Last updated on June 13th, 2021

moomoo (powered by FUTU SG) is one of the newest trading platforms to have entered Singapore.

Meanwhile, Saxo has been in the market for quite a while.

When choosing between both brokers, which one should you go with?

Here’s what you need to know.

Contents

- 1 The difference between moomoo (powered by FUTU SG) and Saxo

- 2 Type of Products Available

- 3 Types of Exchanges Available

- 4 Fees

- 5 Exchange Rates

- 6 Pre and aftermarket trading

- 7 App and Platform Experience

- 8 Ease of Opening Account

- 9 Deposits and Withdrawal

- 10 Type of Custodian Account

- 11 Verdict

- 12 Conclusion

- 13 👉🏻 Referral Deals

The difference between moomoo (powered by FUTU SG) and Saxo

moomoo (powered by FUTU SG) charges lower fees compared to Saxo if you intend to trade in the SG, US and HK markets. However, Saxo offers a wider variety of products on their platform, such as mutual funds, regular savings plans and managed portfolios.

Here is an in-depth comparison between these 2 platforms:

Type of Products Available

Both brokerages offer different kinds of products.

Here is what moomoo offers you:

- Stocks

- ETFs

- REITs

- ADRs

- Options

- Futures

- Warrants and CBBC

Meanwhile, Saxo provides a wider variety of products on their platform. This includes:

- Stocks

- Bonds

- ETFs

- Mutual funds

- Forex

- Futures

- Commodities

- Options (Forex and Listed)

- Managed portfolios

- Regular Savings Plan

Saxo’s managed portfolio is something similar to a robo-advisor. It chooses to invest your money into different funds from:

- LionGlobal

- BlackRock

- Morningstar

- Brown Advisory

- Nasdaq

You can also choose to invest in some of these portfolios via a regular savings plan too.

If you are looking for a platform that provides more investing options, Saxo will be better for you.

However if you are just looking at buying stocks and ETFs, then it will not really which platform you choose!

Types of Exchanges Available

moomoo (powered by FUTU SG) allows you to trade in 3 exchanges.

Meanwhile, Saxo offers you 23 different exchanges to trade in!

Here are some of the exchanges that you are able to trade on using both platforms:

| moomoo | Saxo | |

|---|---|---|

| SGX | ✓ | ✓ |

| HKEX | ✓ | ✓ |

| US | ✓ | ✓ |

| ASX (Australia) | ✕ | ✓ |

| SZSE and SSE (China) | ✕ | ✓ |

| LSE (UK) | ✕ | ✓ |

| Bursa Malaysia | ✕ | ✓ |

| SWX (Switzerland) | ✕ | ✓ |

| TSE (Japan) | ✕ | ✓ |

In terms of the availability of exchanges, Saxo provides a far wider variety!

The one that most Singaporeans may be interested in is the London Stock Exchange (LSE). You are able to buy Irish-domiciled ETFs that help to reduce your taxes in 2 ways:

- Reduce your dividend withholding tax (30% to 15%)

- Reduce the estate taxes that you incur

However, moomoo still has many of the popular exchanges, such as US exchanges and the HKEX.

Fees

The fees that you incur are one of the most important factors that affect your returns.

You’ll need to consider 2 types of fees that you’ll pay each broker:

- Trading commission

- Platform fee

Here are the fees that you’ll incur with both brokers:

| Market | moomoo | Saxo |

|---|---|---|

| SGX | 0.03% * trade value Min $0.99/trade (commission) + 0.03% * trade value Min SGD $1.50 (platform fee) | 0.08% * trade value Min 5 SGD |

| HKEX | 0.03* trade value Min 3 HKD/trade (commission) + 15 HKD/order (platform fee) | 0.15% * trade value Min 90 HKD |

| US | 0.0049/share Min USD 0.99/order (commission) + USD 0.005/share Min USD 1/order (platform fee) | 0.06% * trade value Min $4 USD |

Across all 3 exchanges, moomoo (powered by FUTU SG) offers the cheaper commissions.

Furthermore, you are able to make commission-free trades for 180 days if you sign up using my referral link.

Fees incurred for trading in respective exchanges

On top of the fees that you pay for each platform, you will be charged exchange-specific fees as well. These fees are the same across both brokerages.

For example, you will be charged an additional 0.04% by SGX for each trade that you make.

This includes:

- Trading fee (0.0075% * transaction amount)

- Clearing fee (0.0325% * transaction amount)

There may be some fees that you’ll need to pay, depending on the exchange you’re trading in.

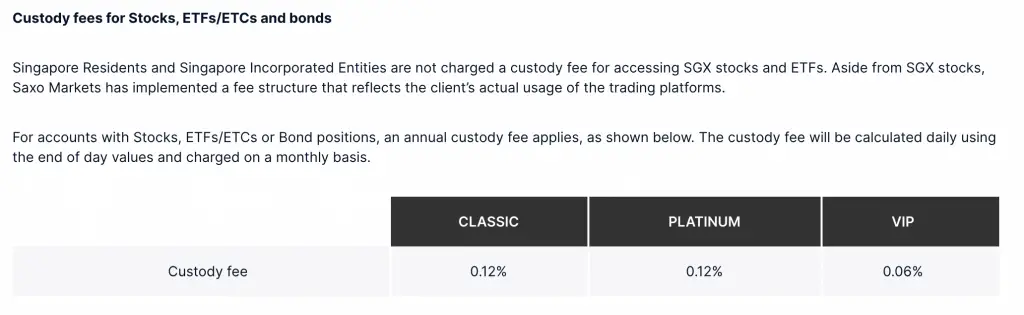

Custodian fees

Saxo charges a 0.12% custodian fee for any stocks that you own that are not from the SGX.

