Last updated on June 6th, 2021

You may have seen the adverts on YouTube regarding SNACK by Income.

What is it exactly and how does it work? Here is an in-depth look into what this app offers:

Contents

- 1 What is SNACK by Income?

- 2 How does SNACK by Income work?

- 3 What are the requirements to purchase these policies?

- 4 What are the policies that I can purchase?

- 5 How do the policies work?

- 6 What are the triggers available?

- 7 SNACKUP gives you additional coverage when you spend at certain brands

- 8 How do I make a claim?

- 9 Are there any disadvantages of using SNACK?

- 10 Is SNACK by Income safe?

- 11 Verdict

- 12 Conclusion

- 13 👉🏻 Referral Deals

- 14 SNACK Sign-Up Promotion (Receive a $10 FoodPanda Voucher)

What is SNACK by Income?

SNACK is a micro-insurance platform that allows you to purchase 3 insurance plans with premiums starting from $0.30. You can select triggers that will activate the purchase of these micro-insurance policies.

After you’ve set up your triggers, you do not need to worry much about managing SNACK. You can continue to build up coverage by just carrying out your daily activities!

This is a great way for you to start purchasing insurance, especially if you can’t afford the expensive monthly premiums!

How does SNACK by Income work?

There are certain triggers you can select from, such as spending in certain categories or completing 5,000 steps with your Fitbit watch. When these triggers are activated, you will purchase a micro-insurance policy. The coverage is based on the premium you selected, and will last for 360 days.

The policy will still last for 360 days, even if you stop activating any triggers or you remove them.

Moreover, you are able to stack your policies together! Here is an example of how the coverage works when you activate multiple triggers:

| Day | Type of Trigger | Coverage Received |

|---|---|---|

| Day 1 | Food | $321 |

| Day 2 | Petrol | $321 |

When you wish to make a claim from Day 2 to Day 360, you will receive $642 worth of coverage. As such, you will receive greater coverage when you activate more triggers!

This is similar to how Grab AutoInvest works. Every time you make a purchase with Grab, a certain amount will be deducted from your GrabPay wallet.

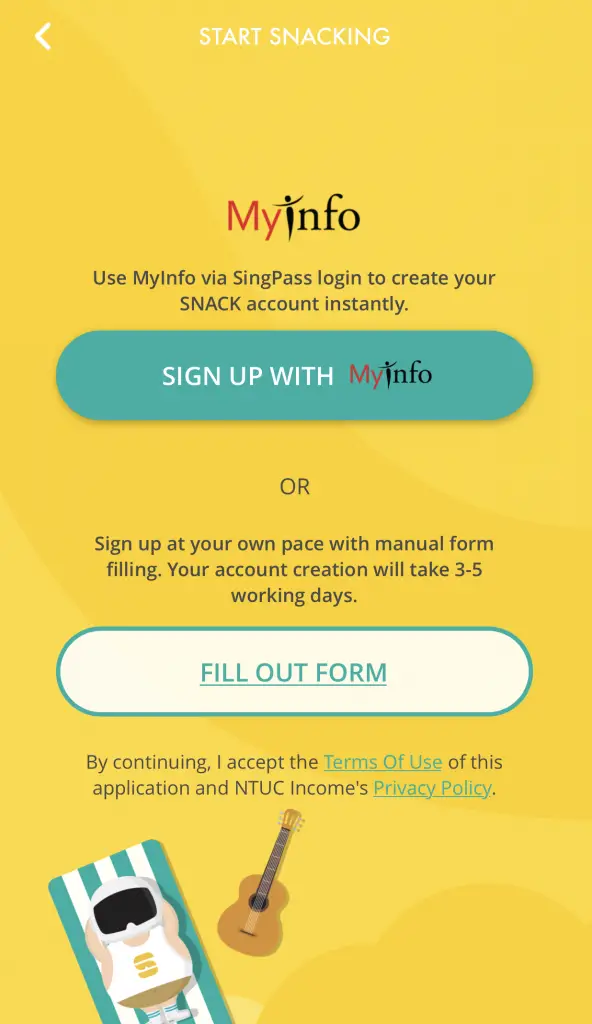

Sign-up process via MyInfo

The signup process is really convenient, as you are able to use MyInfo.

