Last updated on June 6th, 2021

You’re looking for something to help with tracking your expenses and chanced upon the Seedly app.

Since it’s free and does not have a premium plan, is this expense tracker app worth using?

Contents

Seedly App review

The Seedly expense tracker provides many powerful features for a free app. For the app to give you a clear picture of your finances, you will need to be disciplined in updating all of your transactions.

Overall, it is a solid expense tracking app that provides you with a fast way of tracking your expenses.

What is the Seedly app?

The Seedly app is an expense tracker that helps you to view your budgets and finances. It also has the function of linking your bank accounts too. This will help you to get a clearer picture of your finances.

Seedly is also a mobile-only app that doesn’t let you export your transaction history elsewhere. This is great if you wish to track all of your expenses with just one app.

In fact, Seedly initially started off as an expense tracking app back in 2016!

What are the features?

Here are some of the features of this expense tracker app:

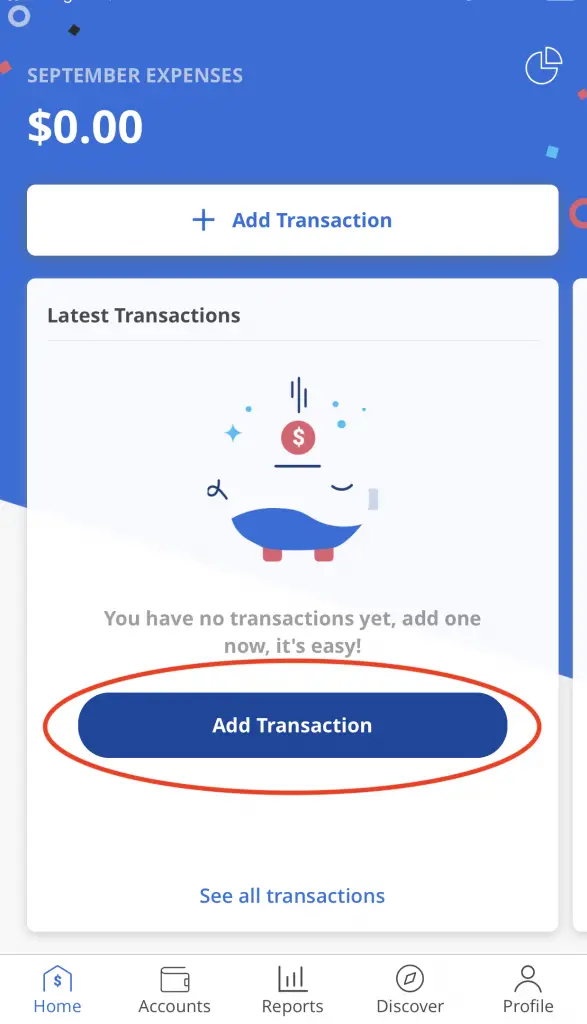

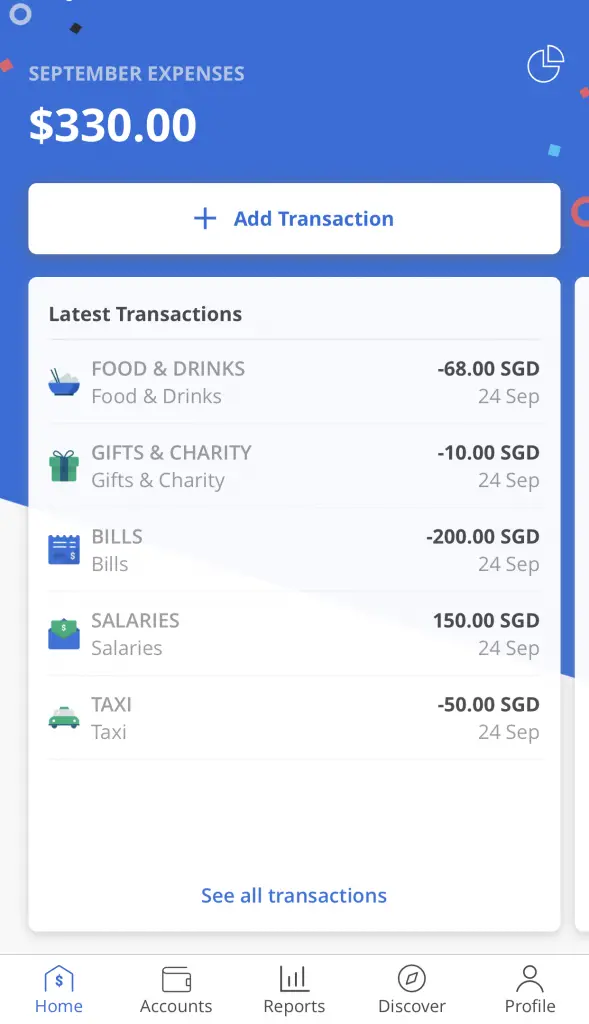

#1 Adding transactions

Just like other expense tracking apps, you are able to add transactions to the app.

