Last updated on September 21st, 2021

The inevitable has happened.

The SingLife Account has reduced its base return rate for the first $10k from 2.5% to 1.5%.

However, you are still able to receive the extra 0.5% if your participate in SingLife’s ‘Save, Spend, Earn’ campaign.

Here’s a deep dive into the campaign to see if it’s worth participating in.

Contents

What is the Save, Spend, Earn Campaign?

SingLife’s Save, Spend, Earn Campaign is a way for you to earn an extra 0.5% p.a. on the first $10k in your SingLife Account. To qualify, you will need to spend a minimum of $500 with the SingLife Visa Debit Card.

This campaign will start from 1 November 2020 until 28 February 2021.

How do I qualify for this campaign?

To qualify for the Save, Spend, Earn Campaign, you will need to have a SingLife Visa Debit Card.

If you have not ordered yours yet, you can check out my step-by-step guide.

How does the Save, Spend, Earn Campaign work?

The Save, Spend and Earn Campaign has 3 main periods:

#1 Card Spend Period

You will need to spend $500 using the SingLife Visa Debit Card within one policy month to qualify for the bonus return.

The campaign starts from 1 November 2020. The very first card spend period will be from 1 November 2020 to the last day of your policy month in November.

Here are 2 ways you can find out your policy start date:

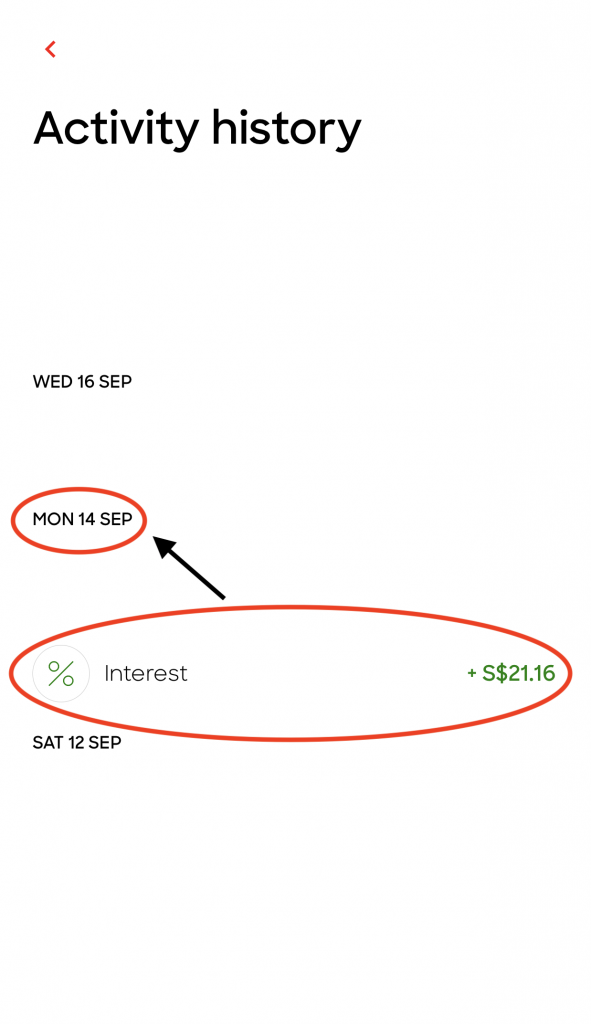

1. Look at when your interest is credited

You can view your transaction history in the SingLife app to see when the interest is being credited to you.

This will help you to figure out your policy start date (mine is on the 14th).

