Last updated on December 21st, 2021

You may have heard about the Crypto.com Card, which offers rather attractive rewards such as cashback with CRO, and even ‘free’ Spotify and Netflix!

However, you may be wary of how this card works, especially if you are new to cryptocurrencies.

Here’s my experience with using the Crypto.com card for the past year.

Contents

- 1 How does the Crypto.com card work?

- 2 Does the Crypto.com Visa card have any cashback exclusions?

- 3 Can I use my Crypto.com Visa card anywhere?

- 4 Can I store foreign currencies on my Crypto.com Visa card?

- 5 Is the Crypto.com card a metal card?

- 6 Is the Crypto.com card contactless?

- 7 Can you use the Crypto.com card for online transactions?

- 8 Can you withdraw money from the Crypto.com Visa card?

- 9 Can I upgrade my Crypto.com Visa card?

- 10 How do I upgrade my Crypto.com Visa card?

- 11 Does the Crypto.com Visa card have a monthly fee?

- 12 Does the Crypto.com card affect my credit score?

- 13 Can I add my Crypto.com card to Apple Pay?

- 14 Can I add my Crypto.com card to Google Pay?

- 15 Can I add my Crypto.com card to GrabPay?

- 16 Is the Crypto.com card worth it?

- 17 👉🏻 Referral Deals

How does the Crypto.com card work?

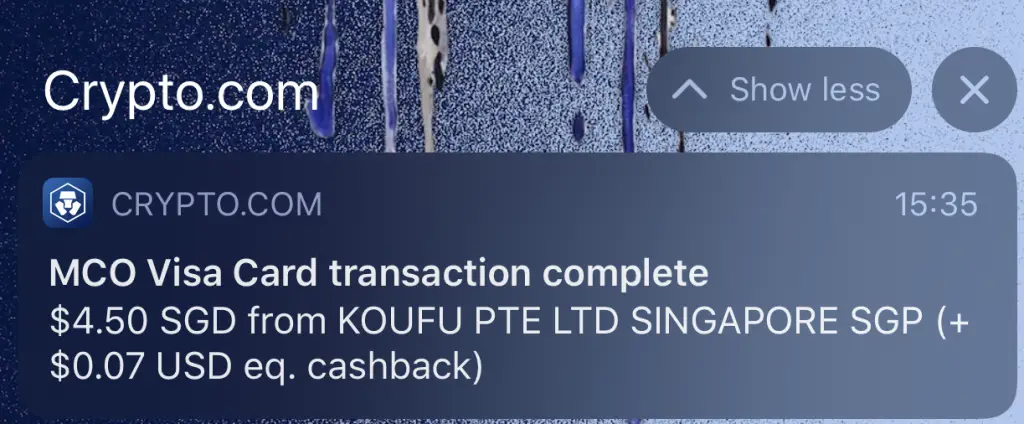

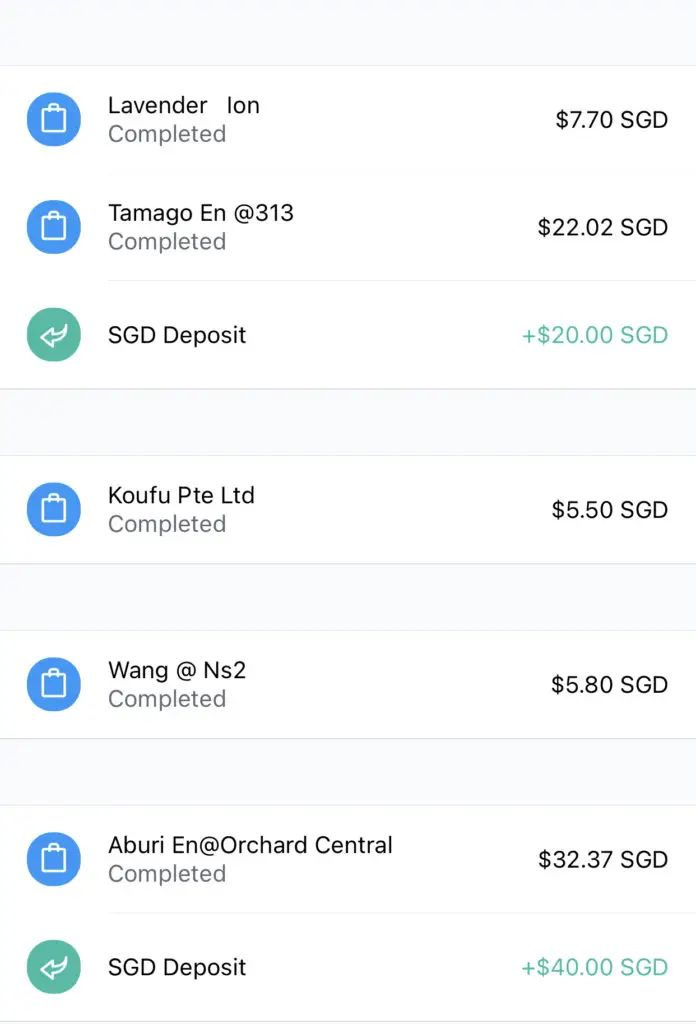

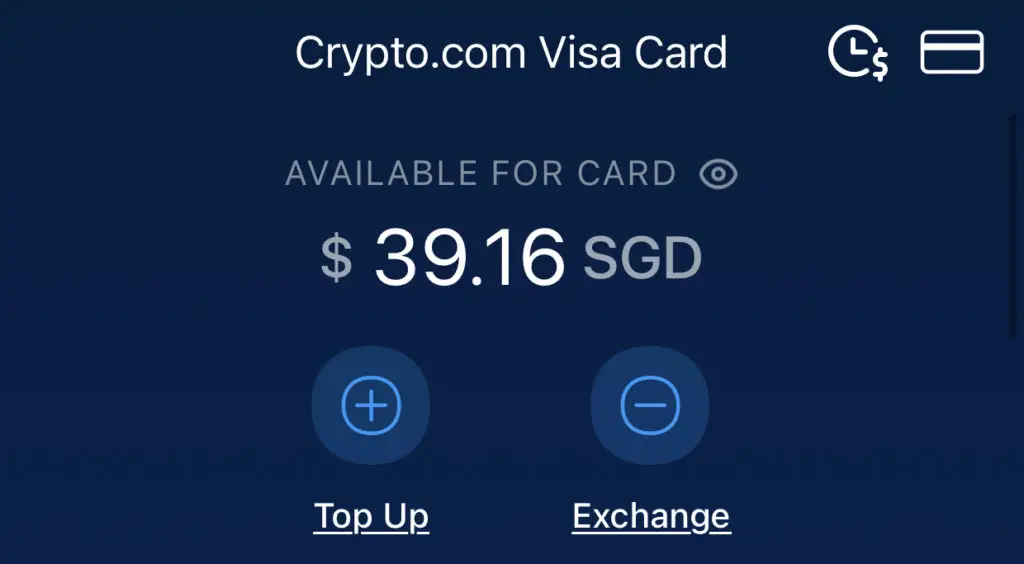

The Crypto.com card is a prepaid Visa debit card that you can use at any merchants which support Visa transactions. You will need to top up your debit card on the Crypto.com app before you can make any purchases. After making each purchase, you will receive cashback in the form of CRO tokens.

The Crypto.com card is a debit card, and not a credit card. Furthermore, it is a prepaid debit card.

This means that you’ll need to fund your account first. If you do not have enough funds on your debit card, your transaction cannot go through!

Here is a step-by-step process of how you can earn cashback on the Crypto.com Visa Card:

- Top up your Crypto.com Visa Card Wallet with a credit card, crypto wallet or fiat wallet

- Make a purchase with your Crypto.com Visa card

- Receive the cashback in your Crypto wallet

The first thing you’ll need to do is to top up your Crypto.com Visa card, using one of these methods:

- Credit card

- Crypto wallet

- Fiat wallet (for some countries only)

