Last updated on October 28th, 2021

Have you ever wanted to use DeFi services, but you aren’t sure how to do so?

Cake DeFi makes DeFi services like staking and liquidity mining really accessible, even if you don’t have any technical knowledge!

Here’s how this platform can help you earn high yields on your crypto:

Contents

Cake DeFi Review

Cake DeFi provides 3 main services that aim to grow your crypto assets. The only fees you are charged are liquidity mining reward fees, as well as fees for withdrawing your assets from their platform. Cake DeFi is very transparent with their transactions, which makes it a rather safe platform to grow your assets.

Here is this platform reviewed in-depth:

What is Cake DeFi?

Cake DeFi is a platform that helps retail investors take advantage of decentralised finance (DeFi) services, even though they do not have the technical knowledge to do so. You are able to use their DeFi services and start earning a high yield on your crypto.

Simply put, Cake DeFi makes DeFi services accessible to anyone. This saves you the hassle of having to know how to stake your coins!

All you’ll need to do is transfer your crypto assets to Cake DeFi’s platform, and you can start using their services.

You can consider using Gemini to send your crypto to Cake DeFi as they do not charge you any fees for your first 10 withdrawals. Furthermore, Gemini’s Active Trader platform only charges you up to 0.35% for each trade you make.

Cake DeFi does not have any minimum deposit. This means that you can start earning rewards on your crypto, no matter how little the amount is.

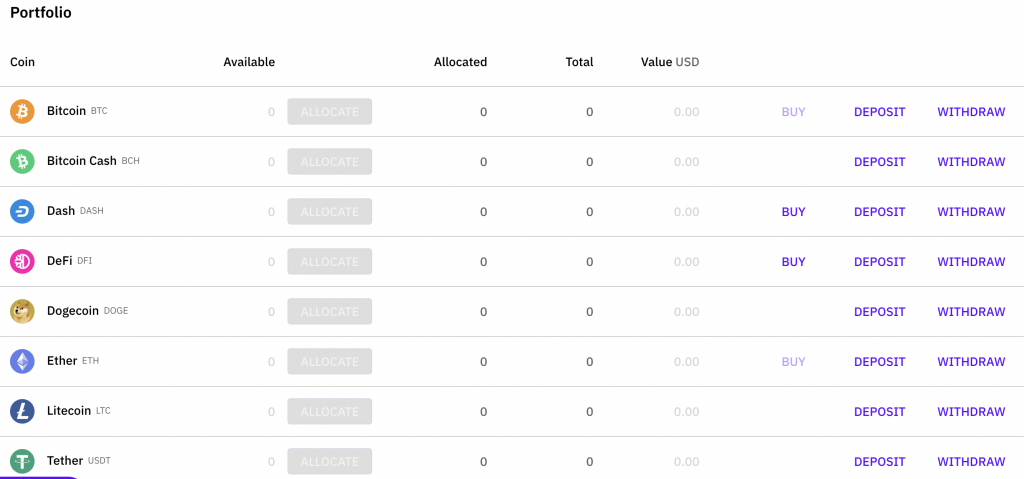

Cake DeFi currently supports 8 different currencies:

DFI is the native token of DeFiChain.

If you’d like to find out more about Cake DeFi, you can check out this video by their CEO, Julian Hosp:

How does Cake DeFi work?

Cake DeFi provides a variety of services to help you to earn interest with your crypto. This includes Liquidity Mining, Staking, as well as Lending. All of these services will help to make your crypto work harder for you and grow your crypto portfolio.

Here are each of these services explained in detail:

#1 Liquidity Mining

Liquidity Mining allows you to deposit a token pair into a liquidity mining pool to mine rewards.

This is somewhat similar to Crypto.com’s Supercharger.

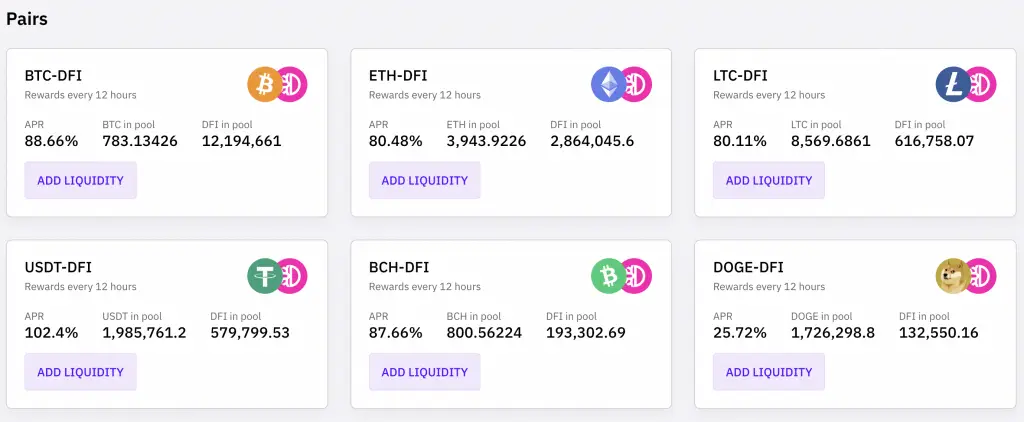

Most of these token pairs usually include DFI being paired with another token:

- BTC-DFI

- ETH-DFI

- LTC-DFI

- USDT-DFI

- BCH-DFI

- DOGE-DFI

Some of these pairs have extremely high yields too!