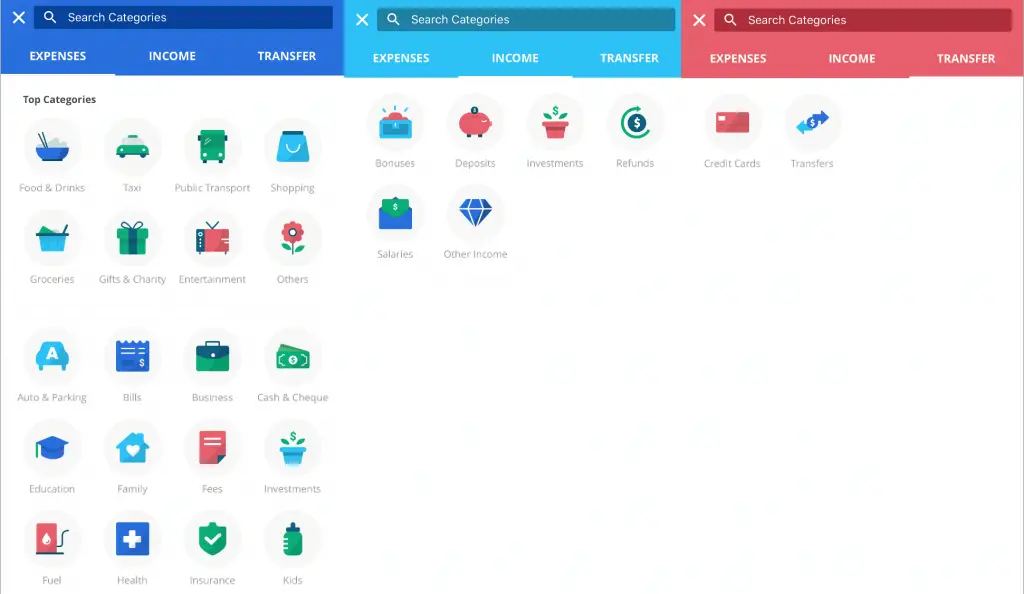

You can choose from a wide variety of categories for the transaction you’re making. There are 3 main types to choose from:

- Expenses

- Income

- Transfer

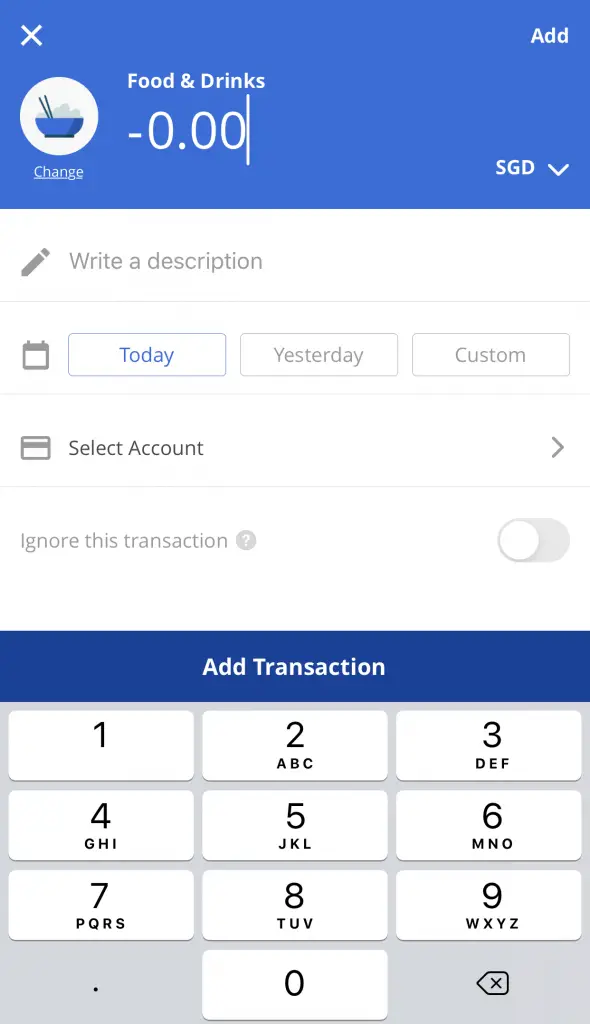

You can then add the amount, description and date.

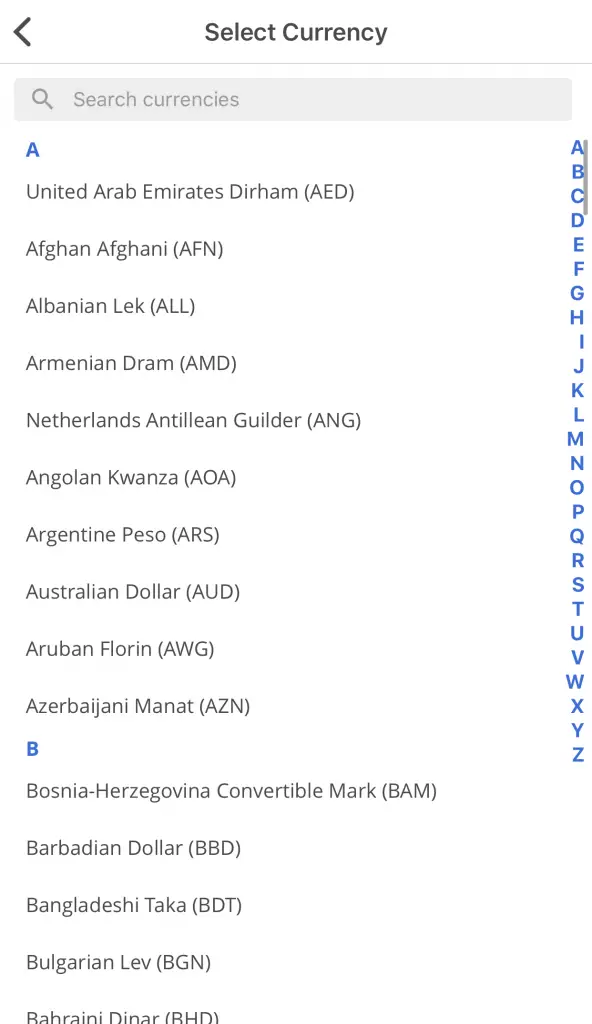

You can even change the currency of the transaction.

