Last updated on November 1st, 2021

You may have noticed that the SingLife app is offering you to invest your money into their new SingLife Grow plan.

How does this plan work and should you be using it?

Contents

- 1 SingLife Grow Review

- 2 What is SingLife Grow?

- 3 How do I sign up for SingLife Grow?

- 4 What funds can I invest with SingLife Grow?

- 5 What are the portfolios I can choose?

- 6 What are the returns I can earn?

- 7 What are the requirements?

- 8 What are the benefits?

- 9 What are the fees?

- 10 Can I surrender my policy?

- 11 Is SingLife Grow safe?

- 12 Verdict

- 13 Conclusion

- 14 👉🏻 Referral Deals

SingLife Grow Review

SingLife Grow is an investment-linked policy (ILP) that offers to help you grow your savings. However, the high fees and restrictions on withdrawals do not make it an attractive option to invest with.

Here is an in-depth review of this ILP:

What is SingLife Grow?

SingLife Grow is an investment-linked policy (ILP) that provides you with both investment returns and insurance coverage.

Unlike other ILPs, SingLife Grow uses 100% of your premiums to invest into the funds. This will help you to grow your savings much faster!

How do I sign up for SingLife Grow?

To sign up for SingLife Grow, you will need to have a SingLife Account first.

You will also need to pass a Customer Knowledge Assessment (CKA) before you can use SingLife Grow.

This is a requirement by the MAS to ensure that you understand the risks of investing with an ILP.

You will need to fulfil at least one of the criteria below to use SingLife Grow:

- Have the relevant educational qualifications.

- Have a professional finance-related qualification.

- Have a minimum of 3 consecutive years of relevant working experience in the past 10 years.

- Have made at least 6 transactions in unlisted SIPs in the last 3 years. Transactions include buying unlisted SIPs or topping up your investment in an unlisted SIP.

- Have completed the free learning modules from ABS-SAS e-learning portal on Specified Investment Products (SIPs) and passed the assessment at the end.

What funds can I invest with SingLife Grow?

There are 9 different funds that you can invest using SingLife Grow. These funds come from a range of fund managers, and are split into 2 categories:

#1 Fixed Income

These funds help to provide you with reasonable and stable returns. Here are the 4 fixed income funds that SingLife Grow uses:

- Neuberger Berman Strategic Income Fund SGD-H

- BlackRock Global Funds US Dollar High Yield Bond Fund SGD-H

- United SGD Fund

- United Asian High Yield Bond Fund SGD-H

The United SGD Fund is also found in some cash management portfolios, like Endowus Cash Smart and Grab AutoInvest.

These funds mainly invest in bonds. While the returns are stable, they might be much lower compared to the equity funds.

#2 Equities

The other 5 funds that SingLife Grow offers are equity funds. They include:

- United Global Quality Growth Fund

- Nikko AM Shenton Global Opportunities Fund

- Fidelity Funds – World Fund

- Eastspring Investments – Global Low Volatility Equity Fund

- JPMorgan Funds – Asia Pacific Equity Fund

These funds invest your money into stocks from different countries. The returns in the long run will be much higher than the fixed income funds.

However, the volatility is much higher as well. There may be times when you may be receiving a negative return!

There are also different types of equity ETFs that you can invest in, such as the ARKK ETF or those that track the S&P 500.

What are the portfolios I can choose?

You can’t choose to invest in a specific fund. Instead, you will be investing in a portfolio that contains these 9 funds.

You will have a different allocation into each of the 9 funds that are available.

