Last updated on June 6th, 2021

Tracking all of your investments can be really hard. This is especially so if you buy stocks in different exchanges.

Do you ever wish that there could be one platform that tracks everything for you?

StocksCafe might just be the answer!

Contents

StocksCafe Review

StocksCafe has an extensive collection of features that will be useful for any investor. Whether you’re a passive investor or a more active investor, there will be something that will help you in your investment journey.

Here is an in-depth overview of this investment platform:

What is StocksCafe?

StocksCafe is a portfolio management platform developed by Evan Koh.

This platform allows you to track your stock holdings from these 7 countries:

| Country | Exchange(s) |

|---|---|

| Singapore | SGX |

| Malaysia | KLSE |

| Japan | TSE |

| Hong Kong | HKEX |

| England | LSE |

| USA | NYSE Nasdaq |

| China | SZSE SSE |

To start tracking your stocks with StocksCafe, you will need to input your entire transaction history into the platform.

After that, you will be able to track how all of your stocks are doing in one place!

You are able to track other assets and liabilities that you may have together with your stocks. This will give you a bird’s-eye view on your entire finances.

How do I add my transactions into StocksCafe?

This is the most important step to start using StocksCafe! You may have bought stocks from a brokerage like Tiger Brokers. After that, you will need to add your transactions into StocksCafe.

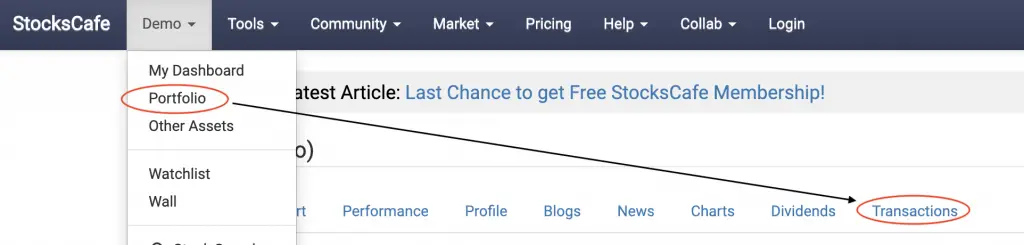

First, you will have to go to the transactions page (Portfolio → Transactions).

There are 5 tabs that are found in this section:

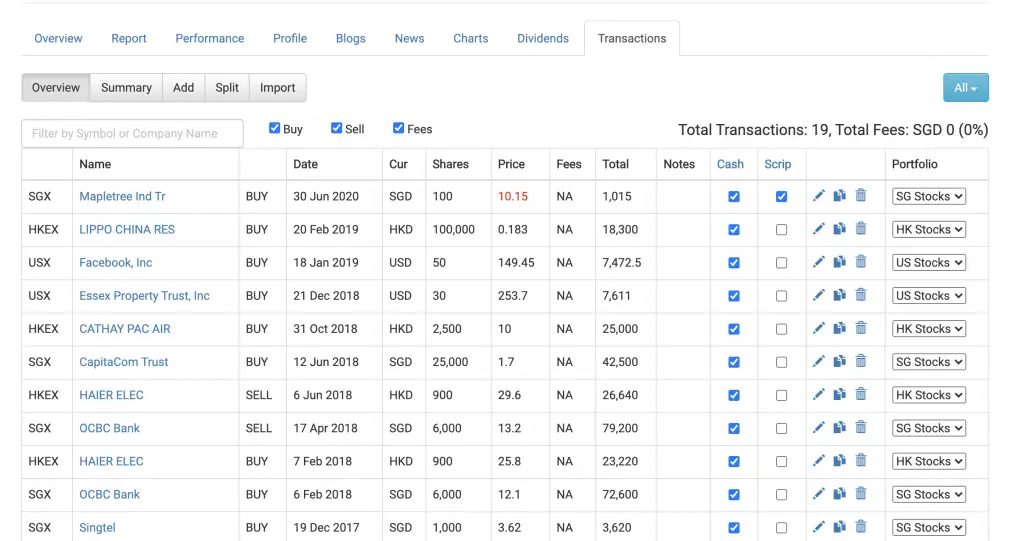

#1 Overview

You are able to see an overview of all the transactions that you have made.

#2 Summary

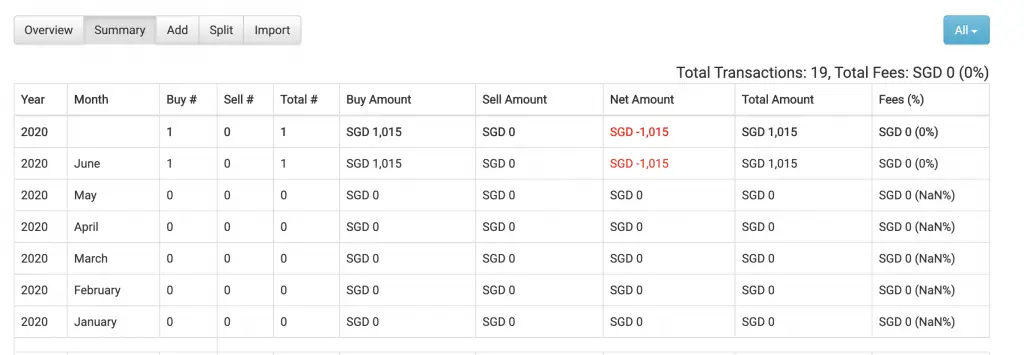

The summary tab gives you a summary of your transactions for each month.

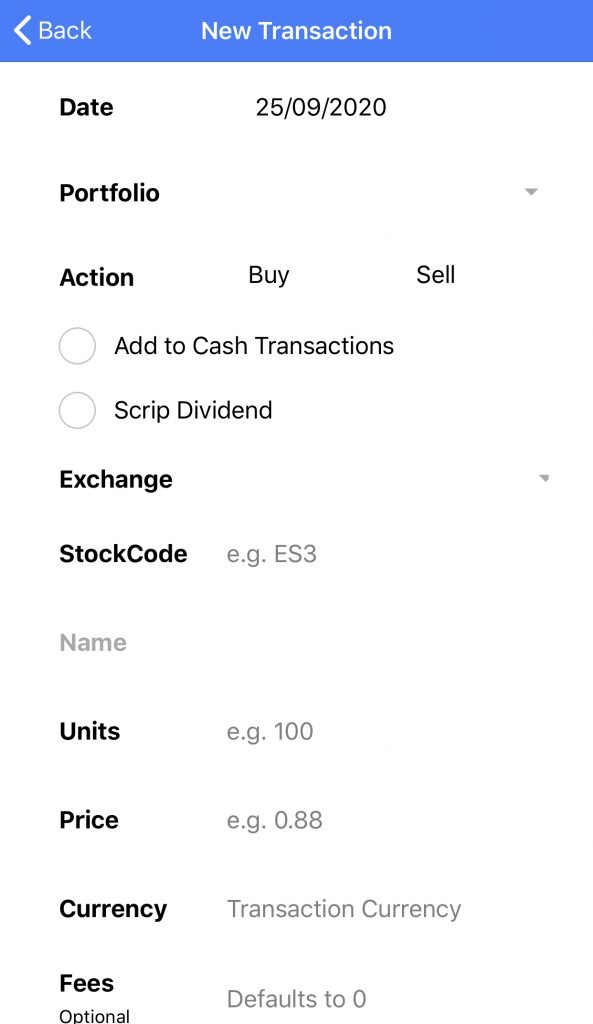

#3 Add

Here, you can add each transaction manually.

There are a few compulsory fields that you’ll need to enter:

- Transaction type (Buy / Sell / Fees)

- Stock Code

- Date

- Portfolio

- Units purchased / sold

- Price paid / received (for each unit)

In the ‘Units Purchased / Sold‘ field, you are able to add in fractional shares or odd lots. This helps you to accurately track all of your investments.

It may be pretty tedious to add all of your transactions using this method. You may choose to import multiple transactions instead.

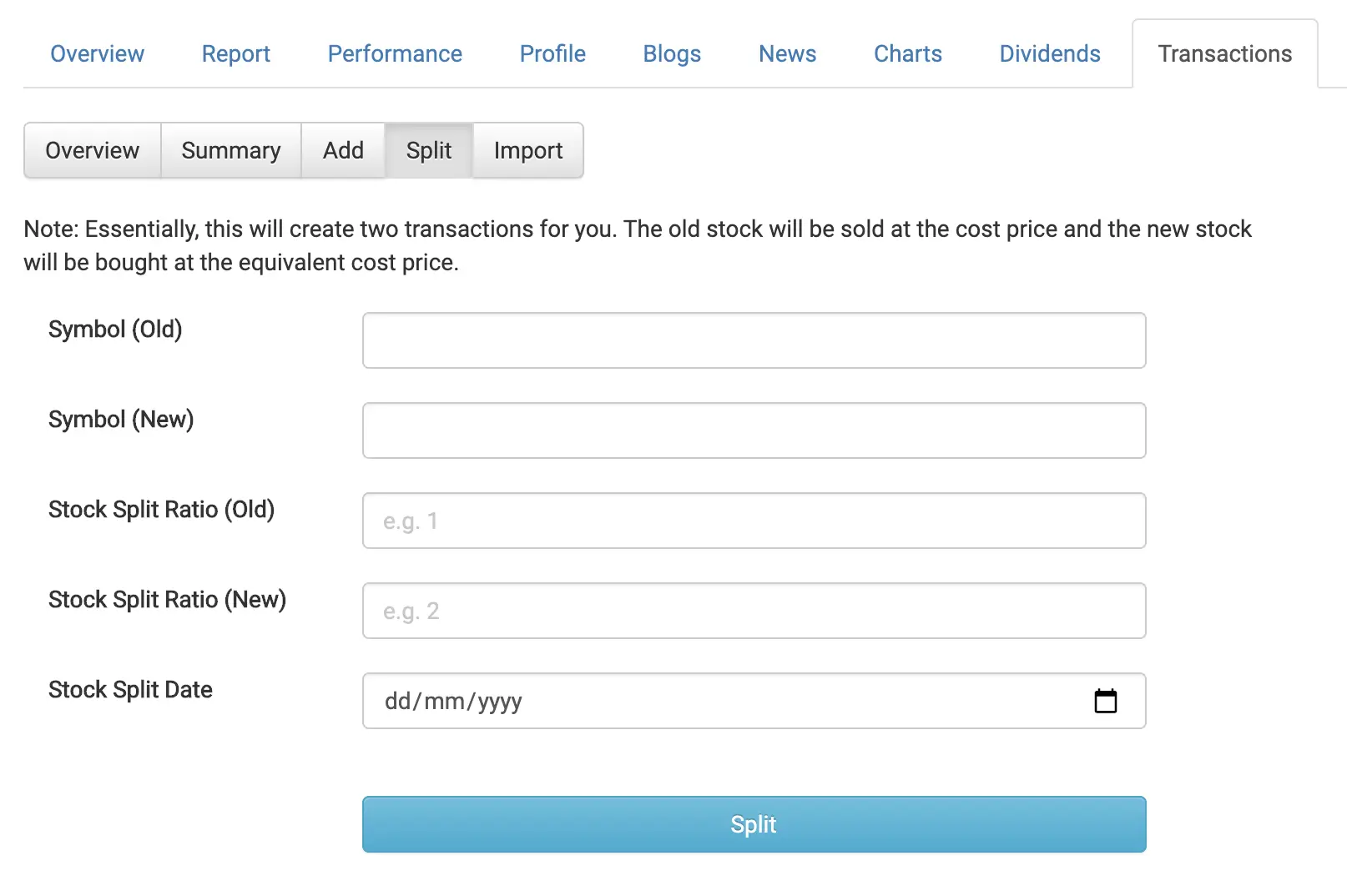

#4 Split

Apple had a stock split in August 2020.

These stock splits may happen from time to time. Companies may do this to make their stock more accessible to investors.

You can make a stock split transaction as well.

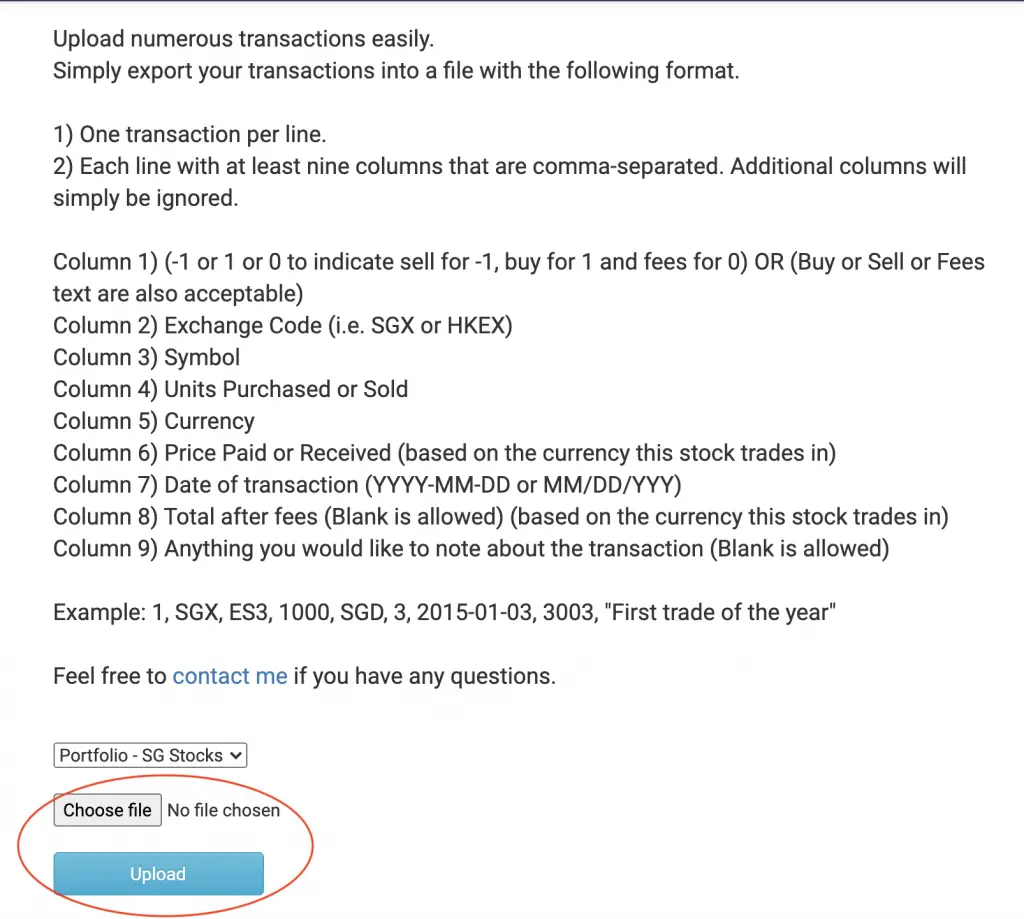

#5 Import

You can choose to import your transactions from a .csv file. This makes it really easy to import multiple transactions at once.

You would not need to manually add them in one by one!

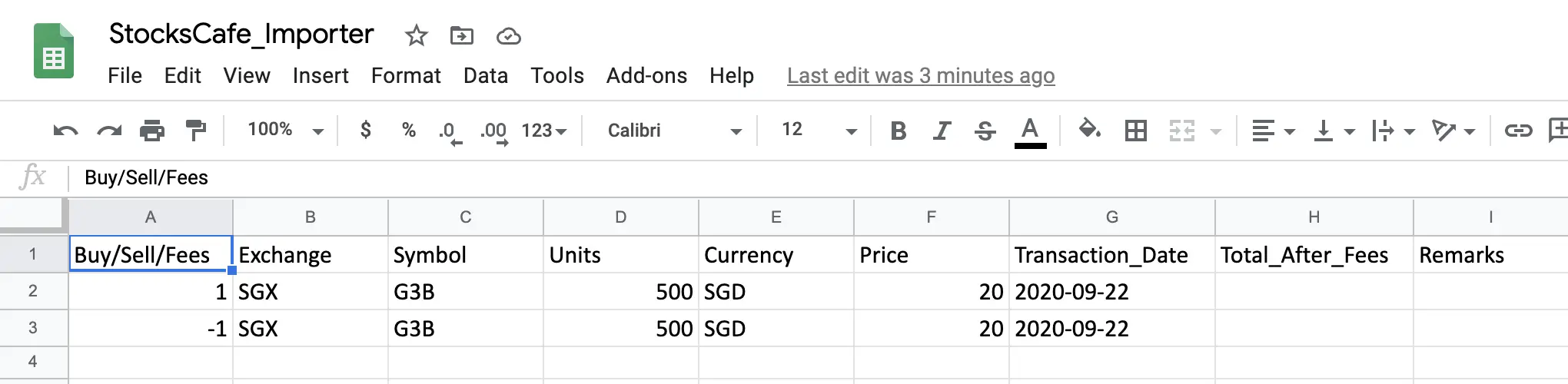

First, you’ll need to create a .csv file. StocksCafe will only read the first 9 columns of your .csv file.

Here’s the information that you’ll need to put.

| Column Number | Information |

|---|---|

| 1 | Buy (1) / Sell (-1) / Fees (0) |

| 2 | Exchange Code (E.g. SGX or HKEX) |

| 3 | Stock Symbol |

| 4 | Units Purchased or Sold |

| 5 | Currency |

| 6 | Price Paid or Received (based on the currency that the stock trades in) |

| 7 | Date of transaction (YYYY-MM-DD or MM/DD/YYYY) |

| 8 | Total after fees (You can leave this blank) |

| 9 | Notes (You can leave this blank) |

If you are unsure of how to create a .csv file, you can download a .csv file that I’ve created.

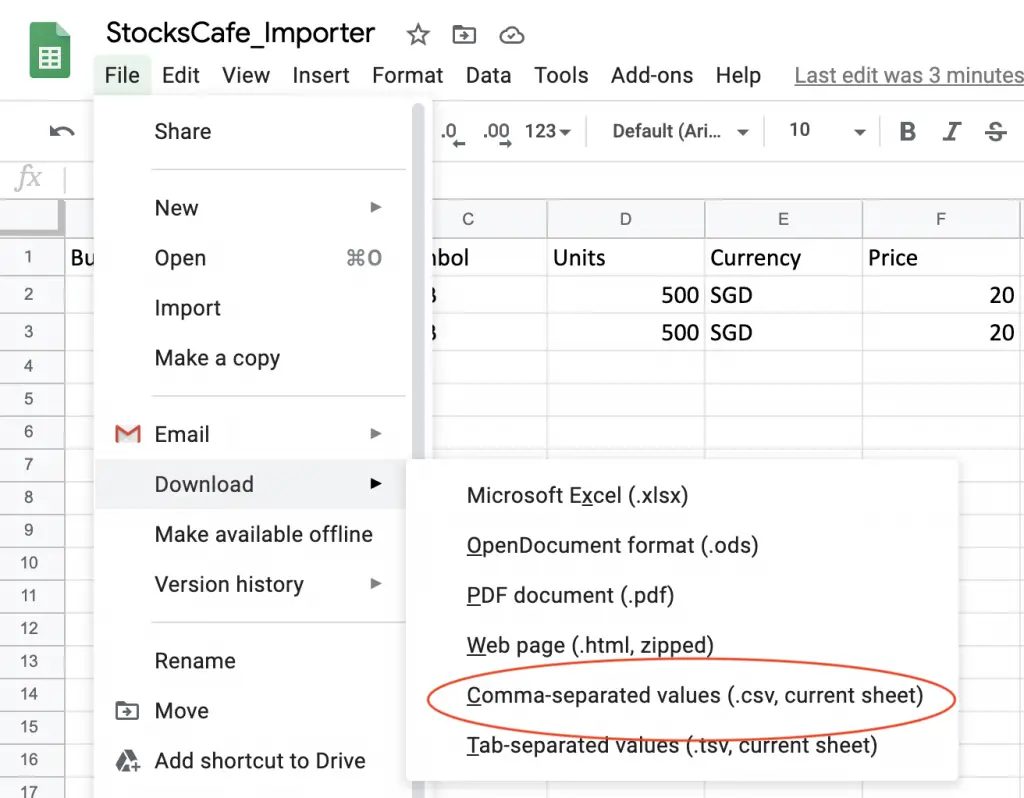

You will have to download the file from Google Drive as a .csv file.

After downloading it, you can start entering your transactions into the sheet!

First, you’ll need to remove the first 2 transactions that I’ve added as an example.

You are able to leave the column headers (row 1) in the .csv file.

After that, you can add in your own transactions!

Once you’ve added your transactions, remember to save the file as a .csv file!

You can then upload the file to StocksCafe.

If everything goes smoothly, you should be able to see all of your transactions in the overview tab.

Issues with importing transactions

A common issue that you may have with importing the transaction is the date.

If you are using the date format with Excel, it will turn out as DD-MM-YY. As such, the format will be rejected by StocksCafe.

I have changed the column format to be plain text instead of the date format. You should not have any issues with the date!

Another issue you may have is with the number values. Since a .csv file uses a comma-separated format, you cannot use a comma in the data field.

The most common place that you may use a comma is when the price of the stock is at least $1,000.

To avoid problems with importing, here are 2 workarounds:

- Remove the commas entirely

- Add quotation marks around the field (e.g. “1,234”)

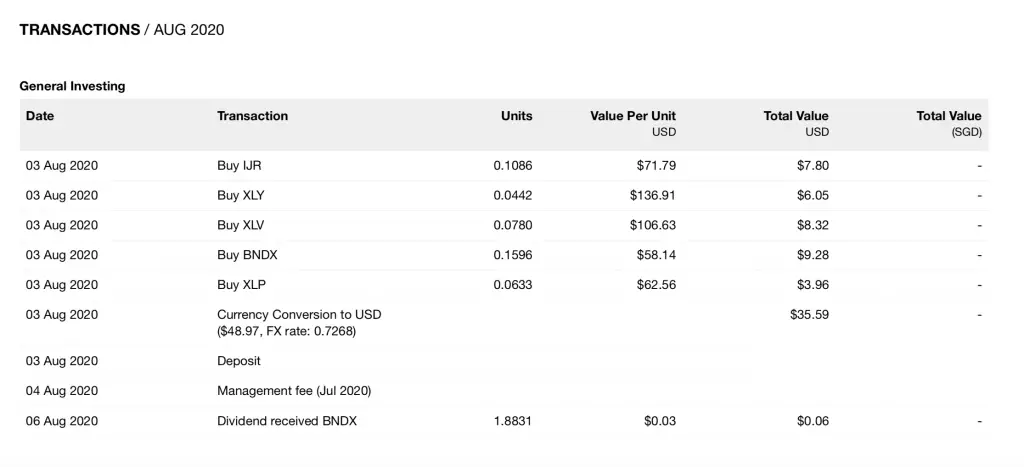

Import transactions from robo-advisors

This import function allows you to import your transactions from robo-advisors too!

Robo-advisors such as StashAway and Syfe will send you a monthly statement. This includes all your transactions for the month.

Using these information, you are able to import your robo-advisor transactions into StocksCafe!

However, the statements are not formatted properly. You may not be able to convert it into an Excel file.

You can check out KPO and CZM’s StashAway and Syfe parsers. These will help you to format the transaction statements to a tabular format.

That way, you can place the necessary fields into the .csv file and import it to StocksCafe.

Features

StocksCafe has 60 different features, and it can be really overwhelming at the start!

