Last updated on June 6th, 2021

There are so many robo-advisors that are available in Singapore. Syfe is one of the more popular ones, while Kristal.AI is not as well known.

How are they different and which one should you be choosing?

Contents

- 1 The difference between Syfe and Kristal.AI

- 2 Type of ETFs used to invest

- 3 Investment strategies used

- 4 Cash management portfolio

- 5 Performance

- 6 Dividend distribution

- 7 Funds you can invest with

- 8 Minimum sum to invest

- 9 Processing time required

- 10 Fees

- 11 Type of account used to handle your assets

- 12 Web platform

- 13 Mobile app

- 14 Verdict

- 15 Conclusion

- 16 👉🏻 Referral Deals

The difference between Syfe and Kristal.AI

Both Syfe and Kristal.AI give you access to US-listed ETFs. Syfe also gives you access to SGX-listed REITs, while Kristal.AI provides access to UCITS ETFs. They mainly differ in terms of their fee structure and the minimum amount to invest.

Here is an in-depth comparison between these 2 robo-advisors:

Type of ETFs used to invest

Both robo-advisors mainly invest in US-listed ETFs. This is because both robo-advisors believe that ETFs provide you with a diversified basket of stocks.

Instead of stock picking, both robo-advisors focus on asset allocation.

Kristal.AI also allows you to invest in UCITS ETFs

Kristal.AI also allows you to invest in UCITS ETFs. These are domiciled in Ireland, which helps to reduce some of the US-related taxes that you’ll incur.

Some of them include the 30% dividend withholding tax and the estate tax!

Kristal.AI gives you access to 10 of these UCITS ETFs:

| Ticker | ETF Name |

|---|---|

| LQDE | iShares $ Corp Bond UCITS ETF |

| IUMO | iShares EdgeMSCI USA MomentumFactr UCITS ETF |

| IB01 | iShares $ Treasury Bond 0-1y UCITS ETF |

| IDTM | iShares $ Treasury Bd 7-10y UCITS ETF |

| FLOA | iShares $ Floating Rate Bd UCITS ETF |

| ICBU | iShares Intermediate Credit Bond UCITS ETF |

| IWDA | iShares Core MSCI World UCITS ETF |

| AT1 | AT1 Capital Bond UCITS ETF |

| IGLT | iShares Core UK Gilts UCITS ETF |

| CSPX | iShares Core S&P 500 UCITS ETF |

Most of these ETFs are bond ETFs. Some of the equity UCITS ETFs you can invest in include IWDA and CSPX.

Syfe’s Equity 100 portfolio does invest in CSPX, which is the UCITS S&P 500 ETF. However, majority of its portfolios still invest in US-listed ETFs.

Syfe REIT+ invests in Singapore REITs directly

Syfe REIT+ is another exception where Syfe invests your funds directly into REITS found in the iEdge S-REIT Leaders Index.

Syfe REIT+ tracks this index directly, without having to invest in an ETF. As such, you will be able to save some management fees!

Investment strategies used

These 2 robo-advisors also use very different investing strategies:

Syfe has different investment strategies for different portfolios

Syfe has 2 main strategies that are used for their different portfolios:

#1 Automated Risk-managed Investments (ARI)

Syfe believes that managing risk is the most important to help you receive good returns.

Their Automated Risk-managed Investments (ARI) strategy helps you to:

- Optimise your returns when the markets are calm

- Limit your losses in volatile times

First, you’ll need to choose your risk level. Syfe’s ARI algorithm will then ensure that your portfolio remains at this risk level.

From time to time, the market conditions may change to become more stable or more volatile. The ARI algorithm will try to limit the amount of fluctuations you may experience.

This ARI algorithm is only applicable to 2 of Syfe’s portfolios:

Other portfolios like Syfe Core do not use this strategy.

#2 Smart beta strategy

Syfe’s Equity 100 focuses on building a smart beta portfolio for you. This is sometimes referred to as factor-based investing.

Syfe aims to provide high returns by concentrating on a few factors. These factors are chosen to ensure that your portfolio will outperform a certain index. Currently, Syfe has selected these 3 factors:

- Growth

- Large-cap

- Low-volatility

Syfe will then select the best ETFs that are weighted towards these factors.

For example, the current portfolio is heavily weighted in the QQQ ETF. This will help to tilt the portfolio towards the growth and large cap factors. Meanwhile, the low-volatility factor is achieved by investing in multiple sector ETFs.

This is different from the original Fama-French 3-factor model, which focused on:

- Size of firms

- Book-to-market values

- Excess return on the market

In the long run, the factors that give the best returns in the future may no longer be these 3 factors.

As such, Syfe has a dynamic factor selection to choose the best factors in the current economic climate. Your portfolio will be over or under-weighted in certain factors to produce the highest risk-adjusted returns.

This helps to ensure that your portfolio will continue to perform in any market condition!