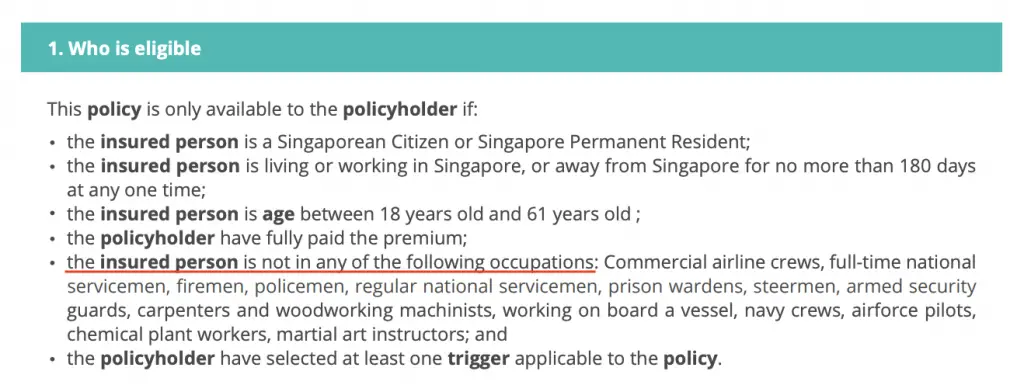

What are the requirements to purchase these policies?

To be able to start using SNACK, here are some requirements you’ll need to meet:

- You are a Singapore Citizen or a Singapore PR

- You are between 18-61 years old

- You have fully paid your premium

- You have selected at least one trigger to activate your policy

The accident policy also has an additional criteria. You cannot purchase this policy if you are working in certain occupations that NTUC Income deems as ‘high-risk’.

What are the policies that I can purchase?

SNACK allows you to purchase 3 different types of policies:

#1 Life

You are able to purchase a life policy. This policy will give you up to $200k of coverage for these 3 scenarios:

- Death

- Total and permanent disability

- Terminal illness

This life policy is similar to the benefits provided by insurance savings plans like the SingLife Account and Etiqa GIGANTIQ.

This is a rather straightforward plan that gives you a payout when you meet certain criteria.

You can view the full conditions and product summary to find out more.

#2 Accident

The accident plan allows you to receive certain payouts when you meet certain conditions:

| Condition | Payout |

|---|---|

| Accidental Death Permanent Disability Accidental Death on Public Transport | 100% of Accumulated Coverage (Up to $100k) |

| Medical expenses for injury (per accident) | 2% of Accumulated Coverage (Up to $2k) |

| Treatment by a Chinese medicine practitioner or a chiropractor (per accident) | 1% of Accumulated Coverage (Up to $1k) |

The most common claim you’ll most likely make will be the medical expenses per injury.

NTUC Income will pay the cost for any fees you incur, including:

- Hospital, dental treatment

- Nursing fees

- Surgical or medical fees

However you can only receive up to 2% of your accumulated coverage for each injury!

The only downside is that you will not be eligible for this policy if you work in certain ‘high-risk’ occupations.

You can view the conditions and product summary on Income’s website to find out more.

#3 Critical Illness

The critical illness plan covers you against any of the 37 severe-stage critical illness defined by the Life Insurance Association (LIA).

You will receive 100% of your accumulated coverage (up to $200k) when you are diagnosed with 36 of the 37 critical illnesses.

The only exception is if you undergo angioplasty or other invasive treatments for coronary artery. You will only receive 10% of your accumulated coverage (up to $25k).

However, you will only receive a lump sum payout after being diagnosed. Even if you are diagnosed with another critical illness, you will not receive another payout!

This is something you might want to take note of, especially if you want coverage for multiple critical illnesses.

You can view the policy conditions and product summary on NTUC Income’s website.

SNACK also has an Invest feature

SNACK by Income has an Invest feature as well. However, it still has not been released at this point in time.

This investing feature will most likely be something similar to Grab’s AutoInvest.

How do the policies work?

For each policy, there are 3 different tiers of premiums that you can pay. This ranges from $0.30 to $0.70 for each trigger that you pay.

This will give you different amounts of coverage for each policy.

| Premium | Life | CI | Accident |

|---|---|---|---|

| $0.30 | $369 | $321 | $204 |

| $0.50 | $615 | $535 | $340 |

| $0.70 | $861 | $749 | $476 |

The coverage shown here depends is the basic coverage if you do not have any medical conditions.

