Last updated on June 6th, 2021

After topping up your GrabPay wallet, you may be looking for a way to withdraw your unused cash to your bank account.

Is this possible? Here’s what you need to know:

Contents

Can I withdraw money From my GrabPay Wallet in Singapore?

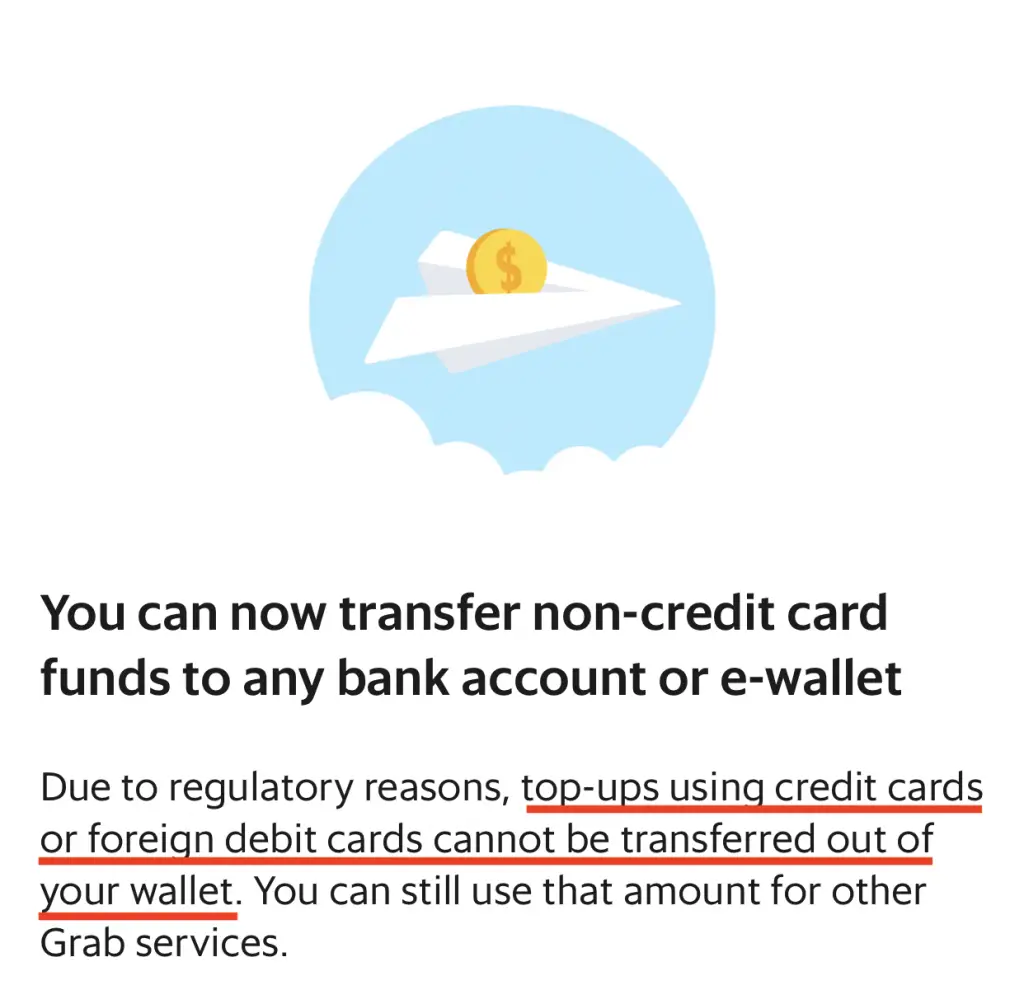

You are able to withdraw your money from your GrabPay wallet to either your bank account, a PayNow registered user or another e-wallet. However due to regulatory reasons, you cannot transfer funds that you topped up using a credit card or a foreign debit card.

