Last updated on January 2nd, 2022

When you are looking to use a brokerage platform to buy stocks, 2 platforms you may come across include Tiger Brokers and Standard Chartered.

How are these platforms different and which should you choose?

Here’s what you need to know:

Contents

- 1 The difference between Tiger Brokers and Standard Chartered

- 2 Type of Products Available

- 3 Types of Exchanges Available

- 4 Fees

- 5 Exchange Rates

- 6 Pre and aftermarket trading

- 7 App and Platform Experience

- 8 Ease of Opening Account

- 9 Deposits and Withdrawal

- 10 Type of Custodian Account

- 11 Verdict

- 12 Conclusion

- 13 👉🏻 Referral Deals

The difference between Tiger Brokers and Standard Chartered

Tiger Brokers charges you lower commissions for every trade that you make on the platform. However, Standard Chartered provides you with greater access to more exchanges, particularly the London Stock Exchange (LSE).

Here is an in-depth comparison between these 2 brokerages:

Type of Products Available

Both brokerages offer different kinds of products:

Tiger Brokers offers basic products for your trading needs

You can buy the standard products from the different exchanges using Tiger Broker’s platform. This includes:

- Stocks

- ETFs

- Mutual funds

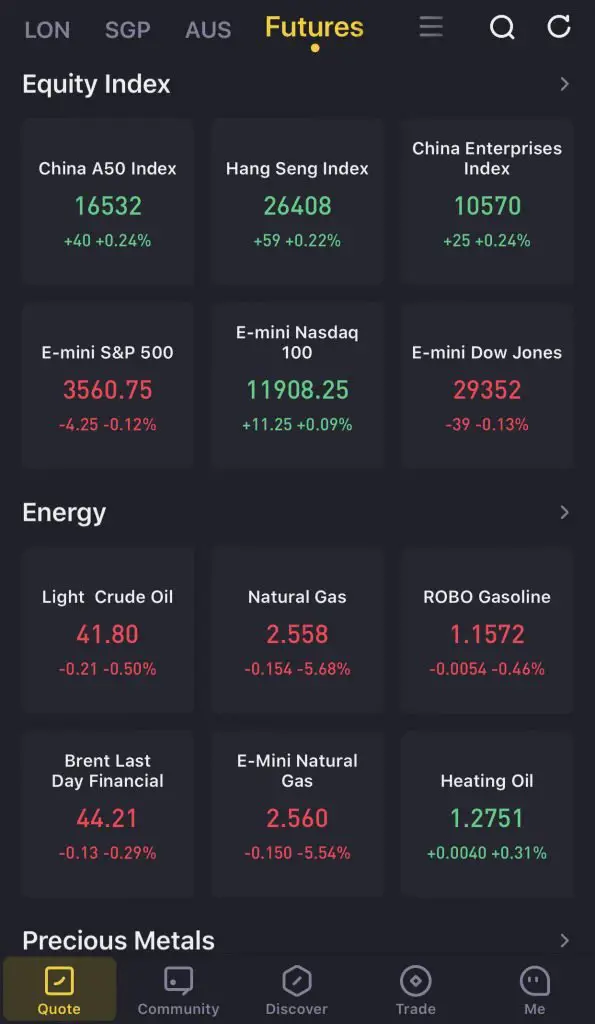

Tiger Brokers also offers you futures and options trading

You are can trade futures and options on Tiger Broker’s platform, which is not available on Standard Chartered.

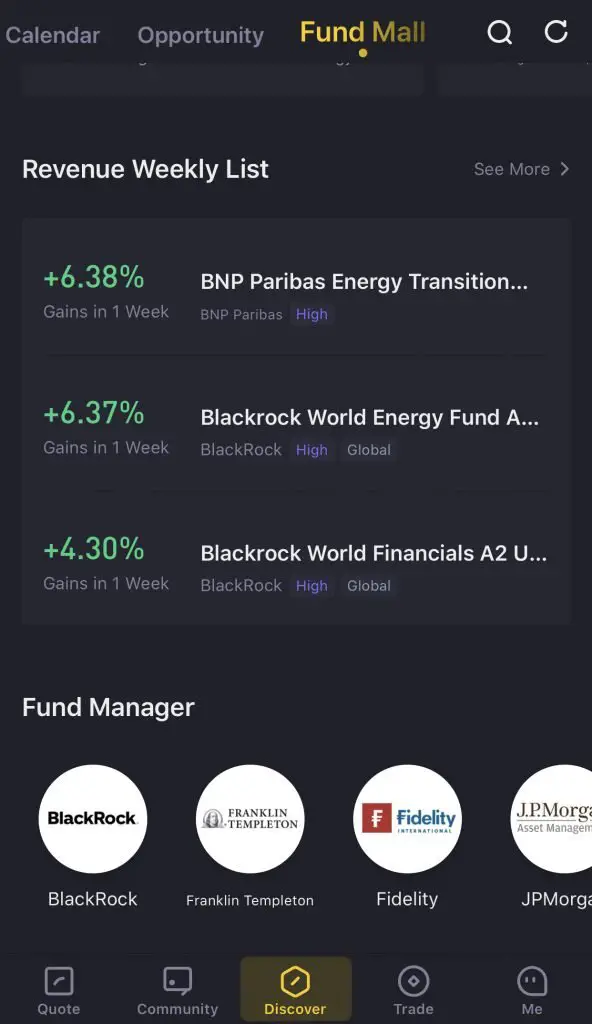

You can also buy mutual funds with Fund Mall

Tiger Brokers has a Fund Mall, where you can buy mutual funds from it. However, the offering is much more limited compared to FSMOne’s.

Standard Chartered only allows you to trade in equities

Standard Chartered only allows you to trade in equities that are listed on the stock exchanges.

As such, you can only buy:

- Stocks

- ETFs

Types of Exchanges Available

Here are the different exchanges that you are able to trade on using both platforms:

| Tiger Brokers | Standard Chartered | |

|---|---|---|

| SGX | ✓ | ✓ |

| HKEX | ✓ | ✓ |

| US | ✓ | ✓ |

| ASX (Australia) | ✓ | ✓ |

| SZSE and SSE (China) | ✓ | ✕ |

| LSE (UK) | ✕ | ✓ |

| SWX (Switzerland) | ✕ | ✓ |

| AMS (Netherlands) | ✕ | ✓ |

| XETR (Germany) | ✕ | ✓ |

| PAR (France) | ✕ | ✓ |

| TSE (Japan) | ✕ | ✓ |

The main advantage is that Tiger Brokers gives you access to the Shanghai and Shenzhen exchanges.

Meanwhile, Standard Chartered gives greater access to the different European exchanges.