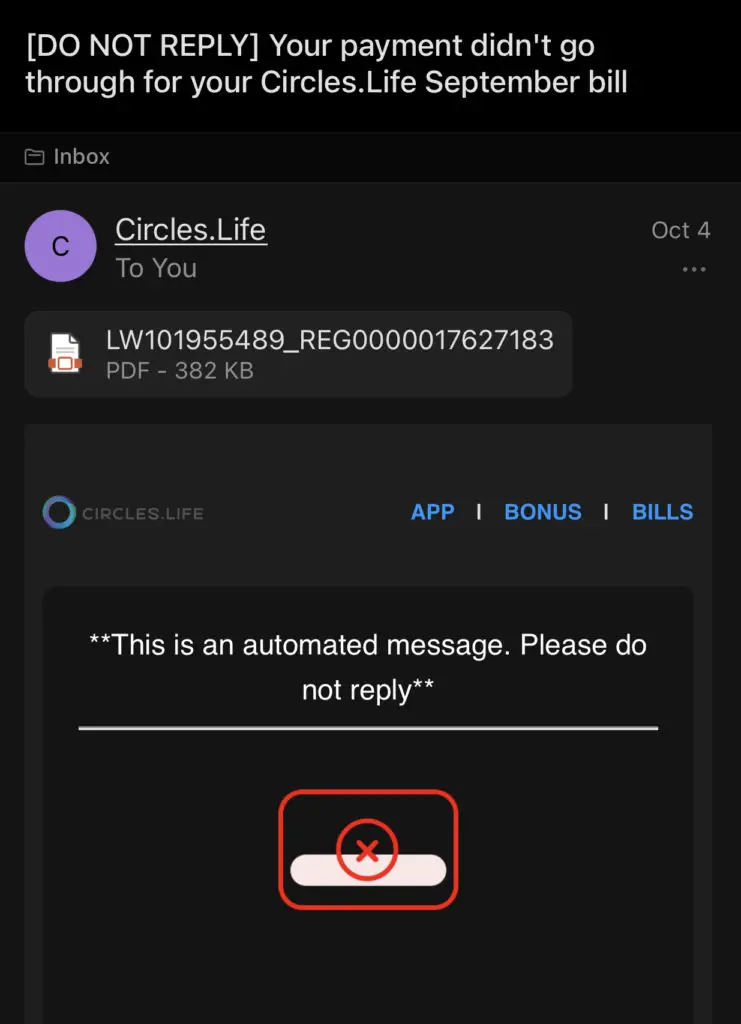

You’ll need to keep track of your top-ups, especially if you’re using your Crypto.com card for recurring transfers.

This has happened to me a couple of times for my Circles Life subscription, as I did not have enough funds in my card to pay for the monthly fee.

If you are looking to top up your Crypto.com card in Singapore, here are 2 ways that you can do so.

Another thing to note is that your Fiat wallet and Card wallet are 2 separate wallets on the Crypto.com App. For example, the Fiat wallet is linked to your StraitsX account if you’re from Singapore.

Meanwhile, your Card wallet is the wallet where your funds will be deducted from whenever you make a purchase with the Crypto.com Visa card.

Even though both of these wallets contain fiat currencies, they are separate from each other.

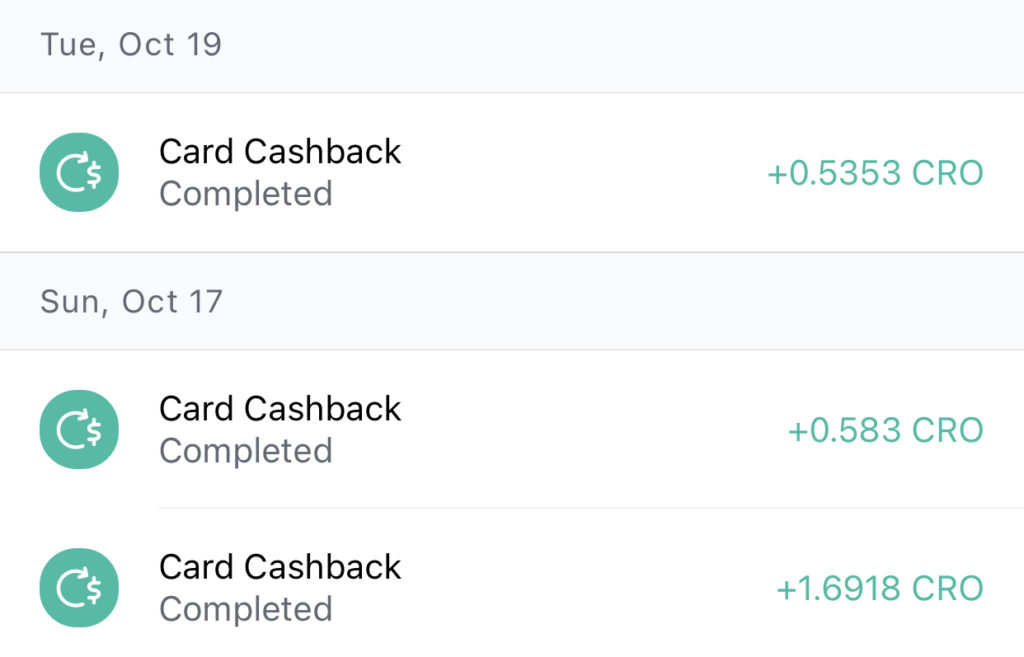

You will earn cashback in the form of CRO

Whenever you make a transaction with your Crypto.com card, you will be eligible for cashback. Here are the cashback rates which depends on the card that you’re using:

| Card | Cashback | CRO Stake Amount (in SGD) |

|---|---|---|

| Obsidian | 8% | $500,000 |

| Frosted Rose Gold / Icy White | 5% | $50,000 |

| Royal Indigo / Jade Green | 3% | $5,000 |

| Ruby Steel | 2% | $500 |

| Midnight Blue | 1% | None |

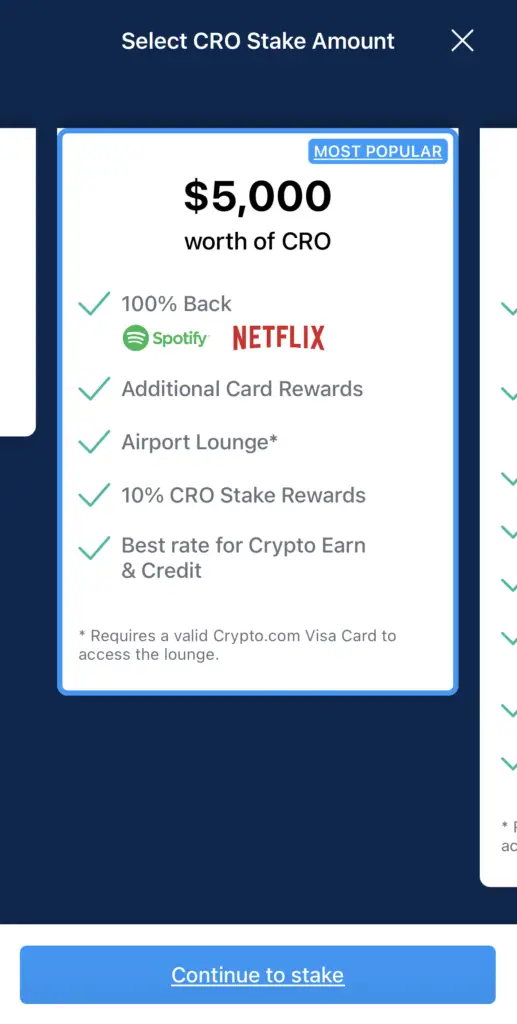

To receive the different cards that are offered by Crypto.com, you will need to stake a certain amount of CRO in the Crypto.com App.

The Crypto.com App is different from the Crypto.com Exchange, and you can view my comparison between these 2 platforms here.

The staking requirements from the Royal Indigo / Jade Green cards onwards is really high! I would only recommend staking these amounts if you are familiar with how cryptocurrencies work.

If you are new to crypto like I initially was, I settled for the Ruby Steel card.

This card offers me a 2% cashback on any transactions that I make with the card.

The cashback reward will be deposited into my CRO Crypto wallet in the Crypto.com app.