Here’s a walkthrough of the most useful ones:

- Wall

- Stock Profile

- Portfolio

- Other Assets

- SSB Tracking

- Dashboard

- Watchlist

- Stock Screener

- Risk Manager

- Forum

- Community

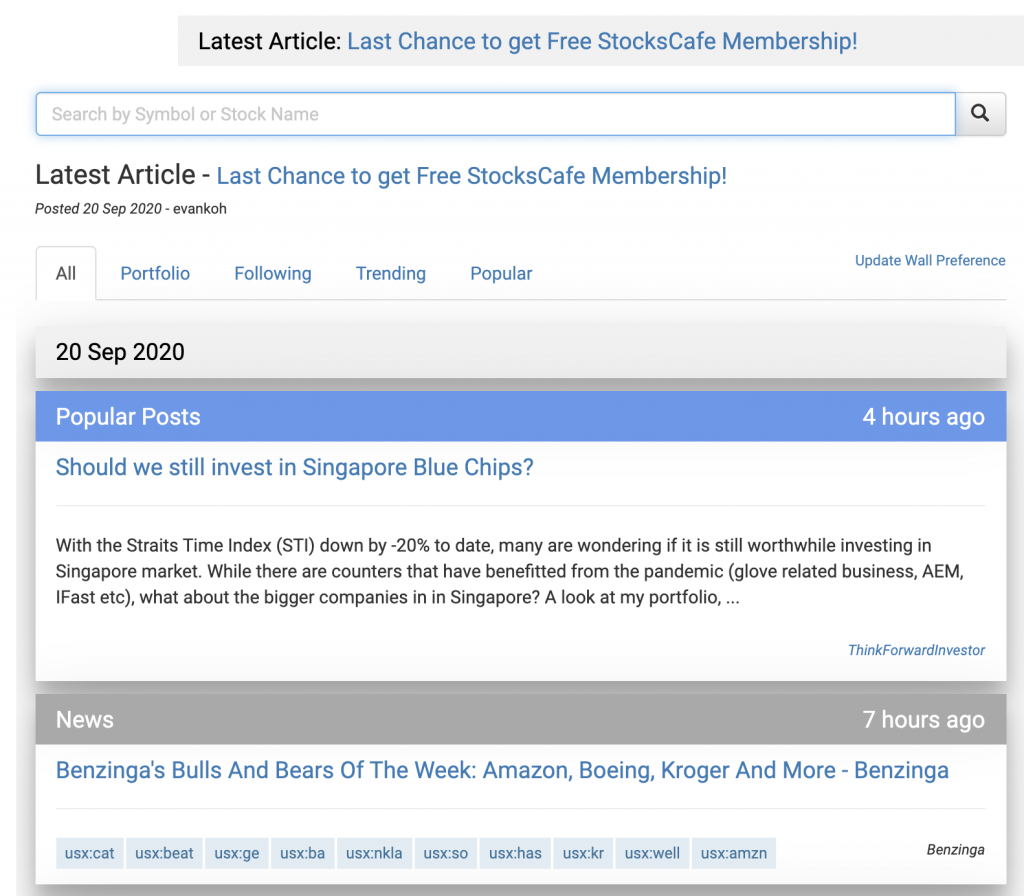

#1 Wall

The wall is the first thing that you’ll be greeted with when you enter the StocksCafe platform.

Here are 5 things that you can see from your wall:

- Trending Stocks News

- Popular Blog Posts

- Portfolio Summary

- Trending Stocks

- Stock of the Day

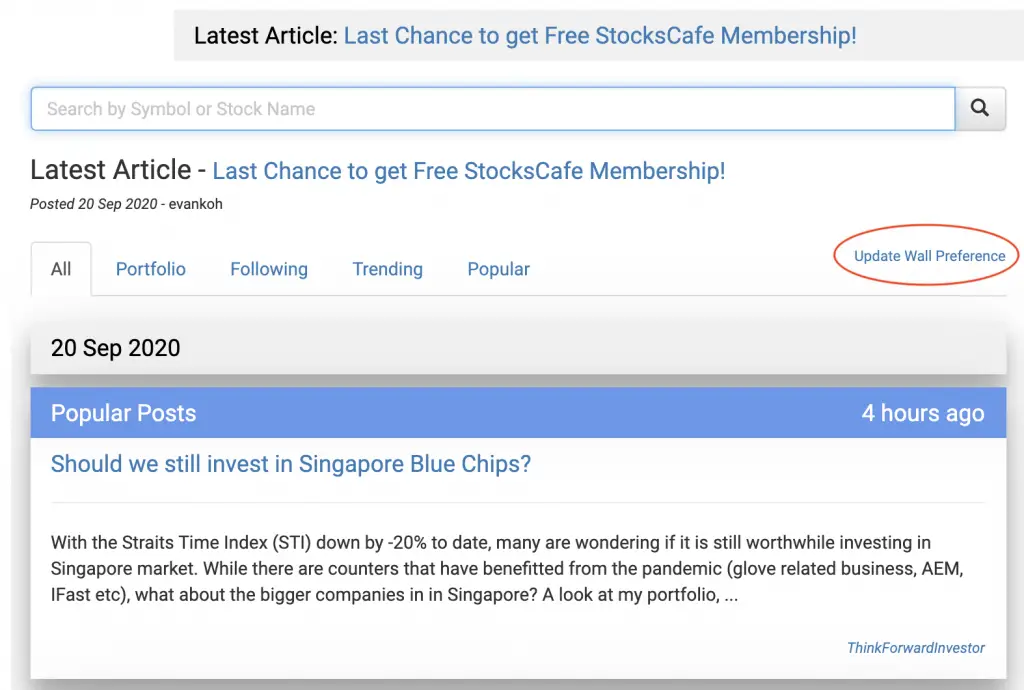

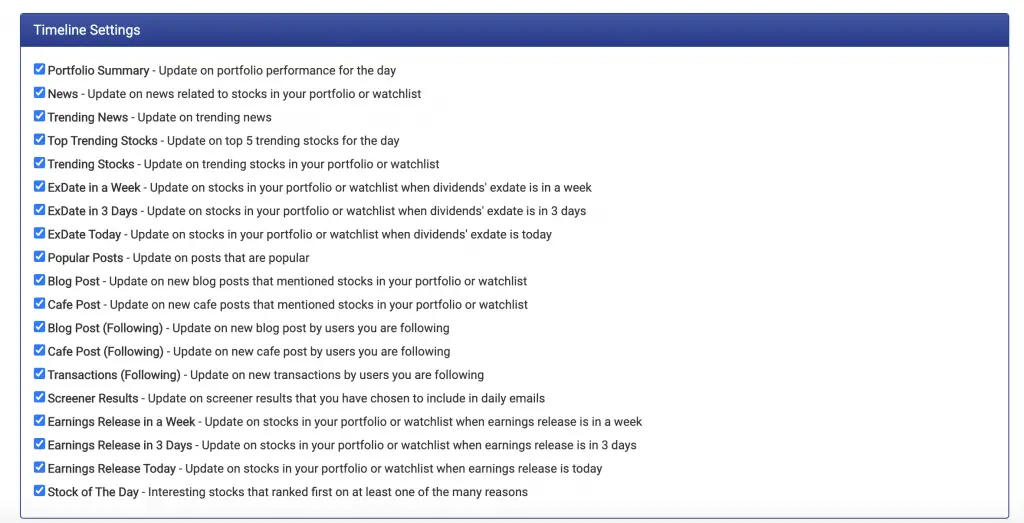

You are able to customise the content on your wall in the preference pane.

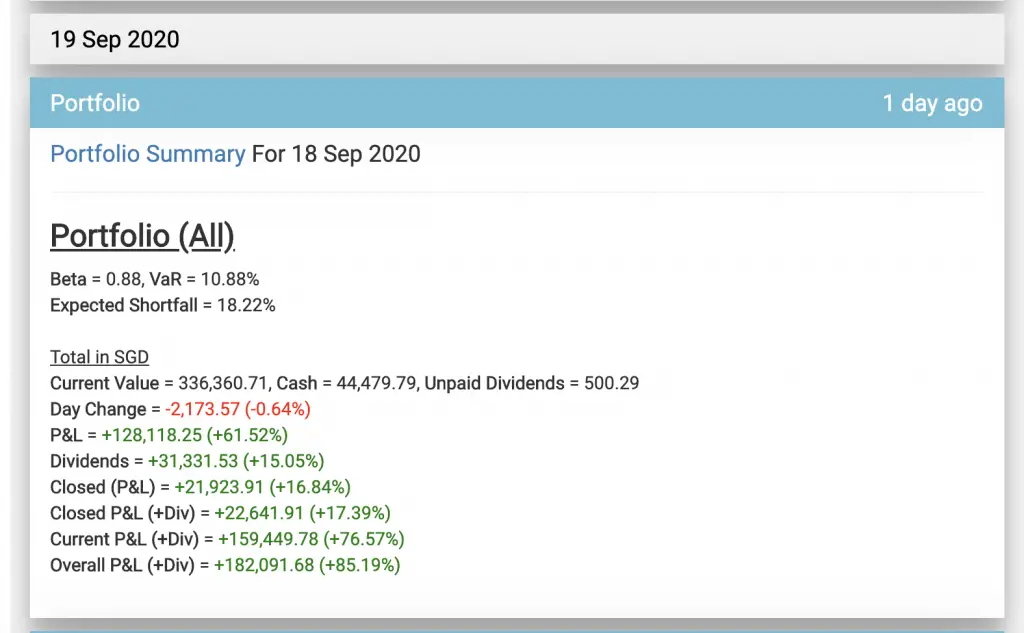

Furthermore, you can view the portfolio tab. This provides you with detailed information about your investment portfolio.

You can view a daily report card of your portfolio as well.

The best part is that everything is denominated in SGD!

However, having these daily updates may be very distracting. If you see your assets’ value constantly dropping, you may be tempted to sell them off.

You may want to reduce the frequency of the portfolio updates, as it may just lead you to make emotional decisions!

#2 Stock profile

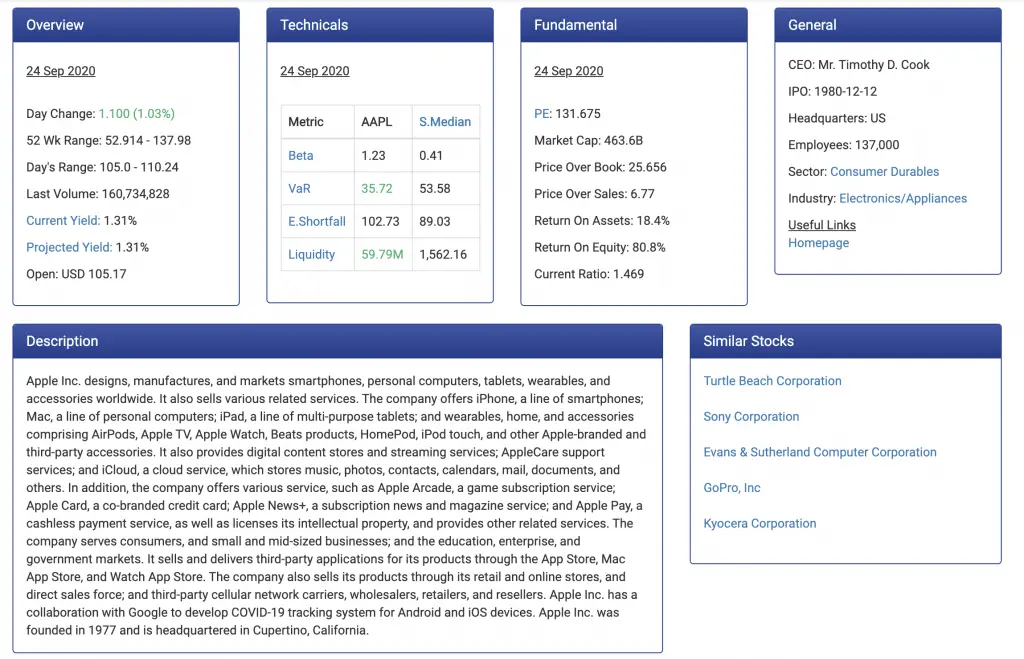

Being primarily a stock platform, StocksCafe has a dedicated profile for each stock.

This provides you with tons of information about each stock.

There are 8 tabs that are available, including:

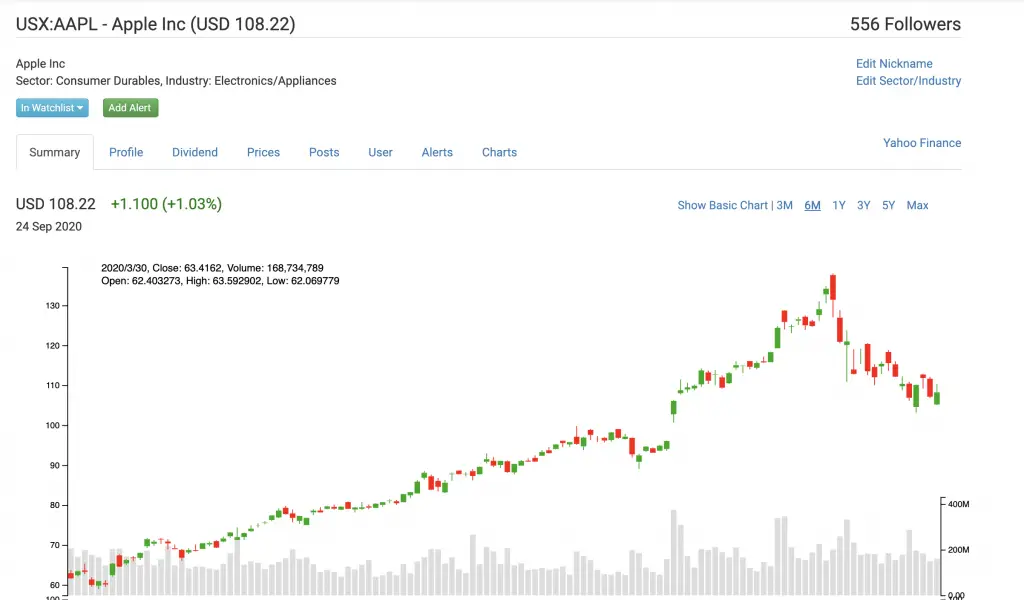

1. Summary

You are able to see the price of the stock, as well as the price history in a chart.

Scrolling down, you can see more statistics of about the stock.

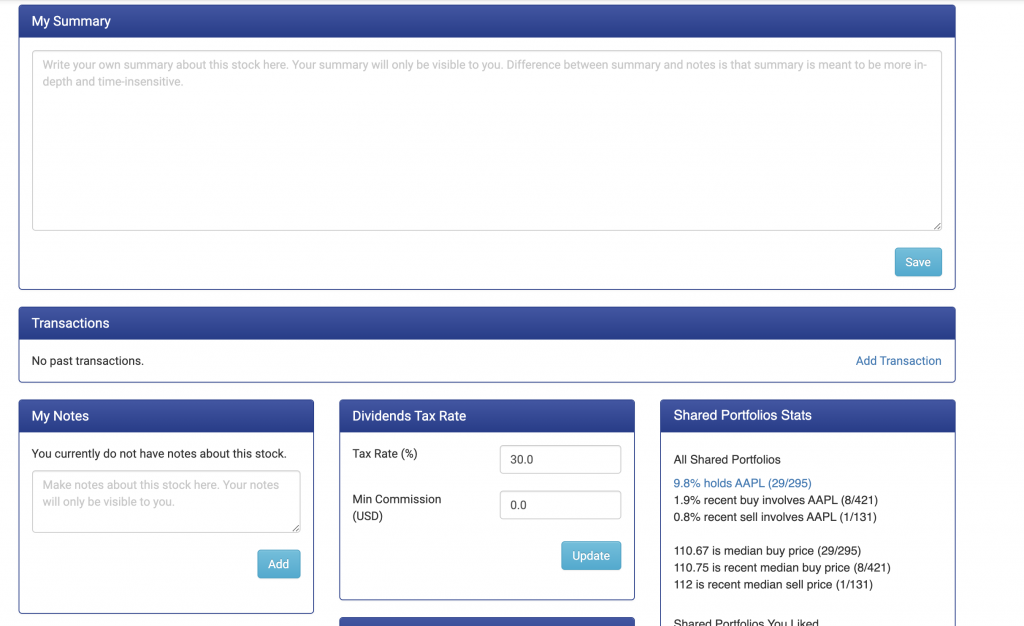

You can even write your own summary of the stock.

According to ‘The Neatest Little Guide to Stock Market Investing‘, Jason Kelly recommends you to develop a pitch for each stock you buy. You need to convince yourself that the stocks that you’re buying are really worth it.

This will help you to stay invested in the long term!

2. Profile

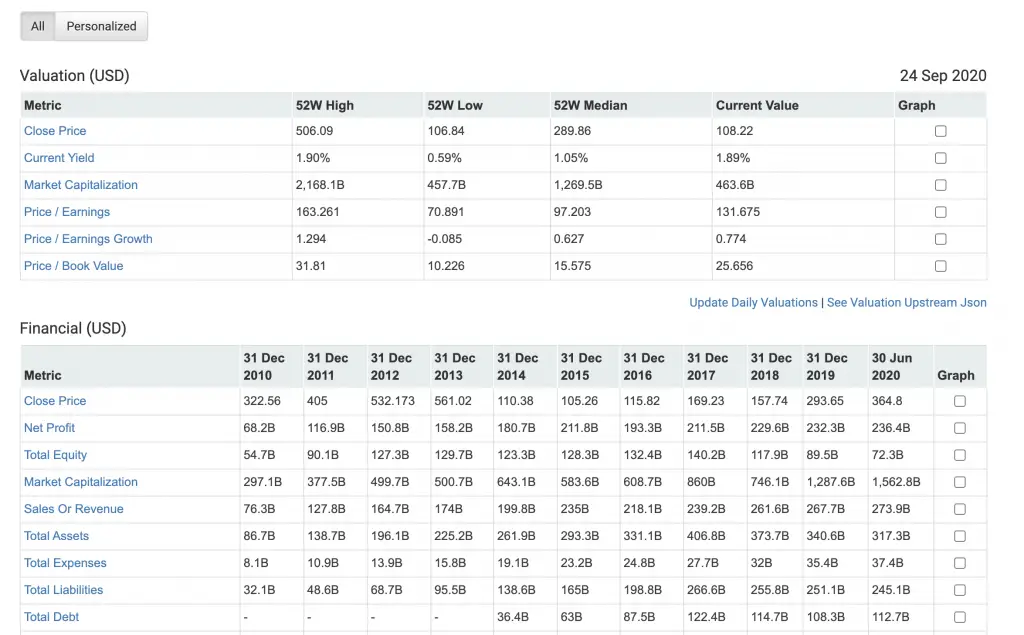

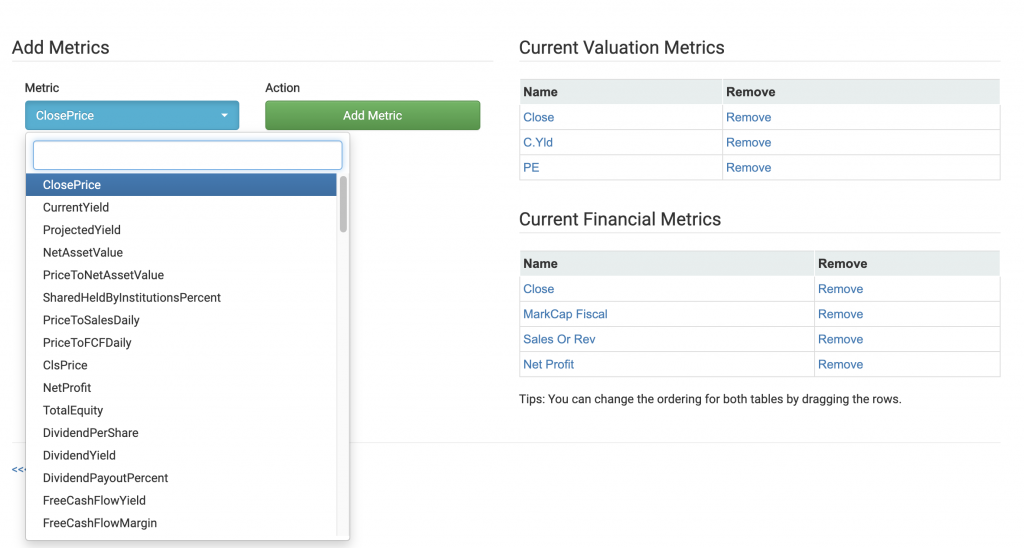

The profile tab gives you access to various metrics about the stock.

You are able to customise the metrics used, according to your needs.

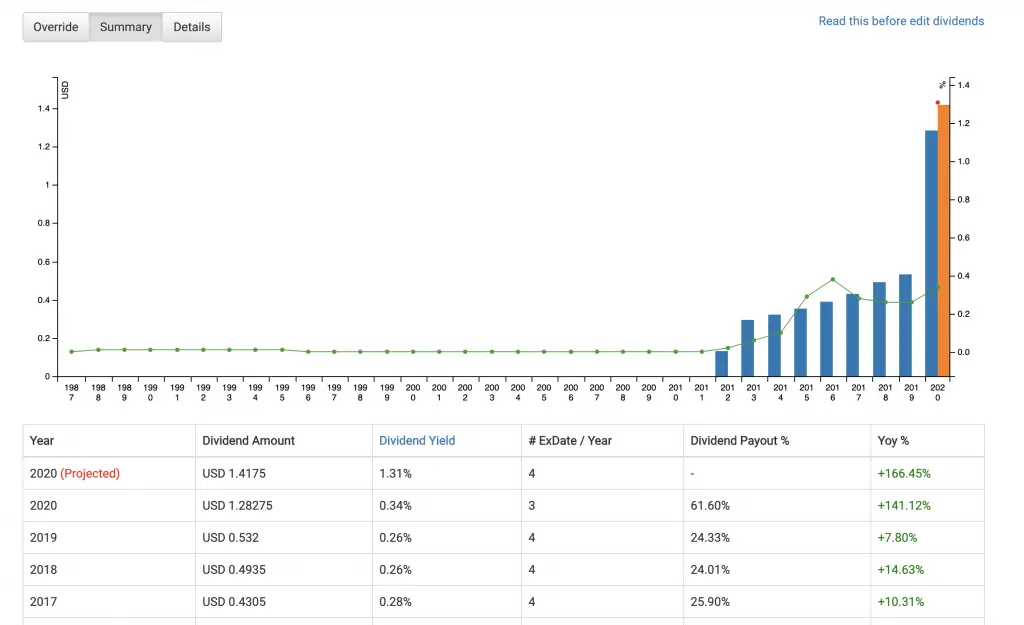

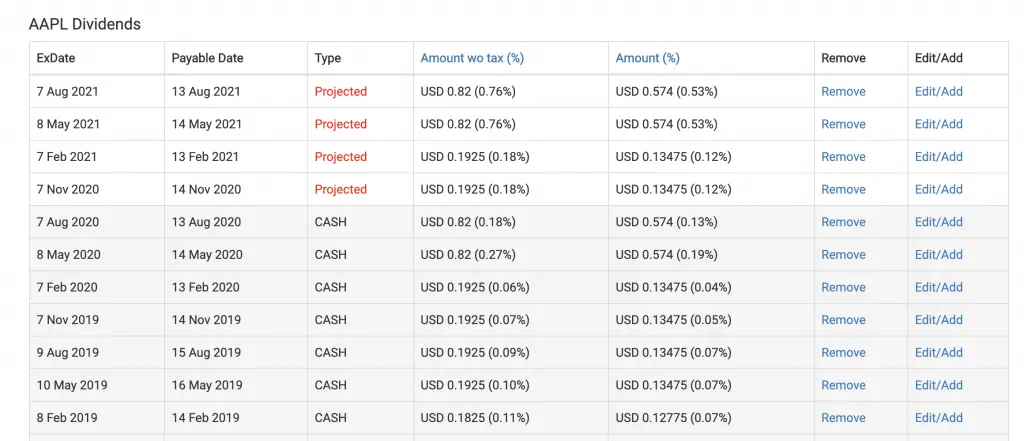

3. Dividends

You are able to track the dividends payouts for that stock. The chart gives you a visual representation of the dividend yield over the years.