The exchange that most Singaporeans may be interested in is the London Stock Exchange (LSE). You are able to buy Irish-domiciled ETFs that help to reduce your taxes in 2 ways:

- Reduce your dividend withholding tax (30% to 15%)

- Reduce the estate taxes that you incur

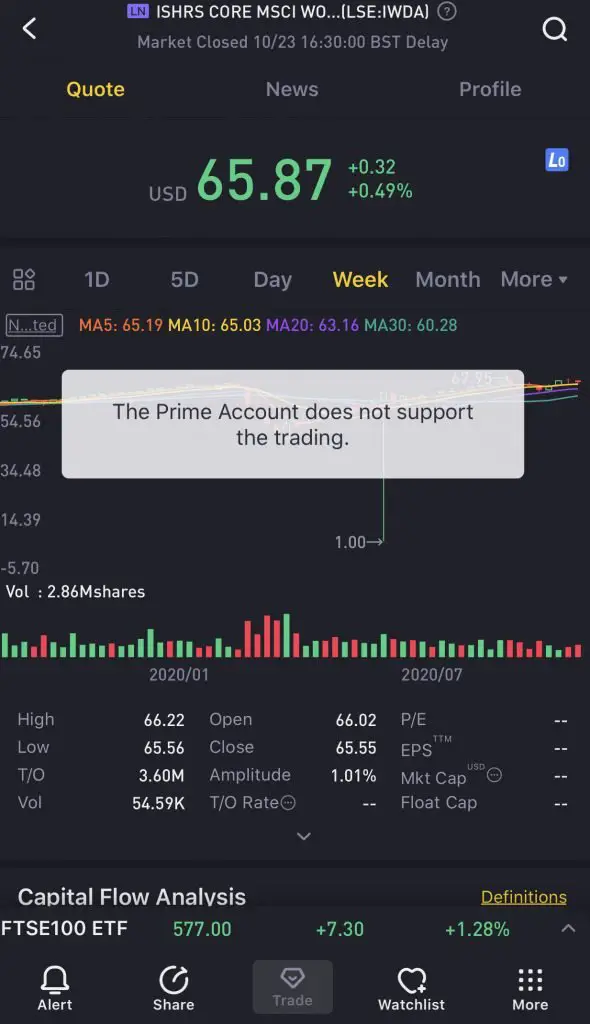

Tiger Brokers has the LSE listed on their platform. However, you can’t trade equities that are listed on the LSE.

Fees

Here are the fees that each broker charges for the similar exchanges:

| Tiger Brokers | Standard Chartered | |

|---|---|---|

| SGX | 0.08% * trade value No minimum (until 31 Dec 2021) Min $2.88 SGD/trade (after 31 Dec 2021) | 0.20% * trade value Min $10 SGD |

| HKEX | 0.06% * trade value Min 15 HKD/trade | 0.25% * trade value Min $100 HKD |

| US | 0.01 USD/share Min 1.99 USD/trade | 0.25% * trade value Min $10 USD |

| ASX | 0.10% * trade value Min $8 AUD | 0.25% * trade value Min $10 AUD |

Tiger Brokers charges the lower commissions for all of the common exchanges! Both the commission per trade and the minimum amount are all lower.

Moreover, Standard Chartered charges GST on your trade commission. This will increase the fees that you pay when trading on their platform!

In terms of fees, Tiger Brokers provides the much cheaper option.

Fees incurred for trading in respective exchanges

On top of the fees that you pay for each platform, you will be charged exchange-specific fees as well. These fees are the same across both brokerages.

The complete fee schedule can be seen on Standard Chartered’s website.

Exchange Rates

If you wish to trade in overseas stocks, you will have to exchange your SGD for a foreign currency.

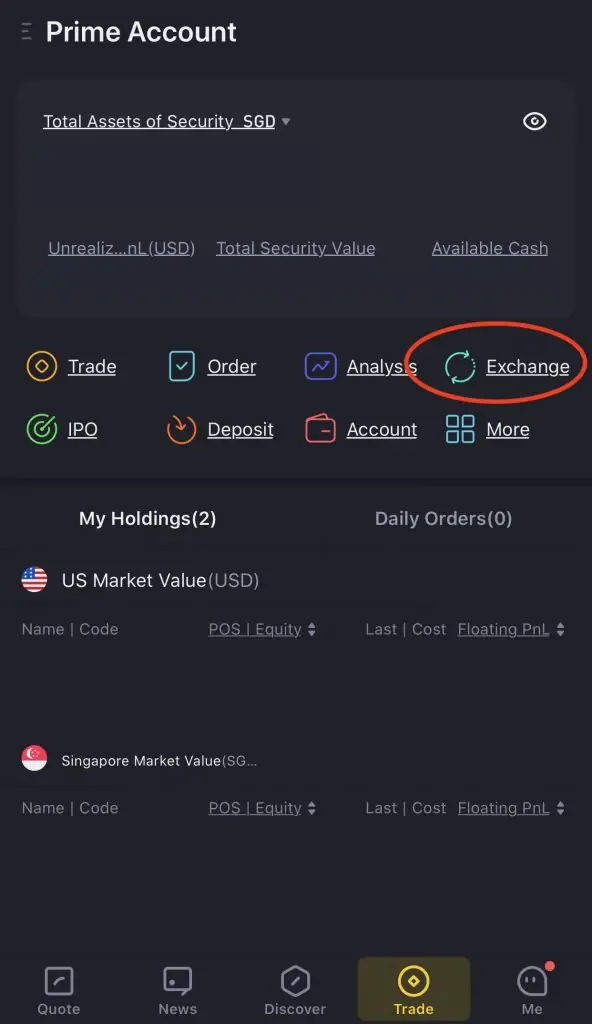

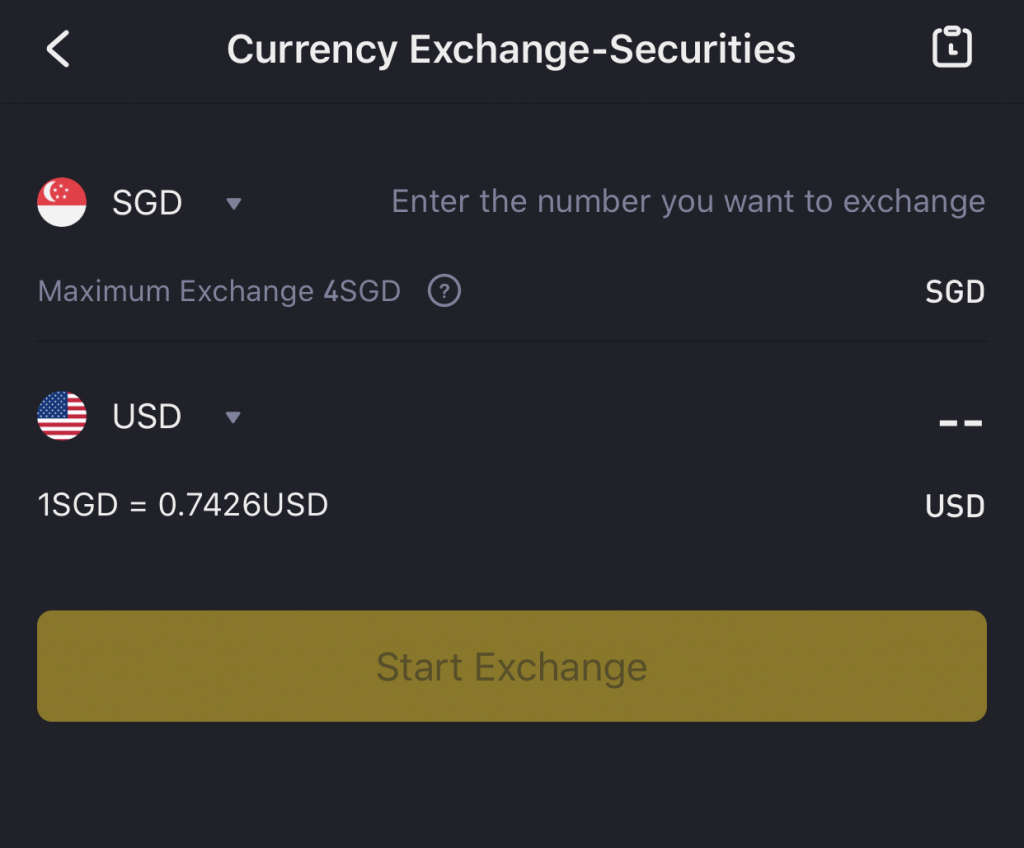

For Tiger Brokers, this can be easily done in-app.