However, you’ll need to deposit both tokens together in the liquidity mining pool.

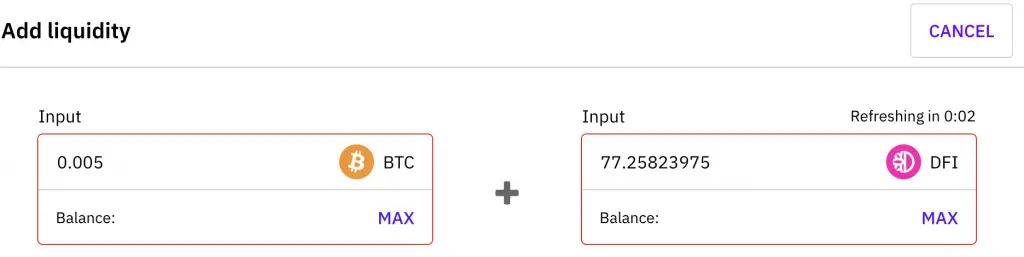

For example, you may want to deposit into the BTC-DFI pool.

You can choose the amount of BTC or DFI that you wish to deposit inside.

If you’ve chosen a certain amount of BTC, Cake DeFi will show you the corresponding amount of DFI to deposit too.

The rate of BTC-DFI will be locked for 30 seconds.

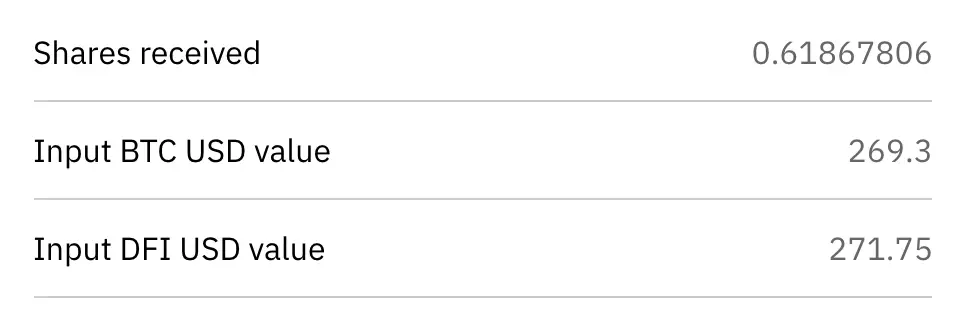

You’ll be able to see the amount of shares you’ll receive for adding liquidity to that pool.

The higher number of shares you own, the higher the rewards you’ll receive!