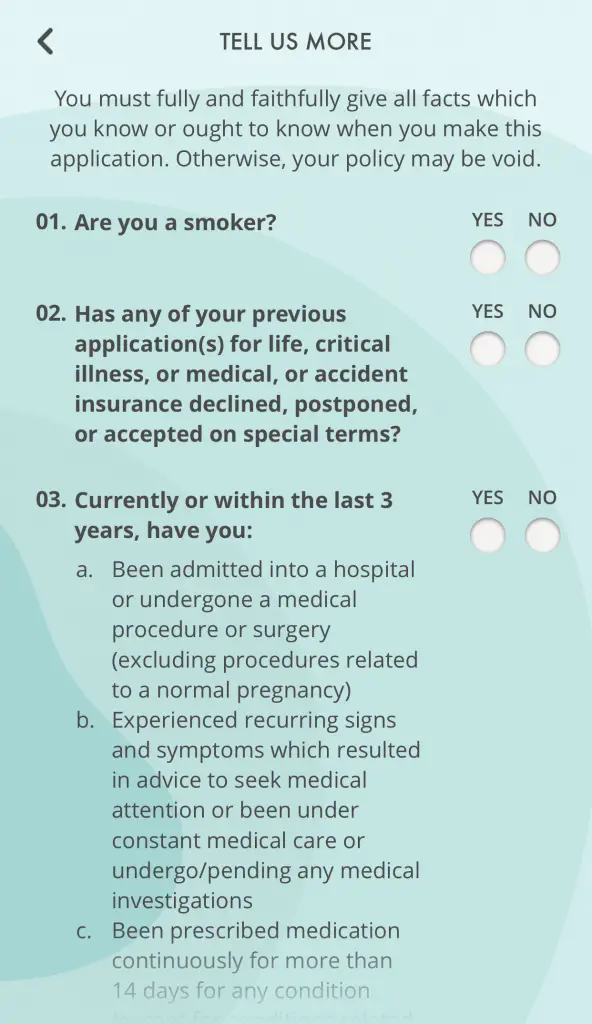

When you sign up for a policy, you are required to fill up a questionnaire. This allows NTUC Income to assess the risk when providing you with the insurance policy.

Your coverage may be lower if:

- You are a smoker

- You have any pre-existing medical conditions

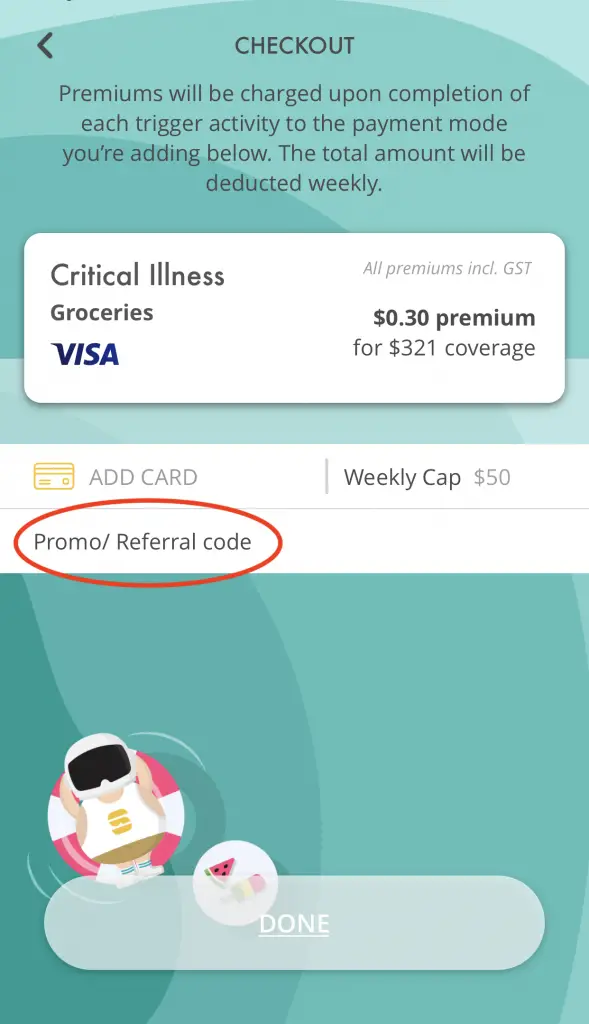

You can only pay your premiums via Visa / Mastercard

The only way that you can pay for the premiums is by a Visa or Mastercard debit / credit card.

The Visa card that you use to pay your premiums can be separate from those that you linked to activate triggers. It is possible to link the same Visa card as a trigger and to pay for your premiums too!

