Last updated on June 18th, 2021

Every robo-advisor has their own cash management plan. There are so many different portfolios you can choose from!

Here’s a breakdown of StashAway Simple and Endowus Cash Smart to help you make a better decision:

Contents

The difference between Endowus Cash Smart and StashAway Simple

Both are cash management portfolios that allow you to earn better returns on your cash, while having good liquidity. Cash Smart differs from StashAway Simple mainly in terms of the minimum amount to invest, the type of funds they invest in, and the relative liquidity of your funds.

Here’s an in-depth comparison between these 2 portfolios:

Funds invested

Both of these cash management portfolios invest your money into 3 different types of funds:

- Money market funds

- Short-term bond funds

- Cash funds

These funds have a rather higher liquidity as they can be bought and sold rather quickly. However, their returns are lower compared to other less liquid instruments. Some of these instruments include:

- Stocks

- Bonds

There is always a tradeoff between returns and liquidity. This is why money in your bank accounts (the most liquid) will have the lowest returns!

Here are some of the funds that these cash management portfolios invest in:

#1 LionGlobal SGD Money Market Fund

This fund will invest your money in 2 main instruments:

- High quality short-term money market instruments

- Debt securities

Some of the types of investments that this fund will invest in include:

- Government and corporate bonds

- Commercial bills

- Deposits with banks

The aim of this fund is to provide a return that is similar to SGD fixed deposits.

#2 LionGlobal SGD Enhanced Liquidity Fund SGD Class I Acc

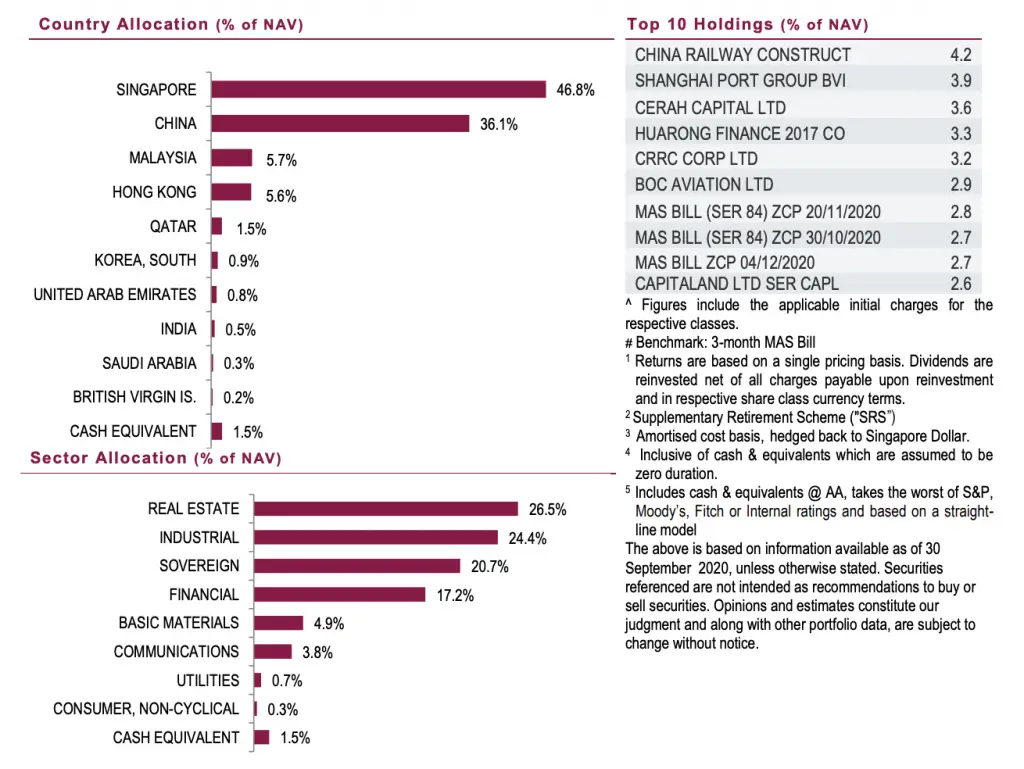

The LionGlobal SGD Enhanced Liquidity Fund aims to invest in high quality debt instruments. Here is the allocation of where your funds will be invested in.

