Last updated on March 8th, 2022

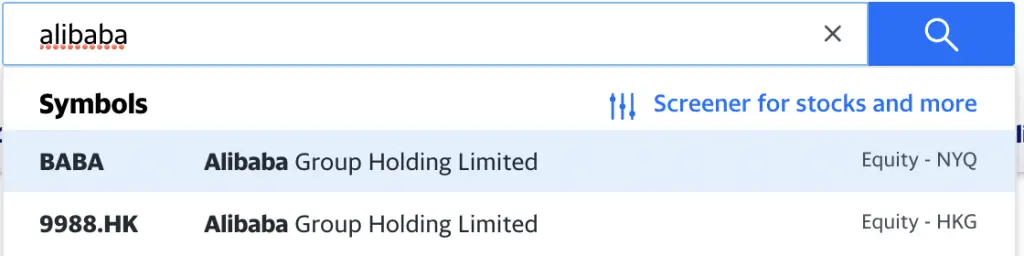

You may want to get your hands on some Alibaba stocks.

However, you realised that there are 2 different stocks that are found on different exchanges!

Are these stocks the same or are they different?

Contents

The difference between BABA and 9988

BABA is an ADR listed on the NYSE, while 9988 is listed on the HKEX. They are both shares of the same company (Alibaba Group), but differ in the currency they trade in and the minimum number of units to invest in.

Moreover, it is possible for you to interconvert between these two stocks. The current conversion rate states that one share of BABA is equal to 8 shares of 9988.

Here’s what you need to know between these 2 stocks:

These stocks were listed at 2 separate times

The Alibaba stock (BABA) was first listed on the New York Stock Exchange (NYSE) in September 2014.

The initial public offering (IPO) holds the record for the largest global IPO of all time, at $25 billion!

There are 3 possible reasons why Jack Ma chose to list his company on the NYSE instead of the HKEX or the China Stock Exchanges. These reasons are:

- Control

- Reputation

- Range of motion

To raise a further $20 billion, Alibaba had a secondary listing on the HKEX (9988) in late 2019.

This was the second IPO that Alibaba had, but on another exchange instead.

There was a change in the HKEX’s regulations. This change allowed Chinese companies to be secondarily listed on the HKEX if they met the following conditions:

- Companies are involved in ‘innovation’

- ≥ 2 years of listing status on the NYSE / Nasdaq, or premium listing on the London Stock Exchange (LSE)

- A market cap of ≥ HK$10 billion

As Alibaba was able to qualify for this secondary listing, they subsequently managed to raise at least $11 billion for this IPO!

In short, BABA was listed earlier in the NYSE in 2014, while 9988 is a secondary listing on the HKEX in 2019.

The stocks are on different exchanges

BABA is listed on the NYSE, while 9988 is listed on the HKEX. This creates some differences in their stocks:

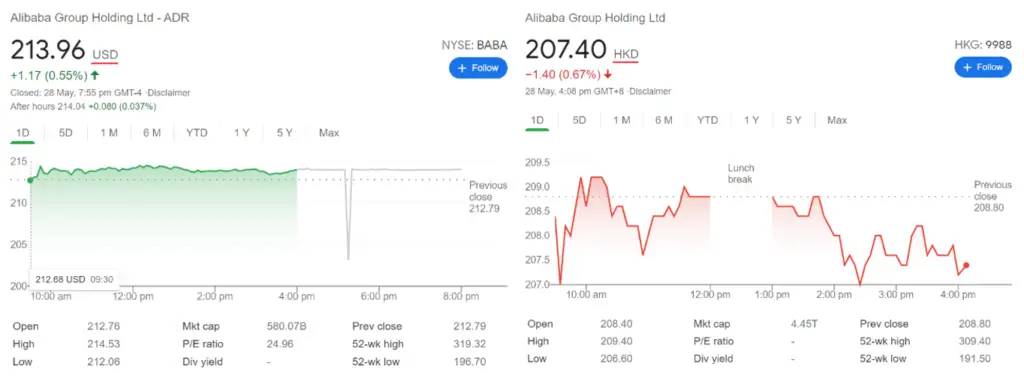

Trading currency

BABA is traded in USD, while 9988 is traded in HKD.

Depending on your home currency, you may be exposed to exchange rate fluctuations!