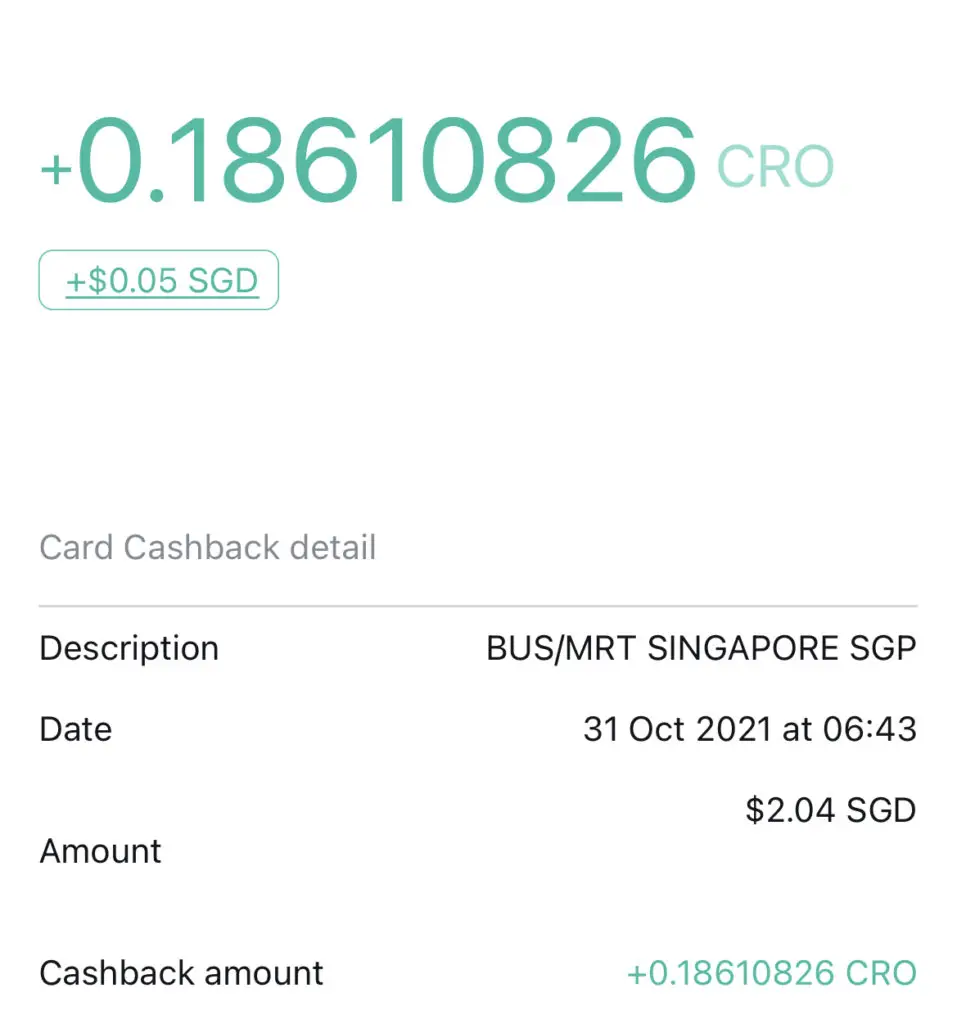

If you’re in Singapore, you will be able to receive cashback when you use the Crypto.com Visa card to pay for your bus and MRT rides!

While the 2% cashback is really sweet, do take note that it is in the form of CRO, and not fiat currency! The price of CRO can be quite volatile, so it really depends on how well this currency performs.

If the value of CRO starts to plunge, you may actually have much less in the form of fiat currency, compared to the time where you earned this cashback.

The CRO cashback will be credited to your Crypto.com App’s Crypto Wallet. This gives you a few options on what you can use with your CRO:

- Trade it for another cryptocurrency on the Crypto.com App

- Sell it to a fiat currency

- Top up your Card Wallet using the CRO you’ve earned

- Put it in Crypto.com Earn or the Supercharger

An example of how the cashback works

Let’s say, for example, you have the Ruby Steel card which gives you 2% cashback.

You may have made a purchase of $50. Since you are receiving 2% cashback, you will receive $0.50 cents worth in rebates.

To make things easier, let’s say the price of CRO is $0.50. This means that you will receive 1 CRO as cashback in your Crypto Wallet.

However, the price of CRO may fluctuate. When you want to cash out your CRO to fiat, the price of 1 CRO may drop from $0.50 to $0.40.

This means that even though you are still selling 1 CRO, you will only receive $0.40 instead of the initial $0.50 you were supposed to receive!

This is due to the fluctuation of prices of CRO with respect to the different fiat currencies.

As such, it would be best to know how cryptocurrencies work before you start using this card!

Does the Crypto.com Visa card have any cashback exclusions?

You will not be able to receive cashback on certain transactions. This includes transactions that fall under a certain MCC (e.g. 4829), as well as transactions made with merchants that are based in a certain country.

You can find out the full exclusion list on Crypto.com’s website.

There are currently 14 MCCs that are excluded from earning cashback with the Crypto.com Visa card. It would be good to double-check if your transaction falls under these categories before making the purchase!

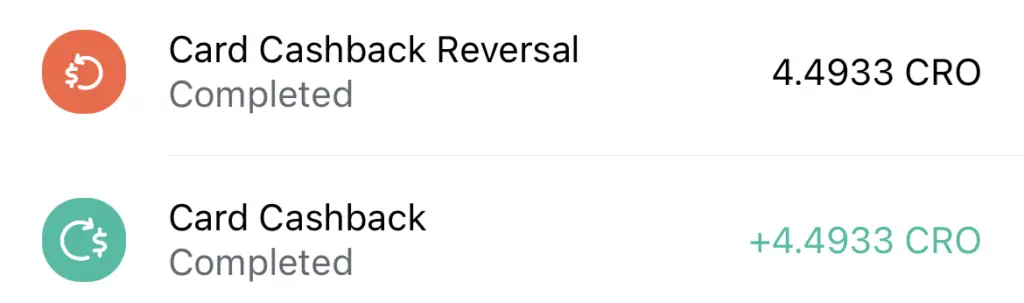

What does the cashback reversal mean for the Crypto.com Visa card?

If you make a transaction with your Crypto.com Visa card that falls under the restricted list, your cashback may be reversed. This means that the CRO that you earned as cashback will be deducted from your Crypto Wallet.

There may be times where the transaction that you make falls under the list of cashback exclusions. Although you received your cashback at first, it will ultimately be deducted from your wallet!

This was the scenario that happened to me.

As such, it would be good to make sure that any transaction that you make does not fall under any of the excluded categories!

Is there a limit on the cashback for the Crypto.com Visa card?

There are no limits to the cashback that you can earn from spending on the Crypto.com Visa card, apart from the top-up limits that are imposed based on your local currency.

Some cashback cards may have a limit to the cashback you can earn, up to a certain amount of spending per month. For the Crypto.com Visa card, there is no limit stated!

However, this depends on the regulations of your country as well. For example, Singapore poses a S$30,000 annual spending limit when you are using the Crypto.com Visa card to make purchases. This would mean that your cashback will be capped to a $30,000 annual spend.

For the special purchase cashback that Crypto.com has, there is a limit to the amount that you can receive:

| Service | Maximum Cashback (%) | Cashback Cap |

|---|---|---|

| Expedia | Up to 10% | US$50 per month |

| Airbnb | Uo to 10% | US$100 per month |

| Spotify | 100% | US$12.99 per month |

| Netflix | 100% | US$13.99 per month |

| Amazon Prime | 100% | US$12.99 per month |

If you are using the Crypto.com Visa card for normal spending apart from these services, there are no such limits.

Can I use my Crypto.com Visa card anywhere?

You are able to use your Crypto.com Visa card at any merchant which accepts Visa payments. However, you may be unable to make a purchase in certain countries, depending on where your card was issued.

Overall, you should be able to use the Crypto.com Visa card at most places where Visa is accepted. With over 180 countries in Visa’s network, you shouldn’t have a problem in most countries!

However, there may be some countries where you can’t use your Crypto.com Visa card in. Since I’m in Singapore, I can’t use my card to make purchases in countries such as:

- Afghanistan

- Central Africa Republic

- Cuba

Depending on where your card is issued, there may be some countries where your card won’t be accepted.

Can I use my Crypto.com Visa card in Singapore?

You are able to use your Crypto.com Visa card at any merchants in Singapore which accept Visa transactions.

I’ve been using my Crypto.com Visa card for the past 1 year. So far, I did not encounter any issues where my Crypto.com Visa card was rejected.

Here’s how I’ve used my Visa card for certain transactions in Singapore.

One reason why your card was rejected could be because you did not have enough money in your Card wallet. It’d be good to check your wallet to make sure you have enough for each transaction.

Can I store foreign currencies on my Crypto.com Visa card?

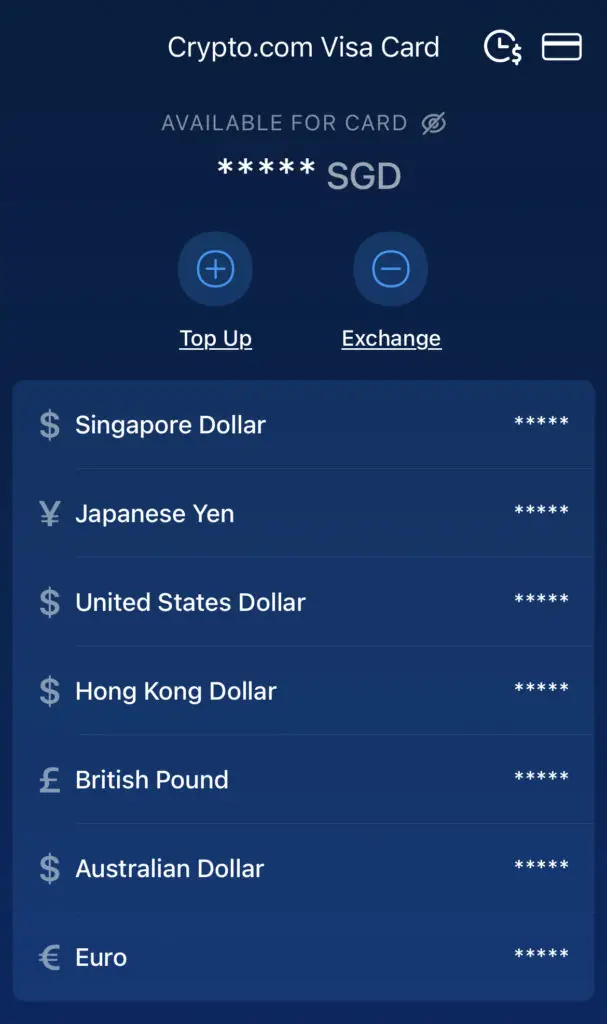

Crypto.com allows you to store up to 8 foreign currencies in your Card Wallet. You are also able to pay for a transaction using the supported foreign currencies based on the prevailing exchange rate.