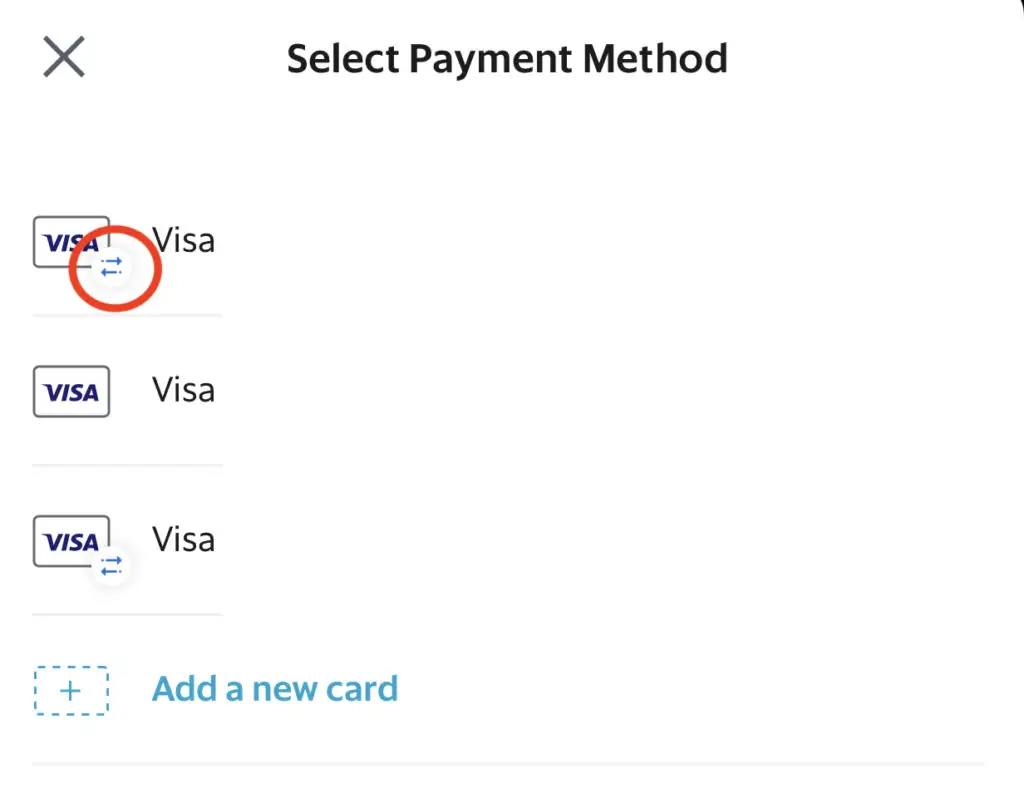

When you are topping up your GrabPay wallet with a credit or debit card, you may see the ‘transferrable‘ symbol.

If you’re card does not have this symbol, the funds that you top up to your GrabPay wallet can’t be withdrawn out!

Previously, this feature was only available in the Philippines or Vietnam. However, Grab announced in Feb 2021 that they were launching GrabPay wallet transfers!

Instead of sending your GrabPay wallet funds to another GrabPay user, you now have the option to send to other destinations:

- Bank accounts

- A registered PayNow user

- Other e-wallets

This makes the funds in your GrabPay wallet much more flexible! You can transfer it to another destination, instead of it being just locked up in your GrabPay wallet!

How to transfer money from GrabPay to bank account

Here are 7 steps you need to do to transfer your money from your GrabPay wallet to your bank account:

- Verify your identity and set up your GrabPIN

- Go to ‘Payment → Transfer’

