If you’re looking to buy stocks on the Hong Kong Exchange (such as Tencent or HSBC) from Singapore, one of the ways you can do so is by buying an ETF that tracks the Hang Seng Index.

This is because the Hang Seng Index tracks the top 64 stocks in the Hong Kong markets.

Here’s what you need to know:

Contents

How to buy the Hang Seng Index in Singapore

Here are 3 steps to buy the Hang Seng Index in Singapore:

- Select an ETF that tracks the Hang Seng Index that is listed on the Hong Kong Exchange (HKEX)

- Select a brokerage platform that provides you with access to the HKEX

- Fund the brokerage platform and make the investment trade

This is each step explained further:

Select an ETF that tracks the Hang Seng Index that is listed on the Hong Kong Exchange (HKEX)

The Hang Seng Index tracks the top 64 stocks in the Hong Kong stock exchange, based on market capitalisation.

The market cap of a company can be determined by multiplying the stock price by the number of outstanding shares.

This is similar to other indices that track the performances of stocks in different markets:

| Index | Countries In Index |

|---|---|

| S&P 500 | USA |

| STI | Singapore |

| MSCI World | 23 Developed Markets |

| FTSE 100 | UK |

However, you are unable to buy the index itself!

Instead, you will need to buy into a fund that tracks the Hang Seng Index. These funds will buy into the stocks that make up the index.

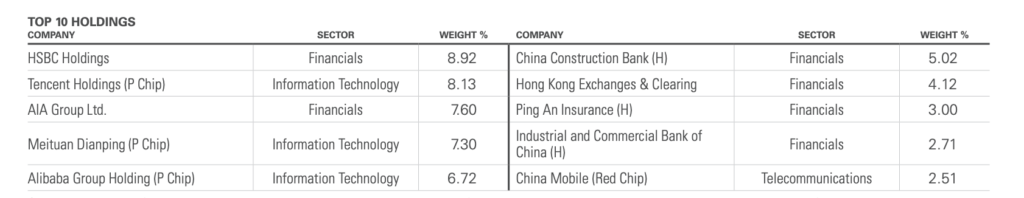

For example, here are the top 10 holdings in the Hang Seng Index.

The ETF will buy these stocks based on the allocation in the index.

There are a few ETFs by different fund managers that are listed on the HKEX that tracks this index:

While these ETFs are all by different fund managers, they should have around the same performance since they are all tracking the same index.

Moreover, none of these ETFs are listed on the SGX, so you won’t be able to use regular savings plans like the OCBC BCIP to purchase them.

When choosing one ETF over another, here are some factors that you may want to consider:

- Number of holdings

- Expense ratio

- Available currencies

Number of holdings

Even though the Hang Seng Index contains 64 stocks, the ETFs that track this index may have more or less holdings:

Interestingly, 3037 has 2 more stocks compared to the actual Hang Seng Index.

This may affect the performance of the ETF as compared to the other ETFs, due to these 2 extra stocks.

Expense ratio

While the returns for these ETFs are more or less the same, one way that your returns are affected is by the funds’ expense ratio.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for these funds:

Most of these expense ratios are relatively quite low, as they are not greater than 0.1%.

2833 offers the cheapest expense ratio, so you will pay less fees to the fund manager.

While these fees may look small, it can compound over the long run and affect your returns!

Available currencies

None of these ETFs is denominated in SGD, so you’ll need to exchange SGD to another currency to purchase these ETFs.

Here are the available currencies for each ETF:

Since the HKEX is in Hong Kong, all of these ETFs has a version that is denominated in HKD.

If you’d like to purchase the Hang Seng Index ETF in USD, the only option will be to buy the ETF that is managed by BlackRock (9115).

Select a brokerage platform that provides you with access to the HKEX

After you have selected which Hang Seng Index ETF to buy, the next step will be to select a brokerage platform that provides you with access to the HKEX.

