Last updated on November 16th, 2021

You’ve just received and activated your Crypto.com Visa card. However, how do you go about topping it up?

Here is a complete guide on how to top up your Crypto.com Visa card in Singapore.

Contents

How to top up your Crypto.com Visa Card in Singapore

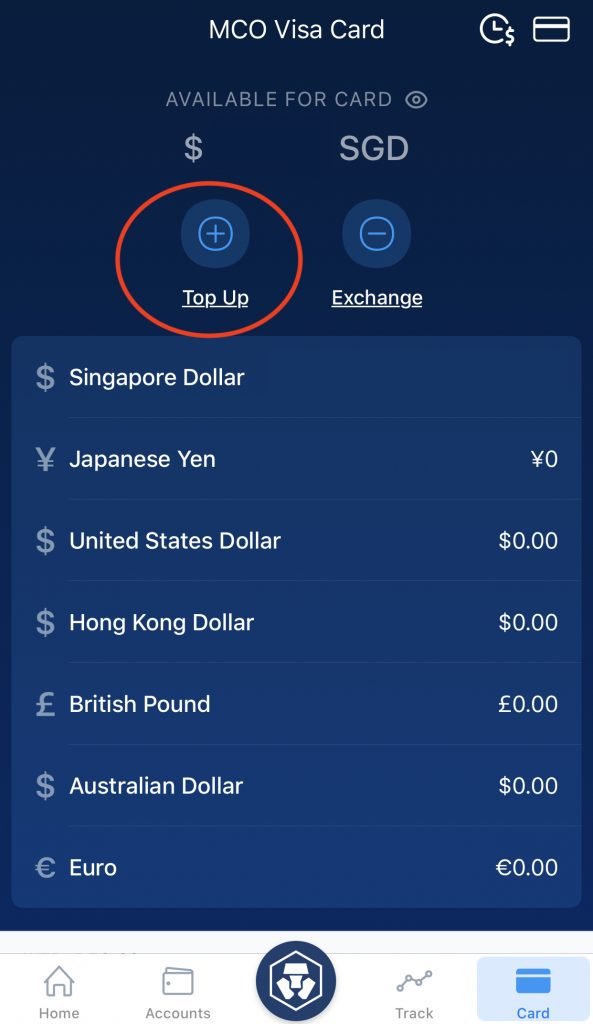

To top up your Crypto.com Visa Card, you will need to go to ‘Card → Top Up‘.

This will bring you to the Top Up page.

There are 2 methods by which you are able to top up your Crypto.com Visa card:

- Credit or debit card

- Cryptocurrency

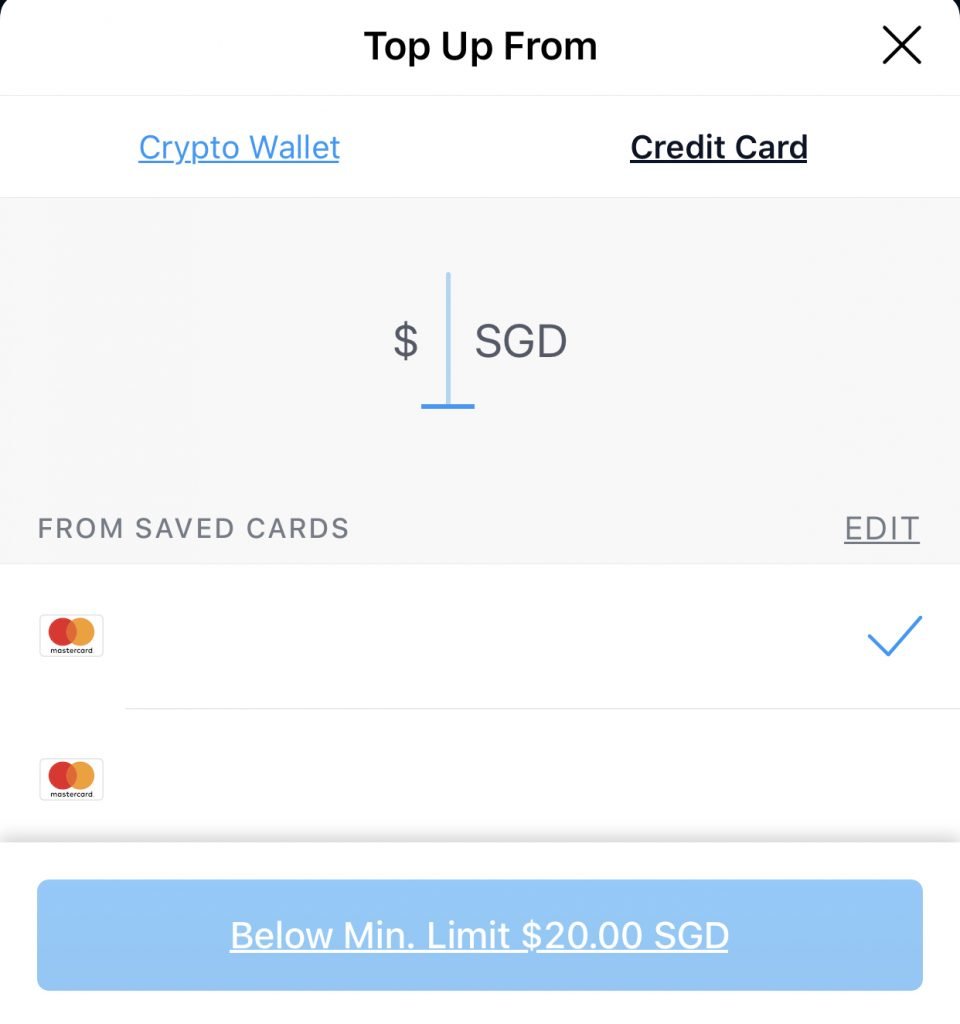

1. Credit or debit card

Here are the debit and credit cards that you can use to top up your Crypto.com Visa card:

| Card Type | Available Networks |

|---|---|

| Credit Card | Mastercard Visa |

| Debit Card | Maestro (Mastercard network) Visa Electron (Visa network) |

Previously, there was some issues with using a Mastercard to top up your Crypto.com Visa card. However, I believe that this issue has already been resolved.

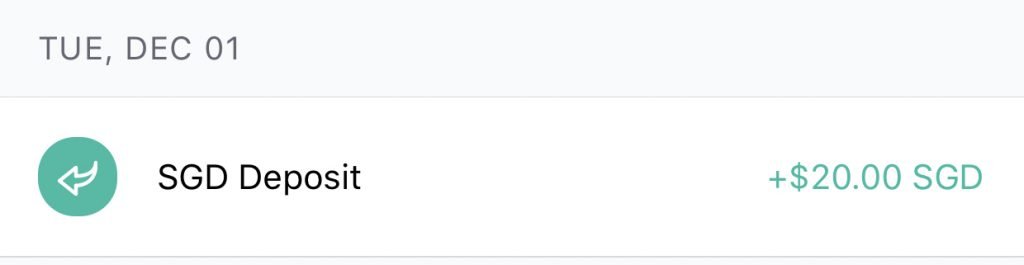

The minimum top-up for the Crypto.com Visa card is $20.

If your Crypto.com Visa card is issued in Singapore, you can only top up in SGD. However, you are able to exchange your SGD to 6 other currencies that are also offered by the Crypto.com Visa Card:

- USD

- EUR

- GBP

- AUD

- JPY

- HKD

Look out for fees

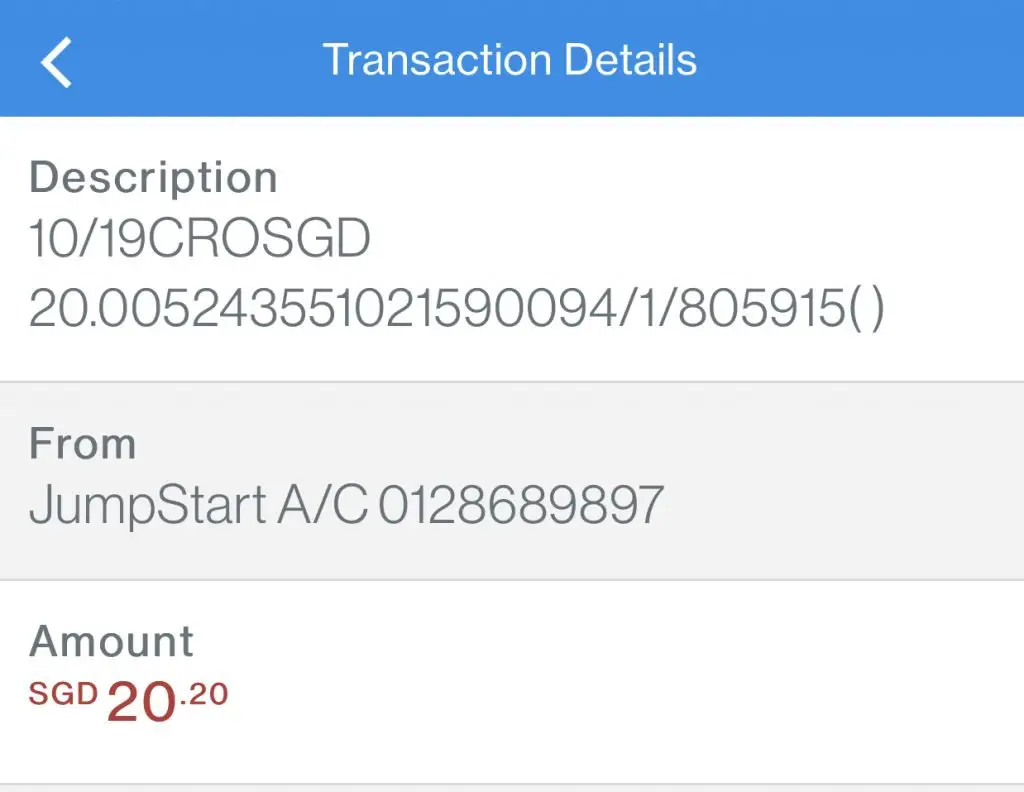

Certain banks may charge you a fee when you are topping up your Crypto.com Visa card using their cards. For example, I was charged a 1% fee when I topped up $20 using my JumpStart debit card.

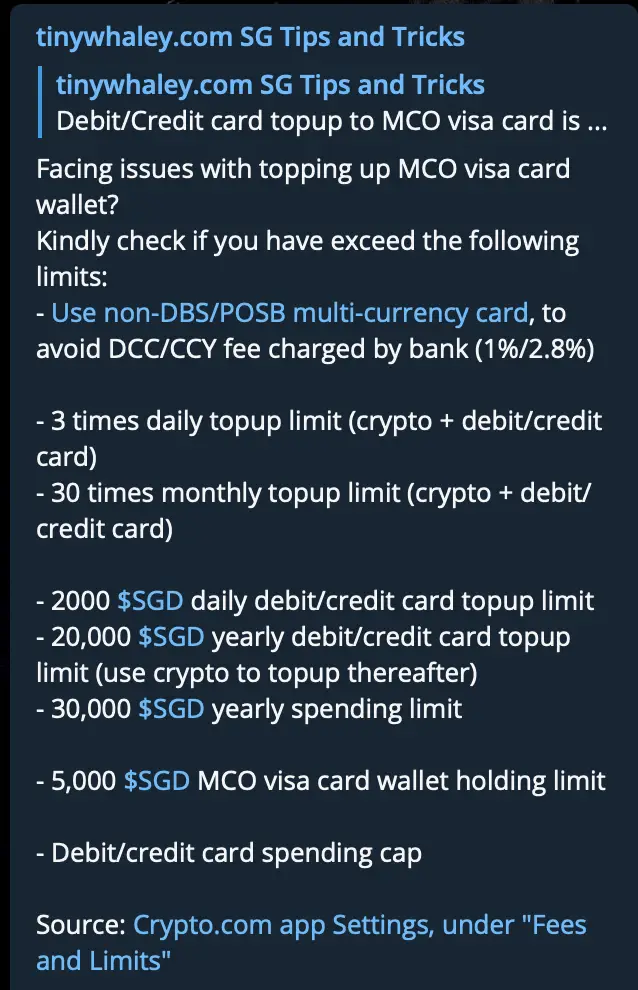

According to this Telegram group, there may be some issues when you top up with either a bank credit or debit card.

OTP confirmation

After selecting the amount to top up, you will usually be asked to input an OTP. After this, your money will be topped up into your CRO wallet.

