Last updated on June 6th, 2021

You’ve decided to purchase an ETF that tracks the S&P 500 Growth Index.

However, there are quite a few different ETFs that track this index, such as SPYG and VOOG.

So which one should you choose?

Contents

The difference between SPYG and VOOG

Both SPYG and VOOG track the S&P 500 Growth Index. Since SPYG has been around for 10 years longer, it has a lower expense ratio, a lower unit price and a higher trading volume compared to VOOG.

Here is an in-depth comparison between these 2 ETFs:

Index tracked

Both SPYG and VOOG track the S&P 500 Growth Index.

The S&P 500 Growth Index consists of large-capitalization U.S. equities that exhibit growth characteristics

BlackRock

There are 3 main factors which the S&P 500 Growth Index uses to measure these growth stocks include:

- Sales growth

- Ratio of earnings change to price

- Momentum

Compared to the S&P 500, the S&P 500 Growth Index only has 232 holdings!

Since both ETFs track the same index, they should roughly have the same performance.

You can see this from their stock price charts.

You can read my guide to find out what do the red and green bars mean in a stock chart.

Apart from very minor changes in price, they essentially give you the same performance!

The main difference in their performance will be due to tracking error. However, this should not make much of a difference, especially if you are investing for the long term!

They are managed by different fund managers

SPYG is managed by State Street Global Advisors (SSGA). Meanwhile, VOOG is managed by Vanguard.

SPYG was started much earlier in September 2000, while VOOG was only incepted in September 2010.

Due to this 10 year difference, SPYG has a much larger assets larger assets under management (AUM).

| SPYG | VOOG | |

|---|---|---|

| AUM | 10 billion | 4.88 billion |

They are listed on the same exchange

Both SPYG and VOOG are listed on the New York Stock Exchange (NYSE). As such, here are some things you’ll need to consider when trading on the NYSE:

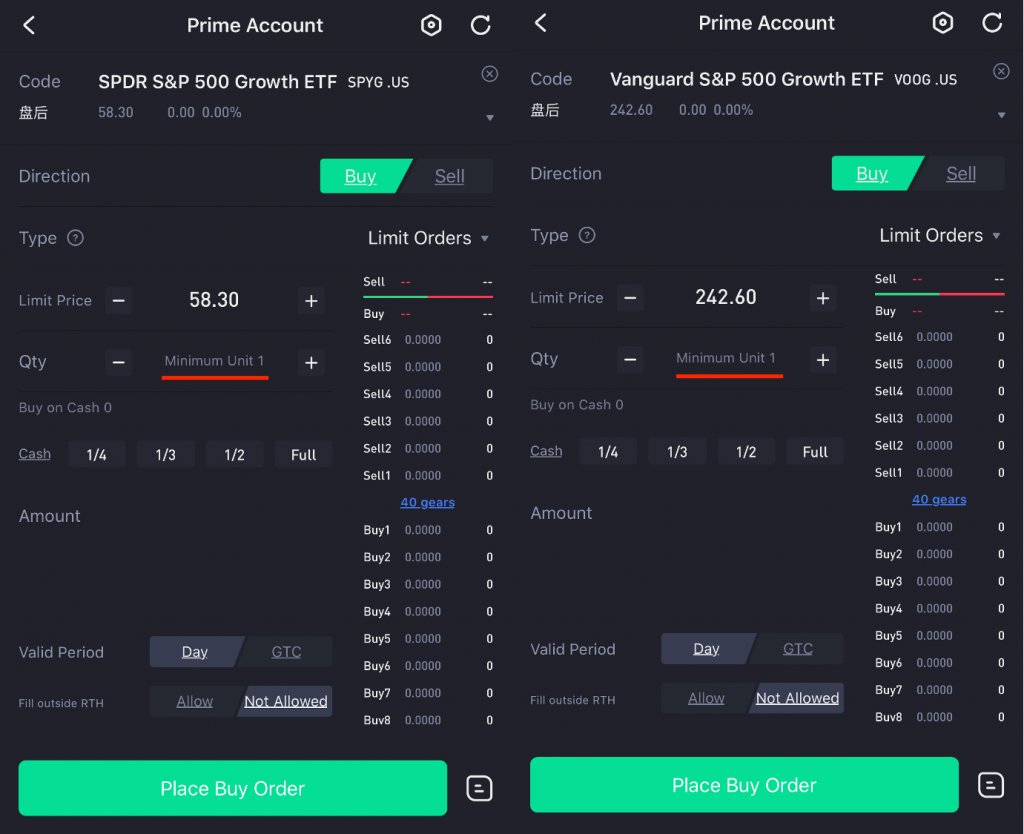

Minimum units to invest

You are required to only invest a minimum of 1 unit for each ETF.

This is similar to the LSE. Moreover, it has better accessibility compared to the SGX, which requires you to purchase in lot sizes of 100 units!

Commissions charged

When you purchase an ETF through a broker, you will be charged a certain commission for each trade you make.

As such, you’ll need to find a broker that gives you the best deal for the amount you intend to invest in!

You can consider Tiger Brokers, which charges a minimum of 1.99 USD for each trade you make.

Unit Price

The unit price of each ETF is the price you’ll need to pay for 1 unit. Both SPYG and VOOG have rather different unit prices.

| SPYG | VOOG | |

|---|---|---|

| Estimated Unit Prices | USD$50 | USD$240 |

SPYG seems to be slightly more accessible due to the lower unit price! If you have a smaller investment amount, it may make sense to invest in SPYG.

This is because the lower unit price gives you more flexibility in your investment amount! You are able to buy SPYG in multiples of around $50, while you can only buy VOOG in multiples of $240.