This fee is calculated daily, based on the total amount of assets that you hold with Saxo. The fee will then be charged to you on a monthly basis.

This custody fee can really eat into your returns!

Meanwhile, moomoo (powered by FUTU SG) does not charge a custodian fee.

Currency conversion fee

Saxo also charges a currency conversion fee, if you exchange your SGD to a foreign currency.

The fees that you pay depend on how you exchange your currency:

| Type of Exchange | Fees |

|---|---|

| Cash Products | 0.75% |

| Account Transfer | 0.30% |

If you make a trade in a foreign currency with your SGD, you will be charged 0.75%.

However if you make the same trade from your sub-account, you are only charged 0.3%.

These additional fees will eat into your returns as well!

moomoo (powered by FUTU SG) does not charge any currency conversion fees when you are exchanging your SGD to another currency.

Neither broker charges an inactivity fee

Both moomoo (powered by FUTU SG) and Saxo do not have any inactivity fees. As such, you do not need to pressure yourself in making a trade to avoid these fees!

moomoo (powered by FUTU SG) has a more attractive price structure

If you are looking to buy stocks in the SG / US / HK markets, moomoo (powered by FUTU SG) offers a more affordable pricing structure.

You pay cheaper commissions on this platform. Furthermore, you do not incur any custodian or foreign conversion fees.

