Last updated on June 6th, 2021

Being a 16 year old is tough. Bank accounts like the SingLife Account will only allow you to open an account when you’re 18.

For those accounts that are available, the interest rates are pretty unattractive.

However, Singapura Finance’s Vivid Savings Account could be the answer for you!

Although it has many limitations, it may be a perfect stop-gap account before you turn 18.

Contents

- 1 What is the Vivid Savings Account?

- 2 What interest rate does Vivid provide?

- 3 What are the requirements to sign up for Vivid?

- 4 What is the Vivid E-Wallet and Prepaid Mastercard?

- 5 Can I make deposits to and withdrawals from Vivid?

- 6 What fees do I need to pay?

- 7 Are there any limitations to Vivid?

- 8 Is Vivid safe?

- 9 Verdict

- 10 Conclusion

- 11 How can I sign up for the Vivid account?

What is the Vivid Savings Account?

Vivid is a savings account provided by Singapura Finance.

Singapura Finance has actually been around since 1950!

Vivid is being marketed as a ‘fully-online’ savings account. By reducing manpower costs, they are able to provide you with a higher interest rate.

What interest rate does Vivid provide?

Vivid provides a pretty decent interest rate, as seen below:

| Account Balance | Interest Rate |

|---|---|

| $0 to $10,000 | 1.05% |

| Above $10,000 and up to $20,000 | 1.30% |

| Above $20,000 | 0.25% |

Vivid is unique as the interest rate is effective for your entire balance.

This is in contrast to other accounts like the SingLife Account. You will receive 2% only for the first $10k, while the next $90k will only earn you 1%.

So long as your balance is greater than $10k and not more than $20k, you will receive a 1.3% interest on your entire balance!

However, if your balance is above $20k, you will only earn a 0.25% interest rate for your entire balance.

It would be best to monitor your account balance to make sure that you do not exceed $20k.

The interest rate is calculated based on your daily balance and will be credited to you at the end of each month.

What are the requirements to sign up for Vivid?

Here are some requirements that you’ll need to use Vivid:

#1 Minimum deposit

To open an account, you are required to make a $500 deposit.

You can do so by 3 methods:

- PayNow

- eNETS

- AXS

#2 Minimum average daily balance

You are required to maintain an average daily balance of $200 in your account.

This is a very low requirement. Most of the other accounts available to you would require a minimum balance of between $500-$1000.

No fall-below fee

You will not have to pay a fall-below fee if your balance is below $200.

However, you will be forced to close your account.

If the account is closed within the first 6 months, you will have to pay an early closure fee.

If you are using Vivid as a spending account, you may want to periodically check its balance!

#3 Minimum age

The minimum age to open a Vivid Account is 16 years old.

This allows you to start earning a 1.05% interest rate, even at a young age!

If you or your child is within this age range, I strongly recommend you to open the Vivid Account.

What is the Vivid E-Wallet and Prepaid Mastercard?

One of Vivid’s unique selling point is its E-Wallet and Prepaid Mastercard.

Here’s how these 2 components work:

#1 Vivid E-Wallet

The Vivid E-Wallet acts as a ‘middleman‘ between your Vivid Account and the Vivid Mastercard.

When you use the Vivid Mastercard, you are not debiting the amount directly from your Vivid Account.

Rather, you would need to transfer the money to the E-Wallet, and then load the money into the prepaid card.

This is a good security feature that prevents access to your entire account balance!

You would need to download the E-Wallet app on the App Store or Google Play Store.

There are 4 main functions that you can use the E-Wallet for:

- Transfer money from your Vivid Account to the E-Wallet

- Send money back from your E-Wallet to the Vivid Account

- Load money from the E-Wallet to the Vivid Prepaid Mastercard

- Unload money from the Vivid Prepaid Mastercard back to the E-Wallet

What’s more, you are able to view your transaction history.

The only downside is that the E-Wallet does not allow you to check your balance in your Vivid Account. You can only check the balance in your E-Wallet and Prepaid Mastercard.

#2 Vivid Prepaid Mastercard

When you apply for the Vivid Account, you will be given the option to apply for the Vivid Prepaid Mastercard.

There are no requirements to apply for this card. You can even apply for it when you’re 16 years old!

Another debit card that you can apply for when you’re 16 is the FRANK debit card.

Once you’ve loaded the money from the E-Wallet, you can start making purchases with the card.

The unique part about the Vivid Prepaid Mastercard is that it comes with a Dynamic CVV.

This is especially applicable for online purchases. When your card details get hacked, the hackers will be able to make purchases using those details.

However with the Vivid Prepaid Mastercard, a new CVV is generated each time you need to make a purchase .

As such, your debit card details are safer!

