Last updated on August 27th, 2021

After creating an account in SAXO, you may find yourself with the issue of having to convert between different currency types.

This article will help you to navigate the main questions and give useful tips on:

- Creating a SAXO sub account for a different currency

- Converting between currencies in SAXO

Contents

- 1 An introduction to your SAXO account

- 2 How do I create a sub account in Saxo?

- 3 How do I transfer my funds between sub accounts in SAXO?

- 4 What are the currency conversion charges in Saxo?

- 5 Is it more cost effective to create my Saxo account in SGD or USD?

- 6 How do I avoid the conversion fee on Saxo?

- 7 Conclusion

An introduction to your SAXO account

SAXO is an online brokerage that allows you to trade in over 40000 stocks worldwide, making it a very versatile platform to use if you intend to invest or trade in multiple asset classes.

Within SAXO, you account is pegged to a single currency type. To trade in instruments of a different currency, you can either:

- Create a sub account which stores your funds under a different currency, or

- Trade directly under the prevailing exchange rate (plus a charge)

What is the default currency in my SAXO account?

The currency which you use for your initial funding will become the default currency of your SAXO account. As a Singaporean, you will most likely deposit SGD in your trading account, which means your default currency will be in SGD.

One thing you’ll need to note is that trading instruments which are of a different currency type from your account will incur extra charges (which will be further elaborated below).

How do I check the base currency in my SAXO account?

In desktop view, your base currency in your SAXO account is reflected as the currency type under “All Accounts” in your Trading screen.

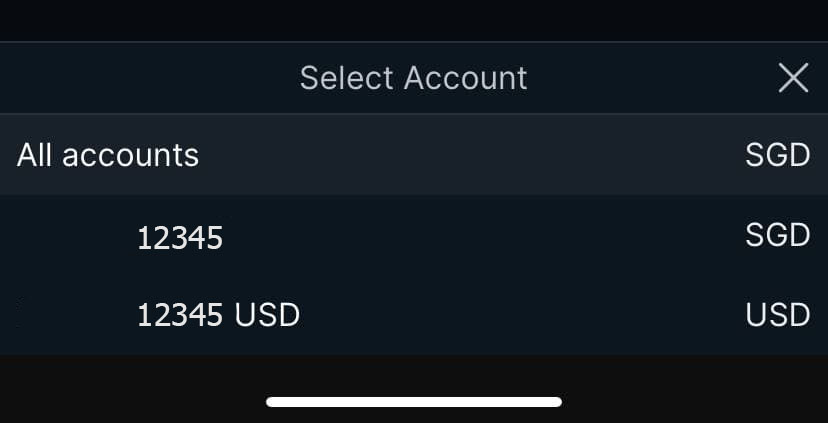

This is the corresponding view in the SAXO Go App, which can be accessed under “Trading” → “Positions”.

Can I change my base currency in Saxo?

It is only possible to change your base currency if your account has not been funded yet. If you wish to trade frequently on instruments which do not carry your base currency, it is recommended that you open a sub account on the currency you frequently trade in.

What is a SAXO sub account?

A sub account in SAXO acts as a separate platform for you to trade in instruments of different currencies from your base currency. Other than being able to trade in a different currency type, it serves the same function as your main account.

A SAXO sub account can be distinguished from the main account by an addition of the currency type that it can be traded in.

In the above example, the base currency of the user’s main account is in SGD, with a sub account that allows him to trade in USD.

How do I create a sub account in Saxo?

Before creating a sub account in SAXO, you will first need to ensure that you have a minimum of $10,000 SGD in your account in any form (cash, stocks, etc) in your SAXO account. Thereafter, you will have to submit a request to SAXO to create your sub account.

Here are the steps to request for a sub account in SAXO:

- Go to the Contact Support section in the platform

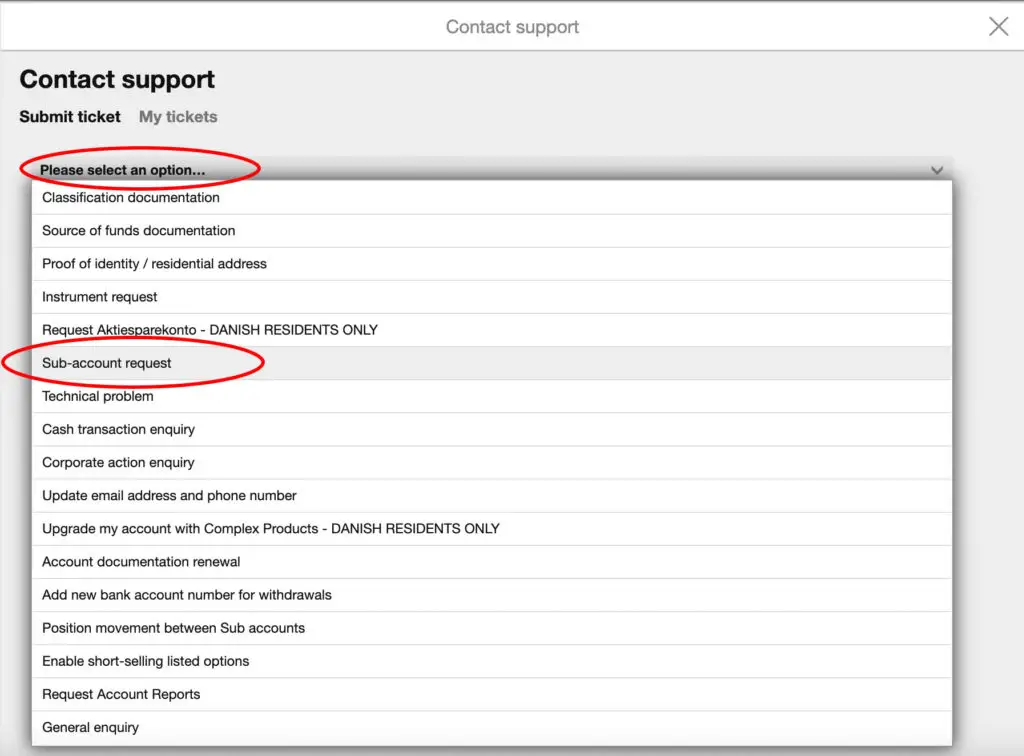

- Select ‘Sub-account request’

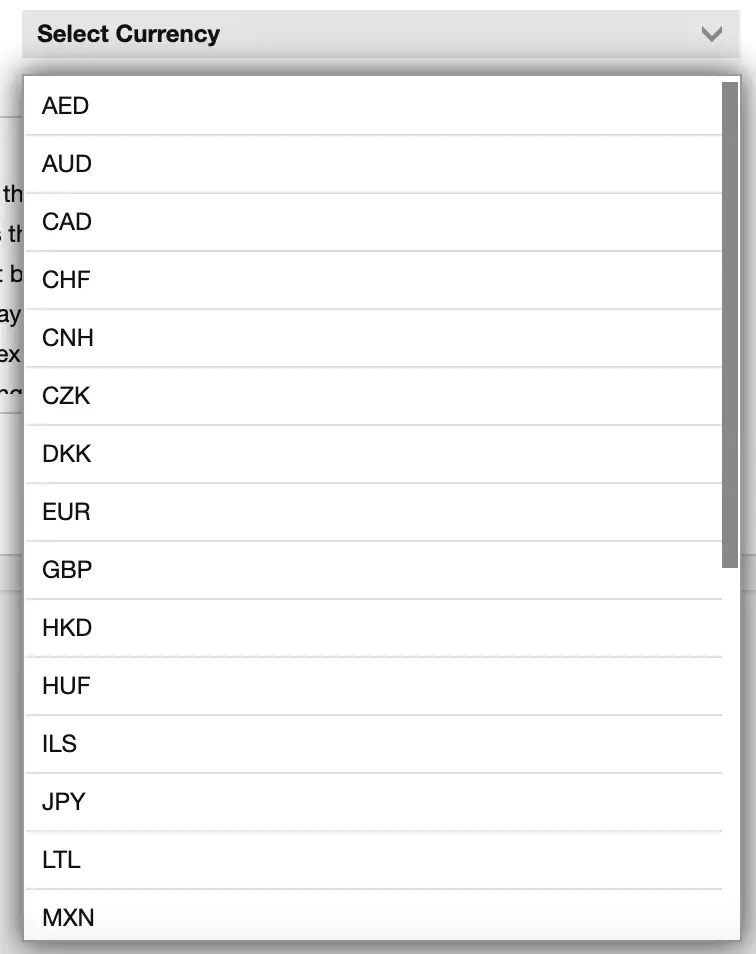

- Select the currency of the sub account you want to create

- Submit your request

Below are detailed steps on how you can submit your request through the following platforms:

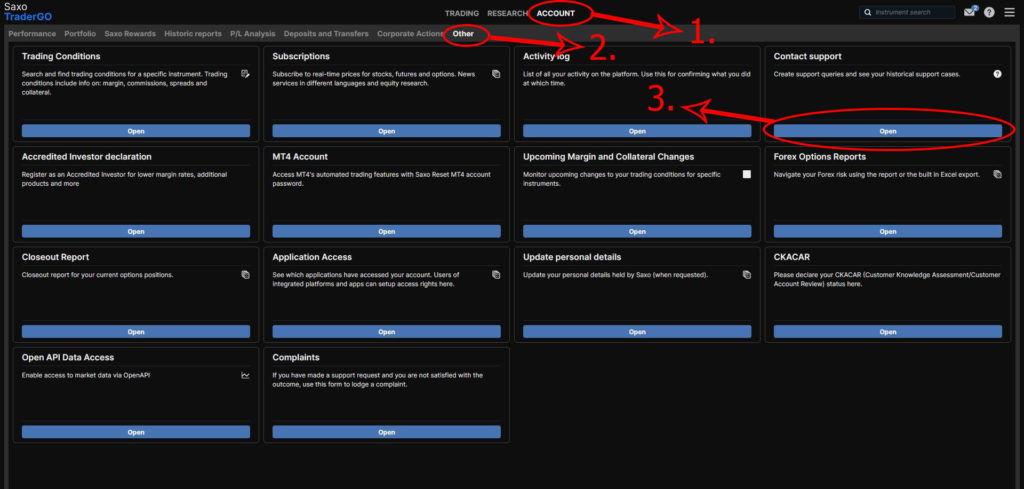

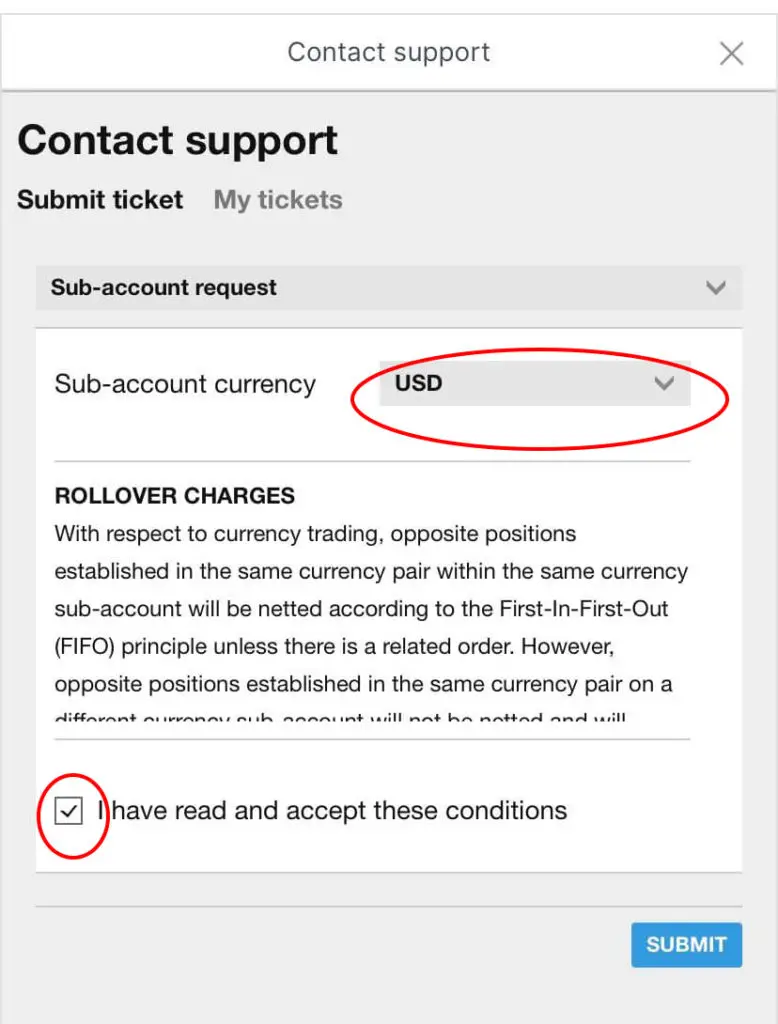

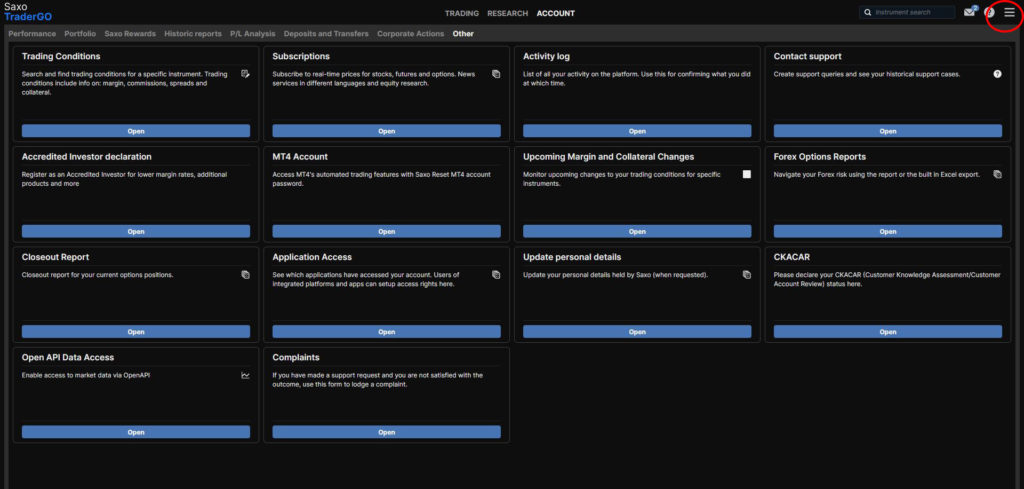

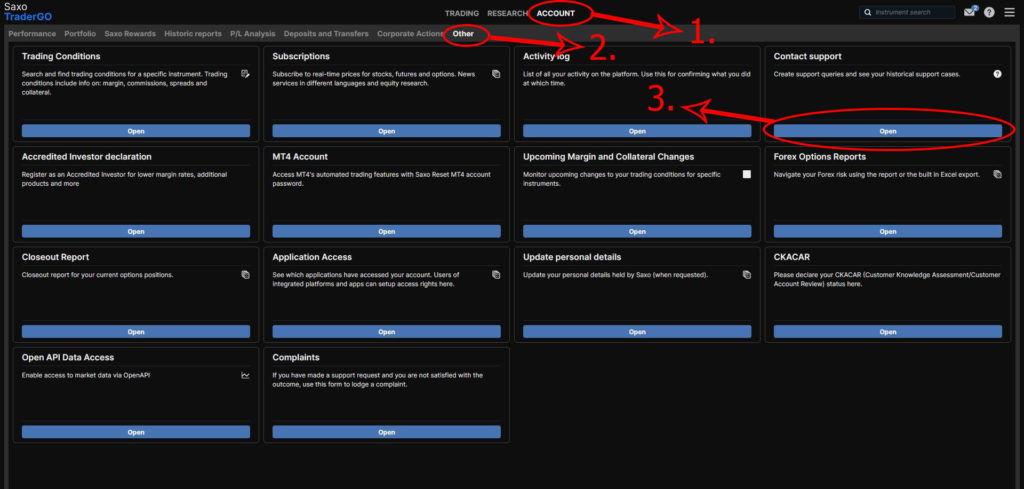

#1 SAXO Trade GO/PRO (Desktop)

In the desktop platform of SAXO GO/PRO, go to Account → Other → Contact Support.

