Last updated on June 6th, 2021

If you’ve applied for a FRANK education loan, you may have been asked to create an OCBC FRANK account as well.

So you may ask, should you be opening this bank account?

Here’s how this bank account works and whether you should use it:

Contents

- 1 What is the OCBC FRANK account?

- 2 Am I eligible for the FRANK account?

- 3 How do I open a FRANK Account?

- 4 What are the characteristics of the FRANK account?

- 5 What are the interest rates for the FRANK account?

- 6 What investment benefits does the FRANK account offer?

- 7 How do I close my FRANK account?

- 8 Verdict

- 9 Is the OCBC FRANK account good?

What is the OCBC FRANK account?

The FRANK account is provided by OCBC bank. This account is mainly targeted at students who are preparing to enter into university and the workforce.

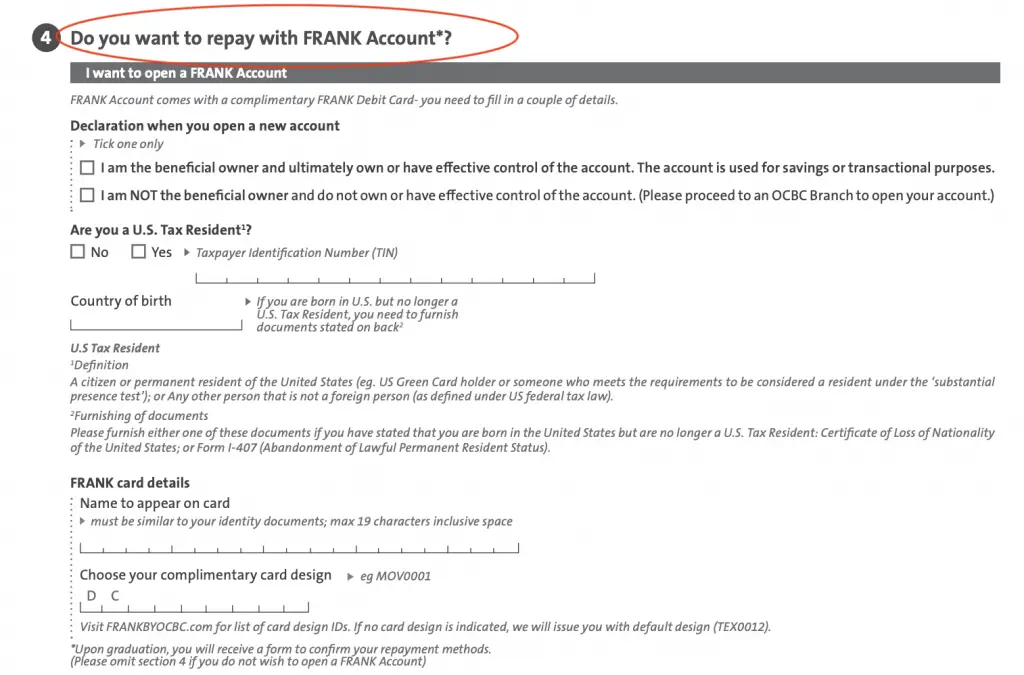

When you apply for the FRANK education loan, you will be asked if you wish to create a FRANK account.

Moreover, you will be given a complimentary FRANK debit card when you create your account.

Is OCBC FRANK a savings or current account?

You may be wondering if OCBC FRANK is considered as a savings or current account.

A current account is a transactional account, mainly for making payments.

Meanwhile, a savings account provides you with an interest rate on your savings.

SingSaver

Based on these definitions, the FRANK account will be considered as a savings account. You are earning interest on the funds that you’ve placed in this account.

Can I create a joint account?

You are able to open a joint FRANK account. However, the FRANK account is only limited to 2 joint account holders.

If you are the primary account holder and are older than 26 years old, the minimum balance will take effect.

What is the branch code of my FRANK account?