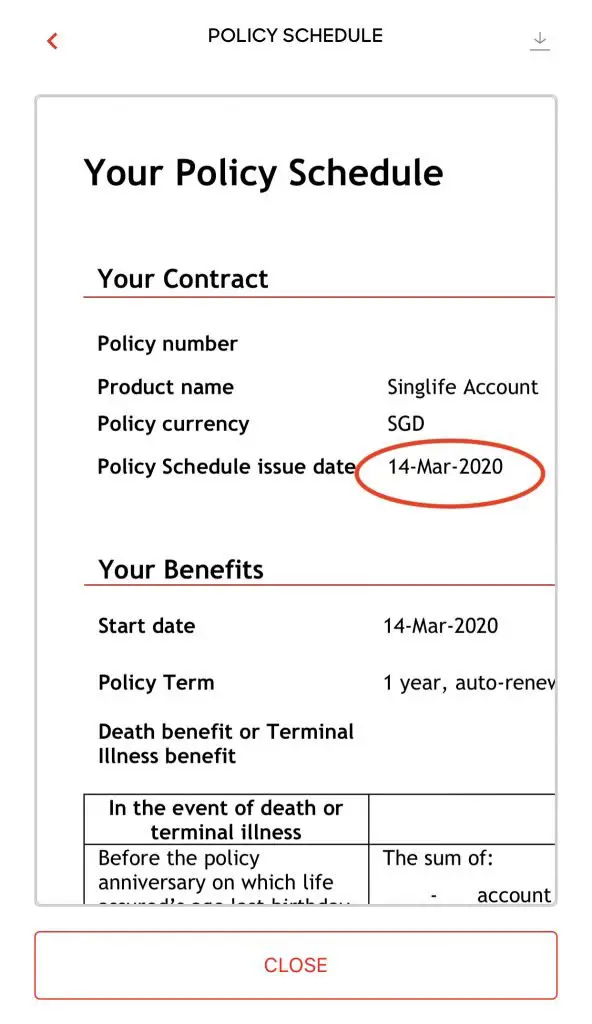

2. Look at your policy schedule document

Alternatively, you can refer to the documents that were issued to you when you created your SingLife Account.

Here’s a step-by-step guide:

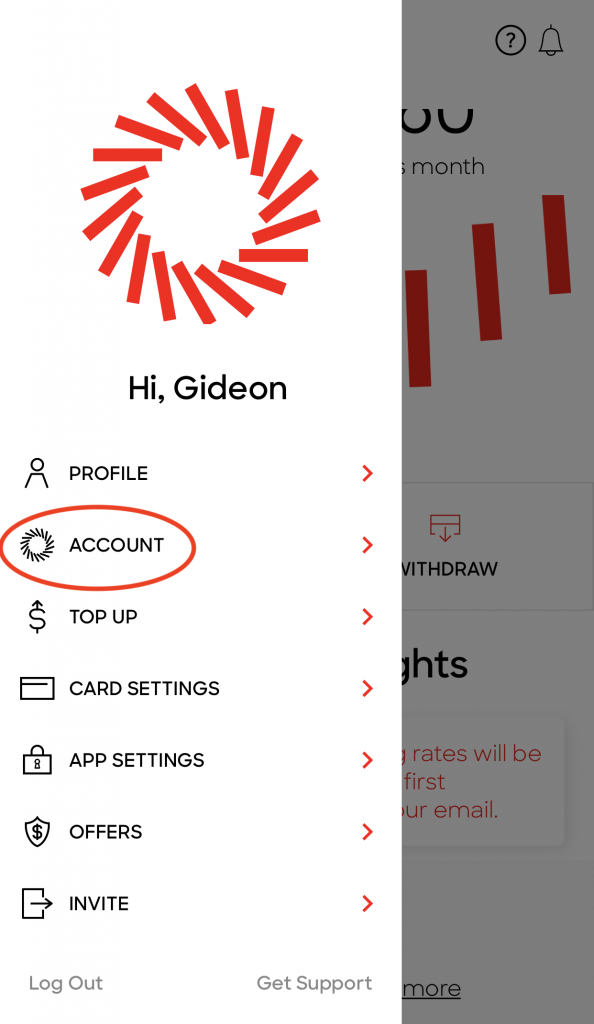

#1 Go to ‘Account’

