Last updated on June 6th, 2021

With the launch of many multi-currency cards in Singapore, we are now spoilt for choice. 2 of the more popular cards are YouTrip and the MCO Visa Card.

Which of these cards is better and which one should you choose? Here’s a complete breakdown between both of these cards.

Contents

The difference between YouTrip and MCO Visa Card

Both cards are multi-currency cards that provide very competitive exchange rates when making online purchases. YouTrip provides you access to more fiat currencies, while the MCO Visa Card offers attractive benefits like cashback. However, the MCO Visa Card has a lot more risks compared to YouTrip.

Type of Card

Both cards are prepaid debit cards. This means that you will have to top-up these cards first before you can use them to make a purchase.

Since they are debit cards, the amount that you pay will be deducted almost immediately from your balance.

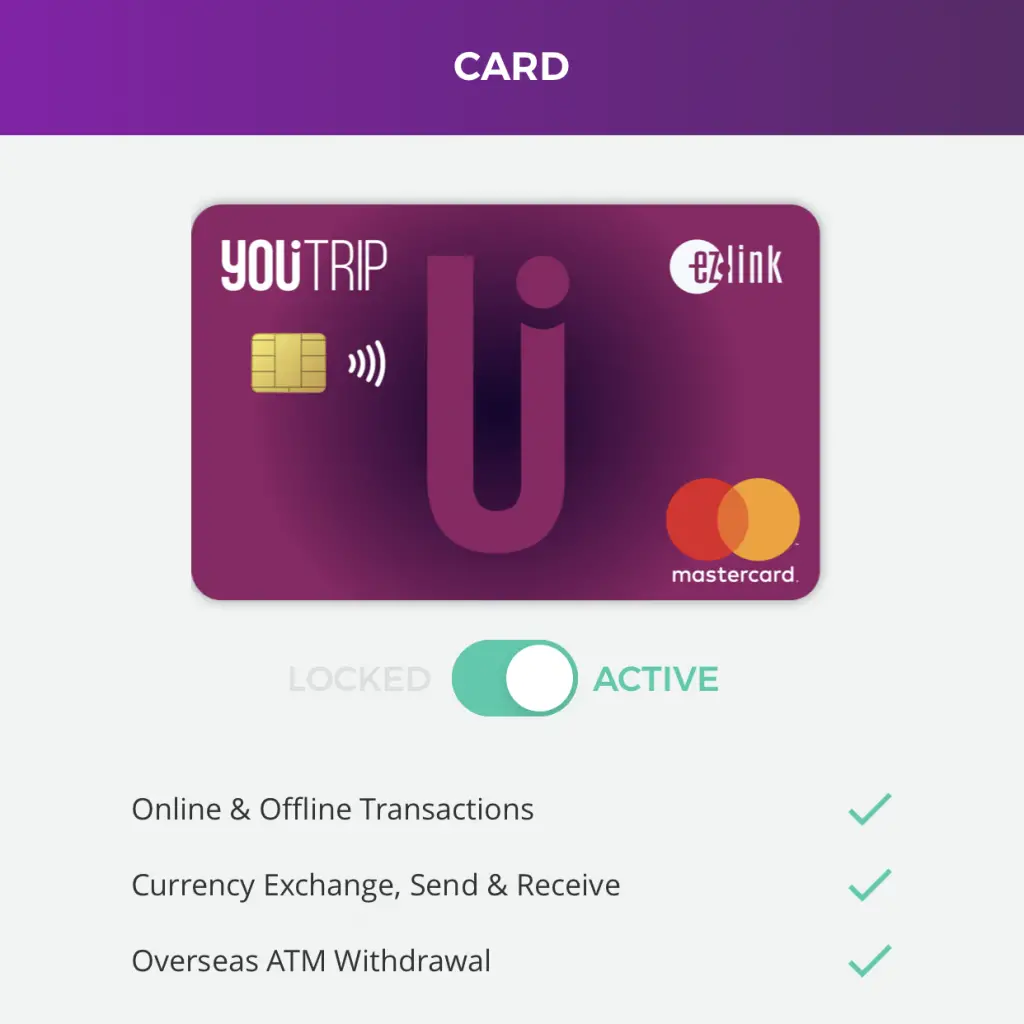

YouTrip is a Mastercard while MCO card is a Visa card

The YouTrip card is a Mastercard,

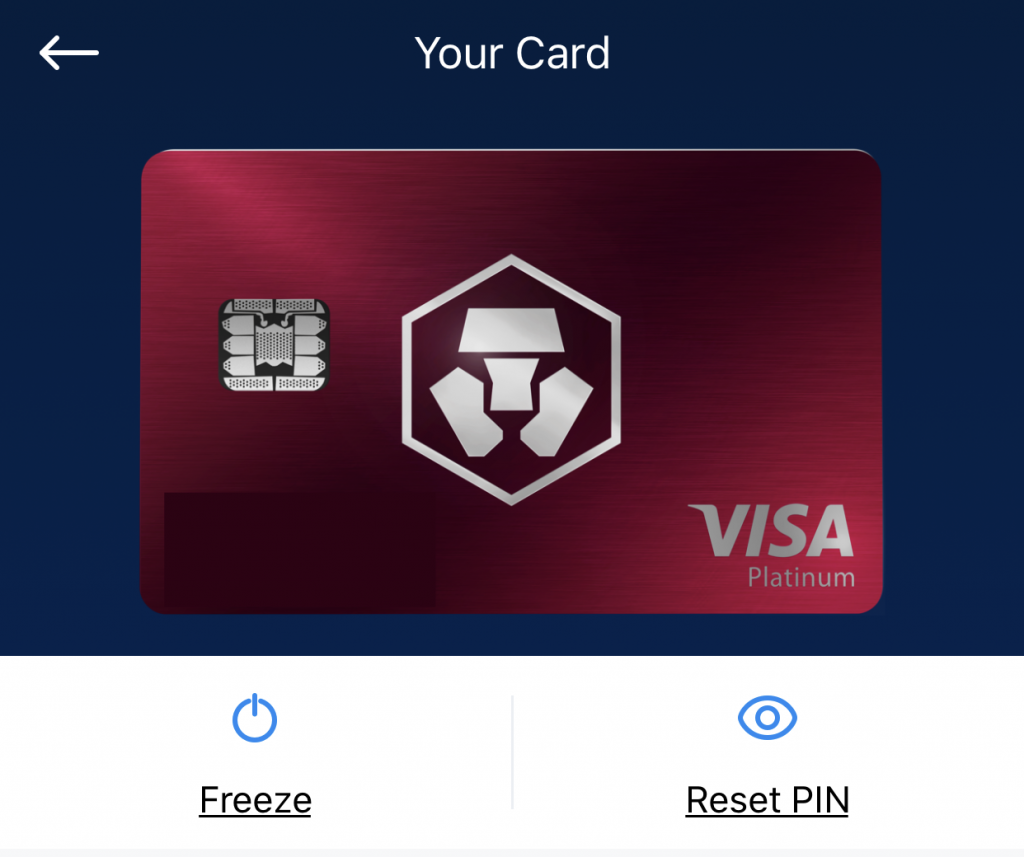

while the MCO is a metal Visa card. This makes it more durable than a plastic card.