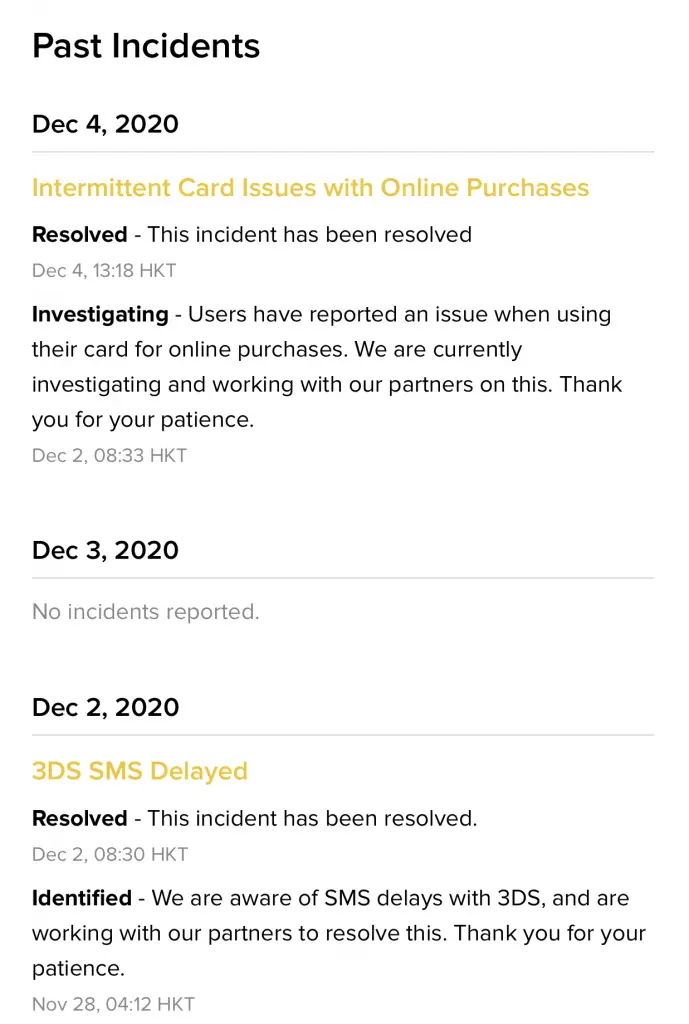

Some issues with top up

There may be some issues with topping up your card from time to time.

This can be rather disruptive when you are trying to top up your card before making a purchase.

What cards work with the Crypto.com Visa card?

If you use debit cards that are linked to your bank account, you would most likely be charged a fee.

As such, here are some possible debit cards that you can top up your Visa card without incurring any fees:

I personally use the BigPay card, as I can get BIG points with each top-up.

If you spend more than $500, you can choose to use the SingLife debit card. This helps you to take advantage of their Save, Spend and Earn program.

