Last updated on June 16th, 2021

Investing in stocks used to be rather inaccessible if you only had a small sum.

The fees were just too expensive and it’ll just eat into your returns.

However, the FinTech revolution has changed that. New services like robo-advisors and low cost brokerage firms have since emerged.

Here is how Tiger Brokers, one of the newest brokerage firms, can help to start your investing journey.

Contents

- 1 Tiger Brokers review

- 2 What is Tiger Brokers?

- 3 What are Tiger Brokers’ main features?

- 4 How do I deposit and withdraw my funds from Tiger Brokers?

- 5 How do I make a trade with Tiger Brokers?

- 6 What are the fees to trade with Tiger Brokers?

- 7 Is Tiger Brokers a custodian or CDP account?

- 8 Is Tiger Brokers reliable and safe?

- 9 What other features does Tiger Brokers have?

- 10 How does Tiger Brokers compare with other brokerages?

- 11 Verdict

- 12 How do I create an account with Tiger Brokers? (Referral)

- 13 👉🏻 Referral Deals

Tiger Brokers review

Tiger Brokers is an attractive brokerage with very competitive commissions compared to other brokers in Singapore. Apart from some translation issues and having less markets to invest in, it is a broker that you can consider investing with.

Here is Tiger Brokers reviewed in-depth:

What is Tiger Brokers?

Tiger Brokers is an online brokerage that was founded by Wu Tianhua in 2014. The company was founded with the aim to allow Chinese investors to trade in the US, HK and Chinese markets.

Being one of the newest brokerage firms, Tiger Brokers is able to take advantage of the latest technologies.

As such, they are able to provide a seamless experience when conducting trades, and at a lower cost too.

Focusing on a mobile-first experience, Tiger Brokers was launched in Singapore in early 2020 to appeal to mobile-savvy millennials. The Singapore arm of Tiger Brokers is headed by Eng Thiam Choon.

The platform has since added the SGX and the ASX to its offerings. You are now able to trade in markets across 5 different exchanges!

What countries can I use Tiger Brokers in?

You may be wondering whether you can use Tiger Brokers in other countries besides China and Singapore. In fact, Tiger Brokers has a significant presence in Asia and Europe!

If you wish to open an account if you’re a US citizen, you would need to open your account through TradeUP.

What are Tiger Brokers’ main features?

Here are the main features of Tiger Brokers:

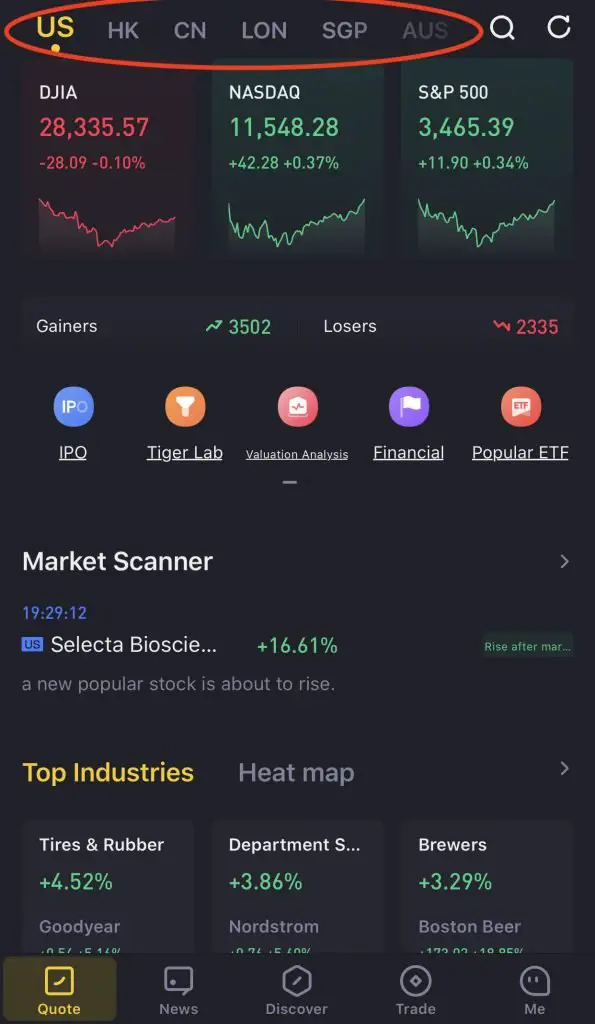

6 different markets available

Tiger Brokers offer you 6 different markets that you can trade in.

This includes:

- Singapore (SGX)

- US (5 different exchanges)

- Hong Kong (HKEX)

- China (SH-HK and SZ-HK Stock Connects)

- Australia (ASX)

- Futures

You are able to perform options trading as well.

You can view all of the markets in the ‘Quotes‘ tab.

It may not be the most extensive list of markets. However, Tiger Brokers does provide you with the more popular options.

5 types of US exchanges to trade in

Here are the 5 US exchanges that you can trade:

- New York Stock Exchange (NYSE)

- Nasdaq Stock Market (NASDAQ)

- American Stock Exchange (AMEX)

- Pink Sheet Exchange (PK)

- Over-The-Counter (OTC)

Having access to most of US’ markets allows you to buy popular ETFs such as the S&P 500 ETFs and the ARKK ETF.

Tiger Brokers allows you to trade some, but not all OTC stocks. However, OTC stocks are considered to be riskier than normal securities, and you should take extreme caution when trading in these stocks.

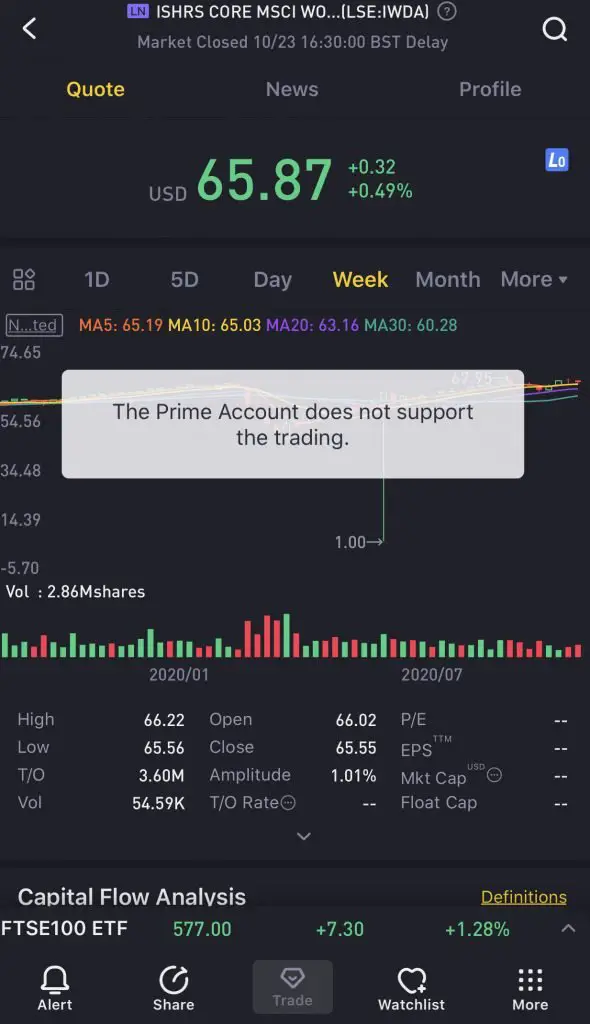

You are unable to trade in the London Stock Exchange (LSE)

You are able to view market data on the London Stock Exchange (LSE) using the app. However, Tiger Brokers does not allow you to make any trades in the LSE.

As such, you are unable to buy the IWDA ETF, which is one of the more popular ETFs on the LSE.

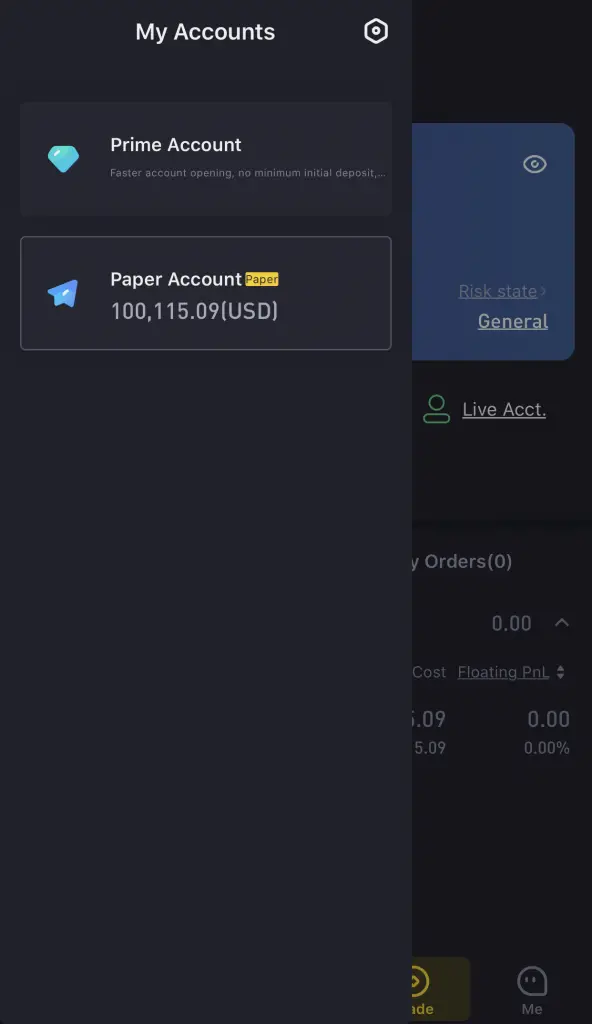

3 different accounts

When you open an account with Tiger Brokers, there are 3 accounts that you’ll have:

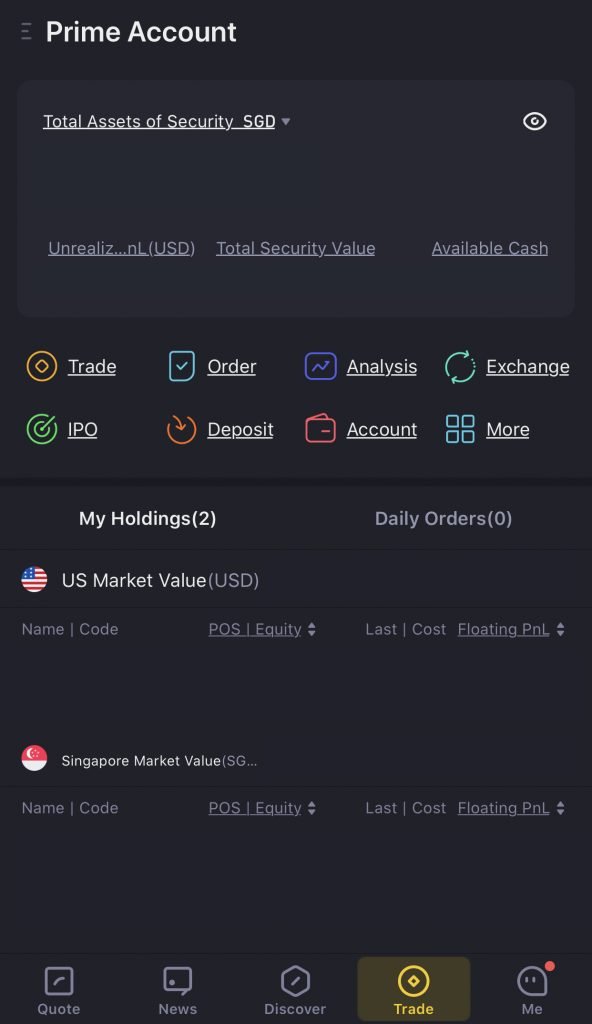

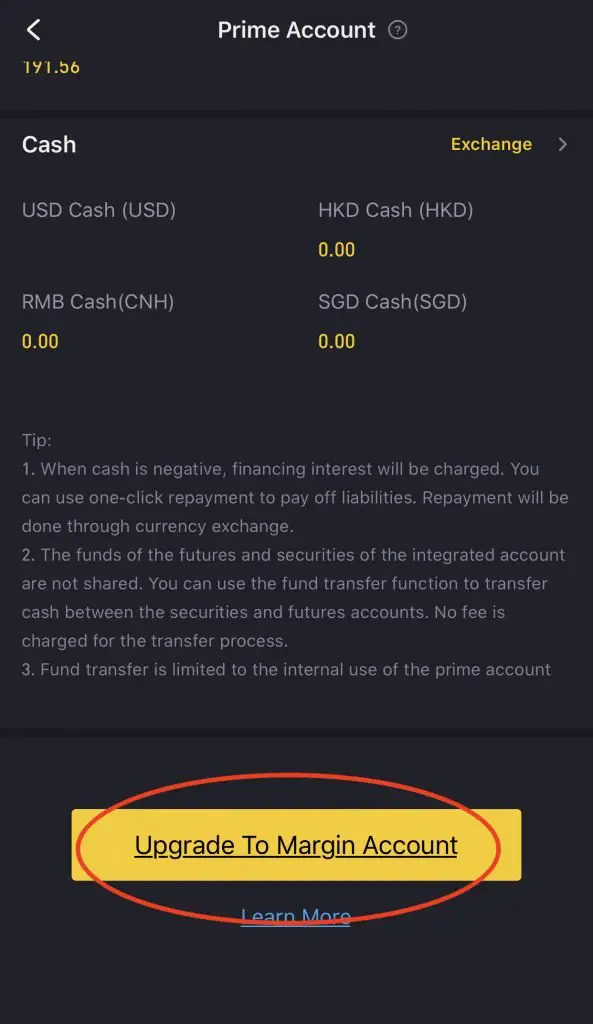

#1 Prime Account

The Prime Account is where you will do all of your actual trading.

Here are some things that you can see in the ‘Trade‘ tab:

- The total value of your assets

- Your Profit or Loss amount

- The value of your stocks and cash available

- Your holdings and daily orders

This is the ‘central hub’ where you can perform any functions related to trading.

Do remember to deposit funds into your account first before starting to trade!

If you wish to perform margin trading, there is an option for you to upgrade your account to a Margin Account.

A margin account allows you to perform:

- Margin trading

- Short selling

There is no limit on the number or frequency of your T+0 trades. For short selling, do note that the daily interest rate will only kick in on ‘Day T+2‘.

Margin trading has lots of risks. If you are a beginner investor, I would not recommend you to create this account.

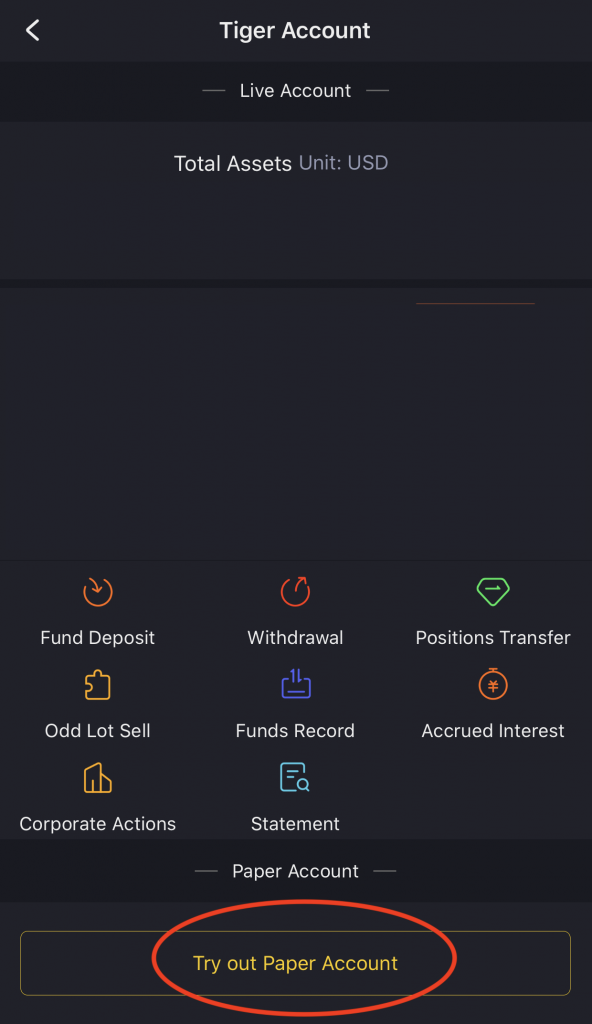

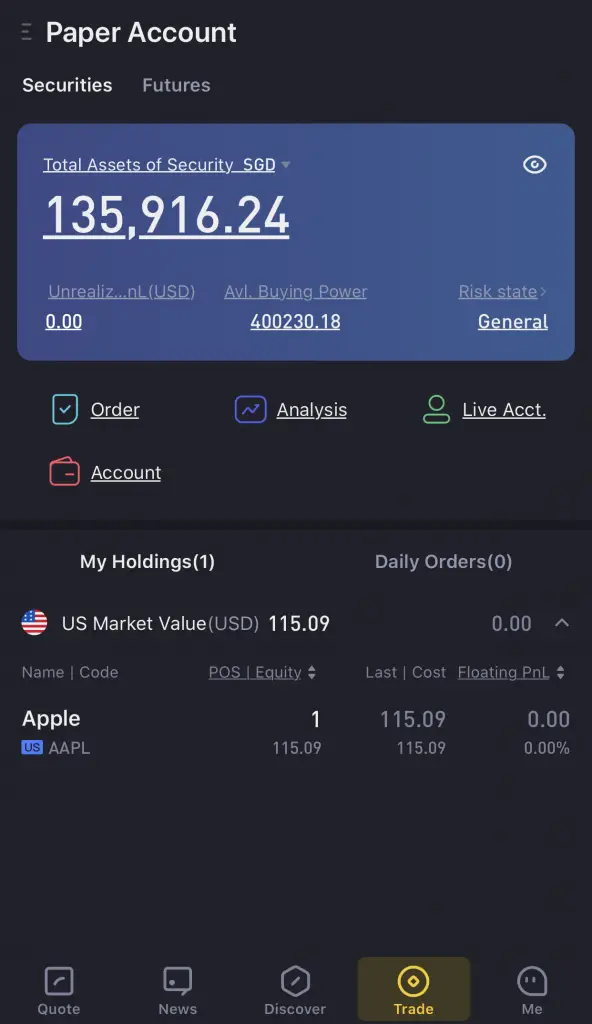

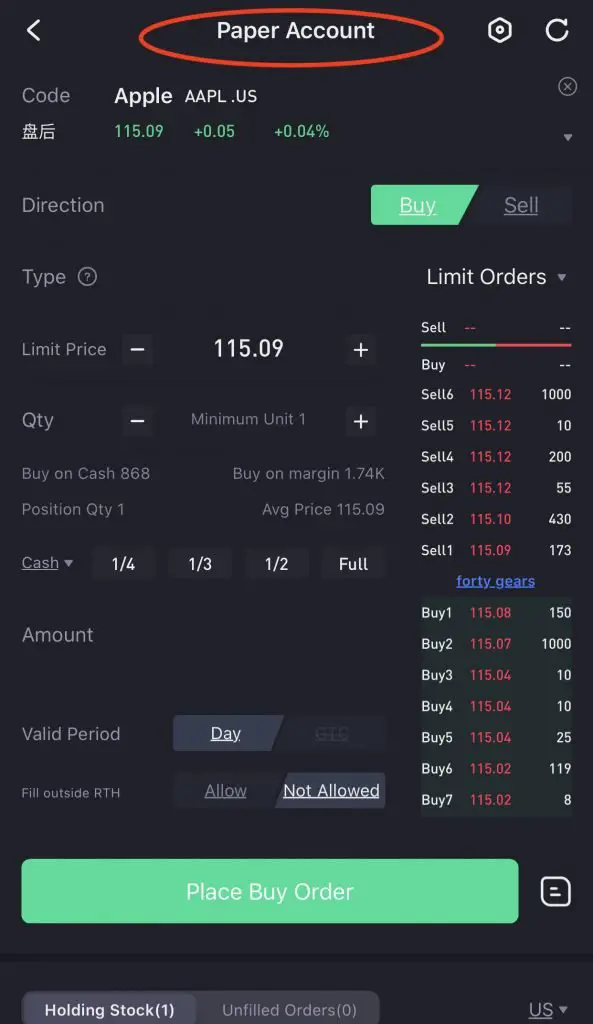

#2 Paper Account

Tiger Brokers allows you to trade with a Paper Account, which is a demo account. You do not use real money and are able to get a feel of how Tiger Brokers works.

