Last updated on June 6th, 2021

You may have received a FRANK debit card when you signed up for the FRANK account.

What benefits does the card provide, and should you be using this card?

Here’s a deep dive into what the FRANK debit card offers.

Contents

- 1 What is the FRANK debit card?

- 2 How do I apply for a FRANK debit card?

- 3 What are the requirements of this card?

- 4 What are the benefits of this card?

- 5 What payment methods can I use with this card?

- 6 What are the fees involved?

- 7 How do I change my FRANK debit card design?

- 8 What happens when my debit card expires?

- 9 Verdict

What is the FRANK debit card?

The FRANK debit card is a Visa debit card offered by OCBC. This card is paired with the OCBC FRANK account.

As such, you will receive this card when you open your FRANK account.

There is a FRANK credit card too

OCBC offers a FRANK credit card as well, so hopefully you won’t be confused between these 2 cards!

The FRANK credit card does provide a lot more benefits. However, you will need to have a minimum income to apply for this card.

How do I apply for a FRANK debit card?

Here’s a step-by-step guide to apply for a FRANK debit card:

#1 Start your application

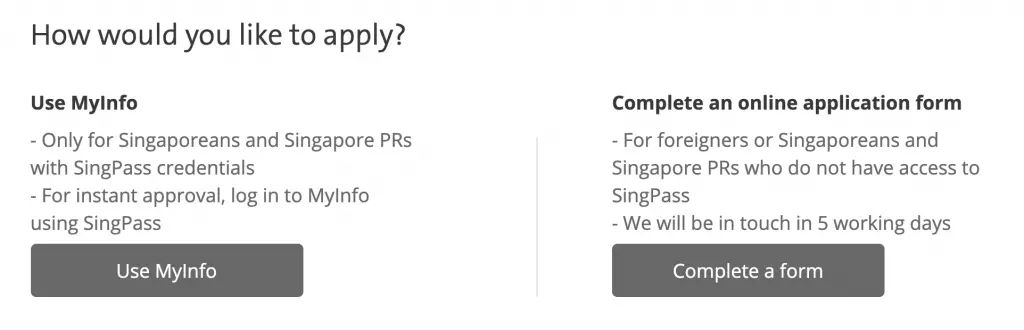

There are 2 ways that you can apply for your FRANK debit card:

1. Online

You are able to apply for your FRANK account and debit card online.

If you have MyInfo, the application can be completely very quickly.

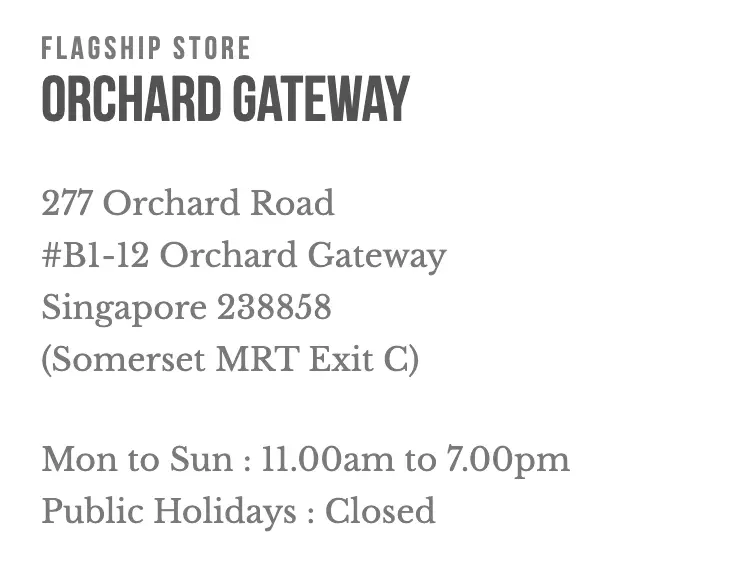

2. In-person at a FRANK store

You can choose to apply for your FRANK account and debit card at a FRANK store. However, only the flagship store at Orchard Gateway is open at this time.

Due to the COVID-19 situation, the 3 stores at NUS, NTU and SMU are all temporarily closed.

