Last updated on June 6th, 2021

You’ve seen many people advising you to invest in the IWDA. It is one of the most globally diversified ETFs out there.

However, you also chanced upon the SWRD ETF, and it looks exactly the same as the IWDA! How are these 2 ETFs different and which one should you choose?

Here’s a comparison between them.

Contents

IWDA vs SWRD

IWDA and SWRD are similar ETFs which track the MSCI World Index. They are managed by different fund managers, and differ slightly from each other. IWDA has both a higher expense ratio and liquidity. SWRD which is the newer fund, has both a lower expense ratio and liquidity. In the end, investing in either ETF will not really make much of a difference.

Both ETFs are managed by different companies

IWDA is managed by iShares, while SWRD is managed by SPDR.

You may be wondering why SWDA shows up on the iShares site instead of IWDA. You can read my comparison of IWDA vs SWDA to see how they are different.

IWDA is the earlier ETF which was launched in Sep 2009. The SWRD was launched much later in 2019!

As such, IWDA has a larger asset under management (AUM).

| ETF | Net Asset Under Management |

|---|---|

| IWDA | $24 billion |

| SWRD | $300 million |

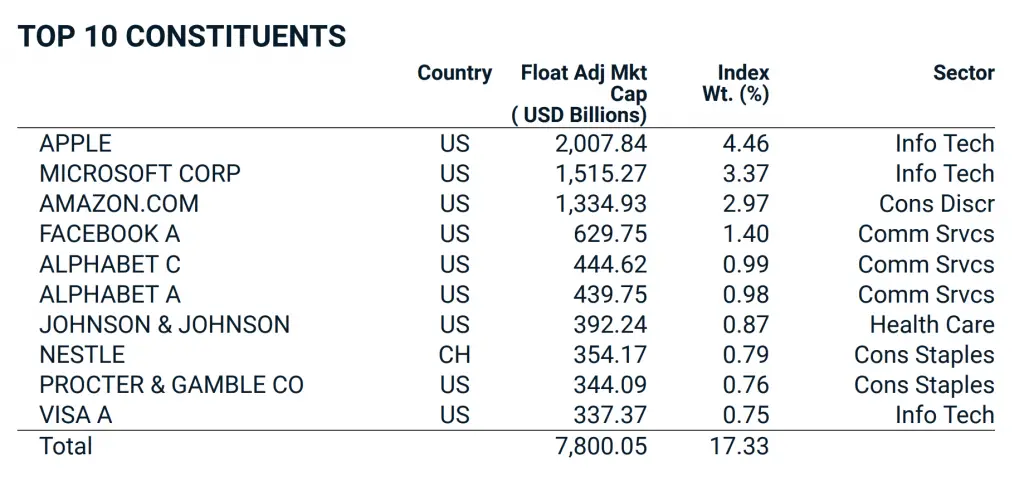

Both track the MSCI World Index

Both of these ETFs are managed by different fund managers. However, they both track the same MSCI World Index.

The MSCI World Index captures the best performing large and mid cap companies across 23 developed markets.

Some of its major holdings include Apple, Microsoft and Amazon.

Since both of these funds track the same index, they should have very similar returns.

Both are accumulating ETFs

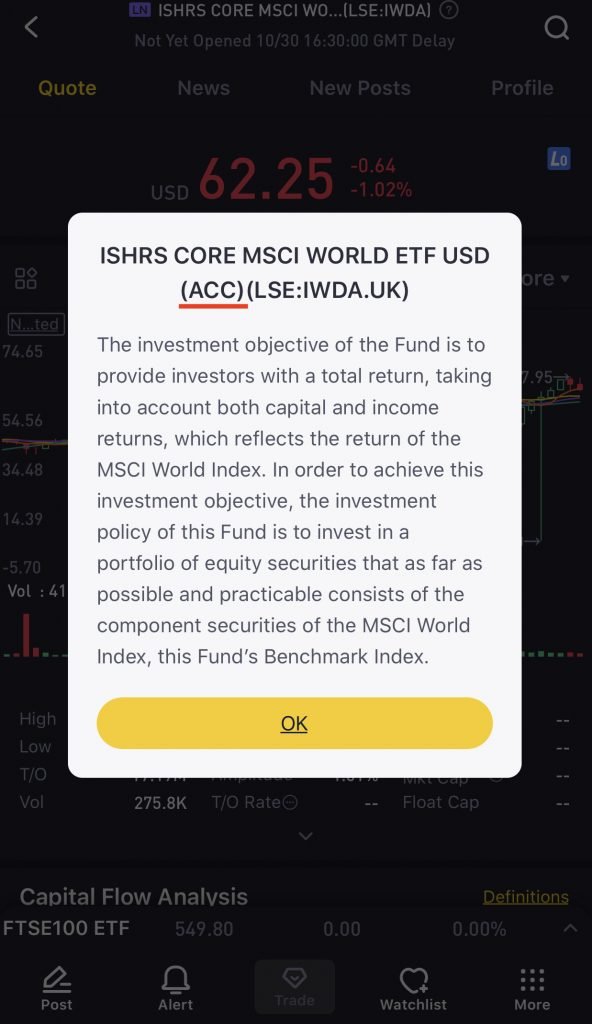

Both of these funds are accumulating ETFs that are listed on the LSE.

These funds will usually have ‘ACC‘ at the back of the fund name.

Here’s how the IWDA looks like on Tiger Brokers:

You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

You will not receive a dividend from accumulating ETFs

This means that the dividends that you receive will be reinvested into the fund.

As such, you will not be able to receive any dividends from either fund!

You can read my comparison between accumulating and distributing ETFs to see how they are different.

They have different expense ratios

Since the returns are rather similar, the cost is something that you should consider.

Here are the expense ratios of the 2 funds:

| ETF | Expense Ratio |

|---|---|

| IWDA | 0.20% |

| SWRD | 0.12% |

Even though SWRD is the newer fund, it is able to charge a lower expense ratio.

IWDA has a higher trade volume

If you are frequent trader, you may be concerned with the ETF’s liquidity. One of the indicators of an ETF’s liquidity is the ETF’s trade volume.

Here are the average trade volumes of these 2 funds on the LSE:

The IWDA is an older fund and more well established. As such, it has a much higher trading volume than the SWRD.

Verdict

Here’s a summary of the comparison between IWDA and SWRD:

| Comparison | IWDA | SWRD |

|---|---|---|

| Fund Manager | iShares | SPDR |

| Index | MSCI World Index | MSCI World Index |

| Type of ETF | Accumulating | Accumulating |

| Expense Ratio | 0.20% | 0.12% |

| Average Trading Volume | 232,597 | 552 |

Both of them have very similar returns. So which one should you choose?

Choose SWRD if you’re a long-term investor

If you are a long-term investor, the ETF’s liquidity may not really affect you that much. The only issue comes when you decide to sell your holdings.

As such, SWRD may be the better choice since you incur a lower expense ratio.

When you invest, you should always try to lower your costs. Even if the expense ratio is a 0.08% difference, it will add up in the long term!

Choose IWDA if you’re a frequent trader

If you make frequent trades, IWDA may be the better option for you. This is because IWDA has a much higher average trading volume.

As such, you will be able to buy and sell this ETF more easily compared to SWRD.

Conclusion

Both ETFs share very similar traits. As such, it may not really make a huge difference if you choose one over the other.

However, there are definitely some advantages if you:

- Choose IWDA if you’re a frequent trader

- Choose SWRD if you’re a long-term investor

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?