You can choose to set a limit for the premiums you pay per week

You are able to set a weekly cap on the amount of premiums you can pay. When you first purchase a policy, the default cap is set at $50.

This is really useful if you may activate the triggers multiple times per week. Having this limit prevents you from overpaying your premiums!

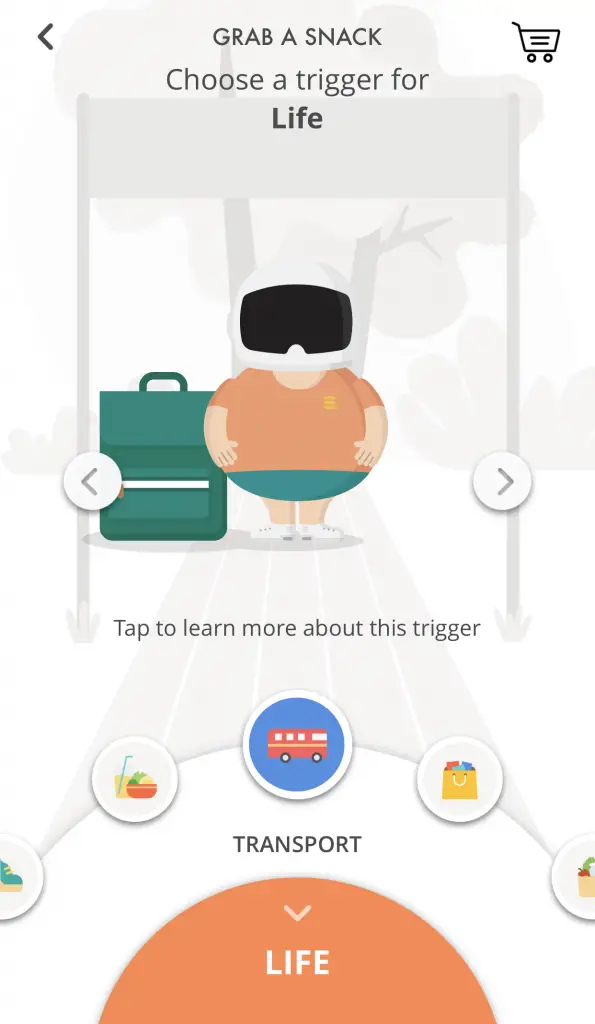

What are the triggers available?

To start paying for a policy, you will first need to activate a trigger.

Here are the 9 possible triggers that you can activate:

| Trigger | How Is It Triggered? |

|---|---|

| Steps | Hit 5,000 steps on your Fitbit |

| Food and Drinks | Pay for meals with Visa card OR redeem a dining deal on Burpple Beyond |