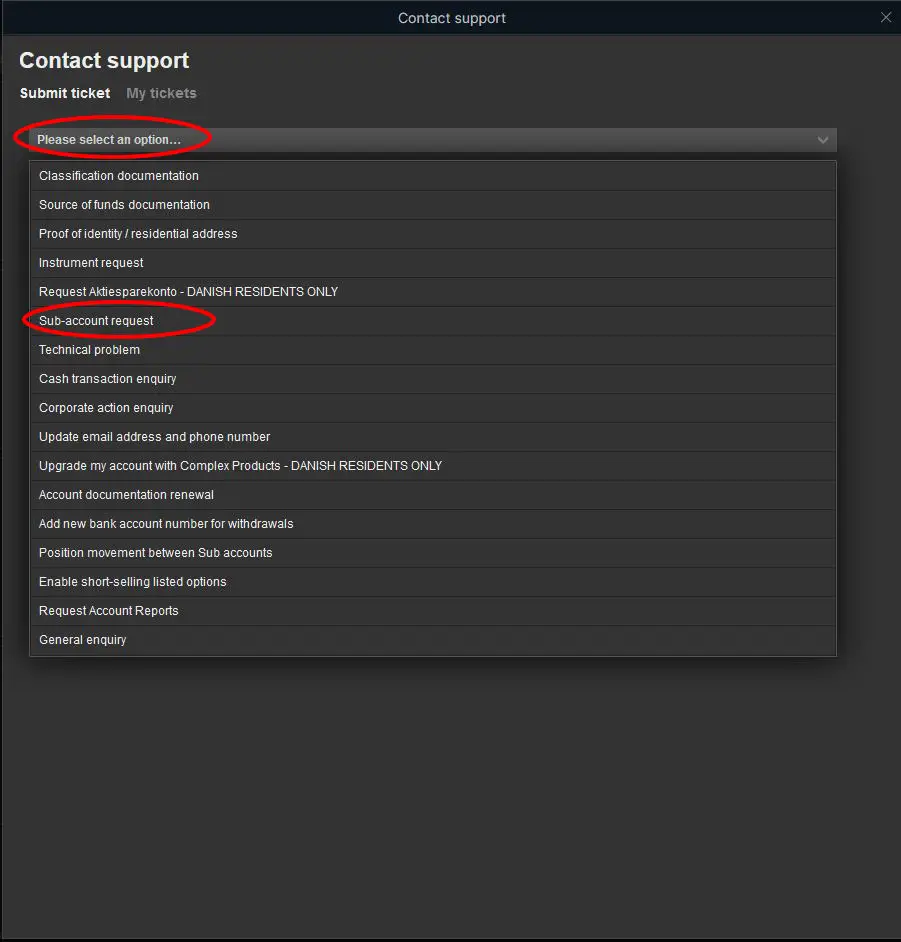

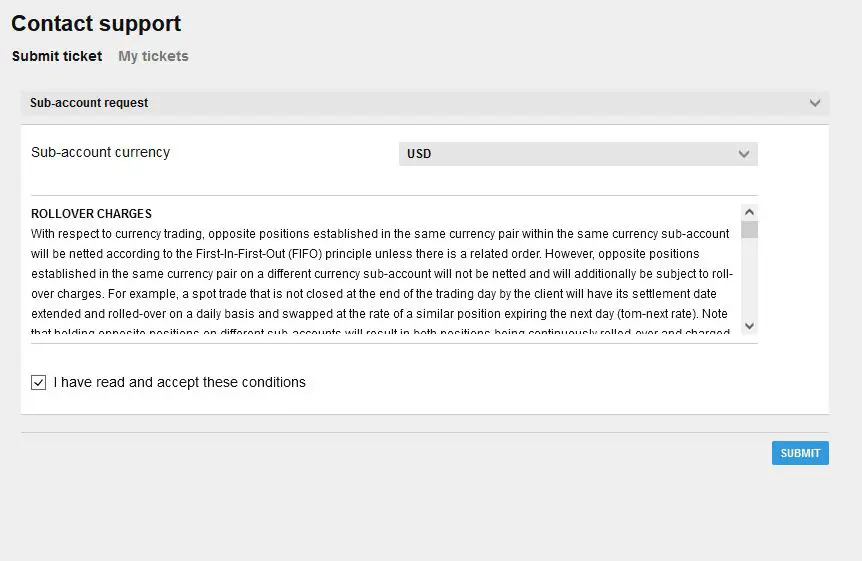

Under the drop down menu, select Sub-account request.

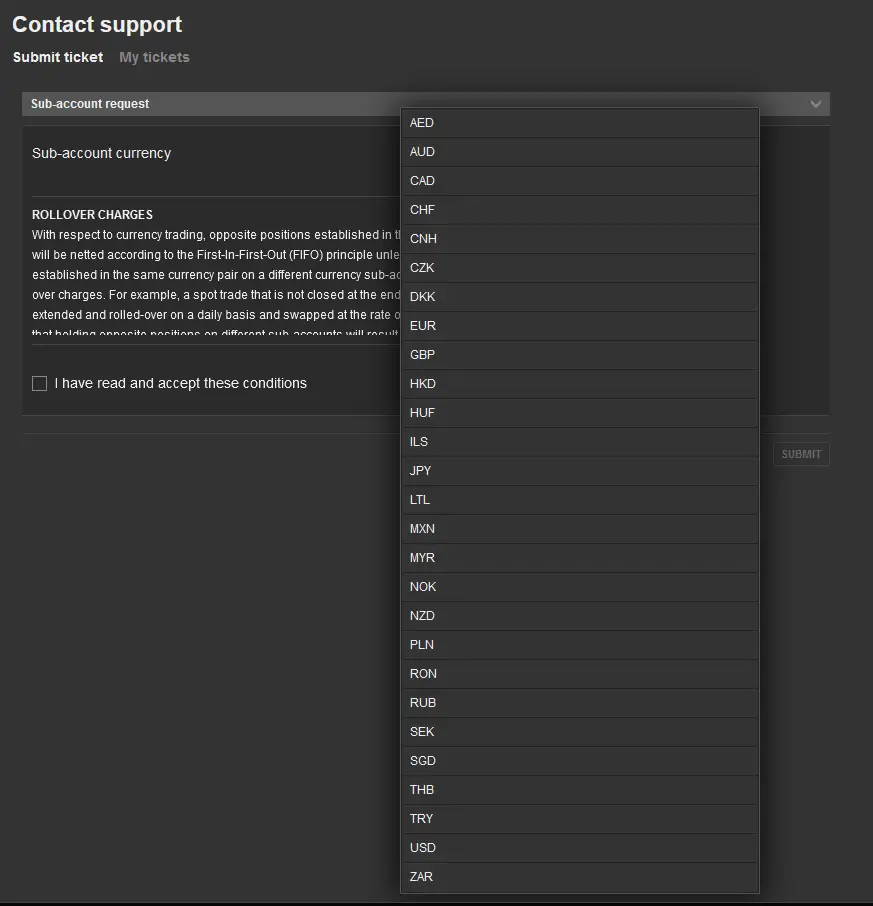

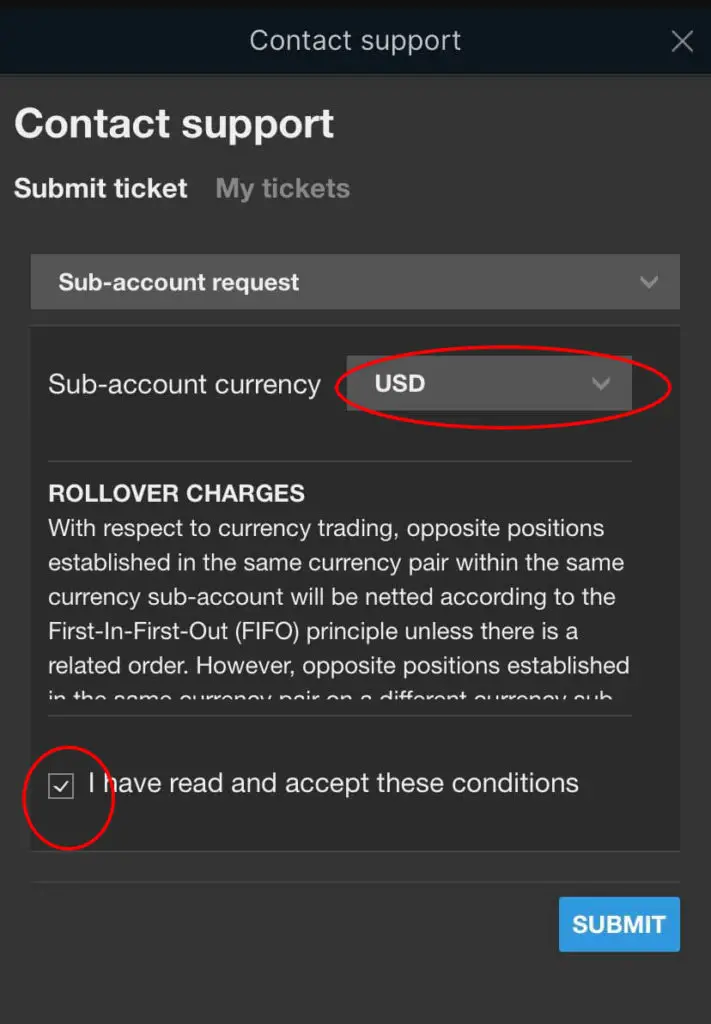

You will then need to select the currency for your sub account.