The main things you would want to take note include:

- The assets are heavily weighted in Singapore (almost 50%)

- It is pretty diversified across different sectors

#3 Fullerton SGD Cash Fund

The Fullerton SGD Cash Fund aims to provide you with a return that is comparable to fixed deposits. Your funds will be placed in Singapore Dollar Deposits.

Here are the main banks where your funds will be deposited in.

The returns that you receive are based on fixed deposit rates. As such, the returns you earn on your funds will be stable, but rather low.

Grab AutoInvest and MoneyOwl WiseSaver invest in this fund as well.

#4 UOB United SGD Fund

The UOB United SGD Fund will invest your funds in these few instruments:

- Money market

- Short term interest bearing debt instruments

- Bank deposits

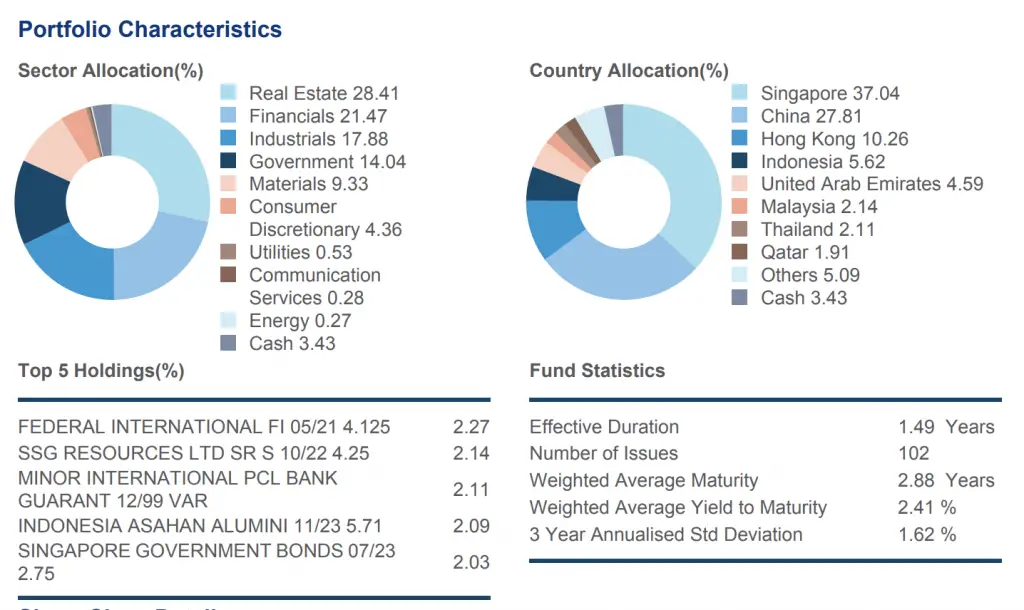

This fund aims to provide you a better return compared to Singapore dollar deposits. Here are some characteristics of this fund:

These are some things you may want to take note of:

- The fund is less weighted to Singapore (only an allocation of 37%)

- The top 5 holdings are more spread out (each only constitutes around 2% of the entire fund)

The UOB United SGD Fund does provide a higher yield (annualised return of 2.22%). However, it is considered to be riskier than the previous 2 funds. This is because it has the highest duration and credit risk.

Types of portfolios

StashAway Simple only has 1 portfolio, while you can choose from 2 different portfolios with Cash Smart:

- Cash Smart Core

- Cash Smart Enhanced

Here is a breakdown of the fund allocation in the different portfolios:

| Fund | StashAway Simple | Cash Smart Core | Cash Smart Enhanced |

|---|---|---|---|

| LionGlobal MMF | 50% | ✕ | ✕ |

| LionGlobal Enhanced Liquidity Fund | 50% | 50% | 50% |

| Fullerton SGD Cash Fund | ✕ | 50% | ✕ |

| UOB United SGD Fund | ✕ | ✕ | 50% |

With these different funds being used, this will affect the performance of each portfolio.

