Last updated on June 6th, 2021

Are you sick and tired of earning 0.05% interest on the money in your bank account?

You can start earning an interest rate of 0.4%, starting from just 18 years old.

The best part? There’s very little requirements you need to achieve to receive this interest rate.

Here’s how the Standard Chartered JumpStart account works, and why I think it’s the best account for students.

Contents

- 1 Standard Chartered JumpStart Review

- 2 How does JumpStart work?

- 3 What are the benefits of JumpStart?

- 4 How can I apply for the JumpStart account?

- 5 How is the online portal and mobile banking like?

- 6 What happens to my JumpStart account when I reach 27 years old?

- 7 How do I close my JumpStart account?

- 8 Is JumpStart worth applying for?

- 9 Verdict

- 10 👉🏻 Referral Deals

Standard Chartered JumpStart Review

The Standard Chartered JumpStart Account is a flexible account with few requirements. The interest rate that you can earn is really competitive, especially if you are a student.

Here is the JumpStart Account reviewed in depth:

How does JumpStart work?

Standard Chartered JumpStart is a high yield savings account with little requirements. You can apply for this account if you are between 18-26 years old.

All you need to do is to put in your money and start earning your interest.

This account is great for students to get the best bang for your buck!

What are the benefits of JumpStart?

The JumpStart account comes with these benefits:

#1 No initial deposit required

When you create your JumpStart account, you are not required to make an initial deposit. All you need to do is sign up for the account and it’ll be created immediately!

#2 Interest rate (0.4% for first $20k)

Here’s the interest rate that the JumpStart account offers:

| Amount | Interest Rate |

|---|---|

| First $20k | 0.4% |

| Any amount > $20k | 0.1% |

Do take note that you will only earn 0.1% for any amount above $20k!

The interest that you earn will be calculated at the end of each day. It will then be credited to your JumpStart account at the end of each month.

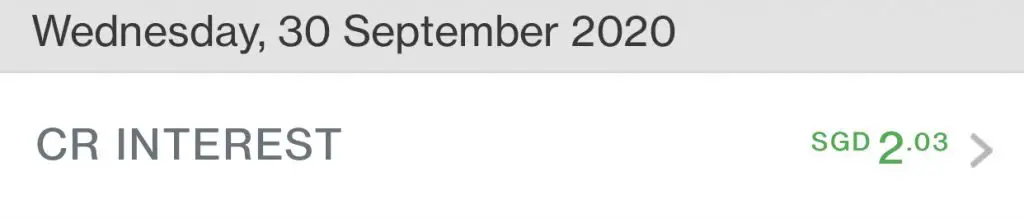

The interest credit will be denoted as ‘CR INTEREST’ in your transaction history.

Drop in interest rate

The interest rate for JumpStart was revised from 1st July 2020 from 2% to 1%. There was a second revision where the interest rate will be 0.4% from 1st Jan 2021.

This was a huge blow as 2% was a really good deal!

However, the JumpStart account still provides the decent interest rate for students without a salary credit.

Comparison against other savings accounts for students

Here are the interest rates of other savings accounts that you can apply as an 18 year old:

| Savings Account | Interest Rate |

|---|---|

| OCBC Frank | 0.05% – 0.3% |

| CIMB FastSaver | 0.3% – 0.75% |

| POSB eMySavings | 0.05% – 0.25% |

| MayBank SaveUp | 0.1875% – 0.3125% |

| Vivid Savings Account | 1.05% -1.3% |

The Vivid Savings Account may look attractive due to its higher interest rate. However, there are many restrictions to the account. You can read my full review to find out more.

For the other accounts, you usually will need to place a larger sum to earn the higher interest rate.

With the JumpStart Account, you can start earning the 0.4% interest right from your minimum investment amount.

I would still encourage you to sign up for JumpStart as soon as you reach 18 years old.

#3 No minimum balance

JumpStart does not have a minimum balance that you need to have in the account. As such, you can leave as little as you want inside this account.

You will not incur a fall-below fee as well!

As such, JumpStart is a great option to use as your spending account.

#4 Debit card with 1% cashback

When you create your JumpStart account, you will receive a debit card too.

This debit card will be mailed to you within 5-7 working days from your account creation.

Here’s how the credit card looks like.