You can trade in 27 different currencies in SAXO!

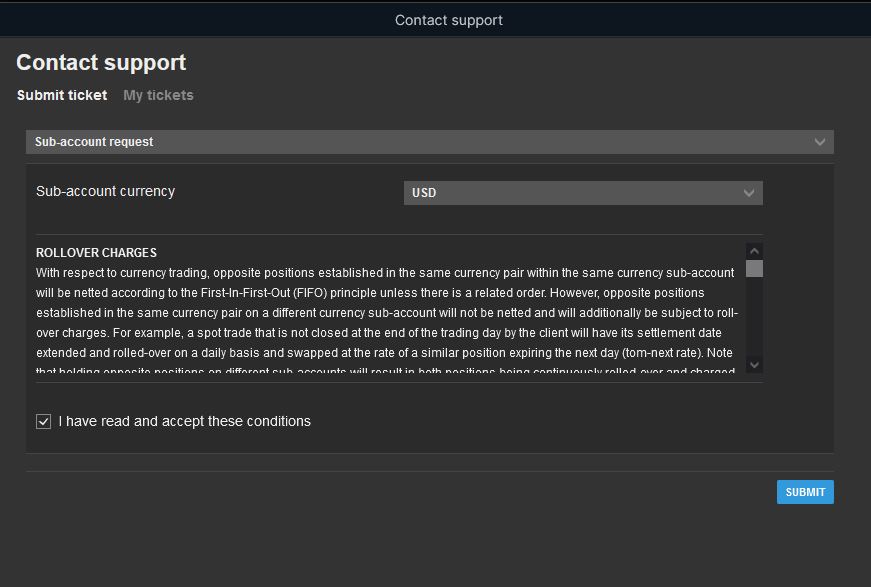

Finally, read and accept the terms and conditions before submitting your request.

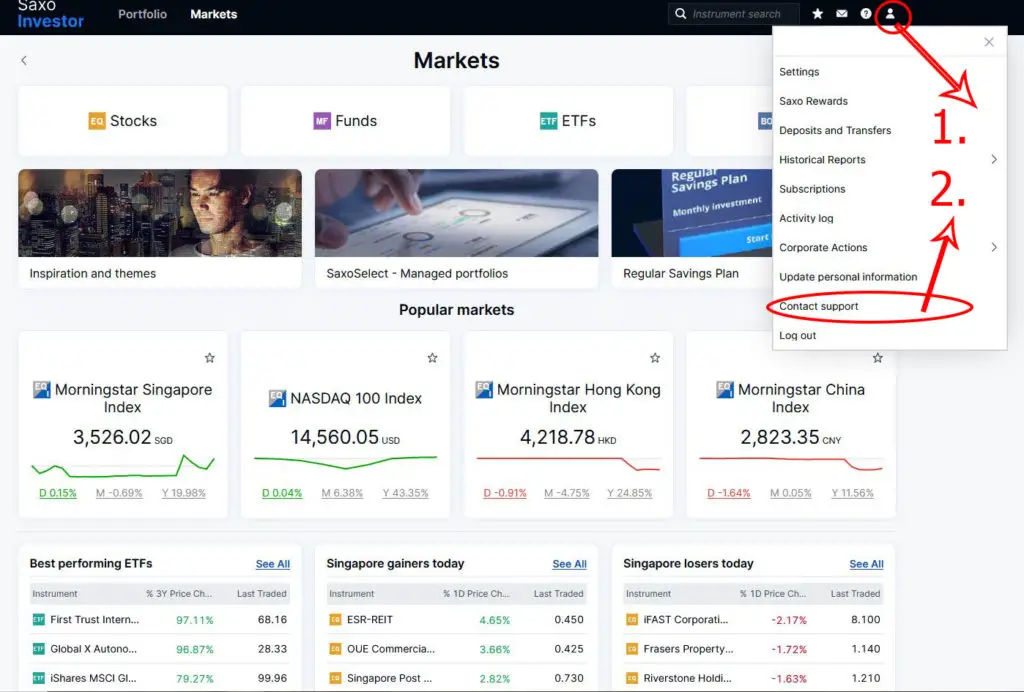

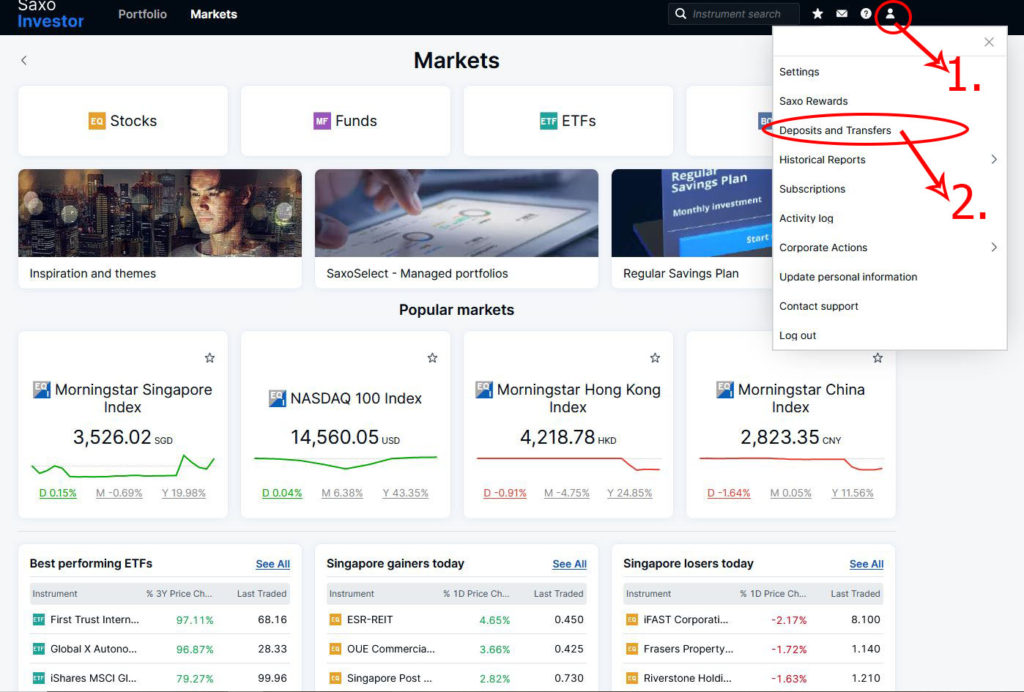

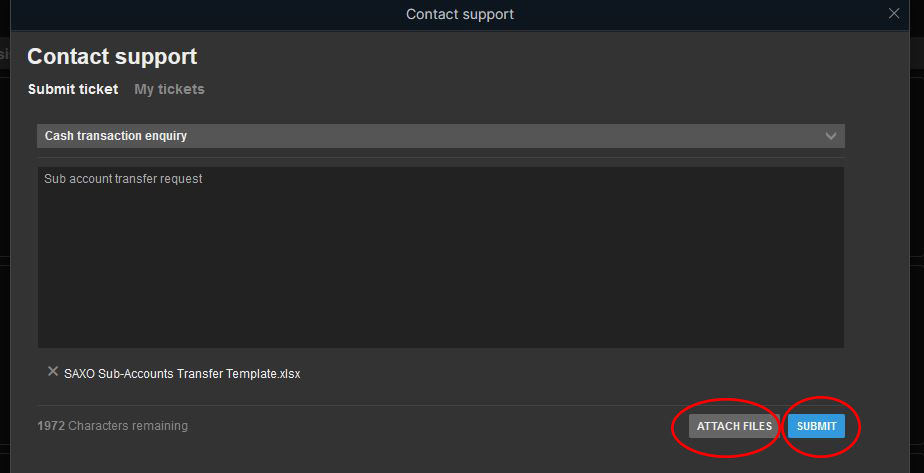

#2 SAXO Investor (Desktop)

In the desktop platform of SAXO Investor, go to the ‘human’ icon on the top right corner of the webpage, followed by Contact support.

Under the drop down menu, select Sub-account request.

Select the currency for your sub account.

Finally, read and accept the terms and conditions before submitting your request.

