Last updated on February 13th, 2022

If you want to earn some interest on your crypto, there are quite a few platforms that offer you high interest rates.

2 of these platforms include Celsius and BlockFi.

How are they different, and which should you choose?

Here’s what you need to know:

Contents

- 1 The difference between Celsius and BlockFi

- 2 Founder

- 3 Number of cryptocurrencies

- 4 Buying cryptocurrency

- 5 Interest rates

- 6 How you earn your rewards

- 7 Borrowers of both platforms

- 8 Deposit

- 9 No lock-in period

- 10 Withdrawal fees

- 11 Taking loans

- 12 Platform

- 13 Security

- 14 Verdict

- 15 Conclusion

- 16 👉🏻 Referral Deals

The difference between Celsius and BlockFi

Celsius allows you to earn interest in a wider number of cryptocurrencies (44 vs 13). The interest rates are generally higher on Celsius, and you get free withdrawals while BlockFi only has 1 free withdrawal per month.

Here is an in-depth comparison between these 2 accounts:

Founder

Celsius was founded in 2017 and is based in New York.

Meanwhile, BlockFi was founded in 2017 and is headquartered in New York.

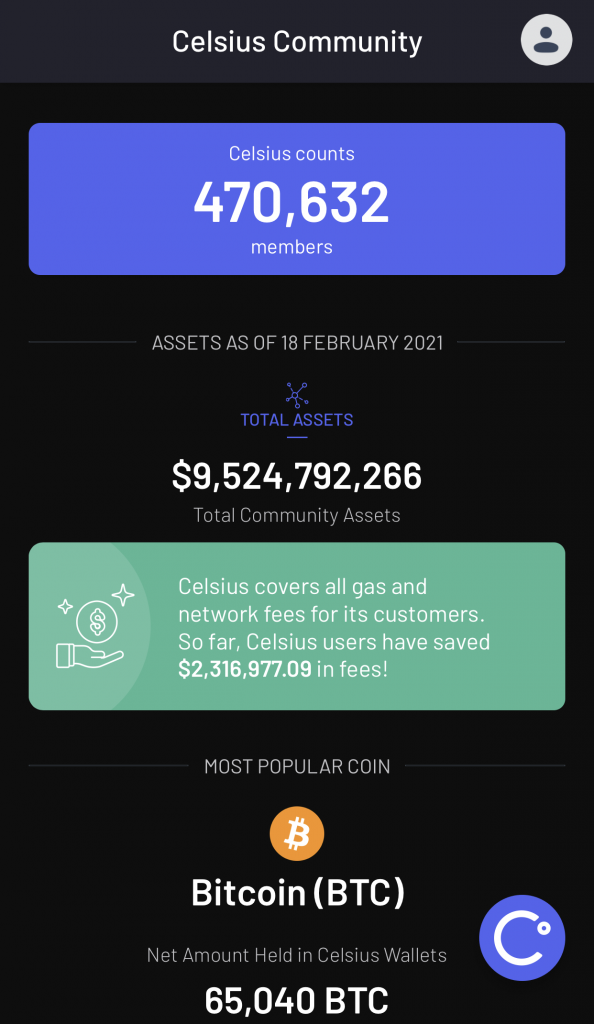

Celsius is the much larger network with over 470k users.

Meanwhile, BlockFi has more than 125,000 users on their platform.

Number of cryptocurrencies

Here are the different cryptocurrencies that you can deposit into either account:

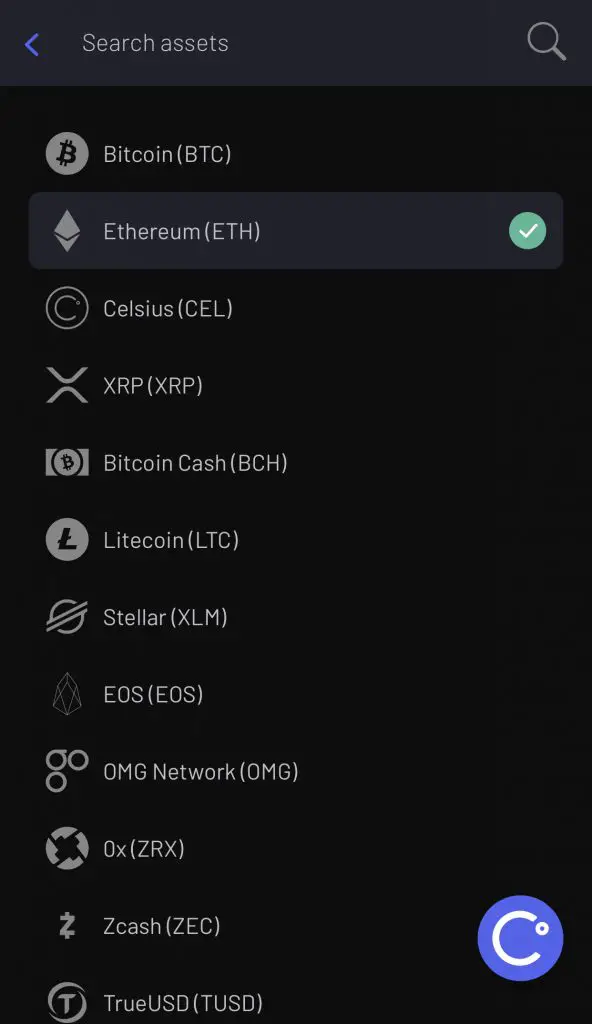

Celsius allows you to deposit 44 cryptocurrencies

Celsius has a really diverse offering. You are able to deposit 44 currencies into their platform.

