Last updated on June 6th, 2021

Every company wants to have their own mobile wallet, and Google does not want to miss out!

Google Pay has been around since 2016, but they’ve recently launched a new version of this app.

So how does this app work and should you consider using it?

Google Pay Review

Google Pay is an attractive mobile payment that combines your card payments with PayNow and your bank accounts. It also provides many rewards when you use it for any transaction.

However, the app is still limited, especially if you have an iPhone. You will only get to enjoy the full benefits of Google Pay with an Android phone.

Here is Google Pay reviewed in-depth:

Contents

- 1 History of Google Pay

- 2 How does Google Pay earn money?

- 3 Is Google Pay safe?

- 4 How do I sign up for Google Pay?

- 5 How does Google Pay work?

- 6 What are Google Pay’s benefits?

- 7 How does Google Pay compare to other mobile wallets?

- 8 Verdict

- 9 Conclusion

- 10 Referral (Earn $3 when you sign up)

- 11 Scratch Card Promotion (Get cashback with eligible transactions)

History of Google Pay

Google Pay actually has a pretty complicated history.

It was first launched in Singapore in 2016, then known as Android Pay. You could add an unlimited number of credit cards to the payment service. This was more flexible compared to Apple Pay’s limit of 12 cards, and Samsung Pay’s limit of 10.

However, Android Pay only allowed you to make transactions using near-field communication (NFC).

If you wanted to make peer-to-peer (P2P) transactions, you needed to use Google Wallet instead (now defunct).

In 2018, Google decided to merge all of their payment methods together. All of their payment methods became integrated into the Google Pay app.

A new app, “Google Pay Singapore”, was then launched in early 2020. This is the current app that you can download on the App Store or Play Store.

How does Google Pay earn money?

Some mobile wallets may charge a transaction fee. However, Google does not charge merchants any fees for using Google Pay.

Moreover, Google Pay is free to use for us consumers!

So how does Google Pay earn money?

Perhaps the question we should be asking is, does Google need to make money from Google Pay?

Google is one of the largest companies in the world. As such, they are definitely able to make some losses from Google Pay.

Although the context of this video is in Malaysia, the concept still holds true.

Google’s main aim now would be to gain market share in the mobile wallet ecosystem.

With many promotions and incentives, they hope that more people would use this payment method.

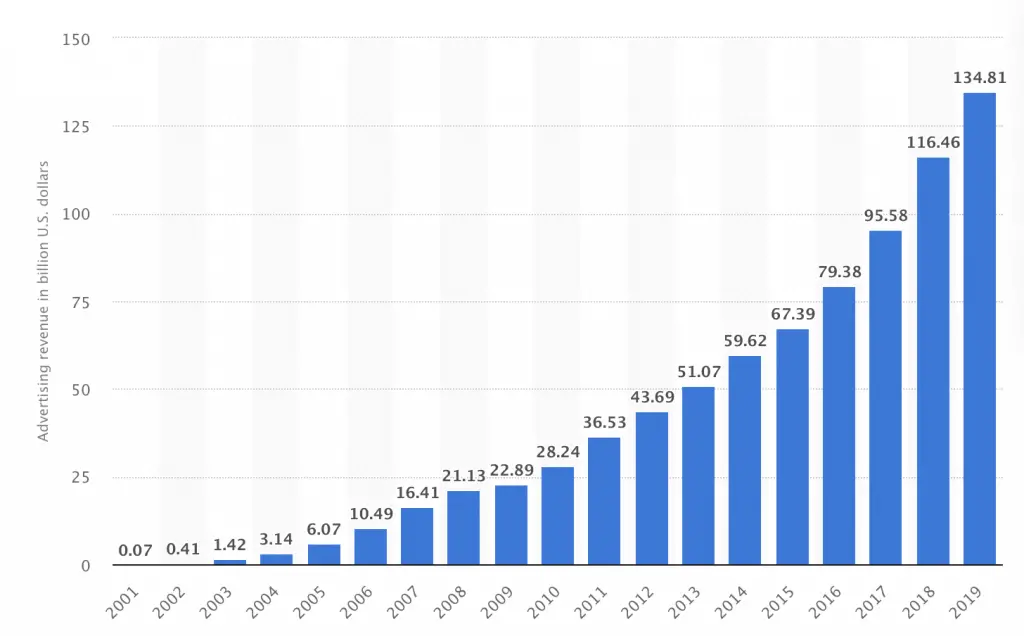

Moreover, one of Google’s main sources of income is ad revenue. There has been a steady growth of their ad revenue over time.

Google has access to your transaction history in Google Pay. It is very possible for them to use your history to serve more targeted ads to you!

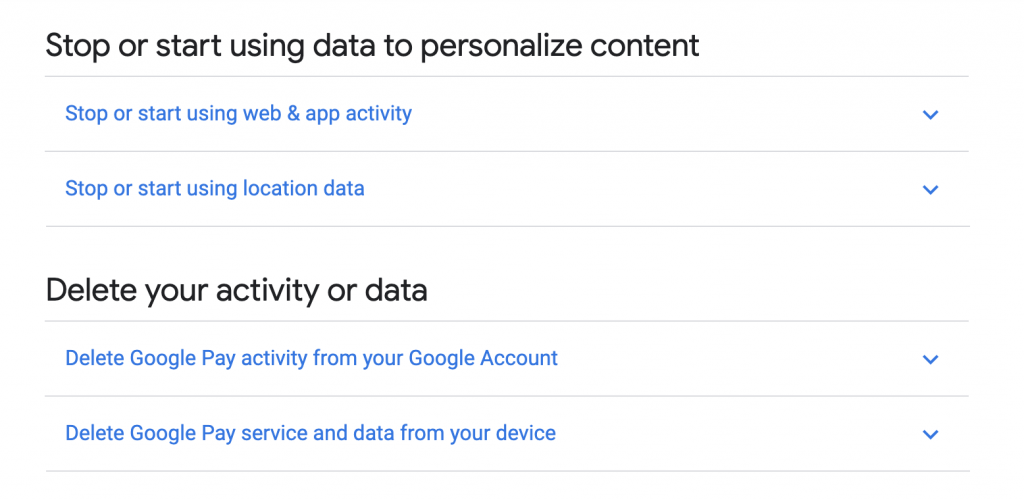

If you’d like to make sure that Google does not use your data to personalise your content, you can check out their guide. It explains the steps you’ll need to take to either:

- Stop using your Google Pay data to personalise your content

- Delete your Google Pay data entirely

Is Google Pay safe?

Google Pay has fraud detection with the help of machine learning, similar to other credit card companies. This ensures that your credit card information is secure and is not easily hacked into.

Google claims that your card info is safe with them. Instead of using your actual card information, they use an encrypted number when you make a transaction.

What’s more, Google uses sophisticated AI methods to ensure that your account is secure.

I would say that it should be one of the safer payment methods!

If you want to make a contactless payment, your phone just needs to be unlocked for it to go through. It is important to ensure that you have set up a proper passcode for your phone!

How do I sign up for Google Pay?

If you’d like to sign up for Google Pay, you can refer to a step-by-step guide below. This will show you how to get a $3 referral bonus as well!

How does Google Pay work?

Google Pay is available for both iOS and Android users. However, the features in the iOS app are more limited compared to the Android app.

Here are 5 features when you make a payment with Google Pay:

#1 Credit / debit card

After adding your debit / credit card to Google Pay, you can make transactions in-store and online.

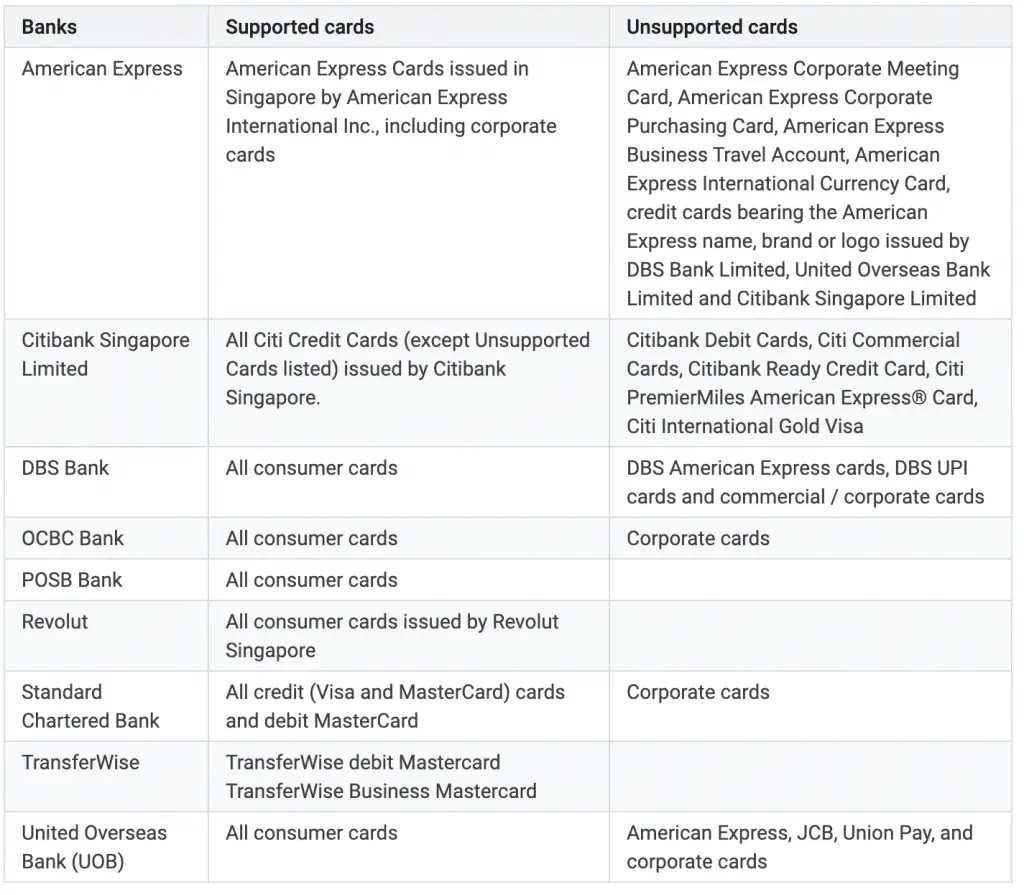

Google Pay accepts a range of different cards, and the full list can be found on Google’s Support Page.

One of the notable omissions from the list of supported cards is the GrabPay Mastercard. You are only able to add the GrabPay Mastercard to Samsung Pay.