Unfortunately, the debit card only comes in one standard design. You are unable to choose a design that you like.

1% cashback on any eligible Mastercard transaction

The best part about this debit card is the cashback that you can earn.

With the JumpStart debit card, you will receive 1% cashback for any eligible Mastercard transaction that you make within the month.

The best part is that there is no minimum spend required. This means that you will get the cashback, now matter how little you’ve spent with the card!

This is definitely more flexible compared to the FRANK debit card.

However, the cashback is capped at $60 per account.

This means that any amount that you spend above $6k will not be eligible for cashback. However, I do not think you will exceed this limit.

Cashback is only eligible if you use Mastercard for the transaction

One thing to note is that you will only get the cashback if you use Mastercard as the payment method.

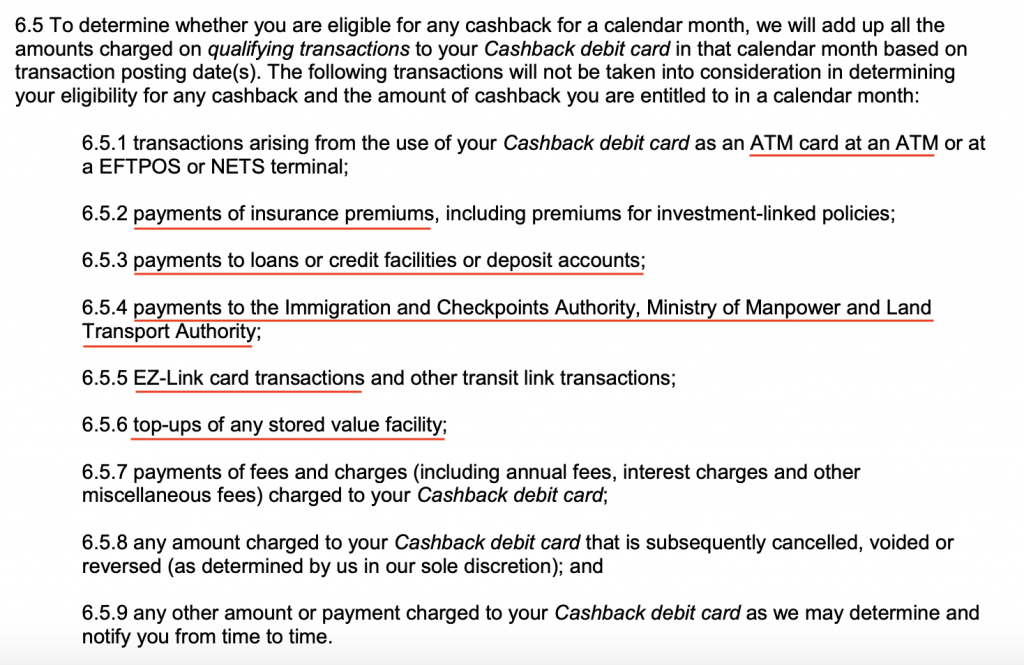

Here are some transactions that do not qualify for the cashback:

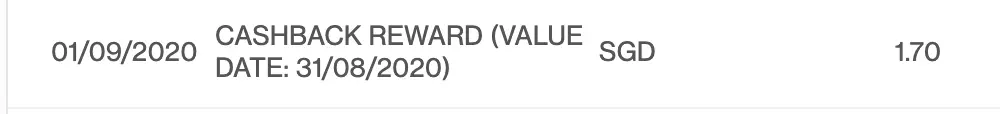

The cashback will be credited to your account at the end of each month.

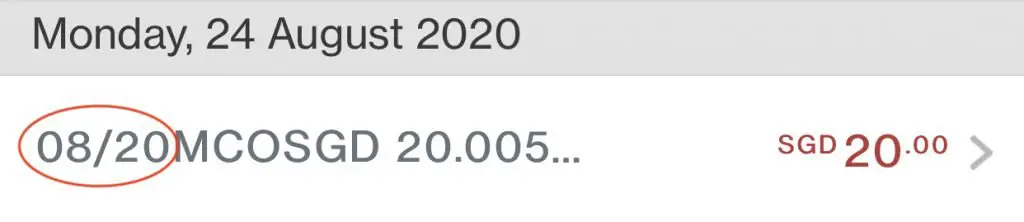

Here’s a way you can check which transactions are eligible for the cashback. These transactions will usually have the date in front.

