Last updated on November 22nd, 2021

You’ve decided to start investing with StashAway. However, you may be wondering how do you go about withdrawing money from this robo-advisor!

Here’s what you need to know about withdrawing your money from StashAway:

Contents

- 1 How to withdraw from StashAway

- 2 How long does a withdrawal from StashAway take?

- 3 Are there any fees charged when I withdraw from StashAway?

- 4 Is there a limit to the amount I can withdraw from StashAway?

- 5 Am I able to withdraw a partial amount of my money on StashAway?

- 6 Can I withdraw my money from StashAway at any time?

- 7 Conclusion

- 8 👉🏻 Referral Deals

How to withdraw from StashAway

Here are the steps you’ll need to withdraw your money from StashAway:

- Go to your portfolio and select withdraw

- Select the reason for withdrawal

- Select your withdrawal amount

- Select the bank account to transfer the money to

- Confirm the withdrawal

- Receive the money

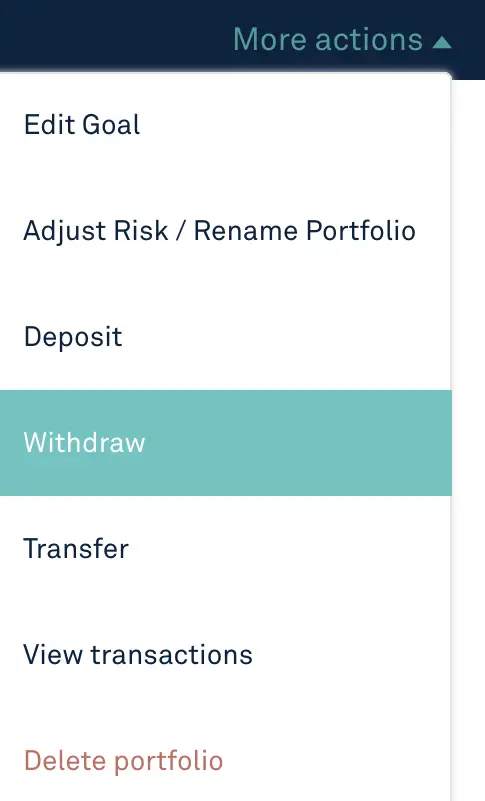

#1 Go to your portfolio and select withdraw

On your homepage, you can select the portfolio which you wish to withdraw your funds from.

StashAway has 3 different portfolios you can choose from:

Once you’ve selected your portfolio, you can click on the ‘Withdraw‘ button. This can be found under ‘More Actions‘.