You can check the past dividends given out, as well as the projected dividends.

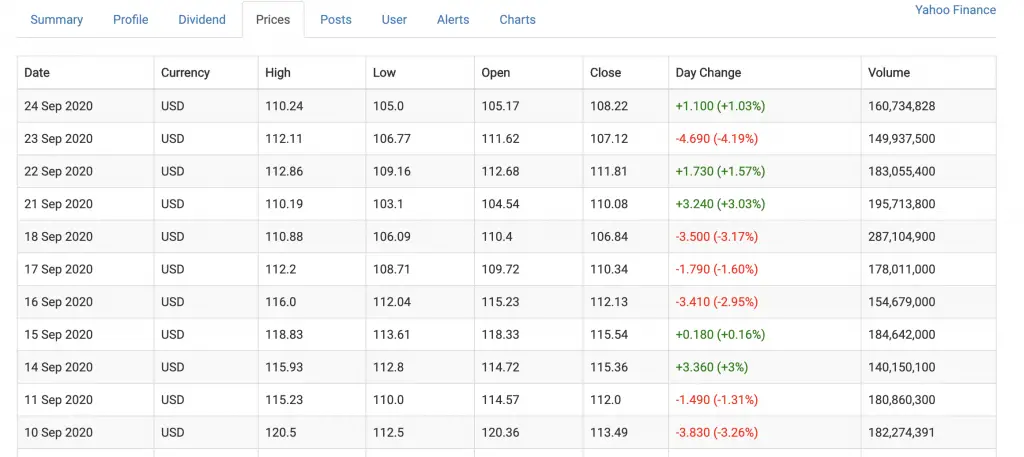

4. Prices

You are able to view the performance of the stock for each day.

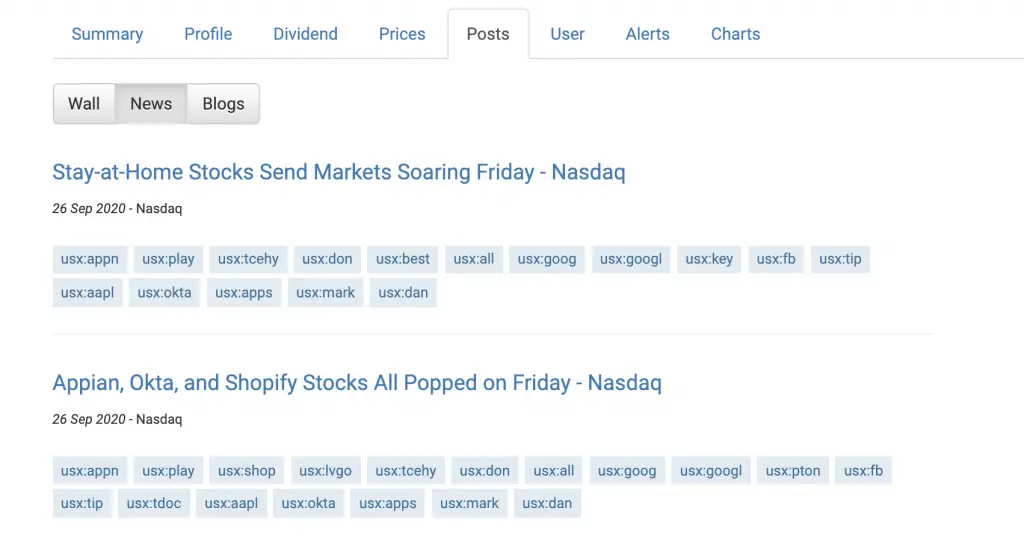

5. Posts

This tab will allow you to view any articles that are related to the stock.

You are able to view articles from news sites and blogs.

6. User

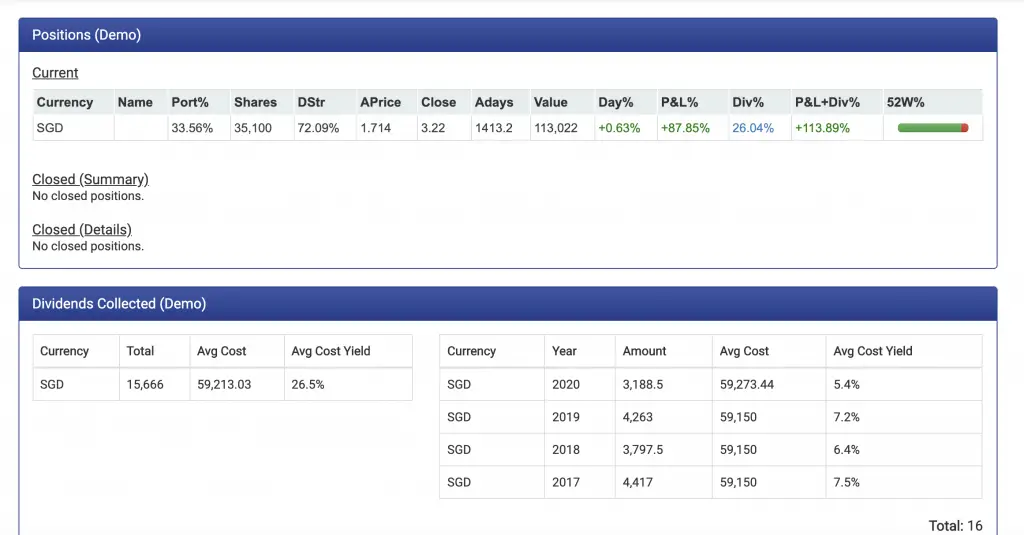

The user tab gives you a summary of your holdings for that specific stock.

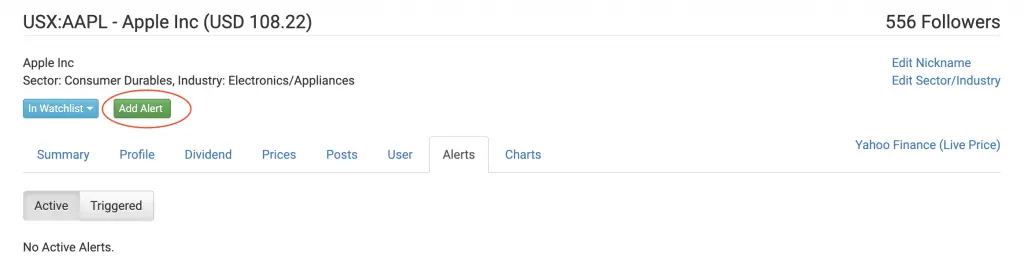

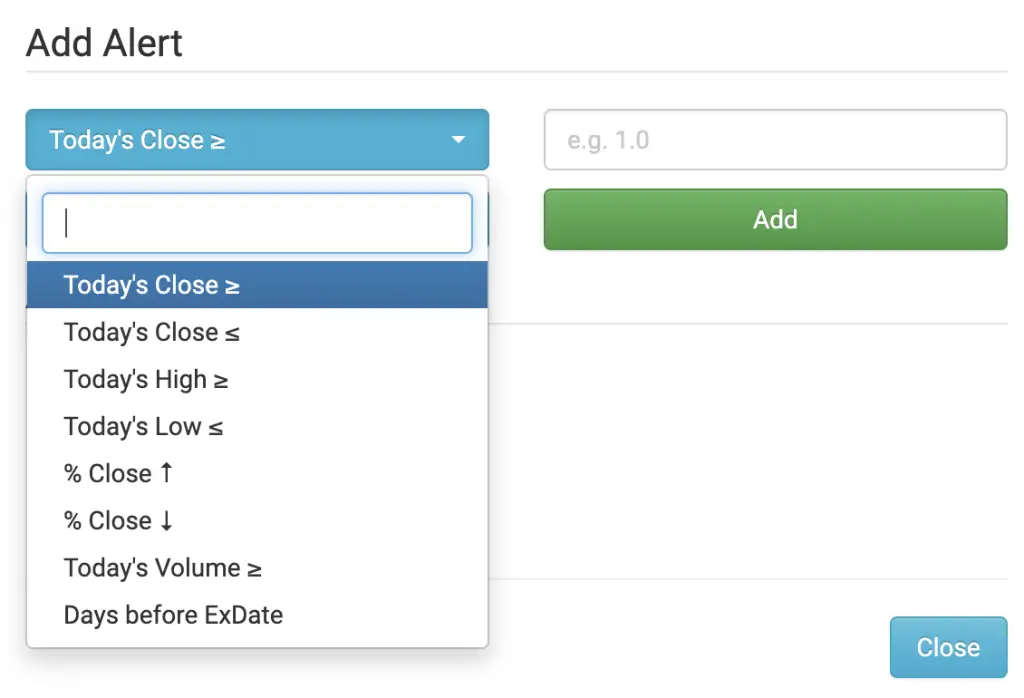

7. Alerts

You are able to set alerts for the stock as well.

First, you’ll need to create the alert.

You can then set the type of alert that you wish to have.

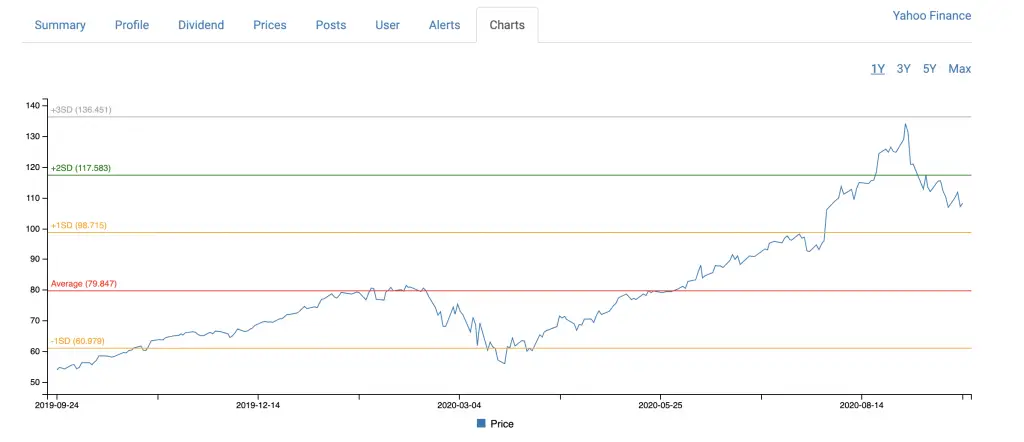

8. Charts

The charts tab allows you to visualise how various metrics have changed over time.

These include:

- Stock Price

- Price / Revenue ratio

- Price / Earning ratio

- Price / Net Asset Value (NAV)

- Price / Free Cash Flow (FCF)

- Dividend yield (%)

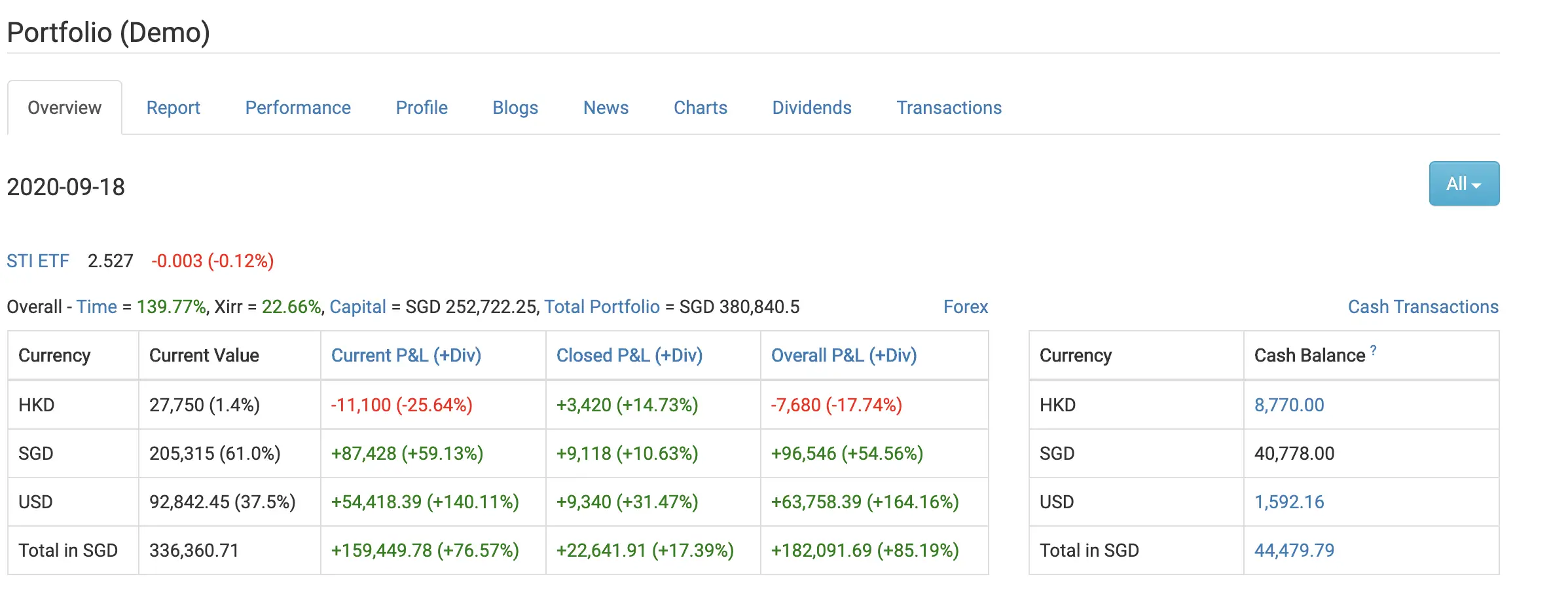

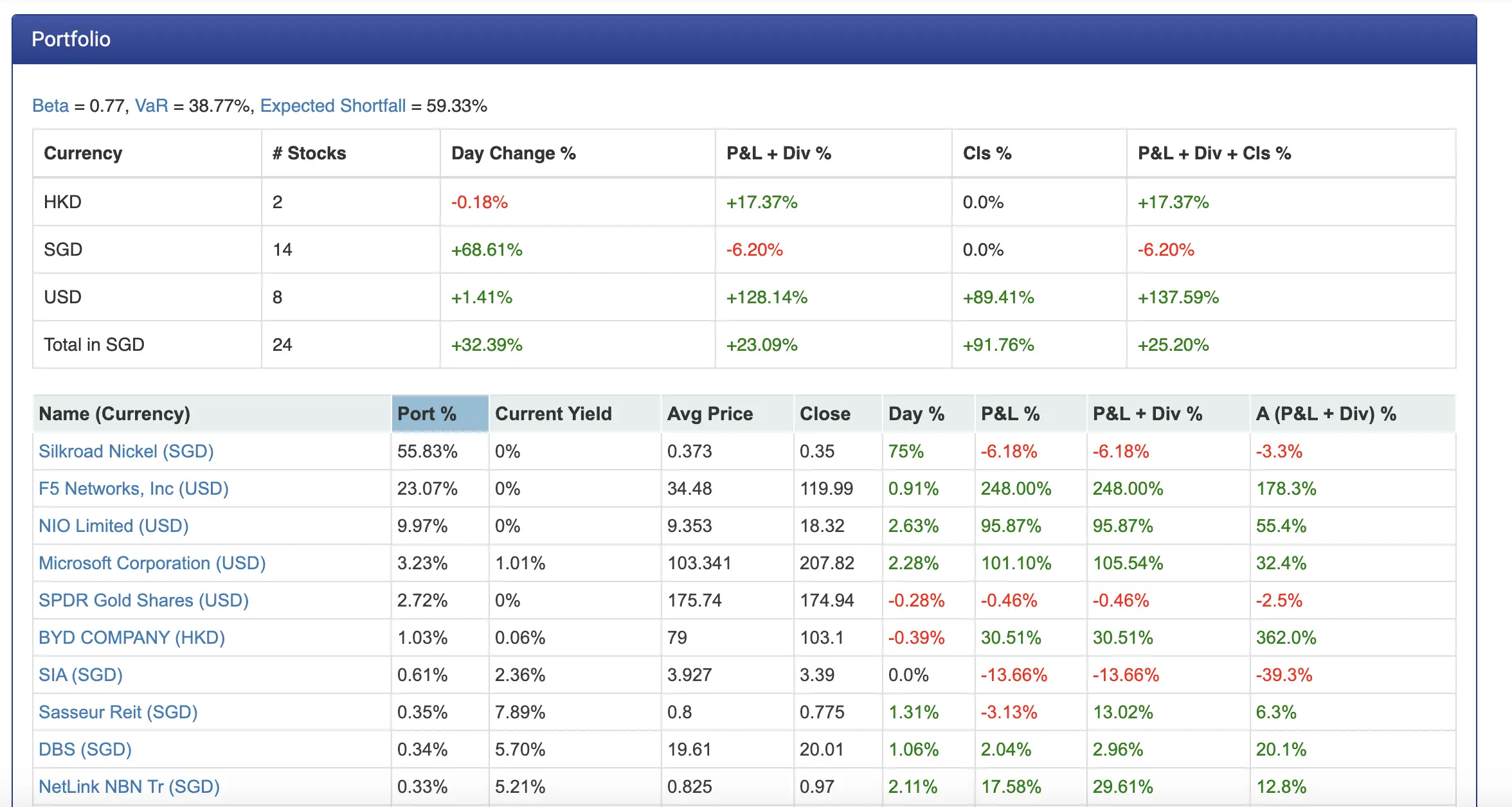

#3 Portfolio

The portfolio function gives you an in-depth analysis of all of your investments.

There are 9 different tabs, each with their own functions:

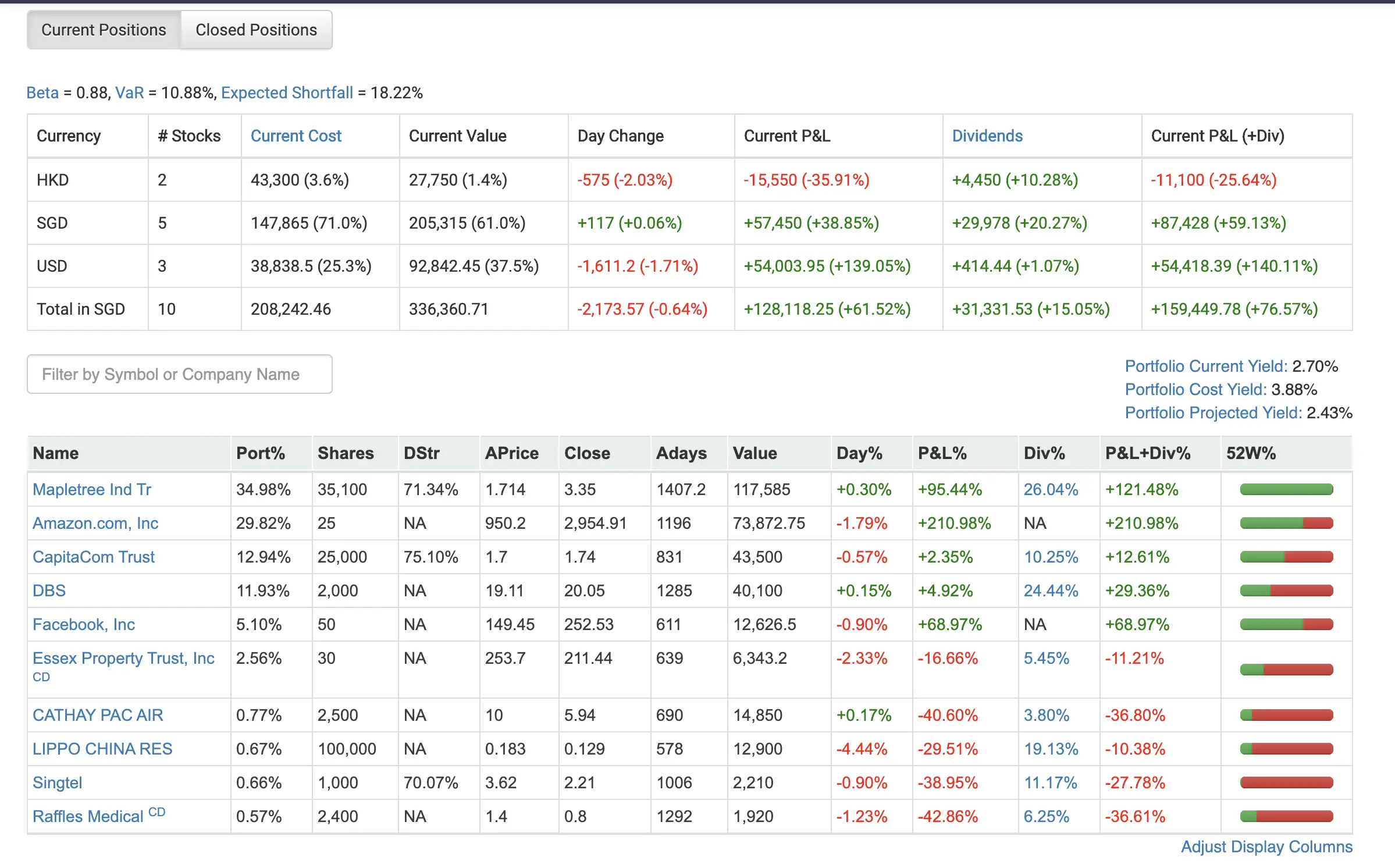

1. Overview

The overview tab allows you to see how your stocks are performing. They are split into their different currencies, but you can the total balance too.

You are able to see your cash balances as well.

This is the amount of cash that you have in your trading accounts.

This may include the dividends that you’ve received from your investments.

Further down the page, you are able to see a detailed analysis about the stocks you own.

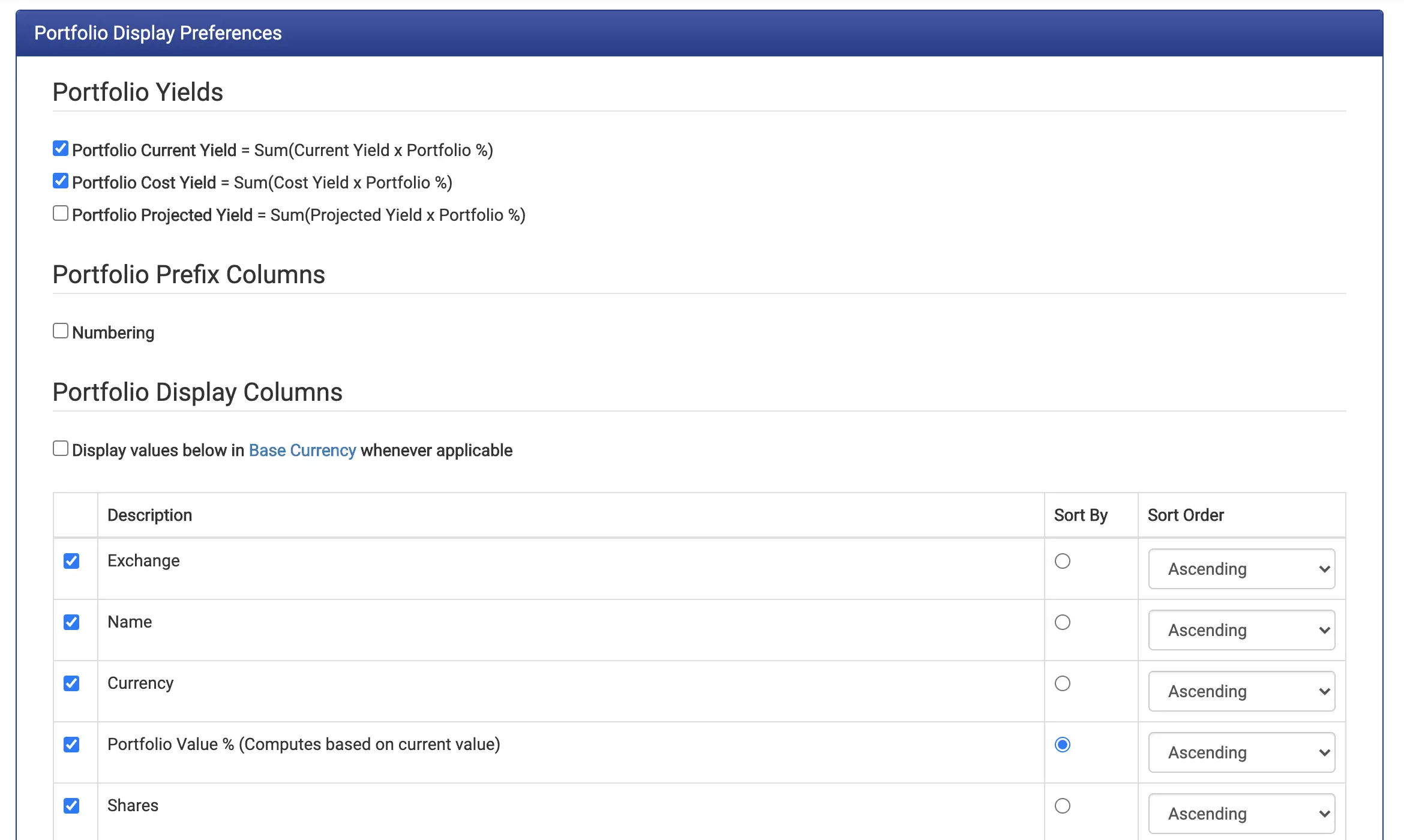

You can choose to adjust the display columns in this section.