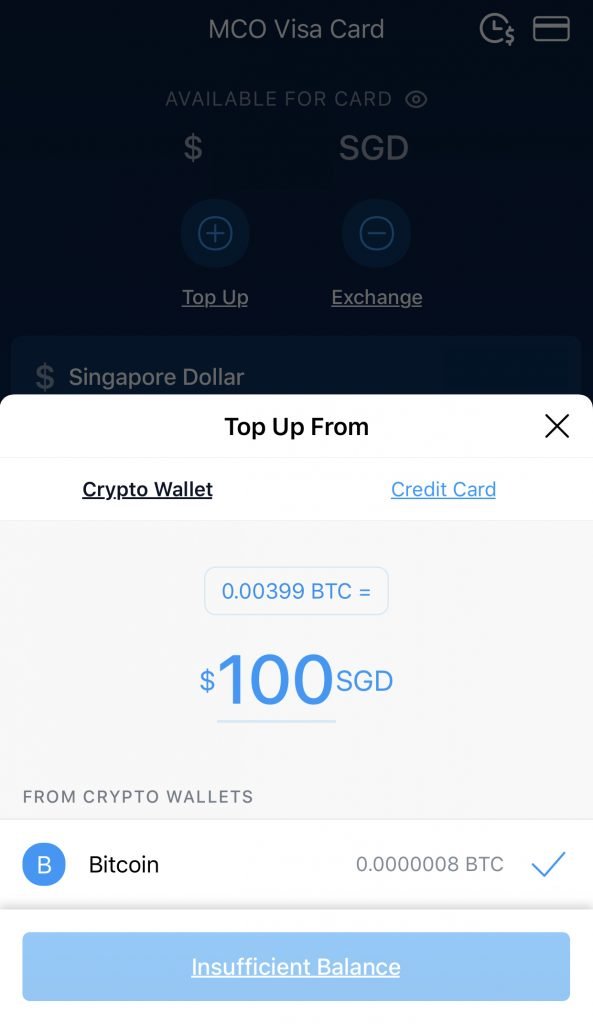

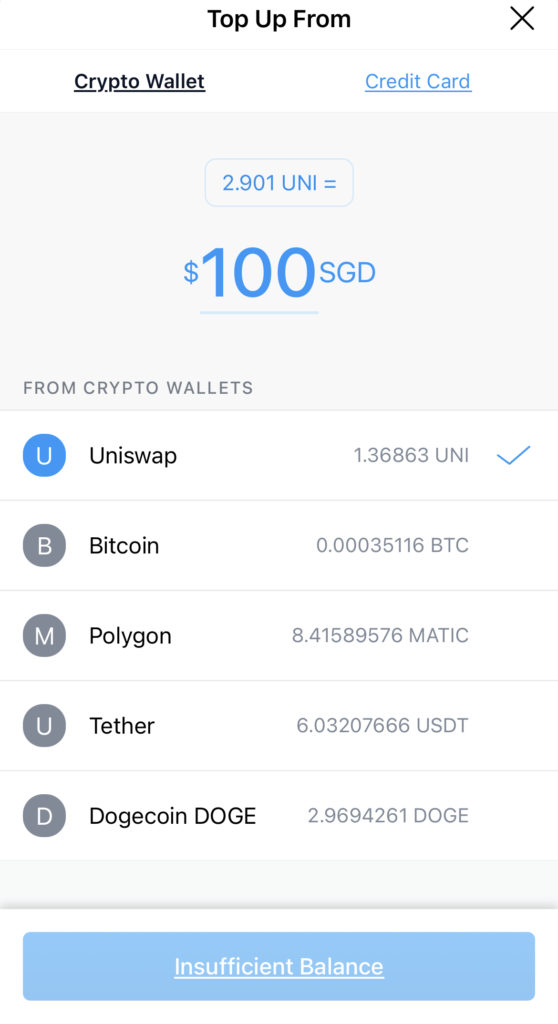

2. Cryptocurrency

You are also able to convert your crypto holdings into fiat currency to spend on your card! There are 4 cryptocurrencies that you can top up your Crypto.com Visa card with. This includes:

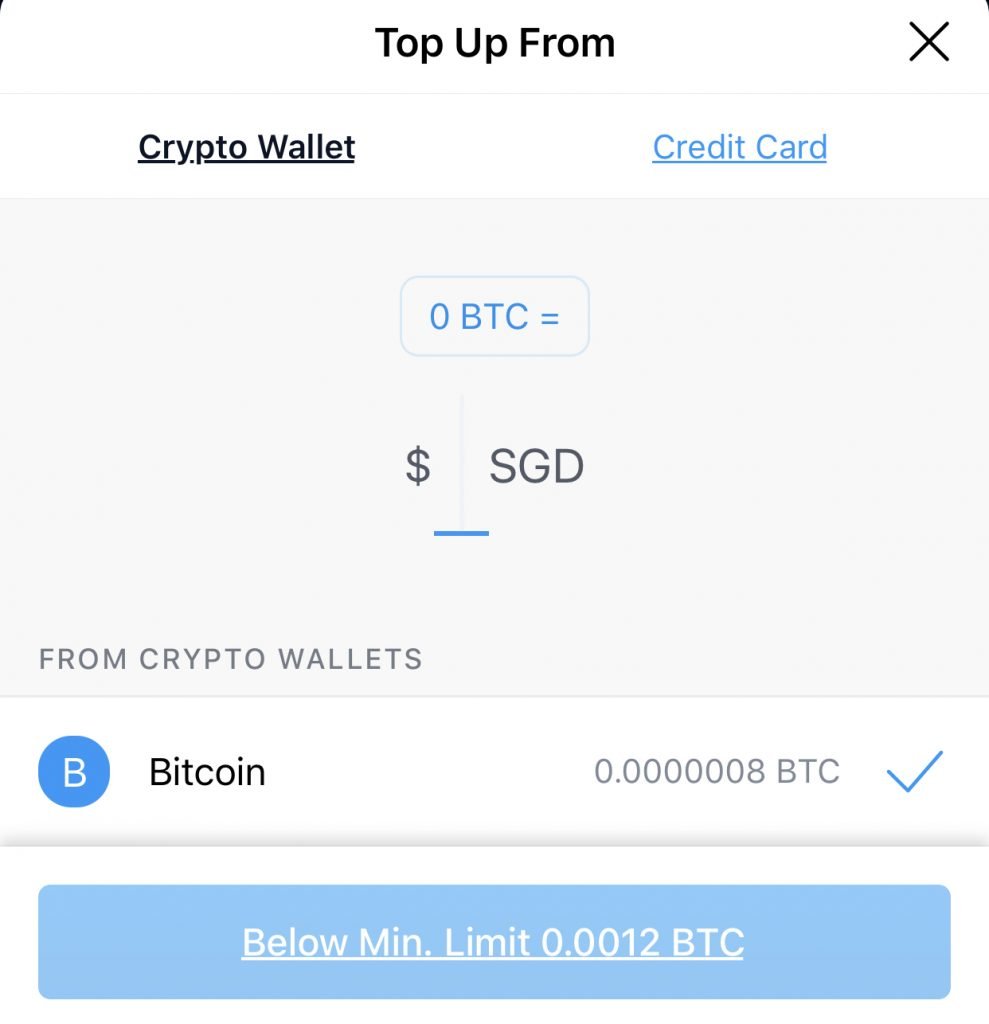

The minimum amount to top up your Crypto.com Visa card depends on the cryptocurrency you’re using.

| Cryptocurrency | Minimum Amount |

|---|---|

| BTC | 0.0012 |

| ETH | 0.035 |

| LTC | 0.4 |

| XRP | 30 |

This is also one possible method where you’re able to sell your cryptocurrency directly to SGD, instead of using Xfers. However, you’ll need to take note of the spread that you may incur, which may eat into your returns!

