Last updated on June 6th, 2021

There are so many mobile wallets that we have in Singapore. One of the more popular wallets is PayLah!, which was created by DBS bank.

After receiving money from your friends through PayLah!, you may wonder if you’re able to transfer it back to your bank account.

Here’s how this mobile wallet allows you to withdraw money to a bank account.

Contents

- 1 Can I transfer money from PayLah! to my bank account?

- 2 Transfer from PayLah! to DBS or POSB account

- 3 Transfer from PayLah! to another bank in Singapore

- 4 There are daily transfer limits to transfer from PayLah! to your bank account

- 5 Transfer all of your money automatically into your bank account (set a $0 wallet limit)

- 6 Conclusion

- 7 👉🏻 Referral Deals

Can I transfer money from PayLah! to my bank account?

You are able to transfer money from DBS PayLah! to your linked Singaporean bank account. This linked account can either be a DBS or POSB account, or a bank account registered under MyInfo.

Here is an in-depth explanation of how to withdraw your money from PayLah!:

Transfer from PayLah! to DBS or POSB account

Signing up for PayLah! is easy when you have a DBS or POSB account.

There is no difference between the two types of accounts as they belong to the same bank.

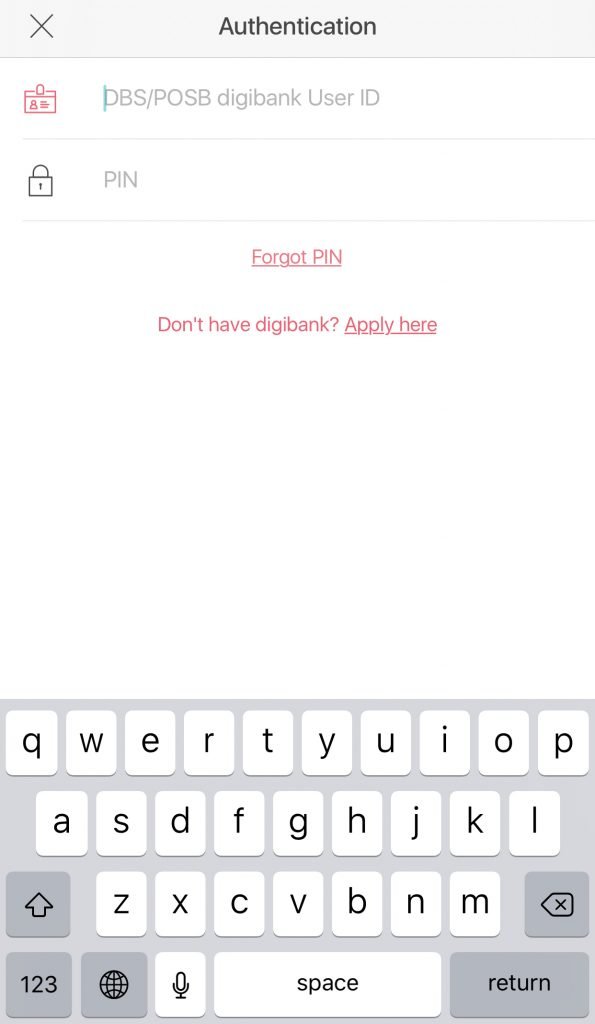

All you’ll need to do is to login to your digibank account to link your PayLah! wallet to your bank account.