This does not really matter in Singapore. However, certain shops overseas may only allow you to use cards from one network.

Topping Up of Cards

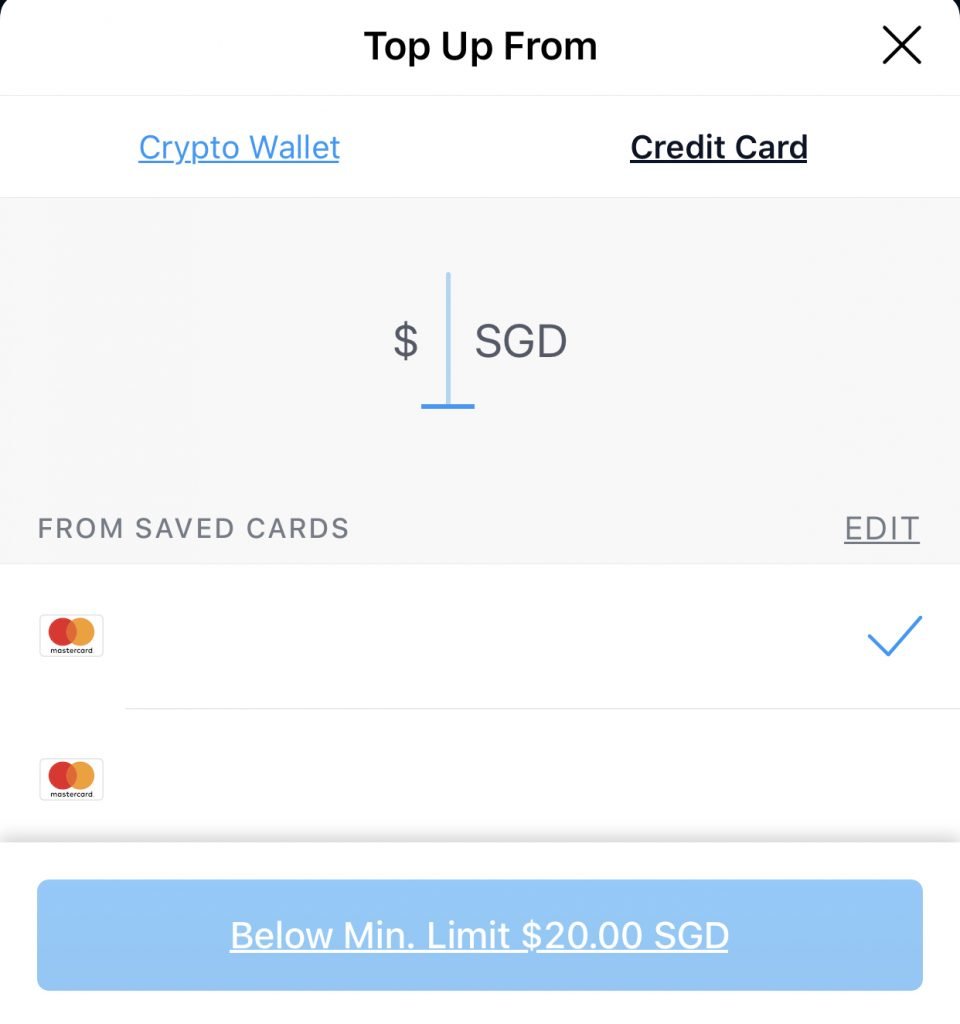

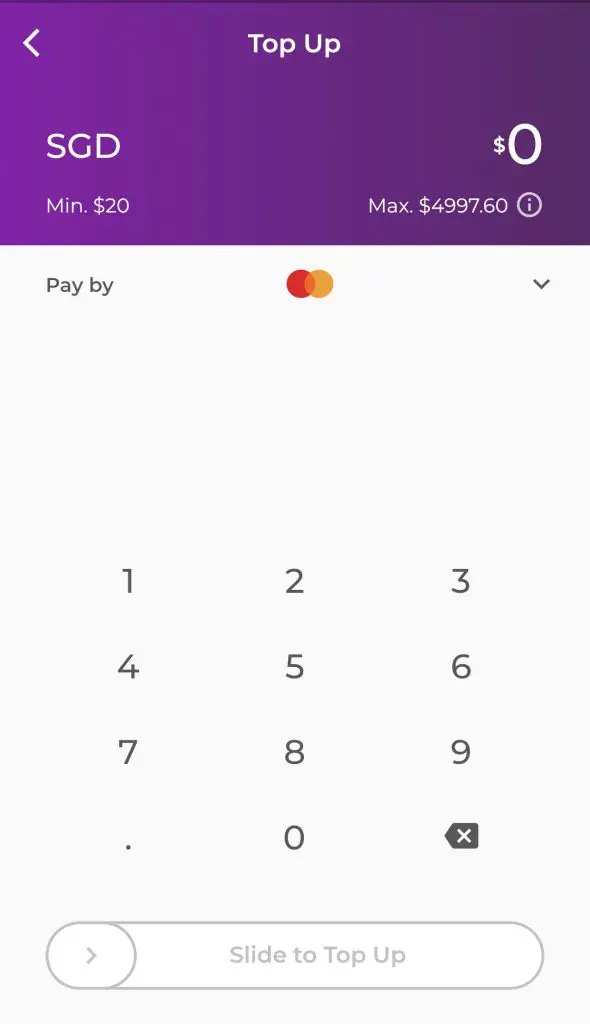

You can use any debit or credit card to top up both cards. As such, the topping up process is rather straightforward. Both cards require a minimum top up of $20.

You are also able to top up your MCO card using cryptocurrency as well.

Most of the time, you will need to enter an OTP to confirm the top up too.