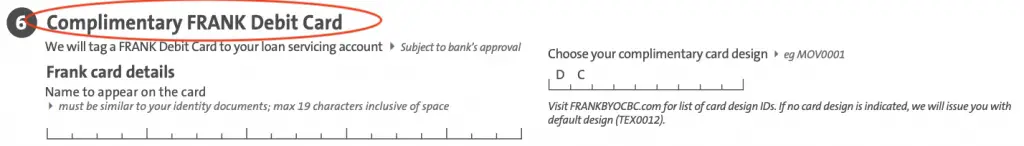

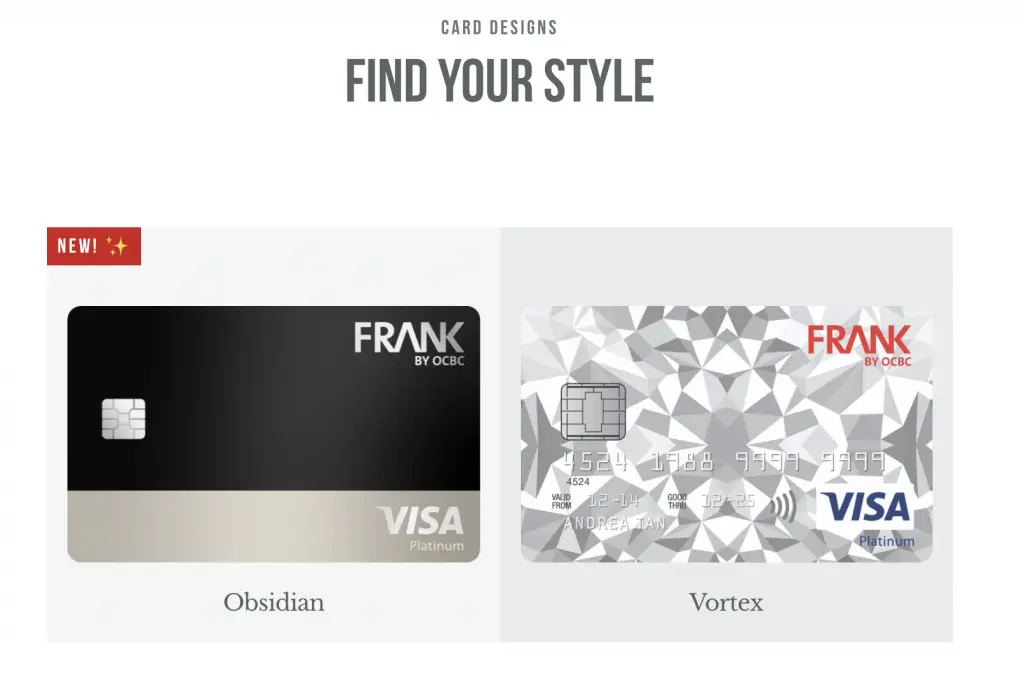

#2 Choose your design

You are able to choose from 60 different designs for your debit card.

When you apply for your card online, you are able to receive your digital card.

This will allow you to make payments when you use Apple Pay, Google Pay or Samsung Pay!

#3 Activate your card

It will take around 10 working days for your physical debit card to be mailed to you.

You will then need to activate your FRANK debit card. To find out more about this process, you can refer to the instructions on OCBC’s website.

What are the requirements of this card?

The requirements for this card are the same as the FRANK account. So long as you are 16 years old and above, you are able to apply for both the FRANK account and debit card.

What are the benefits of this card?

Here are the main benefits of the FRANK debit card:

#1 Cashback on eligible transactions

The main benefit for the FRANK debit card is an unlimited 1% cashback.

However, there are some conditions you’ll need to fulfil first:

1. Eligible transactions

There are only 4 different kinds of transactions that are eligible for the cashback. This includes:

- Fast food

- Selected convenience stores

- Selected online merchants

- Selected transport merchants

Here’s table that explains these transactions in detail:

| Transaction Type | Eligible Transactions |

|---|---|

| Fast Food | Any shop that is under the Visa Merchant Category Code 5814 |

| Convenience Stores | Cheers (except Esso-Cheers) 7-Eleven (except Shell 7-Eleven) |

| Online Merchants | iHerb FairPrice Online ZALORA ASOS Lazada |

| Transport | Comfort and CityCab Grab Go-Jek TADA |

As such, the cashback that you earn is only limited to these merchants.

