Last updated on June 13th, 2021

After topping up your Dash wallet, you may be looking for a way to withdraw your unused cash to your bank account.

However, is this even possible?

Contents

Can I withdraw money from Singtel Dash?

You are able to withdraw money from Singtel Dash to your bank account via FAST or PayNow, after you verify your account. However, if you choose this option, you will no longer be able to top up your Dash wallet with a credit or debit card.

Singtel Dash now allows you to withdraw your money to your bank account! Previously you weren’t able to do so.

How to withdraw from Singtel Dash

Here are the steps you’ll need to do to withdraw your money from Singtel Dash:

- Verify your account

- Accept the terms and conditions

- Go to ‘Send Money’ on your dashboard

- Select PayNow or Bank / Wallet Accounts depending on your mode of transfer

- Select the amount you want to transfer

- Receive your balance

#1 Verify your account

To start using this feature, you’ll have to verify your account first.

You should get a pop-up when you launch the Singtel Dash app to ask you to verify your account.

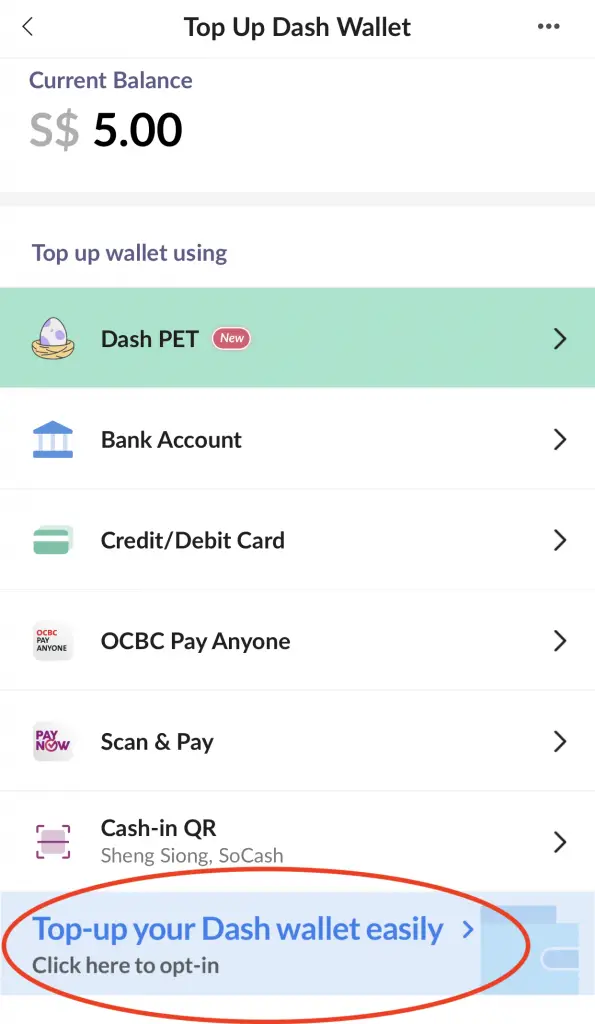

If you don’t receive this pop-up, you can choose this option at the top-up page.

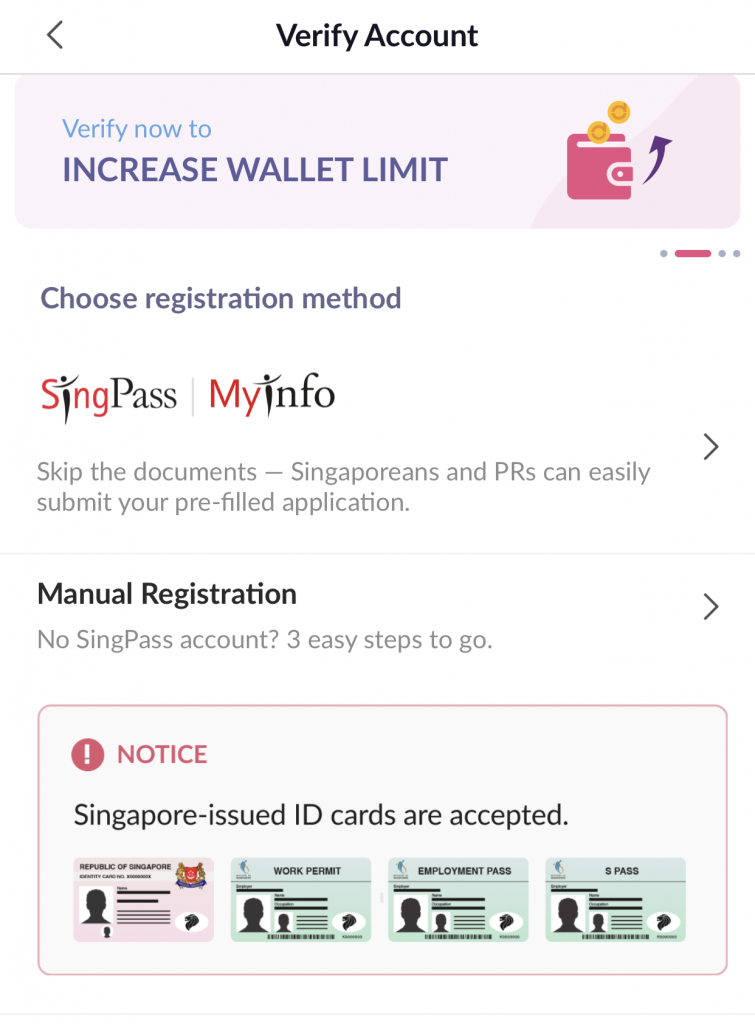

There are 2 ways that you can verify your account:

- MyInfo

- Manual registration

#2 Accept the terms and conditions

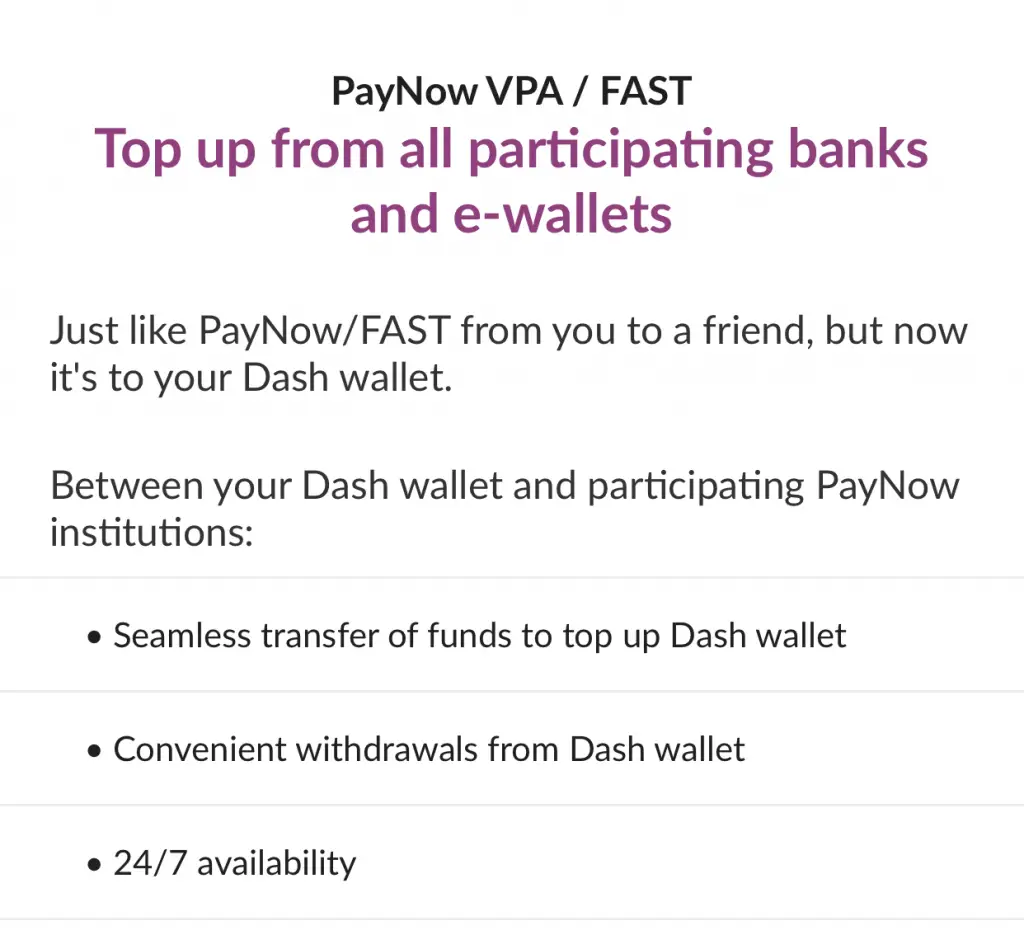

When you launch the Singtel Dash app the next time, you will be asked to enable PayNow VPA / FAST for your Dash wallet.

However, there are some conditions that you’ll need to accept first before you can start using this feature:

- You are not able to use a credit or debit card to top up your Dash wallet

- Once you accept this, you are unable to reverse your registration

Previously, you could top up your Dash wallet with your credit or debit card. When you use some of these cards, you may be eligible for certain rewards, including:

- Miles

- Cashback

- Reward points

However once you enable the PayNow VPA + FAST feature, you can no longer enjoy these benefits. This is something you’ll need to really consider as your decision is irreversible!

If you choose to continue using your credit or debit card to top up the wallet, you can’t withdraw your money from your Dash wallet!

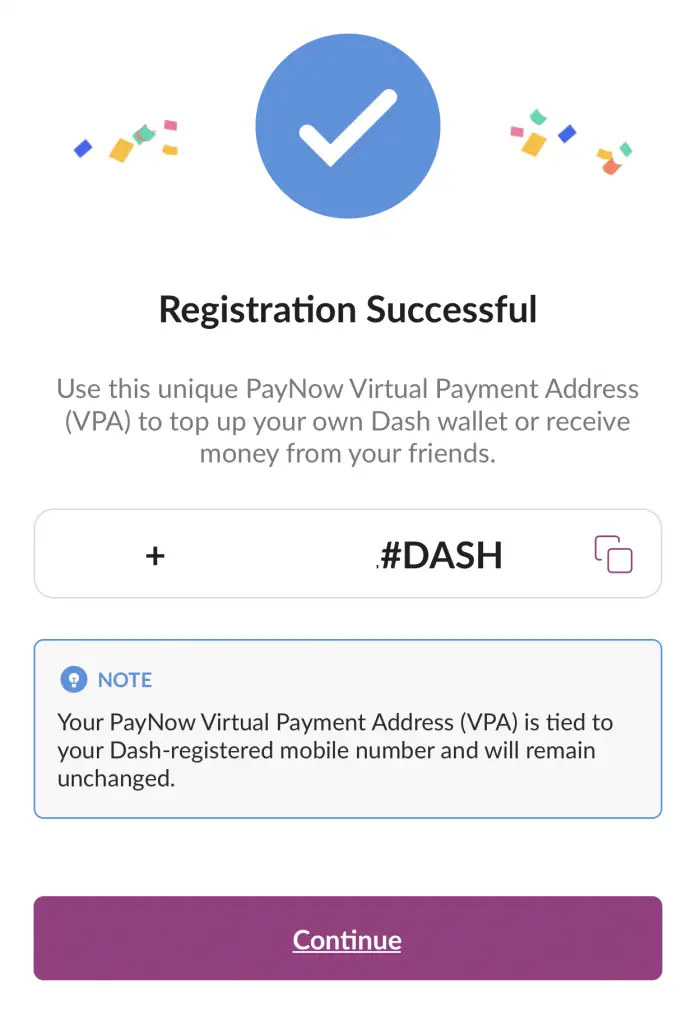

When you complete the registration, you will be given a PayNow Virtual Payment Address (VPA). This address can be used for 2 things:

- Topping up your Dash wallet

- Receiving money from your friends

Your VPA is actually your mobile number with ‘#DASH’ behind it.