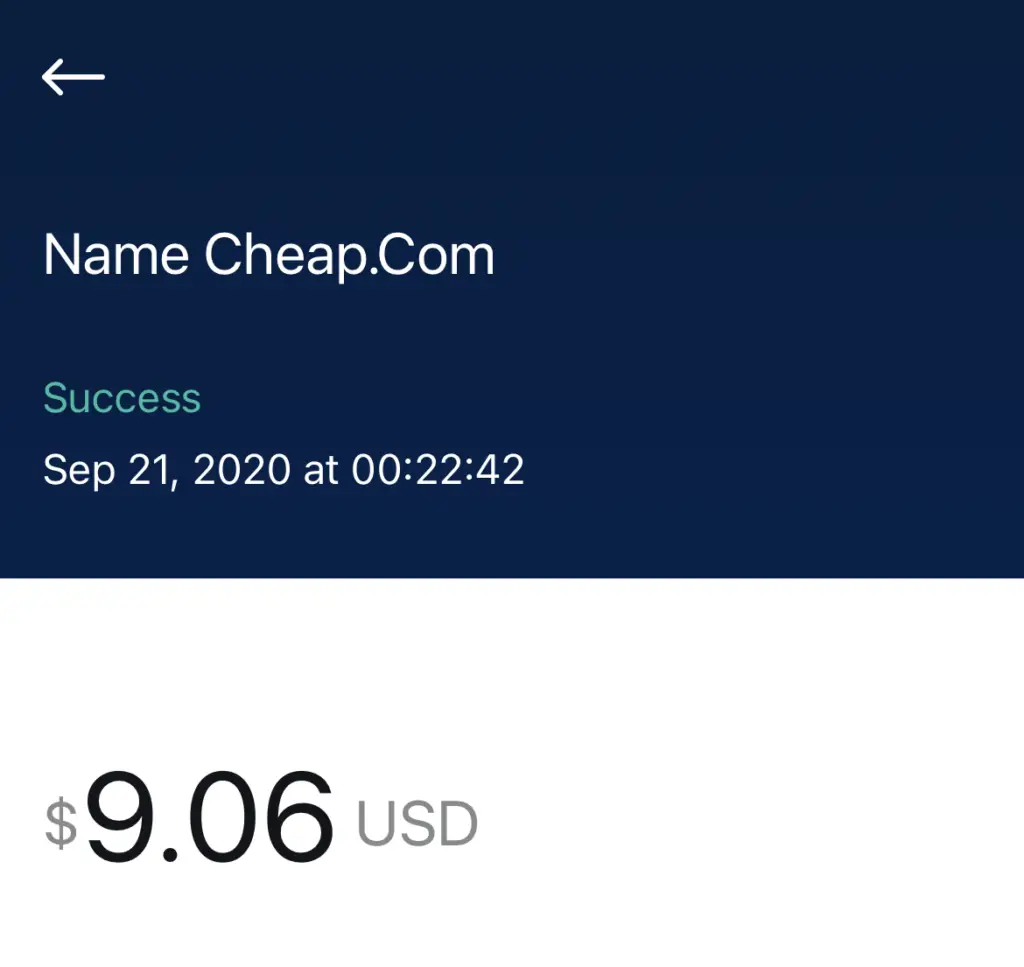

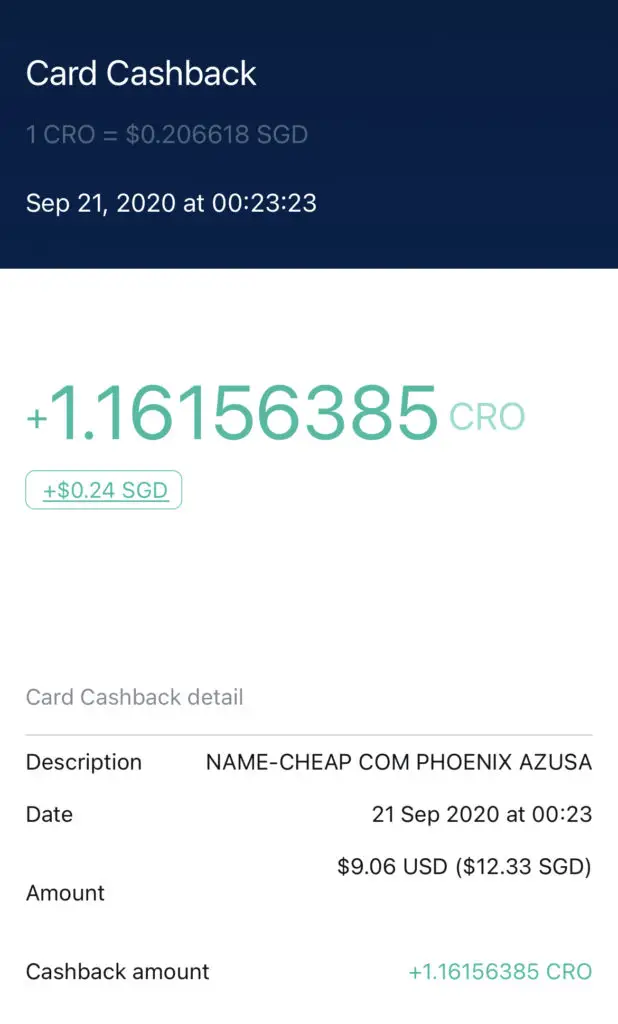

With my Singapore-issued Crypto.com card, I was able to make transactions in USD, such as paying for my domain on NameCheap.

The only issue with this is that the exchange rate is not reflected here. I did not have any USD on my card, and it was automatically converted to USD.

To find out the actual exchange rate, you will need to go to the specific transaction in your CRO wallet.

Over here, you will be able to determine how much in SGD you paid for this USD transaction.

Issues with making foreign transactions for Singapore cards

One issue that I have with my Crypto.com card in Singapore is making transactions in foreign currencies.

There were some transactions that I wanted to make in USD, when my base currency is SGD.

However, the transaction seems unable to go through, even after trying multiple times!

This is quite strange because these transactions in foreign currencies used to work. However, after the Wirecard saga, I am now unable to make any purchases in foreign currencies.

Are there any foreign transaction fees when using the Crypto.com Visa card?