You will be given $10,000 USD and one Apple stock to start your virtual trading.

However, you are only able to trade US and HK stocks with your Paper Account!

You can easily switch between your Paper Account and your Prime Account.

The 2 accounts do look rather similar. As such I would suggest to double check which account you’re using before making any trades!

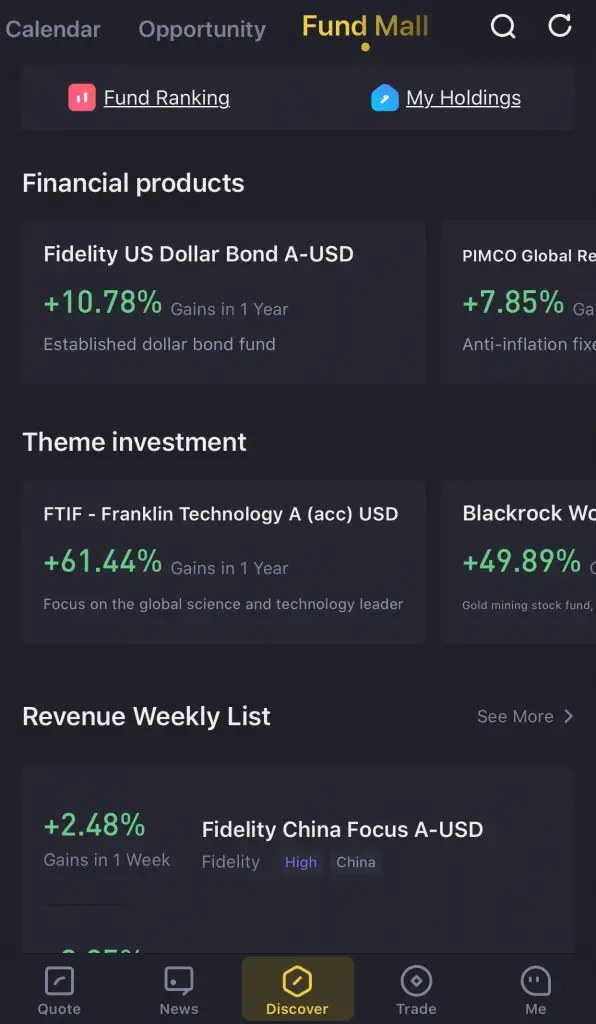

#3 Fund Mall Account

Tiger Brokers offers a Fund Mall, which allows you to invest in a variety of mutual funds. You are able to do a one-time subscription or purchase a regular savings plan.

Besides being able to trade on the markets, you can purchase mutual funds as well on Tiger Brokers.

After choosing the fund that you wish to purchase, you are given 2 options to do so.

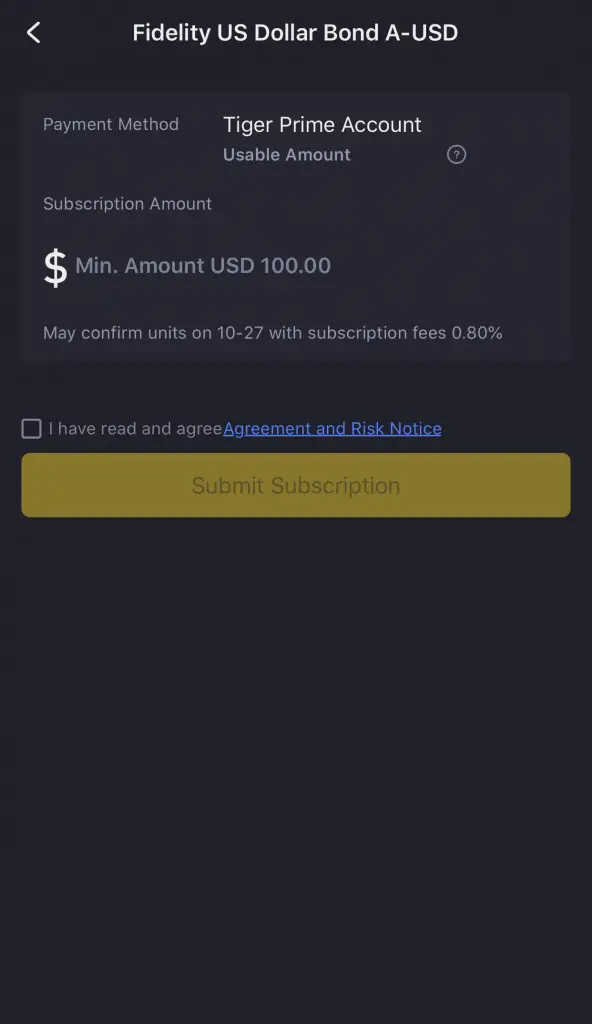

1. Subscribe to the fund

You can choose your investment amount.

Do take note of the subscription fee!

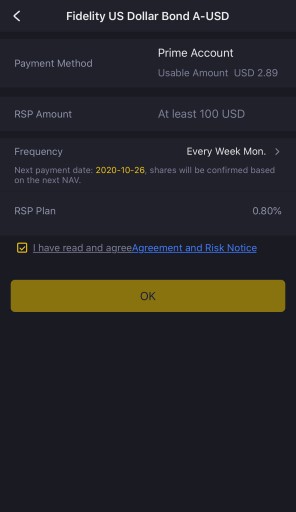

2. Purchase a regular savings plan (RSP)

Tiger Brokers only offers a regular savings plan for funds as of now.

You can choose the amount you wish to purchase and the frequency.

Currency and minimum trade amount

The currency used in Fund Mall is USD, and the minimum trade amount is $100 (for both lump sum and RSP subscriptions).

Fund purchase timeline

Here is the timeline of your fund’s purchase when the buy order is placed on a business day (Day T):

If the order is made at 11am or before

The order will be accepted on the same day (T), with the units purchased using the fund’s NAV on the next day (T+1). The order will be completed on T+4.

If the order is made after 11am

The order will be accepted on the next day (T+1), with the units purchased using the fund’s NAV on the following day (T+2). The order will be completed on T+5.

If the fund was purchased on a non-business day, it will be processed accordingly starting from the next business day.

No fractional shares

Unlike some brokerages, Tiger Brokers does not allow you to purchase fractional shares.

A fractional share is a portion of one full share.

For example, if a share costs $100 and you can only invest $10, you will only receive 0.1 units of that share.

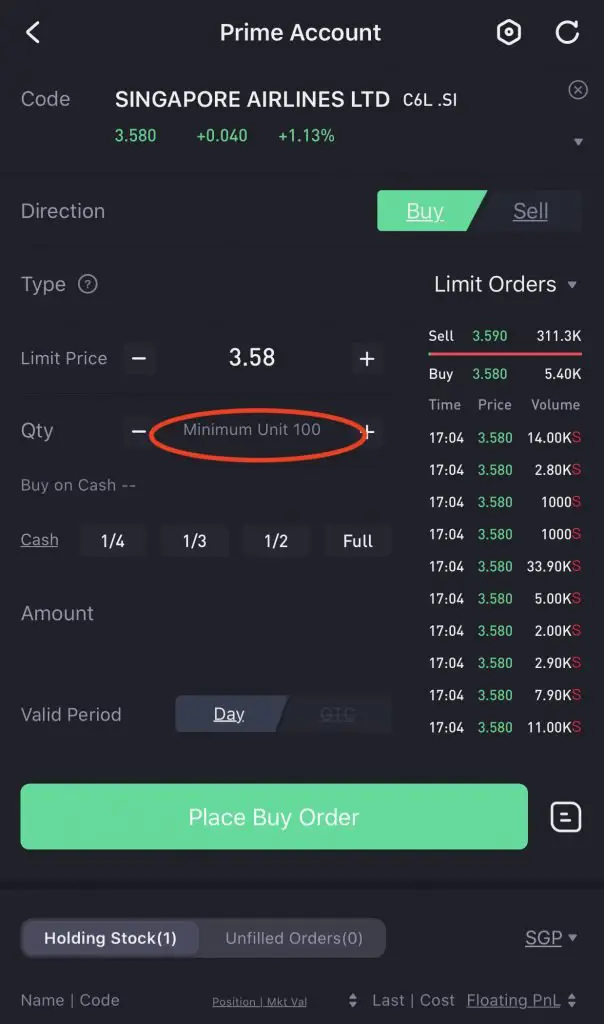

Tiger Brokers only allows you to purchase the minimum unit size. This depends on the market that you wish to invest in.

For example, the Singapore Exchange (SGX) has a minimum unit size of 100.

This means that you can only buy 100 units of that stock, and subsequent multiples of 100 units. However, other products listed on the SGX may have a different lot size.

Here are the lot sizes for each market:

| Market | Minimum Unit Size |

|---|---|

| US | 1 |

| HK | Min 100 shares (depends on stock price) |

| Singapore | 5-100 (depending on product) |

| China | 100 |

| Australia | 1 |

You are unable to make full use of the entire amount that you have in your Prime Account.

This is something you’ll need to take note of as some of your spare cash may just be lying around.

Reasonable exchange rate

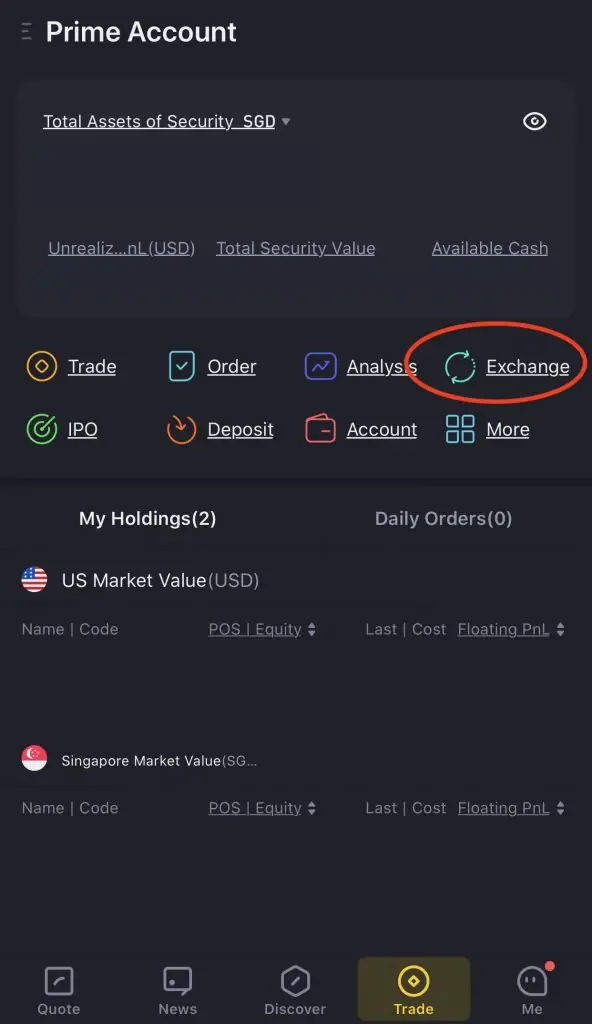

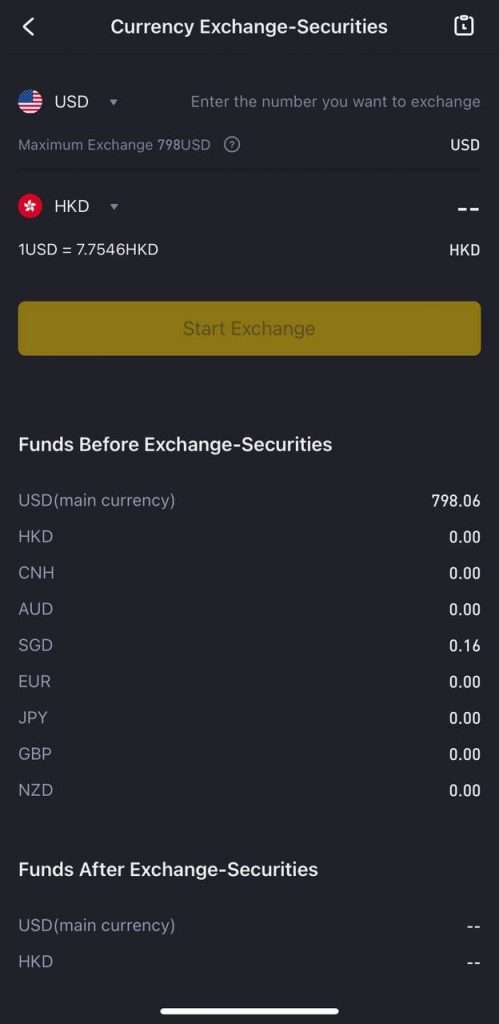

Tiger Brokers allows you to exchange currencies in the app itself.

The good thing is that Tiger Brokers does not charge you any fees for making a currency exchange!

Here are the 9 different currencies that you can trade:

- USD

- HKD

- CNH (Chinese Yuan)

- AUD

- SGD

- EUR

- JPY

- GBP

- NZD

Dividend crediting

Some of the stocks that you own may issue dividends. These dividends will be credited straight to your Prime Account.

Depending on the market that you’re trading in, you may incur a dividend withholding tax.

| Market | Dividend Tax |

|---|---|

| US | 10-30% |

| Australia | 10% |

| HK, SG, China | 0% |

This tax will be deducted before the dividends are credited to your account. After receiving your dividends, you can choose to either:

- Reinvest your dividends

- Withdraw them to your bank account

For mutual funds in Fund Mall, any periodic dividends will be deposited in your Fund Mall account within 4 days after the dividend distribution date.

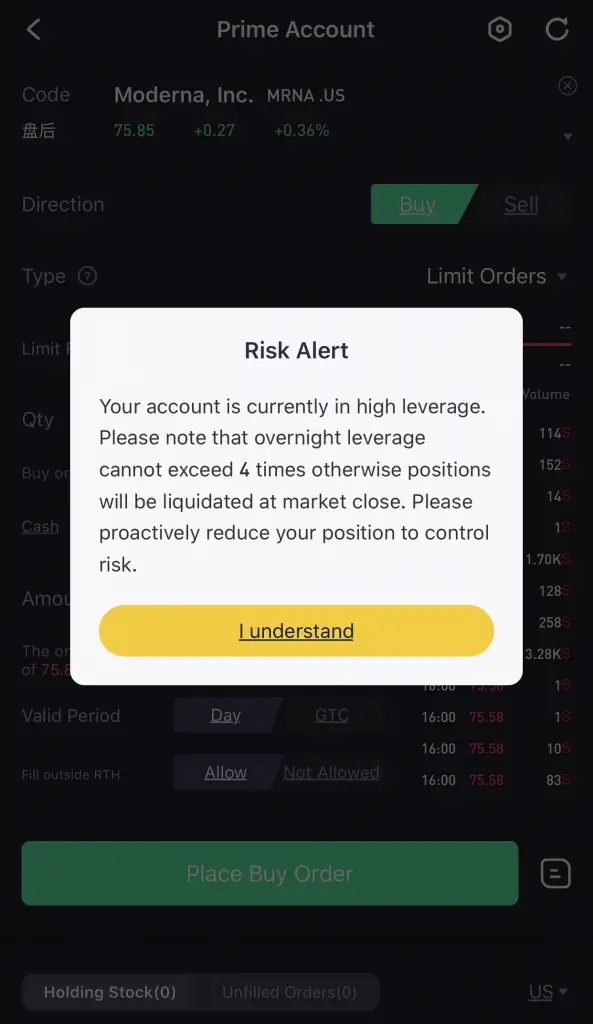

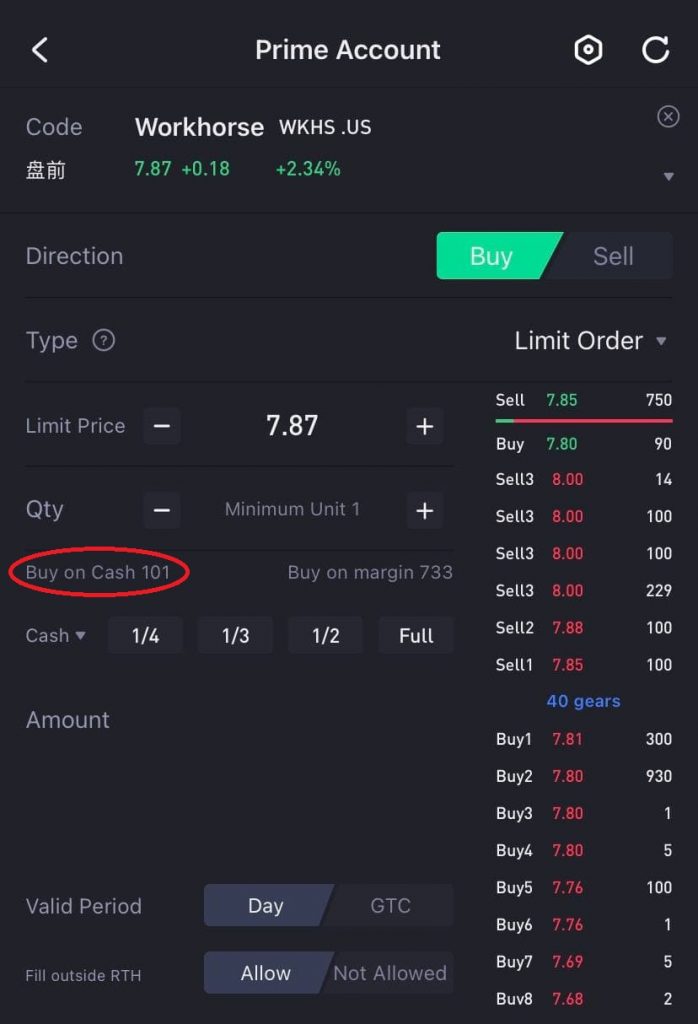

Leverage

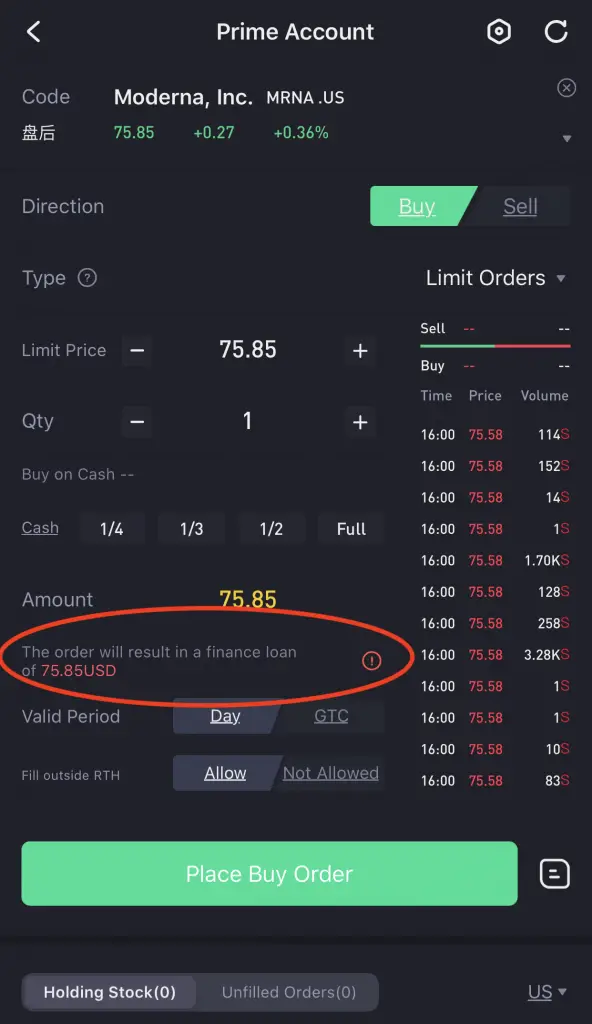

If you do not have enough funds to invest, you may borrow from Tiger Brokers as leverage.