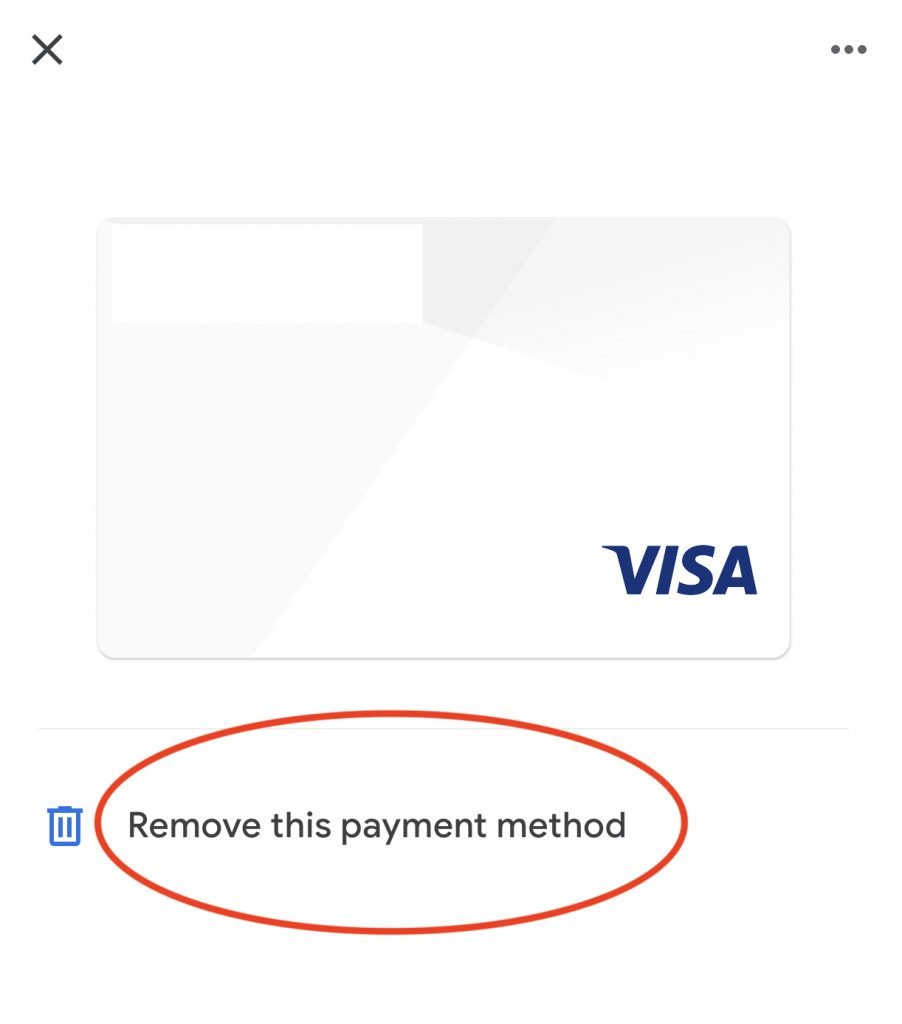

If you wish to remove your card, you are able to do so at any time as well!

#2 Near-field communication (NFC)

You are able to use Google Pay to make contactless payments via NFC. You’ll have to add a credit / debit card to Google Pay first before you are able to use this NFC function.

What devices can I use the NFC function?

If you have an Android device with NFC capabilities and running Android Lollipop 5.0 or higher, you are able to use Google Pay to make contactless payments.

At this point in time, you are unable to make such contactless payments with your iPhone.

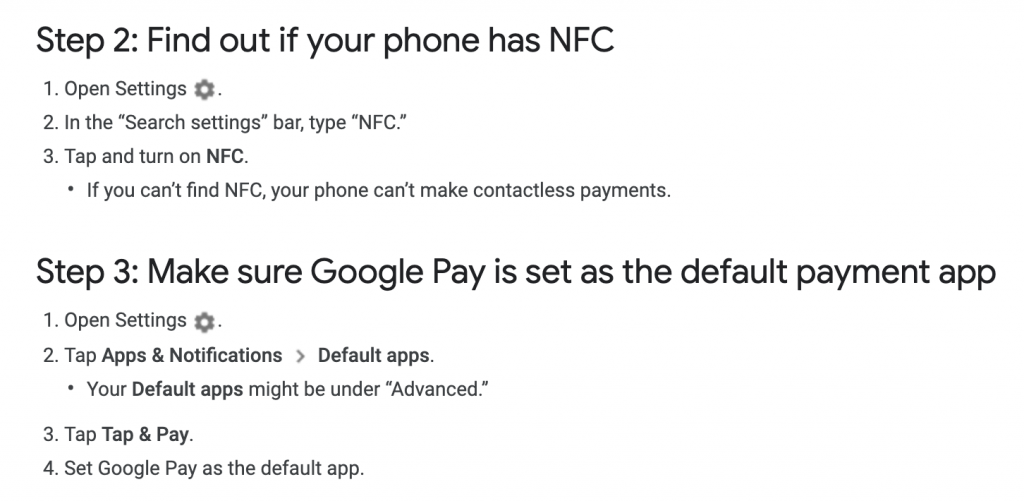

For Android phones, you should make sure that Google Pay is set as your default payment app.

For more info, you can check out the guide by Google.

How can I make a contactless transaction?

You can make a contactless transaction whenever you see the symbols below.

All you need to do is to unlock your phone and hold it close to the payment reader. You do not even need to open the Google Pay app!

This feature is only available for eligible Android devices. Again, you can’t use an iPhone to make these transactions.

Can I use Google Pay for MRT and bus rides?

With the move to a cashless society, you can now use contactless bank cards to make payments for your public transport rides.

With Google Pay, you can even use your mobile phone!

All you need to do is unlock your phone and hold it near the card readers on buses or MRT gantries.

However, some users have been experiencing issues when they used Google Pay for public transport. The SimplyGo website offers a workaround to this issue. You can try to remove and add your card back to Google Pay, and it should be able to work.

Unfortunately, you can’t use your Google Pay on your smartwatch to make payments. This feature is not yet available in Singapore. If you wish to do so, you can consider other alternatives from Watchdata and Garmin.

#3 PayNow

You can use Google Pay for both:

- Making payments to stalls

- Sending P2P transfers to friends

1. Making payments to stalls

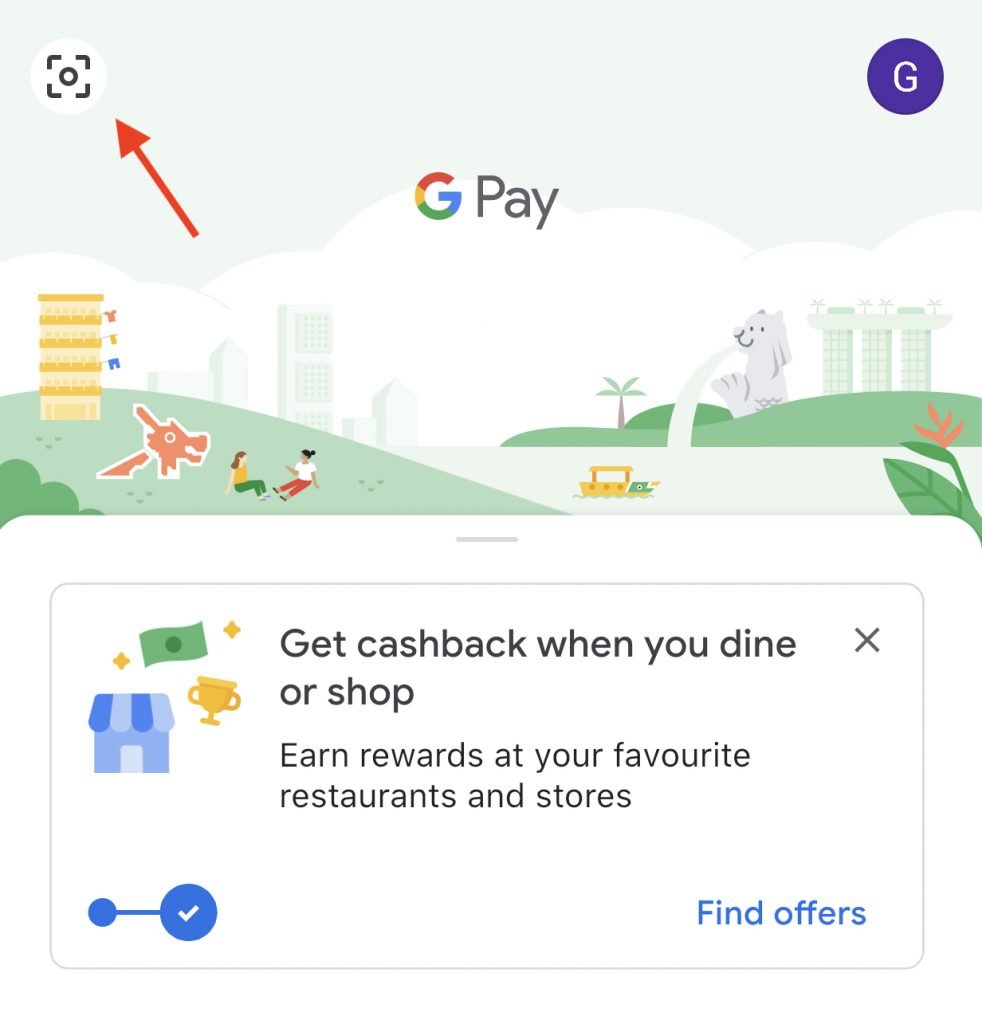

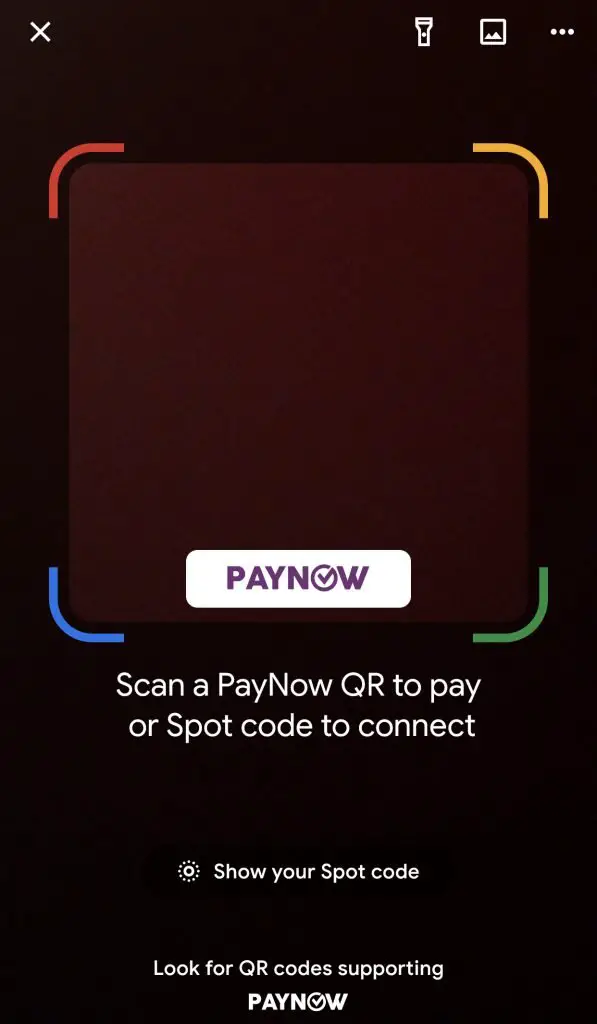

To make a payment to stalls, you will have to use the scan function.

Google Pay now supports PayNow codes as well.

This means that you can use Google Pay at any merchant that supports PayNow QR too.

With the current scratch card promotion, you are able to get cashback for 2 purchases you make each week!

This is great if you’re an iPhone user or an owner of a non-NFC Android phone.

