Last updated on June 6th, 2021

You have a sudden need to withdraw cash from your bank account. However, you forgot to bring along your ATM card!

Is it still possible to withdraw money without an ATM card in Singapore?

Contents

How to withdraw money without an ATM card in Singapore

There are 4 ways that you can withdraw money in Singapore without an ATM card:

- SoCash

- OCBC PayAnyone

- UOB Contactless ATM

- Linking your debit or credit cards for ATM use

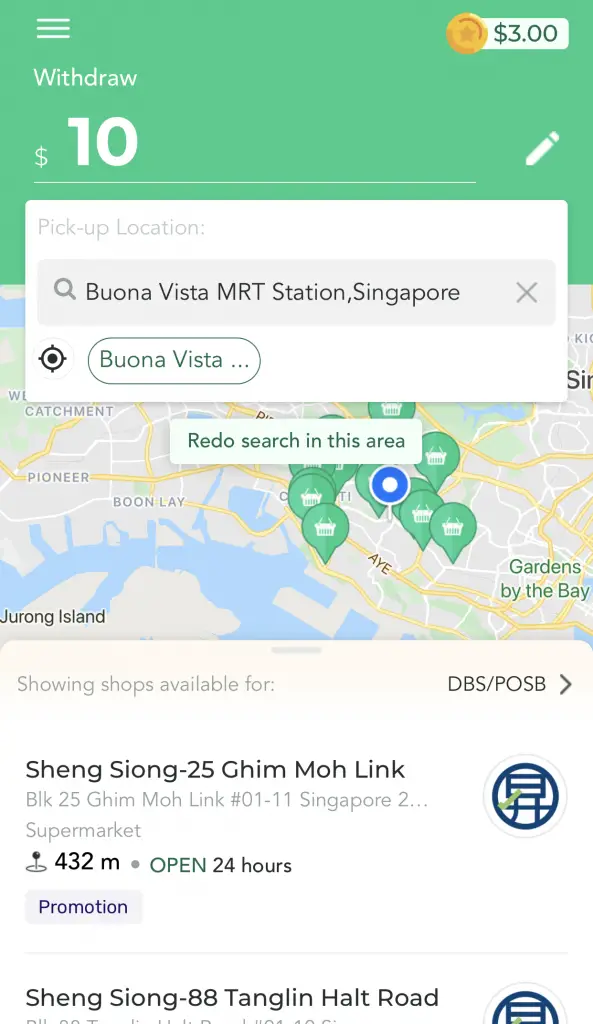

#1 SoCash

SoCash allows you to withdraw cash from cashpoints all around Singapore. It turns your local stores into virtual ATMs.

All you need to do is to walk into the store, scan the QR code and you are able to receive money!

Here are some merchants that have partnered with SoCash:

- Sheng Siong

- Hao Mart

- UStars Supermarket

- Killiney

- 7-Eleven

- Buzz

- Phoon Huat

- Prime Supermarket

Some shops such as 7-Eleven may require you to make a purchase before you can withdraw cash from them.