2. Minimum spend requirement

FRANK has a minimum spend requirement of $400. You will need to hit a minimum spend of $400 in a calendar month before you can receive this cashback.

Due to this requirement, you may be tempted to spend an extra amount to hit $400 a month. However, I would discourage you from spending on things you don’t need, just to earn that cashback!

This minimum spend requirement is rather similar to SingLife’s Save, Spend, Earn campaign.

Cashback is inflexible and slow

Moreover, your cashback may take a while to be credited into your FRANK account.

For example, I made eligible transactions amounting to $400 between 9-11 May.

I only received my cashback on 20 June.

This is in contrast to the JumpStart debit card which credits your cashback at the end of each month!

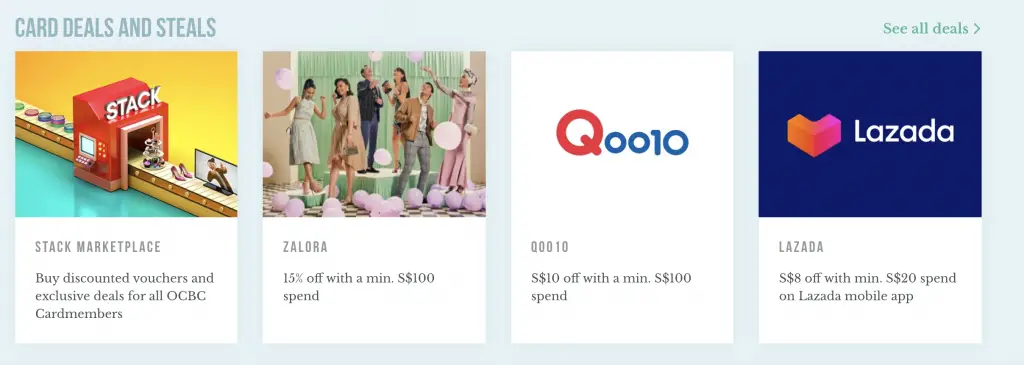

#2 Deals exclusive to FRANK customers

As a FRANK debit card holder, you are entitled to certain exclusive benefits.

You can view all of these deals on OCBC’s website.

These deals are good to have if you purchase from those stores that offer deals.

What payment methods can I use with this card?

Here are some payment methods you can use with your FRANK debit card:

#1 PayWave

Like all other Visa cards, you are able to use PayWave as a form of contactless payment to merchants. You are able to just tap and go!

#2 Adding to your mobile wallets

You can add your FRANK debit card to your mobile wallets. This includes:

- Apple Pay

- Google Pay

- Samsung Pay

#3 Overseas use

You are able to use your FRANK debit card overseas. You are able to do both:

- ATM withdrawals

- Shop purchases

If you want to use it overseas, you’ll first have to activate your card for overseas use. This can be done on OCBC’s iBanking platform.

Here’s how you can activate your card:

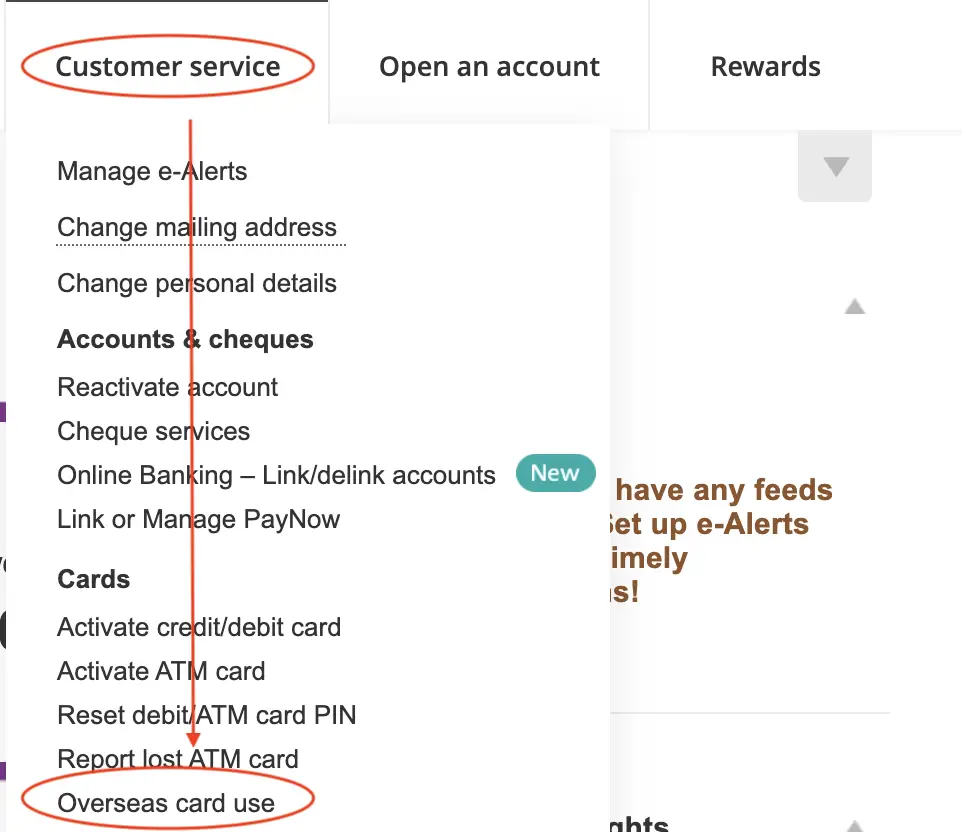

1. Go to ‘Customer Service → Overseas Card Use‘ in OCBC’s iBanking platform

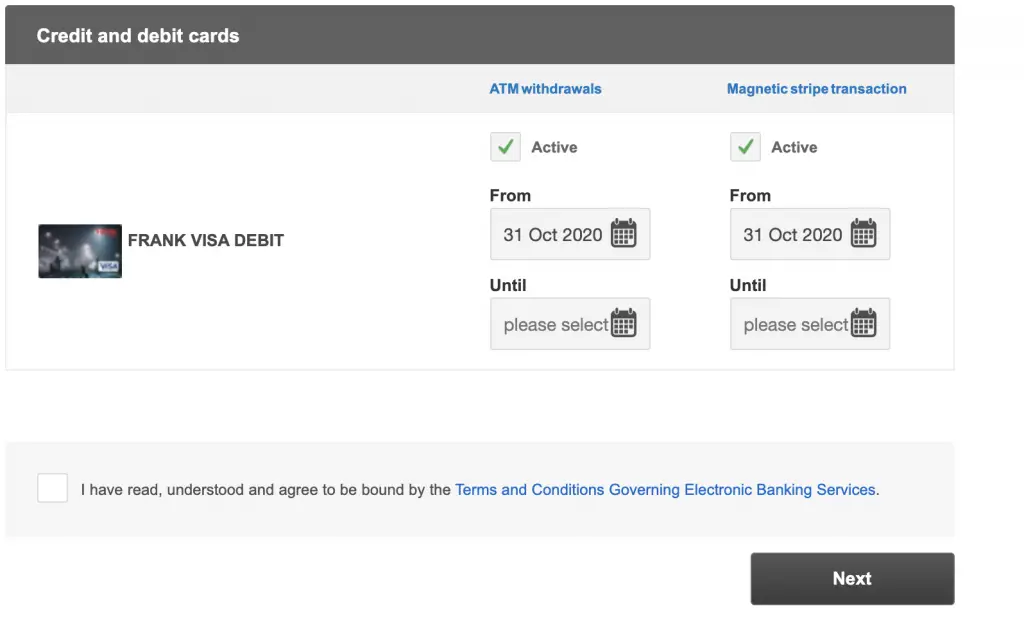

2. Select the functions that you want to activate for overseas use

You can select either or both of:

- ATM withdrawals

- Magnetic stripes transaction

You will need to select the end date of your overseas card use as well!