| Transport | Pay for bus / train / cab using Visa or EZ-Link |

| Retail | Retail spend using your linked Visa card |

| Groceries | Spend on groceries with your linked Visa card |

| Entertainment | Spend on entertainment with your linked Visa card |

| Petrol | Spend on petrol with your linked Visa card |

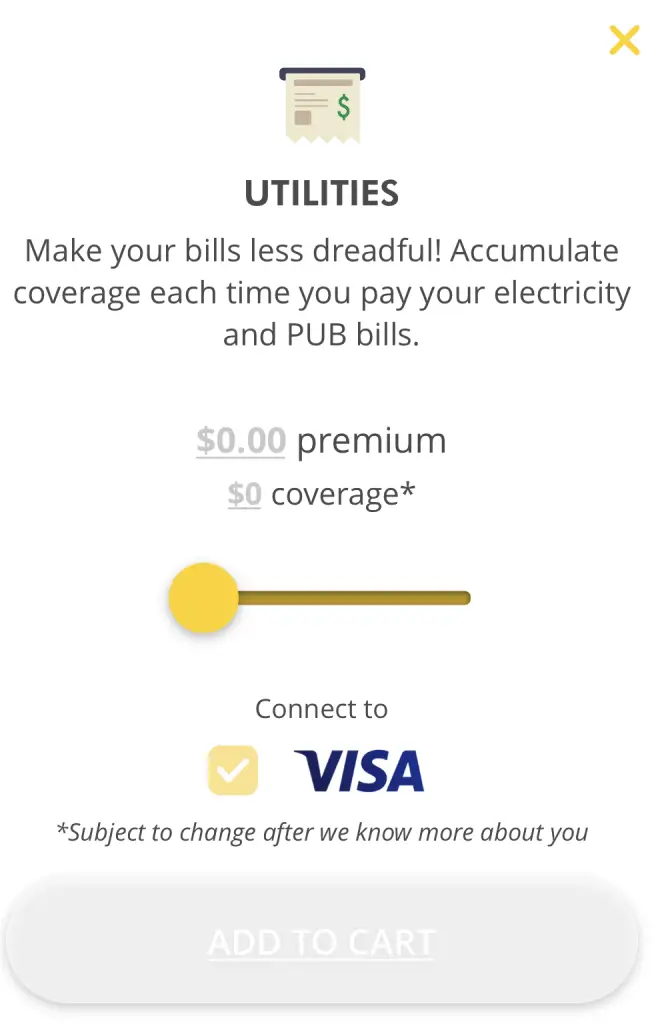

| Utilities | Pay electricity and PUB bills with your linked Visa card |

| Travel | When you pay for air ticket or hotel stay (coming soon) |

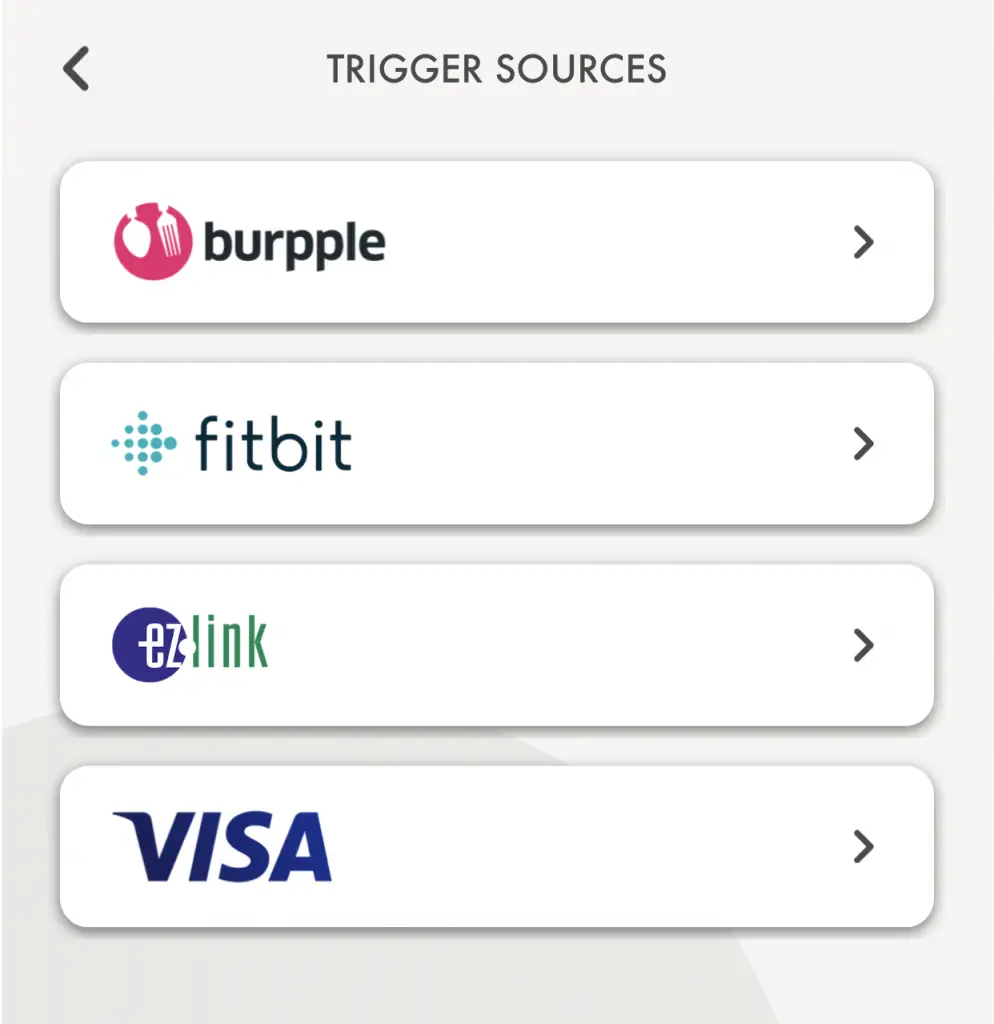

Here are the 4 trigger sources explained further:

#1 VISA

SNACK has partnered with VISA to track your spending on your Visa cards. In this way, they are able to know which categories that you’ve spent on using your Visa card.