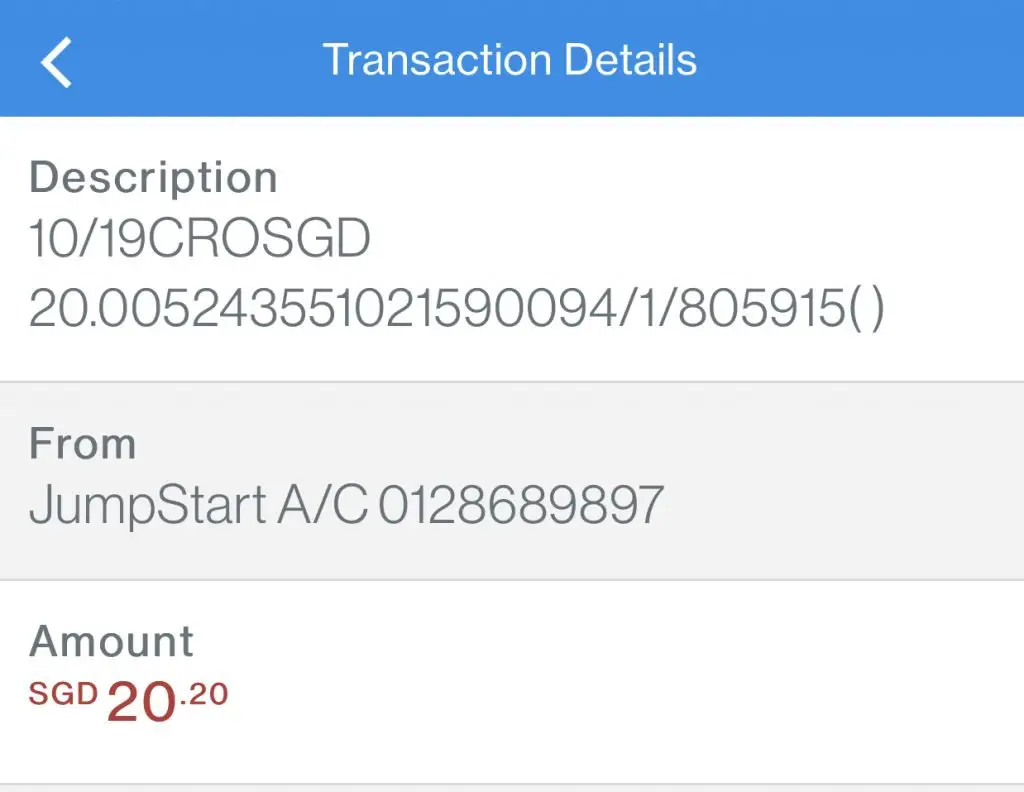

The best part is that you can receive some cashback when topping up these prepaid cards! For example, you can receive a 1% cashback when you use the JumpStart debit card to top up either prepaid debit card.

However, some debit cards may not allow you to top up your MCO card. Some of these include:

- Revolut

- BigPay card

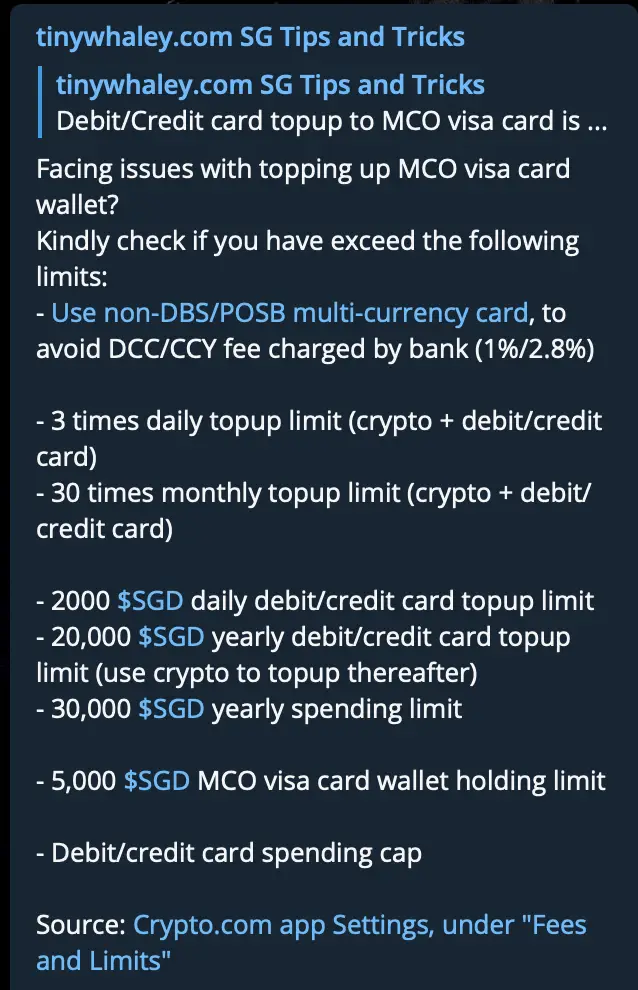

You may be charged a fee when topping up your MCO Visa Card

You may be charged a fee when you top up your MCO Visa Card using certain cards. MCO does not charge this fee. Instead, these fees are charged by the banks!

For example, I was charged a $0.20 fee when I topped up $20 to my MCO card. Essentially, this negates the cashback benefit that I would receive.

According to this Telegram group, you may be charged a fee if you do not use a multi-currency card.

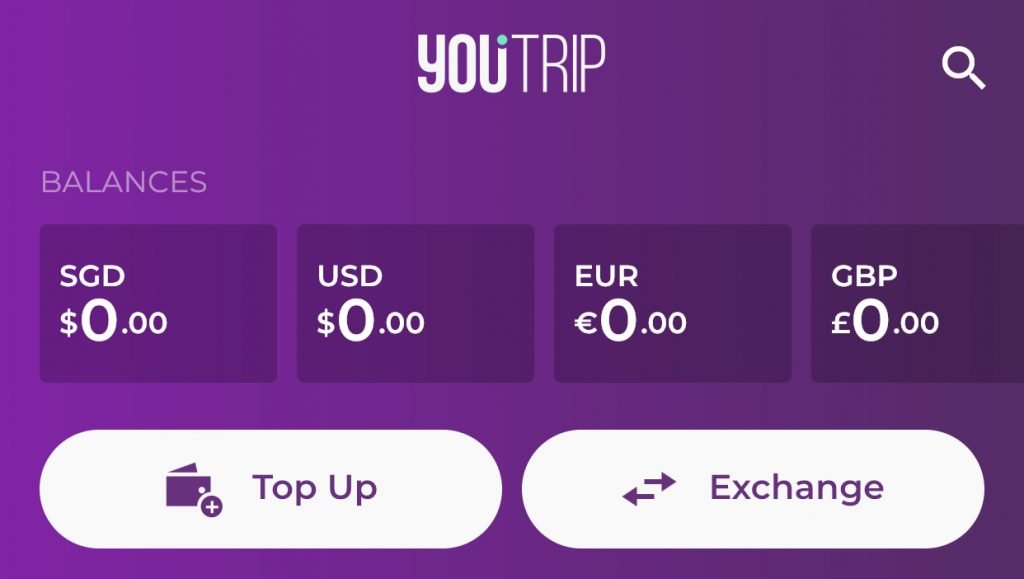

No fees when topping up my MCO card using YouTrip

I tried to top up my MCO card using my YouTrip card instead. I did not incur any fees when I used this method. Although this is slightly more troublesome, it does help me to get the 1% cashback!