Fees charged

Here are the fees charged when you use either of these cash management portfolios:

StashAway Simple does not charge any fees

StashAway does not charge any fees to use their cash management portfolio.

However from time to time, the yield that this portfolio gives you may be less than their projected rate. In this scenario, StashAway will rebate some of the trailer fees that they receive.

This is to ensure that you will still be able to earn the projected rate of return that StashAway advertised.

Endowus charges a 0.05% access fee

Endowus charges an access fee of 0.05% a year for their Cash Smart portfolio. This fee is deducted from your total average daily assets with Endowus each quarter.

Fund level fees

These fees are charged by the different funds that make up each portfolio.

Here are some things that the fund level fees consist of:

- Management fee given to the fund manager

- Expenses incurred by the fund (e.g. marketing)

The fund level fees differ for each fund, and are mainly calculated as a blended rate.

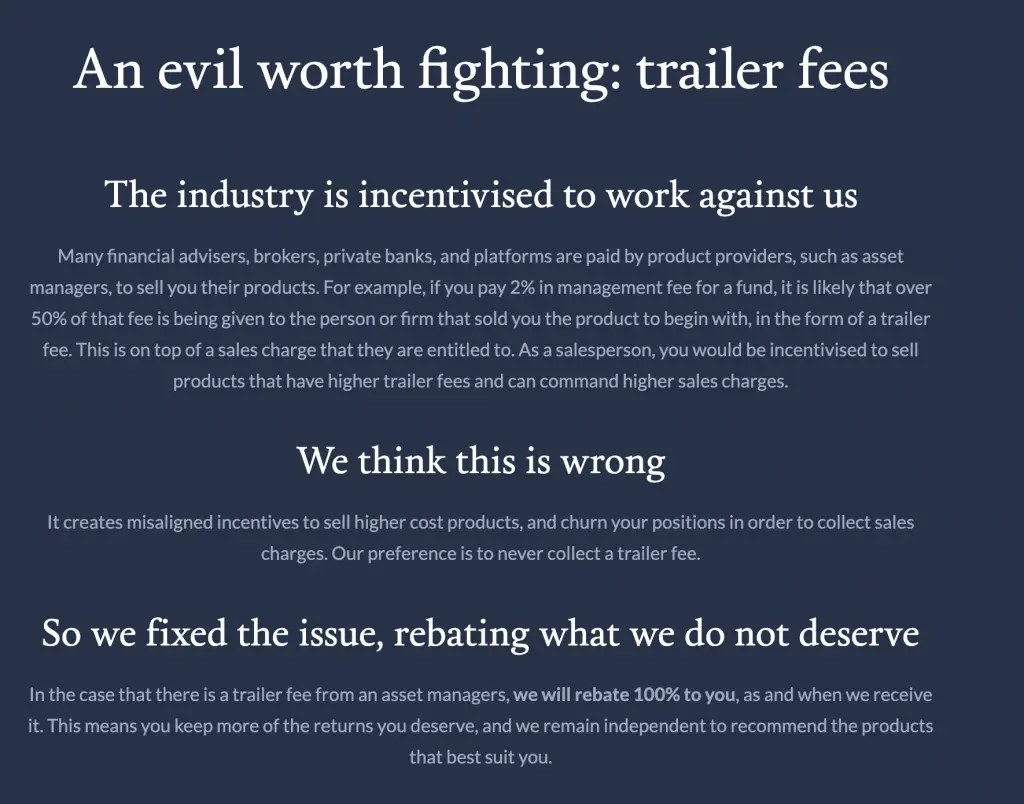

Trailer fees

Some funds will charge a trailer fee when you invest in their funds as well.

