Last updated on June 6th, 2021

With interest rates on bank accounts being really low, you may want to look for alternatives to store your funds.

2 of the more popular options include Syfe Cash+ and Dash PET.

How do they differ and which one should you choose?

Contents

The difference between Syfe Cash+ and Dash PET

Syfe Cash+ is a cash management portfolio, while Dash PET is an insurance savings plan. Dash PET provides a slightly better rate of return (only for the first year). Meanwhile, Syfe Cash+ gives you more flexibility as you do not have to meet that many conditions.

Here is an in-depth comparison between these 2 accounts:

Type of account

Syfe Cash+ is a cash management portfolio. Syfe invests your money into funds that contain the following assets:

- Short-term fixed deposits

- Short-term bonds

- Commercial bills

These assets allow you to earn a higher yield compared to leaving it in your savings account!

Meanwhile, Dash PET is an insurance savings plan provided by Singtel Dash.

However, the actual insurance policy is underwritten by Etiqa, an insurance company.

This plan provides you with insurance for certain conditions, such as:

- Death (105% of Account Value)

- Financial assistance benefit for COVID-19

Since this is a life insurance plan with a ‘sum assured‘ payout, you are able to make multiple claims from your insurance policies.

You are also able to earn a decent return rate on your savings too.

It is important to note that neither account is a savings account nor a fixed deposit!

Yield rates

Here are the projected yields that you’ll earn from each account, based on the amount that you have inside:

| Amount | Syfe Cash+ | Dash PET |

|---|---|---|

| $0 – $10,000 | 1.5% | 1.3% (1st year) |

| ≥ $10,000 | 1.5% | 0.3% (1st year) |

The yield rate for Syfe Cash+ is slightly higher compared to StashAway Simple’s yield.

Syfe Cash+’s yield depends on the funds’ performances

The yields you receive from Syfe Cash+ are not guaranteed.

Syfe recently lowered its projected yield from 1.75% to 1.5% to reflect the low interest rate environment we are in.

However, this is a projected yield. There is a possibility that the underlying funds in Syfe Cash+ may perform better or worse than this projected yield!

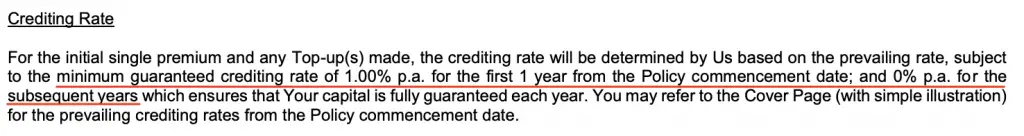

Dash PET’s crediting rate is not fixed

Dash PET has a slightly different crediting rate. For the first year, there are two situations. If you signed up before 27 April 2021, you can receive a guaranteed 1% rate, with a bonus of:

- 0.7% for the first $10k

- 0.2% for any amounts above $10k

However, from that date onwards, the interest rates have changed to:

- 1.3% for the first $10k

- 0.3% for any amounts above $10k

You may want to take note that both of these crediting rates are only guaranteed for the first year after you’ve started the policy.

After that, Dash PET has a guaranteed crediting rate of 0%!

Etiqa may also choose to change the crediting rate if market conditions are poor.

As such, you’ll want to consider the volatility of this crediting rate!