Number of Currencies

Both cards market themselves as multi-currency cards. As such, one of the key comparisons is the currencies that you can use.

YouTrip has a wider variety of currencies

YouTrip allows you to store 10 currencies in the mobile wallet.

This includes:

- SGD

- USD

- EUR

- GBP

- JPY

- HKD

- AUD

- NZD

- CHF

- SEK

You are able to make purchases in 140 other foreign currencies as well! This makes YouTrip really versatile.

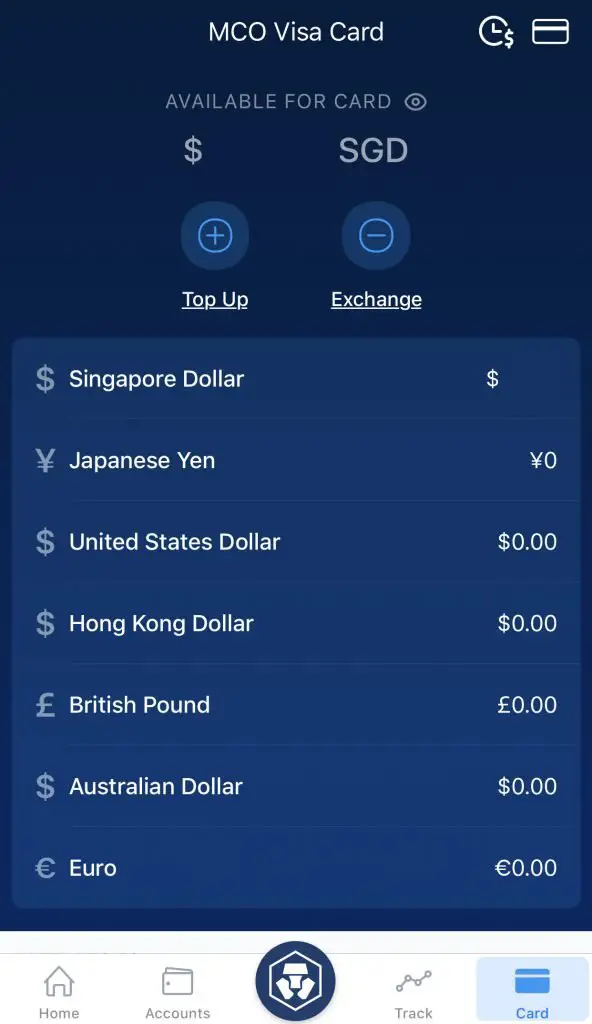

MCO Visa Card only has 7 fiat currencies available on the wallet

The MCO card only allows you to transact using 7 different currencies.

This includes:

- SGD

- JPY

- USD

- HKD

- GBP

- AUS

- EUR

As such, you may still need to use YouTrip if you wish to make purchases in other currencies.

Exchange Rates

Both cards offer pretty competitive exchange rates.

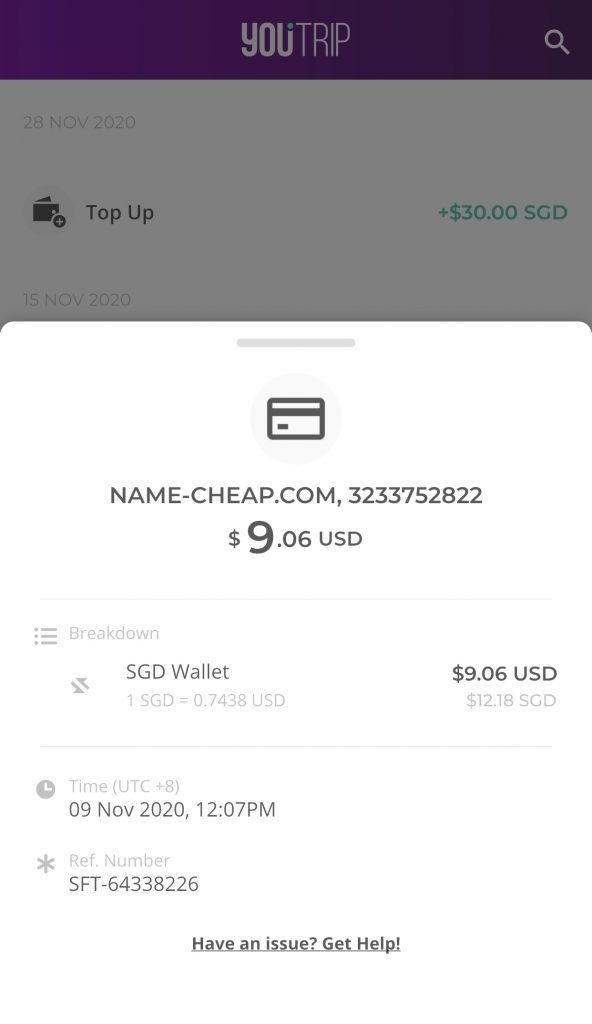

YouTrip offers SmartExchange

YouTrip has a feature called SmartExchange. When you do not have enough of a certain currency in your wallet, YouTrip will convert your funds in other currencies into that currency.

For example, you may have $0 USD and $10 SGD in your YouTrip wallet. To make a purchase of $5 USD, a part of your SGD will be converted into USD.

The transaction is done in real time and the exchange rates are pretty competitive. As such, you just need to load SGD into YouTrip and you can start making overseas purchases!

Here’s a transaction that I performed in USD. Since I did not have any USD in my YouTrip wallet, YouTrip automatically converted my SGD to the required USD.

MCO is not as transparent with its exchange rates

The MCO card will also automatically convert your SGD into the foreign currency required. Unfortunately, the MCO card is not as transparent about the exchange rate as compared to YouTrip.

However without the FX fee, I believe that the exchange rates are still pretty competitive.

Withdrawal from mobile wallet

Both cards come with a linked mobile wallet that you’ll need to top up. However, you are unable to withdraw the money you have inside these wallets!

This is in contrast to PayLah! which allows you to easily withdraw your funds.

There are other wallets like GrabPay and Singtel Dash which allow you to withdraw your funds too. However, you’ll need to meet certain requirements first!

Fees

Here is a comparison of certain fees that these 2 cards may charge you.

