Last updated on September 21st, 2021

Everyone wants the best account for their savings.

The SingLife and JumpStart Accounts are the 2 most popular, especially if you’re a student.

Which account is better and how should you be using them? Here’s a complete breakdown of what each account offers.

Contents

Type of account

JumpStart and the SingLife Account are 2 very different types of accounts:

JumpStart is a standard bank savings account

The JumpStart Account is a regular bank savings account, provided by Standard Chartered.

The SingLife Account is an insurance savings plan

However, the SingLife Account is not a bank account. Instead, it is an insurance savings plan.

An insurance savings plan is a savings plan that is provided by an insurance company.

You will put in premiums into the plan. In return, you will get a return on your premiums, as well as insurance coverage.

The SingLife Account is not a fixed deposit account as well!

They are both covered by different schemes under the SDIC

This is a very important difference, especially when it comes to the coverage by SDIC.

JumpStart will be covered under the Deposit Insurance Scheme, since it is a bank account.

However, the SingLife Account is an insurance savings plan. It will be covered under the Policy Owner’s Protection Scheme instead.

Here’s the difference in coverage for the 2 schemes:

| Deposit Insurance Scheme | Policy Owner’s Protection Scheme |

|---|---|

| The sum of all your bank accounts with the bank, up to $75k | Up to $100k based on the surrender value of the individual life policy |

Interest / Return Rate

Both JumpStart and SingLife have a tiered interest / return rate, based on the amount of money that you have in each account.

Here’s how the tiers for each account work:

| Tier | SingLife Account | JumpStart Account |

|---|---|---|

| Tier 1 | 2% for first $10k | 0.4% for first $20k |

| Tier 2 | 1% for next $90k | 0.1% for any amount above $20k |

If you wish to earn an extra 0.5% for you first $10k in your SingLife Account, you may want to consider participating in the Save, Spend Earn Campaign.

The choice seems clear when deciding where to put your money.

It will be best for you to max out the $10k in your SingLife Account first. This ensures that you will be able to maximise the high return rate that SingLife offers.

I would suggest leaving your money in JumpStart due to the faster withdrawal rates.

Rates are not guaranteed

SingLife might seem to be the better deal now. However, that may change over time.

The interest / return rates for both accounts are not guaranteed. Both SingLife and Standard Chartered reserve to right to revise their rates at any time.

This has happened when Standard Chartered reduced the interest rate from 2% to 1% p.a. for your first $20k. The interest rate has been further reduced to 0.4% since January 2021.

SingLife also reduced the return rate for your first $10k from 2.5% to 2% p.a.

As such, I would recommend you to keep updated on the latest news for both accounts. That way, you can decide which account is more suitable to park your money in.

Eligibility

Here’s the eligible age that you can apply for both accounts:

| SingLife | JumpStart |

| 18-75 y/o | 18-26 y/o |

The SingLife Account is much more accessible. You are able to apply for it even when you’re above 26 years old!

However, the JumpStart account is only catering to a certain age group. You will only be eligible to open the JumpStart account if you’re between 18-26 years old.

Even after you’re 27 years old, it is still possible for you to retain your JumpStart account. You are still able to enjoy the prevailing interest rate.

If you’re between 16-17 years old, you are unable to open either account. Instead, you may want to consider the Vivid Savings Account or Etiqa’s GIGANTIQ instead.

