Last updated on January 4th, 2022

You may have transferred your SGD into your Tiger Brokers account. However, you intend to buy stocks denominated in USD or HKD, such as the S&P 500 ETF.

How do you go about exchanging your SGD to different currencies?

Here’s what you need to know:

Contents

How to exchange currency in Tiger Brokers

Here are the 5 steps you’ll need to take to exchange your currency in Tiger Brokers:

- Go to ‘Trade’

- Go to ‘Exchange’

- Select the currencies you wish to exchange

- Select the amount you wish to exchange

- Make the exchange

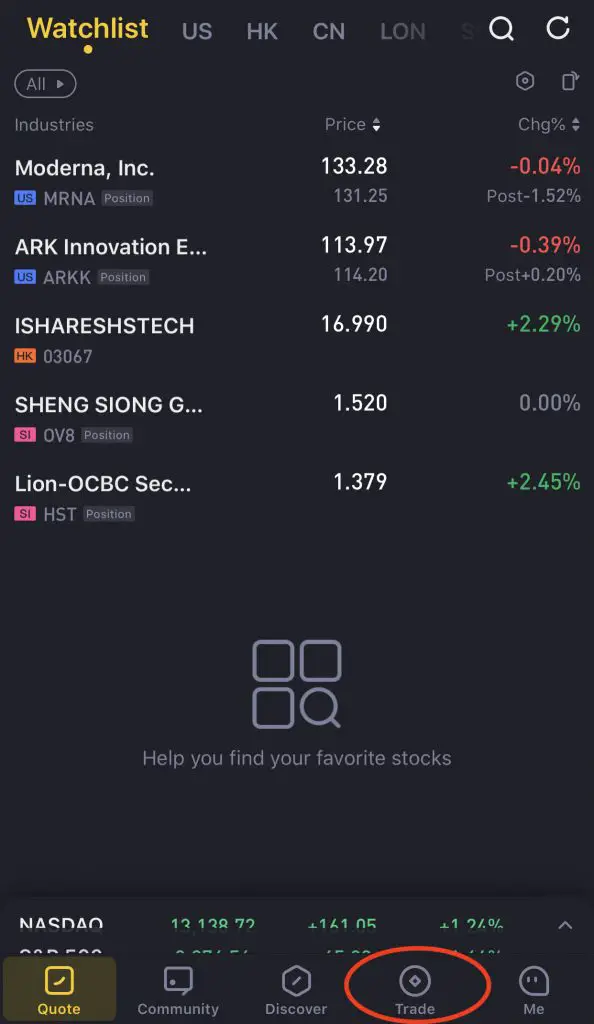

#1 Go to ‘Trade’

When you are on the Tiger Brokers app, you’ll need to go to the ‘Trade‘ tab.

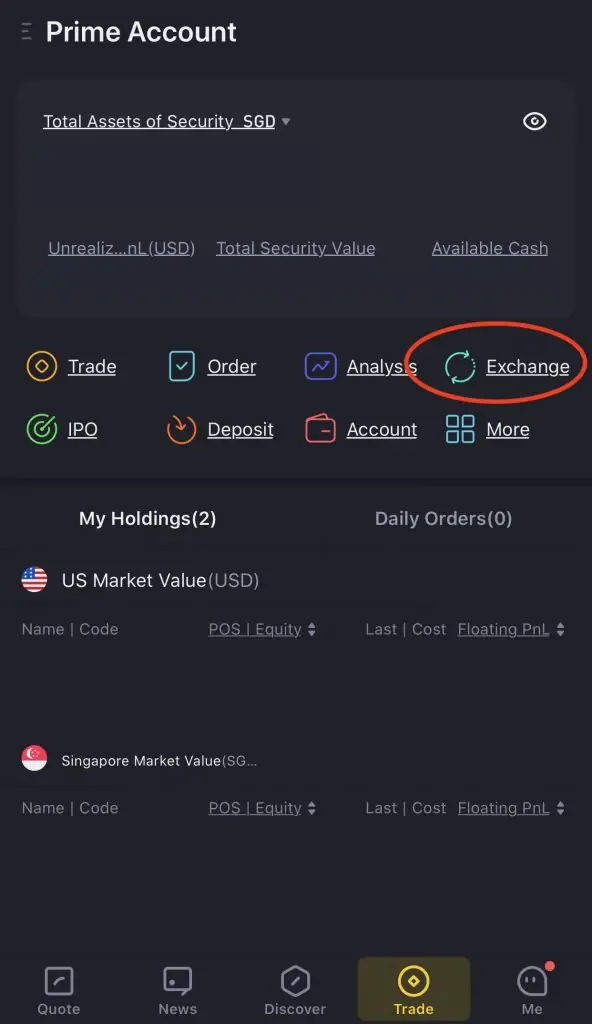

#2 Go to ‘Exchange’