Here are some platforms for your consideration:

| Platform | Minimum Fee Per Order | Additional Fees? |

|---|---|---|

| Tiger Brokers | HKD 15 | No |

| moomoo | HKD 18 | No |

| Saxo | Up to HKD 90 | Yes |

| Interactive Brokers | HKD 18 | Yes |

| Standard Chartered | HKD 100 | No |

| FSMOne | HKD 50 | No |

| POEMS | HKD 30 | Yes |

| Other Singapore Brokers | ~ HKD 80 | Yes |

While you are choosing a brokerage platform, there are some things you’ll need to take note of:

- Trading commission (usually a percentage of the trade)

- Minimum commission

- Other additional fees (e.g. custody fees, currency exchange fees)

There are quite a few brokers you can choose from, and you can view some of my comparisons here:

Fund the brokerage platform and make the investment trade

Once you have decided on which brokerage platform to buy the Hang Seng Index ETF on, you will need to transfer funds to the platform.

Most of them should allow FAST transfers, while some brokers also offer Direct Debit Authorisation by DBS.

Once you have funded SGD to your brokerage platform, you will need to exchange your currency from SGD to HKD or USD to buy the ETF.

You can view my guides on exchanging currency on Tiger Brokers to get a better idea of the process.

If you are looking to deposit USD to buy the 9115 ETF by BlackRock, you can check out my guides on depositing USD to Tiger Brokers or moomoo.

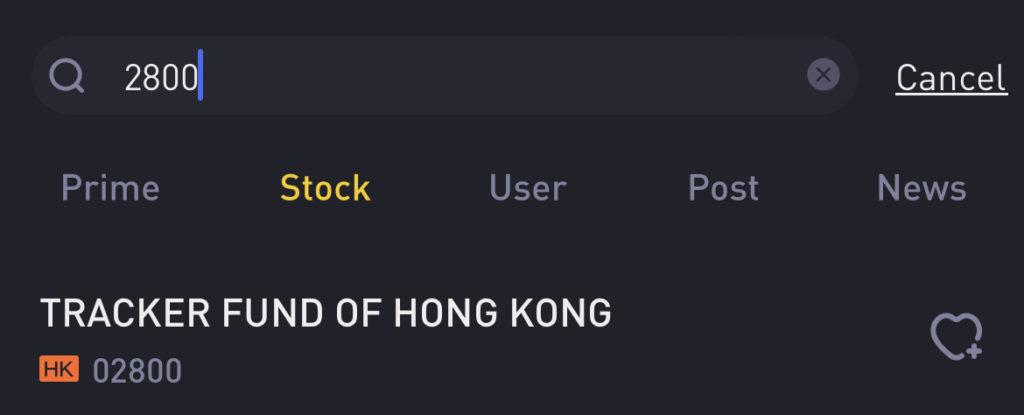

After exchanging your currency to HKD or USD, you can search for the Hang Seng Index ETF that you wish to buy.