2. Sending P2P transfers to friends

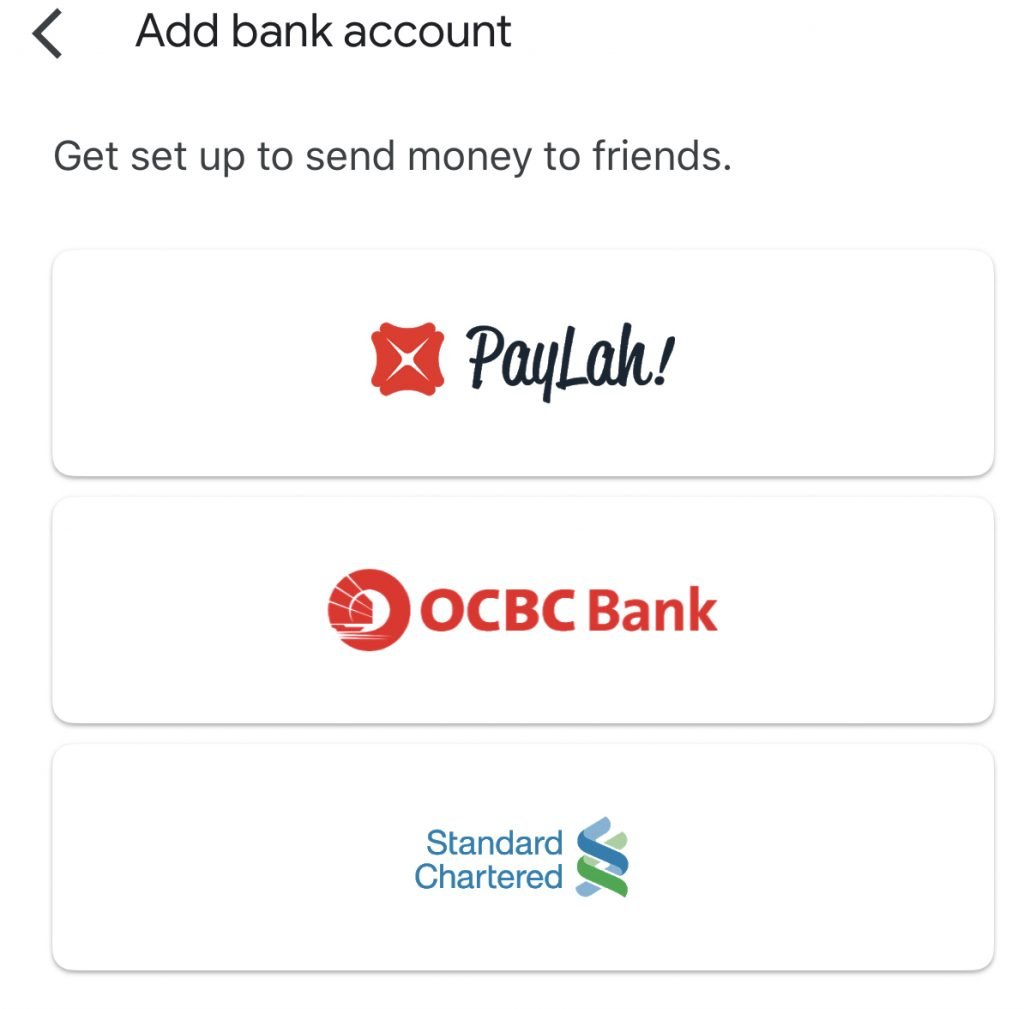

If you wish to send your friends money via Google Pay, you’ll need to add your bank account first.

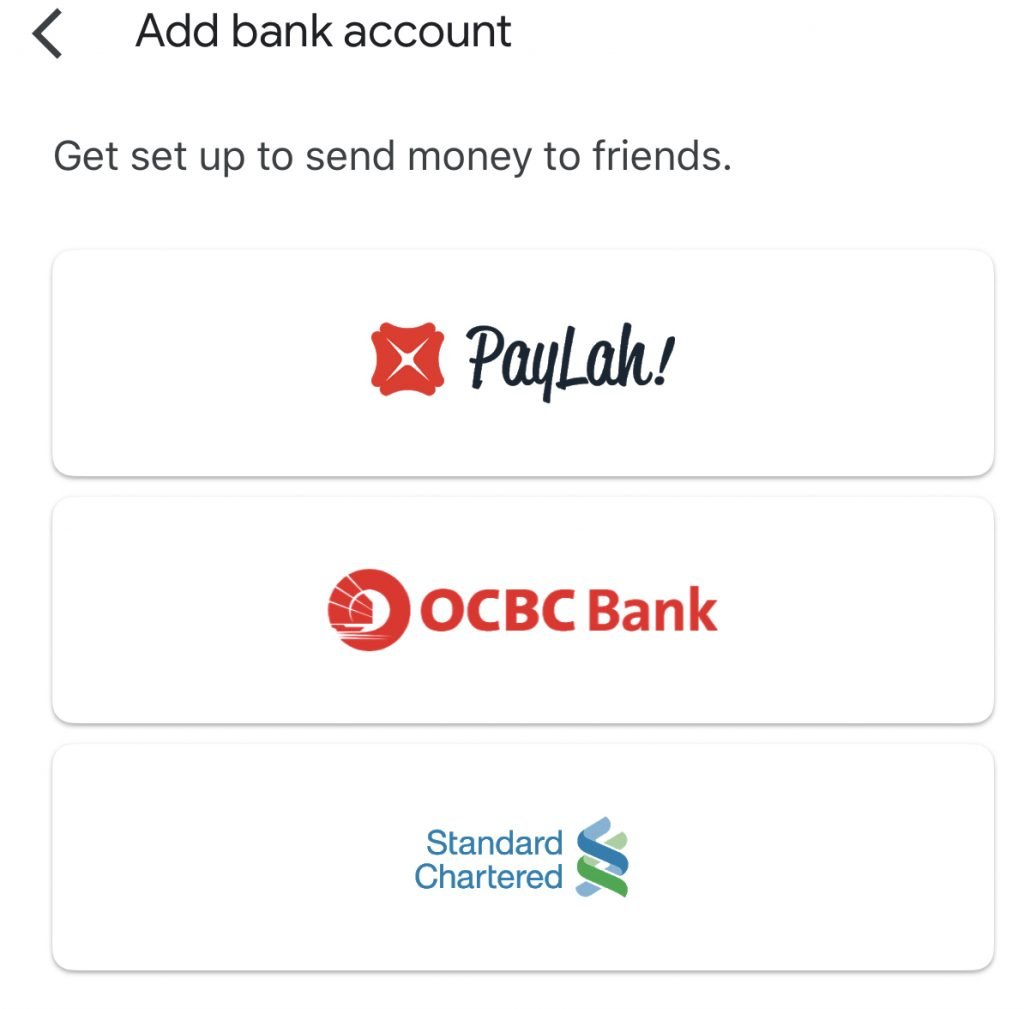

Google Pay allows you to add an account via 3 methods:

- DBS PayLah!

- OCBC Bank

- Standard Chartered

The money that you send will be deducted from the bank account that you added to Google Pay. The recipient will receive the money via PayNow into their bank account linked to their mobile number. This means that the recipient does not need to have Google Pay. The recipient just needs to have their mobile number registered under PayNow.