Once you’re on the ‘Trade‘ tab, you’ll need to go to the Exchange button.

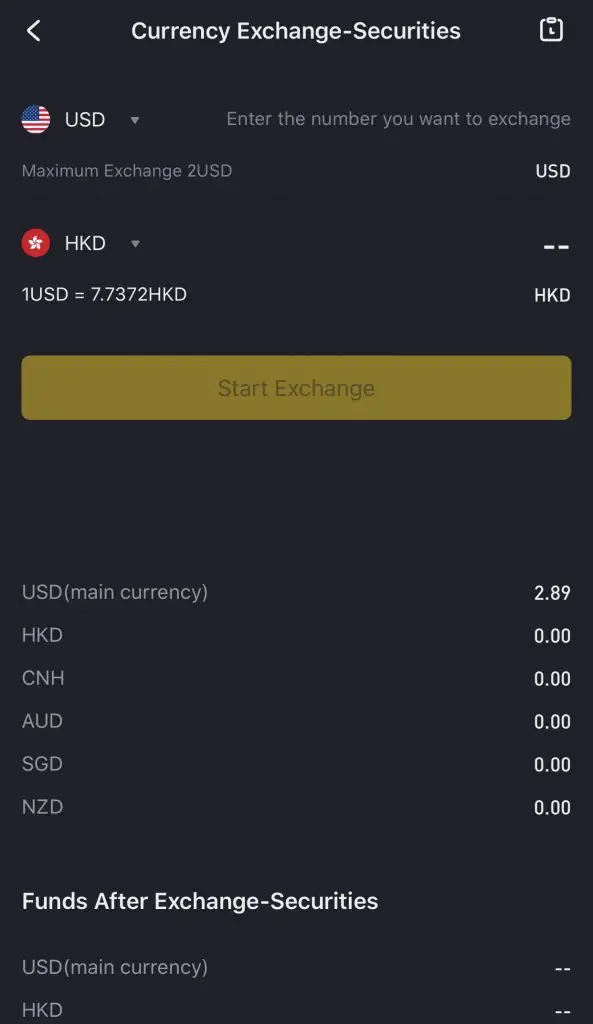

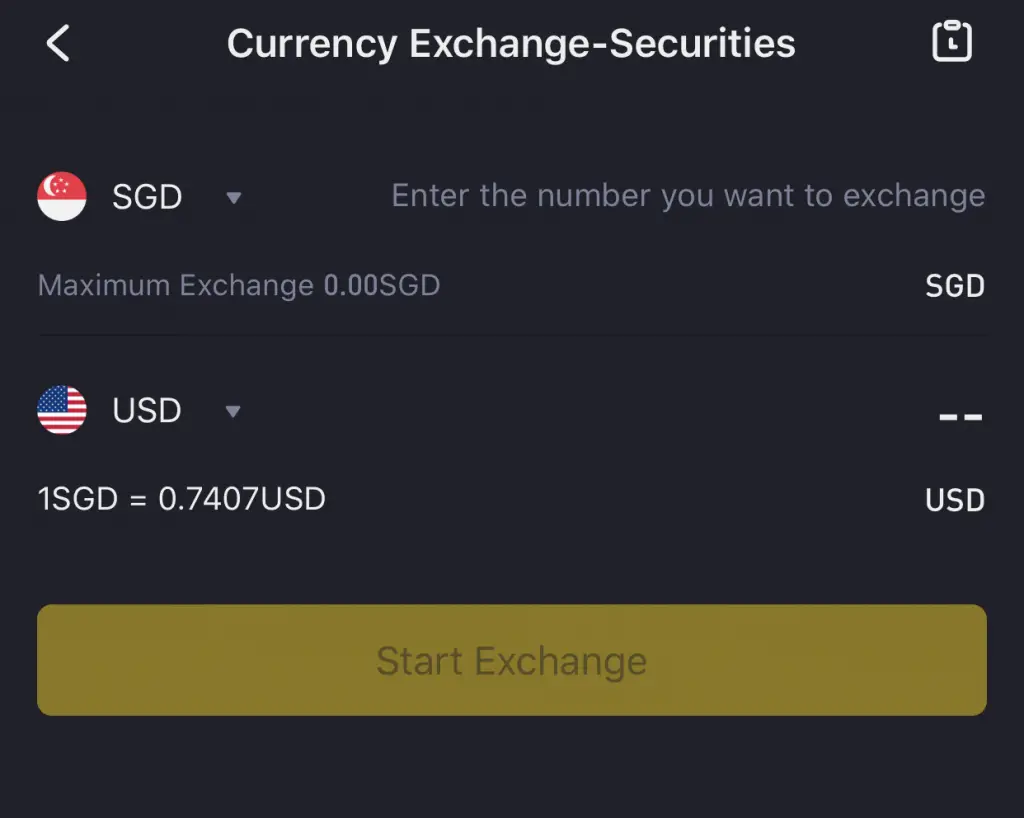

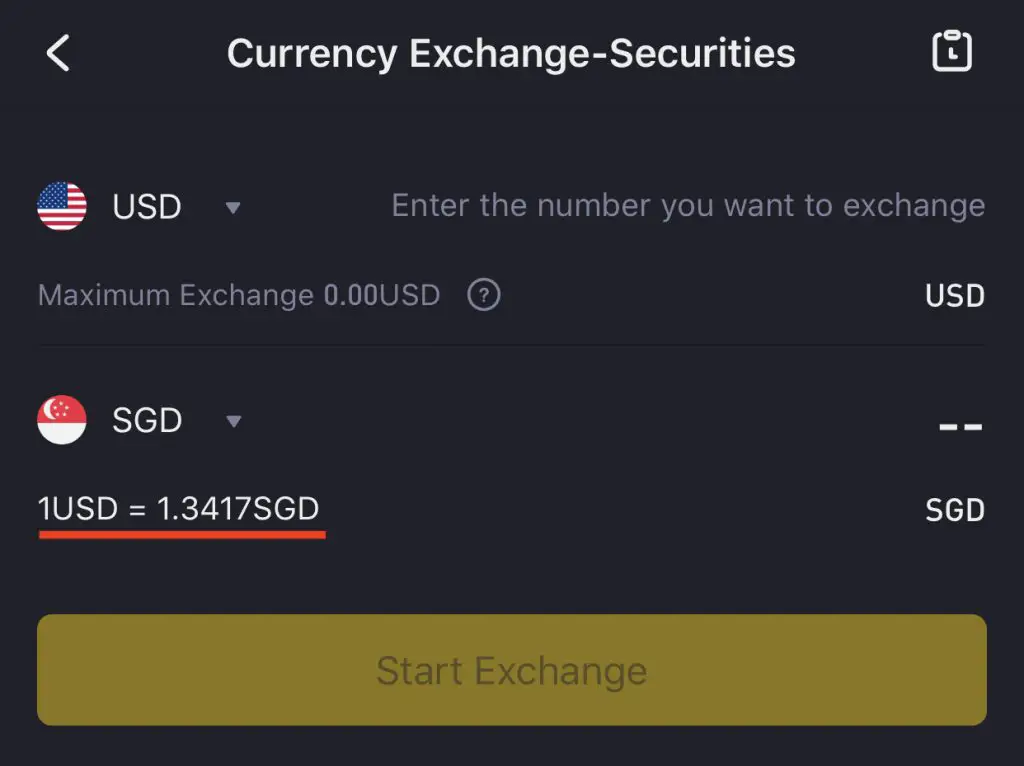

#3 Select the currencies you wish to exchange

After that, you’ll need to select the currencies that you wish to buy and sell.

You can exchange between these 6 currencies:

- USD

- HKD

- CNH

- AUD

- SGD

- NZD

#4 Select the amount you wish to exchange

After selecting the currencies, you’ll need to select the amount that you want to transfer.