However, the leverage charges are quite high.

If you do not have enough funds in your trading currency, Tiger Brokers will first attempt to finance the order using your cash balance from different currencies (eg SGD).

If the total cash balance in all currency forms is insufficient, you will go into leverage!

As such, I would advise you to check the amount of stock you can buy with cash before you start trading.

Tiger Brokers does not allow SRS or CPF investments

One disadvantage is that Tiger Brokers only allows you to invest your cash. You are unable to invest either your CPF or SRS funds with this broker.

This is such a waste as the trading commissions are really low! Hopefully they will be able to add this feature in the future.

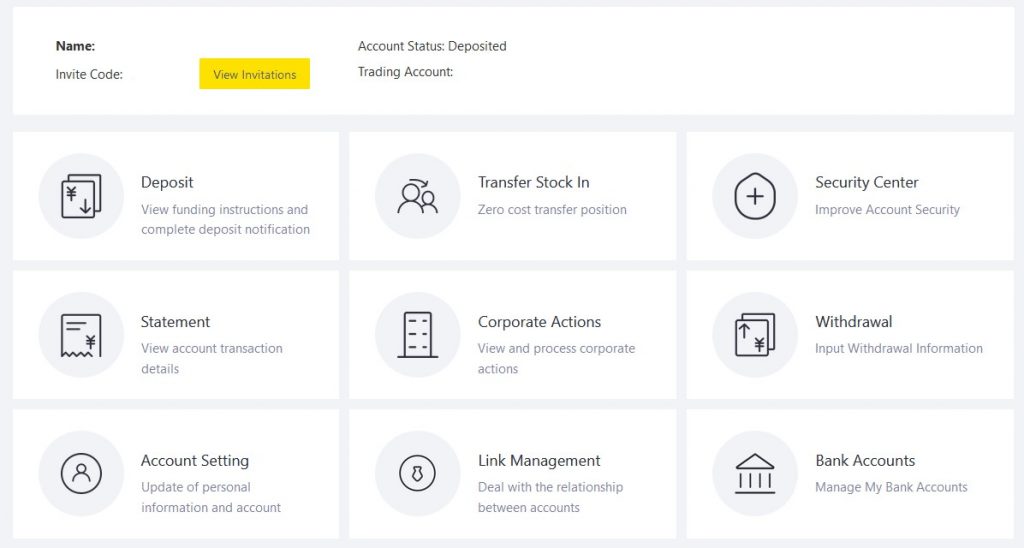

How do I deposit and withdraw my funds from Tiger Brokers?

Tiger Brokers has a rather easy process to deposit and withdraw funds from your Prime Account.

How to deposit your funds into Tiger Brokers

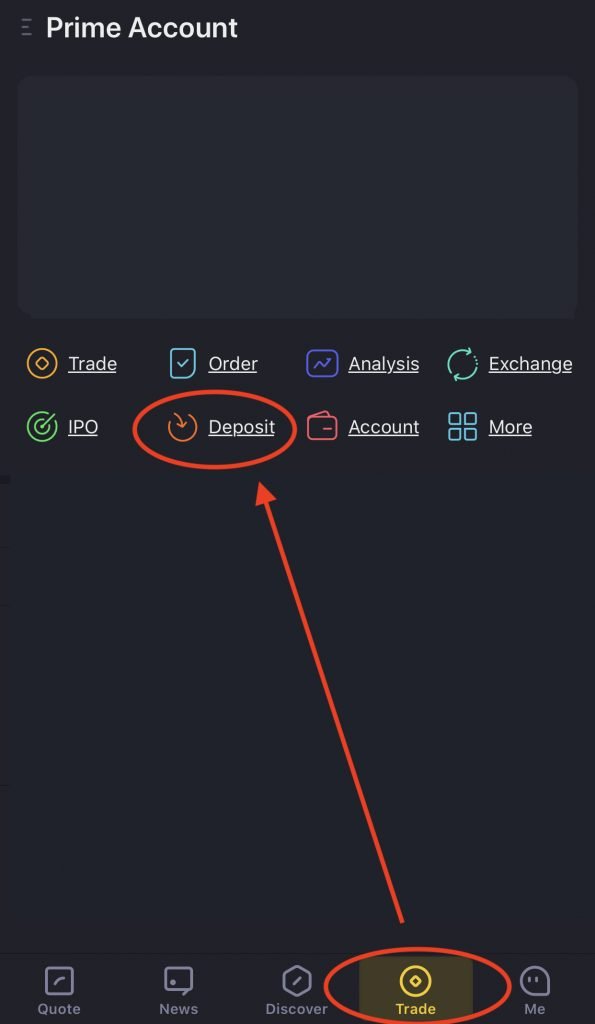

Here’s what you need to do to deposit your funds into Tiger Brokers:

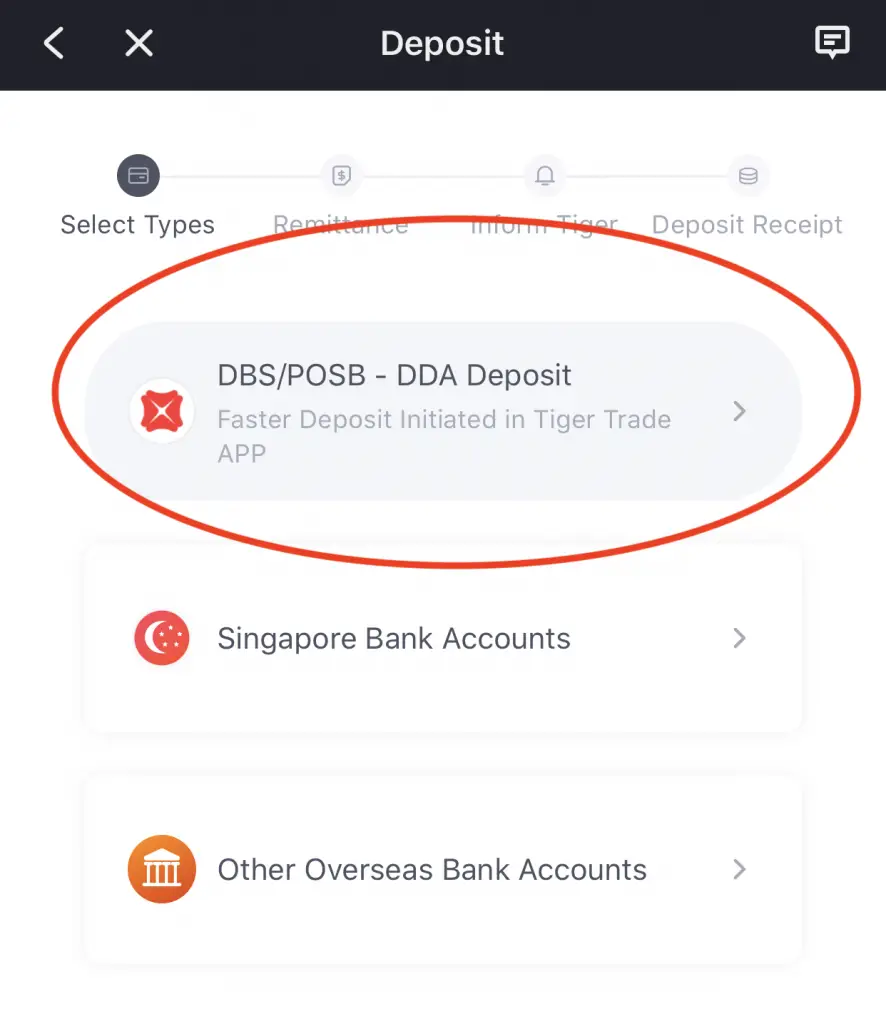

- Go to ‘Trade → Deposit‘

- Choose the currency you wish to deposit

- Transfer the money to Tiger Brokers’ account

- Inform Tiger Brokers about your funds transfer

- Receive a notification on your successful deposit

#1 Go to ‘Trade → Deposit‘

To start trading with Tiger Brokers, you’ll need to deposit funds into your Prime Account. There is no minimum amount that you are required to deposit into your Prime Account.

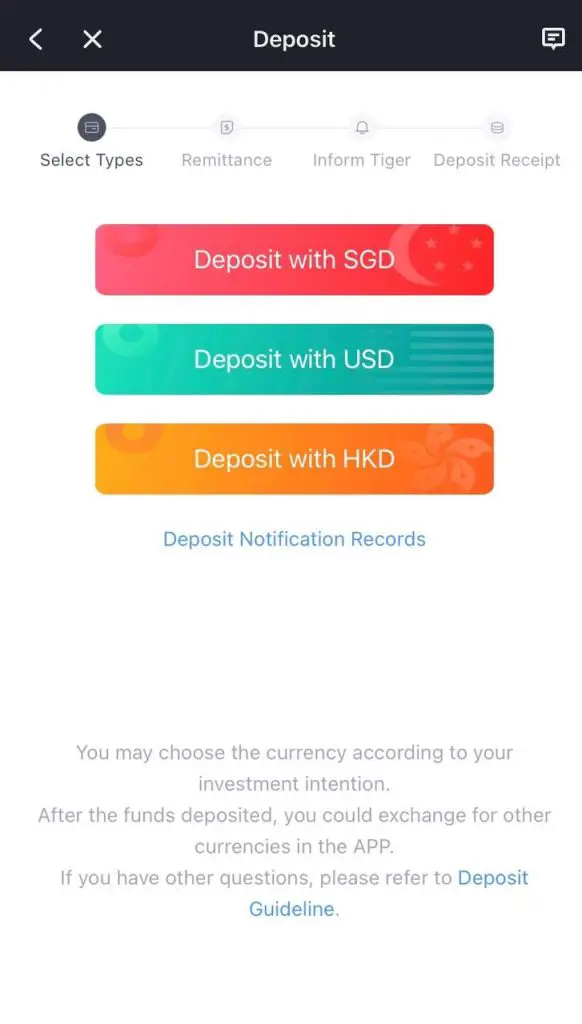

#2 Choose the currency you wish to deposit

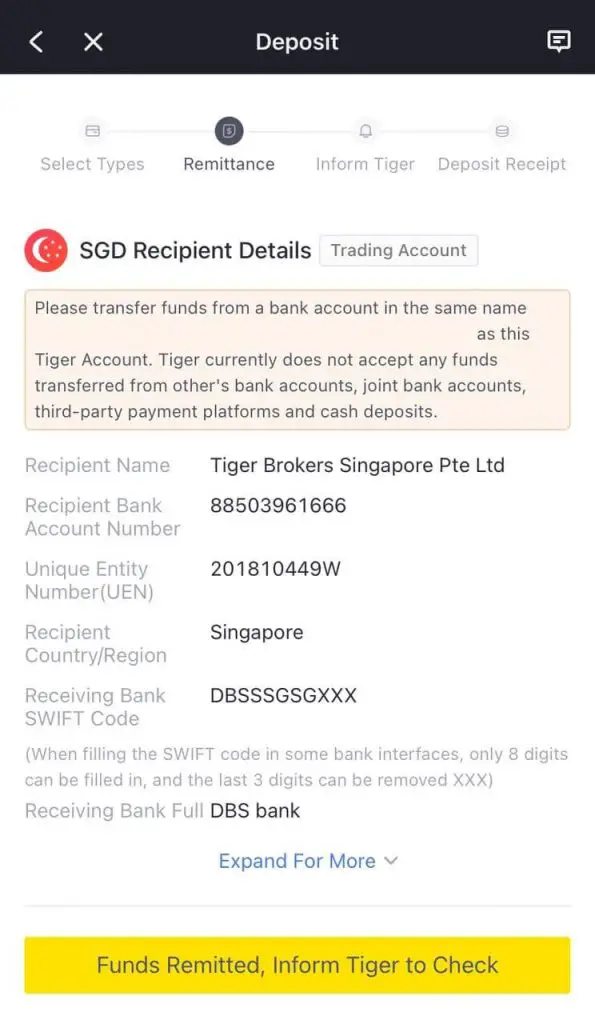

#3 Transfer the money to Tiger Brokers’ account

You will need to transfer your funds to Tiger Brokers’ DBS account.

You are only able to deposit funds from bank accounts that are under your own name.

It is possible for you to transfer your funds via PayNow by using Tiger Brokers’ UEN.

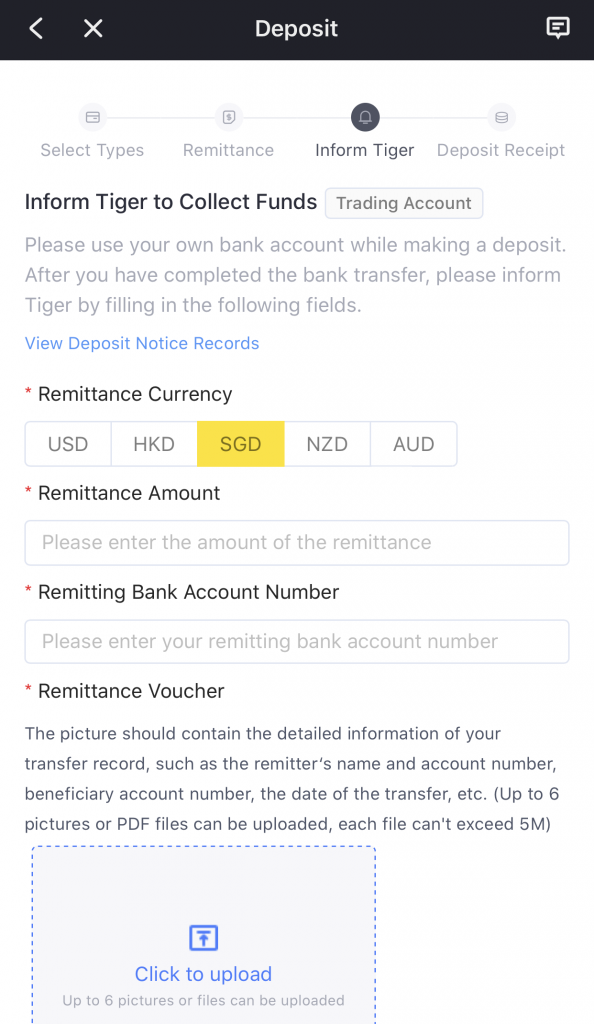

#4 Inform Tiger Brokers about your funds transfer

To speed up the deposit process, you will need to fill up this form below.

Tiger Brokers will then acknowledge that they have received your deposit request.

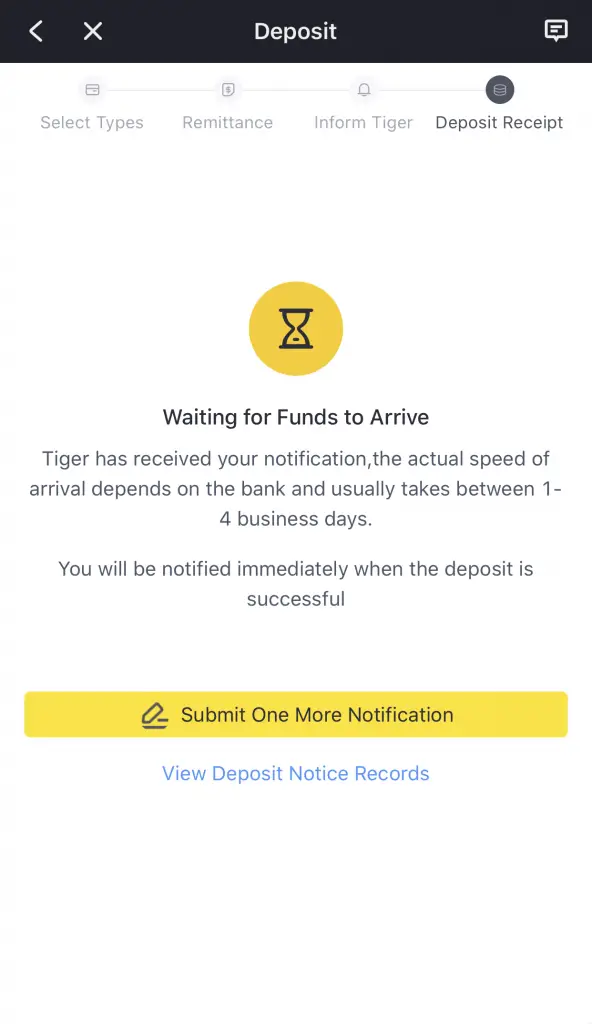

#5 Receive a notification on your successful deposit

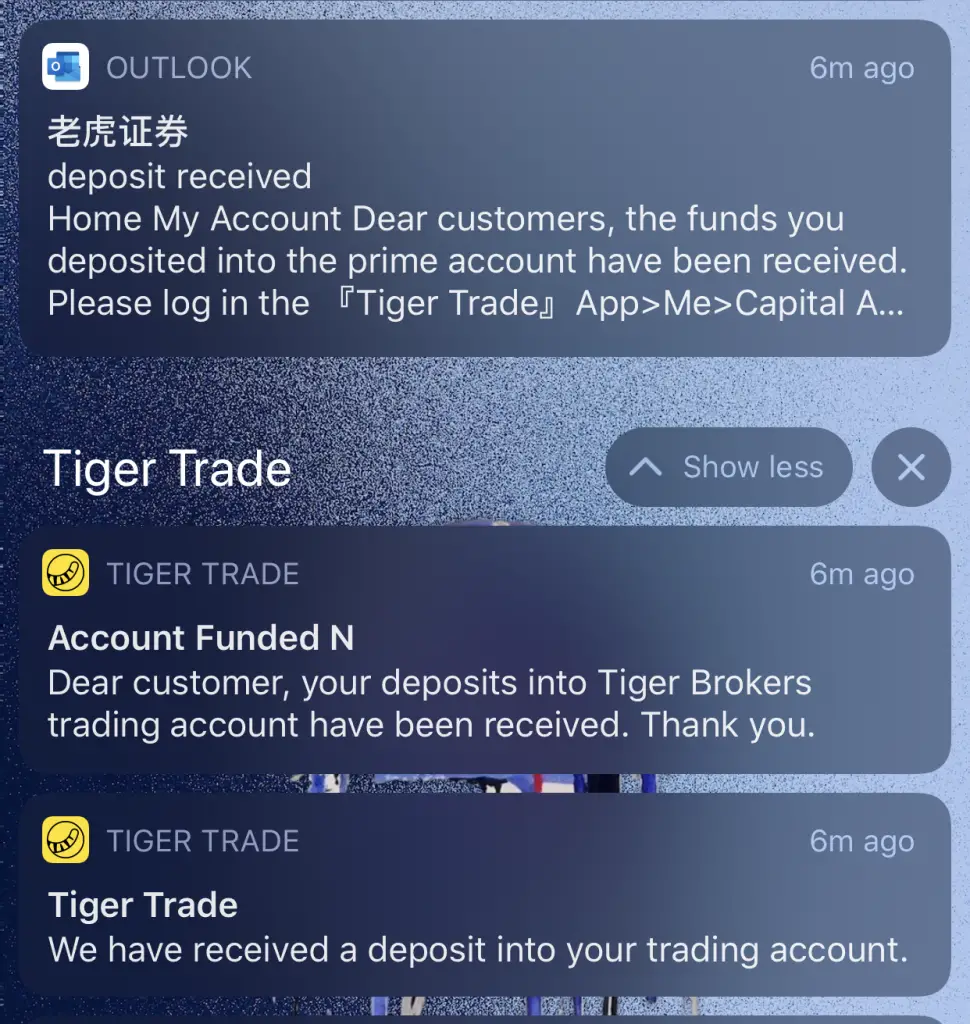

When your funds have been deposited into your Prime Account, you will receive a notification via the app and email.