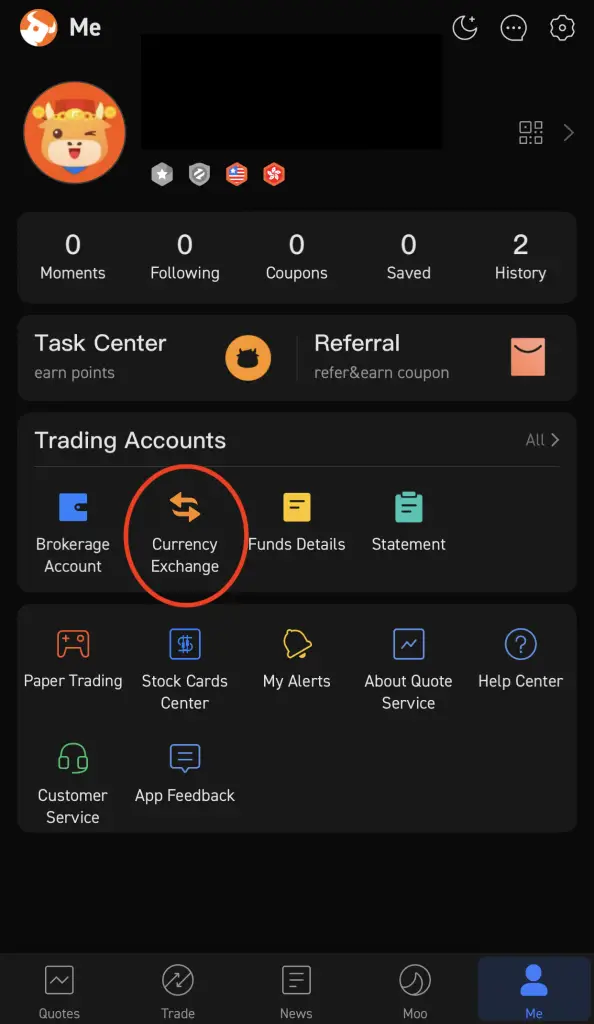

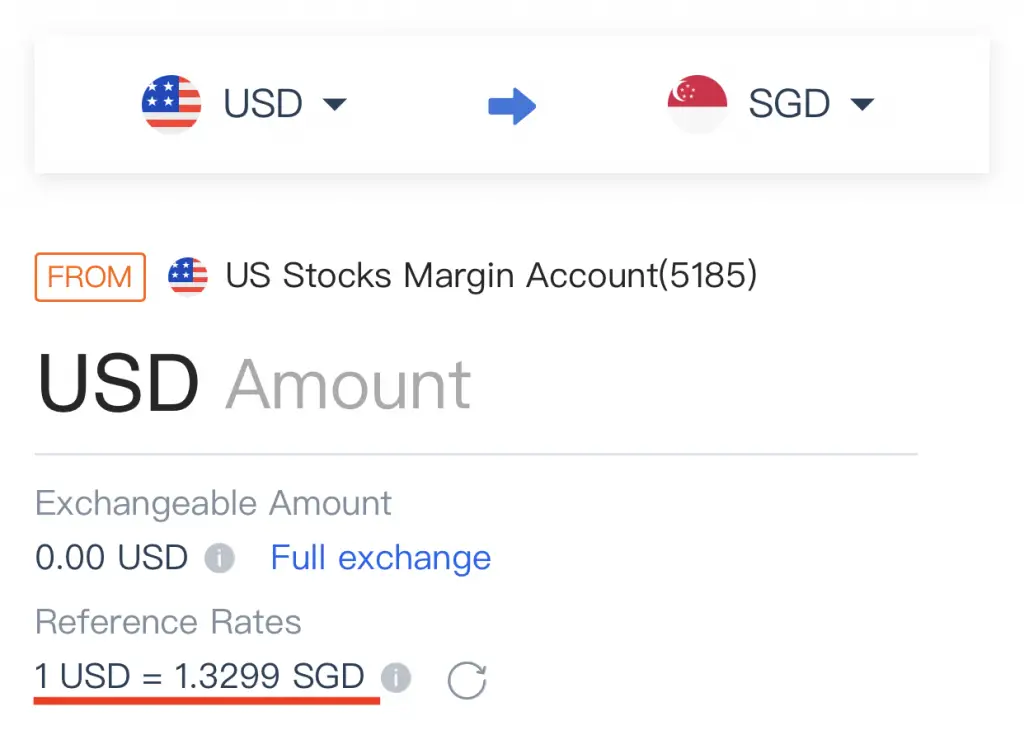

Exchange Rates

If you wish to trade in overseas stocks, you will have to exchange your SGD for a foreign currency.

For moomoo (powered by FUTU SG), this can be done in their app.

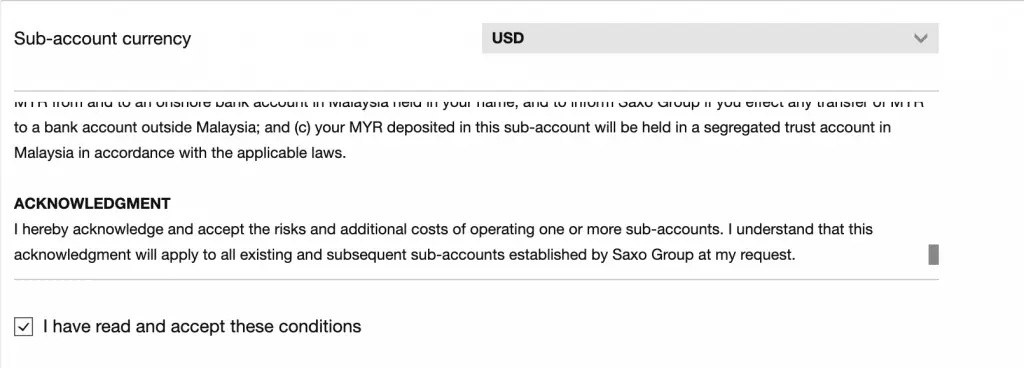

For Saxo, it is a bit more complicated.

Similar to moomoo (powered by FUTU SG), you can make a deposit into your account in SGD.

Remember if you make a trade in a foreign currency directly from your SGD, you will incur a 0.70% fee!

To reduce the currency conversion fees, you will first need to create a sub-account. This sub-account is denominated in the foreign currency that you wish to trade in.

This is similar to creating different Securities Settlement Accounts with Standard Chartered.

After that, you are able to transfer your SGD into the foreign currency!

Saxo has slightly more favourable exchange rates

Here is the exchange rate between SGD and USD at around the same time for Moomoo,

and that for Saxo.

Saxo seems to be providing a slightly better rate compared to moomoo (powered by FUTU SG). This means that you are able to get more USD for the same SGD that you transfer.

However, the difference in the exchange rate will only be significant if you are trading a large sum of money.

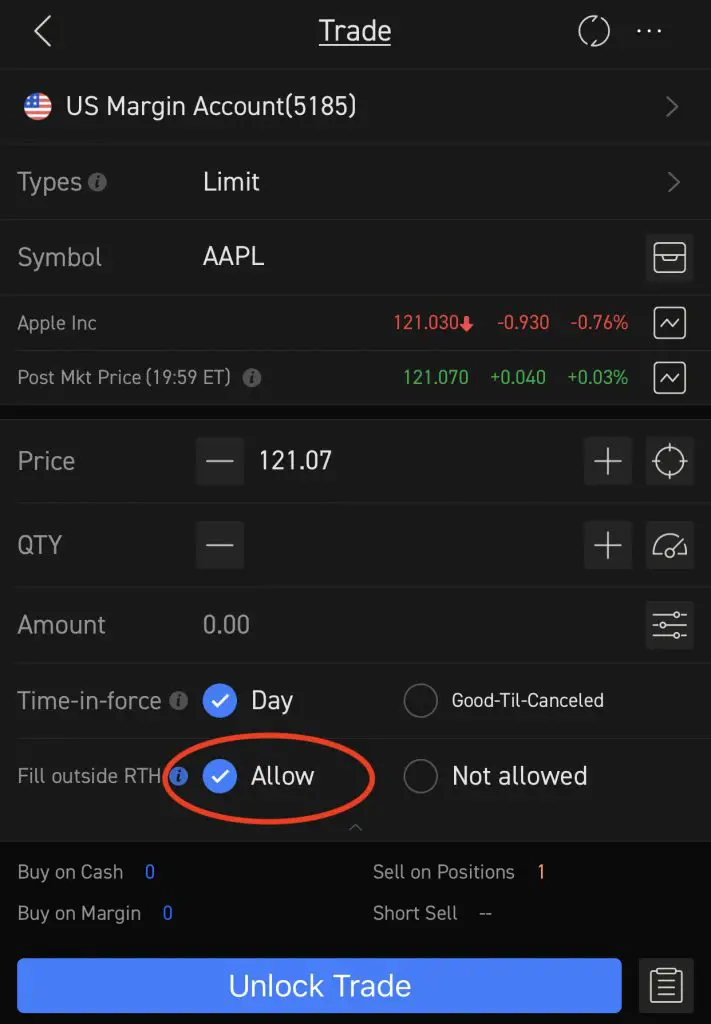

Pre and aftermarket trading

Both moomoo (powered by FUTU SG) and Saxo allows you to conduct pre and aftermarket trading on its platform for US markets. Here are the timings for the 3 periods in Singapore time (GMT +8).

| Trading Period | Timing (GMT +8) |

|---|---|

| Premarket | 1600-2130 |

| Regular Trading | 2130-0400 |

| Aftermarket | 0400-0800 |

To enable pre and aftermarket trading, you will need to enable the ‘Fill Outside RTH‘ option on the trading page for moomoo (powered by FUTU SG).