#3 SAXO GO (Mobile App)

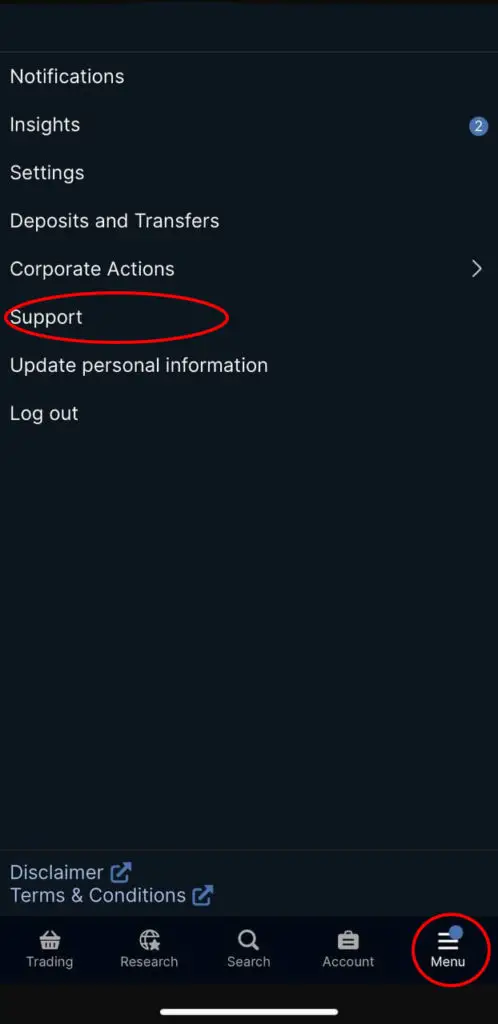

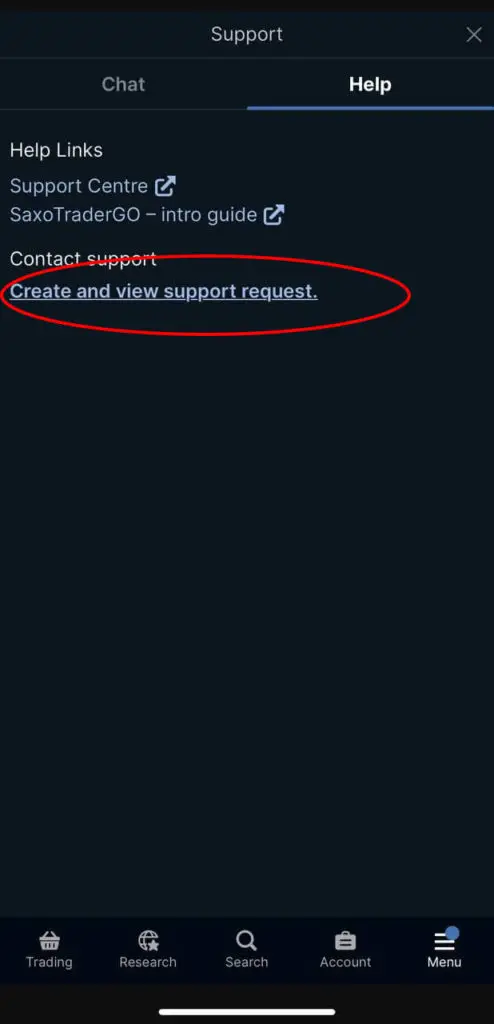

In the mobile app platform of SAXO GO/PRO, go to Menu → Support → Contact Support.

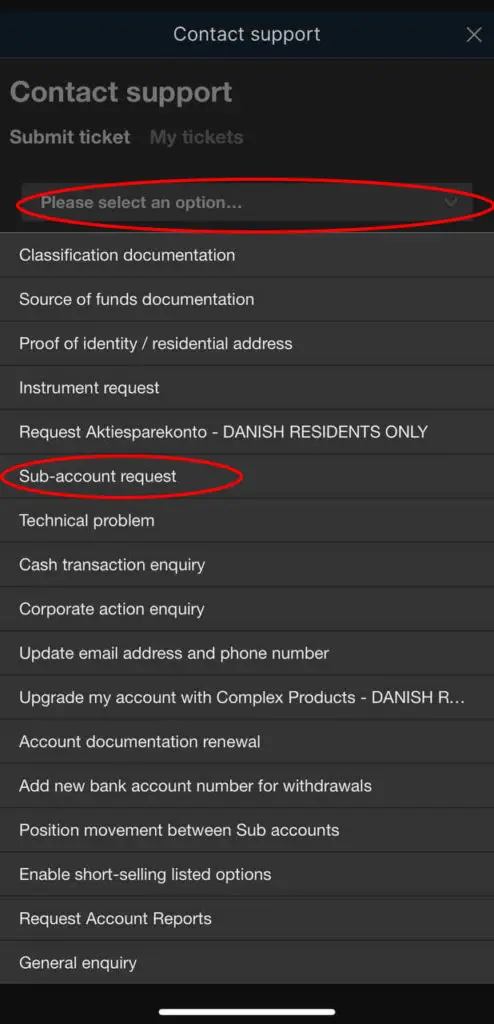

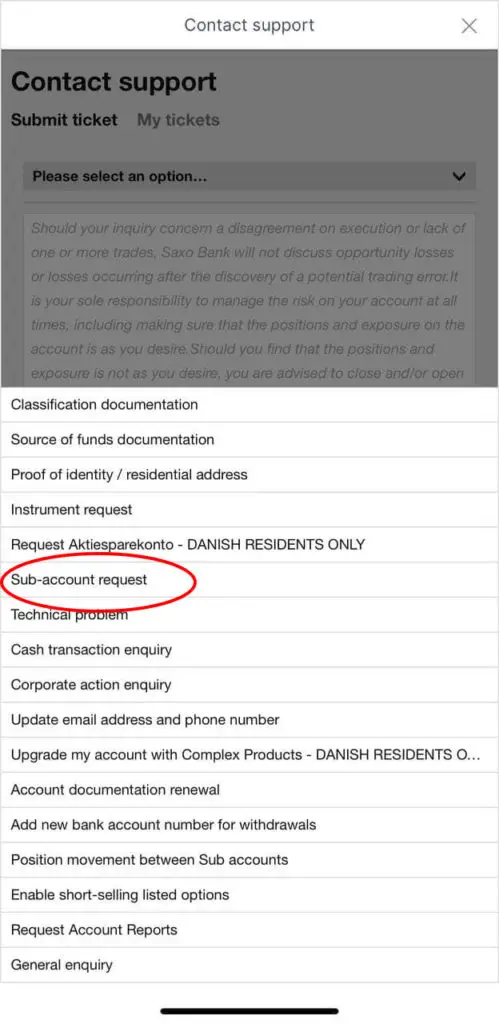

Under the drop down menu, select Sub-account request.

Select the currency for your sub account, and read and accept the terms and conditions before submitting your request.

#4 SAXO Investor (Mobile App)

