Last updated on June 6th, 2021

Do you have a problem with saving money?

OCBC’s Monthly Savings Account may be something you can consider.

Here’s how this bare-bones account works:

Contents

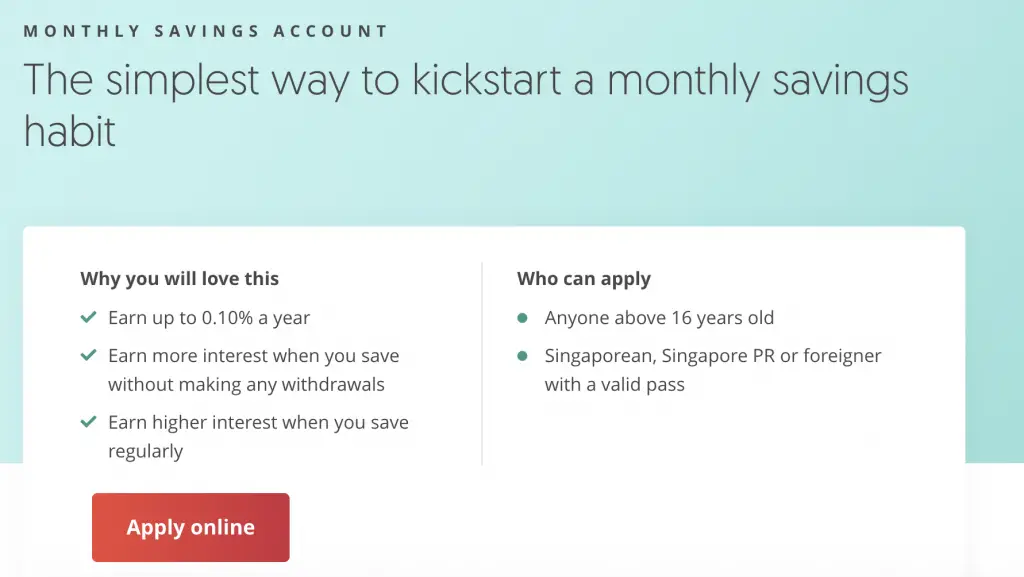

What is the Monthly Savings Account?

OCBC’s Monthly Savings Account is a simple savings account.

You are able to earn extra interest on your funds if you:

- Make a deposit of at least $50 a month

- Do not make any withdrawals in the same month

This will help your money to gradually grow!

What are the requirements for opening this account?

Anyone who is 16 years old and above can apply for this account.

You can either be a:

- Singaporean

- Singaporean PR

- Foreigner with a valid pass

What are the features of the Monthly Savings Account?

Here are 2 main features of the Monthly Savings Account:

#1 No initial deposit

The Monthly Savings Account does not require you to make an initial deposit. You are able to open the account once you have applied for it!

#2 Minimum average balance

The Monthly Savings Account has a minimum average balance of $500. You will have to pay a fall-below fee of $2 if your account balance is below $500.

However, this fall-below fee is waived for the first year.

What is the interest rate for this account?

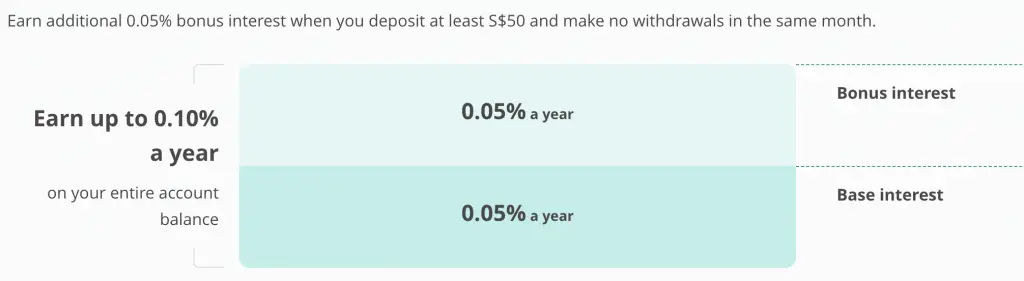

The Monthly Savings Account’s interest rate has 2 components:

#1 Base interest

You will earn a base interest of 0.05% each year. This is the same base interest rate as other savings accounts offered by most banks.

#2 Bonus interest

You will be able to earn a bonus interest of 0.05% if you fulfil the following criteria:

- You make a deposit of at least $50

- You do not make a withdrawal in the same month

Your deposit can be performed in 4 different ways:

- Setting up a monthly GIRO transfer

- Setting up a monthly standing instruction

- Making a fund transfer from any account

- Depositing via cash or cheque into the account

Here are some things to note if you have set up a GIRO transfer:

- If your contributing account is not an OCBC account, the amount will be deducted from that account 1 business day before your contribution date

- If your contributing account is an OCBC account, the deduction date is the same as your contribution date

As such, do remember to have sufficient funds in your contributing account!

You will have to make the deposit within the calendar month. That way, you will be able to enjoy the bonus interest for that month. If you did not make a monthly contribution, you will only earn the base interest of 0.05%.

You can read more about the terms and conditions of the Monthly Savings Account from OCBC’s website.