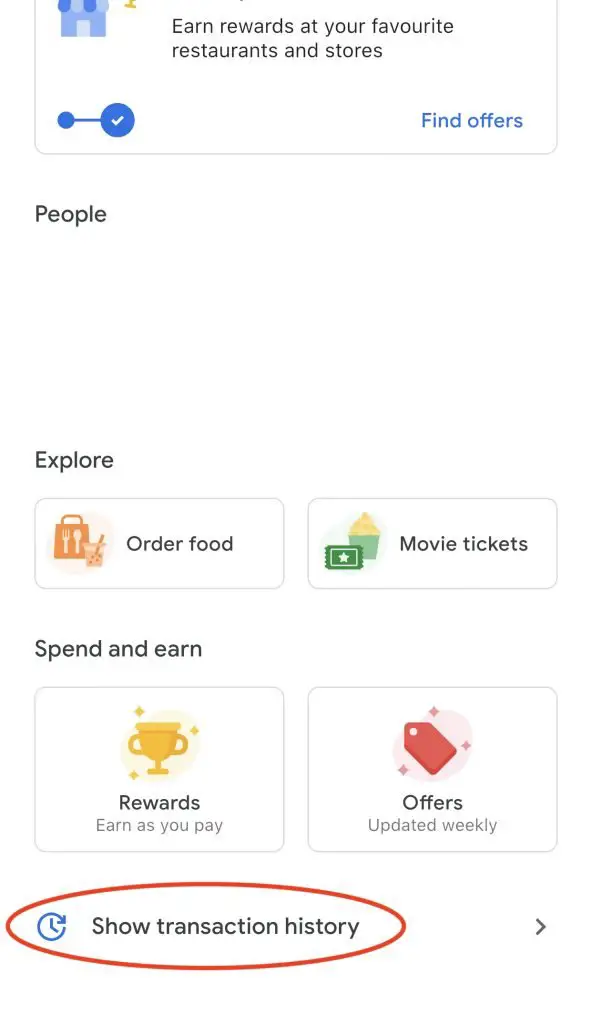

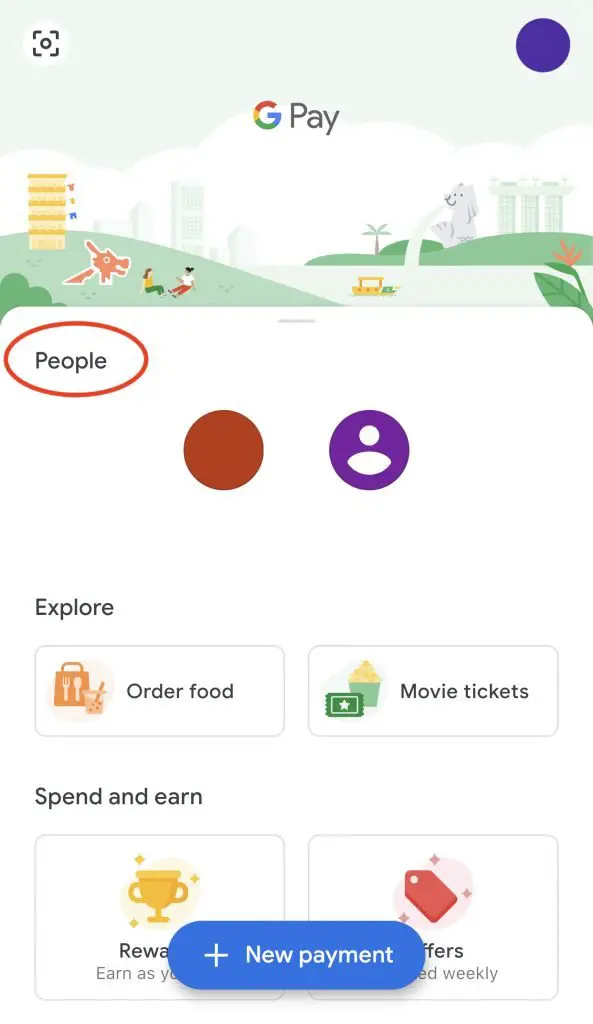

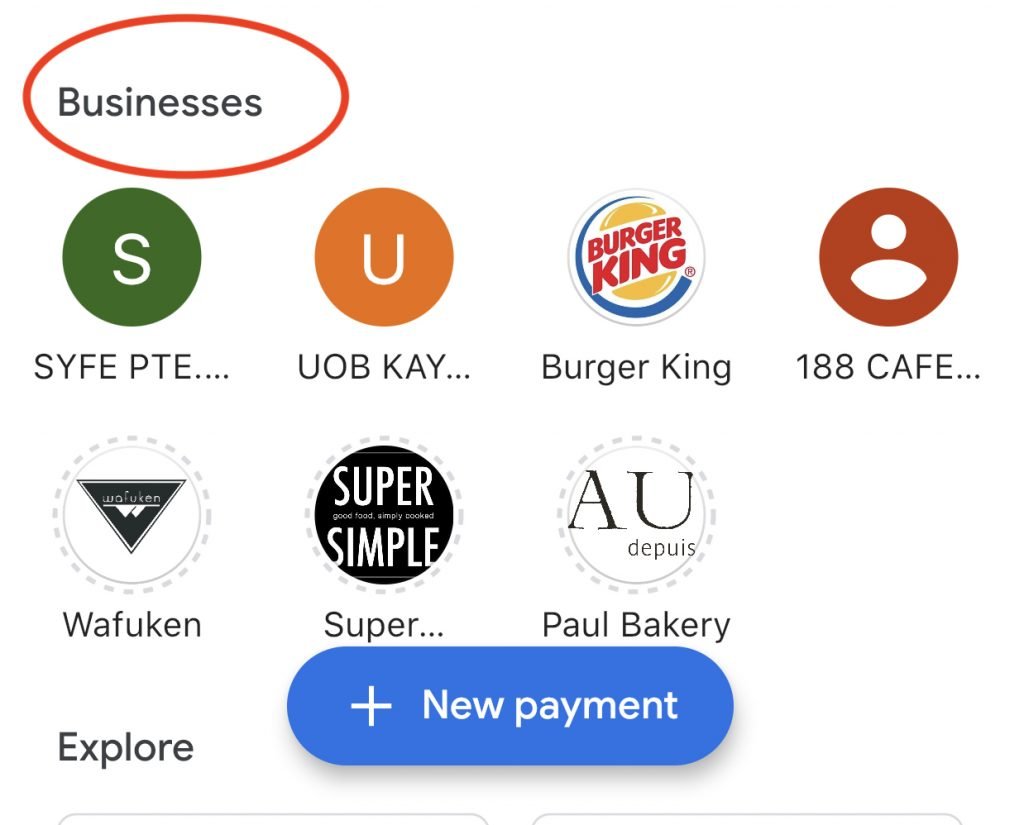

When you enter the home screen, you are able to pay your recent contacts instantly. All you need to do is to click the contact’s icon.

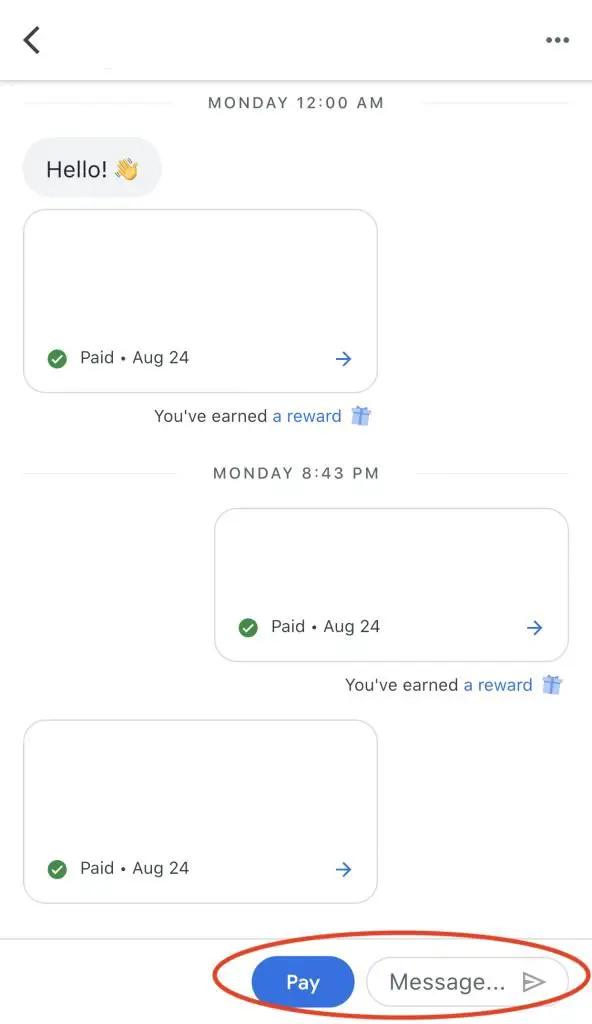

You are able to do a live chat with your contacts as well. You can send them a messages, and send them money within the same page.

Google Pay offers a ‘Split a Bill’ feature as well, where you can request and receive payments from your friends.

Just something to note, this peer-to-peer (P2P) payment method on Google Pay has a daily transfer limit of $1k.

#4 Online Transactions

You now have yet another option to pay for your online transactions. If you see the button below, you can use Google Pay at checkout.

Some of the sites that you can use Google Pay include:

- Asos

- Deliveroo

- Foodpanda

- Klook

- Zalora

#5 Spot Platform

You are able to make payments to merchants if they are on the Spot Platform. This platforms allows merchants to create their ‘Spot’, which is available both online and offline.

You can scan a Spot code using the camera function, or find a Spot on the app itself.

This is a rather under-utilised feature. Over time, I think that more merchants will eventually adopt it as a payment method.

Since you are now able to use PayNow QR codes with Google Pay, this spot platform may not be that useful anymore.

What are Google Pay’s benefits?

There are a few unique features that Google Pay offers:

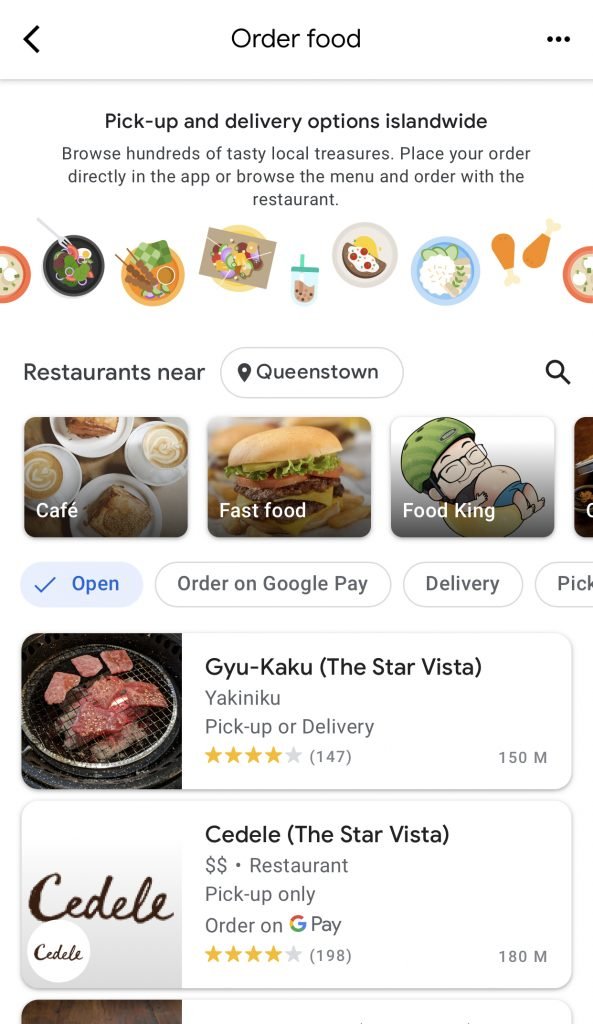

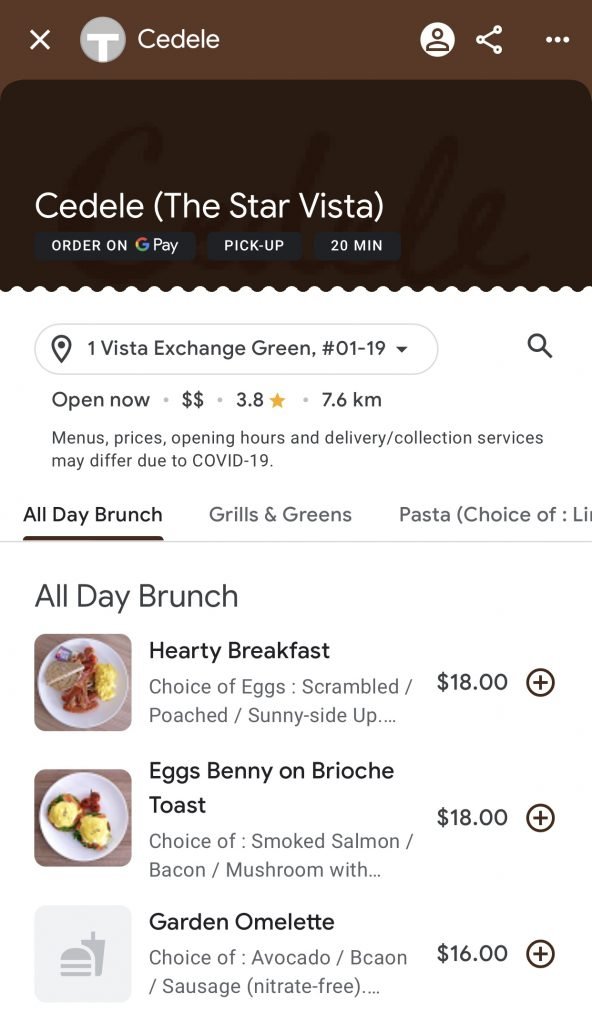

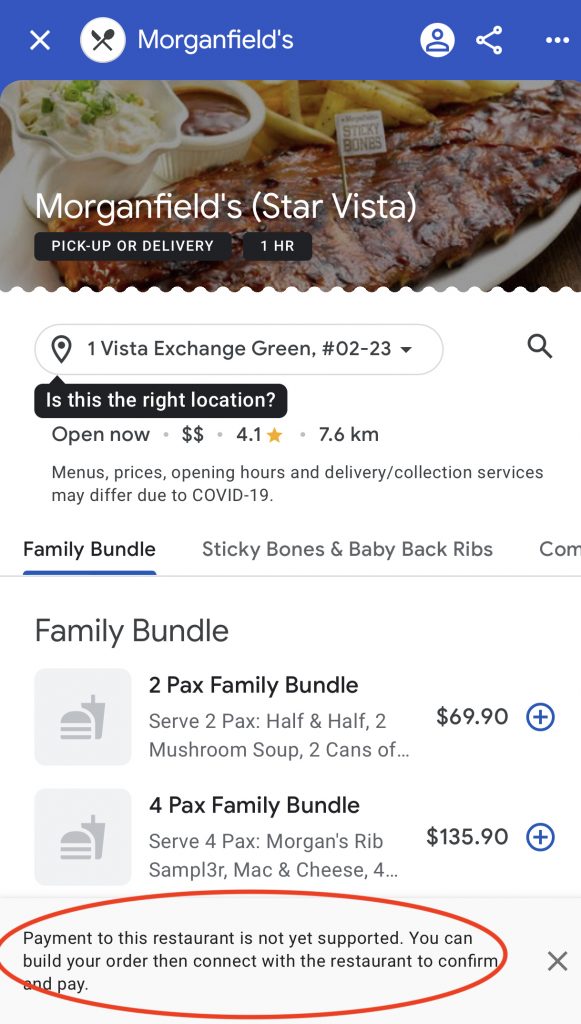

#1 Order food

You are able to order food online using the Google Pay app. Based on your location, you are able to select different restaurants near you.