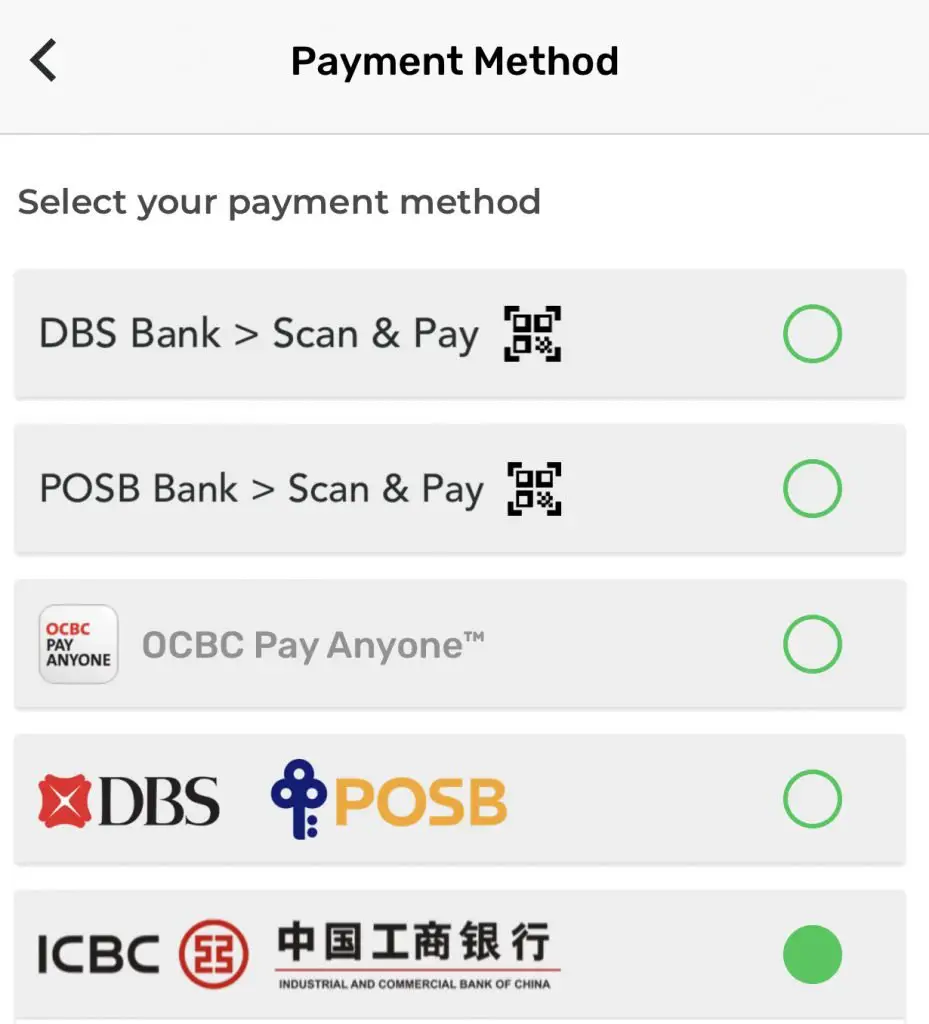

Send your funds from 3 banks

You may be wondering, how do you pay SoCash? You can use 3 different iBanking platforms to pay SoCash. This includes:

- OCBC

- DBS / POSB

- ICBC

You will then be redirected to the bank’s login page to facilitate the transfer.