You can exchange your SGD to the currency that you wish.

For Standard Chartered, there are 2 ways that you can exchange your currency:

- Securities Settlement Account

- LiveFX

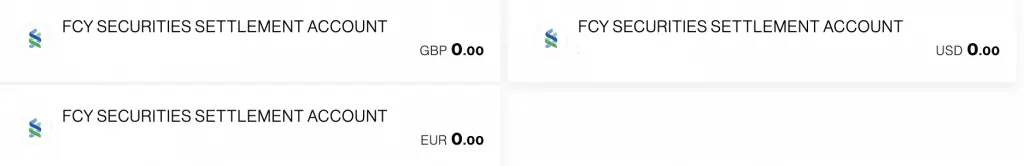

When you create your Standard Chartered trading account, you are required to open Securities Settlement Accounts.

This allows you to exchange your SGD into the foreign currency directly.

You can also use the LiveFX function.

Essentially, LiveFX is like a brokerage. However, this time you are trading currencies instead of stocks!

You can find out how to exchange currencies in Standard Chartered in my guide to buying IWDA.

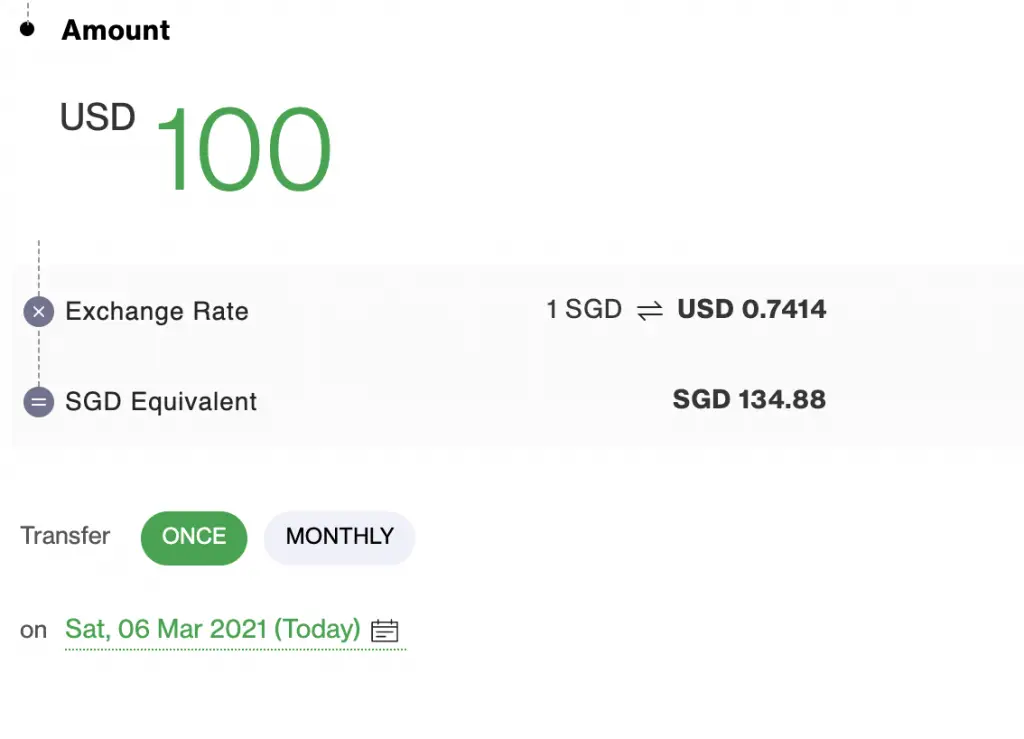

Tiger Brokers has slightly more favourable exchange rates

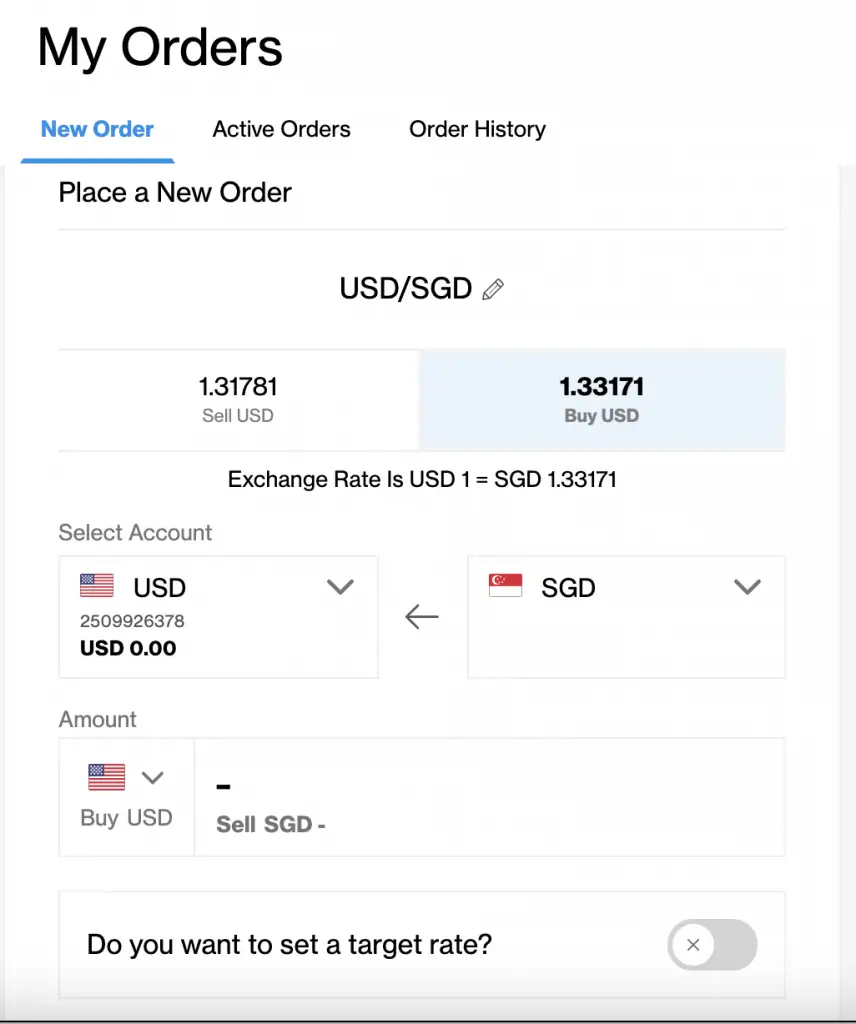

Here is the exchange rate between SGD and USD at around the same time for Tiger Brokers,

and Standard Chartered.

The exchange rate is slightly better for Tiger Brokers. This means that you are able to get more USD for the same SGD that you transfer.

However, the difference in the exchange rate will only be significant if you are trading a large sum of money.