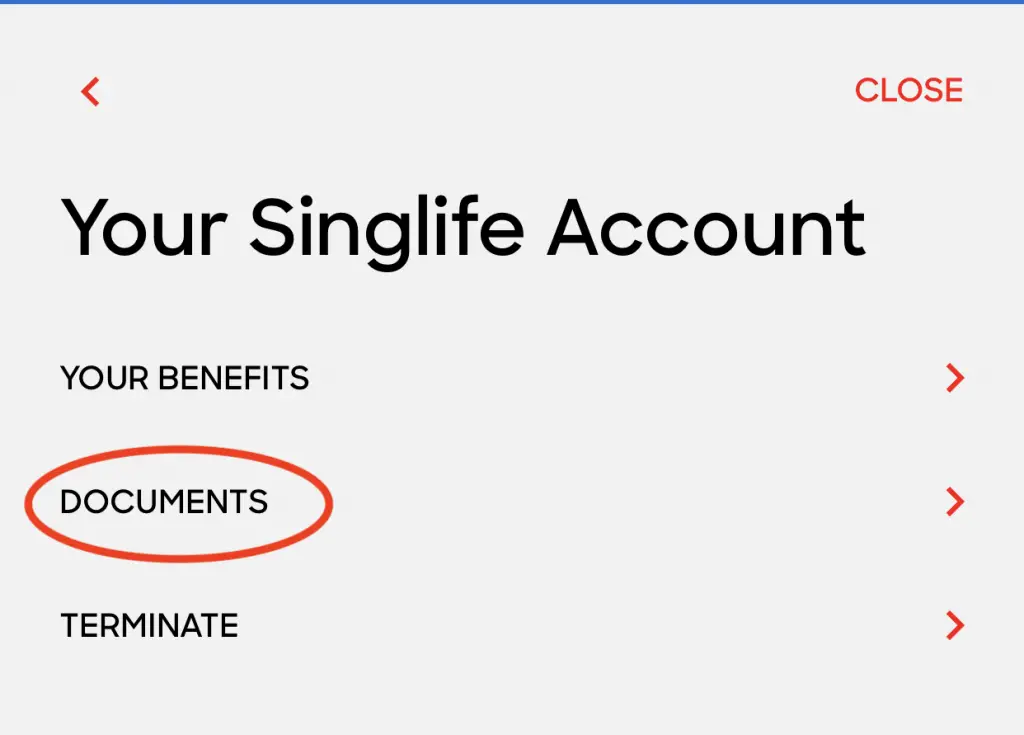

#2 Go to ‘Documents’

