Last updated on March 8th, 2022

You’ve decided to invest in the Hang Seng Tech ETF. However, there are quite a few versions of it!

How does the SGX-listed ETF (HST) compare with the one that’s listed on the HKEX (3067)?

Contents

The difference between HST and 3067

Both HST and 3067 track the Hang Seng Tech Index. They mainly differ in terms of the exchange they are listed on (SGX vs HKEX), the currency denomination (SGD vs HKD) and the expense ratio.

Here is an in-depth comparison between these 2 ETFs:

Fund manager

HST is managed by Lion Global Investors, while 3067 is managed by BlackRock under the iShares family of ETFs.

3067 was started in September 2020, while HST was started in December 2020. As such, both of these ETFs are relatively new.

Index tracked

Both HST and 3067 track the Hang Seng Tech Index.

This index represents the 30 largest technology companies listed in Hong Kong.

To be included in this index, companies have to:

- Have a high business exposure to technology themes

- Pass the index’s screening criteria

These companies all originate from Greater China, and they have to be listed on the Main Board of the HKEX.

They will also have to meet at least one of the 3 criteria below:

- Technology-enabled business (e.g. via internet / mobile platform)

- R&D Expense to Revenue Ratio ≥ 5%

- YoY Revenue Growth ≥ 10%

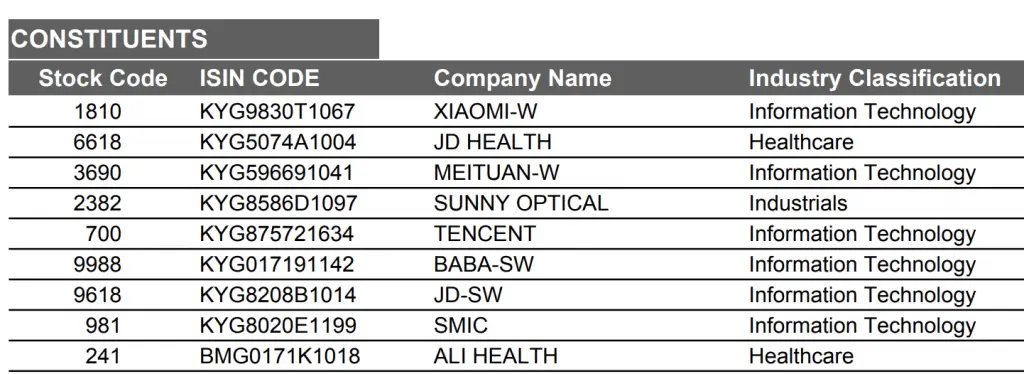

Here are some of the top holdings of this index:

This index was also created very recently in July 2020.

Both ETFs would hold the same stocks in the same proportion. As such, their performance should be very similar.

Exchange listing

HST is listed on the SGX, while 3067 is listed on the HKEX. The listings in these different exchanges will have some implications:

Different currencies of each fund

HST is denominated in SGD, while 3067 is denominated in HKD.

If you are a Singaporean investor, it may be better to invest in HST. You are exposed to less fees when you invest in SGD instead of HKD. This is because:

- You do not incur any currency conversion fees charged by the brokers

- You are not exposed to the fluctuating exchange rates between SGD and HKD

One thing you’ll need to take note of is that all of HST’s assets are denominated in HKD. This means that the fund manager will still need to convert your SGD to purchase the stocks in HKD.

However, the fund managers should get a more preferable exchange rate compared to you.

This will help to lower the amount of fees you’ll need to pay for exchanging currency!