Kristal.AI provides different types of investing strategies

Kristal.AI allows you to invest in 3 different ways:

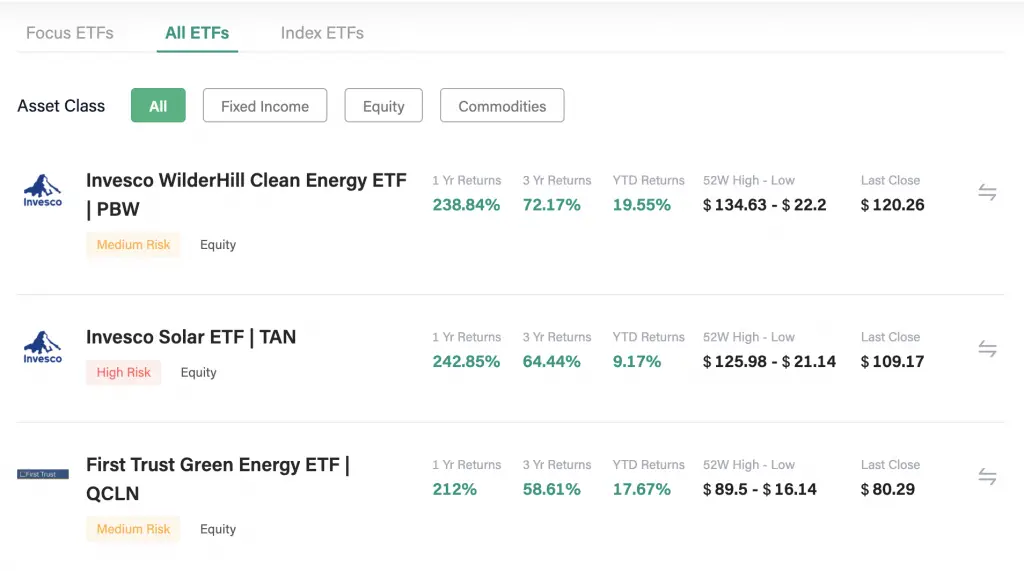

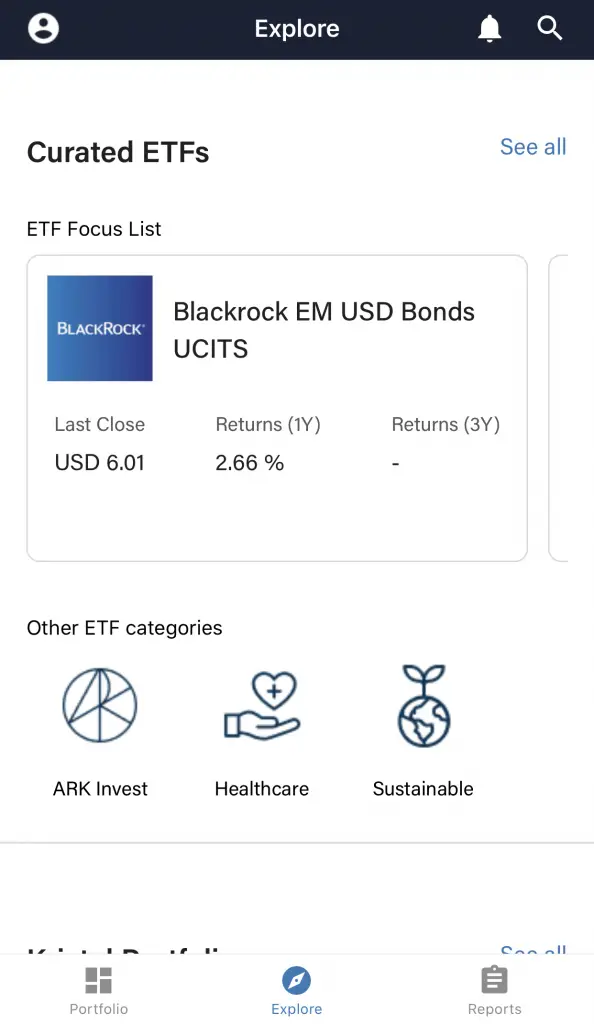

#1 Curated ETFs

Kristal.AI provides you with access to a wide range of ETFs.

This is unlike many robo-advisors which already create a set of portfolios for you. For example, Syfe has created portfolios with a fixed allocation into certain ETFs.

In contrast, you are able to invest into each ETF directly with Kristal.AI!

You are able to find an ETF that is suitable for you based on:

- Risk

- Industry

- Issuer

- Geography

There are many ETFs that you can choose from on Kristal.AI’s platform!

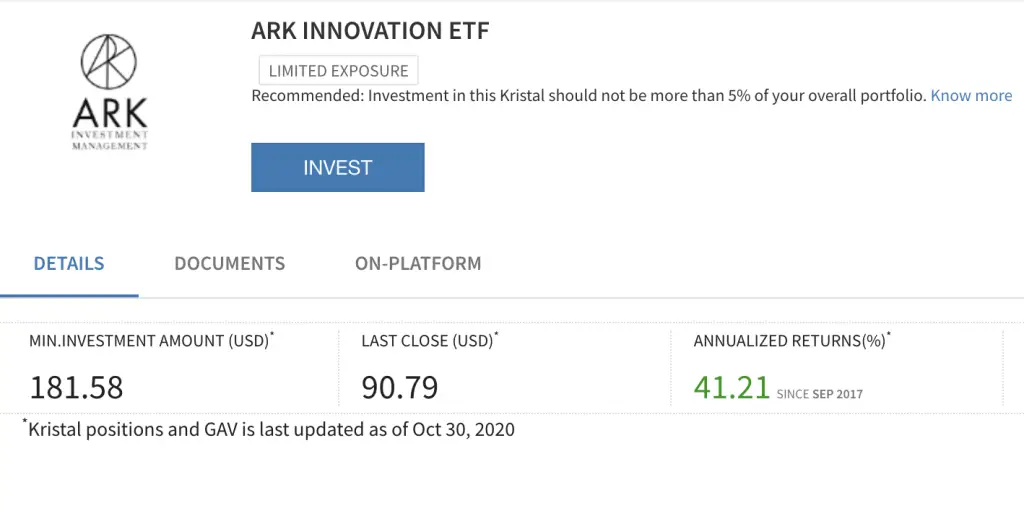

If you do not want to invest using a broker, Kristal.AI provides you with another option to invest in the ARKK ETF or the S&P 500.