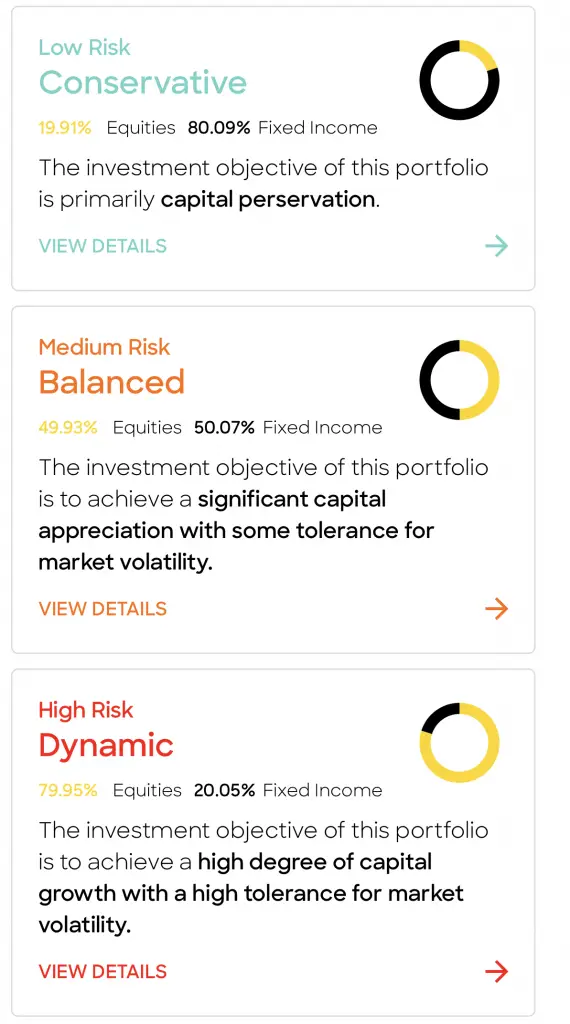

There are 3 main portfolios that you can choose using SingLife Grow, based on your risk profile:

- Conservative

- Balanced

- Dynamic

The allocation of these funds into each portfolio is determined by Aberdeen Standard Investments.