Investment of your funds

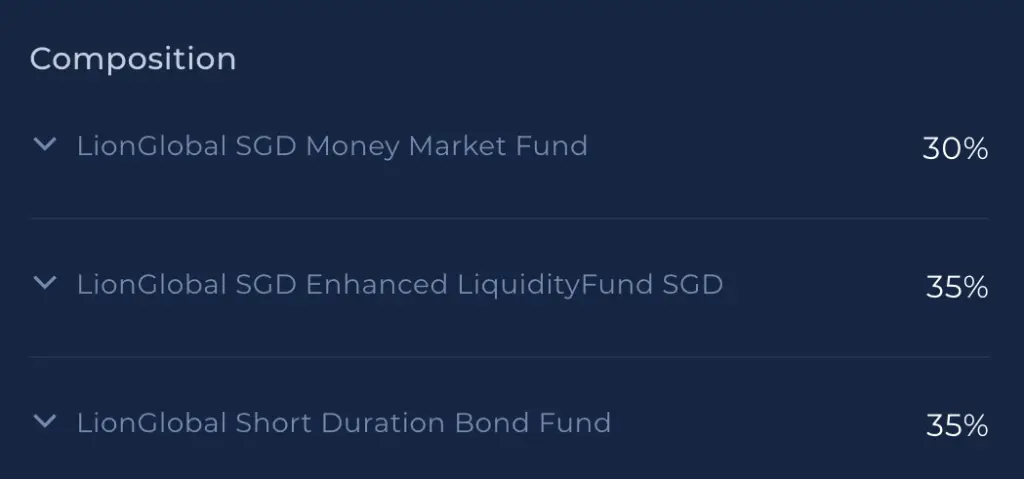

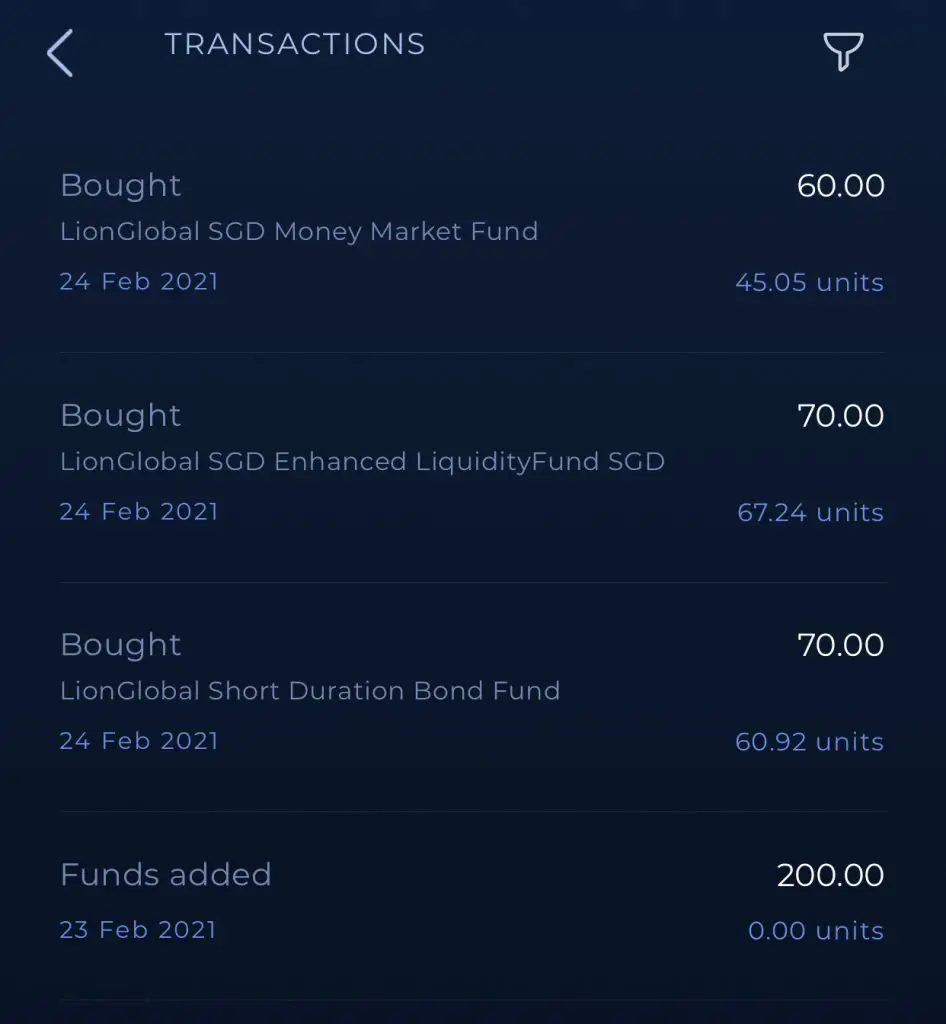

Syfe Cash+ invests your money into 3 funds:

- LionGlobal SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund

- LionGlobal Short Duration Bond Fund

For simplicity, they are just a platform that gives you access to these funds!

On the other hand, for Dash PET, Etiqa does not disclose where they invest your funds into. It should most likely be short-term bonds.

This could explain how they are able to give you a rather high yield for your first $10k!

Crediting of yield

For Syfe Cash+, your money is invested into the 3 funds that form the portfolio. These funds are mutual funds.

As such, each unit that you purchase will have a net asset value.

Mutual funds will only update their net asset value at the end of each trading day. This means that if the fund has increased in value, your portfolio will increase too!