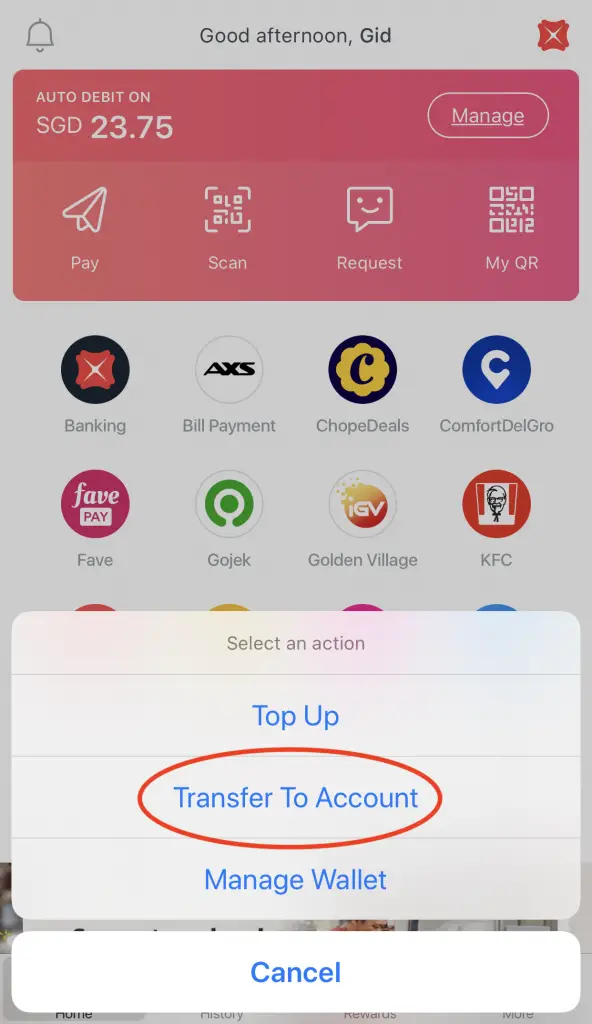

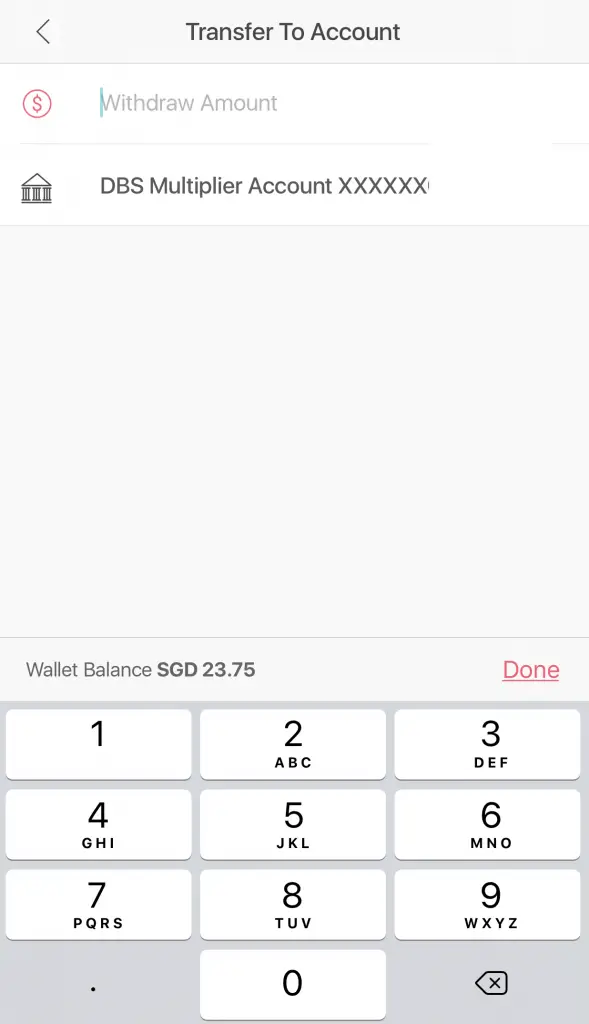

After linking your bank account with PayLah!, you can transfer money to your bank account at any time. You’ll need to tap on ‘Manage → Transfer to Account‘.