You’ll be able to see the exchange rate that you’ll be exchanging at.

#5 Make the exchange

Once you’re done, all you need to do is press ‘Start Exchange‘.

When the currency conversion is completed, the amount will be reflected in the corresponding cash accounts.

You can use the Tiger Brokers app to exchange currency too

You can exchange currency on the Tiger Brokers app too.

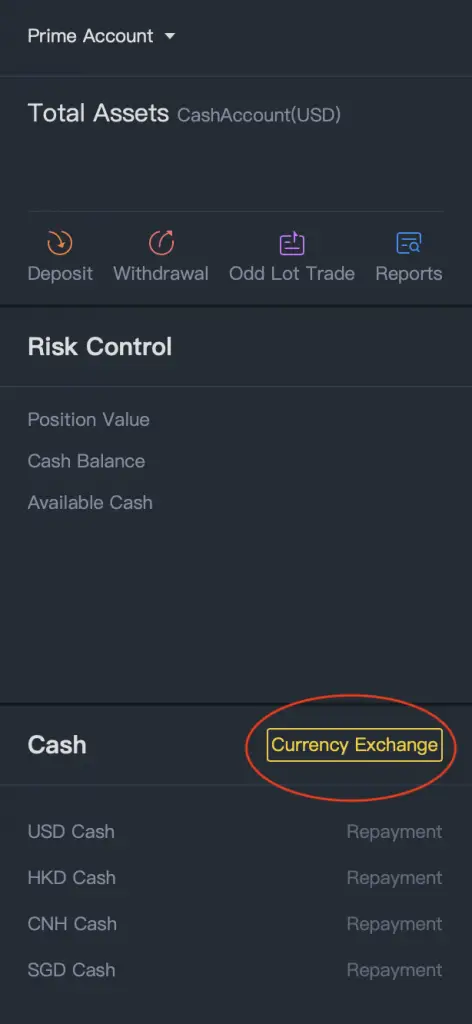

You’ll need to go to ‘Assets‘ on the dashboard,

and then to ‘Currency Exchange‘.

Does Tiger Brokers auto-convert my funds when I’m making trades in other currencies?

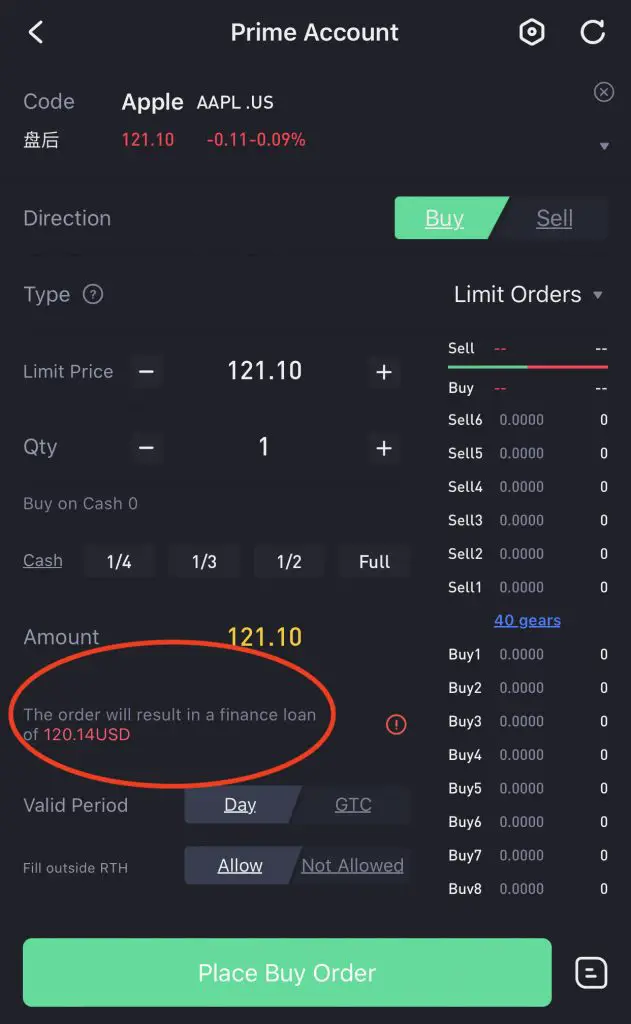

Tiger Brokers does not auto-convert your SGD to other foreign currencies. If you do not exchange your SGD to the foreign currency beforehand, you will be trading using margin. You are borrowing money from Tiger Brokers, which will incur a high interest rate.