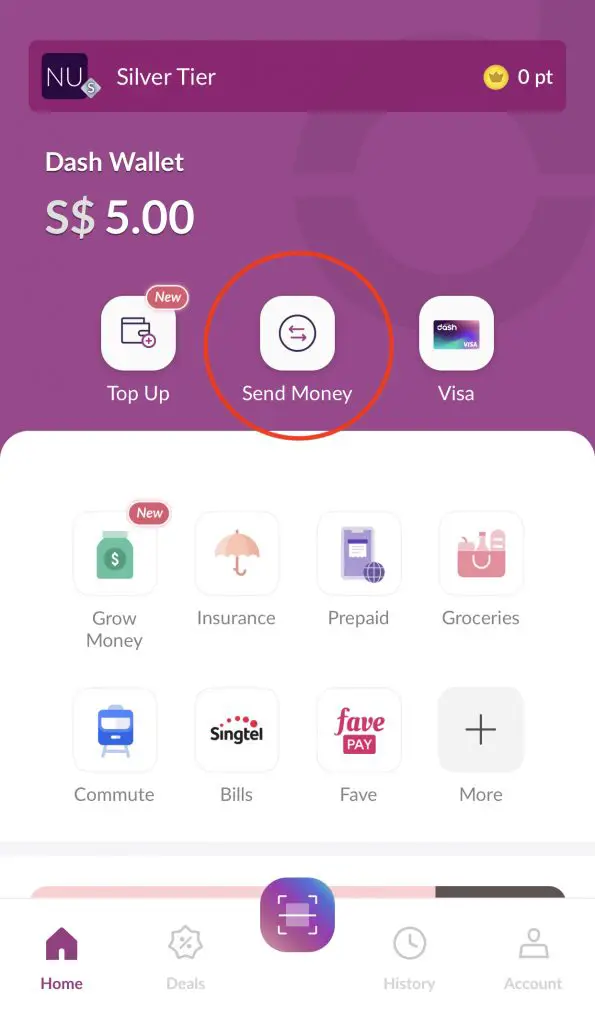

#3 Go to ‘Send Money’ on your dashboard

Once you’ve set up the PayNow VPA + FAST feature, you can go to the ‘Send Money’ icon on your dashboard.

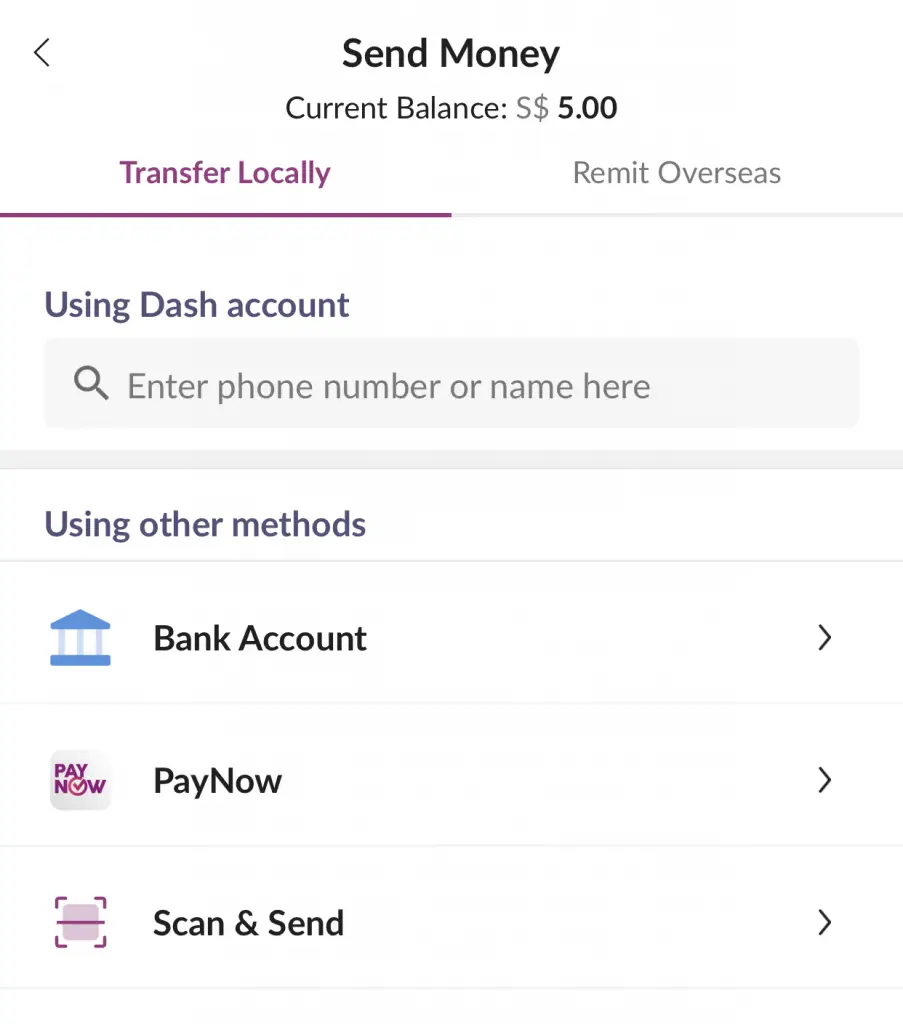

#4 Select PayNow or Bank / Wallet Accounts depending on your mode of transfer

There are two ways that you can send money to a bank account:

- PayNow

- Bank / Wallet account

PayNow

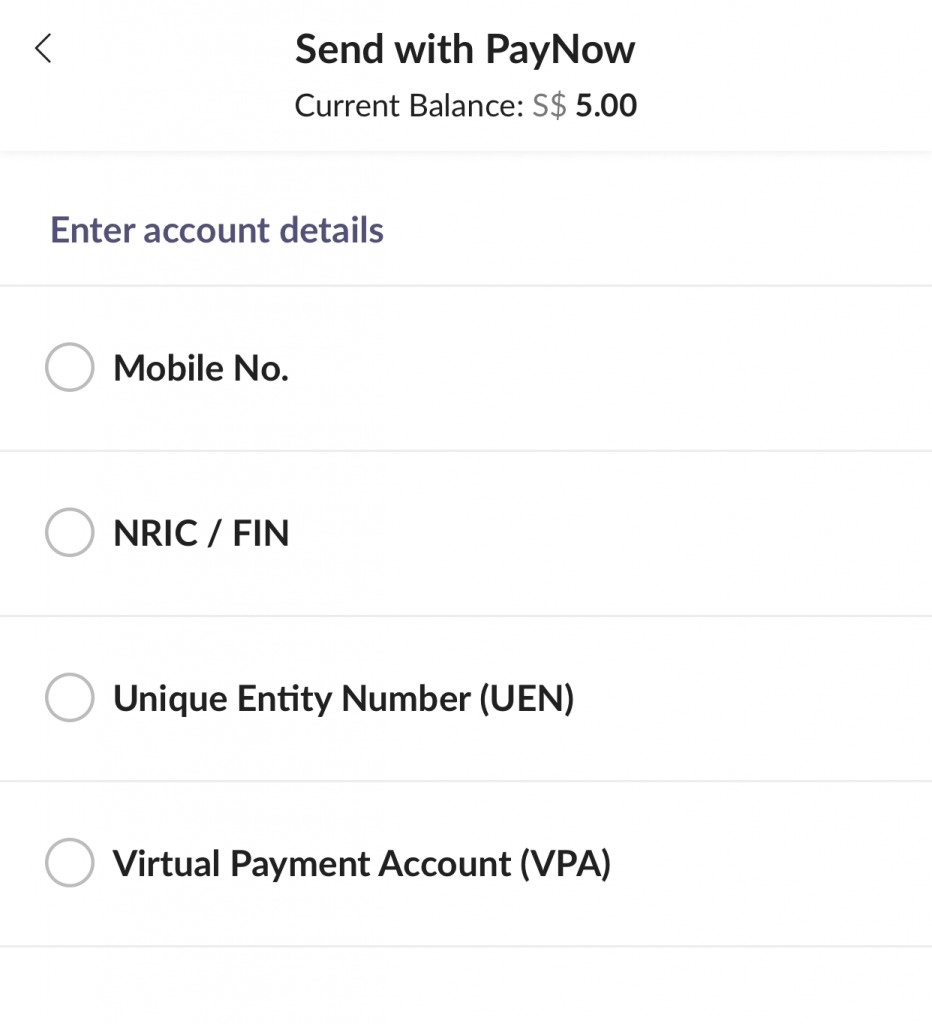

You can use the PayNow function to send money to a bank account using these 4 methods:

- Phone Number

- NRIC

- Unique Entity Number (UEN)

- Virtual Payment Account (VPA)

This is similar to a normal PayNow transfer which can be done on GrabPay and Google Pay.

If you’re transferring to another mobile wallet, you’ll need to take note of the minimum amount! For example, you can only transfer a minimum of $10 to a Grab wallet.

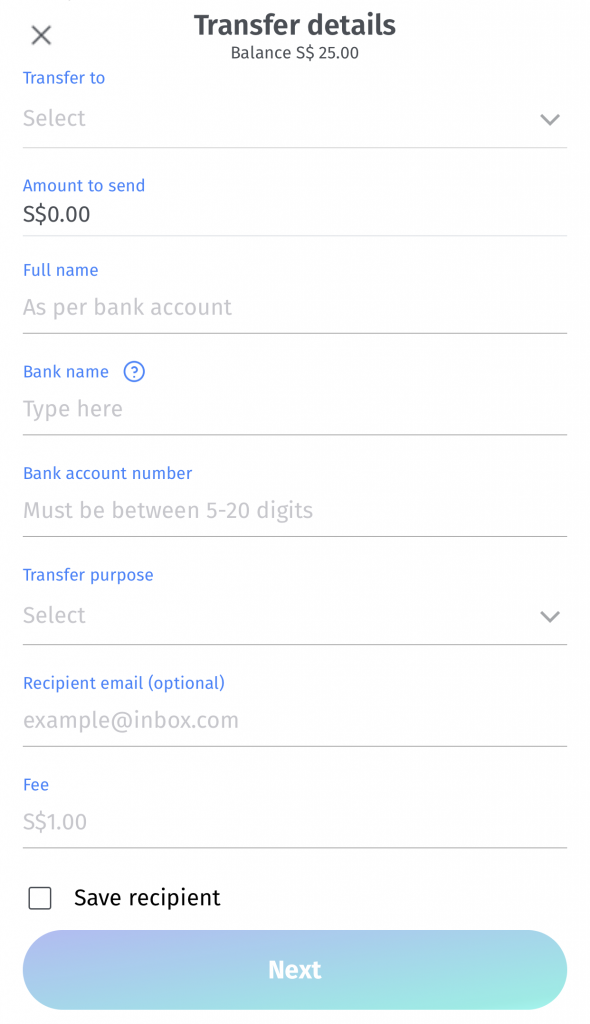

FAST

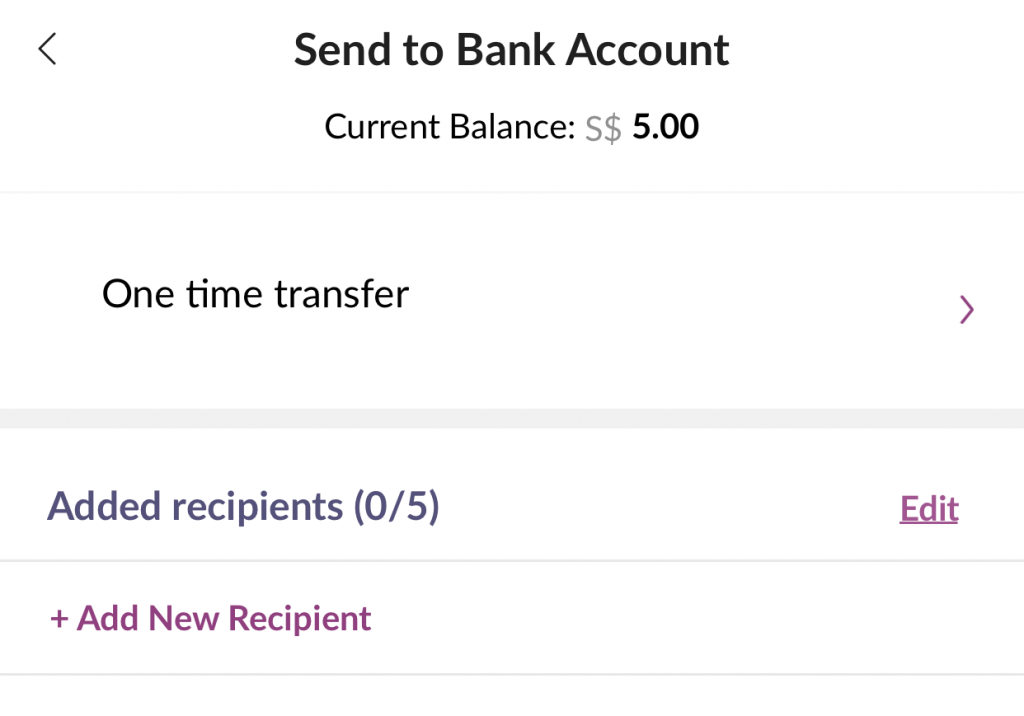

You can use FAST to transfer to a bank account as well.