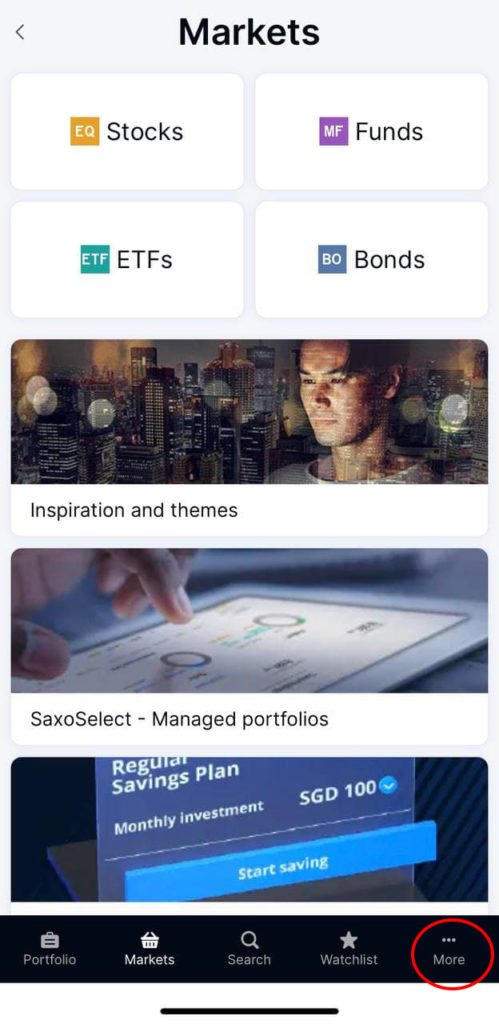

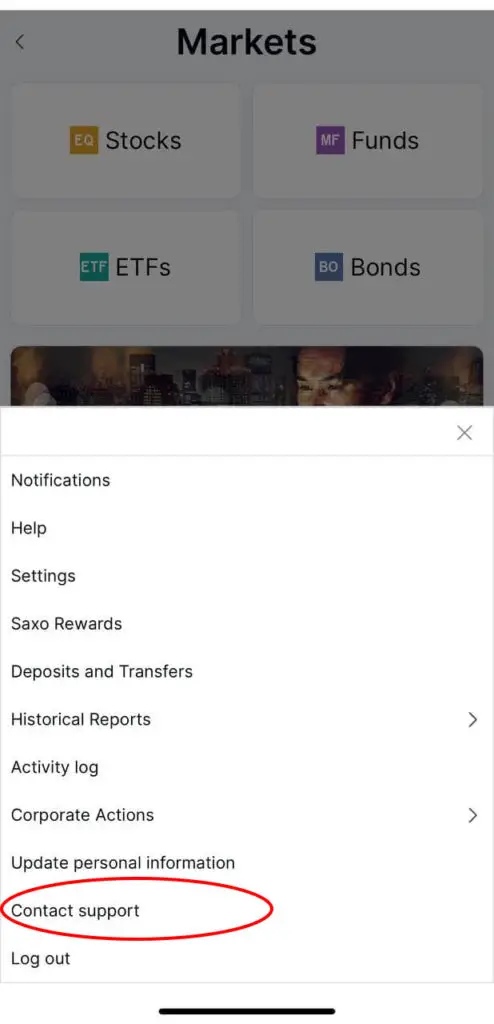

In the mobile app platform of SAXO Investor, go to More → Contact Support.

Under the drop down menu, select Sub-account request.

Select the currency for your sub account, and read and accept the terms and conditions before submitting your request.

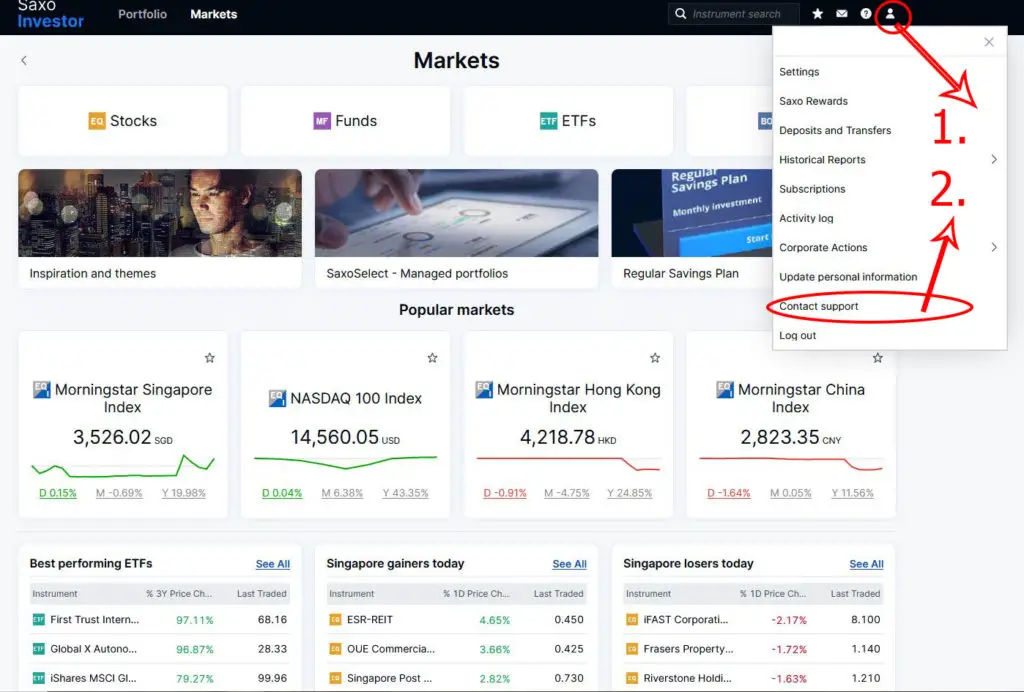

How do I transfer my funds between sub accounts in SAXO?

Now that you have created your SAXO sub account, you may want to transfer some of your funds over. Here are the steps to do so:

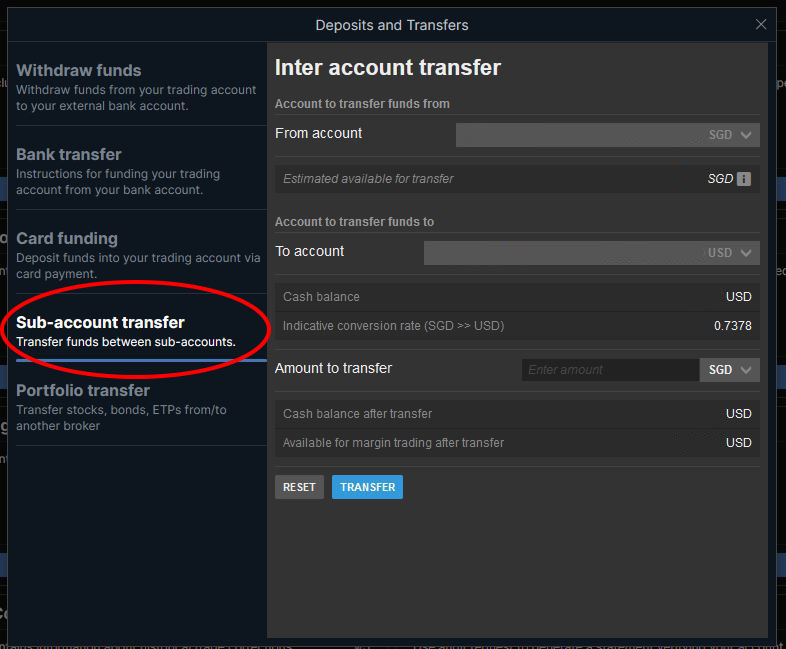

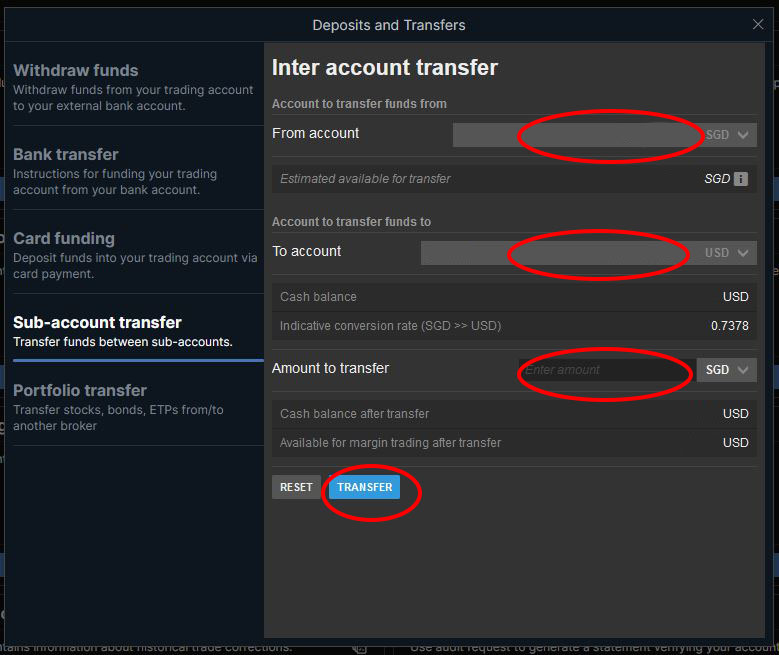

SAXO GO/PRO

Select the menu button at the top right hand of the webpage, followed by Deposits and Transfers → Sub-account transfer.

Select your origin account, your destination account (your sub account) and the amount to transfer, before clicking on the ‘Transfer‘ button.