#1 Exchange rate will be locked for 15 seconds

When you want to sell your crypto for fiat currency, the exchange rate will be locked for 15 seconds. Once you’ve exceeded the 15 seconds, you will have to trade at the current exchange rate again.

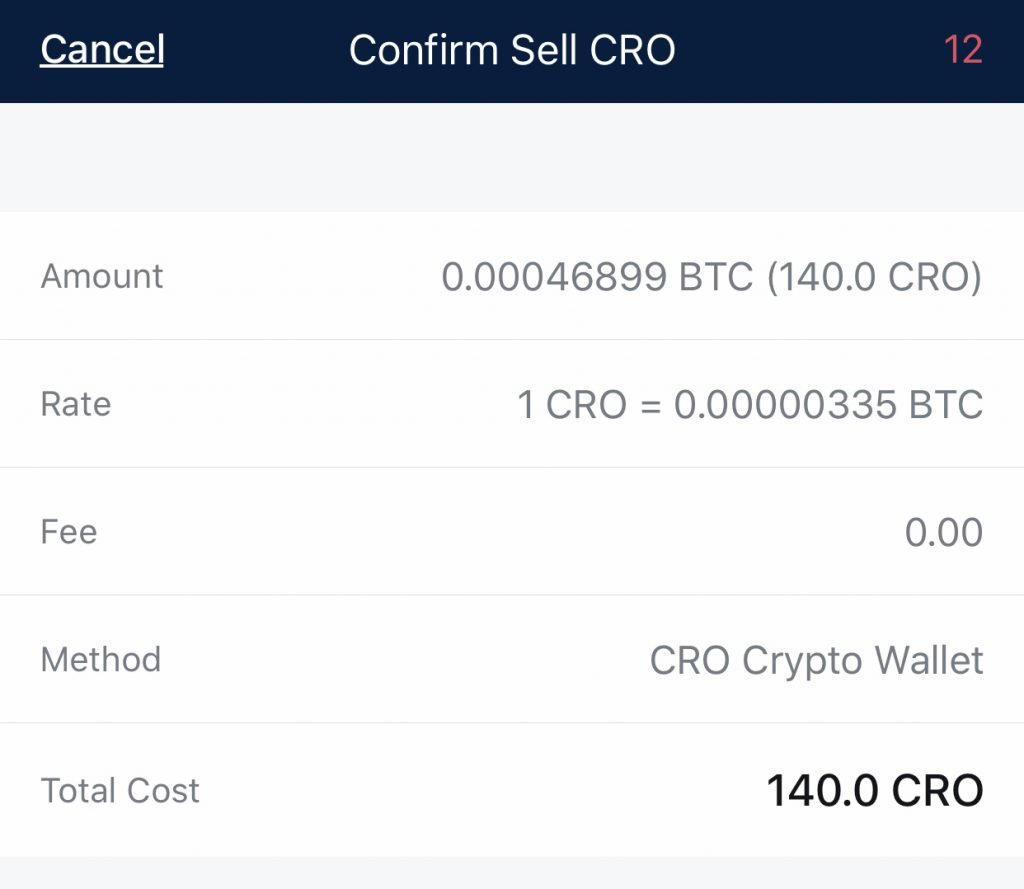

#2 CRO cannot be used to top up your Crypto.com Visa card directly

You may have noticed that the CRO that you earn as cashback cannot be topped up immediately to your Crypto.com Visa card.

This could possibly be due to Crypto.com not wanting you to sell your Spotify or Netflix cashback that you earned in the form of CRO!

One workaround you can use is to trade your CRO into one of the 4 currencies above.

However, the prices of cryptocurrencies fluctuate a lot. Here is the comparison of the exchange rate between CRO and BTC.

As such, you may lose some of your CRO’s value when you are carrying out the trade.

Alternatively, you can earn extra interest with your crypto using Crypto Earn.