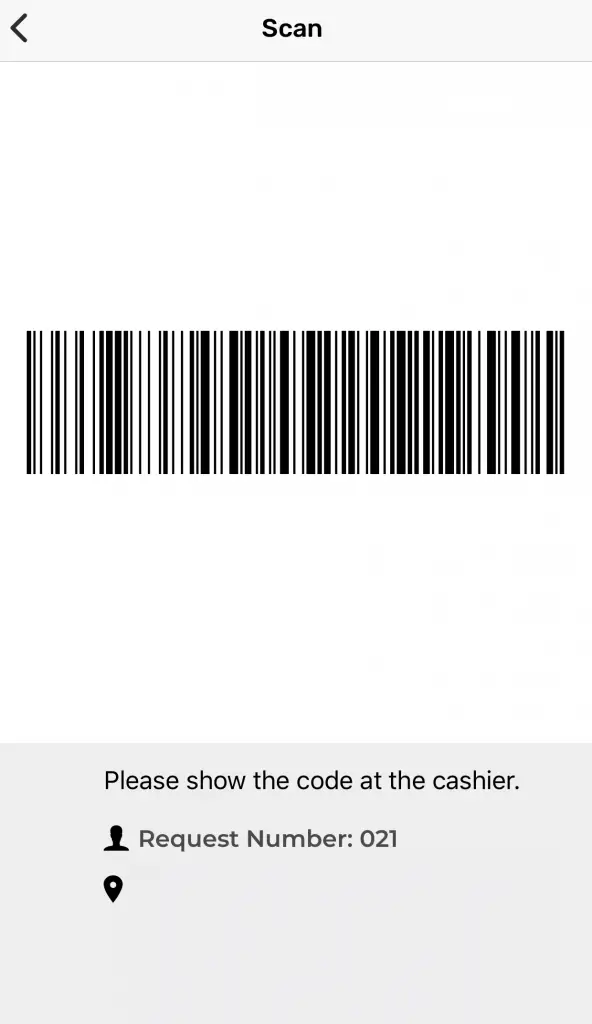

You will be issued a QR code to let the merchant scan

After you have transferred the money to SoCash, you will be given a barcode to let the merchant scan.

After the merchant scans your barcode, you will be issued your cash!

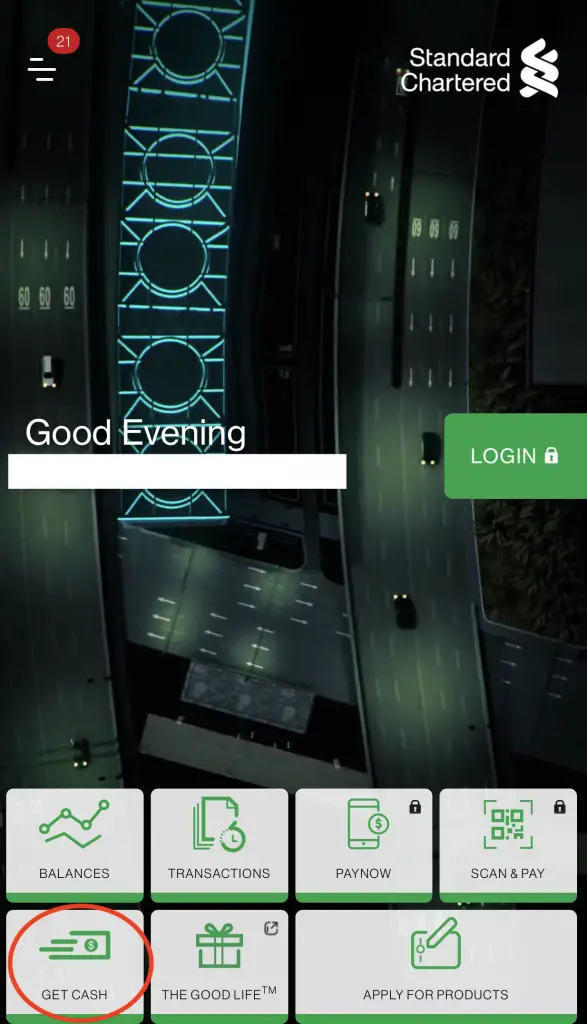

You can use SoCash directly from Standard Chartered’s mobile banking app

If you only have a Standard Chartered bank account, you can use SoCash as well. You can tap on the SoCash button to access this service.

The process will be same as using the other 3 banks (OCBC, DBS or ICBC).

You cannot use a UOB bank account to withdraw money with SoCash

Unfortunately, you are unable to use a UOB bank account with SoCash. It is still possible to withdraw from your UOB bank account using UOB Contactless ATM instead.

SoCash expands the places you are able to withdraw cash from

SoCash helps to convert your local stores into virtual ATMs. As such, this really makes cash much more accessible for you!