Pre and aftermarket trading

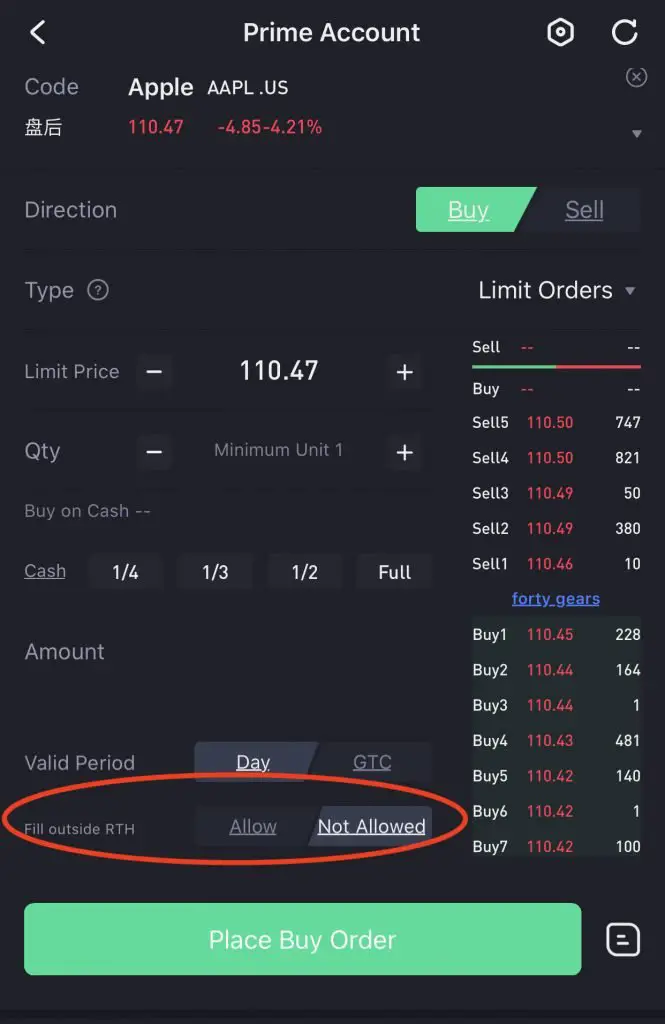

Tiger Brokers allows you to conduct pre- and aftermarket trading on its platform. Here are the timings for the 3 periods in Singapore time (GMT +8).

| Trading Period | Timing (GMT +8) |

|---|---|

| Premarket | 1600-2130 |

| Regular Trading | 2130-0400 |

| Aftermarket | 0400-0800 |

To enable pre and aftermarket trading, you will need to enable the ‘Fill Outside RTH‘ option on the trading page.

This feature is not available on Standard Chartered’s platform.

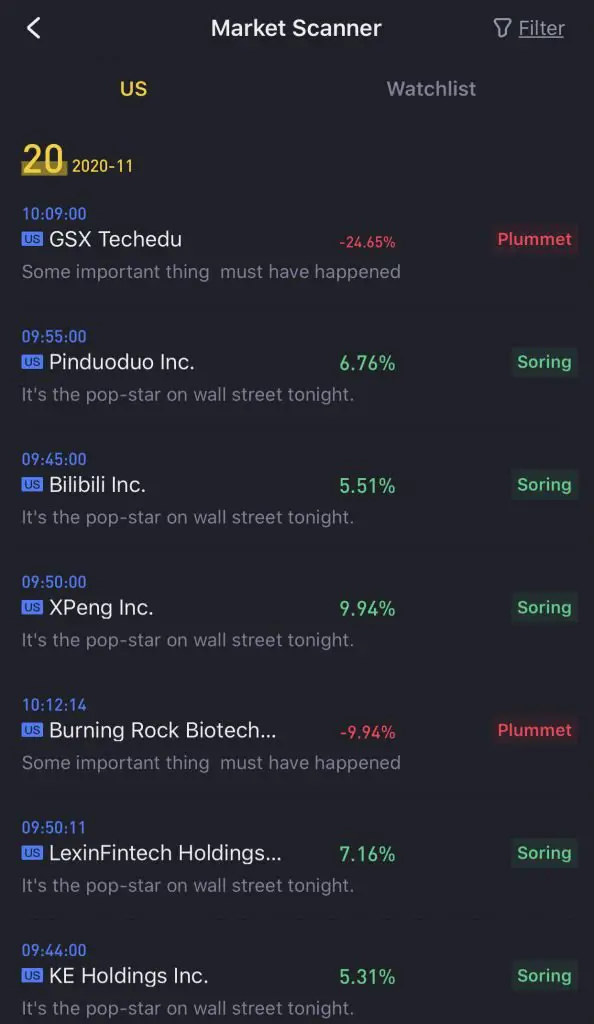

App and Platform Experience

The user experience on the brokerage platform may help you to decide on a broker.

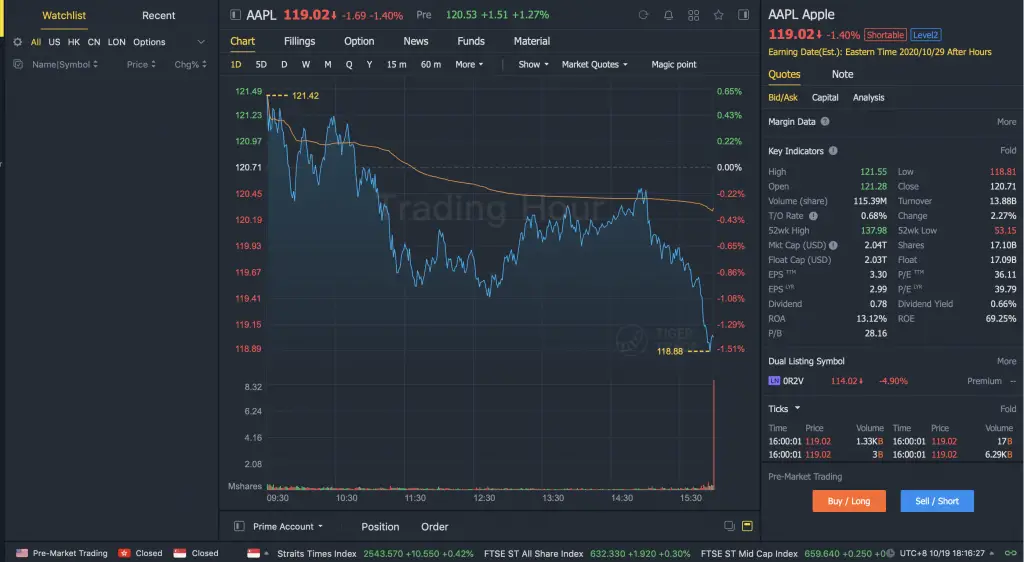

Tiger Brokers provides a much better experience

In general, Tiger Brokers has a much better user experience. The platform is sleek, loads fast and is very easy to use.

However, some pages are still in Chinese, which could have been due to migration problems.

Some of the pages have broken English as well.

This could lead to a frustrating experience, especially if you’re trying to view the latest headlines!

Nevertheless, it is still a pretty fast and sleek app that you can use to trade.

