Last updated on September 21st, 2021

You’ve started earning a salary and are thinking of crediting it to your DBS Multiplier account. However, you realise that the SingLife Account offers a really attractive return rate.

Which account should you choose?

Here’s a comparison between these 2 accounts to see which is better for you.

Contents

Type of Account

The DBS Multiplier is a savings account by DBS. However, the SingLife Account is an insurance savings plan.

This difference is mainly evident in the coverage by SDIC.

DBS Multiplier is covered by the Deposit Insurance Scheme

The DBS Multiplier is covered under the Deposit Insurance Scheme. This means that all of your deposits will be covered up to $75k.

The Deposit Insurance Scheme’s coverage is per depositer per member. This means that the total value of your deposits in DBS and POSB accounts will be covered up to $75k.

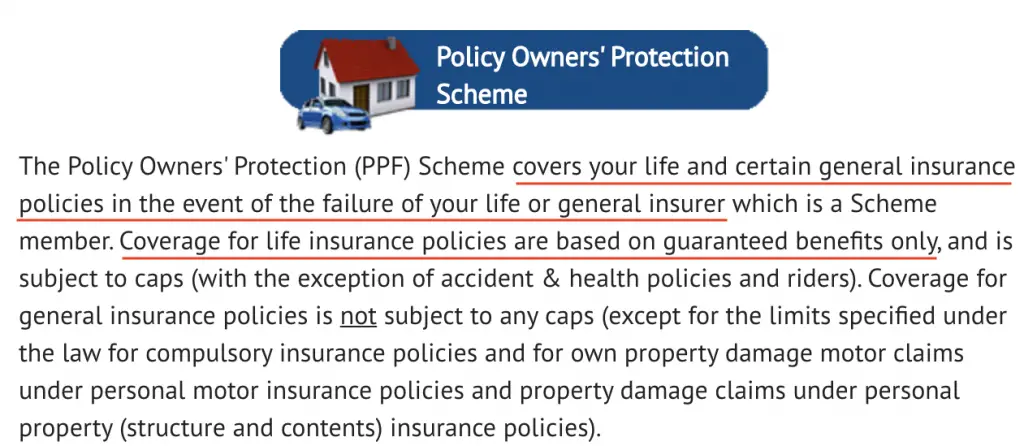

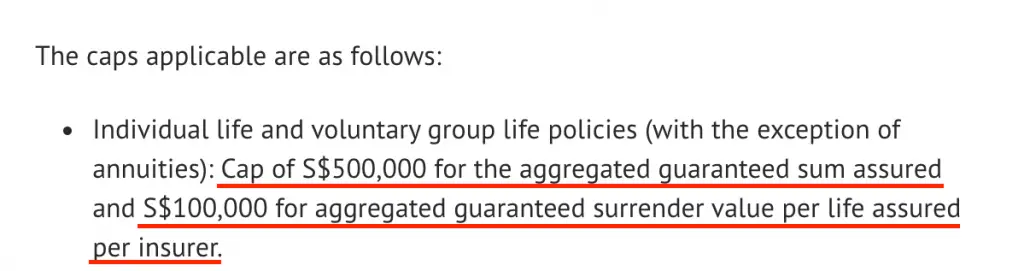

SingLife Account is covered by the Policy Owner’s Protection Scheme

The SingLife Account is an insurance savings plan. This plan provides you with certain benefits, including death and total permanent disability. As such, the amount you put in the SingLife Account will be covered under the Policy Owner’s Protection Scheme.

You will be covered up to $100k in your SingLife Account.

If you put any amount greater than $100k in your SingLife Account, it will not earn any returns. As such, the amount in your SingLife Account should be pretty safe in case SingLife closes down.

Interest / Return Rate

Here are the interest and returns that you can receive when you use these 2 accounts:

You will earn a tiered return rate from SingLife

SingLife offers you a tiered return rate, based on the amount that you have in the account.

| Amount | Return Rate |

|---|---|

| First $10k | 1.5% |

| Next $90k | 1% |

| Amount Above $100k | 0% |

You are able to earn an extra 0.5% on your first $10k with SingLife’s Save, Spend, Earn Campaign. This will allow you to earn 2% for your first $10k.