This is great if you’re keeping track of your expenses in multiple currencies! One way this is useful is if you are travelling to different countries.

Adding your transactions is really easy and simple with the Seedly app.

You can also view your entire transaction history.

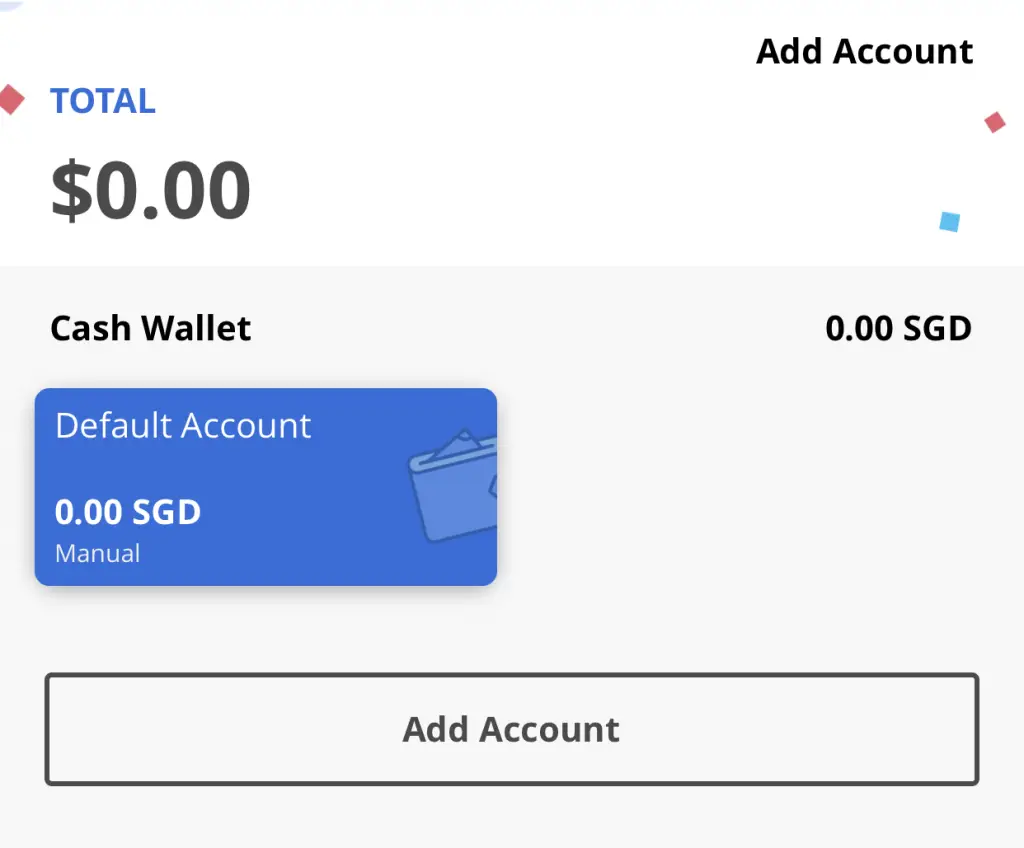

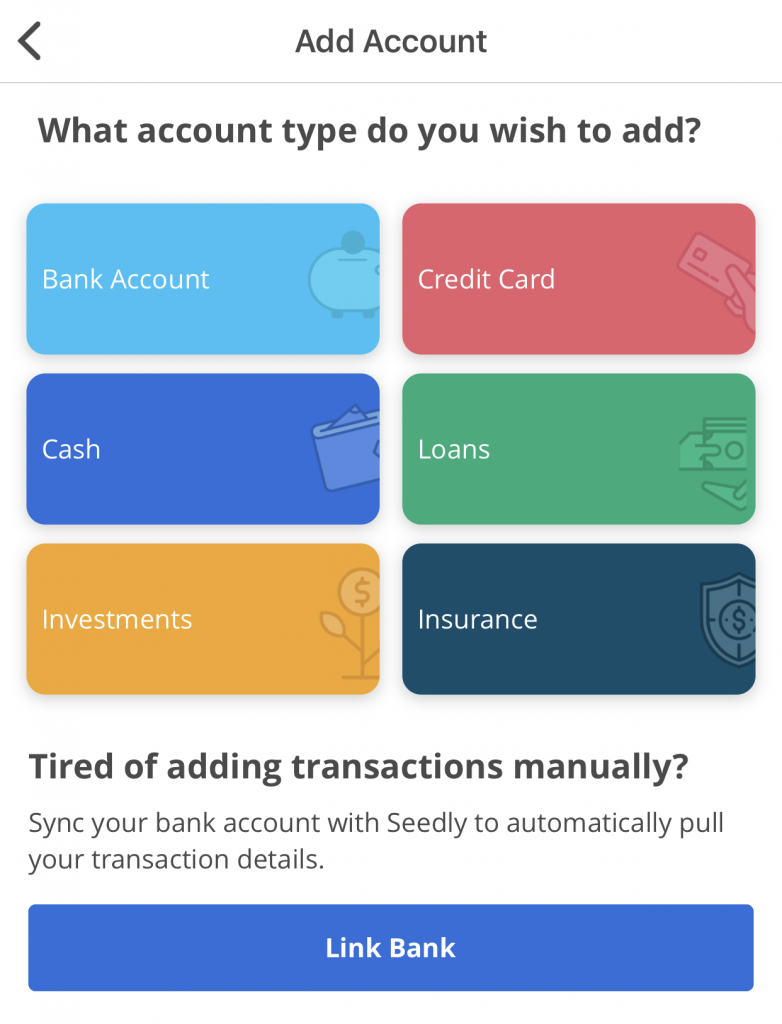

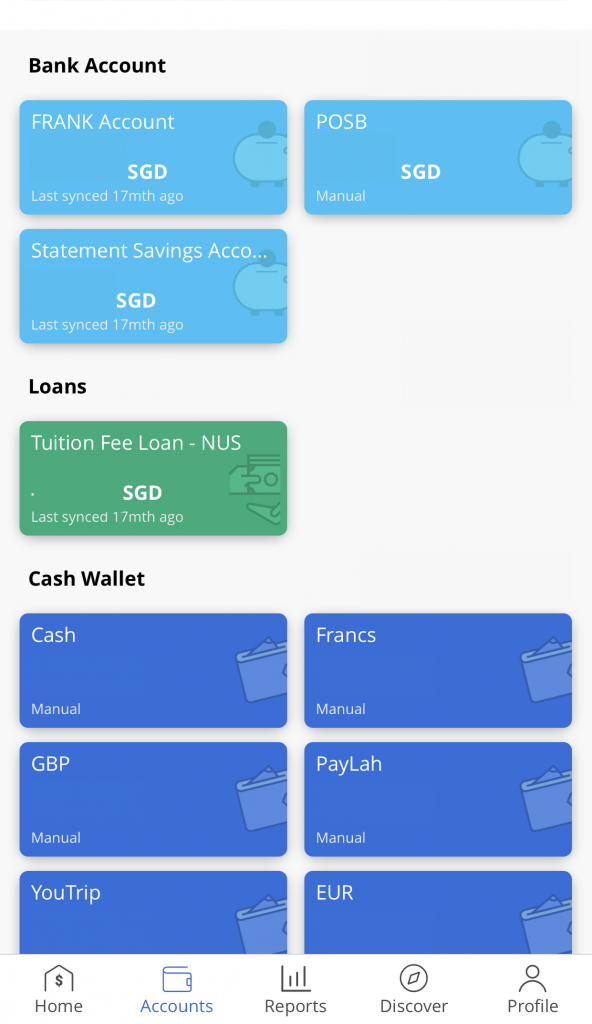

#2 Multiple wallets

Seedly allows you to manage multiple wallets into the app.

You can create wallets in different currencies as well.

Here are the different types of wallets that you can create:

- Bank Account

- Credit Card

- Cash

- Loans

- Investments

- Insurance

Having multiple types of wallets really helps you to segregate your finances well. Essentially, you are able to use the Seedly app to manage all of your finances!

When you have an insurance wallet, you are able to see if you have any overlaps in your policies. This is because there are some policies that do not allow you to make multiple claims from different companies!

However, you will need to be extremely disciplined to update your finances for it to be really accurate.