Moreover, Standard Chartered does not charge any annual fees for this credit card. All you need to do is to spend using Mastercard and enjoy the cashback!

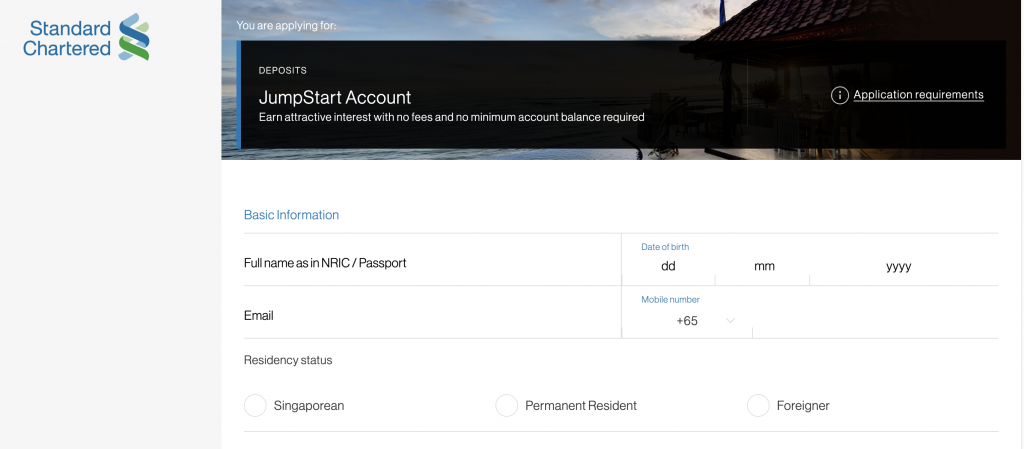

How can I apply for the JumpStart account?

Applying for a JumpStart account is really easy.

Here are the 3 things you need to apply online:

- SingPass with a MyInfo profile

- Singapore mobile number

- Email address

I created my account back in December 2019, and the process was really fast. It took around 10 minutes for my account to be created.

However, you can only create a JumpStart account under your name. It is not possible to create a joint account with JumpStart.

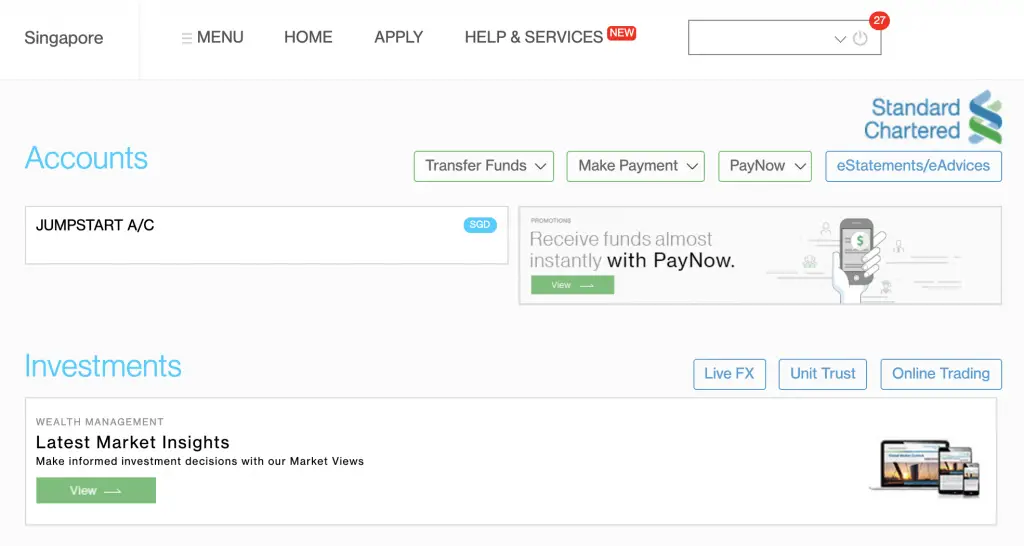

How is the online portal and mobile banking like?

If you are like me, the JumpStart account was the first account that I have with Standard Chartered.

