Last updated on June 6th, 2021

[UPDATE: GIGANTIQ has been fully subscribed. You may want to consider cash management accounts offered by robo-advisors instead, such as Endowus Cash Smart, Syfe Cash+ or StashAway Simple.]

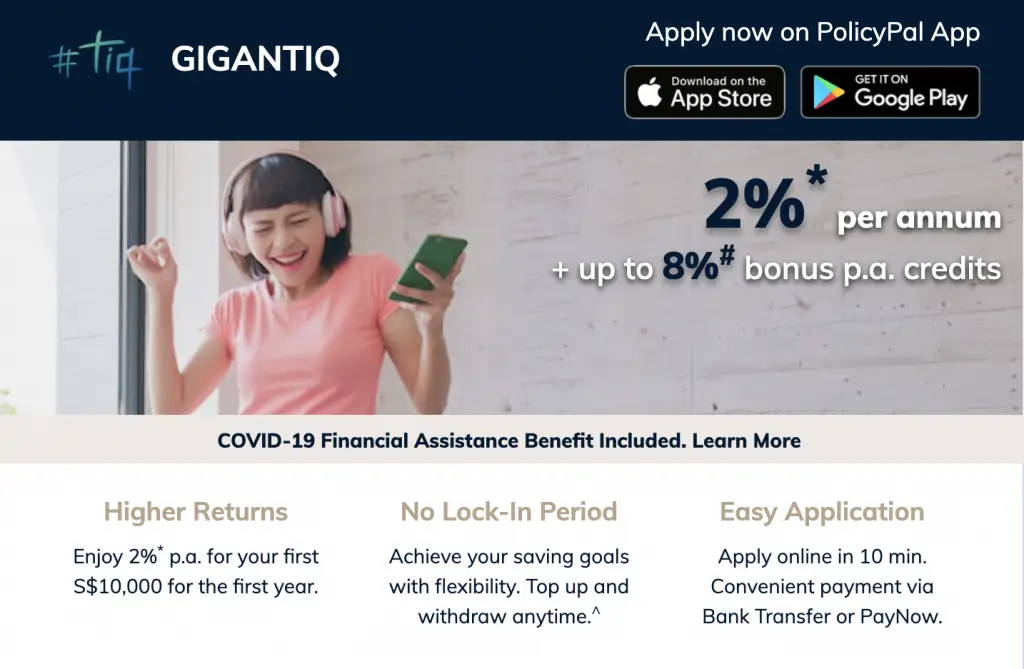

Have you ever wanted to purchase a policy, but could not afford the initial premium? With Etiqa’s GIGANTIQ, you no longer have to worry about this!

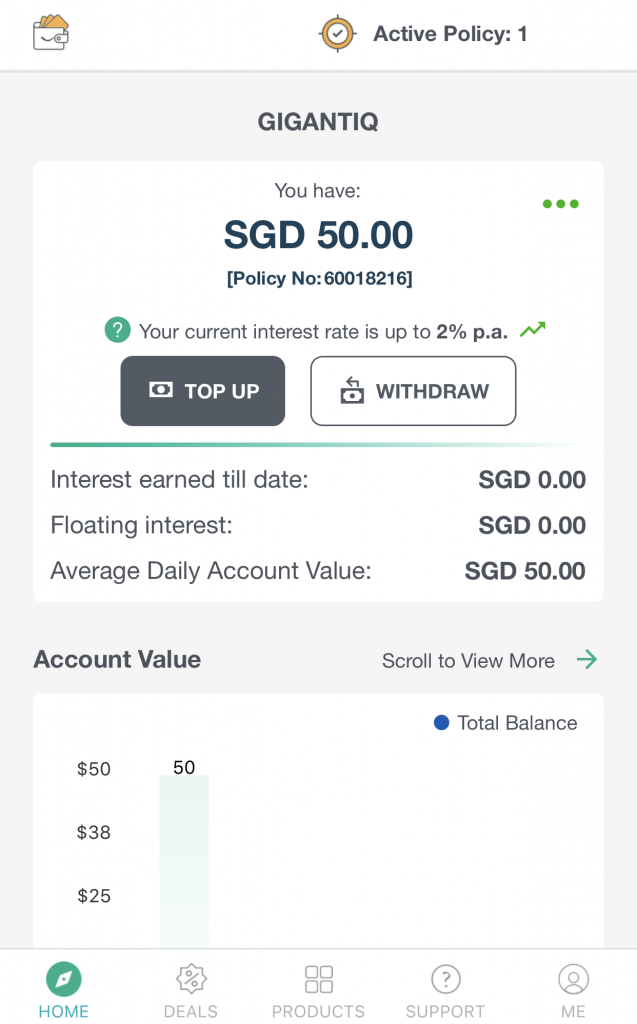

You are able to sign up with just $50, and can earn up to 1.8% p.a. for the first year.

Here’s what GIGANTIQ offers and how it may be a great way to grow your savings.

Contents

- 1 GIGANTIQ review

- 2 What is GIGANTIQ?

- 3 What are the benefits of GIGANTIQ?

- 4 How do I sign up for GIGANTIQ?

- 5 How does GIGANTIQ work?

- 6 Is GIGANTIQ safe?

- 7 Is GIGANTIQ worth it?

- 8 Conclusion

- 9 Etiqa GIGANTIQ Referral (Receive $15 cash)

- 10 GIGANTIQ PolicyPal Referral Code

- 11 PolicyPal Promotion (Up to additional 8% p.a. in PolicyPal credits)

GIGANTIQ review

Etiqa’s GIGANTIQ offers a comparatively higher interest rate compared to that of bank accounts. However, it has some drawbacks such as withdrawal fees and a non-guaranteed interest rate.

Nevertheless, it is a good option to keep your savings for a short term goal.

Here is GIGANTIQ reviewed in depth:

What is GIGANTIQ?

GIGANTIQ is an insurance savings plan that is offered by Etiqa.

Some other insurance savings plans you may have heard of before include the SingLife Account and Etiqa Elastiq.

Here are 5 characteristics of this plan:

#1 Universal life plan

GIGANTIQ is a universal life insurance plan.

These plans are more flexible compared to whole life insurance plans.

You can adjust the premium that you have inside this plan by making withdrawals or top-ups.

However, the only benefit that you’re eligible for is a death benefit.

It is also important to note that GIGANTIQ is neither a bank account nor a fixed deposit.

#2 Single premium

GIGANTIQ is a single premium plan.

This means that all you need is to put in a lump sum into GIGANTIQ. You are not required to pay a premium each month.

The best part is that you can start this plan with just $50!

You are given the flexibility to make withdrawals and top-ups as well.

However, you will need to maintain a minimum account balance of $50.

#3 Non-participating

GIGANTIQ is a non-participating plan. This means that the interest you earn does not depend on the investment’s performance.

Etiqa will invest your funds mainly in bonds. This allows them to provide you with the guaranteed yield.