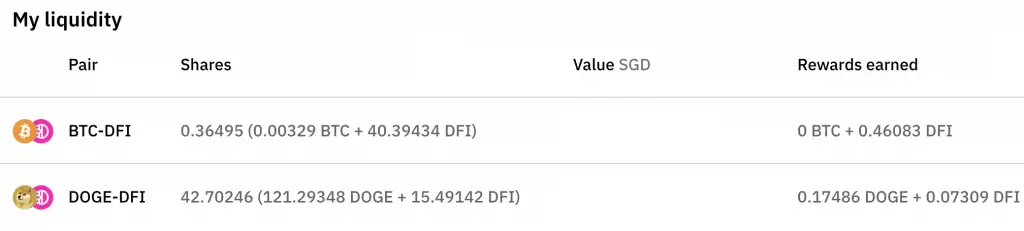

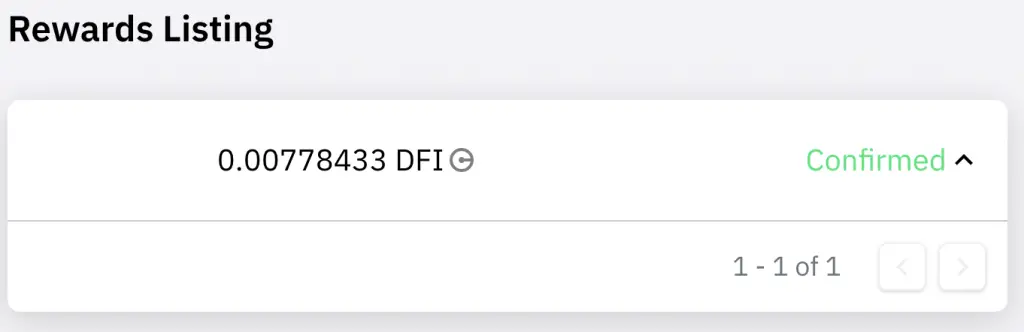

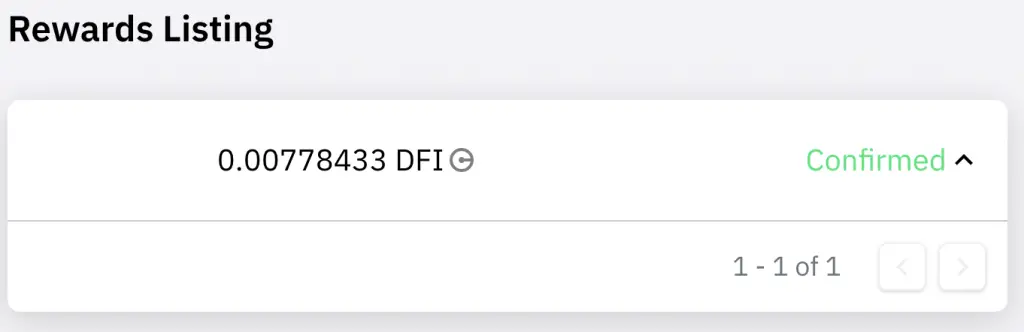

Your rewards will be paid every 12 hours. You can check the total amount of each currency you’ve earned from liquidity mining on the app.

However, I do find that the display of these rewards could be improved, particularly for BTC.

#2 Staking

You are able to stake your coins on Cake DeFi as well.

You can only stake cryptocurrencies that are on a proof-of-stake network.

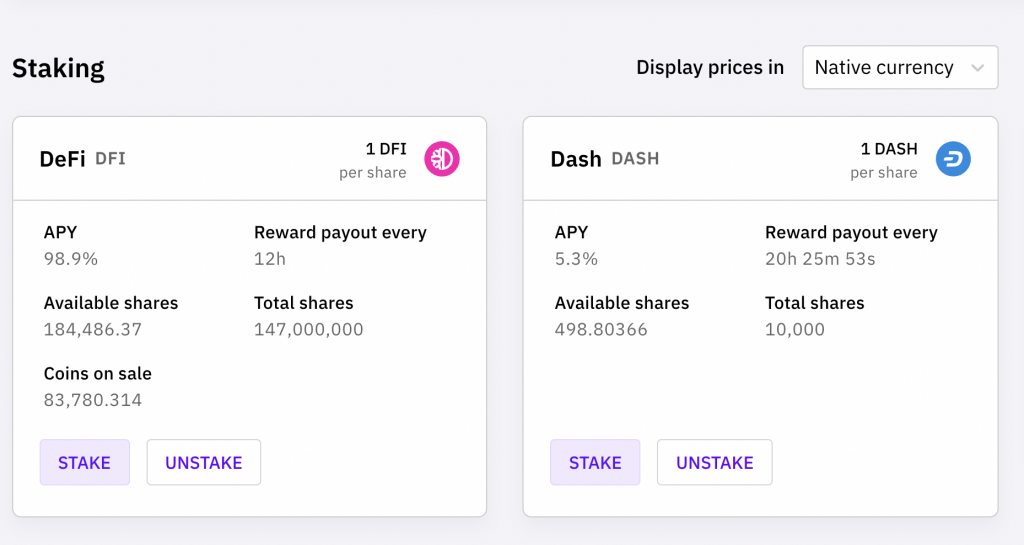

Currently, Cake DeFi only allows you to stake 2 currencies:

- DFI

- DASH

You are able to earn a really high yield on your DFI tokens!

Once you’ve staked your tokens, Cake DeFi will issue you your rewards on a periodic basis.

Staking can be rather complicated, as you have to run a masternode by yourself. Cake DeFi makes it really simple by running the masternodes for you.

Moreover, you can start staking your coins with no minimum amount required!

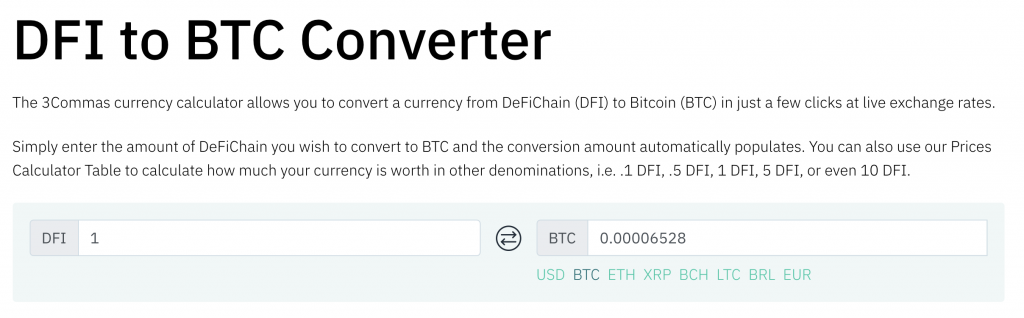

Each DFI or DASH token that you stake is considered as 1 share. You can see the number of shares that are available to stake.

If there are no more available shares, you can no longer stake your crypto!