I deposited my funds on a Tuesday afternoon. Within 2 hours, my funds were deposited into my Prime Account.

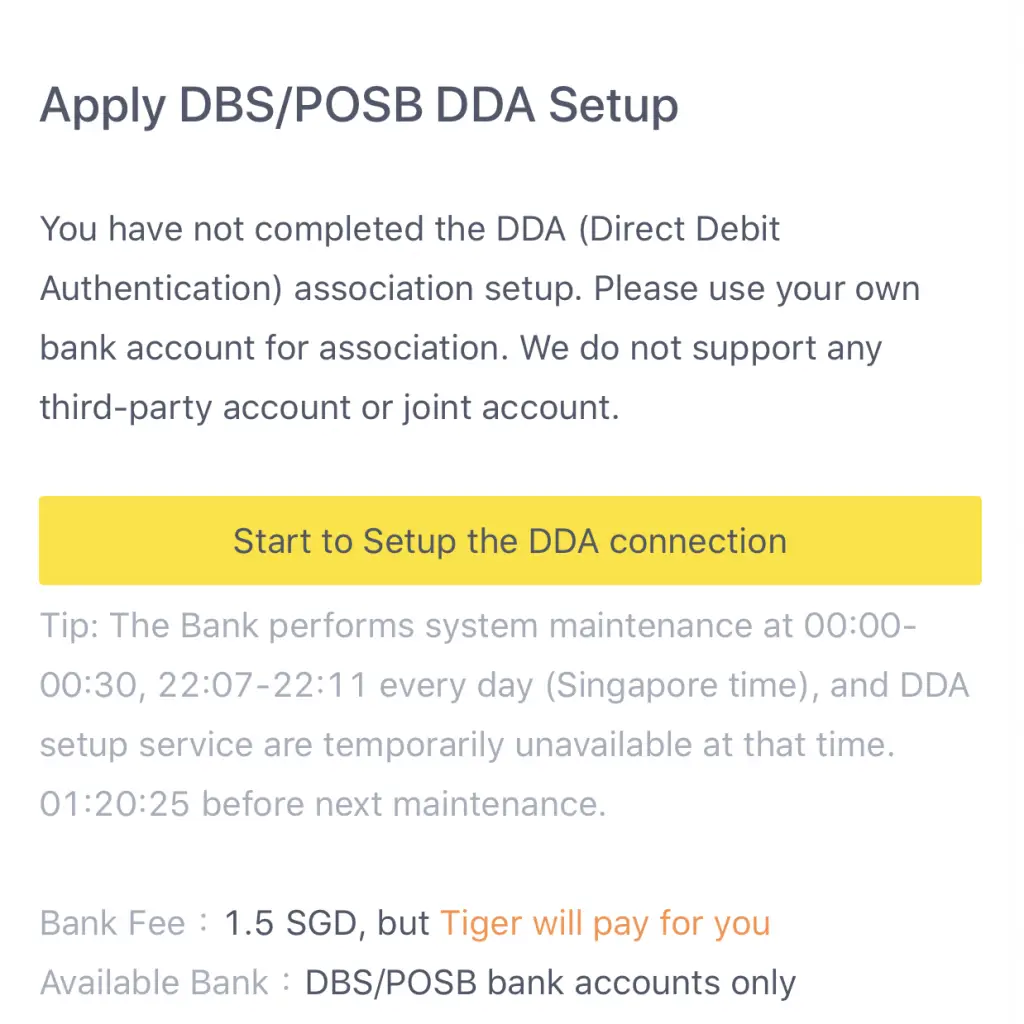

Direct debit via DBS / POSB account

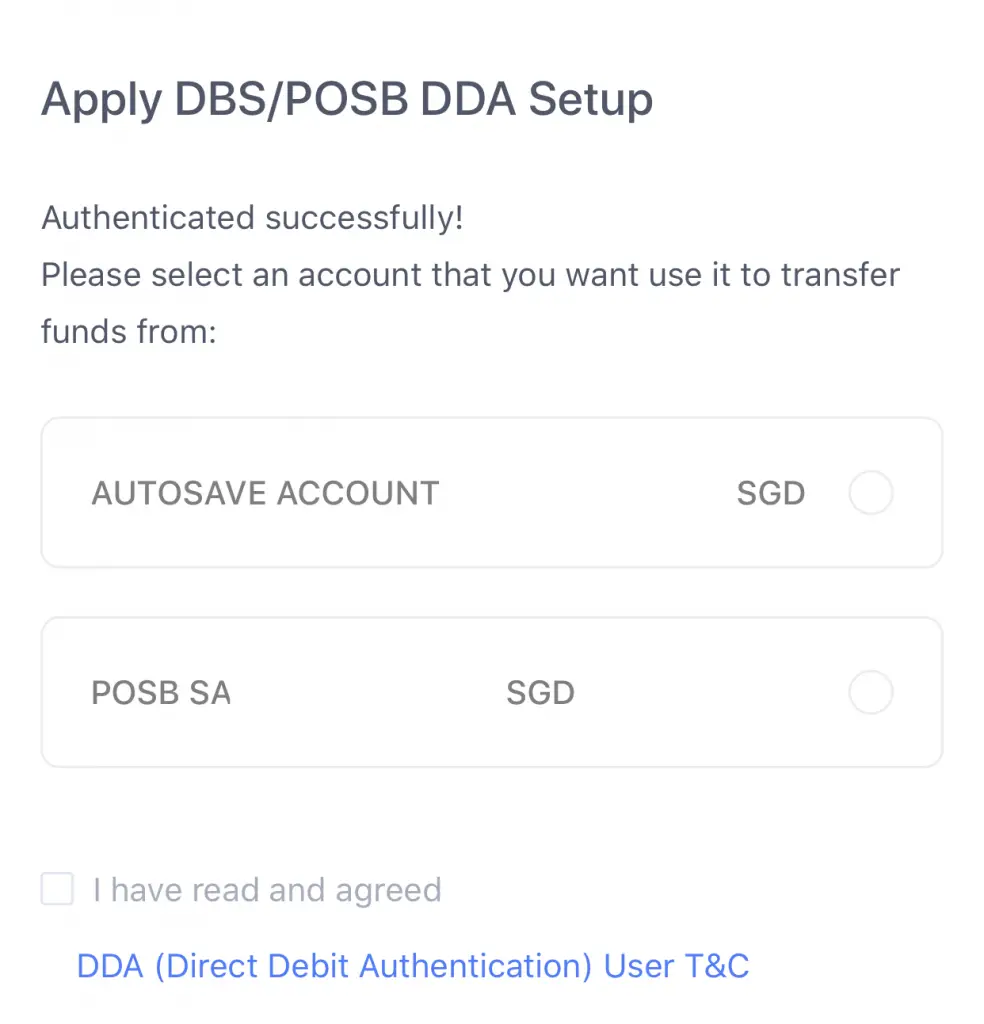

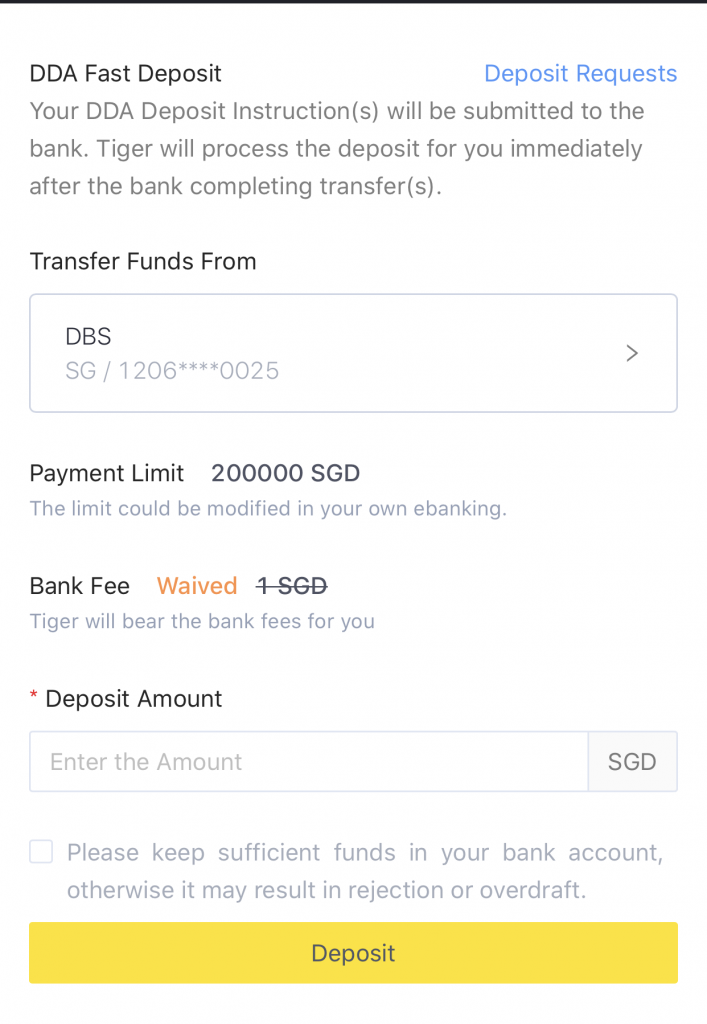

You are able to perform a direct debit from your DBS or POSB bank accounts to your Prime Account. Through this method, you are able to transfer funds more quickly into Tiger Brokers, without incurring additional fees.

You will need to set up the direct debit,

select the account you wish to debit from,

and you’re done!

You can start to directly debit money from your DBS or POSB bank account.

There is a bank fee that is charged for each debit, but Tiger Brokers will pay that fee for you.

Deposit fees

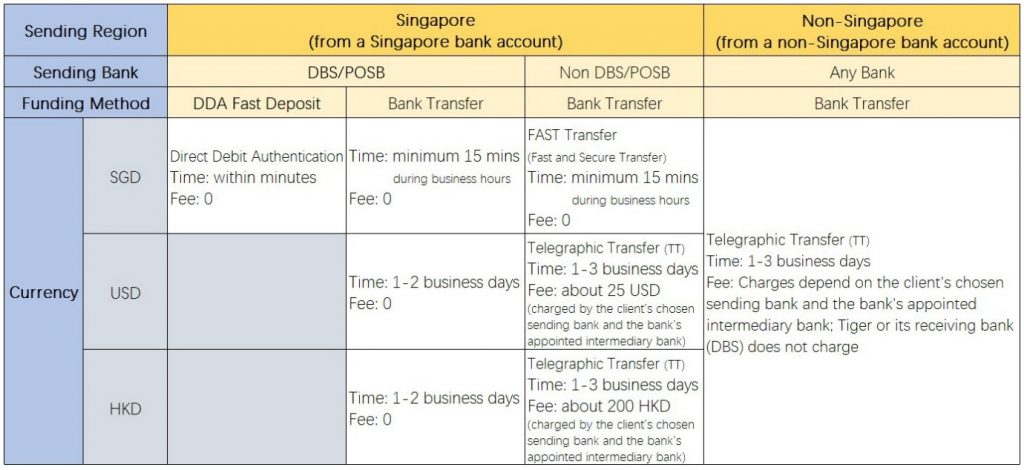

Tiger Brokers may charge you a fee for depositing funds into your Prime Account. Here are the fees that they will charge:

The safest will be to deposit SGD from a Singapore bank account. That way, you will not incur any fees when you deposit your funds.

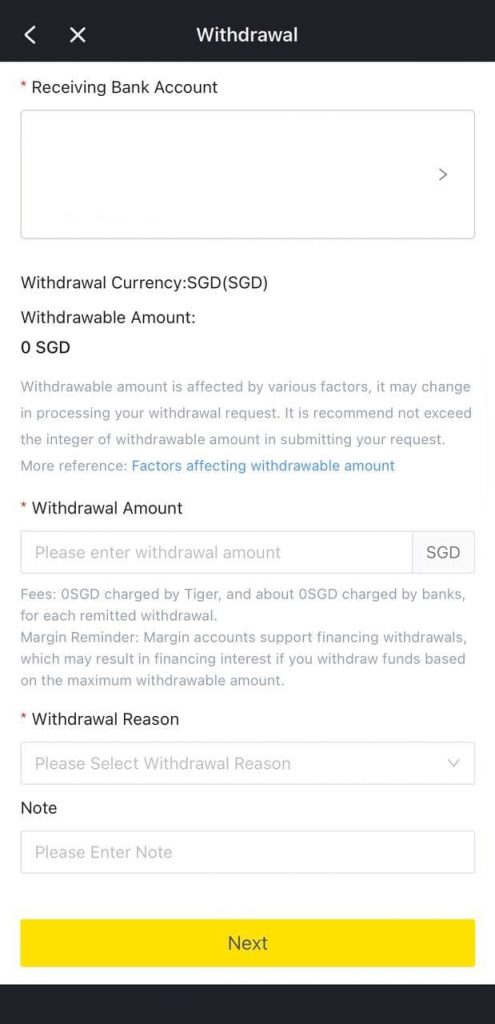

How to withdraw from Tiger Brokers

Here’s what you need to do to withdraw your funds from Tiger Brokers:

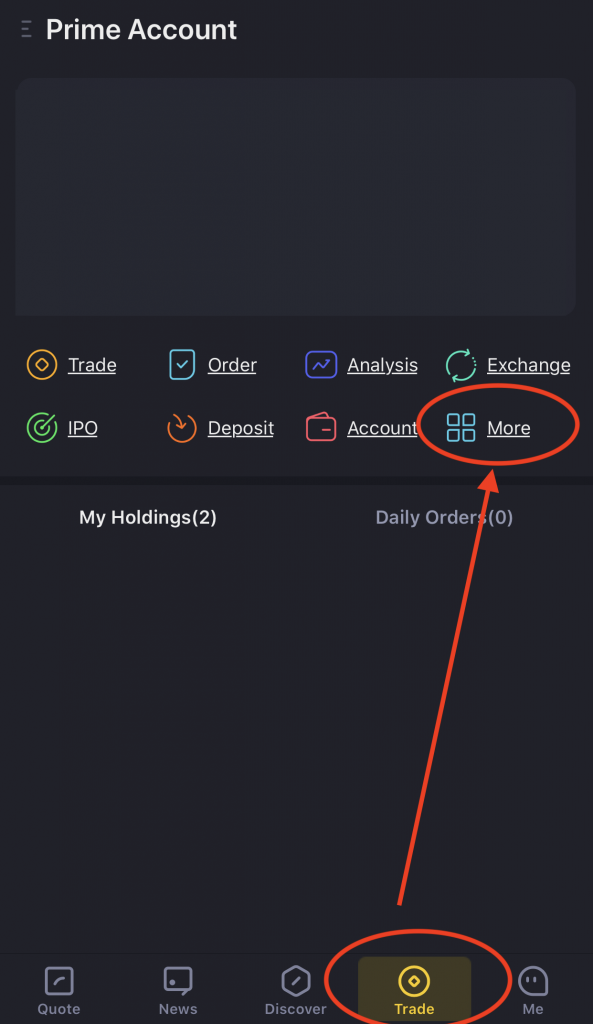

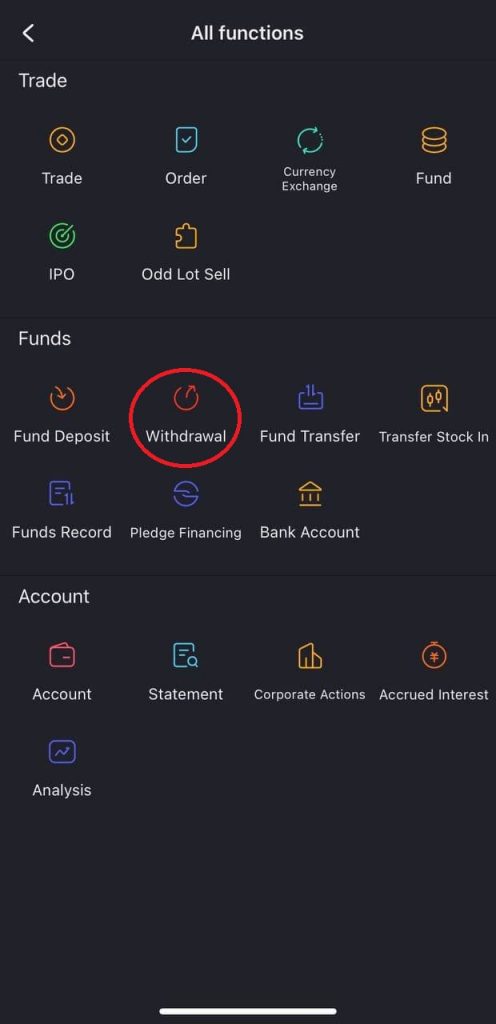

- Go to ‘Trade → More → Withdrawal’

- Select the currency type you want to withdraw in

- Add a receiving bank account

- Select your withdrawal amount and reason

- Email your bank statement to Tiger Brokers

- Receive the funds in your bank account

#1 Go to ‘Trade → More → Withdrawal’

#2 Select the currency type you want to withdraw in

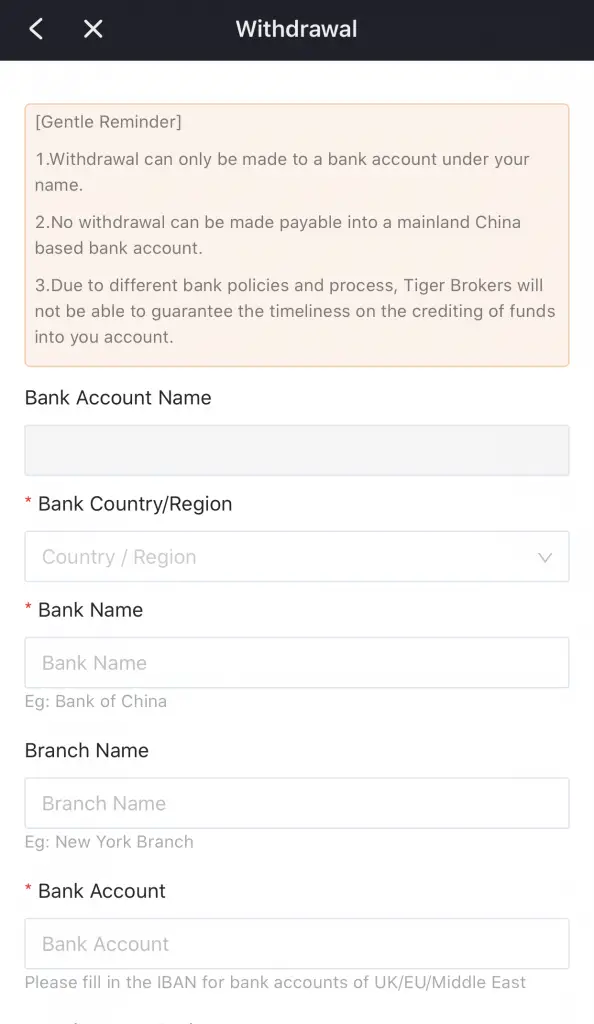

#3 Add a receiving bank account

If you are withdrawing funds for the first time, you will need to add the details of the bank account that you’d like to withdraw to.