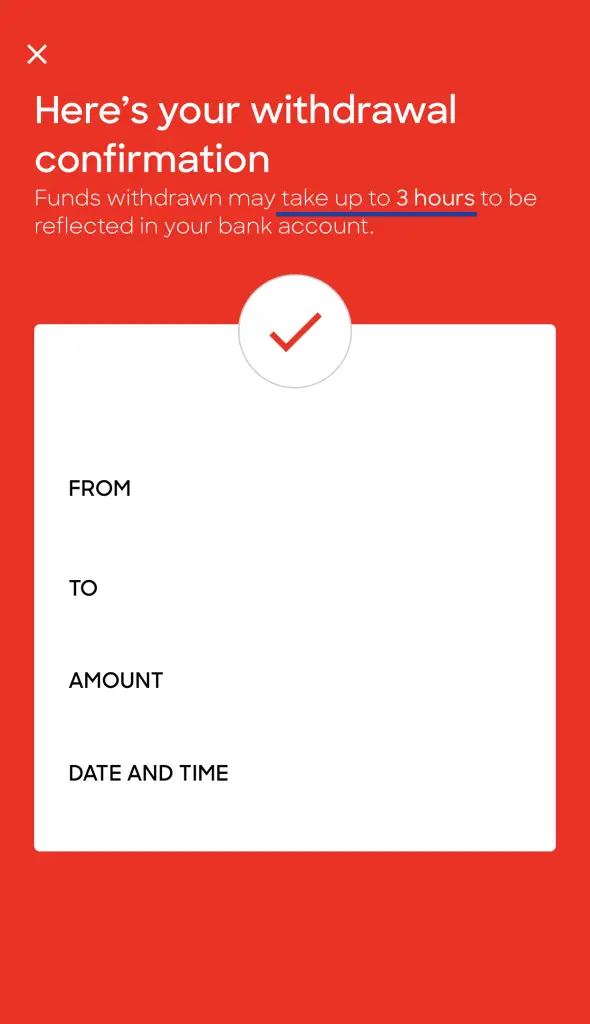

Speed of Transfer

The JumpStart account is a standard savings account by Standard Chartered. As such, you are able to transfer funds almost instantly using FAST transfers.

However, the SingLife Account is not a savings account. Even though you will receive the funds via FAST transfer, it may take a while for SingLife to process the request.

As such, SingLife has put a disclaimer that the funds may take up to 3 hours to reach your account.

So far, the funds have taken less than 15 minutes to reach my account for each withdrawal request.

I believe that the 3 hours is just a buffer. This is just a disclaimer in case many people withdraw from their SingLife account at any one time.

However, I am not willing to put money that I need instant access to in the SingLife account.

As such, JumpStart fares slightly better in terms of liquidity.

Initial deposit

SingLife has an initial deposit of $500, while JumpStart does not require a initial deposit.

The JumpStart account may be more accessible for you, especially if you do not have a lot of cash upfront.

Minimum Account Balance

SingLife has a minimum account balance of $100, while JumpStart has no minimum balance.

Moreover, SingLife will not charge you any fall-below fee if your balance is below $100.

You will just not be able to receive the prevailing return rate on your account’s balance.

Even so, this $100 minimum balance requirement is really little and you should be able to achieve it.

As such, both accounts have very little requirements and you will not be charged any fall-below fees.

Debit card

Both accounts will come with a debit card.

Here are the benefits that you will receive when you spend using the 2 debit cards:

| JumpStart Debit Card | SingLife Debit Card |

|---|---|

| 1% cashback on all eligible Mastercard transactions | No FX fees when making overseas purchases |

| Retrenchment benefits | |

| Able to earn an extra 0.5% on your first $10k through the Save, Spend and Earn campaign |

JumpStart has the more useful debit card

Based on these benefits, I believe that the JumpStart debit card is more useful.

Having a 1% cashback is really beneficial, especially if you are unable to sign up for a credit card. Moreover, there is no minimum spend as well!

SingLife’s debit card is only useful for certain circumstances

The SingLife debit card may be useful for certain circumstances:

- You make a lot of overseas transactions online

- You want to earn the extra 0.5% via the Save, Spend and Earn campaign

The retrenchment benefit has many requirements, and they may be rather hard to meet.

As such, I believe that the JumpStart’s 1% cashback will be more useful for you.

Ultimately, it is important for you to know your spending habits, and find out ways to maximise your benefits based on your habits!

Mobile and Web Platforms

Both SingLife and JumpStart have mobile and web platforms. However, both of them do have some issues in terms of user experience.

SingLife

SingLife has a rather basic app that allows you to top up and withdraw your funds.

There are times where I may encounter this error message.