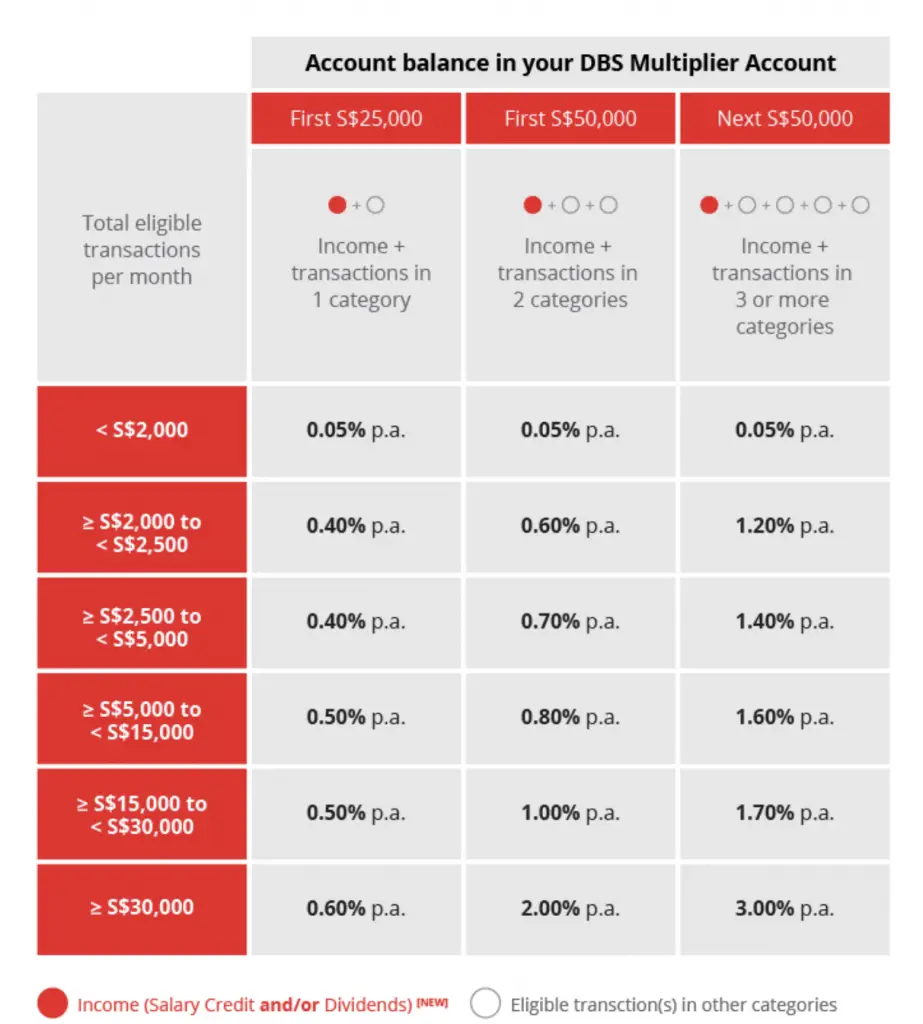

DBS Multiplier offers you different options to earn a higher interest rate

The DBS Multiplier is a really flexible account. You can earn a higher interest rate by having eligible transactions in these categories:

- Income (Salary and / or Dividends)