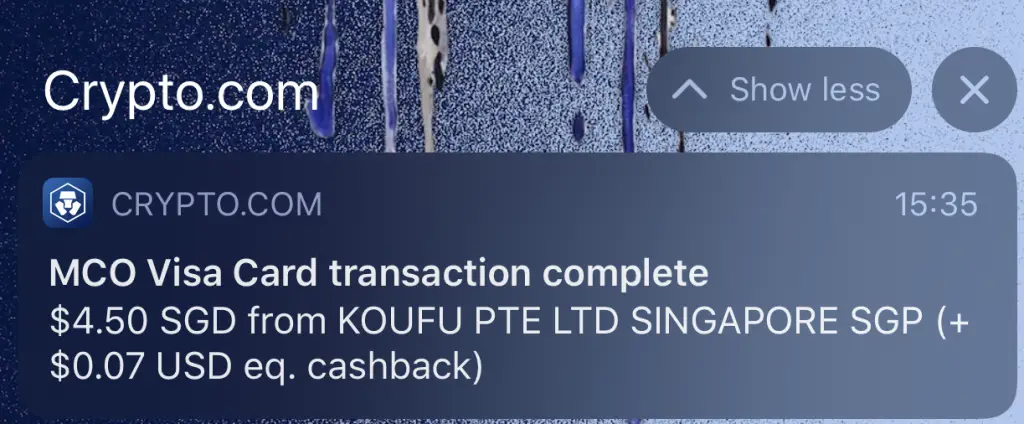

#3 No fees are charged when topping up using cryptocurrency

You will not incur any fees when you top up your Crypto.com Visa Card using cryptocurrency. As such, this may be a more cost-effective way to top up your card compared to selling your crypto to Xfers.

However, you may want to take note of the spread of the Crypto.com App, which can be rather high!

#4 Crypto.com wants you to keep your money in their ecosystem

You are unable to withdraw the cash that you’ve topped up to your Crypto.com Visa card.

This means that your money is locked into Crypto.com’s ecosystem. As such, you have no choice but to use their card to make payments.

This could be the reason why they do not charge any fees when you are exchanging crypto to fiat currency!

Other mobile wallets like GrabPay and Singtel Dash allow you to withdraw your money from the wallet. However, you’ll need to meet certain requirements first before you can do so!

Top up limits for your Crypto.com Visa card

The Crypto.com Visa card is regulated by the MAS under the Payment Services Act. As such, they have placed a limit of $5,000 that you can have in any mobile wallet. Your Visa card wallet will be regulated under this Act as well.

This limit is on your Visa card wallet, and does not affect your Crypto.com wallet. Another thing you may want to note is that this $5,000 limit is inclusive of your non-SGD fiat currencies as well.

Basically, the MAS is trying to regulate the amount of fiat currency you have in the Crypto.com Visa card.

Are there any fees for topping up my Crypto.com Visa card?

Depending on the card that you use to top up your Crypto.com Visa card, you may be charged a 1% processing fee for each top-up. This will be the case for most bank credit cards and some debit cards.

I have tried a few cards where I needed to pay a 1% fee for each top-up:

- Standard Chartered JumpStart Debit Card

- GrabPay Card

- YouTrip

This may hinder the amount of cashback that you eventually earn. If you use the JumpStart debit card to top up, this fee will be negated since the JumpStart debit card gives you a 1% cashback too.

If you want to avoid this fee, you may want to consider using the SingLife debit card, which currently does not charge any fees.

Can I top up my Crypto.com Visa card with CRO?

Crypto.com does not allow you to directly top up your Visa card with the CRO that you have in your Crypto wallet. You will need to trade it to another cryptocurrency (such as BTC or USDT) before you can top it up to your Visa card.

Why did my top up to the Crypto.com Visa card fail?

If you are unable to top up your Crypto.com Visa card with a certain credit or debit card, this could mean that the payment processor does not allow cryptocurrency-related purchases using that card. The best solution would be to use a card that will not result in your transaction being declined.

There have been times where my top up has been declined by Crypto.com. Depending on the card, the issuer may reject your top-up.

However, you may want to try topping up around 3 times with the same card. I’ve had a few occasions where I was finally able to top up the card after trying a few times!

Conclusion

There are 2 main ways in which you can top up your Crypto.com Visa Card in Singapore: via debit / credit card or cryptocurrency. Topping up via cryptocurrency may reduce some fees that you may incur with debit or credit card top-up.

However, with crypto prices being so volatile, you may not top up the amount you intended to.

Another thing that you may want to take note of is the top-up limit for your Crypto.com card. You can only have a maximum of $5,000 in your Crypto.com card wallet, inclusive of your non-SGD fiat currencies as well.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