#4 Select your withdrawal amount and reason

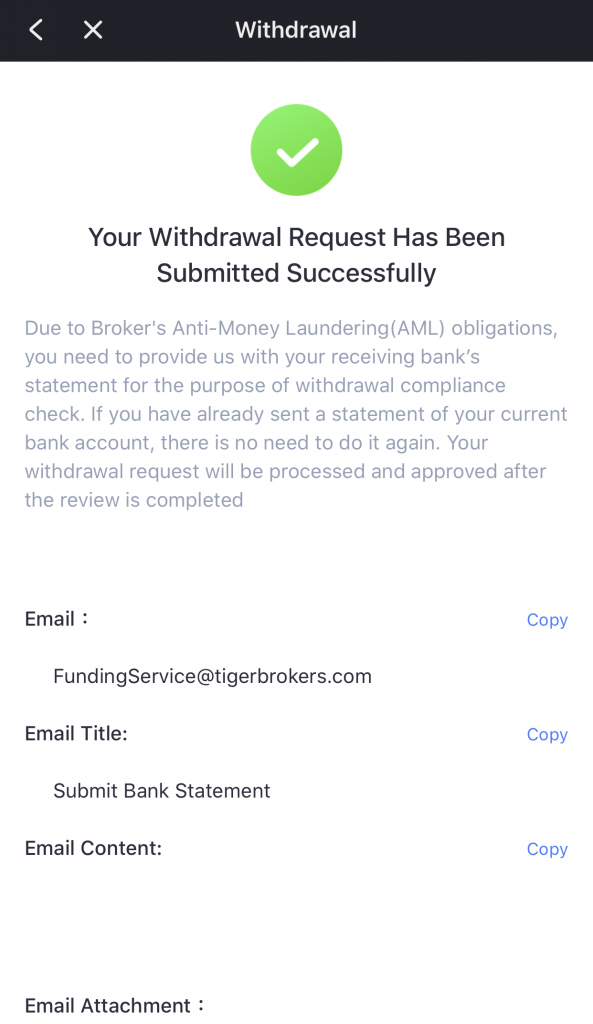

#5 Email your bank statement to Tiger Brokers

If this is the first time you are withdrawing funds, you will need to provide proof that this account belongs to you.

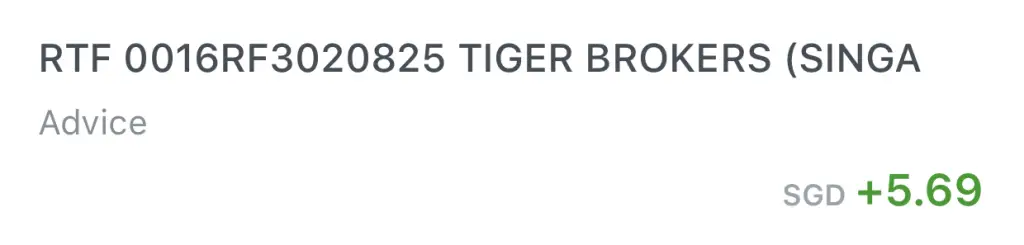

#6 Receive the funds in your bank account

After sending my first withdrawal request, the funds were transferred to my account the next day.

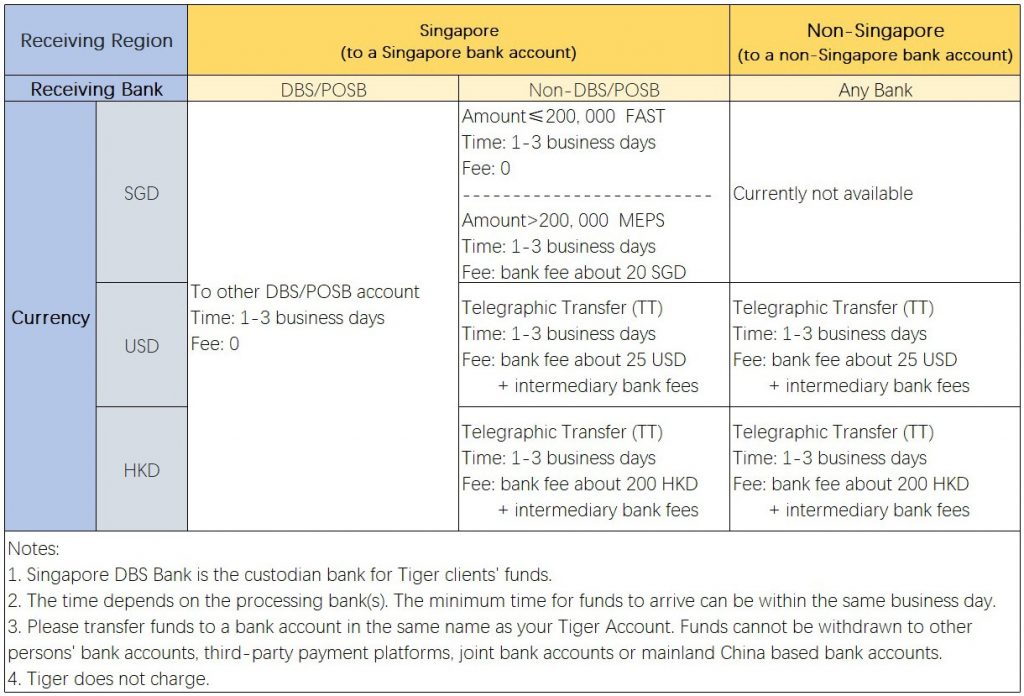

Withdrawal fees

Based on the bank account you are withdrawing to and the currency, you may incur some withdrawal fees. Here are the fees that Tiger Brokers charges:

The safest would be to withdraw your funds to a DBS / POSB account!

How do I make a trade with Tiger Brokers?

Here’s a step-by-step guide on making trades using Tiger Brokers:

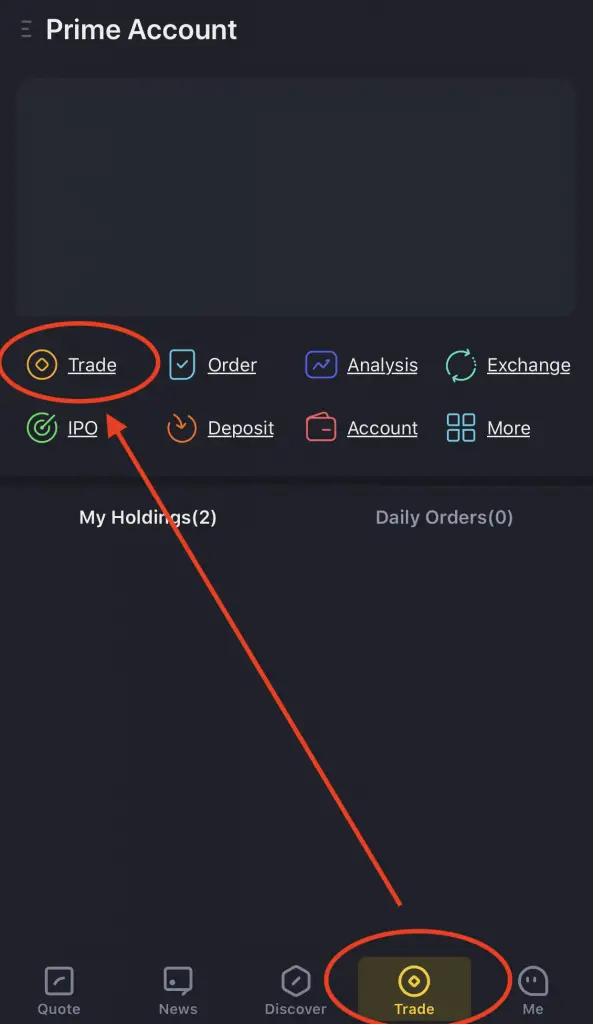

#1 Go to ‘Trade → Trade‘

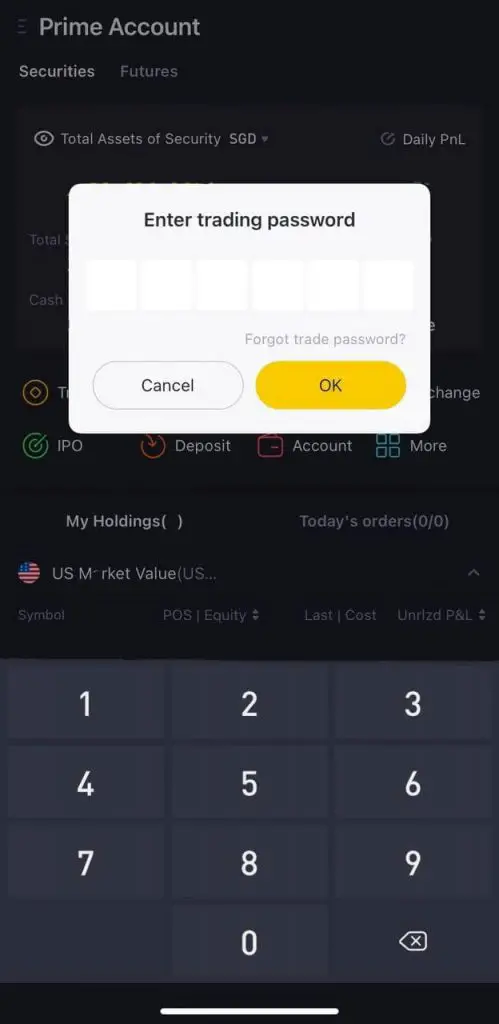

#2 Enter your Trading Password

If your phone is Face ID enabled, you may also enable Face ID on Tiger Trade for quicker authentication.

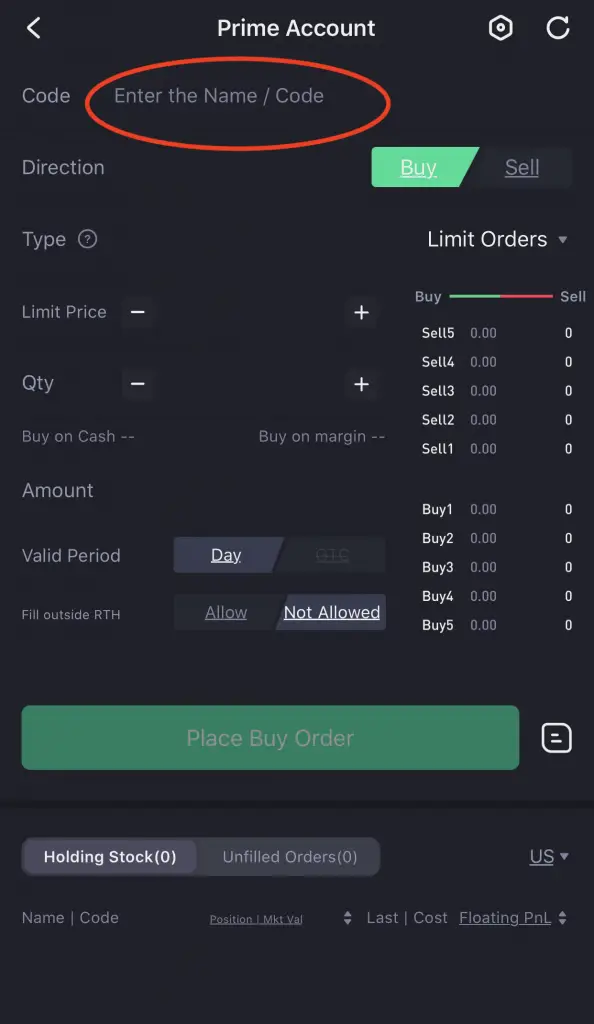

#3 Select the stock you wish to trade

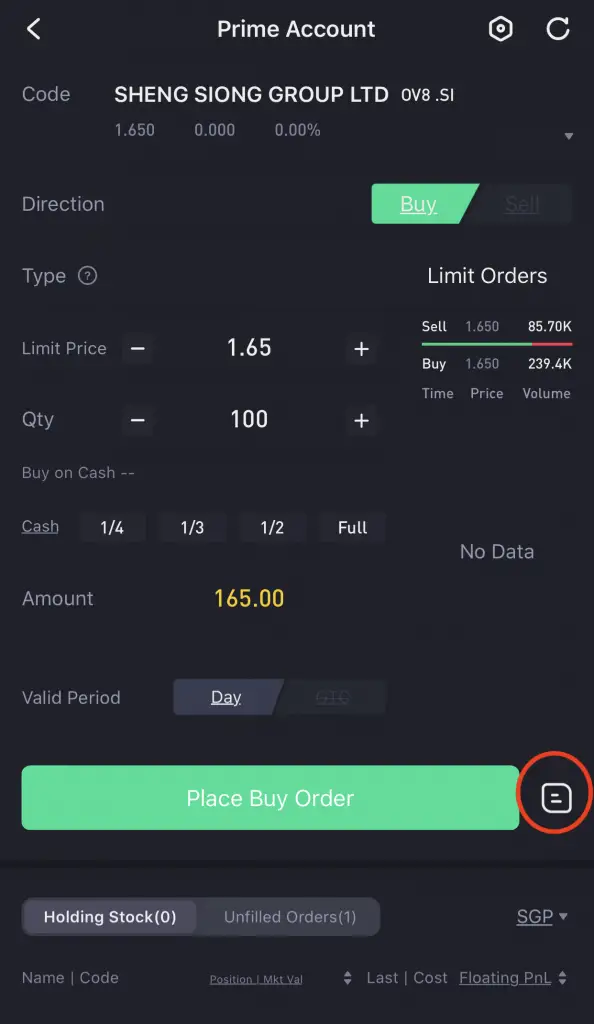

#4 Select the number of units you wish to trade

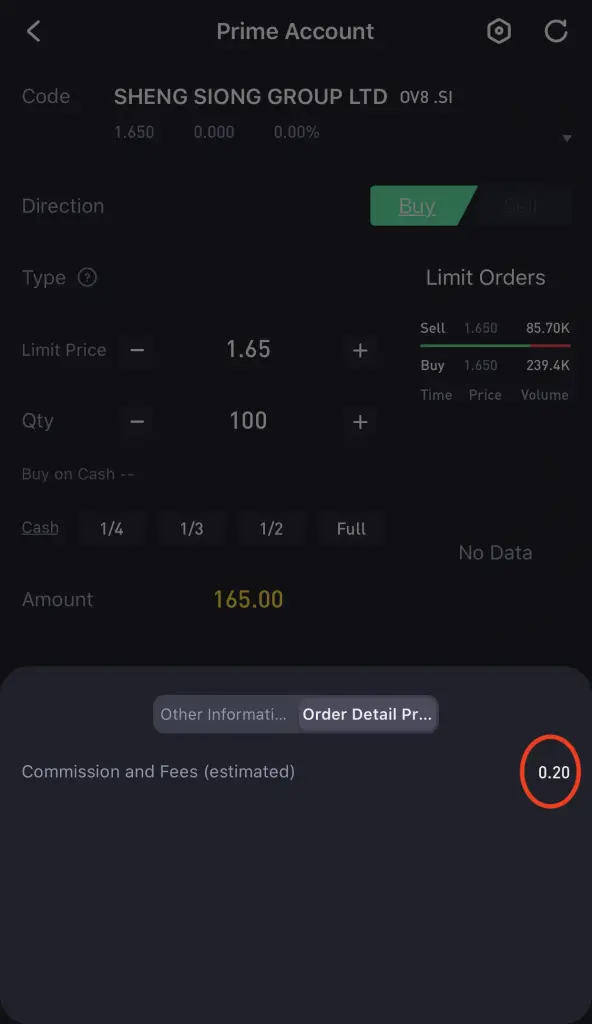

For this example, I purchased 100 units of Sheng Siong.

Disclaimer: This does not constitute as investment advice

Tiger Brokers does not show you the fees you incur before you place the order.

However, you are able to view the estimated fees by tapping on the icon beside the ‘Place Buy Order‘ as circled above.

For SGX-listed stocks, the commissions will be 0.12% of your trade value. The minimum of SGD$2.88 has been waived until 31 December 2021.

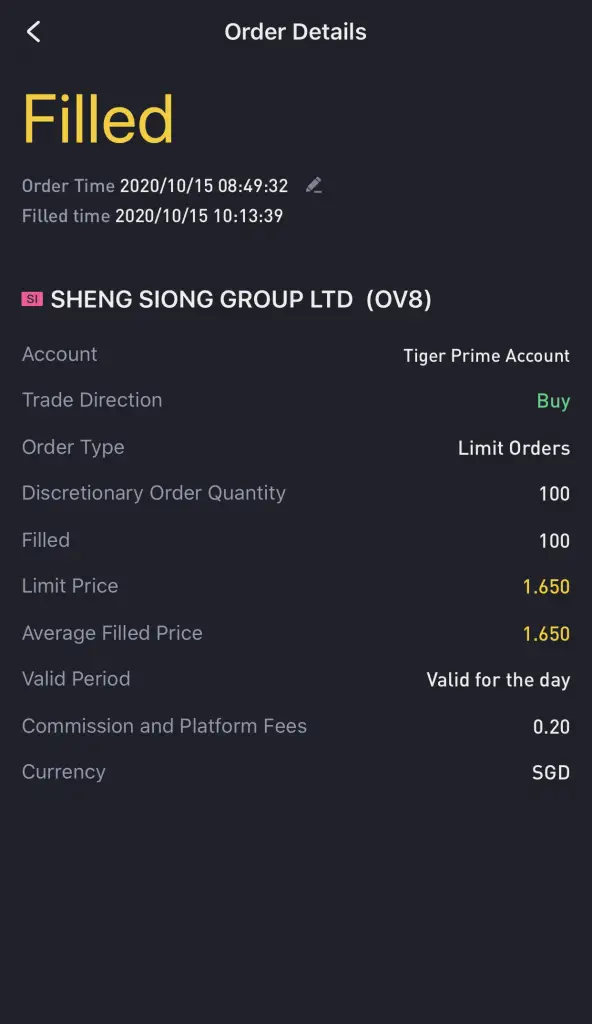

#5 Review order

You can review the order that you’ve made.