You can customise the columns to your personal preference!

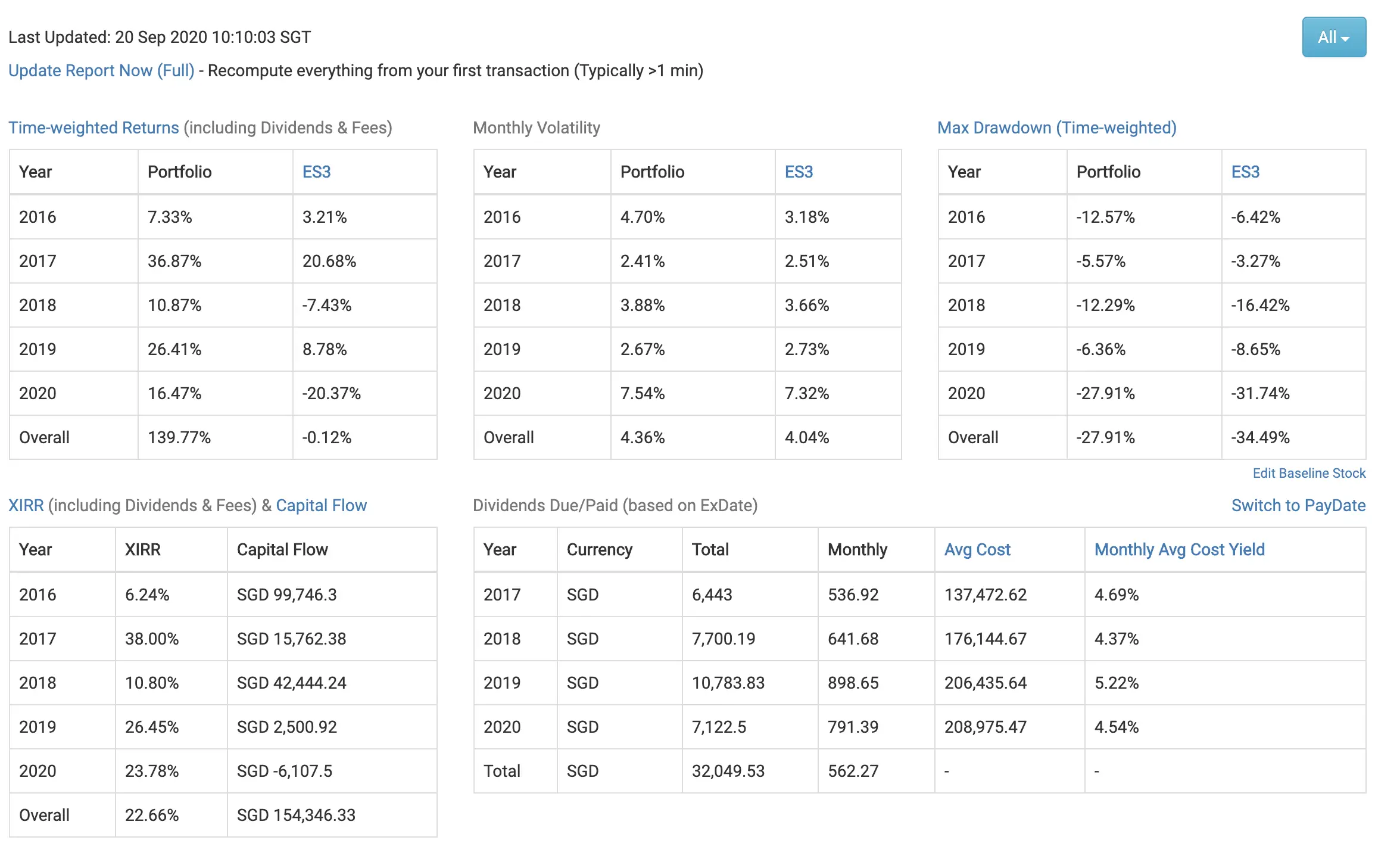

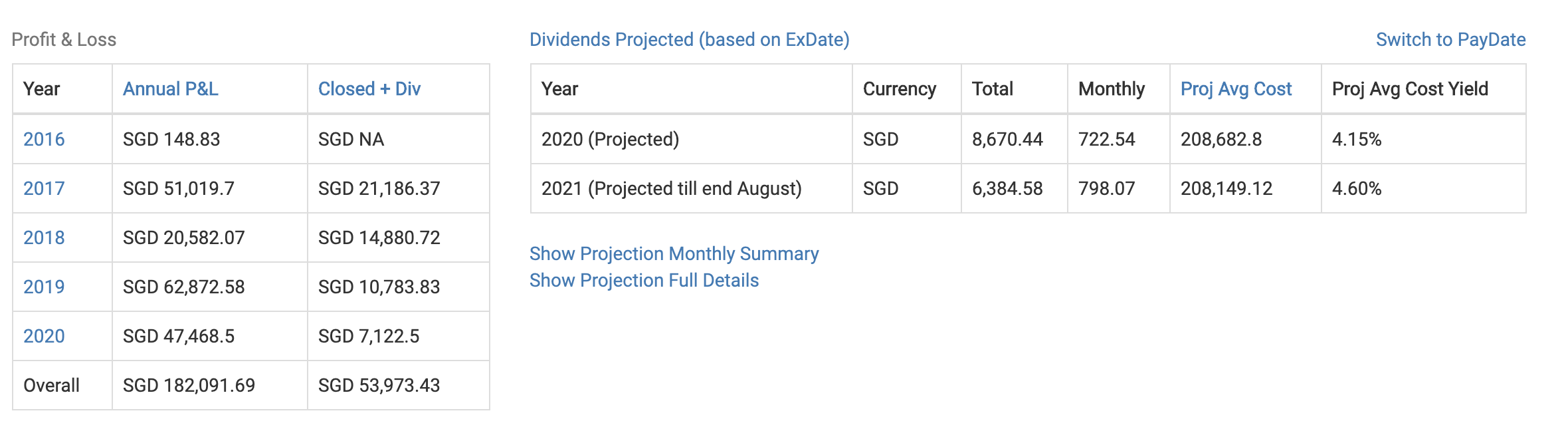

2. Report

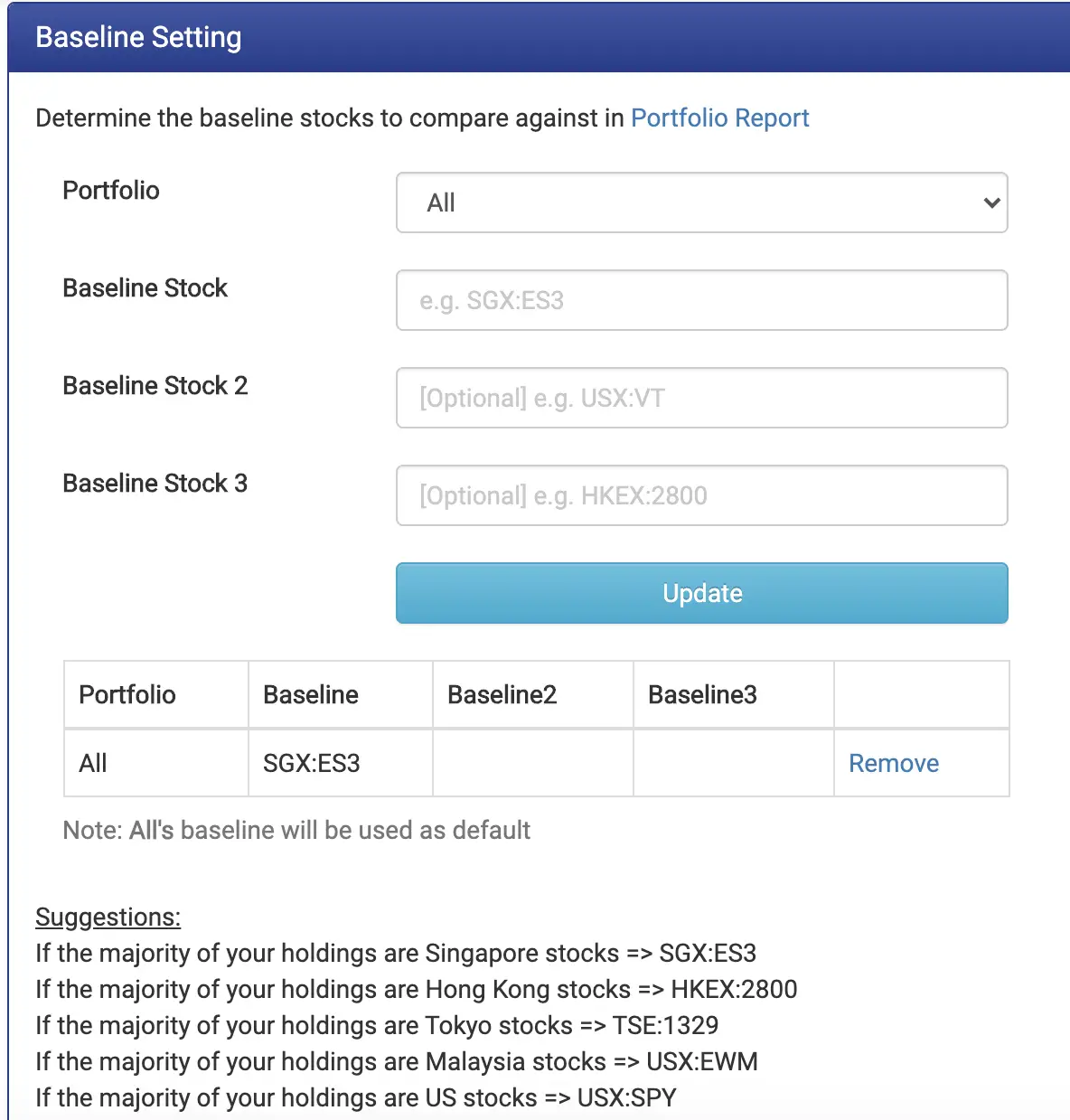

The report tab allows you to see your performance against a benchmark stock.

The benchmarks that you may want to use can be the stock indexes of that market.

The metrics that you can view include:

- Time-weighted returns

- Monthly volatility

- Max drawdown (time-weighted)

- XIRR and capital flow

- Dividends due / paid

- Profit and Loss (P&L)

- Projected dividends

The default benchmark is set as the Straits Times Index (ES3).

If your portfolio is heavy on stocks on other exchanges, you may want to change the baseline.

For example, if you have a US stocks profile, you may want to use the S&P500 as a baseline.

If you’re buying stocks from around the world, you may want to use VT.

You can choose up to 3 baseline stocks.

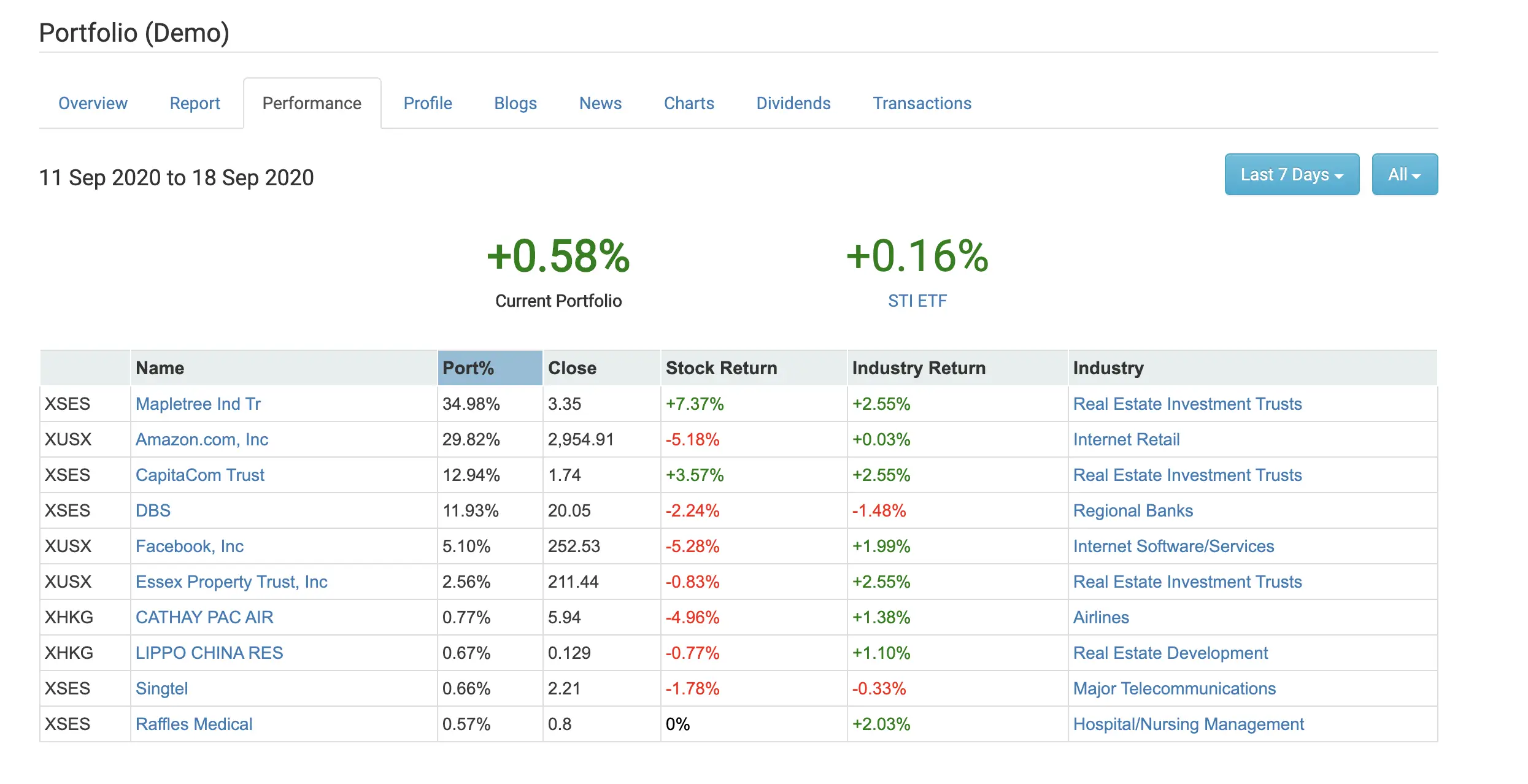

4. Performance

The performance tab compares your stock’s performance against:

- The index you have chosen

- The industry your stocks are in

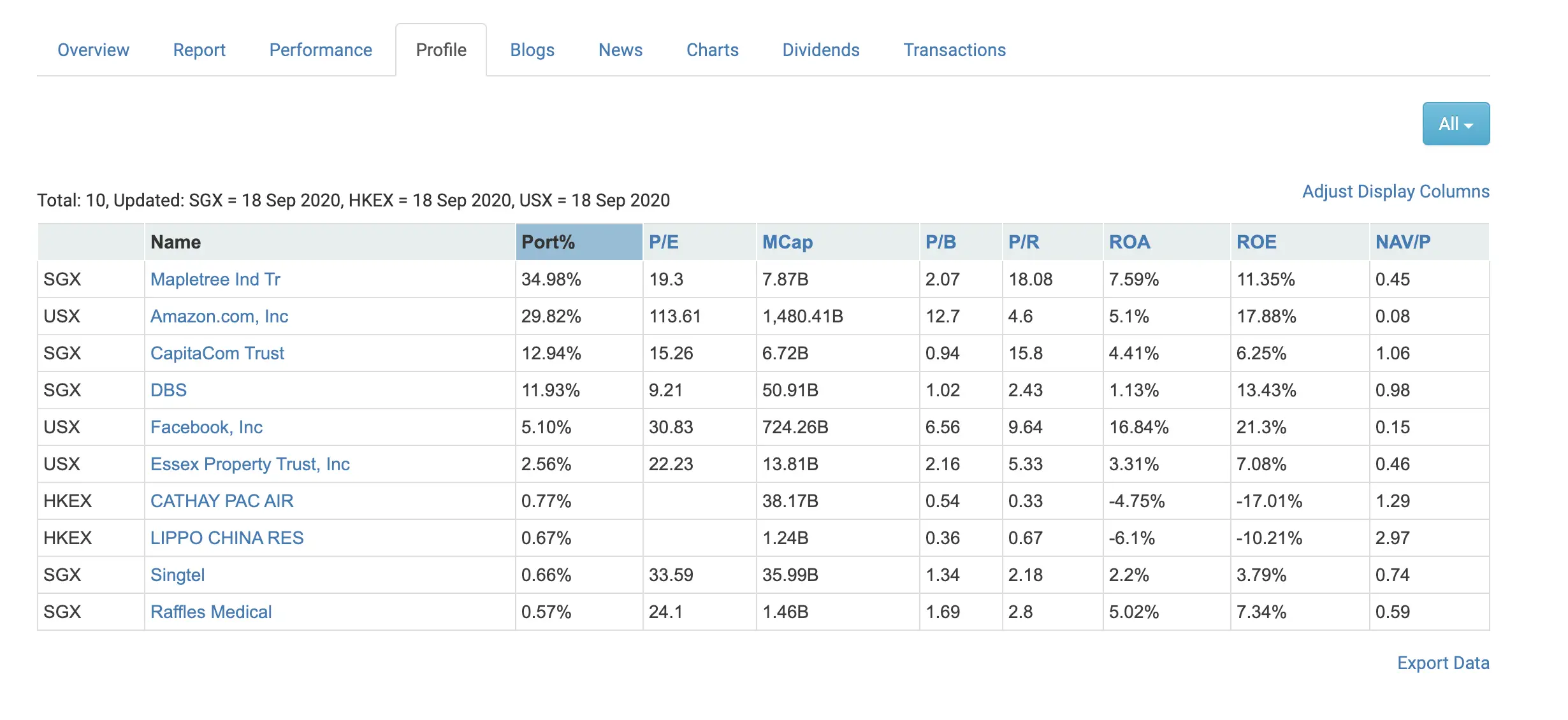

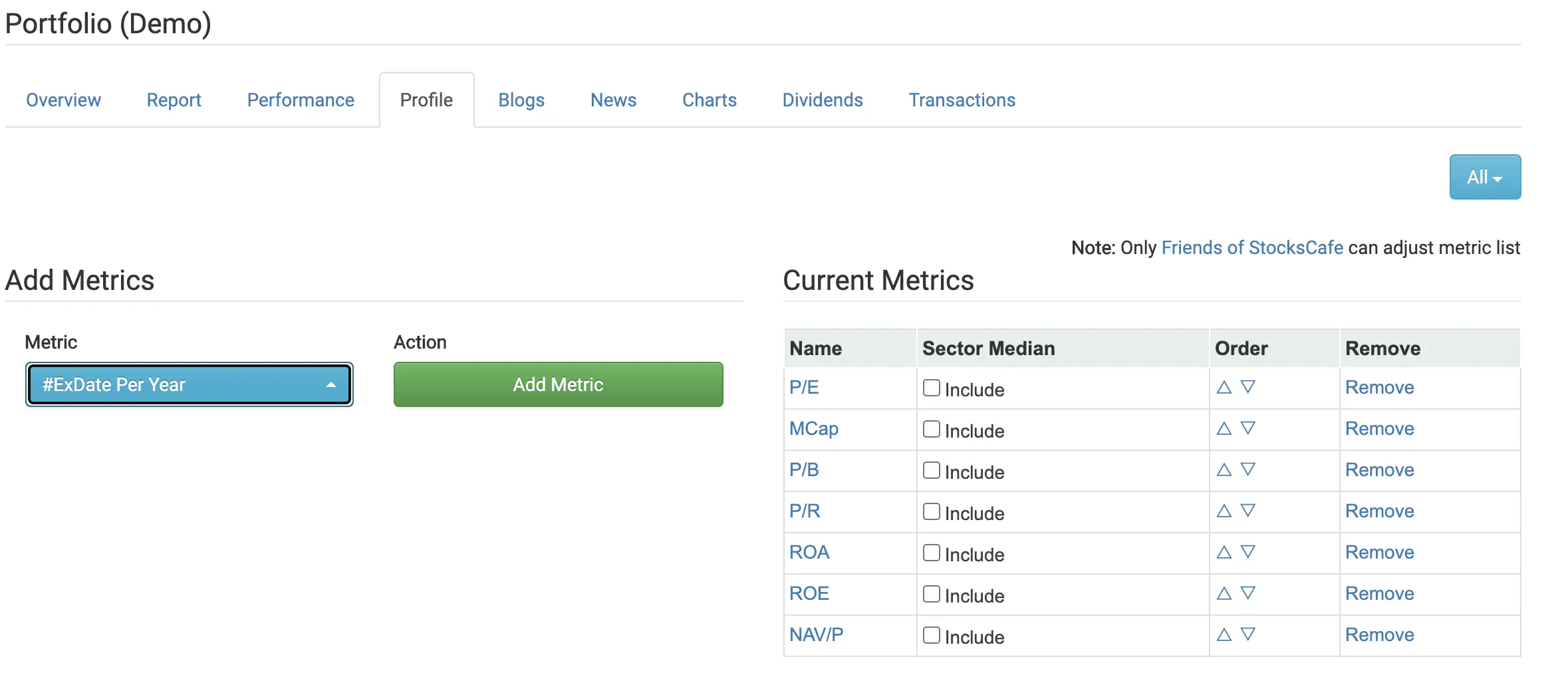

5. Profile

The profile tab lets you see certain metrics of your stocks.

You are able to adjust these metrics, but only if you are a friend of StocksCafe.

