Last updated on June 6th, 2021

You may want to invest in the ARKK ETF, but you notice that Nikko AM is actually offering an ARK fund as well!

How are they different and which one should you invest in?

Contents

The difference between Nikko AM ARK Fund and ARKK

Both funds follow the investment themes that are defined by the ARK Invest team. However, the Nikko AM ARK Fund is a mutual fund, while ARKK is an ETF. This results in a few differences such as the fees you’ll incur and the ways you can invest in them.

Here is a detailed breakdown of these 2 ARK funds:

Fund manager

ARKK is directly managed by the ARK Invest theme. However, both the Nikko AM ARK Fund is managed by Nikko Asset Management, in partnership with ARK Invest.

ARKK was started in October 2014. Meanwhile, the Nikko AM ARK Fund started much later in 2019.

As a result, ARKK has the larger assets under management:

| ARKK | Nikko AM ARK Fund | |

|---|---|---|

| AUM | USD$17.68 billion | USD$8.6 billion |

Investment methodology

Both funds track the 4 themes that are defined by ARK Invest:

| Theme | Definition |

|---|---|

| Genomic Revolution | Advancements in DNA technologies |

| Industrial Innovation | Innovation in energy, automation and manufacturing |

| Next Generation Internet | Innovation in shared technology, infrastructure and services |

| Fintech Innovation | Technologies that make financial services more efficient |

If you are looking to invest in just one of the 4 themes, you can consider investing in these ETFs below:

- ARKG (Genomic Revolution)

- ARKW (Next Generation Internet)

- ARKQ (Industrial Innovation)

- ARKF (Fintech Revolution)

Since they both follow the same methodology, the funds should give you very similar returns. This is before factoring any costs you’ll incur from investing in these funds.

Type of fund

ARKK is an ETF, while the Nikko AM ARK Fund is a mutual fund. The fund type will have some implications in these few areas:

Ways to invest

The ARKK ETF is listed on the NYSE. This means that you can buy this ETF through any broker that allows you to trade in the US markets.

You can read my guide to invest in the ARKK ETF in Singapore to find out more.

Investing in the Nikko AM ARK Fund is more limited

The Nikko AM ARK Fund is not listed on a stock exchange. Unlike ETFs, mutual funds only trade once a day when the market closes.

Moreover, you can only invest in this fund via certain platforms:

You can also invest in this fund with a licensed financial adviser.

Minimum investment

When you invest in the NYSE, the minimum number of units you can purchase is 1.

As such, the minimum amount you can invest in the ARK ETF depends on its price.

Some brokers may allow fractional shares which makes investing in the ARK ETF even more accessible!

However, you’ll need to consider if the fees you incur are worth investing such a small sum.