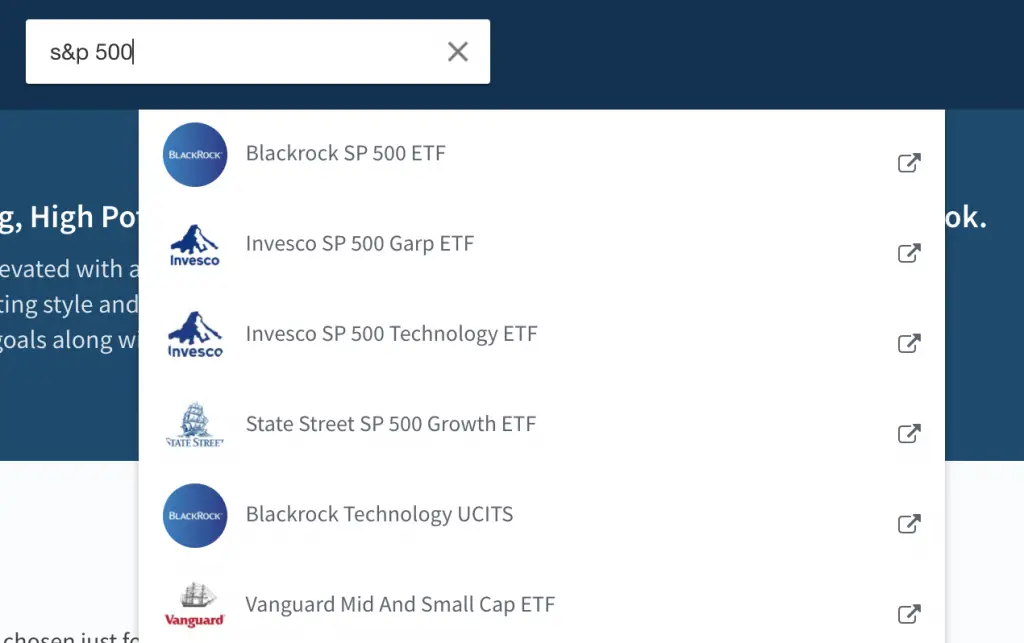

The search function on Kristal.AI’s platform is rather poor

One main issue I have with the ETF platform is the search function.

Kristal.AI does not put the ETF tickers on their platform. They only list the actual name of the ETFs.

As such, it can be quite hard to find the ETF you’re looking for.

For example, if I wanted to search for an S&P 500 ETF, here are the results that I’ll get.

Kristal.AI actually has SPY (SPDR S&P 500 ETF) on their platform. However, it is not showing in the search results!

This can be a rather frustrating experience if you are not familiar with the ETFs’ names.