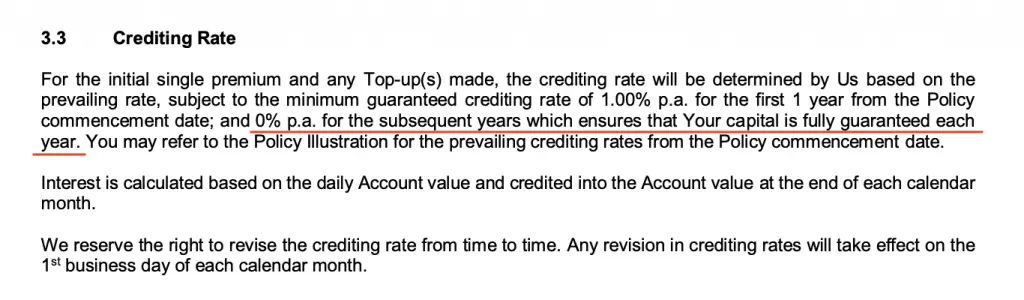

However, Etiqa may decide to change the crediting rate at any time. The guaranteed crediting rate is only for your first year.

#4 No lock-in

GIGANTIQ does not have a lock-in period. This means that you are able to freely withdraw or top-up your account. You can even do so immediately after you create your account!

However, you will incur a fee each time when you make a withdrawal.

You will not incur any fees when you make a top-up.

#5 Able to manage on the go

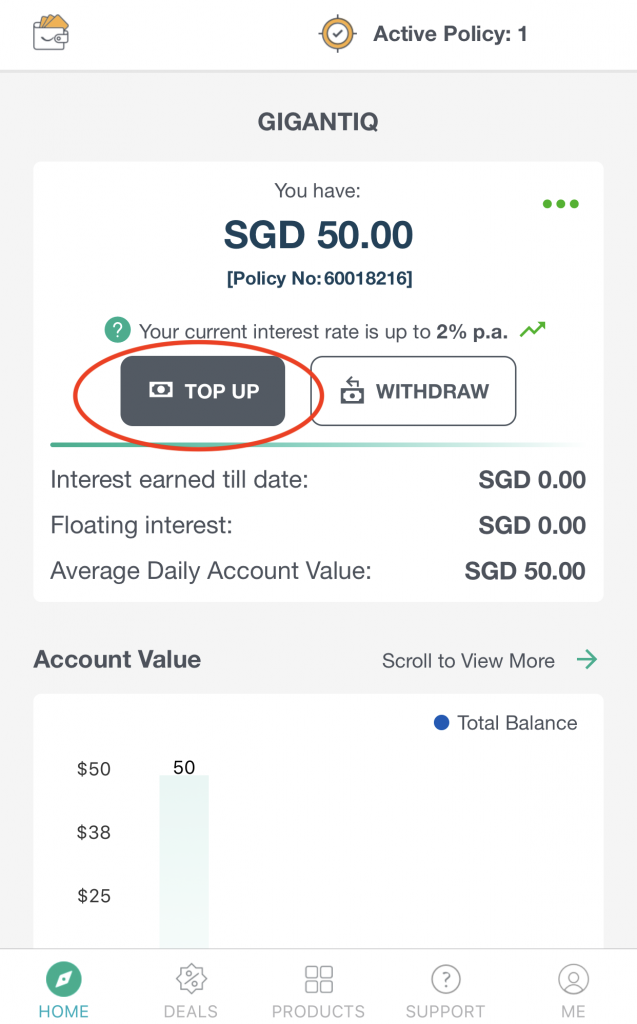

You are able to access your GIGANTIQ plan directly from the Tiq Mobile app.

This allows you do these 2 things on the go:

- Check your account balance

- Make a top-up or withdrawal

What are the benefits of GIGANTIQ?

GIGANTIQ has these 4 main benefits:

#1 Capital guaranteed

GIGANTIQ is a capital guaranteed plan.

Etiqa will absorb whatever loss they incur from investing your money. No matter what, they will return you your capital upon the plan’s maturity.

This can be seen from the policy’s details:

You are guaranteed at least 0% p.a. every year after the first year. As such, your capital will be safe.

#2 Crediting rate

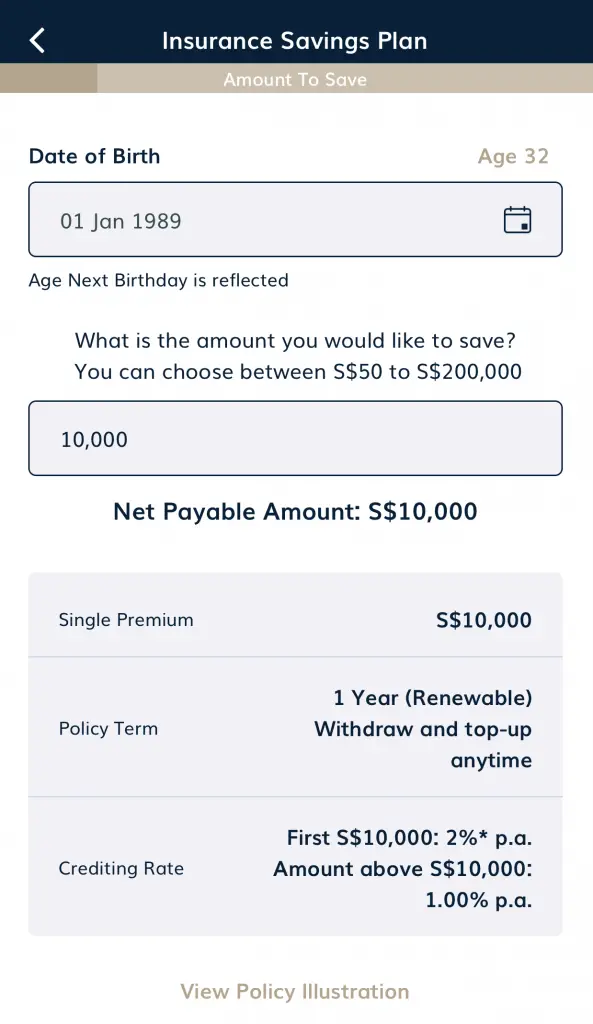

Gigantiq offers you a guaranteed crediting rate of 1% for the first year.

You will receive a bonus crediting rate of 0.8% for your first $10k with Gigantiq. This means you’ll get 1.8% for the first $10k!

| Year | Crediting Rate |

|---|---|

| First year | First $10k: 1.8% p.a. Above $10k: 1% p.a. |

| Subsequent years | Projected to be 1% p.a. |

Etiqa projects the crediting rate to be 1% for the subsequent years.

However, they may change this rate at any time. Any changes in the crediting rate will take effect on the first day of the month.

Etiqa has recently reduced GIGANTIQ’s interest rate from 2% to 1.8% on 18 November.

You interest is calculated daily and will be credited to you at the end of each month.

#3 Death benefit

GIGANTIQ provides you with a death benefit as well. When you pass on at any age before 100 years old, you will receive 105% of your Account Value.

This death benefit is a ‘sum assured‘ benefit. As such, you are able to claim this benefit from different insurance policies!

Once you have received this payout, the policy will end.