If your transaction fits into one of the categories that you’ve set as a trigger, this trigger will be activated. SNACK will charge the premium to your debit or credit card.

The categories that you can use your Visa card include:

- Transport

- Food and Drinks

- Retail

- Groceries

- Entertainment

- Petrol

- Utilities

You can link up to 3 Visa cards to track your spending.

At this point of time, you can’t link a Mastercard to receive the same spending benefits.

#2 Fitbit

To activate this trigger, you will need to walk at least 5,000 steps that is tracked by your Fitbit account.

Even if you do not have a Fitbit watch, it is still possible to track your steps with Fitbit’s MobileTrack.

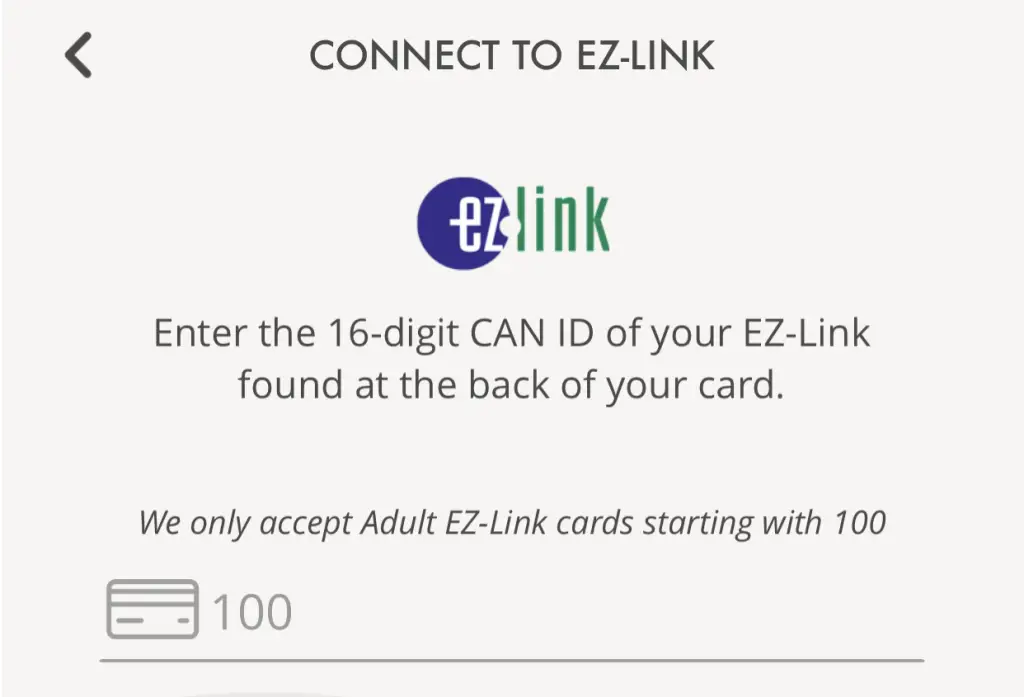

#3 EZ-Link

Besides using your Visa card to pay for public transport, you can link your EZ-Link card instead. You will need to enter the 16 digit CAN ID on your card to link it to SNACK.

One drawback is that you aren’t able to link a NETS FlashPay card with SNACK. You can see my comparison between NETS and Visa payWave to see how they are different.

EZ-Link cards aren’t that useful anymore

However, there are not many enticing reasons to use EZ-Link to pay for public transport anymore. With the introduction of SimplyGo, you are now able to use your debit and credit cards for public transport.

Some of these cards may even give you rewards when you use them to pay for your transport fees!

Furthermore, you are able to use mobile wallets like Google Pay so that you don’t even need to take your card out from your wallet!

The only reason why you may use EZ-Link for SNACK is because you do not have any Visa cards.

#4 Burpple

You are able to link your Burpple account to SNACK as well. You will activate the Food and Drink trigger whenever you redeem a deal on Burpple.

The policy will be issued once you redeem the deal, instead of only when you pay at the restaurant.