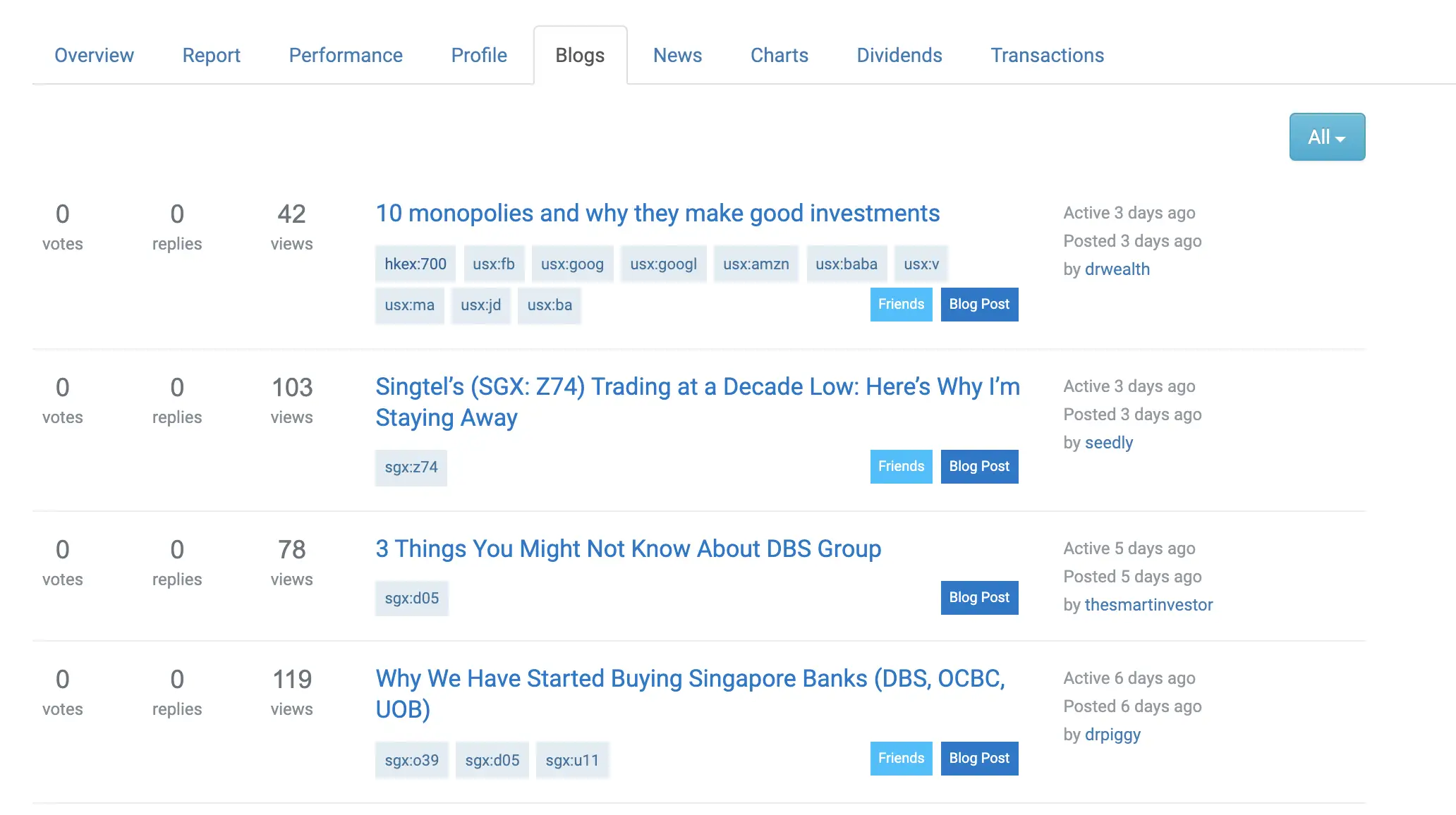

6. Blogs

StocksCafe has many finance blogs in their list.

The blogs tab of the portfolio allows you to track blog posts that write about the stocks in your portfolio.

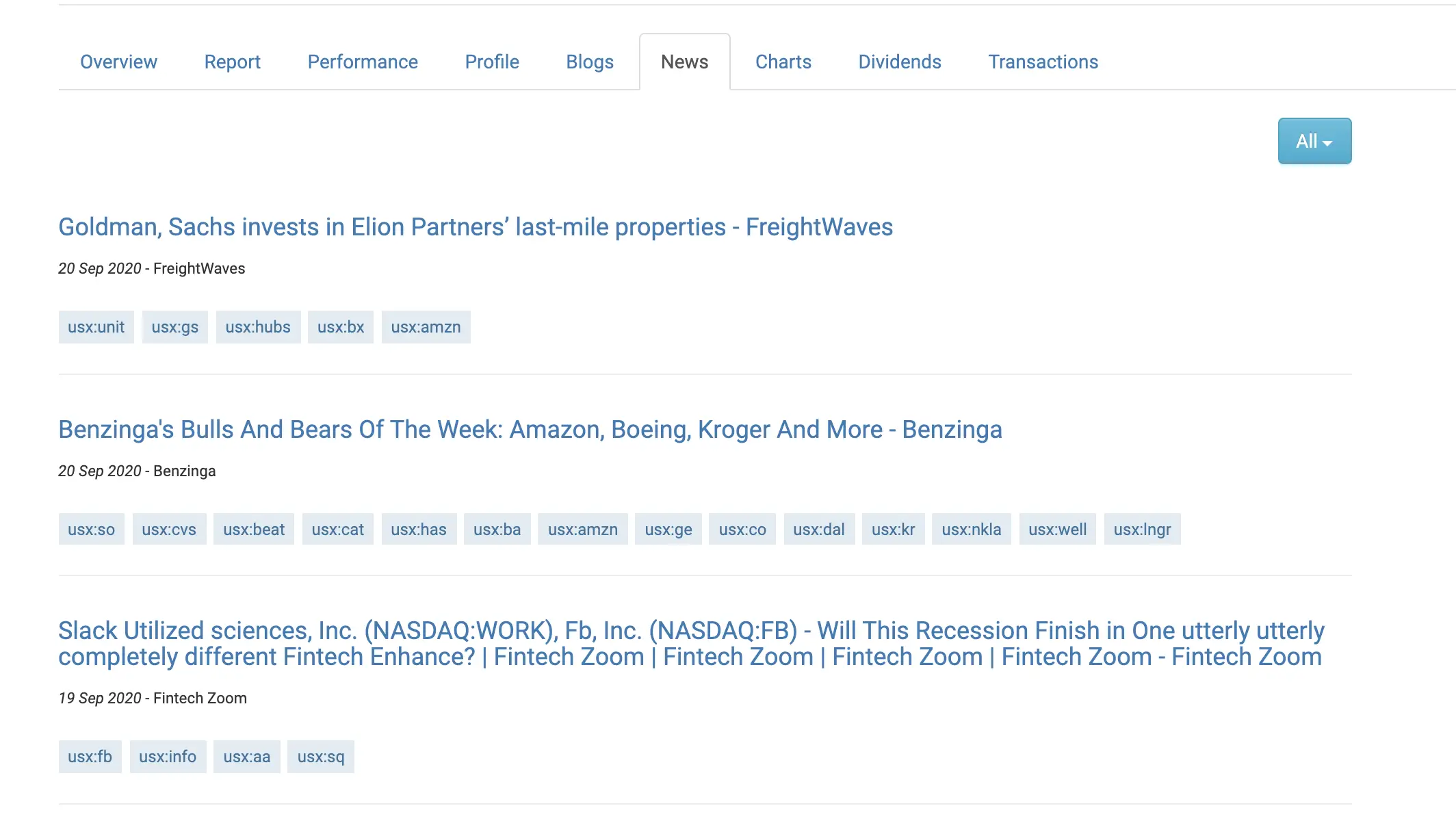

7. News

The news tab helps you to track any news related to your stocks too.

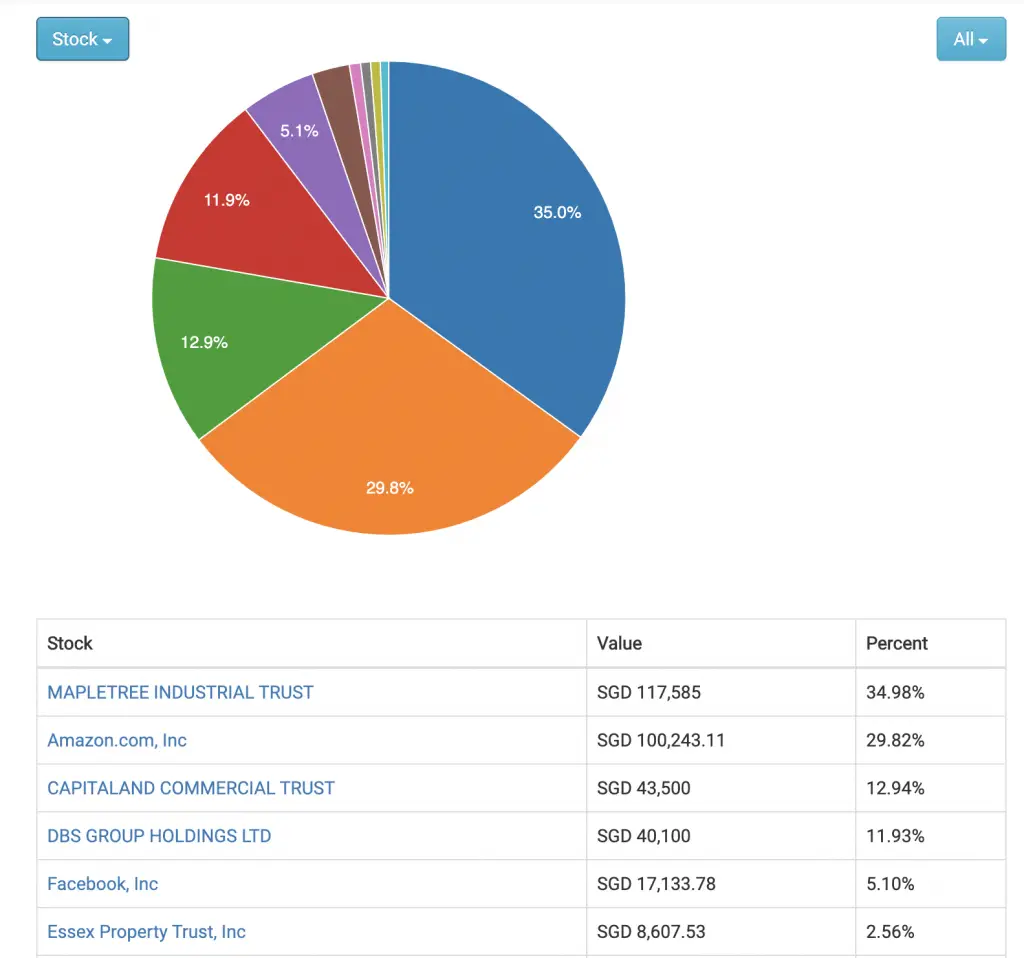

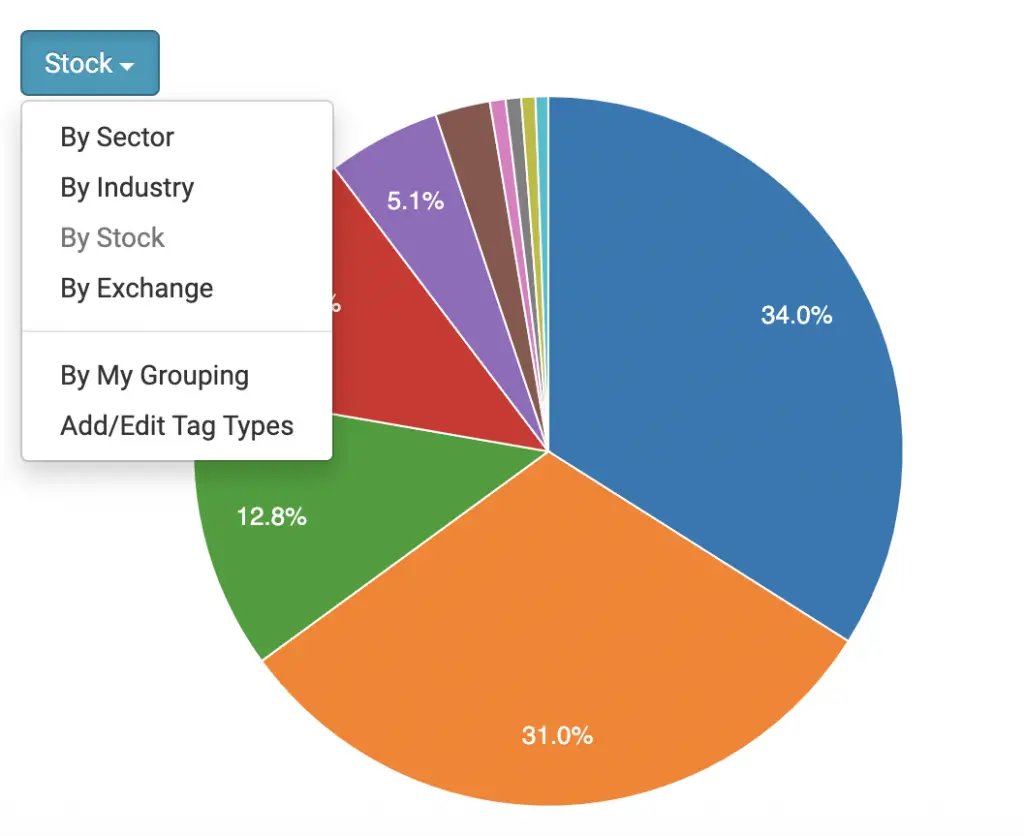

8. Charts

The charts tab helps you to visualise the weightage of each stock in your portfolio.

You can change the pie chart to group your stocks according to:

- Sector

- Industry

- Exchange

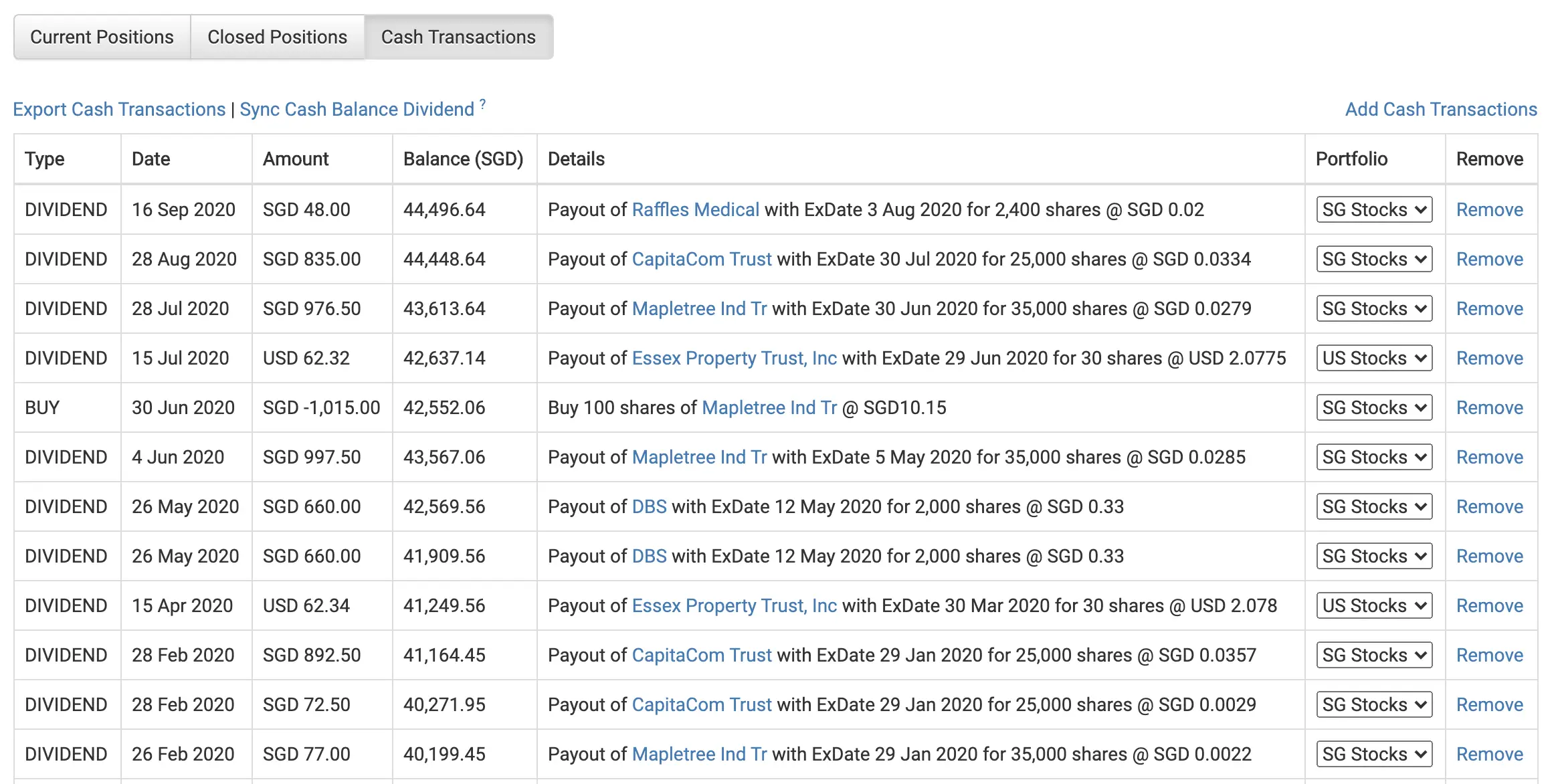

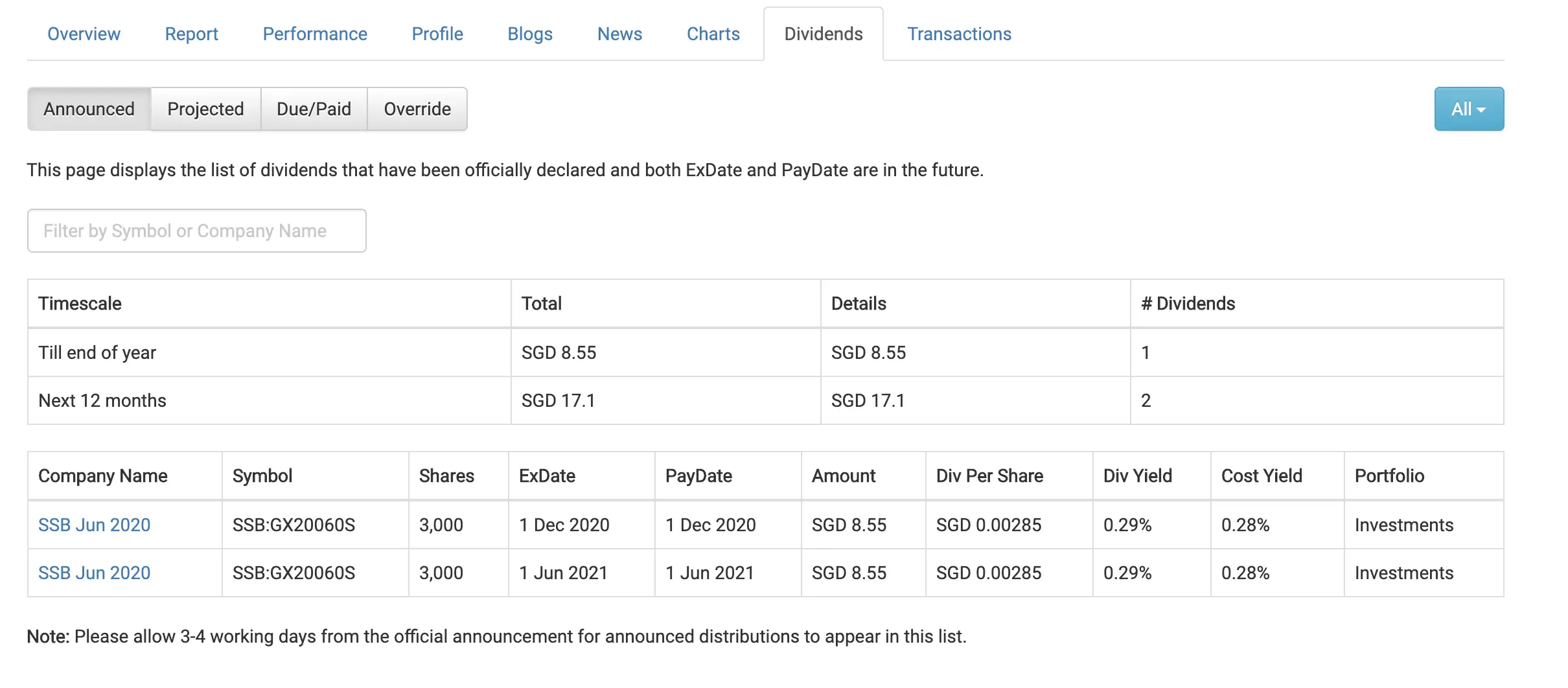

9. Dividends

StocksCafe offers comprehensive dividend tracking for all of your stocks.

There are 4 main tabs to choose from:

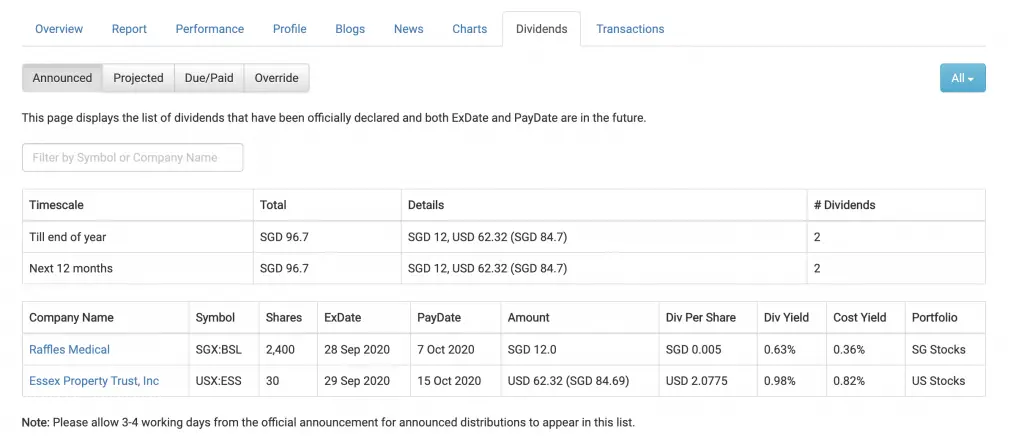

#1 Announced

When dividends are announced for the stocks that you own, they will be listed here.