Minimum units to invest

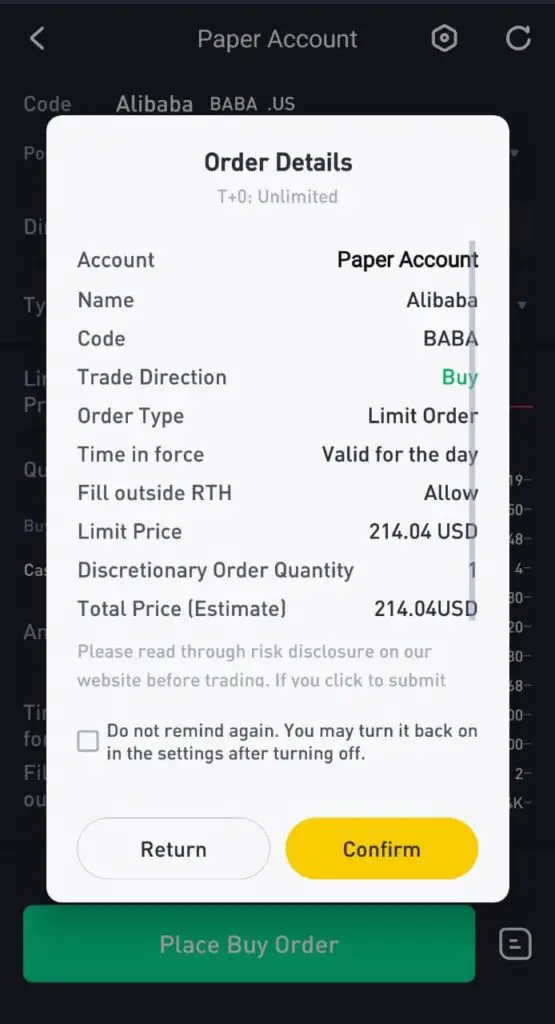

On the NYSE, you can trade a minimum of 1 unit of BABA.

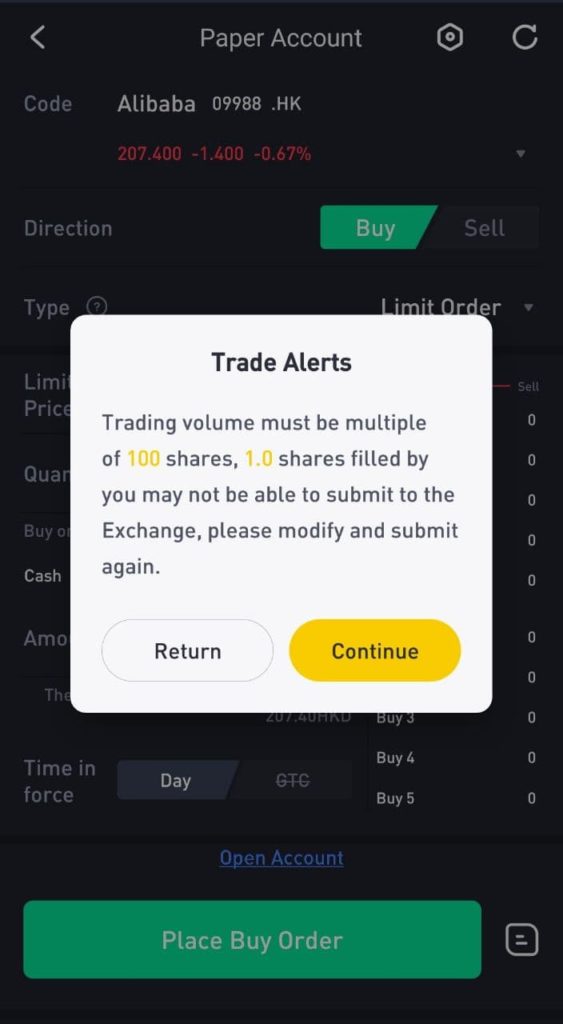

However, the minimum lot size for 9988 is 100 units.

If you convert the cost of buying 1 lot of 9988 stocks to USD, it’ll cost around $2.7k USD. In contrast, you can buy one BABA stock at around $214 USD.

This may make the BABA stock slightly more accessible for you, especially if you only have a small sum to invest.

Different trading hours

The trading hours for the NYSE and HKEX are quite different:

| BABA | 9988 | |

|---|---|---|

| Trading Hours | 2230-0500 | 0930-1200 1300-1600 |

Both timings are taken with reference to GMT +8.

The timings at which you can trade both stocks are quite different. You’ll need to decide which timing is more suitable for you.

Different commissions charged

Depending on which broker you choose, you may be charged a certain amount of fees. Here are some examples of the fees that you’ll be charged when trading in different markets:

| Broker | BABA Rates | 9988 Rates |

|---|---|---|

| Tiger Brokers | 0.005 USD/share Min 1.99 USD/trade | 0.03% * trade value Min 15 HKD/trade |

| moomoo (powered by FUTU SG) | Min. 1.99 USD/trade | 0.03% * trade value Min. 18 HKD/trade |

| FSMOne | 0.08% Min USD 8.80 | 0.08% Min HKD 50 |

| Saxo | 0.02 USD Min USD 7 (Classic) | 0.15% Min HKD 100 (Classic) |

| Standard Chartered | 0.00231% (Sell trades only) Min USD 10 | 0.005% Min HKD 100 |

| DBS Vickers | 0.18% Min USD 25 | 0.18% Min HKD 100 |

Both Tiger Brokers and moomoo (powered by FUTU SG) have rather low fees to trade in either the HKEX or US markets.