#3 Lending

Cake DeFi started out as a lending platform, which is very similar to others like:

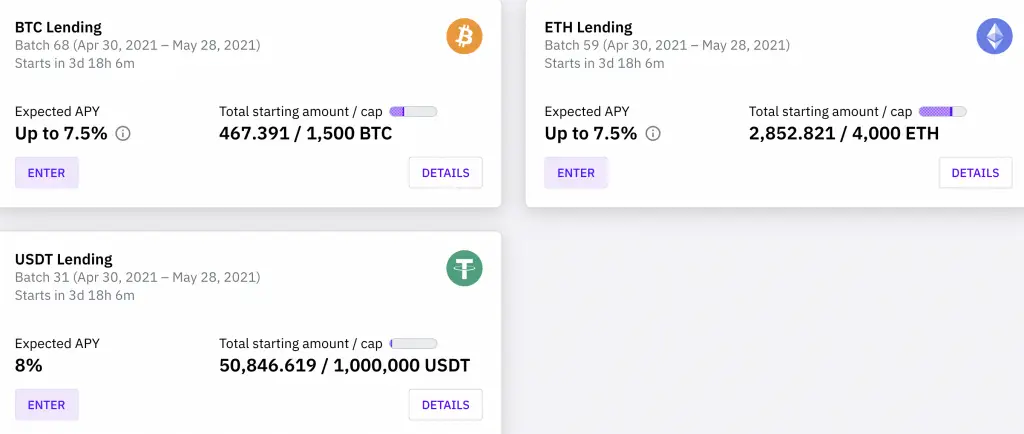

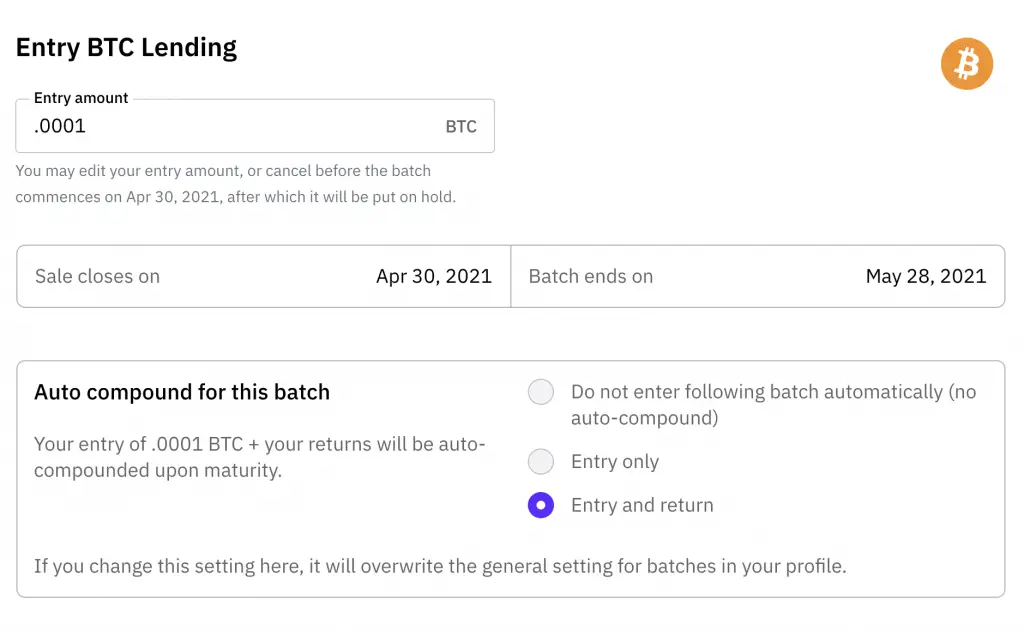

Cake DeFi offers a lending batch for each currency every week. Each batch lasts for 4 weeks, and your crypto will be locked up during this period.

This is slightly more restrictive compared to the platforms above. However, it is comparable to Crypto Earn as well.

Furthermore, the rates of each batch may change over time.

So far, you can only lend out 3 currencies:

- BTC

- ETH

- USDT

The lending rates are not as attractive compared to other platforms.

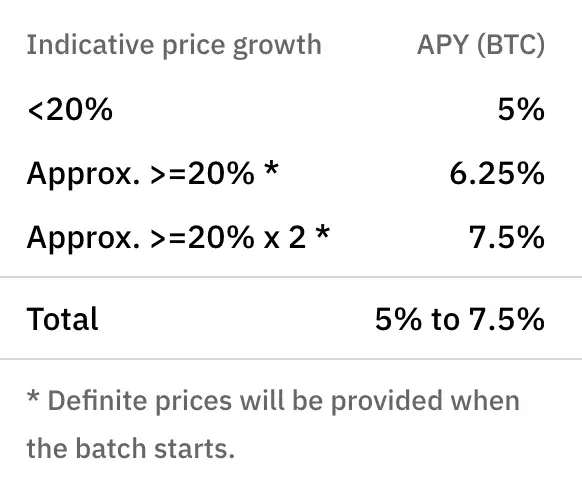

For both BTC and ETH, there is a base reward rate that you will receive.