The holdings will be credited once the order goes through.

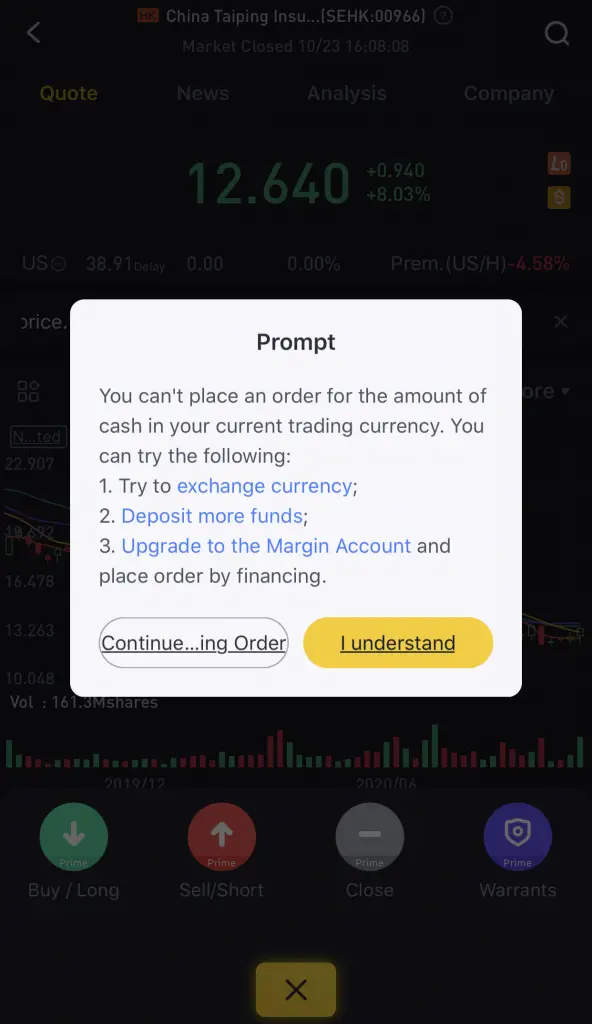

If you do not have enough money to make the trade, you will get this error message:

There are 3 things you will need to do to prevent incurring leverage:

- Exchange your other funds to the stock’s currency

- Deposit more funds

- Upgrade to a Margin Account

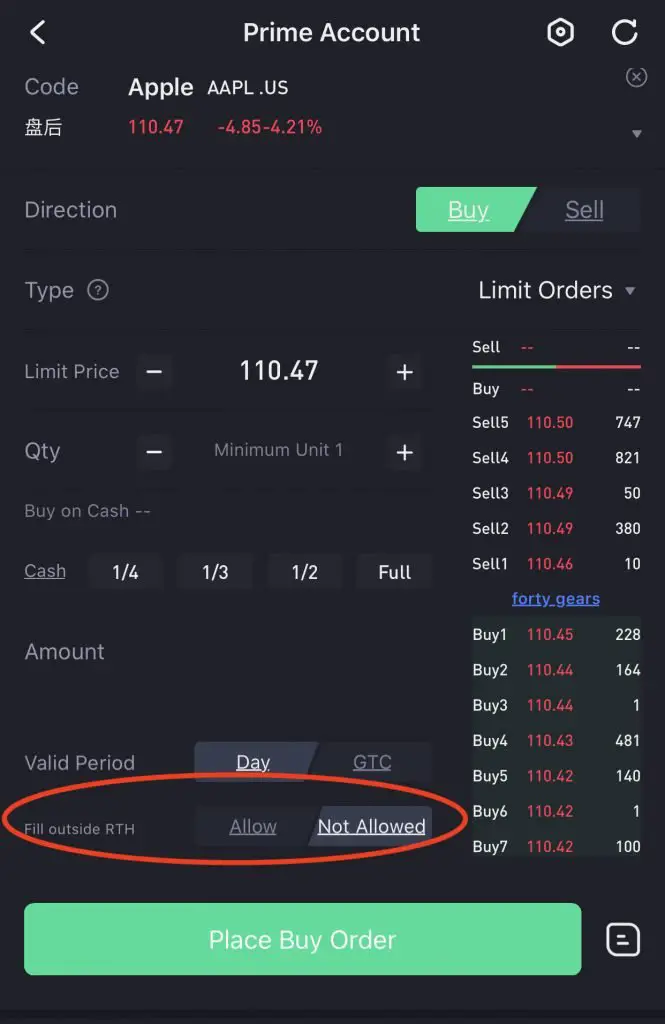

Pre-market trading

Tiger Brokers allows you to perform pre-market and aftermarket trading in the US markets. You are able to buy and sell your stocks before the actual US markets open at 2130 (GMT +8).

Here are the US market trading times in SGT (GMT +8):

| Trading Period | Timing |

|---|---|

| Premarket | 1600-2130 |

| Regular Trading | 2130-0400 |

| Aftermarket | 0400-0800 |

To take part in pre- and aftermarket trading, you can tap ‘Allow’ on the ‘Fill outside RTH‘ field.

RTH stands for regular trading hours.

However, there are some things to note if you wish to do pre-market trading:

- There may be reduced liquidity

- There may be increased volatility

Pre-market trading is very risky, so I would not recommend it if you are a beginner investor!

What are the fees to trade with Tiger Brokers?

Here are the fees that Tiger Brokers charges:

Trading fees

You will incur a trading fee for every buy or sell order that you make. Here are the commissions that Tiger Brokers charges, based on the market that you’re buying in:

| Market | Fee | Minimum Fee |

|---|---|---|

| US | 0.01 USD/share | 1.99 USD/trade |

| HK | 0.06% * trade value | 15 HKD/trade |

| SG | 0.08% * trade value | No minimum (until 31 Dec 2021) 2.88 SGD/trade (after 31 Dec 2021) |

| China | 0.06% * trade value | 15 CNH/trade |

| AUS | 0.1% * trade value | 8 AUD/trade |

You may want to take note of the minimum fee! The fee can be quite high, especially if you trade a small amount of units.

For example, you may buy one US stock for 50USD. Even though the fee is 0.01 USD/share, you will need to pay the minimum of 1.99USD.

You will be paying a commission of almost 4% of your trade amount!

Nevertheless, Tiger Brokers has one of the most affordable fees compared to other brokerages.

Additional fees charged by exchange

Other than the fees that Tiger Brokers charges, you will incur additional fees. This depends on which exchange you are making the trade.

For example, SGX will charge an additional 0.04% on your trade value, which consists of trading and clearing fees.

You can find the full breakdown of the fees that you’ll incur on Tiger Brokers’ website.

Deposit and withdrawal fees

Tiger Brokers may charge you deposit and withdrawal fees.

This depends on:

- The currency you’re depositing or withdrawing

- The amount you’re depositing or withdrawing

- The account that you’re depositing into or withdrawing from

The safest would be to deposit or withdraw in SGD and use a Singapore bank account!

No custody, inactivity and account maintenance fees

Unlike other brokerages, Tiger Brokers does not have any other platform fees.

This includes:

This is great especially if you are a buy and hold investor. You are not pressured to make any trades just so that you do not ned to incur any fees. As such, you will not really incur other fees besides the trading commissions.

No dividend handling fees

Tiger Brokers does not charge any dividend handling fees. This means that the only fees you pay for your dividends are the dividend withholding taxes, depending on the exchange you invest in.

Many brokers in Singapore charge a dividend handling fee of around $10. This will eat into your returns, especially if you are only receiving a small amount of dividends each month.

As such, Tiger Brokers has a huge advantage over these brokers!

Is Tiger Brokers a custodian or CDP account?

When you trade with Tiger Brokers, your shares will be under their custodian account. Tiger Brokers is not linked to your central depository (CDP) account. As such, you are unable to transfer your shares from CDP to Tiger Brokers and vice versa.

This makes Tiger Brokers very attractive as:

- The commission fees are much lower than buying stocks with your CDP account

- No custodian fees are charged by Tiger Brokers

If you are looking to link your CDP account, you will need to find a broker that has this option.

Do I need to have a CDP account to trade with Tiger Brokers?

You do not need to have a CDP account if you want to trade with Tiger Brokers, as they are a custodian platform. You can only sell shares that you have with Tiger Brokers on their platform, and you cannot sell those that are linked to your CDP account.

Is Tiger Brokers reliable and safe?

Tiger Brokers has a Capital Markets Services (CMS) License issued by the MAS, and are backed by reputable names like Xiaomi and Interactive Brokers. Coupled with the substantial funding they are receiving, you can be reassured that Tiger Brokers is rather safe.

Being a new Chinese company, it is understandable that you might be wary of this company. However, here are some reasons why you can trust Tiger Brokers:

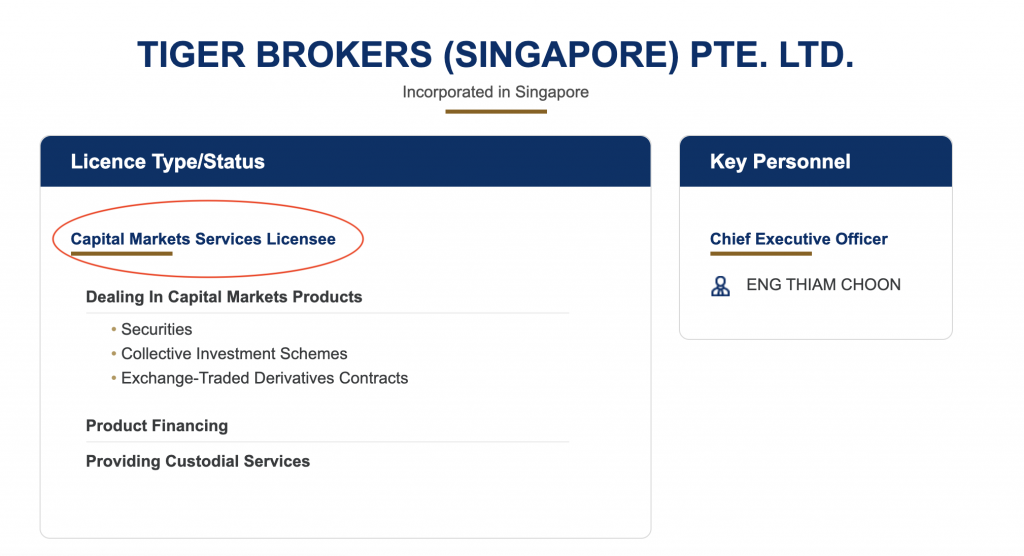

#1 Tiger Brokers is licensed by the MAS

Tiger Brokers is regulated by the Monetary Authority of Singapore (MAS) as they have been issued a Capital Markets Services (CMS) license. This allows Tiger Brokers to provide custodial services for the securities that you purchase with them.

This CMS license requires Tiger Brokers to set up a custodian account for their clients’ funds. This ensures that Tiger Brokers’ funds are separate from your funds.

For Singapore stocks that you buy, they will be under a custodian account in DBS.

Even if Tiger Brokers closes down, they cannot touch your funds.

This is a similar model to how robo-advisors manage your funds.

#2 Tiger Brokers has a strong backing

Tiger Brokers is backed by 3 reputable names:

- Interactive Brokers

- Xiaomi

- Wall Street investment guru Jim Rogers

Having this support should give you some reassurance that Tiger Brokers is a reputable company.

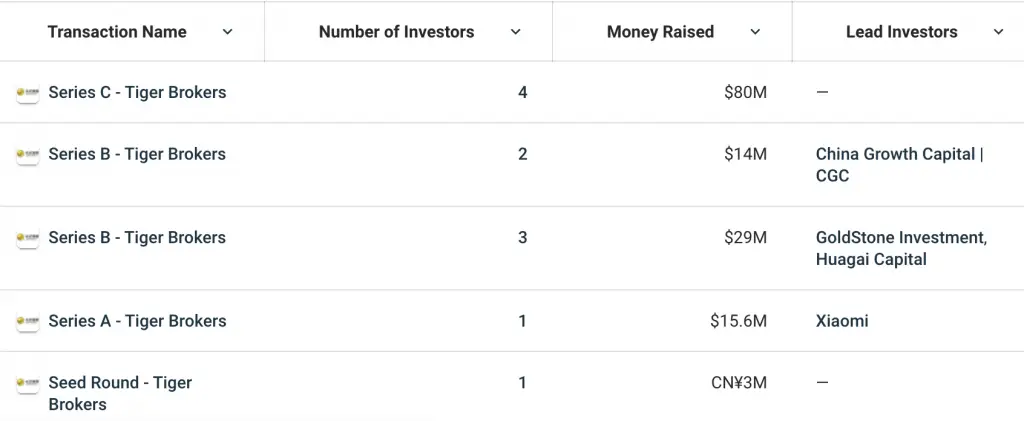

#3 Tiger Brokers has substantial funding

Tiger Brokers has received considerable funding.

In their Series C financing in 2018, they managed to raise $80 million!

Eventually, Tiger Brokers’ parent company, UP Fintech Holding Limited was listed on the NASDAQ (TIGR) in 2019.

With this substantial funding, it does show how confident investors are in this company!

What other features does Tiger Brokers have?

Tiger Brokers has tons of other features as well:

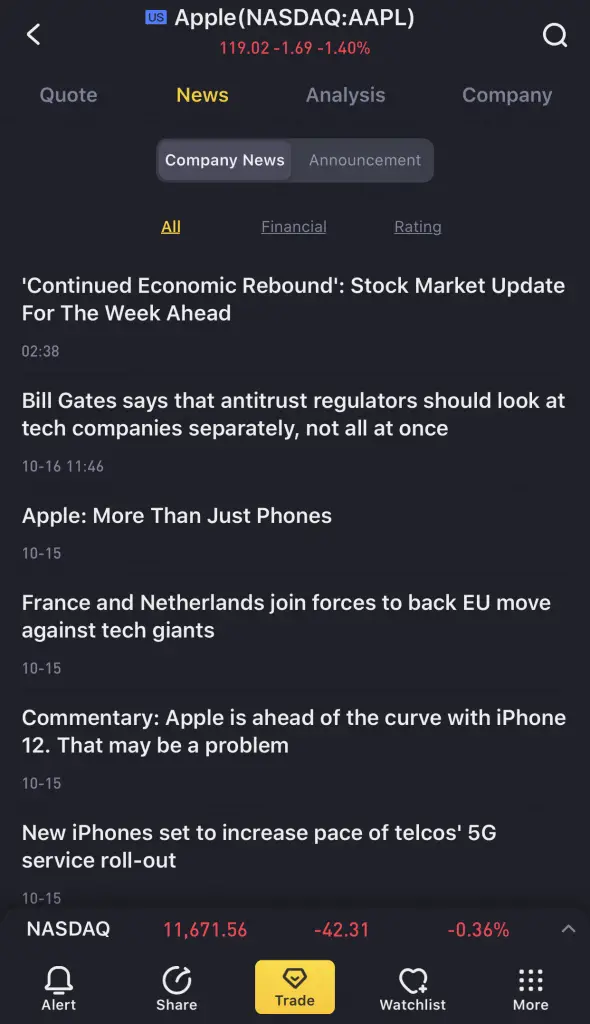

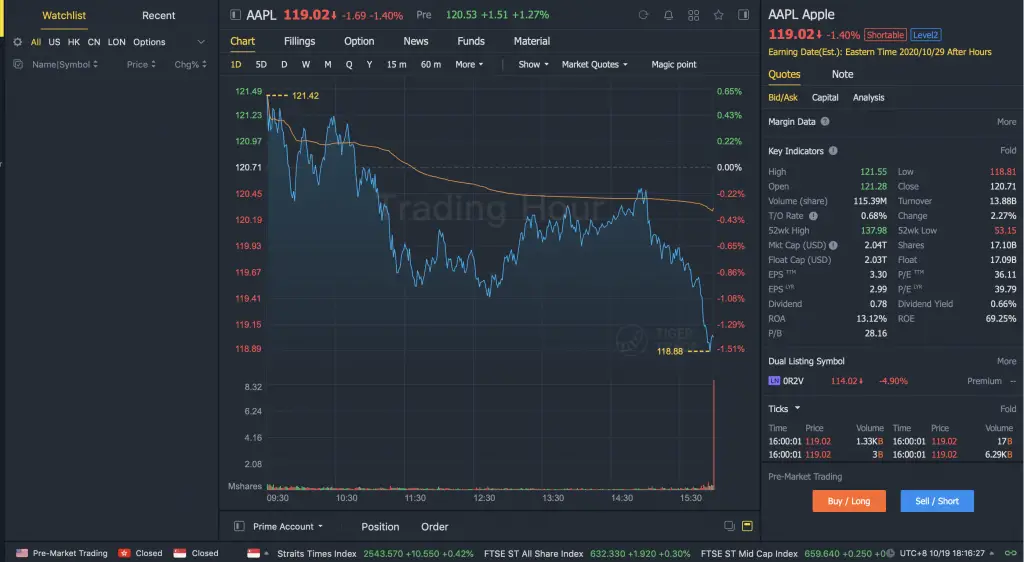

Stock profile

Tiger Brokers has an extensive profile page for each stock.

Here are 4 features you can view in each profile:

#1 Quote

You can check out my explanation on what the red and green bars mean in the stock chart.

#2 Company News

#3 Stock Analysis

#4 Company Information

This information is pretty overwhelming for me. However, I believe it will be really useful if you’re a frequent trader who can understand the various metrics.

