Last updated on June 9th, 2021

You’ve decided that you want to buy some cryptocurrencies to add to your investment portfolio.

You could use cryptocurrency as your satellite portion of your core-satellite portfolio too.

However, you can’t buy cryptocurrencies from most of the traditional brokers in Singapore!

Instead, you’ll need to buy these cryptocurrencies from specific platforms.

Here are some platforms that you can consider.

Contents

How can I buy crypto in Singapore?

Here are 11 crypto platforms that allow you to buy crypto using SGD:

- Coinhako

- Gemini

- Luno

- Zipmex

- Crypto.com

- Liquid

- Tokenize

- Coinut

- AAX

- Binance Singapore

- Binance (P2P)

Here is each of these platforms explained in-depth:

Coinhako

Coinhako is a cryptocurrency exchange that is based in Singapore and founded in 2014.

They were one of the first few exchanges that allowed you to trade cryptocurrencies with SGD. Since then, they have expanded their offering to include many other currencies.

Here is a summary of Coinhako’s features:

| Number of Currencies | 30+ |

| Funding Methods | Xfers FAST |

| Methods of Buying | Instant Buy |

| Withdrawal of Funds | Bank Account |

| Deposit Fees | 0.55% (Xfers), none for FAST |

| Withdrawal Fees | $2 per withdrawal |

| Trading Fees | 0.80% – 1% |

| Sending Fees | Dynamic |

| Minimum Per Trade | $45 |

| Security | Cold storage + hot wallet |

| MAS Regulation | Intends to comply |

| Verdict | Good for rarer altcoins, but fees are rather expensive |

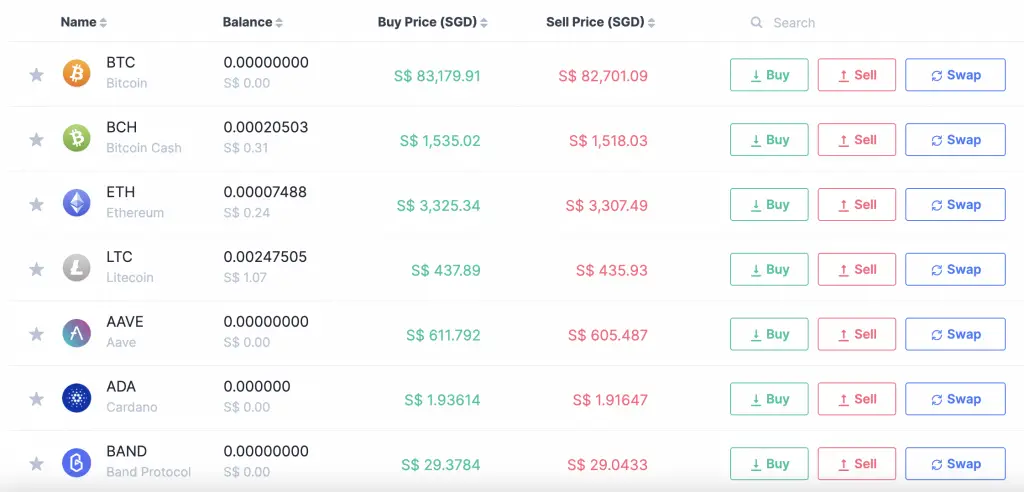

Number of currencies

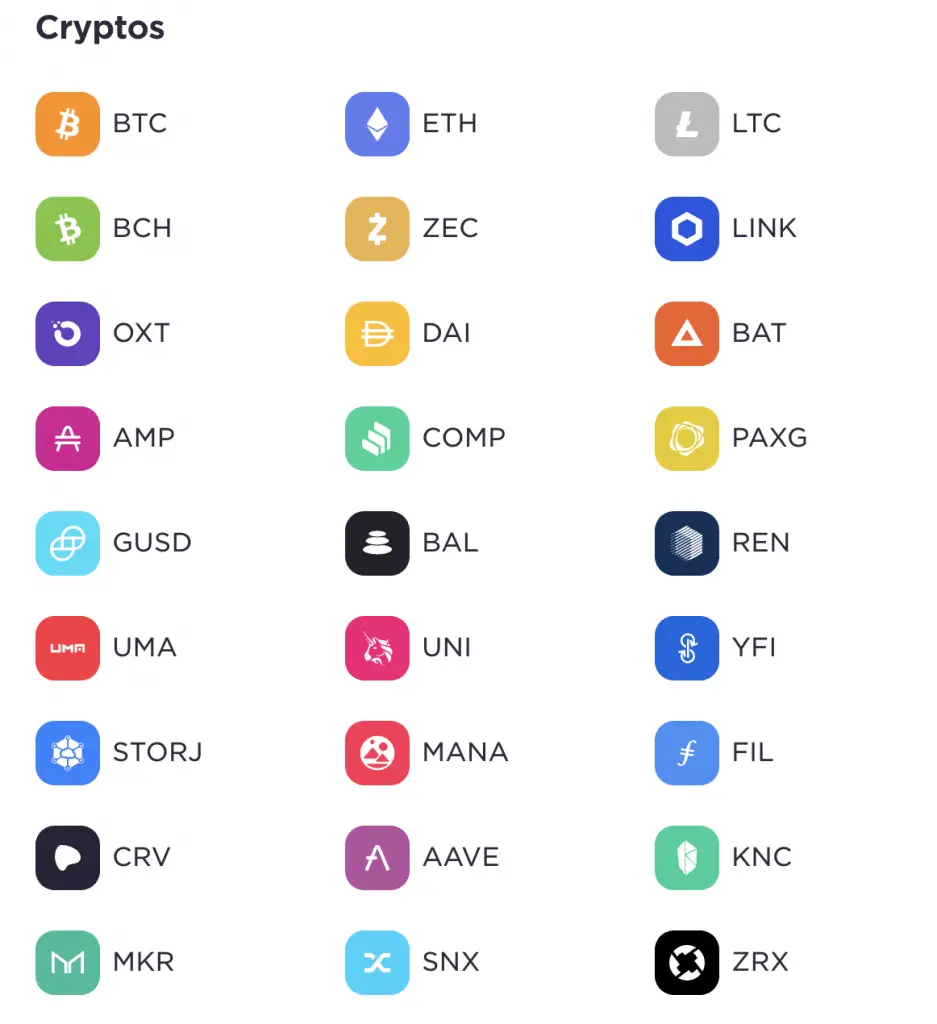

Coinhako allows you to buy a large variety of cryptocurrencies from SGD.

You are able to buy, sell or swap any of these currencies.

Coinhako allows you to trade 30 different cryptocurrencies with SGD, including:

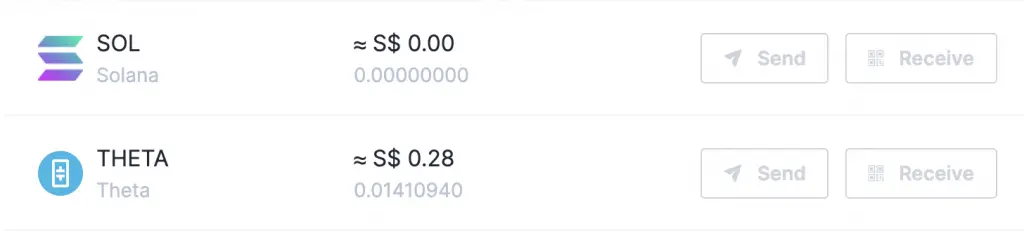

However, some of these currencies have limited functionality. While you can trade them, you can’t send or receive these tokens from another platform. These include:

- LUNA

- NEO

- THETA

- SOL

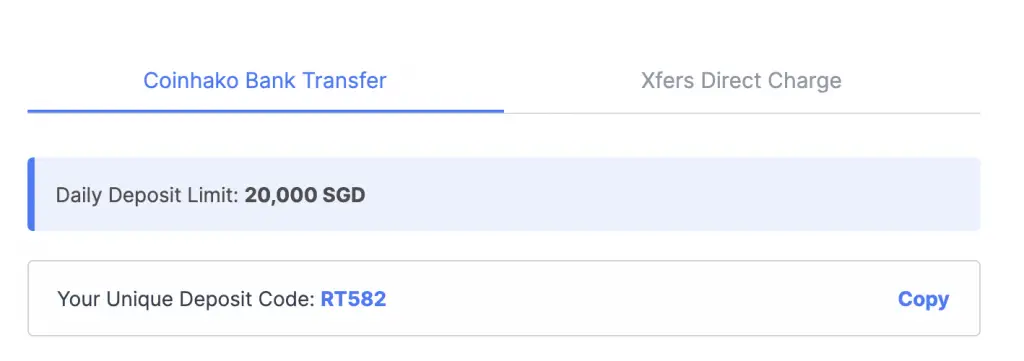

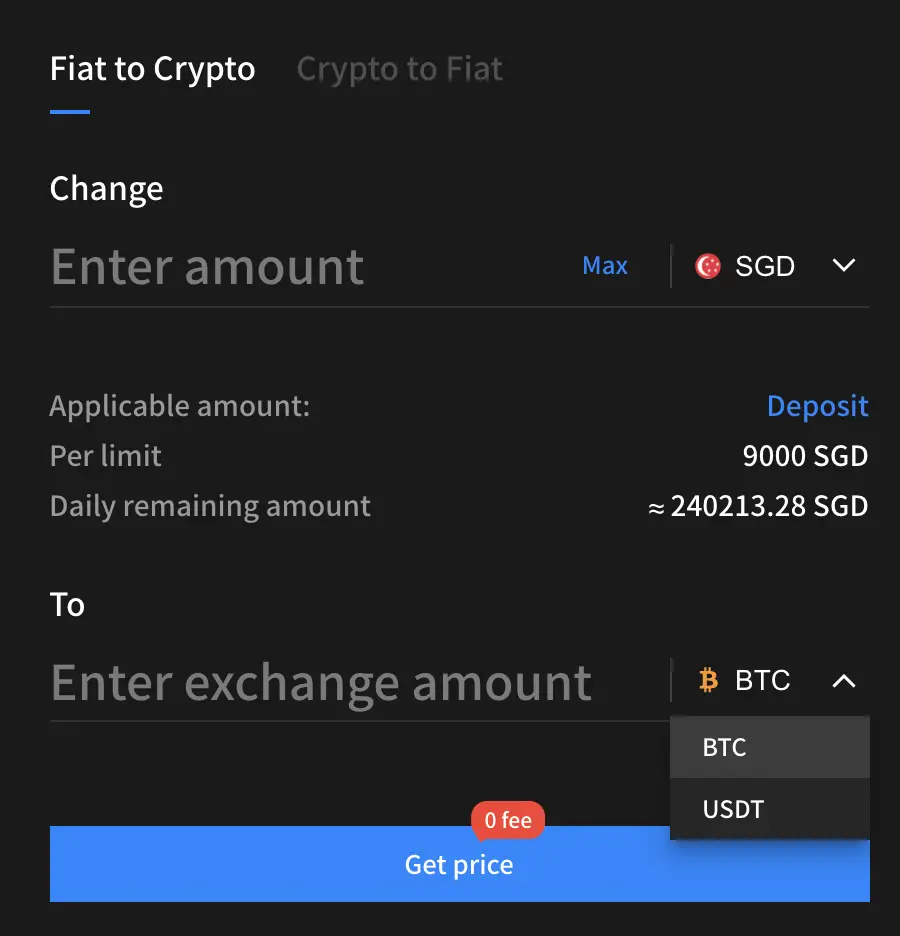

Methods of funding account

There are 2 ways that you can fund your account:

- Xfers Direct

- FAST Transfer

To start using Xfers, you’ll need to create a Xfers wallet if you have not done so yet!

Here are the pros and cons of each method:

| Method | Time Taken For Funds To Reach Account | Fees |

|---|---|---|

| Xfers Direct | Within minutes | 0.55% |

| FAST Transfer | Up to 1 business day | None |

There is definitely a trade-off here.

If you are looking to buy a certain currency that is increasing in price, you may want to use Xfers Direct and pay the fees.

However, if you are just intending to hold onto a coin, then FAST would still be sufficient for you.

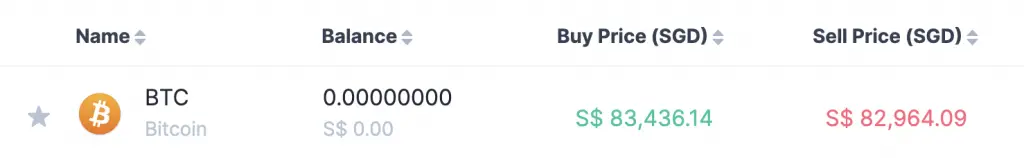

Methods of buying

When you are buying crypto on Coinhako, you are not trading with another party. Instead, you are buying at the prevailing market rate set by Coinhako.

This may be higher or lower than the actual market rate.

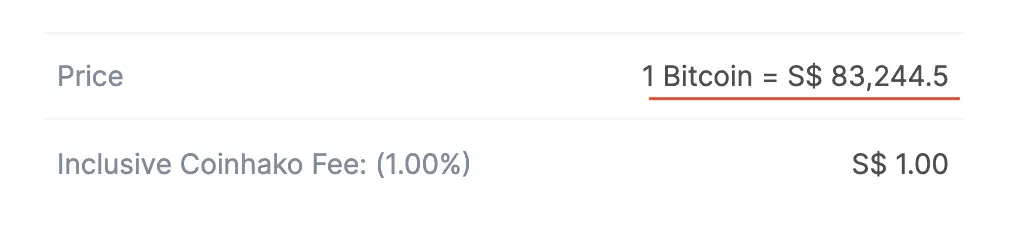

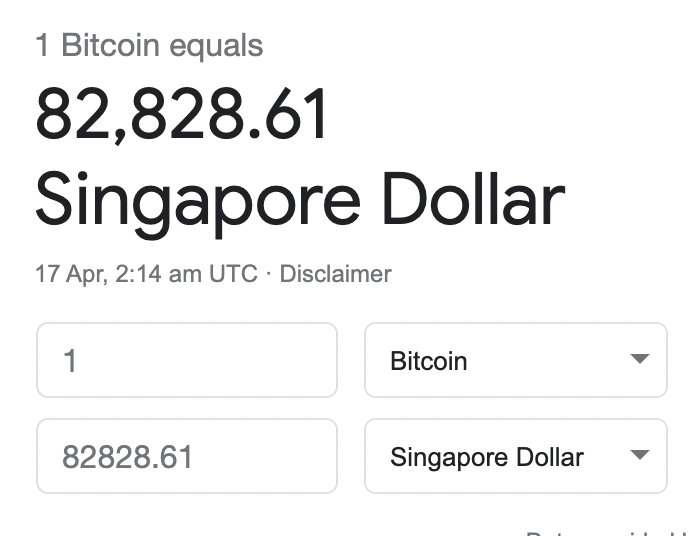

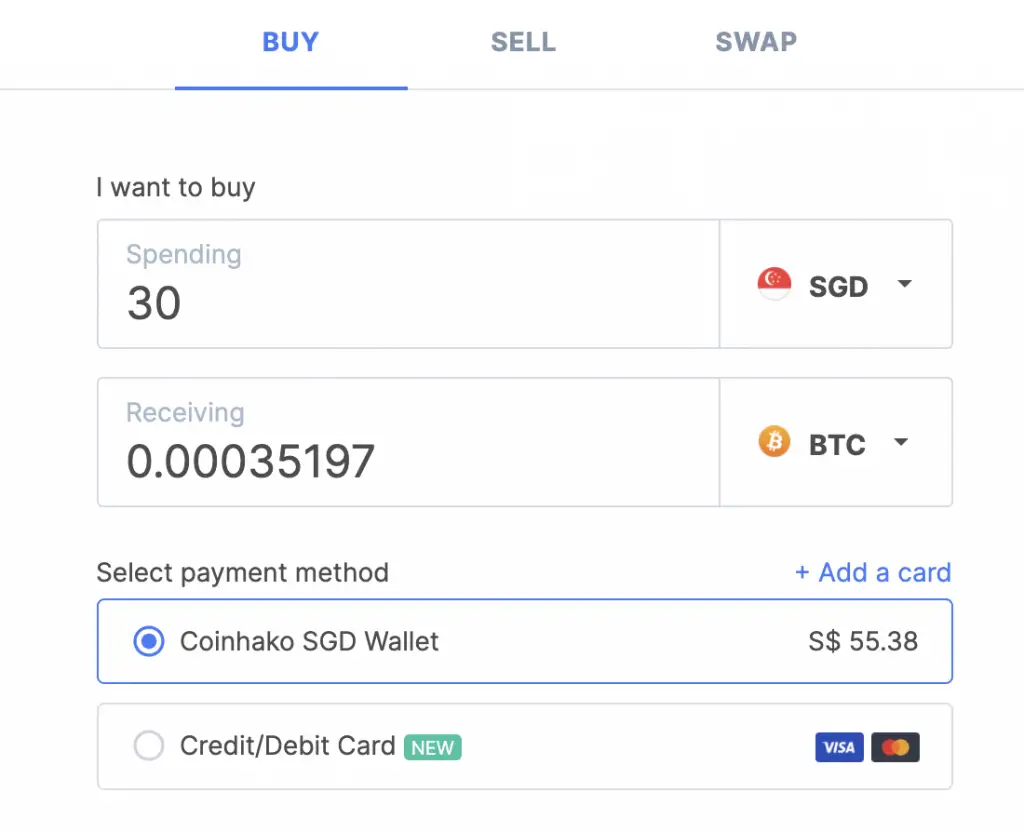

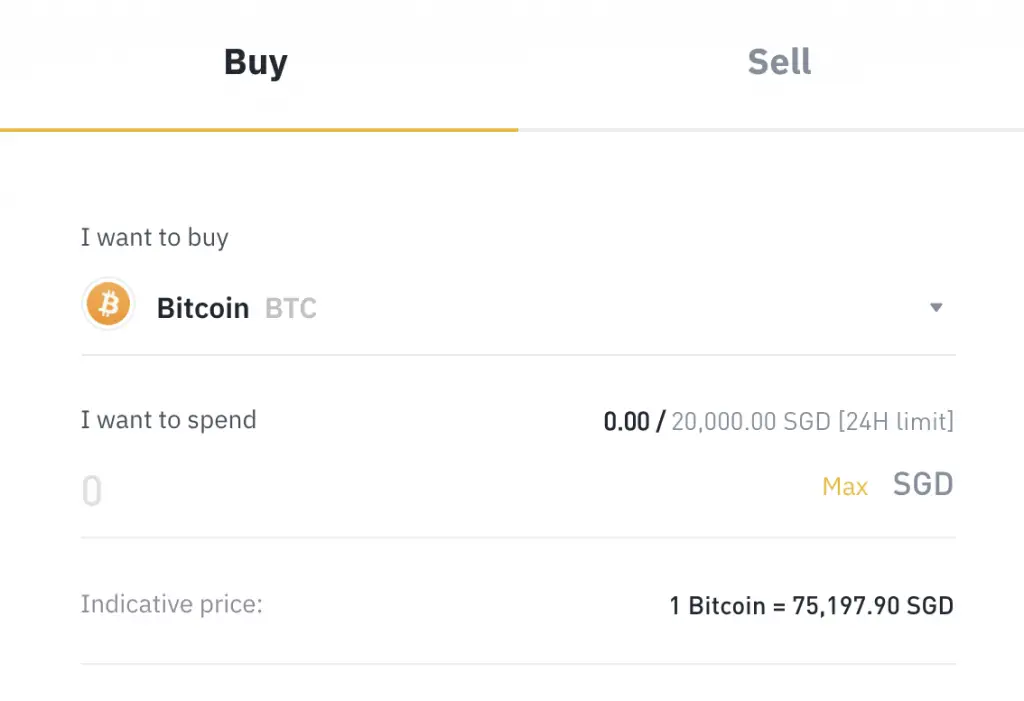

Here is Coinhako’s rate between Bitcoin and SGD,

and here is the market rate on Google at around the same time.