#2 Kristal Portfolios

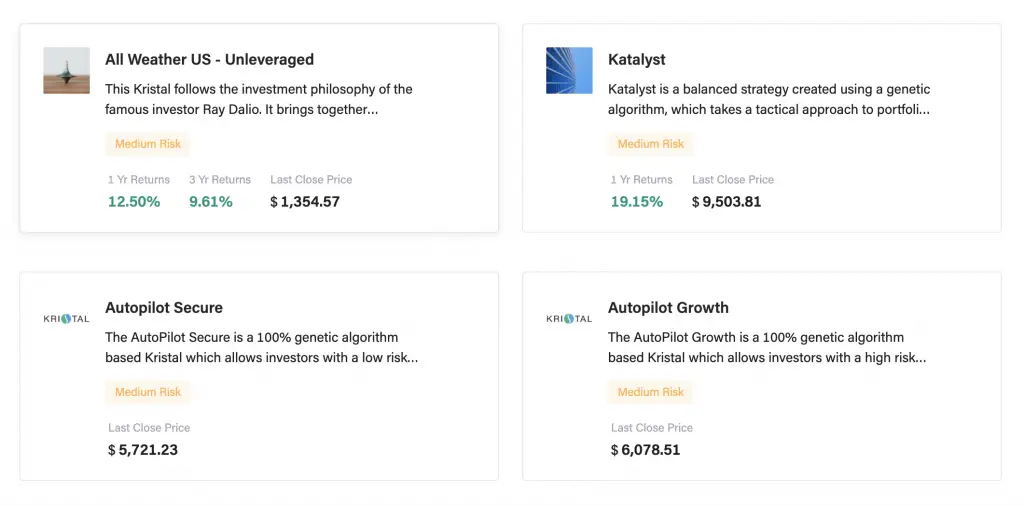

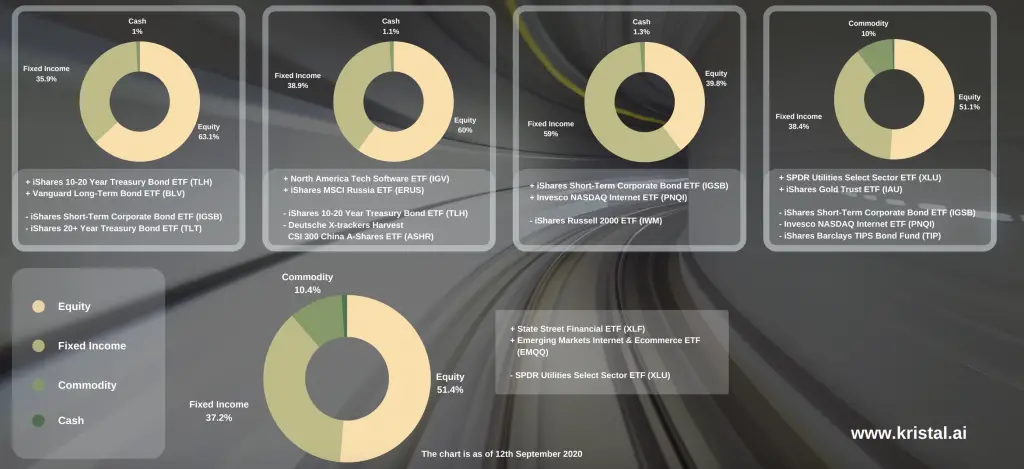

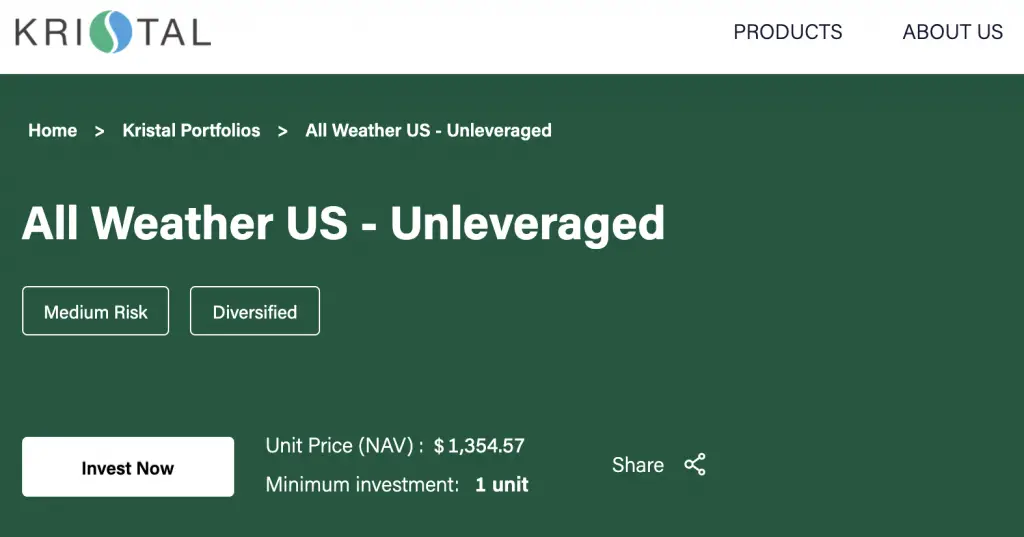

Just like other robo-advisors, Kristal.AI provides you with 4 portfolios to choose from.

This includes:

- All-Weather US Unleveraged

- Katalyst

- Autopilot Secure

- Autopilot Growth

All of these portfolios are created and managed by Kristal.AI’s advisors. Kristal.AI has algorithms which decide which ETFs should be added or removed.

With these algorithms in place, the portfolios seem to be slightly more actively managed.