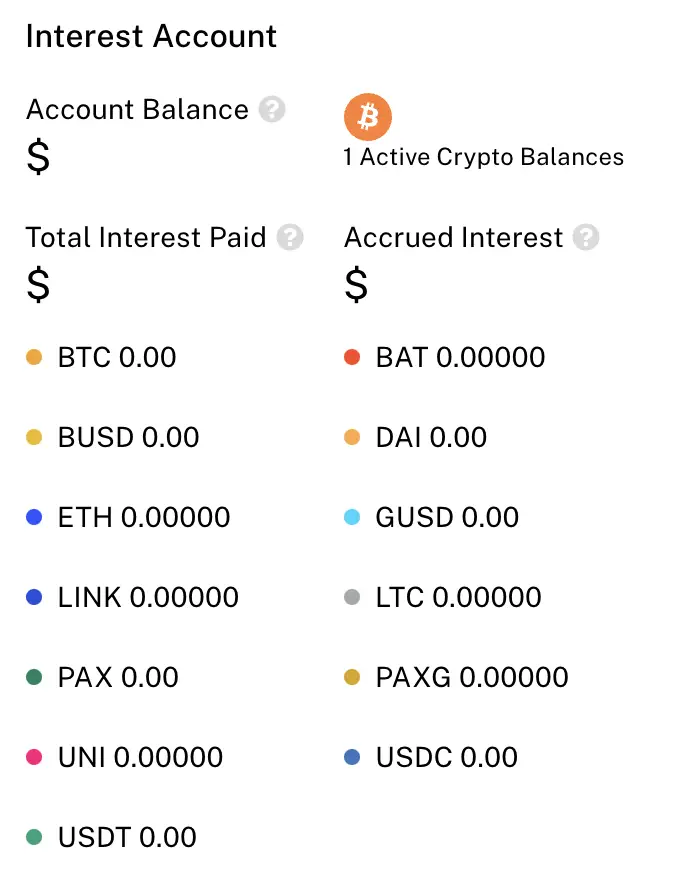

BlockFi allows you to hold 13 different currencies

Meanwhile, BlockFi only allows you to deposit 13 cryptocurrencies into your account.

The number of cryptocurrencies that you can hold are much lower on BlockFi.

Here are some currencies that are found on Celsius, but not on BlockFi:

- UNI

- BAT

- EOS

- XLM

- XRP

- BSV

Buying cryptocurrency

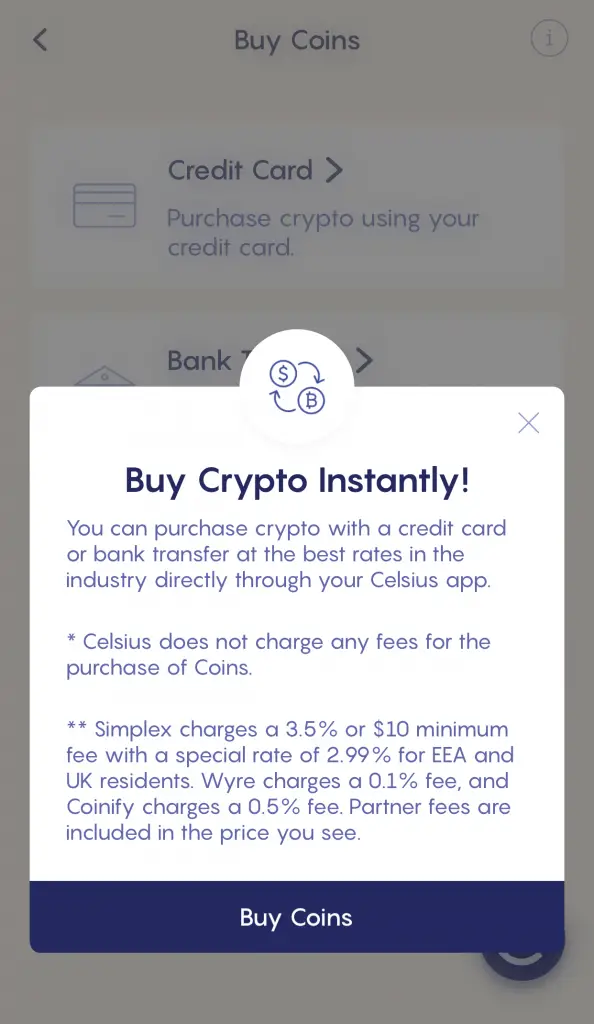

It is possible for you to purchase crypto on the Celsius app!

You can do this via 2 ways:

- Credit or debit card

- Bank transfer

However, the fees that you incur can be pretty hefty:

| Payment Provider | Fees |

|---|---|

| Wyre | 0.1% (ACH transfer, US only) |

| Coinify | 0.5% (manual bank transfer) 2% (EU credit card) 3.5% (non-EU credit card) |

Unless you are staying in the US, it may be better to purchase your crypto on another exchange first. Then, you can deposit your crypto into Celsius from that exchange.