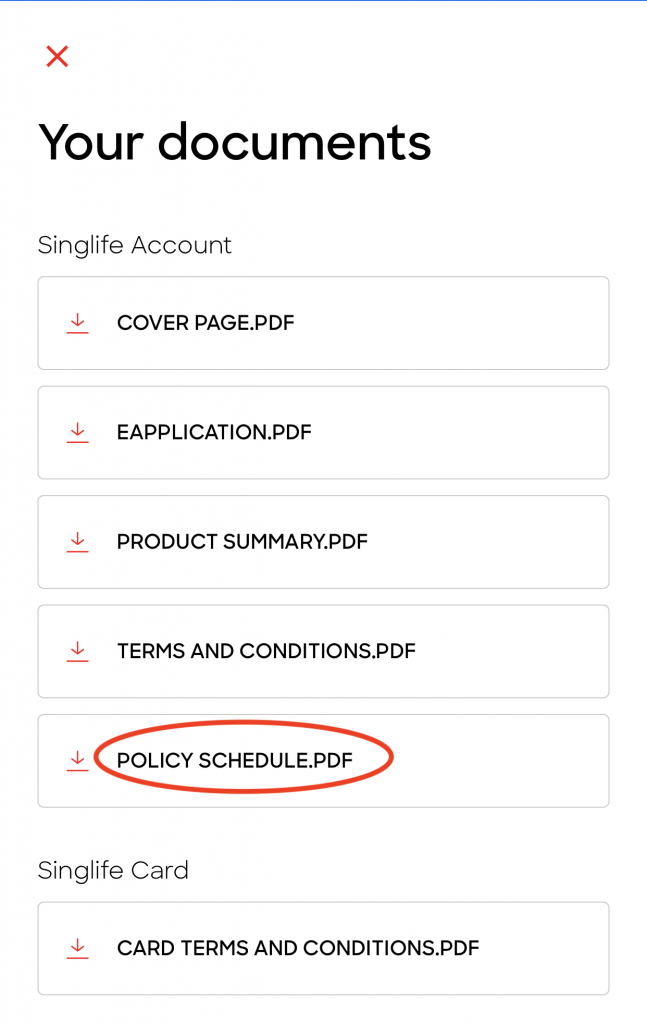

#3 Go to ‘Policy Schedule.pdf’

#4 View your Policy Schedule Issue Date

My policy schedule issue date is on 14 March 2020. As such, my first card spend period will be from 1 November 2020 – 13 December 2020.

My subsequent spending periods will be from the 14th of the first month to the 13th of the next month.

The Save, Spend, Earn Campaign will only last until 28 February 2021. As such, my final card spend period will be from 14 Feb 2021 to 28 Feb 2021.

Here’s a breakdown of the 5 card spend periods that I will have:

| Period | Start Date | End Date |

|---|---|---|

| 1 | 1-Nov-20 | 13-Nov-20 |

| 2 | 14-Nov-20 | 13-Dec-20 |

| 3 | 14-Dec-20 | 13-Jan-21 |

| 4 | 14-Jan-21 | 13-Feb-21 |

| 5 | 14-Feb-21 | 28-Feb-21 |

Yours will be something similar, depending on your policy start date.

You can refer to SingLife’s website that will help you determine your spending periods.

One thing to note is that these 5 card spending periods are separate from one another.

Anything that you do during one period will not affect the other periods.

For example, you may qualify for the first period, but you did not spend $500 in the second period. You are still able to qualify for the third period if you spend $500 using the debit card.

#2 Earning Period

Once you’ve spent $500 in a certain card spend period, you will earn the bonus return in the next policy month.

For example, I have spent $500 in the first period (1 Nov 2020 – 13 Nov 2020). I will then receive a 2% p.a. return instead of 1.5% from 14 Nov 2020 to 13 Dec 2020.

You will receive the 0.5% bonus return only for your first $10k.

As such, you will receive an extra $4.17 during the month if you have maxed out the $10k in your SingLife Account.

0.5% / 12 * 10,000 = $4.17

There are 5 earning periods. Again, this depends on your policy start date.

The earning periods will last all the way to April 2021.

| Period | Start Date | End Date |

|---|---|---|

| 1 | 14-Nov-20 | 13-Dec-20 |

| 2 | 14-Dec-20 | 13-Jan-21 |

| 3 | 14-Jan-21 | 13-Feb-21 |

| 4 | 14-Feb-21 | 13-Mar-21 |

| 5 | 14-Mar-21 | 13-Apr-21 |

#3 Crediting Date

The return will then be credited into your account at the end of each policy month. This is similar to how the SingLife Account credits the usual return to you.

If your policy start date is on the 31st of the month, the returns will be credited to your account on the next day.

Your policy start date might be on 31st July 2020. For example in November 2020, the policy month will end on 30th November. Your return will be credited to you on 1st December 2020 instead.

There are 5 bonus crediting dates, from Dec 2020 to Apr 2021.