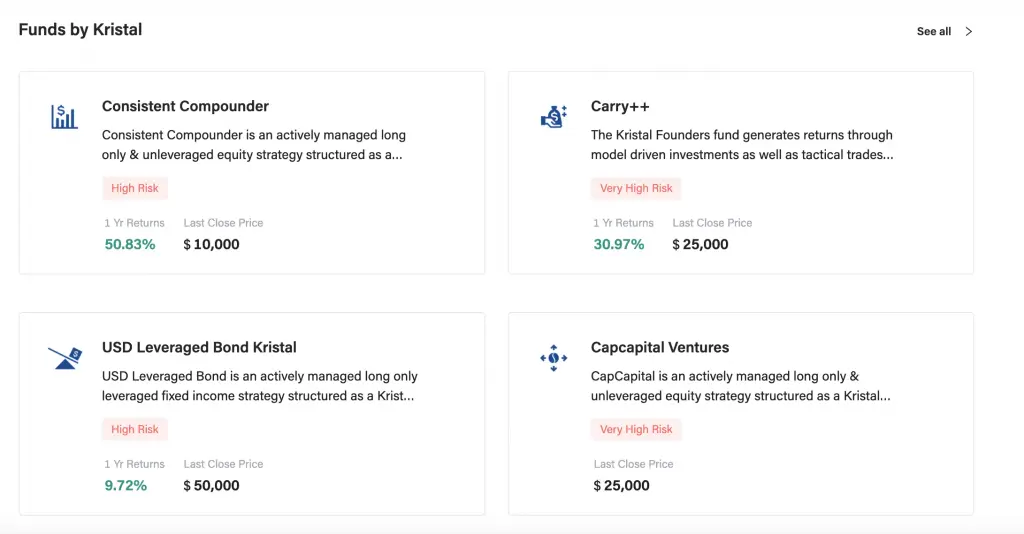

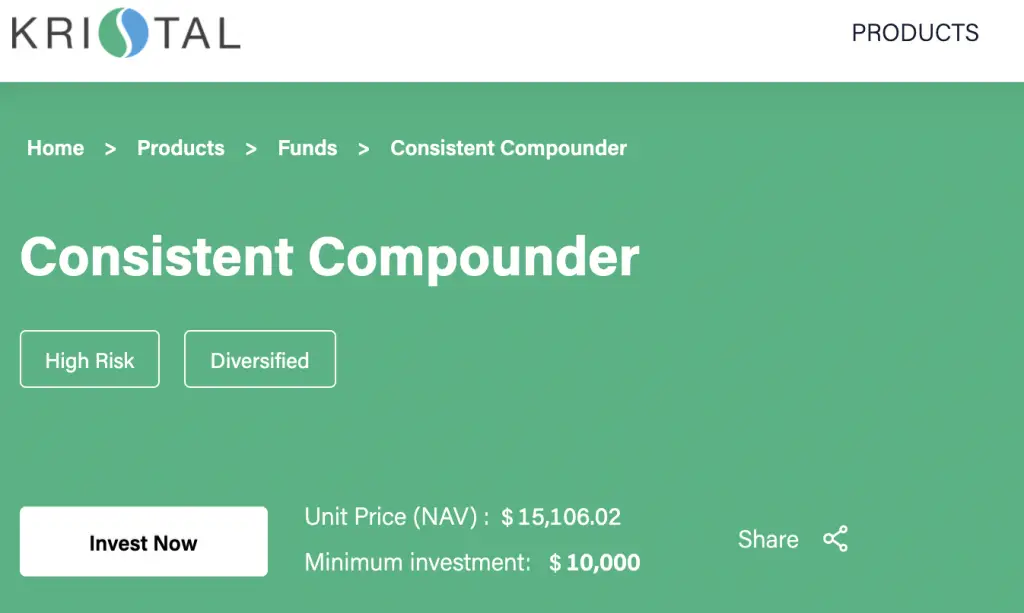

#3 Funds

Kristal.AI also offers some funds on their platform.

However, these funds are only available for accredited investors.

For normal retail investors, you will mainly have access to the single ETFs offered by Kristal.AI.

Cash management portfolio

Syfe has a cash management portfolio (Cash+), while Kristal.AI does not. This portfolio aims to give you a higher return on your savings compared to a bank account.

Syfe Cash+ invests your money into 3 different funds:

- LionGlobal SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund SGD

- LionGlobal Short Duration Bond Fund

Syfe does not charge any management fees and gives you a full rebate on any trailer fees that they receive!

| Gross Return | 1.55% |

| Fund-level Fee | -0.35% |

| Overall Rebates | 0.3% |

| Management Fee | None |

| Projected Return | 1.5% |

You can view my comparison between Syfe Cash+ and StashAway Simple to see which portfolio is better for you.

Performance

Due to the various products that both robo-advisors offer you, it is hard to compare the performance of these 2 advisors.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy of these robo-advisors instead!

Dividend distribution

Both Syfe and Kristal.AI will distribute any dividends that they receive to you.

Since both of them invest in US-listed ETFs, they will be subject to a 30% dividend withholding tax.

The dividends that are distributed to you by Syfe are net of this tax.

For Kristal.AI, you are able to see the amount that you’ve been taxed:

If you invest in the UCITS ETFs on Kristal.AI, you will only incur a 15% dividend withholding tax.

Funds you can invest with

Both Syfe and Kristal.AI only allow you to invest your cash into their portfolios.

This is different from both Endowus and StashAway which allow you to invest your SRS funds. Endowus even allows you to invest your CPF funds with them!

Minimum sum to invest

Here are the minimum sums required to start investing with either robo-advisor:

Syfe has no minimum investment

Syfe stores your funds in a co-mingled account with Syfe’s other customers. This allows you to invest in fractional shares of the various ETFs and REITs that Syfe offers.

As such, Syfe does not have a minimum investment required to start investing with them.

This makes investing extremely accessible, especially if you only have a small sum to invest!

Kristal.AI’s minimum sum depends on the ETF you’re investing in

Kristal.AI has a minimum investment sum of USD$100. However, this also depends on the ETF you’re investing in.

Unlike Syfe, Kristal.AI does not allow you to buy fractional shares. Instead, you can only buy whole units of the ETF.

As such, the minimum amount you can invest in depends on the unit price of the ETF!

If you are investing in an ETF that has a $90 unit price, you cannot purchase 1 unit. This is because you need to invest a minimum of USD$100 each time.

The minimum number of units you can purchase is 2, which amounts to $180 USD for each transaction!

Other ETFs like the SPY ETF have a unit price of around $300 USD. If you wish to invest in this S&P 500 ETF, you’ll have to invest at least $300 USD.

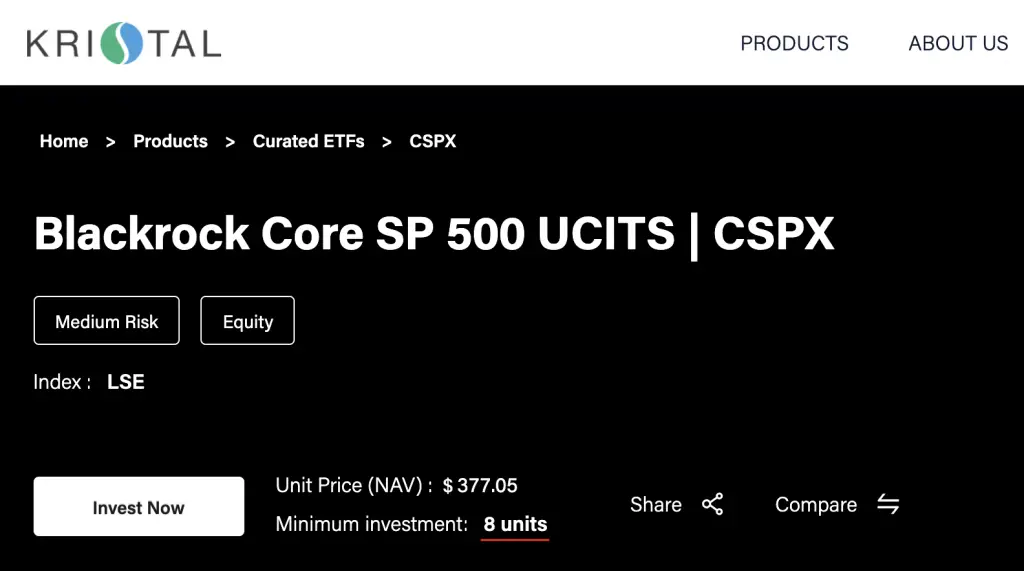

UCITS ETFs have an even larger minimum sum to invest

If you want to purchase a UCITS ETF, the minimum number of units is even higher.