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

Endowus gives you back 100% of the trailer fee that the funds charge you.

As such, you can have quite a bit of cost savings by not paying these fees!

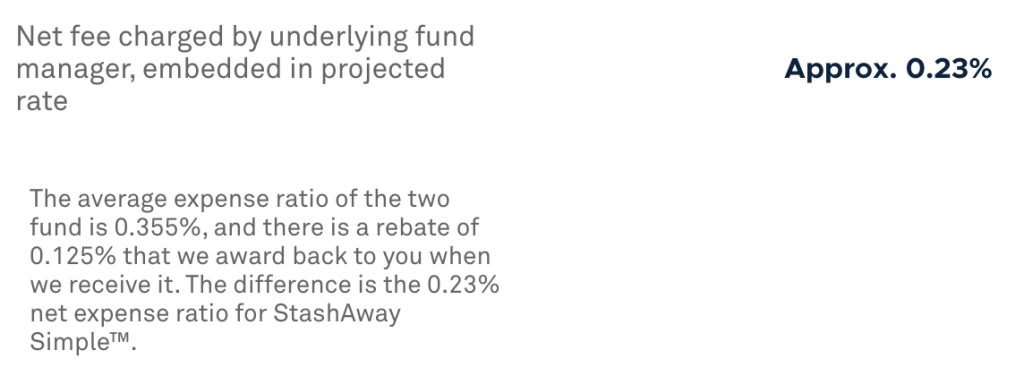

StashAway will give some trailer fee rebates as well. The fund level fees for StashAway Simple is a blended 0.355%.

After giving you the rebate of 0.125%, your total expense ratio will be reduced to around 0.23%.

Performance

The returns that are being advertised for these portfolios are after the deduction of any fees charged.

| StashAway Simple | Cash Smart Core | Cash Smart Enhanced | |

|---|---|---|---|

| Projected Return | 1.1% – 1.2% | 1.8% – 1.9% | |

| Fund-Level Fees | (0.23%) | (0.18%) | (0.3%) |

| Platform Fees | 0% | (0.05%) | (0.05%) |

| Net Return | 1.2% | 0.8% – 0.9% | 1.2% – 1.4% |

The net return that you see is the projected return rate that you will receive.

You may notice that Endowus gives you a range of returns, rather than a fixed number.

Endowus believes in giving you full transparency on the yields of the portfolios. The returns that you earn in your investments may fluctuate each day.

This is because your returns are tied to the interest rates of that day.

As such, a range of projected returns will help you to see how well the portfolio performs in both scenarios:

- When the market is bad

- When the market is performing well

The projected rate of returns have been dropping

Both cash management portfolios have decreased their projected rate of returns. Initially, their rate of returns used to be higher!