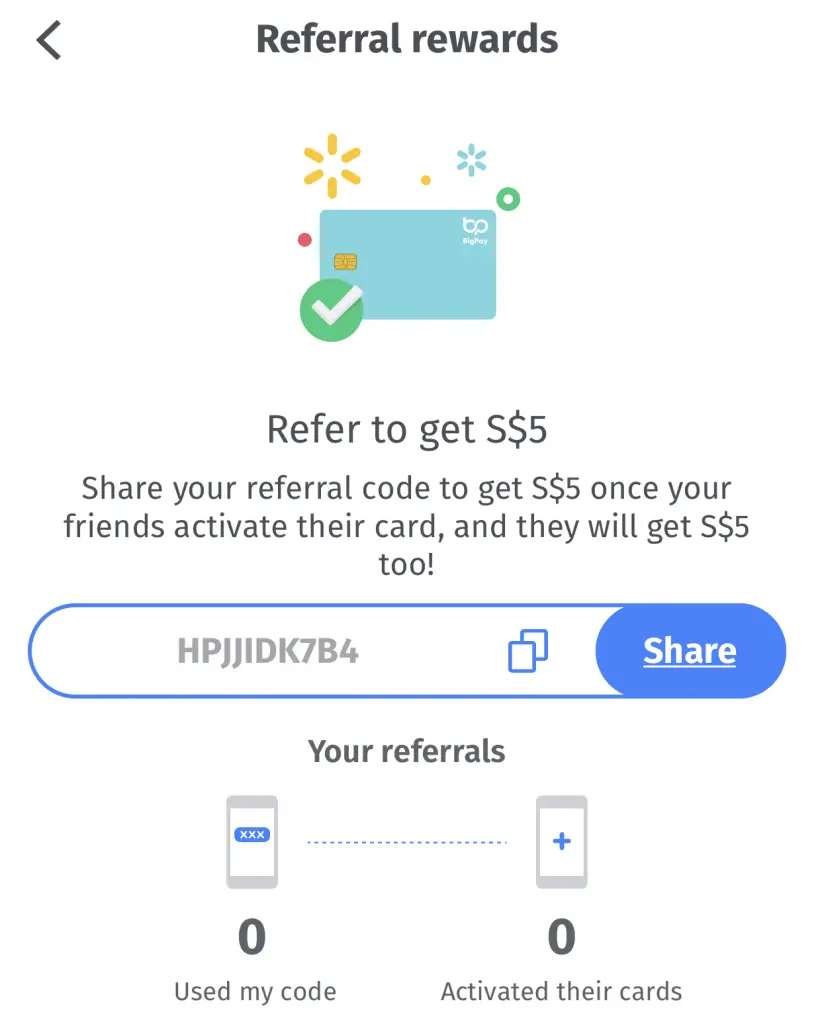

BigPay referral code (Get $5 credited to your BigPay account)

If you are interested in signing up for the BigPay card, you can use the promo code ‘HPJJIDK7B4‘ when you sign up. You will receive $5 in your BigPay wallet after you’ve activated your card!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

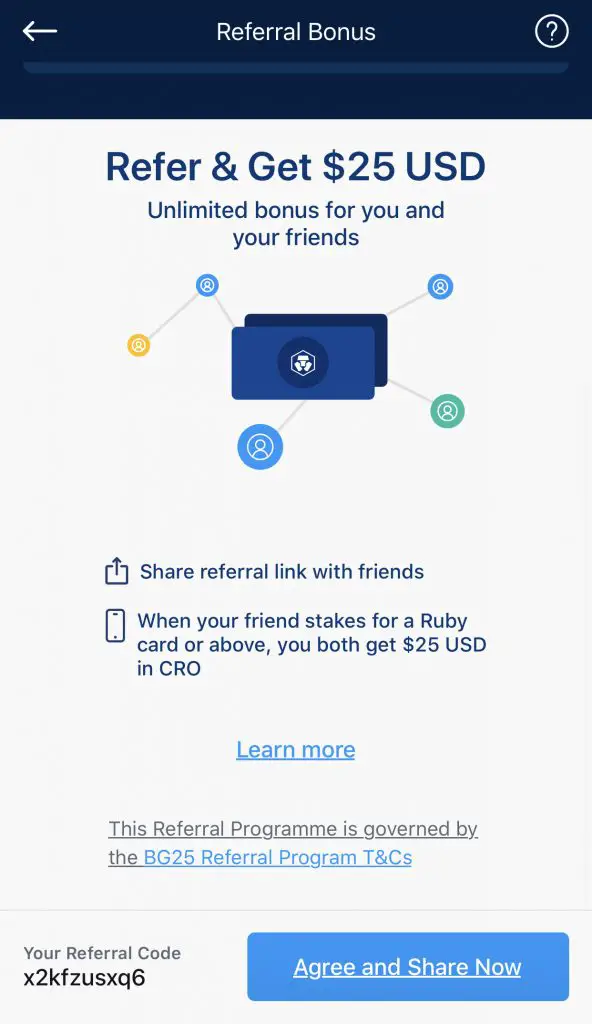

Crypto.com Visa Card Referral (Get $25 USD worth of CRO)

If you are interested in signing up for the Crypto.com Visa Card, you can use my referral link. We will both receive $25 USD worth of CRO in our Crypto Wallet.

Here’s what you’ll need to do:

- Sign up for a Crypto.com account

- Enter my referral code: ‘x2kfzusxq6‘

- Sign up for at least a Crypto.com Ruby Steel Card

You can read more about the referral program on Crypto.com’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?