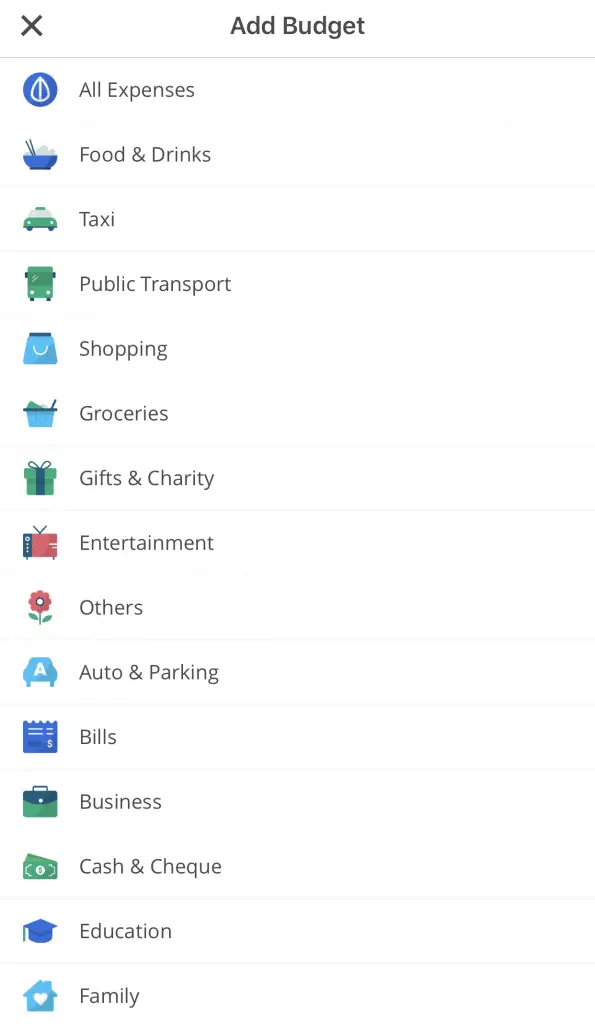

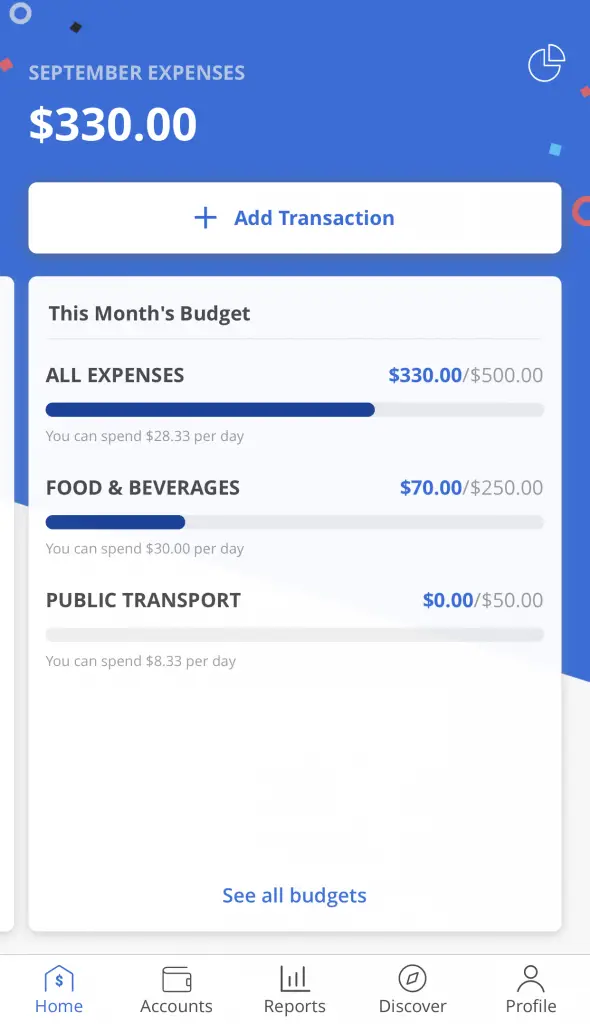

#3 Add budgets

You are able to add budgets for all of your expenditure. You can set 2 types of budgets:

- For your entire expenses

- For a specific category

You can view the remaining amount in your budget for those that you’ve set.

Seedly divides the remaining amount in your budget by the remaining number of days in the month. This gives you a gauge on how much you can spend for each category.

This is a really helpful tool to encourage you to spend within your means!