After clicking one of the restaurants, you will be able to see their menu.

However, the menu takes some time to load and it can be a bit laggy.

There are 2 ways that you can order food on Google Pay:

- Pickup

- Delivery

Some merchants may offer both modes, while others may only offer one.

Not all merchants allow you to pay via Google Pay

Moreover, only a few shops allow you to use Google Pay on checkout. These shops include:

- Burger King

- Omnivore

- Cedele

- Gastronomia

Some of the shops listed do not have this feature. If you wish to order from these shops, you’ll most likely have to use another payment method.

In this case, Google Pay just serves as a platform for you to view the menu and order your food.

The functionality is rather limited now. However, it does look quite promising. With more restaurants adopting Google Pay as a payment method, it’ll soon be more convenient to order food.

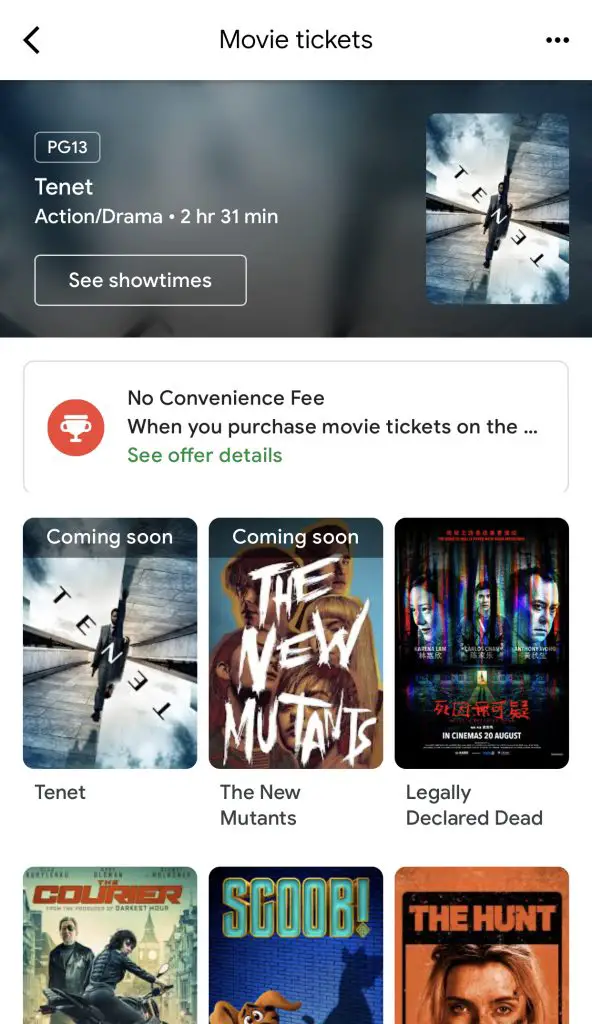

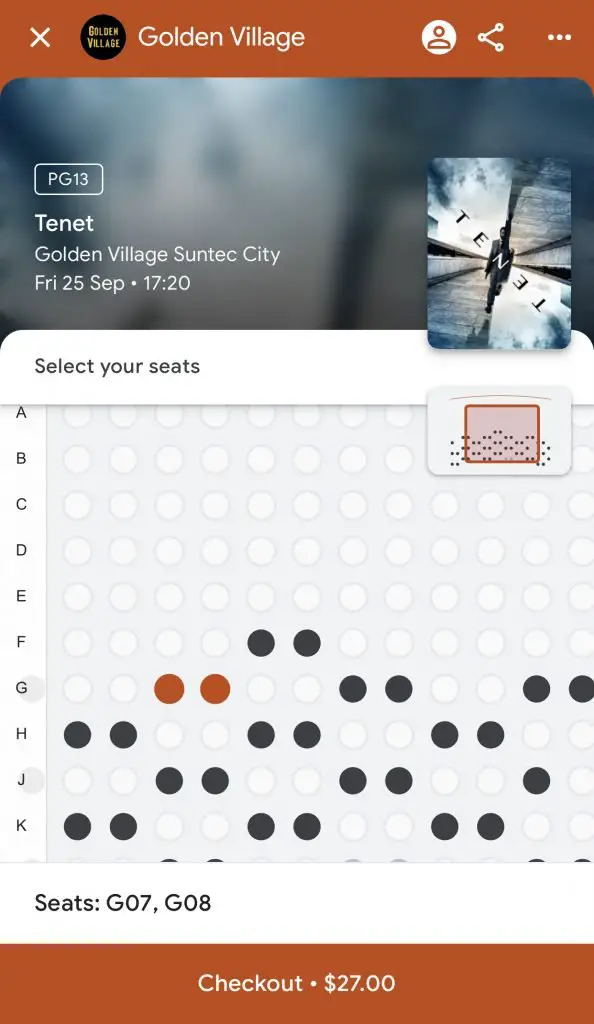

#2 Book movie tickets

You are able to book movie tickets on Google Pay as well!

You are able to book tickets from 2 movie theatres:

- Golden Village

- Shaw Theatres

The app does take a while to load the seats, which can be pretty frustrating at times.

#3 No stored wallet

Google Pay either uses your linked bank account or credit / debit card to make payments. Hence, there is no stored wallet on the app.

This is somewhat similar to PayLah! which allows you to easily withdraw your funds.

There are other wallets like GrabPay and Singtel Dash which allow you to withdraw your funds too. However, you’ll need to meet certain requirements first!

Privacy may be an issue

The only thing that you might want to consider is the amount of data that Google is collecting from you. Although having personalised content is great, you may have concerns about data privacy.

This is something you should consider first, before you start using Google Pay!

How does Google Pay compare to other mobile wallets?

With so many other mobile wallets out there, how does Google Pay compare to them?

#1 Bank Mobile Wallets

Google has far more technical expertise than banks. This allows them to create a more intuitive app.

The user interface is better than DBS’ PayLah. In PayLah, you’ll need to do 2 extra taps before you can choose to pay your recent contacts.

The option to pay your recent contacts on the home screen is found on OCBC’s Pay Anyone too. However, Google Pay loads much faster compared to Pay Anyone.

Compared to the other 2 payment methods, Google Pay provides a better experience.

#2 Apple Pay

If you are an iPhone user, Apple Pay may be the better option for you. Google Pay has very limited functionality on the iPhone.

However, it does offer the option of ordering food and booking movie tickets, which Apple Pay does not provide.

#3 Samsung Pay

Google Pay is more accessible for Android users, whereas Samsung Pay is mainly for Samsung’s Galaxy devices.

One advantage that Samsung Pay has over Google Pay is that it uses magnetic secure transmission technology. This allows you to use Samsung Pay to make payments even with card readers having the conventional magnetic strip.

If you have a Samsung Galaxy device, it would be best to decide on which method you wish to use, and set it as your default method.

Verdict

Here’s a summary of the pros and cons of using Google Pay:

| Pros | Cons |

|---|---|

| Fast and secure payments | Limited functionality on iPhones |

| PayNow Integration | Unable to pay all merchants via Google Pay when ordering food |

| Chat function makes it easy to request for money owed by friends | Booking of movie tickets limited to Shaw Theatres |

| Able to order food and book movies on the platform | May have concerns over using data to personalise content on the platform |

| Able to have contactless payments, even on buses and MRTs (only for compatible phones) | Only OCBC bank accounts are currently supported |

| No stored wallet |

With its current features, it seems like Google wants Google Pay to be the next super app. This follows the footsteps of WeChat, Grab and GoJek.

Conclusion

With Google having the technical expertise and our consumer data, it definitely has the capability to challenge Grab’s market share in Singapore. As its features improve over time, Google Pay is certainly one to watch.

Referral (Earn $3 when you sign up)

If you have not signed up for Google Pay yet, you can use my referral link. You and I will both receive $3 credited directly to our PayNow.

Here’s a step-by-step guide:

- Sign up using my referral link and download the app

- Sign up for Google Pay

- Add a payment method

- Ensure that you opted in for offers and rewards

- Make an eligible transaction (≥ $10)

- Receive referral bonus directly credited via PayNow

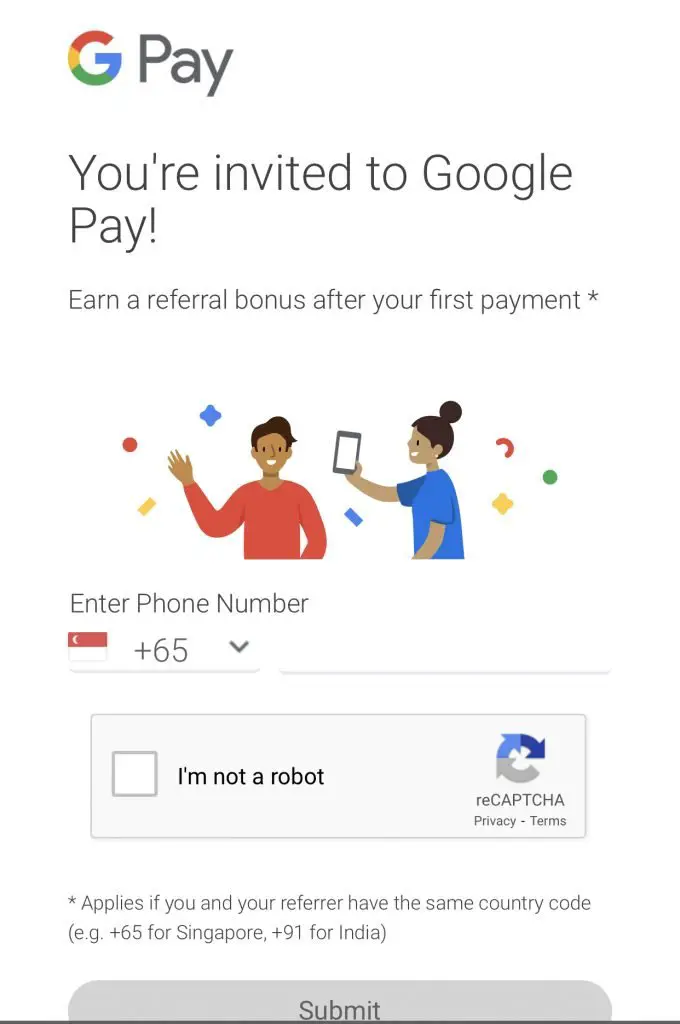

#1 Sign up using my referral link and download the app

First you will need to click on my referral link. (It only works on mobile!)

