Last updated on February 19th, 2022

Whenever you want to make a payment, the cashier may ask if you want to use NETS or payWave.

Have you ever wondered what’s the difference between using these 2 services?

Contents

The difference between NETS and Visa payWave

NETS is a Singaporean debiting payment method which immediately deducts your money from your bank account. Meanwhile, Visa payWave is a global contactless service that allows you to pay via debit or credit.

In terms of rewards, Visa payWave has much better rewards compared to NETS.

Here’s a detailed breakdown of what you need to know:

Type of service

Both of these payment services are rather different:

NETS is a local payment processing service

NETS is a payment service that was developed in Singapore. It allows you to make electronic payments via directly deducting the amount from your bank account.

The 6 banks that allow you to use NETS include:

- DBS / POSB

- OCBC

- UOB

- HSBC

- MayBank

- Standard Chartered

Your payment can be either contact and contactless

When you pay by NETS, you may notice that the cashier will insert your card into the terminal. Afterwards, you are required to enter your PIN to let the transaction go through.

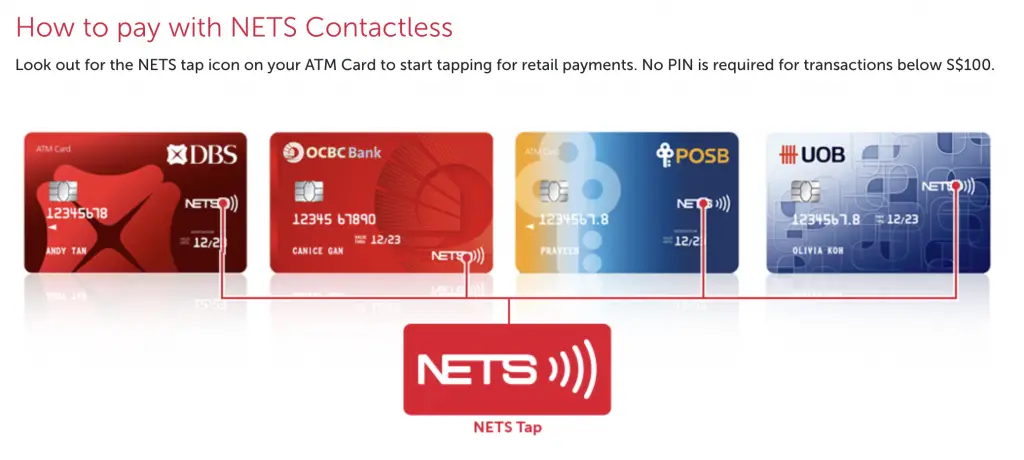

However, NETS has now come up with contactless ATM cards too.

All you’ll need to do is to tap these cards on the terminal. You do not require to enter a PIN when paying by these cards!

You can view my comparison between NETS Tap and NETS FlashPay to see how they are different.

NETS charges lower merchant fees

NETS charges merchants a lower fee compared to Visa. As such, more merchants will have NETS as a payment method compared to payWave.

Moreover, NETS has provided a waiver to hawkers for 3 years.

You will be able to find NETS terminals in most hawker centres and neighbourhood stores. In contrast, you may not find any payWave terminals in these stores.

payWave is a global contactless service

payWave is a contactless payment service that is provided by Visa. All you’ll need to do is to tap your card on any terminal that has the contactless symbol.

payWave can be used worldwide

One advantage of payWave is that you can use it at any merchant globally that supports contactless transactions. In contrast, you can only use NETS in Singapore.

This makes payWave a more universal payment method.

payWave charges higher merchant fees

You may see some shops that accept NETS but not payWave. This is because Visa charges a higher merchant fee for every payWave transaction processed.

According to the Straits Times, merchants are charged a 3% fee!

payWave is a common payment method that you can find in shopping malls. However when it comes to neighbourhood shops, it is rare to find shops that accept this payment method.

Type of payment

The way that these 2 services deduct the money from your bank account is slightly different too.

NETS is a direct debit service

NETS is a direct debit service. This means that the money will be immediately deducted from your bank account.

If you do not have enough money in your bank account, the transaction will not go through!

payWave can be either a debit or credit

Visa payWave usually comes with either a debit or credit card. As such, the payment methods are slightly more flexible.

payWave debit payments take a few days to be processed

If you have a debit card that uses payWave, the amount will be debited from your account. However, it is not as immediate as NETS.

Instead, it will take a few days for the payment to be processed. You can see the amount you ‘owe’ by taking the difference between your ‘Total Balance’ and your ‘Available Balance’.

This can usually be found in your mobile banking app.

Credit payments will be charged at the end of the month

When you use payWave on your credit card, the transaction won’t be deducted immediately too.

Instead, the bill will be accumulated at the end of the month and sent to you.

This is good for you if you do not have the cash at hand to make the payment. You can make purchases up to the credit limit that you’ve set previously.