However, if the price of BTC or ETH increases more than 20%, you will be able to receive the higher rate!

The interest that you can earn when BTC or ETH does well is slightly higher compared to BlockFi.

Even if the price of BTC or ETH goes down, you still will be guaranteed the base reward rate.

There is no minimum amount required

When you want to lend your BTC, you are able to lend as small as 0.0001 BTC!

This allows you to earn rewards on your crypto, no matter how small the amount.

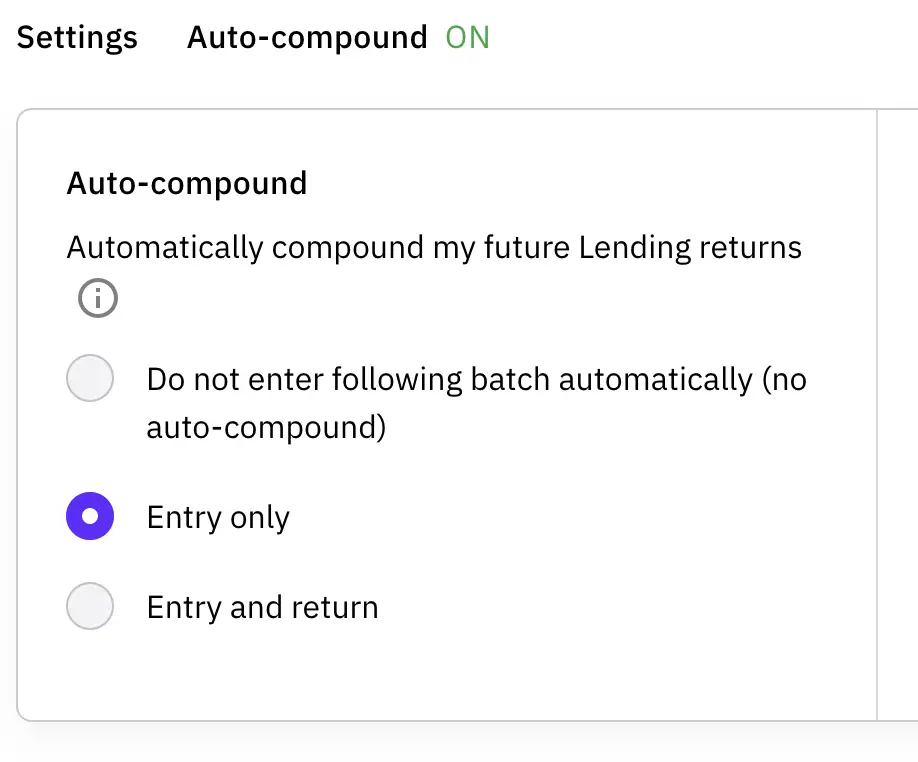

You can choose how to compound your rewards

When you lend out your crypto with Cake DeFi, you can choose how you want to compound your rewards:

- Do not enter the next batch automatically

- Compound the amount that you lent

- Compound both your base amount and your returns

This gives you the freedom to decide how you want to compound your crypto.

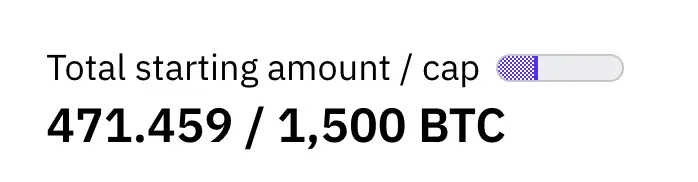

There is a cap to the amount of crypto for each batch

You may want to take note that each batch has a cap on the amount of BTC, ETH or USDT that can earn the rewards.

If the batch reaches the cap, you won’t be able to deposit your crypto!

The services provided are very easy to use

Cake DeFi makes liquidity mining and staking really easy to use, especially if you’re a beginner to crypto.

If you were to stake crypto by yourself, you would need to know how to run the staking nodes by yourself!

If you want to do liquidity mining such as through Uniswap, you would need to have an Ethereum wallet too!

With Cake DeFi, you can buy crypto through an exchange, and then transfer it to their platform.

After that, you’ll just need to deposit your crypto into one of the 3 features to start earning rewards!

Does Cake DeFi have an app?

Currently, Cake DeFi is a desktop-only platform. However, Cake DeFi intends to release a mobile app in the future.

This is slightly restrictive, especially if you are looking to check your rewards on the go.

What are the fees I will incur when using Cake DeFi?

Here are the fees that Cake DeFi charges to use their services:

| Service | Fee |

|---|---|

| Liquidity Mining | 15% of all rewards |

| Staking | None |

| Lending | None |

| Buying Crypto | Depends on partner |

| Exchanging Crypto | None |

| Withdrawal Crypto | Depends on currency |

Cake DeFi receives a commission from their partners for providing the lending services. However, they do not charge any fees directly to you.