There is quite a huge difference!

Furthermore, you may also want to take note that there is a difference between the buy and sell price.

This is similar to how a foreign currency exchange works.

If you intend to constantly buy and sell currencies on Coinhako, you may actually lose quite a bit of your profits.

2 ways of buying crypto

There are 2 ways of buying crypto on Coinhako:

- SGD wallet

- Credit or debit card

Buying with a credit card will be much more expensive!

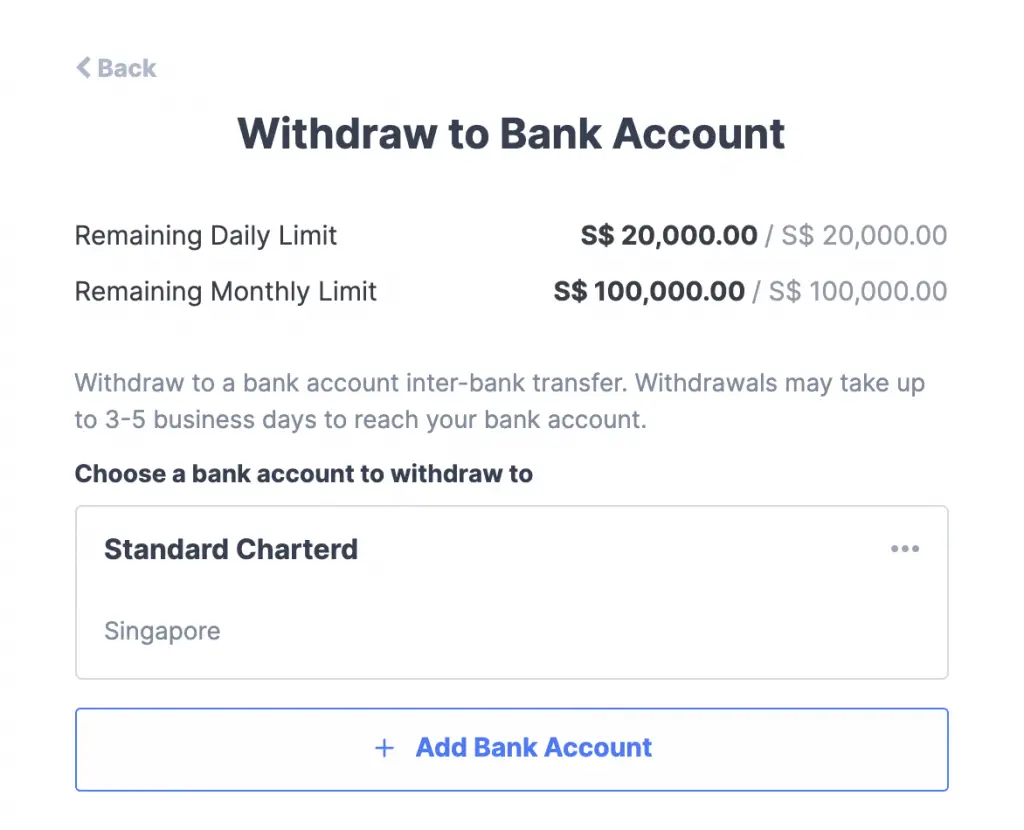

Withdrawal of funds

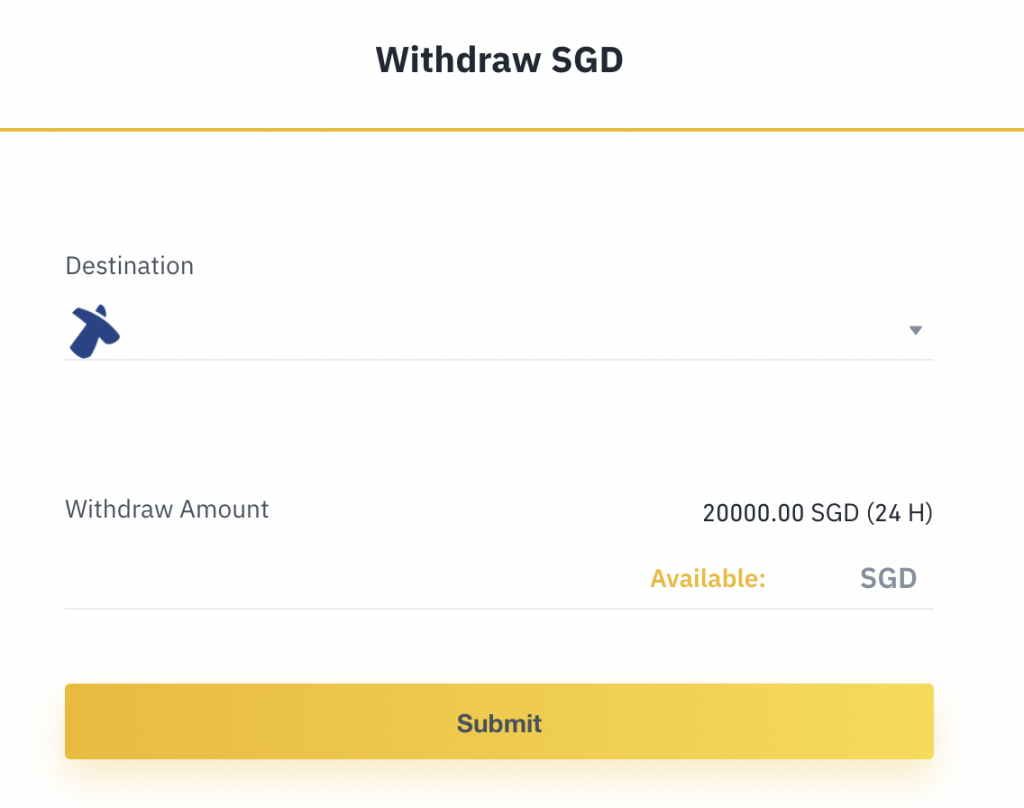

When you want to withdraw the funds from your SGD wallet, you can do so via FAST transfer.

However, you’ll be charged a $2 withdrawal fee for each transaction.

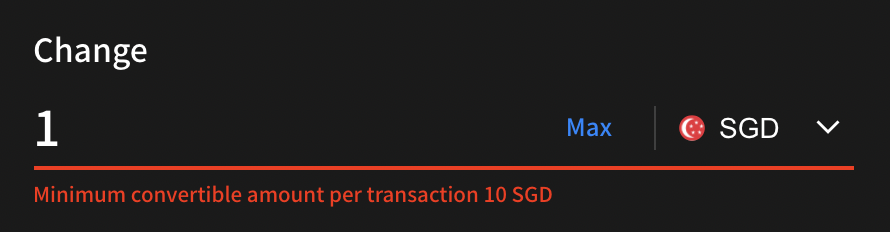

Minimum trade amount

For each trade that you make, you need to buy or sell a minimum of $45.

If you are selling in another cryptocurrency, the total amount needs to be $45 too.

Coinhako increased this amount, as it was previously $30.

Fees

Here are some of the fees that Coinhako charges you:

| Fee | Amount |

|---|---|

| Deposit Fees | 0.55% (Xfers) None (FAST) |

| Withdrawal Fees | $2 per withdrawal |

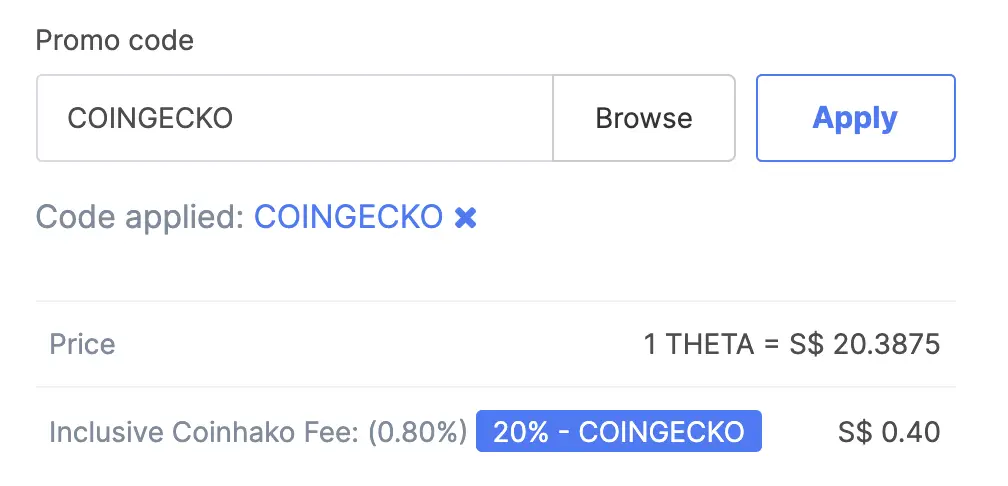

| Trading Fees | 0.80% – 1% |

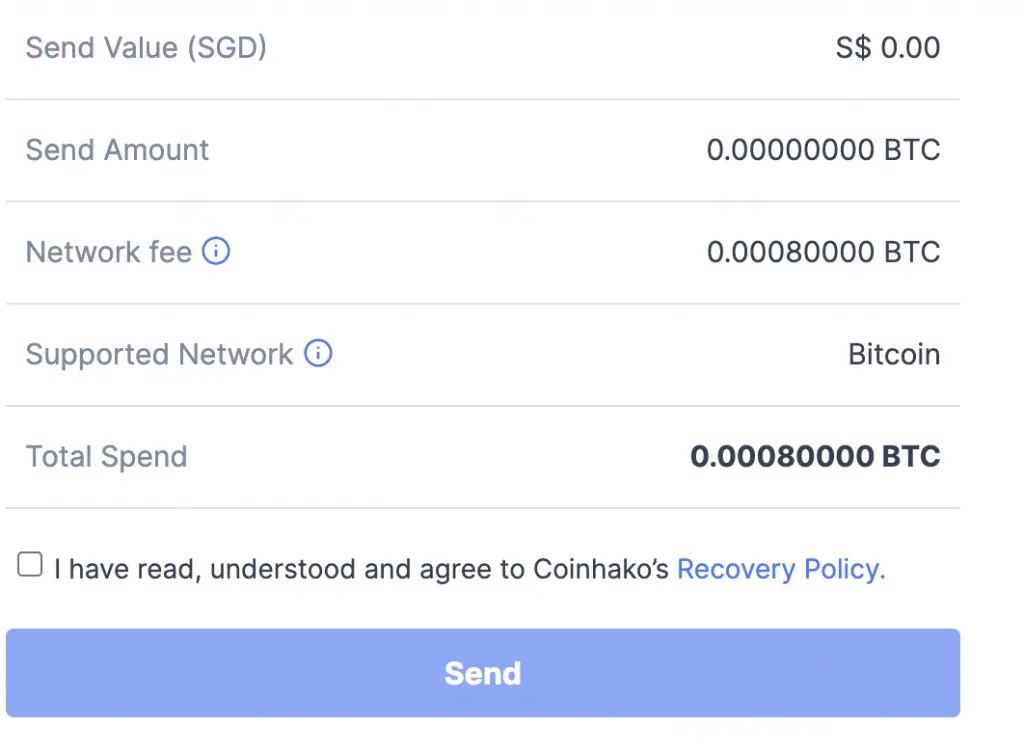

| Sending Fees | Dynamic |

You are able to reduce the trading fees to 0.80% if you use the promo code ‘COINGECKO’.

For the sending fees, it depends on the demand of the network. You can see the fee you’re being charged before performing the transaction.

Security

Coinhako mentioned that they store the majority of your crypto in their ‘highly secure’ cold storage accounts.

Meanwhile, only a small percentage of your funds will be stored on their exchange. This helps to facilitate liquidity where you are able to sell or withdraw your funds.

If hackers are able to gain access to your holdings, they will only gain access to a small percentage on the exchange.

To get the rest of your funds, they will need to hack the cold storage account. This is much harder to do!

As such, most of your crypto with Coinhako will be safe and secure.

Coinhako also allows you to use 2FA apps like Authy to make your account extra secure.

Even with these measures, Coinhako was still hacked on 21st Feb 2020. Thankfully, only 20 users were affected, and any assets that were lost were reimbursed by Coinhako.

MAS regulation

MAS has been attempting to enforce strict regulations on cryptocurrency exchanges via the Payment Services Act.

Being a Singaporean company, Coinhako is striving to comply with the regulations set out under this act.

Verdict

If you are intending to buy more common currencies like BTC, ETH or LTC, then Coinhako’s fees are too high.

There are many platforms that offer cheaper fees for these currencies.

However, Coinhako’s main advantage is the ability to buy ‘rarer’ altcoins with SGD.

For example, they allow you to buy altcoins like DOGE, THETA or LUNA directly from SGD.

In these cases, the higher fees that you incur may be worth it.

Gemini

Gemini was founded in New York in 2014. They were created by the Winklevoss twins, who have seen major success with their crypto exchange.

Gemini can also be found in 50+ countries!

This is a summary of Gemini’s features:

| Number of Currencies | 34 |

| Funding Methods | Xfers |

| Methods of Buying | Instant Buy (Exchange) Trading (Active Trader) |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | From 1.49% (Exchange) and up to 0.35% (Active Trader) |

| Sending Fees | Free for first 10 withdrawals |

| Minimum Per Trade | Depends on currency |

| Extra Features | Gemini Earn |

| Security | Cold storage + hot wallet |

| MAS Regulation | Intends to comply |

| Verdict | A rather safe platform with low fees |

Here is Gemini explained in-depth:

Number of currencies

Gemini allows you to buy 34 currencies on their platform. Here are some of the currencies can buy:

You are also able to buy other currencies like ENJ on their platform too.

Gemini has quite a unique variety of cryptocurrencies on their platform!

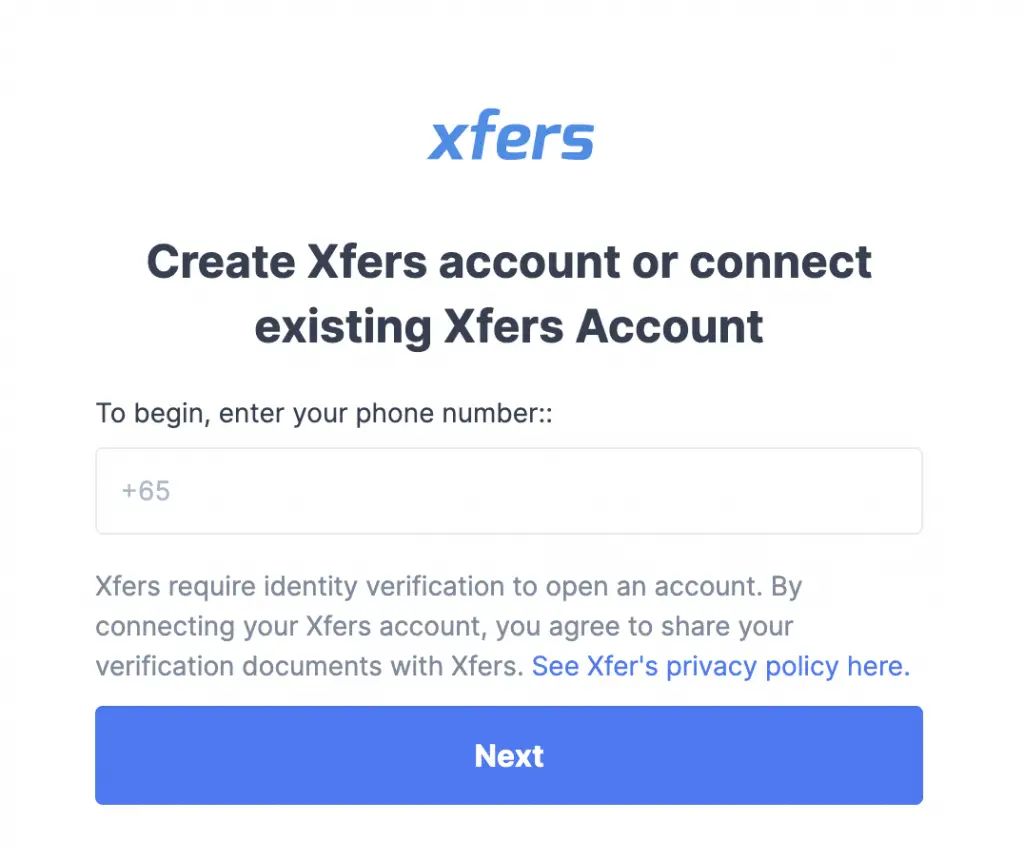

Methods of funding account

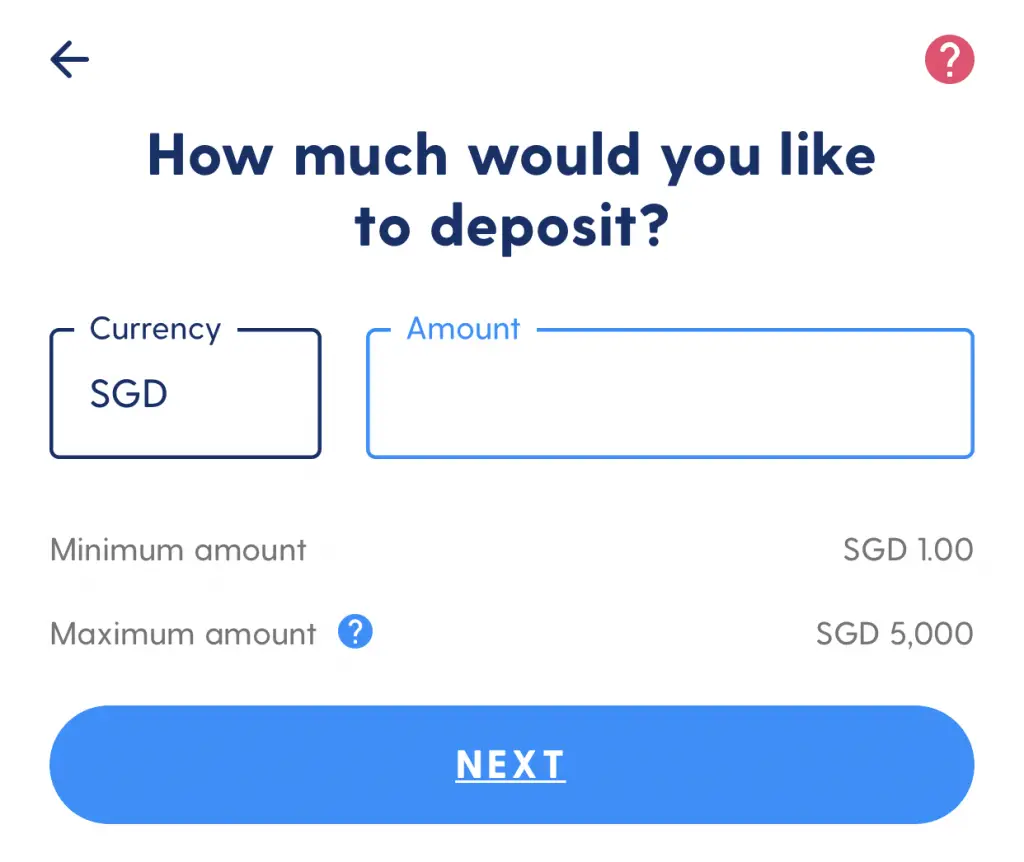

You can deposit funds into Gemini by transferring them to your Xfers wallet.