Despite being really convenient, there are some things you may want to take note about SoCash:

- The app can be quite laggy and the overall user experience is rather poor

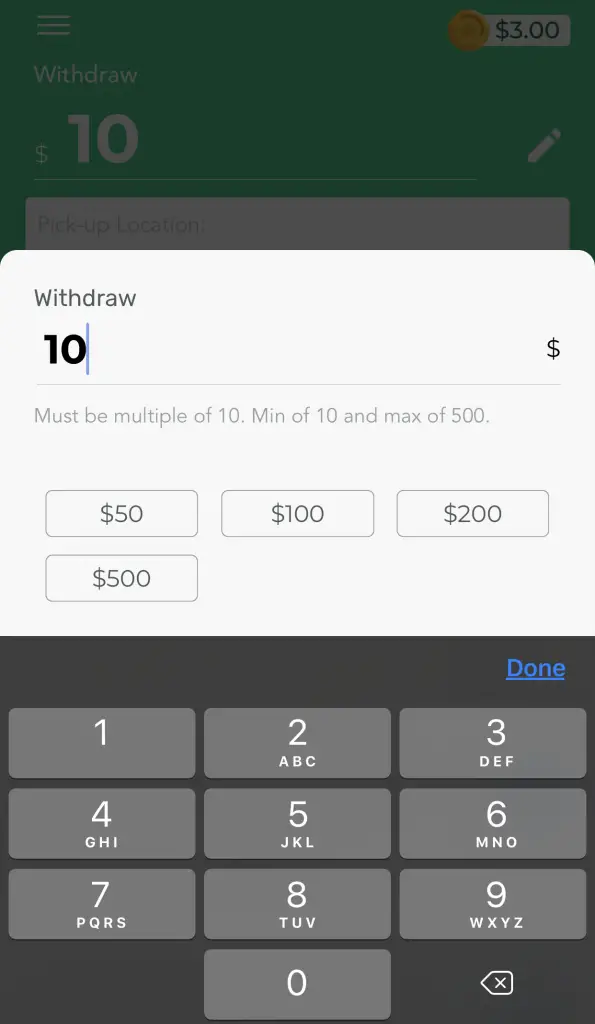

- The minimum withdrawal is $10 and you can only withdraw in multiples of $10

You can read my full review on SoCash to find out more about this service. You will receive a $3 bonus off your first withdrawal when you sign up using my referral code!

#2 OCBC PayAnyone

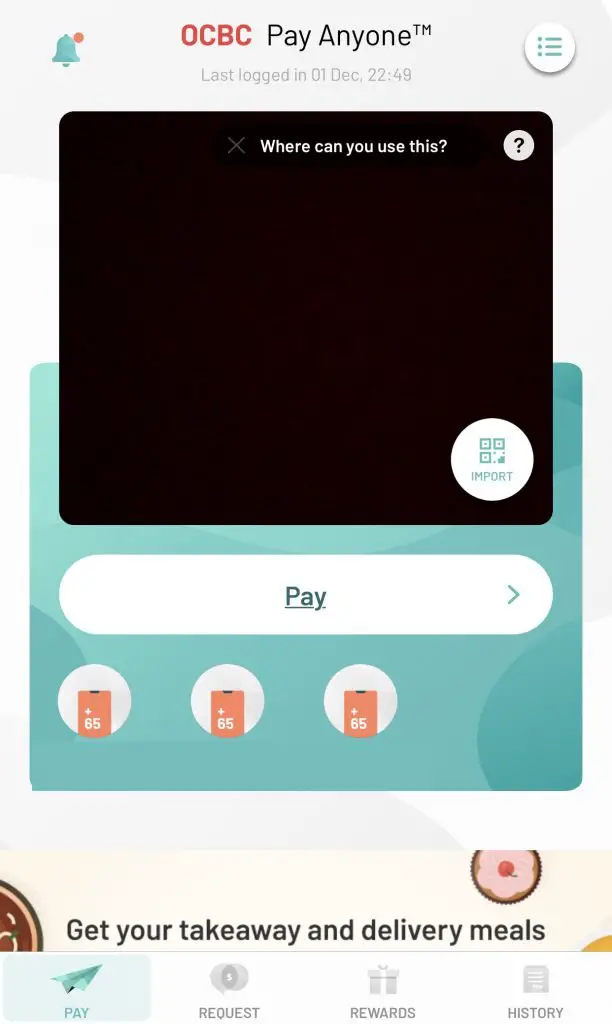

You are able to use OCBC PayAnyone to withdraw cash from any OCBC ATM without your card!