For Saxo, you can only perform premarket trades using the SaxoGO/PRO platforms. You can’t use SaxoInvestor to make the trade.

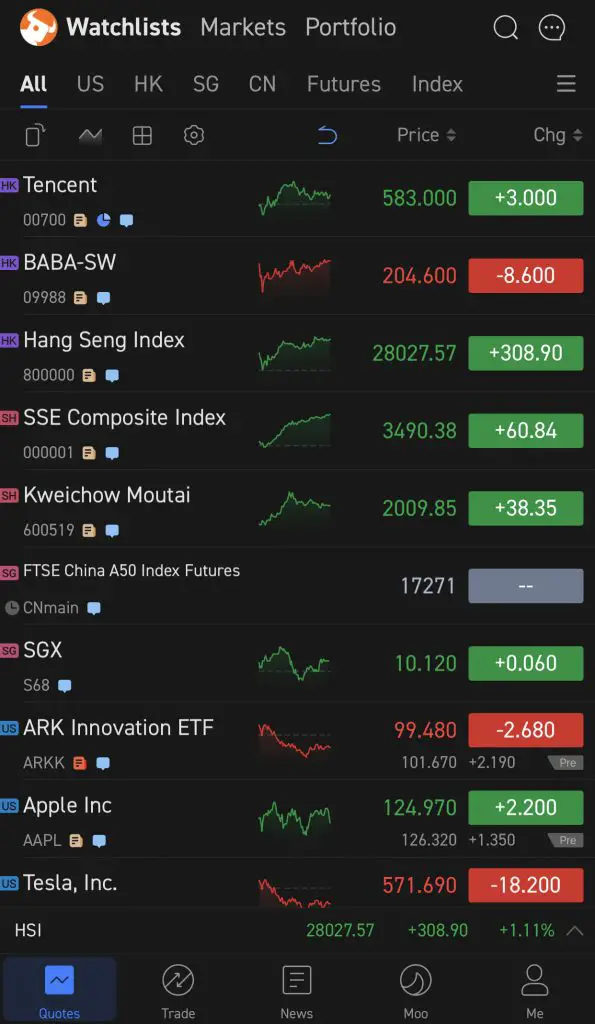

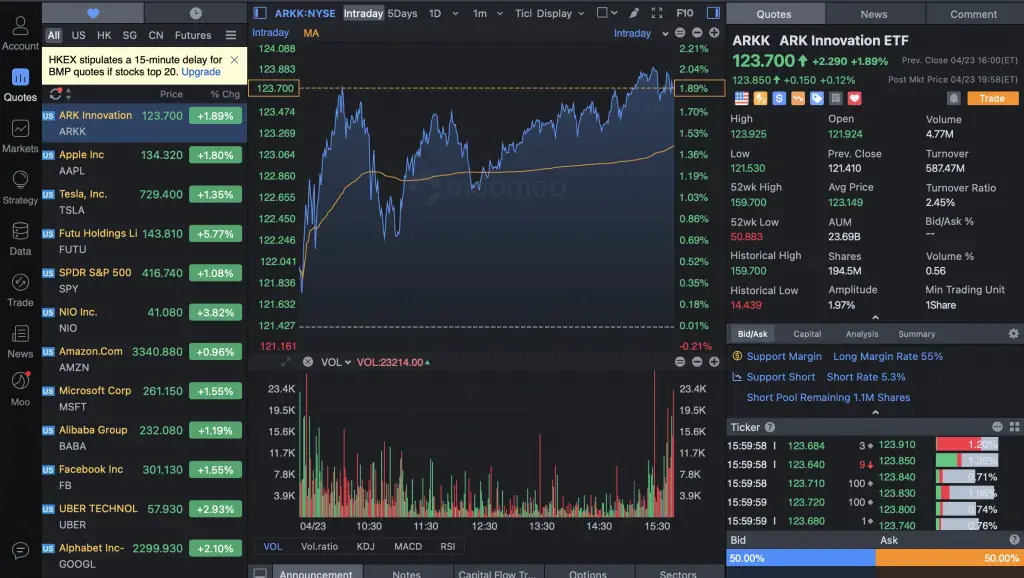

App and Platform Experience

The user experience on the brokerage platform may help you to decide on a broker.

moomoo (powered by FUTU SG) has a good user experience overall. It is rather similar to Tiger Brokers, so you will be quite familiar with it if you have a Tiger Brokers account too.

moomoo (powered by FUTU SG) has a desktop platform too.

While these features are really useful for frequent traders, I do find that the features can be rather overwhelming if you are a beginner investor.