When you transfer in your SGD, you will need to manually convert your SGD into USD.

Tiger Brokers will not auto-convert your currencies for you!

If you want to buy a certain stock and you do not have enough money in your USD account, Tiger Brokers will assume that you are trading on margin.

This is only applicable if you chose to create a Margin Account. You are unable to trade on margin on a Cash Account.

Usually, the interest rates are very high when you borrow money from Tiger Brokers to make the trade.

As such, you may incur really high costs if you do not convert your currency first before trading!

How is the exchange rate like on Tiger Brokers?

Tiger Brokers has a currency spread of between 0.3-0.5%. This is not as competitive as some brokers (e.g. Interactive Brokers), but it is still a decent spread. Nevertheless, it will affect your returns if you are exchanging a large sum of money.

Here is a live comparison of Tiger Broker’s exchange rate (USD to SGD),

and the exchange rate on xe.com.

The difference between the 2 exchange rates is around 0.0041, or 41 pips.

The difference in exchange rates will severely affect you if you are exchanging large amounts of USD to SGD.

Other than that, the difference in exchange rates should be quite minor!

Does Tiger Brokers charge a currency conversion fee?

Tiger Brokers does not charge any currency conversion fees. They will most probably profit from each currency exchange via the spread.

Compared to other brokerages like Saxo or Interactive Brokers, Tiger Brokers does not charge a currency conversion fee.

This helps you to save on the amount of fees that you incur for each currency conversion you make!

Conclusion

Converting currencies on Tiger Broker’s platform is rather straightforward, and you can even do it for the dividends that you receive.

Moreover, you do not need to pay currency conversion fees, which helps to reduce your costs!

The spread can be rather high compared to other brokerages. However, the spread will only affect your funds if you are exchanging a large amount.

After converting your SGD to USD, you can consider withdrawing USD back to your DBS account, and even deposit to FTX!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