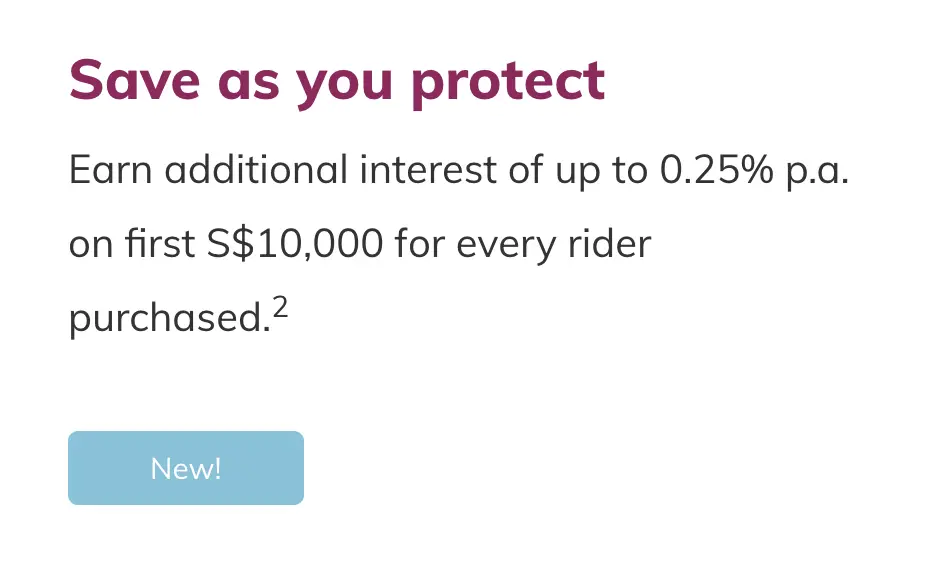

#4 Additional interest with purchase of other insured products

It is possible for you to earn additional interest for GIGANTIQ. If you buy additional insurance plans with Etiqa, you will be eligible for this bonus interest.

Etiqa calls these plans ‘riders‘, which are add-on policies to your GIGANTIQ plan. 3 of the riders that are available include:

All of these policies are ‘sum assured‘ types of policies. So long as a condition is met, you are able to make a claim.

As such, you will be able to claim these benefits from multiple insurance companies.

These premiums can start from as low as $0.02 – $0.03 per day to receive a minimum sum assured of $10k. However, this depends on certain conditions such as:

- Your age

- Your gender

- Whether you’re a smoker or a non-smoker

This is rather similar to SNACK by Income, which charges you $0.30 for each micro-insurance policy.

With each rider that you sign up for, you will receive an additional 0.25% interest on your first $10k in GIGANTIQ.

This offer looks pretty attractive. However, you will need to decide whether you really need the extra riders or not. You should not apply for them just to receive the extra interest!

For more information, you can view Etiqa’s website.

How do I sign up for GIGANTIQ?

To sign up for GIGANTIQ, you will need to be:

- A Singapore citizen or PR with a valid NRIC, OR a foreigner holding a valid Work Pass / Permit or Long-Term Visit Pass

- Between the age of 17 to 75 (age next birthday)

This means that you can sign up for GIGANTIQ from 16 years old.

You can sign up for GIGANTIQ via the PolicyPal app.

If you sign up for GIGANTIQ via Etiqa’s mobile app, you can only deposit the initial premium using direct debit from a DBS / POSB account. However, I will be receiving a $30 referral bonus which I am willing to share with you (more details below)!

PolicyPal allows you to pay for the premium via FAST transfer or PayNow. If you do not have a DBS / POSB account, this will be an easier way for you to sign up for GIGANTIQ!

However, all other subsequent top-ups will require you to have a DBS / POSB account.

Here are the main steps that you’ll need to do:

#1 Download the app and register for an account

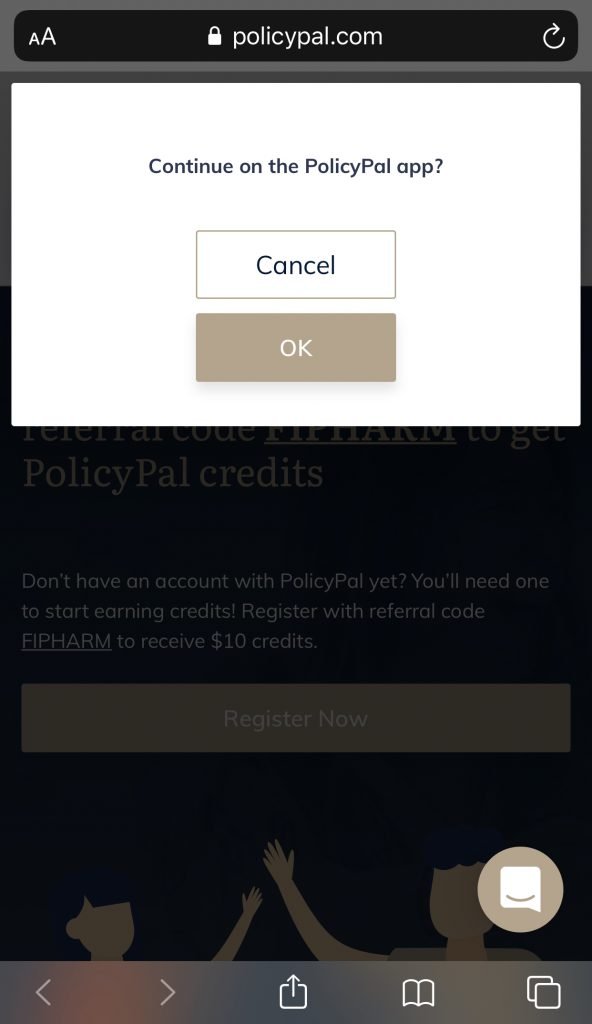

You can sign up for GIGANTIQ via PolicyPal using my referral link. You will be redirected to download the PolicyPal app.

Upon successfully signing up for GIGANTIQ, you will receive 10 PolicyPal credits. You can earn more PolicyPal credits when you participate in their GIGANTIQ promotion.