You will then be asked to enter your phone number.

After submitting, you will be redirected to the App Store or Google Play Store.

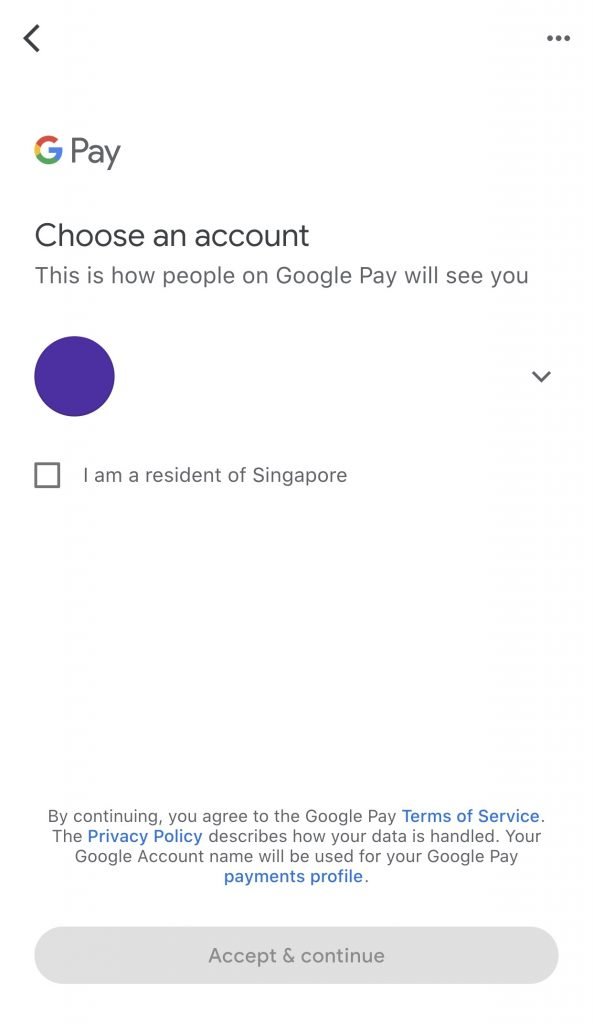

#2 Sign up for Google Pay

Once you’ve downloaded the app, you’ll be asked to enter your mobile number. (This should be the same as the number you used previously.)

Your Google Pay account will then be linked to your Google account with the same mobile number.

Moreover, your PayNow account will be linked as well. This allows you to receive money from people who send money to your mobile number.

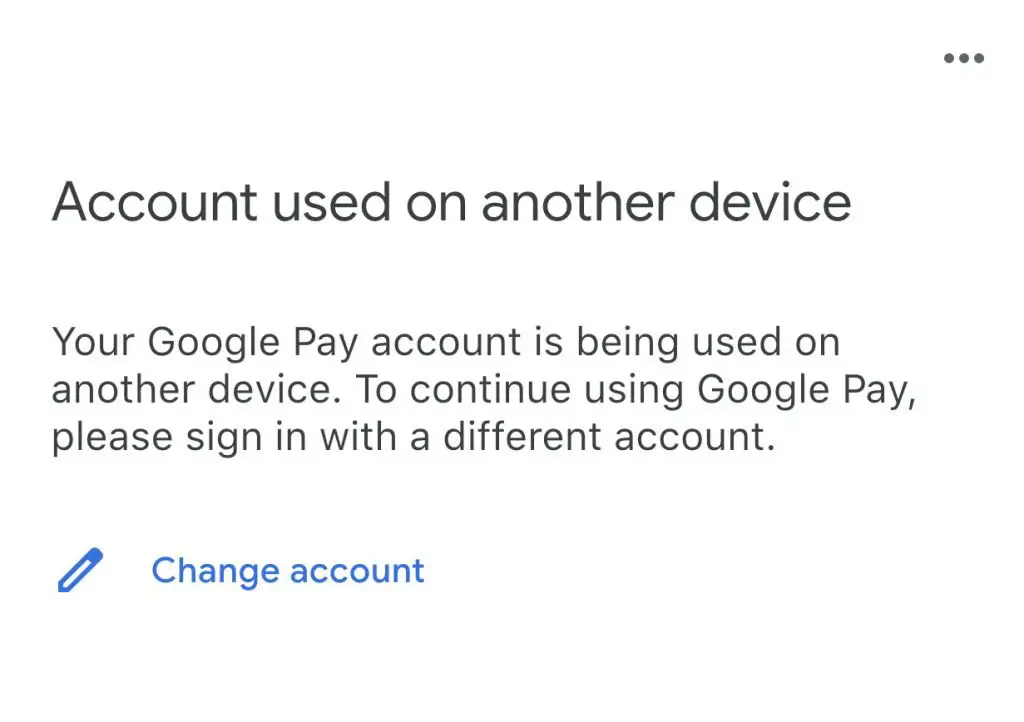

You are only able to use one device to make payments via Google Pay. If you sign in with the same mobile number on multiple accounts, you will receive this error message.

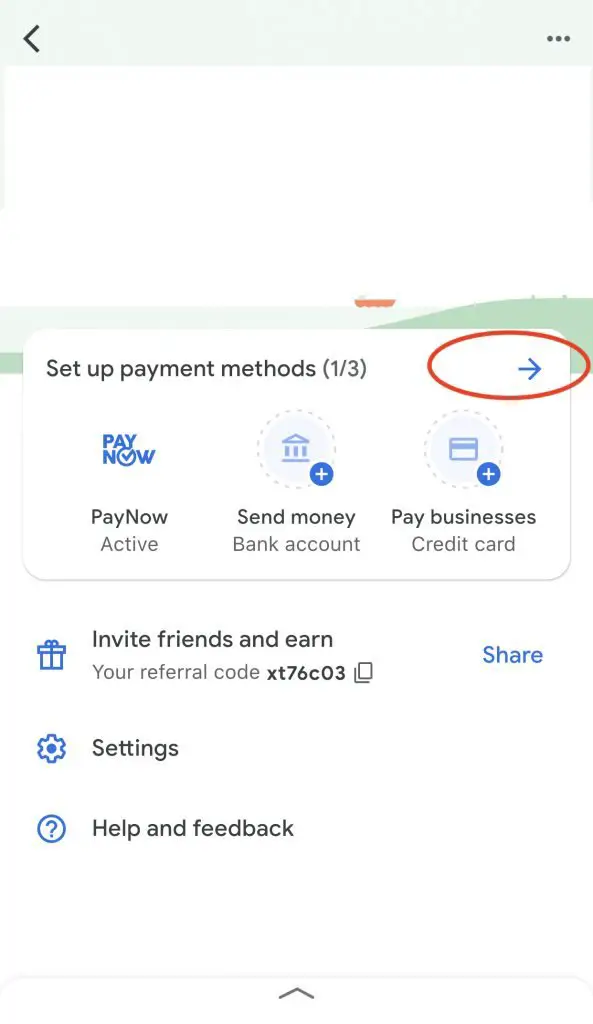

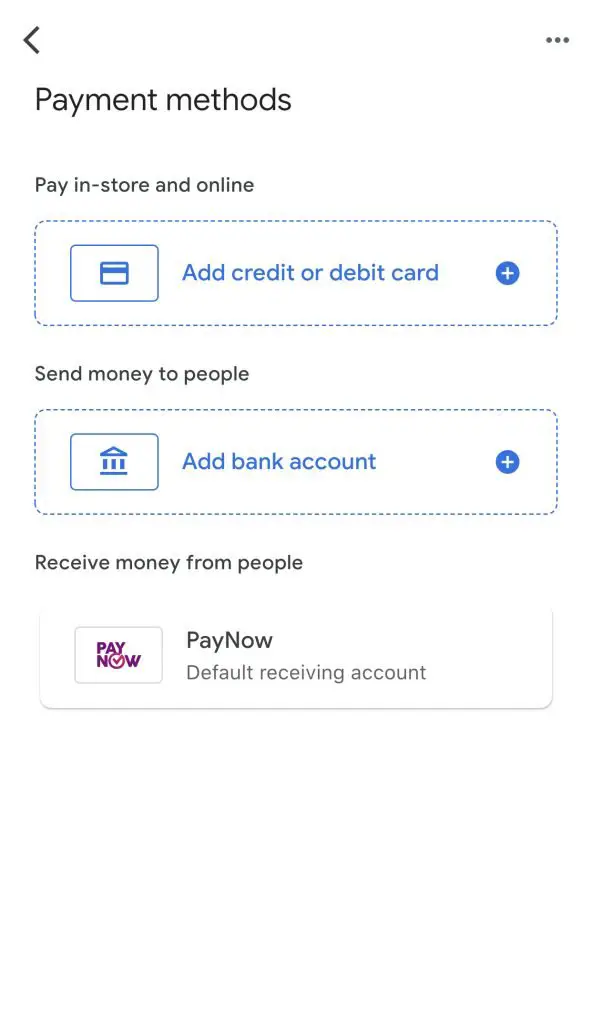

#3 Add a payment method

Now, you’ll have to add a bank account or credit / debit card to Google Pay to make payments.

Here are 3 ways you can add an account to send money to others:

- DBS PayLah!