StashAway Simple used to provide a 1.9% return

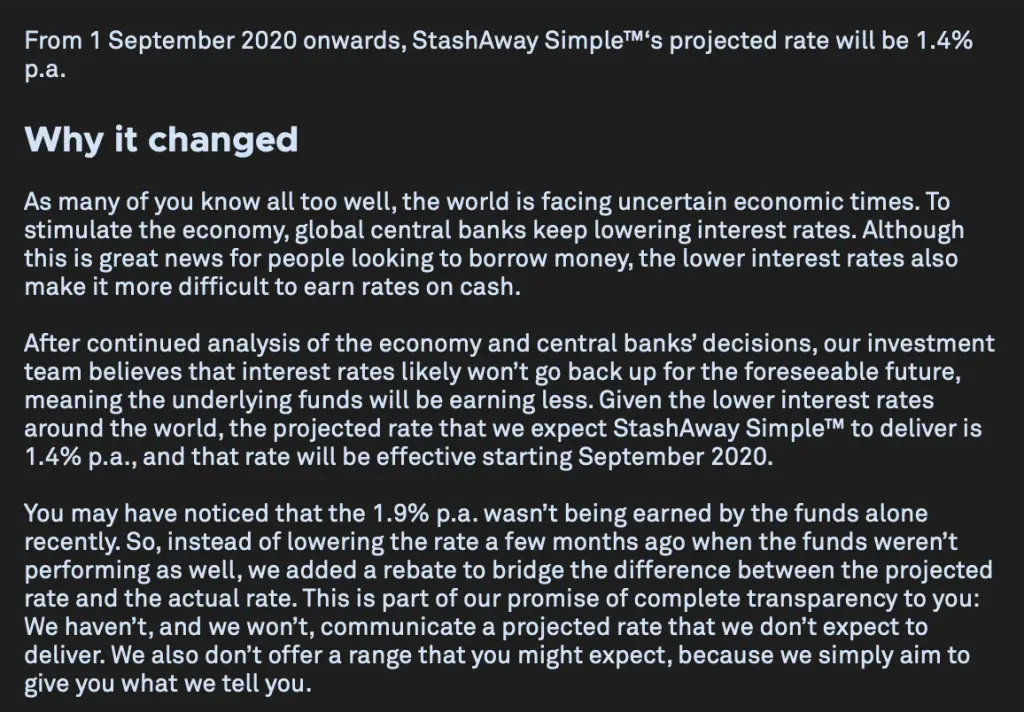

Back in late 2019, StashAway Simple was still able to provide you with a 1.9% return. However, StashAway announced that they will be decreasing the return from 1.9% to 1.4% from September 2020.

StashAway could no longer afford to continue giving you rebates to make up to the 1.9% return rate. As such, they decided to decrease the return to 1.4%.

Cash Smart rates have been dropping too

When Endowus first launched Cash Smart, these were the rates that they were advertising:

| Core Portfolio | Enhanced Portfolio | |

|---|---|---|

| Projected Rate of Return | 1.1% – 1.3% | 1.9% – 2.2% |

You can view this in their webinar below:

However, the interest rates being offered by banks have been falling. Since the funds in Cash Smart are reliant on these interest rates, the yield has been decreasing as well.

Nevertheless, interest rates across the board have been falling. You will still be able to receive a higher yield compared to leaving your money in your bank account!

As such, you should only be investing money that you’re saving for your short term goals into this portfolio. The funds are still relatively liquid and you are able to earn a pretty decent return as well.

Minimum sum required

Both of these portfolios have a different minimum sum required to invest in them:

StashAway Simple has no minimum investment

StashAway Simple makes it really simple for you to start earning a higher return. It does not have any minimum amount to start putting your funds into this portfolio.

If you have a lower sum than that is required to use Endowus, StashAway Simple may be better for you.

Endowus requires you to have a minimum of $1k to start using their platform

The major barrier you may face when wanting to use Endowus is the minimum of $1k required.

This minimum investment can come from 3 different sources:

- Cash

- SRS

- CPF

You are able to combine funds from your Cash, SRS and CPF to reach the $1k total. Moreover, you can use these funds to invest in Endowus’ other portfolios, such as:

- General Investing (for Cash, SRS or CPF)

- Fund Smart

This may be a huge initial amount if you are just starting to invest. As such, this is something you should consider first before you start to use Endowus.

You are required to transfer a minimum of $100 for each transaction

On top of this $1k requirement, there is a minimum amount of $100 for each transaction you make with Cash Smart.

Compared to StashAway Simple, Cash Smart has a much higher barrier to entry. This is another trade-off you’ll need to consider, which is between:

- The minimum amounts required to use the platforms

- The returns you are receiving

Type of funds to invest

Both Cash Smart and StashAway Simple allow you to use either cash or your SRS funds to invest in these portfolios.

This is especially if you are risk adverse and do not want to invest your SRS funds!

Deposits and withdrawals

Another thing you’ll have to consider is the time it takes to process your deposits and withdrawals.

This is important as it’ll help you to determine how liquid your funds really are!