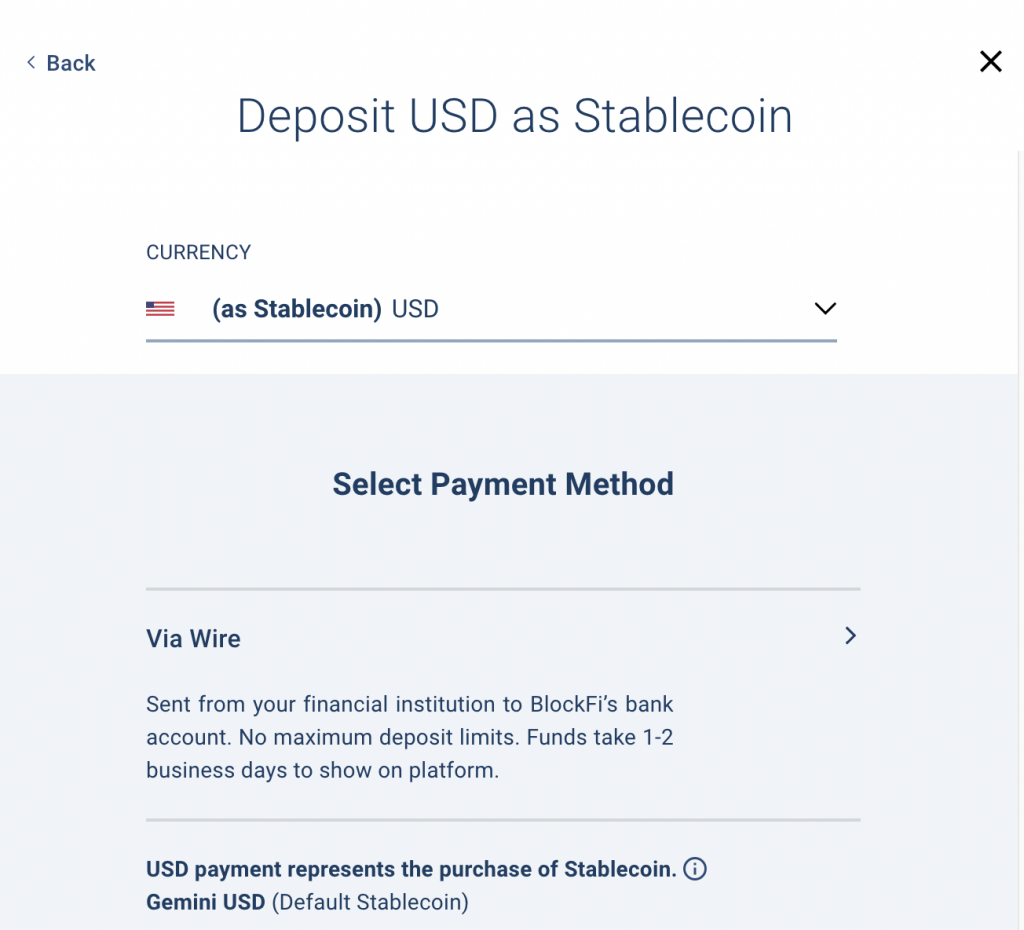

BlockFi does not allow you to purchase crypto directly

Meanwhile, BlockFi only allows you to transfer USD into your account.

You are able to transfer your USD via a wire transfer. The minimum deposit is $10.

You are unable to buy crypto using your credit card, unlike Celsius.

When you deposit USD into your BlockFi account, you will receive the equivalent in GUSD.

GUSD is a stablecoin that is created by Gemini.

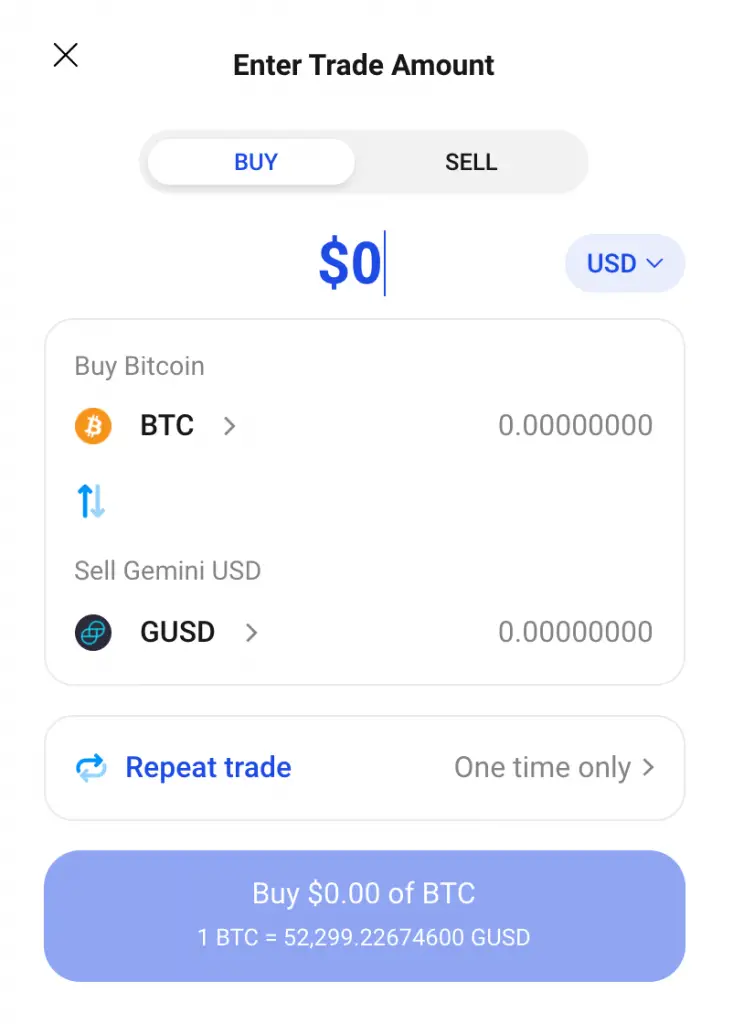

After depositing your USD, you can trade to other cryptocurrencies from your GUSD.

Interest rates

The main thing you’ll be interested in are the interest rates that either account offers you.

Celsius allows you to earn interest in 2 ways:

- In-kind reward (same currency that you own)

- Interest in CEL token

Celsius allows you to earn a higher interest rate, if you choose to earn it in CEL tokens.