- Credit Card Spend

- Home Loan Financing

- Insurance

- Investments

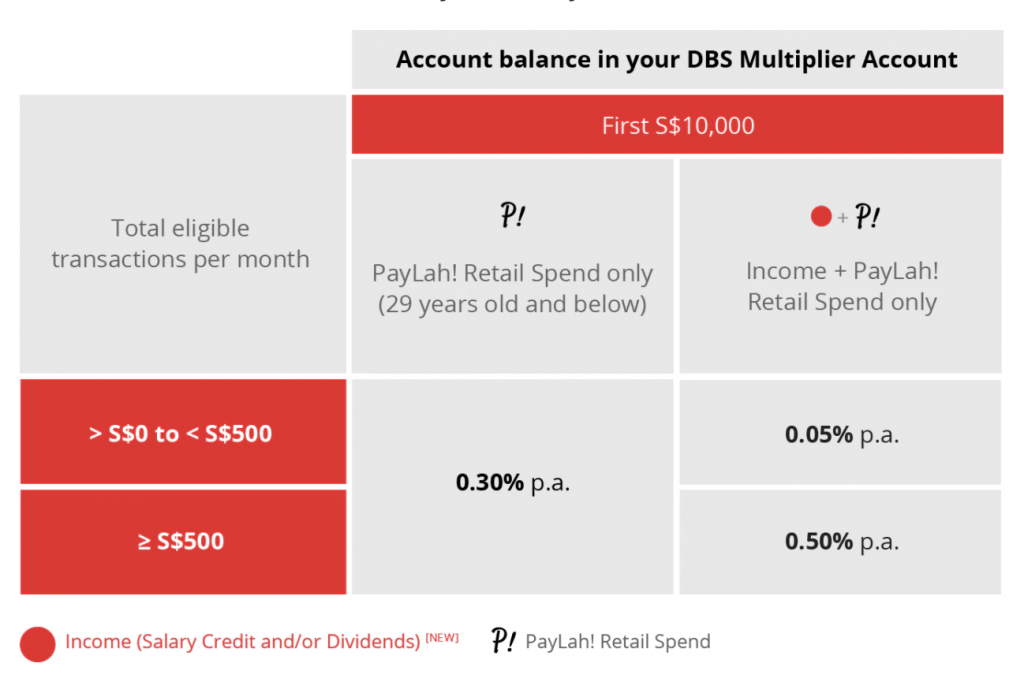

Depending on the eligible transactions each month, here are the interest rates that you can earn:

The main requirement you’ll need to fulfil is to credit your salary and / or your dividends to a DBS / POSB account. This will allow you to earn the interest rates above.

If you don’t have any eligible transactions in the income category, you still can earn some interest rates by using PayLah retail spend.

However, here are some things to note:

- The interest rate will be much lower

- You can only be 29 years old or below

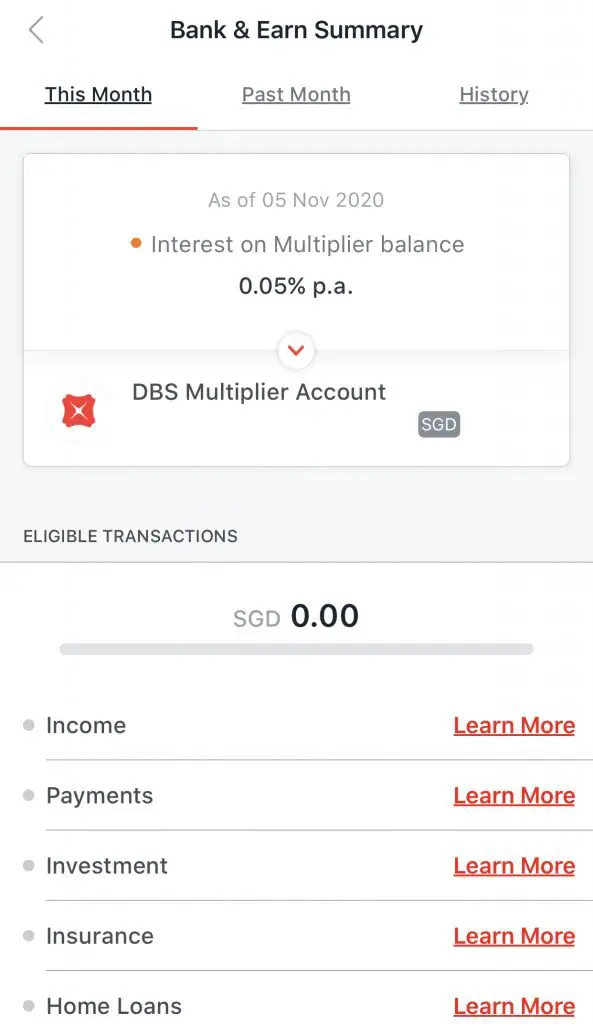

You can check all of your eligible transactions in the Bank & Earn Summary.

Is it easy to earn a 1.5% interest rate in the Multiplier Account?

The more categories you transact, the higher interest rates you will receive. However, earning a similar 1.5% interest rate to the SingLife Account will be tough.

Here are the 2 ways that you can obtain a 2% interest:

- You have eligible transactions from Income and 2 other categories, and have at least $30k in transactions

- You have eligible transactions from Income and 3 other categories, and have at least $30k in transactions

For most of us, we will only be able to fulfil the Income and Credit Card Spend categories.

Let’s assume that you earn the median salary ($4.5k) and have the average monthly expenditure ($4.9k).