Cake DeFi also allows you to buy crypto directly from fiat. They have currently partnered with 2 institutions:

When you buy crypto through these platforms, you may incur a transaction fee.

No fees charged for exchanging crypto

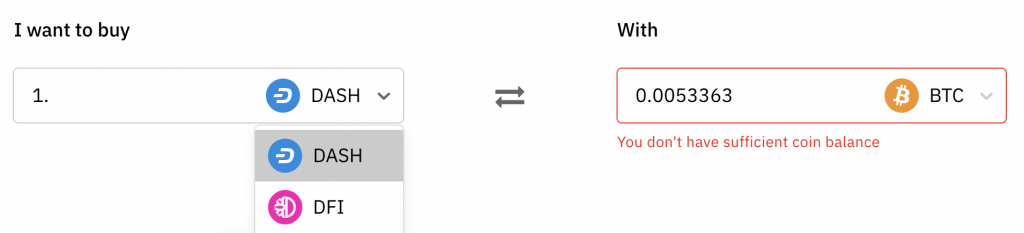

You can choose to exchange your BTC or ETH for either DASH or DFI.

This is particularly useful when you can’t buy crypto on Cake DeFi! As a Singaporean, Cake DeFi does not offer the ‘Buy Crypto’ function to me.

You are not charged any fees when making this swap.

However, you may lose a bit from the spread!

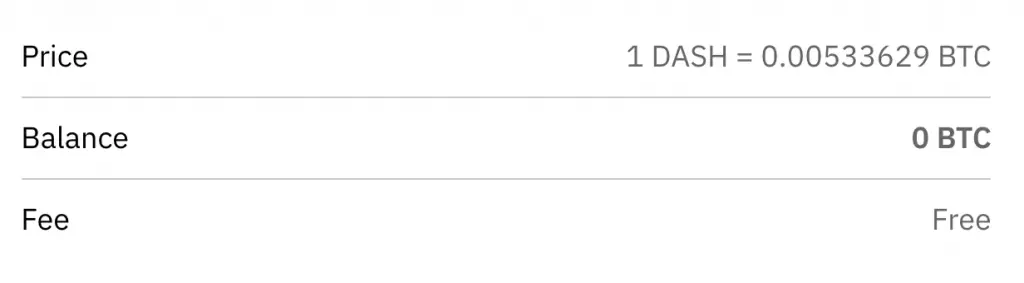

This was Cake DeFi’s exchange rate between DFI and BTC,

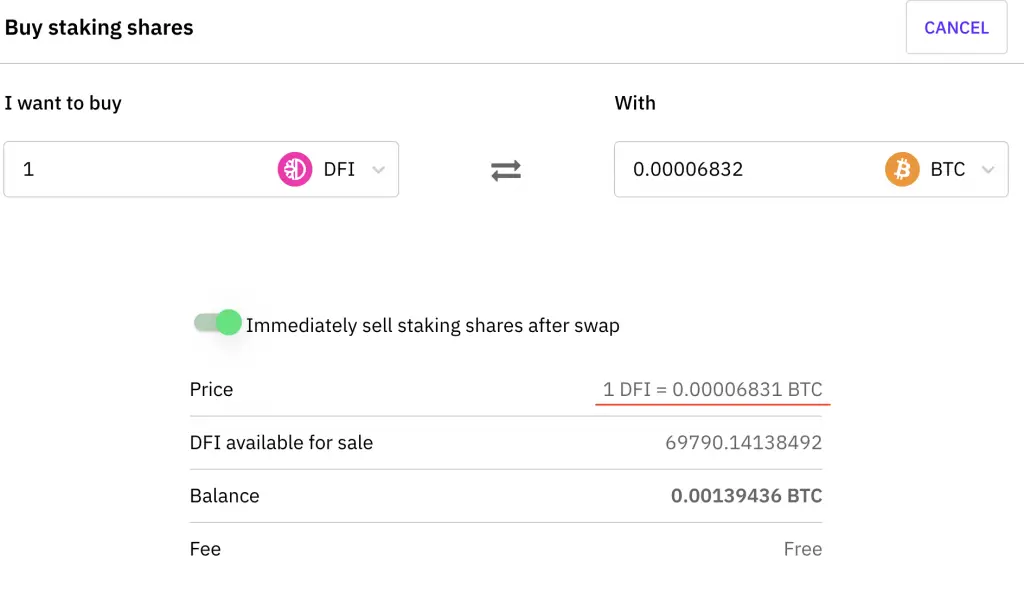

and here was the market price according to 3 Commas.

The difference may seem little, but you can lose some value when you’re exchanging a large amount of BTC!