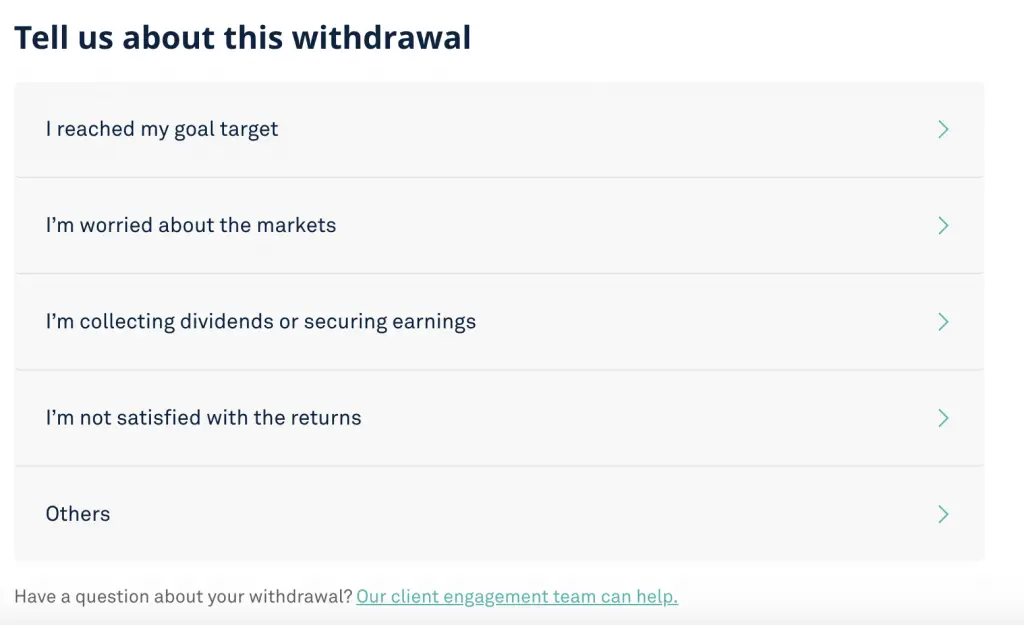

#2 Select the reason for withdrawal

StashAway will ask you for the reason for your withdrawal. You will need to select a reason before you can proceed.

#3 Select your withdrawal amount

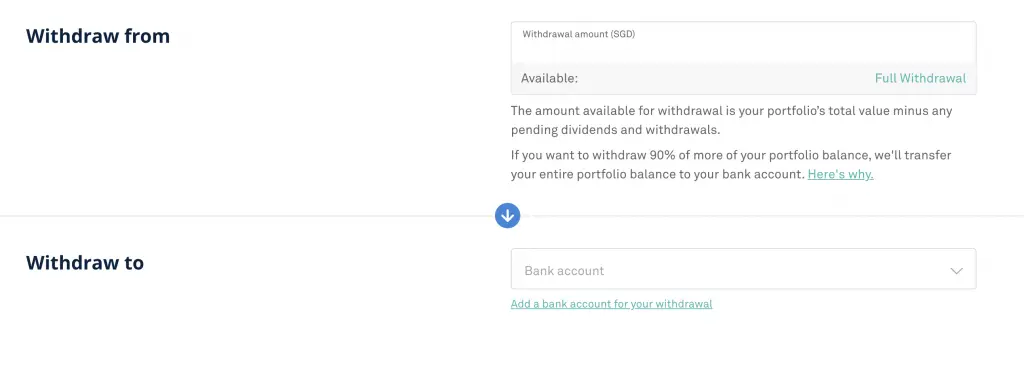

You will need to select how much you withdraw from your portfolio.

If you choose to withdraw more than 90% of your portfolio, StashAway will redeem your entire portfolio.

This is a general rule of thumb for other robo-advisors as well.

StashAway needs to sell the ETFs you own to liquidate it into cash. When you only have around 10% of your portfolio left, you may only own a few units of each ETF in your portfolio.

As such, it is more practical for you to withdraw your full amount!

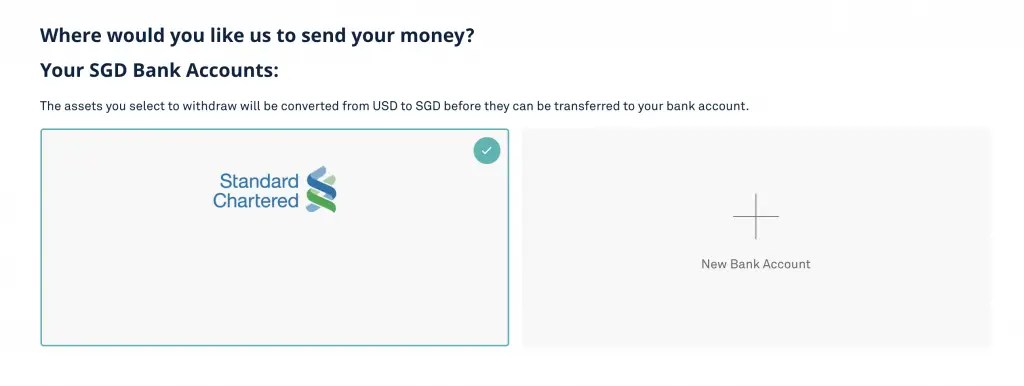

#4 Select the bank account to transfer the money to

You can either choose an existing account or add a new bank account. This is the account that StashAway will transfer your funds to.