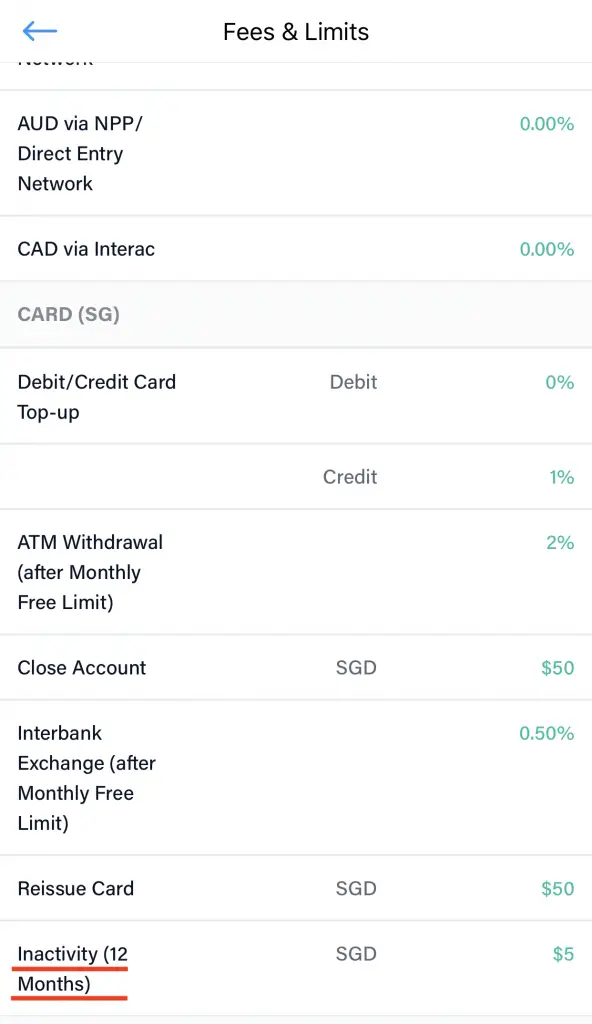

Inactivity fee

YouTrip no longer charges an inactivity fee if you do not use the card for more than 12 months.

However, this inactivity fee is still present for the MCO card.

ATM withdrawal fees

YouTrip charges a flat SGD $5 for any ATM withdrawals that you make. You can withdraw in any of the 150 currencies offered by YouTrip, but you will incur this fee.

For the MCO card, you are able to have free ATM withdrawals up to a certain limit. This limit depends on the tier of MCO card that you have.

The free ATM withdrawals are available for:

- SGD

- USD

- GBP

- EUR

- CAD

If you withdraw above your daily limit, you will incur a 2% fee.

No local ATM withdrawals in Singapore

Another thing you may want to take note of is that you are unable to withdraw SGD from Singapore ATMs using either card.

For the MCO Visa Card, the Payment Services Act prevents you from making local ATM withdrawals.

For YouTrip, the card is meant for overseas spending. As such, YouTrip has not enabled the feature to allow you to withdraw from the local ATMs.

No FX fees

Neither card charges you any foreign transaction fees. In the past, banks may charge you 2 types of fees when you make an overseas purchase. This includes:

- Foreign currency transaction fee

- Currency conversion fee

You could be paying as high as between 7-15% extra for each overseas purchase!

With both of these cards, you do not incur such fees. This makes overseas purchases much more cost effective!

User interface

Both mobile apps have solid interfaces that are extremely user friendly. As such, using either app is really easy and fuss free.

Compared to other app interfaces like the SingLife app, these apps are really pleasant to use.

Wallet Limit

Both cards have a maximum limit of $5000 in either mobile wallet.

The MCO Visa Card also has a spending limit of $30,000 each year.

Cashback

Both cards do provide some cashback offers. However, there are certain drawbacks to both of these promotions.

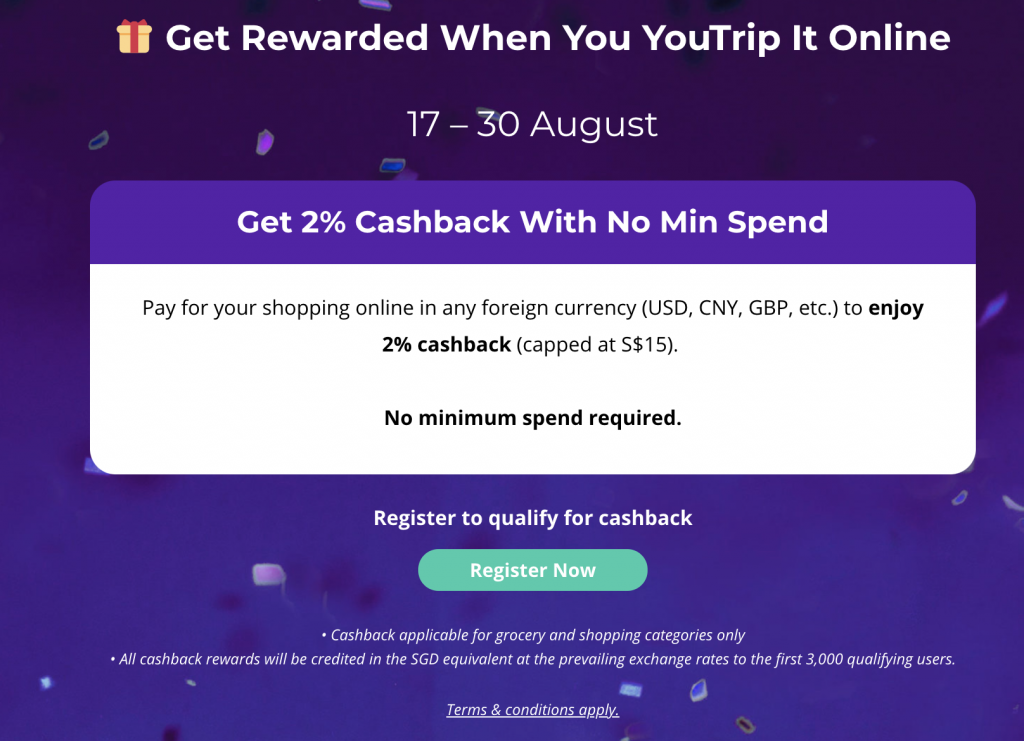

YouTrip has rather limited cashback deals

YouTrip does provide some cashback deals. However, these promotions are rather limited. The latest promotion was done in August.

Moreover, this promotion was only limited to grocery and shopping categories only.

Attractive cashback for MCO

The MCO card offers you cashback on any transaction that you make. If you just have the basic card, you are already able to receive a 1% cashback!