| Portfolio | Equities | Fixed Income |

|---|---|---|

| Conservative | 19.91% | 80.09% |

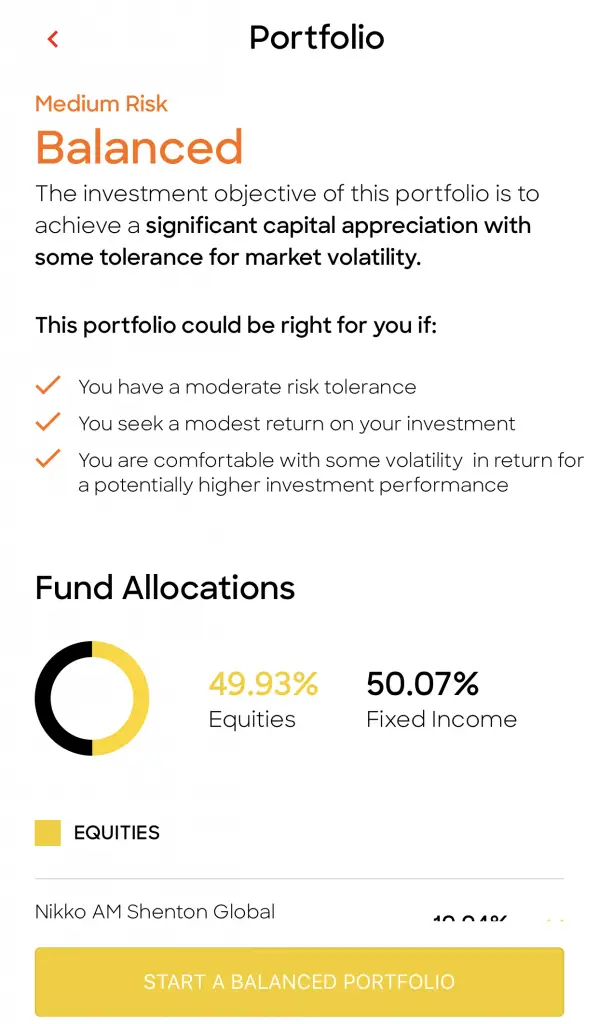

| Balanced | 49.93% | 50.07% |

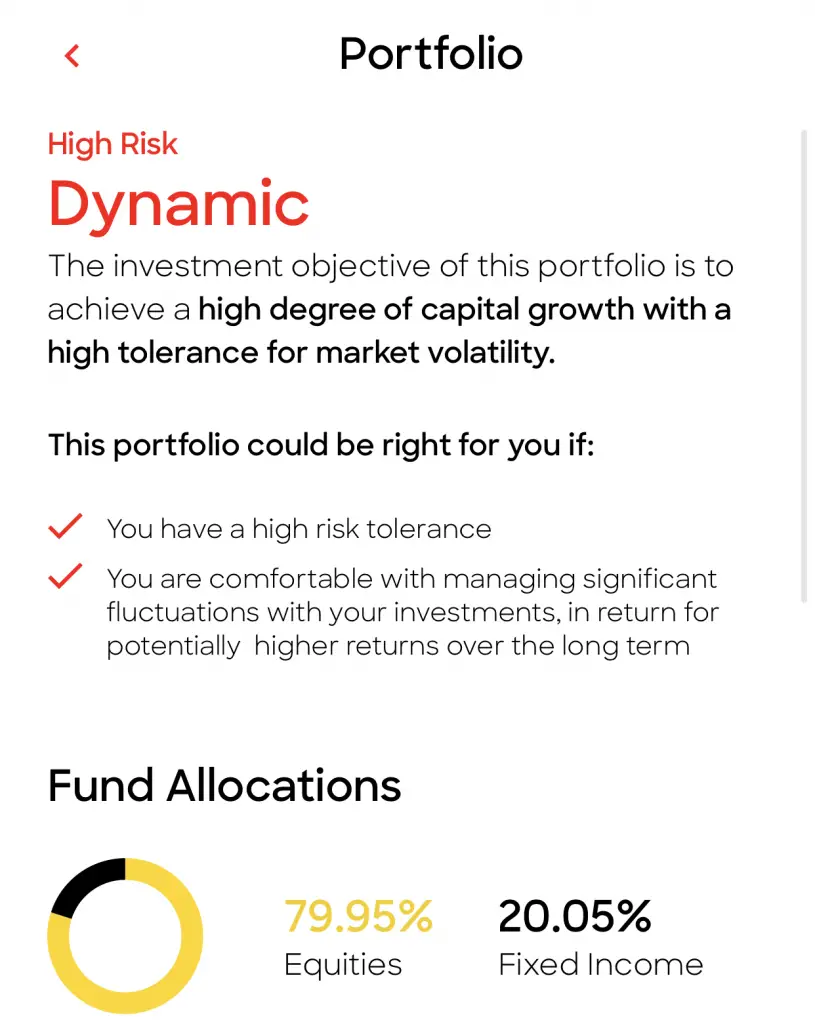

| Dynamic | 79.95% | 20.05% |

This allocation between equities and fixed income is similar to the portfolios offered by Endowus and MoneyOwl.

You can view the allocation of these funds on SingLife’s website.

Choose the portfolio based on your risk profile

SingLife Grow makes it easy for you to choose which portfolio you wish to have. There are only 3 portfolios you need to choose from.

This is unlike other ILPs where you’ll have to choose all the sub-funds by yourself. It may be less stressful for you, especially if you do not know which funds are most suitable for you.

However, this means that you are unable to customise your portfolio to the way you like.

You will have to trust the portfolios that are recommended by Aberdeen Investments instead!

Here are the 3 portfolios you can choose from:

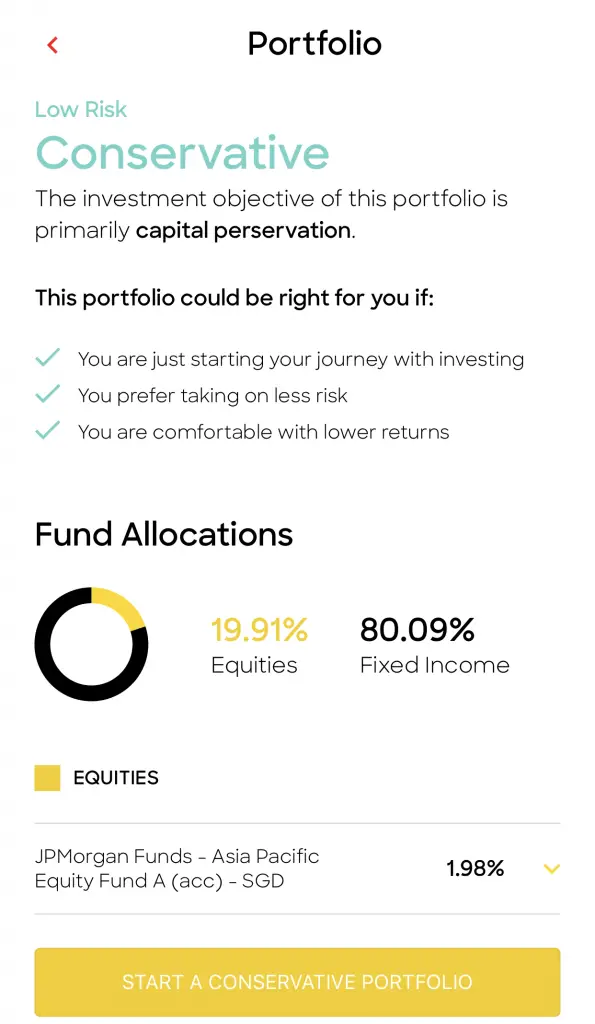

#1 Conservative

The Conservative portfolio mainly invests your money into fixed income funds.

Your returns may not be that high. However, you will still be able to earn a decent return on your investments.

This portfolio is the most suitable if you have a low risk tolerance. This means that you are willing to forgo higher returns for something more stable.

#2 Balanced

The Balanced portfolio has a healthy mix of both fixed income and equity funds.

This allows you to take slightly more risk compared to the Conservative portfolio. However, you are still able to receive rather stable returns due to a high allocation to fixed income funds!

#3 Dynamic

The Dynamic portfolio has a very high allocation into equity funds.

When you invest in this portfolio, you have a high risk tolerance. You are willing to ride out short term volatilities to gain larger returns in the long run!

I would advise you to invest in this portfolio if you do not have the tendency to check your stocks everyday.

Your funds are 100% invested

Unlike other ILPs, 100% of your premiums in SingLife Grow will be invested. None of your premiums will be used for insurance coverage.

In the event that you meet the criteria for a payout, you will receive the higher of:

- 101% of your net premiums or

- Your Account Value

You can create multiple portfolios

You can use SingLife Grow to create multiple portfolios to meet your different needs.

For example, you could be saving for a short term goal like a house. At the same time, you could be saving for your retirement too.

SingLife Grow makes it easy to set up and track your multiple goals. Moreover, you can use different portfolios that cater to your time horizon and risk profile.

However, you will need to take note of the minimum sums required to start a new portfolio!

Switching of portfolios are allowed

You are able to conduct unlimited free switches between the 3 portfolios. This is similar to other ILPs as well.

What are the returns I can earn?

SingLife Grow is an investment-linked policy that invests your funds in a certain portfolio. The returns that you earn are based on your portfolio’s performance. This means that your returns are not capital guaranteed.

Before you choose the portfolio on SingLife Grow, it would be good to understand your risk profile. Having a higher allocation towards equities (stocks) will mean that you have greater potential to earn better returns.

However, the volatility will be much higher. This means that your portfolio’s value may even be negative on some days!

If you are looking for plans with ‘guaranteed’ returns, you may want to consider Etiqa’s GIGANTIQ instead.

What are the requirements?

Here are some requirements you’ll need to fulfil to start using SingLife Grow:

#1 Single premium of minimum $1,000

When you first sign up with SingLife grow, you are required to transfer an initial premium of minimum $1,000.

This can be a rather significant amount, especially if you only have a small minimum sum to invest!

You may want to consider robo-advisors like Syfe or StashAway which do not have any minimum sum.

#2 Recurring single premium (minimum $100)

You are able to add a regular single premium into the plan each month. However, this needs to be a minimum of $100.