However, the option to earn in CEL is not available if you’re from the United States.

Meanwhile, BlockFi only provides you with interest based on the currency that you own.

Here are the interest rates for some currencies that you can deposit on both platforms:

| Currency | Celsius In- Kind APY | Celsius CEL APY | BlockFi APY |

|---|---|---|---|

| BTC | 6.20% (Up to 1 BTC) 3.51% (After 1 BTC) | 4.4% | 4.0% |

| ETH | 5.35% (Up to 100 ETH) 5.05% (After 100 ETH) | 6.35% | 4.0% |

| USDT | 8.88% | 11.21% | 7.5% |

| USDC | 8.88% | 11.21% | 7.5% |

| LTC | 4.08% | 5.12% | 4.5% |

APY stands for annual percentage yield. This takes into effect the compounding interest that you earn on your crypto.

It seems that across the board, Celsius does provide the higher interest rates for your crypto. This is especially if you choose to earn your rewards in CEL tokens.

Even for the stablecoins (USDT and USDC), the in-kind rewards for Celsius are much higher too!

If you are looking to earn a better interest rate, then Celsius seems to be the better platform to use!

Interest rates may change

Like all other accounts, the interest that you earn on your crypto is not guaranteed.

Both accounts reserve the right to change the yields at any time.

For Celsius, the interest that you earn changes on a weekly basis. This is rather volatile, and it may fluctuate quite a bit.

However for BlockFi, they will review their interest rates each month and make any changes accordingly.

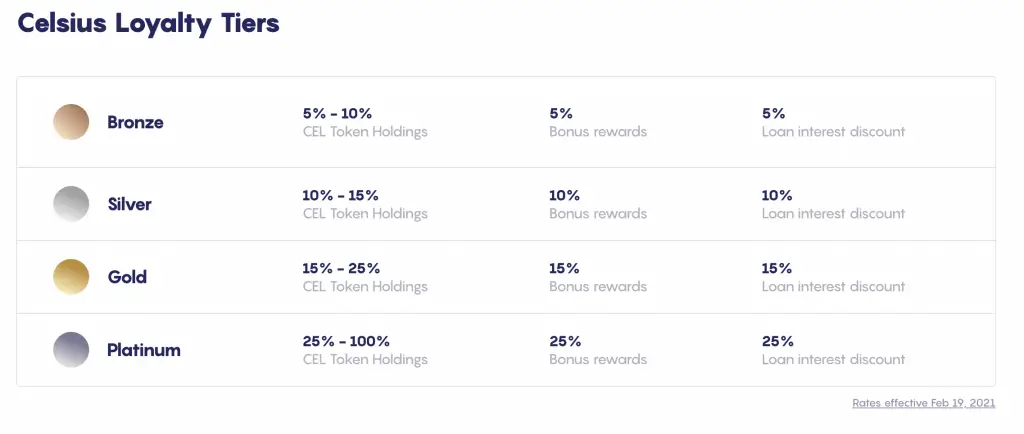

Celsius offers extra rewards based on the amount of CEL you own

Celsius also allows you to earn even more interest if you’re holding the CEL tokens. This is based on the amount of CEL that you own in your Celsius portfolio.

Depending on the amount of CEL that you hold, you are able to earn even more interest!

How you earn your rewards

For Celsius, your rewards are calculated for each week, between Friday to the next Friday.

Your interest is calculated, and then paid on the following Monday.

Meanwhile for BlockFi, your interest is only paid on the first business day of each month. This is similar to how banks pay you.

As such, Celsius may be the better option since it gives you weekly payouts. This way, you are able to compound your returns even faster!

Borrowers of both platforms

How can both of these platforms afford to pay you such a high interest rate on your crypto?

Celsius lends your crypto to their approved borrowers. Your crypto is also secured with collateral too.

Celsius also claims to return up to 80% of the interest that they earn from lending your coins. This allows them to offer such high interest rates to you.

Meanwhile, BlockFi lends your crypto to “trusted institutional and corporate borrowers“. They also lend your crypto “on overcollateralized terms“.

Over-collateralization (OC) is the provision of collateral that is worth more than enough to cover potential losses in cases of default.

Investopedia

This means that your crypto is lent to rather reputable sources who are able to pay in case of a default.

However, the assets that you own in BlockFi are not insured by the FDIC!

Deposit

Both Celsius and BlockFi do not have any minimum deposit.

This means that you can deposit any amount into either account, and still earn interest on it!

However, if you decide to only deposit a small amount into BlockFi, you may want to take note of the minimum withdrawal amount of 0.003 BTC and 0.056 ETH.

While you still can withdraw amounts lower than this minimum, the transaction may take up to 30 days to process.