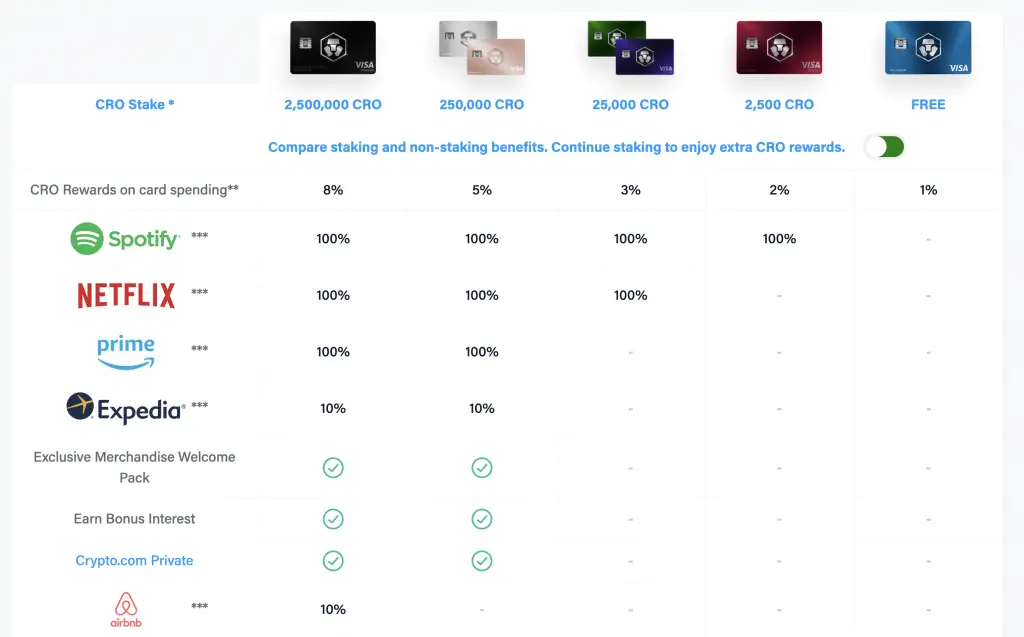

You have to stake MCO if you want higher cashback

If you wish to have a higher cashback than the 1% offered by the free card, you would need to stake your cash as CRO for at least 6 months.

Staking CRO means that you’ll need to buy and hold CRO.

To continue earning the higher cashback, you will need to continue to stake your cash as CRO .

Here are the CRO staking rates for each different tier.

On top of the cashback you can receive, you are able to receive other rewards such as:

- 100% rebates on Spotify, Netflix, Prime or Expedia

- Airport lounge access

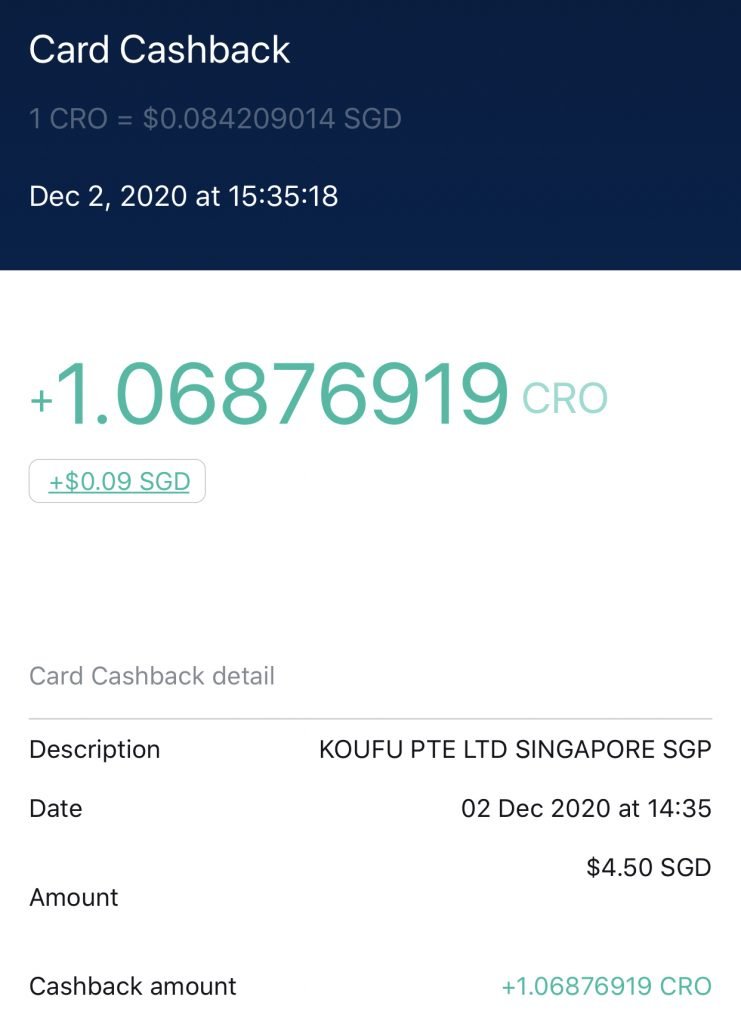

Cashback is credited as MCO

Even though the cashback is great, it will be credited to you in the form of CRO. This is the cryptocurrency that is created by Crypto.com.

The price of CRO is very volatile. Here’s how the price has changed in the past 6 months.

If you withdraw your cashback at a later time, you may sell your CRO at a higher or lower price.