Usually, your OCBC account number will either be 10 or 12 digits. To find out the branch code of your FRANK account, it will be the first 3 digits of your account number.

Am I eligible for the FRANK account?

The minimum age to open the FRANK account is 16 years.

You can open the FRANK account if you’re either a:

- Singaporean

- Singaporean PR

- Foreigner with Employment / Special / Student Pass

How do I open a FRANK Account?

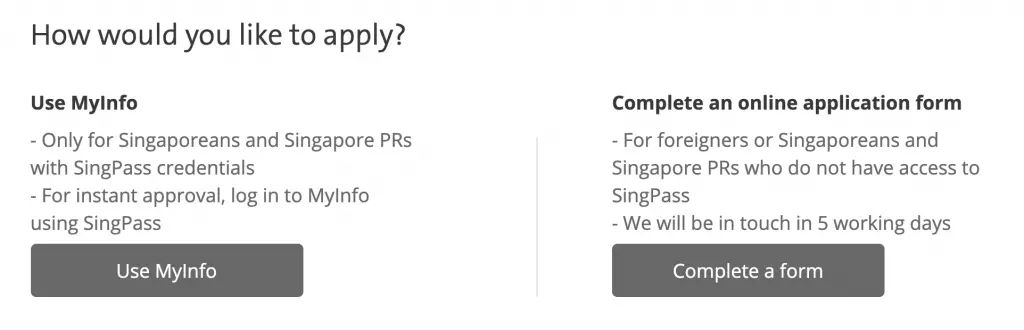

The signup process for a FRANK account is really easy. You can choose to either:

- Use MyInfo to sign up

- Complete an online application form (if you do not have a SingPass)

If you signup using MyInfo, your account should be set up almost instantly.

What are the characteristics of the FRANK account?

Here are some characteristics of the FRANK account:

#1 Initial deposit

The FRANK account does not have an initial deposit requirement. As such, you are able to open the account right away when you apply for it!

#2 Minimum account balance

FRANK does not have a minimum account balance requirement until you are 26 years old. However, once you are 26 years old, the minimum account balance is $1,000.

If you do not have this amount in FRANK, you will need to pay a monthly service fee of $2.

What are the interest rates for the FRANK account?

The FRANK account has a tiered interest rate. The amount of interest you receive depends on the amount that you have in your account.

| Amount in FRANK | Interest Rate |

|---|---|

| First $25k | 0.1% |

| Next $25k | 0.2% |

| Any amount above $50k | 0.05% |

The interest rate is rather low. There are better accounts out there that offer you a higher interest rate!

What investment benefits does the FRANK account offer?

OCBC’s FRANK is mainly targeted at young students or fresh undergraduates. As such, they are trying to encourage you to invest with them as well.

Here are some ways that you can invest with OCBC:

Blue Chip

The OCBC Blue Chip Investment Plan (BCIP) allows you to invest a small sum every month, starting from $100. You are able to deduct an amount from your FRANK account each month to invest in the counter of your choice.

However, you will need to be at least 18 years old to start investing in the BCIP!

Young Investor Programme

OCBC FRANK provides a Young Investor Programme as well. This programme teaches you the fundamentals required to start trading in the markets.

You are able to enjoy special trade commissions if you link your trading account to your FRANK account.

This could be one way to start your investment journey!

How do I close my FRANK account?

Once you’ve hit 26 years old, it may no longer be worth it to keep your FRANK account. This is because you will have to maintain a minimum account balance of $1,000.