Type of holdings

When you purchase the 9988 stock on the HKEX, you are buying ordinary shares of the stock.

However, things are quite different for the BABA stock. When you buy the BABA stock, you are buying into an American Depositary Receipt (ADR).

ADRs are a US security which represents the ownership of shares in a foreign company.

These ADRs can be traded freely just like any other stock.

MoneySense

You can see that you’re buying into an ADR when you buy the BABA stock, based on the ticker name.

A more important aspect of both 9988 and BABA is that they are both part of a variable interest entity (VIE) structure.

A variable interest entity (VIE) refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights.

Investopedia

As such, you may not have an ownership of Alibaba Group when you purchase BABA stock!

Both stocks are fully fungible

BABA and 9988 are fully fungible stocks.

Fungible investments can be bought and sold on multiple exchanges.

The Balance

This means that you are able to buy the BABA stock, and then sell it on the HKEX as 9988. You are able to buy the 9988 stocks and sell it as BABA on the NYSE too.

Here is the official conversion rate of these 2 stocks: 1 BABA stock on the NYSE is equivalent to eight 9988 shares on the HKEX.

You’ll need to find a broker that gives you access to both the NYSE and HKEX.

This is what you’ll need to do to interconvert these 2 stocks (based on Alibaba’s prospectus):

- Sell BABA to Citibank depositary bank, and receive the corresponding number of 9988 shares

- Sell 9988 to Citibank Hong Kong, and receive the corresponding number of BABA shares

However, you will be exposed to 2 kinds of risks during this interconversion:

- Price fluctuations of both stocks

- Exchange rate fluctuations between HKD and USD

Moreover, all the costs of this interconversion will be borne by you. You’ll need to decide if the costs are worth converting between these 2 stocks!

How do I go about interconverting between BABA and 9988?

There are some brokers who will help you to facilitate the conversion. One such broker is Interactive Brokers. Here are some fees that you’ll incur when you do this interconversion:

- Conversion fee (USD 0.05 per share)

- USD 500 processing fee

It can be rather costly to carry out this conversion!

Threat of delisting

Due to the China-US tensions, a new law (Holding Foreign Companies Accountable Act) was passed by Donald Trump.

This law states that if Chinese companies failed to meet auditing requirements, their stocks will be banned from being traded in the US stock exchanges for 3 years.

This Act coincided with Luckin Coffee being forced to delist from the Nasdaq!

There were fears that BABA would get delisted from the NYSE as well. However, there is no confirmation of that.

Even so, there is still some risk that you may have when you own BABA stocks. You do not have this risk if you own 9988 stocks instead.

Verdict

Here is a recap of the comparison between BABA and 9988:

| BABA | 9988 | |

|---|---|---|

| IPO | Sep 2014 | Nov 2019 |

| Exchange | NYSE | HKEX |

| Currency | USD | HKD |

| Minimum Units to Invest | 1 | 100 |

| Type of Holding | ADRs (VIE) | Ordinary shares (VIE) |

| Threat of Delisting | Present | Absent |

So which stock should you choose? Here are some points you may want to consider:

#1 Minimum investment amount

The minimum lot size for 9988 is 100 units, which can cost you a few thousand USD. Furthermore, you are only able to trade in multiples of 100 units.

Therefore, you will need a larger amount to invest in 9988. In contrast, you only need a few hundred USD to buy BABA!

If you only have a small amount to invest, BABA may be more accessible for you.

#2 Type of stock you want to own

Having both of them as VIEs will impose some risks to the investor. However, this should not be too much of a worry if you believe the business behind it is an excellent one.

In addition, buying BABA means that you are not an owner of Alibaba Group. As such, you may only have limited claim to the company’s actual assets.

There may be much more risks involved when you invest in BABA compared to 9988!

Conclusion

In summary, both BABA and 9988 are shares of the same company: Alibaba Holdings. There may be greater risks involved when you invest in BABA.

As a result, you’ll need to decide if the risks are worth the lower minimum prices for the BABA stock!

Alternatively, you can invest in Alibaba through a Hang Seng Tech ETF or a Hang Seng Index ETF. Alibaba has a relatively high weightage in both of them, which gives you quite a bit of exposure to the stock!

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?