The web platform is really comprehensive too:

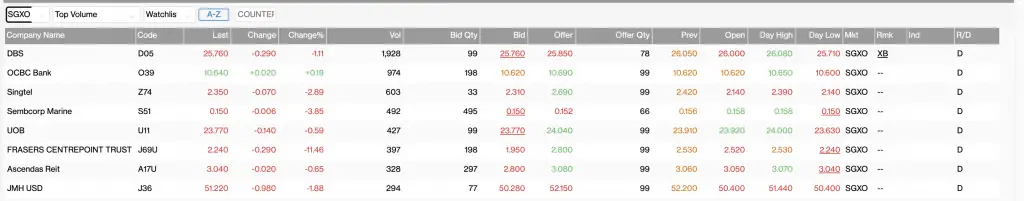

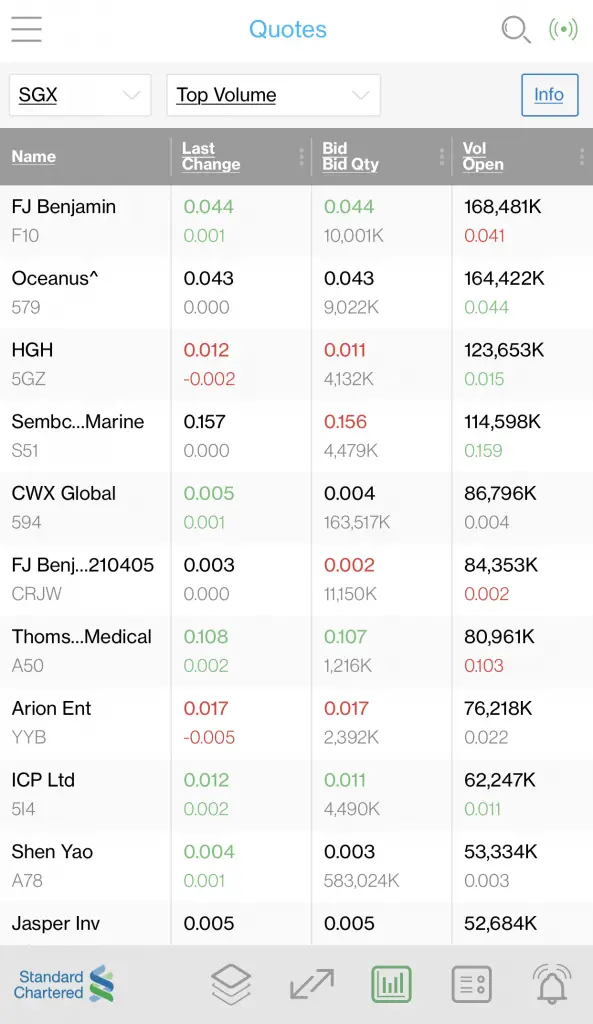

Standard Chartered has a more outdated platform

Standard Chartered’s platform looks less appealing compared to Tiger Brokers.

The mobile app is pretty bland too.

While it does not look that appealing, Standard Chartered’s platform will still get the job done.

Ease of Opening Account

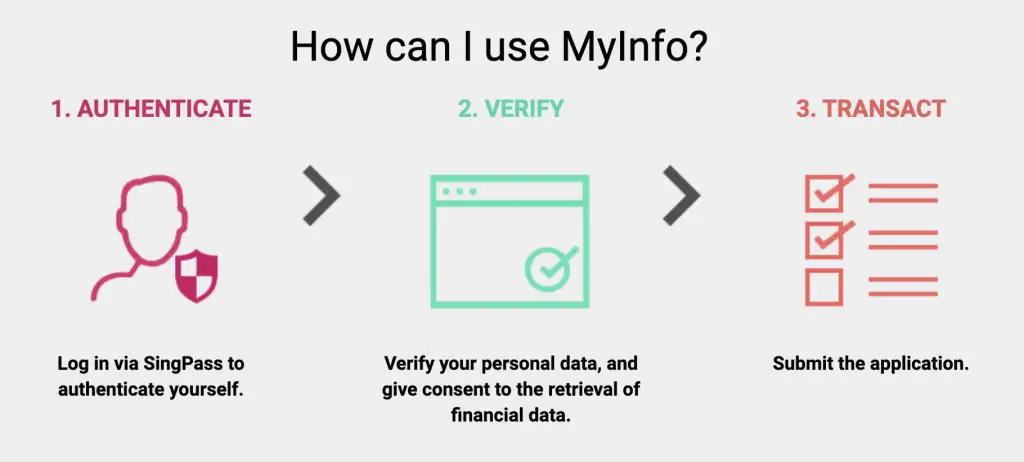

Both Tiger Brokers and Standard Chartered use MyInfo during the signup process.

However, the process is much faster when you’re signing up for a Tiger Brokers account.

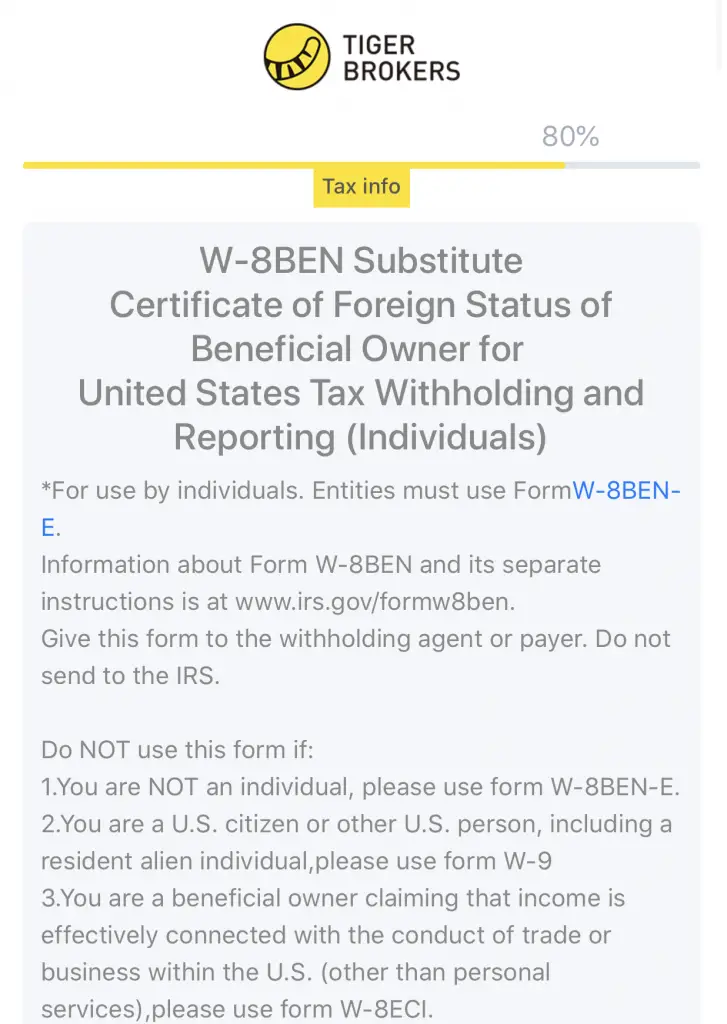

If you wish to trade in the US markets, you are required to sign a W-8 BEN form to declare that you are a non-US citizen.

For Tiger Brokers, you can sign the W-8 BEN form digitally.

Once your account has been approved, you can start trading in US stocks right away!