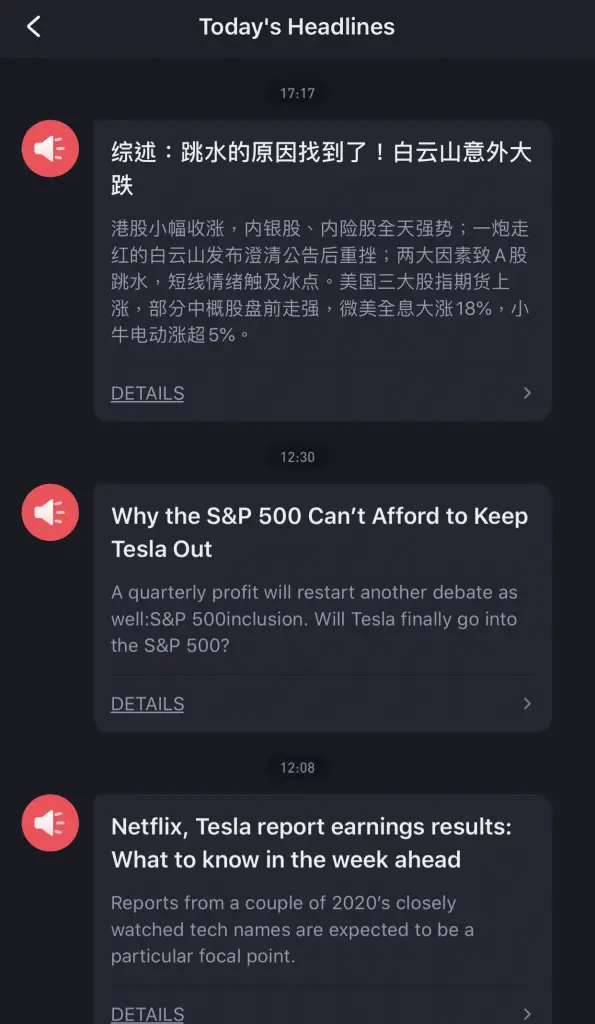

News alerts

You will receive news alerts from time to time. Due to migration issues, some of the notifications may appear in Chinese.

IPO Subscription

Tiger Brokers allows you to participate in initial public offering (IPO) subscriptions. You are only able to participate in US and HK stock IPOs.

If you’d like to find out more about the processes involved, you can view Tiger Brokers’ website that provides you information about US and HK IPO subscriptions.

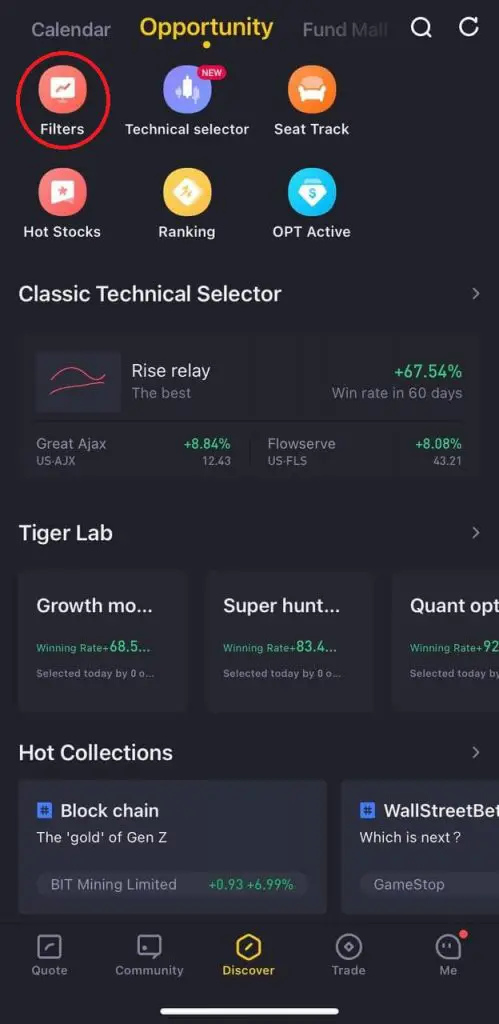

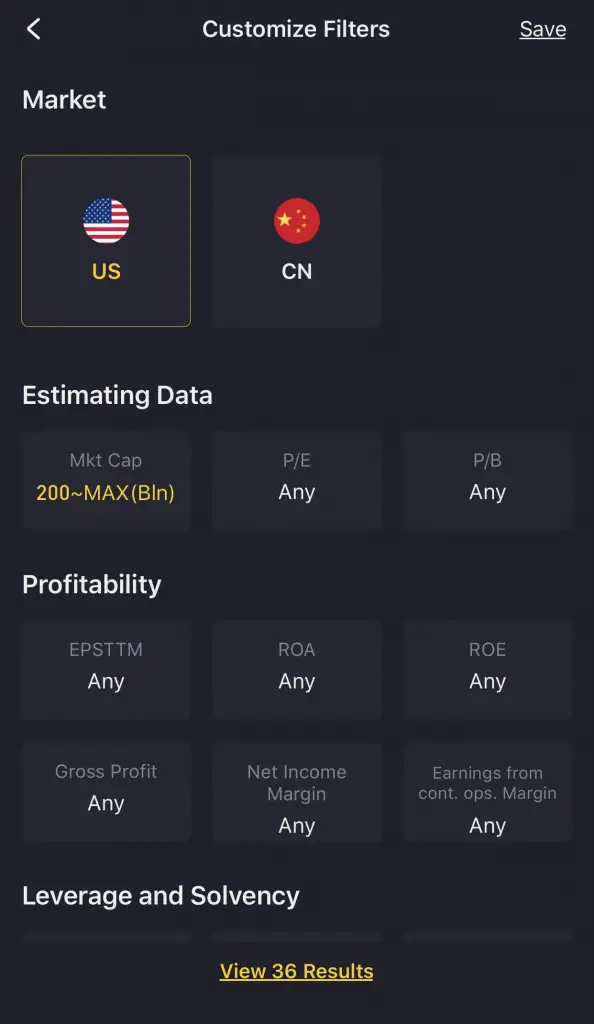

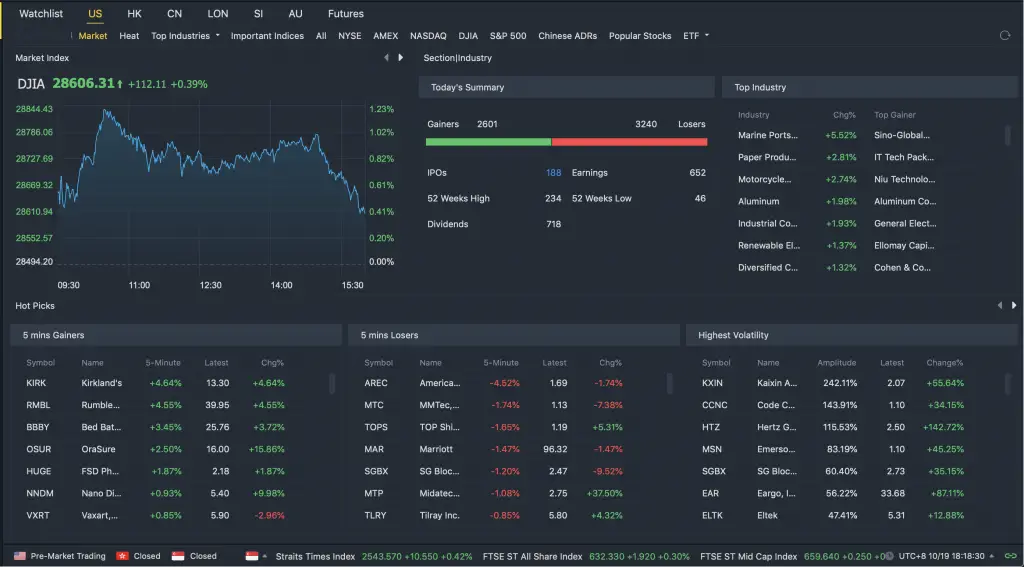

Stock Screener

Tiger Brokers has a stock screener with some parameters that you can choose from. However, it is rather hard for you to find the screener. Here’s how you can find and use it.

#1 Go to ‘Discover → Opportunity → Filters’

#2 Select your parameters

Unfortunately, you are only able to screen either US or China stocks.

#3 View the results of your screen

The screener has rather limited parameters to choose from. If you’d like a more comprehensive screener, you can consider using the one from StocksCafe.

Extensive Stock Analysis

You can choose to view technical analysis of stocks too. Tiger Brokers provides extensive analysis in their ‘Discover‘ tab.

There are lots of features that will help you out if you’re a frequent trader!

If you’d like to backtest your strategy, you can consider trying out the PyInvesting platform as well.

Ace Trader promotion

If you are a frequent trader, you may want to consider this Ace Trader promotion. From now till 31st December 2021, you are able to receive certain benefits if you frequently trade on Tiger Brokers.

Depending on the number of trades you make within the past 3 months, here are some privileges you will receive:

These are pretty attractive benefits if you do frequent trading!

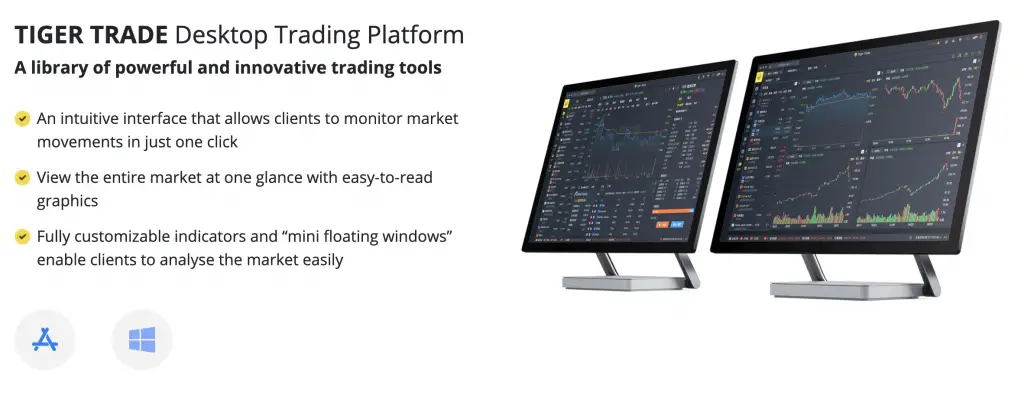

Desktop app

Tiger Brokers has a desktop app that you can download from their website.

It provides you with all the same features as the mobile app.

I feel that it might be a better platform to use if you’re a frequent trader. There are tons of information that you can obtain just by glancing at one screen.

Overall, the app is really neat and polished, and I had a good experience using it.

Website only has limited functions

Tiger Brokers also has a web portal for its users too. However, you are unable to view market data or perform trading actions on their website.

How does Tiger Brokers compare with other brokerages?

Here is how Tiger Brokers compares against other brokerages you can sign up for.

moomoo (powered by FUTU SG)

moomoo (powered by FUTU SG) is another low-cost broker that has recently entered the Singapore market.

Tiger Brokers provides you with access to ASX, SZSE and SSE, which moomoo does not.

Both platforms offer low trading fees, but one platform may offer slightly lower fees, depending on the market that you’re buying into.

You can read my comparison between Tiger Brokers and moomoo to find out more.

FSMOne

FSMOne offers a wide variety of products such as regular savings plans, cash management and managed portfolios.

Other than cash, you can invest your CPF and SRS monies in FSMOne, making this broker a suitable one if you want to consolidate your investments together.

However, you can only invest in SGX, HKEX and the US markets. Furthermore, FSMOne charges a higher minimum trade commission compared to Tiger Brokers.

You can read my analysis of how FSMOne compares to Tiger Brokers to help you decide on the better brokerage for you.

Saxo

Saxo provides a wider variety of markets compared to Tiger Brokers.

Furthermore, it also provides quality in-house commentaries on various market sectors such stocks, FX and commodities with quarterly reports to summarise their performances.

However, one main downside of Saxo is the higher costs of investing compared to Tiger.

The commissions in Saxo are higher, and along with custodian fees and currency conversion fees, it will eat into your returns throughout your investment journey.

Stock analysis in Tiger is more in-depth, with its indicators providing greater technical analysis as compared to Saxo

The main advantages that Saxo has are that it provides a greater variety of products for you to invest in and its high-quality research materials.

Standard Chartered

Standard Chartered only allows you to trade in stocks and ETFs that are listed on the different exchanges.

While it offers a wider variety of exchanges, the fees that they charge are higher compared to Tiger Brokers.

Moreover, you’ll be charged GST on your trade commission for every trade that you make!

Verdict

Tiger Brokers is the first trading account that I have opened, and here are its pros and cons:

| Pros | Cons |

|---|---|

| Fast sign up process | Information can be overwhelming for beginner investors |

| Deposits and withdrawals are processed quickly | Trading may be too easy |

| Access to many popular markets | Issues with migration of platform to English |

| Affordable and very competitive trading commissions | Only able to invest cash, and not CPF or SRS |

| Extensive stock information | Unable to trade in the London Stock Exchange |

| Easy trading process | FX spread may not be the best |

| Attractive rewards for frequent traders | |

| Under strict regulation by MAS, making it a rather safe firm to invest with | |

| No dividend handling fee |

Tiger Brokers is a great brokerage service that gives you access to most of the popular markets.

It may have some issues with the user interface, however the app is sleek and easy to use.

My main concern is that the trading process can be too easy. Moreover, there is so much information on the app that you may be tempted to check your stocks everyday.

As such, it is very important to understand what you’re investing in, before you make the trade!

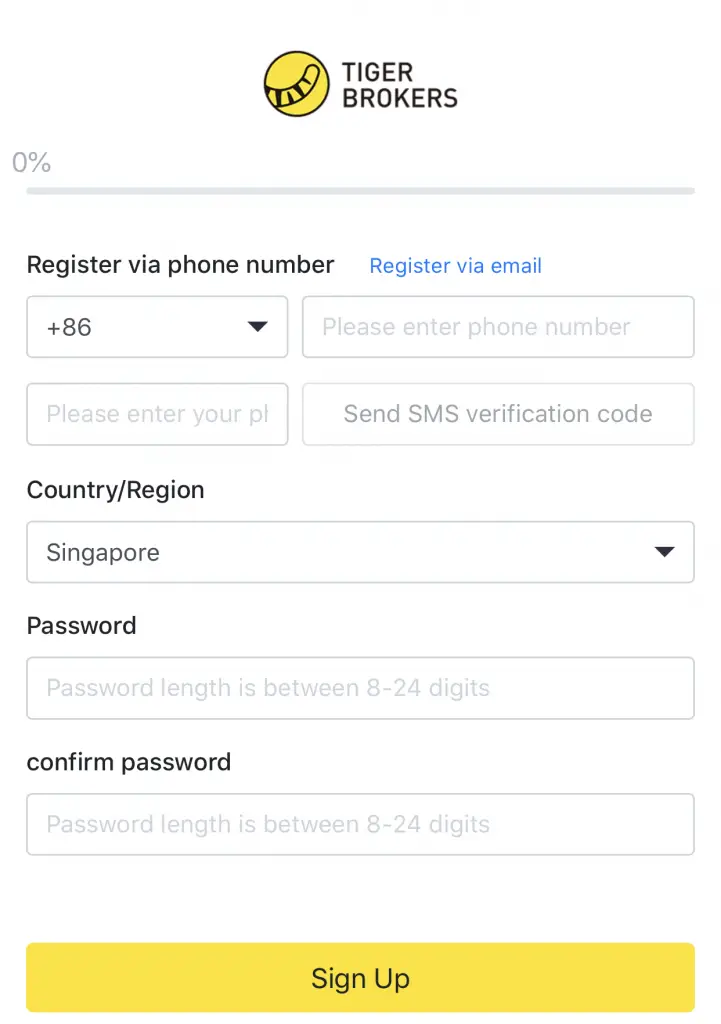

How do I create an account with Tiger Brokers? (Referral)

If you are interested in signing up for a Tiger Brokers account, you can use my referral link. This will give you some referral bonuses that you can view below.

The signup process is really fast, and you can create an account within 20 minutes. Here’s all key things that you’ll need to do:

#1 Set your login details

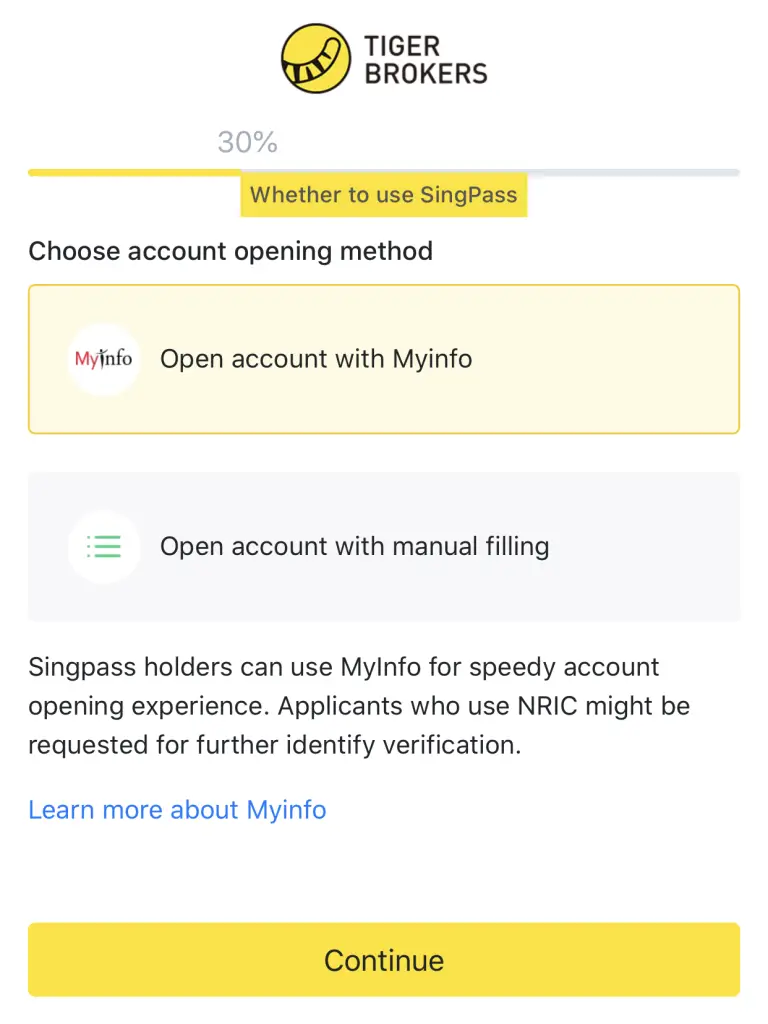

#2 Use MyInfo to sign up

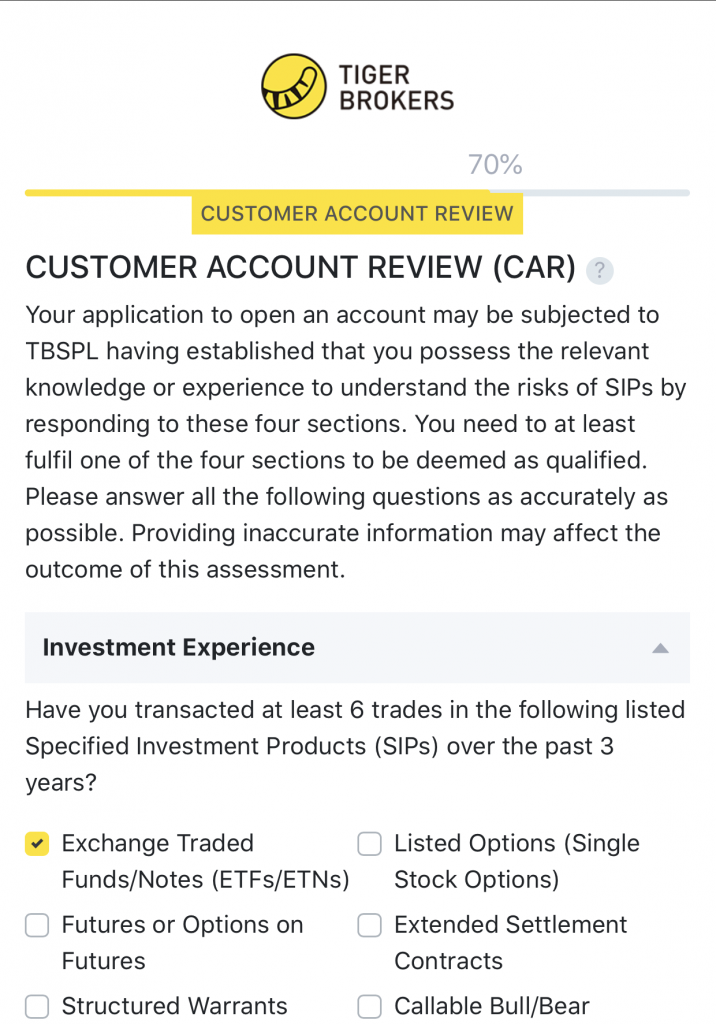

#3 Customer Account Review (CAR)