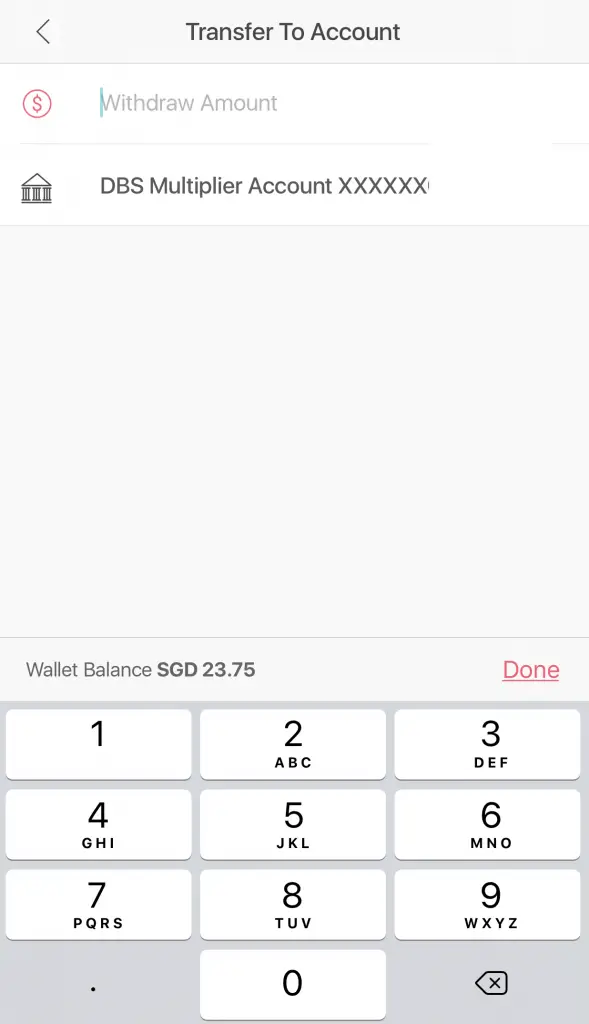

You will be prompted to input the amount you wish to withdraw back to your account.

After that, your money will immediately be transferred to your bank account!

