchange fees

BigPay’s main selling point is that you are able to make overseas transactions without incurring foreign exchange fees.

However, you are unable to store foreign currency in the card, which can be found in other cards like YouTrip and MCO.

Your SGD will only be converted to the foreign currency when the transaction goes through.

#2 The rewards aren’t that enticing

The exchange rate for BIG points ($5 spent for 1 point) is rather low. There are many other debit cards that provide better benefits, such as:

As such, there is no compelling reason for you to use your BigPay card for local transactions.

#3 You are able to withdraw your money into a bank account

Your BigPay wallet is a prepaid wallet. However, it does allow you to withdraw your money to a Singapore bank account for $1.

GrabPay and Singtel Dash also allow you to withdraw your money in their mobile wallet. However, there are certain requirements you’ll need to meet first!

#4 Remittance services may be useful

BigPay provides remittance services that they claim to be cheaper than banks. This might be useful if you want to reduce your fees when remitting money overseas.

However, the fees that BigPay charges is a flat fee. As such, other remittance services with a percentage fee may be cheaper if you are only remitting a small sum.

#5 Other services are only useful if you use the BigPay card for all of your spending

BigPay gives you some really useful features to track your spending, such as:

- Expenditure tracking

- Ability to export your reports to PDF or CSV

- Upload receipts to your transactions

However, these features will only be useful if you use your BigPay card for all your spending.

Since the rewards are pretty unremarkable, I would not think that you will use your BigPay card frequently.

Conclusion

The BigPay card provides an interesting alternative to other multi-currency cards out there. It does have some useful functions like tracking your expenses.

However, the rewards that come with using your BigPay card aren’t really that enticing. There are many other cards out there that can provide you much better rewards!

As such, I believe that BigPay will be most useful for you if:

- You make a lot of overseas transactions

- You need to remit money to other countries

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

BigPay referral code (Get $5 credited to your BigPay account)

If you are interested in signing up for the BigPay card, you can use the promo code ‘HPJJIDK7B4‘ when you sign up. You will receive $5 in your BigPay wallet after you’ve activated your card!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?