To pass the review, you will need to fulfil either of the 4 categories:

- Investment Experience

- Customer Qualification

- Work Experience

- SGX Online Education Programme

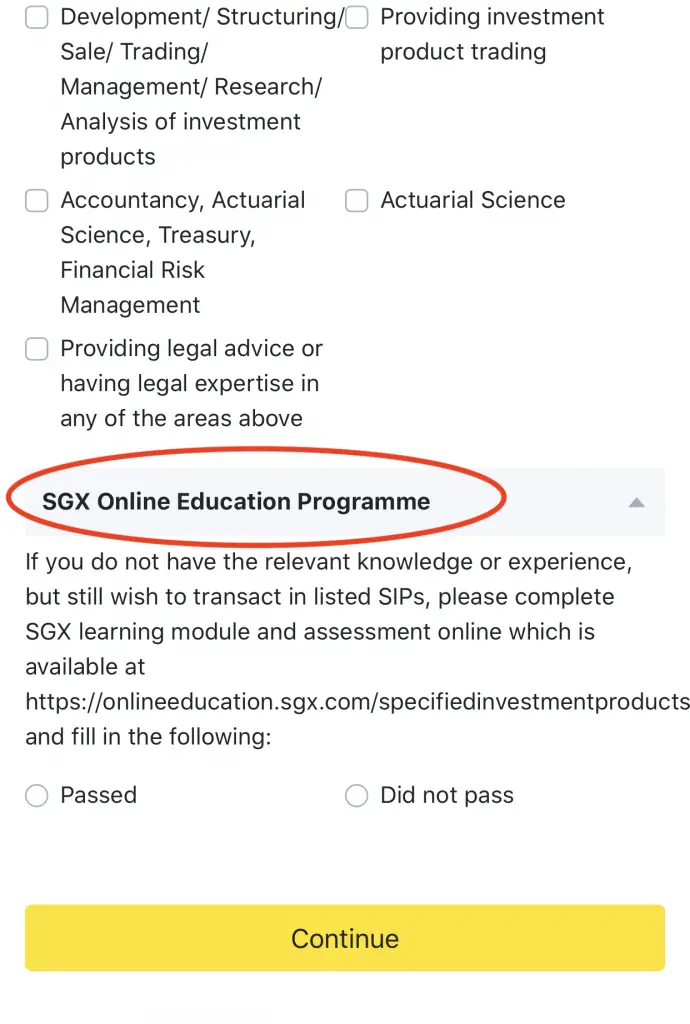

If you do not fulfil any of the first 3 criteria, you will need to pass the SGX programme.

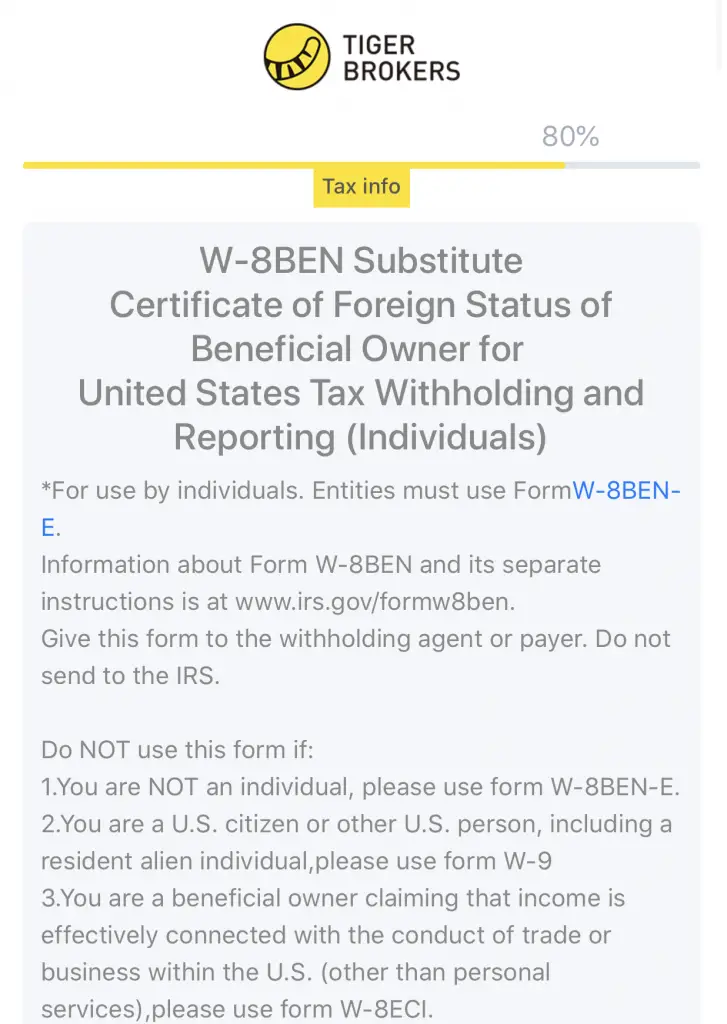

#4 Fill up your W-8BEN Form

To trade in the US markets, you are required to fill up the W-8BEN form. This is a requirement by the IRS. Other brokerages may take a few business days to process your W-8BEN form.

However, the process is automated for Tiger Brokers. Most of the details have already been filled in for you. All you will need to do is to fill up some fields.

This allows you to start trading immediately once your account is approved!

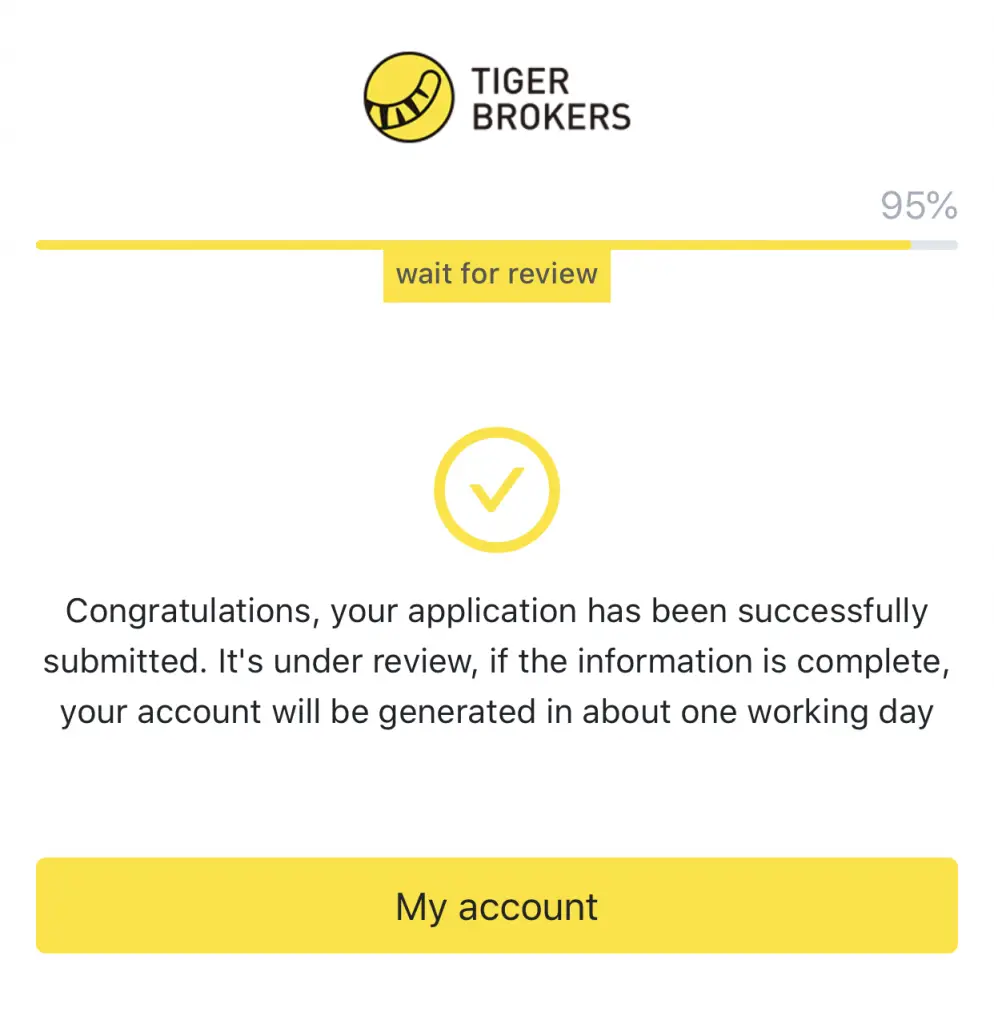

#5 Submit your application

Your application will be reviewed.

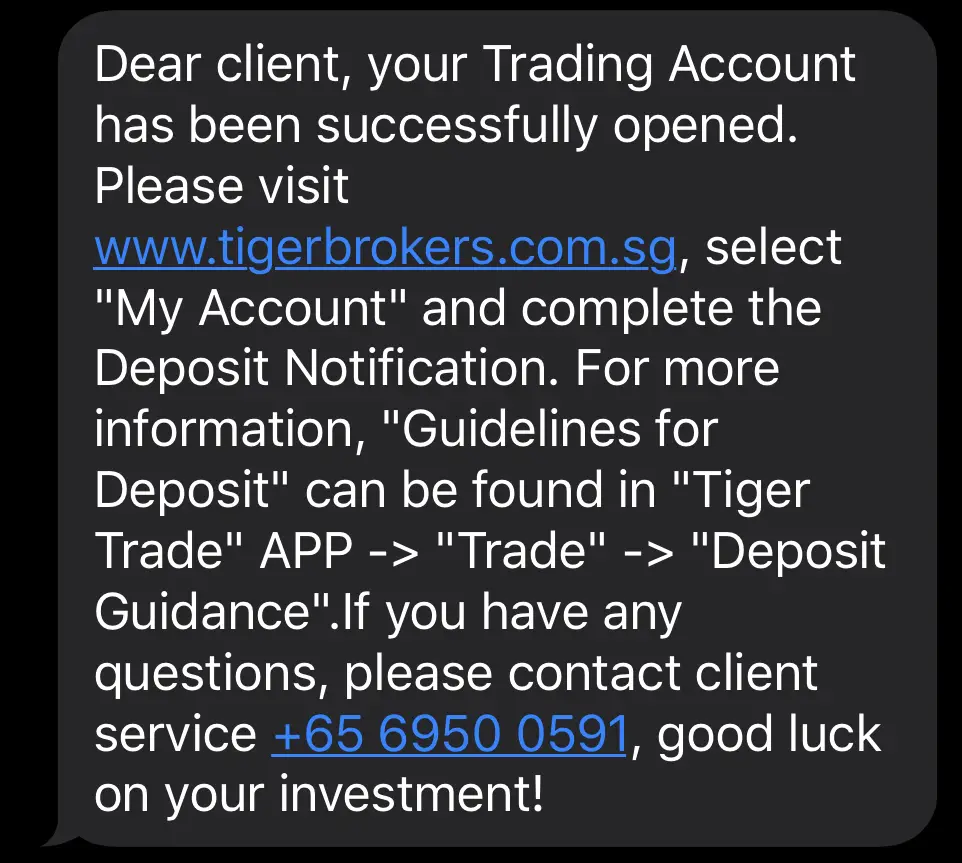

Once you’ve been approved, you will receive an SMS.

You are now able to deposit your money and start trading!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

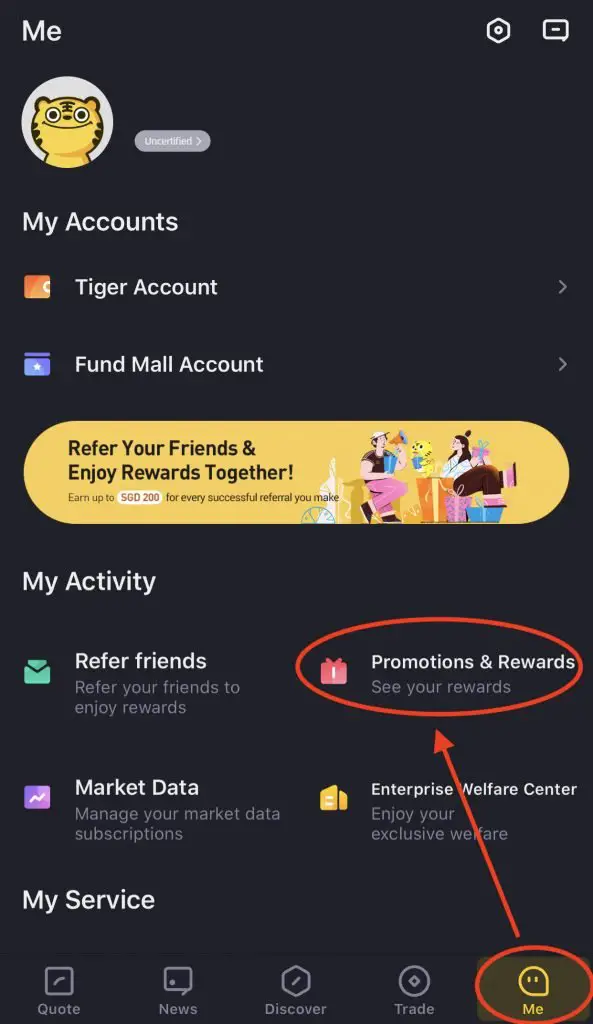

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

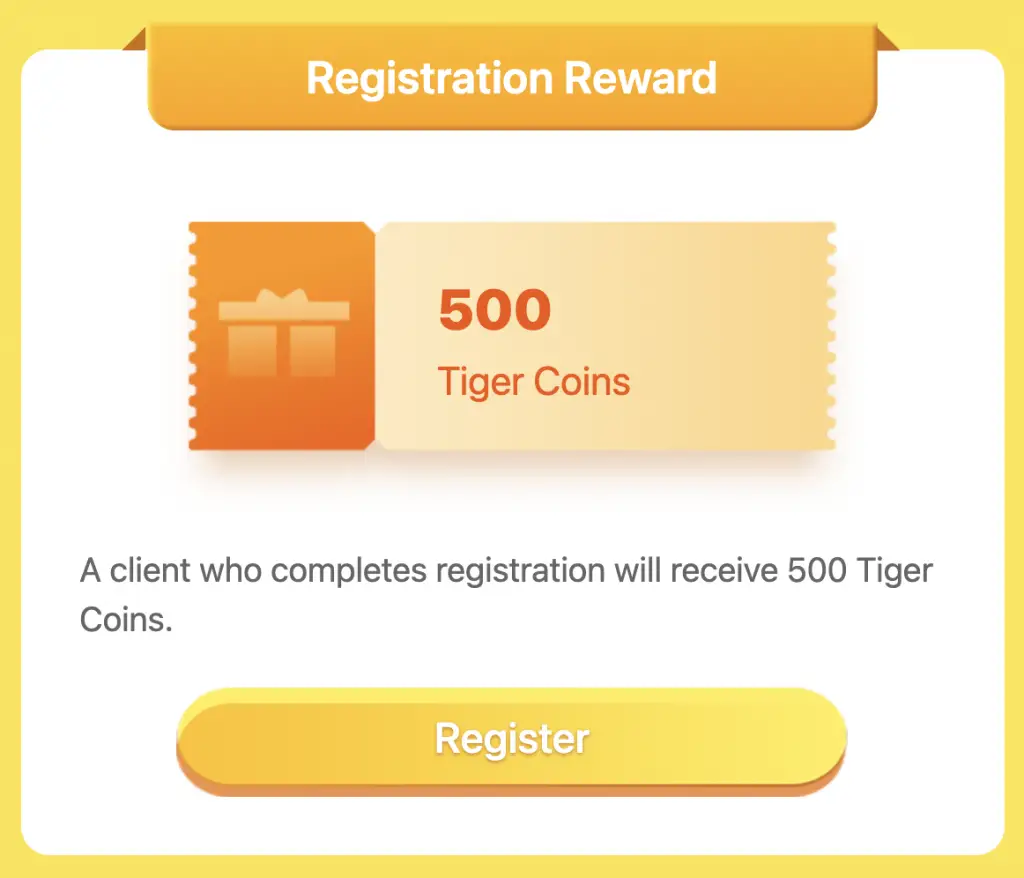

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

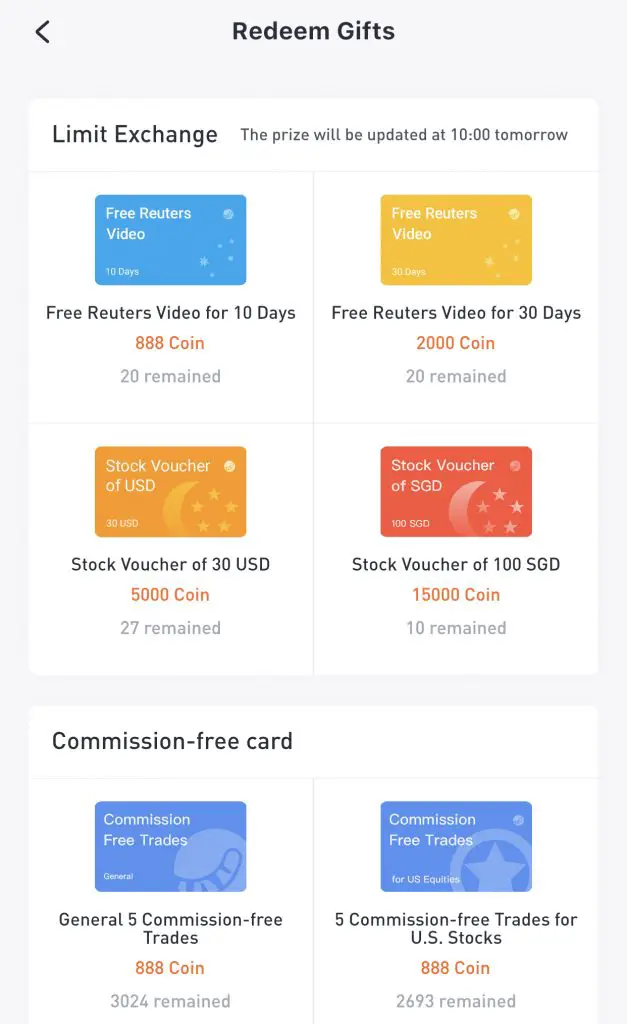

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?