Last updated on June 6th, 2021

Did you know that there are actually stocks that are denominated in USD on the SGX?

Which stocks are these and how do you go about buying them?

Here’s what you need to know:

Contents

USD denominated stocks on SGX

Here is a list of USD denominated stocks, REITs and business trusts that can be traded on the SGX:

| Stock Name | SGX Ticker |

|---|---|

| Dairy Farm International Holdings | D01 |

| HongKong Land Holdings | H78 |

| Jardine Matheson Holdings | J36 |

| Jardine Strategic Holdings | J37 |

| Mandarin Oriental International | M04 |

| Prudential PLC | K6S |

| Tianjin Zhong Xin Group | T14 |

| Manulife US REIT | BTOU |

| Keppel Oak US REIT | CMOU |

| Prime US REIT | OXMU |

| United Hampshire REIT | ODBU |

| Hutchison Port Holdings Trust | NS8U |

| ARA US Hospitality Trust | XZL |

| Eagle Hospitality Trust | LIW |

You can view the entire list of stocks on SGX’s website.

There are a total of 14 securities that are denominated in USD on the SGX. This includes:

- 7 stocks

- 4 REITs

- 3 business trusts

Interestingly, none of the 4 REITs are found in the iEdge S-REIT Index which Syfe REIT+ tracks.

All of these securities require you trade in multiples of 100 units.

USD denominated ETFs on SGX

There are 21 USD-denominated exchange-traded funds (ETFs) which are listed on the SGX.

These funds buy into a basket of stocks or other assets, and can be traded on the SGX.

Here are the 21 ETFs that you can trade:

| ETF Name | SGX Ticker |

|---|---|

| SPDR Gold Shares USD | 087 |

| iShares J.P. Morgan USD Asia Credit Bond Index ETF | N6M |

| iShares Barclays USD Asia High Yield Bond Index ETF | O9P |

| iShares MSCI India Index ETF | I98 |

| Lion-OCBC Hang Seng Tech ETF | HSS |

| Lyxor China Enterprise (HSCEI) UCITS ETF | P58 |

| Lyxor MSCI AC Asia-Pacific ex Japan UCITS ETF | P60 |

| Lyxor MSCI Emerging Markets UCITS ETF | H1N |

| Lyxor MSCI India UCITS ETF | G1N |

| NikkoAM-ICBCSG China Bond ETF | ZHD |

| NikkoAM-StraitsTrading Asia ex Japan REIT ETF | COI |

| Phillip SGX APAC Div Leaders REIT ETF | BYI |

| Phillip Money Market ETF | MMT |

| Principal FTSE ASEAN 40 ETF | M62 |

| Principal S&P Ethical Asia Pac Div ETF | P5P |

| SPDR Dow Jones Industrial Average ETF Trust | D07 |

| SPDR S&P 500 ETF Trust | S27 |

| MSCI Singapore UCITS ETF | O9A |

| MSCI China UCITS ETF | LG9 |

| MSCI Indonesia Swap UCITS ETF | KJ7 |

| FTSE Vietnam Swap UCITS ETF | HD9 |

| ICBC CSOP FTSE Chinese Government Bond Index ETF | CYB |

There are some ETFs which are denominated in both USD and SGD on the SGX. This includes:

| ETF Name | USD | SGD |

|---|---|---|

| ICBC CSOP FTSE Chinese Government Bond Index ETF | CYC | CYB |

| iShares J.P. Morgan USD Asia Credit Bond Index ETF | N6M | QL2 |

| iShares Barclays USD Asia High Yield Bond Index ETF | O9P | QL3 |

| iShares MSCI India Index ETF | I98 | QK9 |

| Lion-OCBC Hang Seng Tech ETF | HSS | HST |

| NikkoAM-ICBCSG China Bond ETF | ZHD | ZHS |

| NikkoAM-StraitsTrading Asia ex Japan REIT ETF | COI | CFA |

| Phillip SGX APAC Div Leaders REIT ETF | BYI | BYJ |

| Phillip Money Market ETF | MMT | MMS |

| Principal FTSE ASEAN 40 ETF | M62 | QS0 |

| Principal S&P Ethical Asia Pac Div ETF | P5P | QR9 |

| MSCI China UCITS ETF | LG9 | TID |

This gives you the option to invest in the same ETF using different currencies! It is suggested to invest in your home currency as you reduce foreign currency risk.

The minimum lot size for these ETFs can range from 5-100 units. Here are some of the minimum units for the different ETFs on the SGX:

| Minimum Lot Size | ETF(s) |

|---|---|

| 5 | SPDR Gold ETF (O87) iShares MSCI India Index ETF (I98) |

| 10 | Lion-OCBC Hang Seng Tech ETF (HSS) ICBC CSOP CGB ETF (CYC) SPDR S&P 500 ETF Trust (S27) |

| 100 | iShares Barclays USD Asia High Yield Bond ETF (QL3) iShares J.P. Morgan USD Asia Credit Bond Index ETF (N6M) |

There doesn’t really seem to be a trend between the ETF’s price and the minimum number of units. This is different compared to the HKEX, where the number of units depends on the ETF’s price!