After receiving the funds, it will be directly credited into your Gemini account.

You can check out my guide on how to deposit funds into Gemini to find out more.

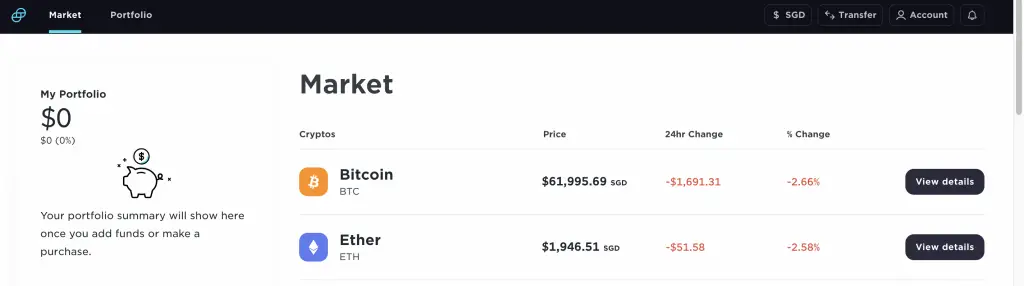

Methods of buying

Gemini allows you to buy crypto on their platform using 2 methods:

- Gemini Exchange

- Gemini Active Trader

Gemini Exchange is an Instant Buy feature, which is similar to Coinhako.

You will buy your crypto at the prevailing market rate that is set by Gemini.

The fees may be quite high too!

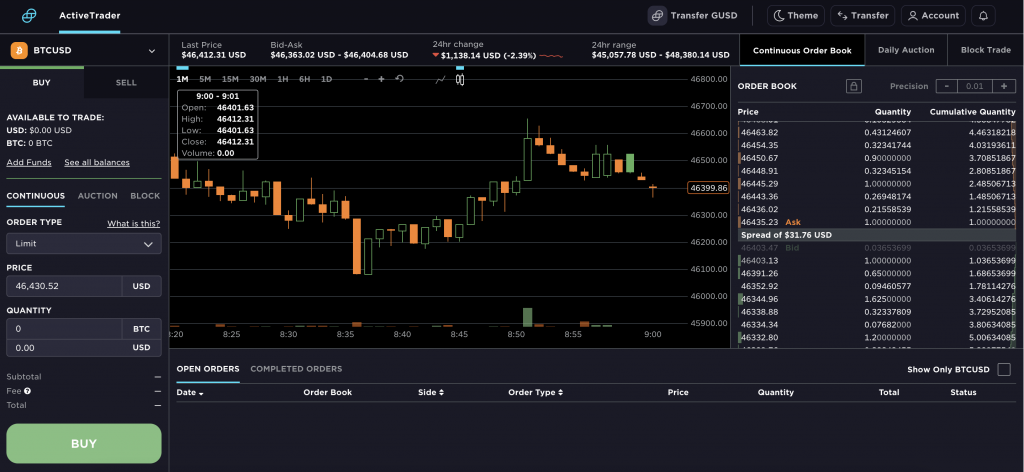

Alternatively, you can consider using Gemini’s Active Trader platform instead.

The fees for Active Trader are much lower!

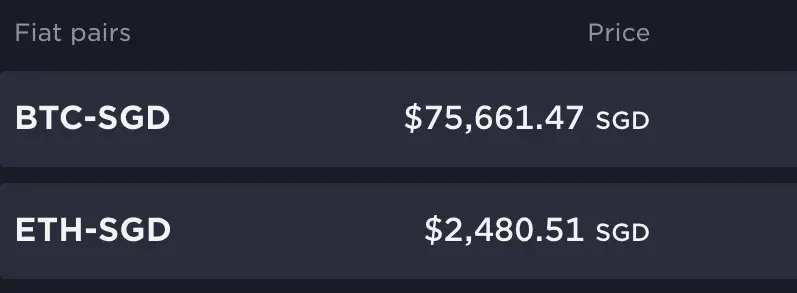

However, the only issue is that Active Trader only has a SGD trading pair with either BTC or ETH.

If you want to buy other currencies like LINK or UNI, you’ll have to make at least 2 trades.

For example, if you want to buy UNI, these are the trades you need to make:

- SGD to BTC

- BTC to UNI

In the end, the fees may still be cheaper compared to buying UNI via Gemini Exchange!

Withdrawal of funds

When you withdraw your funds from Gemini, it will be sent to Xfers.

Your funds should be credited back into your account within one business day.

This means that you’ll still need to go to Xfers and withdraw the funds back into your bank account.

This is may be slightly more troublesome for you.

Minimum trade amount

If you want to trade on Gemini’s Active Trader platform, the trading minimum depends on your currency.

For Gemini Exchange, you can make a purchase with less than $15. However, the fees that you’re charged are really high!

Fees

Here are the fees that you’ll incur when trading with Gemini:

| Fee | Amount |

|---|---|

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | From 1.49% (Exchange) and up to 0.35% (Active Trader) |

| Sending Fees | Free for first 10 withdrawals |

The trading fees for Gemini Exchange are really high:

| Trade Amount (SGD) | Trading Fee (SGD) |

|---|---|

| ≤ $15.00 | $1.50 |

| > $15.00 but ≤ $35.00 | $2.00 |

| > $35.00 but ≤ $70.00 | $2.75 |

| > $70.00 but ≤ $250.00 | $4.00 |

| > $250.00 | 1.49% of your Web Order value |

It is definitely not worth trading anything less than $250!

As such, you may want to consider using Active Trader, which only costs up to 0.35%.

Even if you make multiple trades, it will still be cheaper compared to buying on Gemini’s Exchange!

Another feature of Gemini is that it offers you 10 free withdrawals each month. This is really useful if you want to send your crypto to another platform.

Some currencies may charge a very high fee when sending on their networks!

Extra features

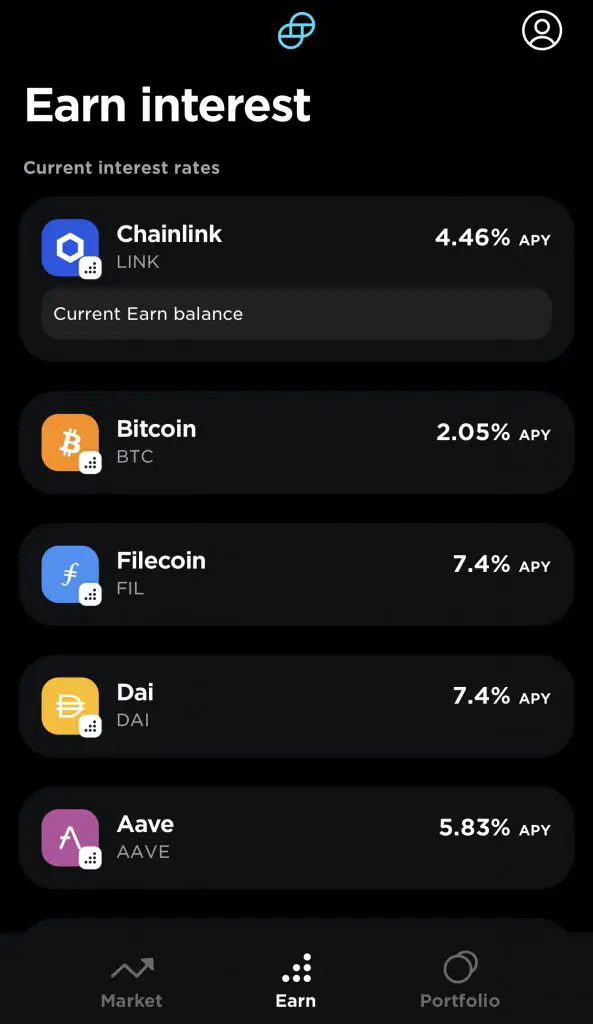

Gemini also has an Earn feature, which allows you to earn interest on your crypto.

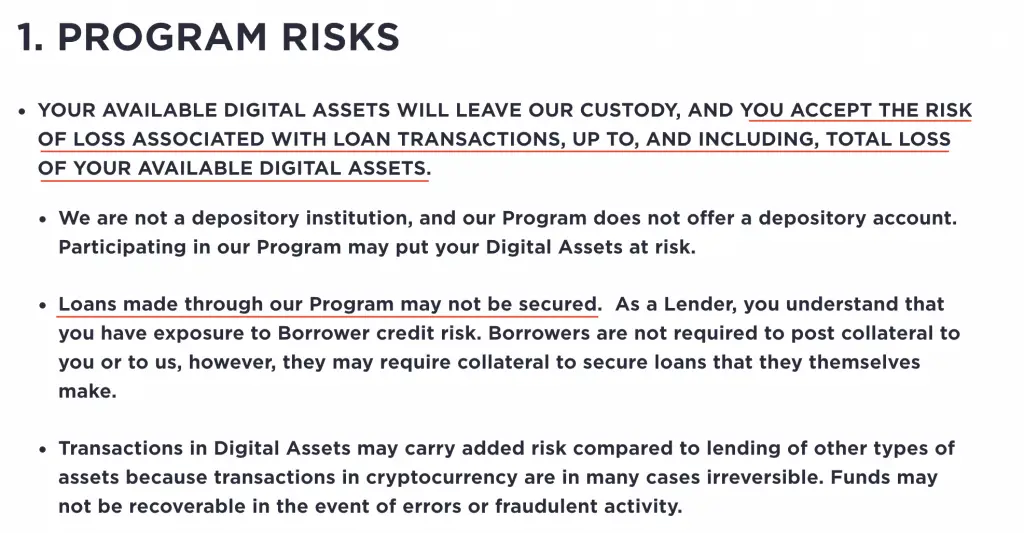

Gemini lends out your currencies to their approved partners. So far, Genesis is their only approved partner.

However, Gemini may not secure your loan with collateral, and they will not take responsibility if your borrower defaults.

This may be riskier compared to lending out your currencies with Celsius or Blockfi.

Security

Gemini claims it is one of the most secure crypto exchanges.

Majority of the assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft.

Gemini

It seems that Gemini’s owners are quite confident about the security of their platform!

MAS regulation

Gemini has hired a Head of Asia Pacific Region to file Gemini’s license under the Payment Services Act.

This shows that they are willing to comply with the regulations being set out by the MAS.

As such, I would believe that Gemini is one of the safer platforms to invest with.

Verdict

Gemini provides a very solid case as the cryptocurrency platform of your choice.

Their fees are really cheap at 0.35% (if you use Active Trader). Furthermore, they do not charge any fees for your first 10 withdrawals!

However, the main limitation is the variety of currencies that they have. While it is still quite a lot, you aren’t able to buy certain large-cap currencies, like ADA or DOT.

Nevertheless, Gemini still offers you a safe way of buying crypto in Singapore.

Luno

Luno is based in London and was founded in 2012.

They have expanded to a few countries like UK, Australia and Singapore.

Here is a summary of their features:

| Number of Currencies | 6 |

| Funding Methods | Xfers |

| Methods of Buying | Instant Buy (App) Trading (Exchange) |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | 1% (Instant Buy) and up to 0.1% (Exchange) |

| Sending Fees | Dynamic |

| Minimum Per Trade | Depends on currency |

| Extra Features | Luno Savings Wallet |

| Security | Cold storage + hot wallet |

| MAS Regulation | Intends to comply |

| Verdict | Cheapest way of buying BTC from Exchange |

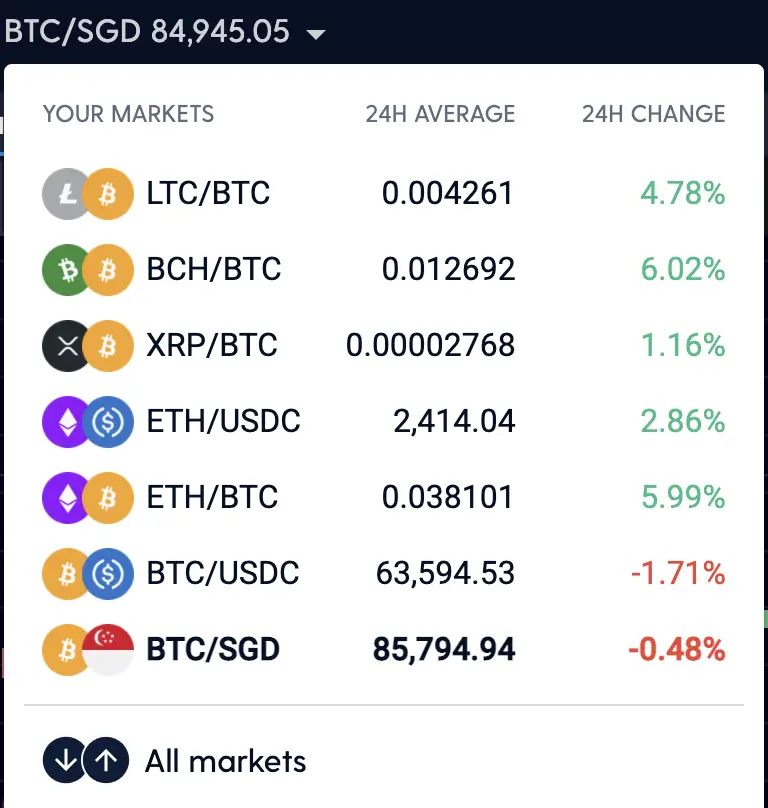

Number of currencies

Luno only offers you 6 currencies on their platform:

Luno’s offering is much lower compared to other platforms.

Methods of funding account

Luno allows you to deposit your funds via Xfers.

This makes it rather convenient to transfer your funds between platforms.

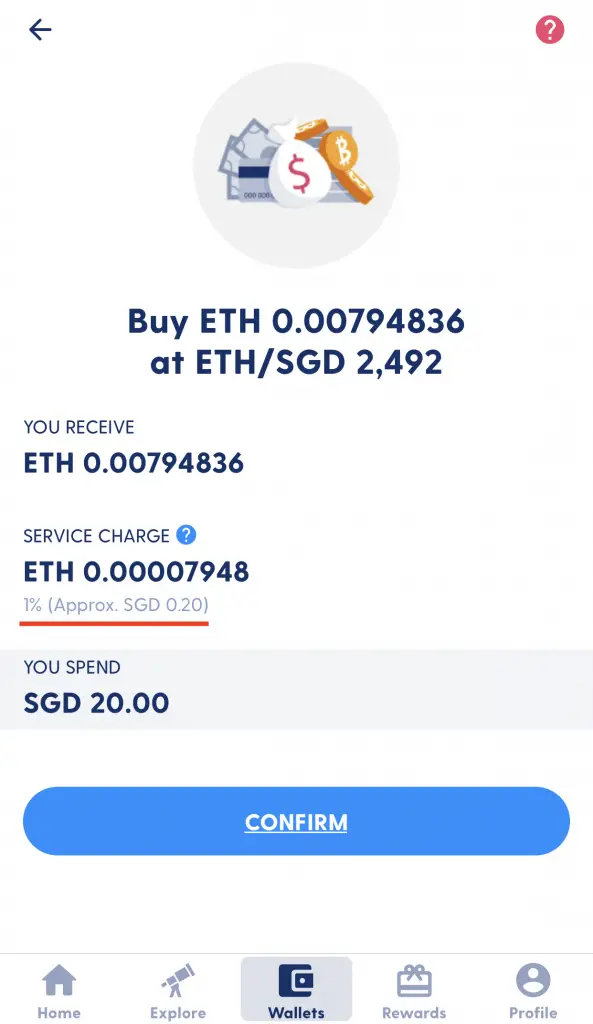

Methods of buying

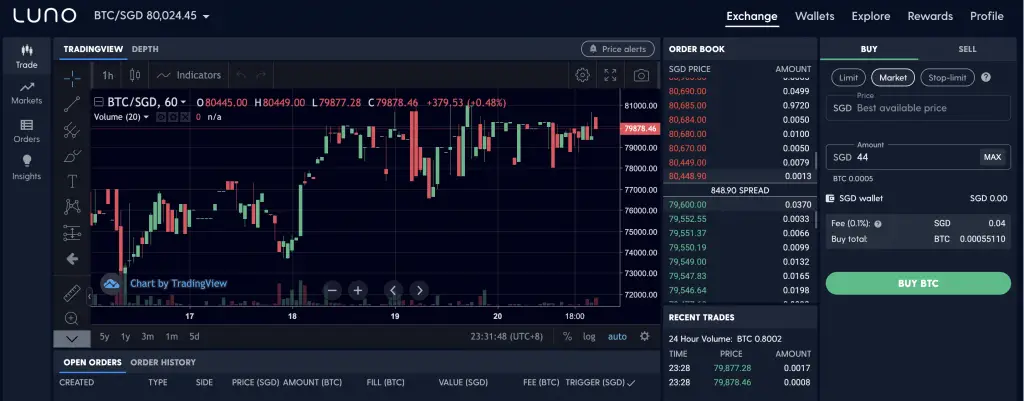

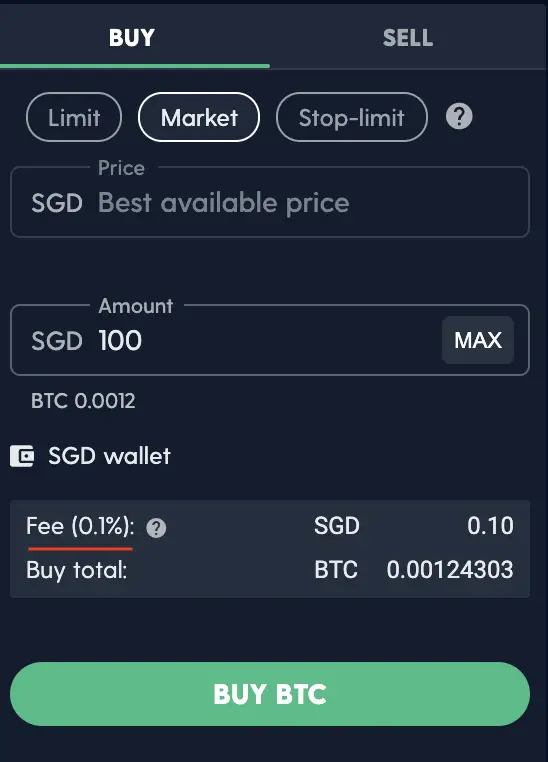

Similar to Gemini, Luno has 2 methods of buying crypto on their platform:

- Instant Buy

- Exchange

For Instant Buy, you will buy crypto at Luno’s prevailing market rate.