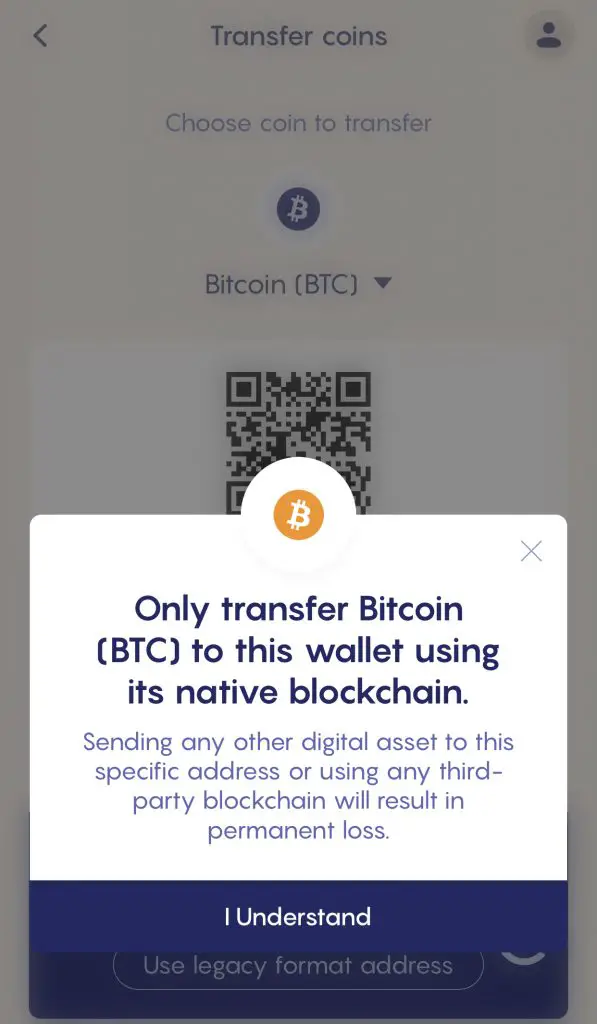

When you are depositing money into either account, you will be given a crypto wallet address to send your crypto to.

You can send your crypto from any exchange that allows you to do so. Some examples include:

It is very important that you only send crypto of the same currency to the wallet. If not, all of your crypto will be lost!

You will also need to make sure that the address that you’re sending to is exactly the same!

The string of letters and numbers are really long. If you make any mistake when typing out the address, your crypto will be lost forever!

As such, you may want to directly copy and paste the address instead.

No deposit fees

You are also not charged any deposit fees for either account.

However, you’ll need to consider the fees you’ll incur when sending your crypto from an exchange!

This depends on the exchange that you’re using, and some of them may be very hefty.

Some exchanges like Gemini allow you to withdraw from them up to 10 times each month without incurring any fees. This will help to save on any fees that you incur.

No lock-in period

Both Celsius and BlockFi do not have any lock-in periods. This means that you are able to freely withdraw your crypto any time you wish!

For BlockFi, you do have certain withdrawal limits over a 7-day period:

| Currency | Withdrawal Limit (Over 7-Day Period) |

|---|---|

| BTC | 100 |

| ETH | 5,000 |

| LTC | 10,000 |

| Stablecoins | 1,000,000 |

| PAXG | 500 |

Withdrawal fees

Celsius does not charge you any fees when withdrawing from your account!

Meanwhile, BlockFi allows you free withdrawals for each month:

- 1 free crypto withdrawal per month

- 1 free stablecoin withdrawal per month

This free withdrawal can only be applied to one currency only.

After that, you’ll be charged withdrawal fees which depends on the currency you withdraw:

| Crypto | Withdrawal Fee |

|---|---|

| BTC | 0.00075 BTC |

| ETH | 0.02 ETH |

| LTC | 0.0025 LTC |

| Stablecoins | $10.00 USD |

| PAXG | 0.015 PAXG |

As such, it may be more cost effective to deposit your crypto into Celsius. This is because you won’t incur any fees when you’re withdrawing your funds in the future!