You will most likely be earning a 1.1% interest rate in your Multiplier Account.

It is possible to invest using Invest Saver to qualify for the Investment category. However, this will only last for 12 months. Also, I would not recommend you buying insurance or taking a home loan just to earn the extra interest!

As such, the interest rate that you earn with DBS Multiplier may be hard to beat SingLife’s 2% return.

Eligibility

You are only able to open both accounts when you are 18 years old. This is similar to Standard Chartered’s JumpStart Account.

If you are between 16-17 years old, you may want to consider some of these accounts instead:

Initial Deposit

Here are the initial deposits you will need when you wish to create these 2 accounts:

| SingLife | DBS Multiplier | |

|---|---|---|

| Initial Deposit | $500 | $0 |

Even though the SingLife Account has a minimum deposit of $500, it is still a rather manageable amount.

Minimum Account Balance

Here are the minimum account balances you’ll need to maintain for these accounts:

| SingLife | DBS Multiplier | |

|---|---|---|

| Minimum Account Balance | $100 | $3,000 (waived if below 29 years old) |

| Penalty | No return rate earned | $5 if fall below minimum amount |

The $5 fall below fee is pretty hefty for the DBS Multiplier. However, the minimum account balance is waived if you’re below 29 years old. This makes it really flexible when you’ve just started work.

For the SingLife Account, the minimum account balance is pretty manageable. Moreover, you will just not earn the return rate, instead of being charged a fall-below fee.

Speed of Transfer

With the DBS Multiplier, you are able to make transfers instantly via FAST.

However for SingLife, it may have some delay. Usually, it has taken around 5-15 minutes for the funds to reach my account.

SingLife also has a disclaimer that it may take up to 3 hours before your funds are successfully transferred.

As such, it may take a while before your funds reach your account. Due to this poorer liquidity, I would suggest to use the SingLife Account as a second option for your emergency fund.

Debit / Credit Cards

The SingLife Account comes with a Visa debit card.

Here are the main benefits you will receive from this card:

- No FX fees

- Retrenchment benefits

I personally do not think that these benefits may be that useful for you.

In contrast, you are able to apply for the DBS Visa Debit Card when you apply for a Multiplier Account.

Here are some of the benefits:

- Up to 3% cashback on qualifying transactions

- Up to 10% cashback on online food delivery and local transport for new cardmembers

- No foreign exchange fee when you link your card to your Multiplier account

Here are the cashback you will receive on these transactions:

| Cashback | Qualifying Transactions |

|---|---|

| 3% | Online Food Delivery Local Transport (Ride-Hailing, Taxis, SimplyGo |

| 2% | Foreign currency spend |

| 1% | Other local Visa contactless spend |

To earn these cashback, here are some conditions you’ll need to fulfill:

- Spend a minimum of $500 using your debit card

- Keep your cash withdrawals to ≤ $400 in a month

The DBS Visa Debit card does seem better compared to the SingLife debit card. However, I would still prefer to use the JumpStart debit card. This is because it does not have a minimum spend requirement.