So it was a big surprise that the online portal and mobile banking apps are rather bad.

Online portal

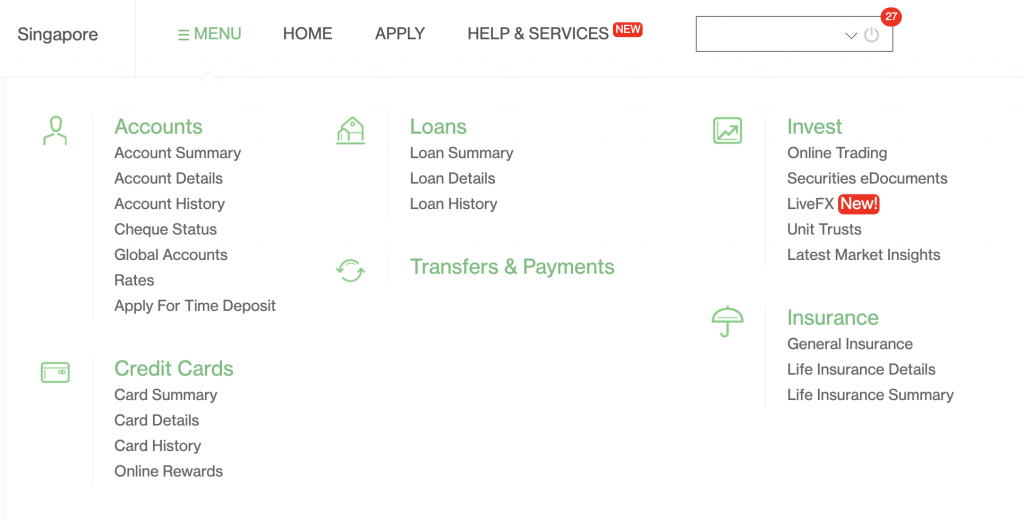

The online portal has a rather poor user interface.

The menus were really overwhelming and hard to read. Moreover, the ‘Transfers & Payments‘ menu didn’t have any options.

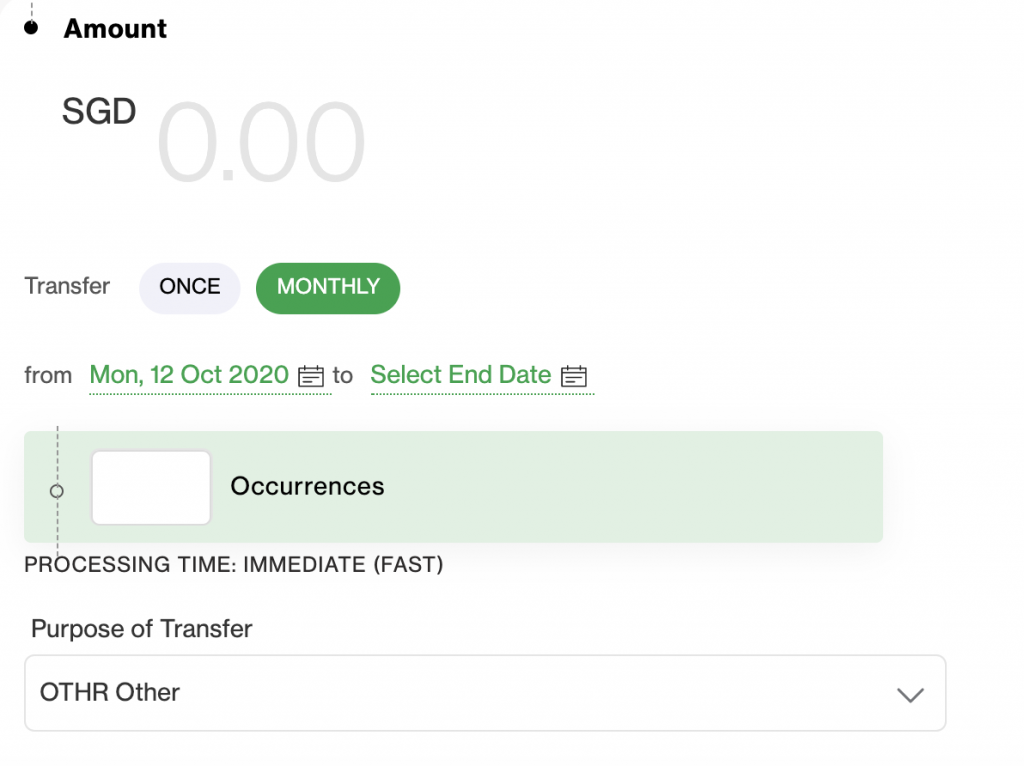

It took me a really long time before I could find the recurring transfers option.