Taking loans

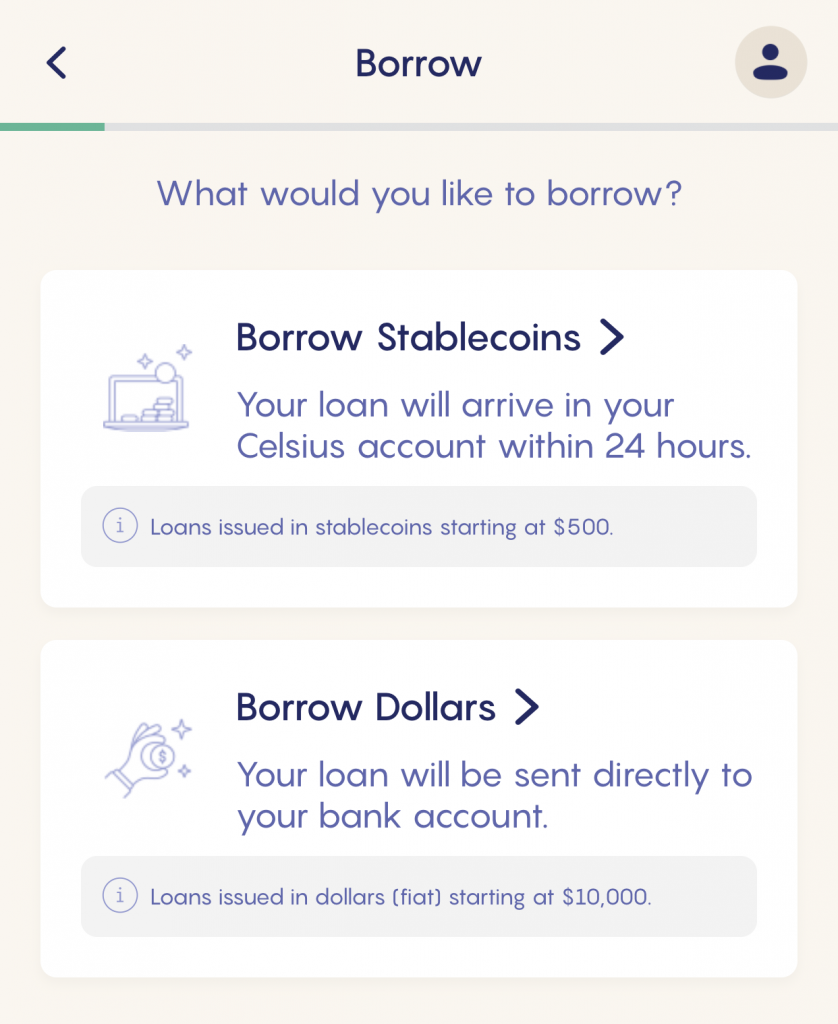

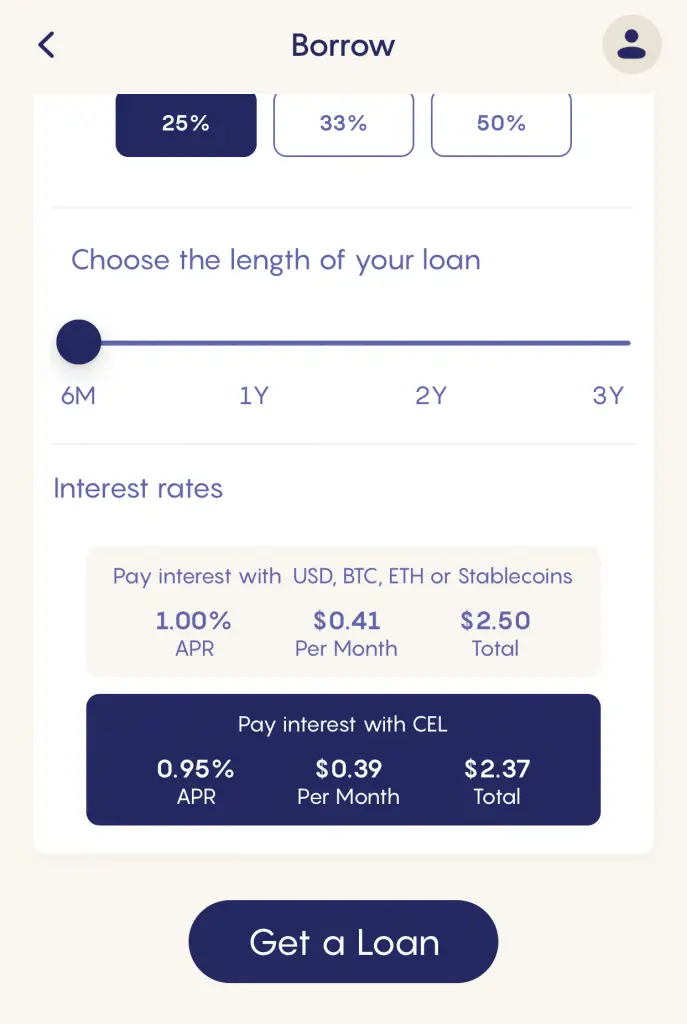

Celsius allows you to take a loan on their platform.

Here are the currencies that you can loan:

| Type of Currency | Currencies Available |

|---|---|

| Crypto | TUSD, GUSD, PAX, USDC, USDT ERC20, DAI |

| Fiat | USD |

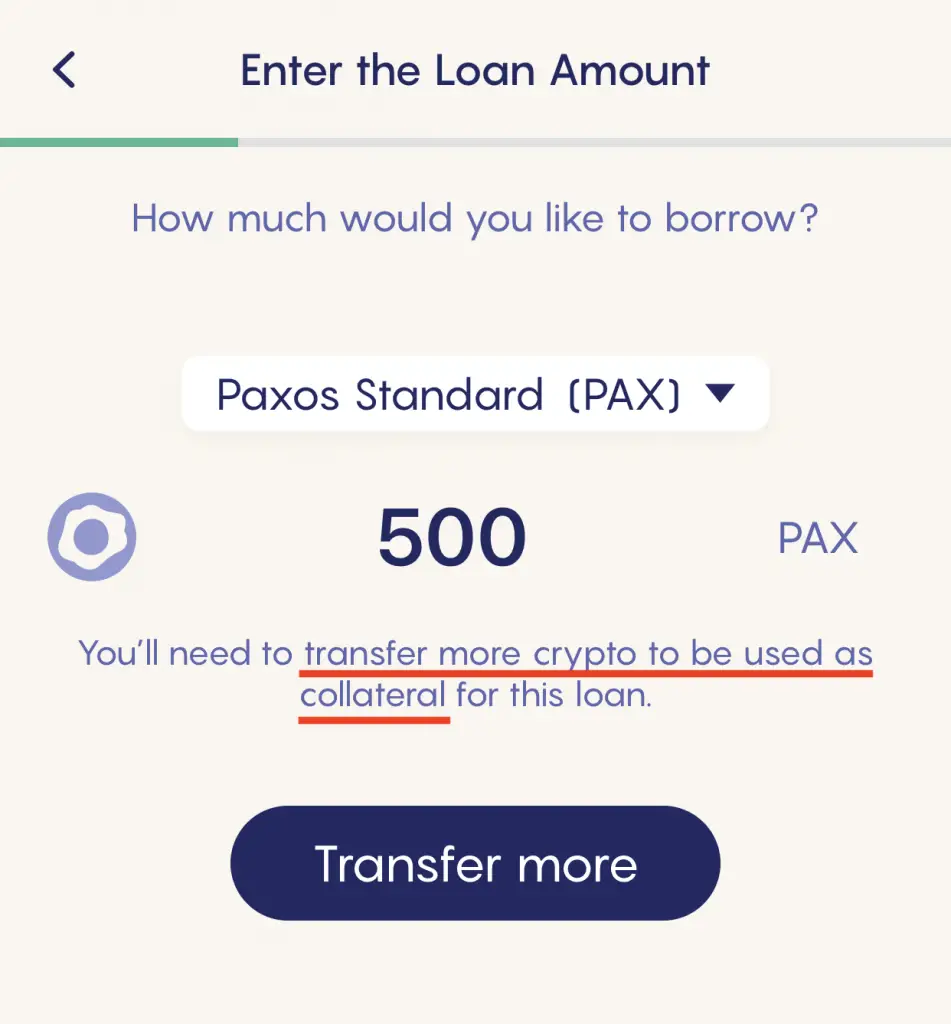

To take a loan, you would need to have some cryptocurrency kept as collateral.