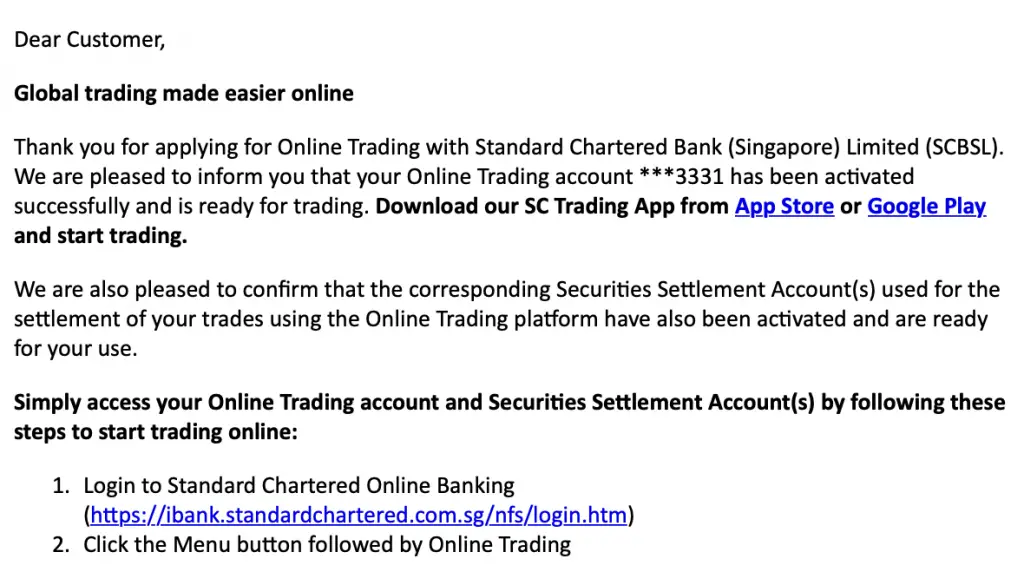

For Standard Chartered, it may take a while longer to get your account approved. Mine took a week before I received the email that the account was open.

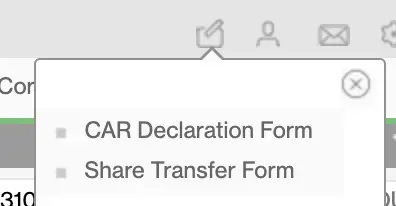

After creating your account, you would still need to complete a Customer Account Review (CAR) before you can trade in overseas markets.

The process is much longer for Standard Chartered compared to Tiger Brokers.

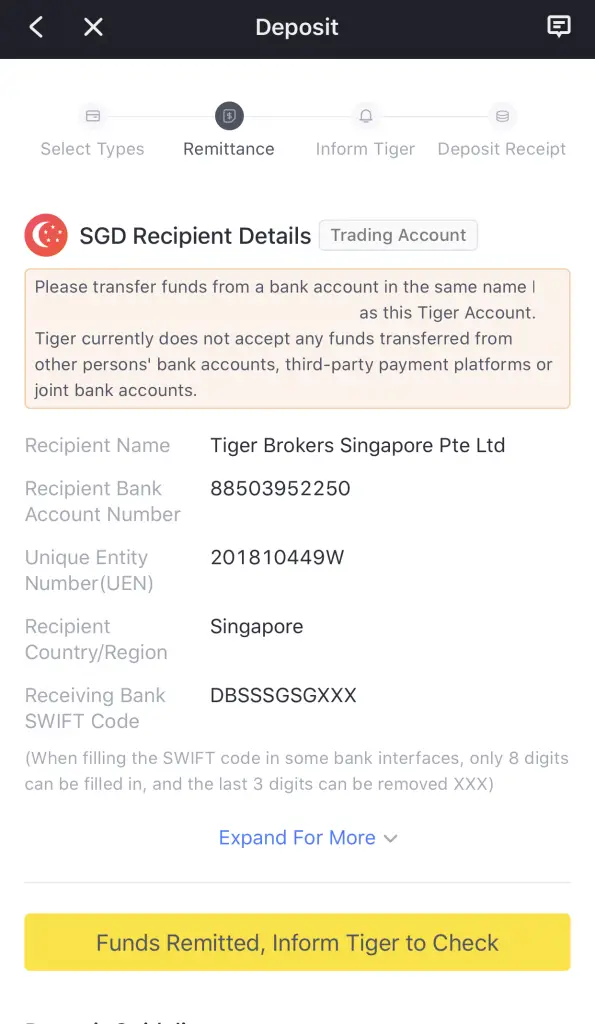

Deposits and Withdrawal

Both online brokerages are pre-funded accounts. This means that you will have to fund your account on either platform first before you can start trading.

No minimum sum to maintain

Both online brokerages do not have a minimum sum to maintain in your account. This is great if you only have a small sum to invest!

Standard Chartered has almost instant transfers

The advantage of using Standard Chartered is that you can use their mobile banking platform.

If you already have an account with them (like the JumpStart Account), you can easily transfer your funds to the Securities Settlement Account.

You will need to have money in your SSA first before you can make a trade.

This makes the transfers almost instant!

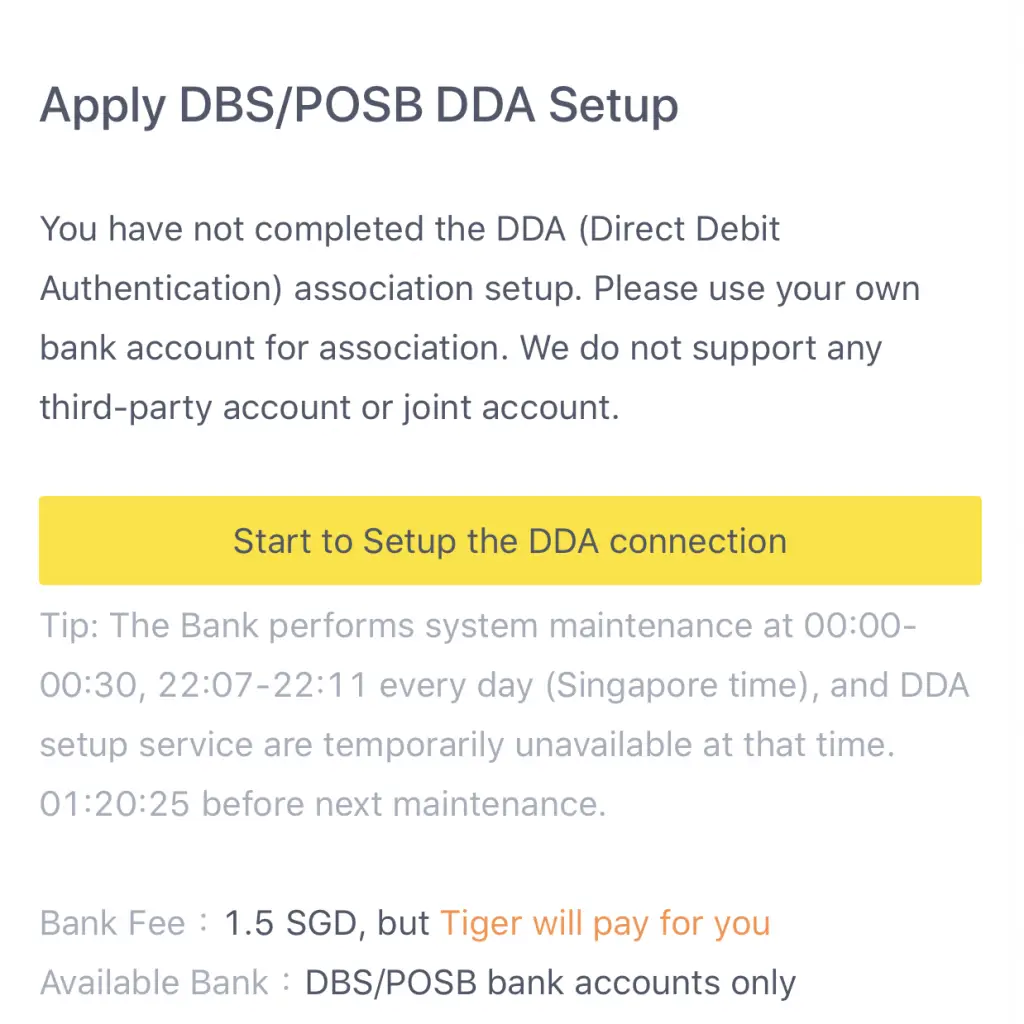

Tiger Brokers has direct debit for DBS / POSB customers

If you are a DBS or POSB customer, you can opt to have a direct debit from your bank account to Tiger Brokers.