- OCBC Bank

- Standard Chartered

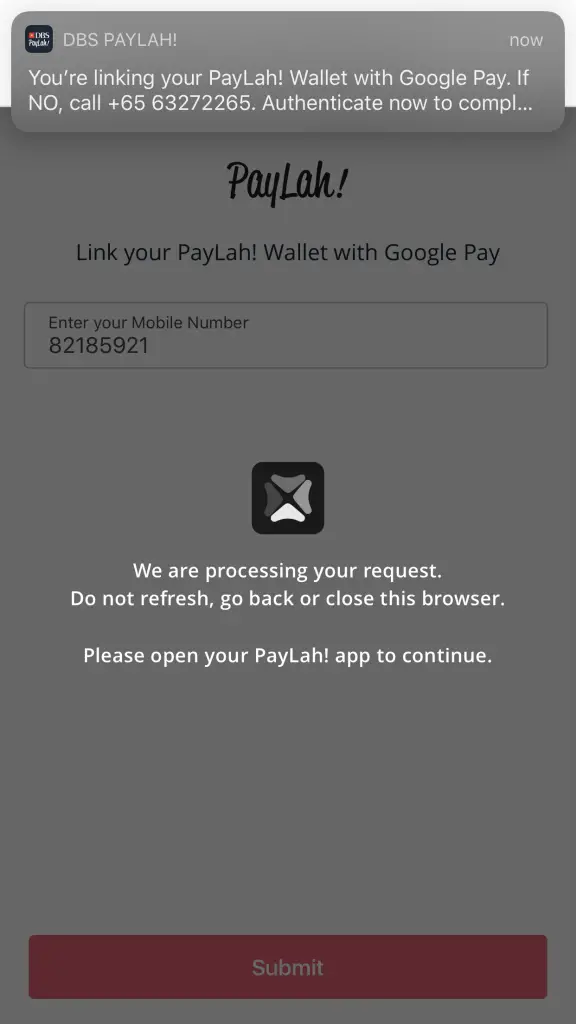

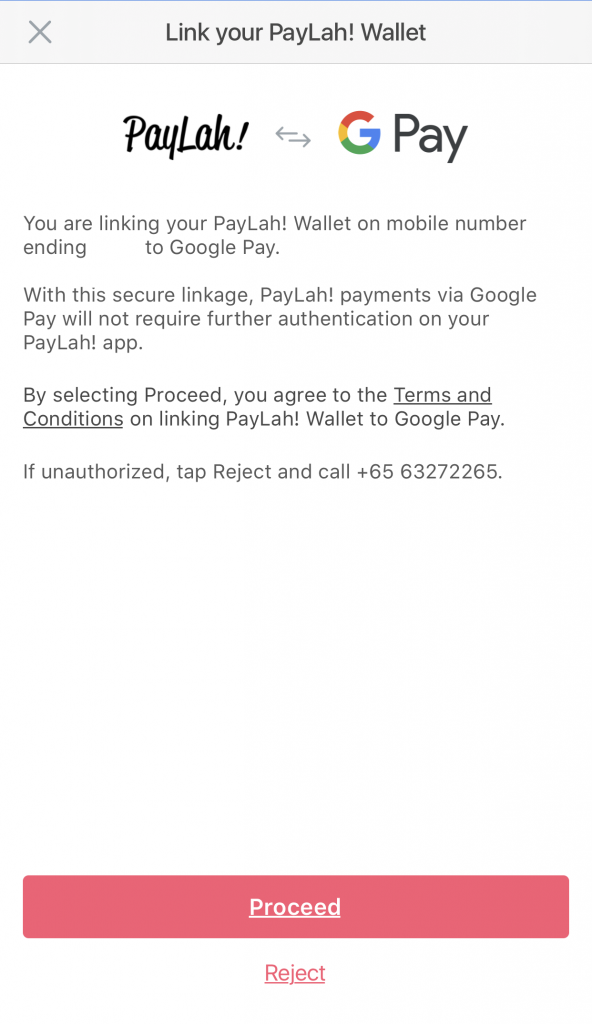

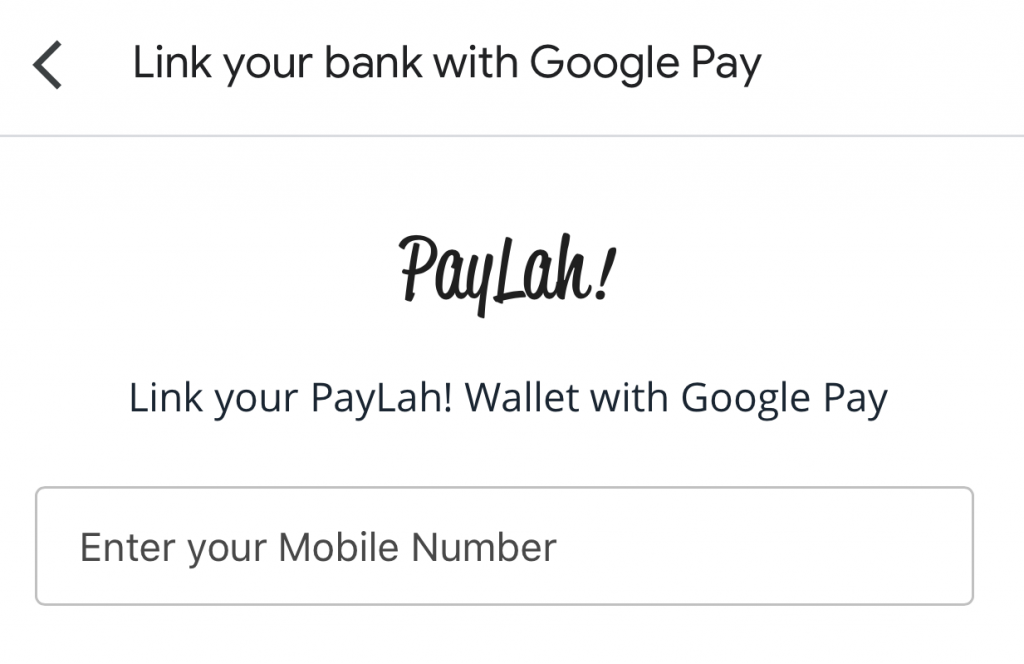

1. DBS PayLah!

Most of you should have a DBS PayLah! account. This makes it very easy for you to link your Google Pay with your PayLah! account.

First, you will need to enter your mobile number.

You will then be redirected to the PayLah! app to verify the linking.

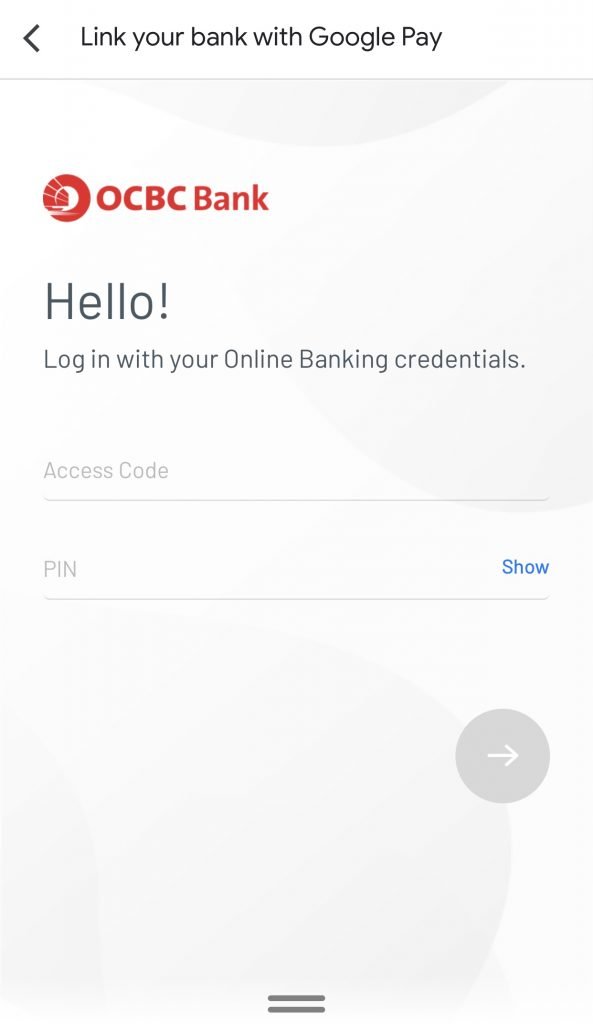

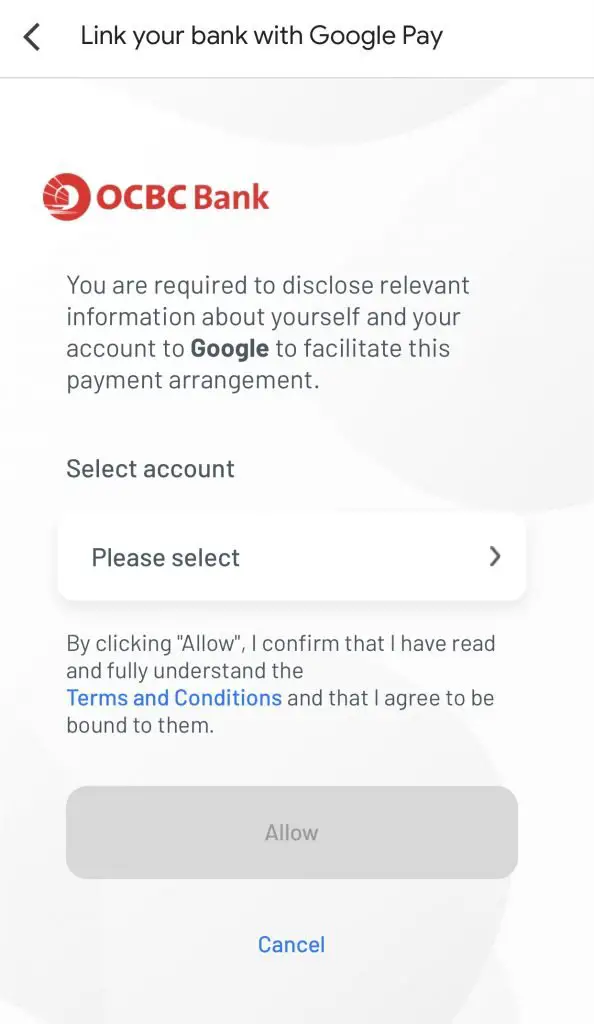

2. OCBC Bank

You will be asked to login to your OCBC online banking account. Afterwards, you’ll have to select which account you’ll want to link to Google Pay.

Whenever you send money to your friends via their mobile number, the money will be deducted from this bank account.

Alternatively, you can add a credit / debit card to Google Pay.

This allows you to make purchases using Google Pay. However, you cannot make P2P transfers to your friends if you only have a credit / debit card that is linked to Google Pay.