The online portal is rather limited as well. You are only able to view your account balance. Moreover, you are unable to withdraw any funds via the online platform.

I believe that the online portal is more suited to view your insurance policies with SingLife, rather than viewing your SingLife account.

Standard Chartered platforms

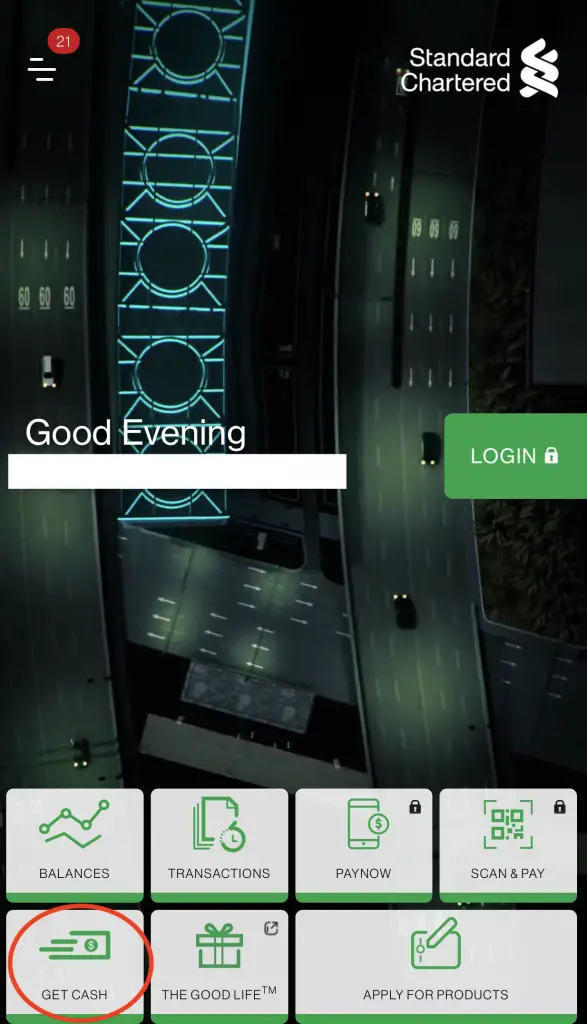

The mobile app is pretty hard to navigate.

And the web platform is not fantastic either.

Overall, both accounts have a rather bad user experience. I really hope that this can be improved in the future!

Cash Withdrawal

There are times that you may need to have some cash at hand. As such, you may want to withdraw cash from your account.