To generate a new CVV, you would have to use the E-Wallet app.

This also means that the CVV at the back of your card is fake. You shouldn’t be using that CVV when you make an online purchase!

The main benefit of the Vivid Prepaid Mastercard is this feature.

Besides this, there are no additional benefits when you use the card.

When you turn 18 years old, here are 2 debit cards that you might want to consider:

| Debit Card | Benefits |

|---|---|

| JumpStart Debit Card | 1% cashback on all eligible Mastercard transactions |

| SingLife Debit Card | No foreign exchange fees when making overseas purchases Competitive exchange rates Retrenchment benefit |

Can I make deposits to and withdrawals from Vivid?

The Vivid Account does not have FAST transfers. As such, here’s how you can make withdrawals and deposits using the Vivid Account:

#1 Deposits

You are able to make a deposit into Vivid via 2 methods:

- Online via PayNow / eNETS / AXS

- Over the counter at Singapura Finance’s branches

#2 Withdrawals

You can only make withdrawals from the account at the customer service branches. There is no option to make a withdrawal online.

As such, you may want to consider how much you wish to store in the Vivid Account.

Once you deposit the money, the only way you can use the money is by spending it with the Mastercard.

Alternatively, you can choose the close the account and to receive your entire balance. However, you will have to pay an early closure fee if you do so within the first 6 months.

Here’s a summary of how you can make deposits and withdrawals using Vivid.

| Type | Over the Counter? | Online? |

|---|---|---|

| Deposits | Yes | Yes |

| Withdrawals | Yes | NO |

What fees do I need to pay?

Here are some fees that you may need to pay for the Vivid Account:

#1 Early closure fee

If you close the account within 6 months, you will need to pay for the early closure fees below:

| Fee | Amount |

|---|---|

| Early Account Closure | $25 |

| Early Card Termination | $30 |

If you have the Vivid Mastercard, you will incur both fees. It’s not worth it to pay $55 just to close the account!

One way that you may have to close your account is if your balance is less than $200. As such, you should try to make sure that your balance does not fall below $200!

#2 Over the counter fees

You may want to make a deposit to or withdrawal from Vivid. You can do so by going to Singapura Finance’s 7 customer service centers to perform the transaction.

However, you will incur an over the counter fee of $3 for each withdrawal or deposit request.

This fee is waived until 31 December 2020.

You are able to make deposits online via PayNow, eNETS or AXS. However, you are unable to make a withdrawal online!

#3 ATM withdrawal fee

Singapura Finance does not have any ATMs. If you wish to make a withdrawal, you can do so using another bank’s ATM.

To do so, you will need to enable a PIN to carry out the withdrawal. You will incur a $5 fee for PIN activation.

You’ll need to pay additional fees for using the ATM too

Furthermore, you will have to pay a fee for using another bank’s ATM. This fee varies from bank to bank.

Singapura Finance estimates it to be at least 0.8% for each transaction.

Here are the fees that you’ll need to pay for an ATM withdrawal.

| Type | Amount |

|---|---|

| Enabling ATM PIN | $5 |

| Resetting ATM PIN | $5 |

| ATM Withdrawal Fee | Minimum 0.8% |

As such, it is not recommended to make an ATM withdrawal using your Vivid Mastercard!

#3 Vivid Prepaid Mastercard Fees

There are many other fees that you might incur when using the Vivid Prepaid Mastercard.

One that you might want to take note of is a 3% foreign exchange fee.

You will be charged this fee when you make an overseas purchase. This is a pretty hefty fee to incur!

If you are looking for a debit card without foreign exchange fees, you can consider the SingLife Account’s debit card.

Are there any limitations to Vivid?

Vivid is not your typical savings account.

To be able to offer a higher interest rate, Vivid has these main 5 limitations:

#1 Fees will be incurred when withdrawing money

There is no way of withdrawing your money without incurring any fees.

Here are the 2 main ways that you can withdraw your money:

- Over the counter withdrawal ($3 fee)

- ATM withdrawal from another bank ($5 PIN activation + min. 0.8% transaction fee)

As such, the money that you put into Vivid is essentially locked up.

The only way that you can use the money in the account is to spend it with the Vivid card.

#2 Unable to make payments via GIRO, PayNow or eNets

As mentioned above, the only way to use the money is via the Vivid card.

This means that you are unable to make payments via other methods like:

- GIRO

- PayNow

- eNETS

As such, you may not want to use the Vivid Account as your main account for transactions. The functions are really limited in this area.

#3 P2P transfers are possible only if your friend has the Vivid E-Wallet

It is possible to make P2P transfers to your friend. However, your friend needs to have the Vivid E-Wallet too.

This really limits the functionality of the P2P feature.