ADRs

Another type of product that is denominated in USD are the American Depositary Receipts (ADRs).

ADRs are a US security which represents the ownership of shares in a foreign company.

These ADRs can be traded freely just like any other stock.

MoneySense

There are 16 ADRs which are listed on the SGX:

| Company Name | SGX Name | SGX Ticker |

|---|---|---|

| Aluminium Corporation of China | ACH ADR US$ | K3HD |

| Baidu Inc | BIDU ADR US$+ | K3SD |

| China Eastern Airlines | CEA ADR US$ | K3CD |

| China Telecom Corporation | CHA ADR US$ | K3ED |

| China Mobile | CHL ADR US$ | K3PD |

| China Unicom (Hong Kong) | CHU ADR US$ | K3ID |

| Hong Kong and Shanghai Bank | HBC ADR US$ | PU6D |

| Huaneng Power International | HNP ADR US$ | K3FD |

| Mizuho Financial | MFG ADR US$ | N6DD |

| MUFJ Financial | MTU ADR US$ | N5YD |

| Netease.com INC | NTES ADR US$+ | K3MD |

| PetroChina Company | PTR ADR US$ | K3OD |

| SinoPec Shanghai Petrochemical | SHI ADR US$ | K3DD |

| Toyota Motor | TM ADR US$ | N6FD |

| Trip.com Group Limited | TRIP ADR US$+ | K3RD |

| China Southern Air | ZNH ADR US$ | K3TD |

The trading of CHA, CHL and CHU have been suspended on the SGX.

The ‘+’ at the end of each ticker represents ADRs that are single-listed. This means that these ADRs are only listed on the SGX!

Why are there USD denominated stocks listed on the SGX?

This could mainly be down to access. Some overseas investors want to invest in the ETFs listed on the SGX. However, they may not want to convert their home currencies into SGD.

As such, the USD-denominated ETFs may help to make these ETFs more accessible.

For the other REITs and stocks, they could be listed in USD because their assets are all in the US. This includes:

How do I trade USD denominated stocks on the SGX?

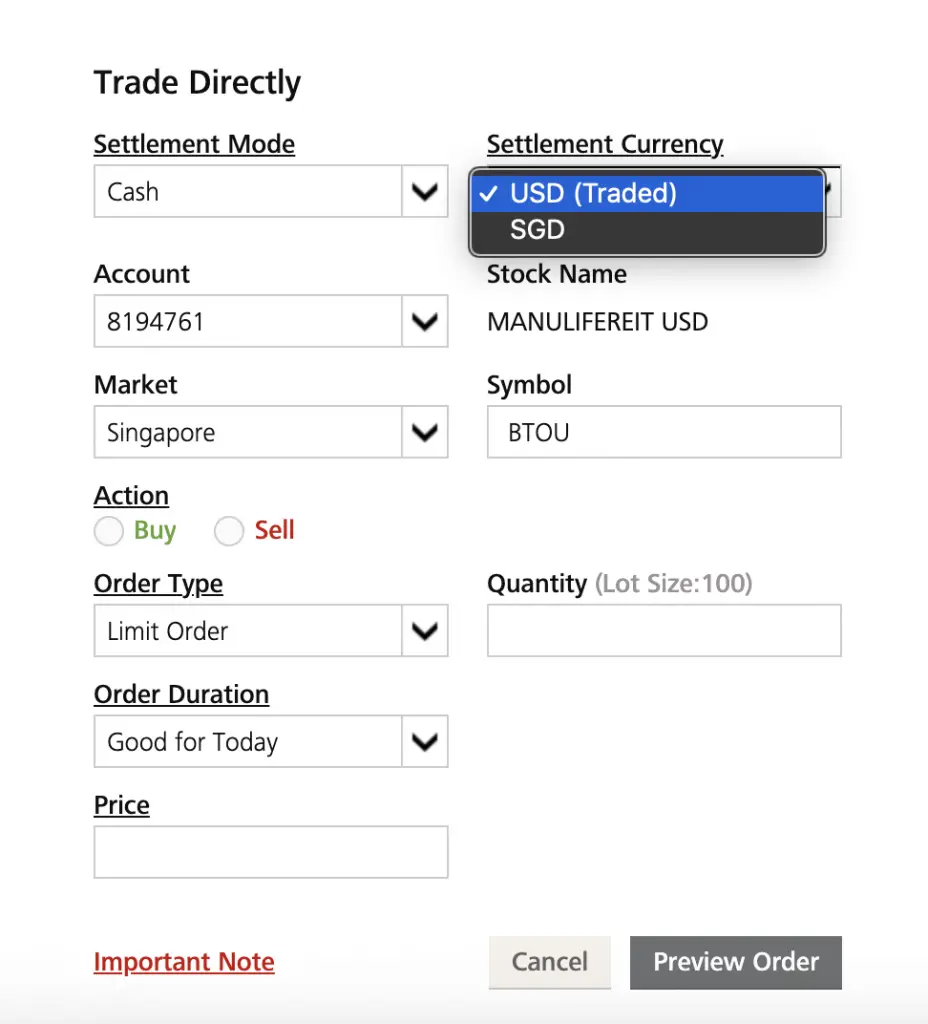

The settlement currency that you can use to make a trade depends on the broker.