- Select ‘Bank Account’ as your funds’ destination

- Add an account via PayNow or using a bank account number

- Enter the amount that you wish to transfer

- Enter your GrabPIN

- Receive confirmation of your transaction

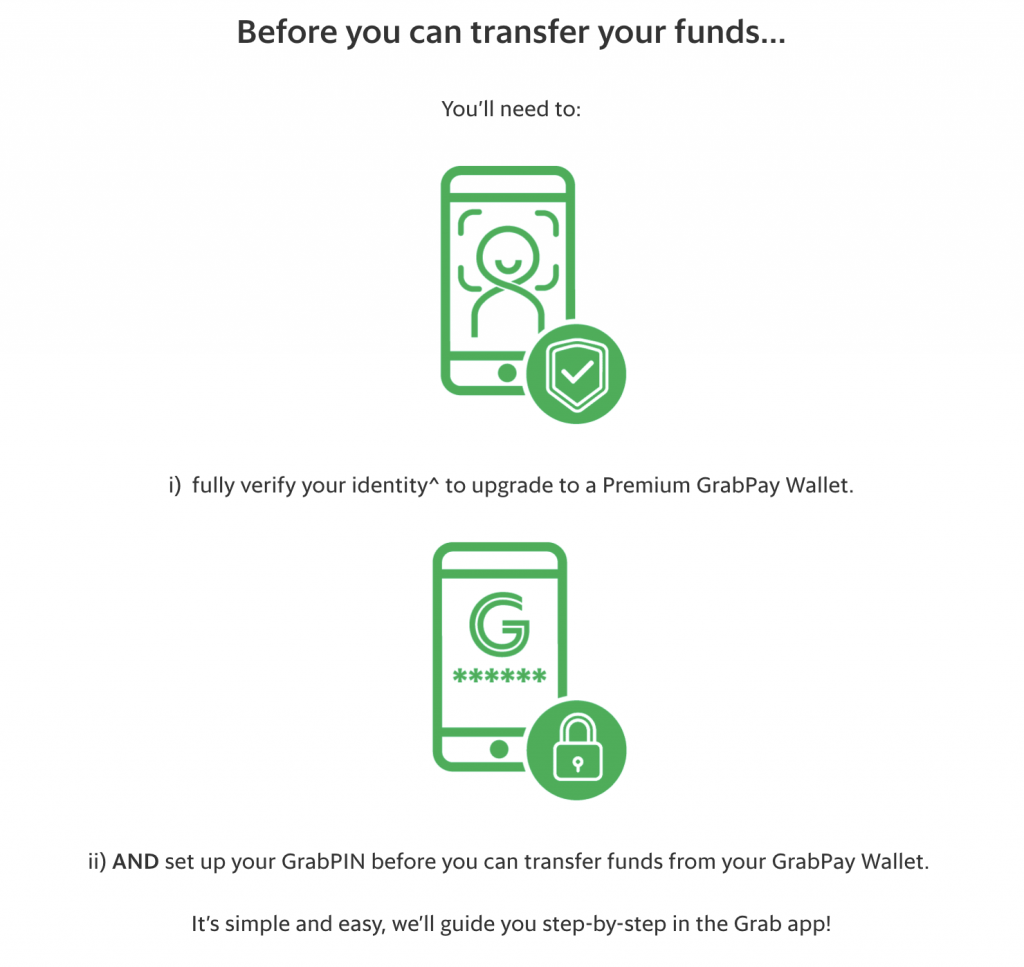

#1 Verify your identity and set up your GrabPIN

Before you can transfer any funds out of your GrabPay wallet, there are 2 steps you’ll need to do:

You’ll need to verify your identity, which is a requirement of MAS. This allows Grab to be a secure platform, where they can identify who the money is being transferred from.

To verify your identity, you can use MyInfo or Singpass on the Grab app.

You’ll also need to set up a GrabPIN, which adds one extra layer of security. You will be prompted to enter your GrabPIN to confirm each transfer you make out of your GrabPay wallet.