If you are looking for ways to be rewarded while making P2P transfers, you can consider Google Pay. Google Pay is currently having a promotion that gives you scratch cards when you make a P2P transfer. You can win up to $15 for each scratch card!

For more information, you can check out my Google Pay review.

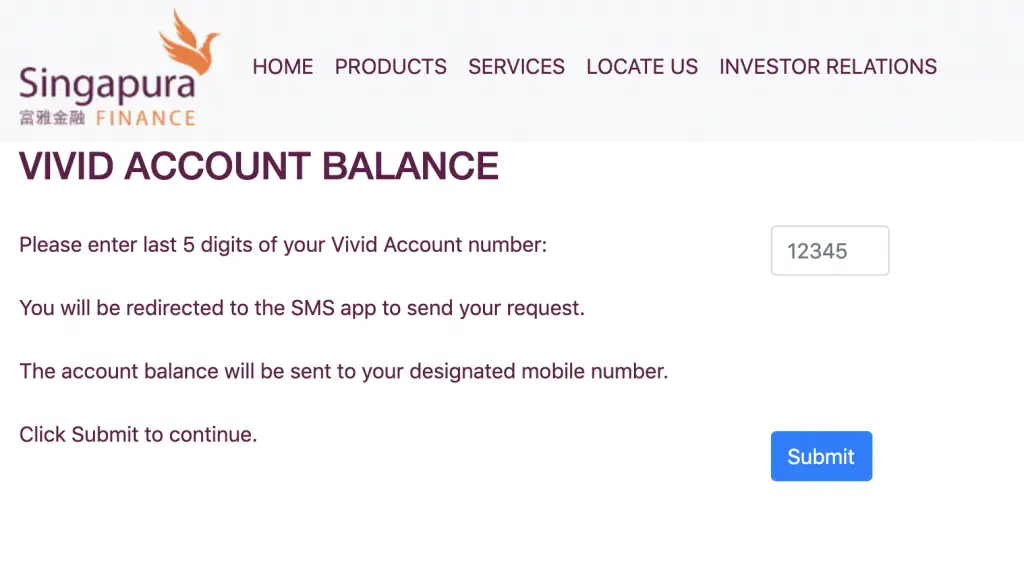

#4 No mobile banking app to check balance

Vivid has a mobile app. However, it is only for your E-Wallet and Vivid Card.

You are unable to check the balance in your Vivid Account via the app!

The only way you can do so is by going to Singapura Finance’s website.

You will need to enter the last 5 digits of your Vivid Account number.

Afterwards, an SMS will be sent to you with your account balance.

It can be pretty troublesome to check your balance!

#5 Unable to make large purchases with the Vivid Card

There are some limitations on the amount you can have in the E-Wallet and Vivid Card.

- You can only transfer a maximum of $500 a day from the Vivid account to the Vivid E-Wallet

- You can only have a maximum combined value of $3,000 in both your E-Wallet and Vivid card

If you want to make a large purchase of more than $500, it may be a hassle for you.

You may have to transfer the money a few days in advance, so that you’ll have enough money to make the purchase.

You may be wondering why this limit is in place.

Singapura Finance is trying to market Vivid to younger people. As such, they have these limits to prevent teens from spending too much money.

Is Vivid safe?

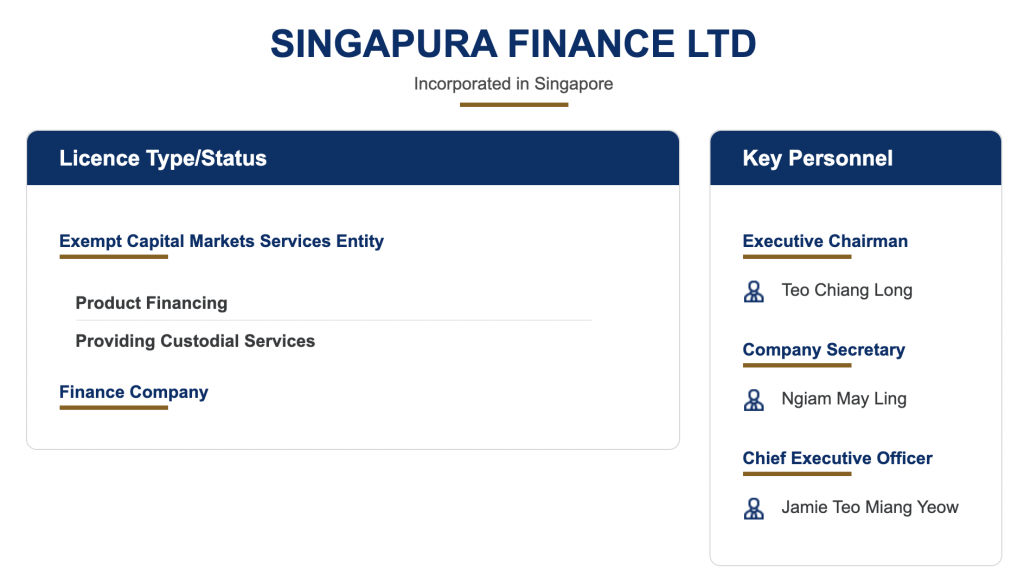

Singapura Finance is a pretty well established company with a long history. As such, the company should be pretty stable.