For example, there are some brokers like DBS Vickers which allow you to trade in either USD or SGD.

Here’s what each type of settlement currency means:

| Currency | Meaning |

|---|---|

| SGD | Your SGD will be converted to USD using the broker’s spread |

| USD | You are required to deposit USD into your account to make the trade |

You will need to decide which method is better for you! Settling in SGD is more hassle free, but you may not receive a favourable exchange rate.

This is because you will be subject to the broker’s spread! As such, finding a broker with a good spread is important.

This is especially so if you want to invest in these stocks for the long term!

You’ll also need to decide if you want to use your Cash or Cash Upfront account to make the settlement on DBS Vickers!

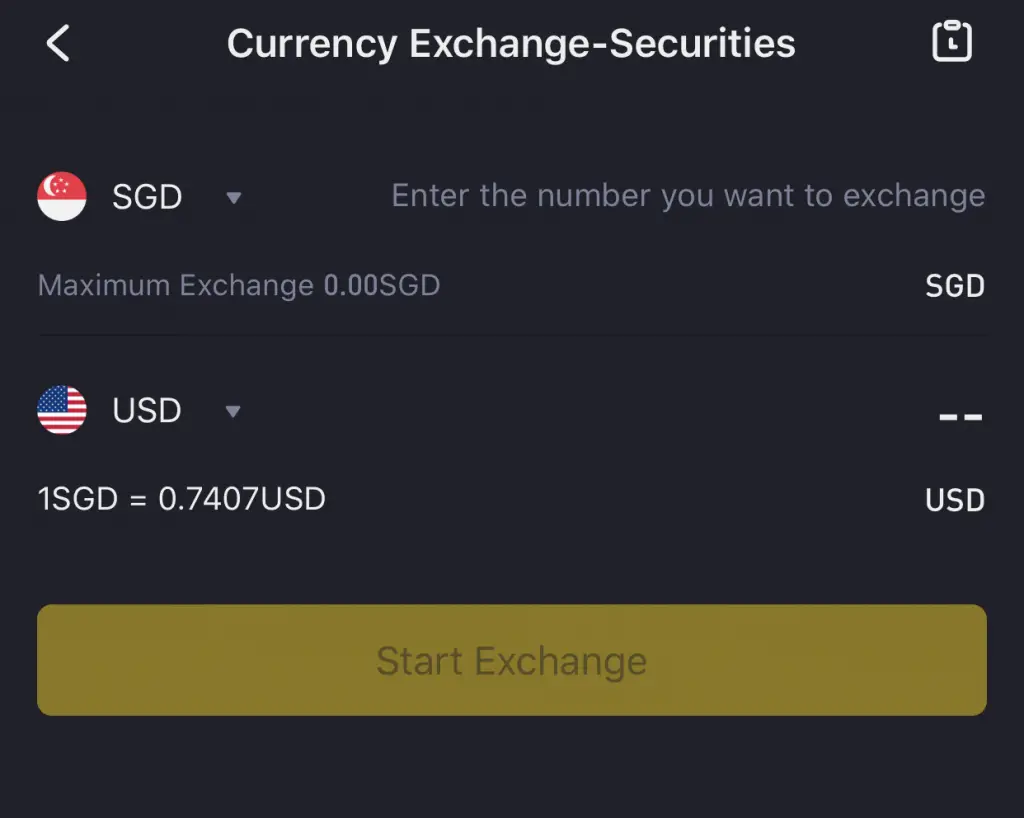

Other brokers require you to exchange currencies on their platform

There are other brokers like Tiger Brokers where you’ll need to manually exchange the currency on their platform.

If you don’t exchange the currency before making a trade, you will incur leverage if you don’t have enough USD!

As such, you would need to deposit SGD into the account. Afterwards, you’ll need to manually exchange it into USD before making your trade.

How do I receive dividends from USD denominated stocks on SGX?

This is similar to how you can make your settlement in different currencies.

For brokers like DBS Vickers, you can receive your dividends either in USD or SGD.

Again, it depends on whether you prefer convenience or the hassle of exchanging money yourself.

However for Tiger Brokers, you will receive the dividends in USD. You will need to manually exchange it to SGD.

This applies to other brokers like Standard Chartered too!

Conclusion

There are quite a few USD-denominated products that are found on the SGX. When you want to purchase them, you will have to consider the settlement currency.

When you choose to settle in SGD, you are subject to the broker’s currency exchange rates. This is usually less favourable than the normal rates. As such, you may lose some of your returns due to these rates.

However, it may be the more convenient option if you only have SGD!

When you choose to settle in USD, you may be able to get slightly better rates elsewhere. If you have multi-currency accounts, these may provide better rates then the brokers’.

It may be more of a hassle, but you might be able to reduce the amount that you lose due to the fluctuating exchange rates!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?