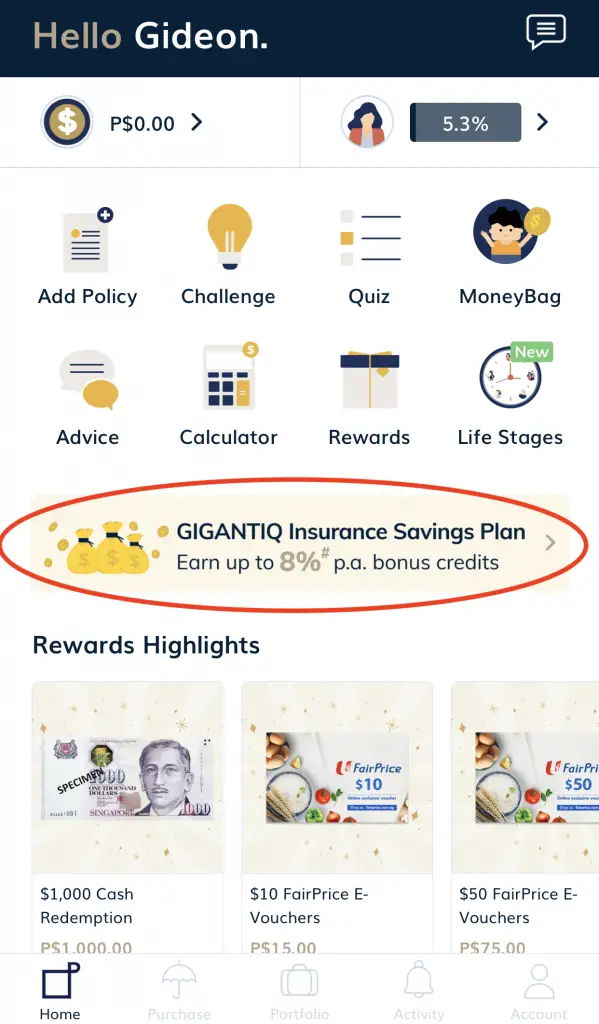

#2 Select GIGANTIQ from the banner

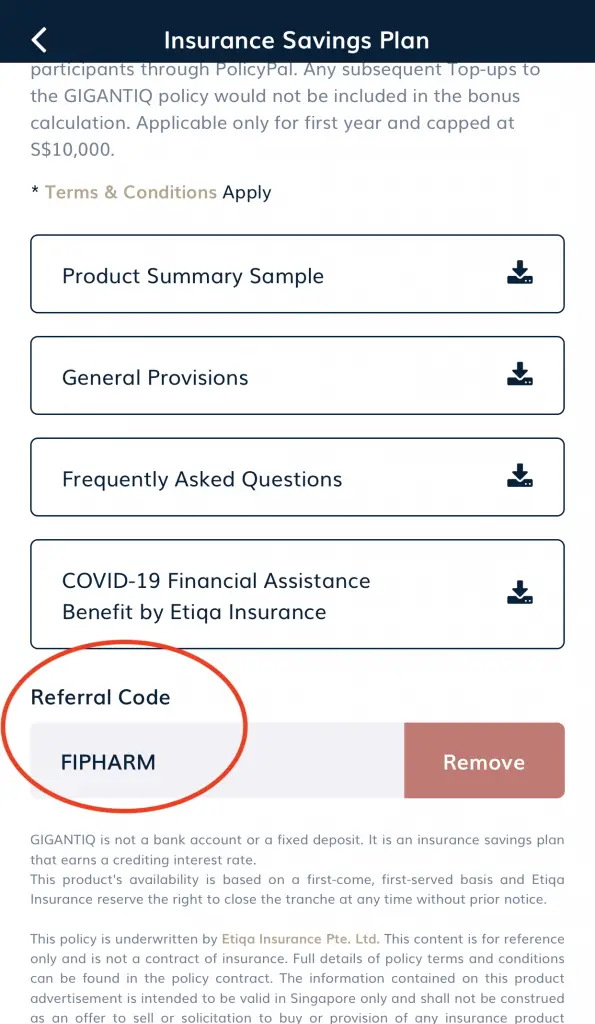

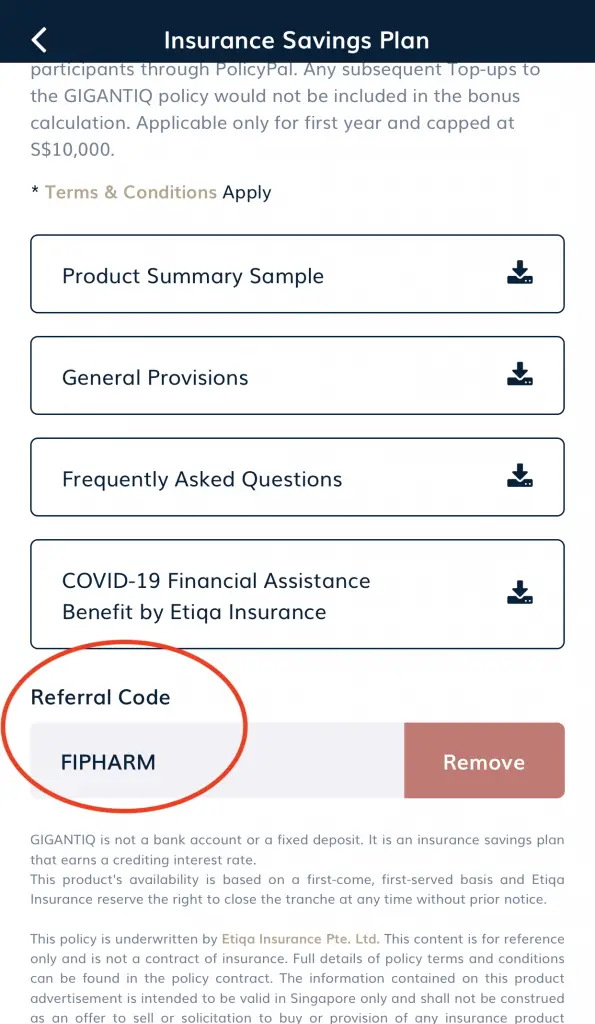

#3 View the necessary documents and referral code

If you’ve previously used my link, the referral code should be already there.

Alternatively, you can type ‘FIPHARM‘ into the referral code field.

You will be opted in for a complementary COVID-19 Financial Assistance Benefit as well.