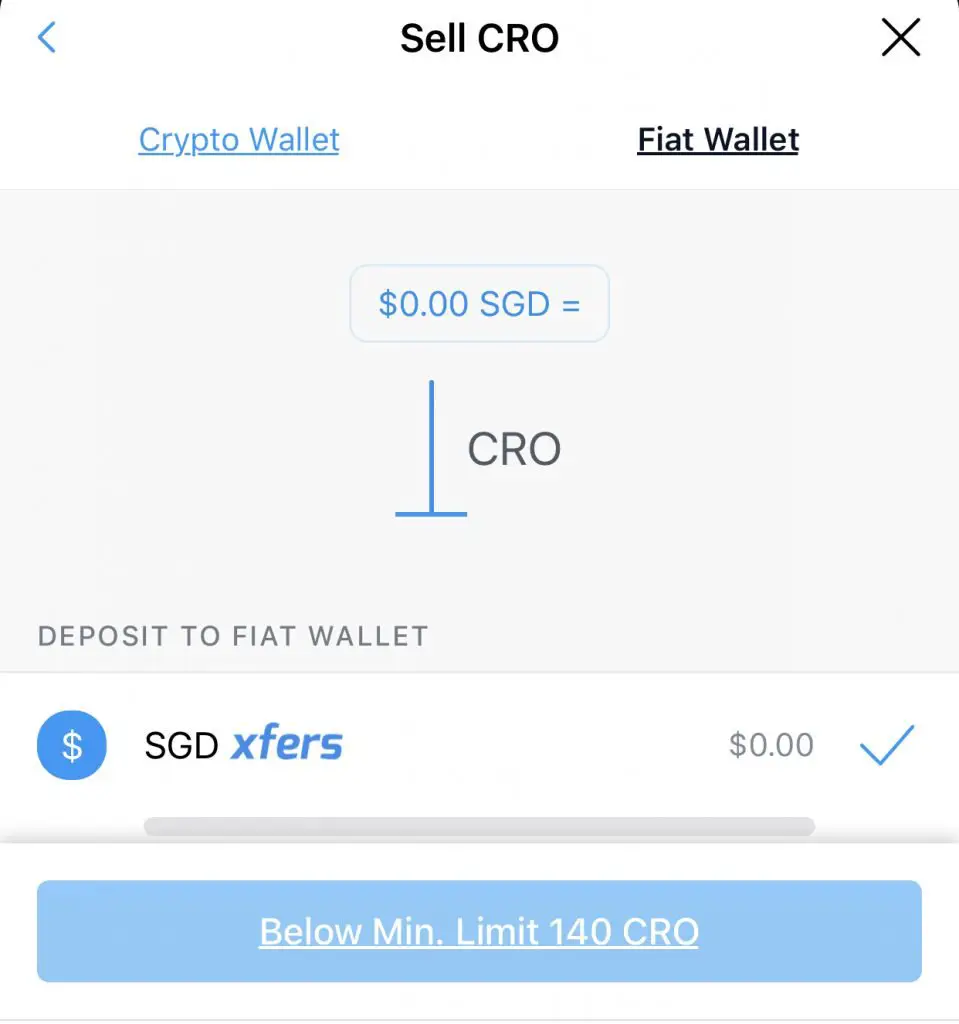

Withdrawing your cashback can be tedious

When you want to withdraw your cashback, there are certain limitations:

- You will need to have a Xfers wallet to sell your CRO

- You will be charged a 0.4% selling fee

- The minimum amount of CRO you can withdraw is 140

The cashback may be a hassle, but it is still free money. The cashback is awarded for any transaction you make with the MCO Visa Card. As such, you can consider using this card for transactions that are not eligible for rewards on your credit cards.

Safety

When it comes to safety, YouTrip seems to be the safer company. It has been well established in Singapore, Hong Kong and Thailand.

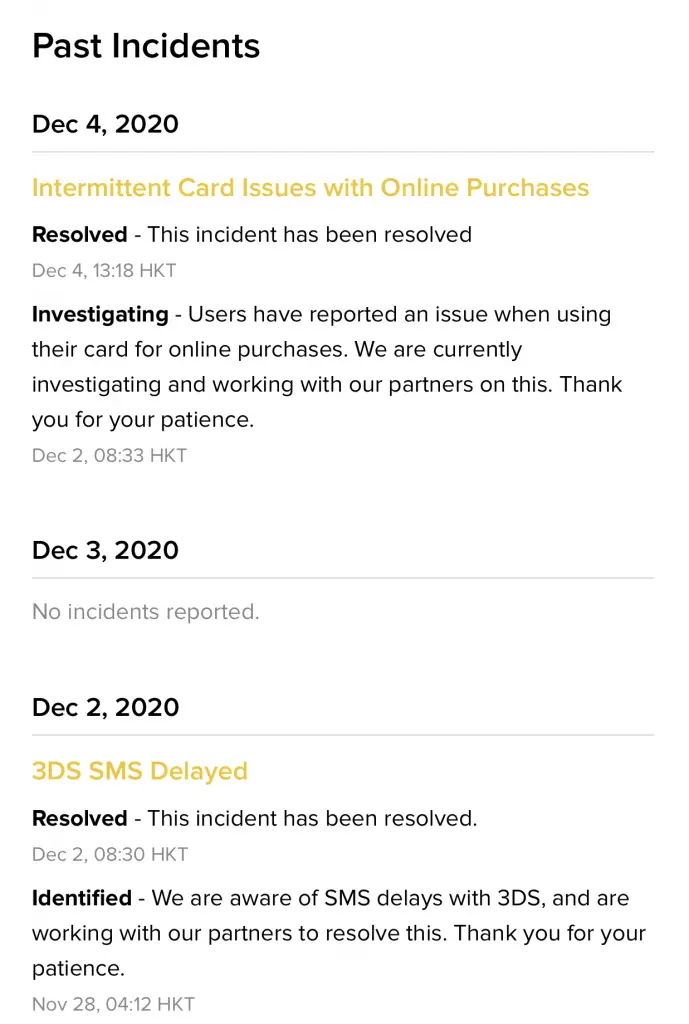

MCO has certain issues

Meanwhile, the MCO Visa Card is being offered by Crypto.com. It previously used Wirecard to issue its debit cards. With the whole Wirecard scandal in 2020, it has led to a lot of issues with the MCO Visa card.

The issuing of the MCO Visa Card was suspended until Crypto.com found PayrNet as its new card issuer. The credit and debit card top up functions were also suspended as well.

This led to a lot of inconvenience if you had been using the MCO card for your daily spending.