If you qualify for all 5 periods, you will continue to earn the 2.5% return from November 2020 to April 2021.

| Period | Bonus Return Crediting Date |

|---|---|

| 1 | 14-Dec-20 |

| 2 | 14-Jan-21 |

| 3 | 14-Feb-21 |

| 4 | 14-Mar-21 |

| 5 | 14-Apr-21 |

Should I participate in the Save, Spend, Earn Campaign?

To decide if it is worth participating in the program, you will need to identify your spending habits.

If you do not know where to get started, you can learn 8 tips on expense tracking.

If you are spending less than $500 a month, then I would not consider this campaign at all.

Personally, I do not encourage you to spend extra money just to get that extra $4.17 return.

However, if you are spending more than $500, here are some things you’ll need to consider:

Am I able to spend at least $500 using my debit card?

Even though you are spending more than $500 a month, you may be spending it using different methods.

These include:

- Cash

- Mobile wallets (e.g. PayLah!)

- Card payments

As such, you will need to consider if you usually spend at least $500 using a credit / debit card.

Since the SingLife debit card is a Visa card, you are able to use it in a variety of places.

This includes:

- Any online transactions

- Any shop that accepts Visa

Any transaction that you make with the card will be eligible for this campaign.

If you have a card spend of at least $500 each month, you can consider participating in the Save, Spend, Earn campaign.

Am I able to get a better deal elsewhere?

The 0.5% p.a. return may seem pretty attractive.

However, you may be eligible for other benefits such as:

- Rewards points

- Cashback

- Miles

You will receive these benefits when you make transactions using other debit / credit cards.

Besides the Save, Spend, Earn campaign, the SingLife debit card only provides 2 other benefits:

- No FX fees when making overseas transactions

- Retrenchment benefits

Unless you are doing a lot of online shopping from overseas stores, the SingLife debit card may not be that beneficial to you.

You will need to consider if the benefit provided by SingLife is better than those that you’re currently receiving.

Moreover, the 0.5% return you receive is tied to the first $10k in your SingLife Account.

Even if you spend more than $500, the maximum that you can receive is $4.17 each month.

If you have less than $10k in your SingLife Account, you’ll be receiving a lower amount!

You should use the JumpStart debit card if you have it

If you’re between 18-26 years old, you may have a JumpStart Account as well.

The JumpStart Account comes along with a debit card.

This card offers you 1% cashback on any eligible Mastercard transaction.

Assuming you spend $500 using the JumpStart debit card, you will receive a cashback of $5!

| SingLife Account | JumpStart Account | |

|---|---|---|

| Card Spend | $500 | $500 |

| Cashback / Return Rate | $4.17 (Assuming $10k in SingLife Account) | $5 |

The more you spend with the JumpStart debit card, the higher amount of cashback you’ll receive.

What’s more, there is no minimum spend requirement for the JumpStart debit card.

If you have the JumpStart debit card, it will be more worth it compared to the SingLife debit card.

You can view my complete breakdown of the SingLife Account vs JumpStart to find out more.

You can consider the SingLife debit card if you’re not eligible for the JumpStart debit card

You may not be eligible for the JumpStart debit card as you’re above 26 years old. As such, you may want to consider debit / credit cards that you’re eligible for.

There may be some cards that exclude certain transactions. If you make such transactions these cards, you will not be eligible for the rewards.

Some examples include:

- Bill payments

- Insurance premiums

- Payments to the government

The SingLife debit card does not have such exclusions. So long as you make a transaction with the card, it will qualify for this campaign.

If you have at least $500 worth of transactions that are non-eligible for rewards given by other cards, you may consider using the SingLife debit card.

Verdict

SingLife’s Save, Spend, Earn campaign may be beneficial to you if:

- You do not use any other cards to make payments

- You are making transactions that are not eligible for other rewards with other cards

I would recommend you to understand your spending habits first. That way, you are able to see if other cards can offer you a better reward than the $4.17 a month offered by SingLife.

If there are no better deals and you have at least a $500 card spend, the Save, Spend, Earn campaign may be a good choice for you.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?