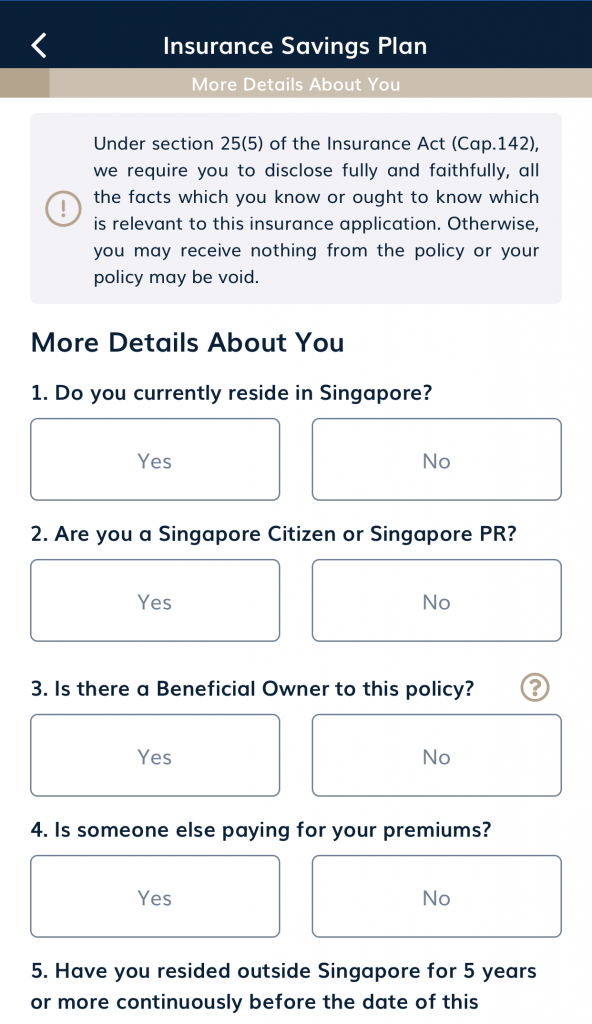

#4 Fill up details about yourself

#5 Select your initial premium

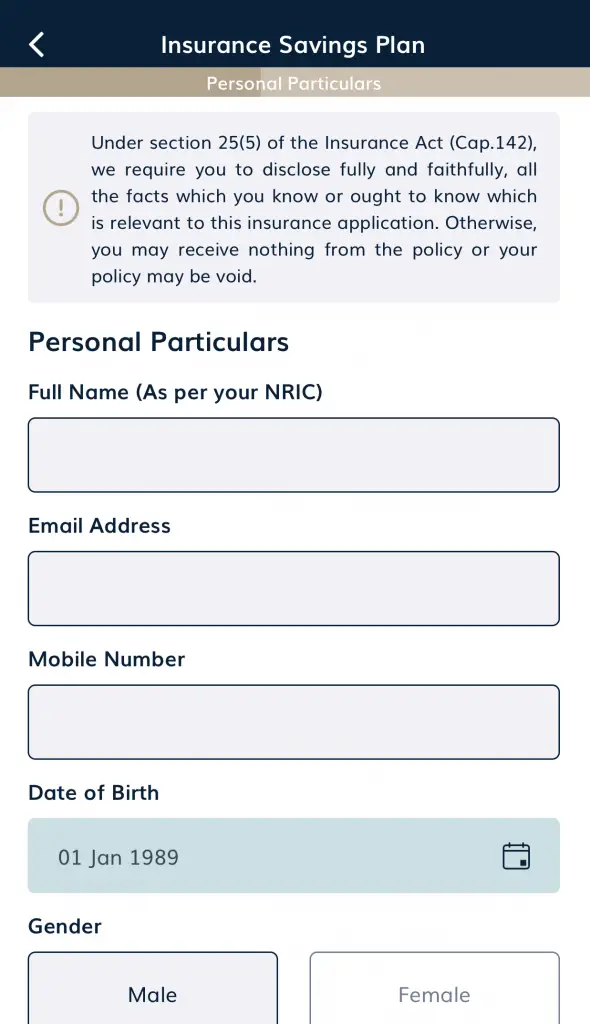

#6 Fill in your personal particulars

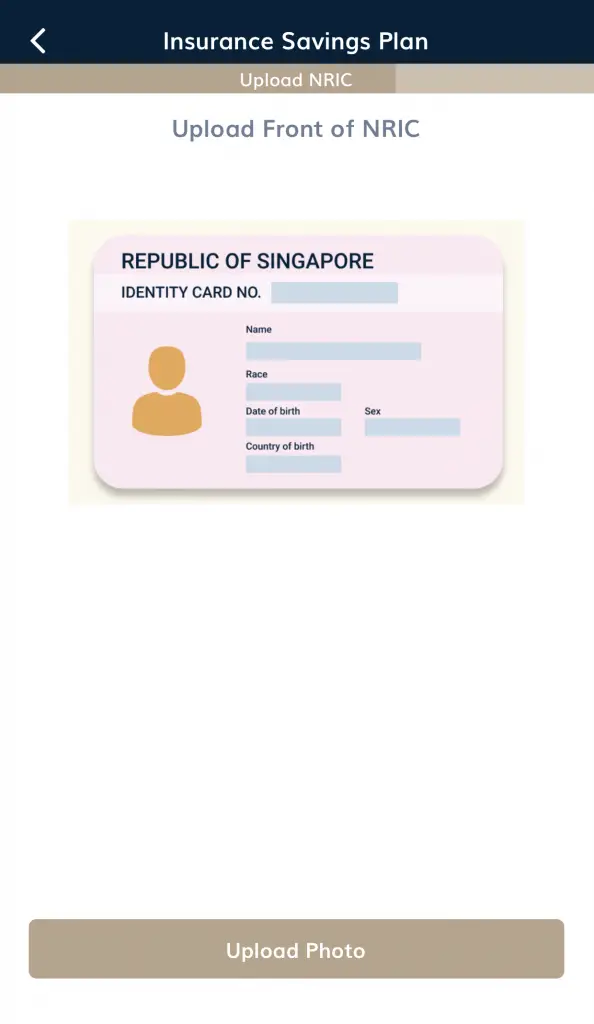

#7 Take a picture of the front and back of your NRIC

#8 Transfer your initial premium via FAST / PayNow

Upon signing up, it will take up to 2 days before the inception of your policy.

How does GIGANTIQ work?

Here’s the breakdown of how GIGANTIQ works:

#1 Initial premium

When you create your GIGANTIQ account, you will be required to deposit your initial premium.

You can start from as low as $50 with subsequent multiples of $1. This makes it really accessible for you to start earning a decent interest rate!

#2 Top-ups

You are able to make a top-up to GIGANTIQ at any time via Etiqa’s mobile app.

Even if you have signed up for GIGANTIQ via PolicyPal, you cannot make a top-up using the PolicyPal app.

All top-ups and withdrawals will have to be done on Etiqa’s mobile app.

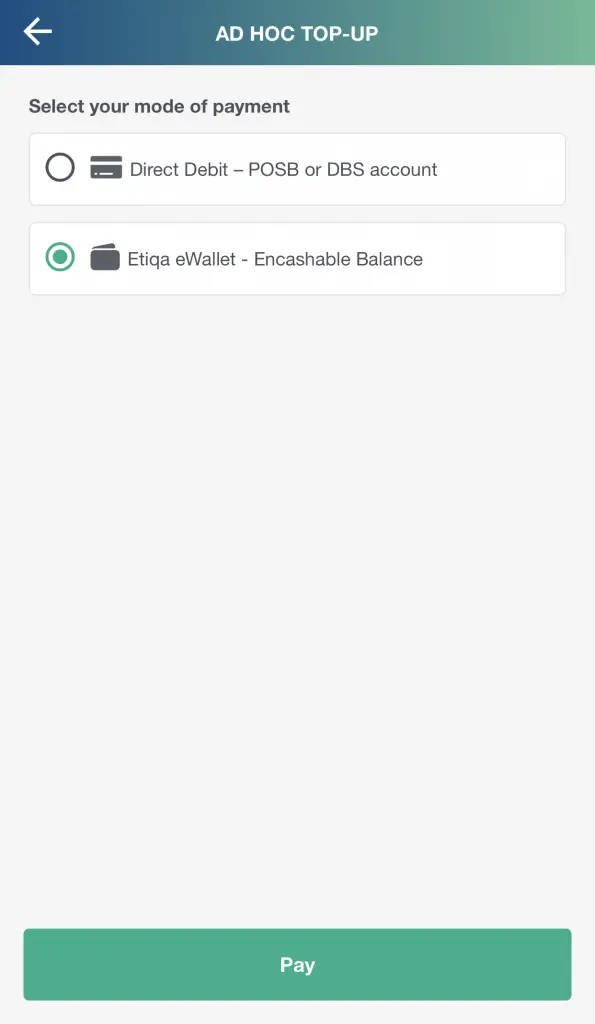

You can choose to make a top-up either by:

- Direct debit via DBS / POSB

- Cashable Etiqa eWallet credits

The minimum top-up is $1. This means that you can top-up almost any amount!

You may want to take note of the cap of $200k. This is the maximum amount that you can top up until.

Whenever you make a top-up, you will not incur any fees.