The amount of interest that you pay depends on 3 factors:

- The loan tenure (6-36 months)

- Loan to Value (25% – 50%)

- Whether you’re paying your loan in CEL or Cash

You can use the in-app calculator to determine the amount you’ll need to pay in interest.

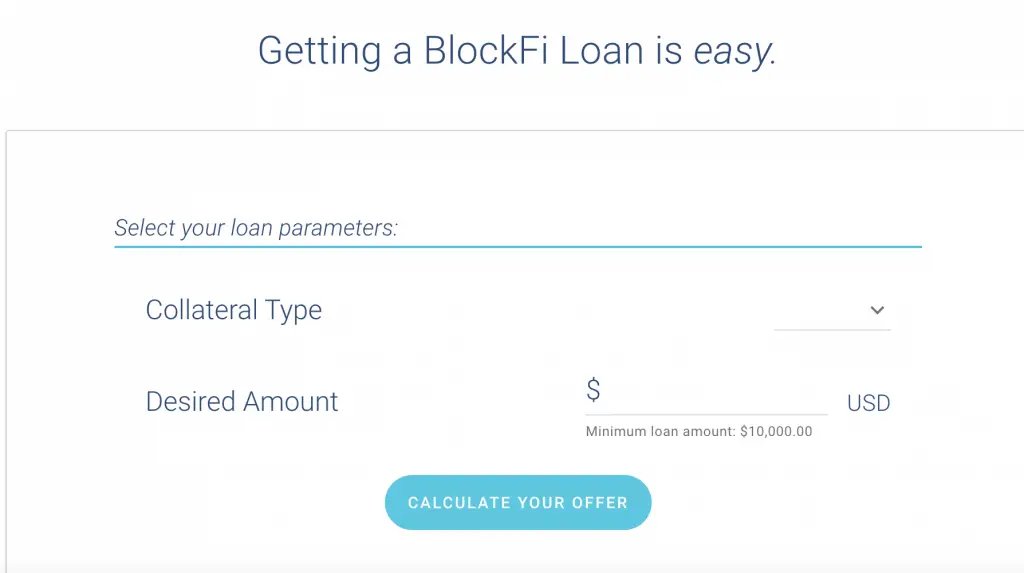

BlockFi also has loans on their platform

BlockFi also allows you to take a loan on their platform.

You will need to select a collateral from 4 cryptocurrencies:

- BTC

- ETH

- LTC

- PAXG

You can only take a loan in USD. This is more restricted compared to Celsius which allows you to take a loan in crypto.

The minimum amount you can loan from BlockFi is $10,000 USD.

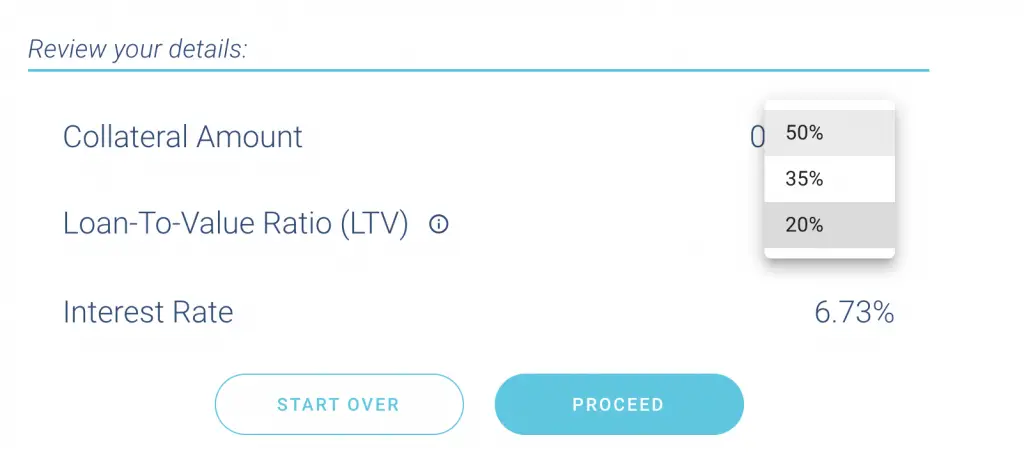

The interest rate that you are charged depends on your Loan-To-Value (LTV) ratio:

The interest rates are much higher compared to Celsius’ rates!