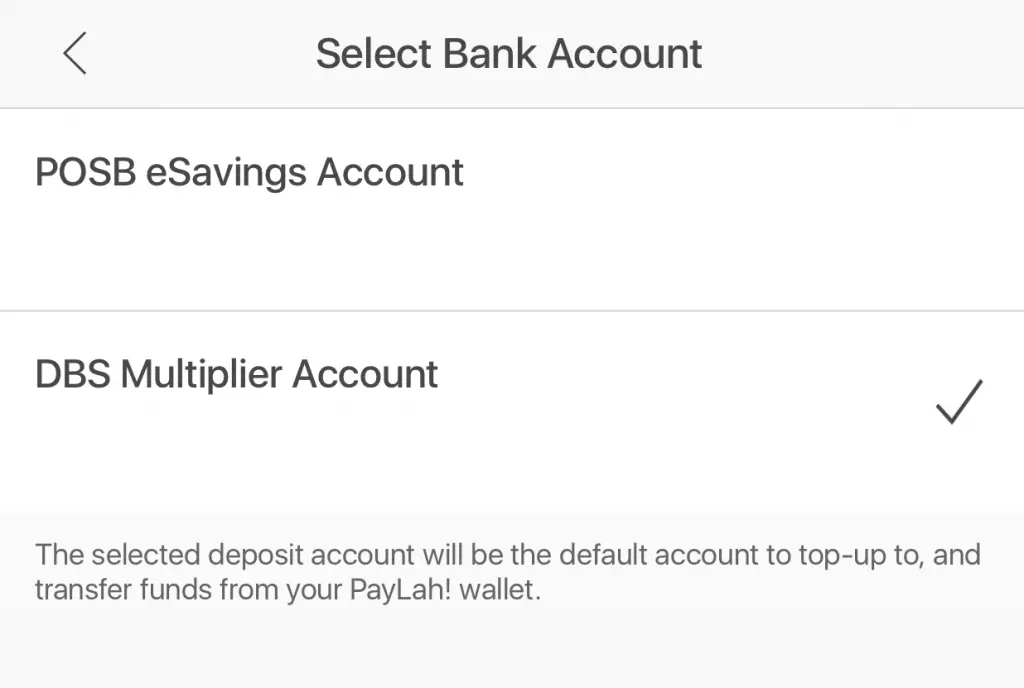

You can change your linked DBS / POSB account

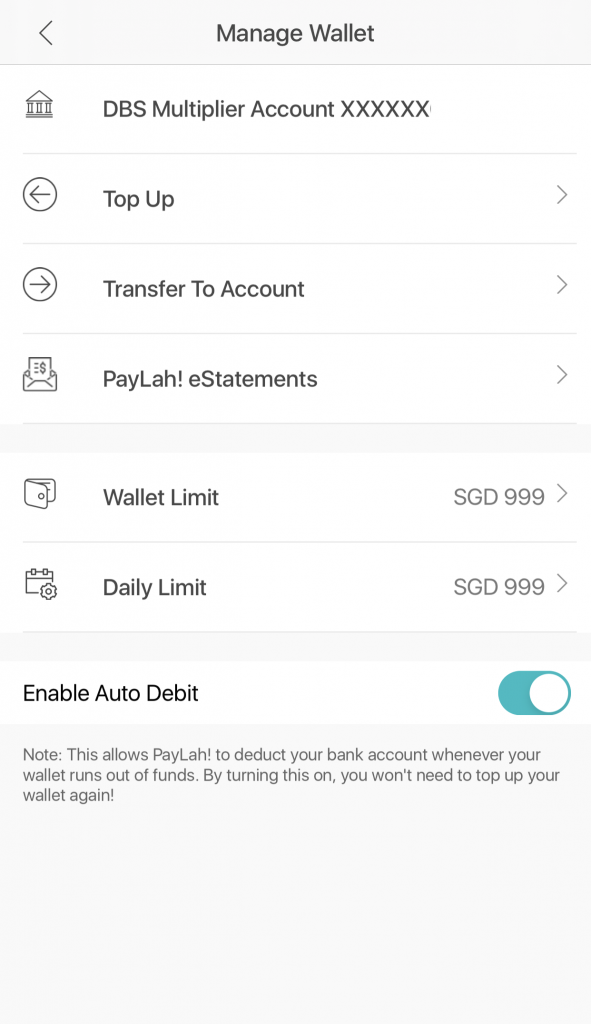

If you wish to change your linked DBS / POSB account, it is possible to do so as well. You’ll need to go to ‘More → Manage Wallet‘.

You will be prompted to login to your digibank account. Afterwards, you will be able to select any of your DBS or POSB accounts to be the linked account.

Transfer from PayLah! to another bank in Singapore

It is possible to link a bank account that does not belong to POSB / DBS with PayLah! too.

When you are signing up for your PayLah! account, you will be asked to register via MyInfo instead.

MyInfo is an integrated data platform that allows all of your data to be retrieved from one place. This is also how you are able to access SGFinDex using your SingPass as well.

MyInfo will link any bank accounts it finds to PayLah!. After that, you are able to withdraw money to your linked bank account via the same steps above!

If you wish to change your linked bank account, it is possible to do so as well. All you’ll need to do is to login using your PayLah! credentials to change your linked account.

There are daily transfer limits to transfer from PayLah! to your bank account

There are daily transfer limits to transfer money from PayLah! to your linked bank account. The limits depends on the type of linked bank account you have.

| Type of Linked Bank Account | Daily Transfer Limit |

|---|---|

| digibank user (POSB / DBS account) | Either of $100, $200, $500, $999, $2000 |

| MyInfo user (Other bank accounts) | $999 (default) |

You may want to take note of these limits, especially if you’re transferring a large amount back to your bank account!

Transfer all of your money automatically into your bank account (set a $0 wallet limit)