You’ll need to go to ‘Menu → Transfers and Payments → Local Transfers → Select JumpStart Account → Select Payee → Set To Monthly Transfer”.

That’s an extremely long process to reach the recurring transfer option!

The mobile banking platform takes really long to load too.

Overall, it has been a really frustrating experience.

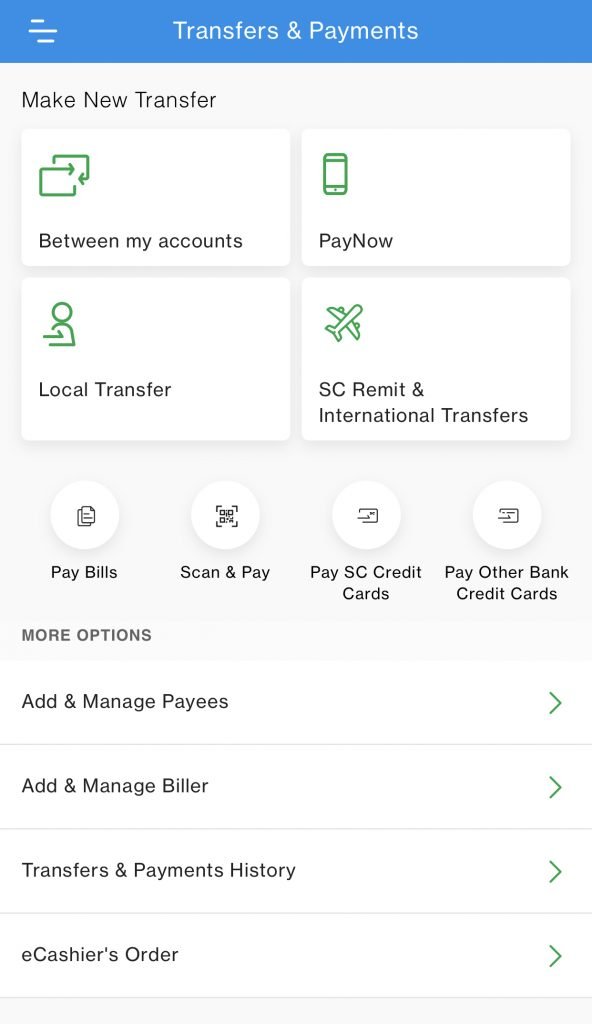

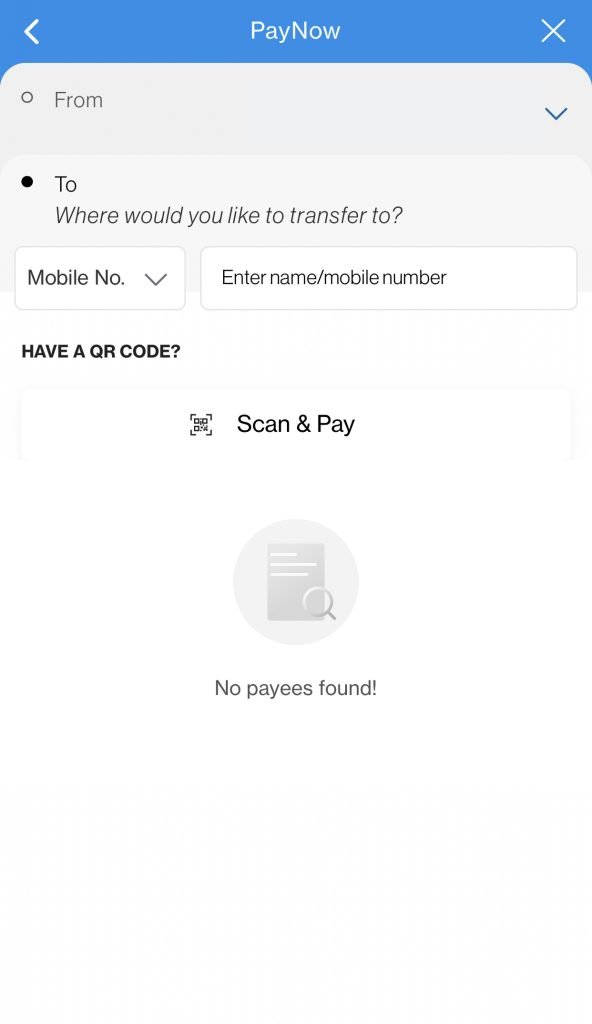

Mobile banking

The mobile banking app is no better either.