Platform

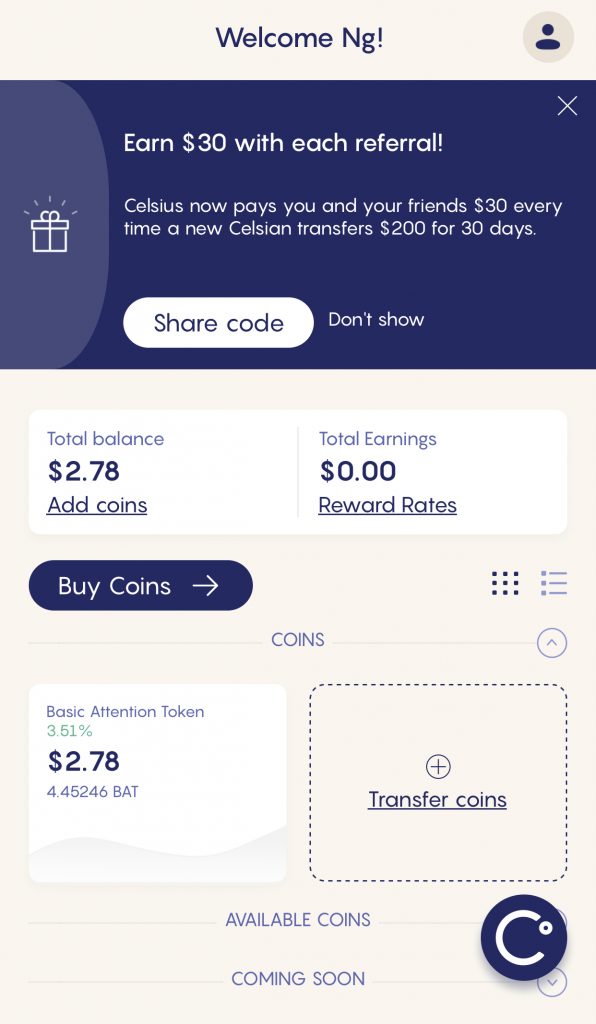

Celsius is a mobile app-only platform.

Even though Celsius has a website, you can’t login from the platform.

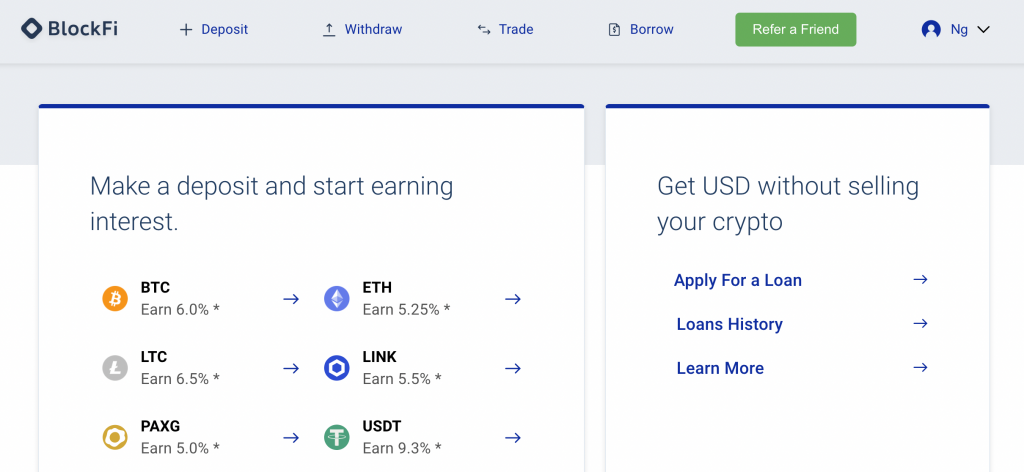

Meanwhile, BlockFi has both a web platform,

as well as a mobile app.

This makes BlockFi slightly more accessible.

Security

If you intend to leave your funds with either account, you will be more at ease if they are secure.

So what measures do both of these accounts have?

Celsius is insured, but only for assets under their custody

Celsius does not disclose the security measures that they have.

However, the assets under their custody are insured by Fireblocks and PrimeTrust.

Your assets are only insured when they are under the custody of Celsius. Once they are loaned out to borrowers, your assets are no longer insured!

However, Celsius is a pretty well established company. Its services are available in more than 100 countries around the world.

As such, I believe that your assets should be rather secure with this platform!

BlockFi uses Gemini as their primary custodian

To ensure that some of your assets are available to be withdrawn quickly, BlockFi leaves your assets under the custody of 3 institutions:

Gemini is BlockFi’s main custodian of your assets.

Majority of your assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft.

Gemini

It seems that Gemini’s owners are quite confident about the security of their platform!

As such, you can be reassured that your assets are rather safe with BlockFi.

Crypto lending is risky

The reason why both platforms are offering such high interest rates on your crypto is because this is quite a risky business.

Cryptocurrency is very volatile, and it may fluctuate in price by a lot!

The amount of crypto that you have in your portfolio really depends on your risk profile.

As such, you should decide if you are willing to take the risks when it comes to investing into any cryptocurrency!

Verdict

Here is a comparison between Celsius and BlockFi:

| Celsius | BlockFi | |

|---|---|---|

| Year Founded | 2017 | 2017 |

| HQ | New York | New York |

| Number of Currencies | 44 | 13 |

| Buying Cryptocurrency | Available | Available (via Trading) |

| Interest Rates | In-Kind CEL (higher interest) | In-Kind |

| Accrual of Interest | Every Monday | Every 1st business day of the month |

| Deposit Fees | None | None |

| Minimum Deposit | None | None |

| Lock-in Period | None | None |

| Withdrawal Fees | None | 1st withdrawal for both crypto and stablecoin are free |

| Loans | Present | Present |

| Platform | Mobile app only | Web and mobile platforms |

| Security | Insured by Fireblocks and PrimeTrust | Gemini as primary custodian |

Both platforms are rather similar, so which should you choose?

I am leaning towards Celsius, because:

- The interest rates are generally higher (especially when you earn in CEL)

- Your interest is credited weekly

- There are no withdrawal fees

- You are able to earn on a wider variety of cryptocurrencies

The only main drawback with Celsius is that the interest rates change weekly. This heavily depends on the market rates and can be very volatile.

Even if the interest rates drop, you can choose to withdraw your crypto for free!

Conclusion

Both accounts allow you to earn extra interest on your crypto, which is similar to Crypto Earn.

Since they are rather similar, it may not really matter which platform you choose!

Here are some things you’ll need to consider:

- The type of currency you intend to hold

- The number of withdrawals you wish to make

- The amount of interest that you wish to earn

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?