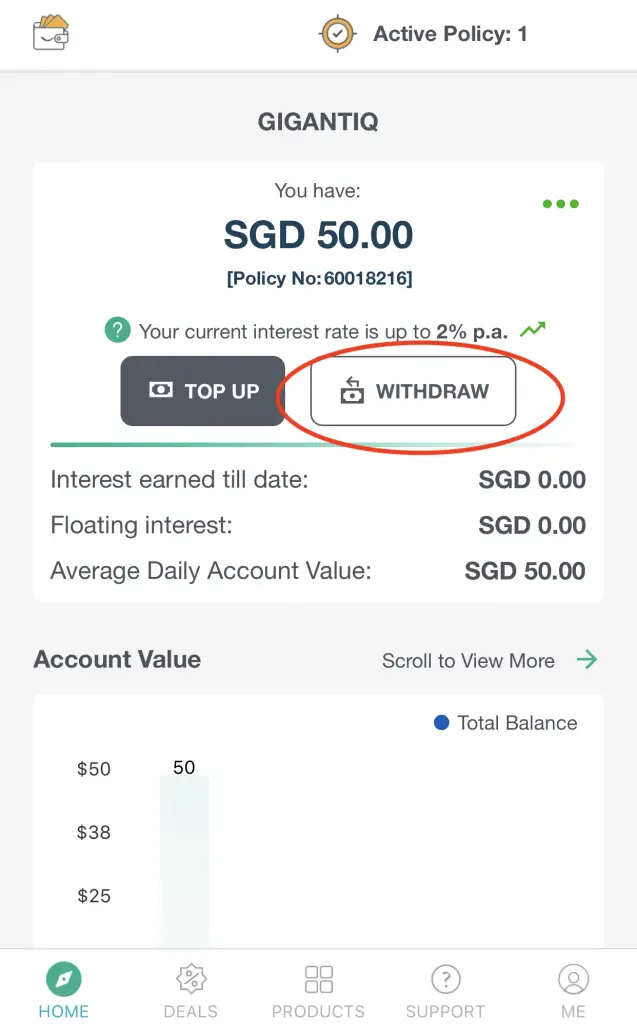

#3 Partial withdrawal

You are able to make a partial withdrawal from your GIGANTIQ plan at any time.

Again, you can only do so with the Etiqa mobile app.

The only requirement is that you’ll need to maintain a minimum balance of $50.

Deactivation of policy if you fall below $50

If your account value falls below $50, your policy will be deactivated.

When your policy is deactivated, you are unable to withdraw the remaining amount inside the policy. Your balance in the policy will not earn any interest as well.

You can choose to restore your policy by topping up your account value to $50 again.

Fees incurred when making a partial withdrawal

Moreover, you will incur a fee for each withdrawal you make.

Here are the fees that you’ll incur, depending on the payment method:

| Payment Method | Fee |

|---|---|

| PayNow | $0.70 |

| Direct Credit (DBS / POSB) | $0.50 |

I would not recommend you to make many withdrawals. You’ll incur a lot of unnecessary fees along the way.

As such, I would only recommend you to use GIGANTIQ for a short term savings goal or for your emergency fund.

When you make a withdrawal, Etiqa may delay the payment for up to 6 months.

However, they would only do so if there is a sudden surge of withdrawals from GIGANTIQ.

#4 Yearly renewal of policy

Your GIGANTIQ policy will be renewed each year before you reach 100 years old.

Once you’ve reached 100 years old, your plan will mature. Etiqa will pay you the maturity benefit, which is your Account value.

#5 Early surrender

If you wish to fully withdraw your entire account value from GIGANTIQ, you may perform an early surrender.

You will receive the Account value minus any amount owed to Etiqa.

Similar to a partial withdrawal, Etiqa may take up to 6 months to reimburse your funds.

You will incur the withdrawal fee as well.

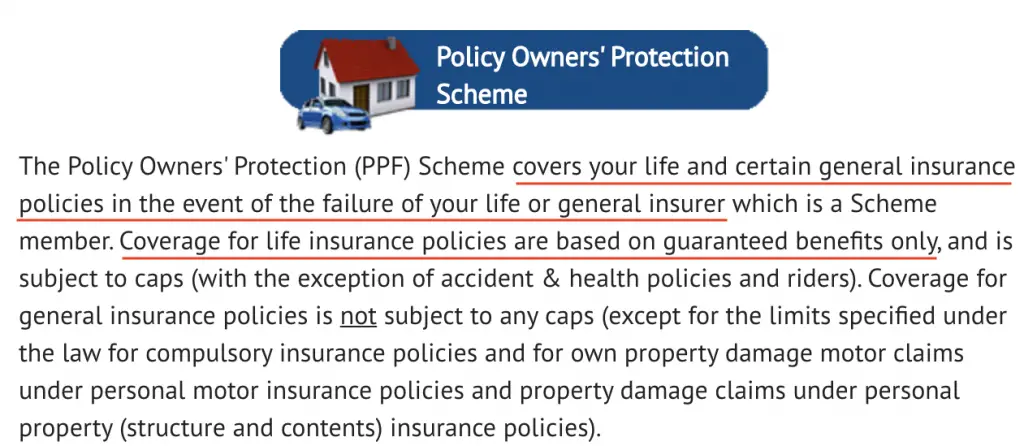

Is GIGANTIQ safe?

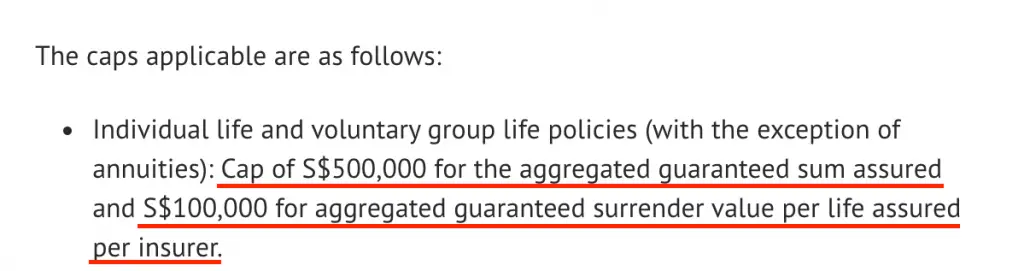

GIGANTIQ is protected under the Policy Owner’s Protection Scheme. This is issued by the Singapore Deposit Insurance Corporation.

This protection is similar to all other insurance savings plans that are in the market.

If Etiqa happens to close down, you will be compensated up to $100k.

If you are still unsure about GIGANTIQ, it offers a free-look period of 14 days. Within these 14 days, you are able to cancel the policy without any penalties.

However, you will still incur the withdrawal fee when you exercise this option.

Is GIGANTIQ worth it?

Here are the pros and cons of this policy:

| Pros | Cons |

|---|---|

| Low initial premium of at least $50 | Withdrawal fee for each withdrawal |

| 1% p.a. guaranteed for first year, with additional 1% p.a. for first $10k | Interest rate of 1% is only guaranteed for first year |

| No lock-in period | Withdrawals and surrender may take up to 6 months to receive your money |

| Minimum account balance of $50 | No recurring transfer option |

| Able to top up and withdraw at any time | |

| Able to top up and withdraw $1 and subsequent multiples of $1 | |

| Able to manage your account with the TiqConnect app | |

| Death benefit of 105% | |

| Protected under Policy Owner’s Protection Scheme | |

| Able to sign up from 16 years old |

So is GIGANTIQ worth signing up for?

GIGANTIQ is a great option for 16-17 year olds

GIGANTIQ is great for 16-17 year olds who are looking for a place to grow your savings.

Most of the other high yield savings accounts like the SingLife Account or Standard Chartered JumpStart require you to be at least 18 years old.

There may be other options for you, such as the Vivid Savings Account.

However, GIGANTIQ may be a better choice as:

- You can earn a higher interest rate for your first $10k (1.8% for the first year)

- You are able to make withdrawals via the app (not possible for Vivid)

You can use GIGANTIQ to grow your savings during these 2 years first. Once you reach 18 years old, you may want to consider other products that you’re eligible for!