However, the fees are rather expensive at 1%.

You can also trade your crypto on the Luno Exchange.

However, you can only buy BTC from SGD, and not other currencies. This is because the only SGD trading pair available is BTC/SGD.

If you want to buy the other 5 currencies on Luno, you’ll have to make at least 2 trades.

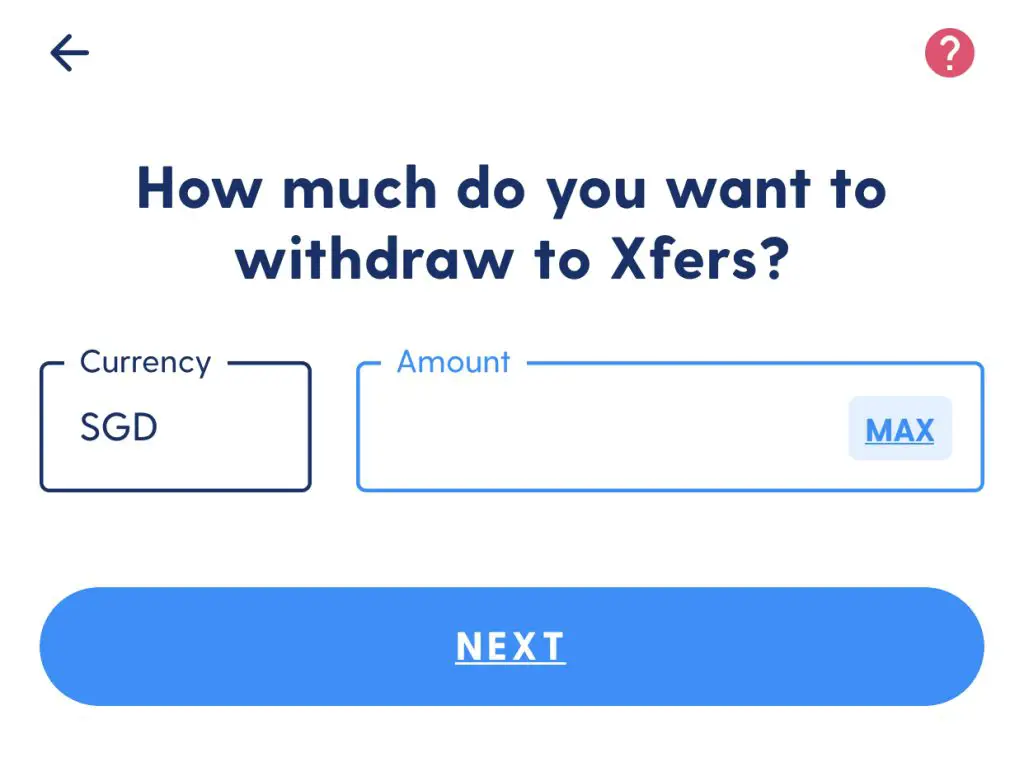

Withdrawal of funds

When you withdraw your funds from Luno, they will be transferred to your Xfers wallet.

Again, you’ll need to transfer the funds from Xfers back to your bank account. This may be slightly more troublesome.

Minimum trade amount

When you are buying crypto on Instant Buy, the minimum is $20.

If you are buying BTC on the Luno Exchange, the minimum amount is 0.0005 BTC.

Fees

If you use Luno’s Instant Buy, you will incur a 1% fee.

Meanwhile, Luno Exchange charges you up to 0.1% per trade.

Luno’s Exchange charges one of the lowest fees when it comes to trading with SGD!

Extra features

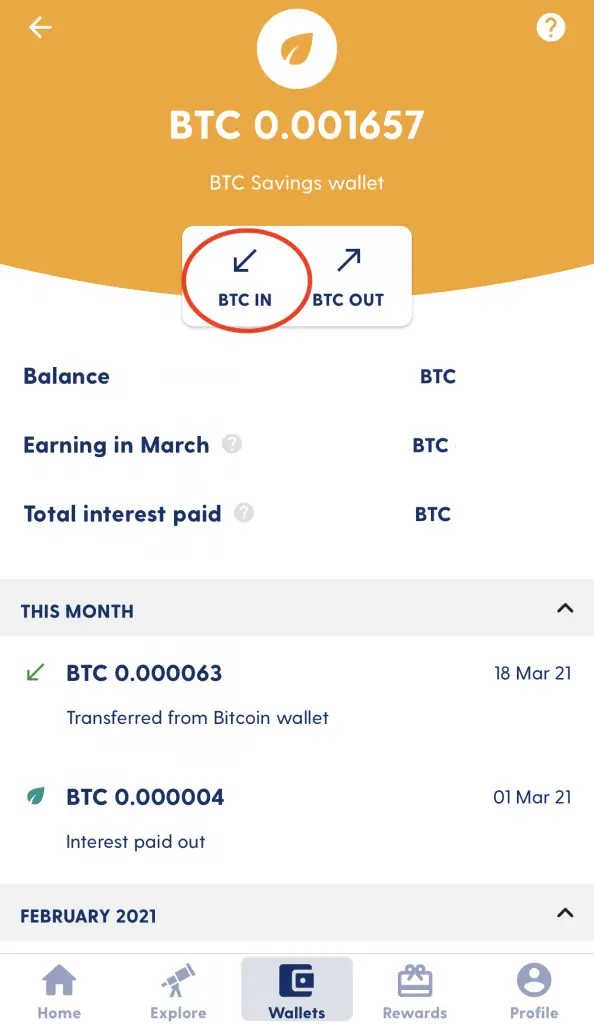

Luno also offers you a way to earn interest on your crypto via the Luno Savings Wallet.

You are able to earn interest on your BTC and ETH. Luno expects to give you up to 4% interest for your crypto that you loan out with them.

Security

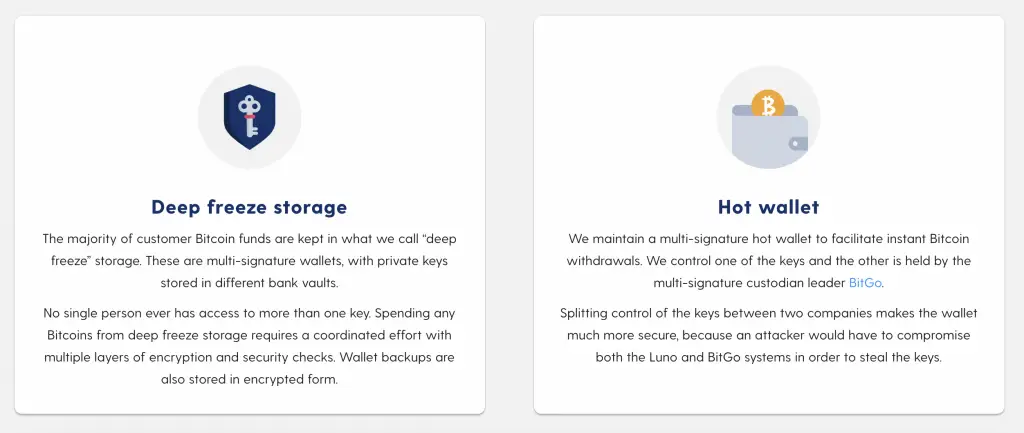

Luno also uses 2 places to store your crypto:

- Deep freeze storage

- Hot wallet

This approach is quite similar to what Coinhako does. Most of your funds are stored in the cold wallet.

However, some of your funds are in their hot wallet, in case you want to quickly withdraw them.

In the hot wallet, another set of keys are held with BitGo. They are considered to be a secure custodian of your crypto.

Once again, your crypto stored with Luno should be rather secure.

Luno provides 2FA to either your email or mobile phone whenever you login to your account.

MAS regulation

Luno was previously known as BitX, and they had to shut down their operations in Singapore in 2017.

This was mainly due to cryptocurrencies being very new in 2017. As such, there were not enough regulations put in place.

However, they reopened in 2019, and is striving to comply with the regulations set by MAS as well.

They also intend to apply for a license under the Payment Services Act.

With this commitment, your funds should be rather safe with them.

Verdict

Luno offers one of the lowest fees if you want to buy these 6 currencies. If you intend to just buy Bitcoin, you can seriously consider using this platform!

Zipmex

Zipmex is an exchange that was founded in Thailand.

Here is a summary of their features:

| Number of Currencies | 17 |

| Funding Methods | Xfers Direct |

| Methods of Buying | Instant Buy Trading |

| Withdrawal of Funds | Bank Account |

| Deposit Fees | None |

| Withdrawal Fees | $5 per withdrawal |

| Trading Fees | 0.2% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | Depends on currency (but quite low) |

| Extra Features | Zipmex Earn |

| Security | Uses BitGo’s technology |

| MAS Regulation | Intends to comply |

| Verdict | Low trading fees, but high SGD withdrawal fees |

Number of currencies

Zipmex supports 17 different currencies, which you are able to directly buy from SGD.

This includes:

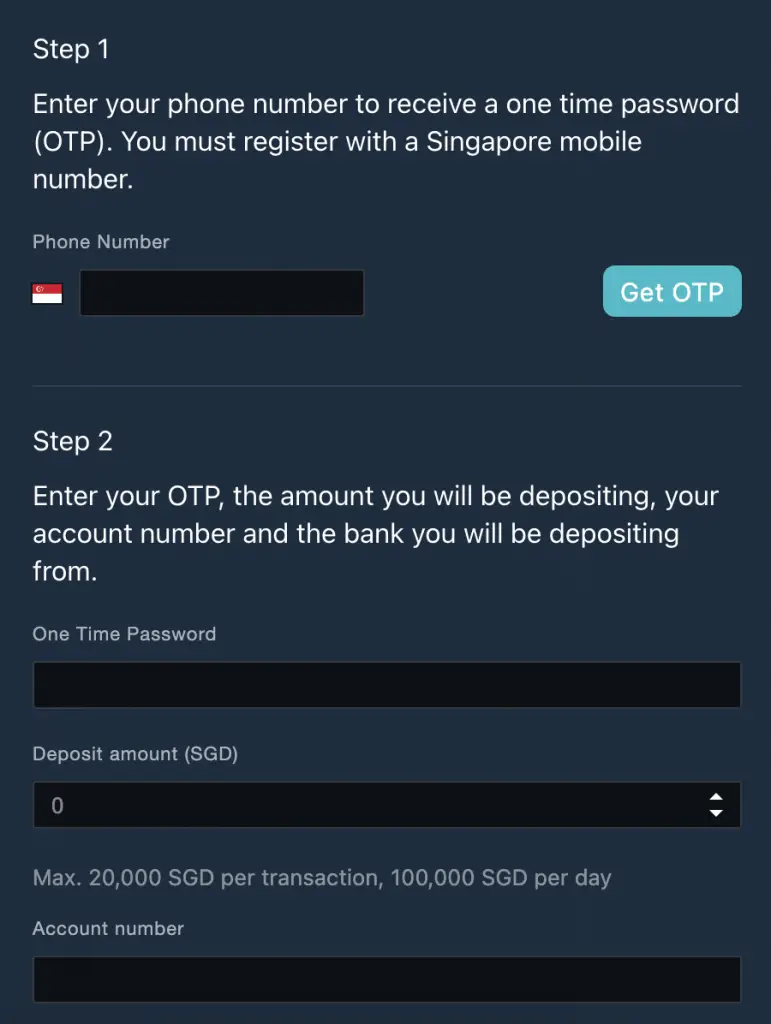

Methods of funding account

If you would like to fund your account, you can deposit your funds via a bank transfer. This will be done via Xfers Direct.

You are required to enter some details so that Zipmex can process your deposit.

This includes:

- Deposit amount

- Account number

- The bank you’re depositing from

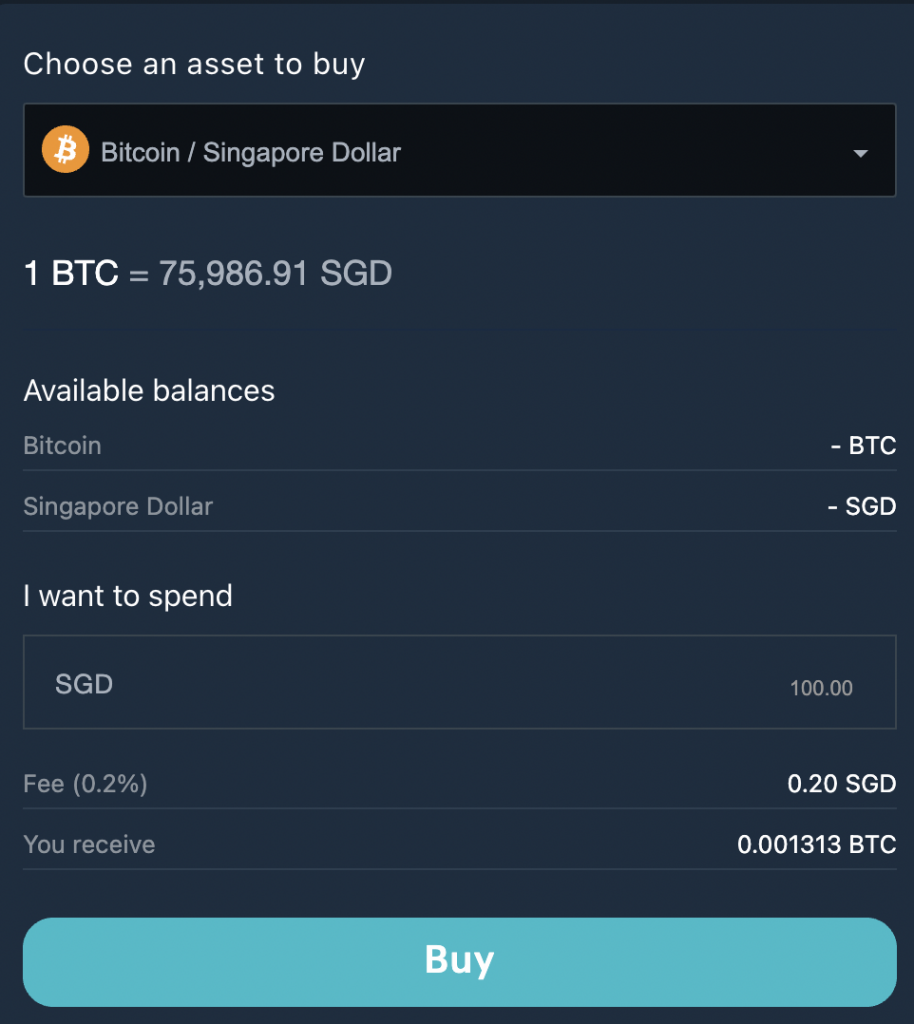

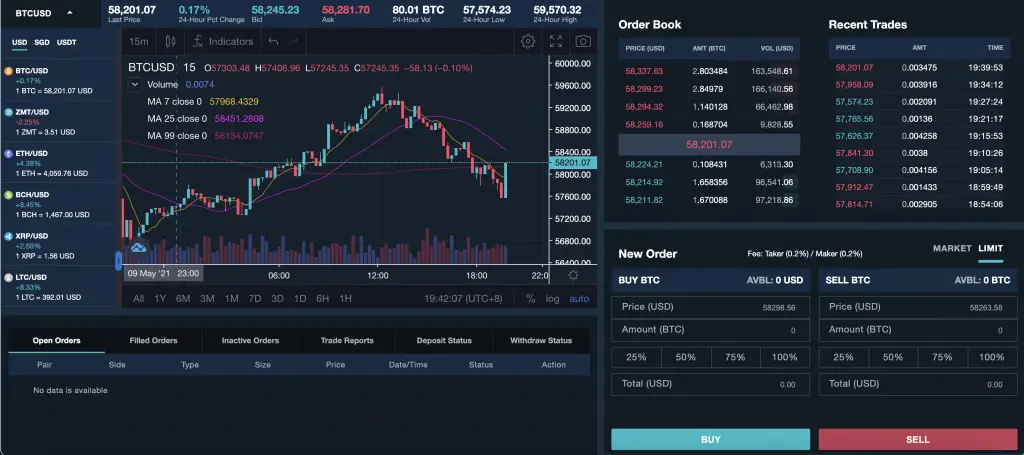

Methods of buying

There are 2 ways of buying crypto on Zipmex:

- Instant Buy

- Trading

You are able to instantly buy your crypto on Zipmex, which is based on the prevailing market rate.

You are also able to trade your crypto on the trading platform.

This allows you to set the price that you’d like to buy your crypto with.

Withdrawal of funds

If you wish to withdraw SGD from Zipmex, you can withdraw it to your bank account via bank transfer too.

Minimum trade amount

The minimum amount that you need for each trade depends on each currency.

Most of these minimums are very low, and they usually cost less than $1 SGD!

You will also need to withdraw a minimum of $10 SGD for each withdrawal you make.

Fees

Here are some of the fees that Zipmex charges you:

| Fee | Amount |

|---|---|

| Deposit Fees | None |

| Withdrawal Fees | $5 per withdrawal |

| Trading Fees | 0.2% |

| Sending Fees | Depends on currency |

The trading fees that you incur on Zipmex are really low!

However, the withdrawal fees are quite high at $5 for each withdrawal.

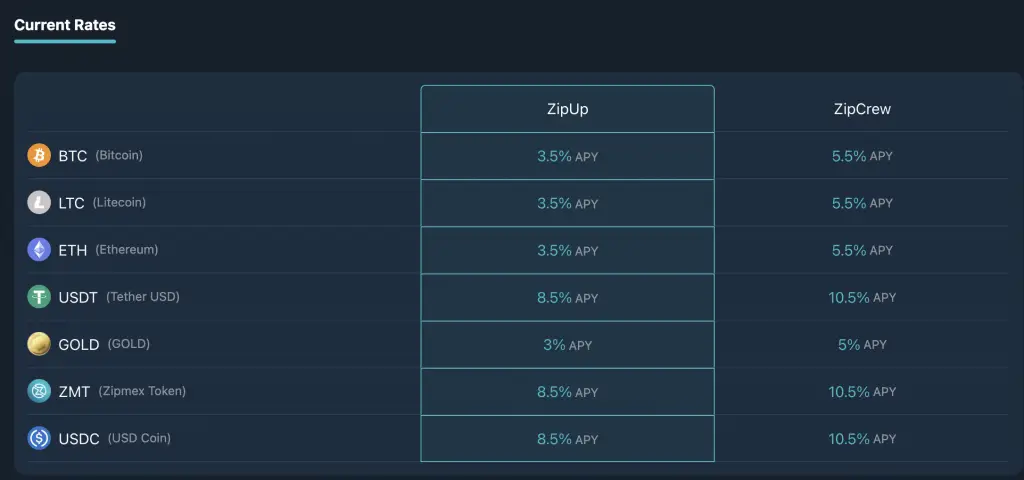

Extra features

Zipmex also has an Earn feature (ZipUp) that allows you to earn interest on your crypto.