Usually, you will have one month to settle your bill. However if you miss the deadline, you will pay a really high interest rate!

As such, you should try to spend within your means so that you will not incur too large of a bill!

Online payments

Both payment methods allow you to make online purchases as well.

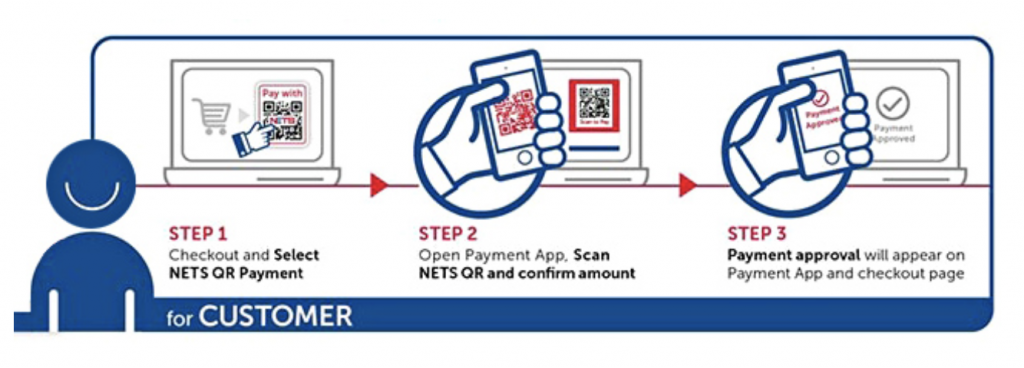

You have to scan a QR code with NETS Online QR

NETS’ online payment method is rather troublesome to use. When you want to use NETS for your online payments, you will be given a NETS QR code to scan.

However, you can only use these 3 mobile payment methods to make a payment:

- DBS PayLah!

- OCBC Pay Anyone

- UOB Mighty

Moreover, not all online merchants have NETS QR as a payment method. As such, you may most likely use NETS QR as much.

payWave does not allow you to make online transactions

payWave is more of a contactless payment. As such, you will not use it when you wish to make an online purchase.

However, all you’ll need to do is to enter your Visa credit / debit card details to make a purchase.

Type of cards that use these networks

Both payment methods can be found in different types of cards.

NETS can be found in a variety of cards

Since NETS is a Singaporean payment service, it will be found in all cards that are issued in Singapore.

This includes:

- ATM cards

- Credit and Debit cards

- NETS cards

Credit and debit cards have NETS function

For those credit and debit cards that are issued by Singaporean banks, they will have the NETS function as well!

As such, you are able to use either NETS or payWave to make payments with your Visa credit or debit card.

However, the NETS function is not available on cards that are not issued by Singapore banks. This includes prepaid Visa cards like BigPay or MCO.

NETS has their own cards too

NETS also has their own series of cards too, including:

- NETS Cashcard

- NETS Contactless Cashcard

- NETS FlashPay

However, all of these are stored value cards. They are not linked to any bank account.

As such, you will have to top up your NETS stored value cards first before you can use them.

You can view my comparison between these cards to see how they differ from each other.

payWave comes with any Visa debit or credit card

Since payWave is a Visa technology, it will come with any card that is issued by them.

Here are some of the cards that have payWave that comes with them:

| Type of Card | Examples |

|---|---|

| Bank Debit Cards | OCBC FRANK Debit Card |

| Bank Credit Cards | OCBC FRANK Credit Card |

| Prepaid Cards | BigPay MCO Card YouTrip Revolut |

| Other Cards | SingLife Visa Debit Card |

Security

Both payment methods have different security features when using them.

NETS requires you to enter a PIN

If you wish to make a transaction with NETS, you will have to enter a 6-digit PIN for the transaction to go through.

However, you may have the new ATM cards which are also contactless. This means that you are able to just tap these cards at the terminal without entering a PIN.

As such, you may want to consider the balance between convenience and security.

payWave requires you to sign for purchases above $200

When you make a purchase under $200, you can just tap your card on the contactless terminal and the transaction will go through.

For purchases above $200, you are required to sign on the terminal to approve the transaction.

This helps to ensure that anyone who has your credit card cannot make big purchases with it.

Rewards

Both payment methods will provide you with rewards for making payments.