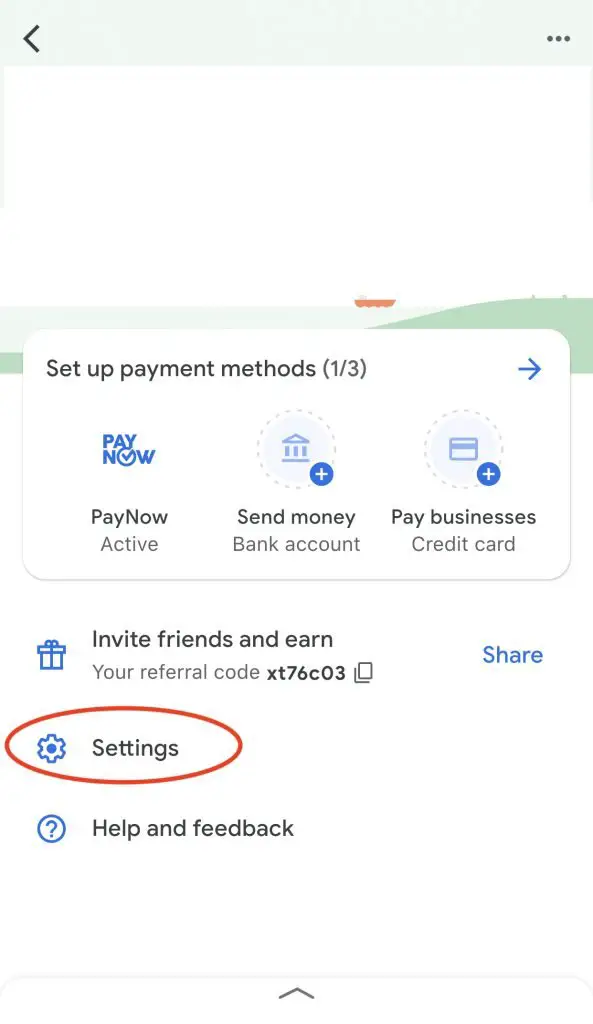

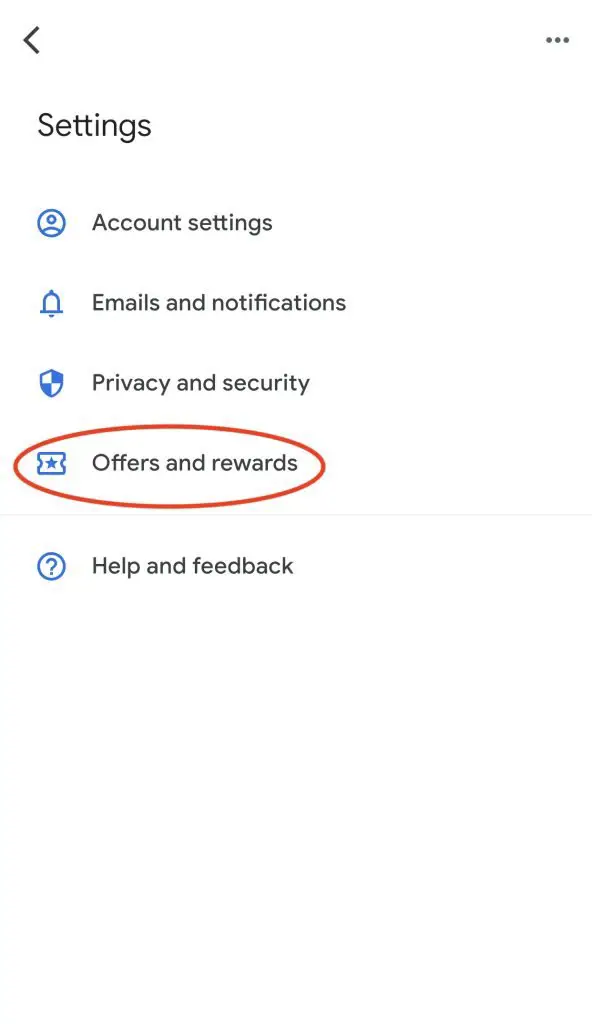

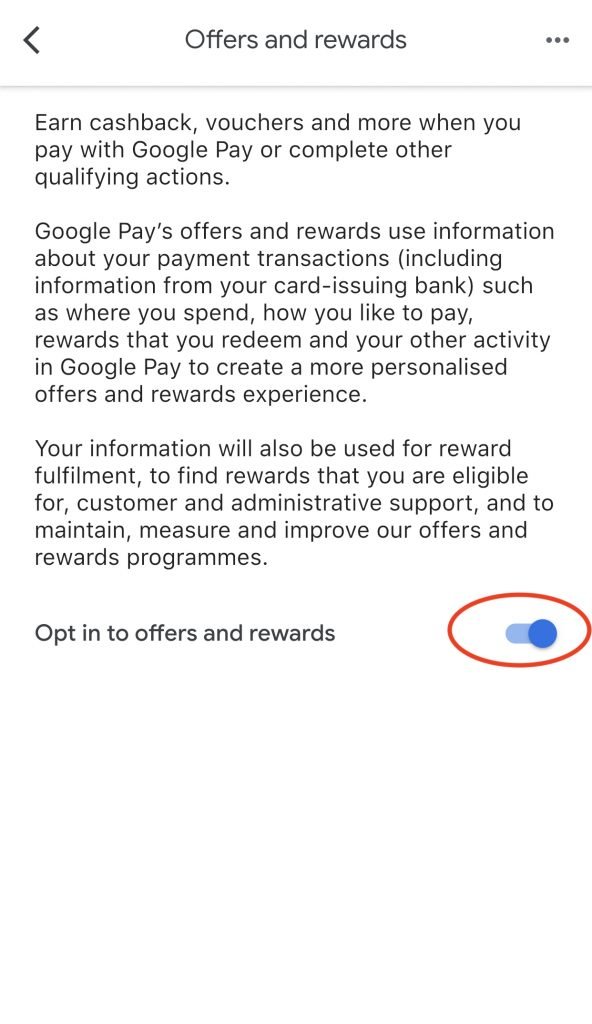

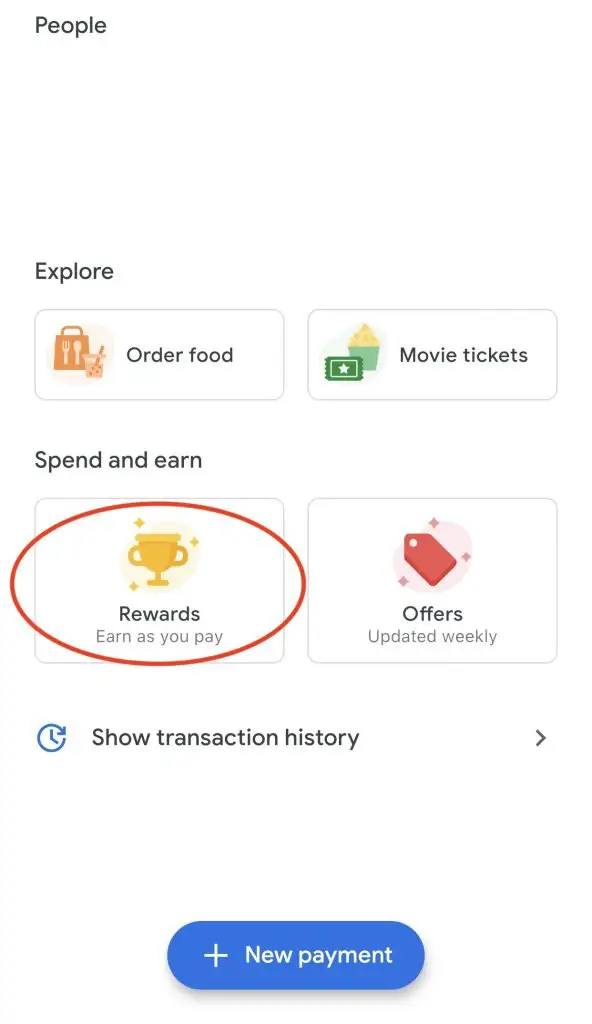

#4 Ensure that you opted in for offers and rewards

You should be automatically opted in, but it doesn’t hurt to check!

You’ll need to go to Settings → Offers and rewards, and ensure that you are opted in.

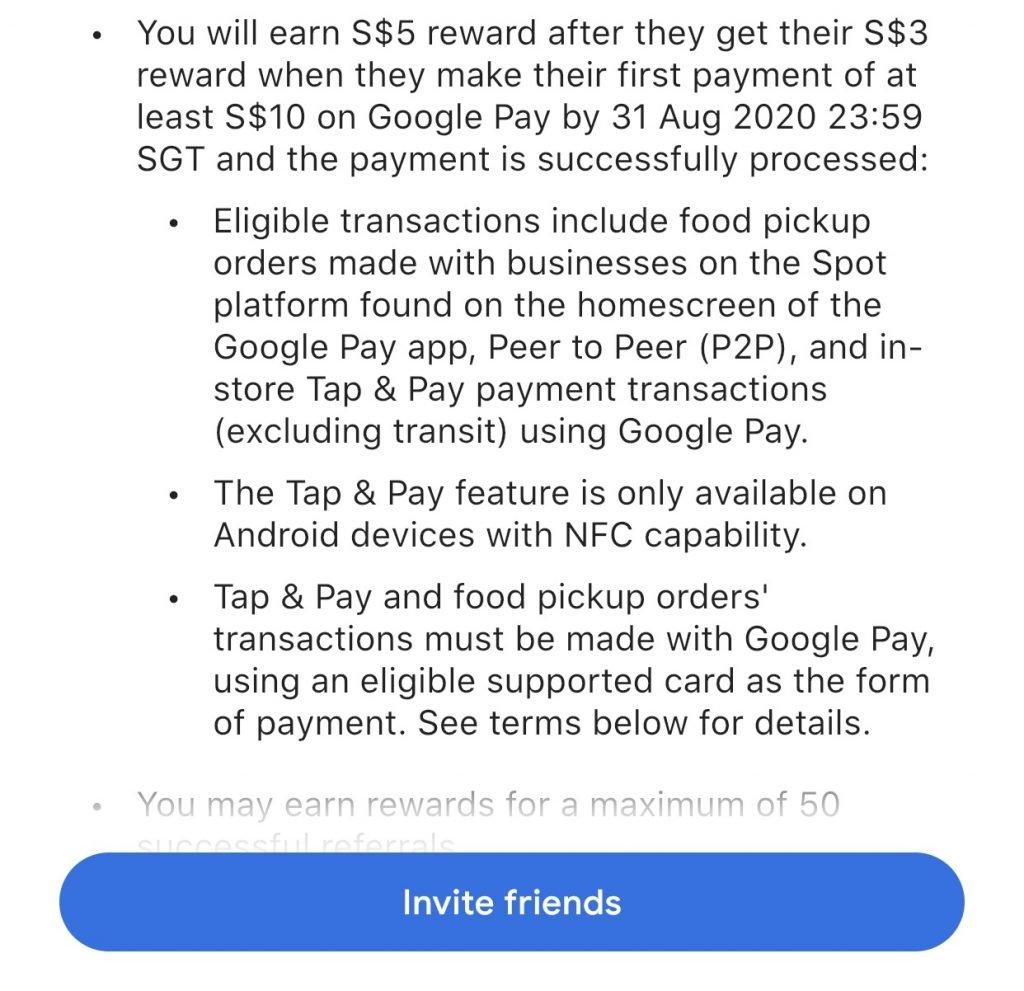

#5 Make an eligible transaction (≥ $10)

You will now have to make an eligible transaction that is at least $10.

An eligible transaction is defined as:

- Food pickup orders made with businesses on the Spot platform

- In-store Tap & Pay transaction (excluding transit)

- P2P payment

For the Tap & Pay, it is only available for Android devices with NFC capabilities.

It will be easiest if you are able to make a P2P transfer to your friend.

#6 Receive referral bonus directly credited via PayNow

After completing all the steps, you should see the $5 in your rewards!

You should get the $3 credited into your bank account via PayNow within 3 days.

You can then use your referral link to refer your friends as well. You will get $3 for every person you successfully refer!

This promotion ends on 24 January 2021, so do sign up for it as soon as possible!

Scratch Card Promotion (Get cashback with eligible transactions)

Did you notice the $0.55 and $0.56 cashback that I received?

There’s an additional scratch card promotion as well!

There are 2 types of scratch cards that you can get by:

#1 Transferring to another Google Pay user

When you transfer at least $10 to another Google Pay user, you will get a scratch card.

Each scratch card can earn you up to $10. You can earn a maximum of 2 scratch cards per week using this method.

Each week will start every Monday, at 8.30AM. The week will end on the next Monday at 8.29AM.

This promotion ends on 24th January 2021.

#2 Using Google Pay at local shops

You can use Google Pay at local merchants and earn a scratch card too!

If you make a payment of at least $3, you will receive a scratch card. You have the opportunity to earn up to $10 for each scratch card.

You can receive 2 scratch cards a week using this promotion (similar to the P2P offer).

Here are 2 ways that you can make a payment to the store:

- In-store Tap & Pay (excluding transit)

- Payment via QR code to store

There are some things to note about the payments:

- The Tap&Pay feature is only available on Android devices with NFC capability, and you need to use a supported card.

- You can make a payment via QR code for any PayNow or SGQR code

This offer will end on 24th January 2021 as well.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?