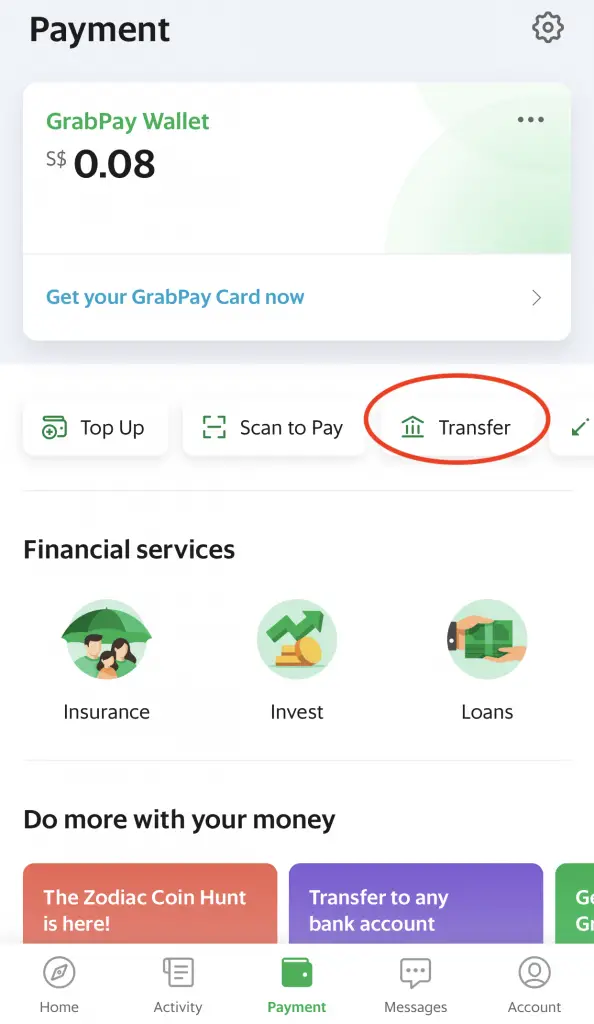

#2 Go to ‘Payment → Transfer’

You’ll need to go to the Payment tab on the Grab app and tap on ‘Transfer’.

If you do not have the ‘Transfer’ button, it means that the feature is not yet available for your account.

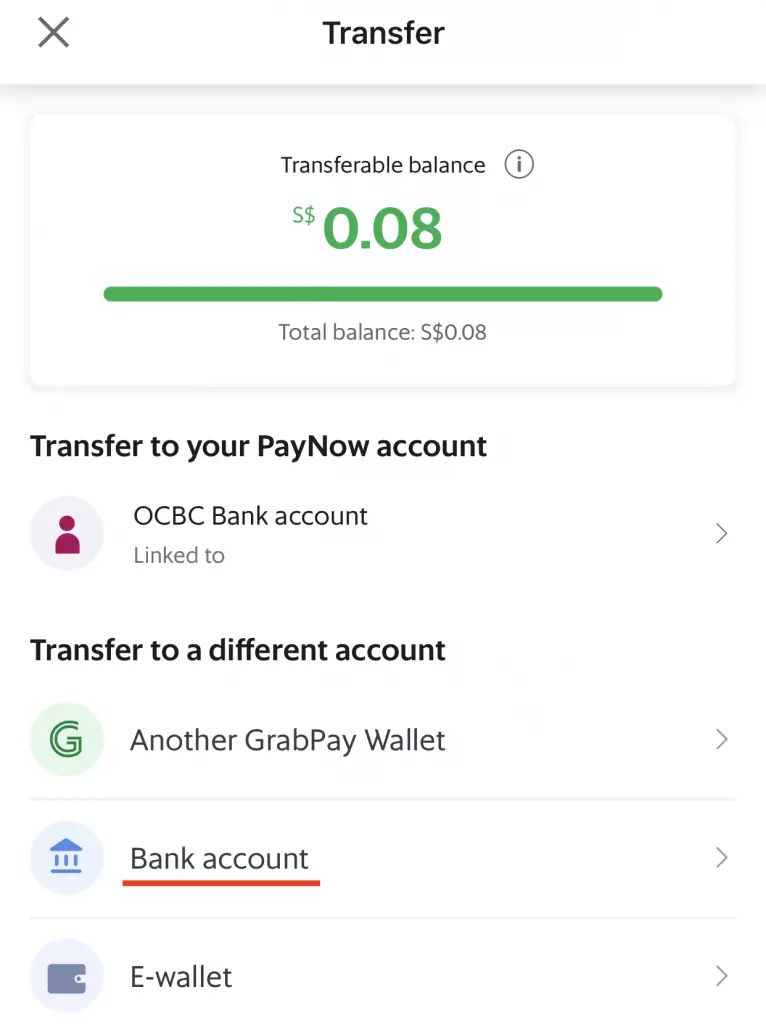

#3 Select ‘Bank Account’ as your funds’ destination

You can select ‘Bank Account‘ as your funds’ destination.