For example, you are required to invest a minimum of 8 units for CSPX, which costs around $300 USD.

This will amount to a $2.4k USD investment!

Kristal.AI’s portfolios and funds have a huge minimum sum too

If you want to invest in Kristal.AI’s portfolios and funds, you need to have a large sum to invest.

Kristal.AI’s All Weather portfolio requires ~USD$1,300 as your minimum investment,

while Kristal’s funds require around USD$10,000 to start!

Kristal.AI is not friendly for beginner investors

With such high requirements, it is not possible for beginner investors with only a small sum to use this platform.

Kristal.AI will be more suitable if you have a larger amount to invest each time!

Processing time required

When you deposit your funds into Syfe or Kristal.AI, it may take a while before your funds get invested.

Syfe takes 1-2 working days

Syfe will take around 1-2 working days to invest your money into the funds that are found in their portfolio.

Once the investment has been fulfilled, it will be reflected on your investment dashboard.

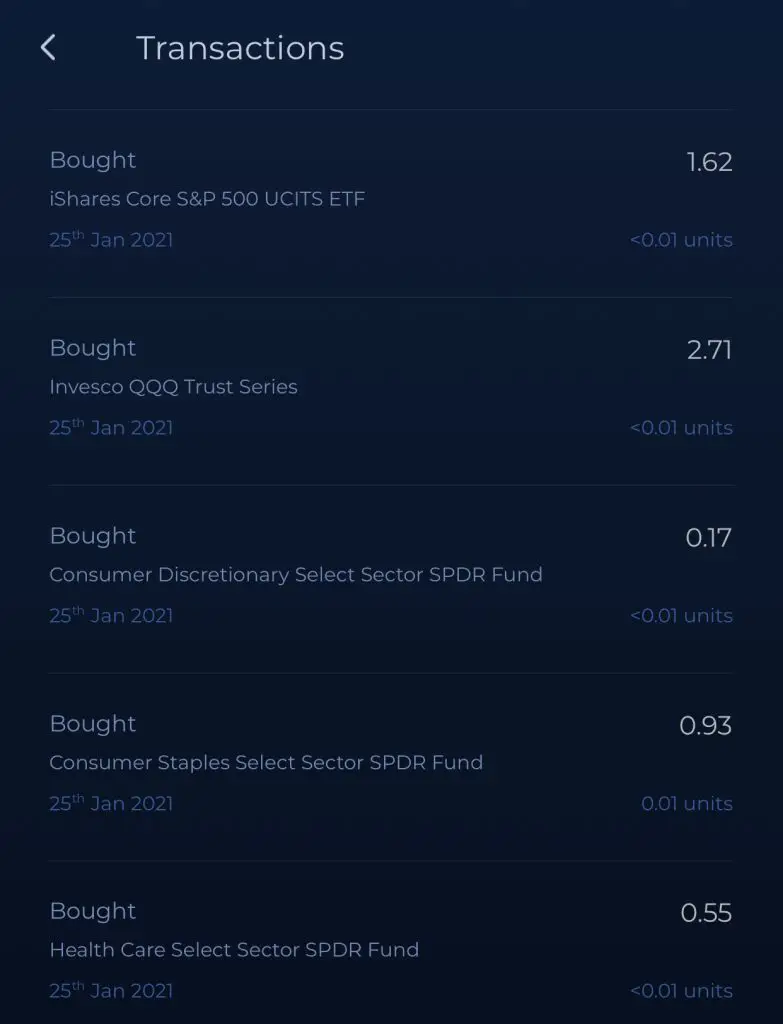

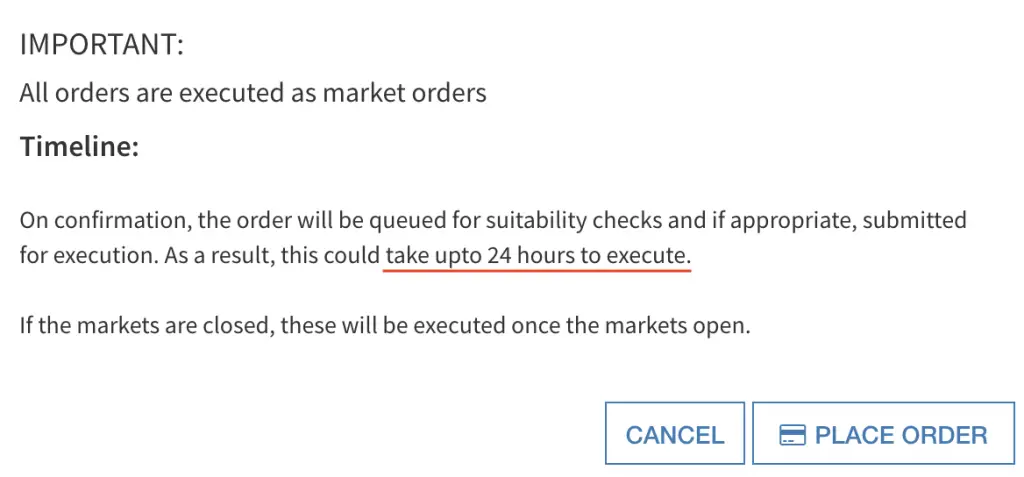

Kristal.AI takes a much longer time

Kristal.AI takes around 2-3 business days to receive your deposit into your account. After that, you will still need to select which funds you want to invest in.