Ability to Store Foreign Currency

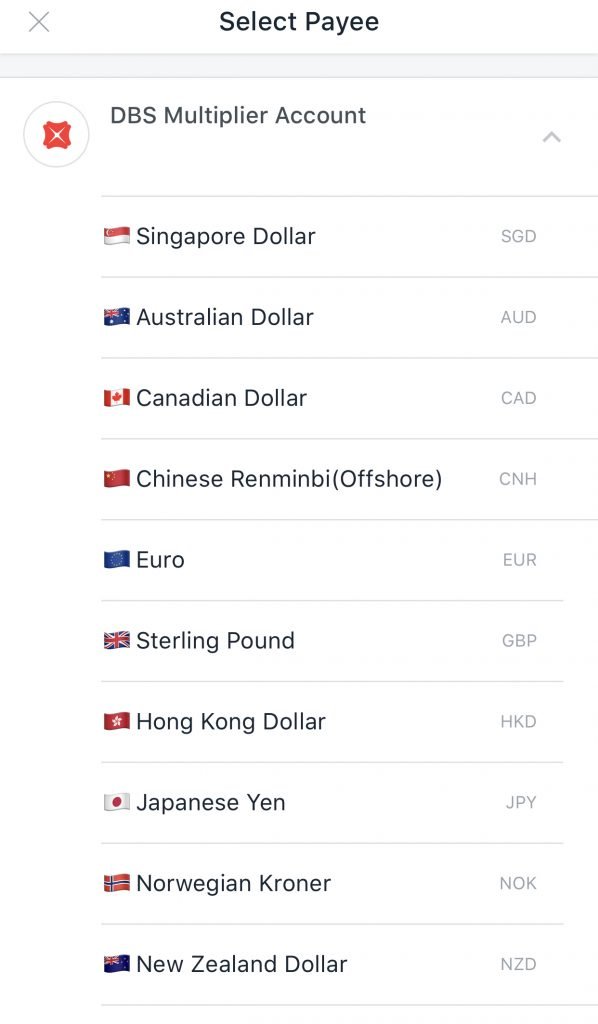

DBS Multiplier is a Multi-Currency Account. As such, you are able to store multiple currencies in the same account.

Here are 12 different currencies that you can exchange to:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Chinese Renminbi (Offshore) (CNH)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Norwegian Kroner (NOK)

- Sterling Pound (GBP)

- Swedish Kroner (SEK)

- Thai Bath (THB)

- US Dollar (USD)

You will not earn any interest rate for the first 11 currencies. The only currency which you can earn some interest is USD:

| Amount In Account | Interest Rate |

|---|---|

| $0 – $350k | 0.03% |

| Amounts above $350k | 0.05% |

Your funds in other currencies will earn very little or no interest rate. As such, you should only have the required amount for your transactions!

This multi-currency feature is not available for the SingLife account.