Alternatively, you can transfer the money to your linked PayNow account as well.

You are only able to transfer your transferable balance to these destinations. For credit card or foreign debit card top-ups, they will form your non-transferable balance.

You can’t withdraw your non-transferable balance!

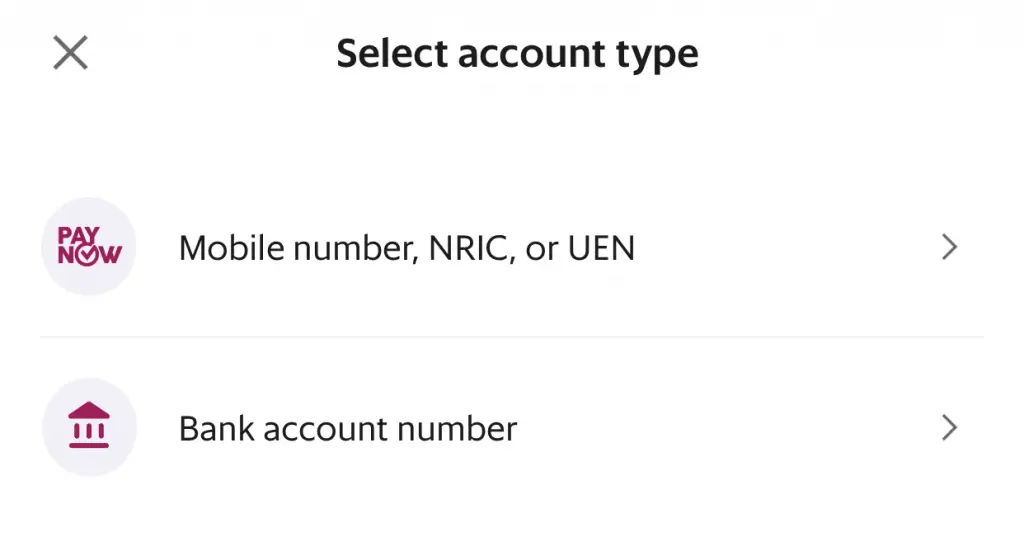

#4 Add an account via PayNow or using a bank account number

If this is your first time sending to a bank account, you’ll need to add these details first:

You can choose to add an account from either a:

- PayNow mobile number / NRIC / UEN

- Bank account number

You are able to transfer your funds to any bank that supports FAST transfers in Singapore. There are 23 banks that are part of the FAST network, including:

- DBS or POSB

- OCBC

- UOB

- Standard Chartered

- CIMB

- Citibank

Unfortunately, you can’t transfer your GrabPay funds to an overseas bank account! You can only transfer it to a local Singapore bank account.