This service is available at all OCBC ATMs

You are able to withdraw your cash using PayAnyone from any OCBC ATM. All you need to do is to have the PayAnyone app.

Tap on ‘Withdraw Cash with OCBC PayAnyone’ at the bottom left corner of the screen

When you want to use an ATM, you will usually slot in your ATM card. Instead, you will need to tap on the ‘Withdraw Cash with OCBC PayAnyone‘ button on the screen.

A QR code will then be displayed on the screen. All you will need to do is to scan the QR code with the PayAnyone app.

After selecting your withdrawal amount, your cash will be issued from the ATM!

Here’s a demo on how this service works:

However, here are some things you may want to take note about this service:

- You are unable to choose the denomination of notes that you will receive

- You cannot withdraw cash from overseas OCBC ATMs or UOB ATMs that are shared with OCBC

- The daily withdrawal limit is $1,000

- The withdrawal limit of your PayAnyone app and your ATM card are different

- You can only use the PayAnyone app and not OCBC’s mobile banking app to make a withdrawal

- You cannot withdraw money from your child’s CDA account

No fees for using the service

You also will not incur any extra fees when you use OCBC PayAnyone to withdraw. This helps to make withdrawing money much easier!

#3 UOB

If you have a UOB card, you can use their contactless withdrawal function to for ATM withdrawals. Instead of inserting your ATM card, you can now use Near Field Communication (NFC) to withdraw your cash instead.

This is the same technology being used for other mobile wallets like Google Pay.

Here are some of the steps that you will need to do to carry out a contactless withdrawal.

1. Add your card to a mobile wallet

To use this function, you will need to add your UOB debit or credit card to a mobile wallet.

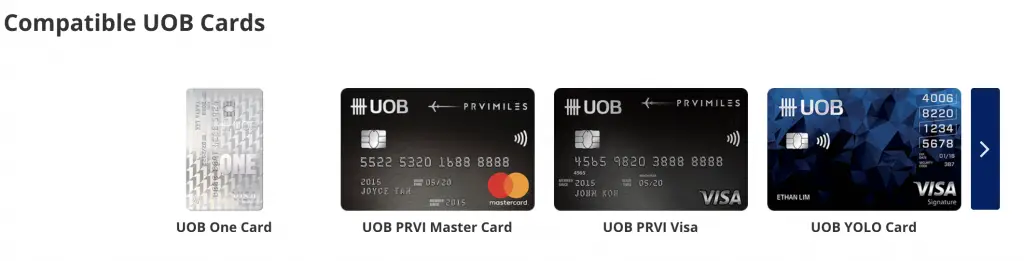

Currently, there are 19 cards that support this function:

- UOB One Card

- UOB PRVI Master Card

- UOB PRVI Visa

- UOB YOLO Card

- UOB Lady’s Card

- UOB Delight Credit Card

- Singtel-UOB Card

- UOB Preferred Platinum Visa Card

- UOB Visa Signature Card

- Metro UOB Card

- UOB Visa Infinite Metal Card

- UOB Professionals Platinum Card

- UOB Debit Card

- UOB Lady’s Debit Card

- UOB Delight Debit Card

- UOB Direct Visa Debit Card

- KrisFlyer UOB Debit Card

- KrisFlyer UOB Credit Card

- Mighty FX Card

If you have an Android phone, you can use the Mighty Pay app to add your UOB ATM card. This way, you are able to withdraw money with your ATM card even if you do not have the physical version!

If you are using a credit card, you will have to link your card to a UOB savings account first. To do so, you would need to go to a UOB branch to carry out the linkage.

3. Download a mobile wallet

The type of mobile wallet you can use depends on your phone’s OS:

| Phone OS | Compatible Mobile Wallets |

|---|---|

| iOS | Apple Pay |

| Android | Mighty Pay Google Pay Samsung Pay Fitbit Pay |

You will have more options for mobile wallets if you are using an Android phone.

