Last updated on September 21st, 2021

The CIMB FastSaver used to be everyone’s favourite fuss-free savings account.

However, its interest rates have since dropped. Moreover, new options such as the SingLife account have emerged.

So how does CIMB FastSaver compare with the SingLife Account?

Here’s a complete comparison of what these 2 accounts offer you.

Contents

Type of Account

The CIMB FastSaver and the SingLife account are 2 different types of accounts.

CIMB FastSaver is a savings account, while the SingLife Account is an insurance savings plan.

Different coverage by SDIC

Both of these accounts are covered by the SDIC.

Even though CIMB is a Malaysian bank, it is still one of the scheme members under SDIC.

However, their coverage under SDIC will be different.

CIMB FastSaver is covered under the Deposit Insurance Scheme

Like other savings accounts, the CIMB FastSaver is covered under the Deposit Insurance Scheme. This means that your deposits with CIMB will be covered up to $75k.

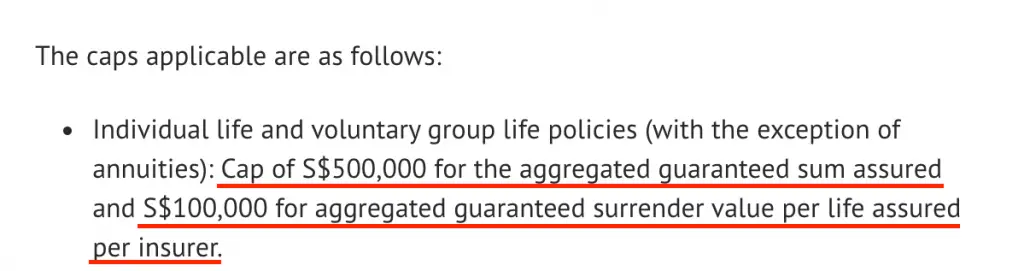

SingLife Account is covered under the Policy Owner’s Protection Scheme

The SingLife Account is an insurance savings plan. It provides you with both death and total permanent disability benefits.

As such, it is covered under the Policy Owner’s Protection Scheme.

The amounts that you put in will be covered up to $100k.

Interest / Return Rate

Both of these accounts have a tiered interest or return rate. The interest or return rate that you earn is based on the amount that you have in the account.

Here are the rates that these 2 accounts offer:

| Tier | FastSaver | SingLife Account |

|---|---|---|

| Tier 1 | 0.3% (First $50k) | 1.5% for first $10k |

| Tier 2 | 0.5% (Next $25k) | 1% (Next $90k) |

| Tier 3 | 0.75% (Next $25k) | 0% (If above $100k) |

| Tier 4 | 0.3% (Above $30k) | NA |

You are able to earn an extra 0.5% on your first $10k in the SingLife Account. This will allow you to receive 2% for your first $10k! However, you will need to participate in SingLife’s Save, Spend and Earn Campaign.

The SingLife Account has a much higher return rate than the CIMB FastSaver!

Eligibility

Here is the minimum age you’ll need to open these 2 accounts:

| Criteria | FastSaver | SingLife Account |

|---|---|---|

| Minimum Age | 16 | 18 |

You are able to open your FastSaver account at a younger age compared to the SingLife Account.

However, FastSaver does not really provide an attractive interest rate. The Vivid Savings Account or GIGANTIQ (an insurance savings plan) provides higher interest rates when you’re 16!

Joint Account

FastSaver gives you the option of creating a joint account.

However, this option is not available for the SingLife Account.

Initial Deposit

CIMB FastSaver does not require an initial deposit to open the account. In contrast, the SingLife account requires you to put in an initial deposit of $500.

Even then, I still think that the initial deposit for the SingLife Account is not too high.

Minimum Account Balance

The CIMB FastSaver does not have any fall below fees.

However, it does have a minimum account balance of $1,000. If you fall below this amount, you will not earn any interest on your funds.

This requirement is more steep compared to other basic savings account like the the OCBC Monthly Savings Account. However, it does provide a much higher base interest rate.