You can see how your Cash+ portfolio changes in value each day. However, I would not advise you to do so, as you may want to withdraw your funds whenever you see it going down in value.

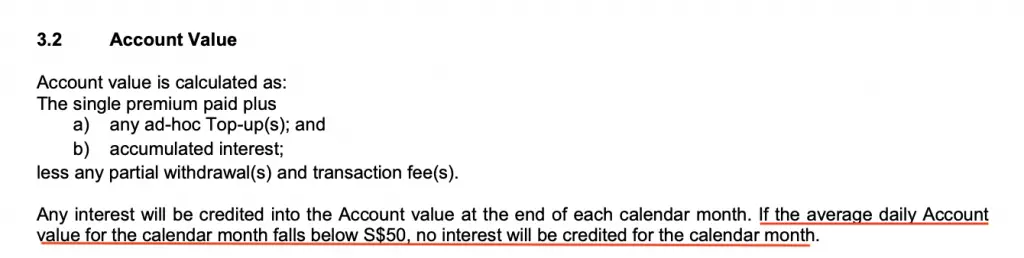

For Dash PET, your returns are calculated daily based on the crediting rate.

However, the returns will only be credited on the 1st of every calendar month.

This is similar to how a bank account works.

Are the funds capital guaranteed?

Syfe Cash+ is not a capital guaranteed investment as it invests your money into individual mutual funds.

As such, the returns you receive from Cash+ depends on the performances of those funds.

However, the funds that Syfe invests in are relatively safe. Even if you have negative performances in one day, you should still receive a net positive return in the long run.

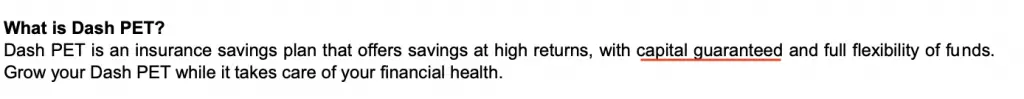

Meanwhile, Etiqa states that Dash PET is capital guaranteed in the policy form.

As such, Dash PET gives you slightly more assurance if you are more risk-averse.

Minimum amount

For Syfe Cash+, you do not need a minimum amount to start using the platform. You can even invest $1 into the portfolio!

Meanwhile for Dash PET, you are required to put in a minimum of $50 to receive the interest credit each month.

The minimum amount is really low, so you should be able to meet the requirement.

If your total amount falls below $50, any interest you earn will be forfeited!

Speed of deposits

When you deposit your funds into Syfe Cash+, you can do so by a few methods:

- FAST transfer

- PayNow

Syfe takes about 2-4 business days to receive your deposits. After that, they’ll still need to invest your money into the 3 funds!

This may take another day or so.

Meanwhile for Dash PET, there are 3 ways that you can deposit your funds:

- Dash Wallet

- PayNow

- eNETs

The minimum top-up using your Dash wallet or PayNow is $1. If you choose to top up via eNETS, the minimum top-up amount is $50.

All these methods will credit your funds instantly into Dash PET. As such, you can start to earn interest almost immediately!

Withdrawals

When you submit a withdrawal request to Syfe Cash+, it may take 2-5 business days before your funds are credited to your bank account.

This takes quite a while before you receive your funds! Due to this poorer liquidity, I would not suggest leaving your emergency funds with Cash+.

Nonetheless, it is possible for you to leave a portion of your emergency funds inside Cash+. Just don’t leave your entire emergency fund inside!

Dash PET may have faster withdrawals

When you want to withdraw from Dash PET, you can use 2 methods:

- PayNow

- Transfer to Dash Wallet

When you make a transfer to PayNow, you will incur a withdrawal fee of $0.70. However, since you can withdraw funds to your Dash Wallet freely, you may want to use that method instead!