JumpStart allows you to withdraw cash

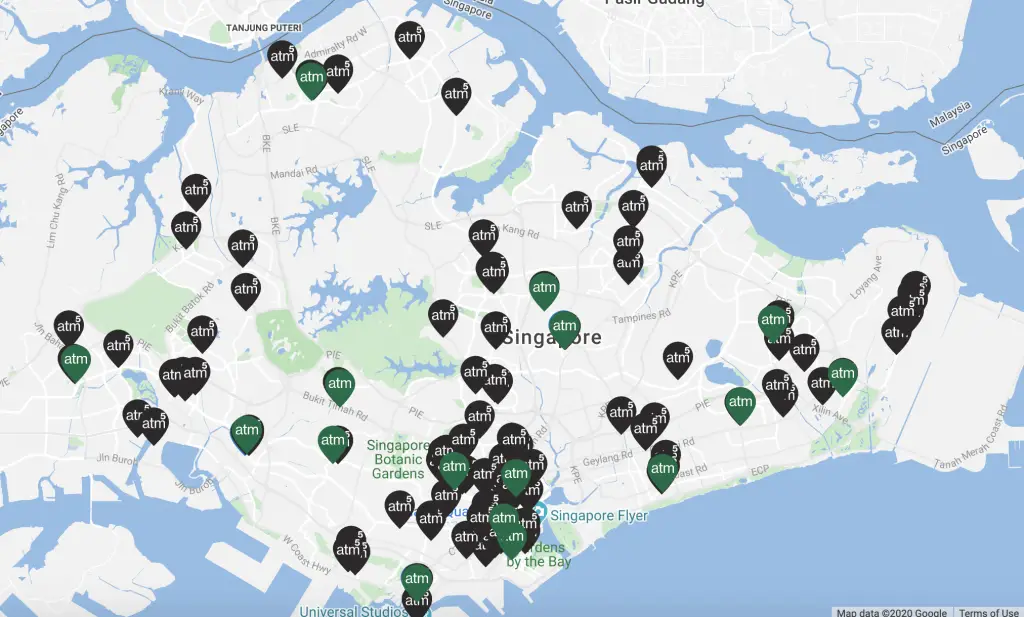

Standard Chartered has a pretty extensive network of ATMs.

Moreover, they are part of the SoCash network. SoCash is a FinTech firm that allows you to withdraw money from their partner merchants.

You are able to access the SoCash network directly from the Standard Chartered mobile banking app.

This makes it really accessible if you are ever in need of cash!

There are other ways which you can withdraw cash without needing an ATM card too.

SingLife does not allow you to make ATM withdrawals

Unfortunately, the SingLife debit card does not allow you to make any ATM withdrawals.

The only 2 ways you can access your cash in the SingLife account is through:

- Withdrawing to an account under your name

- Spending using the SingLife debit card

As such, you are unable to get direct access to cash with the SingLife Account.

Verdict

Here’s the comparison between SingLife and JumpStart:

| SingLife | JumpStart | |

|---|---|---|

| Type of Account | Insurance Savings Plan | Savings Account |

| Interest Rate | 2.5% for first $10k, 1% for next $90k | 0.4% for first $20k, 0.1% for any subsequent balance |

| Eligibility | 18-75 y/o | 18-26 y/o |

| Speed of Transfer | Slower (Up to 3 hours) | Faster (Almost instant) |

| Initial Deposit | $500 | None |

| Minimum Account Balance | $100 | No minimum |

| Debit card | No FX fees Retrenchment benefit Extra 0.5% (Save, Spend Earn) | 1% cashback |

| Mobile and Web Platforms | Poor user experience | Poor user experience |

| ATM Withdrawal | Does not have this feature | Able to withdraw from ATMs and via SoCash |

If you are above 26 years old, you should definitely create your SingLife Account.

However, if you are between 18-26 years old, I believe that you should create both accounts.

Both accounts have their merits, and here’s how I would suggest to use these 2 accounts together:

SingLife has a higher return rate

Due to SingLife’s higher return rate, I would suggest to max out the $10k you have in this account.

If not for its slightly lower liquidity, the SingLife Account would have been perfect for your emergency funds.

However, there is that risk that the funds will take up to 3 hours before it reaches your account.

If you need the cash immediately, you may not want to store it in SingLife.

As such, I will suggest to store some, but not all of your emergency funds in the SingLife Account.

JumpStart has better liquidity and rewards for spending

The JumpStart Account has dual benefits that it can offer you.

As such, here are some ways to use this account:

#1 Spending account

JumpStart can be your main spending account. This is due to the 1% cashback that the debit card offers.

Since there is no minimum spend, you are able to maximise your spending!

However if you are eligible for any credit cards, they may offer you better benefits.

#2 Emergency funds

I would suggest JumpStart as a place to store your emergency funds as:

- It is more liquid than SingLife

- It has one of the highest interest rates for accounts with little requirements

JumpStart has a higher liquidity than SingLife. As such, I would encourage you to store some of your emergency funds in JumpStart.

This ensures that if you need any cash immediately, you can easily withdraw it from JumpStart.

Moreover, you are able to earn a rather decent interest rate of 1%. This ensures that your emergency funds does not erode in value due to inflation.

#3 Combined spending and emergency funds

I would only suggest to use JumpStart for both functions if you have very good discipline.

If you are able to stick to your spending budget, then it is possible to use JumpStart as both your spending and emergency funds account.

Conclusion

The JumpStart and SingLife Accounts are very different products, and each has their own benefits.

If you are eligible for both, I would suggest signing up for both of them.

That way, you are able to get the best of both worlds!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

No Comments