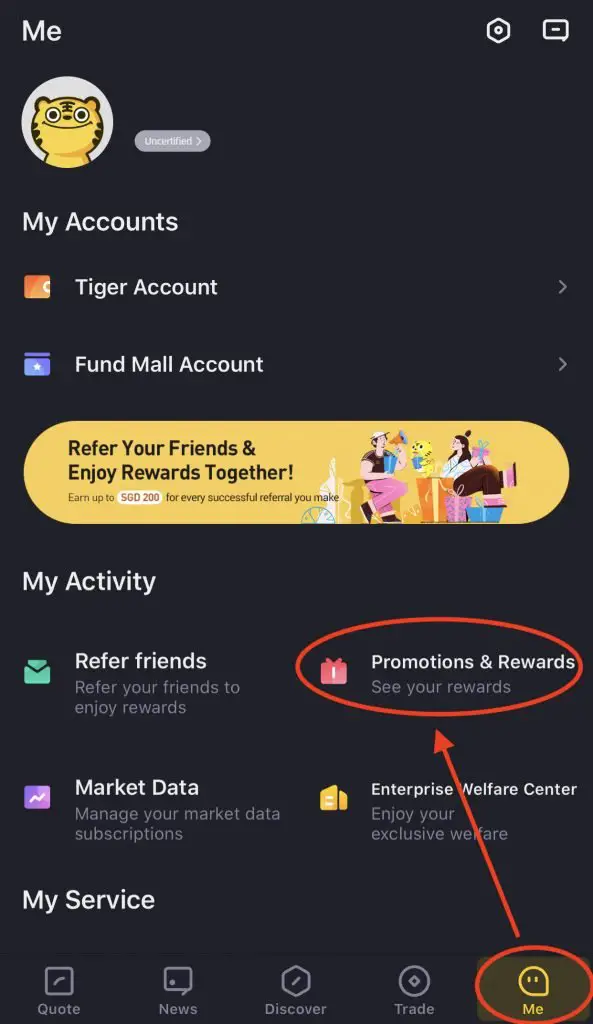

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

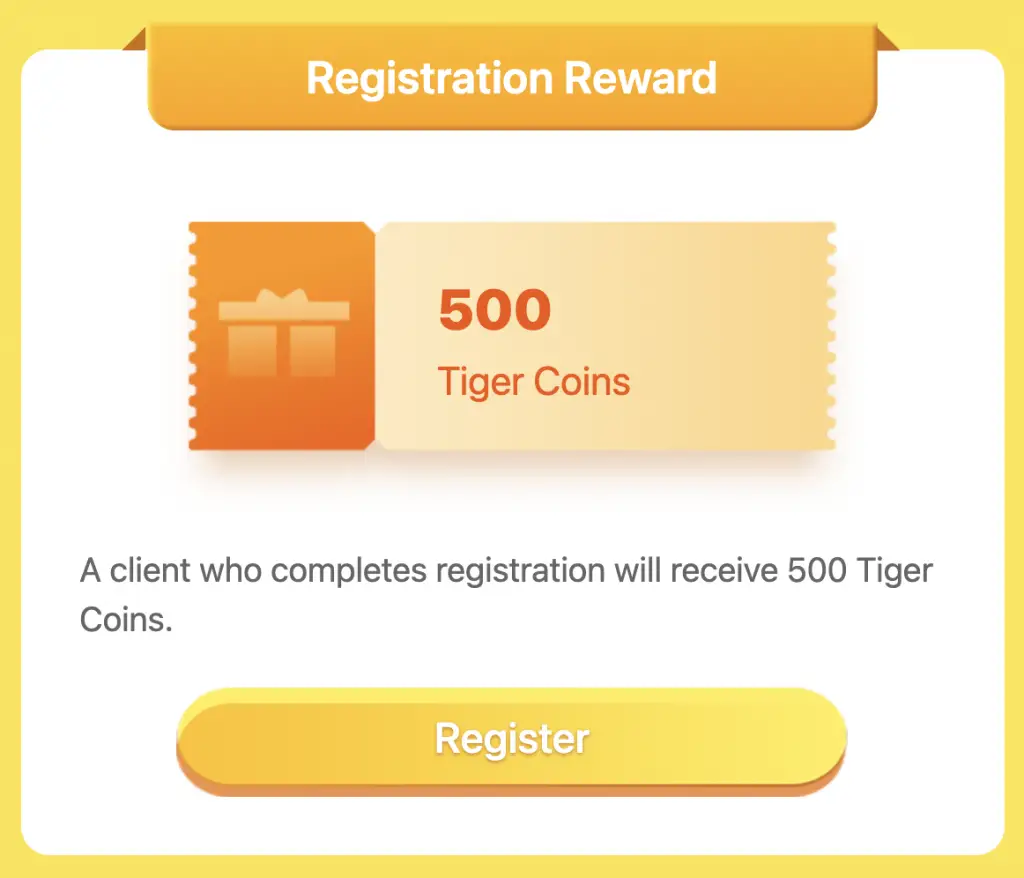

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