The SingLife Account requires you to maintain a minimum balance of $100 in your account. If you fall below this amount, you do not need to pay a fall-below fee. Instead, you will just not be able to earn the return rate on your savings.

The $100 minimum balance is really low. As such, I believe that you most likely would not fall below this amount.

Speed of Withdrawal

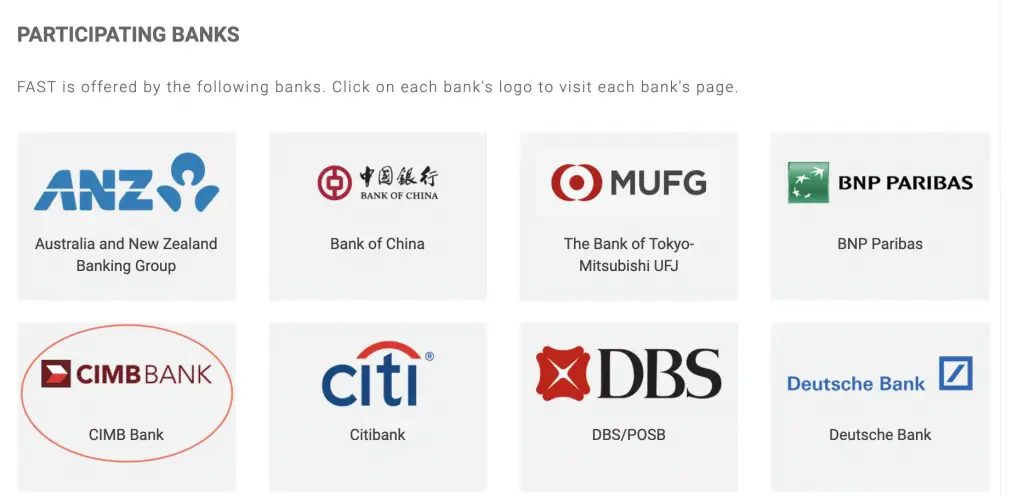

CIMB is one of the participating banks that offer FAST transfers.

As such, you should be able to transfer your funds almost instantly!

However, it is slightly different for the SingLife Account. SingLife is not a bank, so it cannot transfer your money via FAST directly.

It may take a while for your funds to reach your bank account. From my experience, it has taken around 5-15 minutes for the funds to be withdrawn.

SingLife does has a disclaimer that it may take up to 3 hours for your funds to be transferred.

I believe this disclaimer is put in place in case SingLife needs to process a large amount of withdrawals at the same time.

Mobile and Web Platforms

CIMB has a rather outdated platform.

And their mobile app doesn’t look that impressive either.

SingLife has better looking mobile and web platforms. However, it does has it issues too. From time to time, I may experience some lag or encounter this message.

Overall, both user experiences could definitely be improved!

Debit Card

Only the SingLife Account comes with a debit card.

The 2 main benefits of this card include:

- No FX fees on foreign transactions

- Retrenchment benefits

I do not really think that these 2 benefits may be useful for you. You may want to consider cashback debit cards such as the FRANK debit card or the JumpStart debit card.

Ability to Withdraw Cash

Even though you have the SingLife debit card, you are unable to use it to make any ATM withdrawals.