There are 3 details you’ll need to provide:

- Recipient name

- Recipient’s bank / wallet name

- Account number

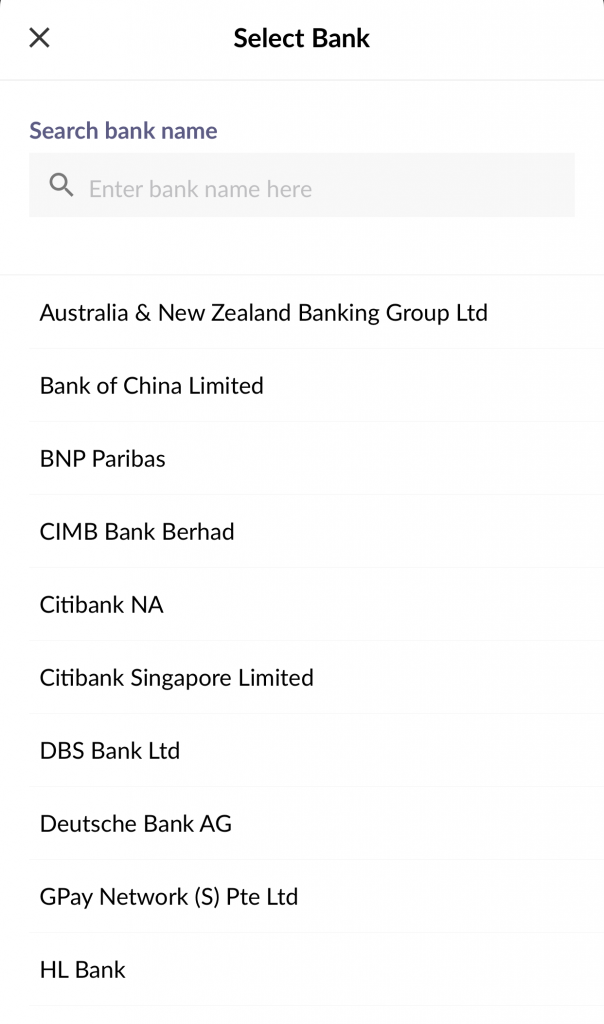

There are 27 different banks that you can transfer to, which are mainly the banks that allow for FAST transfers.

You may be unable to find POSB on the list. This is because DBS and POSB are actually the same bank!

#5 Select the amount you want to transfer

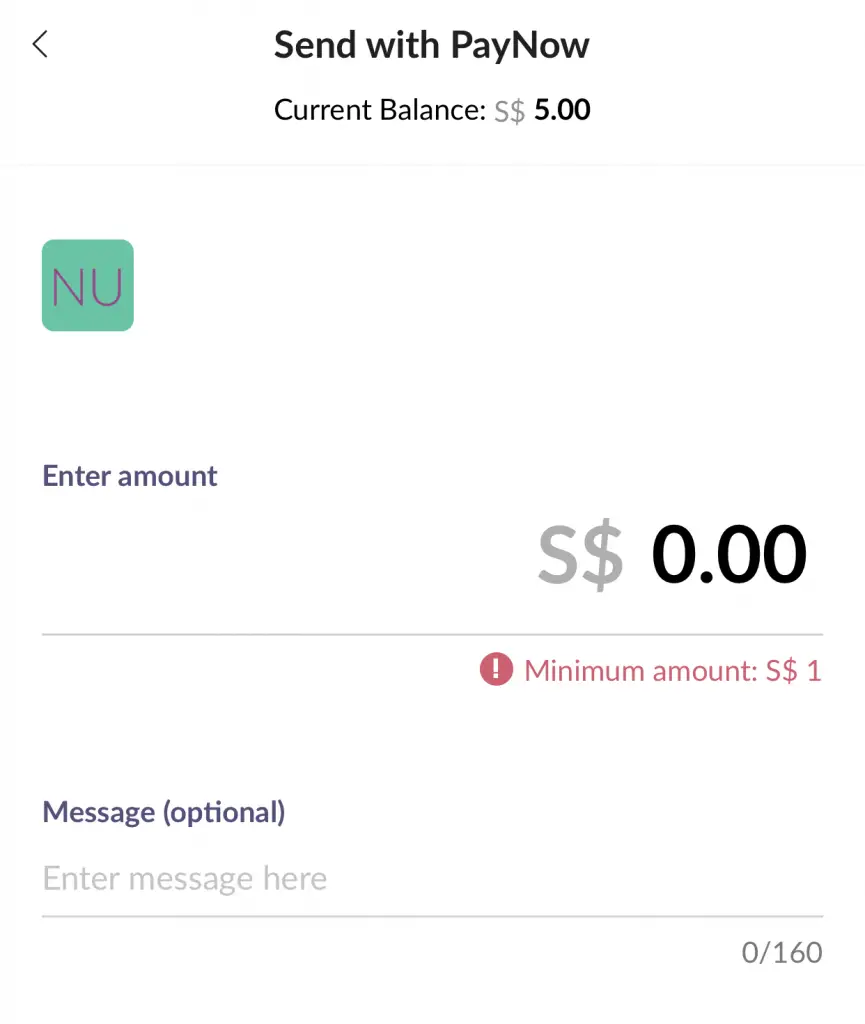

After that, you’ll need to select the amount that you wish to transfer to the account.

The minimum amount that you can transfer out is $1.

Moreover, you are able to transfer out cents too. This means that you can withdraw your entire amount from your Dash wallet!