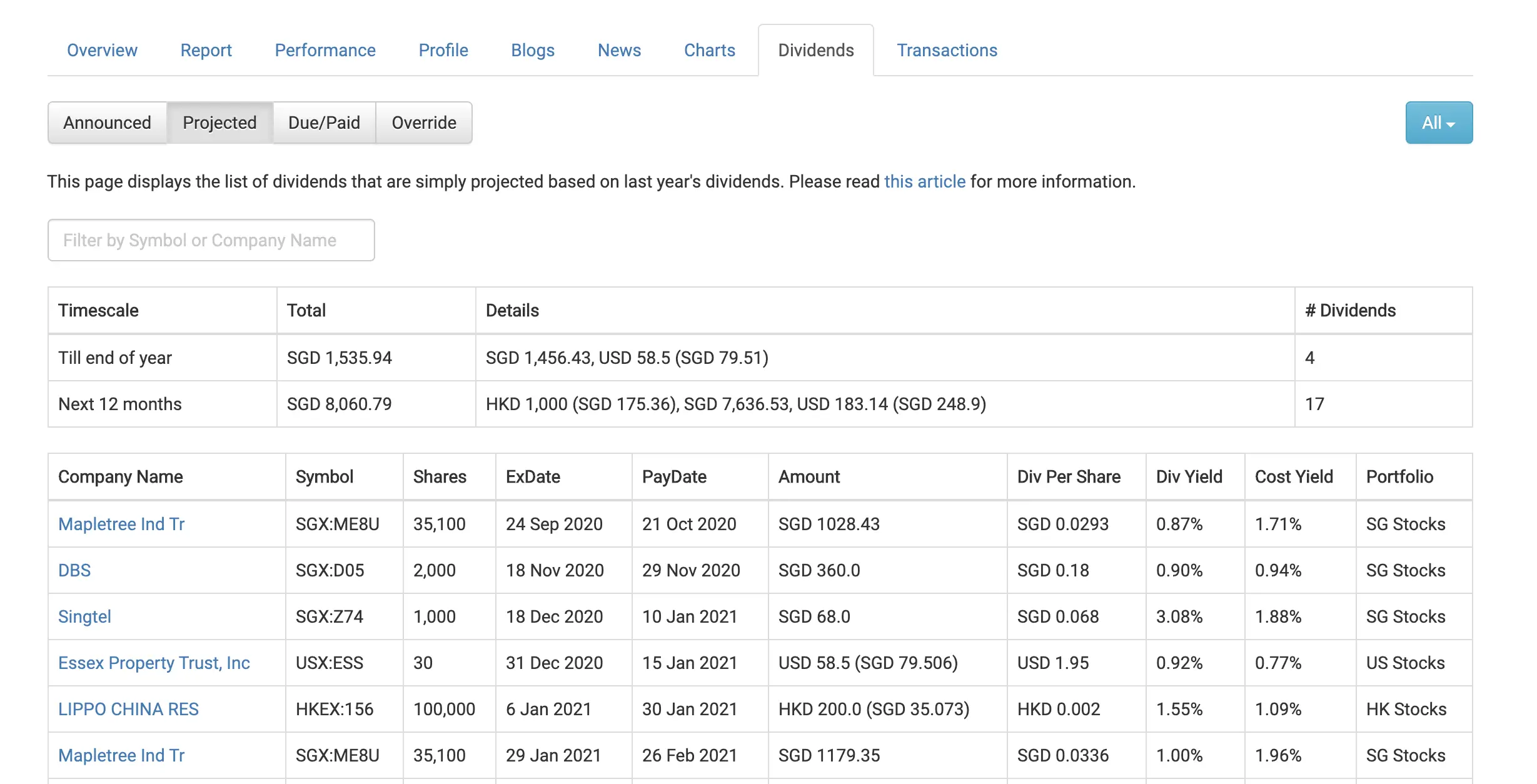

#2 Projected

You can see the projected dividends for your stocks. This is based on the past dividend payouts that the company had given.

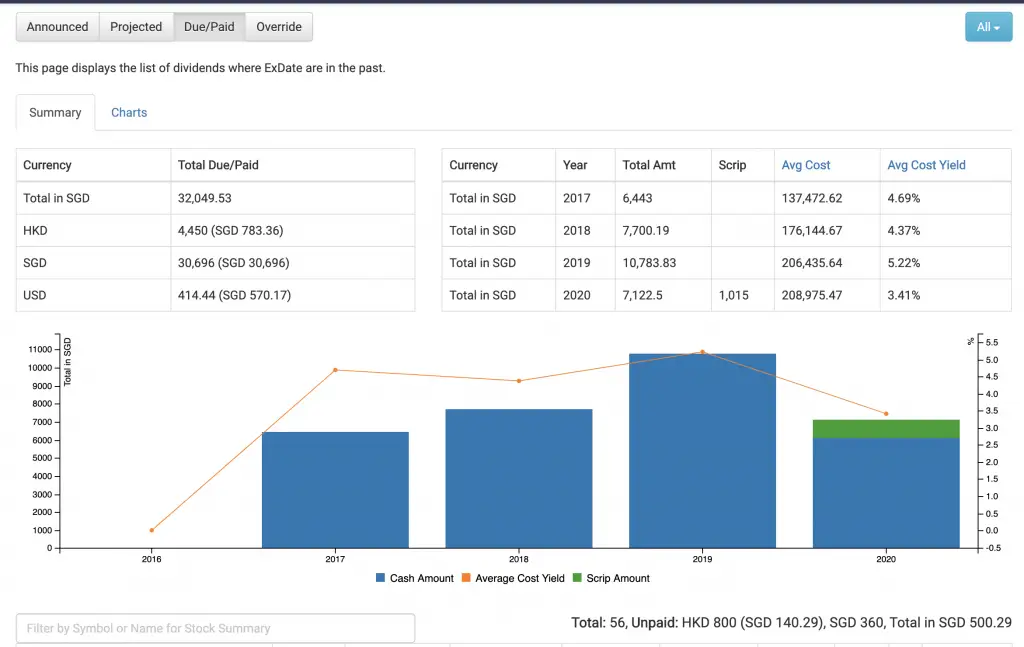

#3 Due / Paid

You are able to view all past dividends that you’ve earned.

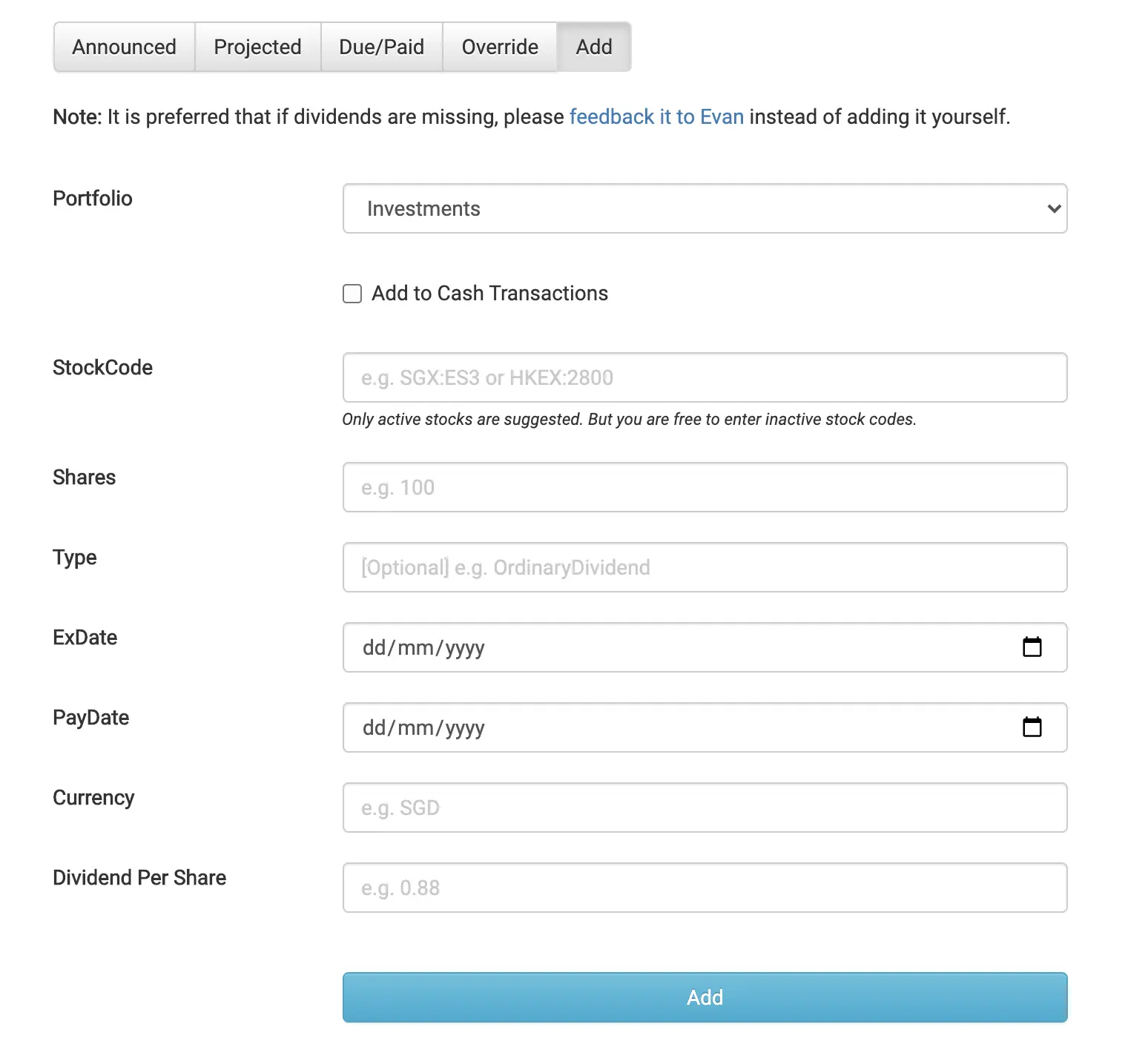

#4 Override

You may have received some dividends that were not being tracked by the platform.

With the add function, you can manually add those dividends in.

However, you are recommended to feedback to Evan about the missing dividend, rather than manually adding it in!

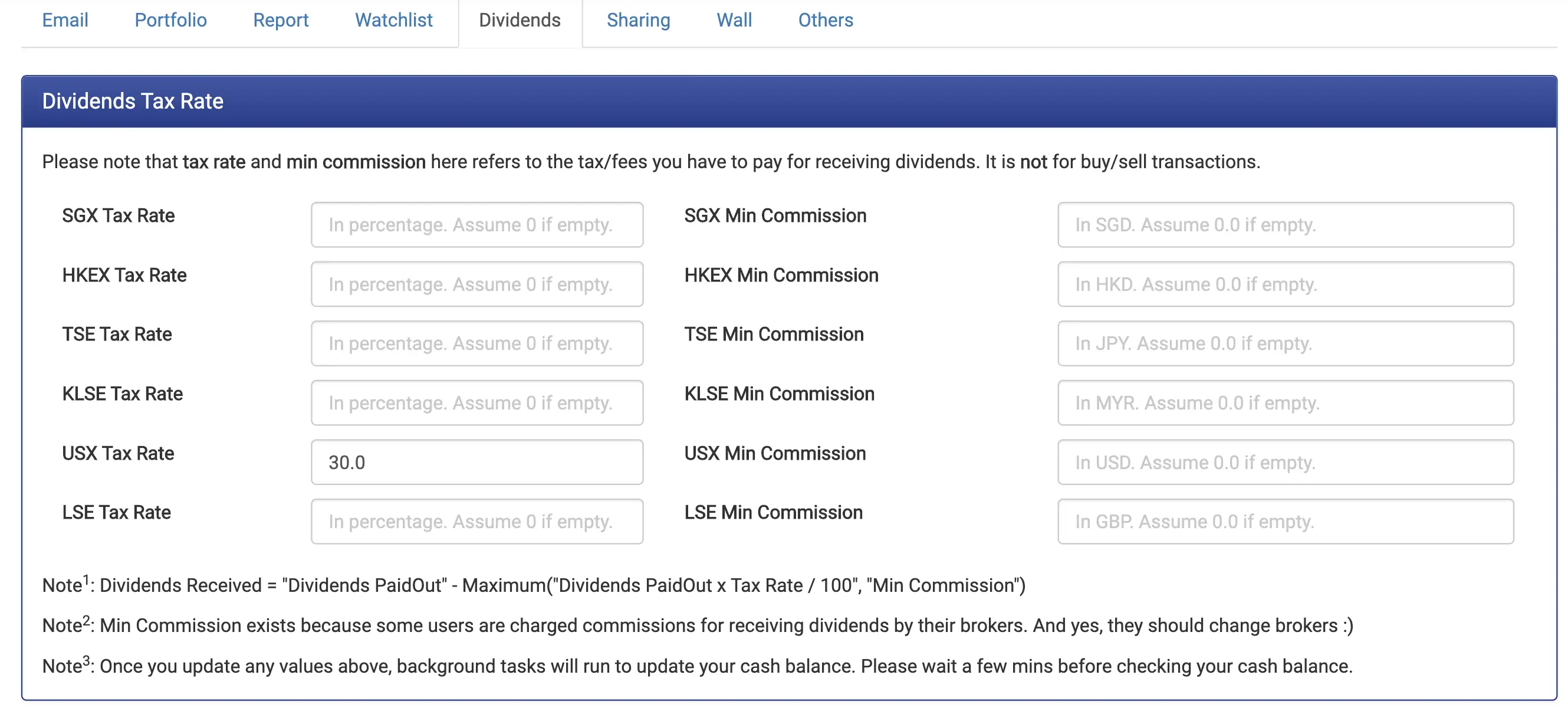

#5 Changing dividend withholding tax rates

If you invest in certain stock exchanges, you may be subjected to dividend withholding taxes.

These taxes will take a portion of your dividends you’ve earned from owning the stock!

The most popular one will be the US stock markets, which charge a 30% dividend withholding tax.

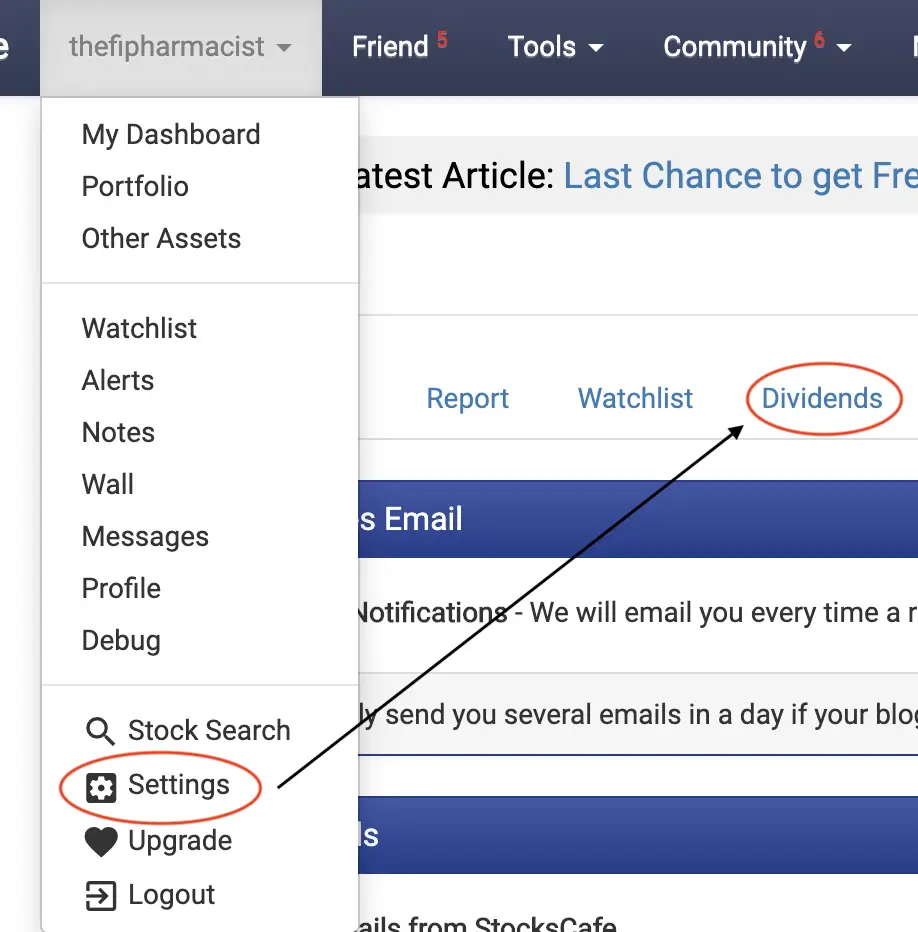

You will need to update the tax rates in StocksCafe. You can do this by going to Settings → Update Preferences → Dividends.

You can update the dividend withholding tax for each stock exchange.

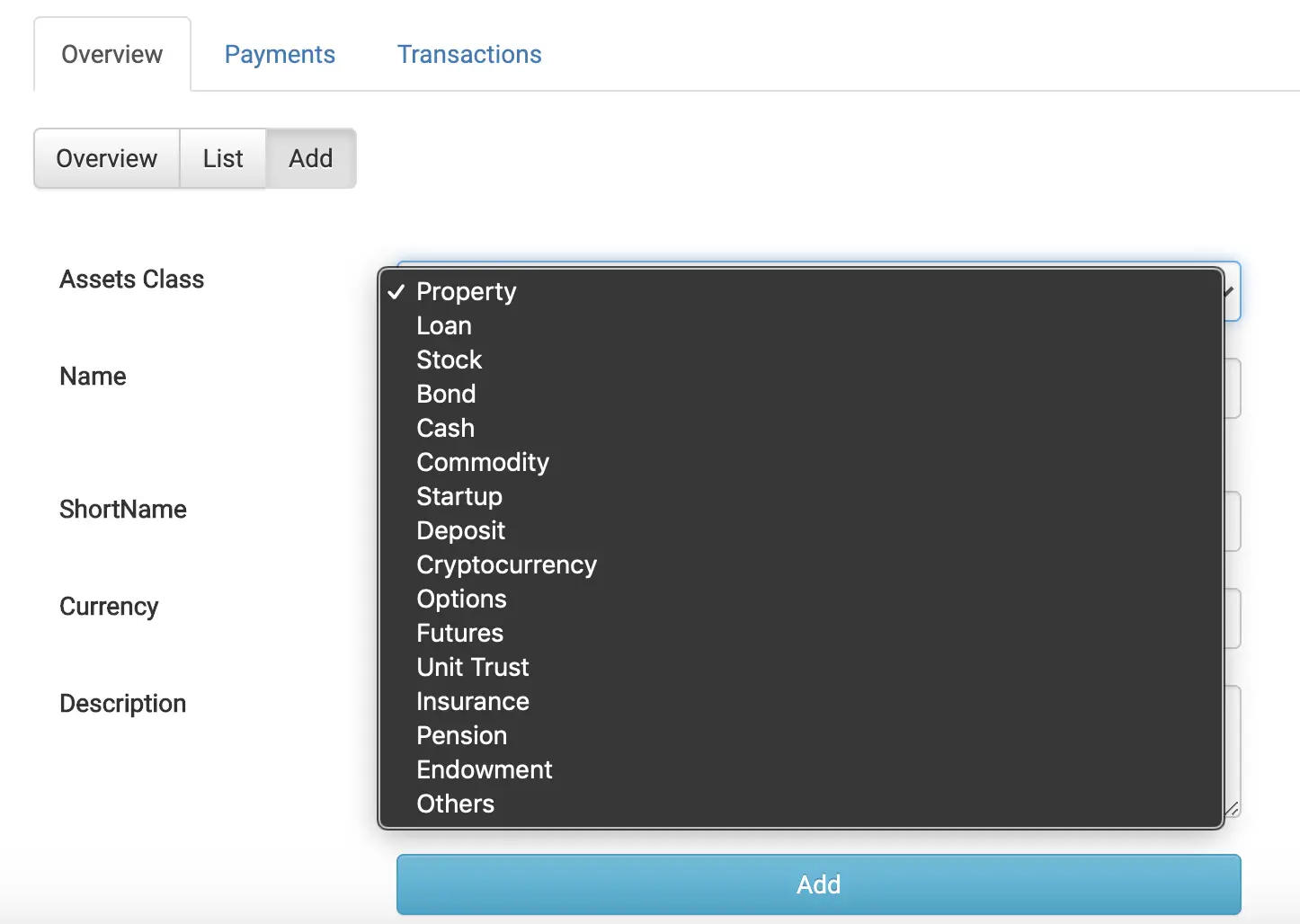

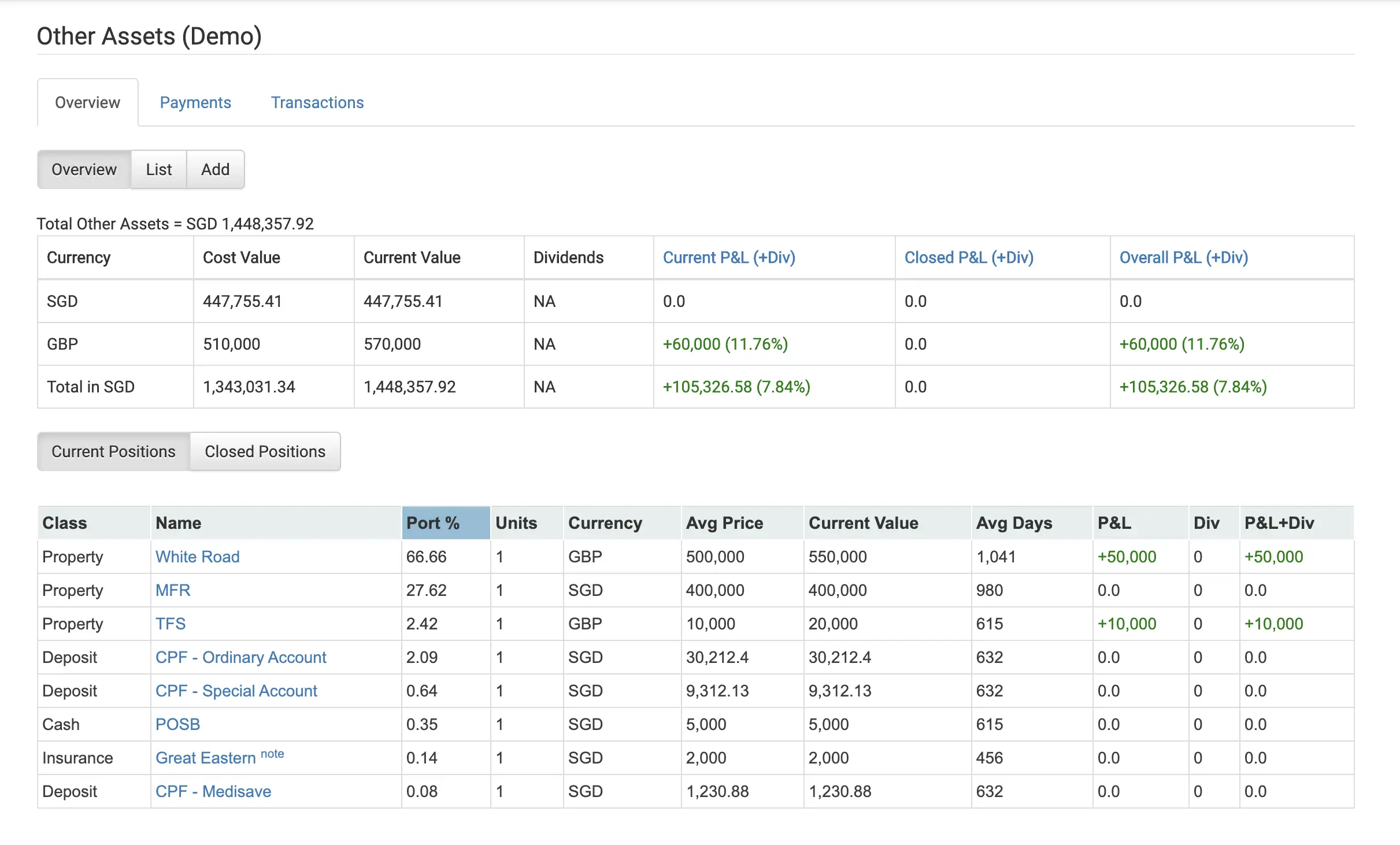

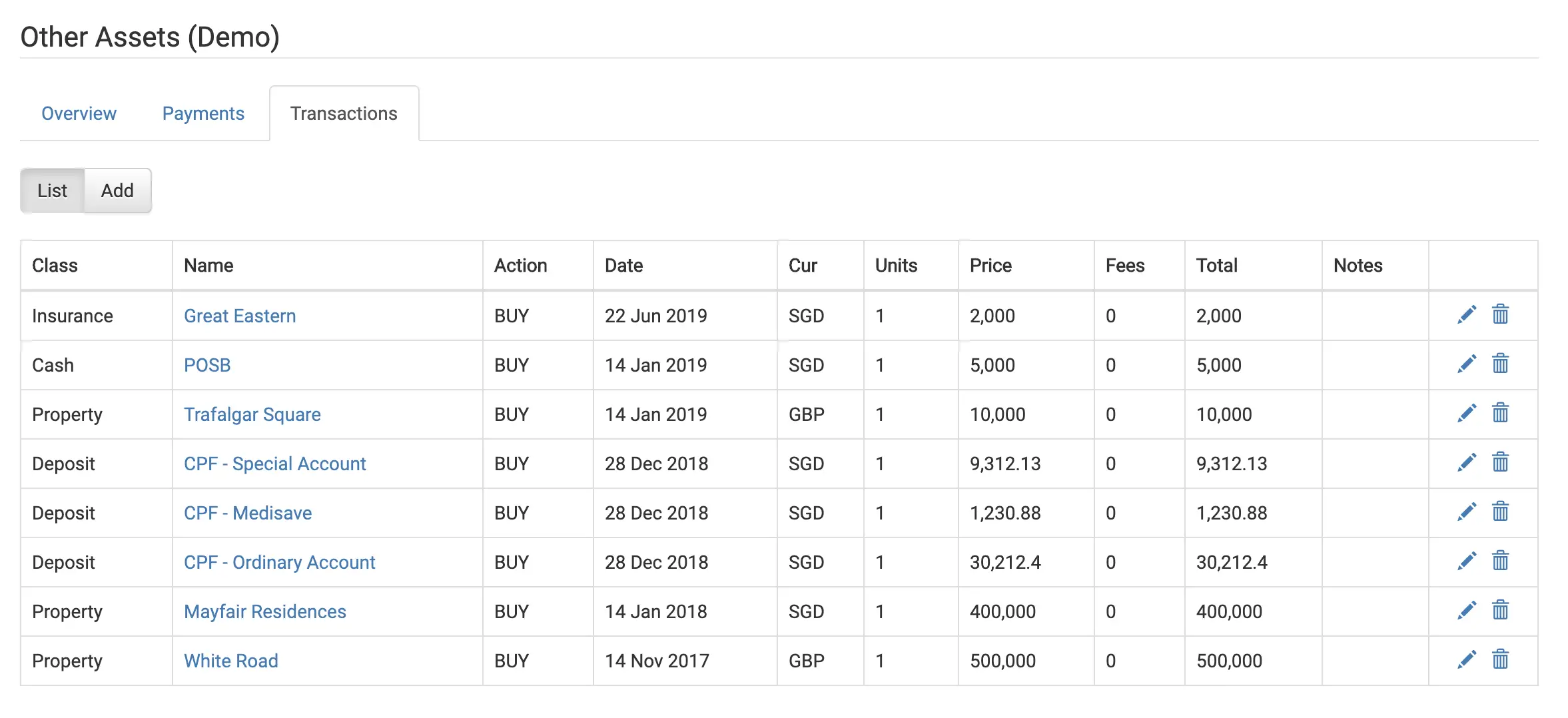

#4 Other Assets

StocksCafe does not just let you track your stocks. You are able to track other assets as well!