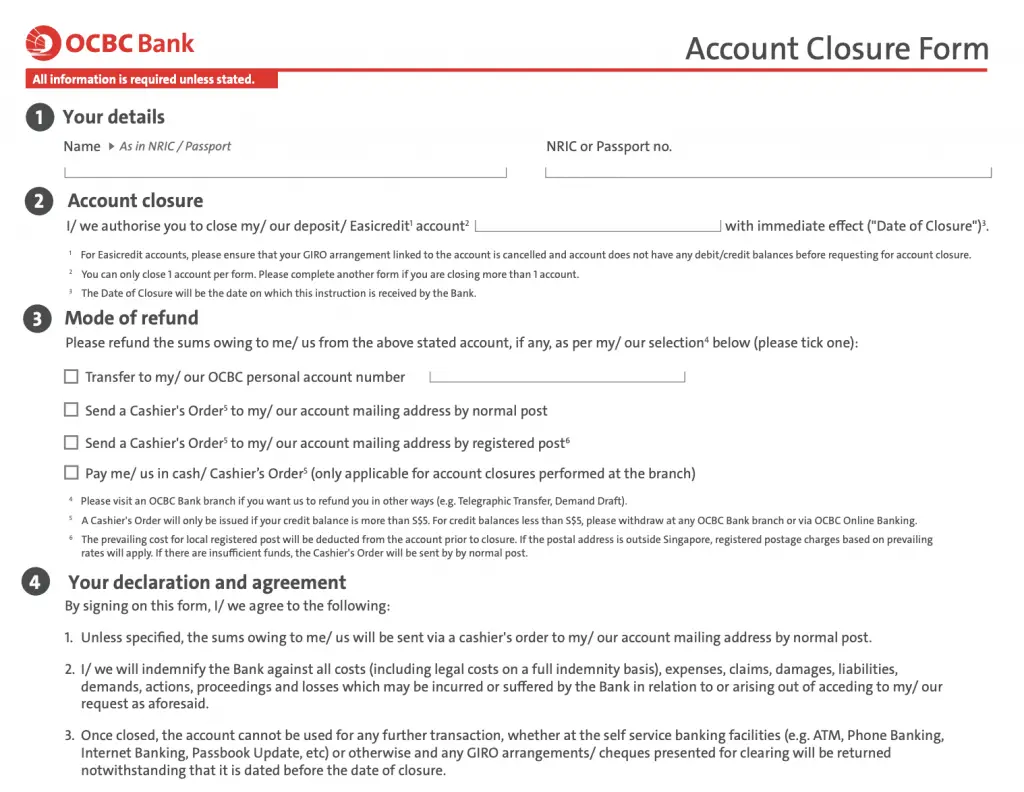

To close your account, you will need to fill up the Account Closure Form, and mail it to OCBC.

The good thing is that the FRANK account does not have an early closure fee.

Verdict

Here are some key pointers for this account:

#1 Interest rates are no longer attractive

The FRANK account used to be one of the more popular accounts for students. FRANK used to provide 0.2% for your first $25k, and 0.4% for your next $25k. The interest rate was the 2nd best behind CIMB FastSaver.

However with the emergence of the JumpStart account in 2019, the FRANK account is no longer that attractive.

You can read my complete breakdown of Jumpstart vs FRANK.

Better options if you are 16 years old

If you are 16 years old, the FRANK account is one of the accounts that you can open. However, there are other accounts that you may want to consider. This includes:

You may want to note that GIGANTIQ is an insurance saving plan, and not a savings account!

The SingLife Account is a much better option if you’re 18 years and above

The SingLife Account may be another option if you’re a student. Both the SingLife account and GIGANTIQ are insurance savings plans. While they are not savings accounts, they have many characteristics that are similar.

If you are 18 years old and above, you should seriously consider getting this account!

It provides a much higher interest rate (2% on your first $10k).

However, the only drawback is its liquidity. It may take up to 3 hours for your funds to reach your bank account when you withdraw them from the account.

It might be worth considering getting both SingLife and JumpStart when you’re 18 years old.

