Last updated on June 6th, 2021

[UPDATE: Elastiq has been fully subscribed. You may want to consider cash management accounts offered by robo-advisors instead, such as Endowus Cash Smart, Syfe Cash+ or StashAway Simple.]

Few months ago, I saw Elastiq’s 1.8% yield and brushed it aside. I was spoilt by JumpStart’s 2% interest rate with no requirements.

After Standard Chartered cut its interest rates, guess who’s laughing now!

Elastiq is being advertised as a flexible savings plan.

But just how flexible is it? And should you be considering it to store your emergency funds?

Contents

What Is Etiqa Elastiq?

Elastiq is a universal life plan offered by Etiqa, a member of the Maybank group. It will mature before you reach 100 years old.

Based on Etiqa’s website, a universal life plan is a ‘whole life insurance that offers flexibility in the amount and timing of premium payments’.

Investopedia also likens a universal life plan to a term life plan.

You can consider Elastiq to be a more flexible insurance savings plan.

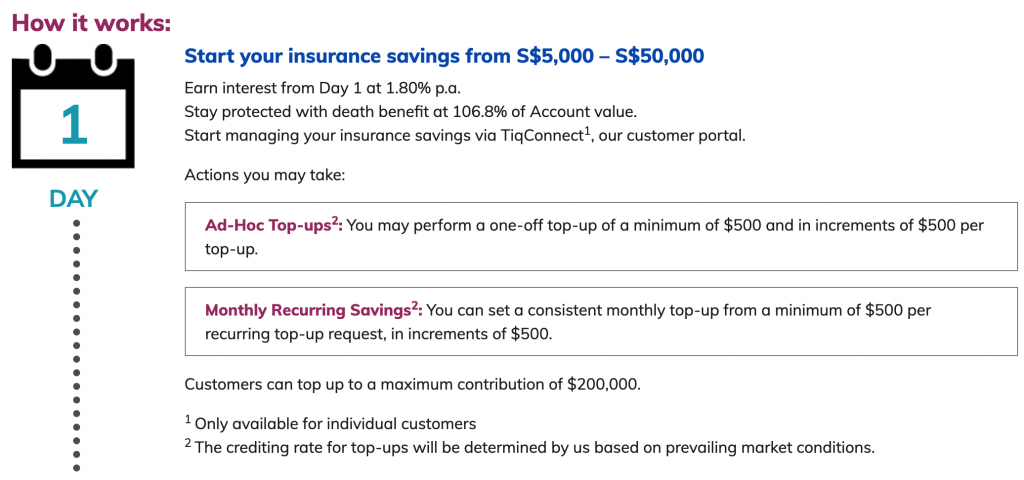

What are the premiums that you need to pay? For the initial premium, you can choose to put in a lump sum of between $5k-$50k.

There are 2 ways that you can fund this savings plan:

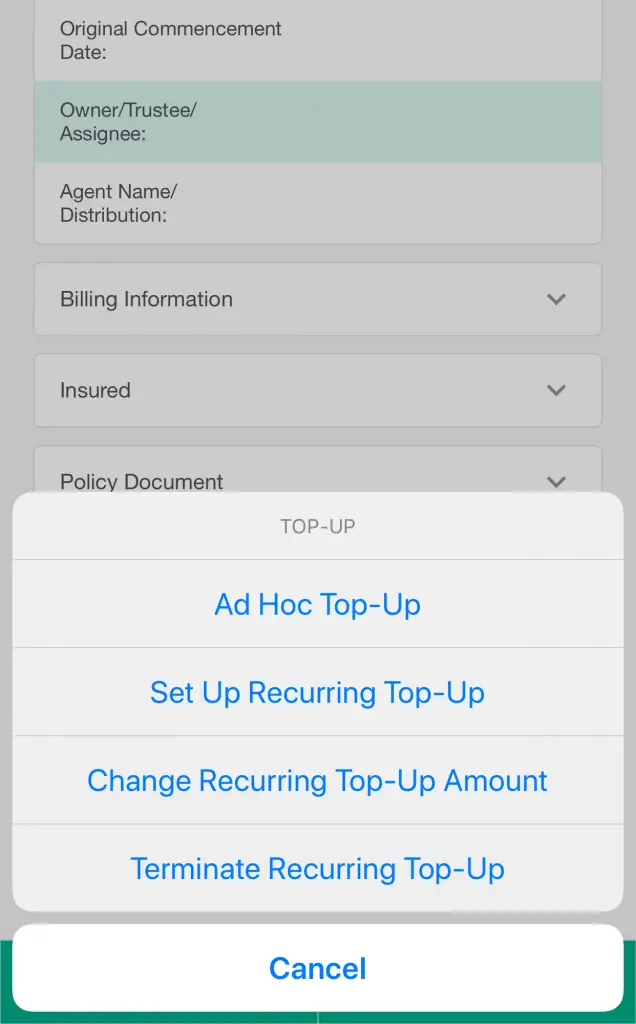

- Ad-hoc top ups at any point of time

- Monthly recurring savings plan

However, for both kinds of top ups, a minimum sum of $500 is needed. Moreover, you can only top up in increments of $500 (e.g. $1k, $1.5k etc.).

The maximum amount that you can contribute to the plan is $200k.

How Does Elastiq Work?

The policy states that the interest rate is guaranteed for the first 3 years after signing up for the policy.

This guaranteed interest is only applicable for your initial single premium.

The current crediting rate is 1.8%. So for the first amount that you top up into your plan (min. $5k), this 1.8% interest rate is guaranteed for 3 years!

This is really attractive compared to the interest rates offered by other bank accounts, which can be subject to change.

How does Elastiq provide such an attractive interest rate?

You may be wondering how Elastiq is able to guarantee you a high rate of return. This is especially when banks have been slashing their interest rates.

From their FAQs, your premiums are mostly invested in bonds.

This means that Etiqa believes that it can get a higher rate of return compared to 1.8% when it invests in bonds. They are able to give you the 1.8% to lend them your money, and earn some returns as well.

Etiqa provides you with a death benefit

Since Etiqa is also a life insurance plan, it provides you with a death benefit too.

In the event that you pass on before the policy matures (i.e. when you reach 100 years old), Etiqa will pay 106.8% of the account value.

This death benefit is a ‘sum assured‘ type of benefit. As such, you will be able to receive multiple death benefits from your various policies!

How Can I Apply For Elastiq?

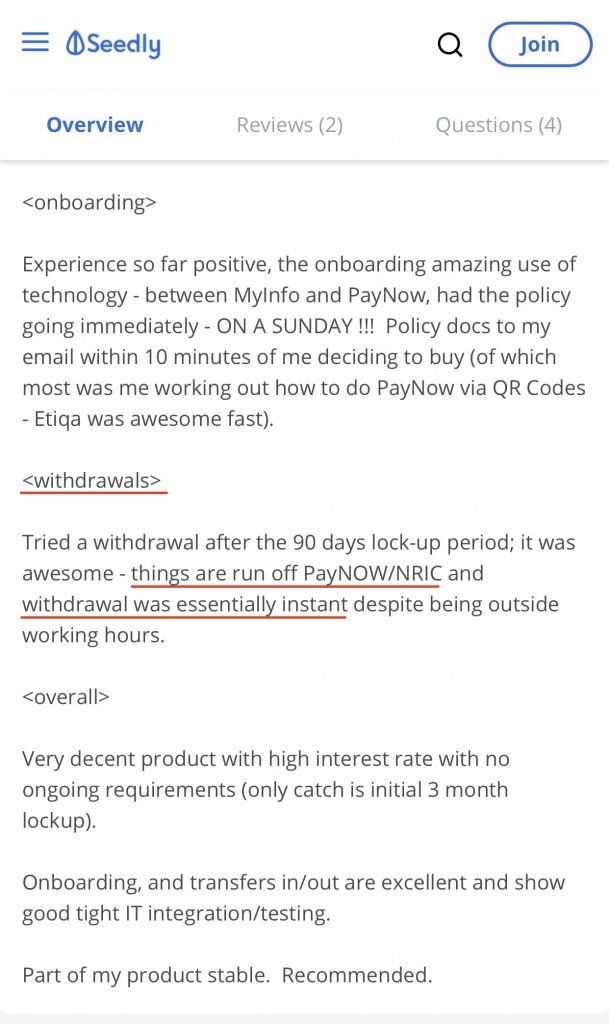

You can apply for Elastiq via their online portal, TiqConnect. The option to use your information via SingPass MyInfo is available.