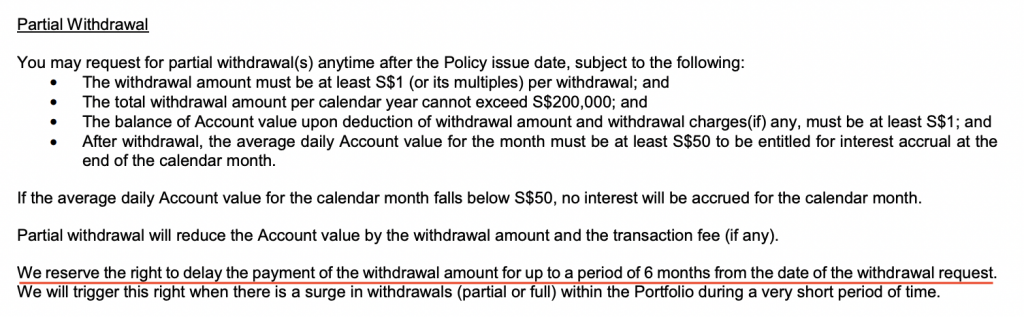

Most of the time, the withdrawal should be almost instant. However, Etiqa has included this clause in their policy:

As mentioned above, Etiqa may delay your withdrawal for up to 6 months if there is a surge of withdrawals!

This may be a bit worrying for you. Furthermore, Etiqa has included this same clause in their previous policies, such as:

I think this condition is more of a fail-safe, in the event that a huge surge of withdrawals happen! For most cases, I do not think they will take that long to process your withdrawal request.

Fees

For Dash PET, you will only be charged a $0.70 transaction fee if you choose to withdraw via PayNow.

However, for Syfe Cash+, you will not be charged any fees when you are using the account.

Then again, you will need to pay an expense ratio for the funds that you hold with Syfe Cash+.

| Fund | Expense Ratio |

|---|---|

| LionGlobal SGD Money Market Fund | 0.35% |

| LionGlobal SGD Enhanced Liquidity Fund | 0.36% |

| LionGlobal Short Duration Bond Fund | 0.34% |

Based on the portfolio allocation of these funds, you are expected to pay a total of 0.35% in fees.

The good thing is that Syfe has already taken these expense ratios into account. The projected yield that you receive is after the deduction of any fees.

Syfe also provides you with a trailer fee rebate too!

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

Syfe provides you with a 0.30% rebate. Essentially, you are only paying 0.05% in fees!

In brief, this is how you are able to obtain the 1.5% yield:

| Returns or Fees | Total Yield |

|---|---|

| Projected Return | 1.55% |

| Fund-Level Fees | (0.35%) |

| Trailer Fee Rebate | 0.3% |

| Platform Fees | 0% |

| Net Return | 1.5% |

Safety of your funds

You may be wondering how safe your funds are with either account. Here’s what you need to know:

Syfe has a Capital Markets Service Licence

Syfe holds a Capital Markets Service Licence that is issued by the MAS.

Under this licence, your funds with Syfe have to be kept separately from Syfe’s accounts.

In the even that Syfe shuts down, you will still be able to have access to your funds!

Usually there will be 2 choices that you can make:

- Sell off your holdings at the current market price or

- Transfer your holdings to another custodian that takes over Syfe

If Syfe closes, it may not matter that much if you only invest in Syfe Cash+. This is because mutual funds can be traded in fractional units.

However, you may use some of their investment portfolios, including:

Syfe allows you to invest in these ETFs with fractional units. This may pose problems when Syfe shuts down.

You may read my analysis on why Smartly closed down to find out more.

Dash PET is protected by the SDIC

Since Dash PET is a life insurance plan, it is insured under the Singapore Deposit Insurance Scheme (SDIC).

In essence, your funds in Dash PET are protected by the Policy Owner’s Protection Scheme.

In the event that Etiqa shuts down, your funds may be insured up to $100k.

This should give you some reassurance that your funds are rather safe with Etiqa!

Verdict

Here is a comparison between Syfe Cash+ and the Dash PET:

| Syfe Cash+ | Dash PET | |

|---|---|---|

| Type of Account | Cash Management Portfolio | Insurance Savings Plan |

| Yield Rate | 1.5% | For first year: 1.3% (first $10k), 0.3% (≥ $10k) |

| Crediting of Yield | Daily (depends on market performance) | Monthly |

| Are Funds Capital Guaranteed? | No | Yes (minimum crediting rate is 0% after 1st year) |

| Minimum Account Amount | None | Minimum balance of $50 |

| Minimum Top Up And Withdrawal Amount | None | $1 for both top ups and withdrawals, except for eNETS ($50) |

| Speed of Deposits | 2-4 business days | Almost instant |

| Speed of Withdrawals | 2-5 business days | Almost instant, but may be up to 6 months |

| Fees | 0.05% (after trailer fee rebate) | $0.70 transaction fee if withdrawing funds via PayNow |

| Safety of Funds | Licensed by MAS (CMS Licence) | Insured under SDIC |

So which account should you use?