Cash Withdrawal

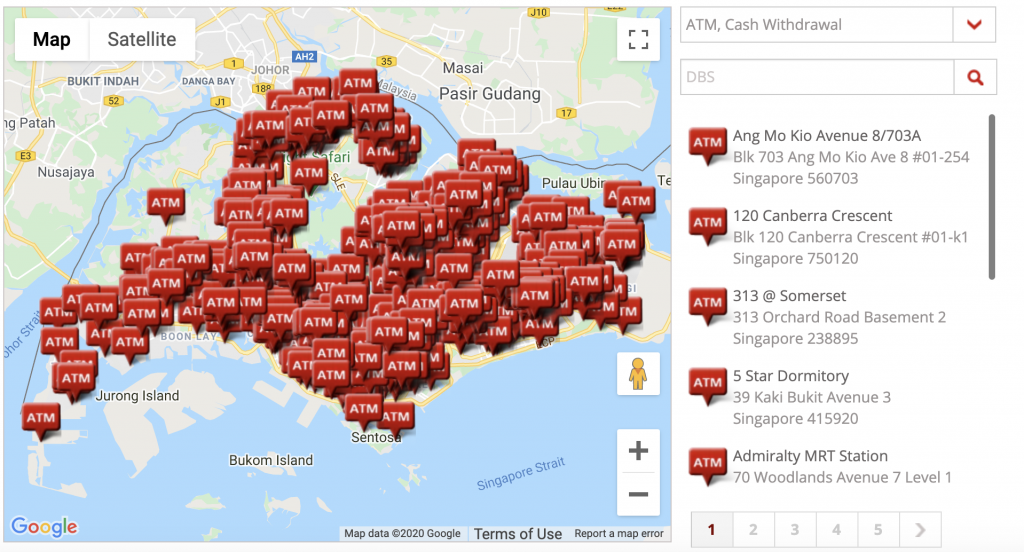

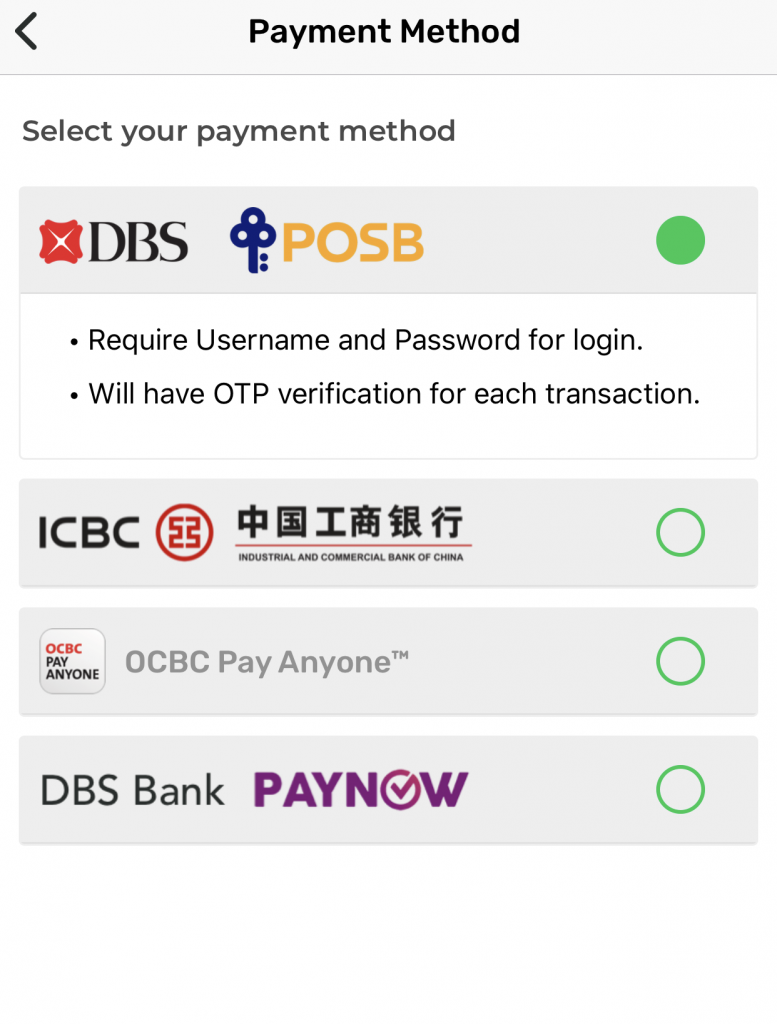

For DBS Multiplier, you are able to withdraw from any of their ATMs in their network.

Moreover, DBS allows you to withdraw money via SoCash as well.

As such, you have lots of options when you are in need of cash!

You can also find out other ways of withdrawing cash without needing your ATM card too.

However, SingLife’s Visa debit card does not come with an ATM withdrawal function. As such, you are not able to withdraw cash from your SingLife Account.

If you do need cash, you can transfer your funds from your SingLife account to a bank savings account!

Verdict

Here’s a comparison between these 2 accounts:

| DBS Multiplier | SingLife Account | |

|---|---|---|

| Type of Account | Savings Account | Insurance Savings Plan |

| Interest / Return Rate | 0.05-3% (depending on qualifying transactions and categories) | 1-2% |

| Eligibility | 18 years old | 18 years old |

| Initial Deposit | $0 | $500 |

| Minimum Account Balance | $3000 (waived until 29 years old) | $100 |

| Minimum Account Balance Penalty | Fall-below fee of $5 | No return rate earned |

| Speed of Transfer | Almost Instant | Up to 3 hours |

| Debit Card | DBS Visa Debit Card | SingLife Visa Debit Card |

| Able to Store Foreign Currency? | Yes | No |

| Cash Withdrawal | Yes | No |

So which account should you choose?

Choose the SingLife Account to earn a higher interest

The SingLife Account allows you to earn a very high 2% return on your first $10k. To get the same rate with the DBS Multiplier, you’ll have to fulfil a lot of different requirements.

As such, I believe that you should max out the $10k in your SingLife Account before considering placing funds in the Multiplier Account.

Due to its poorer liquidity, you can still put some, but not all, of your emergency funds in the SingLife Account.

Choose the DBS Multiplier to maximise your salary

When you start earning a salary, you are able to maximise it by crediting your salary to any DBS or POSB account. This allows you to earn an extra interest rate on your funds in Multiplier.

You should be placing some of your emergency funds in a savings account. This will ensure that you have a liquid option where you can withdraw funds from easily.

If you are able to earn a higher interest rate compared to JumpStart’s 0.4%, you can consider placing your emergency funds in DBS Multiplier instead.

Finding the savings account with the best yield will help to prevent your emergency funds from eroding in value due to inflation.

However, the minimum account balance of $3,000 is pretty steep. You should consider if it’s worth keeping your emergency funds here!

Conclusion

I believe that you should consider creating both accounts. It may be advisable to max out the $10k in SingLife first to maximise your 2% return. After that, you can consider placing your additional funds in the Multiplier Account. This enables the Multiplier Account to act as a liquid option for your emergency funds.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?