The interest rates are lower compared to other platforms that allow you to loan out your crypto.

Security

Zipmex uses BitGo’s infrastructure to secure their platform.

Most of your funds will be stored in a wallet that is offline, so hackers won’t be able to access them.

Zipmex did talk about what would happen if they cease operations. However, they mentioned about the laws in Thailand, and did not mention anything in Singapore.

You may want to be a bit cautious and not put all of your funds into Zipmex!

MAS regulation

MAS has been attempting to enforce strict regulations on cryptocurrency exchanges via the Payment Services Act.

Zipmex has listed the measures that they have taken to comply with the regulations that MAS intends to set out.

As such, I believe that they would be able to attain the Payment Services Act license.

Verdict

Zipmex charges really low trading fees compared to most platforms (except for Luno). It also offers quite a wide variety of currencies too!

However, the withdrawal fees are slightly higher compared to other exchanges.

There is this tradeoff that you’ll need to consider if you decide to trade on Zipmex.

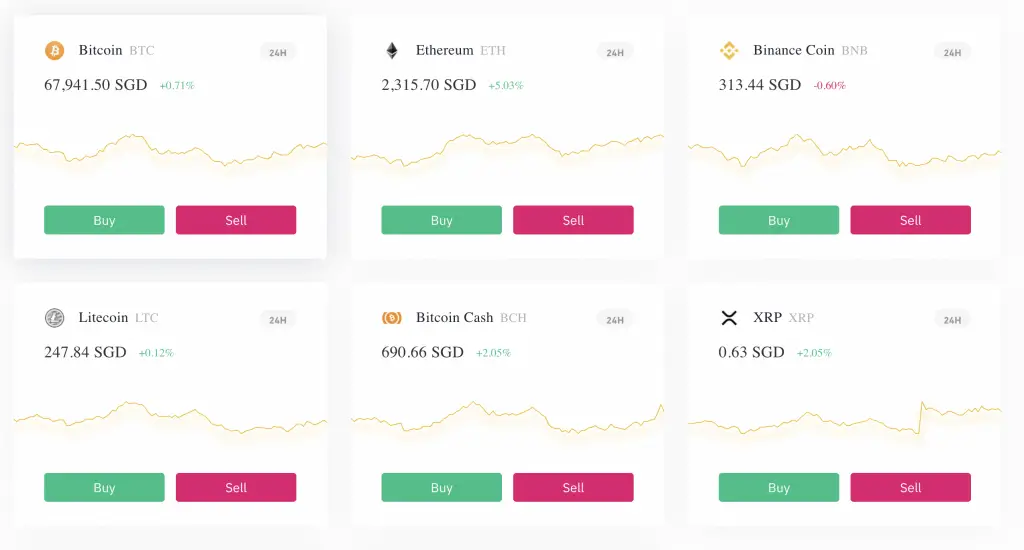

Crypto.com

Crypto.com was founded in June 2016. They are based in Hong Kong, and serves over 10 million customers!

Here is a summary of Crypto.com’s features:

| Number of Currencies | 100+ (8 from SGD) |

| Funding Methods | Xfers Credit card |

| Methods of Buying | Instant Buy |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | 0.4% (Xfers) |

| Trading Fees | None |

| Sending Fees | Depends on currency |

| Minimum Per Trade | USD $1 |

| Extra Features | Crypto Earn Supercharger |

| Security | 100% cold storage |

| MAS Regulation | Intends to comply |

| Verdict | Good if you have the Visa card and want to use Crypto.com’s other features |

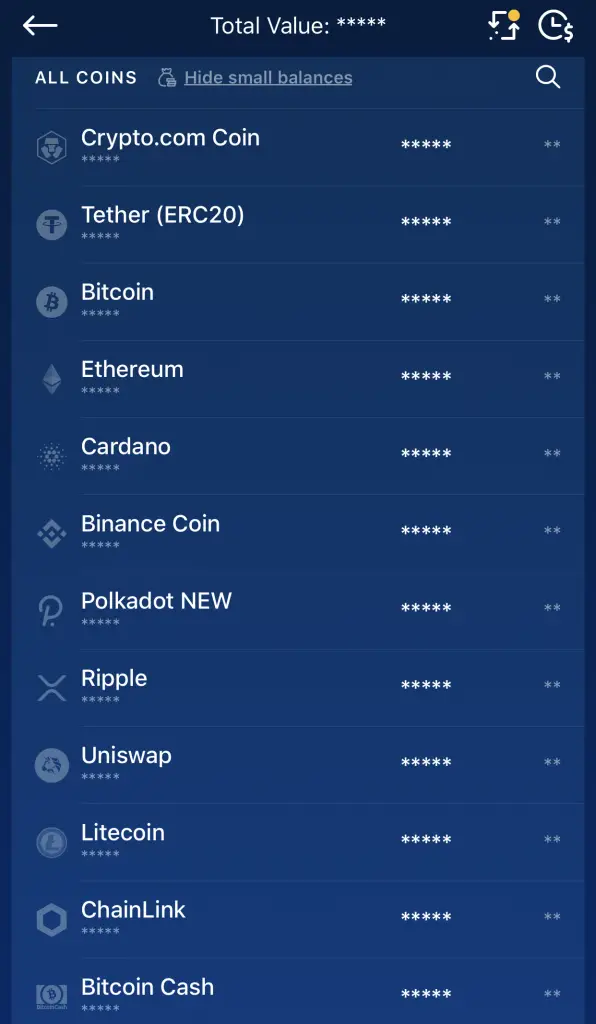

Number of currencies

Crypto.com offers a wide variety of currencies on their platform.

However, there are only 8 currencies that you can buy directly from SGD:

For the other currencies on Crypto.com, you’ll need to make at least 2 trades to buy them.

Methods of funding account

Crypto.com has a fiat wallet that you’ll need to connect with your Xfers account.

Once you’ve transferred your funds to your Xfers account, you can buy crypto using the Crypto.com app.

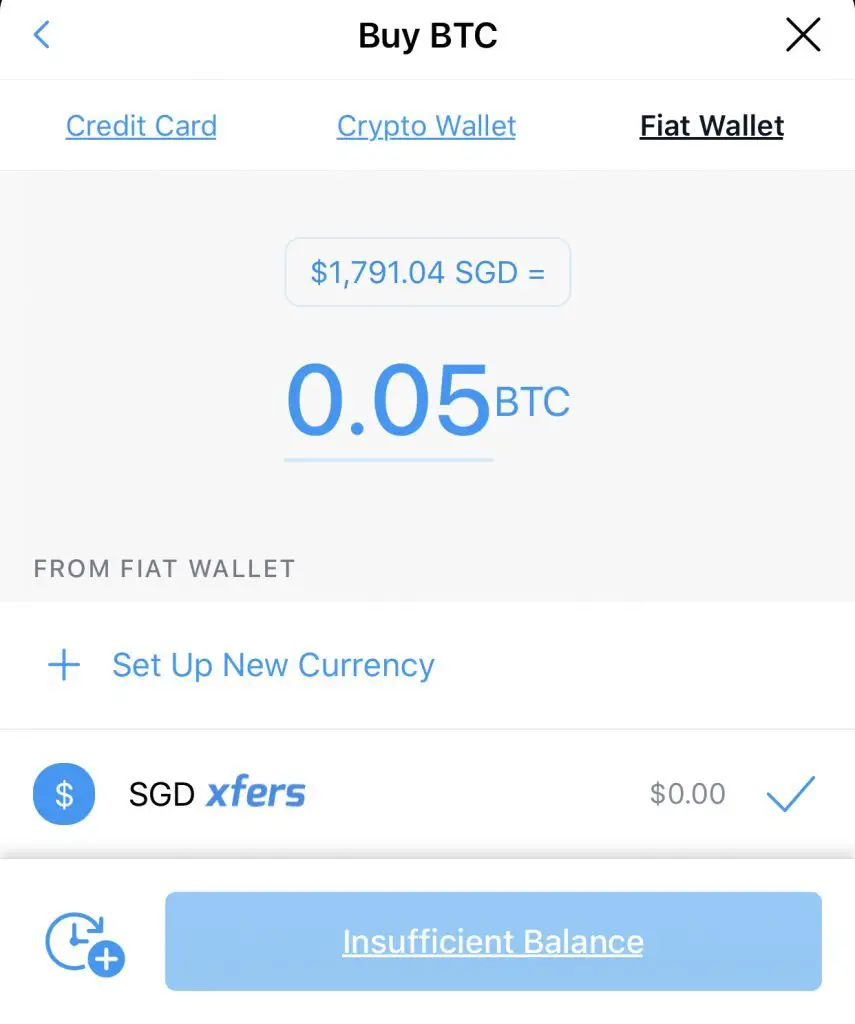

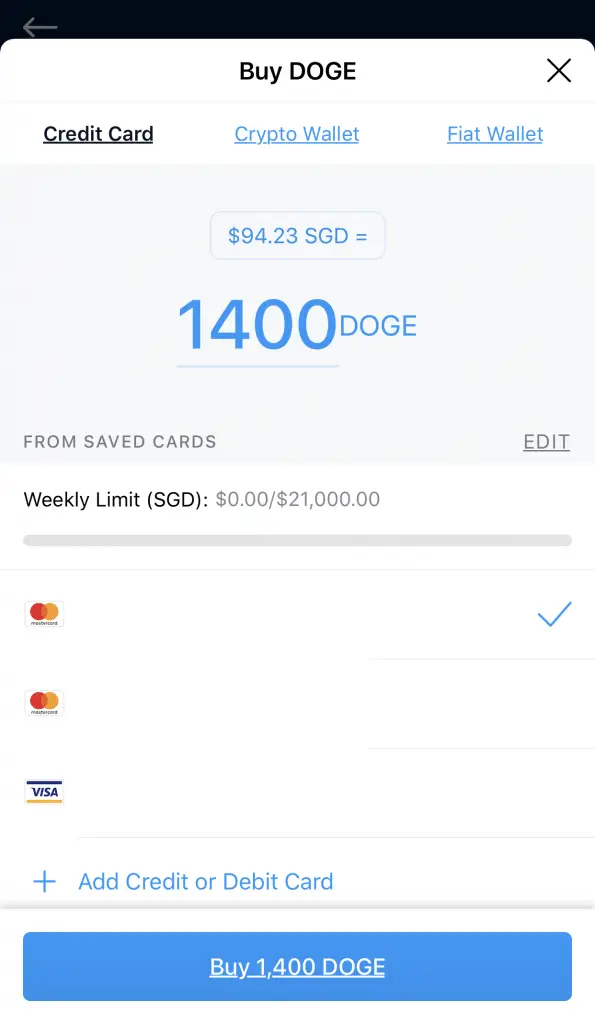

Methods of buying

To buy crypto on Crypto.com, you can use 3 methods:

- Credit card

- Instant buy (fiat wallet)

- Trading from another cryptocurrency

If you’re just starting out trading on Crypto.com, you can choose to buy crypto using a credit card,

as well as directly from Xfers.

However, the fees that you incur when paying with credit card will be quite high!

For both methods, you are buying crypto at Crypto.com’s prevailing market rate.

This may be higher or lower compared to the actual market rate.

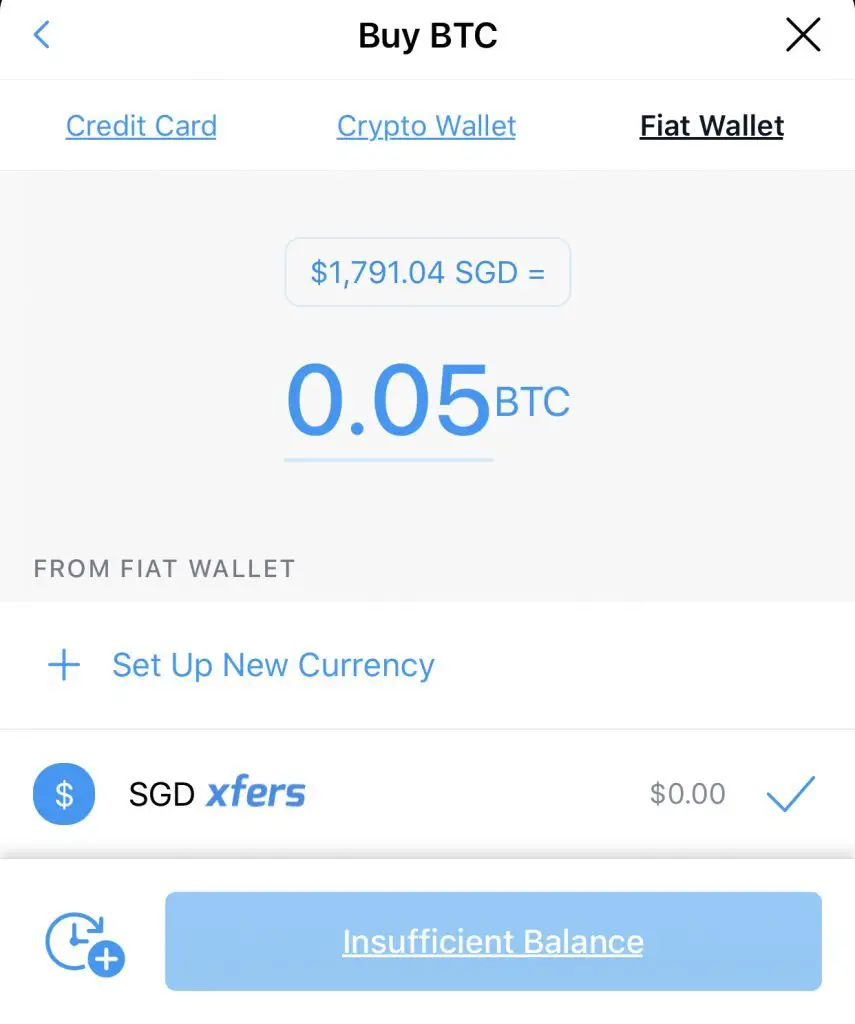

Withdrawal of funds

When you want to withdraw your funds, you would need to withdraw it to Xfers.

You can only sell off the 8 currencies for SGD back into Xfers! These are the same 8 currencies that you can only buy with SGD too.

You will incur a withdrawal fee of 0.4% as well.