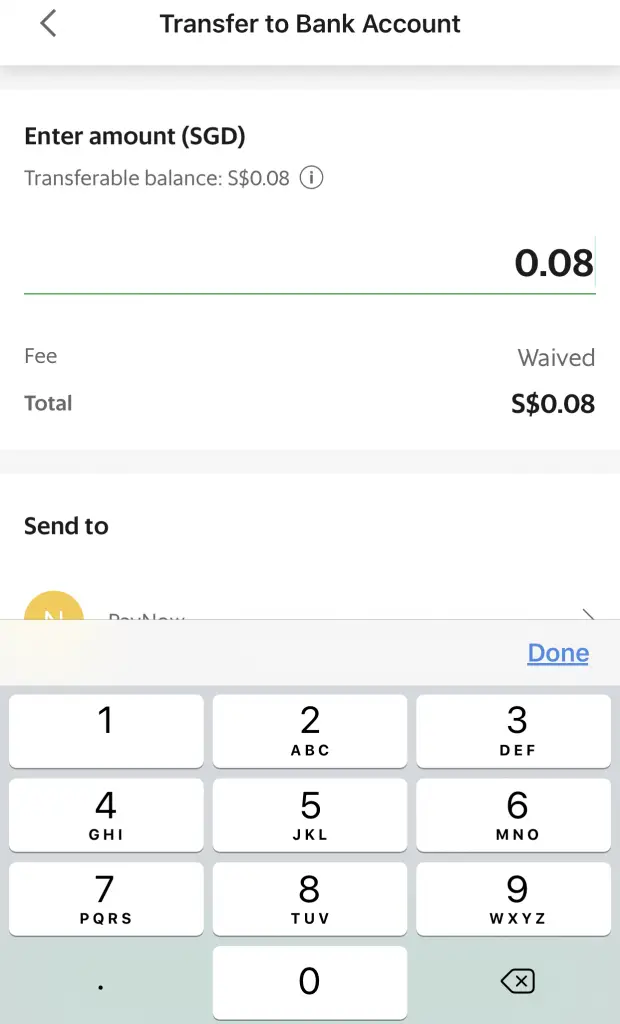

#5 Enter the amount that you wish to transfer

You can choose the amount that you can withdraw from your GrabPay wallet.

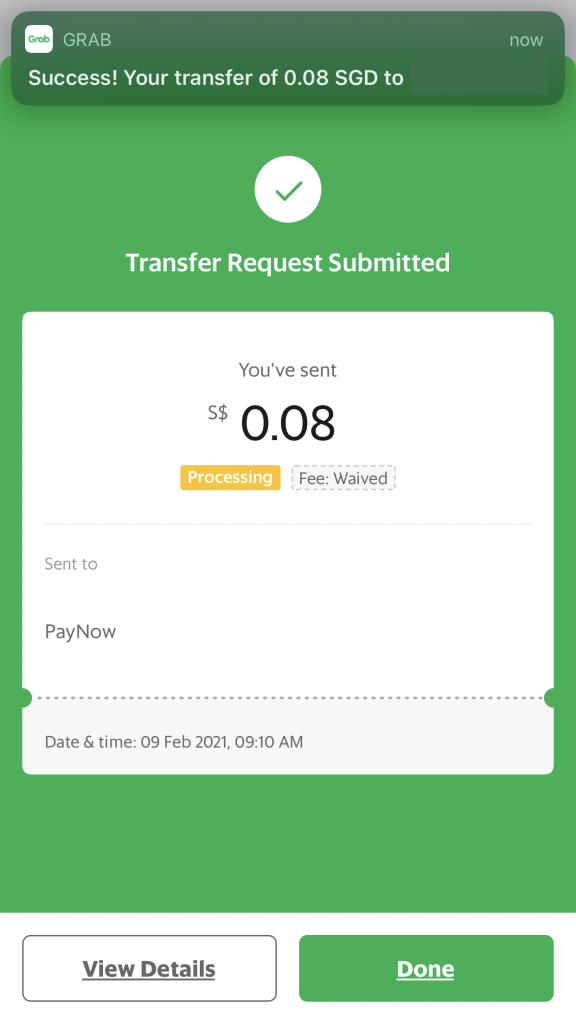

Grab does not have a minimum transfer amount! I was able to transfer out the 8 cents that I had in my GrabPay wallet.

However, you can only transfer the funds from your transferable amount. The funds that you used to top up with your credit card cannot be transferred out!