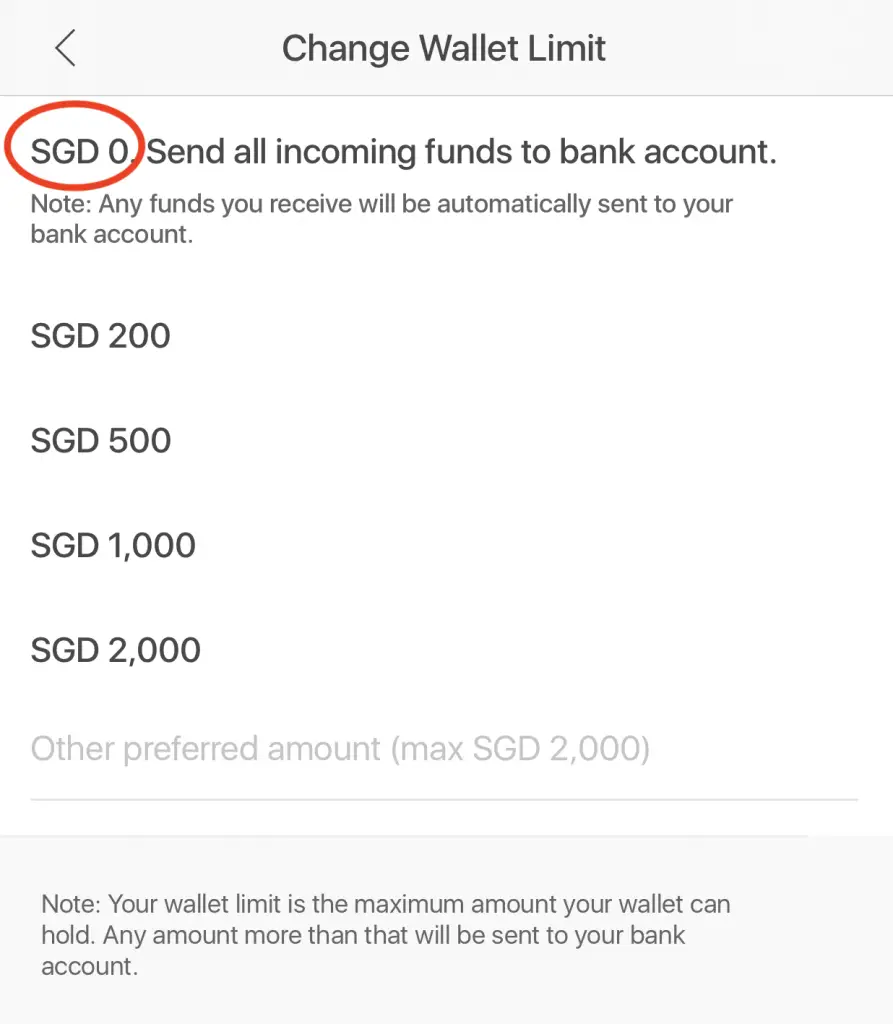

You may be worried about the hassle of constantly withdrawing money from your PayLah! wallet. There is a workaround to this, which is to set a $0 wallet limit!

What this means is that your PayLah! mobile wallet cannot hold any cash inside. Whenever someone makes a payment to you, it will be instantly credited to your linked bank account.

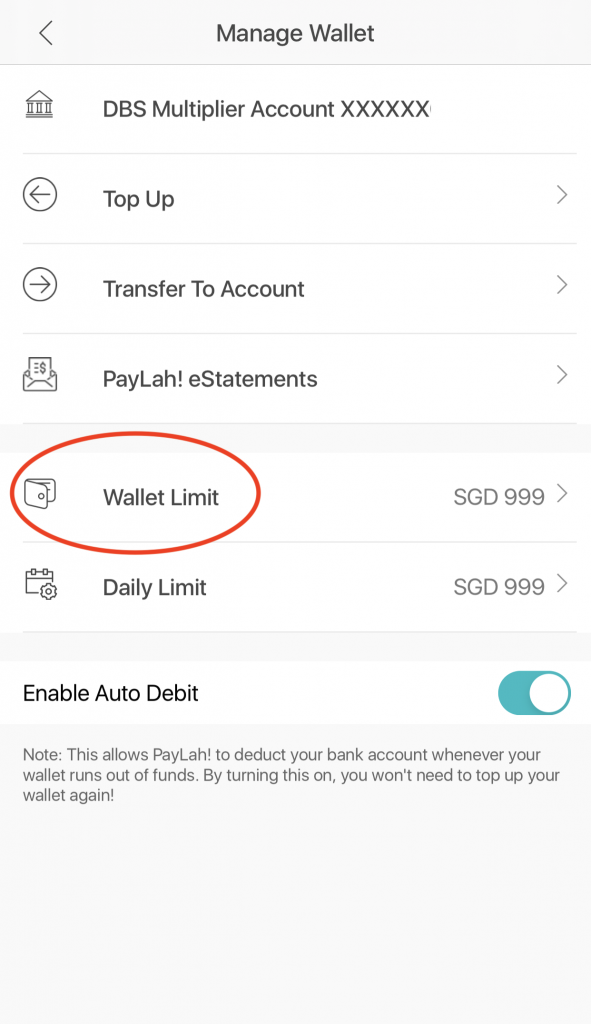

To enable this function, you’ll need to go to ‘More → Manage Wallet → Wallet Limit‘.