However, you’ll need to consider your broker’s commission rates to see if it’s worth investing a smaller amount!

You should not worry about the difference in the unit price. This is because both ETFs are tracking the same index. As such, their performance will be very similar!

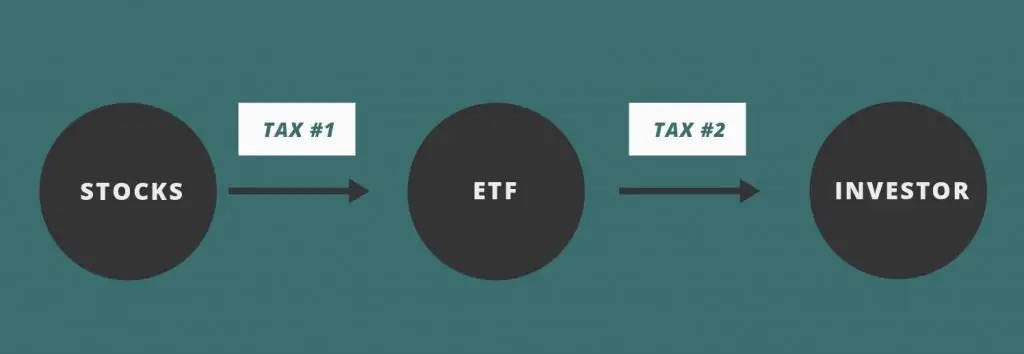

Dividend withholding taxes

Both SPYG and VOOG are domiciled in the US.

If you are a non-resident alien to the US, you will incur a 30% dividend withholding tax.

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

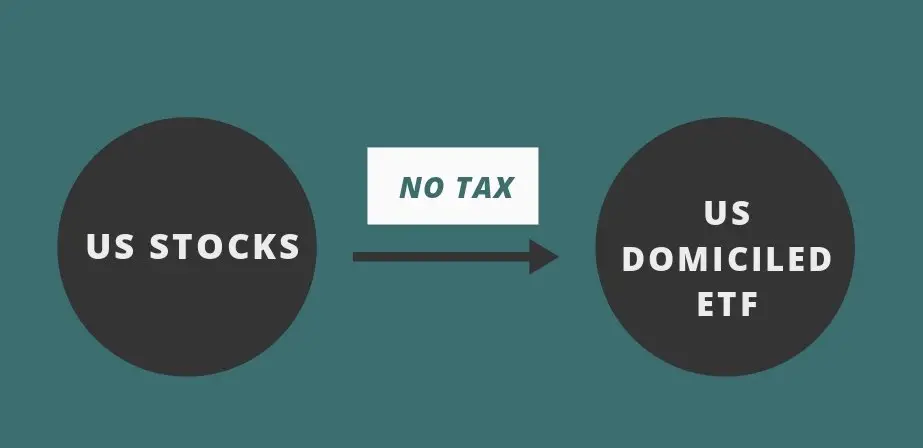

- From stock to ETF

- From ETF to you, the investor

When the stock distributes its dividend to the ETF, no tax is incurred. This is because it is from a US stock to a US-domiciled ETF.

However when the dividends are distributed to you, they will incur the 30% tax. This is because you are a non-resident alien!

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

Both SPYG and VOOG are distributing ETFs. This means that they will issue a dividend to you each quarter.

These 2 ETFs give very similar dividend yields (around 0.84-0.86%).

However, you would still need to factor in the withholding tax!

You can read my comparison between accumulating and distributing ETFs to see how they differ.

Estate tax

Another significant cost of investing in US-related assets is the estate tax. This can go from 18% all the way to 26%!

An estate tax is a tax on the right for you to transfer your assets after you have passed on.

The estate tax is really hefty if you are a non-resident alien of the US.

Since both ETFs are domiciled in the US, they will be included in your taxable estate.

If you wish to leave behind a legacy for your loved ones, you may want to reconsider investing in these ETFs!

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for these 2 funds:

| SPYG | VOOG | |

|---|---|---|

| Expense Ratio | 0.04% | 0.10% |

The expense ratio for VOOG is more than twice that of SPYG. While this difference may seem small, it will affect you in the long run!

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| SPYG | VOOG | |

|---|---|---|

| Liquidity | 1.8 million | 118,000 |

SPYG seems to have a much higher liquidity compared to VOOG!

Since it is more frequently traded, you should be able to buy or sell SPYG at your intended price.

Verdict

Here is the complete breakdown between SPYG and VOOG:

| SPYG | VOOG | |

|---|---|---|

| Index Tracked | S&P 500 Growth | S&P 500 Growth |

| Fund Manager | SSGA | Vanguard |

| AUM | 10 billion | 4.88 billion |

| Exchange | NYSE | NYSE |

| Currency | USD | USD |

| Estimated Unit Prices | $50 | $240 |

| Dividend Withholding Tax | 30% | 30% |

| Dividend Distribution | Distributing | Distributing |

| Estate Tax | Yes | Yes |

| Expense Ratio | 0.04% | 0.10% |

| Average Trading Volume | 1.8 million | 118,000 |

Both ETFs look really similar, so which one should you choose?

I am leaning more towards SPYG, due to these reasons:

- Lower expense ratio

- Larger average trading volume

- Lower unit price

SPYG has a lot of factors that make it a very favourable ETF to invest in. As such, I believe it is the better ETF compared to VOOG!

Conclusion

Both ETFs track the same index, so their performances should be very similar.

However, I believe the SPYG is the better option. The lower expense ratio will definitely improve your return in the long run!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?