Use Syfe Cash+ for more predictable returns and a higher crediting rate

Syfe Cash+ has a slightly more predictable return rate. This is because they will invest your money into rather low-risk funds.

Those funds should provide continuous and stable returns in the long run.

In addition, they have a higher interest rate of 1.5% compared to 1.3% for Dash PET.

Still, the rate of return is very dependent on the prevailing interest rates. If interest rates continue to be low, there may be a chance that Syfe may lower the projected yield subsequently.

On the flip side, the time taken to withdraw your funds is much longer compared to Dash PET. Due to this poorer liquidity, I would suggest using Syfe Cash+ if you are intending to save for a long-term goal.

Use Dash PET for faster withdrawals

Dash PET does provide faster withdrawals compared to Syfe Cash+. However, there may be a chance that your withdrawal may be delayed by up to 6 months!

As such, Dash PET is less liquid compared to a bank account. I would not recommend placing your entire emergency fund inside Dash PET.

That said, it is possible for you to leave some inside as part of a tiered emergency fund strategy!

Conclusion

Both Syfe Cash+ and Dash PET are good ways of ensuring that your cash reserves do not erode due to inflation.

Syfe Cash+ seems to have lesser conditions compared to Dash PET. Moreover, you are able to freely deposit and withdraw from the account.

Having said that, Dash PET provides faster withdrawal than Syfe Cash+.

Ultimately, the rate of returns between both accounts are rather comparable. As such, you could also use both accounts together.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

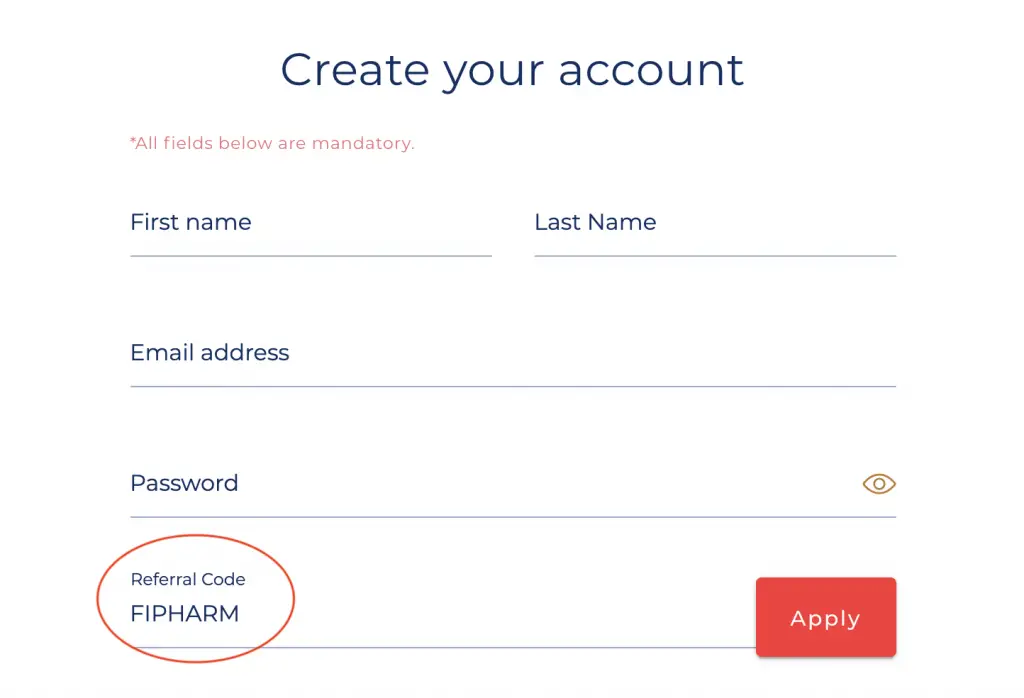

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 3 months.

You will be able to save up to $75 worth of fees!

This applies only to the money that you’ve invested in Syfe’s 3 portfolios. If you are using only Syfe Cash+, you will not be charged any fees by Syfe!

You can view more information about this referral program on Syfe’s website.

Dash Referral (Receive 800 Welcome Bonus Points)

If you are interested in signing up for Singtel Dash, you can use my referral link to sign up.

Alternatively, you can use my referral code ‘DASH-R1W67‘.

You will be able to receive 800 welcome bonus points once you either make a:

- Dash payment or

- Singtel prepaid top-up (minimum $10)

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?