The premiums can be transferred to Etiqa, either by PayNow or bank transfer.

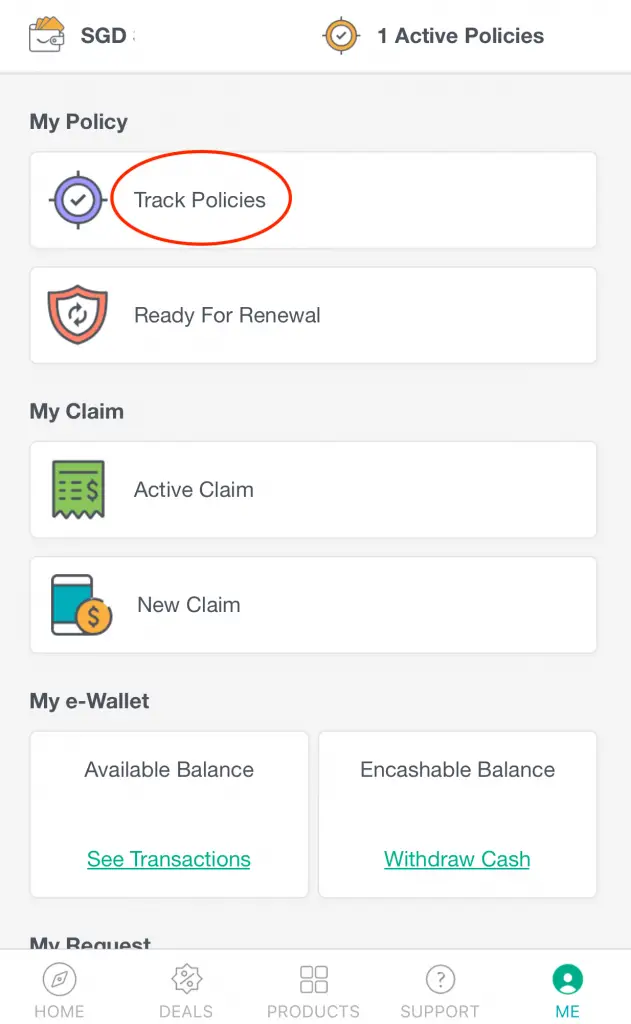

Etiqa also has a mobile app, ‘Tiq by Etiqa Insurance‘, allowing you to view your current balance, as well as make any withdrawals.

It’s highly recommended that you download it on your phone. You can login to the app at any time to see your available balance.

What Are Etiqa’s Benefits?

Here are some benefits of investing with Etiqa:

#1 Ability to have flexible withdrawals

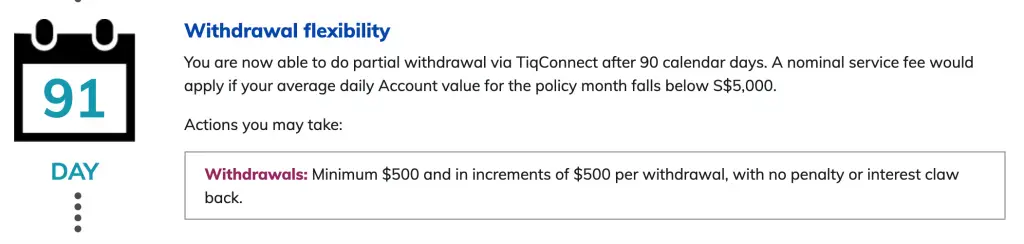

Initially, your money will be locked up in for first 90 days.

From then on, you can do a partial withdrawal (min. $500, in multiples of $500) from the account.

So it does kind of act as a savings account, where you are able to withdraw some of the money, should you require it.