This will allow you to select the wallet limit you wish to have. You can set it at 0 for any amount to be sent to your linked bank account.

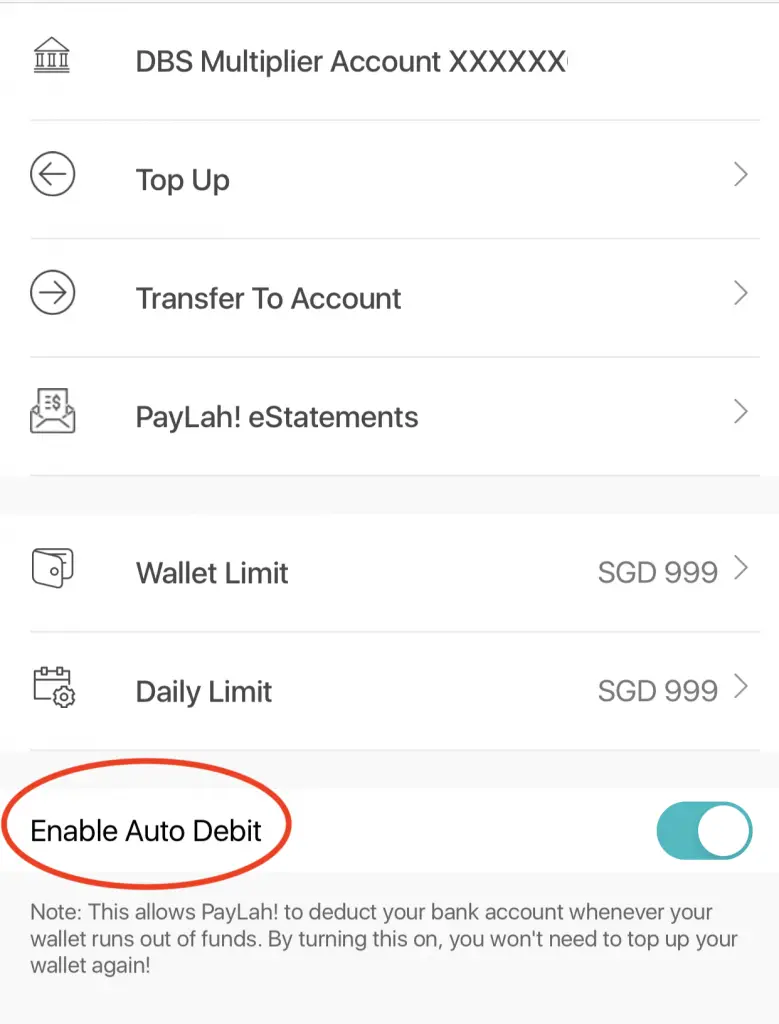

If you wish to use this function, you may want to enable Auto Debit as well.

This allows PayLah! to debit the required amount from your linked bank account. If you do not enable this function, you will not be able to make any payments via PayLah!.

This is because you will not have any money in your mobile wallet to make the payment.

Conclusion

Being able to withdraw money from your PayLah! wallet is an extremely useful feature to have.

Other wallets like GrabPay and Singtel Dash have this feature as well. However, there are certain conditions that you may need to meet first!

In contrast, PayLah! does not have any requirements to withdraw your money from the wallet.

Furthermore, you are able to withdraw your money into any Singaporean bank account. It does not matter whether your account belongs to DBS / POSB or not. This makes PayLah! one of the more flexible mobile wallets in Singapore!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

PayLah! Referral (Get $5 when you sign up)

If you are looking to sign up for a PayLah! account, you can use my referral code ‘GIDOYK921‘.

You will receive $5 after successfully signing up for an account.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?