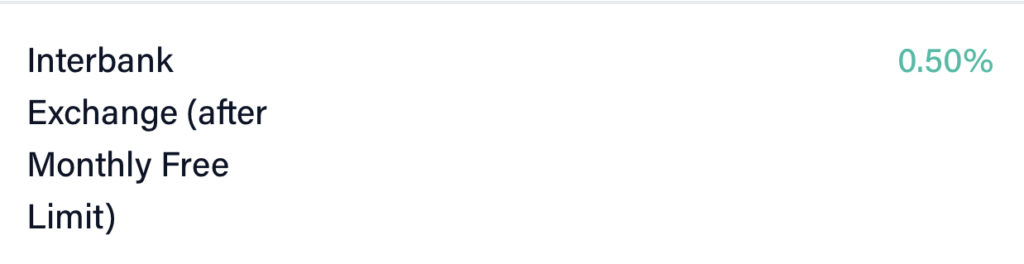

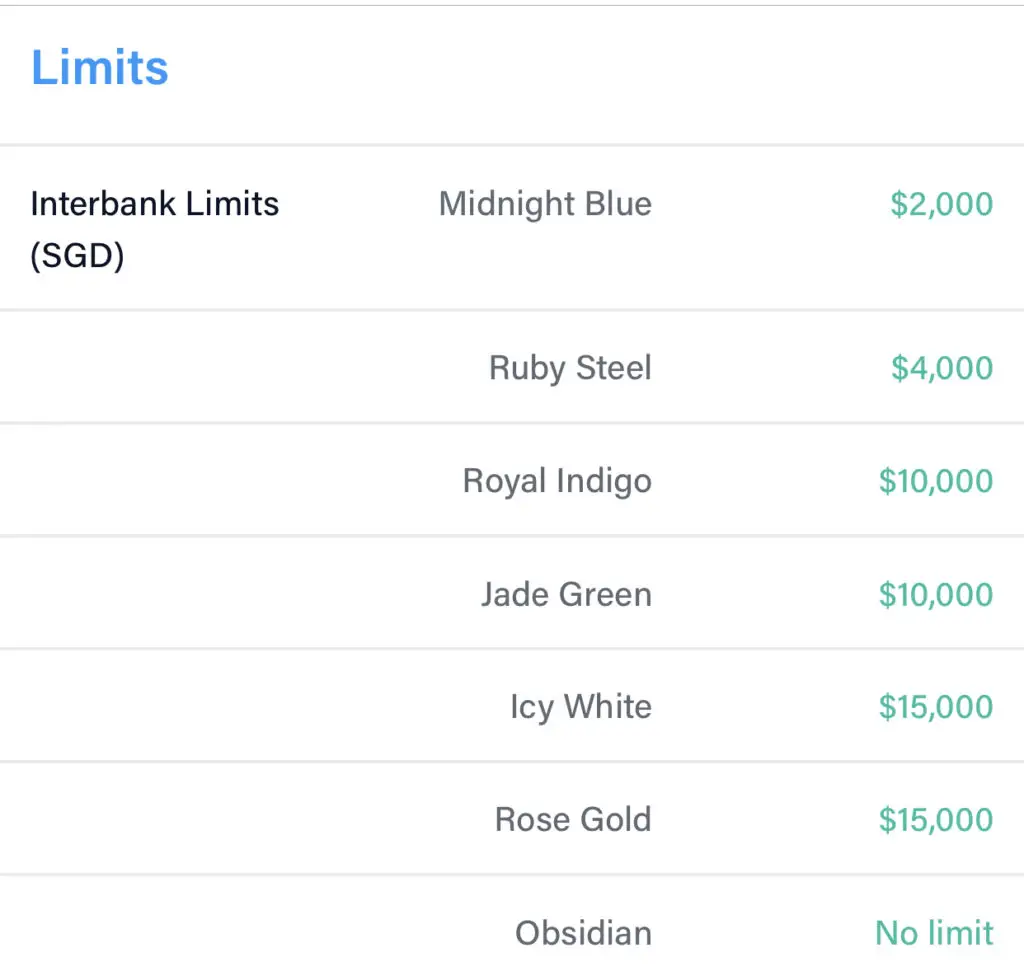

There are no foreign transaction fees when you are using the Crypto.com Visa card, up to a certain limit depending on the current Visa card that you own (only in Singapore). When you are past this limit, you will be charged a 0.5% fee for each transaction.

When you are making a foreign transaction using your Crypto.com card, you will be converting your currency at the current interbank charges.

Once you are past this limit, you will be charged a 0.5% fee.

You can view this under the ‘Fees and Limits‘ section on your Crypto.com App.

The limits that you have depends on the tier of card that you have.

After scrolling through all of the fees for the different countries, it seems that only cards issued in Singapore will be charged this fee.

If you own a card that is issued in another country, you will not be subject to this limit or fee!

Is the Crypto.com card a metal card?

All Crypto.com cards (except for the Midnight Blue card) are metal cards. The metal cards are only issued if you have staked a certain amount of CRO in the Crypto.com App.

If you decide not to stake any CRO, you are still eligible to apply for the Midnight Blue card. However, this card is plastic, and not metal like the other 6 cards!

Can I get a Crypto.com Visa card without staking CRO?

It is possible for you to get a Crypto.com Visa card without staking CRO. However, you will be issued the Midnight Blue Visa card, which has the least amount of cashback and benefits of the different tiers of cards.

If you sign up for the Crypto.com App and just request for a card, you will still be eligible for the Midnight Blue card without staking anything!

However, if you do intend to upgrade in the future, you may want to take note of the $50 card reissue fee for each new card that you request for.

Is the Crypto.com card contactless?

The Crypto.com card is able to support contactless transactions at any merchant that supports Visa payWave.

So long as the shop that you’re making a payment at supports Visa payWave, you should have no issues with making a contactless transaction!

Can you use the Crypto.com card for online transactions?

You are able to use the Crypto.com card at online merchants which support Visa.

If you are deciding if you can use your Crypto.com card for an online purchase, you can look out for the available payment methods at the checkout page.

However, this should not be a problem as most merchants would accept Visa transactions!

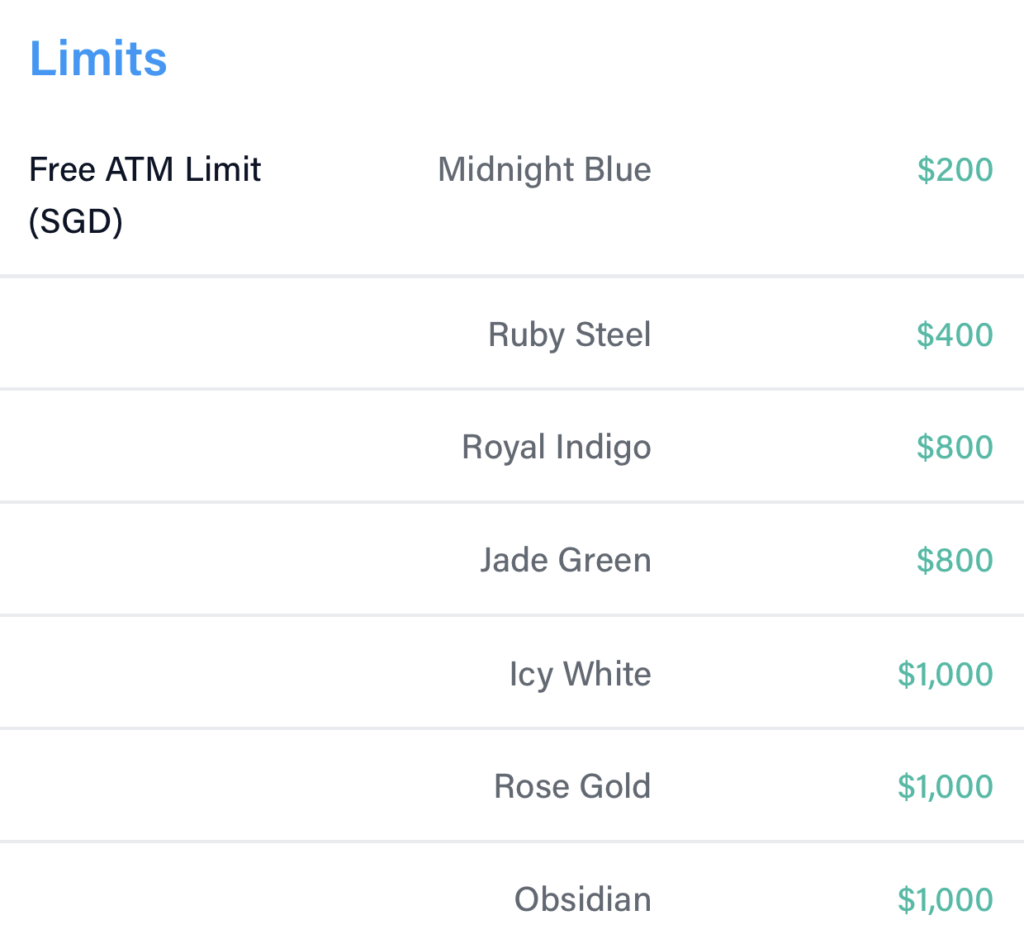

Can you withdraw money from the Crypto.com Visa card?

You are unable to withdraw the money from your Crypto.com Visa card wallet to the fiat wallet in the Crypto.com App. However, it is possible for you to make an ATM withdrawal to withdraw the money from your card.

Currently, Crypto.com does not allow you to transfer funds from your Crypto.com Visa card back to your fiat wallet.

When you look at the ‘Card‘ tab on the Crypto.com App, there is no function for you to transfer the funds from your Card wallet to your Fiat wallet.

Apart from spending money on your Visa card, the only other way that you can withdraw money from the card is by making an ATM withdrawal.

The amount of money that you can withdraw depends on the card tier that you own.

If you exceed your Monthly Free Limit, you will incur a 2% fee.

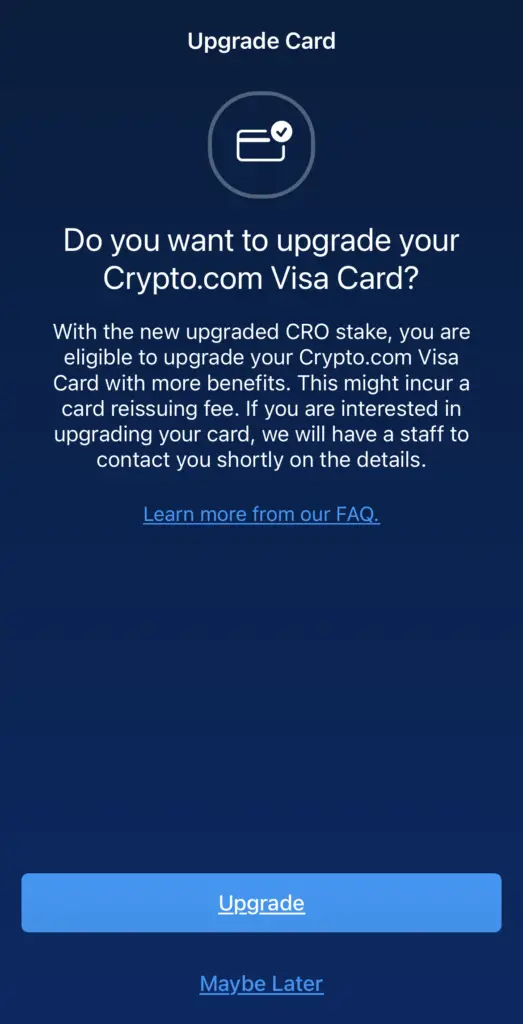

Can I upgrade my Crypto.com Visa card?