MCO has certain risks involved

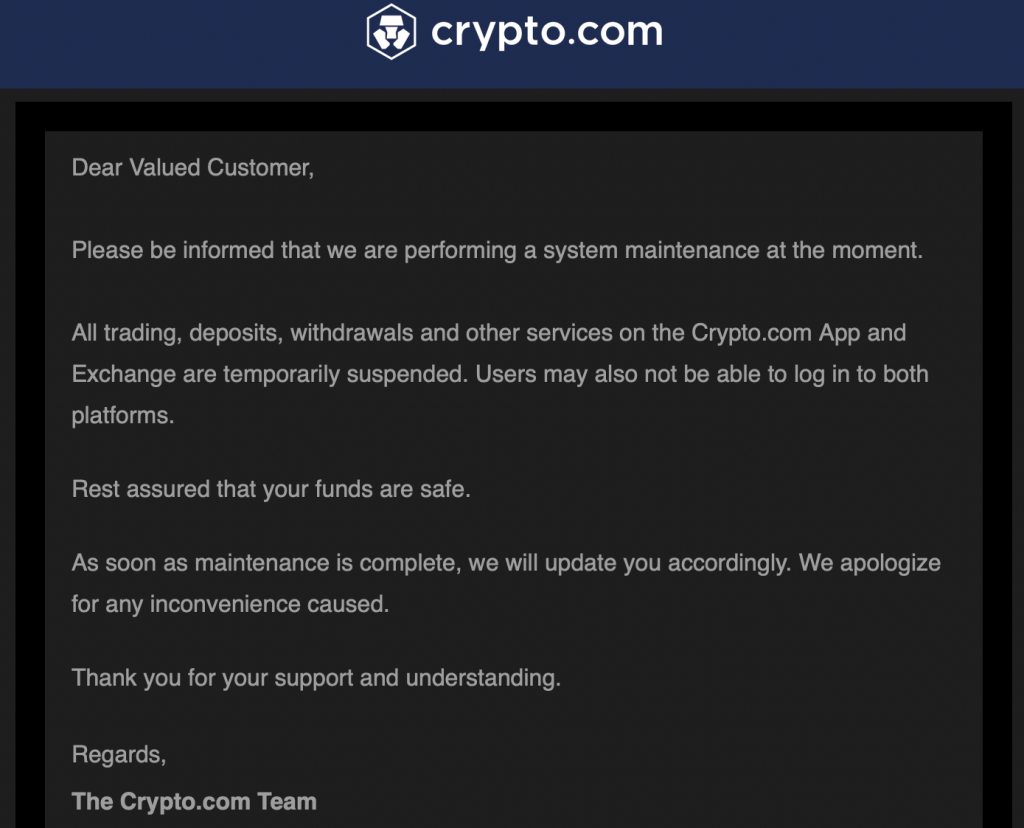

Since crypto is still something new, there are many risks involved with it. From time to time, there are some issues that have been surfaced with the MCO card.

Crypto.com also had an unscheduled maintenance in September 2020. This prevented you from logging into the Crypto.com app.

Moreover, the maintenance took a few hours before it could be resolved.

If you aren’t willing to take the risks, then the MCO Visa Card may not be for you. There are many things that can go wrong with this card since it is still quite new.

You may just want to stick to YouTrip instead!

Card lock function

If you lose either card, you are given the option to lock your card.

This prevents anyone from using your card!

Verdict

Here is a comparison between these 2 multi-currency cards:

| YouTrip | MCO Visa Card | |

|---|---|---|

| Type of Card | Plastic Mastercard | Metal Visa Card |

| Minimum Top Up | $20 | $20 |

| Number of Currencies | 10 in-app + 140 others | 7 |

| Exchange Rate | Competitive | Competitive |

| Withdrawal From Mobile Wallet | Absent | Absent |

| Inactivity Fee | Absent | $5/month after 12 months of inactivity |

| ATM Withdrawal Fee | $5 SGD per withdrawal | 2% after daily ATM limit |

| ATM Withdrawal | Not available in SG | Not available in SG |

| Wallet Limit | $5,000 in wallet | $5,000 in wallet Max spending of $30,000 |

| Cashback | Limited to promotions | Based on tier of card (1-8%) |

| Cashback Credited As | Cash | CRO |

| Safety | Generally safer | Has certain issues |

| Card Lock Function | Present | Present |

Since both of the cards are rather similar, which one should you choose?

Choose YouTrip if you travel often

I believe that the YouTrip card will be more useful if you travel to many different countries. Since you are able to make payments in 150 currencies, it is so much more versatile.

Choose MCO Visa Card if you want the cashback and are ok with the risks

The MCO card has a limited number of currencies you can store. Despite that, it does provide very attractive cashback bonuses for any purchases that you make.

However if you have a card that provides better benefits, I believe that you should use that card instead. You can use the MCO card for those transactions that are not eligible for rewards with your other cards.

With these attractive bonuses, there are a lot of risks associated with it as well. As such, I strongly encourage you to use the MCO card only if you are fully aware of the risks!

Conclusion

The MCO Visa Card is very similar to YouTrip, with added benefits like cashback. However, it does come with certain risks. If you are just happy with a fuss-free card with great exchange rates, YouTrip may be the better card.

If you are willing to take a higher risk for better rewards, then the MCO card may be more enticing to you.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

YouTrip Referral (Receive $5 when you sign up)

If you are interested in signing up for a YouTrip account, you can use my referral link.

You will receive $5 in your YouTrip account after making your first top-up to the account.

You can view more details of this referral program on YouTrip’s website.

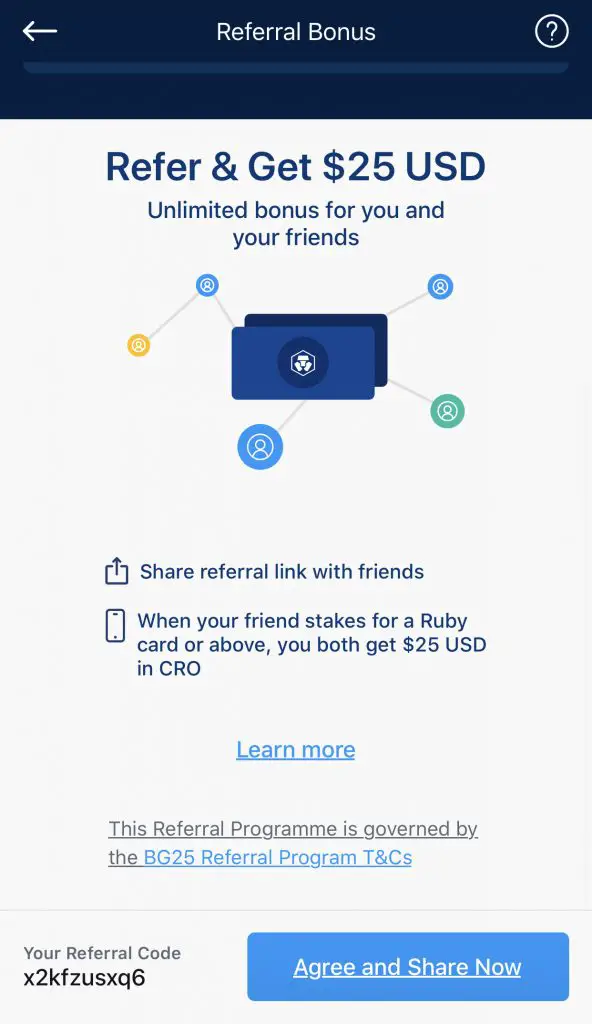

Crypto.com Visa Card Referral (Get $25 USD worth of CRO)

If you are interested in signing up for the Crypto.com Visa Card, you can use my referral link. We will both receive $25 USD worth of CRO in our Crypto Wallet.

Here’s what you’ll need to do:

- Sign up for a Crypto.com account

- Enter my referral code: ‘x2kfzusxq6‘

- Sign up for at least a Crypto.com Ruby Steel Card

You can read more about the referral program on Crypto.com’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?