#6 Receive your balance

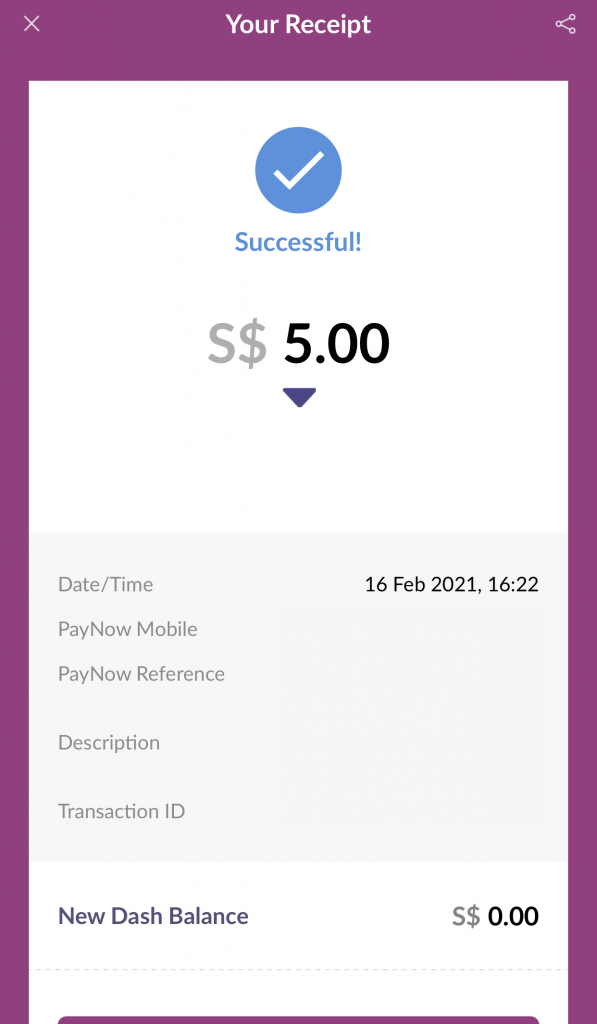

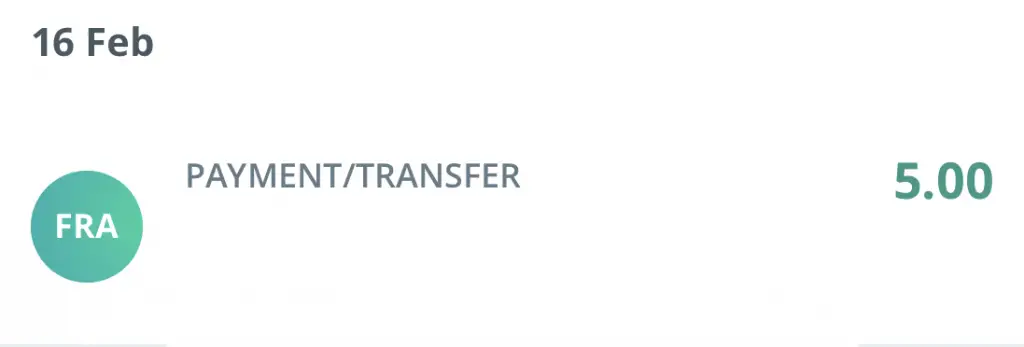

You will receive a confirmation of your withdrawal.

And I managed to receive it in my bank account within a few minutes.

Should I enable PayNow / FAST on Singtel Dash?

With this feature, you are able to seamlessly transfer money from your Dash wallet and bank account.

The only drawback is that you can no longer use credit or debit cards to top up your wallet.

However, you’ll still be able to earn Dash reward points when you use the Dash wallet!

In the end, you’ll need to balance the pros and cons to see which is more suitable for you.

Which other mobile wallets allow me to withdraw my funds?

You may still want to keep the top-up option (for credit / debit cards) for your Dash wallet. Here are some other alternatives to Dash that do not lock your funds in their wallets:

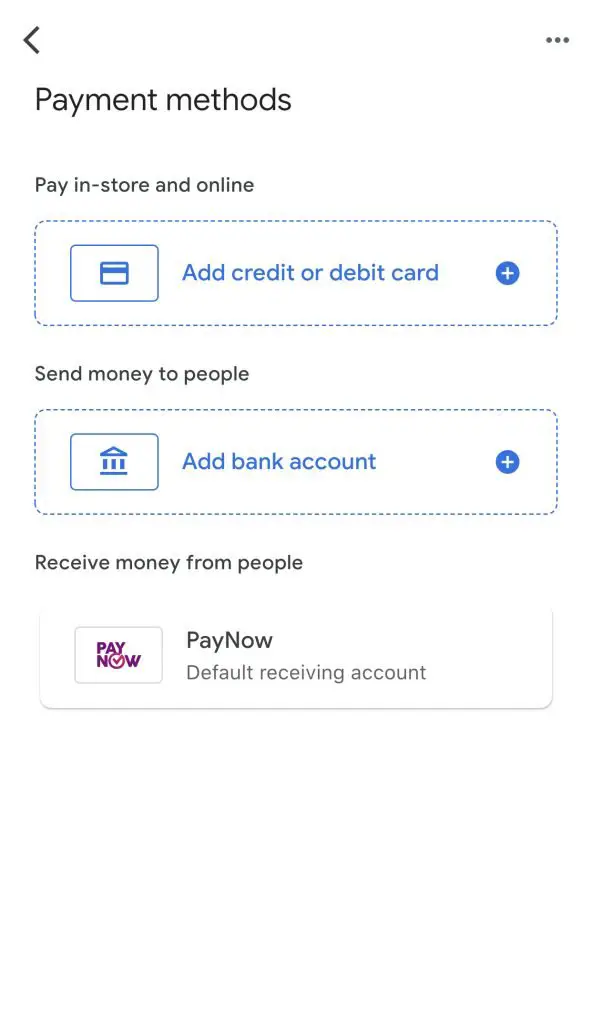

#1 Google Pay

Google Pay uses your credit or debit card directly to make payments to a merchant. Google facilitates the transfer without needing to have a stored wallet.

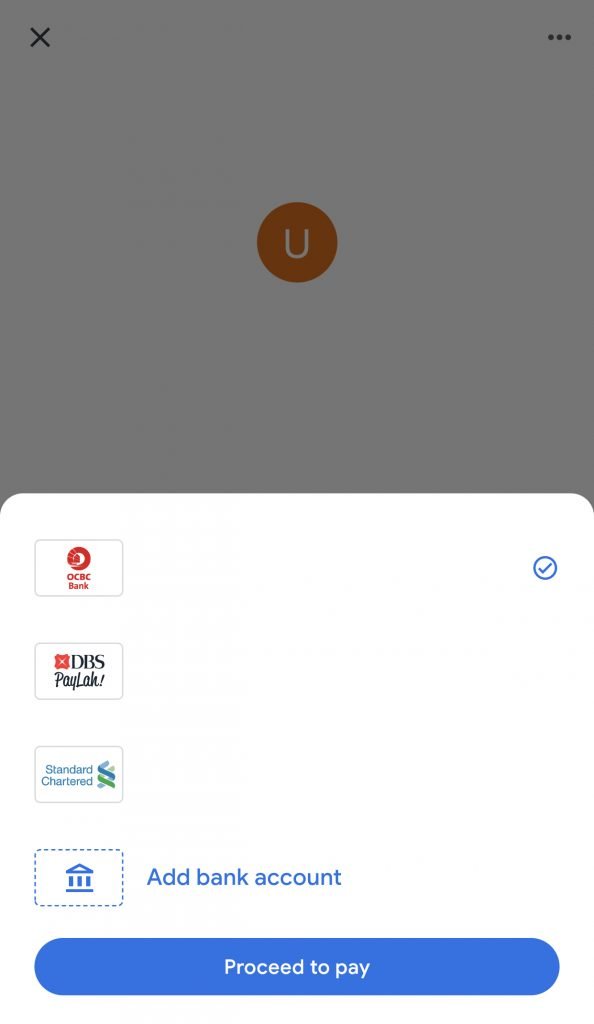

For any P2P or PayNow transfers that you wish to make, you can do so via 3 payment methods:

- OCBC

- Standard Chartered

- DBS PayLah!