Cash Smart takes a longer time before you can receive your funds

When I deposited some money with Cash Smart, it took 3 working days before the funds were invested.

For withdrawals, it will take 6 days (cash) or 10 days (SRS), depending on the source of funds that you use.

StashAway takes a slightly shorter time to process your transactions

If you use StashAway Simple, the processing time is much shorter. When you make a deposit, the amount of days taken will depend on the funds you used to invest:

| Cash | SRS | |

|---|---|---|

| Number of Business Days Before Funds are Invested | 2-3 business days | 3-4 business days |

StashAway also mentioned that it will take 3-4 business days before your money is sent back to you.

From my experience, it took 4 business days before the funds arrived in my bank account.

As such, StashAway Simple is the more liquid portfolio compared to Cash Smart.

Safety of your funds

These 2 robo-advisors handle your assets differently. StashAway stores all of your funds in a co-mingled account. This account includes all of the funds that all their customers have invested.

This is one reason why they are able to have no minimum investment for their investment portfolios.

However, Endowus manages your assets under your own name. You are required to create an account with UOB Kay Hian where all of your assets will be held.

Even if Endowus closes down, you will still be able to control the fate of your assets!

The type of account may not be really relevant for cash management portfolios

However, these differences mainly come into play when you use StashAway’s investment portfolios. Due to the co-mingled account, you will own fractional shares of the ETFs in the portfolio.

For cash management portfolios, your funds are invested in mutual funds. Since they allow you to purchase fractional shares, you still will have some control over how you can manage your assets.

To find out more about how robo-advisors manage their assets, you can view my analysis on why Smartly closed down.

Verdict

Here is a breakdown between Endowus Cash Smart and StashAway Simple:

| Endowus Cash Smart | StashAway Simple | |

|---|---|---|

| Funds Invested | LionGlobal Enhanced Liquidity Fund Fullerton SGD Cash Fund UOB United SGD Fund | LionGlobal MMF LionGlobal Enhanced Liquidity Fund |

| Number of Portfolios Available | 2 (Core and Enhanced) | 1 |

| Platform Fees | 0.05% | 0% |

| Trailer Fee Rebates | Yes | Yes |

| Performance | 0.8% – 0.9% (Core) 1.2% – 1.4% (Enhanced) | 1.2% |

| Minimum Sum to Invest | $1k to use platform $100 for each transaction | No minimum |

| Type of Funds | Cash SRS | Cash SRS |

| Relative Liquidity | Longer time required to withdraw | Shorter time required to withdraw |

| Type of Account Used to Manage Your Funds | Assets held under your own name | Assets held in a co-mingled account |

Which portfolio should you choose?

Choose Endowus Cash Smart if you are ok with a slightly higher return and a lower liquidity

Cash Smart provides a slightly higher return compared to StashAway Simple. However, the main tradeoff you will need to consider is its relatively lower liquidity.

It takes almost twice as long for Cash Smart to transfer the funds to your bank account. As such, Cash Smart should not be used as a place to store all of your emergency funds!

Instead, you should be choosing somewhere that is much more liquid, such as a normal savings account.

You will need to decide if this lower liquidity is worth getting that slightly higher return!

Choose StashAway Simple if you have a lower minimum sum to invest

StashAway Simple provides an extremely accessible way for you to earn high returns on your savings.

It does not have any minimum amount to invest, compared to Endowus which requires a minimum initial investment of $1k.

Moreover, StashAway Simple is slightly more liquid than Endowus Cash Smart. This is because it takes a shorter number of working days for your funds to be withdrawn.

StashAway Simple will be more appropriate for you if:

- You are comfortable with a higher yield than your savings accounts

- You do not have a large amount of money to invest with Endowus

Conclusion

The projected returns are rather similar for both portfolios. As such, it would not really make a huge difference when you decide to invest in one portfolio over the other.

Some of the main considerations you’ll need to have include:

- The amount you can invest into the portfolio

- How liquid you would like your funds to be

- The amount of fees you’re willing to pay

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?