OCBC used to have a bonus interest tier if you contributed to your Child’s CDA account. However, the promotion is no longer available.

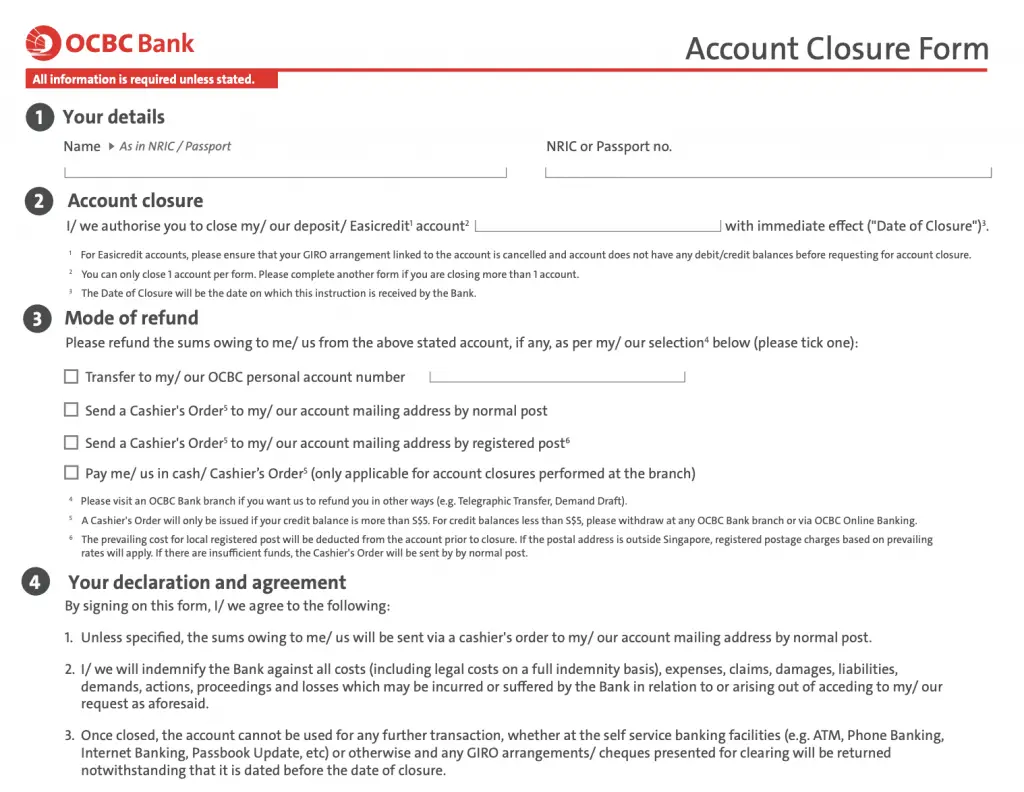

How do I close my Monthly Savings Account?

You may decide to close your Monthly Savings Account. To do so, you will need to fill up the Account Closure Form and mail it to OCBC.

The good thing is that the Monthly Savings Account does not have an early closure fee.

Verdict

Here are 2 key points for this account:

#1 A simple, bare-bones savings account

This is one of the simplest savings accounts that you can create. The only requirement you need to hit is the minimum balance of $500.

As such, it is an account that you can park $500 into and just forget about it.

#2 Extremely low interest rate

The interest rate is pretty bad compared to many other accounts out there. Moreover, I do not think it is worth trying to earn that extra 0.05% by depositing money into the account.

Here are some comparisons against other savings accounts:

| Savings Account | Pros and Cons over MSA |

|---|---|

| Vivid | Higher interest rate but inflexible withdrawals |

| FRANK | Higher interest rate but larger minimum amount |

| JumpStart | Higher interest rate but higher minimum age (18) |

With the rise of flexible insurance savings plans, there are other attractive plans you can consider as well:

| Insurance Savings Plan | Pros and Cons over MSA |

|---|---|

| SingLife | Higher interest rate but higher minimum age (18) |

| GIGANTIQ | Higher interest rate but fees are charged for withdrawals |

The Monthly Savings Account stands out as you are able to create it when you’re 16 years old.

However, there are other accounts like Vivid or OCBC FRANK that you may want to consider instead. These accounts offer a much higher interest rate!

Alternatively, you may consider Etiqa’s GIGANTIQ as well. This is an insurance savings plan that provides a comparable interest rate to Vivid. Moreover, you are able to make flexible withdrawals too.

Is there a need to create this account?

There are so many better accounts out there. Is there even a need to consider creating the Monthly Savings Account?

Here’s a scenario that I believe the Monthly Savings Account might be useful.

If you have invested in the OCBC BCIP like me, you will still need to have an OCBC account. This is because you will need to have an account for your dividends to be credited.

Moreover, if you decide to sell your counters with the BCIP, the amount can only be credited to an OCBC account.

I currently have a FRANK account. However, the minimum account balance is pretty steep at $1,000. Moreover, I do not intend to create an OCBC 360 account.

Once I reach 26 years old, I intend to close my FRANK account and use this account instead.

As such, I believe that the Monthly Savings Account may still have its uses. This is particularly if you are required to have an OCBC bank account. All you need to do is to park $500 in there, and you’ll be set!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?