GIGANTIQ is also useful if you’re above 18 years old

For those of you who are above 18, I would recommend to use GIGANTIQ in these 2 ways:

#1 Short term savings goal

You may be saving up for a short-term goal. This may be a large purchase that you’re making within the next 1-5 years.

Some examples include:

- Phone / Laptop

- House

- Car

GIGANTIQ can be a good way for you to build up the money for your goals, as you are able to contribute a small sum into GIGANTIQ each month.

With the withdrawal fee, it may discourage you from making too many withdrawals!

The only drawback is that GIGANTIQ does not allow you to set a recurring transfer. You’ll have to remember to contribute to GIGANTIQ each month!

You may want to consider Endowus Cash Smart which provides a return of up to 1.7%. This will be useful especially when GIGANTIQ’s interest rate drops after the first year!

#2 Emergency funds

GIGANTIQ may be a place you can consider to store your emergency funds.

Compared to Etiqa ELASTIQ and Dash EasyEarn, GIGANTIQ is slightly more flexible.

These 2 insurance savings plan only allow you to make a partial withdrawal in multiples of $500 (ELASTIQ) and $100 (EasyEarn).

GIGANTIQ does not have these limitations. You can withdraw any amount, so long as your account has at least $50.

However, it does have liquidity issues:

- You will incur a withdrawal fee for each withdrawal

- You may only receive the amount 6 months later

I would not recommend storing all of your emergency funds in GIGANTIQ.

Instead, you should store some of your emergency funds in a savings account. This is because bank accounts have the highest liquidity.

GIGANTIQ can be your third choice for storing your emergency funds

You may want to store your emergency funds in the SingLife Account as well before GIGANTIQ.

This is because:

- SingLife does not charge you a withdrawal fee

- You withdrawal will take up to 3 hours before it reaches your account

I would recommend GIGANTIQ only as the third choice to store your emergency funds.

Conclusion

In summary, GIGANTIQ is a very accessible plan that you can sign up with as little as $50. It is a good choice to save up for a short-term goal, or as a place to store your emergency funds.

Furthermore with the SingLife Account putting new sign-ups on hold, you may want to consider signing up for GIGANTIQ instead!

For more details of this policy, you can refer to GIGANTIQ’s policy provisions.

Etiqa GIGANTIQ Referral (Receive $15 cash)

If you would like to receive $15 in cash, you can sign up for GIGANTIQ using Etiqa’s TiqConnect portal. This is different from signing up with PolicyPal.

When you use my referral code, “R161532“, I will receive a $30 referral.

I will be happy to split the referral bonus with you, so do contact me so that I can transfer the money to you!

GIGANTIQ PolicyPal Referral Code

Alternatively, you can use my referral link to sign up via PolicyPal. You may want to double check that the referral code ‘FIPHARM‘ is in the field. You will be able to earn P$10 (PolicyPal credits) once you successfully sign up for GIGANTIQ!

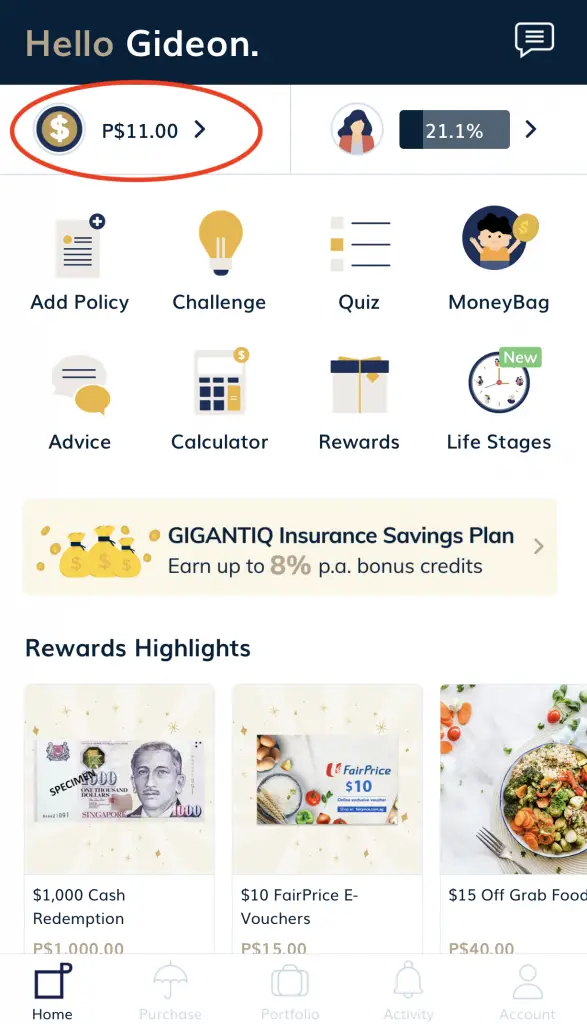

You are able to earn an additional P$10 when you participate in PolicyPal’s MoneyBag game.

PolicyPal Promotion (Up to additional 8% p.a. in PolicyPal credits)

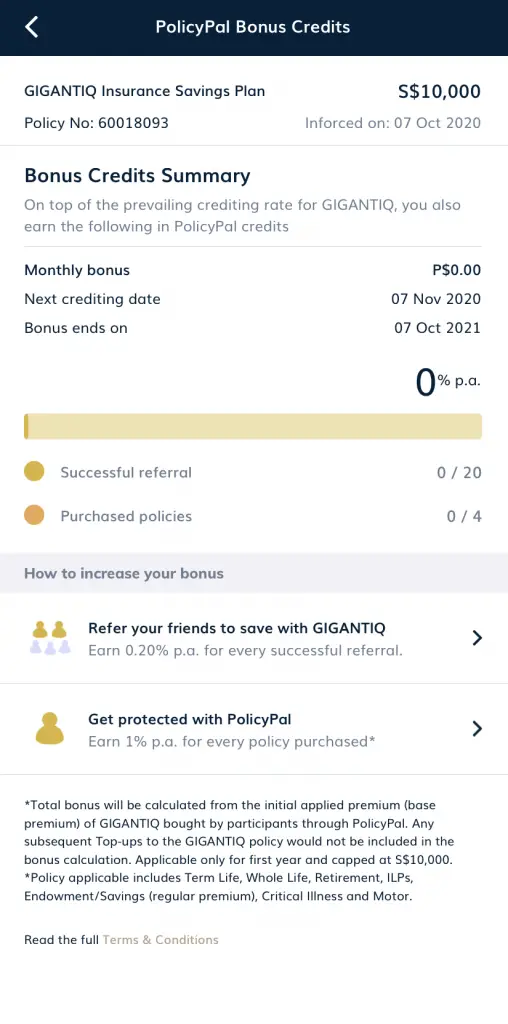

PolicyPal is offering a promotion when you sign up for GIGANTIQ via their platform.