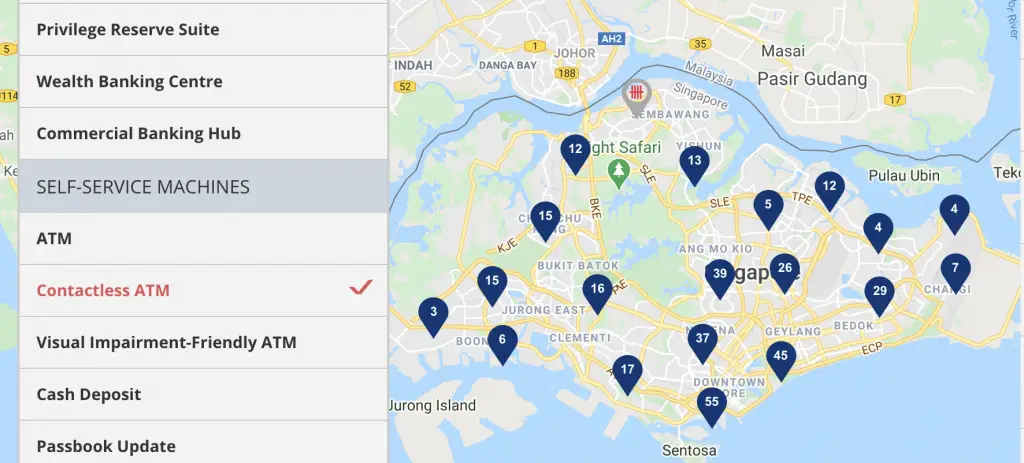

4. Find a compatible contactless ATM

To conduct a contactless withdrawal, you will need to locate a contactless ATM. These ATMs are equipped with a contactless reader with NFC capabilities.

There are quite a lot of ATMs around Singapore that have this capability.

5. Perform the withdrawal

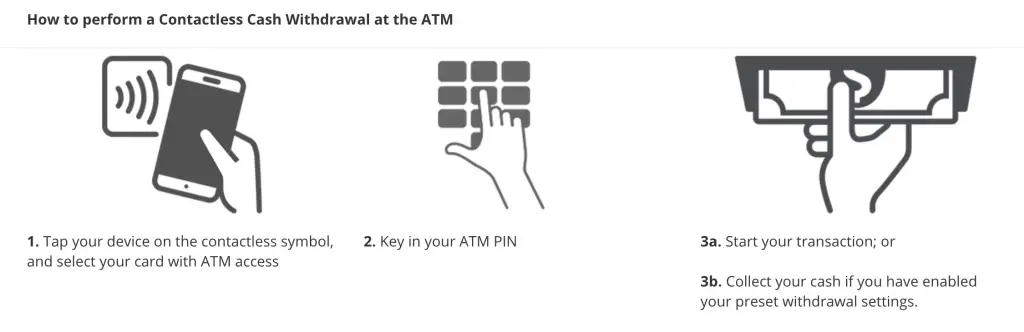

You can now perform your withdrawal using the steps below:

No fees to use this service

Similar to the other services above, you will not be charged a fee for this contactless withdrawal service.

#4 Link your credit cards for ATM use

Did you know that your credit and debit cards can be used to withdraw from ATMs too? All you’ll need to do is to link your card to a current or savings account with that bank.

Here are the methods that you’ll need to use for each bank:

| Bank | Method of Linking Card |

|---|---|

| DBS / POSB | via iBanking |

| OCBC | via iBanking |

| UOB | At UOB branch |

| Standard Chartered | via iBanking |

Once you’ve linked your card, you will be able to use it as an ATM card as well.

Conclusion

The FinTech revolution has changed the way we can gain access to cash. We now have much more options to choose from whenever we need cash upfront!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?