As such, your funds are directly taken from your bank accounts. You do not need to place your funds into a stored wallet!

Google Pay will provide some offers from time to time as well.

The only issue is that not many merchants have taken up Google Pay compared to other mobile payments. However, Google Pay is still rather new. I believe that this payment method will pick up pace in the near future.

If you are interested in earning a $3 sign-up bonus, you can read my review on Google Pay to find out more.

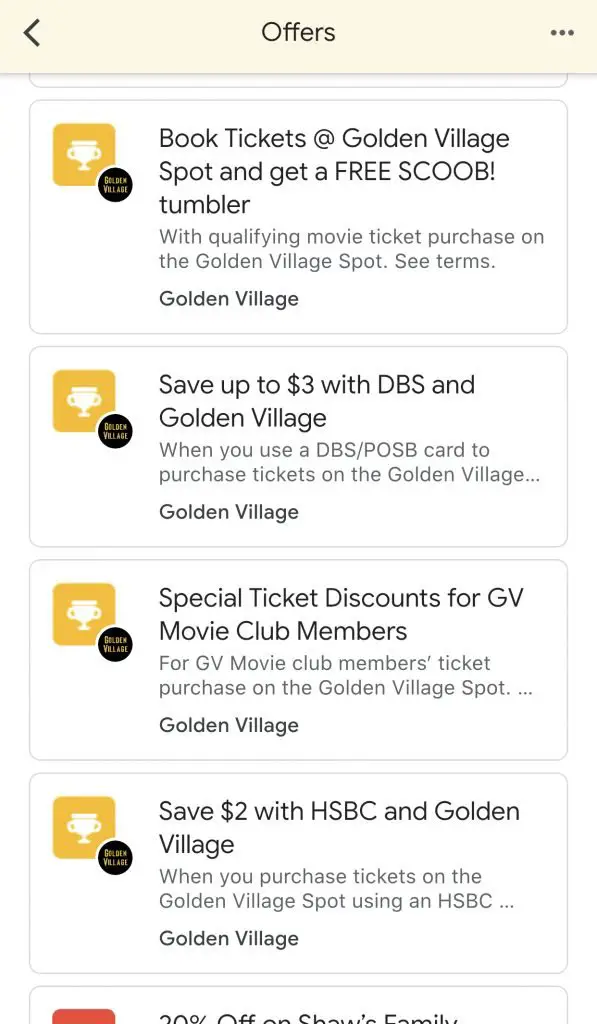

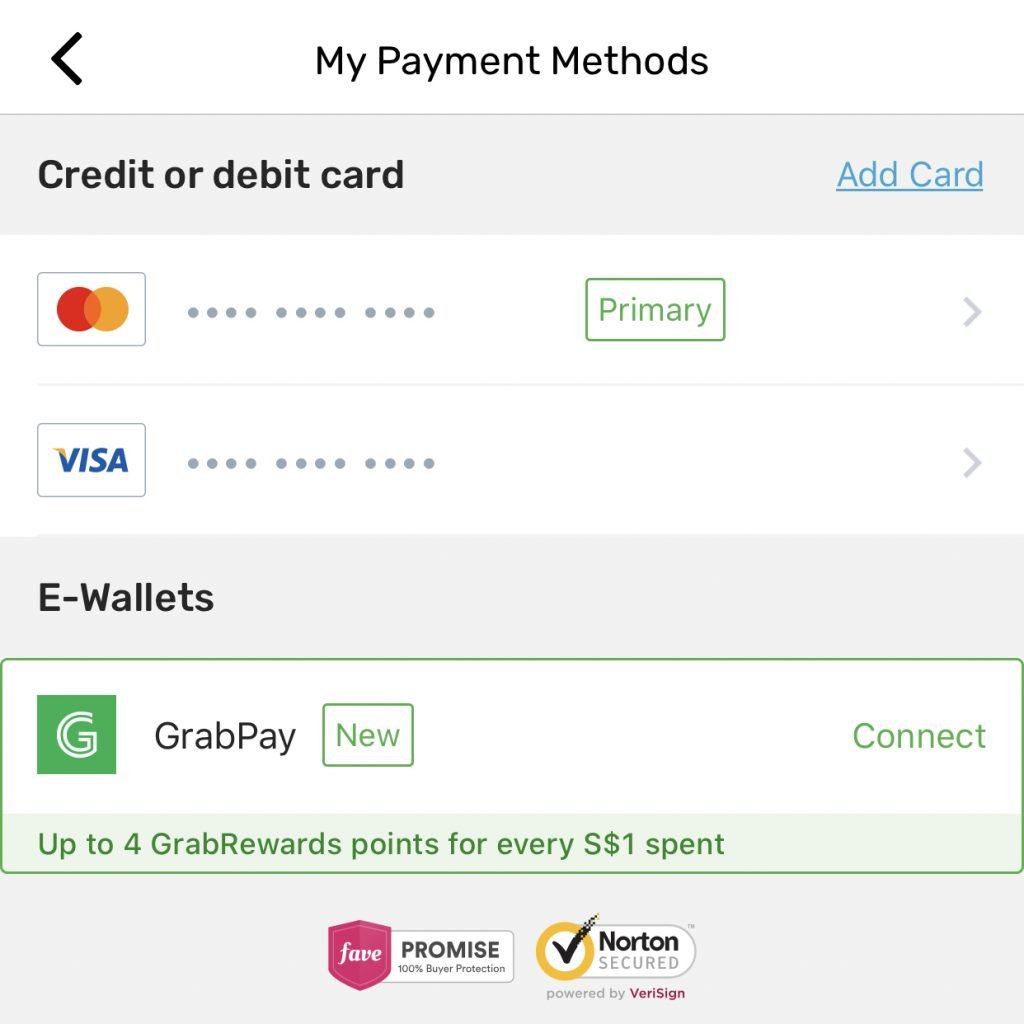

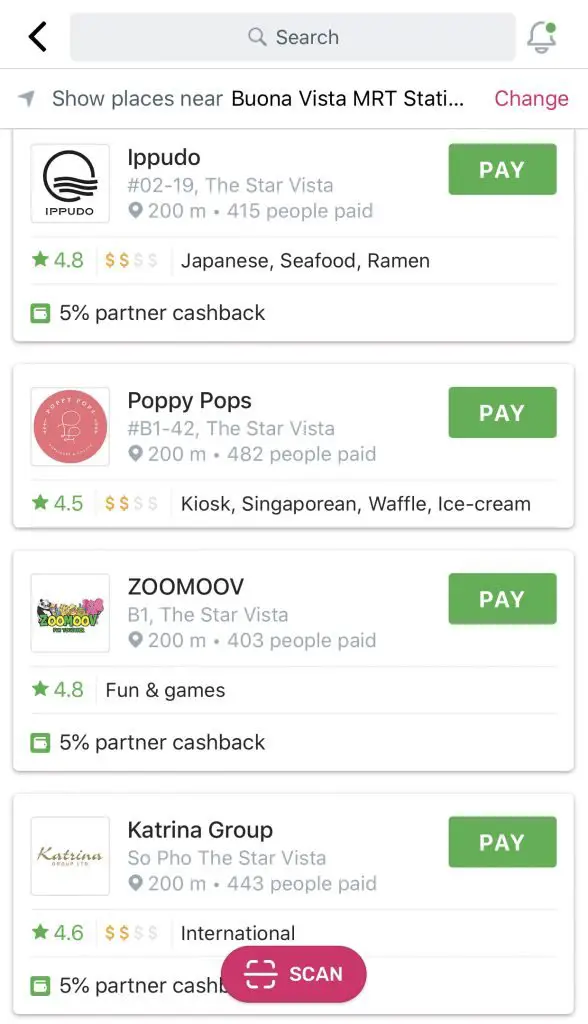

#2 Fave

Similar to Google Pay, you can use your debit or credit card directly when you pay a merchant using Fave. Fave also allows you to connect your GrabPay wallet as well!

You are able to receive really high partner cashbacks.

However, you can only redeem it when you visit the same store in the future.

What I like about Fave is that you can use your credit or debit card to make payments, even if the store does not have PayWave. This allows you to earn rewards when you use your credit or debit card!

You can view my comparison between payWave and NETS to see how these payment methods are different.

Moreover, the cashback you earn is on top of any other rewards that you can claim from your debit or credit cards!

This means that if you use either the Standard Chartered Unlimited or Amex True Cashback cards, you can get the partner cashback and the 1.5% from the cards!

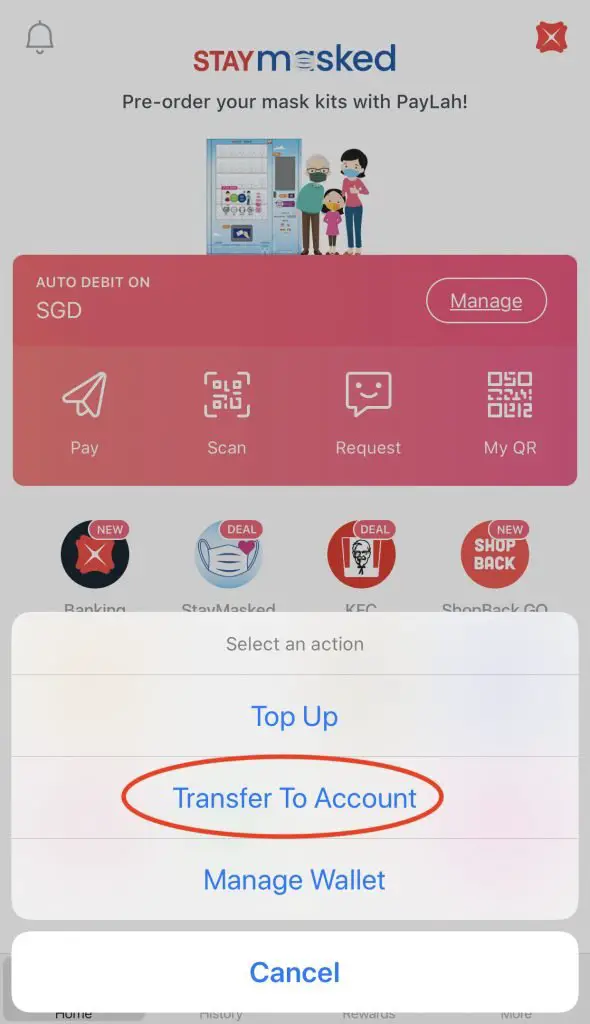

#3 PayLah!

Your PayLah! account will be linked to a bank account that you have.. As such, you can transfer your PayLah! wallet balance to your bank account at any time.