You are able to upgrade the Crypto.com Visa card by increasing the amount of CRO you will be staking on the Crypto.com App. The new amount of CRO that you stake will be locked up for 6 months after increasing your stake.

Whenever you upgrade your Crypto.com Visa card, you will need to increase the amount of staked CRO you have on the Crypto.com App.

The amount that you’ll need to stake will depend on your country.

One thing you may want to note is that your CRO will be locked up for another 6 months. This includes the CRO that you’ve previously staked as well!

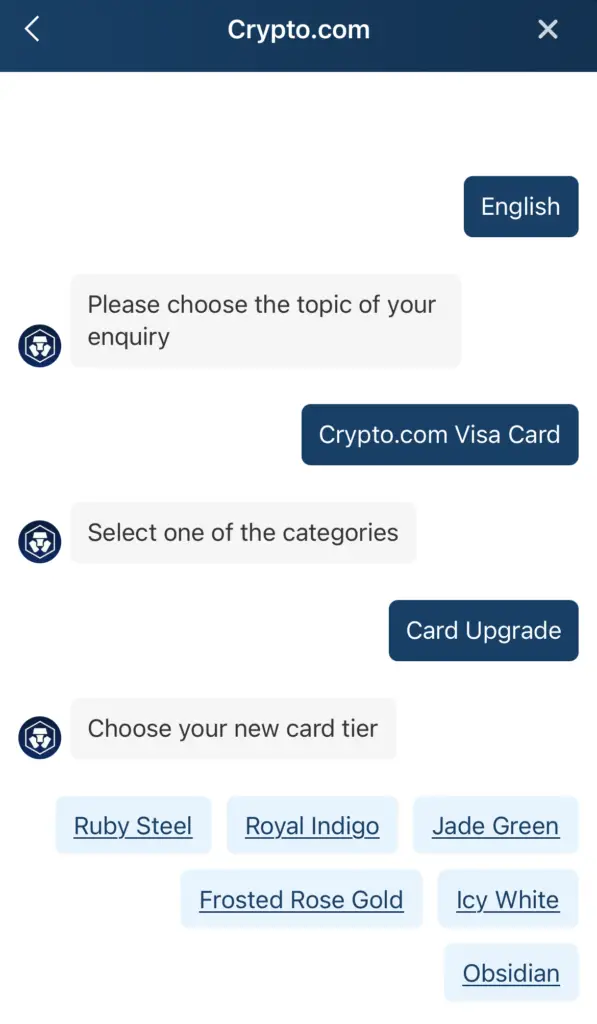

How do I upgrade my Crypto.com Visa card?

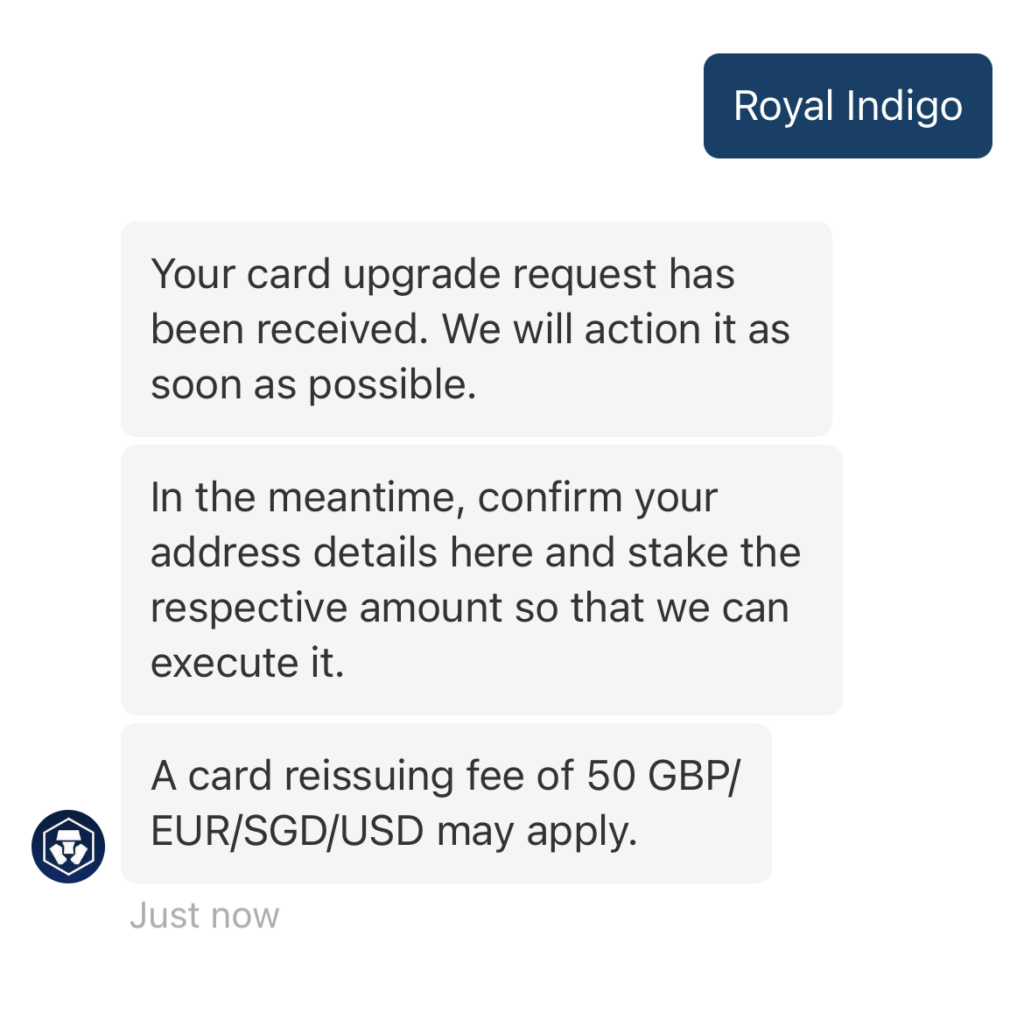

To upgrade your Crypto.com Visa card, you will need to send a support ticket to Crypto.com after you have increased your stake amount. You will be able to select a new card, based on the amount of CRO that you have staked.

After increasing your CRO stake amount, the new Crypto.com Visa card will not be automatically issued to you. Instead, you will need to contact support to upgrade your card.

You will be able to select which Visa card you wish to upgrade to, based on your stake amount.

You may want to note that for every new Crypto.com Visa card that you order after your first card, you will incur a reissue fee of $50.

This fee will be deducted from your Crypto.com card wallet. If you are intending to upgrade your card in the future, this is something to consider!

Should I choose the Ruby Steel or the Jade Green Visa card?

The Jade Green Visa card is suitable if you wish to enjoy the higher cashback, additional free Netflix rebate, as well as higher interest rates on Crypto.com Earn. However, if you are unwilling to commit a high amount of money to buy the required amount of CRO, the Ruby Steel card will be more suitable.

It really depends on the amount of investment that you’re willing to make into the Crypto.com ecosystem. If you believe that Crypto.com will do well in the future, it wouldn’t hurt to invest a larger amount to buy more CRO.

However, you may not have enough funds to buy the Jade Green card. It is still possible to stake enough CRO for the Ruby Steel card before switching to the Jade Green card later.

You may want to note that you will incur a $50 fee when you wish to upgrade to the Jade Green card!

Should I choose the Royal Indigo or Jade Green Visa card?

The Royal Indigo card has a more striking design and it does look more professional compared to the Jade Green card. However, Jade Green will be more suitable for you if you prefer the colour green.

You may want to note that there is no difference in these 2 cards, apart from the design. You will still be able to earn cashback on Spotify and Netflix, as well as a 10% staking return on your CRO!

Ultimately, it depends on which colour you prefer more.

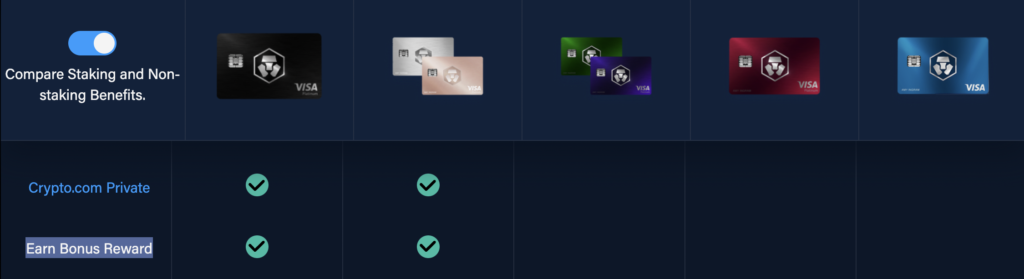

What does ‘Earn Bonus Reward’ mean for the Icy White, Frosted Gold and Obsidian cards?