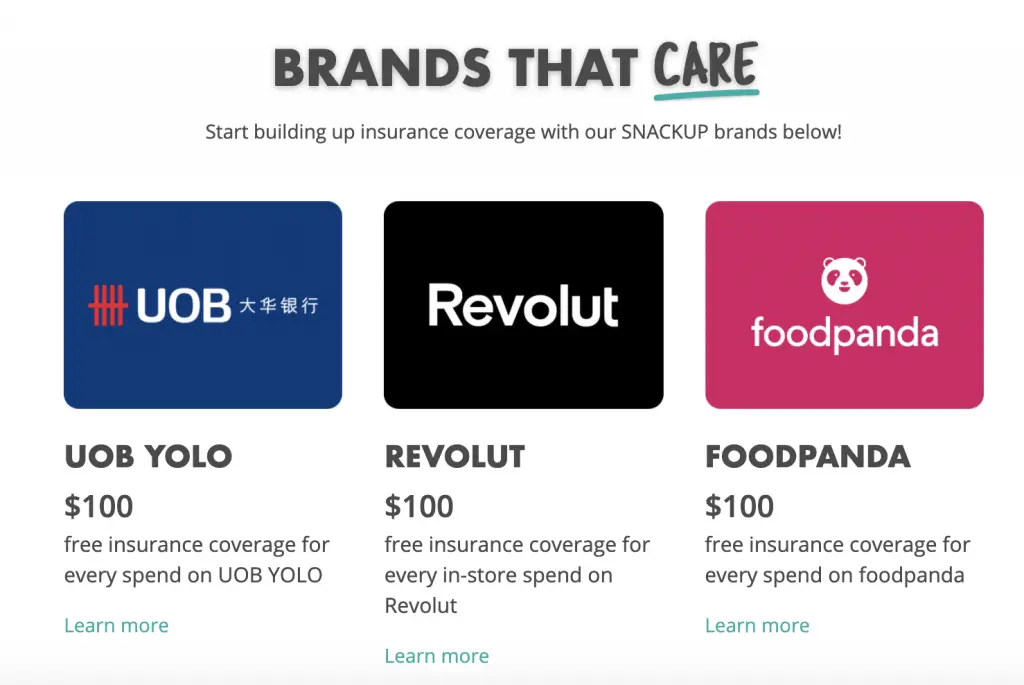

SNACKUP gives you additional coverage when you spend at certain brands

On top of the lifestyle triggers that you’ve activated, it is possible for you to accumulate extra coverage.

SNACK has partnered with certain brands to help you gain between $100-$10,000 extra coverage when you purchase from those brands!

Your purchases are tracked by the Visa cards that you’ve linked to SNACK. There is also no minimum amount required to spend before you can receive this complimentary coverage!

Some of the brands participating in this deal include:

- Foodpanda

- Sarnies

- WhyQ

- Carro (requires promo code SNACKUP116)

- Wafuken

- Revolut

This is a great way to help you accumulate your coverage at a faster rate!

How do I make a claim?

SNACK has also streamlined the process when you want to make a claim. You can do it via the app, or use the online portal instead.

If you wish to make a claim, you will need to inform SNACK within 30 days of the event occurring. If you fail to do so, your claim might be rejected!

The amount that you can claim depends on the coverage you’ve accumulated on the date of your unforeseen circumstance. The more triggers you’ve activated, the greater the coverage you’ve accumulated.

The claims will be paid out via PayNow to the bank account linked to your NRIC.

This makes the claim process much faster!

Are there any disadvantages of using SNACK?

SNACK undoubtedly has a lot of plus points. However, there are some disadvantages if you rely solely on SNACK for your insurance:

#1 The coverage provided may not be enough

The maximum coverage you can obtain from these policies is $200k.

| Policy | Maximum Coverage |

|---|---|

| Life | $200k |

| Accident | $100k |

| Critical Illness | $200k |

However, here are the recommended amounts of coverage you should have (according to the Life Insurance Association of Singapore):

| Policy | Recommended Coverage by LIA |

|---|---|

| Life | 9-10x your annual income |

| Critical Illness | Around $316k |

For accident coverage, it is more of a good to have rather than a must have. Having accident coverage will help to pay for any medical fees that you incur.

You can’t use SNACK as your only insurance policy

SNACK has a maximum life coverage of $200k. If you earn more than $20k a year, it is not recommended that you have SNACK as your only insurance policy.

Moreover, using SNACK alone will not be enough to receive the recommended critical illness coverage. In fact, you will be around $116k short of the recommended coverage!

As such, you should still purchase your own insurance policy since it can give you a higher amount of coverage.

SNACK is a good supplement, but it should not be your only insurance policy!

#2 It will take a while to build coverage

When you first start using SNACK, it may take a while to build enough coverage. The highest amount of coverage you can receive from each trigger is less than $900.

For example, you may be receiving $861 in coverage for a life insurance premium of $0.70. To reach the maximum coverage of $200k, you will need to activate at least 232 triggers!