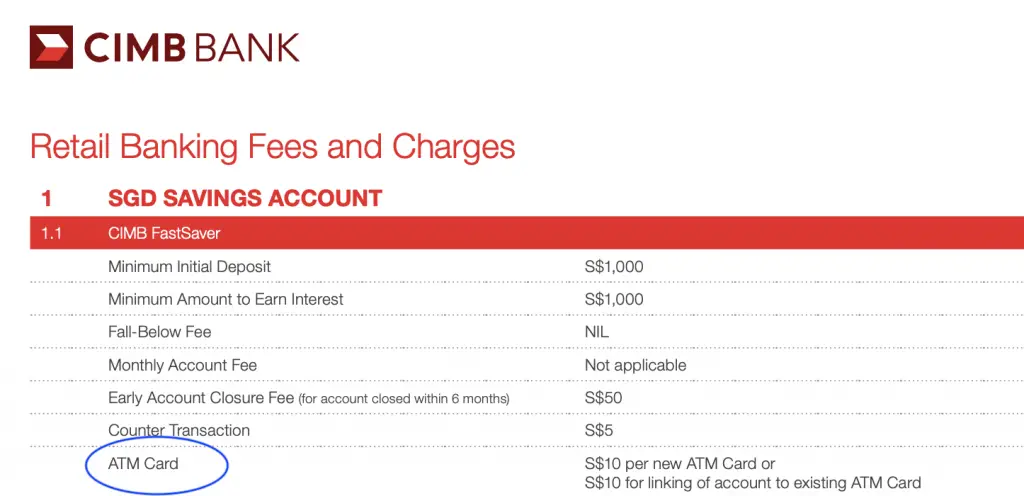

CIMB FastSaver allows you to perform ATM withdrawals. However, here are some things you’ll need to consider:

#1 You will be charged for these ATM card-related fees

You will be charged $10 for either:

- Being issued an ATM card

- Linking your FastSaver account to an existing ATM card

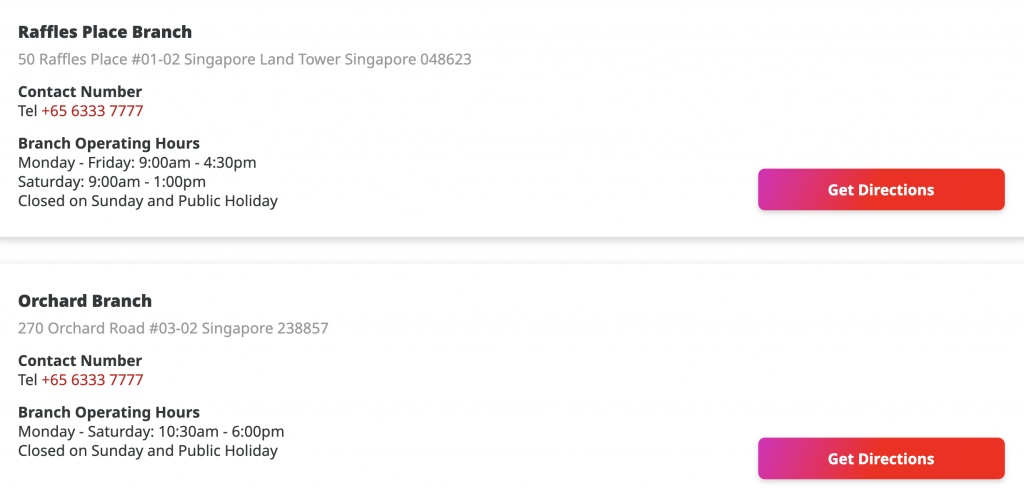

#2 There are only 2 CIMB branches where you can withdraw money from

CIMB only has 2 branches in Singapore.

Moreover, CIMB is neither a partner of the ATM5 network or SoCash. The ATMs you can withdraw money from will only be limited to these 2 branches.

As such, it can be rather inconvenient for you to find an ATM to withdraw from.

CIMB’s intention for FastSaver is to be a fully online account. As such, it is trying to discourage you from making in-person withdrawals. Instead, you can consider transferring your money via FAST to an account from another bank.

Verdict

Here’s a summary of these 2 accounts:

| Comparison | FastSaver | SingLife Account |

|---|---|---|

| Type of Account | Savings Account | Insurance Savings Plan |

| Interest / Return Rate | 0.3-0.75% | 1-1.5% |

| Minimum Age | 16 | 18 |

| Joint Account | Yes | No |

| Initial Deposit | $0 | $500 |

| Minimum Account Balance | $1,000 | $100 |

| Fall-Below Fee | None | None |

| Speed of Withdrawal | FAST | Up to 3 hours |

| Debit Card | Not available | Available |

| Withdrawing Cash | Available | Not Available |

Based on this comparison, it seems that the SingLife Account is the superior account. With its much higher return rate and minimal requirements, it seems to be the better option.

The only major drawback is the speed of withdrawal. As such, it may not be that suitable for your emergency funds.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?