This is similar to regular savings plans like OCBC BCIP and Invest Saver which allow you to purchase stocks or ETFs at $100 each month.

#3 Ad-hoc top ups of minimum $100

You are able to make ad-hoc top ups into your SingLife Grow plan. These top-ups can be done at any time.

However, they will need to be a minimum of $100 as well.

#4 Partial withdrawals are allowed (subject to conditions)

If you want to make a withdrawal, you can do so up to 95% of your account value at any time.

However, there are some conditions that need to be met as well:

- Your withdrawal amount must be at least $1,000

- The account value after your withdrawal cannot be less than $1,000

Even though there are no withdrawal charges, these requirements make your withdrawals very inflexible.

As such, you should not be placing your emergency funds into this plan!

What are the benefits?

Here are some of the insurance benefits that you will receive with SingLife Grow:

#1 Death or terminal illness benefit

You will receive a benefit when you either:

- Die

- Get diagnosed with a terminal illness

When you meet either of these conditions, you will receive the higher of:

- 101% of your net premiums, or

- Your Account Value

These benefits are a ‘sum assured’ type of benefit. As such, it is possible for you to claim these benefits from multiple insurance companies.

This is because your Account Value may be lower than your net premiums, particularly if your investments did not perform well.

As such, you are guaranteed at least a 101% of the net premiums you’ve invested into this ILP.

Once the benefit is paid, your policy will be terminated.

#2 Maturity benefit

If you have reached 100 years old, your policy will terminate and you will receive your account value as the maturity benefit.

What are the fees?

There are no insurance charges for your SingLife Grow plan.

However, SingLife Grow charges a management fee of 0.25% per quarter of your account value. Essentially, this is a 1% p.a. management fee which you’ll incur!

This is much higher compared to robo-advisors which mainly charge less than 1%.

You’ll need to consider the expense ratios of the funds that you invest in

Moreover, you will still need to consider the expense ratios you’ll need to pay to each fund. This is not included in this 1% fee!

Here are the expense ratios of these funds (taken from FSMOne):

The expense ratios of these funds are mostly more than 1%. When you factor in the 1% management fee, you will most likely be paying more than 2% in fees!

Most of the time, the fee will be deducted from the fund’s net asset value. As such, you do not need to make another payment to the fund manager.

However, these fees will still eat into your returns.

When you factor in both of these fees, SingLife Grow can actually be quite an expensive plan!

Can I surrender my policy?

You can choose to surrender your policy with SingLife Grow at any time. SingLife will need to sell off the units in your portfolio first.

After deducting any fees, the remaining Account Value will be transferred to you.

You can expect to receive your proceeds from the sale 7 business days after you have made your partial withdrawal or full surrender request.

Is SingLife Grow safe?

SingLife Grow is an investment-linked policy. Similar to the SingLife Account, it will be protected under the Policy Owners’ Protection Scheme.

In the event that SingLife closes down, the sum assured will be reimbursed by the Singapore Deposit Insurance Corporation.

As such, you can be assured that your SingLife Grow plan is relatively safe.

Verdict

Here are the pros and cons of this ILP:

| Pros | Cons |

|---|---|

| Easy selection of 3 portfolios | Initial premium can be quite costly |

| No withdrawal charges | Limits placed on withdrawals which affects how much you can withdraw |

| Insurance coverage for death and terminal illness | Management fee of 1% p.a. is quite hefty |

Is SingLife Grow worth investing in?

If you are considering the costs, then it may not be the best policy to use. There are many other options out there can provide similar returns but with lower fees.

Moreover, there are many restrictions placed on how much you can deposit or withdraw from your plan. This affects the liquidity of your money!

It may be more effective to either perform DIY investing or invest with a robo-advisor.

Conclusion

SingLife Grow may be useful if you do not have the time to monitor your investments. You can easily transfer your funds from your SingLife Account to invest in this policy.

For everyone else, DIY investing via brokers (e.g. Tiger Brokers) or investing via a robo-advisor may be the better option.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?