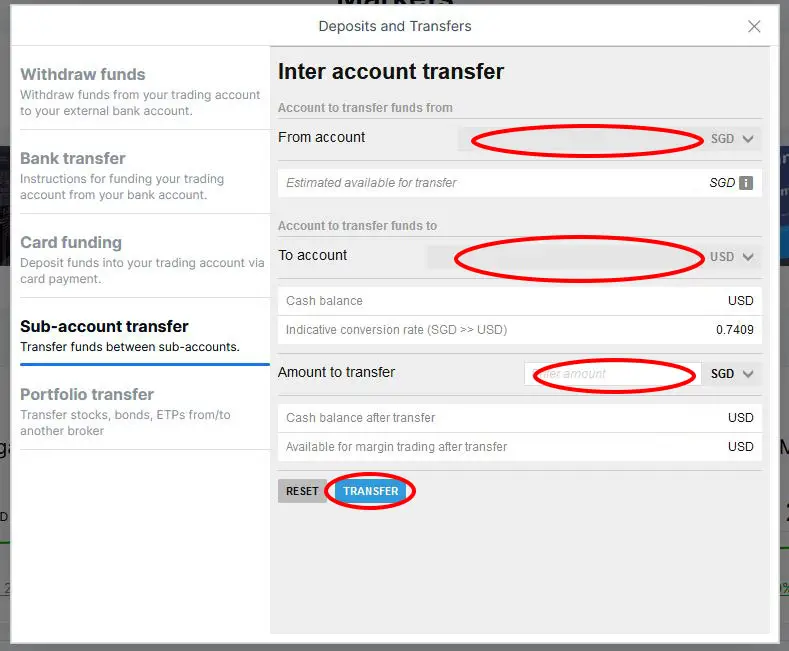

The exchange rate is shown right above the “Amount to transfer” line.

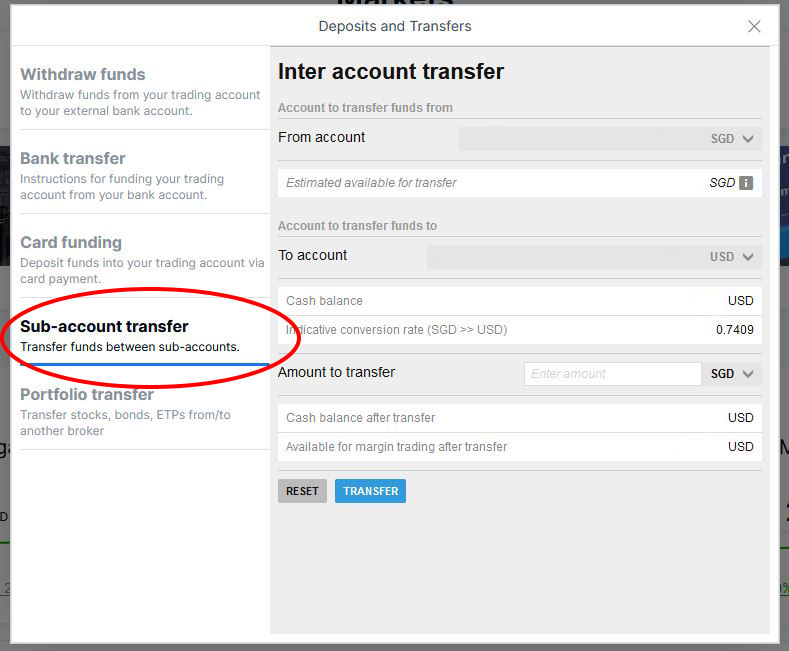

SAXO Investor

Select the human icon on the top right corner of the webpage, followed by Deposits and Transfers → Sub-account transfer.

Select your origin account, your destination account (your sub account) and the amount to transfer, before clicking on the ‘Transfer’ button.

What if I am still unable to transfer funds across sub accounts in Saxo?

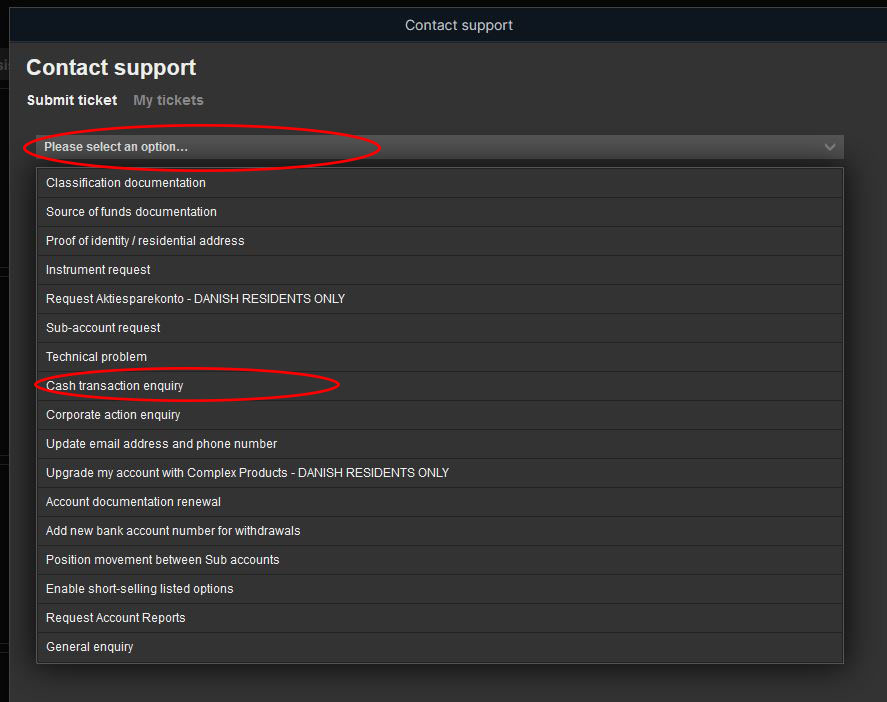

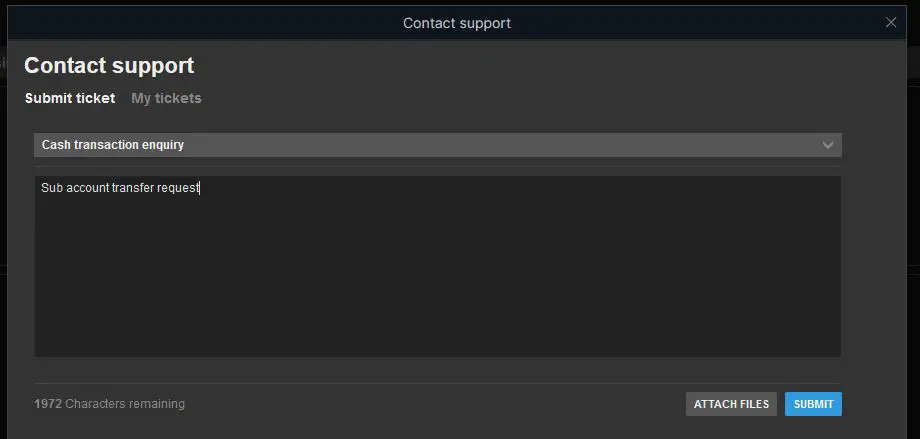

If you are still unable to transfer funds across sub accounts using the above methods, you will need to send a request to Saxo to perform the transfer for you through the following steps:

- Complete the ‘Sub accounts Transfer‘ excel sheet

- Go to the Contact Support section in the platform

- Select ‘Cash transaction enquiry’

- Input “Sub account transfer request”

- Attach the excel sheet and submit your request

Below are detailed steps on how you can submit your request through the following platforms:

SAXO GO/PRO

- Complete the ‘Sub accounts Transfer’ excel sheet attached in this link.

- Go to Account → Other → Contact Support.