You can only withdraw you funds to a bank account under your own name! This is part of the legal requirements set out by the MAS.

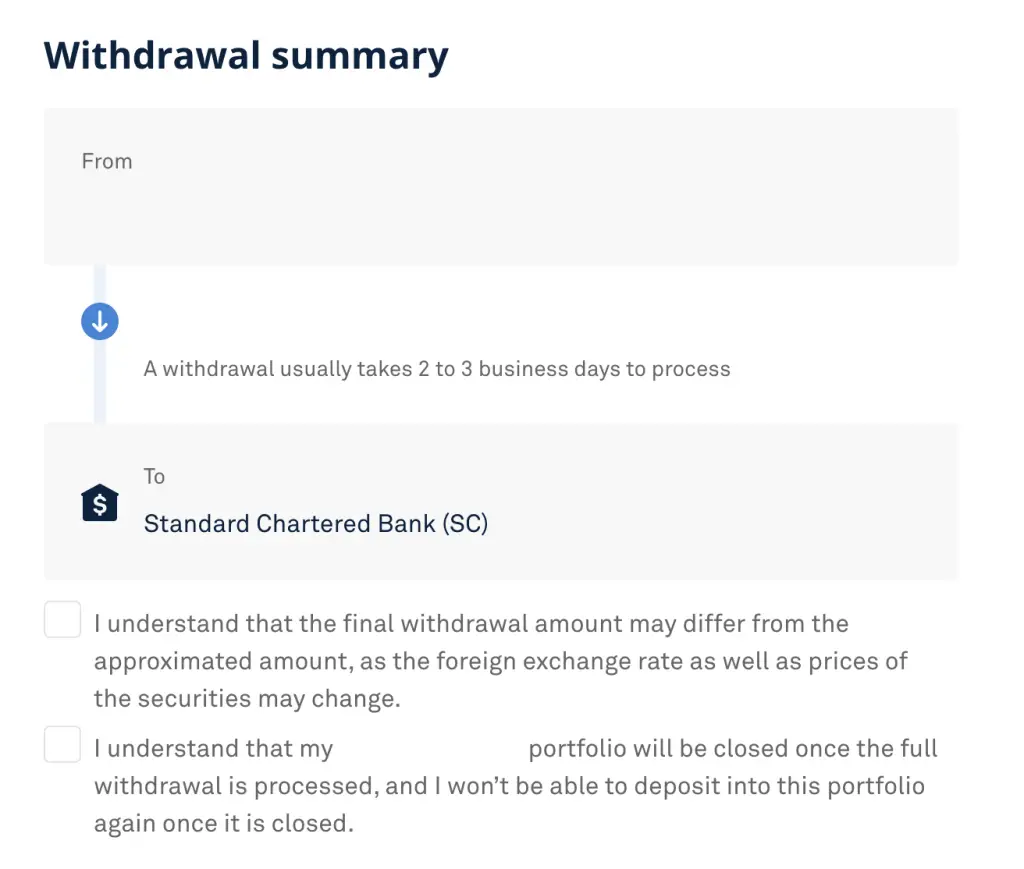

#5 Confirm the withdrawal

The last step you’ll need to do is confirm your withdrawal.

There is a disclaimer that the amount you receive in your bank account may differ from the amount that you choose to withdraw.

This is because there are some factors that might affect your actual portfolio’s value:

- Exchange rate fluctuations

- Price fluctuation of the ETFs you own

If you are withdrawing from StashAway Simple or the Income Portfolio, then you do not need to worry about the exchange rate.

This is because both portfolios are denominated in SGD.

However, StashAway’s General Investing portfolios invest your money into US-listed ETFs. They are all denominated in USD.

As such, your portfolio’s value may change slightly due to the exchange rate!

Moreover, the prices of the ETFs you own may fluctuate. This is because StashAway can’t sell all of your units immediately when you place the order.

The amount that you receive in the end may be higher or lower than what was shown as your portfolio’s value!

#6 Receive the money

You’ll receive a confirmation of your redemption order.

You will be notified by email and on the mobile app once your withdrawal has been completed.