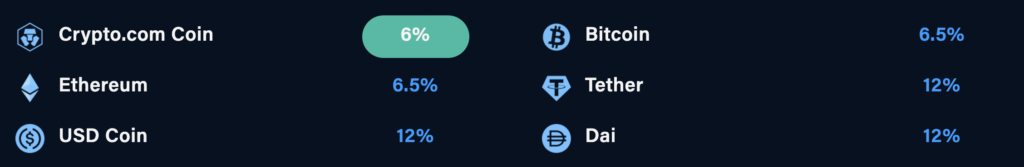

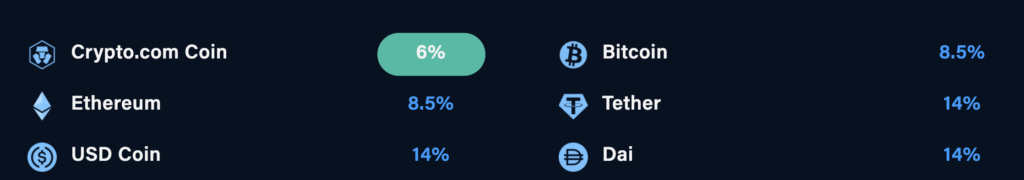

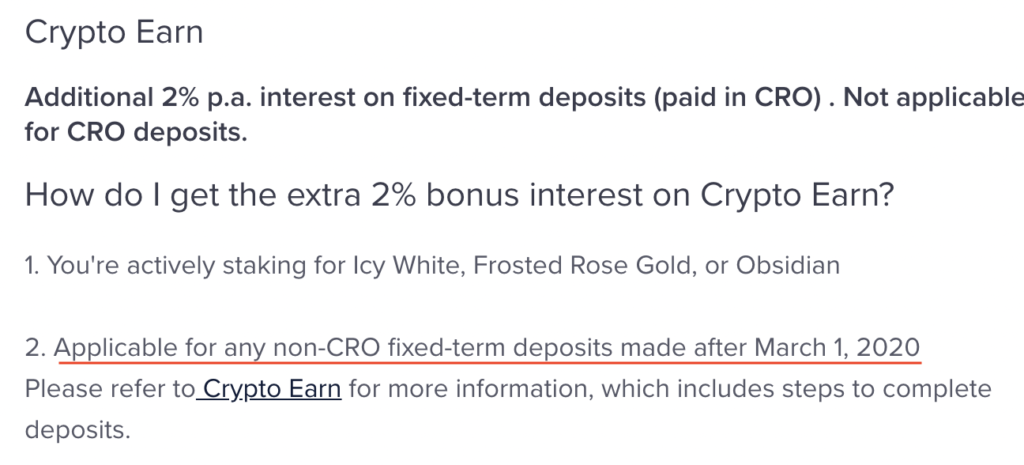

When you upgrade your Crypto.com Visa card to either the Icy White, Frosted Gold and Obsidian card, you will be eligible to earn an extra 2% on your Crypto Earn holdings in the form of CRO (only for non-CRO fixed term deposits).

You may have noticed that the top 2 tiers of the Crypto.com Visa card have an extra benefit called ‘Earn Bonus Reward‘.

What this actually means is that you will be able to earn extra interest in Crypto.com Earn. You will still earn the same interest rates in-kind for the tokens that you’ve lent out with Crypto.com Earn.

For example, you will still earn 6.5% interest on BTC for a 3-month term, so long as you own a Jade Green or Royal Indigo card or higher.

For the top 2 tiers of the Crypto.com Visa Card, you will earn an additional 2% interest on your crypto holdings. Instead of it being in-kind, you will earn this extra 2% in the form of CRO instead.

This will only be applicable to your non-CRO deposits. If you lend out CRO on Crypto.com Earn, you will still earn 6% for a 3-month term.

Does the Crypto.com Visa card have a monthly fee?

The Crypto.com card currently does not charge a monthly fee to use their card.

There are currently no charges that you’ll incur from using the Crypto.com Visa card, apart from the reissue fee.

As such, you do not incur any monthly fees when you are using this card.

Does the Crypto.com card affect my credit score?

The Crypto.com card is a prepaid Visa debit card. As such, it will not affect your credit score directly. However, if you used a credit card to top up your Crypto.com card, that amount that you’ve topped up may affect your credit score if you are unable to pay it back on time.

As a debit card, the Crypto.com card will not directly affect your credit score.

However, if you used a credit card to top up the card, it may affect your credit score if you aren’t able to pay your bills on time!

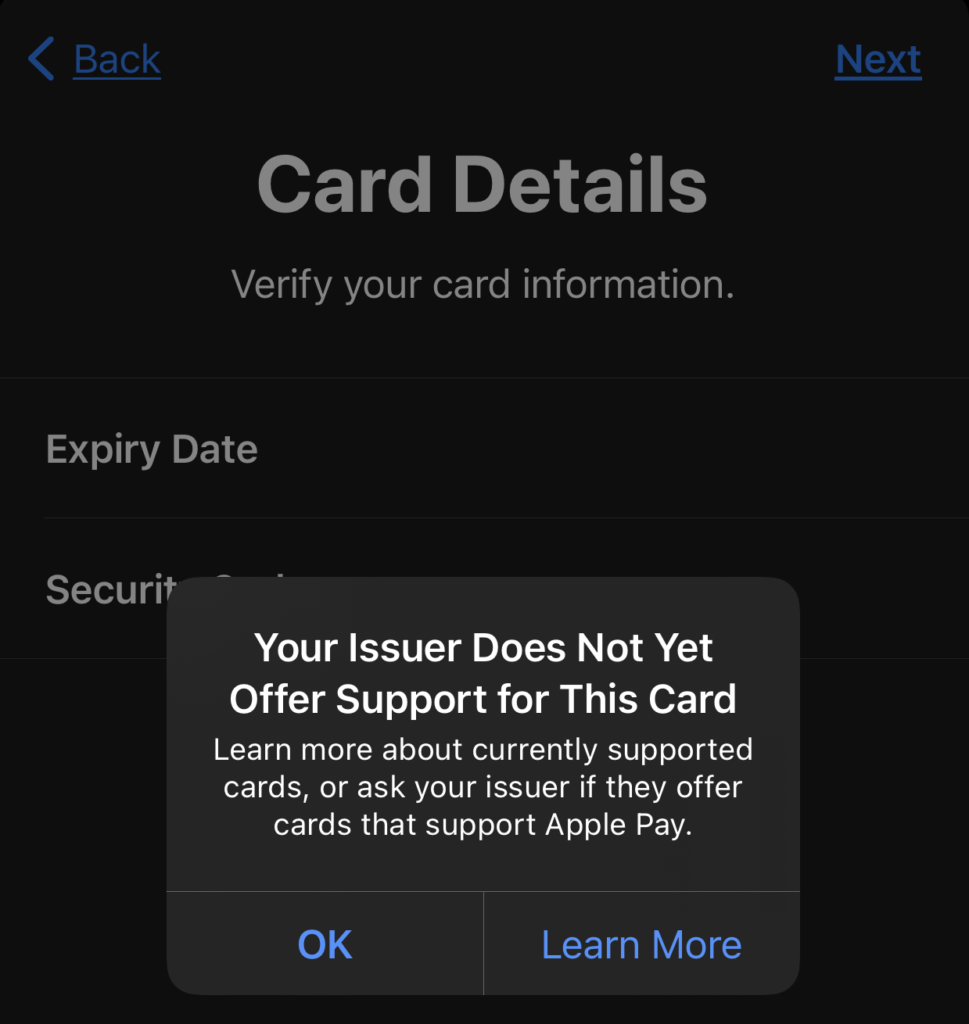

Can I add my Crypto.com card to Apple Pay?

The Crypto.com card can be added to Apple Pay if you’re from the US. However, if you’re from Singapore or Europe, you are unable to add your Crypto.com card to Apple Pay.

I tried to add my Crypto.com card to Apple Pay, but it doesn’t work in Singapore.

This is due to the restrictions on the type of cards that can be added to Apple Pay in Singapore.

However, if you are in the US, there should not be a problem when adding your card to Apple Pay.

Can I add my Crypto.com card to Google Pay?