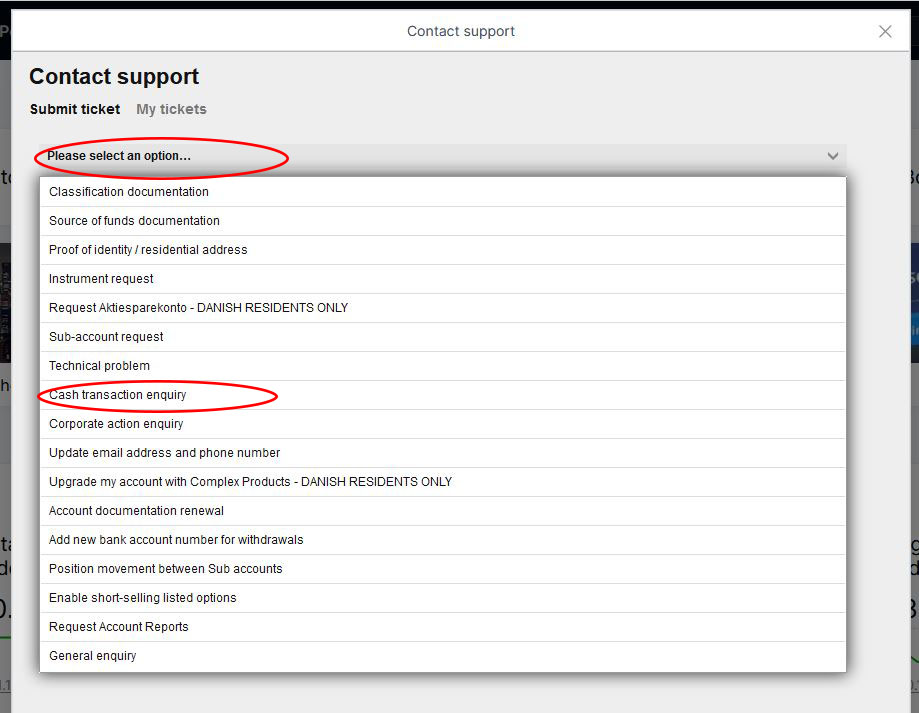

3. Under the drop down menu, select Cash transaction enquiry.

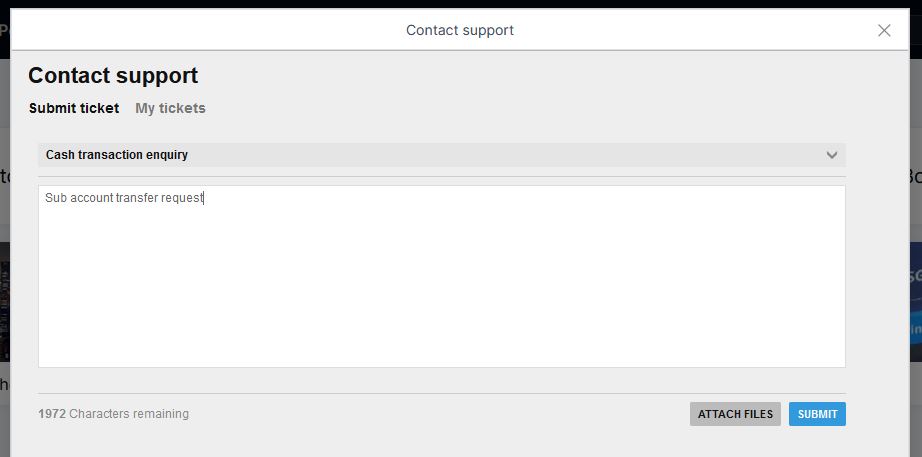

4. Input “Sub account transfer request” in the request details window.

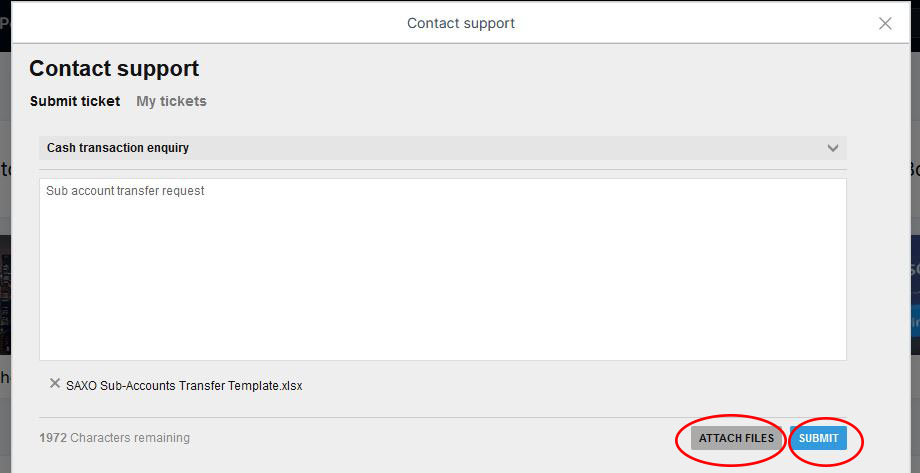

5. Attach the completed excel file from step 1. and click “Submit”.

SAXO Investor

- Complete the ‘Sub accounts Transfer’ excel sheet attached in this link.

- Go to the human icon on the top right corner of the webpage, followed by Contact support.

3. Under the drop down menu, select Cash transaction enquiry.

4. Input “Sub account transfer request” in the request details window.

5. Attach the completed excel file from step 1. and click “Submit”.

What are the currency conversion charges in Saxo?

Your SAXO account may be in SGD, and you may want to trade instruments that are in a different currency (e.g. US stocks). There are two ways to do so:

- Create a sub account under a different currency (e.g. USD)

- Trade directly from your SGD account under the prevailing exchange rate

Both methods involves currency conversion charges, which are as follows:

| Method of conversion | Charges |

|---|---|

| Transfer between accounts | 0.3% |

| Trade from your SGD account (Classic Account) | 0.75% |

If you open a sub account, you will only incur the conversion charge once (at 0.3%) when you transfer your funds between your SGD to USD sub accounts. Thereafter, you can trade your foreign denominated instruments without paying further conversion charges.

In contrast, trading directly from your SGD Account will incur a 0.75% charge for each trade. Assuming a completed trade involving a buy and sell transaction, you would have incurred about 1.5% in currency conversion charges alone, which is a hefty sum!

This excludes other fees such as stock commissions and custody fees!

As such, it is more cost effective to create a sub account before trading in foreign currencies. However, you will need to deposit a minimum of $10,000 SGD in SAXO before you can create a sub account.

Is it more cost effective to create my Saxo account in SGD or USD?

If you intend to trade frequently in US denominated instruments, you may wonder if it is wiser to create your SAXO account in USD instead of SGD to avoid the conversion charges altogether.

In this section, we will examine which method is more economical by comparing the charges involved in funding your SAXO account with USD versus transferring your funds between your SAXO accounts.

This comparison does not take into account exchange rates, which may differ depending on the origin where you made the currency exchange.

Telegraphic Transfers (TT)

One way to fund your SAXO account in USD is through Telegraphic Transfer (TT). Here are the charges for TT for the major banks in Singapore:

| Bank | Charges | Min. Comm. Charge | Max. Comm. Charge |

|---|---|---|---|

| DBS | 0.125% + $20 cable charge* | $10 | $120 |

| OCBC | 0.125% + $20 cable charge | $10 | $100 |

| UOB | 0.0625% + $30 cable charge* | $10 | $100 |

This does not include additional charges from SAXO’s receiving bank (HSBC) and agent charges.

From the above table, we can see that the larger your transaction amount, the lower the percentage rates are for your commission. This is because the proportion of the fixed cable charge (which makes up a significant amount of commissions) diminishes with increasing transaction amounts.

Other than USD, you can fund most leading currencies into your account through TT such as EUR, GBP, AUD, HKD, CNH and JPY.

Credit/Debit Card

For fundings to your SAXO account made via credit or debit card, SAXO will charge an administrative fee of up to 2.93%. This is much higher than the 0.3% charge for inter account transfers!

Therefore, transferring funds through credit card is not advisable due to the large amounts of charges incurred.

You may want to note that credit and debit card payments are applicable for SGD and USD only.

Verdict

If you intend to make large transactions of USD to your SAXO account, it may be more economical for you to create a USD account and funding it through TT.

This can be done by making your very first deposit in your Saxo account in USD.

One more point of consideration before you fund your account in USD is to compare whether SAXO or your currency exchange provides a better exchange rate. You would not want to suffer a net loss from a much poorer exchange rate just to save on charges!

Can I change my SAXO base account from SGD to USD?

You can only change the base currency of your account from SGD to USD only if it has not been funded. Otherwise, you will need to create a sub account in order to trade instruments in USD.

You may want to note that you need at least $10,000 in your base account before you are able to create a sub-account.

How do I avoid the conversion fee on Saxo?

The only way that you can avoid the conversion fee between SGD and USD is by creating your Saxo account as a USD account, instead of a SGD account. However, you will need to consider the transfer charges you’ll incur when transferring USD from a Singaporean bank.

When you invest, the most important thing is to reduce the amount of fees you’ll incur, as they will reduce the amount of returns you receive.

You may need to do some calculations to find out the most cost effective way for you to invest!

Conclusion

Due to SAXO’s structure of allowing only one currency in one account, you may be incurring high charges unknowingly if you trade instruments of a different currency from your base account!

To prevent this, you may want to consider opening a sub account in the currency of the instrument that you want to trade. Alternatively, you may also want to fund your account directly in a foreign currency through TT if you intend to make large transactions into your account.

Are you passionate about personal finance and want to earn some flexible income?