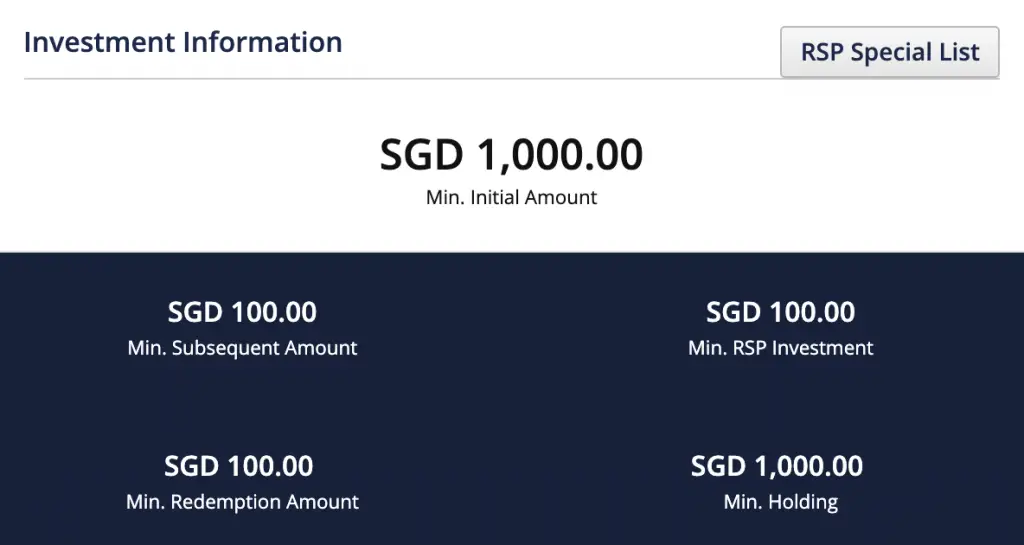

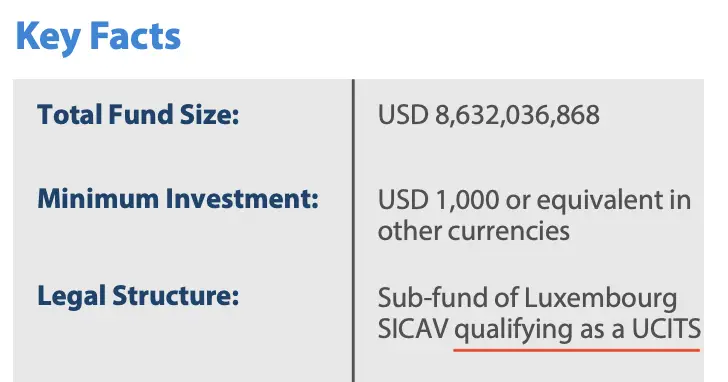

Nikko AM ARK Fund requires a minimum investment of USD$1,000

If you wish to invest in the Nikko AM ARK Fund, the minimum amount you can invest is USD$1,000 or SGD$1,000. This depends on the denomination that you choose.

This is a rather huge sum that you’ll need to start investing in this fund!

Currency

The ARKK ETF is only listed in USD. Meanwhile, the Nikko AM ARK Fund can be denominated in either SGD or USD.

This helps you to save on currency exchange fees as you can just purchase this fund using SGD.

Even though you can purchase units of the Nikko AM ARK Fund in SGD, its base currency is in USD. As such, the underlying assets are still denominated in USD!

However, the fund manager may obtain a better currency exchange rate compared to you. This will still result in some cost savings for you.

Fees

Here are some of the fees you’ll incur when you invest in either fund:

#1 Expense ratio

When you invest in an ETF, the main fee that you’ll incur is the expense ratio.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Both ARKK and Nikko AM ARK Fund charge an expense ratio:

| ARKK | Nikko AM ARK Fund | |

|---|---|---|

| Expense Ratio | 0.75% | 1.5% |

The cost of investing in the Nikko AM ARK Fund is almost twice as much as ARKK!

Both of these expense ratios will be deducted from each unit’s net asset value at the end of each year.

#2 Transaction fees

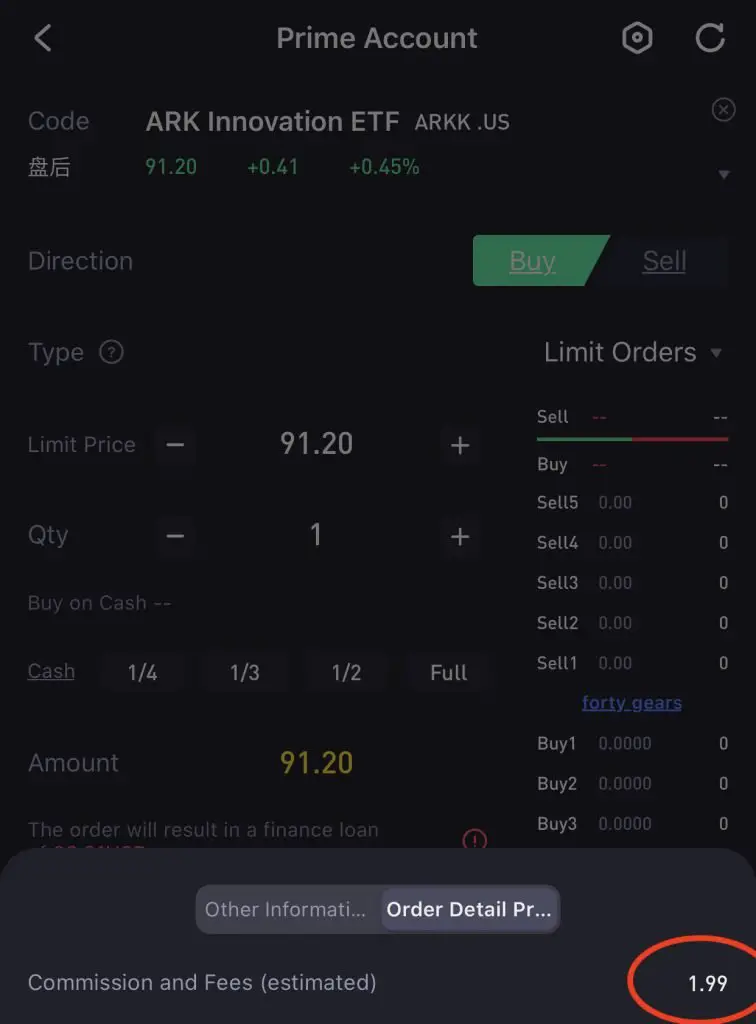

When you are choosing the best brokerage to buy the ARKK ETF, one factor you’ll need to consider is the trading commissions.