There are 16 different asset classes that you can add:

Similar to the portfolio tab, you can have an overview of your assets.

You can view the transactions you have made as well.

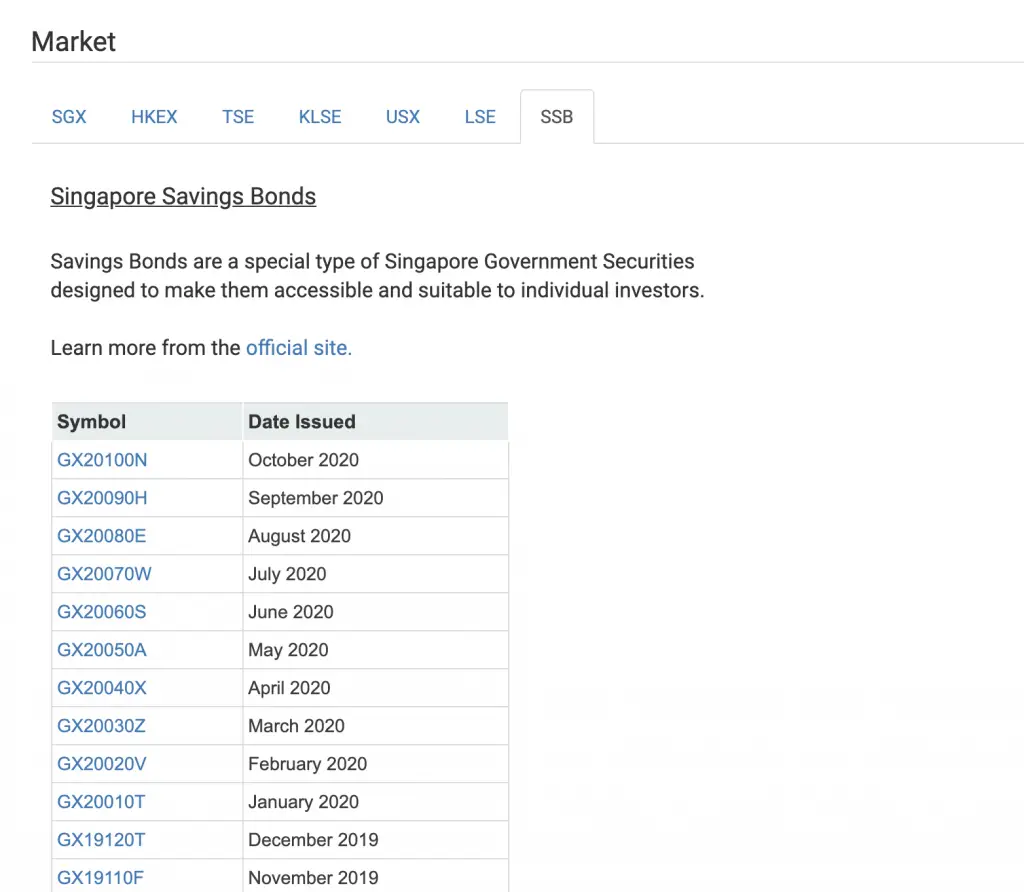

#5 SSB Tracking

StocksCafe allows you to track your Singapore Savings Bonds (SSBs) as well!

It is possibly the only platform that allows you to do so.

You are able to view the past SSBs that have been issued since October 2015.

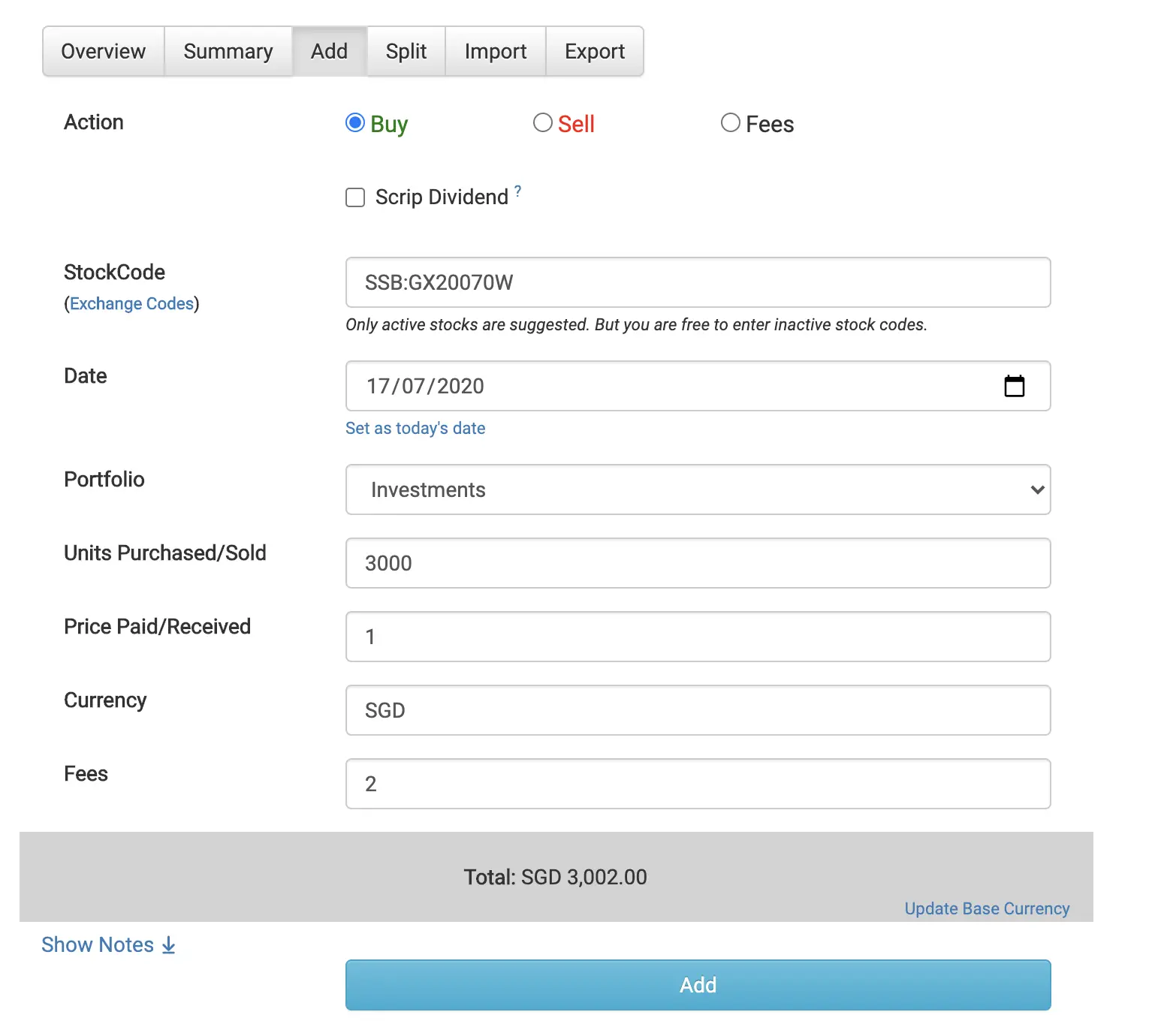

Adding your SSBs

So how can you add your SSBs into StocksCafe? You will have to go to the Transactions tab and click ‘Add‘.

For the stock code, you can add the SSB in 2 ways:

- Type ‘Singapore Savings Bonds’ and choose the month that you bought it

- Type the month (e.g. June 2020) that you bought the SSB

SSBs have a default cost per share of $1.

As such, if you’ve put $3000 into SSBs, your units purchased should be 3000, while the price paid should be 1.

Lastly, you will incur a transaction fee of $2. You will need to add this to the ‘Fees‘ field. In the end, your transaction should look something like this:

You can view the interest rates that you’ll receive every 6 months from the dividends tab.

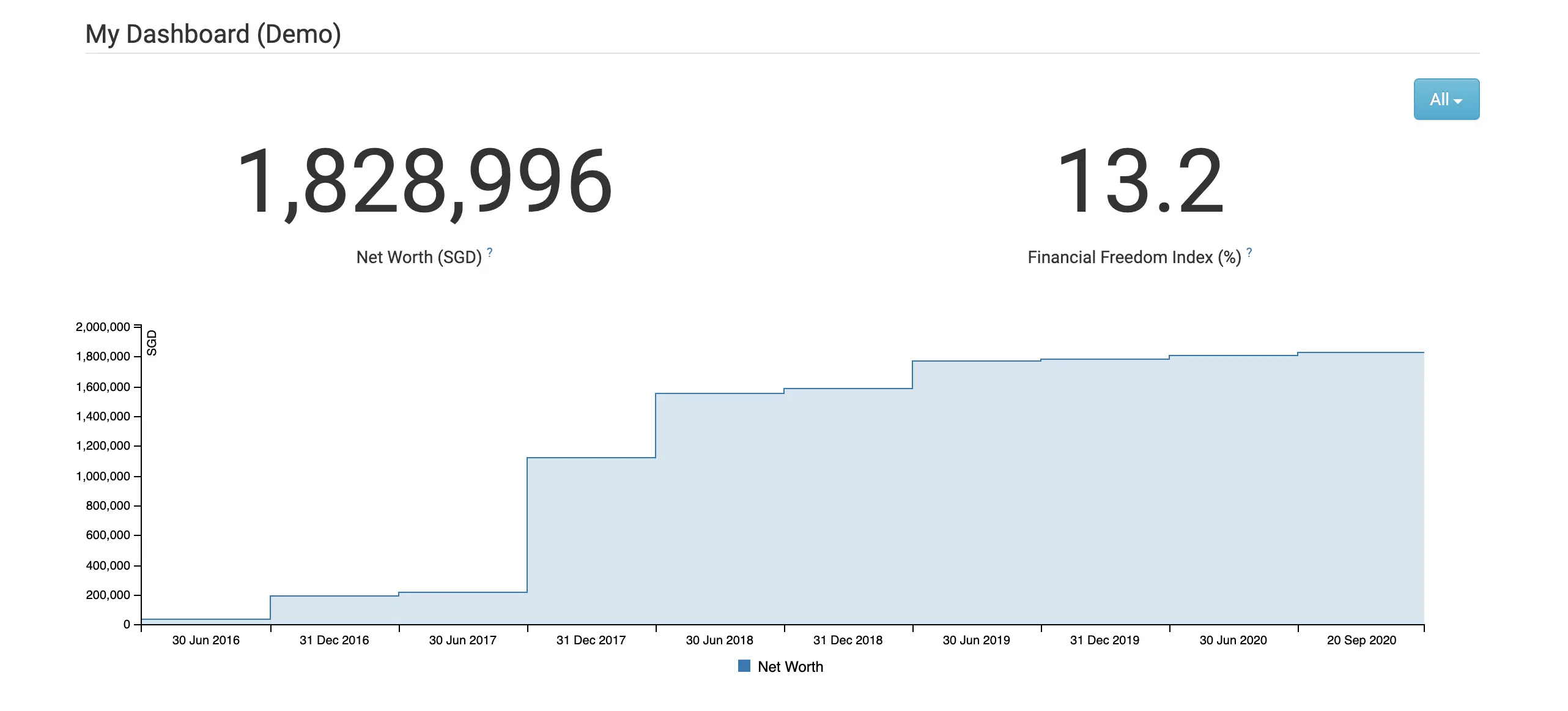

#6 Dashboard

The dashboard gives you an entire summary of your portfolio.

There are 2 main features of the dashboard:

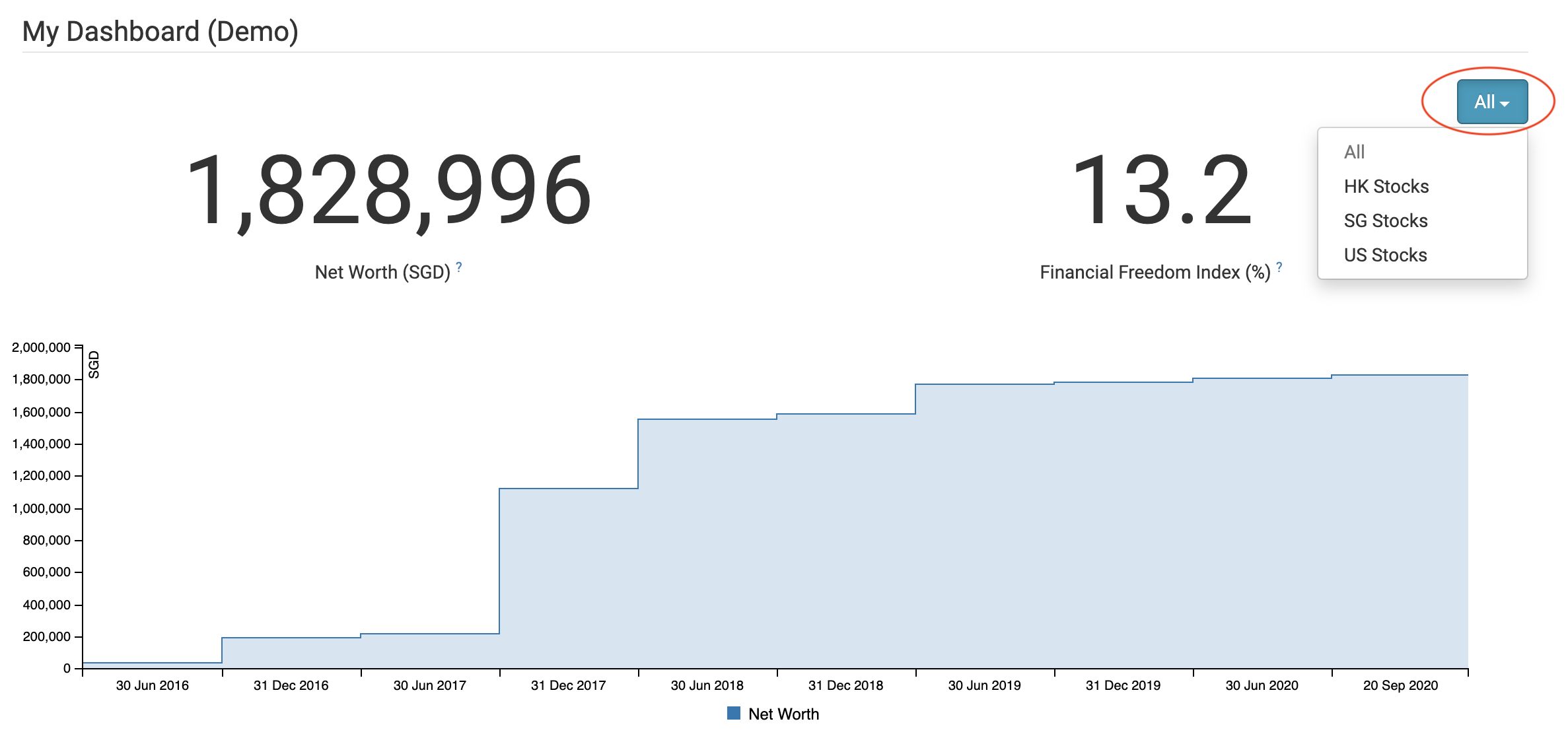

1. Net Worth

The net worth calculates your total assets minus your total liabilities.

You are able to see how your net worth has changed over time.

You can see how your income has changed over each year too.

If you have different portfolios in different exchanges, you can choose to filter them out. This allows you to see how each individual portfolio is performing.

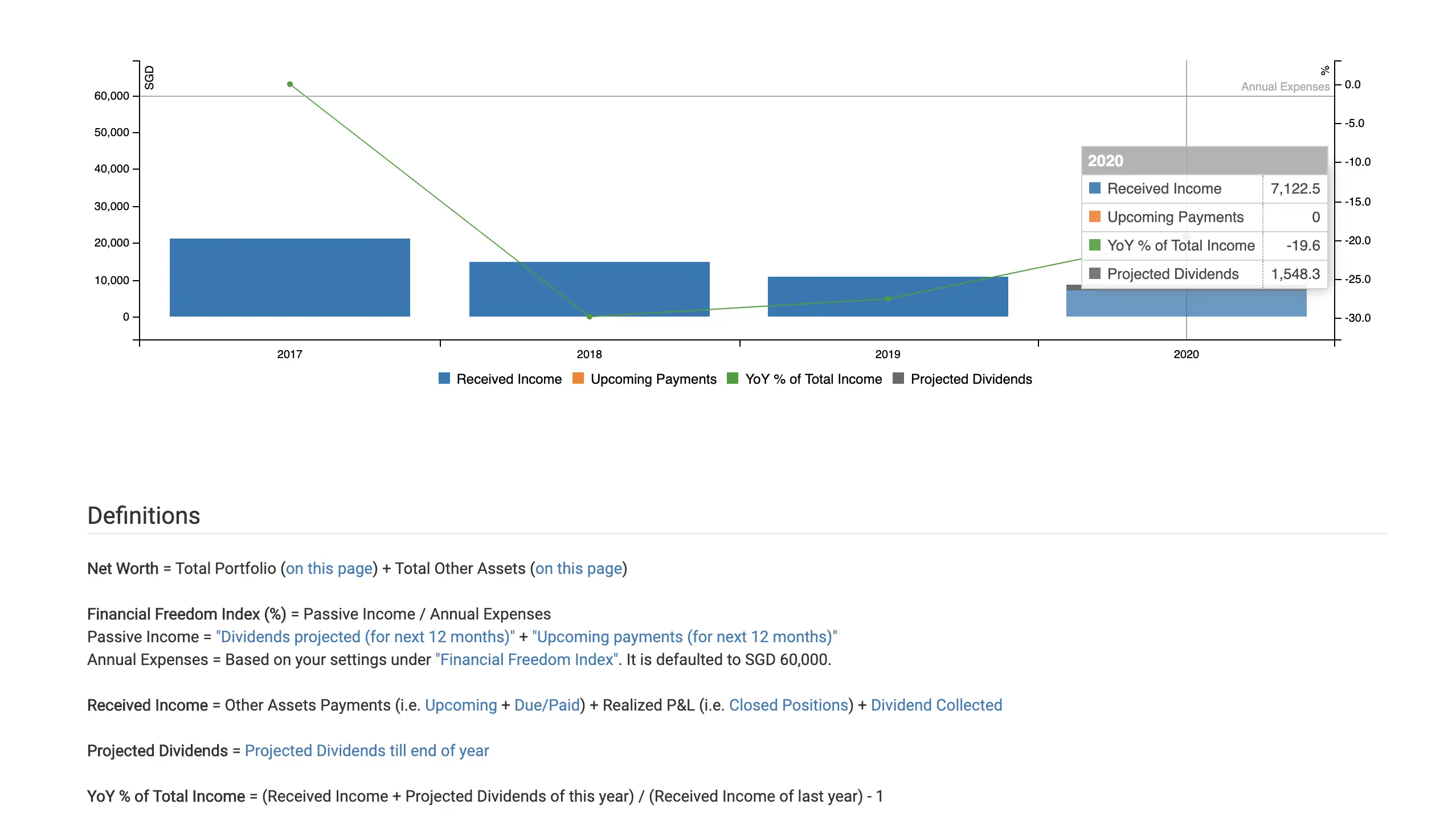

2. Financial Freedom Index

The other metric that is on the dashboard is the financial freedom index.

This is a metric Evan helps you to calculate how far away you are from achieving financial freedom.

The index is calculated by the following formula: Annual Income / Annual Expenses x 100%

Your income consists of:

- Projected dividends for the next 12 months

- Upcoming payments for the next 12 months

Your upcoming payments is taken from the ‘Other Assets‘ tab.

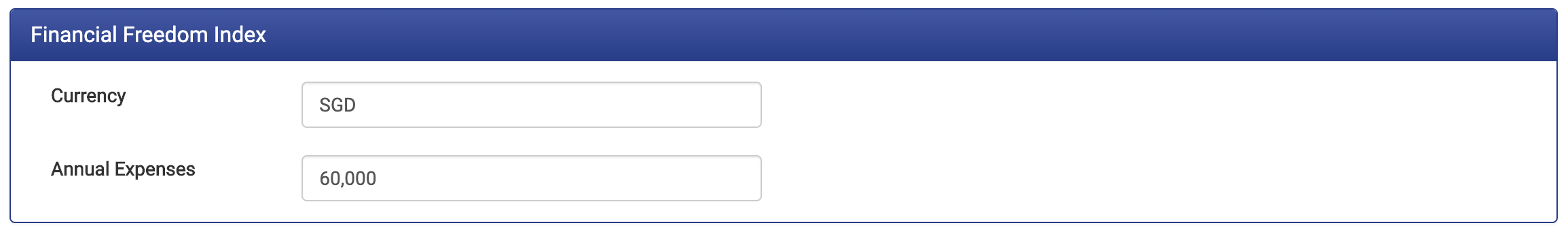

The annual expenses has a default value of $60k. You will have to update your expenses to get a better picture of your finances.