It takes a while to load, and the menu navigation is equally frustrating.

It takes quite a few steps to transfer money via PayNow.

Overall, I’ve had a really bad experience with both the online portal and mobile banking app.

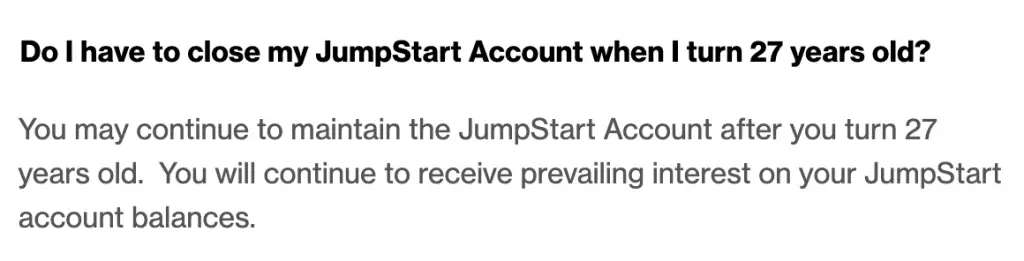

What happens to my JumpStart account when I reach 27 years old?

You are able to hold onto your JumpStart account even after you turn 27 years old. You will continue to receive the prevailing interest rate on your balances. The prevailing rate is the current interest rate that JumpStart offers.

You can only apply for the JumpStart account if you are between 18-26 years old. As such, you may be worried that you may have to close your JumpStart account once you reach 27 years old.

However, here’s the clarification found on Standard Chartered’s website.

However, Standard Chartered may decrease the interest rate in the future too.

Even then, the JumpStart account is still a great account to hold on to.

It has very little requirements, and it does not have a minimum account balance.

As such, I would recommend you to continue holding onto your JumpStart account!