TD Ameritrade and Firstrade both offer 0% commission trades.

You may also want to consider Tiger Brokers as it provides really affordable commissions for each trade.

The commissions are really affordable at a minimum of USD$1.99 per trade!

Ultimately, you should choose an online brokerage that you’re most comfortable with.

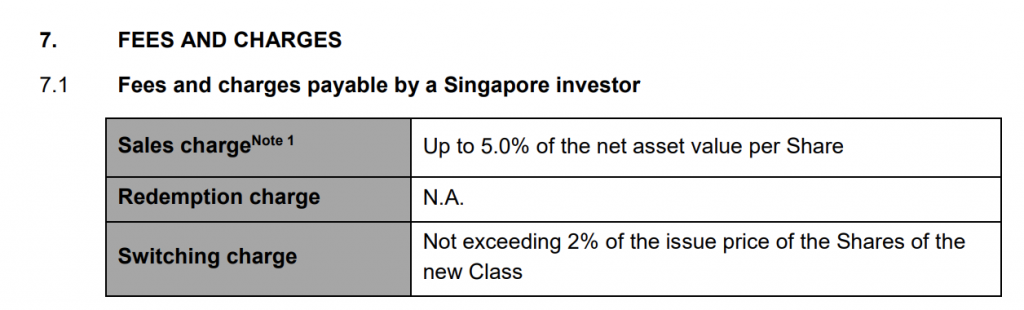

The sales charge for Nikko AM ARK Fund is pretty exorbitant

When you invest in the Nikko AM ARK Fund, you can incur a sales charge of up to 5%.

A sales charge is similar to a transaction fee that is charged by the fund manager.

This sales charge is incurred on the net asset value per share that you purchase. This can be a really hefty fee that you’ll incur!

Estate tax

Another significant cost of investing in US-related assets is the estate tax. This can go from 18% all the way to 26%!

An estate tax is a tax on the right for you to transfer your assets after you have passed on.

Since ARKK is domiciled in the US, it will be included in your taxable estate.

However, the Nikko AM ARK Fund is a UCITS fund.

Even though they own US stocks, you will not incur the estate tax!

If you wish to leave behind a legacy for your loved ones, the Nikko AM ARK Fund may be more ideal to invest in.

Funds to invest

Even though the Nikko AM ARK Fund is listed on Singaporean fund markets, you cannot use your SRS funds to invest in them.

As such, you can only use cash to invest in either fund.

Verdict

Here is a comparison between these 2 funds:

| ARKK | Nikko AM ARK Fund | |

|---|---|---|

| Fund Manager | ARK Invest | Nikko AM (in partnership with ARK Invest) |

| AUM | USD$17.68 billion | USD$8.6 billion |

| Themes Tracked | All 4 of ARK Invest’s themes | All 4 of ARK Invest’s themes |

| Type of Fund | ETF | Mutual fund |

| Ways to Invest | Broker or Kristal AI | Mutual fund platforms |

| Minimum Sum to Invest | Depends on unit price of ETF | USD $1,000 or equivalent |

| Currency | USD | USD or SGD |

| Expense Ratio | 0.75% | 1.5% |

| Transaction Fees | Depends on broker | Sales charge of up to 5% |

| Estate Tax | Yes | No |

| Funds to Invest | Cash | Cash |

The choice seems pretty obvious when comparing these 2 funds. While the Nikko AM ARK Fund can be denominated in SGD, there are many drawbacks, such as:

- High expense ratio and sales charge

- Large minimum amount to invest (USD$1,000 or equivalent)

As such, you may want to consider investing in the ARKK ETF instead.

Conclusion

The ARKK ETF seems to be the better option to invest in. The major drawback about this ETF is that you’ll incur the US estate tax once your assets exceed USD$60k.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?