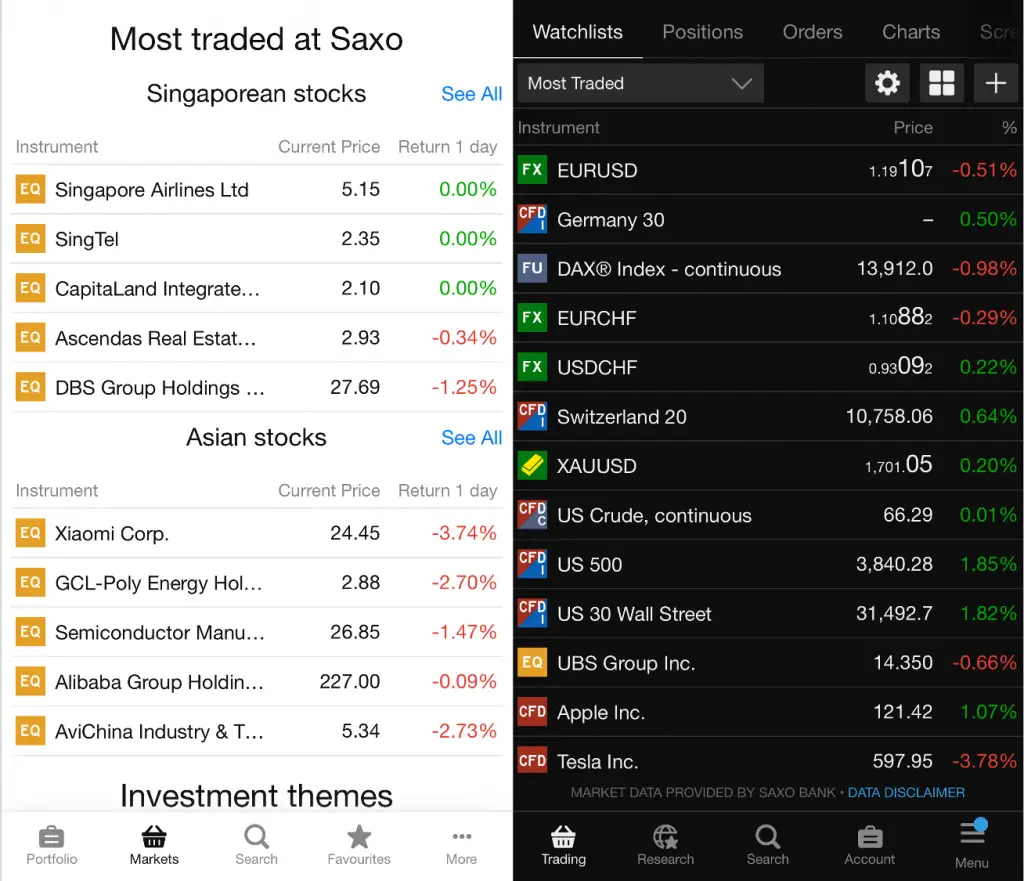

Saxo has multiple platforms

There are 3 different platforms that you can use on Saxo:

- SaxoInvestor

- SaxoTraderGO

- SaxoTraderPRO

Both SaxoInvestor and TraderGO are available on the web browser. However, for TraderPRO, you will need to install a desktop app.

The type of platform that you use depends on the type of investor you are:

| Platform | Suitable For |

|---|---|

| SaxoInvestor | Everyday investors |

| TraderGO | Traders |

| TraderPRO | Serious traders |

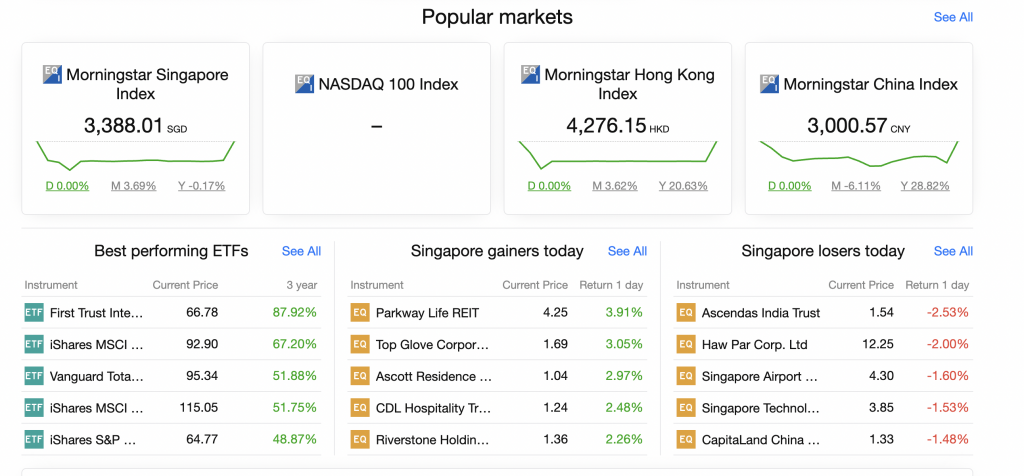

Here’s how SaxoInvestor looks like,

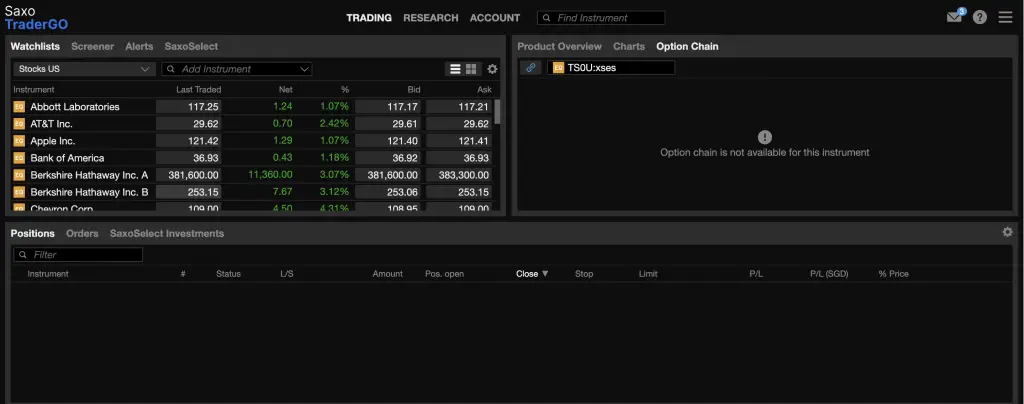

and TraderGO,

as well as TraderPRO.

Both SaxoInvestor and TraderGO have their mobile apps as well.

Both brokers’ platforms seem pretty sleek and easy to use.

Ease of Opening Account

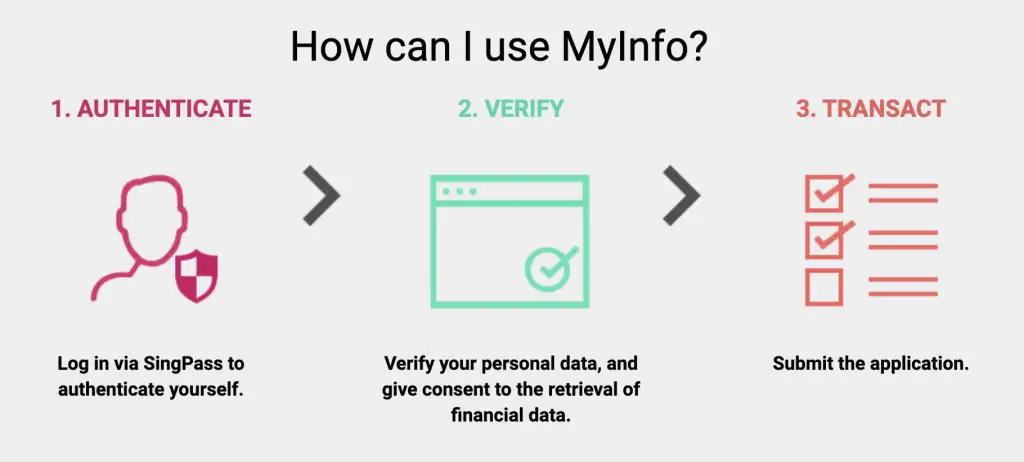

Both FUTU SG and Saxo use MyInfo during the signup process.

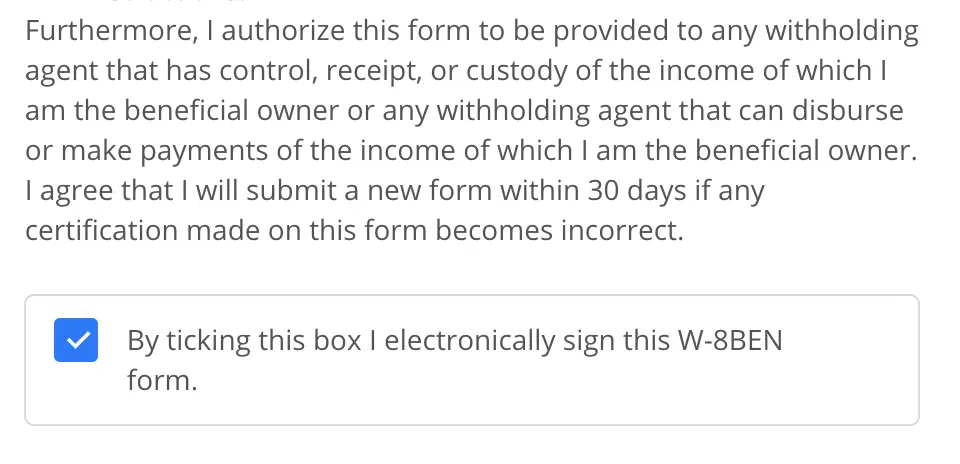

If you wish to trade in the US markets, you are required to sign a W-8 BEN form to declare that you are a non-US citizen.

For Saxo, you are required to sign an online W-8BEN form during the sign-up process.

Once your account has been approved, you can start trading in US stocks right away.

For moomoo (powered by FUTU SG), you do not have to sign the W-8 BEN form. However, you are required to fill up a questionnaire and sign at the bottom of the page.

The account opening process for both platforms is rather smooth. Your account should be opened within the day!

Deposits and Withdrawal

Both online brokerages are pre-funded accounts. This means that you will have to fund your account on either platform first before you can start trading.

No minimum sum to maintain

Both online brokerages do not have a minimum sum to maintain in your account. This is great if you only have a small sum to invest!