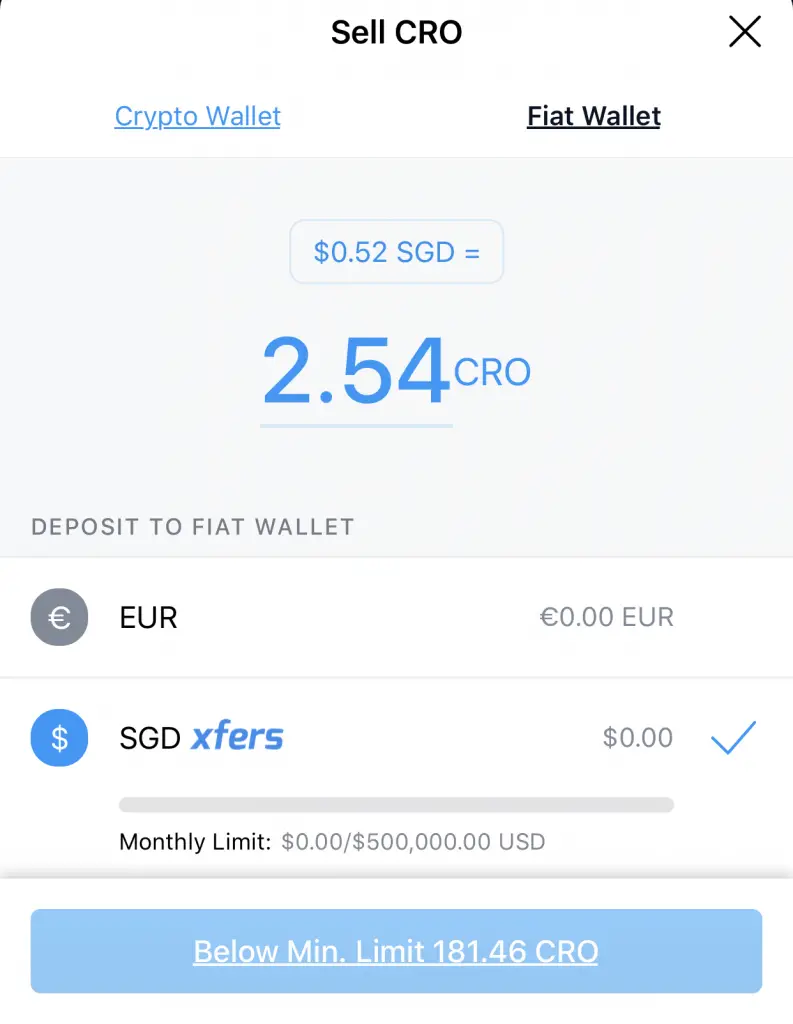

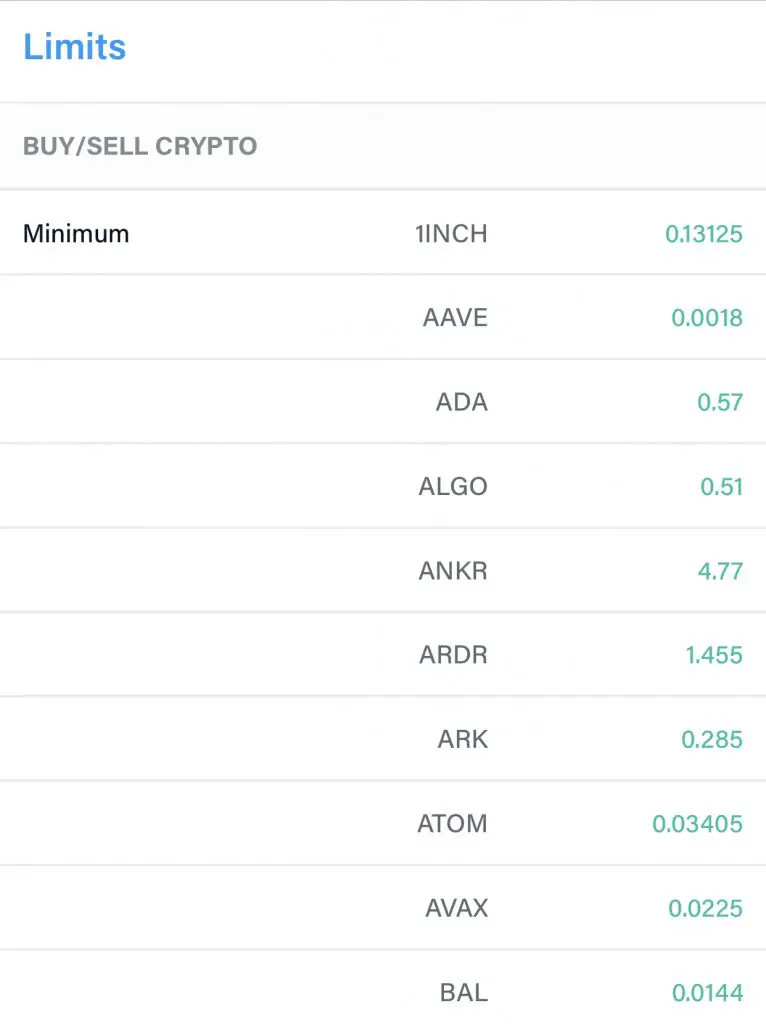

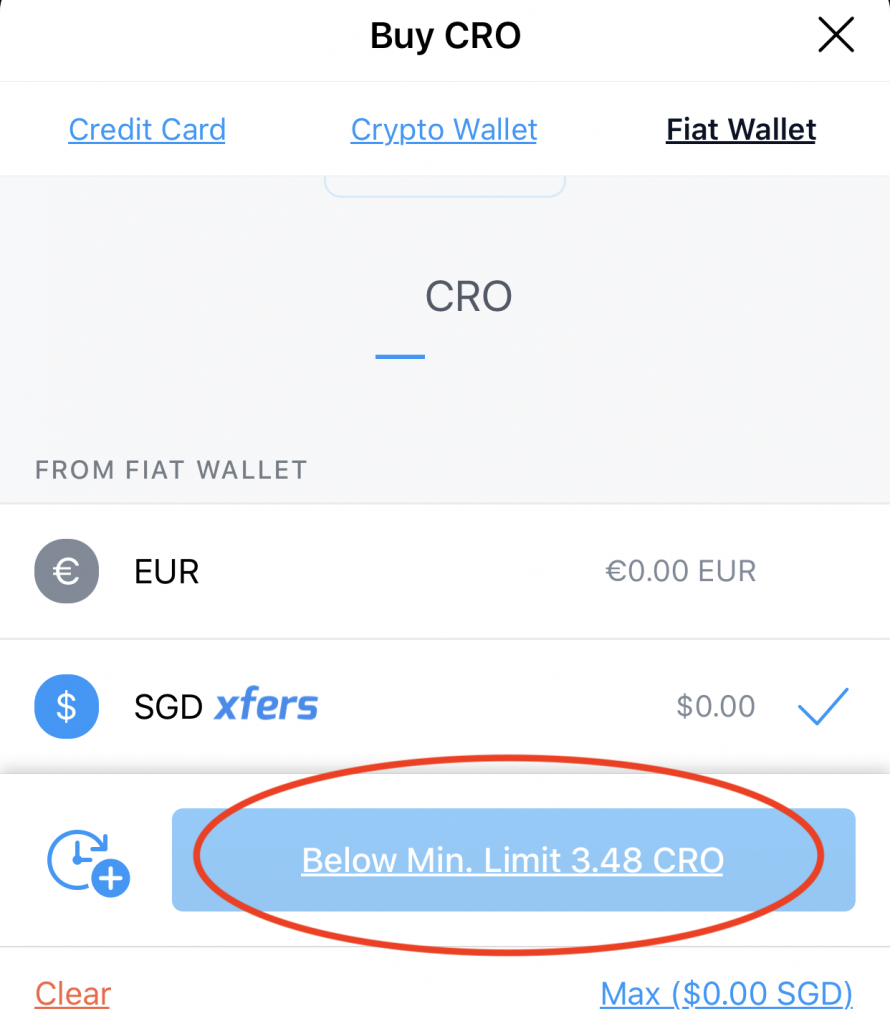

Minimum trade amount

The minimum trade amount depends on each currency.

You can see the minimum amount required for each currency in the ‘Fees / Limits‘ tab.

Most of these minimum trading amounts are equivalent to around $1 USD!

For example, you will require to buy a minimum of 3.48 CRO for each trade.

3.48 CRO is around the equivalent of $1 SGD.

The minimum trade amount is much lower compared to other exchanges! As such, this will make buying crypto much more accessible for you.

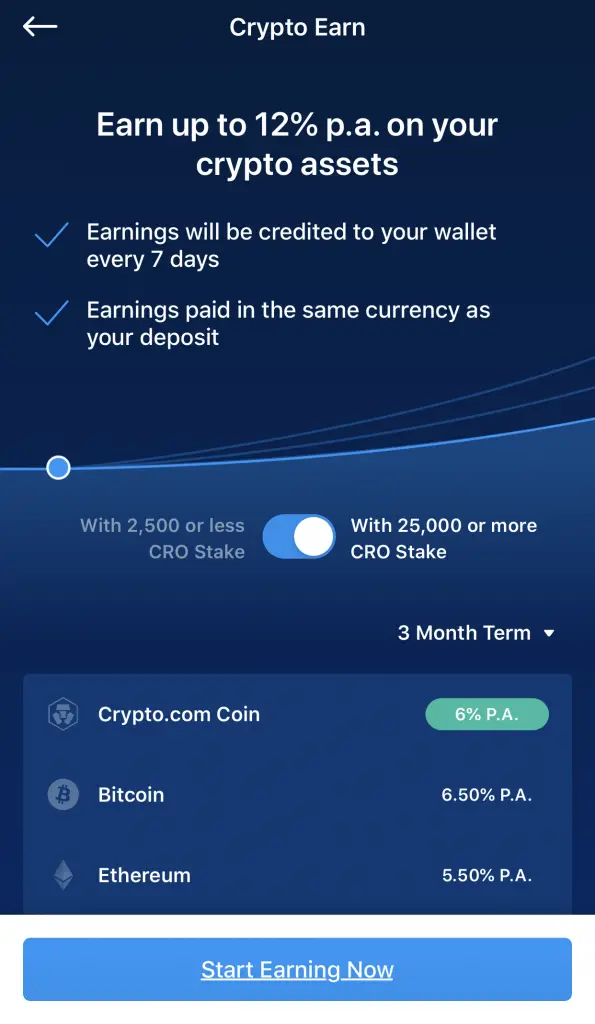

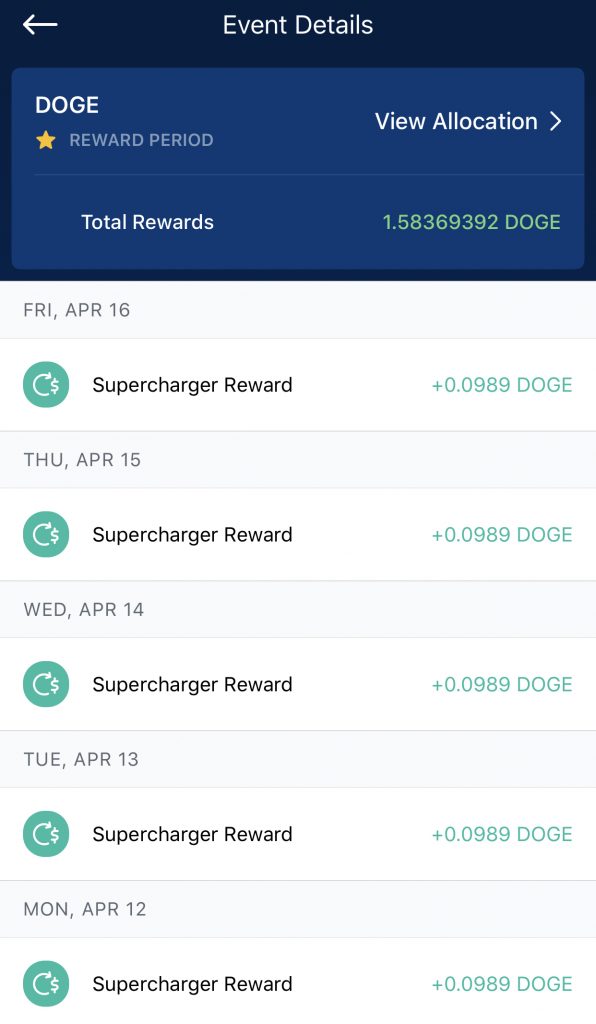

Extra features

The Crypto.com app has lots of other features as well!

You are able to earn interest on your crypto with Crypto.com Earn,

as well as mine DeFi tokens with Supercharger.

There are quite a few features that can help you to earn even more returns with your crypto!

Fees

Here are the fees that you’ll incur when buying crypto on Crypto.com:

| Fee | Amount |

|---|---|

| Deposit Fees | None |

| Trading Fees | None |

| Withdrawal Fees | 0.4% (Xfers) |

You do not incur any fees when converting one cryptocurrency to the other.

However, you’ll need to take note of the spreads.

In this way, you may be buying your crypto at a less favourable rate.

If you are constantly trading crypto, you may want to use Crypto.com’s Exchange instead.

Moreover, you will incur a 0.4% fee when you sell your crypto back to SGD with Xfers.

This withdrawal fee is still pretty reasonable compared to other platforms.

Security

Crypto.com stores 100% of your assets in cold storage.

This means that even if Crypto.com gets hacked, the hackers will not be able to gain access to your coins!

Crypto.com has partnered with Ledger Vault to ensure that your crypto is secure.

As such, your assets should be rather safe with Crypto.com.

MAS regulation

Crypto.com also intends to comply with the Payment Services Act set out by MAS.

This means that they intend to get a licence and be regulated by the MAS too.

Verdict

Crypto.com is a great ecosystem that allows you to trade crypto on their platform. Furthermore, you can earn CRO via cashback from the Crypto.com Visa card.

However, the prevailing market rate on Crypto.com may be less favourable compared to the actual rate.

You may lose quite a bit of returns if you’re constantly trading between currencies!

Nevertheless, it still provides a lot of features in one app, which can be really useful.

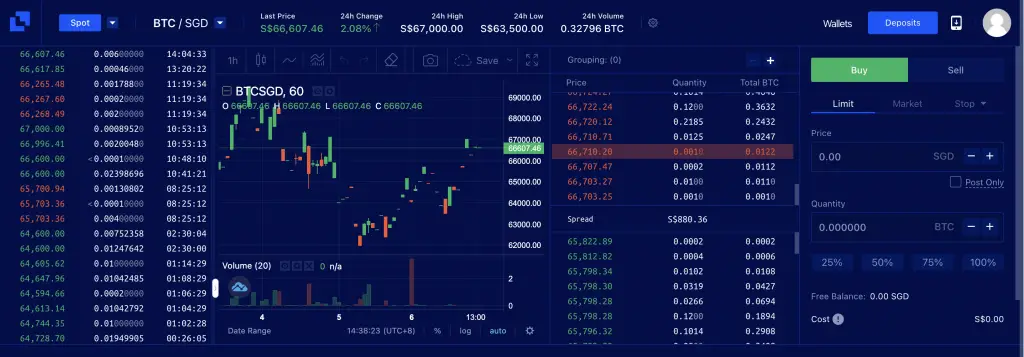

Liquid

Liquid is a crypto exchange that is based in Japan. It was founded in 2014, and has offices in Japan, Singapore and Vietnam.

Here is a summary of Liquid’s features:

| Number of Currencies | 100+ (9 from SGD) |

| Funding Methods | Bank Transfer |

| Methods of Buying | Trading |

| Withdrawal of Funds | Bank Transfer |

| Deposit Fees | Depends on bank |

| Withdrawal Fees | $15 SGD + $30 USD minimum |

| Trading Fees | Up to 0.30% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | NA |

| Security | Cold storage + hot wallet |

| MAS Regulation | Intends to comply |

| Verdict | Good for extremely rare altcoins not found on other platforms |

Here is a look into this platform:

Number of currencies

Liquid supports a lot of currencies on their platform. However, there are only a limited number of cryptocurrencies that you can trade directly from SGD.

Some of them include:

If you want to buy other currencies like LINK or DOT, you will need to make at least 2 trades.

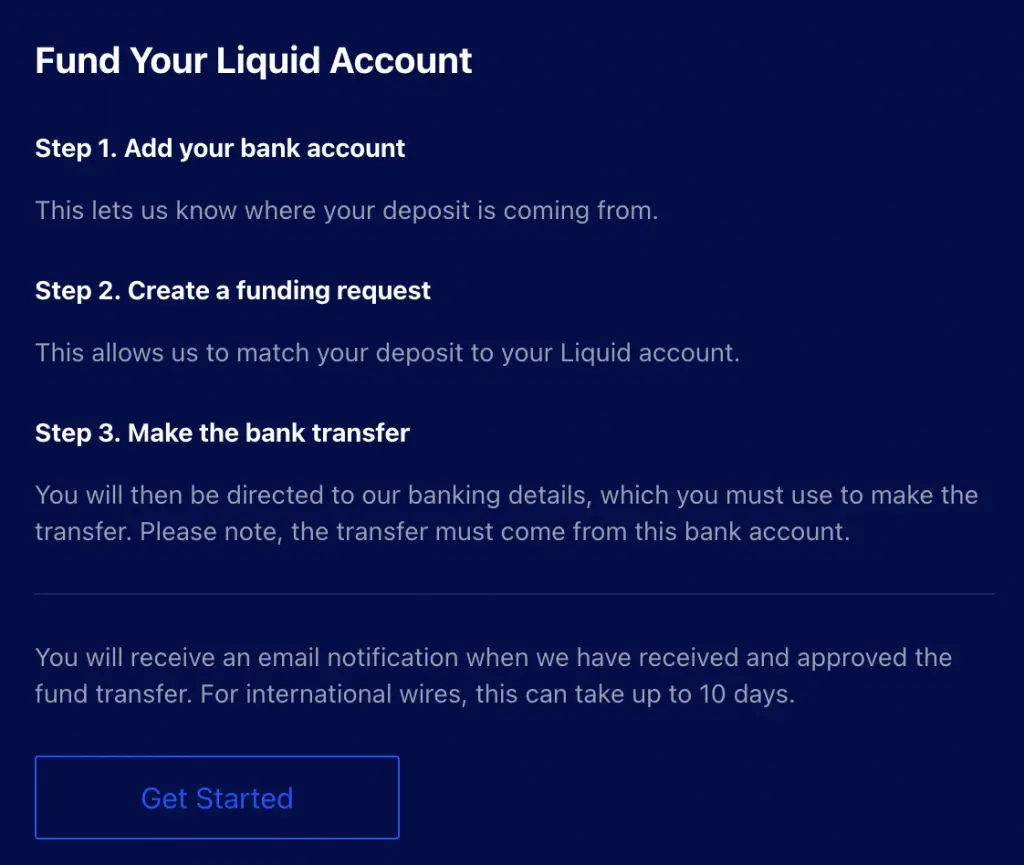

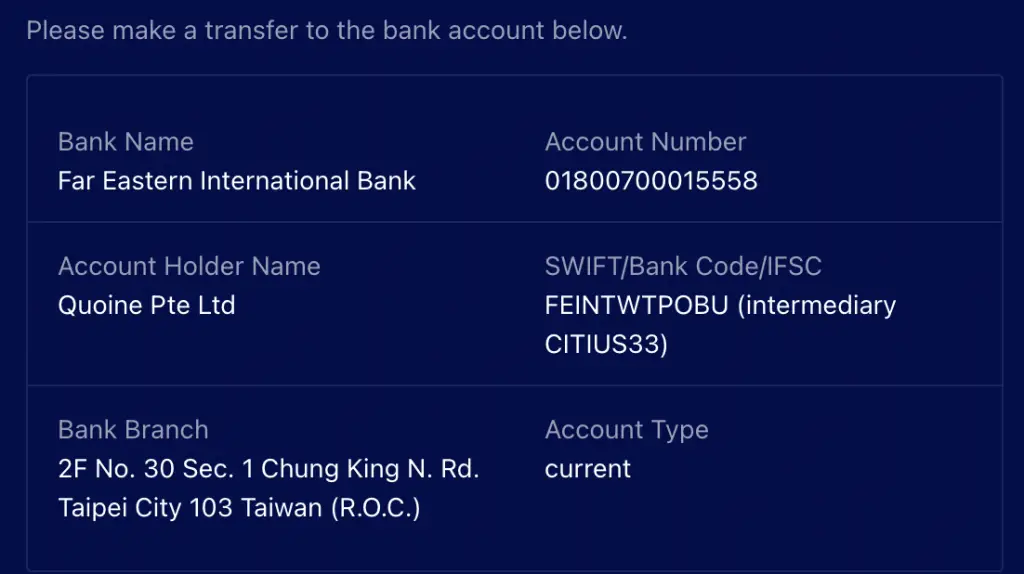

Methods of funding account

Liquid allows you to deposit your SGD via bank transfer.

You will need to transfer your funds from an account under your own name.

When you are transferring money to Liquid, you will be transferred to their account with Far Eastern International Bank.

As such, you may incur some bank fees for this transfer. This depends on the fee structure of your bank.

Methods of buying

Liquid is a trading platform, so you can only perform trades on this platform.

Withdrawal of funds

Liquid allows you to withdraw your SGD back to your bank account.

However, the withdrawal fees for Liquid can be pretty high!

Minimum trade amount

Liquid does not seem to have a minimum trade, which can help you to trade small amounts.

Fees

Here are the fees that you’ll incur when trading with Liquid:

| Type | Amount |

|---|---|

| Trading fees | Up to 0.30% |

| SGD Withdrawal Fees (StraitsX) | 0.55% (Min $4, Max $30) |

| Withdrawal Fees (Bank Transfer) | $15 SGD + $30 USD |

The trading fee is pretty competitive, and slightly lower than Gemini.

However, the withdrawal fees for SGD are really high!

You may want to consider trading on Liquid first. Afterwards, you can send your crypto to another platform like Gemini to sell them for SGD.

This is because Gemini does not charge for any withdrawals that you make.

Security

Liquid stores around 98% of all of their assets in cold storage.

Meanwhile, the remaining 2% of crypto is stored in warm wallets, which is powered by Unbound Tech.

Liquid was previously hacked on 13 Nov 2020, where the hackers tried to gain access to login and 2FA data.

However, no assets were stolen from their platform.

MAS regulation

Liquid also has mentioned their intention to comply with the Payment Services Act.

As such, they have imposed certain regulations on Singaporean customers, such as:

- Know-Your-Customer (KYC) practices

- Anti-Money Laundering (AML) measures

All of this will help to make Liquid more compliant with any measures that the MAS decides to impose.

Verdict

Liquid is a good exchange that you may want to consider, if you want to hold rather ‘rare’ altcoins, such as:

These are very rare altcoins that you can’t find elsewhere.

However, you’ll need to make 2 trades to buy these currencies from SGD!

If you are just intending to buy and hold the common cryptocurrencies, Liquid may not be so suitable for you.

This is because the withdrawal fees are really high!

Tokenize

Tokenize is another exchange from Singapore that was launched in early 2018.