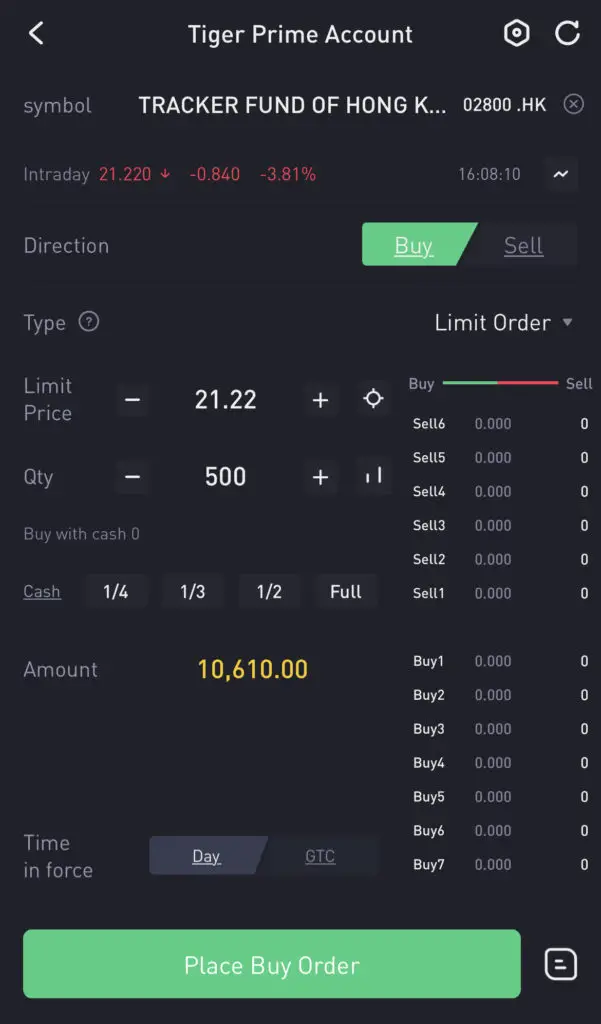

For example on Tiger Brokers, I will search for the Tracker Fund of Hong Kong (2800).

This brings you to the order page. You’ll need to enter the details of the order, such as:

- The price that you want to buy the stock at

- The number of units of the stock you’d like to buy

Once the brokerage platform has matched your buy order with a person’s sell order, you will have successfully bought the Hang Seng Index ETF!

Can I buy a Hang Seng Index ETF on the US stock exchanges?

There are no ETFs that are listed on the New York Stock Exchange that directly track the Hang Seng Index. Instead, there are ETFs that are listed on this exchange that tracks other types of Hong Kong indices:

Since these indices track a different number of holdings compared to the Hang Seng Index, the performances of these ETFs may vary from the Hang Seng Index ETFs.

However, it may be an option for you to consider if you prefer buying ETFs that are listed on the US exchanges.

The MSCI Hong Kong Index is in a similar family of indices as the MSCI World Index.

Things you’ll need to know about the HK markets

After you have chosen which brokerage you want to use, here are some things you’ll need to take note regarding the Hong Kong market:

Trading hours

Here are the trading hours for the Hong Kong exchange (in GMT +8 timing):

| Trading Period | Timing (GMT +8) |

|---|---|

| Pre-opening Session | 0900-0930 |

| Morning Trading Session | 0930-1200 |

| Afternoon Trading Session | 1300-1600 |

Exchange fees

On top of the fees that you need to pay the brokerages, you will need to pay some exchange fees too:

| Fee Type | Fee Amount |

|---|---|

| Trading Tariff | HKD 0.50 per transaction |

| Settlement Fees | 0.002%* transaction amount (minimum HKD 2, maximum HKD 100) |

| Stamp Duty | 0.13%* trasanction amount, rounded up to the nearest dollar (not applicable for ETFs) |

| Trading Fee | 0.005%* transaction amount, minimum HKD 0.01 |

| SFC Transaction Levy | 0.0027%* transaction amount, minimum HKD 0.01 |

| FRC Transaction Levy | 0.00015%*transaction amount |

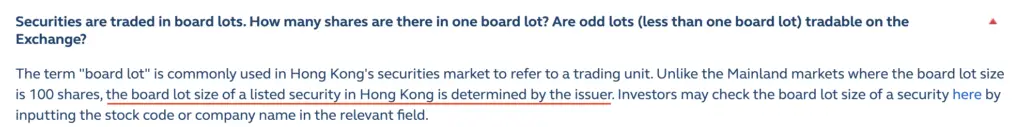

Minimum unit to invest

The minimum lot size for the HKEX varies based on the issuer.

As such, each ETF has a different minimum lot size:

| ETF | Minimum Lot Size |

|---|---|

| 2800 | 500 |

| 2833 | 100 |

| 3037 | 100 |

| 3115 | 100 |

This is in contrast to the SGX, which has a minimum lot size of 100 for stocks.

Conclusion

If you would like to gain exposure to the Hang Seng Index, you will need to buy an ETF that is listed on the HKEX that tracks this index.

There are 4 different ETFs that are managed by different fund managers, but they should have similar returns since they are tracking the same index.

You may also want to note that the Hang Seng Index is different from the Hang Seng Tech Index, which tracks the 30 largest tech companies in Hong Kong.

The ETFs that track this index is different as well, such as HST, 3067, 3088, and 3033.

Once you have decided on an ETF that you wish to buy, you will need to choose a brokerage platform to make the purchase.