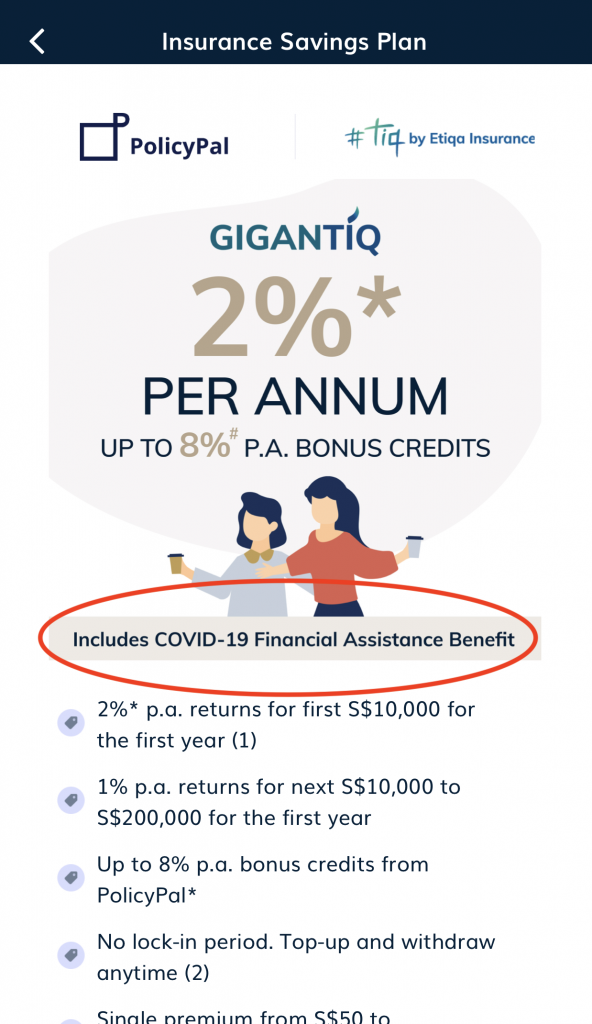

On top of the 1.8% p.a. that you can earn with GIGANTIQ, you are able to earn up to 8% p.a. in PolicyPal credits!

This bonus 8% p.a. will only be for the first $10k that you place in GIGANTIQ.

You can earn this bonus 8% p.a. via 2 ways:

- Refer a friend to purchase GIGANTIQ

- Purchase an additional policy from PolicyPal

Here are the rates that you can receive for each activity you perform:

| Activity | Bonus % | Max Number of Activity | Max Bonus |

|---|---|---|---|

| Friend Referral | 0.2% per friend | 20 | 4% |

| Purchase a policy | 1% per policy | 4 | 4% |

| Total | 8% |

Here are the 7 types of policies that are eligible for this bonus:

- Term Life

- Whole Life

- Retirement

- ILPs

- Endowment / Savings (Advisory – Regular Premiums)

- Critical Illness

- Motor (capped at one per user)

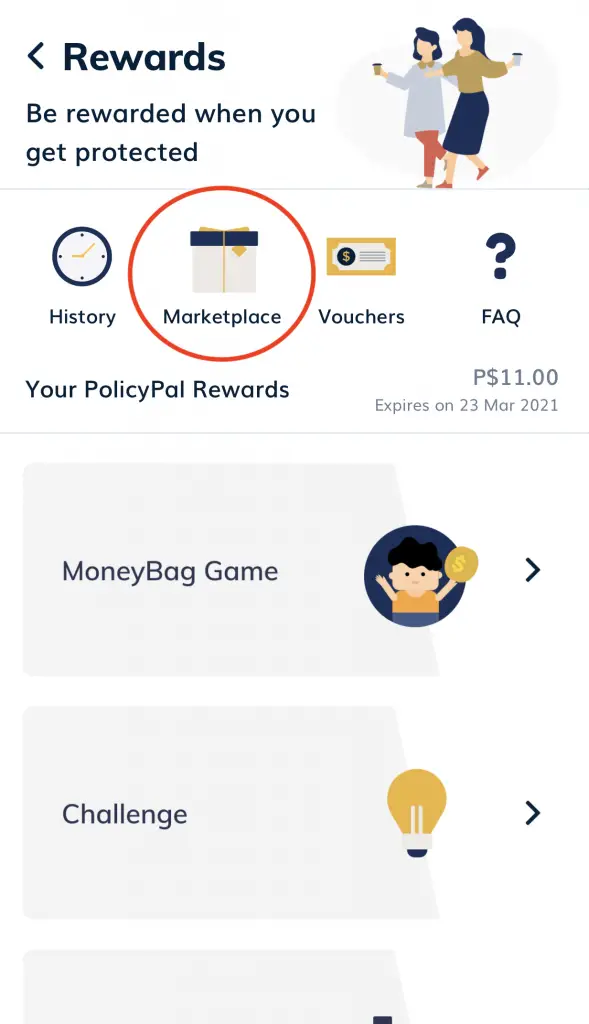

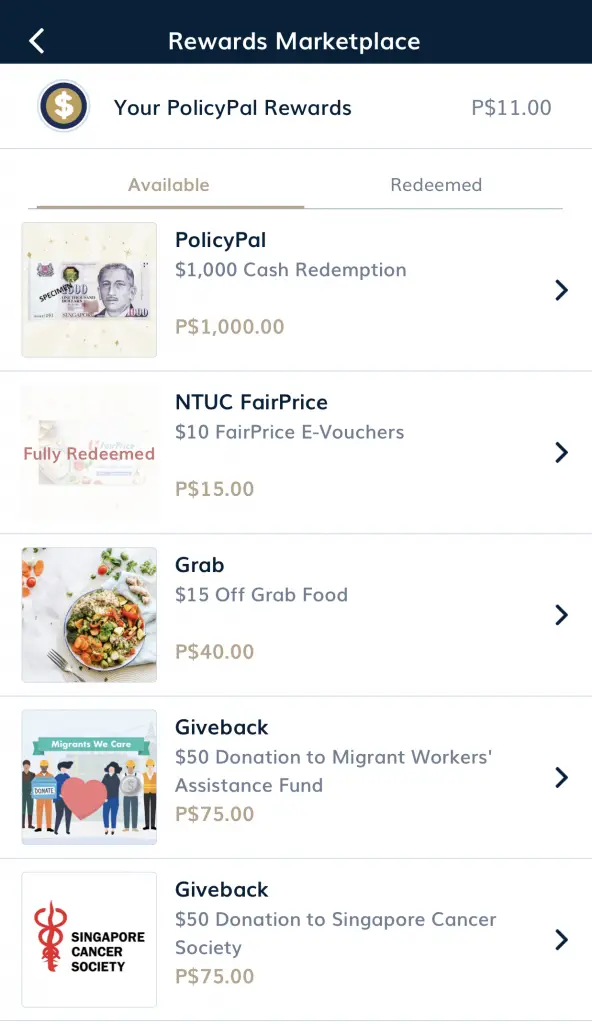

The PolicyPal credits that you earn can be claimed in the PolicyPal Reward Marketplace.

Here’s how you can access the marketplace:

#1 Tap on the PolicyPal credits that you have

#2 Tap on ‘Marketplace’

#3 View the rewards you can redeem

The 3 things that you’ll be able to redeem include:

- Cash

- Vouchers

- Donations

You can only redeem your credits for cash when you’ve accumulated 10,000 credits. As such, you may consider aiming for the vouchers instead.

Morerover, this promotion is only available for your initial deposit amount. If you make any top-ups after your initial premium, these will not be considered in the bonus calculation.

To maximise the credits you earn, you should make an initial deposit of $10k!

You are able to view the bonus that you’ve earned via the PolicyPal app.

For more details of this promotion, you can refer to its Terms and Conditions.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

No Comments