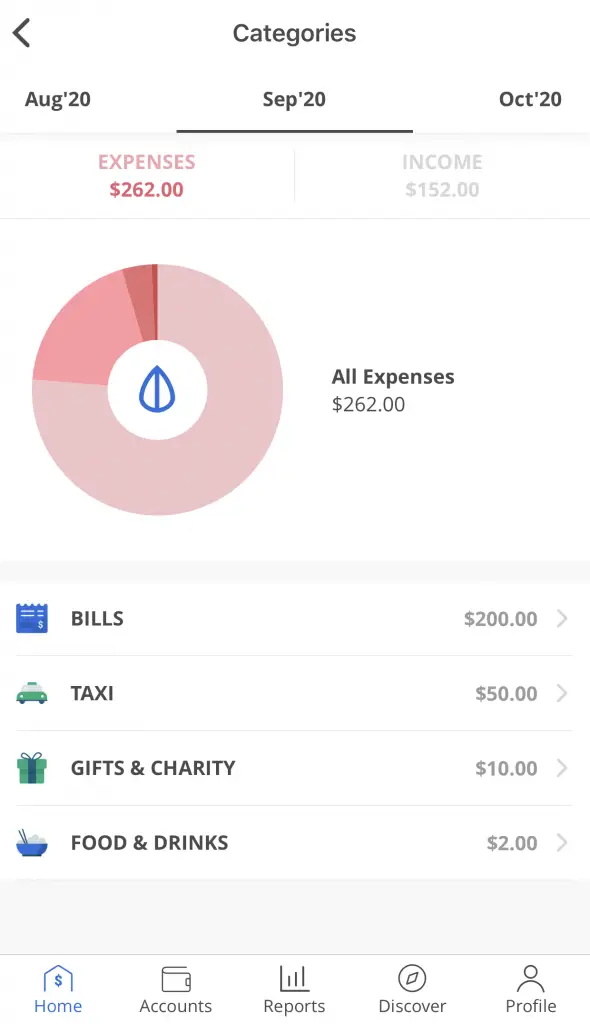

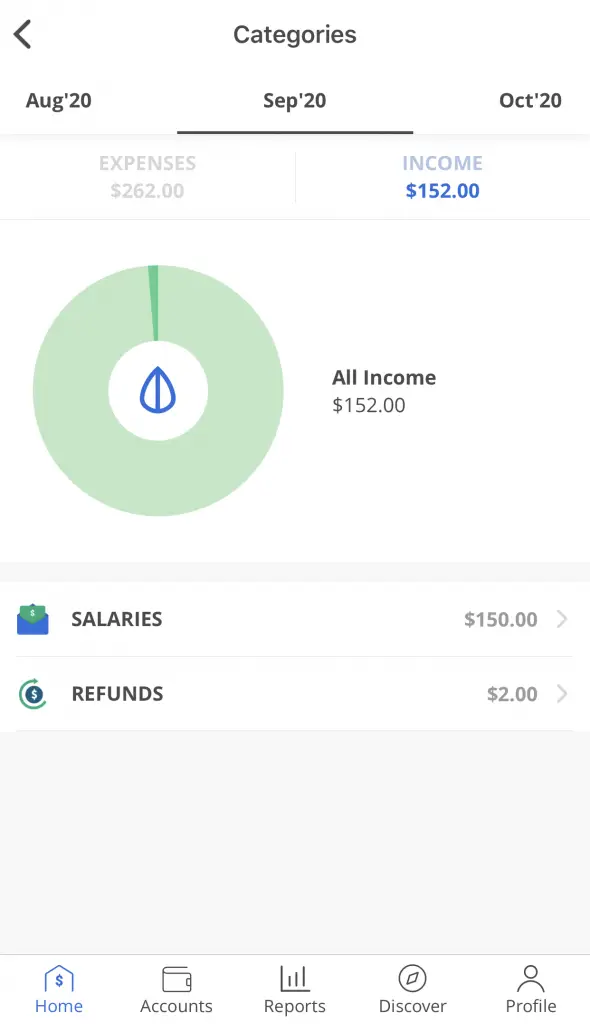

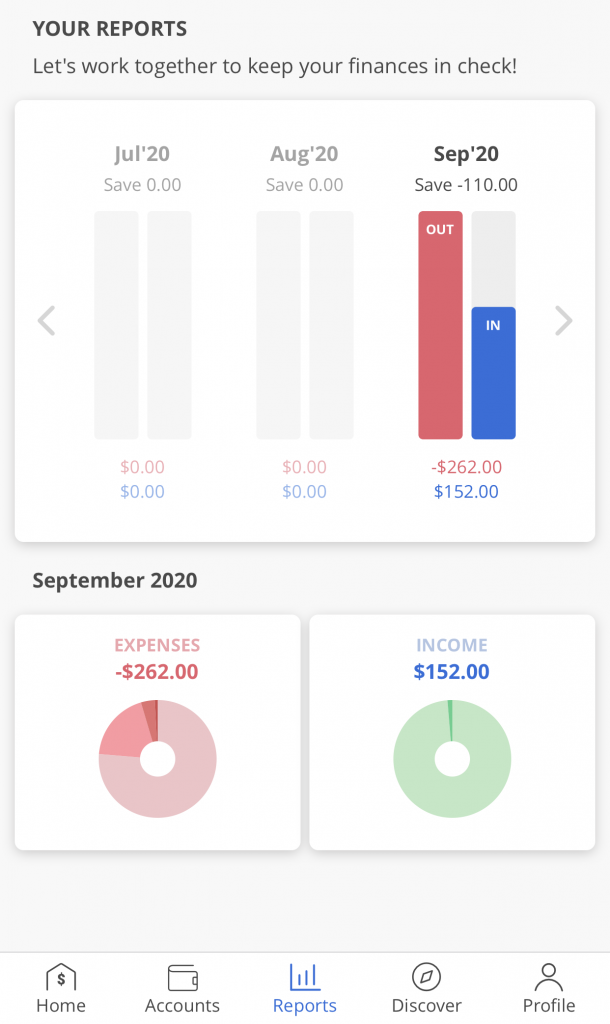

#4 Financial reports

Seedly gives you a monthly income report too.

You are able to see an overview of your expenses,

your income,

as well as an overview (income – expenses) for that month.

This helps you to see how much you’ve saved each month!