Your funds will be credited into your Tiger Brokers account almost instantly.

However if you do not have a DBS or POSB account, you can still transfer your funds via FAST.

However, this process may take a few hours before your funds reach your Tiger account.

Withdrawals are longer for Tiger Brokers

For Standard Chartered, you can transfer your funds from the Securities Settlement Account to your bank account at any time.

However, for Tiger Brokers, you will need to withdraw your funds from the broker. It may take a few business days before your funds are back in your bank account!

Type of Custodian Account

When you trade your assets on both brokerage firms, your assets will be under a custodian account. However, the way that both brokerages hold your assets is slightly different.

Tiger Brokers has a 3rd party custodian account for you

Tiger Brokers uses 3rd party custodians to manage your assets for you.

DBS bank manages your Singapore assets. Meanwhile, Interactive Brokers most likely is handling your assets from other countries.

This is part of the requirements of the Capital Markets License that Tiger Brokers has.

In the unfortunate event that Tiger Brokers closes down, your assets are still kept safe under these custodian accounts.

This 3rd party custodian account arrangement is similar to what robo-advisors use as well.

Standard Chartered is a custodian account too

Your equities and funds are all under the custody of Standard Chartered. This should be really secure as Standard Chartered is a rather reputable bank!

As such, you should not worry about the fate of your assets that much.

Both accounts do not allow CDP linkage

Since both Tiger Brokers and Standard Chartered are custodian accounts, they are unable to be linked to your CDP account.

If you wish to transfer your shares from a CDP-linked broker to either broker, you would have to do a manual share transfer by contacting support.

This may be advantageous if you want to trade SGX stocks with a custodial broker, and not one that is linked to your CDP account.

Verdict

Here is a head-to-head comparison of Tiger Brokers and Standard Chartered:

| Tiger Brokers | Standard Chartered | |

|---|---|---|

| Type of Products Available | Stocks ETFs Mutual funds Futures Options | Stocks ETFs |

| Number of Exchanges Available | 5 countries | 10 countries |

| Trading Commissions | Lower | Higher |

| Exchange Rate | Comparable | Comparable |

| App and Platform Experience | Better | Poorer |

| Ease of Opening Account | Faster | Slower |

| Pre and Aftermarket Funding | Present | Absent |

| Funding Account Speed | A few hours | Almost instant |

| Custodian Account | 3rd party (e.g. DBS) | Under Standard Chartered |

Which broker should you choose?

Choose Tiger Brokers if you are looking for cheaper fees

Tiger Brokers has cheaper trading commissions compared to Standard Chartered. Moreover, it offers you access to the Chinese markets.

One of the ways to receive higher returns on your investments is by keeping your costs low. If you are investing with a smaller sum, Tiger Brokers may be the better choice for you.

Choose Standard Chartered if you want greater access to more markets

Standard Chartered provides greater access to different exchanges:

- European ones (e.g. LSE, AEX etc.)

- Japan (TSE)

Standard Chartered’s main appeal is the ability to invest in the London Stock Exchange (LSE). This is something that most Singaporean passive investors may look out for when choosing a broker.

This is because you may want to buy and hold Irish-domiciled ETFs listed on the LSE for the long term!

In this scenario, using Standard Chartered is best if you intend to perform lump sum investing (e.g. once a year).

If you want to trade in the LSE more frequently, there are other options you can choose too.

Conclusion

Both brokerages do have their advantages. Ultimately, it depends on what you are looking for in a broker, such as:

- The fees that you’ll have to pay

- The exchanges you can trade in

- The types of products you can purchase

If you decide to use both brokers, you can track your portfolios from these 2 brokerages using StocksCafe.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