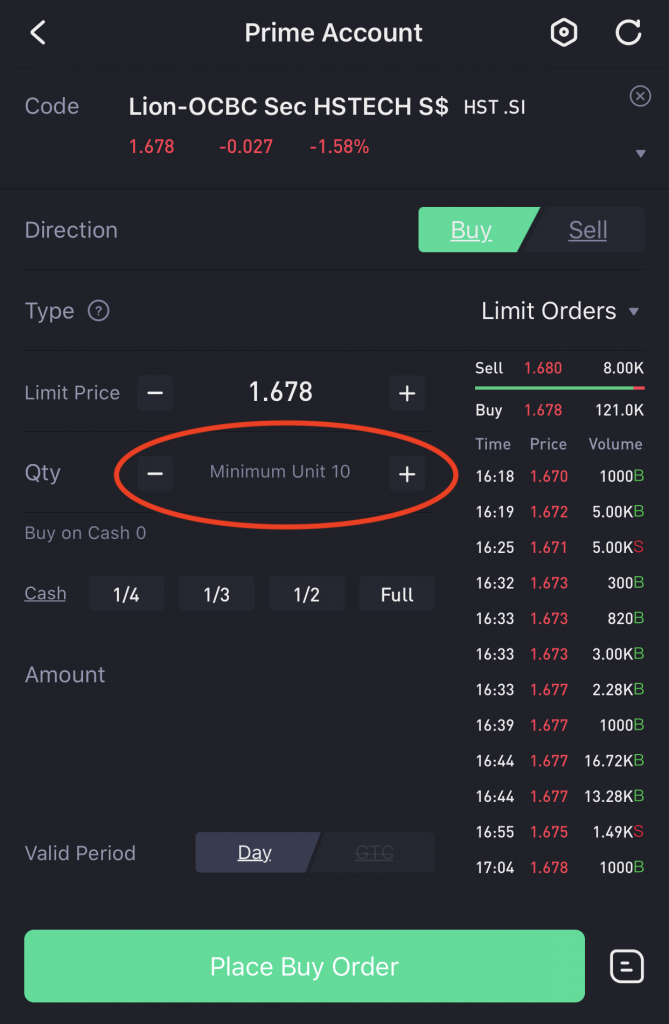

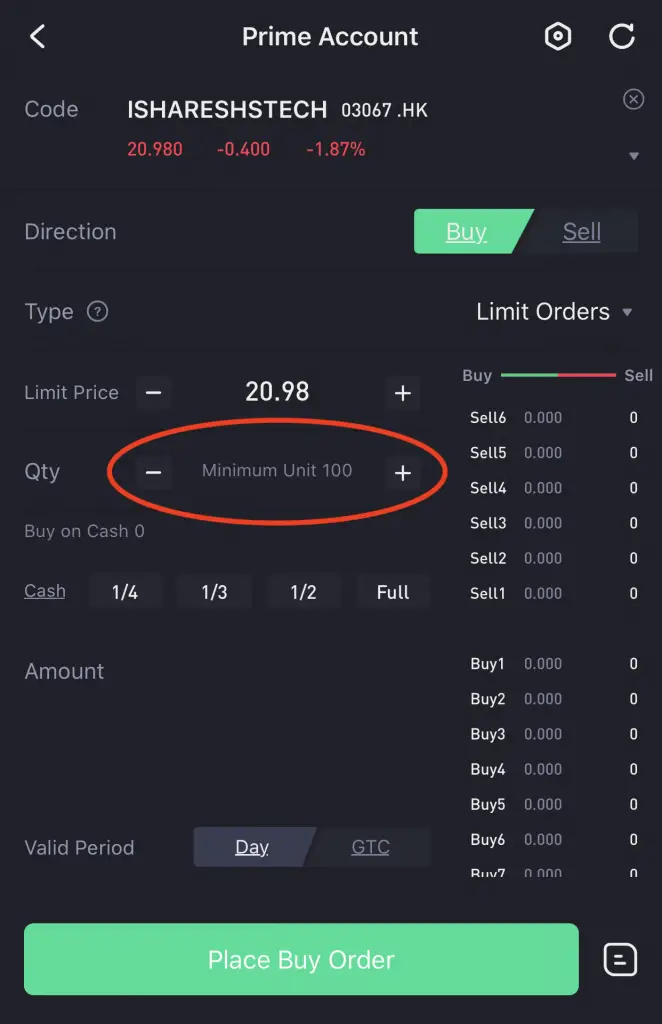

Minimum units to purchase

HST requires you to purchase a minimum of 10 units on the SGX.

Meanwhile, you are required to purchase a minimum of 100 units of 3067 on the HKEX.

This does have some implications on the amount that you can invest each time.

When you convert 21 HKD to SGD, each unit of 3067 costs approximately SGD$3.60. Since you need to buy at least 100 units, the minimum sum to invest in 3067 will be SGD$360!

In contrast, you will roughly need around $16 to invest in HST!

As such, HST may be the more accessible ETF, especially if you only have a small sum to invest.