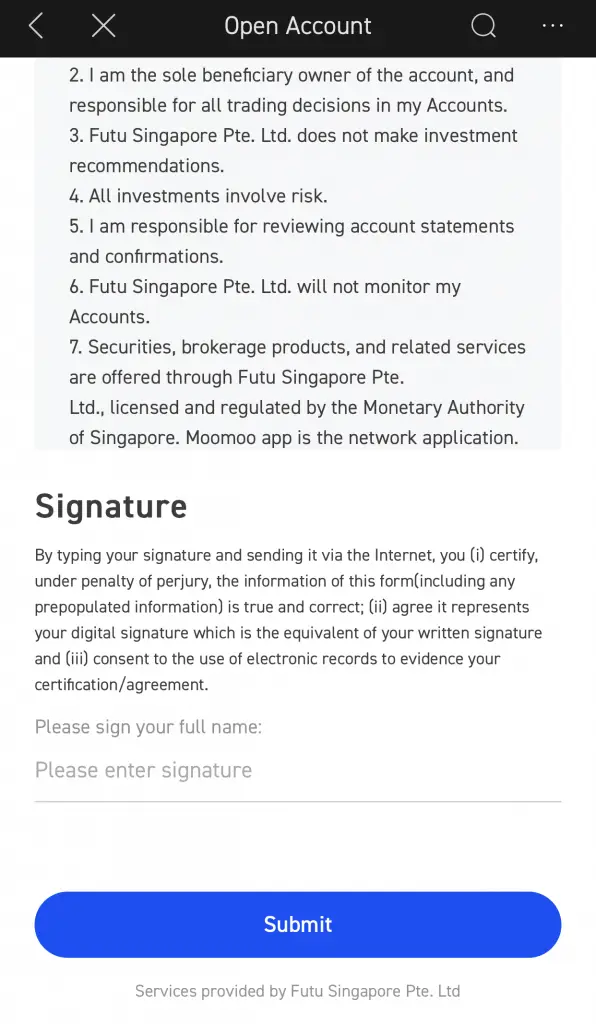

You can only use both FAST and DDA for moomoo (powered by FUTU SG)

For moomoo (powered by FUTU SG), you can make deposits by either FAST or direct debit (either DBS or POSB).

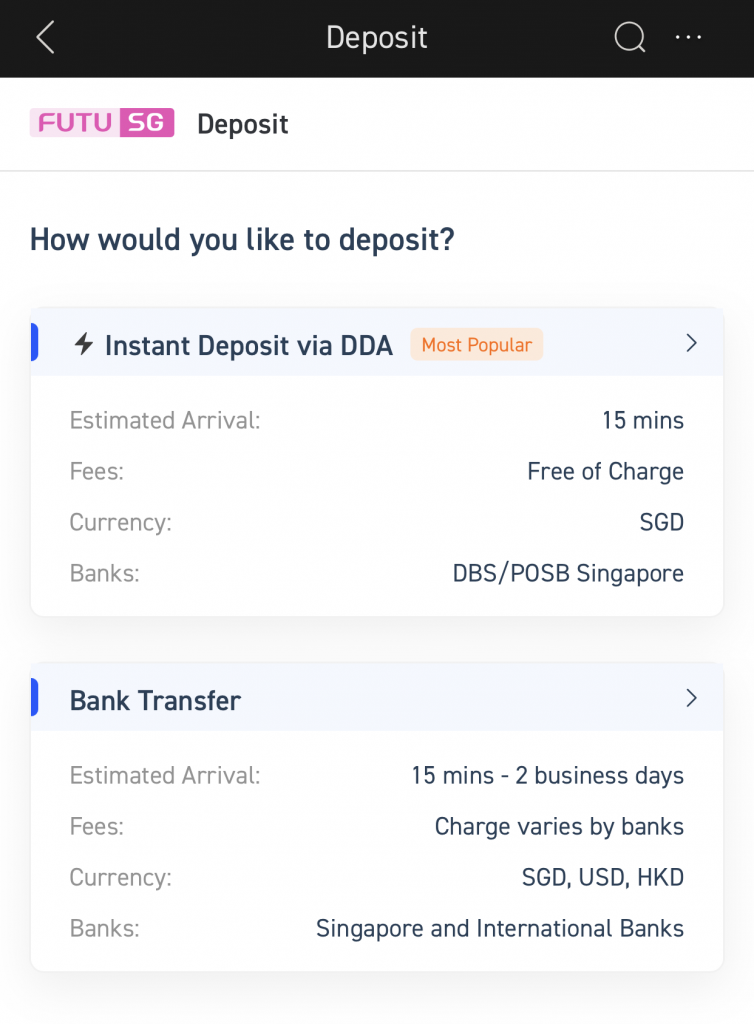

When I deposited my funds with them, it took a few hours before I received an email that moomoo (powered by FUTU SG) received my funds.

However if you have a POSB or DBS bank account, you should choose to use the direct debit (DDA) option.

You will be able to deposit your funds into your trading account in around 15 minutes!

You’ll need to transfer your funds to Saxo’s bank account first

For Saxo, you can transfer your funds in a variety of ways. This includes:

- FAST

- PayNow

- MEPS

- Wire transfer

The easiest way to deposit your funds will be either via FAST or PayNow.

Don’t forget to insert the unique deposit code in the ‘reference’ box when you’re making the transfer!

The deposit will also take a few hours to be processed.

Withdrawals may take a few business days

When you want to withdraw your funds from either platform, it may take a few business days before the funds reach your bank account.

The waiting time is around the same for either platform.

Type of Custodian Account

When you trade your assets on both brokerage firms, your assets will be under a custodian account.

moomoo (powered by FUTU SG) has a CMS License

The moomoo app is a trading platform offered by moomoo Inc., which is a subsidiary of Futu Holdings Limited.

moomoo (powered by FUTU SG) is licensed with the MAS under the Capital Markets License.

However, they do not disclose who their custodians are.

Nevertheless, they still should follow similar practices of keeping your assets separate from theirs.