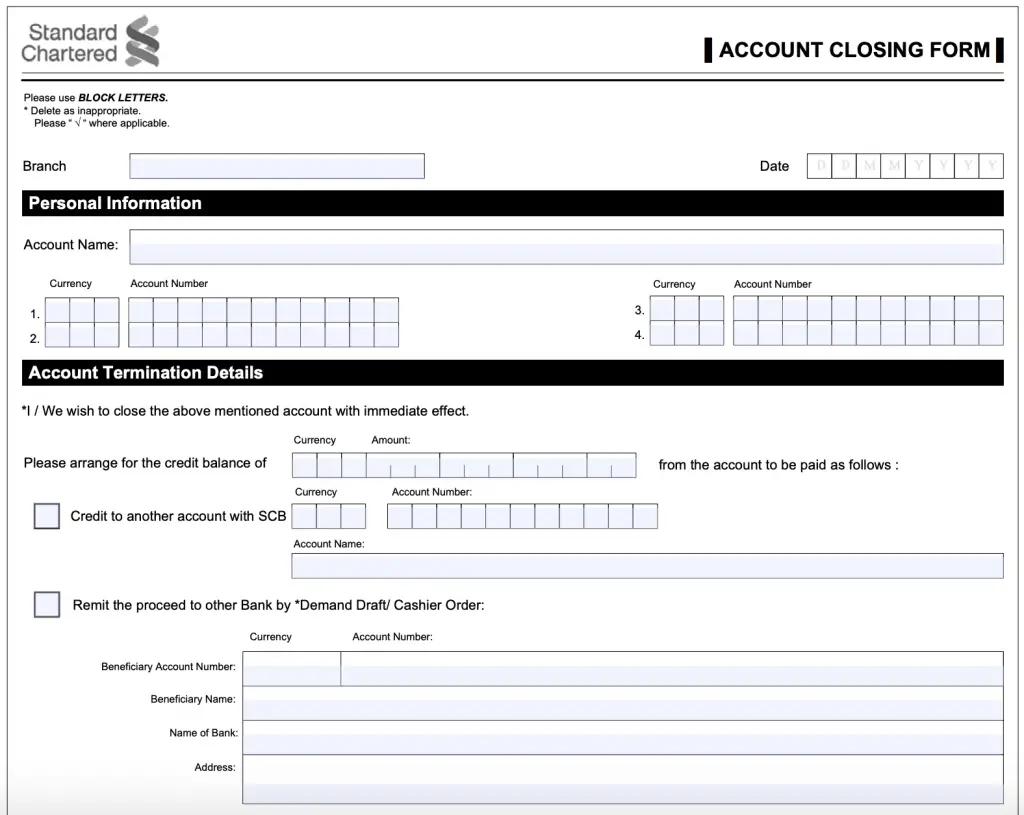

How do I close my JumpStart account?

You may want to close your JumpStart account, especially if there are other accounts with better interest rates.

However, the process is not stated clearly on Standard Chartered’s website.

They do have a closing form on their site.

Based on the e$aver FAQs, you will have to visit a Standard Chartered branch or call their hotline (1800-747 7000).

My guess will be that you have to submit the account closing form to a Standard Chartered branch to close the account.

Is JumpStart worth applying for?

Here’s the pros and cons of this account:

| Pros | Cons |

|---|---|

| 0.4% interest for first $20k | Poor mobile banking experience |

| No initial deposit | Interest rate may decrease further |

| No minimum balance | |

| No salary credit | |

| 1% cashback with JumpStart debit card | |

| No annual fee for debit card |

The interest rate has dropped considerably from the 2% it initially offered in 2019. However, JumpStart still provides one of the higher interest rates especially if you’re a student.

With no minimum balance and an attractive cashback debit card, I still think it is a good account for most students to have.

Based on these characteristics, here are 2 ways that you can use the JumpStart account:

#1 Emergency funds

The JumpStart account is a good place to place your emergency funds. It has a reasonable interest rate to ensure that your funds will not erode in value too much.

Moreover, JumpStart has very good liquidity as it is a savings account.

You may be tempted to put all of your emergency funds in your SingLife Account, as it earns a higher return rate of 1.5% for your first $10k.

However, it may take up to 3 hours before your funds are transferred to another account under your name.

As such, I would recommend to put at least some of your emergency funds in the JumpStart account.

This will ensure that you have some money if you require it for immediate emergencies!

Both SingLife and JumpStart have their merits, and I believe that you should get both accounts if you’re eligible for them.

Alternatively, you can consider signing up for Etiqa’s GIGANTIQ as well.

#2 Spending account

You may want to use JumpStart as your spending account instead. This is because:

- There is no minimum value required in your JumpStart account

- You will receive a 1% cashback for each eligible Mastercard transaction

This means that you can transfer your monthly spending budget into JumpStart. By the end of the month, you may not have anything left in the account.

This is still ok as there is no fall-below fee for JumpStart!

Moreover, the JumpStart debit card gives you 1% cashback with each Mastercard transaction.

This is one of the best deals for students to be rewarded when you spend.

Most other deals either:

- Require you to have a credit card (you’ll need to have a salary credit) OR

- Have a minimum spend

The JumpStart debit card is a fuss-free way to earn cashback without any requirements. It offers the best rewards if you do not have a salary credit.

Verdict

In summary, JumpStart is a savings account that offers a respectable interest rate without the need to meet any requirements. It is a great option that you should seriously consider signing up for if you’re eligible for it.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Standard Chartered JumpStart Account Referral (Receive a $10 Starbucks Gift Card)

Are you interested in signing up for a Standard Chartered JumpStart Account?

You can use my referral link (up till 31st May 2021) to sign up for an account. Upon successful registration, you will be able to receive a $10 Starbucks Gift Card!

Here’s what you need to do:

- Sign up for a JumpStart Account

- Deposit ≥ $5k in fresh funds into your JumpStart Account

- Maintain ≥ $5k in your JumpStart Account for 2 calendar months

For more information, you can view the Terms and Conditions on Standard Chartered’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?