I withdrew from my StashAway Simple portfolio, and it took 4 days for the funds to appear in my bank account!

If you invested your SRS funds with StashAway, the funds will be transferred back to your SRS account.

How long does a withdrawal from StashAway take?

The length of the withdrawal process depends on which portfolio you’re withdrawing from. Here are the general guidelines given by StashAway:

| Portfolio | Days Required For Withdrawal |

|---|---|

| Global Portfolio | 2-3 business days |

| Income Portfolio | 2-3 business days |

| StashAway Simple (Cash) | 3-4 business days |

| StashAway Simple (SRS) | 4-5 business days |

This is similar to the withdrawal time taken for Syfe, but slightly shorter compared to Endowus.

There are a few things that StashAway needs to do before they can transfer your money. This includes:

- Selling your ETFs

- Converting from USD to SGD (if needed)

- Transferring your money from StashAway’s trust account to your bank account

StashAway allows you to purchase fractional shares.

This is the reason why there is no minimum amount required to start investing with StashAway.

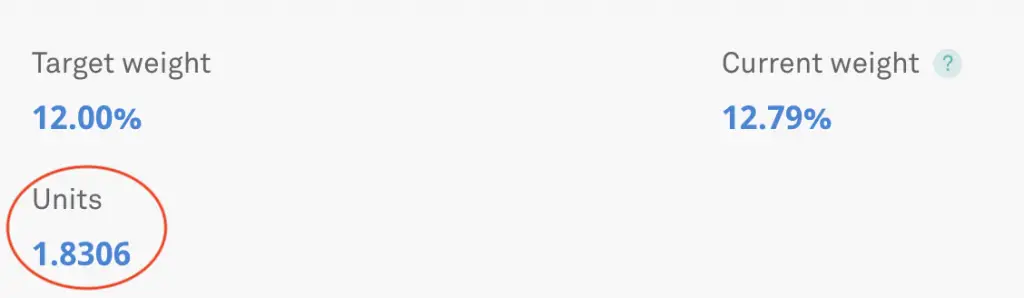

When it comes to selling your assets, you may have difficulties selling the fractional units. This is because you can’t sell 0.8306 units of an ETF on the NYSE, as the minimum unit size is 1.

It is even harder to sell ETFs on the SGX as their minimum lot size is 10 units!

You will need to wait for another StashAway customer to sell their units as well. Only then will you be able to combine your fractional shares with them to be sold on the market.

However, this does not affect StashAway Simple since your money is placed into LionGlobal’s mutual funds.

As such, it may take a while before you are able to sell off your ETF units!

Are there any fees charged when I withdraw from StashAway?

StashAway does not charge you any fees for withdrawing to a bank account. If you are withdrawing to an international account, you may incur some fees with your bank.

This includes:

- Currency conversion fees

- Fees for receiving overseas telegraphic transfers

It is possible for you to withdraw USD from the bank account, but only if you’ve previously deposited USD into StashAway.

Any withdrawal fees have already been included in StashAway’s management fees.

Is there a limit to the amount I can withdraw from StashAway?

There is no minimum amount required for you to withdraw from your StashAway portfolio. The withdrawal limit will be the value of your entire portfolio.

You are even able to withdraw just $1 from your portfolio!

Am I able to withdraw a partial amount of my money on StashAway?

It is possible for you to withdraw a partial amount of your money with StashAway.

Can I withdraw my money from StashAway at any time?

It is possible for you to withdraw your money from StashAway at any time. There is no lock-up period which allows you to make a withdrawal request whenever you require your funds.

Unlike other platforms, StashAway does not have a lock-up period. This means that you are able to freely withdraw your funds at any time!

However, there may still be some processing time needed for StashAway to sell your portfolio before transferring the funds to your bank account.

Conclusion

Withdrawing with StashAway is very simple, and you are not charged any fees for withdrawals that you make.

However, you may be charged some fees by your overseas bank.

It will take at most 5 business days for your funds to be transferred to your account, which is similar to other robo-advisors like Endowus or Syfe.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?