NETS has very limited rewards

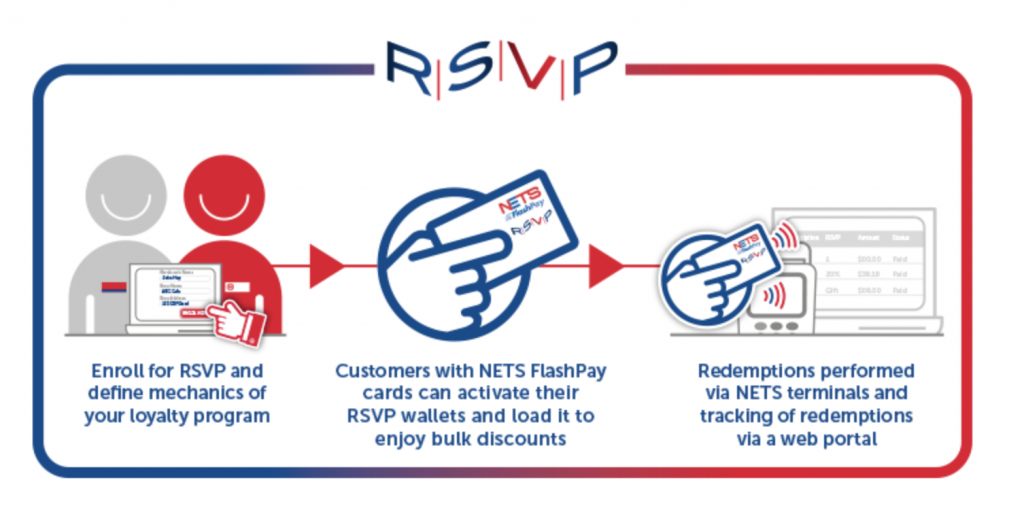

NETS does not really offer you any rewards for using their payment network. The only ongoing rewards programme is the Retailer Stored Value Programme (RSVP).

There are 2 types of rewards you can earn with RSVP:

- Dollar promotions (receive a discount on your transaction)

- Item promotions (purchase a set of items for a discount)

However, there are some caveats to this programme:

- RSVP is only available on NETS FlashPay cards or a merchant co-branded card

- You can only redeem the deals from the same merchant that you’ve purchased from before

- Your NETS FlashPay card can only store RSVP rewards from 20 different merchants

- Your RSVP wallet is different from your NETS FlashPay stored value

Overall, this rewards programme is not really well utilised by both merchants and customers.

As such, NETS does not provide much incentives to use their payment platform. This is different from the EZ-Link rewards program, which awards you 1 point for every 10 cents you spend.

payWave has many different rewards available depending on your card

When it comes to using Visa payWave, there are many different rewards that you can earn. The 3 main kinds of rewards are:

- Cashback

- Miles

- Rewards points

For example, the OCBC FRANK debit card gives 1% cashback, but only for transactions with certain merchants. Other transactions will only give you a 0.3% cashback.

To know what rewards you can get when spending, you can refer to your bank’s website to find out more.

payWave rewards are very enticing

Visa charges merchants in Singapore a higher fee compared to US merchants.

A part of the merchant fees will go to the banks that issue the debit or credit card. Since they receive higher fees, they will use some of this revenue to generate generous credit card promotions.

This will entice you to continue using Visa payWave for your transactions. In return, the banks will earn more money too.

As such, using payWave to make any purchases is to your advantage. You are able to earn some rewards while doing so.

However if Visa charges lower fees in the future, your rewards may be lower as well.

Verdict

Here’s a tabular comparison of both NETS and Visa payWave:

| NETS | payWave | |

|---|---|---|

| Type of Service | Local payment service | Global contactless service |

| Merchant Fees | Lower | Higher |

| Type of Payment | Direct debit | Either debit or credit (depends on card) |

| Online Payment | NETS Online QR | NA |

| Cards | ATM cards Credit and Debit cards NETS cards | Debit and credit cards Prepaid debit cards |

| Security | PIN for non-NETS Tap cards | Signature required for purchases > $200 |

| Rewards | RSVP | Cashback Miles Reward points |

So which payment method should you be using?

Use payWave if you want to earn rewards

payWave gives you better rewards when you use it to make a purchase.

Whenever payWave is available, you should definitely be using it!

This is definitely much better than just using cash which you will not be rewarded from using it.

Use NETS if payWave is not available

If you are still looking for a cashless option to make payment, NETS will be something that you can consider.

It does come with some benefits such as:

- Entering your PIN when making a purchase

- Direct debiting from your account.

If you are worried about spending above your means, NETS may be a better option to use.

Mobile wallets can be another option

Another alternative to NETS are certain mobile wallets. Some of them like Google Pay provide very attractive rewards for using them.

Meanwhile, PayLah! gives you the flexibility to withdraw your money at any time.

There are other mobile wallets that provide the withdrawal feature too, like GrabPay and Singtel Dash. However, you may need to meet certain requirements first before you can withdraw your money!

Cash may still be necessary

If the shop that you wish to purchase from does not have any e-payment methods, cash will be the only way that you can make a purchase.

You can view my guide to withdrawing cash in Singapore, even without an ATM card!

Conclusion

NETS and Visa payWave are just 2 of the diverse payment methods we have in Singapore. Knowing how these methods work will help you to better maximise your spending!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?