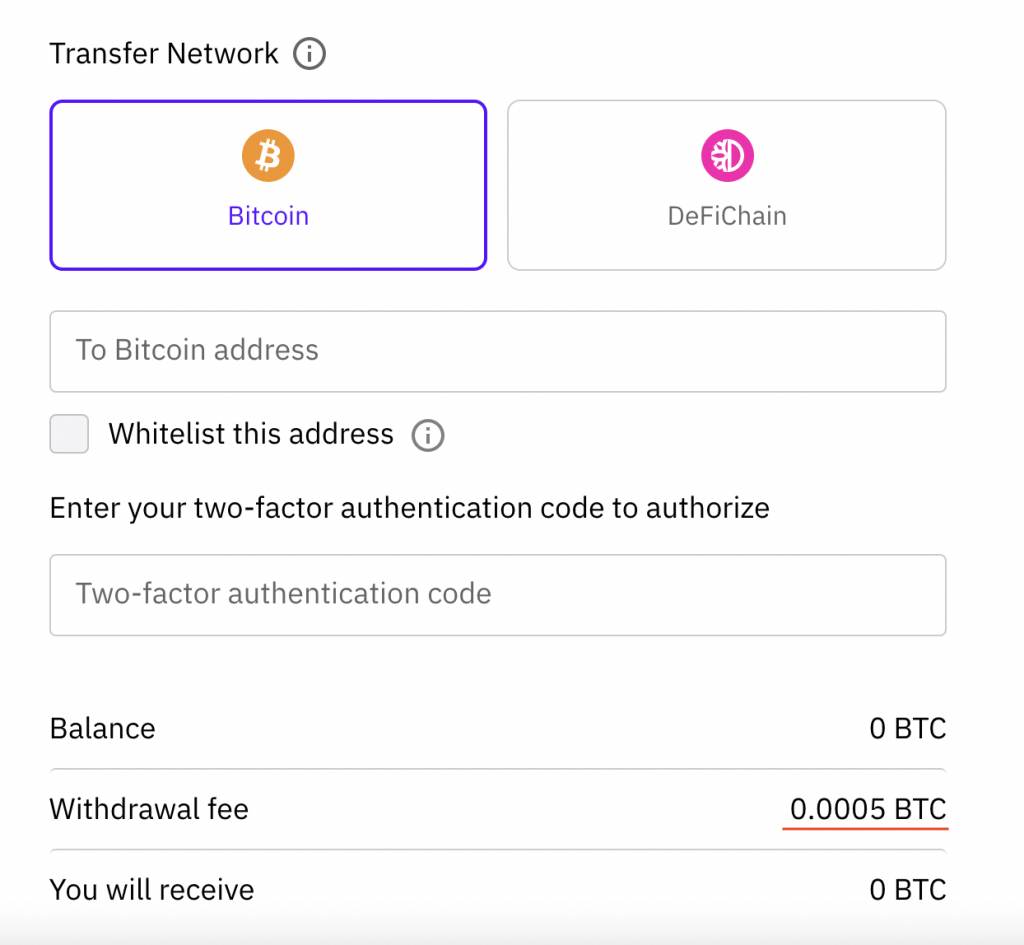

Cake DeFi charges withdrawal fees

If you want to withdraw your crypto out of Cake DeFi’s platform, you will be charged withdrawal fees.

This depends on the currency that you intend to withdraw.

The withdrawal fees may be quite high, and may change from time to time.

However, the good thing is that you’re able to see the fees you’ll incur before making a withdrawal.

This will help you to decide if it’s worth withdrawing your crypto to another platform!

Is Cake DeFi safe?

Cake DeFi aims to be very transparent with each transaction on their platform. They publish quarterly reports on their YouTube channel. Furthermore, the blockchain addresses of their masternode pools are public. This allows anyone to track all of the transactions on Cake DeFi.

By being very transparent with all of the transactions on their platform, you can be reassured that your assets are rather safe with Cake DeFi!

Furthermore, Cake DeFi stores majority of your funds in an offline ‘cold storage’.

If hackers gain access to Cake DeFi, they are only able to steal the funds from the hot wallet, which only contains a small percentage Cake DeFi’s holdings.

However, just like any other DeFi platform, you would have to trust in Cake DeFi’s technology. Anyone can use their platform, which makes it extremely accessible.

However, this also means that if you lose your money on Cake DeFi, no one will be able to help you!

This is in contrast to centralised finance (CeFi), where you are trusting the company to be a custodian for your assets. If anything goes wrong, you still can rely on the platform to help recover some of your funds.

DeFi certainly has higher risks compared to CeFi. However, these risks come with higher rewards.

You’ll need to decide if it’s worth the risk to earn these higher rewards!

Is Cake DeFi regulated by the MAS?

Cake DeFi was founded in Singapore, but it is currently not under regulation by MAS. However, Cake DeFi’s parent company (Cake Pte. Ltd) has submitted their application for a Payment Services Act License. This License is required to handle Digital Payment Tokens in Singapore.

In alignment with Cake DeFi’s transparency goal, they are aiming to be compliant with the MAS.