Again, the accuracy of this report depends on how diligent you are in updating your expenses.

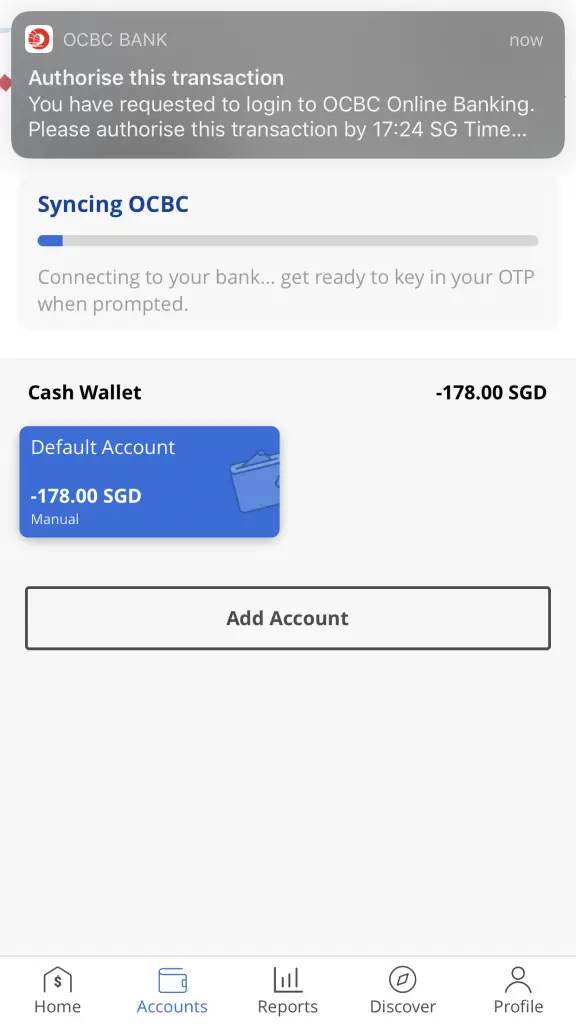

#5 Link bank accounts

One of Seedly’s main selling points is the ability to link your bank accounts with the app. You are given the option to login to your bank to sync your bank data with Seedly.