Trading commissions

The commissions you pay to make a trade may differ based on the exchange you are trading in.

Here is a comparison of some commissions being charged by some brokers, based on the exchange you’re trading on:

| Broker | SGX | HKEX |

|---|---|---|

| Tiger Brokers | 0.08% * trade value No minimum (until 30 April 2021) 2.88 SGD/trade (after 30 April 2021) | 0.06% * trade value Min 15 HKD/trade |

| FSMOne | 0.08% * trade value Min SGD10/trade | 0.08% * trade value Min HKD 50 |

| Standard Chartered | 0.20% Min SGD10/trade | 0.25% Min HKD 100 |

You can view my comparison between Tiger Brokers and FSMOne to see which broker is better for you.

Tiger Brokers seems to provide the cheapest commissions.

You should always try to find the lowest brokerage fees so that they won’t eat into your returns!

Dividend distribution

According to the factsheets of both fund managers, they do not intend to distribute any dividends to you.

This is because most of the stocks in the index are tech stocks. They are aggressive growth stocks that would reinvest most of the profits into their company.

That way, these companies will continue to experience high amounts of growth!

Since the stocks themselves are not distributing dividends, the ETFs can’t distribute dividends to you either.

As such, you should not expect to receive any dividends when investing in this ETF!

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for these 2 funds:

| HST | 3067 | |

|---|---|---|

| Expense Ratio | 0.45% | 0.25% |

The expense ratio for HST is capped at 0.68% p.a. for 2 years from the inception of the fund.

HST has a much higher expense ratio compared to 3067!

Average trading volume

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

Since both funds are rather new, Yahoo Finance does not have enough data to calculate the average trading volume.

| HST | 3067 | |

|---|---|---|

| Trading Volume | 2.1 million | 10.9 million |

Since 3067 is the more well-established fund, it has a much larger trading volume compared to HST.

Funds to Invest

If you are a Singaporean investor, you may be looking for ways to invest your SRS funds. It is possible to invest in HST using your SRS funds since it is listed on the SGX.

The Singapore Government does not have any restrictions on using your SRS to invest in ETFs on the SGX.

This gives you another option to grow your SRS funds!

In contrast, you are only able to invest in 3067 using cash.

You can use the OCBC BCIP to invest in HST too

The OCBC Blue Chip Investment Plan is a regular savings plan (RSP). This helps you to dollar cost average into this ETF every month.

With the launch of HST in late 2020, this ETF is included as one of the counters in the BCIP as well.

This is one additional way that you can invest in this ETF!

However, you’ll need to determine if investing via a RSP or a broker is more cost effective for you.

Verdict

Here is a breakdown between HST and 3067:

| HST | 3067 | |

|---|---|---|

| Index Tracked | Hang Seng Tech Index | Hang Seng Tech Index |

| Fund Manager | LionGlobal | BlackRock |

| Exchange | SGX | HKEX |

| Currency | SGD | HKD |

| Minimum Units to Invest | 10 | 100 |

| Dividend Distribution | NA | NA |

| Expense Ratio | 0.45% | 0.25% |

| Trading Volume | 2.1 million | 10.9 million |

| Ways to Invest | Cash SRS OCBC BCIP | Cash only |

So which ETF should you choose?

Choose HST if you are a Singaporean investor

Investing in HST has many advantages if you are a Singaporean investor. This includes:

- Not having to exchange

- Low price of entry (minimum of 10 units)

- Ability to invest using your SRS funds

The main drawback of this ETF is the higher expense ratio compared to 3067.

However, I do believe that the benefits of HST clearly outweigh the cost!

Choose 3067 if you want a lower expense ratio

If you are a non-Singaporean investor, then 3067 may be the better choice for you. This is mainly due to the lower expense ratio that you’ll incur.

Besides that, BlackRock is a more established fund manager compared to LionGlobal.

As such, you may trust the fund being managed by BlackRock more!

Conclusion

Both HST and 3067 should have very similar performances since they track the same index. If you are a Singaporean investor, I believe that you should invest in HST due to its many advantages.

Besides that, there is not much difference between these 2 ETFs!

Both of these ETFs track the Hang Seng Tech Index, and not the Hang Seng Index. You can check out my guide on buying the Hang Seng Index from Singapore for more information.

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?