Some of the considerations when choosing a platform include:

- Trading commission (usually a percentage of the trade)

- Minimum commission

- Other additional fees (e.g. custody fees, currency exchange fees)

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

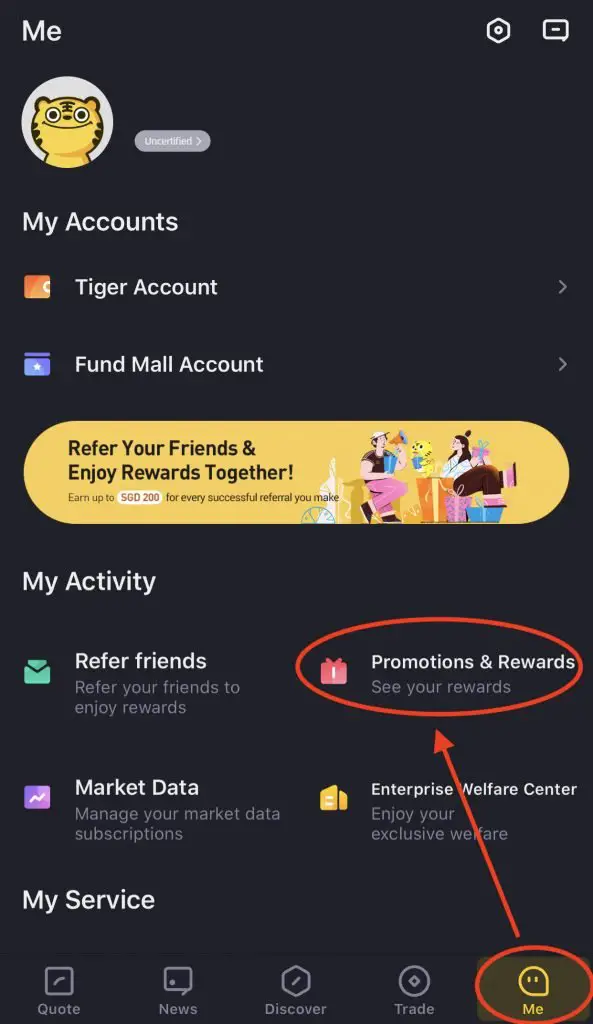

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

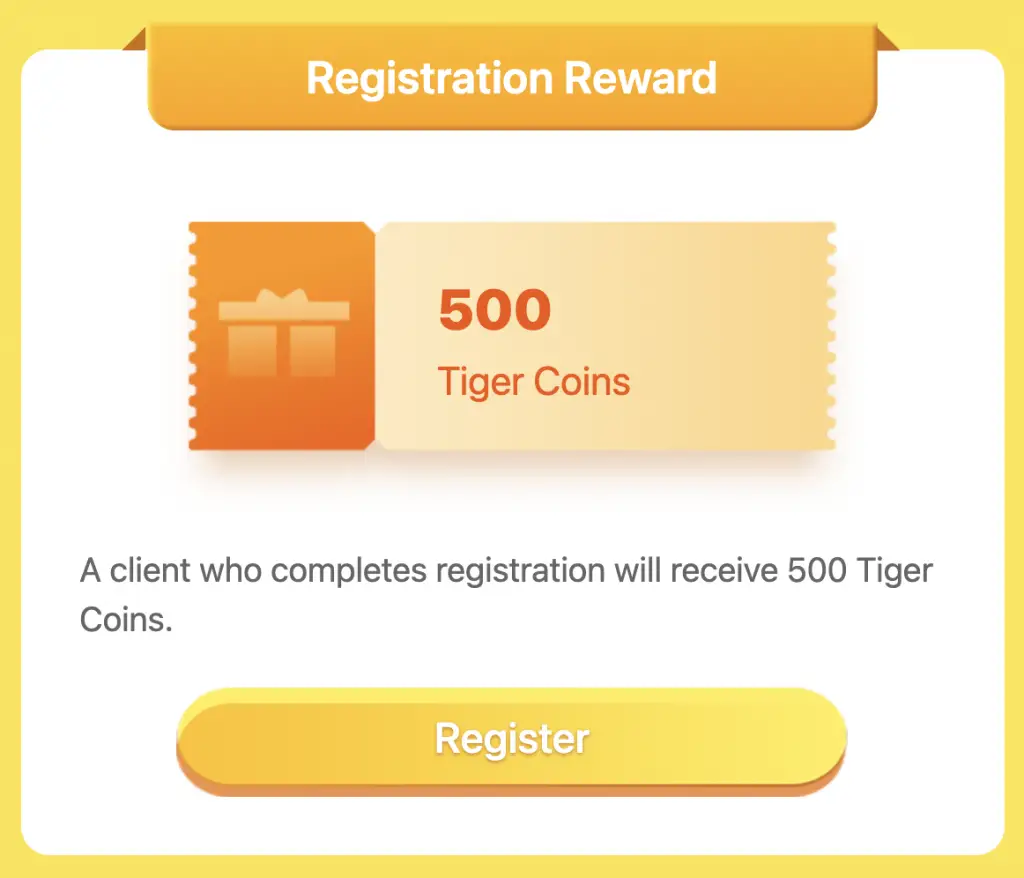

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

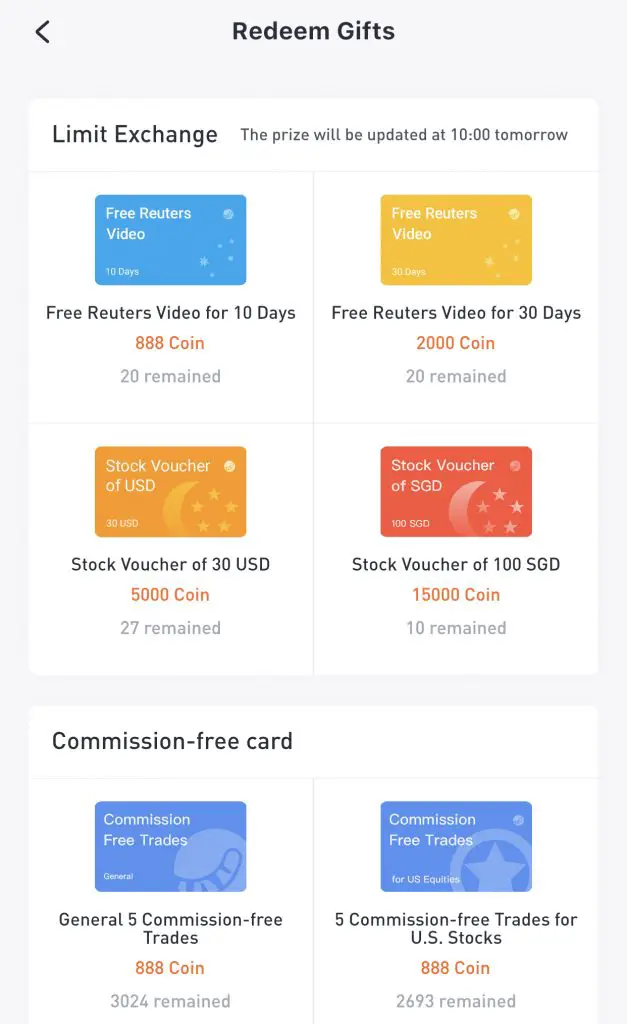

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

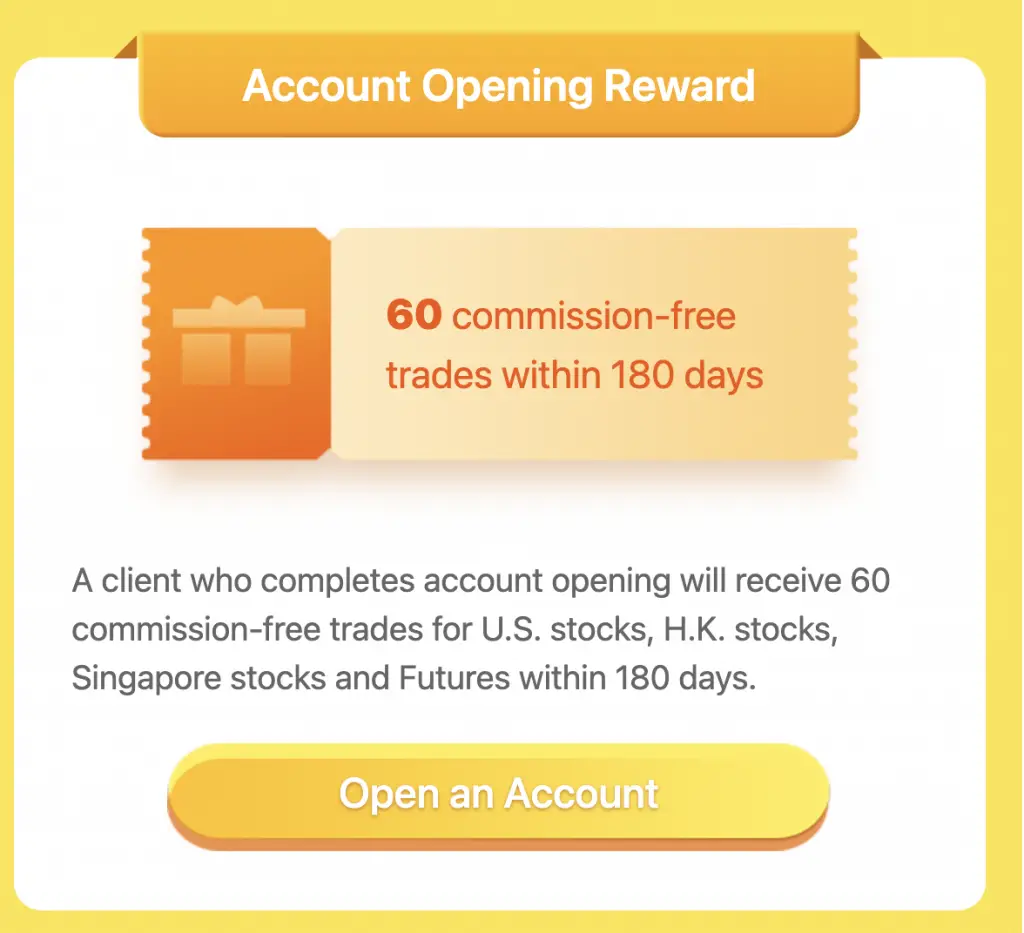

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

moomoo Referral ($200 Stock Cash Coupon Bundle, AAPL Shares and Commission Free Trades for 180 Days)