You will need a greater number of triggers if you choose the lower premiums.

If something happens to you while you’re building up the coverage, you may not receive a high enough payout.

#3 You will need to constantly activate triggers

To continue receiving enough coverage, you will need to continue activating your triggers.

However as you grow older, your spending patterns may change. If you stop spending in a certain category that triggers a policy, then you will not be receiving enough coverage.

You may also change to a Visa card that is not linked with SNACK!

If you do not constantly review your triggers and policies, you may no longer be activating new policies.

Moreover if you are only relying on SNACK as your only insurance policy, you are actually not receiving any insurance coverage at all!

As such, SNACK still requires quite a bit of active management for it to be effective for you.

#4 Policy payouts are limited

The insurance policies you have with SNACK are not your own policies. As such, there are some limitations:

1) Critical illness plan does not have multi-pay

When you are first diagnosed with a critical illness, you will receive the full lump sum payout of your total coverage. After this, the policy will be terminated.

This means that if you are diagnosed with a second critical illness, you will not be eligible to receive another payout!

It is possible re-apply for a new policy once your first policy is terminated. However, the premiums may be much higher. This is because you would have a higher risk of being diagnosed with other critical illnesses!

Other critical illness policies provide a multi-pay option. These policies will give you payouts, even when you are diagnosed for other critical illnesses.

As such, you will need to decide what kind of critical illness plan you would like to have!

2) You can’t decide how your payouts are distributed

In the policy conditions and product summaries, NTUC Income did not mention how your payouts will be distributed.

In the event that you pass on, the full payout will most likely be given to your next of kin. As such, you do not have full control over how your payout is distributed!

You may want to give a certain portion of the payout to your parents, spouse and kids. However, this is not possible with the policies issued by SNACK.

If you want greater control over the distribution of your payouts, you may want to apply for a policy that allows you to do so.

Is SNACK by Income safe?

All of the policies issued by SNACK are under the protection of the Policy Owner’s Protection Scheme. This is being administered by the Singapore Deposit Insurance Corporation (SDIC).

In the highly unlikely event that NTUC Income closes down, you will still be able to receive the guaranteed benefits of your policies. However, this is also subject to the limits set out by SDIC.

Verdict

So is SNACK something that you should get? Here are some key points about this micro-insurance policy:

#1 SNACK makes insurance very accessible

SNACK allows you to start being covered with just $0.30. Even though the coverage may not be the greatest, it is still better than not being covered at all!

SNACK is great for 2 main groups of people:

- Recent graduates who just started work

- Gig economy workers

You will most likely be unable to afford the high premiums that a normal insurance policy will have. As such, SNACK provides a flexible way to accumulate some coverage with lower premiums.

#2 You will need to manage this policy actively

Even though SNACK markets itself as something that you do not have to think about, I believe this is not the case.

If your spending habits are consistent throughout, you may not need to worry much about your policies.

However, your spending patterns will most likely change!

If you are using SNACK, I believe you should check how much coverage you currently have. This will help you to see if you have accumulated enough coverage.

Moreover, you may apply for new Visa cards along the way. If you do not link them to SNACK, you will not activate any triggers!

SNACK is not a set and forget insurance policy. You should still be reviewing it from time to time to see if it meets your needs.

#3 SNACK should not be your only insurance policy

SNACK only insures you up to $200k. If you require additional coverage, SNACK is unable to provide you with it!

Moreover, SNACK does not offer a hospitalisation insurance policy. This is one of the most important plans that you should have to help cover your costly medical bills.

As such, I believe that SNACK is a good complement, but should not be your only insurance policy. You should still consider getting your own insurance policy which you have greater control.

Both life and critical illness policies are sum assured policies. This means that you are able to receive multiple payouts if you have a SNACK policy as well as your personal policy!

However, SNACK is still a great way to accumulate coverage especially if you are unable to afford the usual insurance premiums.

Conclusion

SNACK is an innovative method of integrating insurance into your daily life. It does have some limitations, but it is still a great way for you to accumulate bite-sized coverage for your life, critical illness and accident plans.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SNACK Sign-Up Promotion (Receive a $10 FoodPanda Voucher)

To sign up for SNACK, you can download the app from the Apple or Google Play Store. You will need to enter the promo code ‘SNACKUP1000‘ in the field below.

Once you’ve linked your first lifestyle trigger, you will receive the following benefits:

- $500 bonus coverage

- $10 FoodPanda voucher

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?