This will help you to see your entire finances under one app!

However, there are quite a few drawbacks for this feature:

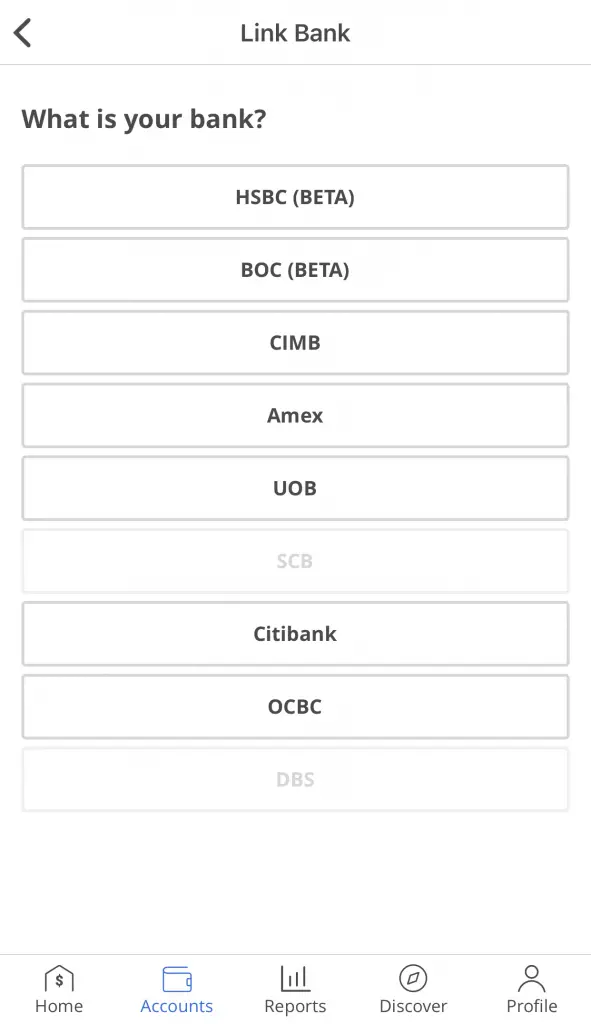

1) You can only link a limited number of banks

Seedly only allows you to link your bank accounts from 7 different banks. This includes:

- HSBC

- BOC

- CIMB

- Amex

- UOB

- Citibank

- OCBC

Both DBS and Standard Chartered do not allow you to link your bank accounts with Seedly. This is a huge blow, especially since most of us would have DBS accounts. Moreover if you’re a student, you may have the JumpStart account as well!

Seedly has suspended syncing with DBS indefinitely due to a change of DBS’ policy on third-party applications.

To include both DBS and Standard Chartered accounts, you can consider using SGFinDex instead. This initiative by the MAS also allows you to link your government service accounts.

You may also be wondering why POSB does not appear on the list. In fact, POSB and DBS are actually the same bank!

2) It takes a while for your information to be updated

Seedly first requires you to login into your iBanking account. After that, it will use your credentials to extract your account information from the bank.

During this extraction, you may be required to enter an OTP.

Whenever you wish to update your bank accounts, it will take quite a while before it is reflected on the app. It can take up to 10 minutes for the accounts to be synced!

Moreover, if you take too long to enter your OTP, the request may timeout. As such, you will have to go through the entire process again!

3) You cannot auto-sync your bank accounts

Due to security reasons, it is not possible for the Seedly app to auto-sync your bank accounts for you.

This makes it really troublesome as you can only manually sync your accounts.

4) You may double count your transactions

When you sync your data from your bank accounts, you may take into account some transactions you’ve made.

If you’ve used either NETS or payWave for a certain transaction, the amount would have been deducted from your bank account.

When you add this transaction manually to Seedly, you are actually double counting the transaction!

One way that you can prevent this is by only tracking cash transactions. However, the cash will still be withdrawn from your bank account. This may still mix up your transactions!

It may be better to just use Seedly as a standalone app to track your expenses.

There is room for improvement for this feature

This initiative by Seedly is really commendable. However, there are many issues which prevent it from being a useful feature.

I still think that SGFinDex is a much better option to synchronise your information from the different banks!