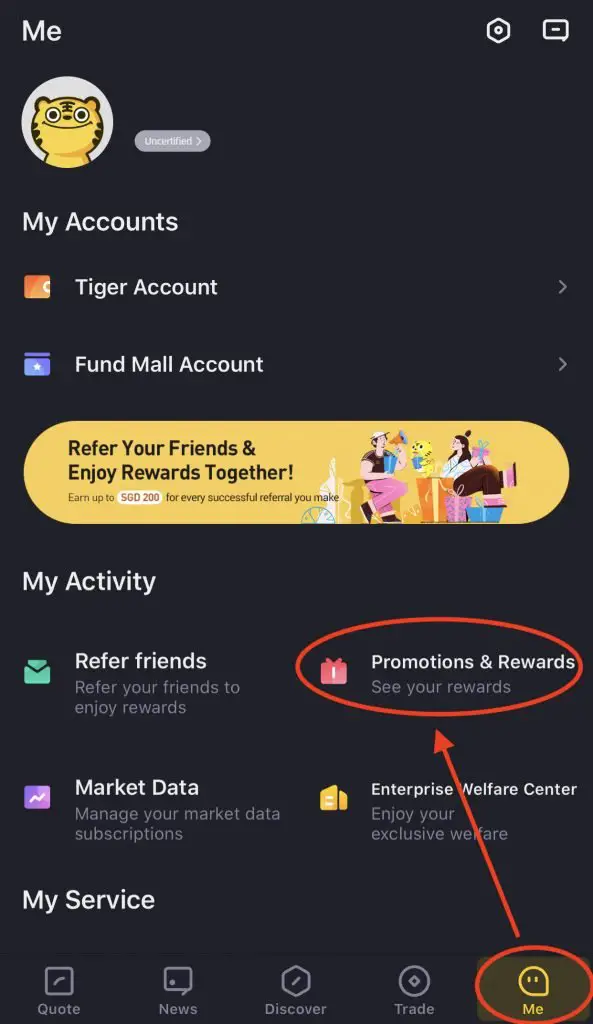

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

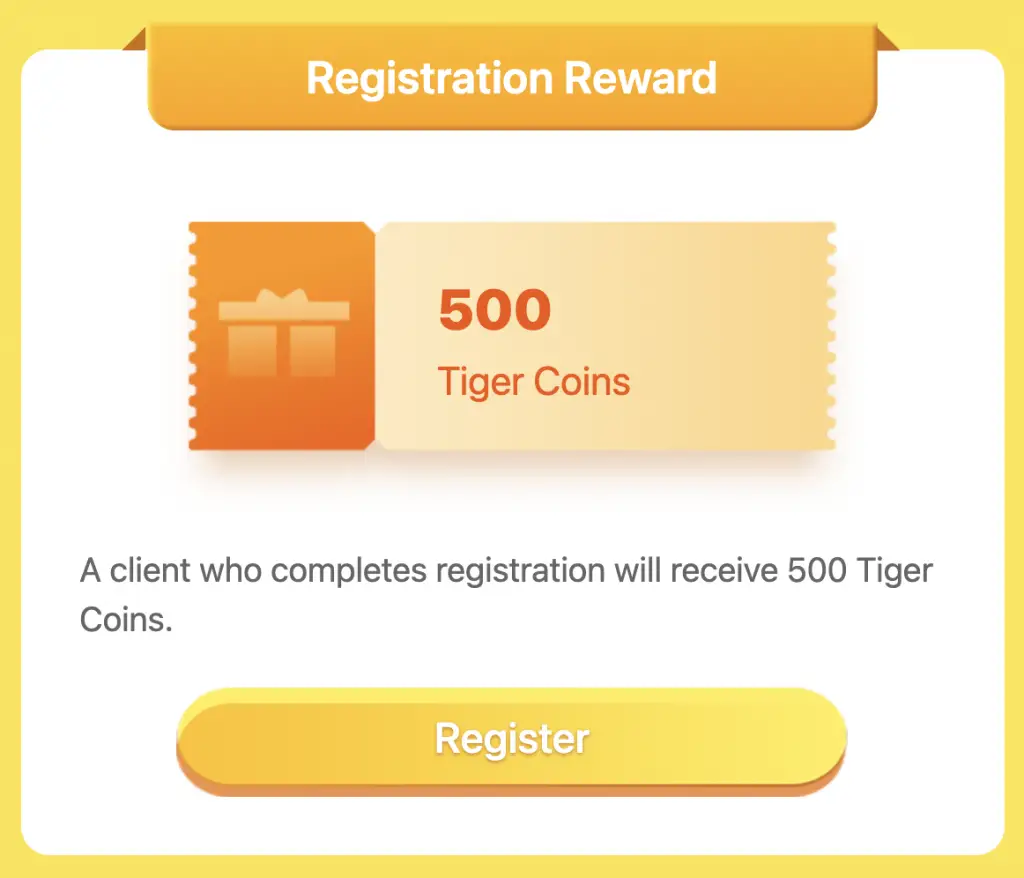

#1 Registration Reward

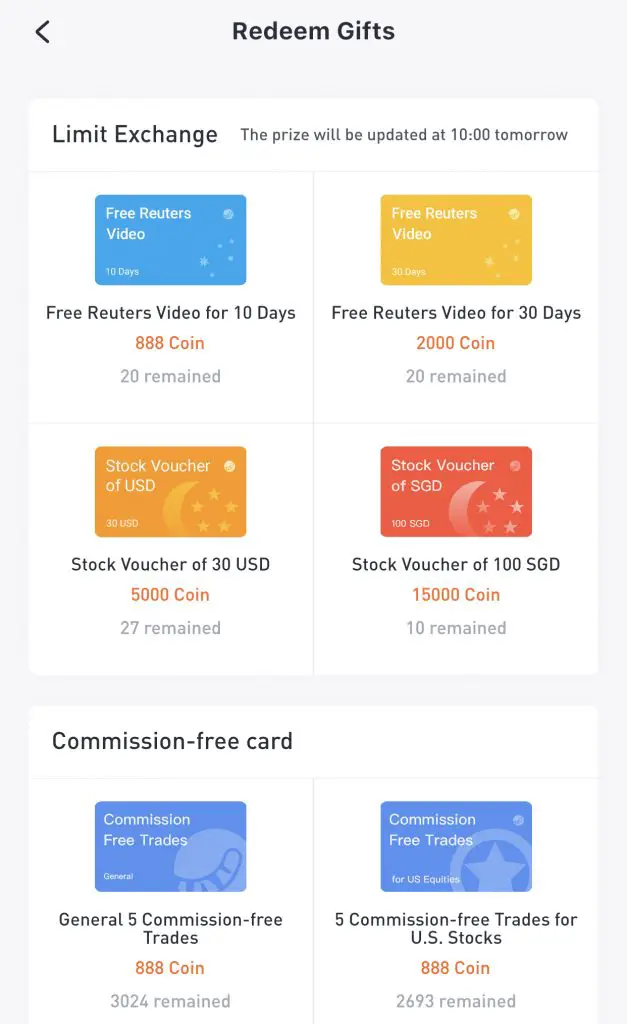

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

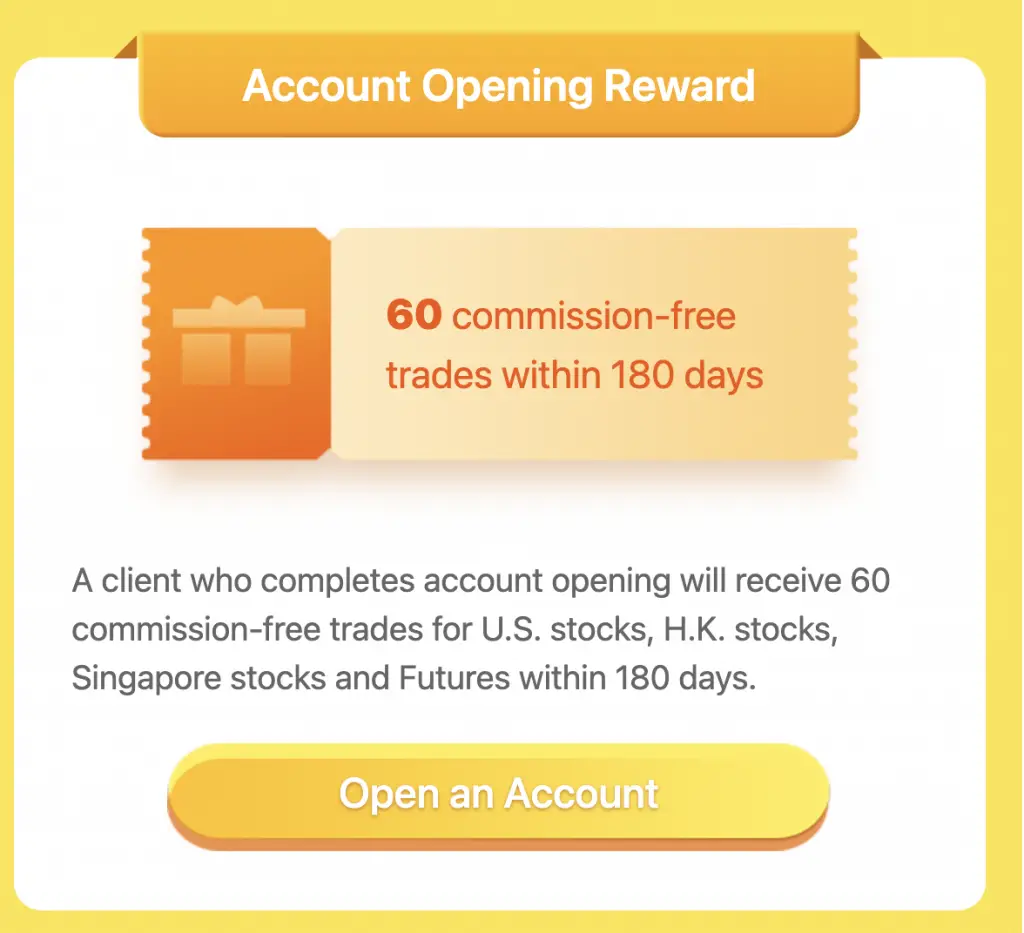

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?