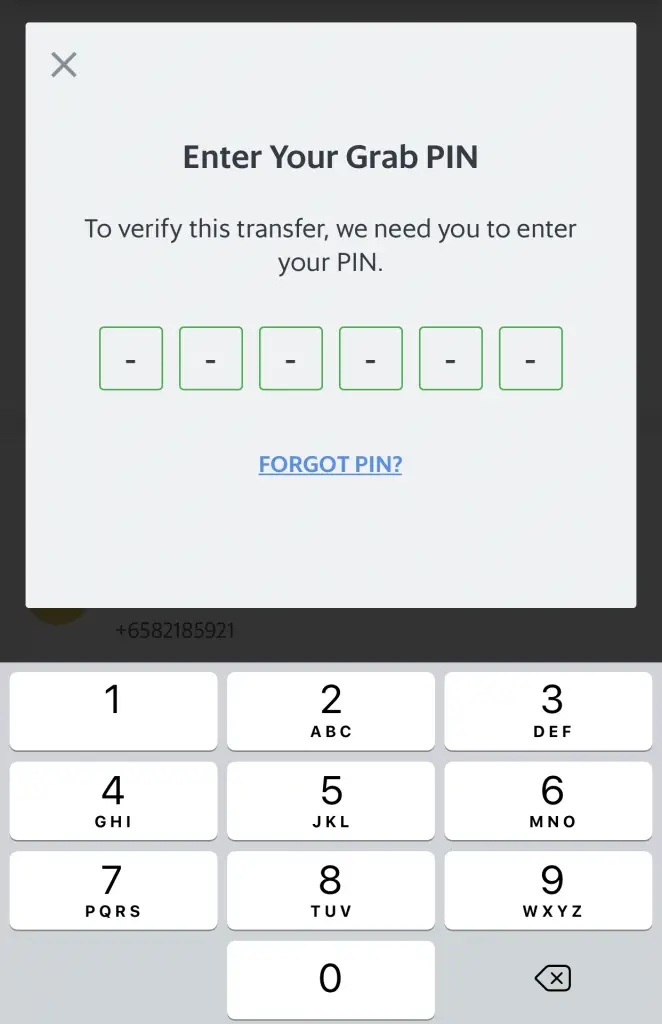

#6 Enter your GrabPIN

You will need to enter your GrabPIN to confirm the withdrawal.

#7 Receive confirmation of your transaction

You will be shown a confirmation of your transaction on the Grab app.

After I made the request, the money was transferred to my bank account!

Where else can I transfer my GrabPay funds to?

Besides transferring your GrabPay funds to a PayNow user or bank account, there are 2 other ways:

#1 Other mobile wallets

You can transfer your funds to 5 other mobile wallets, such as:

- Singtel Dash

- Razer Pay

- Liquid Pay

- TransferWise

- MatchMove

You will be transferring to the mobile wallet that is linked to the mobile number that you provided.

#2 Transfer to another GrabPay wallet user

You can transfer your funds to another GrabPay wallet user. The funds will be found in their GrabPay wallet.

What are the limits for withdrawing my money from GrabPay?

While you are now able to withdraw your money from GrabPay, there are still some limits are present:

#1 You cannot transfer out top ups from credit cards

One of the ways that you can top up your GrabPay wallet is by your credit card. However, this will go into your non-transferable balance.

You are unable to withdraw the amounts that you’ve topped up with your credit card!

You may use your credit card to top up your GrabPay wallet to receive certain rewards. However, you won’t be able to withdraw the funds from here!

The only way you can use these funds is either to spend on Grab services or to put it inside AutoInvest.

Nevertheless, you still can get rewards if you use credit cards like the AMEX True Cashback Card to top up your GrabPay wallet.

#2 Maximum of 2 transfers to bank account or e-wallets per day

You can only use this function twice a day to transfer to your bank account or e-wallet.

This may be a limitation if you are constantly using this withdrawal feature.

#3 No minimum transfer but maximum of $5,000 per transaction

The good thing about this withdrawal is that there is no minimum amount to use it. Even if you have a few cents like me, you are still able to withdraw that amount!

This will help you to withdraw any spare cash you have lying inside your GrabPay wallet!

Moreover, the maximum of $5,000 per transaction is rather high. You should not really exceed this amount when you want to make a withdrawal!

Conclusion

The addition of this withdrawal feature has made the GrabPay wallet much more flexible. GrabPay will still store your funds, unlike other mobile wallets like:

However, you are now able to withdraw your funds from your GrabPay wallet!

It is also better compared to BigPay which charges you a $1 fee for every withdrawal that you make!

The only major disadvantage is that you can’t withdraw the funds that you topped up using a credit card. Besides that, this is really a great step forward for GrabPay!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?