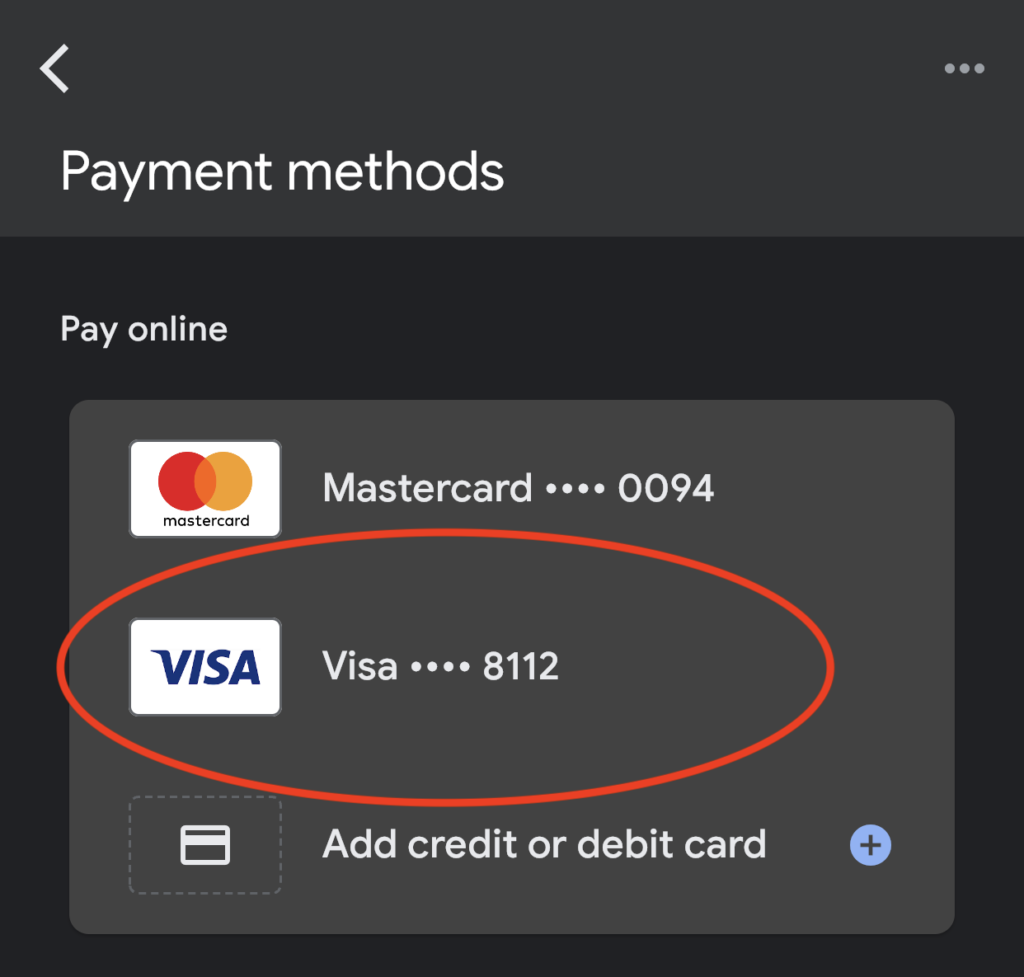

It is possible to add your Crypto.com card to Google Pay. However, this depends on Google accepting the Crypto.com card which may differ from country to country.

For my card that was issued in Singapore, I had no problems in adding my card to Google Pay.

This is even though the Crypto.com Visa card does not fall under this list of supported cards.

If you are wondering if your card can be added to Google Pay, there is definitely no harm in trying it out!

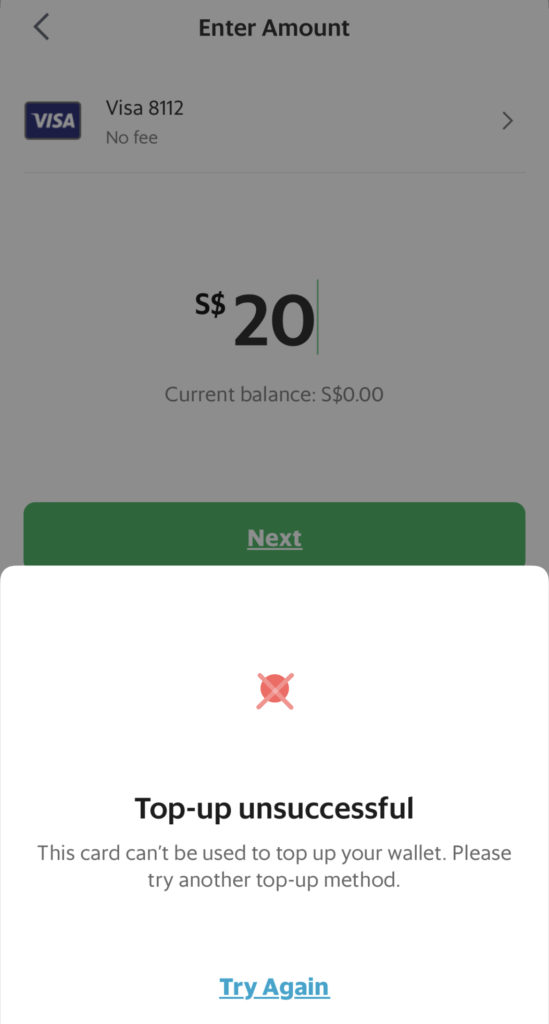

Can I add my Crypto.com card to GrabPay?

It is possible for you to add your Crypto.com card to your Grab wallet to make payments via GrabPay. However, you will be unable to top up your GrabPay wallet using your Crypto.com card.

From time to time, Crypto.com may provide some promotions where you can receive a higher amount of CRO cashback when making payments on Grab.

Once you’ve added your Crypto.com card to your Grab wallet, you can make these purchases and earn the extra cashback!

However, I tried to top up the GrabPay wallet with my Crypto.com Visa card, and here’s the result.

Is the Crypto.com card worth it?

The Crypto.com card is a good way for retail investors to gain their first exposure to cryptocurrencies, due to the ability to connect your fiat wallet with your crypto wallet. If you are confident that CRO will continue to perform well, the Crypto.com card is suitable to help you accumulate CRO for the long term.

Previously, I signed up for the Crypto.com Visa card without exploring much regarding how CRO works. I mainly applied for the card to get the extra cashback!

At that time, I was more focused on selling my CRO back to SGD once it was credited to me.

However, after understanding the value of cryptocurrencies better, I’ve decided to take a buy and hold strategy for CRO.

This is because I believe that the Crypto.com ecosystem has the potential to do very well in the future.

As such, I am now depositing the cashback that I am earning into the Crypto.com Supercharger instead. This allows me to keep my CRO, and still earn some yield on it!

Furthermore, you can also decide to place your CRO into Crypto.com Earn which allows you to earn interest on CRO.

The Crypto.com Visa card is a great add-on to your spending cards, due to its ability to earn cashback on most transactions.

If you understand the value of cryptocurrencies, and especially how to cash them out, the Crypto.com card is definitely something you can consider!

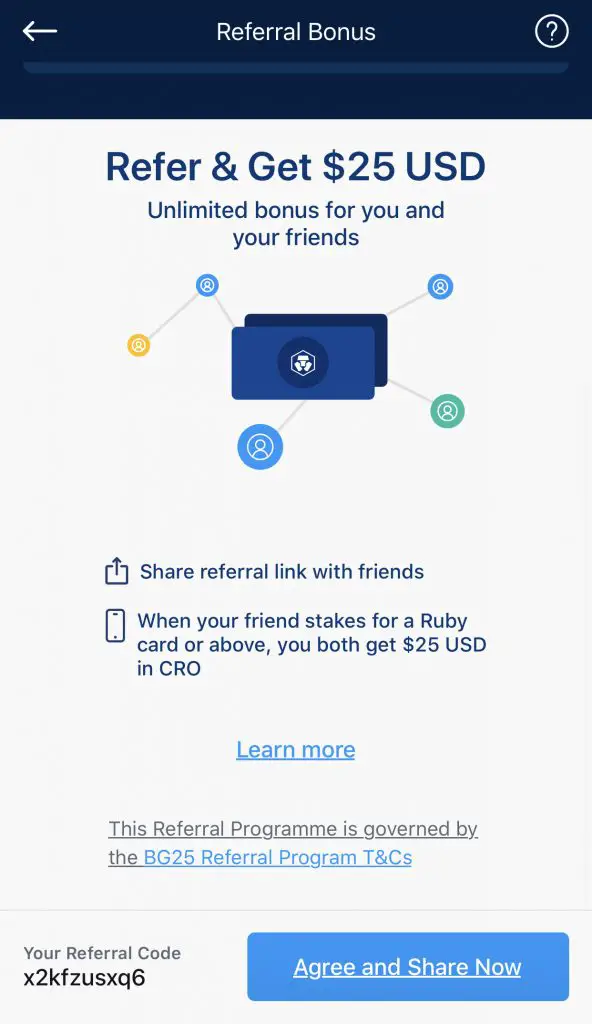

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Crypto.com Referral (Get up to $25 USD worth of CRO)

If you are interested in signing up for Crypto.com, you can use my referral link and enter the code ‘x2kfzusxq6‘.

We will both receive $25 USD worth of CRO in our Crypto Wallet.

Here’s what you’ll need to do:

- Sign up for a Crypto.com account

- Enter my referral code: ‘x2kfzusxq6‘

- Stake enough CRO to unlock a Ruby Steel card or higher

The amount of CRO that you need to stake depends on the card you wish to get, and the currency you are staking in.

You can read more about the referral program on Crypto.com’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?