In the unfortunate event that FUTU SG closes down, they will be unable to touch your assets.

Saxo also has the Capital Markets License

Saxo is also regulated by the MAS under the Capital Markets License.

In the event that Saxo goes bankrupt, your assets will be kept separately from Saxo’s.

Saxo has also been operating in Singapore since 2006. This should give you the reassurance that Saxo is here to stay for the long term.

Both accounts do not allow CDP linkage

Since both moomoo (powered by FUTU SG) and Saxo are custodian accounts, they are unable to be linked to your CDP account.

If you wish to transfer your shares from a CDP-linked broker to either broker, you would have to do a manual share transfer by contacting support.

Verdict

Here is a comparison between moomoo (powered by FUTU SG) and Saxo:

| moomoo | Saxo | |

|---|---|---|

| Type of Products Available | Stocks REITs ETFs Options Margin OTCs Warrants and CBBC Futures | Stocks ETFs Mutual Funds Options Managed Portfolio Regular Savings Plan |

| Number of Exchanges Available | 3 countries | 23 countries |

| Trading Commissions | Lower for US / HK / SG markets | Higher for US / HK / SG markets |

| Custody Fee | None | 0.12% p.a. |

| Currency Conversion Fee | None | 0.3-0.7% |

| Exchange Rate | Comparable | Comparable |

| Pre and Aftermarket Funding | Present | Present |

| Platforms | Mobile and Desktop | Mobile and Desktop |

| Ease of Opening Account | Similar | Similar |

| Funding Account Speed | A few hours ~ 15 minutes if using DDA | A few hours |

| Custodian Account | Did not mention | Under Saxo |

So which broker should you choose?

Choose moomoo (powered by FUTU SG) for cheaper fees in the SG / US / HK markets

While moomoo (powered by FUTU SG) only allows you to buy stocks in 3 countries, they offer cheaper fees compared to Saxo.

Furthermore, you are not charged any custodian or currency conversion fees, which helps to reduce your costs.

If you are intending to buy stocks in these 3 countries, moomoo (powered by FUTU SG) will be the better option for you.

moomoo (powered by FUTU SG) is offering an attractive promotion too, where you are able to receive perks such as:

- 1 free Apple (AAPL) share

- 180 days commission-free trading for US, HK & SG Markets

Choose Saxo for access to more markets and products

While Saxo charges higher fees, you have access to many more markets, such as:

- London Stock Exchange

- Tokyo Stock Exchange

- Bursa Malaysia

Furthermore, you are able to buy mutual funds and regular savings plans on Saxo.

If you want to have a platform with a wider variety of investment products, Saxo will be more suitable for you.

Conclusion

Both brokerages do have their advantages. Ultimately, it depends on what you are looking for in a broker, such as:

- The fees that you’ll have to pay

- The exchanges you can trade in

- The types of products you can purchase

If you decide to use both brokers, you can track your portfolios from these 2 brokerages using StocksCafe.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

moomoo Referral ($200 Stock Cash Coupon Bundle, AAPL Shares and Commission Free Trades for 180 Days)

If you are interested in signing up for a moomoo (powered by FUTU SG) account, you can use my referral link.

Here are some of the rewards you can receive (From 2 Oct 2021):

- Commission-free trading for 180 days (SGX, HKEX and US markets)

- $200 or $2,000 Stock Cash Coupon Bundle (First Deposit Reward)

- Apple share and iPhone 13 (First Transfer-In Rewards)

To receive these bonuses, here are the steps you’ll need to do:

#1 Sign up for a Moomoo account

You’ll need to use my referral link to sign up for a moomoo (powered by FUTU SG) account.

Once you have successfully opened a FUTU SG Securities Account, you will receive:

- 180 days unlimited commission-free trading for the US, HK & SG stock market (to be activated within 90 days)

- Lvl 2 US stock Market Data

- Lvl 1 SG stock Market Data

- Lvl 1 China A-Shares Market Data

First Deposit Reward

You will be able to receive a Stock Cash Coupon Bundle, depending on the amount that you deposit for your very first deposit:

| S$ 2,700 – S$ 199,999 | $200 Stock Cash Coupon Bundle |

| ≥ S$ 200,000 | $2,000 Stock Cash Coupon Bundle |

First Transfer-In Reward (US & HK stocks only)

If you transfer your US or HK stocks from another brokerage account to moomoo, you will be able to receive some rewards:

| SGD 50,000 – SGD 99,999 | 1 Free Apple (AAPL) share |

| SGD 100,000 – SGD 199,999 | 2 Free Apple (AAPL) shares |

| ≥ SGD 200,000** | 1 iPhone 13 (256GB; first 50 sets) OR 3 Free Apple (AAPL) shares |

To learn more, you can view more about this promotion on the FUTU SG website.

Saxo Referral (Earn $100-$250 in cash)

If you are interested in creating a Saxo trading account, you can take part in the referral program.

Here’s are the rewards that you can receive from this program:

| Action | Reward |

|---|---|

| Fund ≥ SGD $3,000 and make ≥ 3 qualifying trades | SGD $100 |

| Fund ≥ SGD $100,000 and make ≥ 3 qualifying trades | SGD $250 |

The 3 qualifying trades that you need to make have to be on margin products, such as:

- CFDs

- FX

- Futures / Forwards

- Options

The process is quite different from other referral programmes, so you can contact me for the next steps for the referral!

You can find out more about the referral program on Saxo’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?