This is very different from endowment plans. Such plans would have a long lock up period of a few years (usually 3-5 years), before you can withdraw your money.

You will need to maintain a minimum of $5k each month

However, you need to keep at least $5k a month inside Elastiq, or a $5 fall below fee would be imposed.

Once you reach the 91st day, you can freely withdraw money from it!

Moreover, based on reviews on their site and on Seedly, the withdrawals are almost instant.

A further quote from Etiqa’s customer service: ‘Partial withdrawal request must be submitted via TiqConnect and the mode of payment we have through Direct Credit/Paynow via NRIC, the transaction is real-time unless we have a massive withdrawal or system issue.’

#2 Ability to earn bonus interest

To reward you for not making any withdrawals in the past 36 policy months, you will receive a bonus 0.3% on the average monthly account value.

That’s pretty great if you’re using Elastiq to store your emergency funds! Your capital is also guaranteed as the policy’s minimum guaranteed crediting rate is 0% p.a.

Even if the interest rate from the 4th year onwards is 0%, you will still have your principal sum and all the interest accrued within that period.

#3 No surrender charges

If you choose to surrender (i.e. cancel) your policy at any time, you will receive the value in the account at that point in time.

No fees or penalties will be imposed if you choose to ‘cancel’ the policy.

#4 Monthly updates on your Etiqa account

What’s more, you will receive monthly updates via SMS on the amount of interest you’ve earned.

This makes it really easy to track how much interest you’re accumulating.

How Do I Withdraw From Elastiq?

You will need to have the ‘Tiq by Etiqa‘ app on your phone (Google Play Store and App Store).

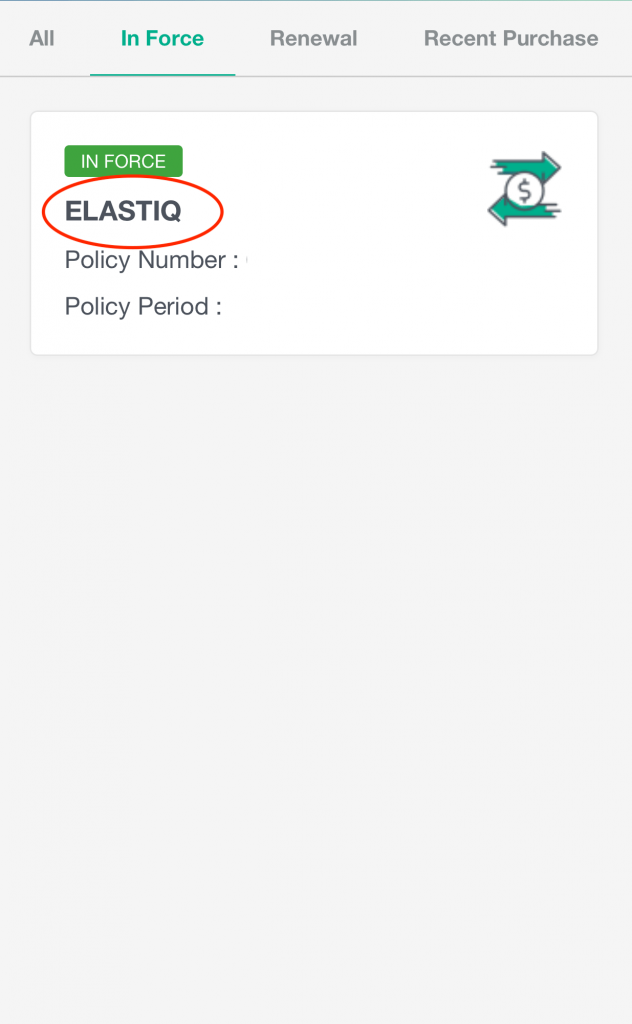

Withdrawals from Elastiq can be done in 4 steps:

- Go to ‘Track Policies‘

- Select the ‘Elastiq‘ policy

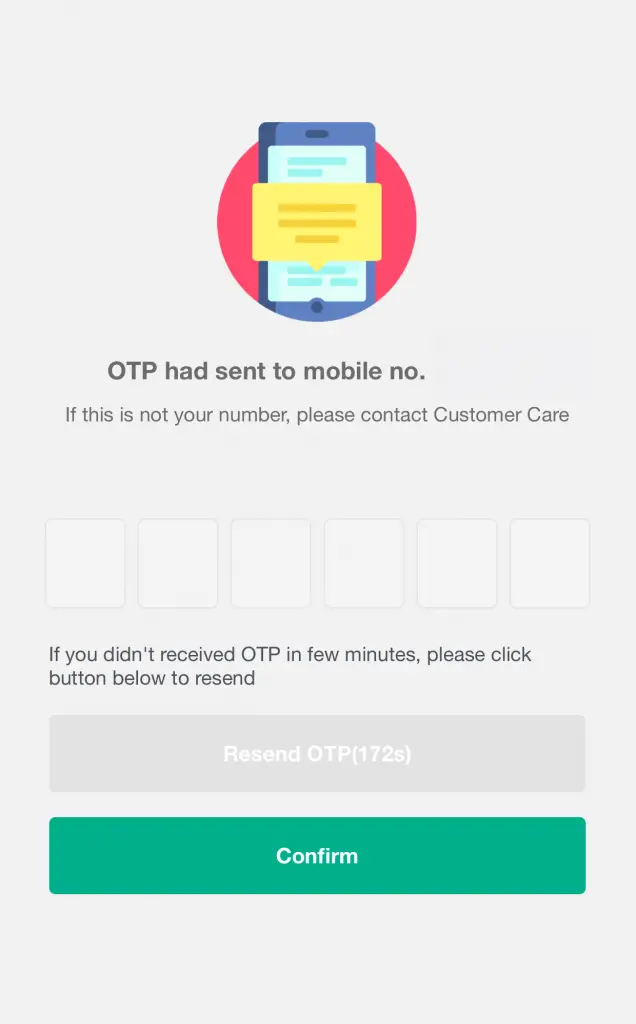

- Enter your OTP

- Click on ‘Withdrawal‘ to make the withdrawal

With the app, you are able to check the policy value, which is updated daily.

You can make a top up when you’re at the policy page as well. From the options you can either make an ad-hoc or recurring top up.

What Are Elastiq’s Cons?

Certainly with all these benefits, there are some caveats as well.

#1 Interest rates for subsequent top ups are not guaranteed

The interest rate for subsequent top ups that you make are not guaranteed. These rates are based on ‘prevailing market conditions‘.

The 1.8% rate is only guaranteed for your initial premium.

#2 Interest rates are only guaranteed for the first 3 years

The 1.8% rate is also only guaranteed for the first 3 years. From the 4th year onwards, the interest rate will be determined according to prevailing market rates.

This rate could be higher or lower than 1.8%.

#3 Withdrawals are limited to multiples of $500

When you withdraw your money, you can only do so by a minimum sum of $500, and in subsequent multiples of $500.

If you have an odd amount of balance in the account that is below $500, you would not be able to withdraw it.

#4 The interest rate is only credited at the end of each month

The interest is calculated daily but is credited monthly.

In the event that you surrender the policy in the middle of the month, you would not receive the interest for this month.

So that’s something to consider when you decide to surrender it!

Moreover, when you surrender the policy, a repurchase of Elastiq is not allowed within the same tranche.

The definition of a tranche is ‘a plan with the same category or premium‘.

Another caveat is that Etiqa “reserves the right to delay the payment of the surrender or partial withdrawal value for up to a period of 6 months from the date of your surrender or partial withdrawal application“.

The crediting rate for your initial premium may change down the road. Initially, the interest rate was at an attractive 2.02%.

It has since lowered to the current rate of 1.8%.

From the policy document, ‘any revision in crediting rates will take effect on the 1st business day of each calendar month’.

There is a high possibility that Elastiq’s interest rate may be lowered in the near future.

Is Elastiq Safe?