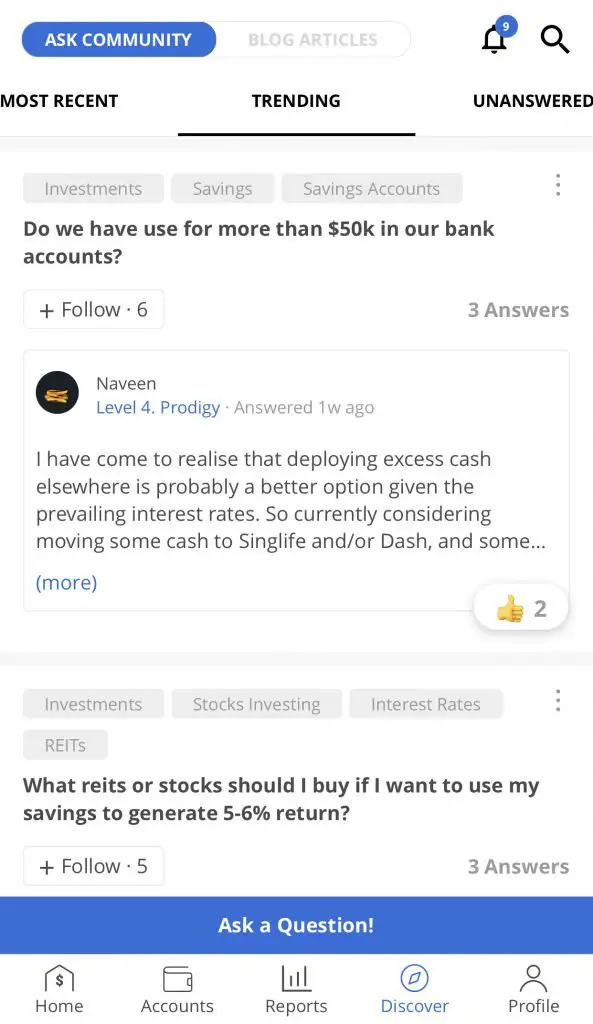

#6 View articles on Seedly

Seedly has evolved from just an expense tracking app to a full-fledged finance site.

You are able to view the discussions on the Seedly forums,

as well as the articles that they’ve posted on their site.

What are some cons about using the Seedly App?

Here are the 4 main issues that I have with this app:

#1 The app logs you out if you do not login frequently

Seedly will log you out of your account if you are do not use the app for a while.

This may be a minor annoyance for some of you.

#2 There are no recurrent transactions

Seedly does not allow you to add recurrent transactions into your wallet. This is more of a quality of life feature that I wish that this app would have.

There are many different subscriptions that you can sign up for, such as:

- Netflix

- Spotify

- Microsoft Office

By having the recurring transaction feature, you will no longer need to worry about adding the same transaction every month!

#3 There is no option to upload receipts

Unlike other expense trackers, Seedly does not have a function to upload your receipts into the app.

The receipt tracking feature is really useful as you do not need to keep so many receipts with you. It also helps you to keep track of your credit card bill at the end of each month!

I hope that such a feature will be available in future versions of the app.

#4 You are unable to export your transactions to Excel

The Seedly app does not give you an option to export your transactions to a .csv file.

Seedly aims to bring a mobile-only experience for you to track your expenses.

This is great if you intend to use Seedly for the long run. However, things get really tricky if you wish to switch to another expense tracking app!

I personally prefer to use a computer to do my expense tracking compared to a phone. Without the flexibility of exporting transactions, the Seedly app is something that I wouldn’t use.

Is the Seedly app safe?

Seedly is a read-only service that does not store your banking credentials. Moreover, your data is securely stored using asymmetric encryption. This prevents hackers from gaining access to your financial data stored on Seedly.

Here are the security measures explained in depth:

Seedly does not store your banking credentials

When you login to your iBanking platform via Seedly, they are only able to read the financial data that you have. As such, Seedly is unable to make any amendments to your data.

Seedly also states under their privacy statement that they do not store any of your login credentials. You will need to trust Seedly that they’ll keep their word in this agreement!

I do believe that it is safe to trust your credentials with Seedly. Ultimately, you will need to decide whether you are willing to take that leap of faith and trust them.

Evven if someone does get access to your credentials, the banks have various security measures in place. This includes having a phone OTP to approve transactions, and SMS alerts for any transactions you make.

Saltedge aggregates your data from the different banks

After you’ve extracted all of your financial information from your different banks, Seedly uses Saltedge to aggregate your data.

This allows you to view all of your financial information in the Seedly app.

Saltedge is a well established company in the Fintech space. They also have many layers of protection to prevent any hackers from stealing your data, such as asymmetric encryption.

As such, you can be assured that all of your data is in rather safe hands.

Security comes at a cost

The main reason why the Seedly app takes so long to load your banks’ data is due to these security features. While these help to make your data more secure, it actually slows down the whole process.

You’ll need to decide if it’s worth the risks and time taken to use this service provided by Seedly!

Alternatively, you can manually key in all of your transactions. While it is rather troublesome, it does help you to avoid any issues with syncing your bank accounts.

Verdict

Here are the pros and cons of the Seedly app:

| Pros | Cons |

|---|---|

| Transactions are easy to add | Linking of bank accounts is rather troublesome and slow |

| Multiple wallets allow you to track different goals | Unable to link bank accounts from DBS or Standard Chartered |

| Budgets and reports help you to see your monthly savings | Unable to add recurrent transactions |

| Simple and easy to use | Unable to upload receipts |

| Able to track expenditure in different currencies | Unable to export transactions to Excel |

| App is completely free | Requires strict discipline to constantly updates your expenses |

Seedly provides a mobile-first experience to track your expenses. If you prefer to use your phone to do all of your tracking, then you should use this app!

However to make the Seedly app work for you, you will have to be really disciplined in updating your transactions!

If you do not constantly update your expenses, it will be hard to get a good picture of your financial standing.

Conclusion

The Seedly app has many powerful features for a free app. However, there are still some features that are lacking or that can be improved.

For those of you who want a simple expense tracker, I believe that Seedly is a great app that you can use.

However if you require more features, you may want to consider other paid expense trackers instead!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?