Your order may take up to 24 hours to execute

After placing your order with Kristal.AI, it will take around 24 hours for it to be processed.

There will be a time lag between the time you place the order and when it gets executed.

The NAV that you see on the ETF’s page is based on the last market close price.

During this time, the price of your ETF may fluctuate. The actual price that you purchase your ETF may be higher or lower than this last close price.

Anything can happen in the markets!

As such, you may want to have slightly more cash in your Kristal account than the last close price. This is because Kristal.AI only allows you to invest in whole units.

If the amount in your account is lower than the purchase price, you will be unable to purchase the your ETF!

This is in contrast to the online brokerages like Tiger Brokers, where your trades can be done almost instantly.

Fees

Here are the fees that both robo-advisors will charge you:

Syfe charges you 0.65% for your first $20k

Here is Syfe’s pricing structure:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

Unlike other fee structures, Syfe does not have a tiered fee structure. For example if you have $30k invested with Syfe, you will incur a 0.5% fee on your entire investment amount.

Kristal.AI does not charge any management fees for your first $10k

If you have less than USD$10k in your Kristal Account, you do not have to pay any management fees!

Once your investment amount is above $10k, you will need to pay 0.3% for that amount.

You may need to pay brokerage fees too

Unlike other robo-advisors, you will also incur brokerage fees when you use Kristal.AI:

- US$1 + taxes per trade for US-listed ETFs

- At Actuals for non-US-listed assets

There may be other broker charges that are charged directly to your account by Saxo.

Even though you do not pay any management fees, you will still have to pay a commission for every trade you make.

As such, the fees that you incur with Kristal.AI may not be worth it. This is especially so once your total assets under management exceeds $10k.

Type of account used to handle your assets

Both robo-advisors use different types of accounts to manage your assets:

Syfe uses a co-mingled account

Syfe co-mingles your assets with all of its other customers under one account.

This allows Syfe to purchase fractional shares for your portfolio. While this makes investing very accessible, there may be problems when Syfe closes down.

Your fractional shares may not be able to be sold off in the NYSE and SGX! This is because you can only sell off whole shares and not fractional ones on these exchanges.

As such, you do not have control over the fate of your assets, especially for your fractional shares.

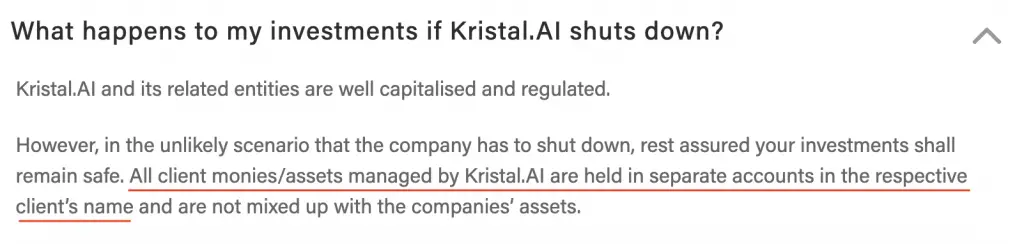

Kristal.AI creates an account under your own name

Under Kristal.AI’s FAQs, they claim to hold your assets in separate accounts in your own name.

Kristal.AI has partnered with both Interactive Brokers and Saxo to perform your trades. As such, your assets should be held in accounts under your own name with these brokers.

Moreover, Kristal.AI does not allow you to trade fractional shares. In the event that Kristal.AI closes down, you will still have full control over your assets.

Kristal.AI will help you to transfer your assets to another broker, so that you can still manage them.

You can see how different types of custodian accounts will affect your funds in my analysis of why Smartly closed down.

Web platform

Here is how Syfe’s web platform looks like,

and how Kristal.AI’s platform looks like.

I do not really like the user experience I had with Kristal.AI. The platform is slightly laggy, and it is hard to navigate around.

Overall, Syfe’s platform is much easier to use, especially if you’re a beginner investor!