If you are interested in signing up for a moomoo (powered by FUTU SG) account, you can use my referral link.

Here are some of the rewards you can receive (From 2 Oct 2021):

- Commission-free trading for 180 days (SGX, HKEX and US markets)

- $200 or $2,000 Stock Cash Coupon Bundle (First Deposit Reward)

- Apple share and iPhone 13 (First Transfer-In Rewards)

To receive these bonuses, here are the steps you’ll need to do:

#1 Sign up for a Moomoo account

You’ll need to use my referral link to sign up for a moomoo (powered by FUTU SG) account.

Once you have successfully opened a FUTU SG Securities Account, you will receive:

- 180 days unlimited commission-free trading for the US, HK & SG stock market (to be activated within 90 days)

- Lvl 2 US stock Market Data

- Lvl 1 SG stock Market Data

- Lvl 1 China A-Shares Market Data

First Deposit Reward

You will be able to receive a Stock Cash Coupon Bundle, depending on the amount that you deposit for your very first deposit:

| S$ 2,700 – S$ 199,999 | $200 Stock Cash Coupon Bundle |

| ≥ S$ 200,000 | $2,000 Stock Cash Coupon Bundle |

First Transfer-In Reward (US & HK stocks only)

If you transfer your US or HK stocks from another brokerage account to moomoo, you will be able to receive some rewards:

| SGD 50,000 – SGD 99,999 | 1 Free Apple (AAPL) share |

| SGD 100,000 – SGD 199,999 | 2 Free Apple (AAPL) shares |

| ≥ SGD 200,000** | 1 iPhone 13 (256GB; first 50 sets) OR 3 Free Apple (AAPL) shares |

To learn more, you can view more about this promotion on the FUTU SG website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?