SimplyGo for public transport

If you wish to use your FRANK debit card for bus and MRT rides, it is possible to do so. With the SimplyGo function, you are able to use your contactless card to pay for your rides.

You can track the transactions you’ve made by adding your card to the SimplyGo app.

No EZ-Link or NETS FlashPay

With the implementation of SimplyGo, the FRANK debit card no longer has EZ-Link or NETS FlashPay capabilities.

What are the fees involved?

Here are the fees involved when you use the FRANK debit card:

Overseas charges

You will be charged a currency conversion fee when you make any overseas transactions. This includes online transactions as well!

I (mistakenly) made a purchase on the App Store with my FRANK debit card. Here are the fees were charged.

Replacement fees

If you happen to lose your FRANK debit card, you will need to pay a replacement fee.

This replacement fee is waived for your first 2 replacements within a 12 month period. However, you will need to pay $30 for your third replacement.

No annual fees

You are not required to pay any annual fees when you use the FRANK debit card.

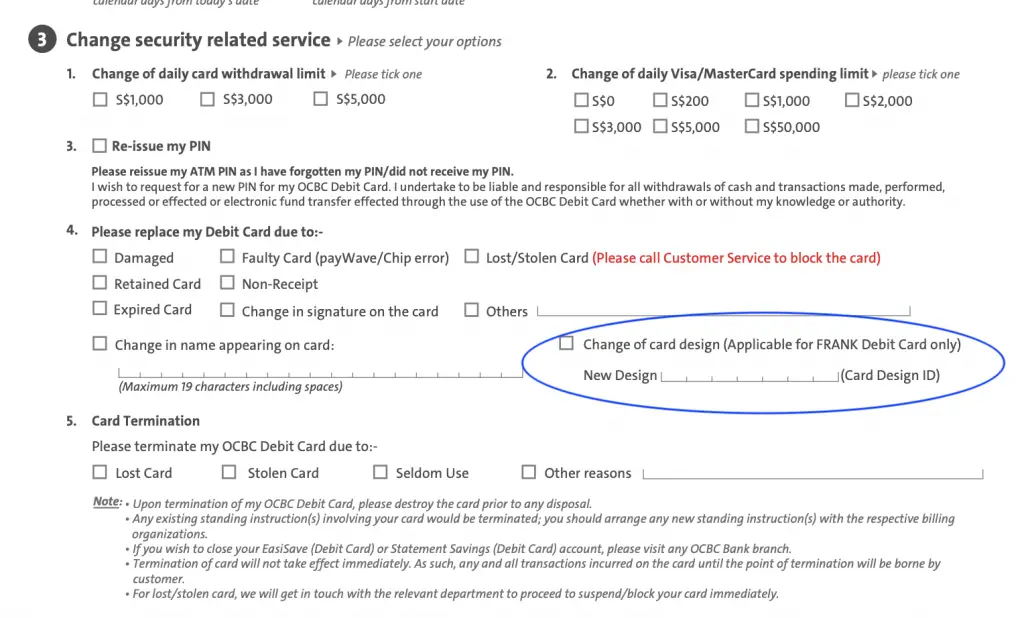

How do I change my FRANK debit card design?

You may want to change the design of your FRANK debit card. You will need to fill up a Debit Card Maintenance Form.

Alternatively, you can head down to a FRANK store to change your card.

What happens when my debit card expires?

A renewal card will be sent to you one month before your debit card expires.

You can also choose to change your debit card design when your new card is coming. You will need to fill up the Debit Card Maintenance Form as well.

Verdict

Should you be getting the FRANK debit card?

Here are some reasons why I think the JumpStart debit card is much better:

- The cashback is credited at the end of every month

- More transactions are eligible for cashback

- There is no minimum spend requirement

Moreover, the JumpStart account is more attractive than the FRANK account as a whole.

Here is the scenario which I think that the FRANK debit card is useful for you:

- You will spend at least $400 each month

- The majority of your transactions are eligible for cashback

I feel that the JumpStart debit card is still the better choice, due to its versatility. As such, I would still recommend getting the JumpStart account over FRANK!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?