They are licensed by MAS as well.

In the event that Singapura Finance closes down, your deposit in Vivid will be covered under the SDIC.

Under the Deposit Insurance Scheme, your deposits are covered for up to $75k in each bank.

However, one thing to note is that the funds in your E-Wallet and Vivid Mastercard are not covered by the Deposit Insurance Scheme!

Verdict

Here’s a summary of this account’s pros and cons:

| Pros | Cons |

|---|---|

| Decent interest rate of 1.05% – 1.3% | Fees incurred when withdrawing money |

| Interest rate is applied to entire balance | Lower liquidity compared to a normal savings account |

| Low minimum balance requirement of $200 | Cannot make any transactions besides using the Vivid Mastercard |

| Security features of the Vivid Mastercard are great for teens | P2P transfers are only available if your friend has the E-Wallet app too |

| SDIC insured | No mobile banking app to check your account balance |

| Unable to make large purchases with the Vivid Mastercard | |

| Vivid Mastercard does not provide other benefits like cashback |

The Vivid Account has lesser capabilities compared to a normal savings account.

As such, here are the 2 scenarios which I believe you can maximise the Vivid Account:

- A ‘fixed deposit account‘ of at least 6 months

- A secure way of spending money with the Vivid Prepaid Mastercard

I feel that teenagers aged 16-17 years old will be the best group to benefit from this account.

Why is this account great for 16-17 year olds?

There are 2 main reasons why this account is ideal for 16-17 year olds:

#1 Highest interest rate for this age range

You will need to be at least 16 years old to sign up for Vivid.

There are a few accounts that provide attractive interest rates, such as the SingLife Account and Standard Chartered JumpStart.

However, these accounts require you to be at least 18 years old to create them!

Other accounts that are available to 16 year olds do not have high interest rates too.

These include:

Most of these accounts have a much lower interest rate compared to Vivid.

CIMB FastSaver used to have a high interest rate of 1% for your first $50k. However, they have since revised it to 0.5%. This is no longer as attractive as Vivid’s interest rate.

As such, Vivid will be the best way to maximise your savings when you’re below 18.

Another alternative you may want to consider is GIGANTIQ. It is an insurance savings plan that provides a comparable interest rate. Moreover, you have the flexibility of making withdrawals too!

#2 Vivid Mastercard has many security features

The Vivid Mastercard has some security features that make it great for a young teenager.

These include:

- Dynamic CVV which reduces security risks

- Transfer limits prevent you from making large purchases

- Only the amount on your Vivid Mastercard can be used to make purchases

With such features, the Vivid Mastercard is a great way to introduce your child to a debit card.

How should I use the Vivid account?

I would recommend to sign up for the account, only if you are below 18 years old.

There are other products that offer higher rates once you’re 18!

You will then have to keep the account for at least 6 months. This ensures that you do not pay for the early closure fee.

Once you’re 18, you can then close the account and sign up for both the:

Conclusion

The Vivid account is a great way to grow your savings when you’re below 18.

Besides that, you may not want to sign up for this account. There are too many limitations to the account.

It may not be worth signing up just to get a slightly higher interest rate!

How can I sign up for the Vivid account?

Here’s a step-by-step guide to sign up for Vivid:

#1 Sign up for the account on Vivid’s website

You can sign up for the account from this link. You will then need to use SingPass MyInfo to apply for the account.

It would take around 3-5 days to process your application. If successful, you will receive an email to activate your Vivid Account.

#2 Activate your Vivid Savings Account

You will need to make a deposit (minimum $500) to activate your Vivid Account.

You can do so via 3 methods:

- PayNow

- eNETS

- AXS

#3 Activate your Vivid E-Wallet

You can download the Vivid E-Wallet app on the App Store or Google Play Store.

Once you activate both your account and the E-Wallet, you will receive the Vivid Prepaid Mastercard by mail.

#4 Activate your Vivid Prepaid Mastercard

Once your card arrives, you can activate it.

And you’re done! You can start using the Prepaid Mastercard for your purchases.

Don’t forget to load the card using the E-Wallet first!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?