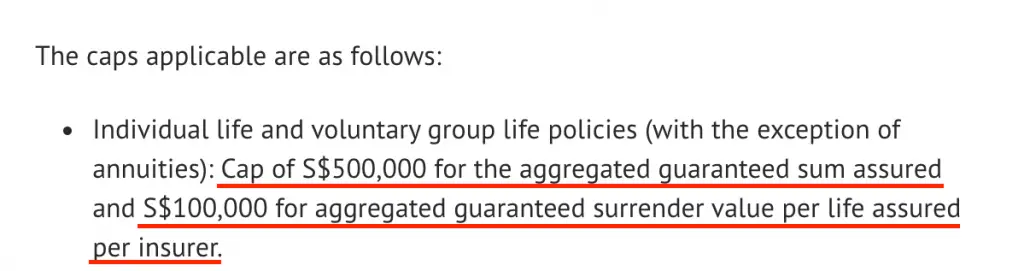

Elastiq is an insurance policy. Hence, it is protected under the Policy Owners’ Protection Scheme, administered by the Singapore Deposit Insurance Corporation (SDIC).

In case Etiqa goes bankrupt, the surrender value of your policy would be reimbursed, provided that the surrender value is below $100k.

I have clarified with the staff and they recognise Elastiq as an individual life policy, and hence Elastiq will have these caps.

How Does Elastiq Compare to SingLife?

The SingLife Account is another insurance savings plan that provides great flexibility as well.

You can read my review on the SingLife Account to find out more about this insurance savings plan.

Comparing the two, SingLife is the clear winner here:

| Plan | SingLife | Elastiq |

|---|---|---|

| Interest / Return | 1.5% for first $10k, 1% for next $90k | 1.8% for initial premium |

| Initial Sum | $500 | $5,000 |

| Lock-in Period | None | 90 days |

| Min. Daily Balance | $100 | $5,000 |

| Fall Below Fee | None | $5 |

| Min. Withdrawal | None | $500 |

| Withdrawal Fee | None | None |

| Min. Top-up | None | $500 |

| Death Benefit | 105% | 106.8% |

I would recommend you to max out your $10k in SingLife first, before considering Elastiq as another option.

Is Elastiq Right For Me?

Here’s a quick summary of what we’ve discussed so far:

| Pros | Cons |

|---|---|

| Able to withdraw money from the account after 90 days | 1.8% is only guaranteed for initial premium and not subsequent top-ups |

| Withdrawals are almost instant via PayNow | 1.8% is only guaranteed for first 3 years, subject to change from the 4th year onward |

| Mobile app allows checking of balance and making withdrawals on the go | Minimum $5k balance in account required, if not there will be a $5 fall below fee |

| Loyalty bonus of 0.3% if no withdrawal for the past 36 policy months | Withdrawals can only be made with a minimum of $500 and subsequent multiples of $500 |

| Capital guaranteed plan | Interest is calculated daily but credited monthly, so you may lose out if you surrender the policy within a month |

| No penalty in surrendering the policy at any time | Unable to repurchase Elastiq after surrendering it |

| Protected by Policy Owners’ Protection Scheme under SDIC | After applying for a full surrender or partial withdrawal, Etiqa reserves the right to delay payment of the surrender or partial withdrawal value for up to 6 months |

| Interest rate for initial premium is subject to change at the start of each month |

Is Elastiq the right plan for you?

Elastiq is good for your short term goals

I believe that Elastiq is great for your short-term financial goals.

These are usually goals that you intend to achieve in 1-5 years.

Elastiq provides a reasonable interest rate with little risk.

What’s more, by using Elastiq as a separate account, it helps you to separate your savings from your expenses.

Elastiq should not be used for emergency funds

However, due to the limited liquidity that Elastiq has, I believe that it should not be used for your emergency funds.

With the withdrawals being limited to multiples of $500, it restricts the flexibility to withdraw any amount that you want.

If you’d like to find out where you should store your emergency funds instead, you can read my article that provides you with some options.

Conclusion

The Etiqa Elastiq plan is certainly an intriguing product.

Due to its liquidity issues, you should carefully consider your options before committing to the initial premium.

Despite that, the guaranteed 1.8% for 3 years really stands out and it’s worth considering Elastiq as part of your savings plan.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?