The OCBC 360 account is the better choice if you’ve graduated

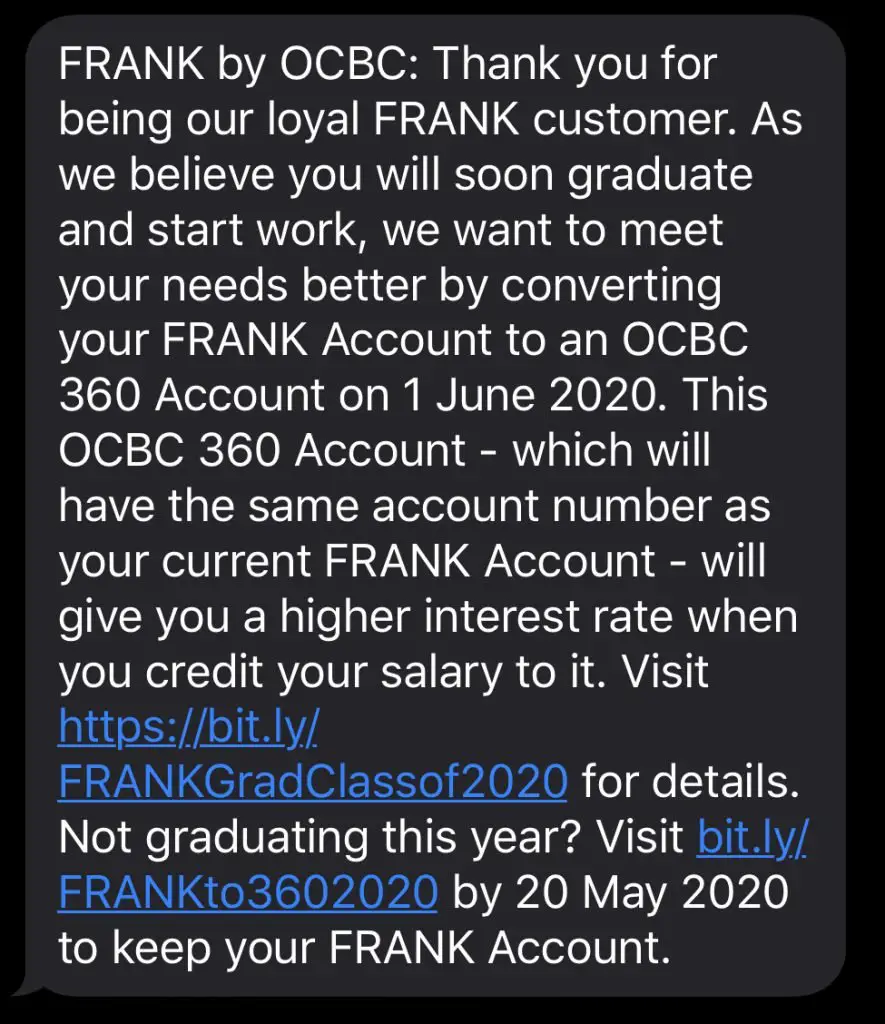

If you decide to stick to your FRANK account, you may want to consider upgrading to an OCBC 360 account.

When you are almost ready to graduate, OCBC will offer you this upgrade via SMS.

The 360 account provides a much higher interest rate. You are able to earn up to 2.68% on your first $75k.

However, you do need to fulfil certain requirements, such as:

- Credit your salary

- Increase your average daily balance

- Purchase an insurance product from OCBC

- Purchase an investment product from OCBC

As such, I believe that OCBC is using the FRANK account as a stepping stone. Ultimately, they want you to create a 360 account!

#2 Interest rate is comparable to Monthly Savings Account

FRANK’s interest rate is rather comparable to OCBC’s Monthly Savings Account. Moreover, the Monthly Savings Account has a minimum account balance of $500.

You may require to have an OCBC account, especially if you have invested with them. As such, I believe that the Monthly Savings Account may be a better choice for you.

Is the OCBC FRANK account good?

The OCBC FRANK account is a decent account for students. However, the JumpStart account is much better than FRANK in almost every aspect. I believe that you should be creating the JumpStart account first before even considering the FRANK account.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?