Here is a summary of its features:

| Number of Currencies | 30 |

| Funding Methods | Xfers Direct Charge FAST |

| Methods of Buying | Trading |

| Withdrawal of Funds | FAST |

| Deposit Fees | None |

| Withdrawal Fees | 0.55% SGD $100 admin fee if trading volume < SGD $1,000 |

| Trading Fees | 0.80% – 1%, minimum $1 |

| Sending Fees | Depends on currency |

| Minimum Per Trade | NA |

| Security | Not disclosed |

| MAS Regulation | Intends to comply |

| Verdict | Good for buying rare altcoins like SUSHI and 1INCH |

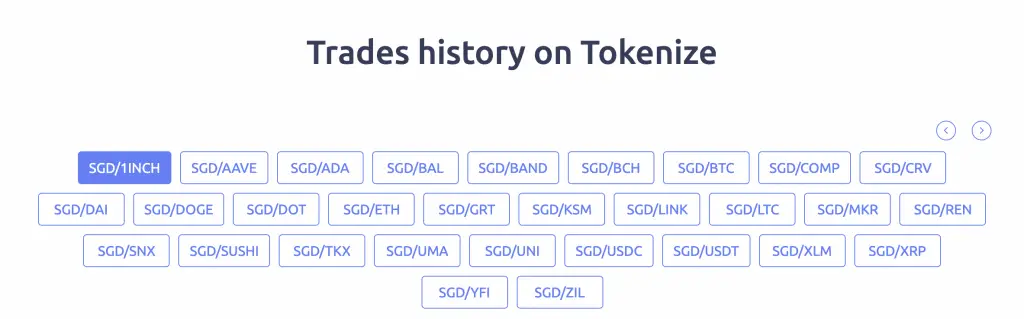

Number of currencies

Similar to Coinhako, Tokenize allows you to trade quite a wide variety of currencies from SGD.

They allow you to buy ‘rarer’ altcoins like:

Tokenize provides you with a lot of currencies that you can buy directly from SGD.

Methods of funding account

Tokenize allows you to deposit your SGD via 2 ways:

- Xfers Direct Charge

- Bank transfer

However, you can only use the bank transfer option if you’re a Premium or Platinum member.

Similar to Coinhako, you will need to pay a 0.55% fee if you decide do use Xfers Direct Charge.

Methods of buying

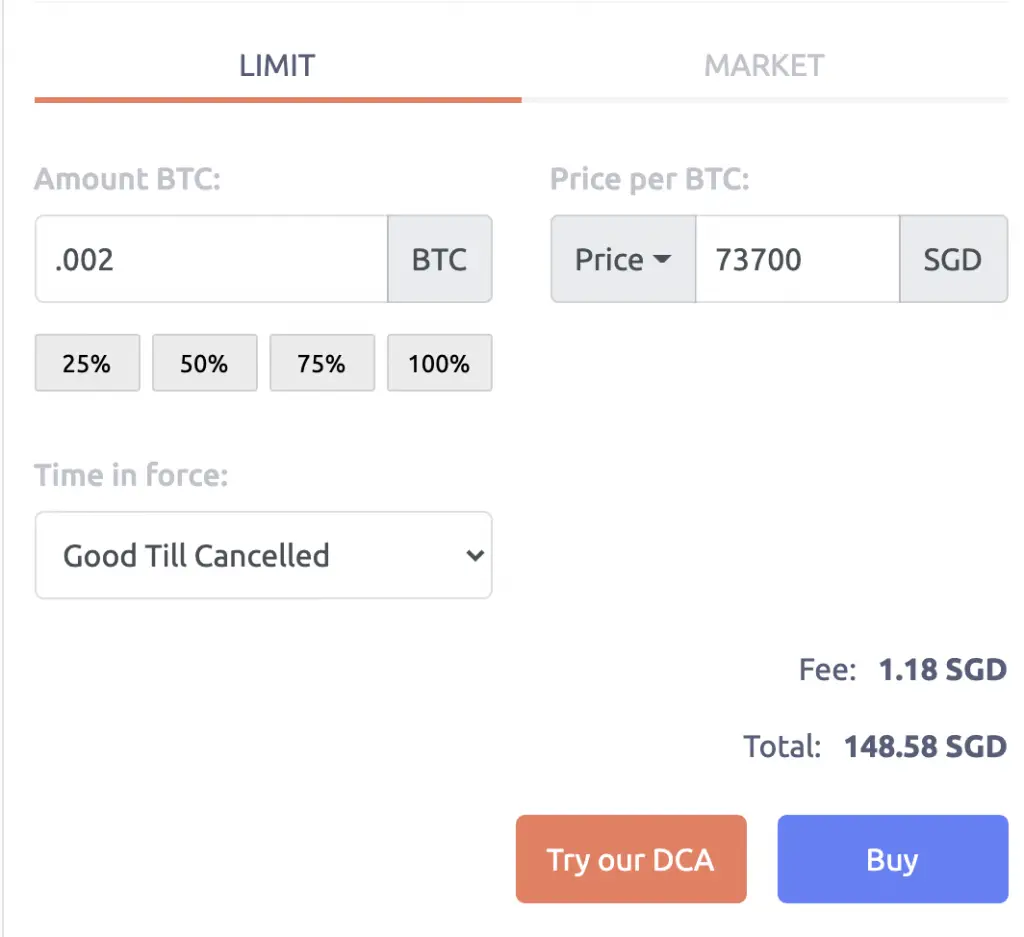

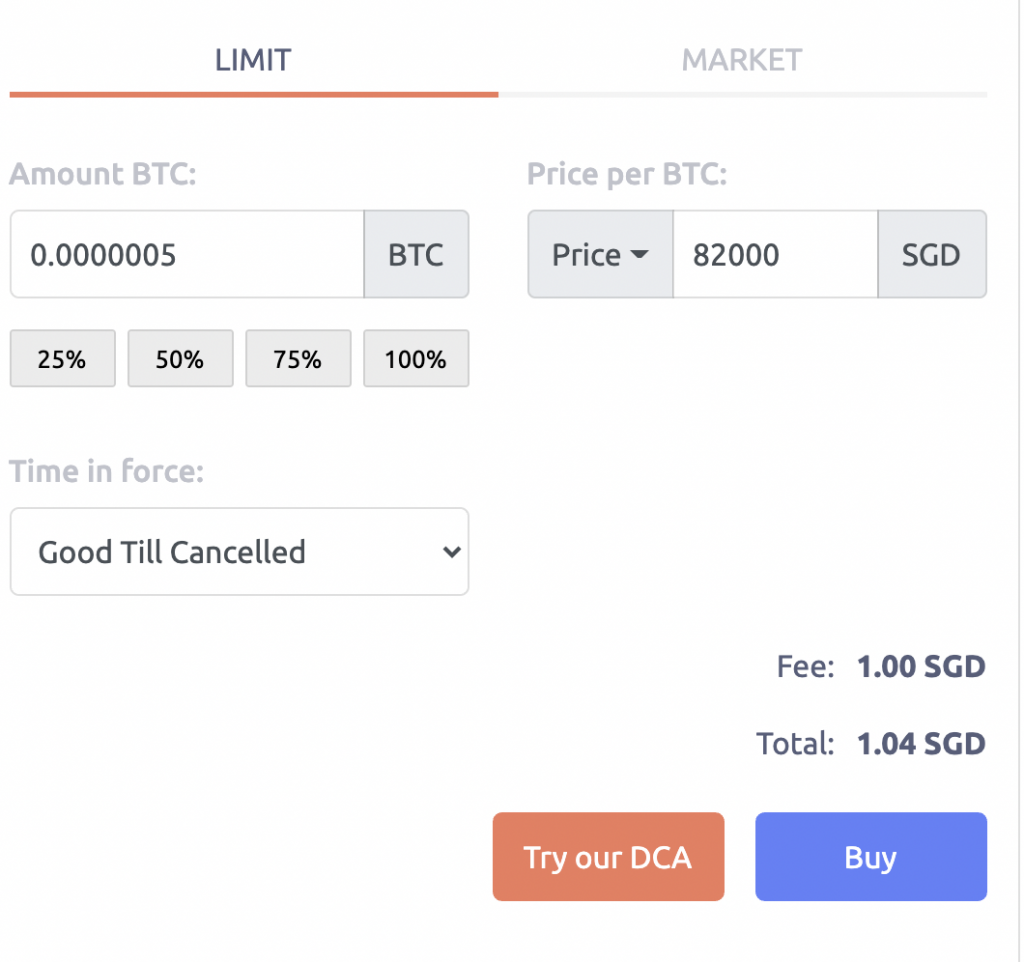

When you want to buy on Tokenize, you can only do so via the trading platform.

This is similar to Luno’s Exchange too.

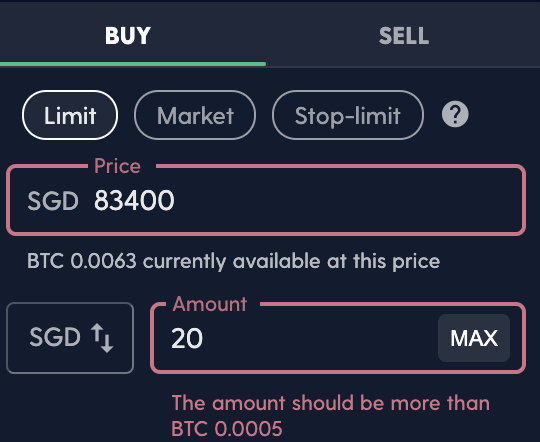

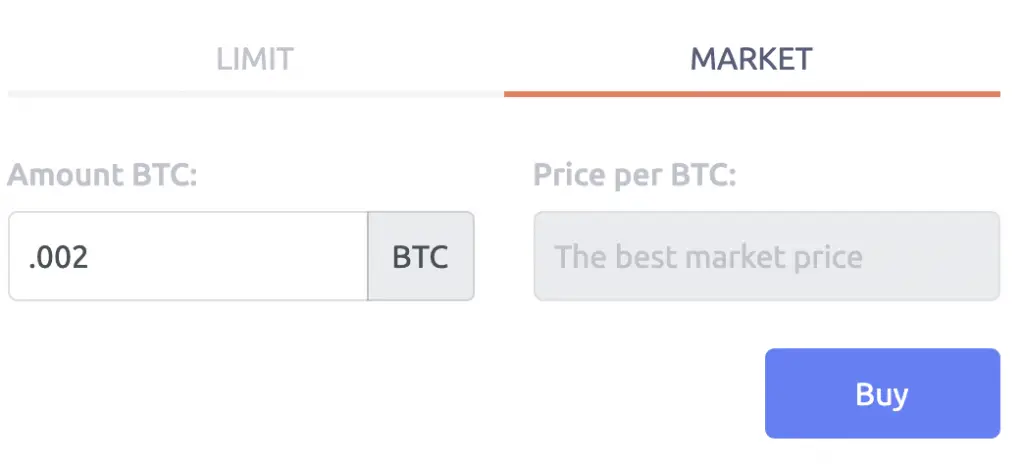

There are 2 types of orders you can make with Tokenize:

- Limit

- Market

Limit orders will allow you to determine the price of the crypto that you wish to pay.

This gives you more control over the price that you want to pay.

Meanwhile, market orders will purchase your crypto at the current market price.

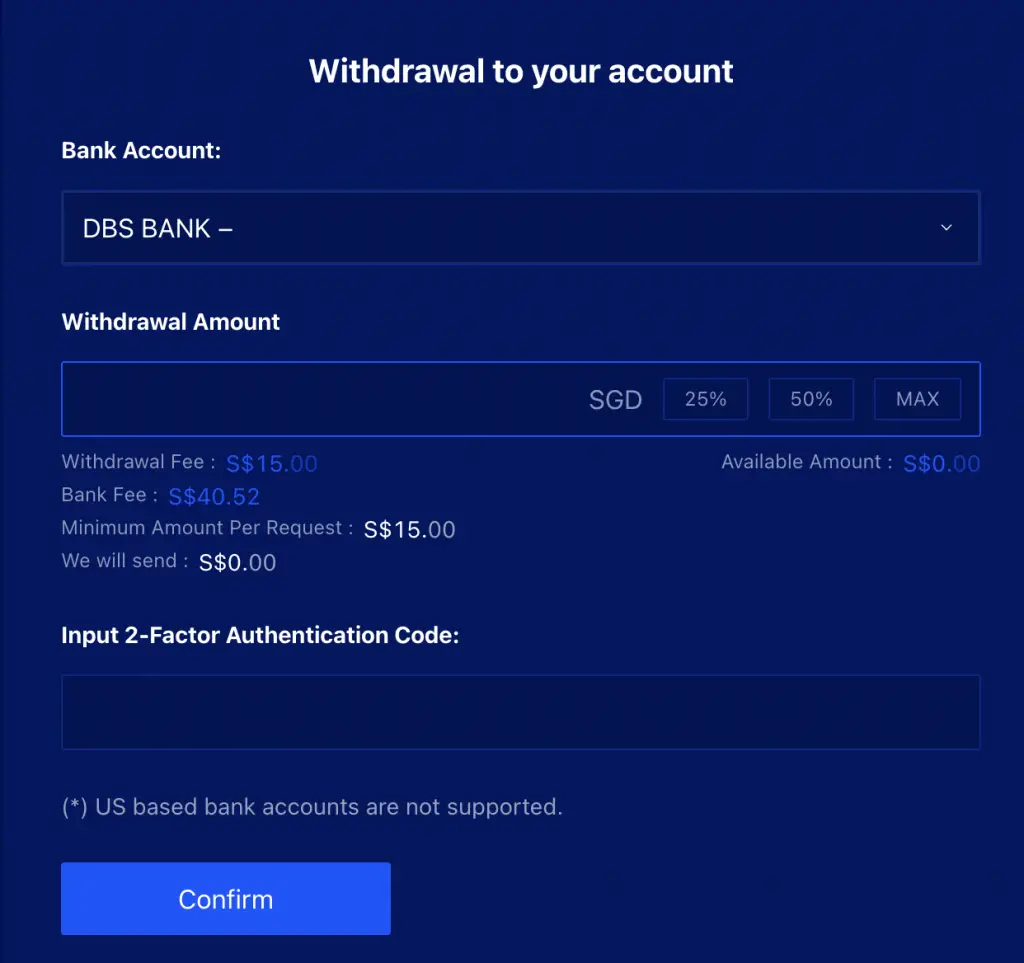

Withdrawal of funds

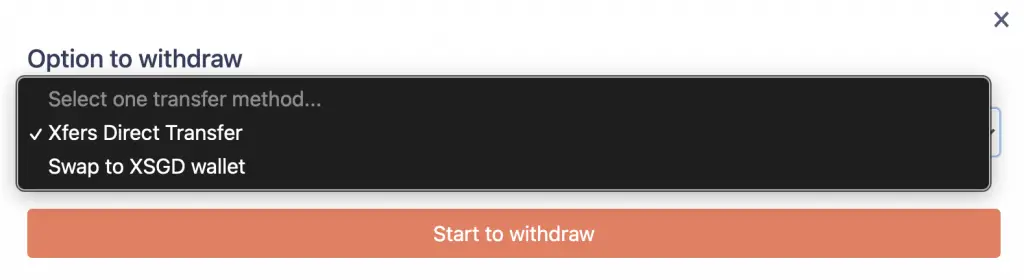

Tokenize only allows you to withdraw your funds via Xfers Direct Charge.

This will incur additional withdrawal fees for you as you are also charged 0.55%.

Minimum trade amount

Tokenize does not have a minimum trade amount, which is good if you want to trade small amounts.

However, they charge a minimum trading fee of $1. This will eat into your funds if you only trade small amounts!

Fees

Here are the fees that you’ll incur when trading on Tokenize:

| Fee | Amount |

|---|---|

| Deposit Fees | 0.55% |

| Trading Fees | 0.80% – 1% (Minimum $1) |

| Withdrawal Fees (SGD) | 0.55% SGD $100 admin fee if trading volume < SGD $1,000 |

| Withdrawal Fees (Crypto) | Depends on currency |

Even though Tokenize states that their fee is only at 0.80%, I have seen them charging 1% for coins like DOGE or ADA.

You may want to take note of the $100 admin fee when you are making SGD withdrawals to your bank account.

If your fiat-crypto trading volume is less than SGD $1,000, you will incur this fee!

As such, Tokenize may not be suitable if you are only looking to trade small amounts of SGD for crypto.

Security

Tokenize uses a cold wallet from Bitgo to custodise your assets, while being backed by the Digital Asset insurance coverage being offered by Bitgo. Tokenize also aims to comply with strict security requirements that are set out by the MAS.

This makes Tokenize rather secure and you can have some reassurance that your assets are safe with them.

MAS regulation

Tokenize also follows the same KYC and AML requirements by MAS.

As such, they should be regulated under the MAS as well.

Verdict

Tokenize is a good option that you may want to consider when buying ‘rarer’ altcoins, like:

- KSM

- 1INCH

- SUSHI

The one advantage that they have over Coinhako is that you can trade your currencies. In contrast, you can only buy currencies on Coinhako at the prevailing market rate.

You may be able to buy your coins at a more favourable rate.

However, the trading and withdrawal fees are quite high too. These are some costs you’ll need to consider if you want to buy these altcoins.

If you are looking to buy the common currencies, it may be more cost effective to use another platform instead.

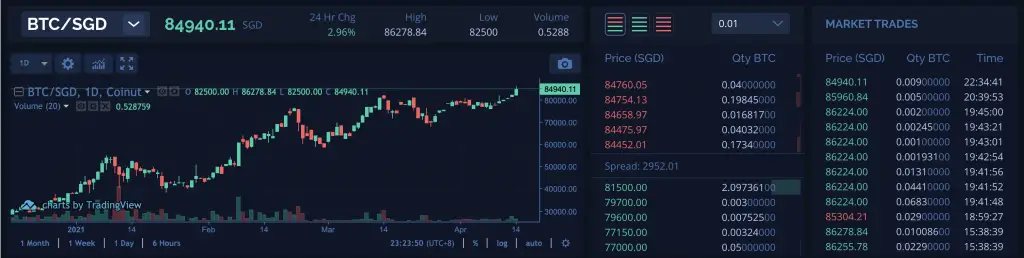

Coinut

Coinut is another exchange that is founded in Singapore in 2013.

However, it is not as well known as other exchanges.