Even if you do not have a DBS or POSB account, you can still send your wallet balance to a Singaporean bank account registered under MyInfo.

DBS PayLah! is one of the most widely used mobile wallets in Singapore. It is the most versatile wallet as certain stores would only have PayLah! as a digital payment option.

However since you are not using a debit or credit card to make a payment, you will not receive rewards like cashback or rewards points.

#4 BigPay

BigPay is a mobile wallet by AirAsia, and they have a mobile wallet too. You are able to withdraw money from your BigPay wallet to your bank account.

However, you will incur a $1 flat fee for each transaction.

Conclusion

With the ability to transfer your funds from your Dash wallet to your bank account, this has made it more flexible compared to other wallets like Razer Pay.

However, the only drawback is that you can no longer top up your Dash wallet with a debit or credit card!

As such, you’ll need to decide between:

- Transferring your Dash wallet balance to a bank account

- Using your credit or debit card to top up your wallet

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Dash Referral (Receive 800 Welcome Bonus Points)

If you are interested in signing up for Singtel Dash, you can use my referral link to sign up.

Alternatively, you can use my referral code ‘DASH-R1W67‘.

You will be able to receive 800 welcome bonus points once you either make a:

- Dash payment or

- Singtel prepaid top-up (minimum $10)

PayLah! Referral (Get $5 when you sign up)

If you are looking to sign up for a PayLah! account, you can use my referral code ‘GIDOYK921‘.

You will receive $5 after successfully signing up for an account.