Mobile app

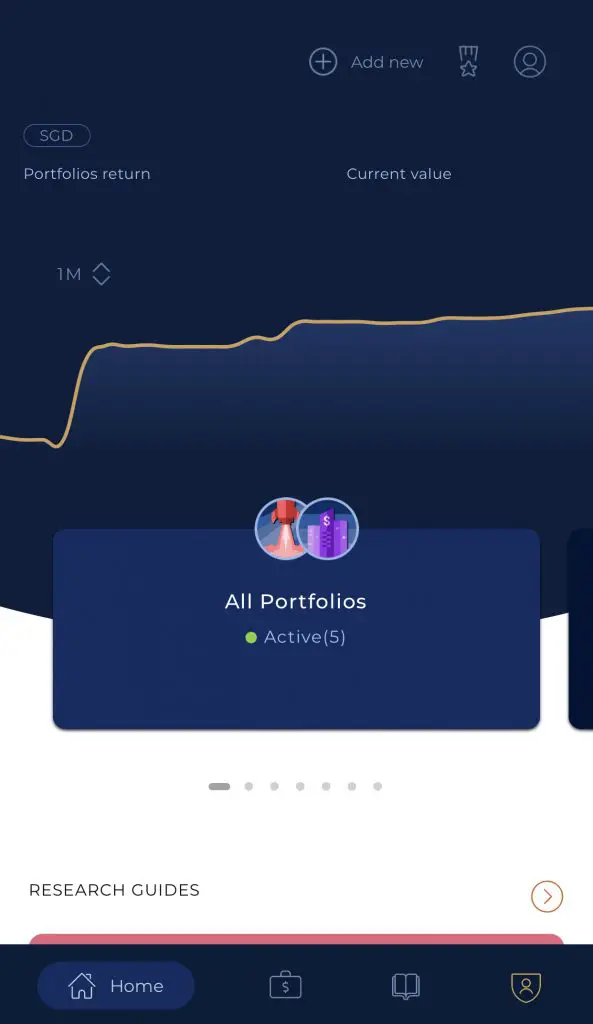

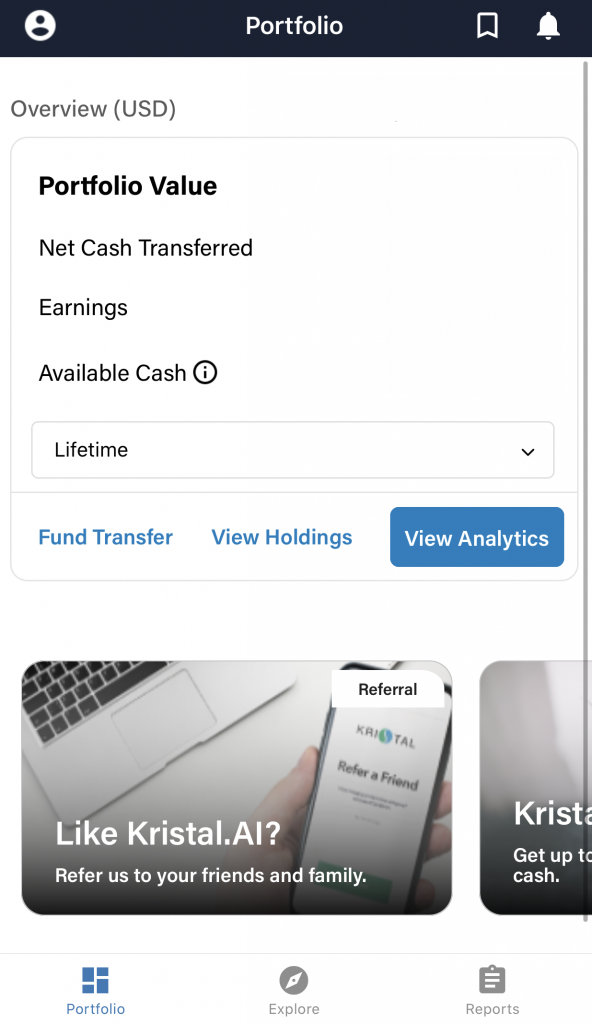

Both robo-advisors also have a mobile app too. Here’s how Syfe’s app looks like,

and how Kristal.AI’s app looks like.

Kristal.AI’s app does not show any graphs, unlike Syfe’s app. Instead, it mainly shows you the ETFs and portfolios available for you to invest in.

Verdict

Here’s a breakdown between Syfe and Kristal.AI:

| Syfe | Kristal.AI | |

|---|---|---|

| Type of Product | ETFs or REITS | ETFs (US-listed or UCITS) |

| Investment Strategy | ARI Smart Beta | Curated ETFs Kristal Portfolios Funds |

| Cash Management Portfolios | Syfe Cash+ | None |

| Dividend Distribution | 30% tax for US | 30% tax for US 15% tax for Irish ETFs |

| Funds to Invest | Cash only | Cash only |

| Minimum Sum to Invest | None | USD$100 per transaction (Minimum depends on unit price of each ETF) |

| Processing Time | 1-2 days processing after deposit is made | 1-2 days to receive deposit 24 hours to execute trade |

| Fees | 0.4-0.65% | Free for first $10k 0.3% for subsequent amounts US$1 per trade |

| Type of Account to Handle Assets | Co-mingled | Account under your own name |

| Platform User Interface | Easy to use | Can be improved |

So which robo-advisor should you choose?

Choose Syfe if you have a lower investment amount

Syfe is great if you’re just starting out and do not have a large sum to invest. With its pretty affordable fees, it is a great way for you to start your investment journey.

Moreover, Syfe offers very specialised portfolios like Equity 100 and REITS+. These portfolios invest in specific asset classes that can form a part of your entire investment portfolio!

Choose Kristal.AI if you want to invest in specific ETFs

Kristal.AI will be more suitable if you want to invest in specific ETFs. They have a wide variety of ETFs (both US and UCITS) for you to choose from.

However, it does take quite a while for your investments to be processed. During this lag time, the unit price of the ETF may increase.

In the end, there might not be many compelling reasons why you would want to invest with Kristal.AI. Their offerings also seem to be geared towards individuals with a higher net worth, instead of the everyday investor.

If you want to purchase US-listed ETFs, you may want to consider brokers like Tiger Brokers instead!

Conclusion

Both robo-advisors have their own strengths which cater to different kinds of investing needs.

The main considerations that you should have when choosing between these 2 platforms are:

- The amount of money you are able to invest

- The investment strategy you agree with

- The fees you are willing to pay

- How fast you want your orders to be processed

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?