Here is a summary of Coinut’s features:

| Number of Currencies | 7 |

| Funding Methods | FAST |

| Methods of Buying | Trading |

| Withdrawal of Funds | FAST |

| Deposit Fees | 0.55% (min $1) |

| Withdrawal Fees | 0.55% (min $1) |

| Trading Fees | Up to 0.50% |

| Sending Fees | USDT 12 for USDT |

| Minimum Per Trade | NA |

| Security | Information stored offline |

| MAS Regulation | Intends to comply |

| Verdict | Good for buying stablecoins like USDT or DAI |

Number of currencies

Coinut allows you to trade 7 currencies:

- BTC

- LTC

- ETH

- ETC

- DAI

- USDT

- XSGD

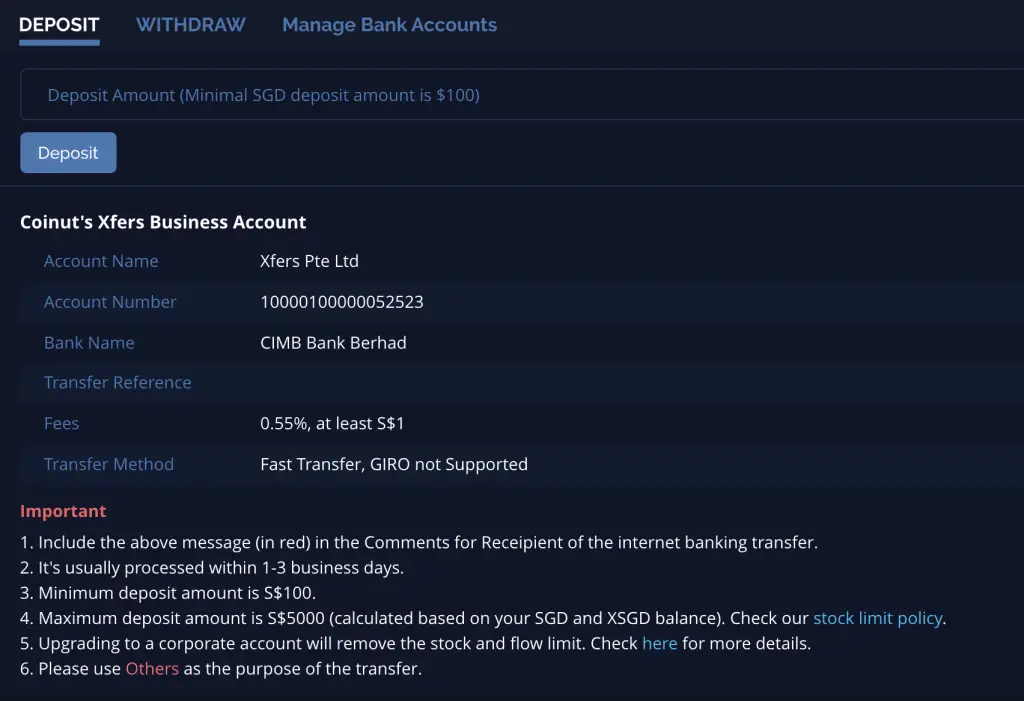

Methods of funding account

To deposit SGD into Coinut, you’ll need to send your funds via Xfers Direct.

You’ll need to make a minimum deposit of at least $100.

Methods of buying

Coinut is a trading platform.

This allows you to set both market or limit orders.

Withdrawal of funds

You are able to withdraw your SGD via FAST as well. The minimum withdrawal is $51, which is rather high.

Furthermore, the withdrawal fees on Coinut are quite expensive too!

Minimum trade amount

Coinut does not have any minimum trade amount as well.

This means that you can start buying crypto with as little money as possible.

However, you’ll need to consider the minimum deposit of $100 too.

Fees

Here are the fees and minimum amounts for Coinut:

| Type | Amount |

|---|---|

| Deposit Fee | 0.55% Minimum $1 SGD |

| Trading Fee | Up to 0.50% |

| Minimum Deposit | $100 |

| Withdrawal Fee | 0.55% Minimum $1 SGD |

The trading fees on Coinut are pretty reasonable compared to the other platforms.

However, the withdrawal fee can be pretty high!

Security

Coinut states that they are a rather secure platform, as they have a high ICO rating in 2018.

Coinut stores their data online using encryption technology. Meanwhile, important data regarding your cryptocurrencies are stored offline.

It would be quite hard for hackers to access any information from Coinut.

Coinut also tracks your transactions semi-manually. This may occur when your account has a sudden increase in transactions.

Coinut may require you to authenticate each transaction, before they process them.

As such, they can be a rather secure platform.

MAS regulation

Coinut has expressed their desire to comply with the Payment Services Act set out by MAS. They have already been registered under the FINTRAC (Money Service Business) by the Government of Canada.

As such, they should be able to receive approval for their license in Singapore too.

Verdict

Coinut offers pretty low fees when trading on their platform.

Furthermore, their withdrawal fees for USDT are pretty low, at USDT 12.

This means that you can send your USDT to another platform like Binance or Huobi. These platforms have many trading pairs with USDT, which allow you to buy a lot of altcoins.

Apart from buying stablecoins like DAI or USDT, there are platforms that offer lower fees if you want to trade BTC, ETH or LTC.

AAX

Atom Asset Exchange (AAX) was founded in 2018, and is based in Hong Kong.

They are the first cryptocurrency exchange to be powered by LSEG Technology. Moreover, they have also joined the London Stock Exchange’s partner platform.

Here is a summary of AAX’s features:

| Number of Currencies | 32 (only 2 from SGD) |

| Funding Methods | Bank transfer |

| Methods of Buying | Instant Buy and Trading |

| Withdrawal of Funds | Bank transfer |

| Deposit Fees | $35 (none if deposit ≥ $1.5k) |

| Withdrawal Fees | 0.3% minimum $10 |

| Trading Fees | Up to 0.1% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | $10 for fiat to crypto |

| Security | Cold storage |

| MAS Regulation | Intends to comply |

| Verdict | A good option if you intend to trade large sums of crypto |

Number of currencies

AAX allows you to trade quite a large number of currencies on their platform.

However, you can’t buy all of them directly from SGD!

You can only buy BTC or USDT from SGD using AAX’s Exchange feature.

AAX does not charge you any fees for using this service.

However, the market rate that you buy BTC at from AAX may be higher than the actual rate.

Similar to Crypto.com, you may lose some money based on the spread.

Methods of funding account

When you want to transfer your SGD to AAX, you will need to do so via bank transfer.

You can deposit a minimum of $50. However, you may incur quite a hefty deposit fee for small amounts!

Methods of buying

When you want to buy BTC or USDT from SGD, you can only do so via the Exchange.

Once you’ve exchanged your SGD for either currency, you can start to make trades on AAX’s spot market.

Withdrawal of funds

When you wish to withdraw your SGD back to your bank account, you’ll need to do a wire transfer too.

You will need to withdraw a minimum of $150.

Minimum trade amount

When you are converting your SGD to BTC or USDT, you’ll need to convert a minimum of $10.

When you are trading on the Spot platform, the minimum trade amount depends on the currency.

Fees and minimums

Here are the fees and minimums when you’re trading on AAX:

| Deposit Minimum | $50 |

| Deposit Fees | $35 if deposit < $1500, none if deposit ≥ $1500 |

| Trading Fees | Up to 0.1% |

| Withdrawal Minimum | $150 |

| Withdrawal Fees | 0.3% (Minimum $10) |

| Sending Fees | Depends on currency |

If you want to save on the deposit fees, you’ll have to deposit at least $1.5k into your AAX account each time!

The trading fees are as competitive as Binance (up to 0.1%). However, AAX has the added advantage of supporting fiat currencies like SGD.

I would think that AAX is more suitable if you intend to trade a large amount of crypto. This is due to the deposit and withdrawal minimums that AAX has.

Security

AAX also stores majority of your cryptocurrency in an offline wallet. It also aims to comply with the Cryptocurrency Security Standard (CCSS), which ensures that it is extra secure.

So far, AAX has not been hacked yet, which should give you an ease of mind.

MAS regulation

AAX has shown that it is interested in working with the MAS. Furthermore, they have been allowed to accept users from Singapore from Feb 2021.

As such, they should be a rather safe exchange to trade with as well.

Verdict

AAX offers quite a lot of currencies, but not as many as Binance or Huobi.

It does have the advantage over both of these exchanges as AAX supports SGD, which Binance and Huobi do not.

However, you’ll need to deposit a huge amount (≥ $1.5k) to avoid the deposit fees.

Due to its many restrictions, AAX would be a suitable platform only if you trade a large amount of crypto.

Binance Singapore

Binance Singapore was launched in 2019, and it is actually a separate exchange from Binance.com.

Here is a summary of Binance Singapore’s features:

| Number of Currencies | 8 |

| Funding Methods | Xfers |

| Methods of Buying | Instant Buy |

| Withdrawal of Funds | Xfers |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Trading Fees | 0.6% |

| Sending Fees | Depends on currency |

| Minimum Per Trade | $20 |

| Security | Not disclosed |

| MAS Regulation | Intends to comply |

| Verdict | Cheaper way to buy NEO from SGD, compared to Coinhako |

Number of currencies

Binance Singapore allows you to trade in 8 cryptocurrencies.

This includes:

Methods of funding account

Binance Singapore allows you to send SGD using your Xfers account.

Xfers is directly connected to your Binance Singapore account. As such, you don’t need to transfer your SGD between both platforms.

This saves you the hassle of making one extra transfer!

Methods of buying

Similar to Coinhako, Binance Singapore allows you to buy crypto via Instant Buy.

You can only buy the crypto at the prevailing market rate, which you can see on the ‘Buy’ page.

If you check the current price on sites like CoinMarketCap, it may be slightly different from what you see on either platform.

Withdrawal of funds

Binance Singapore only allows you to withdraw to your Xfers wallet.

This is slightly more troublesome as you’ll have to go to Xfers and withdraw your funds to your bank account.

Fees

Here are the fees and minimum trading amounts that you’ll need to pay with Binance Singapore:

| Type | Amount |

|---|---|

| Minimum Trading Amount | $20 |

| Trading fees | 0.60% |

| Withdrawal fees | None |

Overall, Binance Singapore has quite a high trading fee compared to other platforms.

However, it does allow you to buy NEO at a cheaper fee compared to Coinhako (0.80% – 1%).

Security

Binance Singapore does not disclose the security measures they have put in place. This may be slightly worrying if you are very concerned about security.

Binance.com faced a security breach in 2019. However, Binance Singapore declared that the breach did not affect their exchange.

Although the platform is quite new, Binance Singapore has not been hacked so far.

MAS regulation

Binance’s CEO Zhao Changpeng mentioned that Binance Singapore has applied for an operating licence in Singapore under the Payment Services Act.

As such, this platform should be regulated under MAS.

Verdict

Binance Singapore is a fuss-free way of buying crypto from SGD. However, you are able to buy most of the cryptocurrencies listed on their platform for a cheaper fee elsewhere.

The only exception is NEO, where Coinhako charges a higher fee.

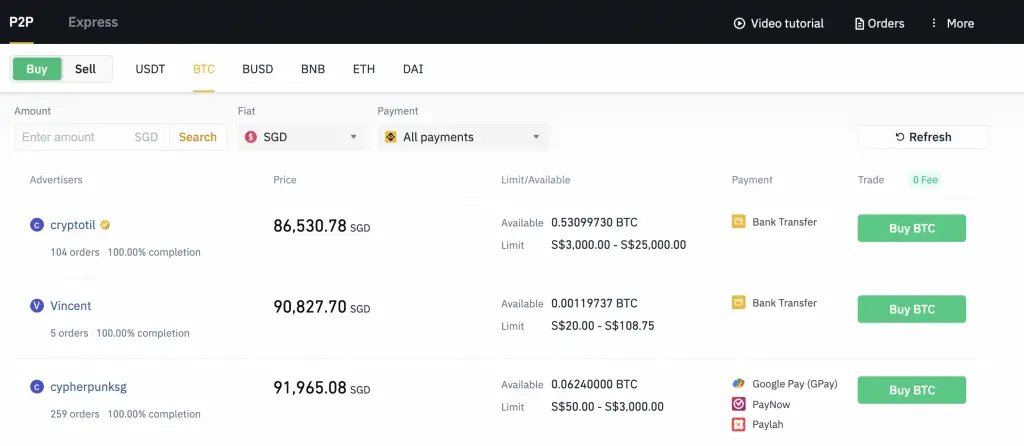

Binance (P2P)

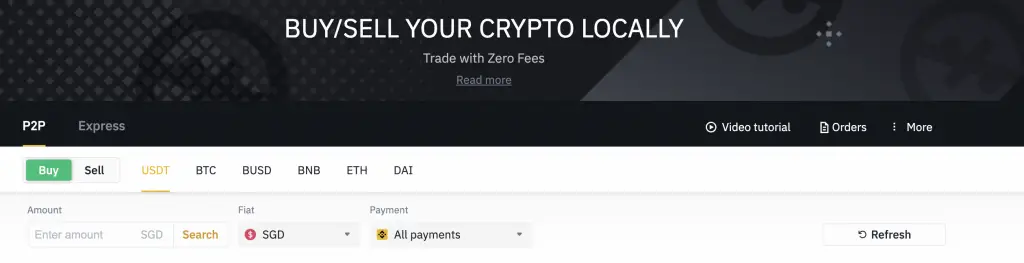

This is kind of cheating, since Binance does not offer any fiat support in their trading pairs.

However, you still can buy crypto with SGD using Binance’s P2P platform.

This is a summary of Binance P2P’s features:

| Number of Currencies | 6 |

| Funding Methods | Bank transfer |

| Methods of Buying | Trading with advertiser |

| Trading Fees | None |

| Minimum Per Trade | Depends on advertiser |

| Security | Strict regulations for advertisers |

| MAS Regulation | Intends to comply |

| Verdict | Cheaper way of buying crypto to trade on Binance, but there are a lot of risks |

Number of currencies

You can only buy 6 different currencies on Binance’s P2P platform:

- USDT

- BTC

- BUSD

- BNB

- ETH

- DAI

The advantage is that you can buy these currencies with your SGD. After that, you can trade them for many other altcoins on the Binance exchange.

Methods of paying

How the P2P trade works is that you’ll transfer your SGD to the advertiser outside of the Binance platform.

The crypto that you bought will be transferred to your Binance account.

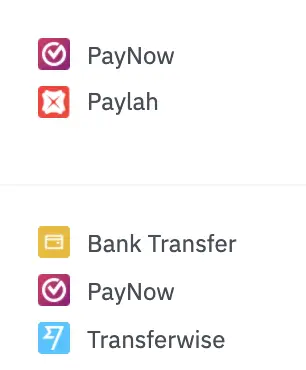

There are a few ways that you can transfer your SGD to the advertiser:

- PayNow

- PayLah

- Bank Transfer

However, you can’t determine the transfer method! It will depend on the advertiser, and which method that he accepts.

Minimum trade amount

The minimum trade amount depends on each advertiser. They will show the minimum amounts they can afford in each advertisement.

Fees

Binance does not charge any fees for using their platform to make a P2P trade.

However, they will charge you up to 0.1% if you are using their Exchange platform to buy other altcoins.

Security

Binance claims to have very high standards for advertisers that are listed on their platform.

For a person to post advertisements, they would need to meet certain requirements, such as:

- 30-day order completion rate ≥ 80%

- Number of completed P2P orders ≥ 10

This will help to ensure that only legitimate advertisers will be on the platform.

However, you still should be very careful of scams!

There have been reports of scams on Binance’s P2P platform, which can still occur if you are not careful.

As such, you’ll have to pay extra attention, especially when you’re selecting an advertiser!

MAS regulation

Binance has recently announced that they have a partnership with CapBridge Financial.

CapBridge Financial is a regulated private markets platform in Singapore.

This partnership should help Binance to comply with the local regulations set out by the MAS.

Verdict

Binance P2P is the riskiest way of buying crypto from SGD, compared to other platforms.

You may fall prey to a scammer during the transactions!

I would also suggest not to trade very large volumes (>$1k) on the platform.

In the event that you do fall prey to a scam, the loss would not be so painful!

Even if you want to buy a large amount of crypto with your SGD, it may be better to split up the transactions.

In this way, you would not lose your entire investment amount at one shot!

Conclusion

There are many ways that you can buy cryptocurrencies directly from SGD. With crypto becoming more mainstream, there may be more platforms that support SGD in the future!

With so many different platforms available, which should you choose? Here are some considerations for you:

- The currency that you wish to buy

- The availability of a SGD trading pair with your currency

- The type of platform (Instant Buy vs Trading)

- The deposit, trading and withdrawal fees you’ll incur

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Gemini Referral (Earn $10 USD in BTC)

If you are interested in signing up for a Gemini account, you can use my referral link.

You will be able to receive $10 USD in BTC!

Here’s what you need to do:

- Register for a Gemini account

- Trade ≥ USD $100 or equivalent on Gemini’s platform

- Receive USD $10 worth of BTC in your account

Luno Referral (Earn SGD $30 in Bitcoin)

If you are interested in signing up for a Luno account, you can use the referral code ‘T5N74J‘ or my referral link to sign up for an account.

You’ll be able to earn SGD $30 worth in Bitcoin!

Here’s what you need to do:

- Sign up for a Luno Account

- Deposit and buy ≥ SGD $200 of BTC via Instant Buy

- Receive SGD $30 in Bitcoin

You will need to purchase BTC using the Instant Buy function. The fees that you incur will be 0.75%.

It would be best to buy only $200 SGD worth of BTC, which only incurs you a $1.50 fee. The $30 SGD bonus will be able to offset the fee!

Crypto.com Referral (Get up to $25 USD worth of CRO)

If you are interested in signing up for Crypto.com, you can use my referral link and enter the code ‘x2kfzusxq6‘.

We will both receive $25 USD worth of CRO in our Crypto Wallet.

Here’s what you’ll need to do:

- Sign up for a Crypto.com account

- Enter my referral code: ‘x2kfzusxq6‘

- Stake enough CRO to unlock a Ruby Steel card or higher

The amount of CRO that you need to stake depends on the card you wish to get, and the currency you are staking in.

You can read more about the referral program on Crypto.com’s website.

Tokenize Referral (Get 5 TKX worth ~ $25 SGD)

If you are interested in signing up for a Tokenize account, you can use my referral link.

You will be able to receive 5 TKX in your account (worth ~$25 SGD)!

Here’s what you need to do:

- Sign up for a Tokenize account

- Trade at least $1000 USD worth of crypto

- Receive 5 TKX in your Tokenize wallet

You can view details of this referral program on Tokenize’s website.

Receive a further SGD $50 worth of TKX when you upgrade to Premium

You are able to receive another SGD $50 worth of TKX if you upgrade to the Premium or Platinum membership of Tokenize.

You will need to pay 160 TKX to upgrade your membership to the Premium tier.

Once you have upgraded your membership tier, you will receive the TKX bonus!

You can view more information about this promotion on Tokenize’s website as well.

Coinut Referral (Receive 73 USDT worth $97 SGD)

If you are interested in signing up for a Coinut account, you can use my referral link.

You will be able to receive 73 USDT upon signing up!

Here’s what you’ll need to do:

- Sign up for a Coinut account and complete your KYC assessment

- Trade ≥ $100 USD worth of crypto using a Market Order (using SGD) within 180 days of registering your account

Once you’ve completed the 2 steps, you’ll receive 73 USDT in your account.

Binance Referral (Receive 5% off your trading fees)

If you are interested in signing up for a Binance account, you can use my referral link.

You will be able to receive 5% off all of your trading fees on Binance!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?