The financial freedom index is a quick way to see how close you are to becoming financially independent!

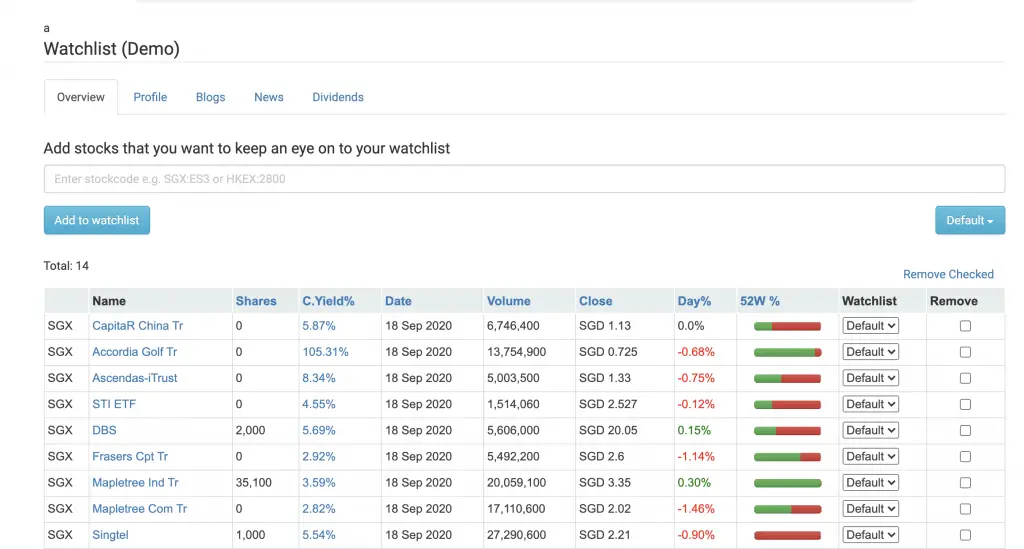

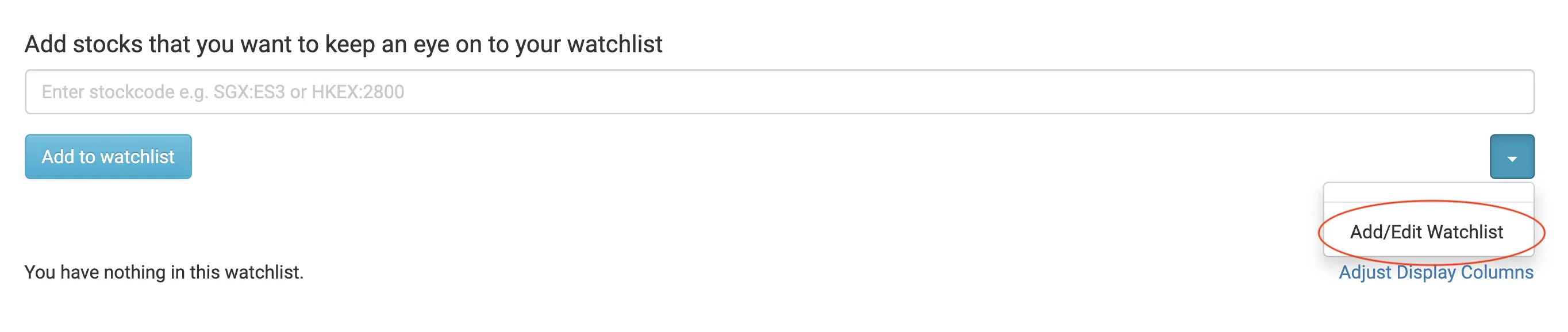

#7 Watchlist

You can add stocks to your watchlist as well.

First, you’ll have to create your watchlist.

After creating your watchlist, you can start adding stocks to it.

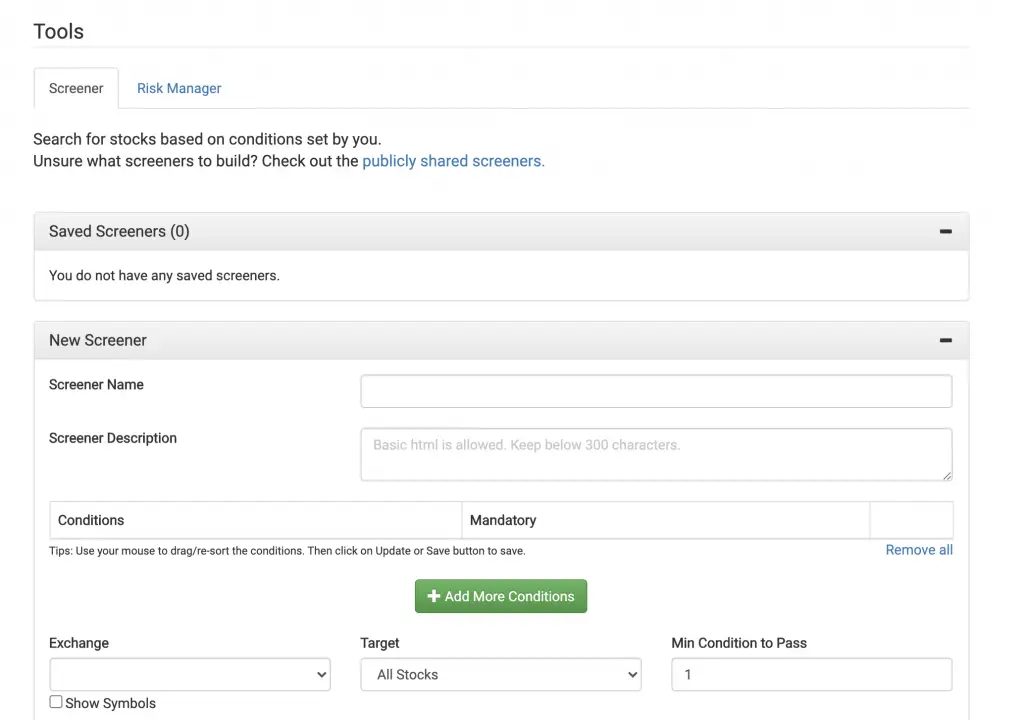

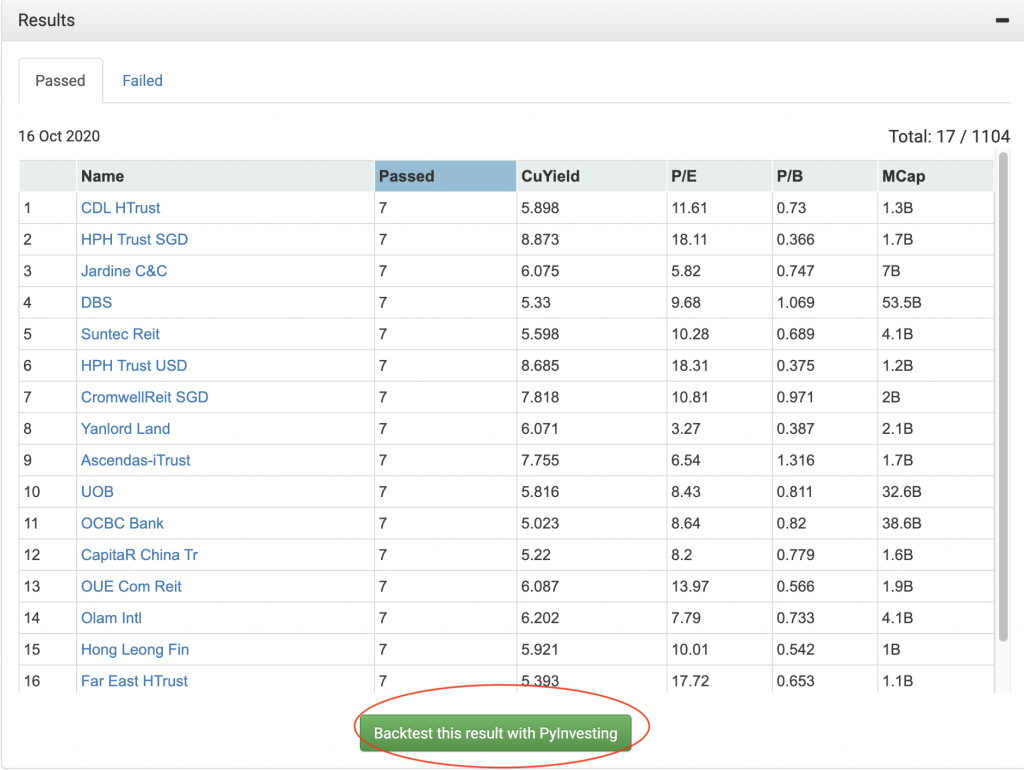

#8 Stock Screener

StocksCafe allows you to screen for stocks too.

You can choose various conditions, and then view stocks that fit these conditions.

After successfully screening your stocks, you can consider backtesting your strategy using PyInvesting.

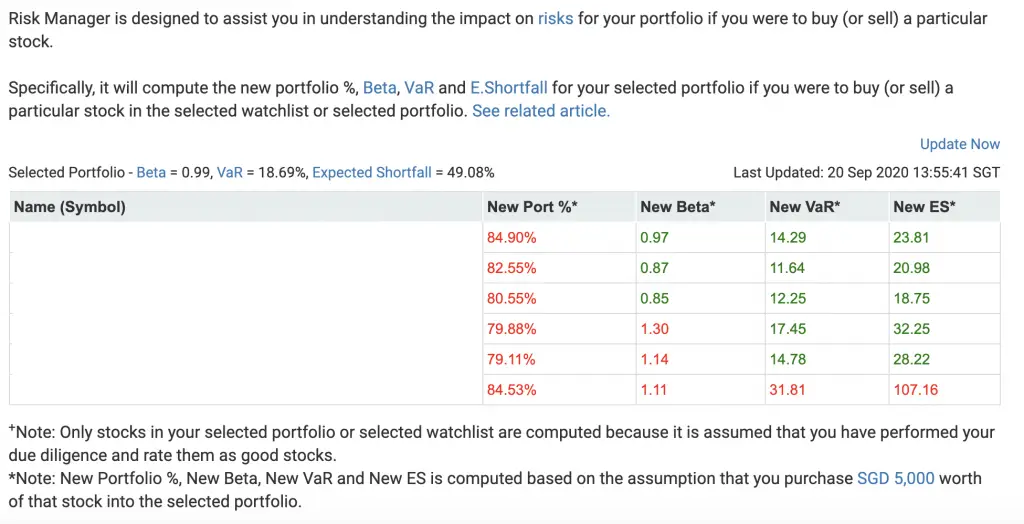

#9 Risk Manager

For those of you who are more investment savvy, StocksCafe comes with a risk manager as well.

This allows you to see various metrics of your portfolio, such as:

- Beta

- VaR

- Expected shortfall

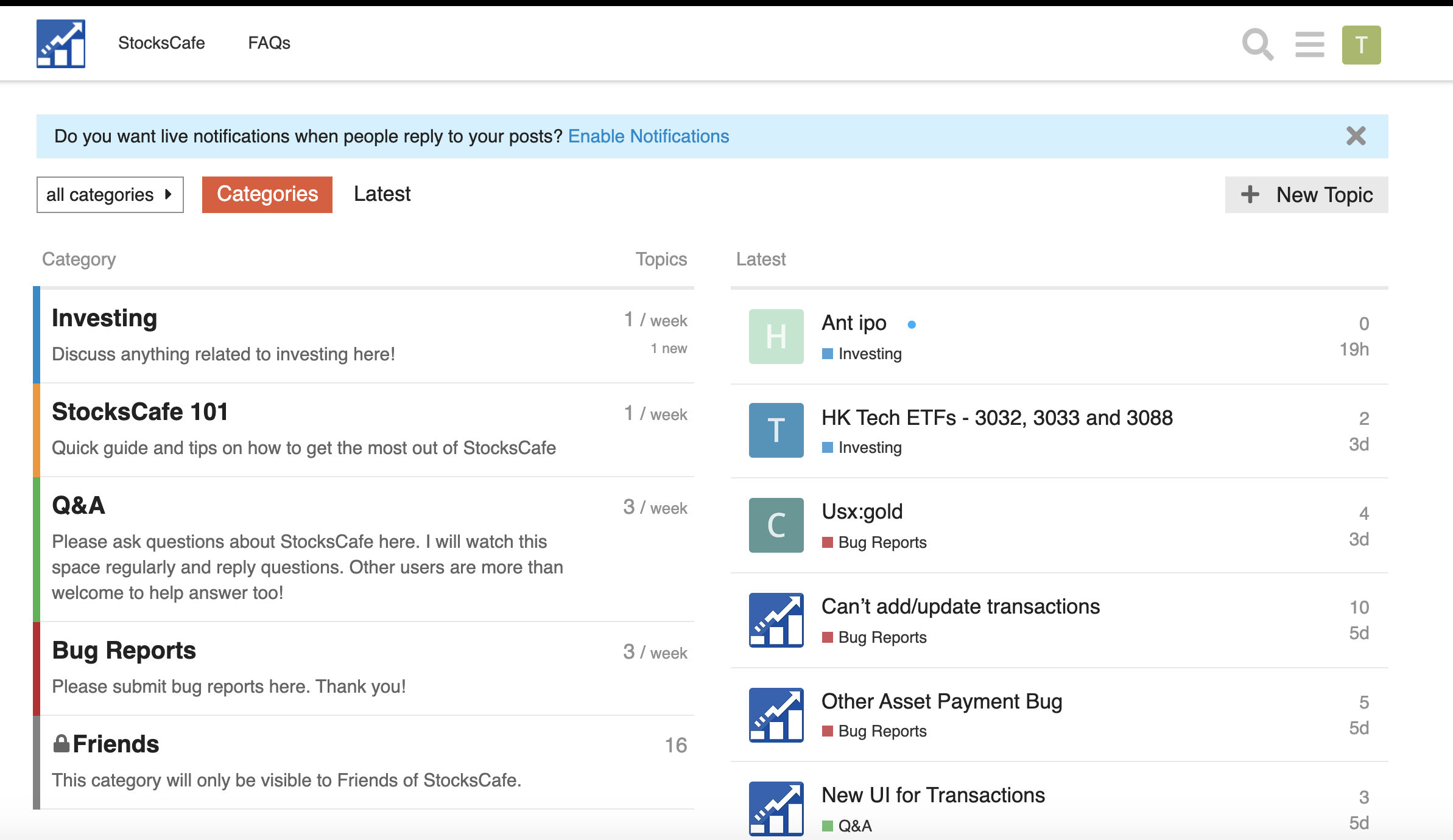

#10 Forum

StocksCafe has a devoted community. You can ask them anything related to investing.

There are many posts that will be useful for you as an investor!

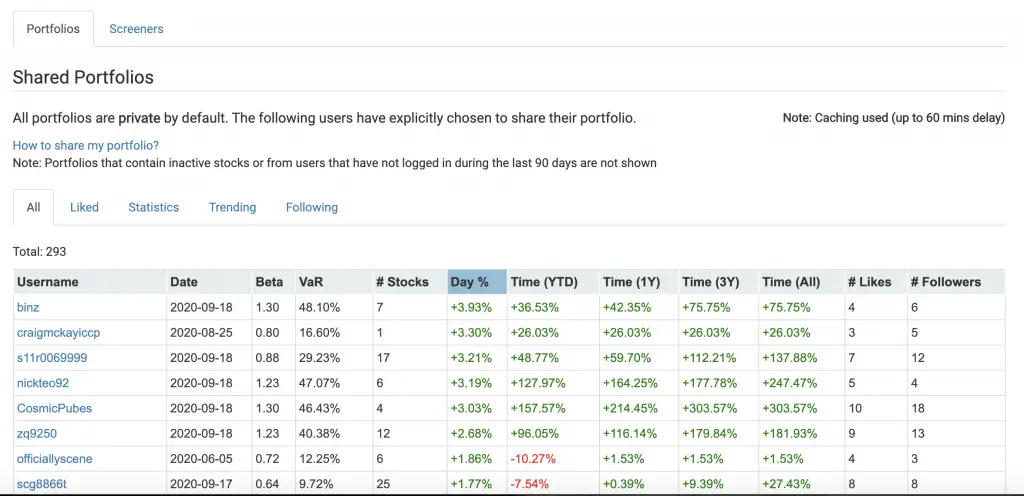

#11 Community

StocksCafe has a huge community of Singapore investors.

In the community tab, you are able to view shared portfolios and screeners by other users.

Shared Portfolios

Not sure on which stocks you should be buying? You can refer to portfolios of other investors to gain some inspiration.

You are able to see all of the investor’s holdings in their portfolio.

All portfolios are private by default.

You can choose to make yours public if you wish to share your portfolio with others!

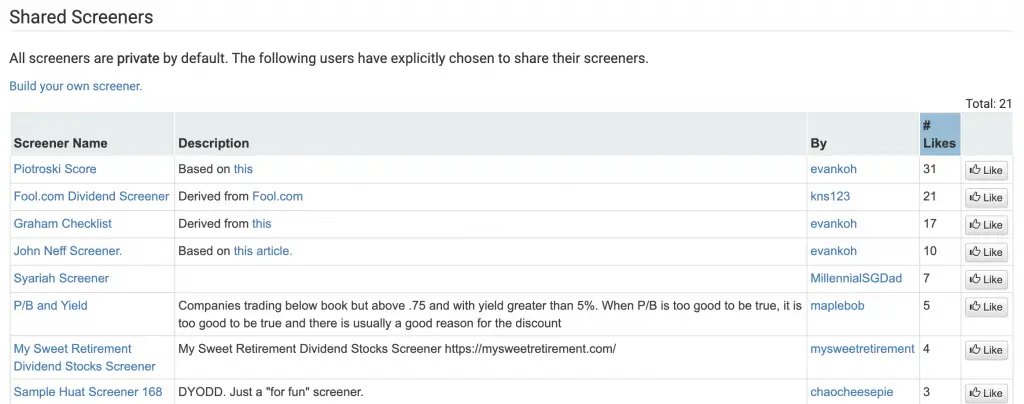

Shared Screeners

Some investors may have developed their own investing strategies. These strategies may be based on specific metrics.

With the shared screener function, you can view screeners that other users have uploaded!

Evan has created a few screeners, based on investing strategies from various sources.

Again, your screeners are set to private by default. You can choose to make them public to share them with others.

Make sure you research before investing

These community options are a great way to see how other people are investing.

However, this doesn’t mean that you should follow their strategies exactly!

I would suggest to use these screeners and portfolios just as a reference.

Ultimately, only you will know the stocks that best suit your risk profile and strategy.

As such, you should do your own research first before investing in any stock!

StocksCafe App

StocksCafe has a mobile app that you can download on the Apple Store or Google Play Store.

These are the main things that you can do on the app:

- Wall

- Blogs

- Portfolio

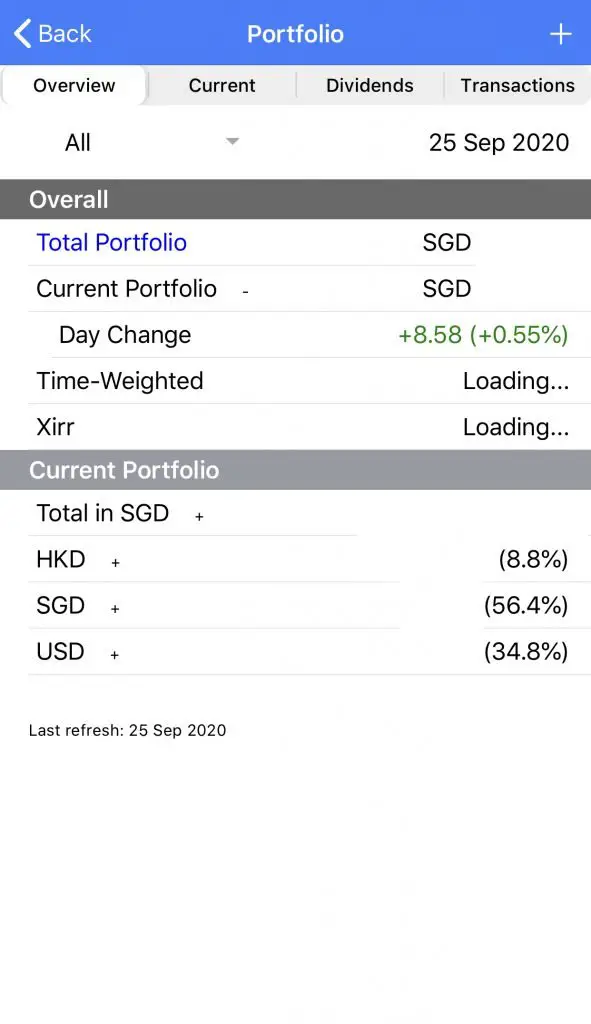

You are able to check your portfolio on the go with the mobile app.

The 4 main things that you can do are:

- Overview of your portfolio

- Current holdings

- Dividend tracking

- Transaction history

You are even able to add transactions on the app!

The StocksCafe app makes it really easy to check your investments’ performances.

However, I would advise you against checking your stocks everyday. You may make decisions that you may regret in the future!

Alternatives to StocksCafe

There are many investment tracking platforms that are available besides StocksCafe.

These include:

- Yahoo Finance

- SGX Mobile

- Bloomberg

- Investing.com

- InvestingNote

- Google Finance

However, StocksCafe is rather unique.

It has features that most platforms would not have, such as:

- Tracking other assets besides stocks

- Tracking SSBs

- Tracking your net worth and financial freedom index

- A comprehensive set of features to analyse your stocks

As such, StocksCafe is a platform that you should consider to use!

Pricing

StocksCafe has a free and paid tier.

To become a Friend of StocksCafe (paid tier), here are the fees that you’ll need to pay:

| Length | Fee |

|---|---|

| Monthly | $5.50/mth |

| Yearly | $45 ($3.75/mth) |

| 3 Years | $115 ($3.19/mth) |

Here are the main limitations if you choose to use a free account:

- You are limited to 25 portfolio transactions

- You can only have a single portfolio

- You are limited to 20 active alerts and 15 stocks in your watchlist

- You have limited access to the stock screener and dividend strength metric

If you just want to have a quick overview of your portfolios’ performance, the free tier may be sufficient. However, you will be limited to 25 transactions.

The multiple portfolios option is great if you use different brokerages or robo-advisors to invest. You are able to separate them and track each account individually.

By paying to be a Friend of StocksCafe, you are able to get access to all full-fledged features of this platform. This is great if you want to analyse your stocks in-depth!

Verdict

StocksCafe is a comprehensive platform that provides for all of your investment needs.

The only problem that I have is the learning curve can be pretty steep. There are so many features available, and you may not know where to start!

I would suggest to import all of your transactions into StocksCafe first. After playing around with the platform, you can customise it to suit your needs!

| Pros | Cons |

|---|---|

| Extensive features to track all of your investments | Learning curve may be really steep |

| Comprehensive profile for each stock | Free tier is rather limited, especially with the 25 transaction limit |

| Able to track stocks from 6 countries | |

| Dividend tracking is really easy across different exchanges | |

| Able to add SSBs into your portfolio | |

| Community allows you to view portfolios of other investors | |

| App allows you to track your investments on the go |

StocksCafe Referral

If you’d like to give StocksCafe a try, you use my referral link when you sign up for an account.

The referral code will be automatically included in the signup page.

Alternatively, you can type ‘thefipharmacist‘ in the referral code field when you signup.

You will get 2 months worth of ‘Friends of StocksCafe’ benefits for free!

This should give you enough time to decide if this portfolio management platform is the right one for you.

If you enjoy the features, you can consider paying for the subscription to continue supporting Evan’s platform!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?