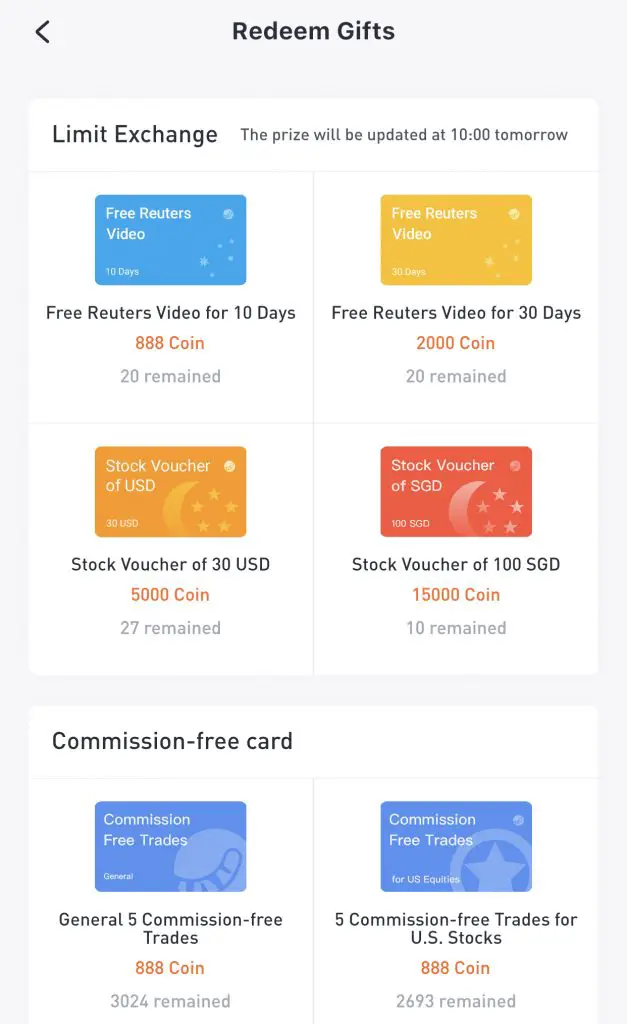

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

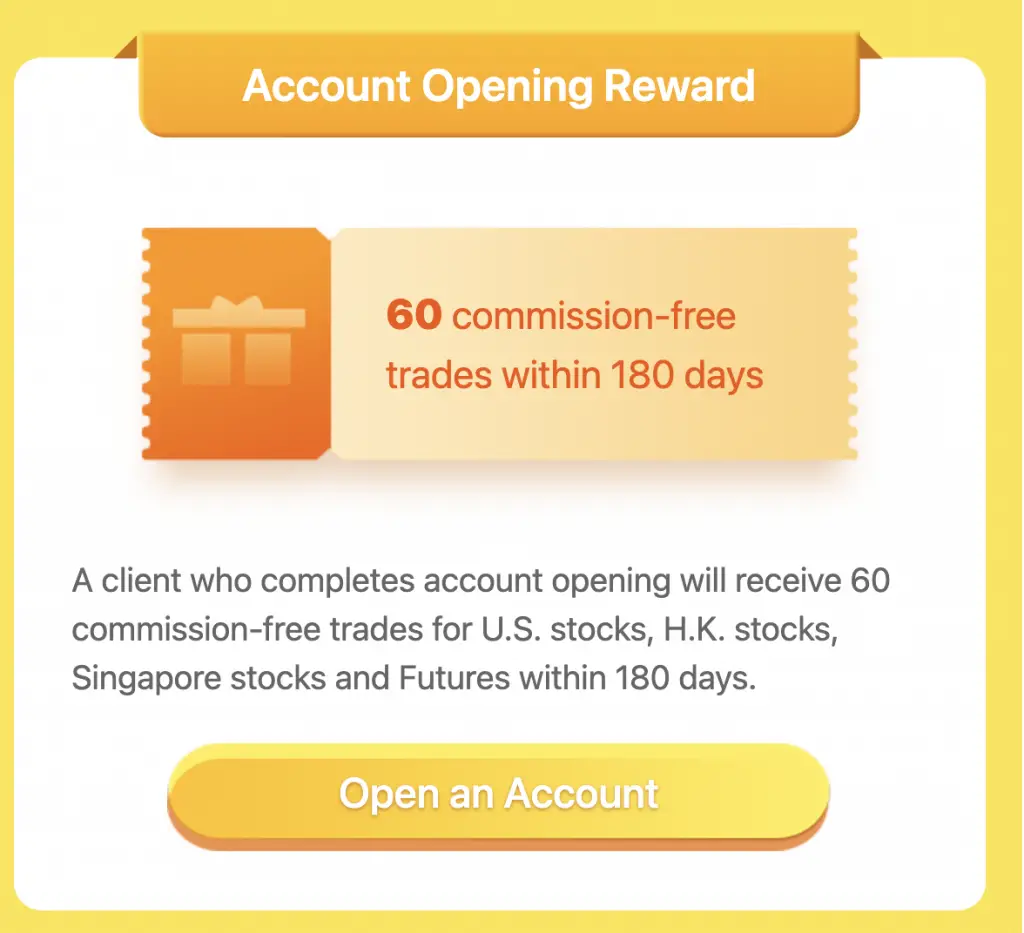

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?