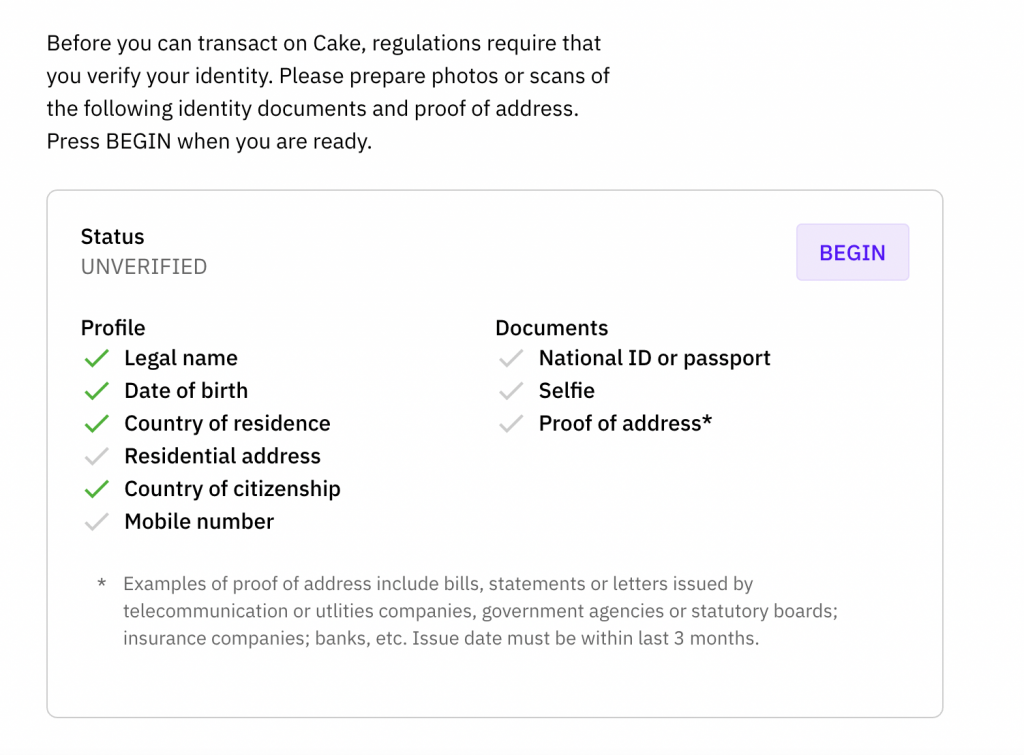

When you create an account with Cake DeFi, you would need to undergo a Know-Your-Customer (KYC) Assessment.

Even though the process is a bit tedious, I was really impressed when my KYC application was approved in minutes!

The KYC assessment is a requirement by the MAS to prevent cryptocurrency being used for money laundering.

Is Cake DeFi legit?

Cake DeFi provides an easy way for you to grow your crypto assets with just a few clicks. It is one of the most suitable platforms if you’re very new to this space. Furthermore, Cake DeFi is extremely transparent with their transactions. This should assure you that Cake DeFi is a well established platform.

The interest rates that you earn when lending may not be that competitive, especially for USDT.

However, staking and performing liquidity mining is really easy on their platform! You may want to consider using Cake DeFi for these 2 services, instead of their lending feature.

Overall, Cake DeFi is a platform that you can seriously consider to multiply your crypto assets.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Cake DeFi Referral (Receive $30 USD worth of DFI tokens)

If you are interested in signing up for a Cake DeFi account, you can use my referral link.

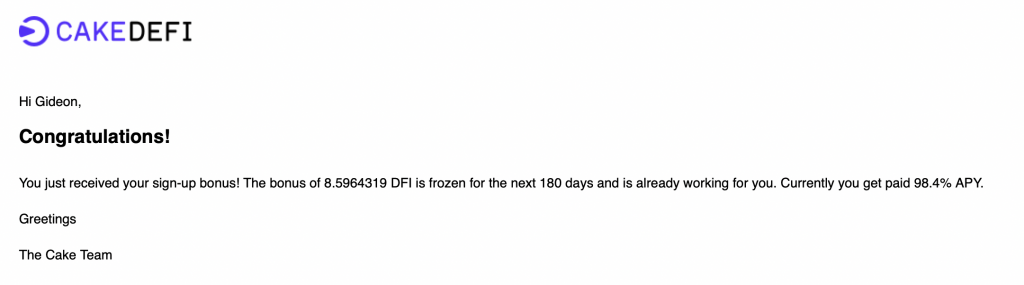

After making your first deposit of ≥ $50 USD worth of crypto, you will be able to earn $30 USD worth of DFI tokens!

Here’s what you’ll need to do:

- Sign up for a Cake DeFi account

- Make a deposit of ≥ $50 USD worth of crypto into your Cake DeFi wallet

- Receive $30 USD worth of DFI tokens ($20 base + $10 referral bonus)

Your DFI tokens should be credited to you on the following Monday.

The DFI tokens that you earn will be locked up for 180 days in the Confectionery program. You will be able to earn the base APY for staking DFI tokens.

Even though your DFI is being locked up, you are still able to earn rewards on it!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?